Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Folkup Development Inc. | fldi_ex231.htm |

| EX-21.1 - SUBSIDIARIES - Folkup Development Inc. | fldi_ex211.htm |

| EX-5.1 - OPINION - Folkup Development Inc. | fldi_ex51.htm |

As filed with the Securities and Exchange Commission on July 20, 2021

Registration No. 333-___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| FOLKUP DEVELOPMENT INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 3620 |

| 32-0499929 |

| (State or Other Jurisdiction of Incorporation or Organization) |

| (Primary Standard Industrial Classification Number) |

| (IRS Employer Identification Number) |

Folkup Development Inc.

Unit 17-18, 23/F, Metropole Square

2 On Yiu Street, Sha Tin

New Territories, Hong Kong

+852 3487-6330

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Hak Yiu Ng

President

Folkup Development Inc.

Unit 17-18, 23/F, Metropole Square

2 On Yiu Street, Sha Tin

New Territories, Hong Kong

+852 3487-6330

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant Section 7(a)(2)(B) of the Exchange Act. ☒

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered |

| Amount to Be Registered (1) |

|

| Proposed Maximum Offering Price per Share (2) |

|

| Proposed Maximum Aggregate Offering Price |

|

| Amount of Registration Fee |

| ||||

| Common Stock, par value $0.001 per share |

|

| 5,000,000 |

|

| $ | 3.00 |

|

| $ | 15,000,000 |

|

| $ | 1,636.50 | (3) |

_____________

| (1) | The company may not sell all of the shares, in fact it may not sell any of the shares. For example, if only 50% of the shares are sold, there will be 2,500,000 shares sold and the gross proceeds will be $7,500,000. |

|

|

|

| (2) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

|

|

|

| (3) | The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

|

|

|

| (4) | The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the price of the shares that were sold to our shareholders in a private placement pursuant to an exemption from registration under the Securities Act. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

_____________

| (1) | In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended. |

|

| |

| (2) | This offering price has been estimated solely for the purpose of computing the registration fee in accordance with Rule 457(o) of the Securities Act. |

| 2 |

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION ON JULY 20, 2021

5,000,000 SHARES OF COMMON STOCK

This is a public offering (the “Offering”) of common stock of Folkup Development Inc. and no public market currently exists for the securities being offered. We are offering for sale a total of up to 5,000,000 shares of our common stock at a fixed price of $3.00 per share. We estimate our total offering registration costs to be approximately $75,000. There is no minimum number of shares that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. None of the funds from the offering will be placed in an escrow, trust or similar account, but will be available to us immediately. The Offering will commence promptly on the date upon which the registration statement is declared effective with the Securities and Exchange Commission (the “SEC”) and will conclude upon the earlier of (i) when the Offering period ends (16 months from the effective date of this prospectus), (ii) the date when the sale of all 5,000,000 shares is completed, (iii) when the board of directors decides that it is in the best interest of the Company to terminate the Offering prior to the completion of the sale of all 5,000,000 shares registered under the Registration Statement of which this Prospectus is part. The Offering is being conducted on a self-underwritten, best efforts basis, which means our officers and directors will attempt to sell the shares in reliance on the safe harbor from broker-dealer registration under Rule 3a4-1 of the Securities Exchange of 1934, as amended (the “Exchange Act”). This prospectus will permit our directors to sell the shares directly to the public. No commission or other compensation related to the sale of the shares will be paid to the directors. We are making this Offering without the involvement of underwriters or broker-dealers.

|

|

| Offering Price Per share |

|

| Commissions |

| Proceeds to Company After Expenses if 25% of the shares are sold |

|

| Proceeds to Company After Expenses if 50% of the shares are sold |

|

| Proceeds to Company After Expenses if 75% of the shares are sold |

|

| Proceeds to Company After Expenses if 100% of the shares are sold |

| |||||

| Common Stock |

| $ | 3.00 |

|

| Not Applicable |

| $ | 3,750,000 |

|

| $ | 7,500,000 |

|

| $ | 11,250,000 |

|

| $ | 15,000,000 |

|

| Totals |

| $ | 3.00 |

|

| Not Applicable |

| $ | 3,750,000 |

|

| $ | 7,500,000 |

|

| $ | 11,250,000 |

|

| $ | 15,000,000 |

|

We may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that has not received enough proceeds from the offering to begin operations and has no market for its shares.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For more information, see the prospectus section titled “Emerging Growth Company Status” starting on page 7.

The Company is currently in an early stage of growth and has little revenues to date and there can be no assurance that the company will be successful in furthering its operations and/or revenues. Persons should not invest unless they can afford to lose their entire investment.

