Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - ALTAIR INTERNATIONAL CORP. | atao0715form10kexh32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ALTAIR INTERNATIONAL CORP. | atao0715form10kexh31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - ALTAIR INTERNATIONAL CORP. | atao0715form10kexh31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED MARCH 31, 2021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

COMMISSION FILE NO. 333-190235

ALTAIR INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

99-0385465

IRS Employer Identification Number

Altair International Corp.

322 North Shore Drive, Building 1B, Suite 200

Pittsburgh, PA 15212

Tel. (412) 770-3140

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (X 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☑ | Smaller reporting company ☑ |

| Emerging growth company ☑ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☑

The aggregate market value of the 198,055,440 shares of voting and non-voting common equity held by non-affiliates computed by reference to the closing price of $0.17 on September 30, 2020, at which the common equity was last sold in its most recently completed second fiscal quarter was approximately $33,669,425.

As of July 14, 2021, there were 556,418,735 shares of common stock outstanding.

| Page | ||

| PART I | ||

| ITEM 1 | Description of Business | 3 |

| ITEM 1A. | Risk Factors | 4 |

| ITEM 2. | Properties | 4 |

| ITEM 3. | Legal Proceedings | 4 |

| ITEM 4. | Mine Safety Disclosures | 4 |

| PART II | ||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 6 |

| ITEM 6. | Selected Financial Data | 7 |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 |

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 9 |

| ITEM 8. | Financial Statements and Supplementary Data | 10 |

| ITEM 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 26 |

| ITEM 9A. | Controls and Procedures | 26 |

| ITEM 9B. | Other Information | 26 |

| PART III | ||

| ITEM 10. | Directors, Executive Officers, and Corporate Governance | 28 |

| ITEM 11. | Executive Compensation | 30 |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 31 |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 32 |

| ITEM 14. | Principal Accountant Fees and Services | 32 |

| ITEM 15. | Exhibits and Financial Statement Schedules | 33 |

| Signatures | 34 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context hereof, references in this report to “Company,” “ATAO,” “we,” “us” and “our” are references to Altair International Corp. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Our Business

Altair International Corp. (“Altair”) is a development stage company that was incorporated in Nevada on December 20, 2012.

The Company is currently engaged in identifying and assessing new business opportunities. In this regard, the Company entered into a Mining Lease effective August 3, 2020 with Oliver Geoservices LLC under which the Company received an exclusive lease to mine certain unpatented lode mining claims known as the Walker Ridge located in Elko County, Nevada for a period of five years. The lease can be extended for an additional twenty years if certain extension payments are made within the term of the lease. The Company made an initial payment of $25,000 to secure the lease and is required to make advance royalty payments to maintain its exclusivity commencing December 1, 2020, starting at $25,000 and increasing in $25,000 increments each year for the initial five year term to $100,000 as well as a 3% net smelter fee royalty on all mineral production from the leased property. The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement which was filed as Item 1.01 to a Form 8-K filed on August 14, 2020.

The Company has completed the staking process of 187 claims on the Walker Ridge site. The claims must be registered with the Nevada Bureau of Land Management. We estimate that the cost to register the claims to be between $40,000 and $50,000. To date, we have not registered the claims. The Company is currently awaiting completion by the United States Forestry Service (the “USFS”) of the calculations for the required Reclamation Bond which is required to begin work on the drill site. We estimate the value of the bond to be between $40,000 and $50,000.

About Walker Ridge

Location

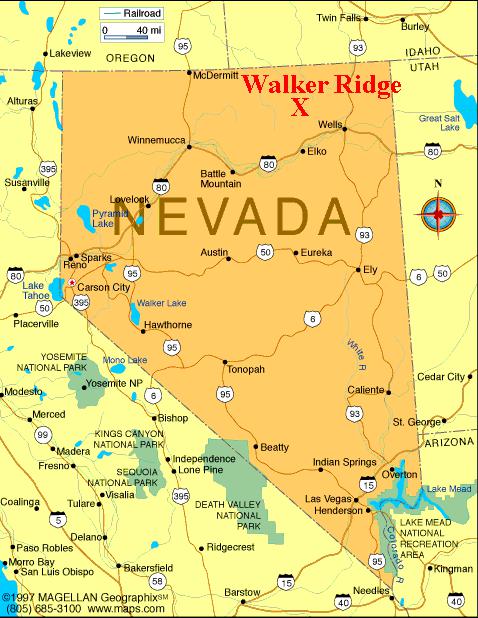

The Walker Ridge Property is located in Elko County, Nevada, approximately 40 air miles (64 km) north of Elko. It is reached by driving north approximately 55 miles (88 km) from Elko on highway 225 to the PX ranch near mile marker 55. Traveling west on the gravel road for 20 miles (32 km) reaches the eastern boundary of the property. The center of the target area is at a latitude/longitude of 41 30’38” North and 115 55’48” West. Driving time from Elko to the property is approximately one hour.

| 3 |

Walker Ridge Property History

A large area (boundaries uncertain), located between the Jerritt Canyon and Big Springs properties, including ground covered by the present Walker Ridge Property claims, was explored by Tenneco (subsequently acquired by Echo Bay). From 1985-87, Tenneco/Echo Bay conducted geologic mapping, rock chip and soil geochemistry sampling (3400 samples) and drilled 31 shallow holes (maximum depth 400 ft or 122m), mostly to the southwest of the Walker Ridge Property. There are no useable maps available from this work, only summary reports. One shallow hole drilled within the present claim block (Figure 7.3), hole number FC1-87, intercepted Snow Canyon Fm below McAfee Quartzite at 245 feet (75m). It was anomalous in gold from there to TD at 300 feet (91m).

Independence Mining Company optioned the same property from Echo Bay between 1988 and 1993, drilling 6 holes totaling 4,920 feet (1,500m), southwest of the present claims. A deep rotary/core hole reached favorable Carlin-style host lithologies (Roberts Mountain Formation) at 1,495 feet (456m), or approximately 6,000 feet (1,830m) above mean sea level. There are no maps showing this work currently available, only summary reports. Echo Bay was absorbed by Kinross several years ago. It is possible that some of that data may be preserved in the archives of Kinross.

In 2007 an infill soil sampling program was carried out by Stratos over the central part of the current claim block to reduce the sample spacing to 200 feet (60m). The Company optioned the property in 2011. At the direction of the Company, Walker Ridge Gold Corp staked additional claims in 2011 and 2012. All claim staking has been paid by the Company and all additional claims have become a part of the option agreement. The Company has carried out gravity and CSAMT geophysical surveys in the fall of 2012.

