Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Trinseo S.A. | tm2122546d1_ex99-1.htm |

| 8-K - FORM 8-K - Trinseo S.A. | tm2122546d1_8k.htm |

Exhibit 99.2

ΠTrademark of Trinseo S.A. or its affiliates Acquisition of Aristech Surfaces July 19, 2021

2 Presenters & Disclosure Rules Presenters • Frank Bozich, President & CEO • David Stasse, Executive Vice President & CFO • Andy Myers, Director of Investor Relations Disclosure Rules Cautionary Note on Forward - Looking Statements. This presentation may contain forward - looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underl yin g assumptions and other statements, which are not statements of historical facts or guarantees or assurances of future performa nce . Forward - looking statements may be identified by the use of words like "expect," "anticipate," "intend," "forecast," "outlook," " will," "may," "might," "see," "tend," "assume," "potential," "likely," "target," "plan," "contemplate," "seek," "attempt," "should," "c ould," "would" or expressions of similar meaning. Forward - looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding the estimated and future results of operations, expected margins, growth potential and synergies relating to the acquisition of Aristech Surfaces LLC (“Aristech”), and the t imi ng and completion of the acquisition, our business, the economy and other future conditions. Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to pr edi ct. Factors that might cause such a difference include, but are not limited to, our ability to successfully complete the Aristech acquisi tio n or meet the conditions to closing, including regulatory approvals, our ability to successfully integrate Aristech and its employ ees , to generate expected cost and revenue synergies and expected margins, and to profitably grow the Aristech business, as well as those factors discussed in our Annual Report on Form 10 - K, under Part I, Item 1A — "Risk Factors" and elsewhere in our other reports, filings and furnishings made with the U.S. Securities and Exchange Commission from time to time. As a result of thes e o r other factors, our actual results may differ materially from those contemplated by the forward - looking statements. Therefore, we caution you against relying on any of these forward - looking statements. The forward - looking statements included in this press release are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward - looking stateme nt as a result of new information, future events or otherwise, except as otherwise required by law.

3 Disclosure (continued) Use of non - GAAP measures and Aristech financial information In addition to using standard measures of performance and liquidity that are recognized in accordance with accounting princip les generally accepted in the United States of America (“GAAP”), we use additional measures of income excluding certain GAAP item s (“non - GAAP measures”), such as Adjusted EBITDA and Adjusted EBITDA Margin and measures of liquidity excluding certain GAAP items, such as Free Cash Flow and Free Cash Flow Conversion. We believe these measures are useful for investors and management in evaluating business trends and performance each period. These measures are also used to manage our business and assess current period profitability, as well as to provide an appropriate basis to evaluate the effectiveness of our pric ing strategies. Such measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity, as applicable. Adjusted EBITDA is a non - GAAP financial performance measure, which we define as income from continuing operations before interest expense, net; income tax provision; depreciation and amortization expense; loss on extinguishment of long - term debt; as set impairment charges; gains or losses on the dispositions of businesses and assets; restructuring charges; acquisition related cos ts and benefits, and other items. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenue. In doing so, we are providing management, investors, and credit rating agencies with an indicator of our ongoing performance and business trends, removing the impact of transactions and events that we would not consider a part of our core operations. Free Cash Flow is defined as cash from operating activities, less capital expenditures. Free Cash Flow Conversion is defined as Adjusted EBITDA less Capital Expenditures, divided by Adjusted EBITDA. We believe that Free Cash Flow and Free Cash Flow Conversion provide an indicator of the Company’s ongoing ability to generate cash through core operations, as it excludes the ca sh impacts of various financing transactions as well as cash flows from business combinations that are not considered organic in nature. We also believe that these measures provide management and investors with useful analytical indicators of our ability to service our indebtedness, pay dividends (when declared), and meet our ongoing cash obligations. On July 19, 2021, Trinseo announced its entry into an agreement with SK AA Holdings, LLC, an affiliate of Falcon Private Holdings , LLC, to acquire Aristech Surfaces LLC, a leading North America manufacturer and global provider of polymethyl methacrylates (PMMA) continuous cast and solid surface sheets, serving the wellness, architectural, transportation and industrial markets. The financial information of Aristech provided herein is unaudited and is derived from information provided to Trinseo by Aristec h management in conjunction with ongoing due diligence procedures, including projected financial information of Aristech, for w hic h the accompanying projected GAAP information was not provided to Trinseo management as part of our due diligence procedures. This information has not been conformed to the accounting policies followed by Trinseo. Further, the definitions of performan ce and liquidity measures of Aristech, such as Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, and Free Cash Flow Conversion, may not align with the definitions of Trinseo. As a result, it may be difficult to use these financial measures t o c ompare the performance of Aristech and Trinseo’s performance.

