Attached files

Exhibit 99.2

Heliogen Investor Presentation 2021 Replacing Fossil Fuels with Concentrated Sunlight

Disclaimer 1 This information pack (this “Pack”) is being provided for informational purposes only and has been prepared to assist interes ted parties in evaluating a business combination transaction between Heliogen, Inc. (“the Company” or “Heliogen”) and Athena Technology Acquisition Corp. (“Athena”) and is not to be used for any other purpose.. No representations or warranties, express or implied, are given in, or in respect of, the accuracy or completeness of the Pac k. To the fullest extent permitted by law, in no circumstances will the Company, Athena or any of their subsidiaries, stockholde rs, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indire ct or consequential loss or loss of profit arising from the use of the Pack, its contents, its omissions, reliance on the inform ati on contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. The Company is prov idi ng the information in this Pack on an “as is” basis. You are encouraged to conduct your own investigation and analysis of the Co mpany in connection with any transaction. ANY TRANSACTION INVOLVING THE COMPANY INVOLVES A HIGH DEGREE OF RISK ”. The Company and Athena each disclaims all warranties, whether express, implied or statutory, including, without limitation, any i mpl ied warranties of title, non - infringement of third - party rights, merchantability, or fitness for a particular purpose. The Pack discusses trends and markets that the Company’s and Athena’s respective leadership teams believe will impact the development and success of the Company based on its current understanding of the marketplace. Industry and market data used in the Pack have been obtained from third - party industry publications and sources as well as from research reports prepared for other purpos es. The Company has not independently verified the data obtained from these sources and cannot assure you of the data’s accur acy or completeness. This data is subject to change. Nothing in this agreement imposes on the Company, Athena or their advisors o r r epresentatives any obligation to provide further Packs or update or correct any inaccuracies in the Pack. Forward - Looking Statements The Pack includes “forward - looking statements”. Forward - looking statements may be identified by the use of words such as “estimate, ” “plan,” “project,” “forecast,” “intend,” “would,” “should,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or oth er similar expressions that predict or indicate future events or trends or that are not statements of historical matters. “Forward - looking statements” include all statements about the Company’s future plans and performance, regardless of whether the foregoing expr ess ions are used to identify them. In addition, these forward - looking statements include, but are not limited to, statements regarding: estimates and forecasts of financial and performance metrics; projections of market opportunity and market share, expectation s a nd timing related to the announcement of strategic partnerships; the potential success of the Company’s business strategy; the C omp any’s research and development efforts; and the Company’s proposed plans to scale and expectations, including statements regarding the effectiveness and efficiency of its services. These statements are based on various assumptions, whether or not identified in the Pack, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied o n by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events an d circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward - looking statements are subject to a n umber of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions, projections of market opportunity and market share, potential benefits and commercial attractiveness to its custo mer s of the Company’s services, the potential success of the Company’s marketing and expansion strategies, the Company’s ability to scale and the timing of expected business milestones, the inability of the parties to successfully or timely consummate the p rop osed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are sub jec t to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business c omb ination or that the approval of the stockholders of the Company or Athena is not obtained, failure to realize the potential b ene fits of the business combination (including with respect to stockholder value), the effects of competition on the Company’s future bu sin ess, the amount of redemption requests made by Athena’s public stockholders, the ability of Athena or the combined company to issue equity or equity - linked securities in connection with the proposed business combination or in the future, and expectations related to the terms and timing of the potential transactions and those factors discussed in Athena’s final prospectus filed on February 5, 2021, under the heading “Risk Factors,” and other documents of Athena filed, or to be filed, including the proxy statement /pr ospectus expected to be filed in connection with the business combination, with the Securities and Exchange Commission (“SEC” ). If any of these risks materialize or if assumptions prove incorrect, actual results could differ materially from the results imp lie d by these forward - looking statements. There may be additional risks that are not presently known to the Company or that the Com pany currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking sta tements. In addition, forward - looking statements reflect the Company’s expectations, plans or forecasts of future events and vie ws as of the date of the Pack. The Company anticipates that subsequent events and developments will cause the Company’s assessments to ch ange. However, while the Company may elect to update these forward - looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward - looking statements should not be relied upon as representi ng the Company’s assessments as of any date subsequent to the date of the Pack. Accordingly, undue reliance should not be placed upon the forward - looking statements. Use of Projections and Description of Key Relationships The Pack contains projected financial information with respect to the Company, namely revenue and the non - GAAP financial measures, E BITDA and Free Cash Flow for 2021 – 2026. Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The as sum ptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide varie ty of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ mater ial ly from those contained in the prospective financial information See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the projected fina ncial information contained in the Pack, and the inclusion of such information in the Pack should not be regarded as a repres ent ation by any person that the results reflected in such projections will be achieved. The independent registered public accounting f irm of the Company has not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpo se of their inclusion in the Pack, and accordingly, does not express an opinion or provided any other form of assurance with respec t t hereto for the purpose of the Pack .