Investing in our securities involves a high degree of risk. You should purchase these shares of common stock only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

| 3 |

PART I - INFORMATION REQUIRED IN PROSPECTUS

| 4 |

| Table of Contents |

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this prospectus, references to the “Company”, “we”, “our”, “us”, “Folkup Development” refer to Folkup Development Inc., unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

OUR COMPANY

Our Corporate History and Background

The Company was incorporated on July 5, 2016, under the laws of the State of Nevada.

On June 26, 2020, Milena Topolac Tomovic, the then major shareholder, entered into a Stock Purchase Agreement with Hak Yiu Ng, wherein Milena Topolac Tomovic sold 3,000,000 shares of the Company’s common stock, then representing approximately 78.9% of all issued and outstanding shares of common stock, to Mr. Ng.

Milena Topolac Tomovic served as President, Secretary, Treasurer and a director from July 5, 2016 until her resignation on July 6, 2020. Effective from July 6, 2020, Milena Topolac Tomovic resigned as a director, and from the offices of President, Secretary and Treasurer of, the Company. Immediately prior to such resignation, Ms. Topolac Tomovic, as the sole member of the board of directors at such time, appointed Hak Yiu Ng as a director, and as President, Secretary and Treasurer of the Company. Mr. Ng was the Company’s sole officer and director until November 25, 2020.

On November 25, 2020, Hak Yiu Ng resigned as Secretary and was appointed Chairman of the Board of Directors of the Company. On November 25, 2020, Huang Zhen Kun was appointed Chief Executive Officer and a Director; Lau Kit Yan, Mark was appointed Chief Financial Officer, Secretary and a Director; Poon To Ming was appointed Chief Operating Officer; Wong Ka Hing Andrew was appointed Chief Marketing Officer; and Xu Ming was appointed Chief Technology Officer.

The Company does not have any current plans, arrangements, discussions or intentions, whether written or oral, to engage in a merger or acquisition with an identified or unidentified company or person to be used as a vehicle for a private company to become a reporting company.

From inception until we completed our reverse acquisition of Powertech Holdings, the principal business of the Company was a plan to establish a business to lease and sell certain items or means of what we referred to as eco-transport. These items are commonly known under the names: a Segway, a gyro-scooter or a self-balanced two-wheeled scooter, a self-balanced mono-wheeled scooter and a two-wheeled hoverboard. We expected our products and services to be demanded by establishments or enterprises or events, for instance, conferences held in large facilities, or touristic agencies and other establishments or organizations that face the problem of covering large distances by employees or visitors of theirs.

| 5 |

| Table of Contents |

Recent Developments

Share Exchange Agreement

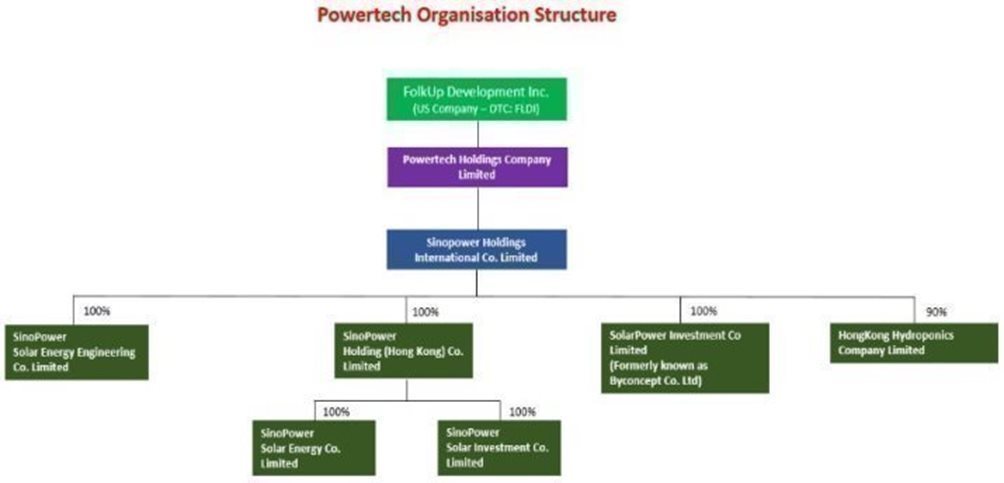

On November 25, 2020, the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”), by and among the Company, Powertech Holdings Company Limited, a British Virgin Islands corporation (“Powertech Holdings”), and the holders of common shares of Powertech Holdings. The holders of the common stock of Powertech Holdings consisted of 48 stockholders.

Under the terms and conditions of the Share Exchange Agreement, the Company offered, sold and issued 6,000,000 shares of common stock in consideration for all the issued and outstanding shares in Powertech Holdings. Hak Yiu Ng, the Company’s sole officer and director, is the beneficial holder of 4,000,000 common shares, or 76.8%, of the issued and outstanding shares of Powertech Holdings. The effect of the issuance of the 6,000,000 shares issued under the Share Exchange Agreement is that the former shareholders of Powertech holdings acquired 61.2% of the issued and outstanding shares of common stock of the Company.