There are no resource estimates, historical or current, and no recorded production from the property.

Earn-In Agreement

On November 23, 2020, the Company entered into an Earn-In Agreement with American Lithium Minerals, Inc. (“AMLM”) under which we agreed to make total payments of $75,000 to AMLM in exchange for a 10% undivided interest in 63 unpatented placer mining claims comprised of approximately 1,260 acres, and 3 unpatented lode mining claims in Nevada. This $75,000 obligation has been fully satisfied by the Company ($30,000 paid 12/8/2020 and $45,000 paid 1/5/2021), resulting in Altair owning a 10% undivided interest in the claims. The Company has the option to increase its ownership interest by an additional 50% by a total payment of $1,300,648 for exploration and development costs as follows: $100,648 within year one for an additional 10/%, $600,000 in year two for an additional 20% and $600,000 in year three for an additional 20% ownership interest. The Earn-In Agreement grants Altair the exclusive right to explore the properties.

License and Royalty Agreement

On February 10, 2021, the Company entered into a License and Royalty Agreement (the “License Agreement”) with St-Georges Eco-Mining Corp. (“SX”) and St-Georges Metallurgy Corp. (“SXM”) under which Altair has received a perpetual, non-exclusive license from SX of its lithium extraction technology for Altair to develop its lithium bearing prospects in the United States and SXM’s EV battery recycling technology for which Altair has agreed to act as exclusive master agent to promote the licensing and deployment of the EV battery recycling technology in North America. Altair has agreed to provide SX with a net revenue interest royalty on all metals and minerals extracted (the “Products”) and sold from Altair’s mineral interests in the United States and SX has agreed to provide Altair with a 1% trailer fee on any royalty received by SX from the licensing of the SX EV battery recycling technology to each licensee of the SX EV battery recycling technology referred by Altair or Altair’s sub-agents. Altair will pay a royalty of 5% of the net revenue received by Altair for sales of Products using the lithium extraction technology which decreases to 3% of the net revenue on all payments in excess of US$8,000,000 of production on an annualized basis.

Employees

As of the date of this Report, the Company has no full-time nor part-time employees. Our sole officer has a current agreement with the Company to serve in these capacities. We intend to increase the number of our employees and consultants to meet our needs as the Company grows.

| 4 |

ITEM 1A. RISK FACTORS

Not applicable to smaller reporting companies.

ITEM 2. DESCRIPTION OF PROPERTY

We do not own any real estate or other properties.

ITEM 3. LEGAL PROCEEDINGS

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

ITEM 4. MINE SAFETY DISCLOSURES

None.

| 5 |

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common shares are quoted on the OTC Market under the symbol “ATAO” . Trading in stocks quoted on the OTC Market is often thin and is characterized by wide fluctuations in trading prices due to many factors that may be unrelated to a company’s operations or business prospects. We cannot assure you that there will be a market in the future for our common stock.

OTC Market securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTC Market securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTC Market issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Number of Holders

As of July 2, 2021, 556,418,735 issued and outstanding shares of common stock were held by 67 shareholders of record.

Dividends

No cash dividends were paid on our shares of common stock during the fiscal year ended March 31, 2021. We have not paid any cash dividends since our inception and do not foresee declaring any cash dividends on our common stock in the foreseeable future.

Recent Sales of Unregistered Securities

None.

Purchase of our Equity Securities by Officers and Directors

On September 1, 2020, the Company entered into a service agreement with Oliver Geoservices LLC for a term of one year. Per the terms of the agreement the Company will issue them 300,000 shares of common stock per month. In addition, they received 150,000 shares of common stock for services provided prior to the execution of the service agreement. As of March 31, 2021, Oliver Geoservices LLC received 1,950,000 shares of common stock for total non-cash expense of $401,250. In addition, 300,000 shares have not yet been issued by the transfer agent and have been disclosed on the balance sheet as common stock to be issued of $72,000. All shares were valued at the closing stock price on the date of grant.

On December 9, 2020, the Company entered into two separate service agreements with Paul Pelosi to be a member of the Company’s advisory board. Both agreements are for a term of one year. Per the terms of the agreements the Company will issue Mr. Pelosi a total of 6,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. The initial 3,000,000 shares were valued at the closing stock price on the date of grant for total non-cash expense of $870,000.

On December 14, 2020, the Company entered into a service agreement with Adam Fishman to be a member of the Company’s advisory board for a term of one year. Per the terms of the agreements the Company will issue Mr. Fishman 5,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. The initial 2,500,000 shares were valued at the closing stock price on the date of grant for total non-cash expense of $750,000.

On February 6, 2021, the Company issued 2,000,000 shares of common stock to a service provider. The shares were valued at $0.47, the closing stock price on the date of grant, for total non-cash stock compensation expense of $940,000.

On February 11, 2021, the Company issued 2,000,000 shares of common stock to St. Georges Eco-Mining Corp pursuant to the terms of its binding term sheet with St. Georges Eco-Mining Corp. The shares were valued at $0.38, the closing stock price on the date of grant, for total non-cash stock compensation expense of $760,000.

During the year ended March 31, 2021, EROP Enterprises LLC, converted $104,500 and $3,579 of principal and interest, respectively, into 734,820 shares of common stock.

During the year ended March 31, 2021, Williams Ten, LLC, converted $15,000 and $930 of principal and interest, respectively, into 109,862 shares of common stock.

During the year ended March 31, 2021, Company issued 4,000,000 common shares to Mr. Leonard Lovallo for his role as an independent member of the Company’s Board of Directors. The shares were valued at $0.005, the closing stock price on the date of grant, for total non-cash stock compensation expense of $20,000. Mr. Lovallo was also issued 26,000,000 common shares for his role as Chief Executive Office and President of the Company. The shares were valued at $0.26, the closing stock price on the date of grant, for total non-cash stock compensation expense of $6,760,000.

| 6 |

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements, including the notes thereto, appearing elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

RESULTS OF OPERATIONS

We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

We expect we will require additional capital to meet our long term operating requirements. We expect to raise additional funds through, among other things, the sale of equity or debt securities although no assurance can be given as to availability of funds or the terms thereof.

FISCAL YEAR ENDED MARCH 31, 2021 COMPARED TO FISCAL YEAR ENDED MARCH 31, 2020

Revenues

The Company has not recognized any revenue to date.