Disclaimer 2 The Pack contains descriptions of certain key business relationships of the Company. These descriptions are based on the Comp any ’s management team’s discussions with such counterparties and the latest available information and estimates as of the date o f the Pack. In certain cases, such descriptions are subject to negotiation and execution of definitive agreements with such cou nte rparties which have not been completed as of the date of the Pack and, as a result, such descriptions of key business relatio nsh ips of the Company, remain subject to change Financial Information; Non - GAAP Financial Measures The financial information and data contained in the Pack is unaudited and does not conform to Regulation S - X. Some of the financ ial information and data contained in the Pack, such as EBITDA and Free Cash Flow, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). EBITDA is defined as net earnings (loss) before interest exp ens e, income tax expense (benefit) depreciation and amortization Free cash flow is defined as net income, plus depreciation and amortization, less capital expenditures (incl. acquisitions) and less change in net working capital. The Company believes the se non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the use of th ese non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and t rends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non - GAAP financ ial measures to investors. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non - GAAP financial measures is that the y exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expens e a nd income are excluded or included in determining these non - GAAP financial measures. In order to compensate for these limitation s, management presents non - GAAP financial measures in connection with GAAP results. Please refer to the Appendix for a reconciliati on of the Company’s projected EBITDA and free cash flow for full years 2021 - 2026 to the most directly comparable measure prepared in accordance with GAAP because the Company is unable to provide this reconciliation without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adju st ments may be recognized.. In addition, all the Company historical financial information included herein is preliminary and subject to change pending fi nal ization of the 2020 audit of the Company in accordance with PCAOB auditing standards. Trademarks The Pack contains trademarks, service marks, trade names and copyrights of the Company and other companies, which are the pro per ty of their respective owners. Additional Information and Where to Find It In connection with the proposed business combination, Athena Technology Acquisition Corp. (“Athena”) intends to file with the SE C a registration statement on Form S - 4 containing a preliminary proxy statement and a preliminary prospectus of Athena, and afte r the registration statement is declared effective, Athena will mail a definitive proxy statement/prospectus relating to the pr opo sed business combinations to its stockholders. This communication does not contain all the information that should be conside red concerning the proposed business combinations and is not intended to form the basis of any investment decision or any other d eci sion in respect of the business combinations. Additional information about the proposed business combinations and related transactions will be described in Athena’s combined proxy statement/prospectus relating to the proposed business combinations an d the businesses of Athena and Heliogen, Inc. (“Heliogen”), which Athena will file with the SEC. The proposed business combinations and related transactions will be submitted to stockholders of Athena for their consideration. Athena’s stockhold ers and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendmen ts thereto and the definitive proxy statement/prospectus and other documents filed in connection with Athena’s solicitation of p rox ies for its special meeting of stockholders to be held to approve, among other things, the proposed business combinations and re lated transactions, because these materials will contain important information about Heliogen, Athena and the proposed business com bin ations and related transactions. When available, the definitive proxy statement/prospectus and other relevant materials for t he proposed business combinations will be mailed to stockholders of GigCapital2 as of a record date to be established for voting on the proposed business combinations and related transactions. Stockholders may also obtain a copy of the preliminary or defini ti ve proxy statement/prospectus, once available, as well as other documents filed with the SEC by Athena, without charge, at the S EC’ s website located at www.sec.gov or by directing a request to Phyllis Newhouse, President and Chief Executive Officer, Athena Technology Acquisition Corp., 125 Townpark Drive, Suite 300, Kennesaw, GA 30144, or by telephone at (970) 924 - 0446 .. Participants in the Solicitation Athena, Heliogen and their respective directors and executive officers and other persons may be deemed to be participants in the solicitations of proxies from Athena’s stockholders in respect of the proposed business combinations and related transactions . Information regarding Athena’s directors and executive officers is available in its Registration Statement on Form S - 1 and the p rospectus included therein filed with the SEC on March 3, 2021. Additional information regarding the participants in the prox y solicitation and a description of their direct and indirect interests will be contained in the preliminary and definitive pro xy statements/prospectus related to the proposed business combinations and related transactions when it becomes available, and w hic h can be obtained free of charge from the sources indicated above. No Offer or Solicitation This communication shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall th ere be any sale of securities in any jurisdiction in which the offer, solicitation, or sale would be unlawful prior to the re gis tration or qualification under the securities laws of any such jurisdiction.

