Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | bokf-20210721.htm |

July 21, 2021 Q2 Earnings Conference Call

2 LEGAL DISCLAIMERS Forward-Looking Statements: This presentation contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the expected or potential impact of the novel coronavirus (COVID-19) pandemic, and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward- looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, consumer or business responses to, and ability to treat or prevent further outbreak of, the COVID-19 pandemic, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of June 30, 2021 unless otherwise noted.

Steven G. Bradshaw Chief Executive Officer

NET INCOME Q2 SUMMARY 4 Noteworthy Items Impacting Profitability • Another outstanding earnings quarter from our Wealth Management team • Net interest income stabilization • $35 million negative provision for credit loss • Expense management remains excellent ($Million, Exc. EPS) Q2 2021 Q1 2021 Q2 2020 Net Income $166.4 $146.1 $64.7 Diluted EPS $2.40 $2.10 $0.92 Net Income Before Taxes $215.6 $186.7 $80.1 Provision for Credit Losses ($35.0) ($25.0) $135.3 Pre-Provision Net Revenue* $179.9 $163.4 $215.8 *Non-GAAP measure $0.8 $0.92 Attributable to Shareholders Per Share (Diluted) $64.7 $154.0 $154.2 $146.1 $166.4 $0.92 $2.19 $2.21 $2.10 $2.40 2Q20 3Q20 4Q20 1Q21 2Q21

ADDITIONAL DETAILS 5 ($Billion) Q2 2021 Quarterly Growth Year over Year Growth Period-End Loans $21.4 (5.0)% (11.3)% Average Loans $22.2 (2.6)% (8.0)% Period-End Deposits $37.4 (1.1)% 10.5% Average Deposits $37.5 2.7% 14.8% Fiduciary Assets $58.7 4.3% 25.5% Assets Under Management or in Custody $96.6 5.1% 21.6% • PPP forgiveness accounts for $727 million of $1.1 billion reduction in loan balances • Average deposits continue to grow • Assets under management or in custody and fiduciary assets both increased this quarter primarily due to favorable equity markets

Stacy Kymes Chief Operating Officer

LOAN PORTFOLIO 7 ($Million) June 30, 2021 Mar 31, 2021 June 30, 2020 SEQ. LOAN GROWTH YOY LOAN GROWTH Energy $3,011.3 $3,202.5 $3,974.2 (6.0)% (24.2)% Services 3,389.8 3,421.9 3,779.9 (0.9)% (10.3)% Healthcare 3,381.3 3,290.8 3,289.3 2.8% 2.8% General business 2,690.6 2,742.6 3,115.1 (1.9)% (13.6)% Total C&I $12,472.9 $12,657.8 $14,158.5 (1.5)% (11.9)% Commercial Real Estate 4,247.0 4,503.3 4,554.1 (5.7)% (6.7)% Loans to Individuals 3,575.0 3,524.2 3,361.8 1.4% 6.3% Core Loans $20,294.9 $20,685.3 $22,074.5 (1.9)% (8.1)% Paycheck Protection Program 1,121.6 1,848.6 2,081.4 (39.3)% (46.1)% Total Loans $21,416.5 $22,533.8 $24,155.9 (5.0)% (11.3)% LOANS OVERVIEW • Energy balances decline, but at a slower pace than previous periods • Quarterly growth in healthcare primarily in senior housing space • Core C&I stabilizing despite low utilization rates • Commercial real estate pressure as clients refinance to permanent market as threat of rate hikes increases • Nearly 40% of PPP loans forgiven during the quarter

KEY CREDIT QUALITY METRICS 8 0.25% 0.41% 0.31% 0.28% 0.30% 0.00% 0.20% 0.40% 0.60% 2Q20 3Q20 4Q20 1Q21 2Q21 NET CHARGE-OFFS TO AVERAGE LOANS Energy Healthcare Commercial Real Estate Residential & Other QUALITY METRICS OVERVIEW • Total non-accrual loans down $36.4 million • A decrease of $31.5 million in Energy non-accruals • Potential problem loans (substandard, accruing) totaled $384 million at 6/30, compared to $422 million at 3/31 • Net charge-offs were relatively flat at 30 basis points excluding PPP loans, remaining below historical averages • Last four quarter average net charge-offs at 32 basis points excluding PPP loans continues to be at or below historic range of 30 to 40 basis points • Appropriately reserved with an ALLL excluding PPP loans of 1.54% and combined allowance of 1.66% including unfunded commitments excluding PPP loans ANNUALIZED, NET OF PPP ($Million) $255.4 $221.2 $234.7 $216.0 $179.6 $0 $50 $100 $150 $200 $250 $300 2Q20 3Q20 4Q20 1Q21 2Q21 NON-ACCRUALS

