Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HCA Healthcare, Inc. | d191036d8k.htm |

| EX-5.1 - EX-5.1 - HCA Healthcare, Inc. | d191036dex51.htm |

| EX-4.11 - EX-4.11 - HCA Healthcare, Inc. | d191036dex411.htm |

| EX-4.10 - EX-4.10 - HCA Healthcare, Inc. | d191036dex410.htm |

| EX-4.9 - EX-4.9 - HCA Healthcare, Inc. | d191036dex49.htm |

| EX-4.3 - EX-4.3 - HCA Healthcare, Inc. | d191036dex43.htm |

| EX-4.2 - EX-4.2 - HCA Healthcare, Inc. | d191036dex42.htm |

Exhibit 5.2

D: +1 (212) 225-2632

dlopez@cgsh.com

June 30, 2021

HCA Inc.

HCA Healthcare, Inc.

c/o HCA Healthcare, Inc.

One Park Plaza

Nashville, Tennessee 37203

Ladies and Gentlemen:

We have acted as special counsel to HCA Inc., a Delaware corporation (the “Company”), and HCA Healthcare Inc., a Delaware corporation (the “Parent Guarantor”), in connection with the Company’s offering pursuant to a registration statement on Form S-3 (No. 333-226709), as amended as of its most recent effective date (June 21, 2021), insofar as it relates to the Securities (as defined below) (as determined for purposes of Rule 430B(f)(2) under the Securities Act of 1933, as amended (the “Securities Act”)) (as so amended, including the documents incorporated by reference therein but excluding Exhibit 25.1, the “Registration Statement”) and the prospectus, dated August 9, 2018, as supplemented by the prospectus supplement thereto, dated June 21, 2021 (together, the “Prospectus”), of (i) $850,000,000 aggregate principal amount of 23/8% Senior Secured Notes due 2031 (the “2031 Notes”) and (ii) $1,500,000,000 aggregate principal amount of 31⁄2% Senior Secured Notes due 2051 (the “2051 Notes” and, together with the 2031 Notes, the “Notes”). The Notes were issued under an indenture dated as of August 1, 2011 (the “Base Indenture”), among the Company, the Parent Guarantor, Delaware Trust Company (as successor to Law Debenture Trust Company of New York), as trustee (the “Trustee”) and Deutsche Bank Trust Company Americas, as paying agent, registrar and transfer agent (the “Paying Agent”), as supplemented (i) with respect to the 2031 Notes, by the twenty-seventh supplemental indenture dated as of June 30, 2021 (the “Twenty-Seventh Supplemental Indenture”) among the Company, the Parent Guarantor, the subsidiary guarantors named on Schedule I thereto (the “Subsidiary Guarantors” and, together with the Parent Guarantor, the “Guarantors”), the Trustee and the Paying Agent and (ii) with respect to

Cleary Gottlieb Steen & Hamilton LLP or an affiliated entity has an office in each of the cities listed above.

HCA Healthcare, Inc.

HCA Inc., p. 2

the 2051 Notes, by the twenty-eighth supplemental indenture dated as of June 30, 2021 (the “Twenty-Eighth Supplemental Indenture” and, together with the Twenty-Seventh Supplemental Indenture, each a “Supplemental Indenture;” and the Base Indenture as supplemented by each Supplemental Indenture, each an “Indenture”) among the Company, the Parent Guarantor, the Subsidiary Guarantors, the Trustee and the Paying Agent.

In arriving at the opinions expressed below, we have reviewed the following documents:

| (a) | the Registration Statement; |

| (b) | the Prospectus; |

| (c) | an executed copy of the of the Underwriting Agreement dated June 21, 2021 among the Company, the Guarantors and the several underwriters named in Schedule I thereto; |

| (d) | an executed copy of each of the Base Indenture and each Supplemental Indenture, including the guarantees of the Notes set forth in each Supplemental Indenture (the “Guarantees” and, together with the Notes, the “Securities”); |

| (e) | a facsimile copy of the Notes in global form as executed by the Company and authenticated by the Trustee; |

| (f) | copies of the Company’s Amended and Restated Certificate of Incorporation and Amended and Restated By Laws certified by the Secretary of State of the State of Delaware and the corporate secretary of the Company, respectively; |