Operating Expenses

Mining and exploration expense for the year ended March 31, 2021 was $215,786 compared to $0 for the year ended March 31, 2020. The Company’s mining and exploration expense has increased in the current period as it pursues its new mining activities.

Consulting expense for the year ended March 31, 2021 was $3,913,870 compared to $0 for the year ended March 31, 2020. In the current year we issued 11,450,000 shares of common stock for total non-cash compensation expense of $3,721,250.

Compensation expense – related party for the year ended March 31, 2021 was $6,806,000 compared to $0 for the year ended March 31, 2020. In the current year we issued 30,000,000 shares of common stock for total non-cash compensation expense of $6,780,000.

Director expense for the year ended March 31, 2021 was $2,400 compared to $0 for the year ended March 31, 2020.

General and administrative expense (“G&A”) for the year ended March 31, 2021 was $171,504 compared to $3,451 for the year ended March 31, 2020. The increase can be attributed to an increase in professional fees, investor relation expense, filing fees and a general increase in other expenses for the year. G&A expense has increased in the current year as a result of the change of our business to focus on mining operations.

Other Expense

Total other expense for the year ended March 31, 2021, was $884,964, consisting of $170,462 of interest expense, which includes $158,119 of debt discount amortization, a loss on the change in the fair value of derivative of $143,686, a loss on the issuance of convertible debt of $79,130, a loss on the settlement of debt of $41,686 and $450,000 of impairment expense, compared to $1,805 of interest expense in the prior year.

Net Loss

Net loss for the year ended March 31, 2021 was $11,994,524, in comparison to a net loss of $5,256 for the year ended March 31, 2020. The large increase to our net loss is largely attributed to our non-cash stock-based compensation expense.

| 7 |

LIQUIDITY AND CAPITAL RESOURCES

Cash flow used in Operating Activities.

We have not generated positive cash flows from operating activities. During the year ended March 31, 2021, the Company used $342,361 of cash for operating activities compared to $110 of cash for operating activities in the prior period.

Cash flow used in Investing Activities.

During the year ended March 31, 2021, we paid $75,000 as part of our Earn-In Agreement with American Lithium Minerals, Inc.

Cash flow from Financing Activities

We have financed our operations primarily from either advancements or the issuance of equity and debt instruments. During the year ended March 31, 2021 the Company received $559,490 of cash from financing activities offset by payments of $20,000 to settle loans payable to related parties.

PLAN OF OPERATION AND FUNDING

We expect that working capital requirements will continue to be funded through a combination of our existing funds, advances from shareholders and further issuances of securities. Our working capital requirements are expected to increase in line with the growth of our business.

Existing working capital, further advances and debt instruments, and anticipated cash flow are expected to be adequate to fund our operations over the next six months. We have no lines of credit or other bank financing arrangements. Generally, we have financed operations to date through the proceeds of the private placement of equity and debt instruments. In connection with our business plan, management anticipates additional increases in operating expenses and capital expenditures relating to: (i) developmental expenses associated with a start-up business); (ii) acquisition of assets; and (iii) sales and marketing expenses. We intend to finance these expenses with further issuances of securities and debt issuances. Thereafter, we expect we will need to raise additional capital and generate revenues to meet long-term operating requirements. Additional issuances of equity or convertible debt securities will result in dilution to our current shareholders. Further, such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavors or opportunities, which could significantly and materially restrict our business operations.

Critical Accounting Estimates and Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Note 1 to the Financial Statements describes the significant accounting policies and methods used in the preparation of the Financial Statements. Estimates are used for, but not limited to, contingencies and taxes. Actual results could differ materially from those estimates. The following critical accounting policies are impacted significantly by judgments, assumptions, and estimates used in the preparation of the Financial Statements.

We are subject to various loss contingencies arising in the ordinary course of business. We consider the likelihood of loss or impairment of an asset or the incurrence of a liability, as well as our ability to reasonably estimate the amount of loss in determining loss contingencies. An estimated loss contingency is accrued when management concludes that it is probable that an asset has been impaired, or a liability has been incurred and the amount of the loss can be reasonably estimated. We regularly evaluate current information available to us to determine whether such accruals should be adjusted.

We recognize deferred tax assets (future tax benefits) and liabilities for the expected future tax consequences of temporary differences between the book carrying amounts and the tax basis of assets and liabilities. The deferred tax assets and liabilities represent the expected future tax return consequences of those differences, which are expected to be either deductible or taxable when the assets and liabilities are recovered or settled. Future tax benefits have been fully offset by a 100% valuation allowance as management is unable to determine that it is more likely than not that this deferred tax asset will be realized.

| 8 |

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

Recent Accounting Pronouncements

On June 20, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 is intended to reduce cost and complexity and to improve financial reporting for share-based payments to nonemployees (for example, service providers, external legal counsel, suppliers, etc.). Under the new standard, companies will no longer be required to value non-employee awards differently from employee awards. Meaning that companies will value all equity classified awards at their grant-date under ASC718 and forgo revaluing the award after this date. The Company has chosen to early adopt this standard. There has been no material impact on our financial statements as a result of adopting this standard.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable to smaller reporting companies.

| 9 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

ALTAIR INTERNATIONAL CORP.

INDEX TO FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm | 11 |

| Report of Independent Registered Public Accounting Firm | 12 |

| Consolidated Balance Sheets as of March 31, 2021 and 2020 | 13 |

| Consolidated Statements of Operations for the Years ended March 31, 2021 and 2020 | 14 |

| Consolidated Statement of Stockholders’ Deficit for the Years ended March 31, 2021 and 2020 | 15 |

| Consolidated Statements of Cash Flows for the Years ended March 31, 2021 and 2020 | 16 |

| Notes to the Consolidated Financial Statements | 17 |

| 10 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Altair International Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of Altair International Corp. (“the Company”) as of March 31, 2021, and the related consolidated statements of operations, changes in stockholders’ deficit, and cash flows for the year ended March 31, 2021, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2021 and the results of its operations and its cash flows for the year ended March 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has incurred net losses since inception. This factor raises substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Accounting for Embedded Conversion Features on Notes Payable — Refer to Note 5 to the consolidated financial statements

Critical Audit Matter Description

The Company has issued several notes payable during the year with conversion rates that are adjustable at a discounted rate to public trading prices near the conversion date. The terms allow for variable amounts of shares to be converted for a set dollar value; this and other factors require the embedded conversion feature to be accounted for as a derivative and revalued at the conversion date or each period end if still outstanding. Calculations and accounting for the notes payable and embedded conversion features require management’s judgments related to initial and subsequent recognition of the debt and related features, use of a valuation model, and value of the inputs used in the selected valuation model.