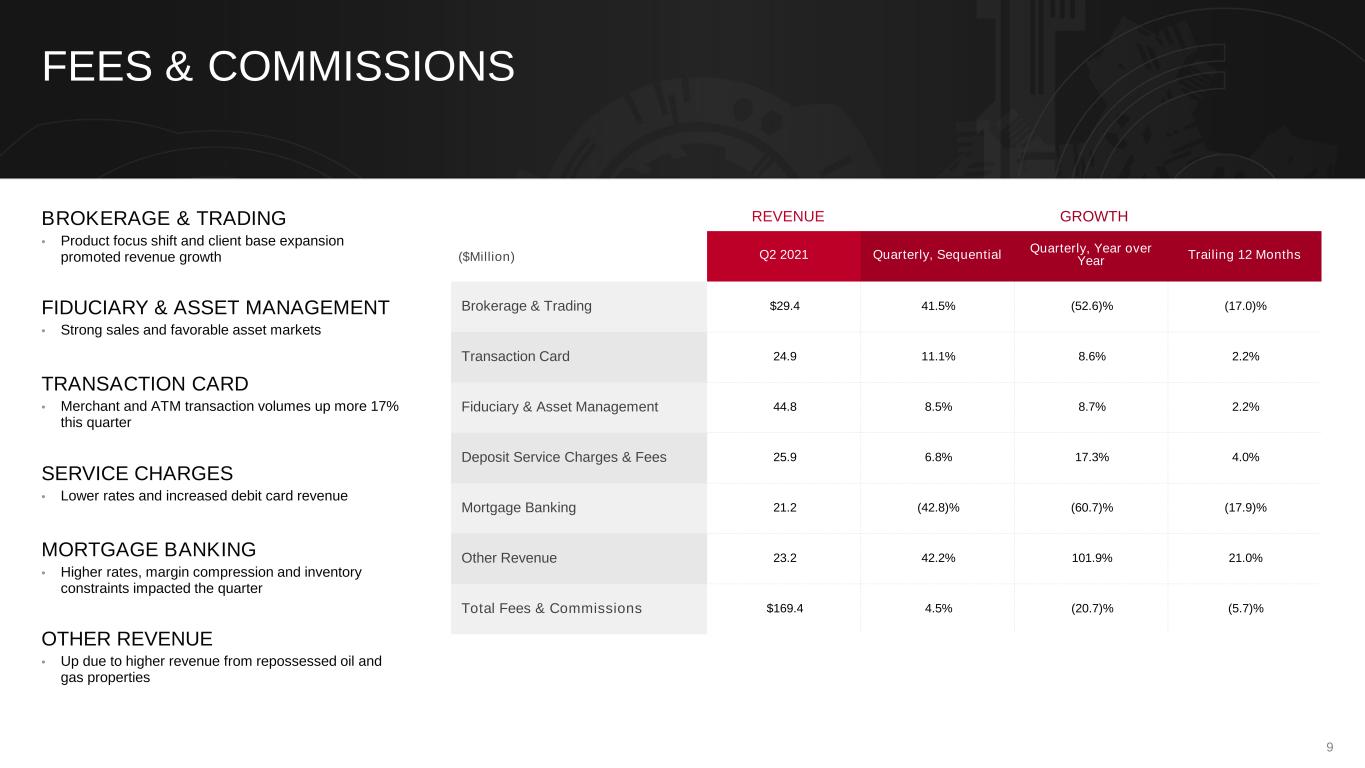

($Million) Q2 2021 Quarterly, Sequential Quarterly, Year over Year Trailing 12 Months Brokerage & Trading $29.4 41.5% (52.6)% (17.0)% Transaction Card 24.9 11.1% 8.6% 2.2% Fiduciary & Asset Management 44.8 8.5% 8.7% 2.2% Deposit Service Charges & Fees 25.9 6.8% 17.3% 4.0% Mortgage Banking 21.2 (42.8)% (60.7)% (17.9)% Other Revenue 23.2 42.2% 101.9% 21.0% Total Fees & Commissions $169.4 4.5% (20.7)% (5.7)% FEES & COMMISSIONS 9 BROKERAGE & TRADING • Product focus shift and client base expansion promoted revenue growth FIDUCIARY & ASSET MANAGEMENT • Strong sales and favorable asset markets TRANSACTION CARD • Merchant and ATM transaction volumes up more 17% this quarter SERVICE CHARGES • Lower rates and increased debit card revenue MORTGAGE BANKING • Higher rates, margin compression and inventory constraints impacted the quarter OTHER REVENUE • Up due to higher revenue from repossessed oil and gas properties GROWTHREVENUE

Steven Nell Chief Financial Officer

YIELDS, RATE & MARGIN 11 ($Million) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 Net Interest Revenue $280.3 $280.4 $297.2 $271.8 $278.1 Net Interest Margin 2.60% 2.62% 2.72% 2.81% 2.83% Yield on Available for Sale Securities 1.85% 1.84% 1.98% 2.11% 2.29% Yield on Loans 3.54% 3.55% 3.68% 3.60% 3.63% Cost of Interest-bearing Deposits 0.14% 0.17% 0.19% 0.26% 0.34% Cost of Wholesale Borrowings 0.51% 0.50% 0.54% 0.51% 0.44% NET INTEREST REVENUE • Net interest revenue largely unchanged from previous quarter NET INTEREST MARGIN • Net interest margin largely stable with substantial pressure felt in previous quarters waning