Athena Technology Acquisition Corp. (“Athena”) (Ticker: ATHN) Athena Investment Thesis Isabelle Freidheim Chairman of the Board and Director • Venture capitalist and the co - founder of Magnifi (acquired by the Tifin Group), for which she served as CEO • Co - founder and managing partner at StarwoodVC, where she leads late stage investments in technology companies Phyllis W. Newhouse Chief Executive Officer and Director • Founder and CEO of XTreme Solutions, a cybersecurity company with $500m in revenues, 6,500 employees globally and a state of the art proprietary ethical hacking technology • Ernst and Young Entrepreneur of the Year • Previously served in the United States Army with a focus on National Security where she established the Cyber Espionage Task Force Grace Vandecruze Chief Financial Officer • Founder and Managing Director at Grace Global Capital, a boutique investment banking advisory firm providing M&A financial advisory, restructuring, and valuation services • Extensive expertise in mergers and acquisitions and capital raising with over 20 years of experience and over $25bln in transactions • Athena’s mission is to work with world - class disruptive technology companies • Athena believes Heliogen has the potential to transform the world’s energy production and positively impact climate change • Heliogen is a leader in next generation Concentrated Solar Power (“CSP”) – Unique and differentiated technology – Highly accomplished leadership team – Strong customer and business pipeline • Heliogen uniquely enables an Industrial and Green Fuel Energy transition • Athena is a SPAC committed to Diversity & Inclusion and found a target in Heliogen sharing this commitment Heliogen’s Business Combination with Athena Technology Acquisition Corp. 3

Heliogen’s Mission: Empower a sustainable civilization with low - cost solar energy that makes clean power more affordable than fossil fuels. 4

College – Patented a new loudspeaker design and started his second company, GNP Loudspeakers Inc., which he sold soon after graduating from Caltech 1980s – Started GNP Development Inc., which made a natural language product for Lotus called HAL. Sold in 1995 to Lotus 1991 – Started Knowledge Adventure, an educational software publisher that eventually sold to Havas Vivendi 1996 – Started Idealab, a technology incubator in California that was the first of its kind, proving to be a wildly successful concept 2013 – Started working on what would become Heliogen, looking to create a company that could solve the Earth’s climate crisis 2019 – Announced Heliogen broke 1,000 o C, and we believe has become the first and only company prepared to create cost - effective hydrogen without fossil fuels “Powering the planet renewably I believe is the biggest financial opportunity in history. I have spent most of my life invent ing and refining a solution to enable solar energy to compete with fossil fuel, and Heliogen’s solution is the result.” Childhood – Started his first company, Solar Devices, in high school during the 1973 energy crisis, helping him pay for college Idealab has participated in 150+ companies, with 40+ M&A exits and IPOs. Through Idealab Bill has started and sold multiple solar companies. Founder & CEO Founder & Chairman Bill Gross: Founder & CEO of Heliogen 5

