Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Torrid Holdings Inc. | d895088dex232.htm |

| EX-23.1 - EX-23.1 - Torrid Holdings Inc. | d895088dex231.htm |

| EX-5.1 - EX-5.1 - Torrid Holdings Inc. | d895088dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 30, 2021

No. 333-256871

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TORRID HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5600 | 84-3517567 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

18501 East San Jose Avenue

City of Industry, California 91748

(626) 667-1002

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Elizabeth Muñoz

Chief Executive Officer

Torrid Holdings Inc.

18501 East San Jose Avenue

City of Industry, California 91748

(626) 667-1002

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Joshua N. Korff Michael Kim Aslam A. Rawoof Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Michael Benjamin Stelios G. Saffos Latham & Watkins LLP 1271 Avenue of the Americas New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☒

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price(2)(3) |

Amount of Registration Fee(4) | ||||

| Common stock, $0.01 par value per share |

11,500,000 |

$21.00 |

$241,500,000 |

$26,348 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,500,000 shares of common stock that the underwriters have the option to purchase from the selling stockholders. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Includes the offering price of the 1,500,000 shares the underwriters have the option to purchase from the selling stockholders. |

| (4) | Includes $21,079 of fees previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 30, 2021

PROSPECTUS

10,000,000 Shares

Torrid Holdings Inc.

Common Stock

This is the initial public offering of Torrid Holdings Inc. (“Torrid”). The selling stockholders identified in this prospectus are offering 10,000,000 shares. Torrid will not be selling any shares in this offering and will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $18.00 and $21.00. Torrid has applied to list the common stock on the New York Stock Exchange (“NYSE”) under the symbol “CURV.”

After the completion of this offering, affiliates of Sycamore Partners Management, L.P. (“Sycamore”) will continue to own a majority of the voting power of shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Management—Corporate Governance.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to certain reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in the common stock involves risks that are described in the “Risk Factors” section beginning on page 21 of this prospectus.

|

Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

The underwriters may also exercise their option to purchase up to an additional 1,500,000 shares from the selling stockholders, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2021.

| Morgan Stanley |

BofA Securities | Goldman Sachs & Co. LLC | Jefferies |

| Baird |

Cowen | William Blair | ||||

| Telsey Advisory Group | ||||||

The date of this prospectus is , 2021.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

We have not and the selling stockholders and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor the selling stockholders or the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

i

Table of Contents

BASIS OF PRESENTATION

Our fiscal year ends on the Saturday nearest to January 31 and each fiscal year is generally comprised of four 13-week quarters (although in years with 53 weeks, the fourth quarter is comprised of 14 weeks). Fiscal years are identified in this prospectus according to the calendar year in which they begin. For example, references to “2020” or similar references refer to the fiscal year ended January 30, 2021 and references to “calendar year 2020” or similar references to refer to the calendar year ended December 31, 2020.

As used in this prospectus:

| • | “active customer” means a customer who has completed at least one purchase transaction either in-store or online in the preceding twelve-month period; |

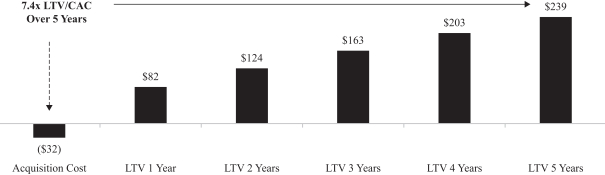

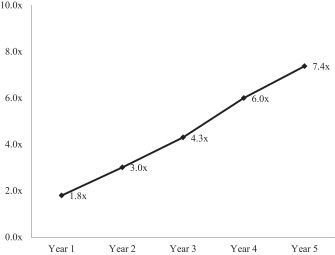

| • | “CAC,” or “customer acquisition cost,” means marketing expenses, including our marketing organization, digital and performance marketing, direct mail, store and brand marketing, public relations, and photography, partially offset by marketing and promotional funds received from a third party private label credit card partner, divided by the number of customers who placed their first order in the period during which these expenses were incurred; |

| • | “comparable sales” means for a given period the sales of our e-Commerce operations and stores that we have included in our comparable sales base during that period. We include a store in our comparable sales base after it has been open for 15 full fiscal months. If a store is closed during a fiscal year, it is only included in the computation of comparable sales for the full fiscal months in which it was open. The computation of comparable sales includes results from stores that were temporarily closed due to COVID-19. Partial fiscal months are excluded from the computation of comparable sales. We apply current year foreign currency exchange rates to both current year and prior year comparable sales to remove the impact of foreign currency fluctuation and achieve a consistent basis for comparison. Comparable sales allow us to evaluate how our unified commerce business is performing exclusive of the effects of non-comparable sales; |

| • | “contribution profit” means merchandise profit less distribution, shipping and fulfillment expenses, store occupancy, including maintenance, supplies and utilities, store payroll, and other operating expenses, such as credit card processing fees. We include store occupancy and store payroll costs in contribution profit as stores are an integral part of our unified commerce strategy and serve as a vehicle to both acquire and service customers on an ongoing basis; |

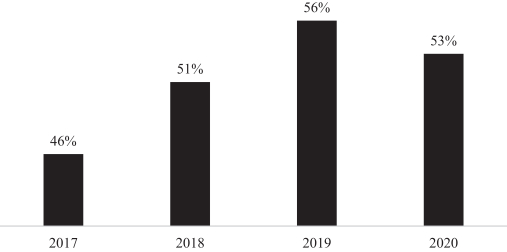

| • | “e-Commerce penetration” means net sales generated in the e-Commerce channel, including sales generated from our website, mobile app, and through the buy-online-pickup-in-store and ship from store offerings, divided by total net sales; |

| • | “LTV,” or “customer lifetime value,” means the cumulative contribution profit attributable to a particular customer cohort; |

| • | “Net Promoter Score,” or “NPS,” is a commonly used metric to measure consumer satisfaction and loyalty and indicates the percentage of consumers rating their likelihood to recommend a product or service to a friend. The percentage of “detractors,” or consumers who respond with a rating of 6 or less, is subtracted from the percentage of “promoters,” or consumers who respond with a 9 or 10, to yield NPS. We have calculated NPS for us and a set of 27 peers based on a survey of plus-size consumers we commissioned, using the same methodology for all companies. For purposes of the NPS, we define “peer average” NPS as the average NPS of us and the 27 peers, which include select department stores, mass-retailers, specialty retailers and direct to consumer brands; |

| • | “omni-channel customer” means a customer who has completed at least one purchase transaction in each of our store and e-Commerce channels in a twelve-month period; and |

| • | “store-level contribution” means a particular store’s net sales, less product costs and direct operating costs, including payroll, occupancy and other operating costs specifically associated with that store. |

ii

Table of Contents

| Store-level contribution is an assessment of store-level profitability and a supplemental measure of the operating performance of our stores that is neither required by, nor presented in accordance with, accounting principles generally accepted in the United States (“GAAP”) and our calculations thereof may not be comparable to those reported by other companies. We present this measure as we believe it is frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and we use it internally as a benchmark to compare our performance to that of our competitors. This measure has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. |

References to the membership of our customer loyalty program, Torrid Rewards (formerly Torrid Insider), refer to the total number of customers that have signed up for Torrid Rewards, and not unsubscribed, over the life of the program; there is no additional requirement for these customers to have been recently or repetitively active as customers of Torrid.

Certain figures in this prospectus have been subject to rounding adjustments. Therefore, figures shown as totals in certain tables may not sum due to rounding.