Immediately prior to the closing of the transactions under the Share Exchange Agreement, Mr. Ng was the holder of 3,000,000 shares of common stock, or 78.9%, of the issued and outstanding shares of common stock of the Company. Giving effect to the closing of the transactions under the Share Exchange Agreement, Mr. Ng acquired 4,607,408 shares of common stock of the Company, by virtue of his 76.8% beneficial ownership of Powertech Holdings. The remaining 47 common shareholders of Powertech Holdings acquired 1,392,592 shares of common stock under the Share Exchange Agreement, by virtue of their aggregate of 23.2% beneficial ownership of Powertech Holdings.

Giving effect to the transactions under the Share Exchange Agreement, Mr. Ng is now the beneficial holder of 7,607,408 shares of common stock, or 77.6%, of the issued and outstanding shares of common stock of Powertech Holdings.

As a result of the share exchange, Powertech Holdings is now a wholly-owned subsidiary of the Company.

The share exchange transaction with Powertech Holdings was treated as a reverse acquisition, with Powertech Holdings as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this Form 8-K to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Powertech Holdings.

On November 25, 2020, the Company’s Board of Directors approved a change in its fiscal year end from November 30 to December 31, effective beginning with the Company’s next fiscal year, which will now begin on January 1, 2021 and end on December 31, 2021 (the “New Fiscal Year”).

Exclusive Patent License Agreements

Effective November 25, 2020, the Company entered into an Exclusive Patent License Agreement with Fushan Baohua Renewable Energy Co Ltd (PRC) (“Fushan Baohua”), an entity duly formed and existing under the laws of the People’s Republic of China (the “Fushan Baohua License Agreement”), pursuant to which the Company has licensed from Fushan Baohua the patents for the technology underlying Liftable Soar Pergola, Expandable Soar Pergola and Foldable Solar Pergola products of the Company. The term of the Fushan Baohua License Agreement is for the terms of the underlying patents and covers all countries and territories in the world. The Liftable Soar Pergola patent expires on August 5, 2029, the Expandable Soar Pergola patent expires on August 2, 2029, and the Foldable Solar Pergola patent expires on August 2, 2029. The Company paid consideration of $10.00 for entering into the Fushan Baohua License Agreement. Fushan Baohua is controlled by Hak Yiu Ng, the President, Chairman of the Board of Directors and majority stockholder of the Company.

Effective November 25, 2020, the Company entered into an Exclusive Patent License Agreement with PowerWatt Engineering Co. Ltd. (“PowerWatt Engineering”), an entity duly formed an existing under the laws of Hong Kong, (the “PowerWatt Engineering License Agreement”), pursuant to which the Company has licensed from PowerWatt Engineering the patents for the technology underlying the Foldable Solar Pergola, The Solar Photovoltaic Sunlight House, and RPP Ballast Solar System products of the Company. The term of the PowerWatt Engineering License Agreement is for the terms of the underlying patents and covers all countries and territories in the world. The Foldable Solar Pergola patent expires on November 26, 2028, the Solar Photovoltaic Sunlight House patent registered in China expires on March 7, 2029, and registered in Hong Kong expires on August 2, 2027, and the RPP Ballast Solar System registered in China expires on March 7, 2029, and registered in Hong Kong expires on August 5, 2027. The Company paid consideration of $10.00 for entering into the PowerWatt Engineering License Agreement. PowerWatt Engineering is controlled by Hak Yiu Ng, the President, Chairman of the Board of Directors and majority stockholder of the Company.

| 6 |

| Table of Contents |

Certain Information about this Offering

|

|

| Offering Price Per share |

|

| Commissions |

| Proceeds to Company After Expenses if 25% of the shares are sold |

|

| Proceeds to Company After Expenses if 50% of the shares are sold |

|

| Proceeds to Company After Expenses if 75% of the shares are sold |

|

| Proceeds to Company After Expenses if 100% of the shares are sold |

| |||||

| Common Stock |

| $ | 3.00 |

|

| Not Applicable |

| $ | 3,750,000 |

|

| $ | 7,500,000 |

|

| $ | 11,250,000 |

|

| $ | 15,000,000 |

|

| Totals |

| $ | 3.00 |

|

| Not Applicable |

| $ | 3,750,000 |

|

| $ | 7,500,000 |

|

| $ | 11,250,000 |

|

| $ | 15,000,000 |

|

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. While our shares of common stock are quoted on the Pink tier of the OTC Markets Group, Inc. (the “OTC Markets”), our common stock is not traded or on any exchange. There can be no assurance that any market for our stock will develop on the OTC Markets or that our common stock will ever be quoted on a stock exchange.