How the Critical Audit Matter Was Addressed in the Audit

Our audit procedures related to evaluating the Company’s accounting for notes payable and related accounts included the following, among others:

| · | Confirmation of notes payable and related terms. |

| · | Independent assessment of the appropriate valuation model for derivatives, performing independent calculations based on the model and comparing the Company’s results to a reasonable range as determined during the audit. |

| · | Determining if there were unusual transactions related to notes payable and the appropriate accounting treatment for such transactions. |

| · | Testing of substantially all transactions related to this matter. |

|

We have served as the Company’s auditor since 2021.

Spokane, Washington | |

| July 15, 2021 | |

| 11 |

MICHAEL GILLESPIE & ASSOCIATES, PLLC

CERTIFIED PUBLIC ACCOUNTANTS

10544 ALTON AVE NE

SEATTLE, WA 98125

206.353.5736

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors & Stockholders’

Altair International Corp.

Opinion on the Financial Statements

We have audited the accompanying balance sheet of Altair International Corp. as of March 31, 2020 and the related statements of operations, changes in stockholder’s deficit, cash flows, and the related notes (collectively referred to as “financial statements”) for the period then ended. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2020 and the results of its operations and its cash flows for the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note #2 to the financial statements, although the Company has limited operations it has yet to attain profitability. This raises substantial doubt about its ability to continue as a going concern. Management’s plan in regard to these matters is also described in Note #2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/S/ MICHAEL GILLESPIE & ASSOCIATES, PLLC

We have served as the Company’s auditor since 2017.

Seattle, Washington

June 1, 2020

| 12 |

ALTAIR INTERNATIONAL CORP. CONSOLIDATED BALANCE SHEETS | ||||||||

| March 31, 2021 | March 31, 2020 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 122,155 | $ | 26 | ||||

| Prepaids | 10,000 | 1,789 | ||||||

| Total Current Assets | 132,155 | 1,815 | ||||||

| Advanced royalty payments | 25,000 | — | ||||||

| 10% ownership in Stonewall and Kingman properties | 75,000 | — | ||||||

| Total Assets | $ | 232,155 | $ | 1,815 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 70,347 | $ | 8,186 | ||||

| Loans payable, net of current portion | 24,155 | 14,165 | ||||||

| Interest payable | 7,695 | 3,176 | ||||||

| Convertible notes payable, net of $63,023 discount | 41,977 | — | ||||||

| Loans payable – related party | — | 30,000 | ||||||

| Derivative liability | 142,642 | — | ||||||

| Total Current Liabilities | 286,816 | 55,527 | ||||||

| Loans payable | 325,000 | — | ||||||

| Total Liabilities | 611,816 | 55,527 | ||||||

| Stockholders' Deficit: | ||||||||

| Common Stock, $0.001 par value, 2,000,000,000 shares authorized; 550,027,235 and 496,732,553 shares issued and outstanding, respectively | 550,028 | 496,733 | ||||||

| Common stock to be issued | 522,000 | — | ||||||

| Additional paid in capital | 11,443,973 | 350,693 | ||||||

| Accumulated deficit | (12,895,662 | ) | (901,138 | ) | ||||

| Total Stockholders' Deficit | (379,661 | ) | (53,712 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 232,155 | $ | 1,815 | ||||

| The accompanying notes are an integral part of these consolidated financial statements. | ||||||||

| 13 |

ALTAIR INTERNATIONAL CORP. CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||

| For The Years Ended March 31, | ||||||||

| March 31, 2021 | March 31, 2020 | |||||||

| Operating Expenses: | ||||||||

| Mining exploration expense | 215,786 | — | ||||||

| Consulting | 3,913,870 | — | ||||||

| Compensation – related party | 6,806,000 | — | ||||||

| Director fees | 2,400 | — | ||||||

| General and administrative | 171,504 | 3,451 | ||||||

| Total operating expenses | 11,109,560 | 3,451 | ||||||

| Loss from operations | (11,109,560 | ) | (3,451 | ) | ||||

| Other Expense: | ||||||||

| Interest expense | (170,462 | ) | (1,805 | ) | ||||

| Impairment expense | (450,000 | ) | — | |||||

| Loss on issuance of convertible debt | (79,130 | ) | — | |||||

| Change in fair value | (143,686 | ) | — | |||||

| Loss on settlement of debt | (41,686 | ) | — | |||||

| Total other expense | (884,964 | ) | (1,805 | ) | ||||

| Loss before provision for income taxes | (11,994,524 | ) | (5,256 | ) | ||||

| Provision for income taxes | — | — | ||||||

| Net Loss | $ | (11,994,524 | ) | $ | (5,256 | ) | ||

| Loss per share, basic and diluted | $ | (0.02 | ) | $ | (0.00 | ) | ||

| Weighted average shares outstanding, basic and diluted | 527,404,180 | 496,732,553 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 14 |

ALTAIR INTERNATIONAL CORP. CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT FOR THE YEARS ENDED MARCH 31, 2021 AND 2020 | ||||||||||||||||||||||||

| Common Stock | Additional Paid in | Common Stock To be | Accumulated | |||||||||||||||||||||

| Shares | Amount | Capital | Issued | Deficit | Total | |||||||||||||||||||

| Balance, March 31, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | — | $ | (895,882 | ) | $ | (48,456 | ) | |||||||||||

| Net loss | — | — | (5,256 | ) | (5,256 | ) | ||||||||||||||||||

| Balance, March 31, 2020 | 496,732,553 | 496,733 | 350,693 | — | (901,138 | ) | (53,712 | ) | ||||||||||||||||

| Shares issued for Officer services | 30,000,000 | 30,000 | 6,750,000 | — | — | 6,780,000 | ||||||||||||||||||

| Shares issued for debt – former related party | 11,000,000 | 11,000 | 44,000 | — | — | 55,000 | ||||||||||||||||||

| Shares issued for debt | 844,682 | 845 | 424,480 | — | — | 425,325 | ||||||||||||||||||

| Shares issued for services | 11,450,000 | 11,450 | 3,709,800 | 72,000 | — | 3,793,250 | ||||||||||||||||||

| Shares issued for acquisition | — | — | — | 450,000 | 450,000 | |||||||||||||||||||

| Warrant expense | — | — | 165,000 | — | — | 165,000 | ||||||||||||||||||

| Net loss | — | — | — | — | (11,994,524 | ) | (11,994,524 | ) | ||||||||||||||||

| Balance, March 31, 2021 | 550,027,235 | $ | 550,028 | $ | 11,443,973 | $ | 522,000 | $ | (12,895,662 | ) | $ | (379,661 | ) | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 15 |