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, studies and surveys conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

TRADEMARKS AND TRADE NAMES

This prospectus includes our trademarks such as “Torrid” and “Torrid Curve” which are protected under applicable intellectual property laws and are the property of Torrid Holdings Inc. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights, of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow are supplemental measures of our operating performance that are neither required by, nor presented in accordance with, GAAP and our calculations thereof may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA represents GAAP net income (loss) plus interest expense less interest (income), net of other (income) expense, plus provision less (benefit) for income taxes, depreciation and amortization (“EBITDA”), and share-based compensation, non-cash deductions and charges, other expenses and the duplicative and start-up costs associated with the West Jefferson, Ohio, distribution center. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of our total net sales. Free Cash Flow represents net cash provided by operating activities less capital expenditures. We believe Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow facilitate operating performance comparisons from period to period by isolating the effects of certain items that vary from period to

iii

Table of Contents

period without any correlation to ongoing operating performance. We also use Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow as three of the primary methods for planning and forecasting the overall expected performance of our business and for evaluating on a quarterly and annual basis actual results against such expectations. Further, we recognize Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow as commonly used measures in determining business value and, as such, use them internally to report and analyze our results and we additionally use Adjusted EBITDA as a benchmark to determine certain non-equity incentive payments made to executives.

Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow have limitations as analytical tools. These measures are not measurements of our financial performance under GAAP and should not be considered in isolation or as alternatives to or substitutes for net income (loss), income (loss) from operations or any other performance measures determined in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Our presentation of Adjusted EBITDA and Adjusted EBITDA margin should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

For a reconciliation of net income to Adjusted EBITDA, see “Prospectus Summary—Summary Consolidated Historical Financial and Other Data.”

For a reconciliation of net cash provided by operating activities to Free Cash Flow, see “Selected Historical Financial and Other Data.”

iv

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our Company, the common stock being sold in this offering and our consolidated financial statements and the related notes appearing elsewhere in this prospectus. You should carefully consider, among other things, our consolidated financial statements and the related notes thereto included elsewhere in this prospectus and the matters discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements. See “Forward-Looking Statements.”

Except where the context otherwise requires or where otherwise indicated, the terms “Torrid,” “we,” “us,” “our,” “our Company” and “our business” refer, prior to the Reorganization (as defined below), to Torrid Parent Inc. together with its consolidated subsidiaries, and after the Reorganization, to Torrid Holdings Inc. together with its consolidated subsidiaries.

Company Overview

Our Mission

Torrid is on a mission to be the best direct-to-consumer apparel and intimates brand in North America by providing an unparalleled fit and experience that empowers curvy women to love the way they look and feel.

Who We Are

Torrid is the largest direct-to-consumer brand of women’s plus-size apparel and intimates in North America by net sales. We grew our net sales by 8% CAGR between 2017 and 2020, making us among the fastest growing direct-to-consumer brands in the plus-size apparel and intimates market. We served 3.2 million active customers and generated net sales of $974 million in 2020. Our proprietary product offering delivers a superior fit for the curvy woman that makes her love the way she looks and feels. We offer our customer high quality products across a broad assortment that includes tops, denim, dresses, intimates, activewear, footwear and accessories. Our style is unapologetically youthful and sexy. We believe our customer values the appeal and versatility of our curated product assortment that helps her look good for any occasion, including weekend, casual, work and dressy, all at accessible price points. We specifically design for stylish plus-size women and are maniacally focused on fit because fit is the highest priority for them, according to a consumer study we commissioned. Based on the same study, plus-size consumers consistently rank our fit as #1 among our peers, which contributes to our leading net promoter score (“NPS”) of 55, nearly two times the peer average score of 30. Our consistent fit contributed to a return rate of only 9% for e-Commerce purchases in 2020, whereas return rates for e-Commerce purchases generally can be as high as 30%, according to Optoro’s research. Through our product and brand experience, we connect with customers in a way that other brands, many of which treat plus-size customers as an afterthought, have not.

We are the category-leading brand, by net sales, in the $85 billion U.S. women’s plus-size apparel and intimates market, which serves 90 million plus-size women, defined as wearing sizes 10 and up. We design for a

1

Table of Contents

25 to 40 year old curvy woman, who leads a social and active lifestyle and wants to wear clothes that make her look and feel good. While 58% of our 2020 customers are under 40 years old and our average customer is a size 18, our products and style appeal to women of all ages and across the range of plus-sizes. Our target market is large, growing and underserved across both online and in-store channels. The average plus-size woman has historically struggled to find stylish products that fit well and 78% of plus-size women reported that they would spend more on clothing if they had more options available in their size. Through our differentiated product, unified go-to-market strategy, strong connection with our customer and data-driven merchandising approach, we believe we are uniquely positioned to unlock this untapped spend potential by providing her an experience that has not previously been available to her.

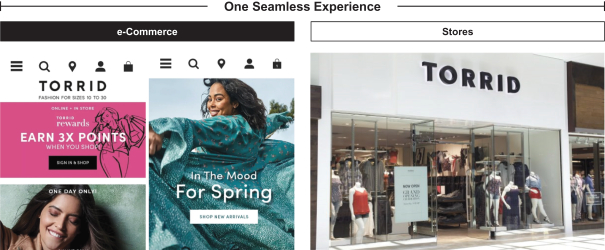

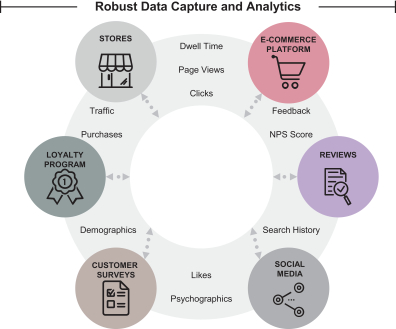

We execute a customer-first unified commerce strategy that is channel-agnostic, allowing our customer to experience our brand and unparalleled proprietary fit wherever and whenever she wants. We market directly to consumers via our e-Commerce platform and our physical footprint of 608 stores as of May 1, 2021. E-Commerce sales represented 42% and 48% of net sales in 2018 and 2019, respectively, having grown by 28% in 2018 and 28% in 2019. In 2020, e-Commerce sales represented 70% of net sales as e-Commerce sales grew by 38% and store sales declined as a result of temporary store closures and a slowdown in store traffic associated with the global COVID-19 pandemic. For the twelve months ended May 1, 2021, e-Commerce sales represented 69% of net sales. Our broad digital ecosystem—from our engaging e-Commerce website and mobile app to social media channels and our Torrid Rewards loyalty program—allows us to better connect, engage, track and service customers. This ecosystem also provides robust quantitative and qualitative customer data that we use to inform all aspects of our operations, from product development, to merchandising and marketing. Our stores are designed to create an inclusive and welcoming environment where our customers can discover and engage with our brand, experience our fit and connect with a community of like-minded women. Our stores also serve as an effective and profitable source of new customer acquisition with a payback period of less than two years. The integration of e-Commerce and stores is fundamental to our customer-centric strategy as those two channels complement and drive traffic to one another. We have a history of converting single-channel customers into highly valuable omni-channel customers. In 2020, on average, omni-channel customers made 7.8 purchases and spent approximately 3.2 times more than single-channel customers. Our consistent product fit and the unified experience between our stores and e-Commerce platform creates a powerful flywheel effect that results in low customer acquisition cost, high repeat purchasing behavior and high customer lifetime value.