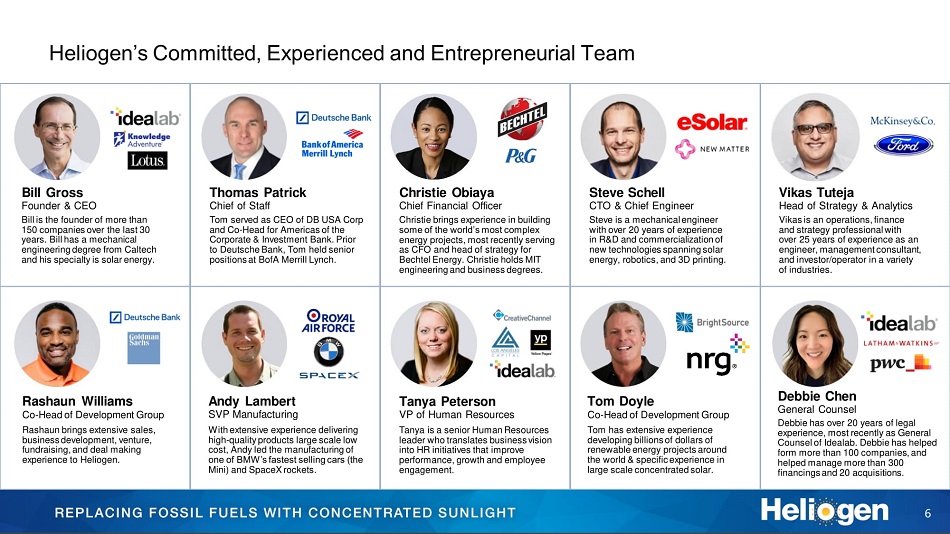

Heliogen’s Committed, Experienced and Entrepreneurial Team 6 Bill Gross Founder & CEO Bill is the founder of more than 150 companies over the last 30 years. Bill has a mechanical engineering degree from Caltech and his specialty is solar energy. Steve Schell CTO & Chief Engineer Steve is a mechanical engineer with over 20 years of experience in R&D and commercialization of new technologies spanning solar energy, robotics, and 3D printing. Vikas Tuteja Head of Strategy & Analytics Vikas is an operations, finance and strategy professional with over 25 years of experience as an engineer, management consultant, and investor/operator in a variety of industries. Thomas Patrick Chief of Staff Tom served as CEO of DB USA Corp and Co - Head for Americas of the Corporate & Investment Bank. Prior to Deutsche Bank, Tom held senior positions at BofA Merrill Lynch. Rashaun Williams Co - Head of Development Group Rashaun brings extensive sales, business development, venture, fundraising, and deal making experience to Heliogen. Tom Doyle Co - Head of Development Group Tom has extensive experience developing billions of dollars of renewable energy projects around the world & specific experience in large scale concentrated solar. Debbie Chen General Counsel Debbie has over 20 years of legal experience, most recently as General Counsel of Idealab . Debbie has helped form more than 100 companies, and helped manage more than 300 financings and 20 acquisitions. Christie Obiaya Chief Financial Officer Christie brings experience in building some of the world’s most complex energy projects, most recently serving as CFO and head of strategy for Bechtel Energy. Christie holds MIT engineering and business degrees. Andy Lambert SVP Manufacturing With extensive experience delivering high - quality products large scale low cost, Andy led the manufacturing of one of BMW’s fastest selling cars (the Mini) and SpaceX rockets. Tanya Peterson VP of Human Resources Tanya is a senior Human Resources leader who translates business vision into HR initiatives that improve performance, growth and employee engagement.

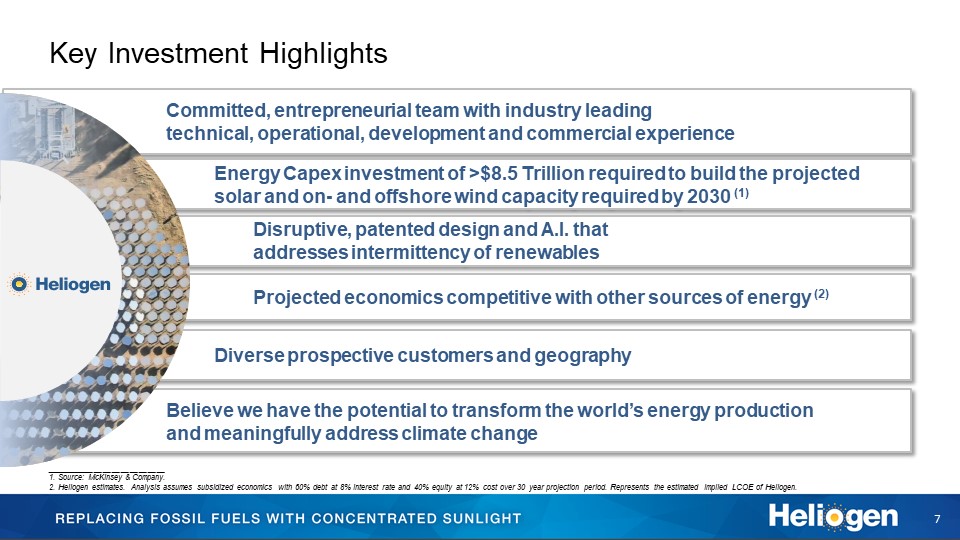

Committed, entrepreneurial team with industry leading technical, operational, development and commercial experience Energy Capex investment of >$8.5 Trillion required to build the projected solar and on - and offshore wind capacity required by 2030 (1) Disruptive, patented design and A.I. that addresses intermittency of renewables Diverse prospective customers and geography Believe we have the potential to transform the world’s energy production and meaningfully address climate change Projected economics competitive with other sources of energy (2) Key Investment Highlights 7 ___________________________ 1. Source: McKinsey & Company. 2. Heliogen estimates. Analysis assumes subsidized economics with 60% debt at 8% interest rate and 40% equity at 12% cost ove r 3 0 year projection period. Represents the estimated implied LCOE of Heliogen.