ALTAIR INTERNATIONAL CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

| For the Years Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| CASH FLOW FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (11,994,524 | ) | $ | (5,256 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Debt discount expense | 158,119 | — | ||||||

| Stock based compensation | 10,738,250 | — | ||||||

| Impairment expense | 450,000 | — | ||||||

| Loss on settlement of debt | 41,686 | — | ||||||

| Derivative liability expense | 222,816 | — | ||||||

| Changes in Operating Assets and Liabilities: | ||||||||

| Advances and deposits | (33,211 | ) | 356 | |||||

| Accounts payable | 62,159 | 2,986 | ||||||

| Accrued interest | 12,344 | 1,804 | ||||||

| Net Cash Used in Operating Activities | (342,361 | ) | (110 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payment for exploration earn in option | (75,000 | ) | — | |||||

| Net Used in by Investing Activities | (75,000 | ) | — | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from convertible notes payable | 224,500 | — | ||||||

| Proceeds from loans payable | 334,990 | — | ||||||

| Repayment of related party loan | (20,000 | ) | — | |||||

| Net Cash Provided by Financing Activities | 539,490 | — | ||||||

| Net Increase in Cash | 122,129 | (110 | ) | |||||

| Cash at Beginning of Period | 26 | 136 | ||||||

| Cash at End of Period | $ | 122,155 | $ | 26 | ||||

| Cash paid during the period for: | ||||||||

| Interest | $ | — | $ | — | ||||

| Income taxes | $ | — | $ | — | ||||

| Supplemental non-cash disclosure: | ||||||||

| Related party (former) debt settled with common stock | $ | 13,314 | $ | — | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 16 |

ALTAIR INTERNATIONAL CORP.

Notes to the Consolidated Financial Statements

March 31, 2021

NOTE 1 - ORGANIZATION AND BUSINESS OPERATIONS

Organization and Description of Business

ALTAIR INTERNATIONAL CORP. (the “Company” “Altair”) was incorporated under the laws of the State of Nevada on December 20, 2012. The Company’s physical address is 322 North Shore Drive, Building 1B, Suite 200, Pittsburgh, PA 15212. The Company is in the development stage as defined under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 915-205 "Development-Stage Entities.”

Mining Lease

The Company is currently engaged in identifying and assessing new business opportunities. In this regard, the Company entered into a Mining Lease effective August 3, 2020 with Oliver Geoservices LLC (“OGS”) under which the Company received an exclusive lease to mine certain unpatented lode mining claims known as the Walker Ridge located in Elko County, Nevada for a period of five years. The lease can be extended for an additional twenty years if certain extension payments are made within the term of the lease. The Company made an initial payment of $25,000 to secure the lease and is required to make advance royalty payments to maintain its exclusivity commencing January 31, 2021, starting at $25,000 and increasing in $25,000 increments each year for the initial five-year term to $100,000 as well as issuing common shares to OGS in accordance with the following schedule.

| On or before December 1, 2021 | 500,000 common shares |

| On or before December 1, 2022 | 500,000 common shares |

| On or before December 1, 2023 | 750,000 common shares |

| On or before December 1, 2024 | 750,000 common shares |

In addition, a 3% net smelter fee royalty is payable on all mineral production from the leased property. The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement which was filed as Exhibit 1.01 to a Form 8-K dated August 14, 2020.

The Company had previously planned to enter into license and distribution agreements for oral thin film nutraceutical products. This plan was abandoned in the 2017 fiscal year as the Company was unable to obtain the working capital required to bring the products to market.

Earn-In Agreement

On November 23, 2020, the Company entered into an Earn-In Agreement with American Lithium Minerals, Inc. (“AMLM”) under which we agreed to make total payments of $75,000 to AMLM in exchange for a 10% undivided interest in 63 unpatented placer mining claims comprised of approximately 1,260 acres, and 3 unpatented lode mining claims in Nevada. This $75,000 obligation has been fully satisfied by the Company ($30,000 paid 12/8/2020 and $45,000 paid 1/5/2021), resulting in Altair owning a 10% undivided interest in the claims. The Company has the option to increase its ownership interest by an additional 50% by a total payment of $1,300,648 for exploration and development costs as follows: $100,648 within year one for an additional 10/%, $600,000 in year two for an additional 20% and $600,000 in year three for an additional 20% ownership interest. The Earn-In Agreement grants Altair the exclusive right to explore the properties.

License and Royalty Agreement

On February 10, 2021, the Company entered into a License and Royalty Agreement (the “License Agreement”) with St-Georges Eco-Mining Corp. (“SX”) and St-Georges Metallurgy Corp. (“SXM”) under which Altair has received a perpetual, non-exclusive license from SX of its lithium extraction technology for Altair to develop its lithium bearing prospects in the United States and SXM’s EV battery recycling technology for which Altair has agreed to act as exclusive master agent to promote the licensing and deployment of the EV battery recycling technology in North America. Altair has agreed to provide SX with a net revenue interest royalty on all metals and minerals extracted (the “Products”) and sold from Altair’s mineral interests in the United States and SX has agreed to provide Altair with a 1% trailer fee on any royalty received by SX from the licensing of the SX EV battery recycling technology to each licensee of the SX EV battery recycling technology referred by Altair or Altair’s sub-agents. Altair will pay a royalty of 5% of the net revenue received by Altair for sales of Products using the lithium extraction technology which decreases to 3% of the net revenue on all payments in excess of US$8,000,000 of production on an annualized basis.

| 17 |

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The Company’s financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”).

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Concentrations of Credit Risk

We maintain our cash in bank deposit accounts, the balances of which at times may exceed federally insured limits. We continually monitor our banking relationships and consequently have not experienced any losses in our accounts. We believe we are not exposed to any significant credit risk on cash.

Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. There were no cash equivalents for the years ended March 31, 2021 or 2020.

Principles of Consolidation

The accompanying consolidated financial statements for the year ended March 31, 2021, include the accounts of the Company and its wholly owned subsidiary, EV Lithium Solutions, Inc. All significant intercompany transactions have been eliminated in consolidation.

Mining Expenses

The Company records all mining exploration and evaluation costs as expenses in the period in which they are incurred.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1: | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| Level 2: | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| Level 3: | Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

The carrying amount of the Company’s financial assets and liabilities, such as cash, prepaid expenses and accrued expenses approximate their fair value because of the short maturity of those instruments. The Company’s notes payable approximates the fair value of such instruments as the notes bear interest rates that are consistent with current market rates.