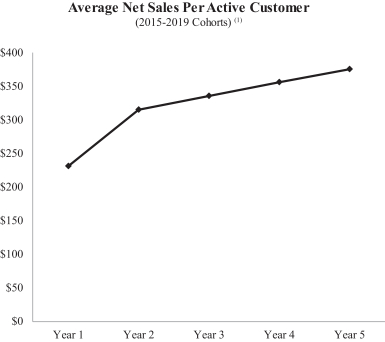

We form long-standing relationships with our customers, who are empowered by their Torrid experience and develop what we believe to be a deep, emotional connection with our brand. We were able to attribute approximately 98% of our net sales in 2020 to individual customers through our extensive customer and sales data resulting from our loyalty program and highly engaged customer base. Our customers’ repeat purchasing behavior is evidenced by our strong net sales retention. In 2020, we retained 82% of net sales from the prior year’s identifiable customers. While the net sales retention was down from 96% in 2019 due to temporary store closures resulting from the COVID-19 pandemic, we expect net sales retention to recover in future periods. The rich database of information provided by our loyalty program gives us deep insight into the plus-size consumer’s purchasing behavior and allows us to market to our customers more effectively. Our stores and efficient marketing spend enable low CAC that, combined with our high repeat purchase behavior, generates an attractive ratio of customer LTV to CAC. For example, the 5-year LTV of our 2015 customer cohort was approximately 7.4 times the cost of acquiring those customers, which is a testament to our ability to efficiently acquire new customers.

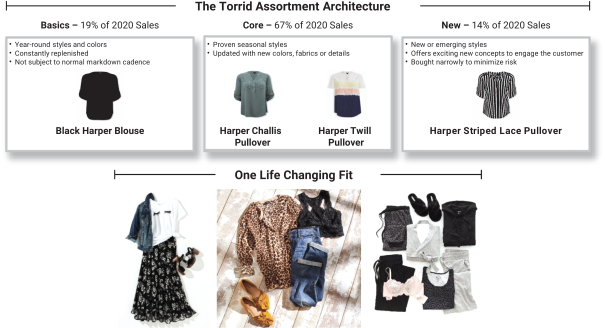

We employ a data-driven approach to design, merchandising and inventory planning and allocation to deliver high quality products that combine the fit, style and attitude that our customer wants. As a fit-first company, we do not rely on being fashion leaders and instead provide a curated assortment of Basic, Core and New products. We internally design and develop the vast majority of our products, a model we describe as vertical sourcing, which gives us control to deliver consistent fit, quality and cost across our products. We

2

Table of Contents

leverage our robust customer data to inform purchasing decisions and have the flexibility to respond quickly to the latest sales trends and incorporate customer feedback to deliver the product our customer wants. Further, we utilize a read-and-react testing approach with shallow initial buys to iterate our New product offering, thus minimizing fashion and inventory risk. Our merchandising strategy has enabled us to generate approximately 80% of our net sales from products sold at regular price, which we define as products sold at initial ticket price or with a standard marketing promotion (e.g., “Buy One Get One 50% Off”). We believe our data-driven approach will continue to drive market growth and market share gains with our rapidly growing and underserved customer base.

Response to the COVID-19 Pandemic

Commencing in December 2019, the novel strain of coronavirus, COVID-19, spread rapidly throughout the world. The global crisis resulting from the spread of COVID-19 has disrupted, and continues to significantly disrupt, local, regional and global economies and businesses in the United States and internationally. Because apparel retail stores were generally deemed “non-essential” by most federal, state, provincial and local government authorities in North America, our stores had to remain closed or operate on reduced hours; we estimate that in 2020, our stores were open, on a same-store-basis, 47% fewer operating hours than in 2019. COVID-19 has accelerated the secular shift towards e-Commerce as consumers increasingly shopped online amid the temporary store closures, and we believe we were well positioned to serve our customers through our robust e-Commerce platform and accelerated investments in omni-channel offerings such as curbside pickup, buy-online-pickup-in-store (“BOPIS”) and ship from store. In response to the COVID-19 pandemic, Torrid proactively implemented various initiatives with a focus on ensuring the health and safety of employees and customers, minimizing the financial impact of COVID-19 and continuing to build the foundation for future growth and profitability. The initiatives implemented include, but are not limited to:

| • | Accelerated investments in omni-channel offerings and rolled out BOPIS across all U.S. stores in June 2020, and curbside pickup and ship from store in select stores in August 2020; |

| • | Made targeted investments and changes to our process to improve the speed and flexibility of our supply chain including shortening our development cycle by two weeks; |

| • | Leveraged data analytics and insights to tailor marketing and promotional strategies in response to consumer behavior changes related to the ongoing COVID-19 pandemic, allowing us to reduce our CAC by 7% in 2020 from 2019; |

| • | Utilized new technologies to communicate with stores in real time and facilitate virtual store visits for District and Regional Managers; |

| • | Managed expenses by reducing headcount and general and administrative expenses; |

| • | Extended and improved payment terms with vendors and negotiated rent relief, including variable rent leases, for a significant portion of stores; and |

| • | Deferred non-essential capital expenditures and new store opening plans. |

Our Financial Performance

We believe our fit-focused product strategy, direct-to-consumer model and passionate team have resulted in high growth and a leading market position over the last several years. We have grown comparable sales for 35 of the last 37 quarters; the only two quarters of decline were in 2020 as a result of the disruption caused by COVID-19. In early 2020, as COVID-19 disrupted our customers’ lives, Torrid’s business demonstrated resiliency beyond our initial expectations. By May 2020, net sales growth began to rebound even as store traffic remained challenged, as consumers increasingly shifted their spending to online channels. Financial performance

3

Table of Contents

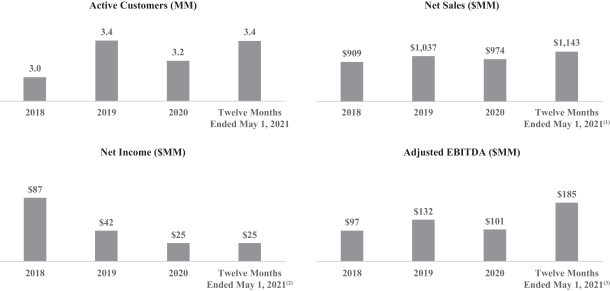

in 2020 demonstrates the strong inherent demand for our differentiated product and the resiliency of our business model. Since 2018, we have recorded the following financial results:

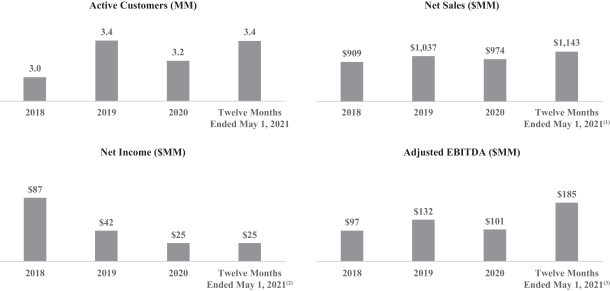

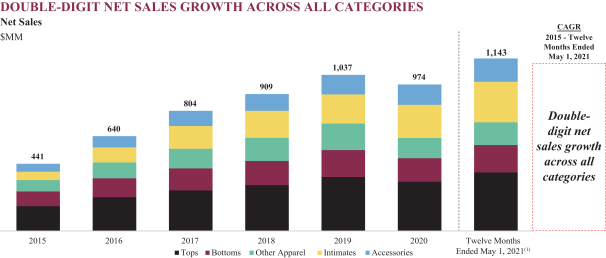

| • | Total active customers grew 11% year-over-year from 3.0 million in 2018 to 3.4 million in 2019. In 2020, total active customers declined by 5% to 3.2 million, as a number of customers held off on making purchases in 2020. Total active customers grew 6% year-over-year from 3.2 million as of May 2, 2020 to 3.4 million as of May 1, 2021; |