We are a “Smaller Reporting Company”

We are a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have (i) a public float of less than $250,000,000 or (ii) annual revenues of less than $100,000,000 during the most recently completed fiscal year and no public float, or a public float of less than $700 million. As a “smaller reporting company,” the disclosure we will be required to provide in our SEC filings are less than it would be if we were not considered a “smaller reporting company.” Specifically, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002 requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being permitted to provide two years of audited financial statements in annual reports rather than three years. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

Emerging Growth Company

We are an ‘‘emerging growth company’’ within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Risks Related to this Offering and our Common Stock – We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors” on page 10 of this prospectus.

Our fiscal year end is December 31. Our audited financial statements for the quarter ended March 31, 2021, were prepared assuming that we will continue our operations as a going concern. Our accumulated loss for the period from March 15, 2016 (inception) to the fiscal quarter ended March 31, 2021 was $1,936,988. For the three months ended March 31, 2021, we earned revenues of $796,301.

Due to the uncertainty of our ability to meet our current operating and capital expenses, our independent auditors have included a going concern opinion in their report on our audited financial statements for the period ended December 31, 2020. The notes to our financial statements contain additional disclosure describing the circumstances leading to the issuance of a going concern opinion by our auditors.

| 7 |

| Table of Contents |

The Offering

| Securities offered: |

| We are offering up to 5,000,000 of our common stock. |

|

| ||

| Offering price: |

| We will offer and sell our shares of common stock at a fixed price of $3.00 per share. |

|

| ||

| Shares outstanding prior to offering: |

| 9,800,000 |

|

|

|

|

| Shares outstanding after offering: | 14,800,000 | |

|

| ||

| Market for the common shares: |

| There is a limited public market for our shares. Our common stock is quoted on the OTC Pink tier of the OTC Markets Group, Inc. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. |

|

|

| |

| Use of proceeds: |

| We intend to use the net proceeds from the sale of our 5,000,000 shares (after deducting estimated offering expenses payable by us) for professional fees, further development of our business. See “Use of Proceeds” on page 20 for more information on the use of proceeds. |

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the fiscal year ended December 31, 2020, and our unaudited financial statements for the three months ended March 31, 2021. Our working capital balance at March 31, 2021 was $3,114,392.

|

|

| For the Fiscal Year December 31, 2020 |

| |

|

|

|

|

| |

| Financial Summary (Audited) |

|

|

| |

| Cash and Deposits |

| $ | 347,751 |

|

| Total Assets |

|

| 3,324,778 |

|

| Total Liabilities |

|

| 210,386 |

|

| Total Stockholder’s Equity (Deficit) |

| $ | (1,588,513 | ) |

| 8 |

| Table of Contents |

|

|

| For the Fiscal Year ended December 31, 2020 |

| |

|

|

|

|

| |

| Consolidated Statements of Expenses and Net Loss |

|

|

| |

| Total Operating Expenses |

| $ | 1,465,988 |

|

| Net Loss for the Period |

| $ | (907,225 | ) |

|

|

| For the Fiscal Quarter ended March 31, 2021 |

| |

|

|

|

|

| |

| Financial Summary (Unaudited) |

|

|

| |

| Cash and Deposits |

| $ | 347,751 |

|

| Total Assets |

|

| 3,324,778 |

|

| Total Liabilities |

|

| 210,386 |

|

| Total Stockholder’s Equity (Deficit) |

| $ | (1,588,513 | ) |

|

|

| For the three months ended November 30, 2019 |

| |

|

|

|

|

| |

| Total Operating Expenses |

| $ | 9,136 |

|

| Net Loss for the Period |

| $ | (35,214 | ) |

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the years ended December 31, 2020 and 2019, and our unaudited financial statements for the three months ended March 31, 2021, were prepared assuming that we will continue our operations as a going concern. Our wholly-owned subsidiary, Powertech Holdings, was incorporated on September 21, 2020, and has net revenues of $796,301, and a net loss of $35,214, at March 31, 2021. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

| 9 |

| Table of Contents |

If our estimates related to future expenditures are erroneous or inaccurate, our business will fail and you could lose your entire investment.

Our success is dependent in part upon the accuracy of our management’s estimates of our future cost expenditures for legal and accounting services (including those we expect to incur as a publicly reporting company), for website and mobile application marketing and development expenses, and for administrative expenses, which management estimates to be approximately $2,000,000 over the next twelve months. If such estimates are erroneous or inaccurate, or if we encounter unforeseen costs, we may not be able to carry out our business plan, which could result in the failure of our business and the loss of your entire investment.

If we are not able to develop our business as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your investment.

