Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Kismet Acquisition One Corp | ea144384-8k_kismetacq1.htm |

| EX-99.2 - PRESS RELEASE, DATED JULY 19, 2021 - Kismet Acquisition One Corp | ea144384ex99-2_kismetacq1.htm |

| EX-10.1 - FORM OF SUBSCRIPTION AGREEMENT - Kismet Acquisition One Corp | ea144384ex10-1_kismetacq1.htm |

| EX-2.1 - AMENDMENT NO. 1 TO BUSINESS COMBINATION AGREEMENT, DATED AS OF JULY 17, 2021 - Kismet Acquisition One Corp | ea144384ex2-1_kismetacq1.htm |

Exhibit 99.1

ff ff ff ff ff

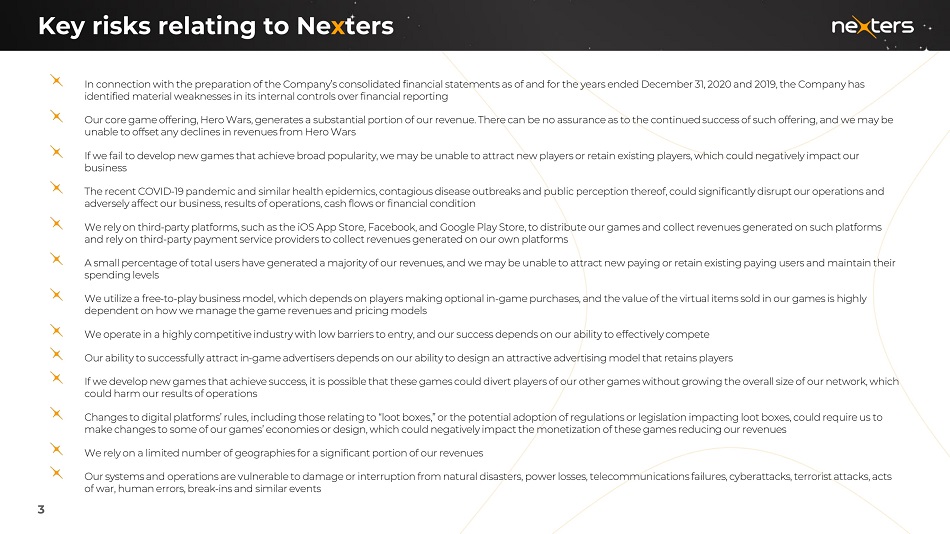

Key risks relating to Ne x fers · n e rs ·. ' i , ' + 'x_ 'x_ In connection with the preparation of the Company's consolidated financial statements as of and for the years ended December 37, 2020 and 2079, the Company has identified material weaknesses in its internal controls over financial reporting Our core game offering, Hero Wars, generates a substantial portion of our revenue. There can be no assurance as to the continued success of such offering, and we may be unable to offset any declines in revenues from Hero Wars If we fail to develop new games that achieve broad popularity, we may be unable to attract new players or retain existing players, which could negatively impact our business The recent COVID - 79 pandemic and similar health epidemics, contagious disease outbreaks and public perception thereof, could significantly disrupt our operations and adversely affect our business, results of operations, cash flows or financial condition We rely on third - party platforms, such as the iOS App Store, Facebook, and Google Play Store, to distribute our games and collect revenues generated on such platforms and rely on third - party payment service providers to collect revenues generated on our own platforms A small percentage of total users have generated a majority of our revenues, and we may be unable to attract new paying or retain existing paying users and maintain their spending levels We utilize a free - to - play business model, which depends on players making optional in - game purchases, and the value of the virtual items sold in our games is highly dependent on how we manage the game revenues and pricing models We operate in a highly competitive industry with low barriers to entry, and our success depends on our abilityto effectively compete Our ability to successfuIly attract in - game advertisers depends on our abi Iity to design an attractive advertising model that retains players If we develop new games that achieve success, it is possible that these games could divert players of our other games without growing the overall size of our network, which couId harm our resuIts of operations Changes to digital platforms' rules, including those relating to "loot boxes," or the potential adoption of regulations or legislation impacting loot boxes, could require us to make changes to some of our games' economies or design, which could negatively impact the monetization of these games reducing our revenues We rely on a limited number of geographies for a significant portion of our revenues Our systems and operations are vu Inerable to damage or interruption from naturaI disasters, power losses, telecommunications faiIu res, cyberattacks, terrorist attacks, acts of war, human errors, break - ins and similar events 3