| • | Net sales grew 14% year-over-year from $909 million in 2018 to $1,037 million in 2019. In 2020, net sales declined 6% year-over-year to $974 million as significant declines in store-based sales were partially offset by increases in e-Commerce sales. Nevertheless, we estimate Torrid was able to gain market share in women’s plus size apparel and intimates in 2020. Net sales grew 108% from $156 million for the three months ended May 2, 2020 to $326 million for the three months ended May 1, 2021; |

| • | Net income declined 52% year-over-year from $87 million in 2018 to $42 million in 2019. In 2020, net income declined 41% year-over-year to $25 million. Net income grew 5% from $12 million for the three months ended May 2, 2020 to $13 million for the three months ended May 1, 2021; and |

| • | Adjusted EBITDA grew 36% year-over-year from $97 million in 2018 to $132 million in 2019, representing a margin increase of 200bps from 11% to 13% during the same time period. In 2020, Adjusted EBITDA declined 24% year-over-year to $101 million driven by temporarily lower gross profit margin and fixed cost deleverage as a result of the challenges presented by COVID-19. Adjusted EBITDA grew from $(8) million for the three months ended May 2, 2020 to $76 million for the three months ended May 1, 2021. For a reconciliation of net income to Adjusted EBITDA, see “Prospectus Summary—Summary Consolidated Historical Financial and Other Data.” |

| (1) | Net Sales for the Twelve Months Ended May 1, 2021 calculated as Net Sales of $325.7 million for the three months ended May 1, 2021, plus Net Sales of $973.5 million for 2020, less Net Sales of $156.5 million for the three months ended May 2, 2020. |

| (2) | Net Income for the Twelve Months Ended May 1, 2021 calculated as Net Income of $12.9 million for the three months ended May 1, 2021, plus Net Income of $24.5 million for 2020, less Net Income of $12.3 million for the three months ended May 2, 2020. |

| (3) | Adjusted EBITDA for the Twelve Months Ended May 1, 2021 calculated as Adjusted EBITDA of $75.7 million for the three months ended May 1, 2021, plus Adjusted EBITDA of $100.8 million for 2020, less Adjusted EBITDA of $(8.2) million for the three months ended May 2, 2020. |

4

Table of Contents

As of May 1, 2021, we had $202.0 million of outstanding indebtedness, net of unamortized original issue discount and debt financing costs, consisting of term loans under the Original Term Loan Credit Agreement (as defined herein). On June 14, 2021, we entered into a term loan credit agreement which provided for a new $350.0 million senior secured seven-year term loan facility in an initial aggregate amount of $350.0 million (the “New Term Loan Credit Agreement”) and used borrowings thereunder to, among other things, repay and terminate the Original Term Loan Credit Agreement. For a description of our debt service obligations, including mandatory repayments, under the New Term Loan Credit Agreement, see “Description of Certain Indebtedness—New Term Loan Credit Agreement.”

Our Industry

We believe we are uniquely positioned to capture outsized share in the highly attractive and growing women’s plus-size apparel industry.

Large and Rapidly Growing Addressable Market Comprised of 90 Million Plus-Size U.S. Women

The market for women’s plus-size apparel and intimates is large and growing. As of December 31, 2019, more than two-thirds of all U.S. women, or 90 million, were plus-size. According to a third-party study we commissioned, the women’s plus-size apparel and intimates market was approximately $85 billion in calendar year 2019, compared to the women’s straight size market of approximately $96 billion for the same period, and is expected to grow at a 3%-5% CAGR, more than twice the rate of the overall U.S. women’s apparel and intimates market. Further, the number of women in this size range is growing fastest among women under 45 as well as women with higher incomes, according to U.S. government agencies. Based on our 3.4 million active customers as of May 1, 2021, we believe Torrid is less than 4% penetrated among U.S. plus-size women and has a significant opportunity to expand share in this growing market.

Plus Size Women Are Significantly Underserved with Untapped Spend Potential

Plus-size women are underserved with apparel and accessories offerings that are characterized by poor fit, plain styling and limited selection. 69% of plus-size women report that it is difficult to find clothing as stylish and attractive as those available to non-plus-size women. For most apparel brands, plus-size is an afterthought as they do not invest time and resources to optimize fit on real plus-size models but rather simply rely upon “grading-up” existing non-plus-size offerings through extended sizing, which leads to poor, inconsistent quality and fit. Most of the existing dedicated plus-size brands target an older consumer or lack the product design and technical capabilities to deliver the fit she wants. We estimate there is currently only one dedicated women’s plus-size apparel store for every 51 women’s specialty apparel stores. As a result, there were approximately 78,000 plus-size women for each dedicated women’s plus-size apparel store, as compared to approximately 700 women for every other women’s specialty apparel store. We believe our superior fit, brand experience and our unified commerce strategy position us well to cater to this underserved market.

Due to the lack of options, the plus-size woman underspends on apparel and intimates annually compared to her non-plus-size peers and 78% of plus-size women reported that they would spend more on clothing if they had more options available in their size. We estimate this underspend to be $19 billion, implying a 22% embedded wallet growth opportunity beyond the $85 billion calendar year 2019 women’s plus-size apparel and intimates market, for a total addressable market size of $104 billion. We believe Torrid has a significant opportunity to unlock this additional, untapped spend potential and increase overall market share by better serving plus-size customers.

Significant Growth in Digital and Omni-Channel Shopping

The majority of all apparel purchases in the United States occur in stores. However, consumers have increasingly been shopping for apparel online, a behavior that has meaningfully accelerated during the pandemic.

5

Table of Contents

We believe this consumer behavior will continue for the next several years. According to Torrid’s estimates based on eMarketer’s Apparel & Footwear 2021 data:

| • | U.S. online apparel sales were $125 billion in calendar year 2019 and are expected to reach $270 billion in calendar year 2024, growing at a CAGR of 17%; and |

| • | Online penetration in apparel has increased from 20% to 26% in the United States from the end of calendar year 2016 through calendar year 2019. U.S. online penetration in apparel is expected to reach 38% in 2021 and 51% in 2024. |

Additionally, digital channels play an important role in consumers’ offline purchase decisions. Specifically, when asked about their shopping behaviors prior to making a purchase in a physical retail store, 39% of digital consumers visited a brand’s website, 36% read customer reviews and 33% attempted to price match the product online, according to BigCommerce’s 2018 Omnichannel Buying Report that is based on a global survey of nearly 3,000 digital consumers. We believe retailers that employ an omni-channel strategy offering both a high-quality experiential brick-and-mortar footprint and a compelling online store supported by a strong digital presence and omni-channel offerings such as curbside pickup, BOPIS and ship from store have a competitive advantage in serving potential customers. We believe our unified commerce strategy, which includes 70% of net sales from e-Commerce in 2020 and robust omni-channel functionality, positions Torrid well to succeed in this evolving environment.