Heliogen Overview

1. Reflect sun rays to top of tower 2. Bring hot air down to thermal storage tank 3. Store heat in rocks 4. Heat exchanger brings heat to heat engine 5. Heat engine makes power 6. Electrolyzer makes Hydrogen Heliogen’s operational prototype facility in Lancaster, California The Heliogen Process The c losed - loop system uses computer vision to identify the precise position of every single mirror, then make micro - adjustments in real time to achieve a perfect focus 8

• The peak demand curve is essentially the opposite of the solar peak curve, which leads to curtailment during the middle of the day – Heliogen expects to be able to provide the energy bridge to match the demand curve • Heliogen’s power will be “more valuable” because it can be delivered either flat/continuously, or match the peak • In addition, because of its superior storage solution, we believe Heliogen will be able to provide constant energy throughout the day to produce hydrogen with an electrolyzer Heliogen’s Differentiator Will Be Always - Available Renewable Energy 9 Peak Demand Peak Demand Peak Sun Continuous Level Power Available Solar Net Load Load Curtailment 2am 4am 6am 8am 10am 12pm 2pm 4pm 6pm 8pm 10pm

Business Model 10 Plant estimated to produce: • > 85% Capacity factor renewable power • < 5 cents per kW - hour power cost (1) • < 1/6 th square mile footprint (650m x 650m) • > 850,000 kilograms of hydrogen/year Modular and Scalable Plant Design ~ 650m x 650m 1. Heliogen estimates. Analysis assumes subsidized economics with 60% debt at 8% interest rate and 40% equity at 12% cost over 30 year projection period. Represents the estimated implied LCOE of Heliogen. We build ONE modular 5MW plant and replicate it to meet our customers’ demand: • ~100MW of electrical energy can be produced with ~20 modules • Modular and easy scalable design will allow for growth to compete with large scale renewable projects ~ 2100ft x 2100ft

Heliogen has a strong portfolio of 6 granted and 13 pending patents 11 Rich portfolio of technology advancements and proprietary software includes the following issued patents: • Closed loop tracking system (9,010,317, 10,101,430) • Heliostat tracking based on radiance maps (11,017,561) • Heliostat intensity & polarization tracking (10,359,215, ZL 201710278774.4) • Covered heliostat array (11,035,592) • Self - ballasted suspended heliostat (appl. no. 16/426599 allowed) • Solar panel tracking assembly (ZL201721163276.7, ZL201721163153.3, ZL201721163240.9)

Heliogen is Re - Inventing the Concentrated Solar Power Paradigm: 1. Artificial intelligence (AI) / computer - vision closed loop tracking 2. Pre - fabricate in the factory 3. Eliminate expensive slew drive gearbox 4. Robotic installation and maintenance 5. Low - cost energy storage with hot air and rocks 6. Modular plant design 12 Heliogen’s operational prototype facility in Lancaster, California