The following table classifies the Company’s liabilities measured at fair value on a recurring basis into the fair value hierarchy as of March 31, 2021:

| Description | Level 1 | Level 2 | Level 3 | |||||||||||

| Derivative | $ | — | $ | — | $ | 142,642 | ||||||||

| Total | $ | — | $ | — | $ | 142,642 | ||||||||

Income taxes

The Company follows Section 740-10-30 of the FASB Accounting Standards Codification, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the fiscal year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the fiscal years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Statements of Income in the period that includes the enactment date.

The Company adopted section 740-10-25 of the FASB Accounting Standards Codification (“Section 740-10-25”) with regards to uncertainty income taxes. Section 740-10-25 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under Section 740-10-25, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Section 740-10-25 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of Section 740-10-25.

| 18 |

Stock-based Compensation

In June 2018, the FASB issued ASU 2018-07, Compensation – Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 allows companies to account for nonemployee awards in the same manner as employee awards. The guidance is effective for fiscal years beginning after December 15, 2018, and interim periods within those annual periods. We adopted this ASU on January 1, 2019. The adoption of ASU 2018-07 did not have a material impact on our consolidated financial statements.

Basic and Diluted Earnings Per Share

Net income (loss) per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period. The weighted average number of common shares outstanding and potentially outstanding common shares assumes that the Company incorporated as of the beginning of the first period presented. As of March 31, 2021 the Company does not have any potentially dilutive shares.

Recent Accounting Pronouncements

On June 20, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 is intended to reduce cost and complexity and to improve financial reporting for share-based payments to nonemployees (for example, service providers, external legal counsel, suppliers, etc.). Under the new standard, companies will no longer be required to value non-employee awards differently from employee awards. Meaning that companies will value all equity classified awards at their grant-date under ASC718 and forgo revaluing the award after this date. The Company has chosen to early adopt this standard. There has been no material impact on our financial statements as a result of adopting this standard.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

NOTE 3 - GOING CONCERN

The Company’s financial statements have been prepared on a going concern basis, which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Company has incurred losses since inception resulting in an accumulated deficit of $12,895,662 as of March 31, 2021 ($11,116,250 of the accumulated deficit is non-cash stock-based compensation and expense). Further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from third parties and/or private placement of common stock. The financial statements of the Company do not include any adjustments that may result from the outcome of these uncertainties.

NOTE 4 – SIGNIFICANT TRANSACTION

On March 19, 2021, the Company, through its newly formed Nevada subsidiary, EV Lithium Solutions, Inc., entered into an Asset Purchase Agreement with CryptoSolar LTD, a company formed under the laws of the United Kingdom, that has energy storage technology for a variety of industries, including electric vehicles, to be used in place of traditional batteries that rely upon chemical reactions rather than an electric field for higher energy output and a longer life than traditional batteries. The Company purchased a battery technology for solid-state lithium batteries and prototypes. No liabilities were assumed. Under the terms of the Asset Purchase Agreement, CryptoSolar received 2,500,000 shares of Altair’s common stock at the closing of the transaction and will receive up to 900,000 additional shares of common stock in connection with the successful commercial development of the scaled-up EV battery prototype and 20% of the net profits from all products sold by Altair incorporating or based upon the assets acquired from CryptoSolar. In addition, Altair International entered into a five-year Consulting Agreement with the sole founder of CryptoSolar LTD, Andreas Tapakoudes, under which he will receive a consulting fee of $4,000 per month to develop a commercial lithium battery and a manufacturing facility for its commercial production.

The 2,500,000 shares issued were valued at $0.18 per share, the closing stock price on the date of grant, for total non-cash expense of $450,000. The Company determined that it was unable to substantiate the actual fair value of the technology that was acquired so has chosen to expense the full amount of $450,000.

| 19 |

NOTE 5 – CONVERTIBLE NOTES PAYABLE

A summary of the Company’s convertible notes as of March 31, 2021 is presented below:

| Note Holder | Date | Maturity Date | Interest | Balance March 31, 2020 | Additions | Conversions | Balance March 31, 2021 | |||||||||||||||||||

| Williams Ten, LLC (1) | 5/11/2020 | 5/11/2021 | 8 | % | — | $ | 15,000 | $ | (15,000 | ) | $ | — | ||||||||||||||

| EROP Capital, LLC (2) | 5/13/2020 | 5/13/2021 | 8 | % | — | 20,000 | (20,000 | ) | — | |||||||||||||||||

| Thirty 05, LLC (1) | 5/18/2020 | 5/18/2021 | 8 | % | — | 17,500 | — | 17,500 | ||||||||||||||||||

| EROP Capital, LLC (2) | 6/5/2020 | 6/5/2021 | 8 | % | — | 10,000 | (10,000 | ) | — | |||||||||||||||||

| EROP Capital, LLC (2) | 7/16/2020 | 7/16/2021 | 8 | % | — | 7,500 | (7,500 | ) | — | |||||||||||||||||

| EROP Capital, LLC (2) | 8/14/2020 | 8/14/2021 | 8 | % | — | 12,500 | (12,500 | ) | ||||||||||||||||||

| Thirty 05, LLC (3) | 8/14/2020 | 8/14/2021 | 8 | % | — | 12,500 | — | 12,500 | ||||||||||||||||||

| EROP Capital, LLC (2) | 8/27/2020 | 8/27/2021 | 8 | % | — | 7,500 | (7,500 | ) | — | |||||||||||||||||

| EROP Capital, LLC (1) | 9/30/2020 | 9/30/2021 | 8 | % | — | 10,000 | (10,000 | ) | — | |||||||||||||||||

| EROP Capital, LLC (1) | 12/3/2020 | 12/3/2021 | 8 | % | — | 7,000 | (7,000 | ) | — | |||||||||||||||||

| EROP Capital, LLC (1) | 12/7/2020 | 12/7/2021 | 8 | % | — | 30,000 | (30,000 | ) | — | |||||||||||||||||

| Thirty 05, LLC (3) | 12/31/2020 | 12/20/2021 | 8 | % | — | 75,000 | — | 75,000 | ||||||||||||||||||

| Total | $ | — | $ | 224,500 | $ | (119,500 | ) | $ | 105,000 | |||||||||||||||||

| Less Discount | (63,023 | ) | ||||||||||||||||||||||||

| Total | $ | 41,977 | ||||||||||||||||||||||||

Total accrued interest on the above Notes as of March 31, 2021, was $3,339.