Cultural Tailwinds Driving Torrid’s Market

We believe Torrid stands to benefit from thriving cultural movements involving female empowerment, body positivity and socially-influenced purchasing. Growing celebration of femininity, inclusivity and self-identity, along with the emergence of plus-size celebrities and influencers, inspires young curvy customers to demand more flattering and stylish clothing they are proud to wear. At the same time, younger generations are embracing social media platforms, including Instagram, which act as vehicles for community building and discovery. This seamless, constant exchange of community-based inspiration encourages consumers to purchase better-fitting and youthful clothing that allows for unapologetic self-expression. We believe these cultural shifts will continue to support the growth of the women’s plus-size apparel market.

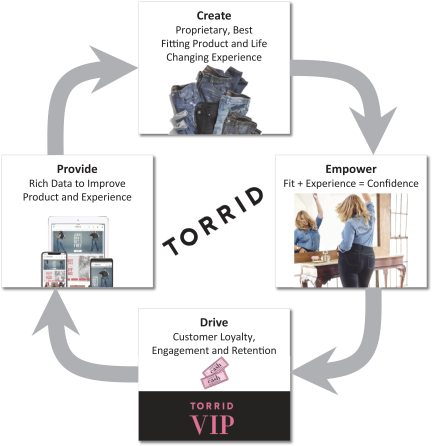

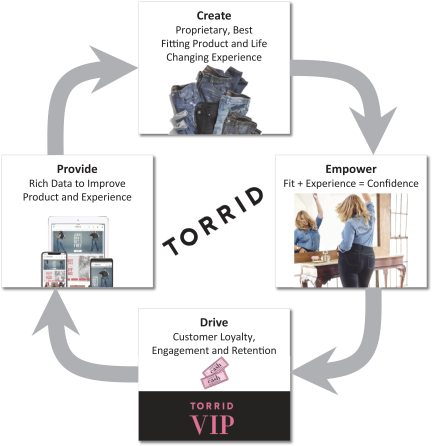

The Torrid Approach

To achieve our mission of being the best direct-to-consumer plus-size apparel and intimates brand, we have created a proprietary fit that empowers our customers and drives loyalty. In turn, our loyal customers provide us with a rich set of data that allows us to improve our product and experience, thus creating a virtuous cycle that reinforces our leading position in plus-size apparel and intimates.

6

Table of Contents

A FIT-ENABLED VIRTUOUS CYCLE

FIT TO PERFECTION

| • | We provide a fit she knew she wanted but never had access to; |

| • | We accomplish this by fitting every single article of clothing we produce on a real woman, tailoring for her special needs, not simply “grading up” non-plus-size apparel; |

| • | We utilize a proprietary sizing process that is constantly updated through data and our continuous customer feedback loop, until we fit to perfection; and |

| • | We deliver unparalleled technical fit combined with unapologetic attitude and style. |

7

Table of Contents

Competitive Strengths

We attribute our continued success to the following competitive strengths:

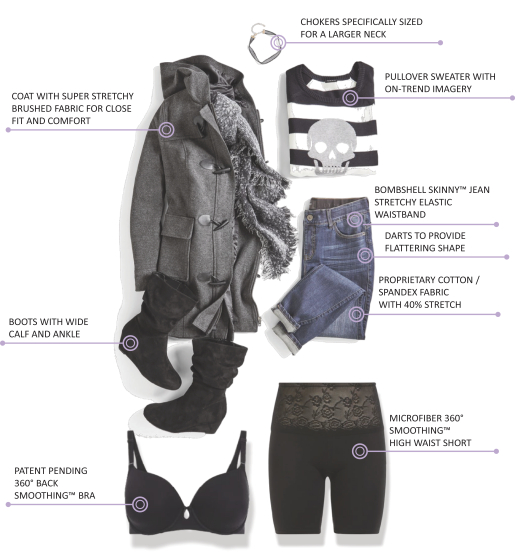

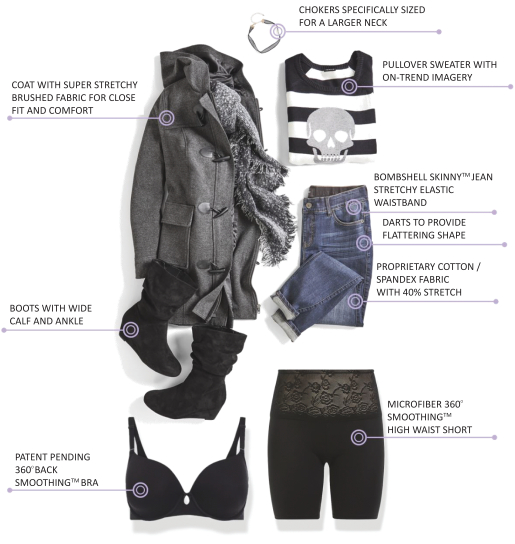

First at Fit. Our capability to deliver the best fit for the curvy woman is unrivaled in the industry and hard to replicate. We have a maniacal focus on fit across our entire organization, which is rooted in our recognition of the importance of fit to our customer. Our team of highly skilled designers, artists and product engineers internally design and develop products that represented approximately 89% of our net sales in 2020. Unlike other brands, we do not rely on mannequins during the fit process, but rather fit all of our products on full-time plus-size fit models, our staff, and often our most loyal customers. We have developed our differentiated technical fit by building and continuously refining a database of fit specifications derived from testing, measuring and cataloging over 13,000 garments each year on our fit models. The discipline and rigor of our fit process differentiates our approach to technical design. We also utilize proprietary fabrics specifically engineered to enhance the fit for the plus-size woman. Our vertical sourcing model gives us control to deliver consistent fit, quality and cost, and allows us to incorporate customer feedback quickly and effectively. Our customers often

8

Table of Contents

start their Torrid journey in fit-critical categories such as denim and intimates that lead to increased loyalty and drive higher LTV over time. In intimates, we leverage our design and engineering expertise to develop highly technical bra features, such as our patent-pending back smoothing technology and recently introduced wire free bra that require significant investment and are not easy to replicate by competitors. We believe our differentiated ability to deliver consistent fit and quality combined with style and comfort represents a significant competitive advantage.

Differentiated, Leading Brand for the Plus-Size Woman. Torrid is the largest direct-to-consumer brand of women’s plus-size apparel and intimates in North America by net sales. We grew our net sales by 8% CAGR between 2017 and 2020, making us among the fastest growing direct-to-consumer brands in the plus-size apparel and intimates market. We believe many of our customers form a deep emotional connection with our brand, as their discovery of Torrid is often the first time they have felt truly understood and well-served by an apparel company. The Torrid brand represents a distinctive combination of high quality, stylish and well-fitting products combined with a brand experience that makes the plus-size woman feel confident and empowered. Our customers engage with us across multiple channels including online, in-store, through community events, surveys and on social media, with many becoming our biggest brand advocates. Our brand satisfaction is among the highest for apparel brands, as illustrated by our leading NPS of 55, nearly two times the peer average score of 30. We believe this significant brand value will facilitate sustainable net sales growth and market share gains over time.

A Deep Connection to Our Loyal and Passionate Customer. We form long-standing relationships with our customers, who are empowered by their Torrid experience and reward us with their loyalty. In 2020, 2.9 million out of our approximately 3.2 million active customers were members of our loyalty program, accounting for 95% of net sales. Members of the top two tiers of our loyalty program, Torrid VIP and Loyalist, are our most loyal customers who purchase from us more often and spend significantly more than the average customer, accounting for an outsized share of net sales. In 2020, Torrid VIP and Loyalist members accounted for 16% of active customers and 41% of net sales. On average, they purchased more than 9 times per year and spent approximately $750 during the same period. Our customers’ repeat purchasing behavior is evidenced by our strong net sales retention. In 2020, we retained 82% of net sales from the prior year’s identifiable customers, despite the challenges presented by the COVID-19 pandemic. While the net sales retention was down from 96% in 2019 due to the COVID-19 pandemic, we expect net sales retention to recover in future periods. As a result of our strong customer loyalty and net sales retention, we generate high customer LTV, which we intend to leverage to help drive future growth.