Our wholly-owned subsidiary, Powertech Holdings, was incorporated on September 21, 2020, and our net loss for the year ended December 31, 2019 was $598,941, and our comprehensive loss for the year ended December 31, 2019 was $602,843. We have a limited number of customers, and we have earned limited revenues to date. Our business prospects are difficult to predict because of our limited operating history, and unproven -marketing strategy. Our primary business activities will be focused on selling our renewable energy products. Although we believe that our business has significant profit potential, we may not attain profitable operations and our management may not succeed in realizing our business objectives. If we are not able to develop our business as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your entire investment.

Potential disputes related to the existing agreement pursuant to which we purchased the intellectual property rights underlying our business could result in the loss of rights that are material to our business.

The acquisition of the intellectual property of Powertech Holdings, by way of the Share Exchange Agreement, by and among the Company, Powertech Holdings, and the holders of common shares of Powertech Holdings, is of critical importance to our business and involves complex legal, business, and accounting issues. Although we have clear title to and no restrictions to use our intellectual property, disputes may arise regarding the Share Exchange Agreement, including but not limited to, the breaches of representations or other interpretation-related issues. If disputes over intellectual property that we have acquired under the Share Exchange Agreement prevent or impair our ability to maintain our current intellectual property, we may be unable to successfully develop and commercialize our business.

We expect to suffer losses in the immediate future that may cause us to curtail or discontinue our operations.

We expect to incur operating losses in future periods. These losses will occur because have limited revenues to offset the expenses associated with the development of brand and our business operations, generally. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate meaningful revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will almost certainly fail.

We may not be able to execute our business plan or stay in business without additional funding.

Our ability to generate future operating revenues depends in part on whether we can obtain the financing necessary to implement our business plan. We will likely require additional financing through the issuance of debt and/or equity in order to establish profitable operations, and such financing may not be forthcoming. As widely reported, the global and domestic financial markets have been extremely volatile in recent months. If such conditions and constraints continue or if there is no investor appetite to finance our specific business, we may not be able to acquire additional financing through credit markets or equity markets. Even if additional financing is available, it may not be available on terms favorable to us. At this time, we have not identified or secured sources of additional financing. Our failure to secure additional financing when it becomes required will have an adverse effect on our ability to remain in business.

| 10 |

| Table of Contents |

We process, store and use personal information and other data, which subjects us to governmental regulations and other legal obligations related to privacy. Our actual or perceived failure to comply with such obligations could harm our business.

We receive, store and process personal information and other user data, including credit card information for certain users. There are numerous federal, state and local laws around the world regarding privacy and the storing, sharing, use, processing, disclosure and protection of personal information and other user data, the scope of which are changing, subject to differing interpretations, and may be inconsistent between countries or conflict with other rules. We generally comply with industry standards and are subject to the terms of our privacy policies and privacy-related obligations to third parties (including, in certain instances, voluntary third-party certification bodies). It is possible that these obligations may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. Any failure or perceived failure by us to comply with our privacy policies, our privacy-related obligations to users or other third parties, or our privacy-related legal obligations, or any compromise of security that results in the unauthorized release or transfer of personally identifiable information or other user data, may result in governmental enforcement actions, litigation or negative publicity and could cause our users and advertisers to lose trust in us, which could have an adverse effect on our business. Additionally, if third parties with whom we work, such as advertisers, vendors or developers, violate applicable laws or our policies, such violations may also put our users’ information at risk and could have an adverse effect on our business.

We operate in a highly competitive industry and may face increased competition.

We operate in the renewable energy industry and face strong competition in terms of distribution, brand recognition, taste, quality, price, availability, and product positioning. The market is highly fragmented, and the resources of our competitors may increase due to mergers, consolidations or alliances, and we may face new competitors in the future. Our main competitors include approximately 20 competitors in Hong Kong, and we expect more competitors in the future, some of which we expect will be supported by government subsidies. In addition, as we seek to expand our market share and to penetrate into new markets, we may have difficulty competing. From time to time in response to competitive and customer pressures or to maintain market share, we may be forced to reduce our selling prices or increase or reallocate spending on marketing, advertising, or promotions in order to compete. These types of actions could decrease our profit margins. Such pressures may also restrict our ability to increase our selling prices in response to raw material and other cost increases. In light of the strong competition that we currently face, and which may intensify in the future, there can be no assurance that we will be able to increase the sales of our products or even maintain our past levels of sales, or that our profit margins will not be reduced. If we are unable to increase our product sales or to maintain our past levels of sales and profit margins, our business, financial condition, results of operations and prospects may be materially and adversely affected.

Our potential customers will require a high degree of reliability in the delivery of our products and services, and if we cannot meet their expectations for any reason, demand for our products and services will suffer.

Our success depends in large part on our ability to deliver highly functional products and generally error-free services, and a satisfactory experience for our customers. To achieve these objectives, we depend on the quality, performance and scalability of our products and services, the responsiveness of our technical support and the capacity, reliability and security of our operations. We also depend on third parties over which we have no control.