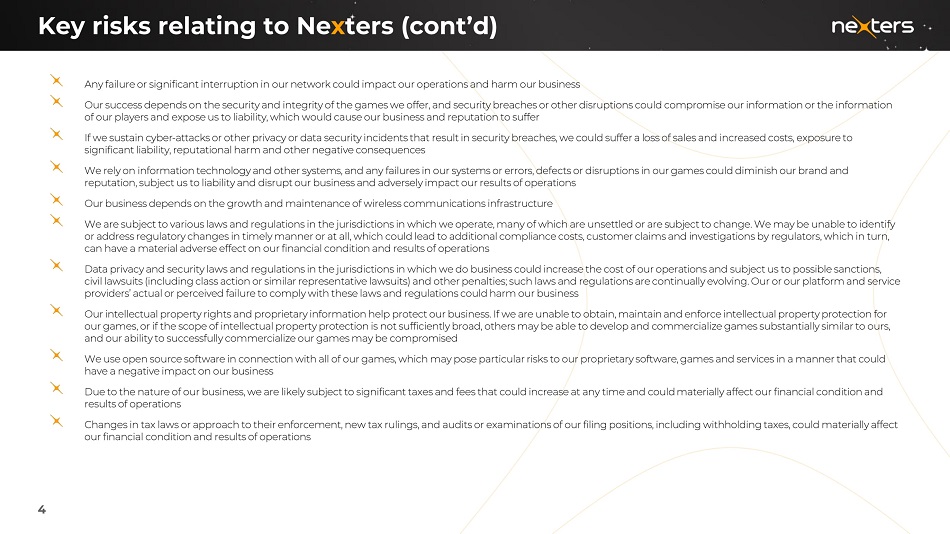

Key risks relating to Ne x fers (cont'd) ne rs ·. ' i , ' + Any failure or significant interruption in our network could impact our operations and harm our business Our success depends on the security and integrity of the games we offer, and security breaches or other disruptions could compromise our information or the information of our players and expose us to liability, which would cause our business and reputation to suffer If we sustain cyber - attacks or other privacy or data security incidents that result in security breaches, we could suffer a loss of sales and increased costs, exposure to significant liability, reputational harm and other negative consequences We rely on information technology and other systems, and any failures in our systems or errors, defects or disruptions in our games could diminish our brand and reputation, subject us to liability and disrupt our business and adversely impact our results of operations Our business depends on the growth and maintenance of wireless communications infrastructure We are subject to various laws and regulations in the jurisdictions in which we operate, many of which are unsettled or are subject to change. We may be unable to identify or address regulatory changes in timely manner or at all, which could lead to additional compliance costs, customer claims and investigations by regulators, which in turn, can have a material adverse effect on our financial condition and results of operations Data privacy and security laws and regulations in the jurisdictions in which we do business could increase the cost of our operations and subject us to possible sanctions, civil lawsuits (including class action or similar representative lawsuits) and other penalties; such laws and regulations are continually evolving. Our or our platform and service providers' actual or perceived failure to comply with these laws and regulations could harm our business Our intellectual property rights and proprietary information help protect our business. If we are unable to obtain, maintain and enforce intellectual property protection for our games, or if the scope of intellectual property protection is not sufficiently broad, others may be able to develop and commercialize gamessubstantiallysimilarto ours, and our abilityto successfully commercialize our games may be compromised We use open source software in connection with all of our games, which may pose particular risks to our proprietary software, games and services in a mannerthat could have a negative impact on our business Due to the nature of our business, we are likely subjectto significanttaxes and fees that could increase at any time andcould materially affect our financial condition and results of operations Changes in tax laws or approach to their enforcement, new tax rulings, and audits or examinations of our filing positions, including withholding taxes, could materially affect our financial condition and results of operations 4