Dynamic Direct-to-Consumer Business Model. Our unified commerce platform provides our customer with an inspiring shopping experience whenever and wherever she chooses to shop with us. We market directly to consumers via our e-Commerce platform, which accounted for 70% of sales in 2020, and our physical footprint of 608 stores as of May 1, 2021. Our broad digital ecosystem—from our engaging e-Commerce website and mobile app to social media channels and our Torrid Rewards loyalty program—allows us to better connect, engage, track and service customers. This ecosystem also provides robust quantitative and qualitative customer data that we use to inform all aspects of our operations, from product development, to merchandising and marketing. E-Commerce sales represented 42% and 48% of net sales in 2018 and 2019, respectively, having grown by 28% in 2018 and 28% in 2019. In 2020, e-Commerce sales represented 70% of net sales as e-Commerce sales grew by 38% and store sales declined as a result of temporary store closures and a slowdown in store traffic associated with the global COVID-19 pandemic. For the twelve months ended May 1, 2021, e-Commerce sales represented 69% of net sales. Our stores are designed to deliver an immersive brand and fit discovery experience further supported by personal connection with store associates who act as brand ambassadors. Our stores also act as a low cost source of new customer acquisition, requiring a small upfront investment that is quickly paid back. Our e-Commerce platform and store base complement and drive traffic to one another. Once she discovers her size in store, she increasingly shops online with us as she knows she can rely

9

Table of Contents

on the consistency of our fit. Our consistent product fit and the unified experience between our stores and e-Commerce platform creates a powerful flywheel effect that results in low CAC, high repeat purchasing behavior and high customer LTV.

Data-Driven, Low-Risk Merchandising Model. We employ a data-driven approach to design, merchandising and inventory planning and allocation to deliver high quality products that combine the fit, style and attitude that our customer wants. We have excellent visibility into our customer’s preferences through her purchase history and our outsized share of her apparel wallet. We leverage this robust customer data along with market trends to inform all purchasing decisions. Through our vertical sourcing model, we have the flexibility to respond quickly to the latest sales trends and make adjustments to our current offering based on customer feedback to deliver product our customer wants. We focus on fit, not fashion, and do not rely on being a fashion leader. We have a low-risk assortment that is anchored by our recurring, fit-focused offering of Basics and Core styles, which together represented approximately 86% of net sales in 2020. New product, which represents new or emerging styles, accounted for the remaining approximately 14% of net sales in 2020. We utilize a read-and-react testing approach with shallow initial buys and data-driven repurchasing decisions to iterate our New product offering, thus minimizing fashion and inventory risk.

Proven, Experienced Management Team and Mission-Driven Culture. We have created a company culture focused on attracting, training, retaining and developing talent that does not settle for the low expectations historically associated with the women’s plus-size apparel market. Approximately 93% of our employees identify as female. Our organization is comprised primarily of women who are also customers and align with our goal to empower curvy women to love the way they look and feel. In addition, they embody our philosophy and dedication to our product and serve as brand ambassadors on a daily basis. Our team is led by our Chief Executive Officer, Liz Muñoz, who is a direct-to-consumer brand veteran and joined the Company in January 2010 after having served as the President of Lucky Brand. Liz has a strong background in product fit and design, having spent years fitting clothing, and later leading the design and merchandising efforts at both Lucky Brand and Torrid. We employ a highly talented team of 446 corporate employees, comprised of skilled and experienced apparel and direct-to-consumer executives, combined with artists, designers, merchants, product engineers and data analysts.

Growth Strategies

We believe we have a significant opportunity to increase market share in the massive and growing plus size apparel and intimates markets. We intend to continue driving growth in our business through the following strategies:

Grow Torrid Curve

We plan to accelerate growth of Torrid Curve®, our line of bras and other intimates, activewear, loungewear and sleepwear tailored specifically to a plus-size customer, through targeted investments in marketing and product innovation. The same discipline and rigor of our fit process for apparel is applied when designing and developing our Torrid Curve products. In intimates, we leverage our design and engineering expertise to develop highly technical bra features, such as our patent-pending back smoothing technology and recently introduced wire free bra that require significant investment and are not easily replicated by competitors. Our deep connection with our customer has guided our product development pipeline so that we build products she needs and wants. For example, the idea for our back smoothing technology came from direct feedback from customers who expressed their desire for a solution to address her specific needs. We leverage this community to test our new products and perfect their development before launch. According to our estimates, the intimates market is growing at a rate of 8% which is 3 percentage points higher than the growth of the women’s plus-size apparel market, according to Statista. Our customers’ sizes are often not sold by leading intimates brands and we believe

10

Table of Contents

existing product options fail to combine functionality with appealing design. Intimates is a fast-growing category with significant incremental penetration opportunity both within our existing Torrid customer base and with new customers. Bras help attract customers to our brand; bras are, behind tops, the second most frequent item in a new customer’s first purchase. For 2019 and 2020, on average, customers who have bought Torrid Curve products spent 3x more than someone who did not and their retention rates were 1.5x higher. We believe Torrid Curve will be a meaningful driver of our growth in the future.

Attract New Customers to Torrid

We believe there is a clear path to further increasing brand awareness and acquiring new customers through an integrated digital marketing and strategic store expansion strategy.

| • | Increase Brand Awareness and Accelerate Customer Acquisition Across Channels. We intend to grow our brand awareness among plus-size women from approximately 31% as of April 2021, by making incremental investments in our marketing spend, which was only approximately 5.3% of net sales in 2020. We believe we can do so profitably given our high ratio of LTV to CAC. We expect to further drive brand awareness, engagement and conversion through targeted investments in performance and brand marketing, including paid search, retargeting, social media campaigns, plus-size community-based events, in-store experiences and product collaborations. |

| • | Grow With Disciplined Store Expansion. We believe the plus-size woman is dramatically underserved in her choice of apparel and intimates offerings and as a result we plan to capitalize on the opportunity to selectively grow our store footprint. Based on our proven, profitable store model, we intend to continue to capture this underpenetrated market with a disciplined roll-out of new stores that drive both in-store and e-Commerce sales. Our stores generate a high level of positive contribution and act as a low cost source of new customer acquisition, requiring a small upfront investment of capital expenditures and pre-opening expenses that is quickly paid back as a result of our customers’ high repeat purchasing behavior across channels. We target payback periods of less than two years, in line with our historical openings. |

Deepen Customer Relationships to Increase Wallet Share

We intend to continue to leverage the strength of our customer relationships and data, which allowed us to attribute approximately 98% of net sales in 2020 to individual customers. This robust customer data allows us to better engage with customers, increase retention and drive spend per customer.

| • | Expand Assortment Based on Trusted Fit. We intend to leverage data and our customer’s trust in our proprietary fit and style to enhance core entry points, such as denim and intimates, and broaden and deepen our offering in nascent categories, including activewear, workwear, special occasion and footwear. |

| • | Leverage Our Data. We plan to further deepen customer relationships with personalization, customization and clienteling across channels in ways that we are not currently doing today. Leveraging loyalty program data, we seek to tailor our marketing messages, promotions and product recommendations to her preferences, which we believe will further drive conversion online and in stores and increase our share of her wallet. |

| • | Grow Loyalty Program Engagement. As of May 1, 2021, 90% of our active customers are members of our loyalty program and we intend to continuously find new ways to engage her and bring her back to our site, such as increased personalization, dedicated loyalty member events, and opportunities for accelerated tier migration, which we believe will deepen her loyalty and continue to drive recurring purchasing behavior. |