Technology changes rapidly in our business and if we fail to anticipate or successfully implement new technologies or the manner in which use our products and services, the quality, timeliness and competitiveness of our products and services will suffer.

Rapid technology changes in our industry require us to anticipate, sometimes years in advance, which technologies we must implement and take advantage of in order to make our products and services competitive in the market. Therefore, we must start our product development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, or our competition may be able to achieve them more quickly and effectively than we can. In either case, our products and services may be technologically inferior to our competitors’, less appealing to consumers, or both. If we cannot achieve our technology goals within the original development schedule of our products and services, then we may delay their release until these technology goals can be achieved, which may delay or reduce revenue and increase our development expenses. Alternatively, we may increase the resources employed in research and development in an attempt to accelerate our development of new technologies, either to preserve our product or service launch schedule or to keep up with our competition, which would increase our development expenses. Any such failure to adapt to, and appropriately allocate resources among, emerging technologies would harm our competitive position, reduce our market share and significantly increase the time we take to bring our product to market.

| 11 |

| Table of Contents |

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Successful promotion of our brand and our ability to attract customers depends largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. It is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

Our potential customers will require a high degree of reliability in the delivery of our services, and if we cannot meet their expectations for any reason, demand for our products and services will suffer.

Our success depends in large part on our ability to assure generally error-free services, uninterrupted operation of our network and software infrastructure, and a satisfactory experience for our customers’ end users when they use Internet-based communications services. To achieve these objectives, we depend on the quality, performance and scalability of our products and services, the responsiveness of our technical support and the capacity, reliability and security of our network operations. We also depend on third parties over which we have no control. For example, our ability to serve our customers is based solely on our network access agreement with one service provider and on that service provider’s ability to provide reliable Internet access. Due to the high level of performance required for critical communications traffic, any failure to deliver a satisfactory experience to end users, whether or not caused by our own failures could reduce demand for our products and services.

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Successful promotion of our brand and our ability to attract customers depends largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. It is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

We operate in a highly competitive industry and may face increased competition.

We operate in the renewable energy industry and face strong competition in terms of distribution, brand recognition, taste, quality, price, availability, and product positioning. The market is highly fragmented, and the resources of our competitors may increase due to mergers, consolidations or alliances, and we may face new competitors in the future. Our main competitors include approximately 20 competitors in Hong Kong, and we expect more competitors in the future, some of which we expect will be supported by government subsidies. In addition, as we seek to expand our market share and to penetrate into new markets, we may have difficulty competing. From time to time in response to competitive and customer pressures or to maintain market share, we may be forced to reduce our selling prices or increase or reallocate spending on marketing, advertising, or promotions in order to compete. These types of actions could decrease our profit margins. Such pressures may also restrict our ability to increase our selling prices in response to raw material and other cost increases. In light of the strong competition that we currently face, and which may intensify in the future, there can be no assurance that we will be able to increase the sales of our products or even maintain our past levels of sales, or that our profit margins will not be reduced. If we are unable to increase our product sales or to maintain our past levels of sales and profit margins, our business, financial condition, results of operations and prospects may be materially and adversely affected.

| 12 |

| Table of Contents |

If demand for solar energy projects does not continue to grow or grows at a slower rate than we anticipate, our business will suffer.

Our future success depends on continued demand for solar energy solutions and the ability of solar equipment vendors to meet this demand. The solar industry is an evolving industry that has experienced substantial changes in recent years, and we cannot be certain that consumers and businesses will adopt solar energy as an alternative energy source at levels sufficient to grow our business. If demand for solar energy fails to develop sufficiently, demand for our products will decrease, which would have an adverse impact on our ability to increase our revenue and grow our business.

The interruption of the flow of components and materials from international vendors could disrupt our supply chain, including as a result of the imposition of additional duties, tariffs and other charges on imports and exports.

We purchase most of our components and materials from China through arrangements with various vendors. Political, social or economic instability in these regions, or in other regions where our products are made, could cause disruptions in trade, including exports to Hong Kong. Other events that could also cause disruptions to our supply chain, no matter from where we obtain components and materials, include:

|

| • | the imposition of additional trade law provisions or regulations; |

|

| • | quotas imposed by bilateral trade agreements; |

|

| • | foreign currency fluctuations; |

|

| • | natural disasters; |

|

| • | public health issues and epidemic diseases, their effects (including any disruptions they may cause) or the perception of their effects, such as the ongoing novel coronavirus outbreak; |

|

| • | theft; |

|

| • | restrictions on the transfer of funds; |

|

| • | the financial instability or bankruptcy of vendors; and |

|

| • | significant labor disputes, such as dock strikes. |

We cannot predict whether the countries in which our components and materials are sourced, or may be sourced in the future, will be subject to new or additional trade restrictions imposed by non-Hong Kong governments, including the likelihood, type or effect of any such restrictions. Trade restrictions, including new or increased tariffs or quotas, border taxes, embargoes, safeguards and customs restrictions against certain components and materials, as well as labor strikes and work stoppages or boycotts, could increase the cost or reduce or delay the supply of components and materials available to us and adversely affect our business, financial condition or results of operations.