| (1) | the Note holder has the right to convert all or a portion of the outstanding balance of the Note into common shares of the Company at a rate of the lesser of (i) $0.25 or (ii) 80% of the lowest closing bid price of the common stock in the 15 days prior to conversion. |

| (2) | On notice, the Note holder has the right to convert all or a portion of the outstanding balance of the Note into common shares of the Company at a rate of the lesser of (i) $0.25 or (ii) 70% of the lowest closing bid over the prior five trading days prior to conversion. |

| (3) | On notice, the Note holder has the right to convert all or a portion of the outstanding balance of the Note into common shares of the Company at a rate of the lesser of (i)$0.25 or 70% of the lowest closing bid price of the common stock in the 15 days prior to conversion. |

| 20 |

A summary of the activity of the derivative liability for the notes above is as follows:

| Balance at March 31, 2020 | $ | — | ||

| Increase to derivative due to new issuances | 198,322 | |||

| Decrease to derivative due to conversion/repayments | (199,366 | ) | ||

| Derivative loss due to mark to market adjustment | 143,686 | |||

| Balance at March 31, 2021 | $ | 142,642 |

A summary of quantitative information about significant unobservable inputs (Level 3 inputs) used in measuring the Company’s derivative liability that are categorized within Level 3 of the fair value hierarchy as of March 31, 2021 is as follows:

| Inputs | March 31, 2021 | |||

| Stock price | $ | 0.1547 | ||

| Conversion price | $ | .0973 | ||

| Volatility (annual) | 518.04% - 159.93% | |||

| Risk-free rate | .01 - .06 | |||

| Dividend rate | — | |||

| Years to maturity | .13 - .75 | |||

A summary of quantitative information about significant unobservable inputs (Level 3 inputs) used in measuring the Company’s derivative liability that are categorized within Level 3 of the fair value hierarchy at the time of conversion is as follows:

| Inputs | ||||

| Stock price (1) | $ | .4112 - .43 | ||

| Conversion price (2) | $ | .145 - .147 | ||

| Volatility (annual) | 183.27 – 470.97 | |||

| Risk-free rate | .05 | |||

| Dividend rate | — | |||

| Years to maturity | .27 - .89 | |||

NOTE 6 – LOANS PAYABLE

A summary of the Company’s loans payable as of March 31, 2021 is presented below:

| Note Holder | Date | Maturity Date | Interest | Balance March 31, 2020 | Additions | Balance March 31, 2021 | ||||||||||||||||

| Third party | 8/24/2020 | 8/24/2021 | 0 | % | 14,165 | $ | — | $ | 14,165 | |||||||||||||

| Byron Hampton | 8/24/2020 | 8/24/2021 | 8 | % | — | 9,990 | 9,990 | |||||||||||||||

| Byron Hampton | 12/22/2020 | 12/22/2021 | 8 | % | — | 5,000 | 5,000 | |||||||||||||||

| Byron Hampton | 12/30/2020 | 12/30/2021 | 8 | % | — | 20,000 | 20,000 | |||||||||||||||

| EROP Enterprises, LLC | 12/29/2020 | 12/29/2022 | 6 | % | — | 100,000 | 100,000 | |||||||||||||||

| EROP Enterprises, LLC | 2/1/2021 | 12/29/2022 | 6 | % | — | 100,000 | 100,000 | |||||||||||||||

| EROP Enterprises, LLC | 3/8/2021 | 3/8/2022 | 6 | % | — | 100,000 | 100,000 | |||||||||||||||

| Total | $ | 14,165 | $ | 334,990 | $ | 349,155 | ||||||||||||||||

Total accrued interest on the above notes payable as of March 31, 2021 was $4,356.

| 21 |

NOTE 7 – COMMON STOCK

On September 1, 2020, the Company entered into a service agreement with Oliver Geoservices LLC for a term of one year. Per the terms of the agreement the Company will issue them 300,000 shares of common stock per month. In addition, they received 150,000 shares of common stock for services provided prior to the execution of the service agreement. As of March 31, 2021, Oliver Geoservices LLC received 1,950,000 shares of common stock for total non-cash expense of $401,250. In addition, 300,000 shares have not yet been issued by the transfer agent and have been disclosed on the balance sheet as common stock to be issued of $72,000. All shares were valued at the closing stock price on the date of grant.

On December 9, 2020, the Company entered into two separate service agreements with Paul Pelosi to be a member of the Company’s advisory board. Both agreements are for a term of one year. Per the terms of the agreements the Company will issue Mr. Pelosi a total of 6,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. The initial 3,000,000 shares were valued at the closing stock price on the date of grant for total non-cash expense of $870,000.

On December 14, 2020, the Company entered into a service agreement with Adam Fishman to be a member of the Company’s advisory board for a term of one year. Per the terms of the agreements the Company will issue Mr. Fishman 5,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. The initial 2,500,000 shares were valued at the closing stock price on the date of grant for total non-cash expense of $750,000.

On February 6, 2021, the Company issued 2,000,000 shares of common stock to a service provider. The shares were valued at $0.47, the closing stock price on the date of grant, for total non-cash stock compensation expense of $940,000.

On February 11, 2021, the Company issued 2,000,000 shares of common stock to St. Georges Eco-Mining Corp pursuant to the terms of its binding term sheet with St. Georges Eco-Mining Corp. The shares were valued at $0.38, the closing stock price on the date of grant, for total non-cash stock compensation expense of $760,000.

During the year ended March 31, 2021, EROP Enterprises LLC, converted $104,500 and $3,579 of principal and interest, respectively, into 734,820 shares of common stock.

During the year ended March 31, 2021, Williams Ten, LLC, converted $15,000 and $930 of principal and interest, respectively, into 109,862 shares of common stock.

Refer to Note 9 for common stock issued to related parties.

| 22 |

NOTE 8 – WARRANTS

On October 15, 2020, the Company entered into a service agreement with a third party for a term of six months. Per the terms of the agreement the party was granted 1,000,000 warrants to purchase shares of common stock. The warrants vested on April 15, 2021.

The warrants have an exercise price of $0.25 and expire in three years. The aggregate fair value of the warrants totaled $180,000 based on the Black Scholes Merton pricing model using the following estimates: stock price of $0.18, exercise price of $0.25, 1.57% risk free rate, 735.46% volatility and expected life of the warrants of 3 years. The value of the warrants is being amortized to expense over the six-month term of the agreement. During the year ended March 31, 2021, the Company recognized $165,000 of the expense.