11

Table of Contents

| • | Enhance Customer Experience. We believe near-term initiatives, both online and in-store, will greatly enhance the ease of transaction and overall experience for customers. We are upgrading the functionality and features of our mobile app to deliver enhanced personalization such as size recommendations and complementary items, to expedite purchase decisions and increase order value. Further, we have accelerated our investments in and will continue to invest in omni-channel offerings such as curbside pickup, BOPIS and ship from store to drive both customer acquisition and retention. |

| • | Implement New Technology. We have continued to enhance e-Commerce functionality with tools for product recommendations, enhanced payment options (e.g., buy now pay later), and improved returns process to drive conversion and increase order value. We also believe there is opportunity to further leverage artificial intelligence and machine-learning tools to drive better customer segmentation, leading to more efficient customer acquisition and retention marketing. |

Expand Operating Margins by Leveraging Completed Investments in Data and Multidisciplinary Teams

We have created a highly scalable foundation for growth through significant infrastructure investments. We will continue to strategically invest in our business while driving operational excellence and leveraging our fixed cost base to grow profitability.

| • | Leverage Data to Improve Pricing and Promotion Strategy. In addition to our robust merchandising team, we plan to continue to leverage data across the organization in various ways, allowing us to optimize pricing and promotional activity, including personalized promotions, to drive increased purchases and higher merchandise margins. |

| • | Enhance Supply Chain Flexibility. We have developed internal processes that we refer to as our “speed model,” including pre-positioning fabrics with our third-party factory partners to accelerate product replenishment cycles, improve inventory turnover and drive higher margin sales. |

| • | Leverage Cost Base. We believe our scalable infrastructure and team will yield increasing operational leverage as our sales continue to grow relative to our cost base. |

Recent Developments

New Senior Credit Facilities and Special Cash Distribution

On June 14, 2021, we entered into (i) the New Term Loan Credit Agreement and (ii) an amendment to the existing senior secured five-year revolving credit facility to, among other things, (A) increase the facility amount to $150.0 million and (B) extend the maturity to five years from the effective date (the “Amended ABL Facility” and, together with the New Term Loan Credit Agreement, the “New Senior Credit Facilities”). We used borrowings under the New Term Loan Credit Agreement to (i) repay and terminate the Original Term Loan Credit Agreement, (ii) partially fund a special cash distribution in an aggregate amount of $300.0 million (the “Special Cash Distribution”) to the direct and indirect holders of our equity interests, consisting of funds managed by Sycamore and members of our former and current management and (iii) pay transaction expenses. The Special Cash Distribution was funded with $131.7 million of borrowings under the New Term Loan Credit Agreement and $168.3 million of our existing cash and cash equivalents. We intend to use the Amended ABL Facility to finance the working capital needs and other general corporate purposes of the Company. For a description of the New Senior Credit Facilities see “Description of Certain Indebtedness.”

12

Table of Contents

Summary of Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition or results of operations. You should carefully consider these risks, including the risks discussed in the section entitled “Risk Factors,” before investing in our common stock. Risks relating to our business include, among others:

| • | our operations and financial performance have been affected by, and may continue to be affected by, the COVID-19 pandemic; |

| • | our business is sensitive to consumer spending and general economic conditions, and an economic slowdown could adversely affect our financial performance; |

| • | our business is dependent upon our ability to identify and respond to changes in customer preferences and other related factors; |

| • | our business depends in part on a strong brand image; |

| • | damage to our reputation arising from our use of social media, email and text messages; |

| • | our reliance on third parties to drive traffic to our website; |

| • | we could face increased competition from other brands that could adversely affect our ability to generate higher net sales and margins, as well as our ability to obtain access to digital marketing channels or favorable store locations; |

| • | our ability to attract customers to our physical stores that are located in shopping centers depends on the success of these shopping centers; |

| • | if we are unable to successfully adapt to consumer shopping preferences and develop and maintain a relevant and reliable omni-channel experience for our customers, our financial performance and brand image could be adversely affected; |

| • | risks related to our dependence on third parties for manufacturing and other services; |

| • | the potential of the interruption of the flow of merchandise from international manufacturers to disrupt our supply chain, including as a result of the imposition of additional duties, tariffs and other charges on imports and exports; |

| • | we could fail to effectively utilize information systems and implement new technologies, experience unauthorized disclosure of sensitive or confidential information, whether through a breach of our computer system or otherwise, or fail to comply with federal and state laws and regulations and industry standards relating to privacy, data protection, advertising and consumer protection; |

| • | changes in tax laws or regulations or in our operations may impact our effective tax rate; |

| • | government or consumer concerns about product safety; |

| • | our ability to protect our trademarks and other intellectual property rights; |

| • | the effects of our indebtedness and lease obligations on our financial flexibility and competitive position; |

| • | our ability to design, implement and maintain effective internal controls; and |

| • | our status as a “controlled company” and ability to rely on exemptions from certain corporate governance requirements. |

13

Table of Contents

Our Principal Stockholder

Sycamore Partners Management, L.P. is a private equity firm based in New York specializing in retail, distribution, and consumer investments. The firm has approximately $10.0 billion in aggregate committed capital. Sycamore’s strategy is to partner with management teams to improve the operating profitability and strategic value of their businesses. Sycamore’s investment portfolio includes Azamara, Belk, CommerceHub, Express, Hot Topic, LOFT / Ann Taylor, Lane Bryant, MGF Sourcing, NBG Home, Pure Fishing, Staples, Inc., Staples United States Retail, Staples Canada, Talbots, The Limited and Torrid.

Following this offering, Sycamore will control approximately 77.0% of the voting power of our outstanding common stock (or 75.8% if the underwriters exercise their option to purchase additional shares from the selling stockholders). As a result, Sycamore will control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger or sale of all or substantially all of our assets. Because Sycamore will hold more than 50% of the voting power of our outstanding common stock, we will be a “controlled company” under the corporate governance rules for NYSE-listed companies. We will therefore be permitted to, and we intend to, elect not to comply with certain corporate governance requirements. See “Management—Corporate Governance—Board Composition; Director Independence; Controlled Company Exemption.”

Implications of Being An Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), enacted in April 2012. As an “emerging growth company,” we may take advantage of specified reduced reporting and other requirements that are otherwise applicable to public companies. These provisions include, among other things:

| • | exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; |

| • | exemption from new or revised financial accounting standards applicable to public companies until such standards are also applicable to private companies; |

| • | exemption from compliance with any requirement that may be adopted by the Public Company Accounting Oversight Board or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | an exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements; and |

| • | reduced disclosure about executive compensation arrangements. |

We may take advantage of these provisions until the end of the fiscal year following the fifth anniversary of our initial public offering (“IPO”) or such earlier time that we are no longer an “emerging growth company.” We will cease to be an “emerging growth company” upon the earliest of: (i) the last day of the fiscal year (A) in which we had more than $1.07 billion in “total annual gross revenues,” (B) we are deemed to be a “large accelerated filer” under the rules of the SEC, or (C) following the fifth anniversary of the date of the completion of this offering; and (ii) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of these reduced burdens. For example, we have taken advantage of the reduced reporting requirement with respect to disclosure regarding our executive compensation arrangements and expect to take advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. For as long as we take advantage of the reduced reporting obligations, the information that we provide stockholders may be different from information provided

14

Table of Contents

by other public companies. We are irrevocably electing to “opt out” of the extended transition period relating to the exemption from new or revised financial accounting standards and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-”emerging growth companies.”