66%

□ □ □ □ □ □ □ □ □ □ : □ □ □ □ □

□ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □

2 1

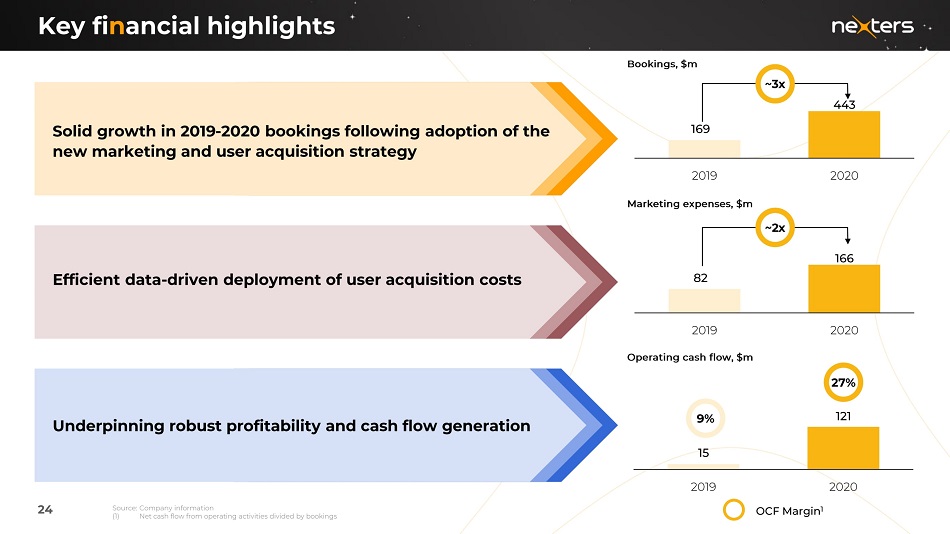