| (g) | copies of the Parent Guarantor’s Amended and Restated Certificate of Incorporation and Second Amended and Restated By Laws certified by the Secretary of State of the State of Delaware and the corporate secretary of the Parent Guarantor, respectively; and |

| (h) | copies of the respective organizational documents certified by the secretary (or assistant secretary) of each Subsidiary Guarantor listed on Schedule I hereto and incorporated as a corporation in the State of Delaware (each, a “Delaware Corporate Subsidiary Guarantor”), each Subsidiary Guarantor listed on Schedule I hereto and formed as a limited liability company in the State of Delaware (each, a “Delaware LLC Subsidiary Guarantor”) and each Subsidiary Guarantor listed on Schedule I hereto and formed as a limited partnership in the State of Delaware (each, a “Delaware LP Subsidiary Guarantor” and, together with the Delaware Corporate Subsidiary Guarantors and the Delaware LLC Subsidiary Guarantors, the “Delaware Subsidiary Guarantors” and, together with the Parent Guarantor, the “Delaware Guarantors”). |

HCA Healthcare, Inc.

HCA Inc., p. 3

In addition, we have reviewed the originals or copies certified or otherwise identified to our satisfaction of all such corporate, limited liability company or limited partnership records, as the case may be, of the Company and the Delaware Guarantors and such other documents, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinions expressed below.

In rendering the opinions expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified the accuracy as to factual matters of each document we have reviewed.

Based on the foregoing, and subject to the further assumptions and qualifications set forth below, it is our opinion that:

| 1. | The Notes are the valid, binding and enforceable obligations of the Company, entitled to the benefits of the applicable Indenture. |

| 2. | The Guarantees are the valid, binding and enforceable obligation of each Guarantor, entitled to the benefits of the applicable Indenture. |

Insofar as the foregoing opinions relate to the validity, binding effect or enforceability of any agreement or obligation of the Company or any Guarantor, (a) we have assumed that each party to such agreement or obligation has satisfied those legal requirements that are applicable to it to the extent necessary to make such agreement or obligation enforceable against it (except that no such assumption is made as to the Company or any Guarantor regarding matters of the law of the State of New York, or as to the Company or any Delaware Guarantor regarding matters of the General Corporation Law of the State of Delaware, the Delaware Limited Liability Company Act or the Delaware Revised Uniform Limited Partnership Act, as the case may be, that in our experience normally would be applicable to general business entities with respect to such agreement or obligation), and (b) such opinions are subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally and to general principles of equity. In addition, the waiver of defenses contained in Section 12.01 and 12.07 of each Supplemental Indenture may be ineffective to the extent that any such defense involves a matter of public policy under the law of the State of New York.

We express no opinion as to the validity, binding effect or enforceability of any provisions of the Supplemental Indentures relating to the right of set-off to the extent that such provisions imply that set-off may be made without notice. We express no opinion as to Section 12.01 of each Supplemental Indenture requiring any Delaware Subsidiary Guarantor to guarantee the performance of any non-monetary obligation of the Company or any other Guarantor.

In giving the foregoing opinion relating to the validity, binding effect or enforceability of any agreement or obligation of any Subsidiary Guarantor that is not a Delaware Subsidiary Guarantor, we have assumed, without independent investigation, the correctness of the opinion of Robert A. Waterman, Senior Vice President and General Counsel of the Company, a copy of which is filed as Exhibit 5.1 to the Current Report on Form 8-K of the Parent Guarantor dated June 30, 2021 (the “June 30, 2021 8-K”), and our opinion is subject to all of the limitations and qualifications contained therein.

HCA Healthcare, Inc.

HCA Inc., p. 4

The foregoing opinions are limited to the law of the State of New York, the Delaware Limited Liability Company Act, the Delaware Revised Uniform Limited Partnership Act and the General Corporation Law of the State of Delaware.

We hereby consent to the use of our name in the Prospectus Supplement under the heading “Legal Matters” as counsel for the Company that has passed on the validity of the Securities and to the filing of this opinion letter as Exhibit 5.2 to the June 30, 2021 8-K. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Securities and Exchange Commission thereunder.