The loss of the services of Hak Yiu Ng, our sole director and officer, and majority shareholder, or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services.

We are highly dependent on Hak Yiu Ng, who is our sole director and officer, and beneficially owns approximately 77.6% of our issued and outstanding shares of common stock. The development of our business will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officers who are developing our business, and on our ability to identify and retain competent consultants and employees with the skills required to execute our business objectives. The loss of the services of Mr. Ng or our failure to timely identify and retain competent personnel would negatively impact our ability to develop our business and license our brand, which could adversely affect our financial results and impair our growth.

Our failure to protect our intellectual property and proprietary technology may significantly impair our competitive advantage.

Our success and ability to compete depends in large part upon protecting our proprietary technology. We rely on a combination of patent, trademark and trade secret protection, nondisclosure and nonuse agreements to protect our proprietary rights. The steps we have taken may not be sufficient to prevent the misappropriation of our intellectual property, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. The patent and trademark law and trade secret protection may not be adequate to deter third party infringement or misappropriation of our patents, trademarks and similar proprietary rights.

| 13 |

| Table of Contents |

We may in the future initiate claims or litigation against third parties for infringement of our proprietary rights in order to determine the scope and validity of our proprietary rights or the proprietary rights of our competitors. These claims could result in costly litigation and the diversion of our technical and management personnel.

We may face costly intellectual property infringement claims, the result of which would decrease the amount of cash we would anticipate to operate and complete our business plan.

We anticipate that from time to time we will receive communications from third parties asserting that we are infringing certain copyright, trademark and other intellectual property rights of others or seeking indemnification against alleged infringement. If anticipated claims arise, we will evaluate their merits. Any claims of infringement brought of third parties could result in protracted and costly litigation, damages for infringement, and the necessity of obtaining a license relating to one or more of our products or current or future technologies, which may not be available on commercially reasonable terms or at all. Litigation, which could result in substantial cost to us and diversion of our resources, may be necessary to enforce our patents or other intellectual property rights or to defend us against claimed infringement of the rights of others. Any intellectual property litigation and the failure to obtain necessary licenses or other rights could have a material adverse effect on our business, financial condition and results of operations.

We incur costs associated with SEC reporting compliance, which may significantly affect our financial condition.

The Company made the decision to become an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys’ fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $50,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

We may be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with our Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. No assurance can be given that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year-end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $250 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $250 million.

| 14 |

| Table of Contents |

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We face risks related to the Novel Coronavirus (COVID-19) which could significantly disrupt our research and development, operations, sales, and financial results.

Our business will be adversely impacted by the effects of the Novel Coronavirus (COVID-19). In addition to global macroeconomic effects, the Novel Coronavirus (COVID-19) outbreak and any other related adverse public health developments will cause disruption to our operations and sales activities. Our third-party vendors, third-party distributors, and our customers have been and will be disrupted by worker absenteeism, quarantines and restrictions on employees’ ability to work, office and factory closures, disruptions to ports and other shipping infrastructure, border closures, or other travel or health-related restrictions. Depending on the magnitude of such effects on our activities or the operations of our third-party vendors and third-party distributors, the supply of our products will be delayed, which could adversely affect our business, operations and customer relationships. In addition, the Novel Coronavirus (COVID-19) or other disease outbreak will in the short-run and may over the longer term adversely affect the economies and financial markets of many countries, resulting in an economic downturn that will affect demand for our products and services and impact our operating results. There can be no assurance that any decrease in sales resulting from the Novel Coronavirus (COVID-19) will be offset by increased sales in subsequent periods. Although the magnitude of the impact of the Novel Coronavirus (COVID-19) outbreak on our business and operations remains uncertain, the continued spread of the Novel Coronavirus (COVID-19) or the occurrence of other epidemics and the imposition of related public health measures and travel and business restrictions will adversely impact our business, financial condition, operating results and cash flows. In addition, we have experienced and will experience disruptions to our business operations resulting from quarantines, self-isolations, or other movement and restrictions on the ability of our employees to perform their jobs that may impact our ability to develop and design our products and services in a timely manner or meet required milestones or customer commitments.

It will be extremely difficult to acquire jurisdiction of and enforce liabilities against our officers, directors and assets outside the United States.