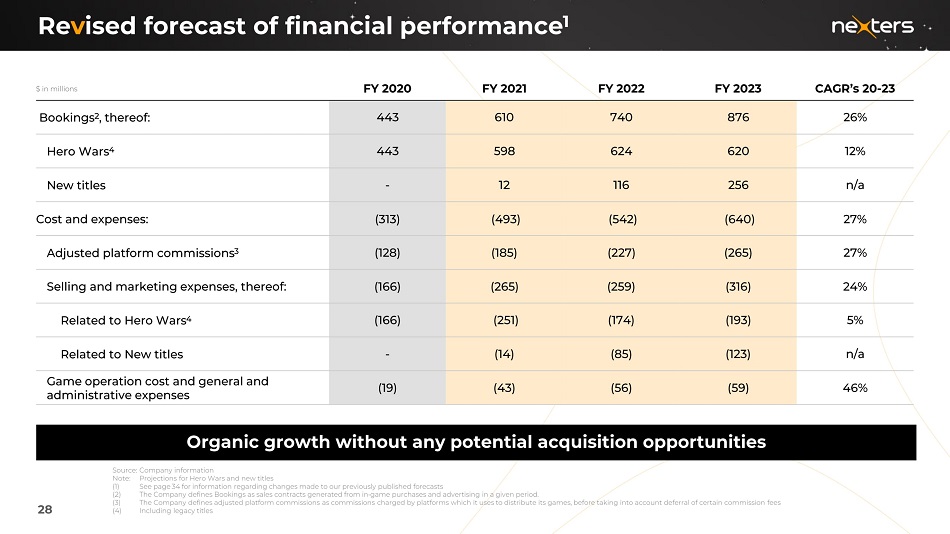

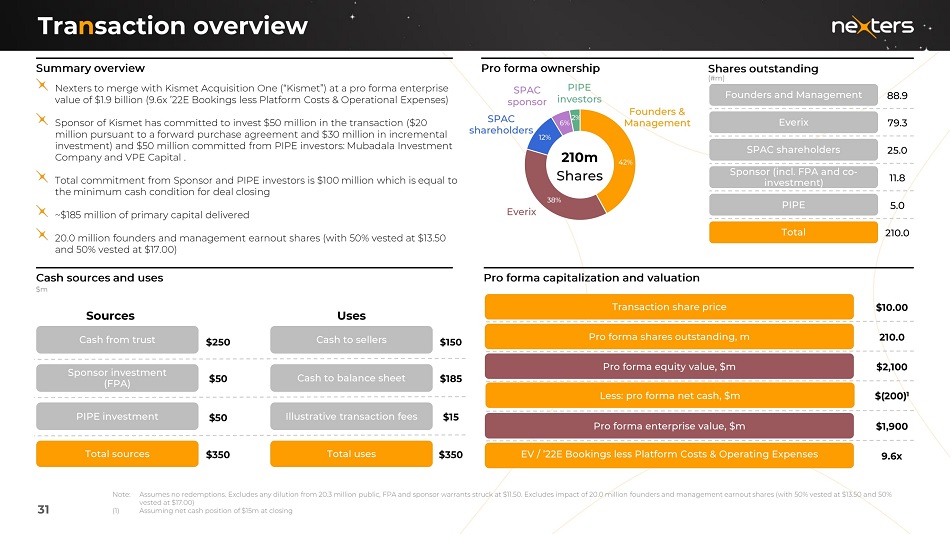

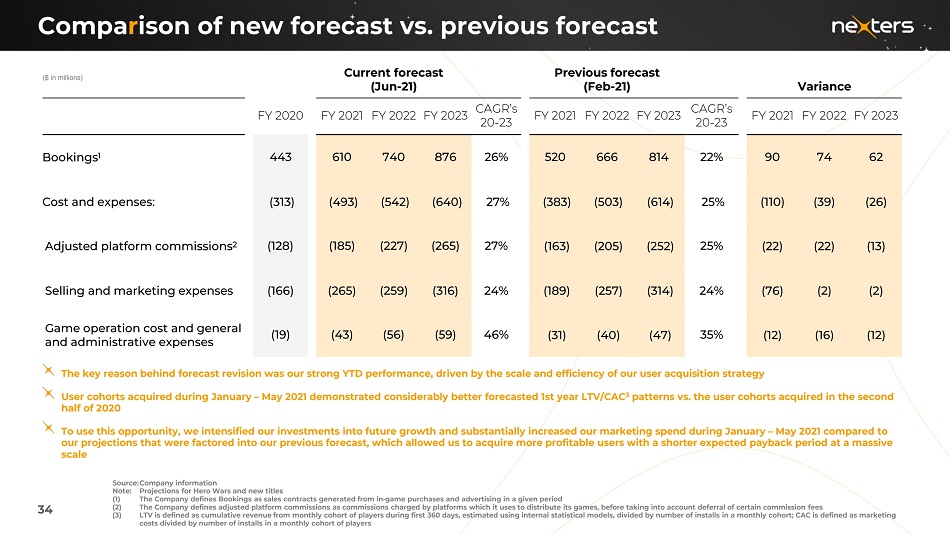

($ in millions)