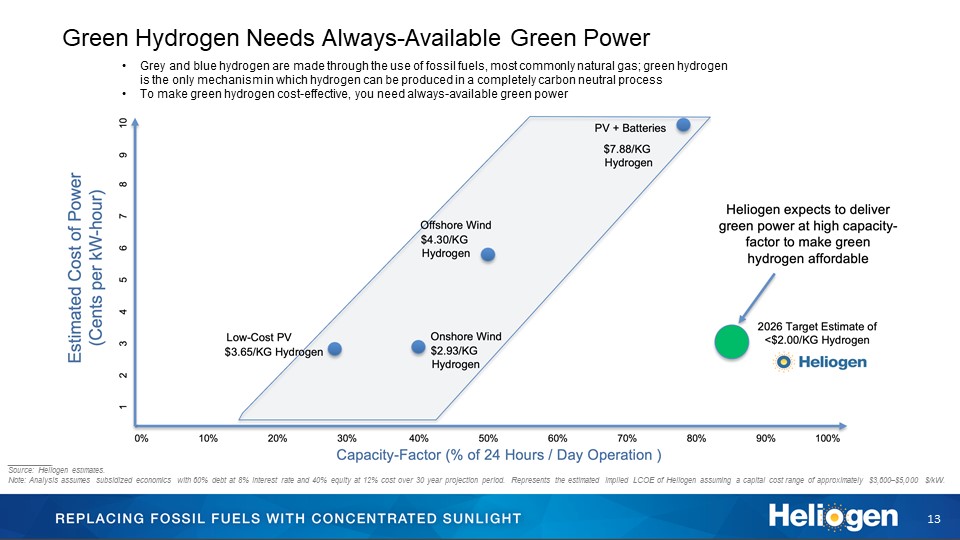

Green Hydrogen Needs Always - Available Green Power 13 ___________________________ Source: Heliogen estimates. Note: Analysis assumes subsidized economics with 60% debt at 8% interest rate and 40% equity at 12% cost over 30 year project ion period. Represents the estimated implied LCOE of Heliogen assuming a capital cost range of approximately $3,600 – $5,000 $/kW. • Grey and blue hydrogen are made through the use of fossil fuels, most commonly natural gas; green hydrogen is the only mechanism in which hydrogen can be produced in a completely carbon neutral process • To make green hydrogen cost - effective, you need always - available green power

Business Model

Heliogen’s Solar Refinery w designed to capture, concentrate and refine sunlight into cost - efficient energy on demand. This 24/7, low - carbon energy can be available as heat, power, or fuel in modular/scalable deployments. HelioHeat creates heat up to 800 ° C+ 24/7 to power industrial processes or mining. HelioPower delivers the HelioHeat solar thermal energy to a heat engine to produce electrical power 24/7. HelioFuel systems couple a HelioPower plant with a large - scale water electrolyzer to produce green Hydrogen fuel. The collected sunlight is processed and converted to: • HelioHeat • HelioPower • HelioFuel Delivery range of this product is approximately 1 mile. Delivery range of this product is approximately 100 miles. Delivery range of this product is greater than 10,000 miles. 14

Strategic and Commercial Relationships 15 ___________________________ 1. Value of total project is expected to be ~$70mm with ~$31mm funded from private investor. • One of the world’s leading steel and mining companies • Largest steel manufacturer in North America, South America and Europe • Selected to negotiate $39mm (1) award to develop, build, and operate supercritical carbon dioxide power integrated with thermal energy storage supplied by heliostat field • Australian oil and gas company with global presence • Mining and metals company operating in 35 countries around the world • One of the largest producers of iron ore, copper, diamonds and gold Global Oil & Gas Producer

Technology Evolution 16 1st Gen (2015 – 2016) 2nd Gen (2016 – 2017) 3rd Gen (2018 – 2019) 4th Gen (2019 – 2021) Heliostat Achieved 1/10th degree accuracy Achieved 1/15th degree accuracy Achieved 1/20th degree accuracy Achieved 1/36th degree accuracy Receiver Stainless Steel Screen 600 ƒ C Stainless Steel Screen 600 ƒ C Fecralloy Coil 800 ƒ C Silicon Carbide Foam 1,000 ƒ C Prototype System Pasadena – Achieved 450 ƒ C China – Achieved 550 ƒ C Lancaster, CA – Achieved 1,000 ƒ C Lancaster, CA – Achieved 1,000 ƒ C Mirror accuracy maximizes solar concentration, heat capture and energy capabilities Upgraded receiver materials support higher temperatures, enabling process effectiveness Proven demonstration - scale process as a key step toward cost - effectively replacing fossil fuels with concentrated sunlight THE OUTCOME

Investment Opportunity

($ in millions) 2021E 2022E 2023E 2024E 2025E 2026E Total New Modules Installed per Year - - 3 15 57 120 Projects Installed 3 4 4 5 Revenue $8 $24 $197 $569 $1,414 $2,396 Revenue Growth N/A 204% 709% 189% 149% 69% EBITDA ($29) ($59) ($92) ($114) $287 $831 % Margin NM NM NM NM 20% 35% Capital Expenditures (10) (15) (34) (36) (56) (97) Free Cash Flow ($40) ($70) ($132) ($183) $84 $433 Attractive Long Term Financial Model • Significant growth profile • Attractive EBITDA margins through multiple segments • Subsidies for power projects are not reflected and represent potential upside • Cash flow positive beginning in 2025 • No debt currently on the balance sheet • Capital light business model we believe optimizes efficiency 17 ___________________________ Source: Heliogen estimates. 1. Assumes 4 modules per project in 2024E, 16 modules per project in 2025E and 27 modules per project in 2026E. Project numbers hav e been rounded to the nearest whole number 2. Revenue from 2021E and 2022E are from work in progress projects. 3. EBITDA is defined as net earnings (loss) before interest expense, income tax expense (benefit) depreciation and amortization. EB ITDA is a non - GAAP financial measure and may be different from measures of EBITDA used by other companies. Please refer to the Appendix for a reconciliation of non - GAAP financial measures. See “Disclaimer – Financial Stateme nts; Non - GAAP Financial Measures”. 4. Free cash flow is defined as net income, plus depreciation and amortization, less capital expenditures (incl. acquisitions) a nd less change in net working capital. Free cash flow is a non - GAAP financial measure and may be different from measures of free cash flow used by other companies. Please refer to the Appendix for a reconciliation of non - GAAP financial meas ures. See “Disclaimer – Financial Statements; non - GAAP Financial Measures.” (1) (3) (4) (2)