4 Third Step in Major Transformation to Become a Specialty Materials & Sustainable Solutions Provider Accelerates Growth in Asia Pacific Market and Drives Supply Chain Optimization Accretive to Earnings, Margins and Cash Flow in Year 1 Expansion into Wellness, Niche Leisure and Architectural Markets and Enables Full Offering of PMMA Sheet Technologies Continued Commitment to Strong Balance Sheet Acquisition Rationale

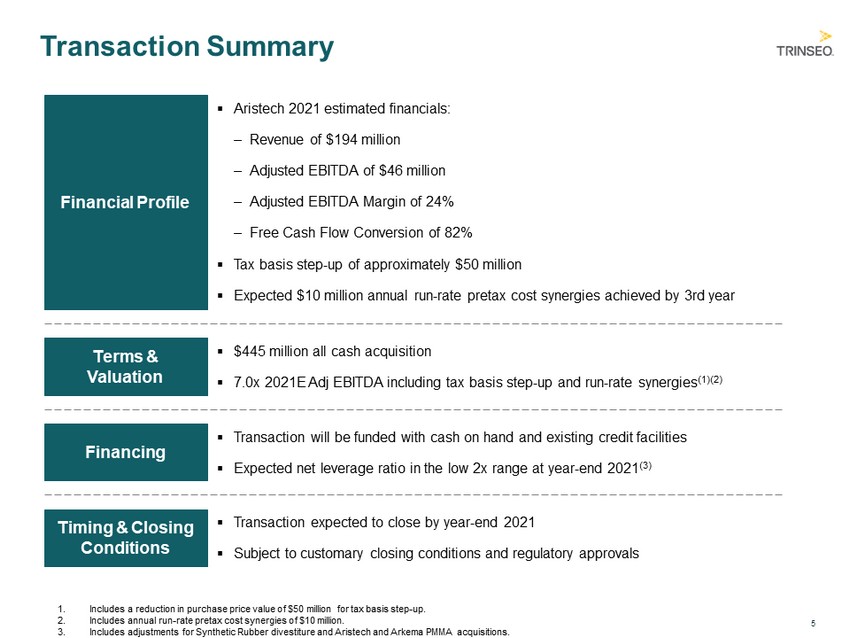

5 Financial Profile Terms & Valuation Financing Timing & Closing Conditions ▪ $445 million all cash acquisition ▪ 7.0x 2021E Adj EBITDA including tax basis step - up and run - rate synergies (1)(2) ▪ Transaction will be funded with cash on hand and existing credit facilities ▪ Expected net leverage ratio in the low 2x range at year - end 2021 (3) ▪ Transaction expected to close by year - end 2021 ▪ Subject to customary closing conditions and regulatory approvals ▪ Aristech 2021 estimated financials: – Revenue of $194 million – Adjusted EBITDA of $46 million – Adjusted EBITDA Margin of 24% – Free Cash Flow Conversion of 82% ▪ Tax basis step - up of approximately $50 million ▪ Expected $10 million annual run - rate pretax cost synergies achieved by 3rd year 1. Includes a reduction in purchase price value of $50 million for tax basis step - up. 2. Includes annual run - rate pretax cost synergies of $10 million. 3. Includes adjustments for Synthetic Rubber divestiture and Aristech and Arkema PMMA acquisitions. Transaction Summary

6 Leading producer of continuous cast acrylic sheet, operating 4 of 5 production lines in North America Specialized applications in niche high - end and high - margin markets, including wellness market, with sustainable, long - term growth; high correlation with building & construction High quality and highly differentiated continuous cast technology and material manufacturing process Strong track record of innovation and deep pipeline for continued growth Loyal customer relationships and powerful supply chain partnerships Acquisition Highlights Low capital expenditures leads to excellent margin profile and free cash flow conversion