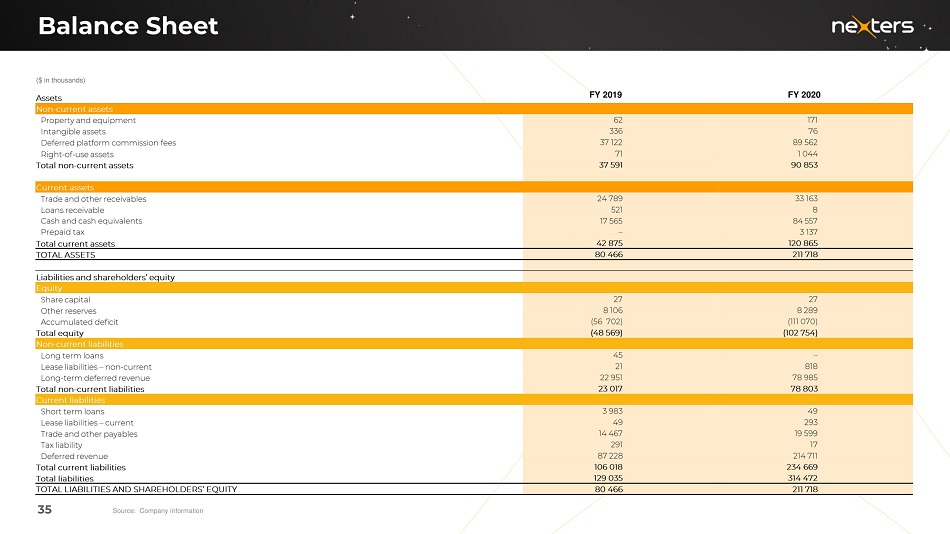

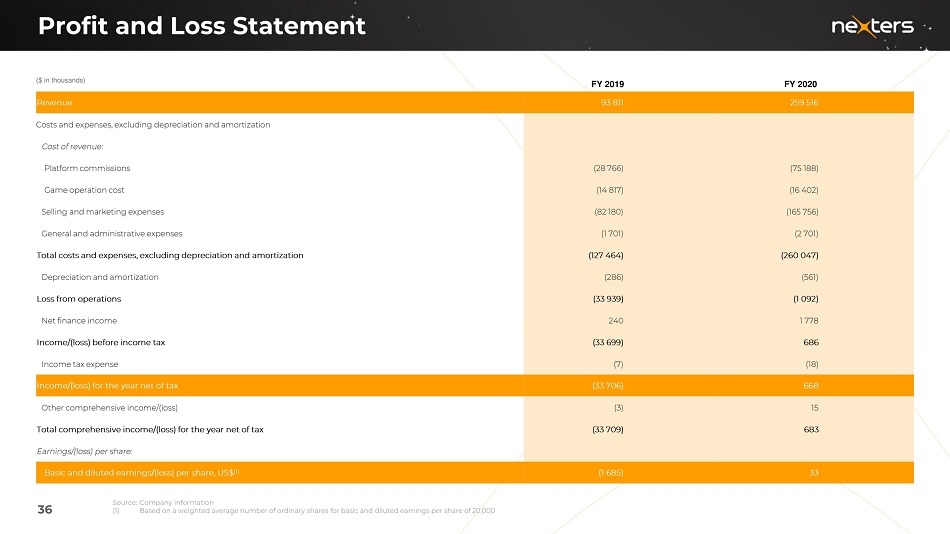

Source: Company information ($ in thousands) FY 2019 FY 2020

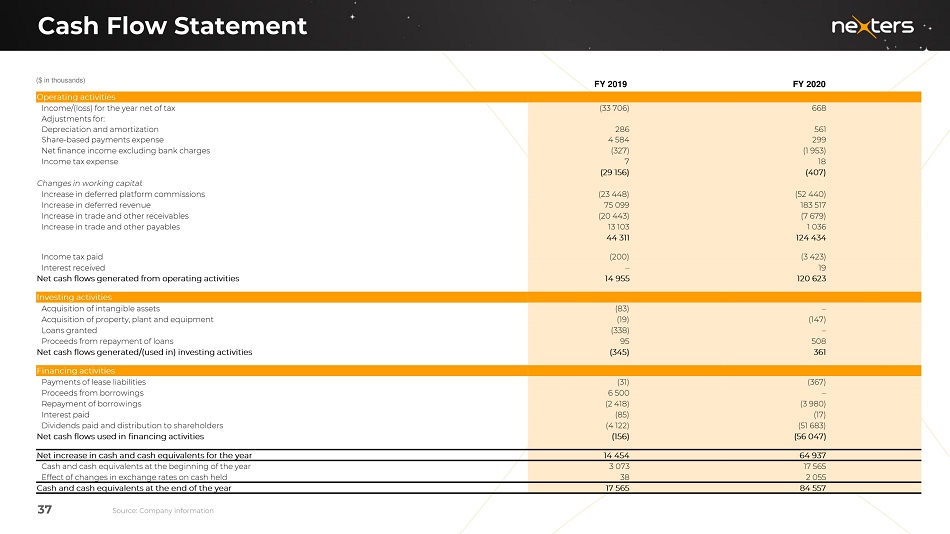

($ in thousands) FY 2019 FY 2020

($ in thousands) FY 2019 FY 2020