Our model does not include the following potential upsides: • Government subsidies besides the investment tax credit • Government or country mandates for renewable energy percentages • Carbon taxes or credits • Ability to capture incremental additional revenue due to failure by other companies to meet their commitments to green energy • Licensing revenues (delivering further scale and boost to margins) Strong Potential for Upside Opportunities 18

Transaction Structure Valuation (1) Total Proceeds (3) HLGN $2.0bn ~$415mm Heliogen and Athena Technology Acquisition Corp (“ATHN”) would enter into a business combination structured as a reverse merger with Heliogen becoming a wholly - owned subsidiary of ATHN The transaction is expected to close in 4Q 2021 It is anticipated that the post closing company, Heliogen, will be listed on NYSE with ticker symbol “HLGN” Transaction implied a pro forma Enterprise Value (“EV”) of approximately $2.0 billion, EV / Revenue of ~0.8x based on 2026E revenue Heliogen shareholders will rollover 100% of their equity and own $1.85 billion shares, or ~78.3% of the pro forma equity; ATHN public shareholders will own ~10.6%; PIPE investors will own ~7.0%; and the ATHN founders will own ~4.1% (2) The transaction will be funded by a combination of Athena cash in trust, newly issued shares of Heliogen common stock, and proceeds from a PIPE Transaction expected to result in ~$415 million of total proceeds raised to fund growth, comprised of ~$250mm cash in trust and ~$165mm of PIPE proceeds (2) Transaction Summary 19 ___________________________ 1. Assumes $0 million of net debt and cash in excess of net working capital requirements due to Company financials, assumes no r ede mptions and assumes no shares issued pursuant to the public warrants, private warrants, equity incentive plan or employee stock purchase plan. 2. Post - closing percentage ownership assumes $165mm in aggregate PIPE investments and no redemptions. Excludes dilution from 8,566, 667 as - converted shares from public warrants and private warrants, as well as equity incentive plan and employee stock purchase plans. Includes the impact of 510,000 additional class A shares that will be issued to Athena’s s pon sor in consideration for its waiver of anti - dilution rights under Athena’s organization documents. 3. Excludes transaction costs of $30mm.

($ in millions) SPAC IPO Investors 25.0mm shares 10.6% PIPE Investors 16.5mm shares 7.0% Sponsor Shares 9.8mm shares 4.1% Heliogen Shareholders 185.0mm shares 78.3% Key Transaction Terms (1) (2) Pro Forma Ownership (1) Sources and Uses Athena / Heliogen Transaction Structure • $2.0bn Pro Forma Enterprise Value immediately after de - SPAC (~0.8x 2026 Revenue of ~$2.4B) • Heliogen stockholders receive $1.85bn in shares (or 185.0mm shares) at $10.00/share (100% rollover) • Heliogen receives $385mm cash to fund operations 20 1. Heliogen shares subject to a 180 day lock - up period except that 50% of the shares, 25% of the shares and 25% of the shares subje ct to earlier release from the lock - up if closing stock price shares equals or exceeds $12.00, $13.50, and $17.00 respectively, for any 20 trading days within a 30 - day trading period following the business combination. The sponsor shar es are subject to an identical lock - up as the Heliogen shares. Includes the impact of 510,000 additional class A shares that will be issued to Athena’s sponsor in consideration for its waiver of anti - dilution rights under Athena’s organiza tion documents. 2. Assumes $0 million of net debt and cash in excess of net working capital requirements due to Company financials and assumes n o r edemptions. Also excludes 8,566,667 as - converted shares from public warrants and private warrants, as well as equity incentive plan or employee stock purchase plan. Sources Athena Cash in Trust $250 Stock Consideration to Heliogen 1,850 PIPE Financing 165 Total Sources $2,265 Uses Stock Consideration to Heliogen $1,850 Cash Consideration to Existing Shareholders - Cash to Balance Sheet 385 Estimated Transaction Costs 30 Total Uses $2,265