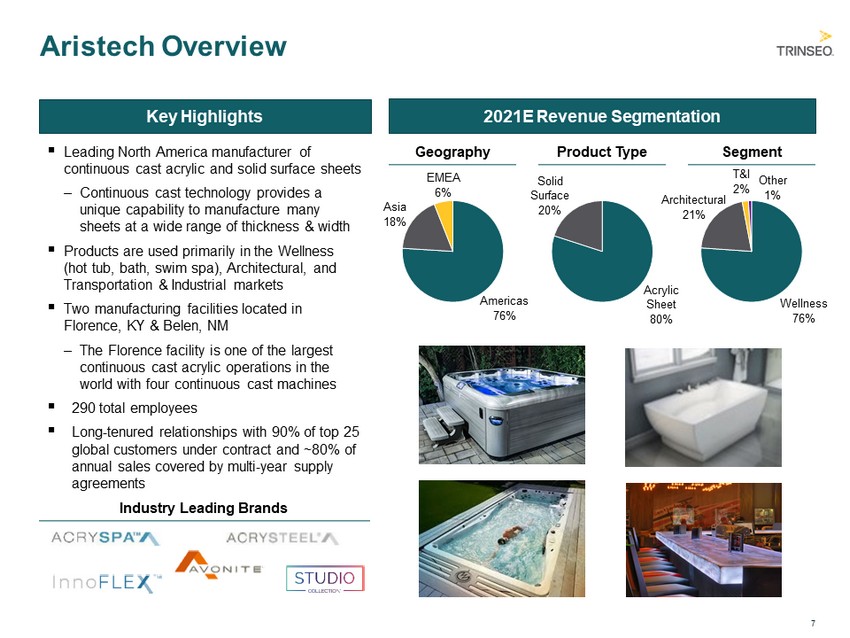

7 ▪ Leading North America manufacturer of continuous cast acrylic and solid surface sheets – Continuous cast technology provides a unique capability to manufacture many sheets at a wide range of thickness & width ▪ Products are used primarily in the Wellness (hot tub, bath, swim spa), Architectural, and Transportation & Industrial markets ▪ Two manufacturing facilities located in Florence, KY & Belen, NM – The Florence facility is one of the largest continuous cast acrylic operations in the world with four continuous cast machines ▪ 290 total employees ▪ Long - tenured relationships with 90% of top 25 global customers under contract and ~80% of annual sales covered by multi - year supply agreements Aristech Overview Product Type 2021E Revenue Segmentation Geography Segment Americas 76% Asia 18% EMEA 6% Acrylic Sheet 80% Solid Surface 20% Wellness 76% Architectural 21% T&I 2% Key Highlights Other 1% Industry Leading Brands

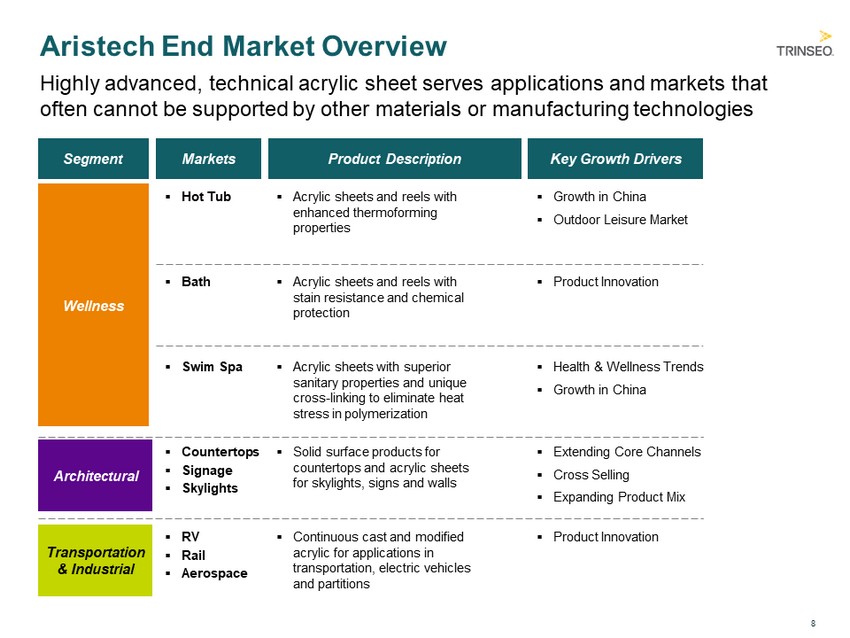

8 Markets Architectural Transportation & Industrial Product Description Segment Key Growth Drivers ▪ Bath ▪ Acrylic sheets and reels with stain resistance and chemical protection ▪ Product Innovation Wellness Aristech End Market Overview Highly advanced, technical acrylic sheet serves applications and markets that often cannot be supported by other materials or manufacturing technologies ▪ Solid surface products for countertops and acrylic sheets for skylights, signs and walls ▪ Extending Core Channels ▪ Cross Selling ▪ Expanding Product Mix ▪ Countertops ▪ Signage ▪ Skylights ▪ Hot Tub ▪ Acrylic sheets and reels with enhanced thermoforming properties ▪ Growth in China ▪ Outdoor Leisure Market ▪ Swim Spa ▪ Acrylic sheets with superior sanitary properties and unique cross - linking to eliminate heat stress in polymerization ▪ Health & Wellness Trends ▪ Growth in China ▪ Continuous cast and modified acrylic for applications in transportation, electric vehicles and partitions ▪ RV ▪ Rail ▪ Aerospace ▪ Product Innovation

9 Third Step in Major Transformation to Become a Specialty Materials & Sustainable Solutions Provider Accelerates Growth in Asia Pacific Market and Drives Supply Chain Optimization Accretive to Earnings, Margins and Cash Flow in Year 1 Expansion into Wellness, Niche Leisure and Architectural Markets and Enables Full Offering of PMMA Sheet Technologies Continued Commitment to Strong Balance Sheet Closing Summary – Investment Thesis