The opinions expressed herein are rendered on and as of the date hereof, and we assume no obligation to advise you or any other person, or to make any investigations as to any legal developments or factual matters arising subsequent to the date hereof that might affect the opinions expressed herein.

| Very truly yours, | ||

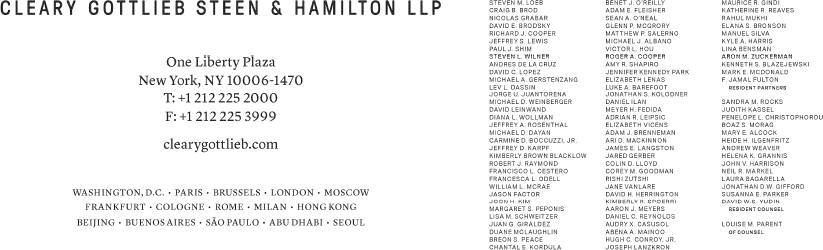

| CLEARY GOTTLIEB STEEN & HAMILTON LLP | ||

| By | /s/ David Lopez | |

| David Lopez, a Partner | ||

HCA Healthcare, Inc.

HCA Inc., p. 5

Schedule I

Delaware Corporate Subsidiary Guarantors

American Medicorp Development Co.

GPCH-GP, Inc.

HCA — IT&S Field Operations, Inc.

HCA — IT&S Inventory Management, Inc.

Hospital Development Properties, Inc.

Management Services Holdings, Inc.

MH Hospital Holdings, Inc.

Midwest Holdings, Inc.

Outpatient Services Holdings, Inc.

PatientKeeper, Inc.

Riverside Hospital, Inc.

Terre Haute Hospital GP, Inc.

Terre Haute Hospital Holdings, Inc.

U.S. Collections, Inc.

Delaware LLC Subsidiary Guarantors

Centerpoint Medical Center of Independence, LLC

Cy-Fair Medical Center Hospital, LLC

Dallas/Ft. Worth Physician, LLC

EP Health, LLC

Fairview Park GP, LLC

FMH Health Services, LLC

GenoSpace, LLC

Goppert-Trinity Family Care, LLC

Grand Strand Regional Medical Center, LLC

HCA American Finance LLC

hInsight-Mobile Heartbeat Holdings, LLC

Houston NW Manager, LLC

Houston - PPH, LLC

HPG Enterprises, LLC

HSS Holdco, LLC

HSS Systems, LLC

HTI MOB, LLC

Lakeview Medical Center, LLC

Lewis-Gale Medical Center, LLC

Medical Centers of Oklahoma, LLC

Medical Office Buildings of Kansas, LLC

MH Hospital Manager, LLC

MH Master, LLC

Midwest Division - ACH, LLC

Midwest Division - LSH, LLC

HCA Healthcare, Inc.

HCA Inc., p. 6

Midwest Division - MCI, LLC

Midwest Division - MMC, LLC

Midwest Division - OPRMC, LLC

Midwest Division - RMC, LLC

Mobile Heartbeat, LLC

North Houston - TRMC, LLC

Notami Hospitals, LLC

Oklahoma Holding Company, LLC

Outpatient Cardiovascular Center of Central Florida, LLC

Parallon Holdings, LLC

Pearland Partner, LLC

Reston Hospital Center, LLC

Samaritan, LLC

San Jose Medical Center, LLC

San Jose, LLC

Sarah Cannon Research Institute, LLC

Savannah Health Services, LLC

SCRI Holdings, LLC

Sebring Health Services, LLC

SJMC, LLC

Southeast Georgia Health Services, LLC

Spalding Rehabilitation L.L.C.

SSHR Holdco, LLC

Trident Medical Center, LLC

Utah Medco, LLC

Vision Consulting Group LLC

Weatherford Health Services, LLC

Wesley Medical Center, LLC

Delaware LP Subsidiary Guarantors

CHCA Bayshore, L.P.

CHCA Conroe, L.P.

CHCA Mainland, L.P.

CHCA West Houston, L.P.

CHCA Woman’s Hospital, L.P.

Columbia Rio Grande Healthcare, L.P.

Columbia Valley Healthcare System, L.P.

Good Samaritan Hospital, L.P.

HCA Management Services, L.P.

JFK Medical Center Limited Partnership

Palms West Hospital Limited Partnership

Plantation General Hospital, L.P.

San Jose Healthcare System, LP

San Jose Hospital, L.P.

Terre Haute Regional Hospital, L.P.