Anticipated Use of Proceeds Tailored Towards Technology Improvements and Rapid Commercialization 21 Research & Development Capital Expenditures & Net Working Capital In - House Manufacturing of Key Components • Focused on quality control and cost reductions • Potential acquisitions to drive interconnectivity Maintaining First Mover Advantage • Look to improve efficiencies across the entire Heliogen value chain from Heliostat all the way to end user • Scale manufacturing and supply chain to increase profit margin Recruit & Retain Top Talent Best in Class Engineering Talent • Continue to recruit and develop top - tier talent to drive growth • Target to grow execution capability, increasing headcount by 3x in the near to medium - term General Corporate Purposes & Balance Sheet Strength Healthy Public Company Flexibility • Maintain flexibility while driving growth • Regional presence to manage global project development and client relationships

Appendix

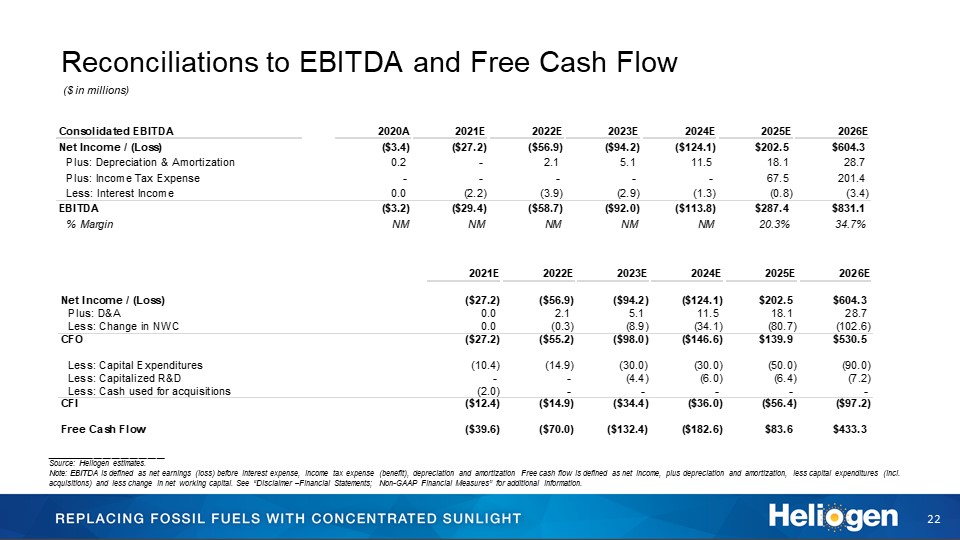

Reconciliations to EBITDA and Free Cash Flow 22 ___________________________ Source: Heliogen estimates. Note: EBITDA is defined as net earnings (loss) before interest expense, income tax expense (benefit), depreciation and amorti zat ion Free cash flow is defined as net income, plus depreciation and amortization, less capital expenditures (incl. acquisitions) and less change in net working capital . See “Disclaimer – Financial Statements; Non - GAAP Financial Measures” for additional information. Consolidated EBITDA 2020A 2021E 2022E 2023E 2024E 2025E 2026E Net Income / (Loss) ($3.4) ($27.2) ($56.9) ($94.2) ($124.1) $202.5 $604.3 Plus: Depreciation & Amortization 0.2 - 2.1 5.1 11.5 18.1 28.7 Plus: Income Tax Expense - - - - - 67.5 201.4 Less: Interest Income 0.0 (2.2) (3.9) (2.9) (1.3) (0.8) (3.4) EBITDA ($3.2) ($29.4) ($58.7) ($92.0) ($113.8) $287.4 $831.1 % Margin NM NM NM NM NM 20.3% 34.7% ($ in millions) 2021E 2022E 2023E 2024E 2025E 2026ENet Income / (Loss) ($27.2) ($56.9) ($94.2) ($124.1) $202.5 $604.3 Plus: D&A 0.0 2.1 5.1 11.5 18.1 28.7 Less: Change in NWC 0.0 (0.3) (8.9) (34.1) (80.7) (102.6) CFO ($27.2) ($55.2) ($98.0) ($146.6) $139.9 $530.5 Less: Capital Expenditures (10.4) (14.9) (30.0) (30.0) (50.0) (90.0) Less: Capitalized R&D - - (4.4) (6.0) (6.4) (7.2) Less: Cash used for acquisitions (2.0) - - - - - CFI ($12.4) ($14.9) ($34.4) ($36.0) ($56.4) ($97.2) Free Cash Flow ($39.6) ($70.0) ($132.4) ($182.6) $83.6 $433.3