A summary of the status of the Company’s outstanding stock warrants and changes during the year is presented below:

| Number of Warrants | Weighted Average Price | Weighted Average Fair Value | Aggregate Intrinsic Value | |||||||||||||||

| Outstanding, March 31, 2020 | — | $ | — | $ | — | $ | — | |||||||||||

| Issued | 1,000,000 | $ | 0.25 | $ | 0.18 | |||||||||||||

| Exercised | — | $ | — | $ | — | |||||||||||||

| Expired | — | $ | — | $ | — | |||||||||||||

| Outstanding, March 31, 2021 | 1,000,000 | $ | 0.25 | $ | 0.18 | $ | — | |||||||||||

| Exercisable, March 31, 2021 | — | $ | — | $ | — | $ | — | |||||||||||

| Range of Exercise Prices | Number Outstanding 3/31/2021 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | |||||||||||

| $0.25 | 1,000,000 | 2.54 years | $0. 25 | |||||||||||

The aggregate intrinsic value represents the total pretax intrinsic value, based on warrants with an exercise price less than the Company’s stock price as of March 31, 2021, which would have been received by the warrant holder had the warrant holder exercised their warrants as of that date.

| 23 |

NOTE 9 – RELATED PARTY TRANSACTIONS

On September 29, 2017, a Promissory Note (the “Note”) in the principal amount of $45,000 was issued to Alan Smith the Company’s former sole officer and director for loans made to the Company in prior periods. The Note was unsecured and bore interest at 6% per annum. The Note matured March 31, 2018. On June 29, 2018, the Company made a partial payment of $15,000 on the Note. The balance of the Note including principal and interest was repaid through a cash payment of $20,000 and the issuance of 11,000,000 common shares valued at $0.005 per share in the three-month period ended June 30, 2020.

On April 10, 2018, the Company agreed to pay the former sole officer and director of the Company $2,500 per month for a period of 4 months for the provision of management and financial services. On September 1, 2018, the Company agreed to extend this contract on a month-to-month basis at the existing rate of $2,500 per month. $22,500 was paid and $5,000 accrued as payable to February 28, 2019 when the agreement was terminated. The payable amount was paid in the three-month period ended June 30, 2020.

On April 29, 2020 the Company entered into a General Services Agreement with Alan Smith, a director and the Company’s sole officer for the performance of duties of a CEO including the provision of management and financial services. The Agreement commenced May 1, 2020 and was to remain in full force and effect until December 31, 2020. Under the terms of the Agreement, Alan Smith received the following compensation:

| i) | A monthly fee of $2,500; |

| ii) | Payment of past fee accruals in cash in the amount $5,000; |

| iii) | Settlement of the of the outstanding balance of the Promissory Note due to Alan Smith in the amount of $30,000 plus accrued interest through the payment of $20,000 in cash and the issuance of 11,000,000 common shares at $0.005 per share. |

On September 1, 2020 Mr. Smith notified the Company of his need to resign from his positions with the Company for health reasons. The General Services Agreement was therefore terminated.

During the year ended March 31, 2021, Company issued 4,000,000 common shares to Mr. Leonard Lovallo for his role as an independent member of the Company’s Board of Directors. The shares were valued at $0.005, the closing stock price on the date of grant, for total non-cash stock compensation expense of $20,000. Mr. Lovallo was also issued 26,000,000 common shares for his role as Chief Executive Office and President of the Company. The shares were valued at $0.26, the closing stock price on the date of grant, for total non-cash stock compensation expense of $6,760,000.

NOTE 10 - INCOME TAX

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. The U.S. federal income tax rate is 21%.

The provision for Federal income tax consists of the following March 31:

| 2021 | 2020 | |||||||

| Federal income tax benefit attributable to: | ||||||||

| Current Operations | $ | 3,118,600 | $ | 1,400 | ||||

| Less: valuation allowance | (3,118,600 | ) | (1,400 | ) | ||||

| Net provision for Federal income taxes | $ | — | $ | — | ||||

The cumulative tax effect at the expected rate of 21% of significant items comprising our net deferred tax amount is as follows:

| 2021 | 2020 | |||||||

| Deferred tax asset attributable to: | ||||||||

| Net operating loss carryover | $ | 1,965,000 | $ | 234,300 | ||||

| Less: valuation allowance | (1,965,000 | ) | (234,300 | ) | ||||

| Net deferred tax asset | $ | — | $ | — | ||||

At March 31, 2021, the Company had net operating loss carry forwards of approximately $1,965,000 that maybe offset against future taxable income. No tax benefit has been reported in the March 31, 2021 or 2020 financial statements since the potential tax benefit is offset by a valuation allowance of the same amount.

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur, net operating loss carry forwards may be limited as to use in future years.

ASC Topic 740 provides guidance on the accounting for uncertainty in income taxes recognized in a company’s financial statements. Topic 740 requires a company to determine whether it is more likely than not that a tax position will be sustained upon examination based upon the technical merits of the position. If the more-likely-than-not threshold is met, a company must measure the tax position to determine the amount to recognize in the financial statements.

The Company includes interest and penalties arising from the underpayment of income taxes in the statements of operations in the provision for income taxes. As of March 31, 2021, the Company had no accrued interest or penalties related to uncertain tax positions.

| 24 |

NOTE 11 – SUBSEQUENT EVENTS

In accordance with SFAS 165 (ASC 855-10) management has performed an evaluation of subsequent events through the date that the financial statements were available to be issued and has determined that it does not have any material subsequent events to disclose in these financial statements other than the following.

On April 23, 2021, the Company issued to EROP Enterprises LLC a convertible promissory note (the “Note”) in the principal amount of $400,000 bearing annual interest at 8% and due in 12 months from the date of the Note. The Company used $304,268 of the Note to repay the three prior secured promissory notes and accrued interest under those notes issued by Altair to EROP Enterprises LLC dated March 8, 2021, February 2, 2021 and December 29, 2020 that were secured by the Walker Ridge claims and project that Altair purchased under a Mining Lease dated August 14, 2020 between Altair and Oliver Geoservices LLC involving Altair’s right to mine certain property in Nevada for a period of five years that can be extended for an additional twenty years if a certain extension payment are made within the term of the lease as more fully described in the Form 8-K filed August 18, 2020 by Altair. The conversion price under the Note will be the lesser of $.25 or 80% of the lowest closing bid over the prior five trading days prior to conversion.