Substantially all of our assets are currently located outside of the United States. Additionally, our sole director and officer resides outside of the United States, in Hong Kong. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws. Moreover, we have been advised Hong Kong and the PRC do not have a treaty providing for the reciprocal recognition and enforcement of judgments of courts with the United States. Further, there are no extradition treaties now in effect between the United States and, on the other hand, Hong Kong and China, which would permit effective enforcement of criminal penalties of the Federal securities laws.

| 15 |

| Table of Contents |

RISKS ASSOCIATED WITH OUR SECURITIES

Our shares of common stock presently has a limited trading market, with no substantive daily trading volume, and the price may not reflect our value and there can be no assurance that there will be an active market for our shares of common stock either now or in the future.

Although our common stock is quoted on the OTC Markets, our shares of common stock trade only nominally and the price of our common stock, if traded, may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Market liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result holders of our securities may not find purchasers our securities should they to sell securities held by them. Consequently, our securities should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite period of time.

If a more active market should develop, the price of our shares of common stock may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in our securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

We expect to experience volatility in our stock price, which could negatively affect stockholders’ investments.

Although our common stock is quoted on the OTCQB under the symbol “FLDI”, there is a limited public market for our common stock. No assurance can be given that an active market will develop or that a stockholder will ever be able to liquidate its shares of common stock without considerable delay, if at all. Many brokerage firms may not be willing to effect transactions in the securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price and liquidity of our common stock.

In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. Due to the volatility of our common stock price, we may be the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources.

Stockholders should also be aware that, according to SEC Release No. 34-29093, the market for “penny stock”, such as our common stock, has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the future volatility of our share price.

| 16 |

| Table of Contents |

Because there is no escrow, trust or similar account, the offering proceeds could be seized by creditors or by a trustee in bankruptcy, in which case investors would lose their entire investment.

Any funds that we raise from our offering of 5,000,000 shares of common stock will be immediately available for our use and will not be returned to investors. We do not have any arrangements to place the funds received from our offering of 5,000,000 shares of common stock in an escrow, trust or similar account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscription funds. As such, it is possible that a creditor could attach your subscription funds which could preclude or delay the return of money to you. If that happens, you will lose your investment and your funds will be used to pay creditors.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We are selling this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares. We intend to sell our shares through our Hak Yiu Ng, our Chief Executive Officer and sole director, who will receive any commission. He will offer the shares to friends, family members, and business associates, however, there is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares and we receive the proceeds from this offering, we may have to seek alternative financing to implement our business plan.

| 17 |

| Table of Contents |

If we issue additional shares in the future, whether in connection with a financing or in exchange for services or rights, it will result in the dilution of our existing stockholders.

Our articles of incorporation authorize the issuance of up to 75,000,000 shares of common stock with a par value of $0.001 per share. As of the date of this Prospectus, the Company had 9,800,000 shares of common stock issued and outstanding. Accordingly, we may issue up to an additional 65,200,000 shares of common stock. Our Board of Directors may choose to issue some or all of such shares to acquire one or more companies or properties, to fund our overhead and general operating requirements and in exchange for services rendered to the Company. Such issuances may not require the approval of our stockholders. We have previously issued shares of our common stock in exchange for services provided to the Company and for certain rights, including as consideration for intellectual property rights. Any future issuances may reduce the book value per share and may contribute to a reduction in the market price of the outstanding shares of our common stock. If we issue any such additional shares in the future, such issuance will reduce the proportionate ownership and voting power of all current stockholders.

As an emerging growth company within the meaning of the Securities Act, we may utilize certain modified disclosure requirements, and we cannot be certain if these reduced requirements will make our common stock less attractive to investors.

We are an emerging growth company, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute compensation not previously approved. We have in this prospectus utilized, and we may in future filings with the SEC continue to utilize, the modified disclosure requirements available to emerging growth companies. As a result, our stockholders may not have access to certain information they may deem important.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to not “opt out” of this exemption from complying with new or revised accounting standards, and, therefore, we are permitted to adopt new or revised accounting standards at the time private companies adopt the new or revised accounting standard and are permitted to do so until such time that we either (i) irrevocably elect to “opt out” of such extended transition period or (ii) no longer qualify as an emerging growth company.

We could remain an emerging growth company until the earliest to occur of (i) the last day of the fiscal year during which we had total annual gross revenues of at least $1.07 billion (as indexed for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt, or (iv) the date on which we are deemed to be a “large accelerated filer,” as defined under the Exchange Act.

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

The Company does not intend to seek registration or qualification of its shares of common stock the subject of this offering in any State or territory of the United States. Aside from a “secondary trading” exemption, other exemptions under state law and the laws of US territories may be available to purchasers of the shares of common stock sold in this offering,

| 18 |

| Table of Contents |

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of us.

Though not now, we may be or in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of us from doing so if it cannot obtain the approval of our board of directors.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.