EXPENSES 12 ($Million) Q2 2021 Q1 2021 Q2 2020 %Incr. Seq. %Incr. YOY Personnel expense $172.0 $173.0 $176.2 (0.6)% (2.4)% Other operating expense $119.1 $122.8 $119.7 (3.0)% (0.5)% Total operating expense $291.2 $295.8 $296.0 (1.6)% (1.6)% Efficiency Ratio 64.20% 66.26% 59.68% EXPENSES OVERVIEW • Quarterly personnel expense flat due to regular compensation decrease of $1.1 million was mostly offset by an increase in incentive compensation expense • Quarterly non-personnel expense down largely due to decreased mortgage banking costs and data processing expense • Efficiency ratio remains above our target of 60% due to NIR headwinds and mix shift

LIQUIDITY & CAPITAL 13 Q2 2021 Q1 2021 Q2 2020 Loan to Deposit Ratio 57.2% 59.5% 71.3% Period End Deposits $37.4 billion $37.9 billion $33.9 billion Available secured wholesale borrowing capacity $12.8 billion $12.8 billion $12.8 billion Q2 2021 Q1 2021 Q2 2020 Common Equity Tier 1 12.0% 12.1% 11.4% Total Capital Ratio 13.6% 14.0% 13.4% Tangible Common Equity Ratio 9.1% 8.8% 8.8% • Deposit growth continues to be strong • Nearly $13 billion of secured borrowing capacity • CET1 and Total Capital are 490bp and 310bp above well-capitalized, respectively • Repurchased 492,994 shares at an average price of $88.84 per share in the open market

FORECAST & ASSUMPTIONS 14 • Loan growth will slowly accelerate in tandem with the broader economic recovery this year, excluding the impact of PPP • We expect the overall loan loss reserve as a percent of loan balances to continue to migrate toward pre-pandemic levels • NIM may continue to move down slightly largely from continued downward repricing in our available-for-sale securities portfolio o We believe we are close to a bottom in our interest bearing deposit pricing at 14 basis points o We believe the significant pressure on NIM seen the last few quarters is largely behind us now • Most fee revenue categories expected to grow modestly for the remainder of 2021 • Operating expenses budgeted to grow at a low single digit pace • Opportunistic share repurchase activity to continue

Steven G. Bradshaw Chief Executive Officer

QUESTION AND ANSWER SESSION