Reorganization

Following the date of effectiveness of the registration statement of which this prospectus forms a part and prior to the completion of this offering, (i) our direct parent, Torrid Holding LLC, will contribute to Torrid all outstanding shares of stock of Torrid Parent Inc., the current parent company of our operating subsidiaries, and (ii) Torrid will assume the obligations of Torrid Holding LLC under the related party promissory notes due to Torrid, which will result in the legal cancellation of such notes but will have no impact on our capitalization (together, the “Reorganization”).

Corporate Information

Torrid Holdings Inc., the issuer of the common stock in this offering, is a Delaware corporation. Our corporate headquarters is located at 18501 East San Jose Avenue, City of Industry, California 91748. Our telephone number is (626) 667-1002. Our website address is www.torrid.com. The information contained in or connected to our website is not deemed to be part of this prospectus.

15

Table of Contents

The Offering

| Issuer in this offering |

Torrid Holdings Inc. | |

| Common stock offered by the selling stockholders |

10,000,000 shares. | |

| 11,500,000 shares if the underwriters exercise their option to purchase additional shares in full. | ||

| Common stock to be outstanding immediately after this offering |

110,000,000 shares. | |

| Use of proceeds |

We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” | |

| Controlled company |

Upon completion of this offering, Sycamore will continue to beneficially own more than 50% of our outstanding common stock. As a result, we are eligible to, and we intend to, avail ourselves of the “controlled company” exemptions under the rules of the NYSE, including exemptions from certain of the corporate governance listing requirements. See “Management—Corporate Governance—Board Composition; Director Independence; Controlled Company Exemption.” | |

| Voting rights |

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of our stockholders. | |

| Dividend policy |

We currently expect to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness and therefore we do not anticipate paying any cash dividends in the foreseeable future. Our ability to pay dividends on our common stock is limited by the New Term Loan Credit Agreement and the credit agreement governing the Amended ABL Facility, and may be further restricted by the terms of any of our future indebtedness. See “Dividend Policy.” | |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Symbol for listing and trading on NYSE |

“CURV.” | |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of our common stock to be outstanding immediately after this offering:

| • | excludes 8,550,000 shares of common stock reserved for future grants under the LTIP (as defined herein), which we plan to adopt in connection with this offering, as well as any shares of common stock that become available pursuant to provisions in the LTIP that automatically increase the share reserve under the LTIP. See “Executive Compensation—Long-Term Incentive Awards—Long-Term Incentive Plan”; |

16

Table of Contents

| • | excludes 3,650,000 additional shares of common stock reserved for future issuance under the ESPP (as defined herein), as well as any shares of common stock that become available pursuant to provisions in the ESPP that automatically increase the share reserve under the ESPP. see “Executive Compensation—Long-Term Incentive Awards—Employee Stock Purchase Plan”; |

| • | gives effect to a 110,000-for-1 split of Torrid Holdings Inc.’s common stock, which was effected on June 22, 2021 (the “Stock Split”); and |

| • | assumes (1) no exercise by the underwriters of their option to purchase up to 1,500,000 additional shares from the selling stockholders, (2) an assumed initial public offering price of $19.50 per share, the midpoint of the initial public offering price range indicated on the cover of this prospectus, and (3) the completion of the Reorganization. |

17

Table of Contents

Summary Consolidated Historical Financial and Other Data

The following tables present our summary consolidated financial and other data as of and for the periods indicated. We have derived the summary consolidated statements of operations and cash flows data for the fiscal years ended February 2, 2019, February 1, 2020 and January 30, 2021 from our audited consolidated financial statements for such periods included elsewhere in this prospectus. Our summary consolidated balance sheet data as of February 1, 2020 and January 30, 2021 have been derived from our audited consolidated financial statements for such periods included elsewhere in this prospectus.

We have derived the summary consolidated statements of operations and cash flows data for the three months ended May 2, 2020 and May 1, 2021 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. Our summary consolidated balance sheet data as of May 1, 2021 has been derived from our unaudited condensed consolidated financial statements for such period included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, include all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the information set forth herein. Interim financial results are not necessarily indicative of results for the full year or any future reporting period.

The summary consolidated historical financial and other data presented below should be read in conjunction with our consolidated financial statements and the related notes thereto, included elsewhere in this prospectus, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our summary consolidated historical financial and other data may not be indicative of our future performance.

| Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

| February 2, 2019 | February 1, 2020 | January 30, 2021 | May 2, 2020 | May 1, 2021 | ||||||||||||||||

| (dollars in thousands, except where noted) | ||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 909,147 | $ | 1,036,984 | $ | 973,514 | $ | 156,477 | $ | 325,747 | ||||||||||

| Cost of goods sold |

586,121 | 640,909 | 643,215 | 115,535 | 180,815 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

323,026 | 396,075 | 330,299 | 40,942 | 144,932 | |||||||||||||||

| Selling, general and administrative expenses |

170,530 | 253,378 | 222,093 | 6,858 | 109,913 | |||||||||||||||

| Marketing expenses |

48,774 | 65,704 | 51,382 | 14,036 | 9,525 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations(1) |

103,722 | 76,993 | 56,824 | 20,048 | 25,494 | |||||||||||||||

| Interest expense |

1,053 | 16,493 | 21,338 | 6,094 | 4,624 | |||||||||||||||

| Interest income, net of other (income) expense |

(85 | ) | (202 | ) | (42 | ) | 133 | (109 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before provision for income taxes |

102,754 | 60,702 | 35,528 | 13,821 | 20,979 | |||||||||||||||

| Provision for income taxes |

16,042 | 18,833 | 10,991 | 1,552 | 8,054 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 86,712 | $ | 41,869 | $ | 24,537 | $ | 12,269 | $ | 12,925 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Earnings Per Share(2): |

||||||||||||||||||||

| Basic and diluted |

$ | 87 | $ | 42 | $ | 25 | $ | 12 | $ | 13 | ||||||||||

| Weighted Average Number of Shares(2): |

||||||||||||||||||||

| Basic and diluted (#) |

1,000 | 1,000 | 1,000 | 1,000 | 1,000 | |||||||||||||||

| Pro Forma Earnings Per Share (unaudited)(3) |

||||||||||||||||||||

| Basic and diluted |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Pro Forma Weighted Average Number of Shares (unaudited)(3) |

||||||||||||||||||||

| Basic and diluted(#) |

110,000,000 | 110,000,000 | 110,000,000 | 110,000,000 | 110,000,000 | |||||||||||||||

18

Table of Contents

| Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

| February 2, 2019 |

February 1, 2020 |

January 30, 2021 |

May 2, 2020 | May 1, 2021 | ||||||||||||||||

| (dollars in thousands, except where noted) | ||||||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||

| Operating activities |

$ | 115,092 | $ | 99,090 | $ | 151,821 | $ | 7,192 | $ | 73,834 | ||||||||||

| Investing activities |

(40,507 | ) | (56,120 | ) | (11,570 | ) | (6,076 | ) | (2,786 | ) | ||||||||||

| Financing activities |

(72,841 | ) | (23,335 | ) | (45,925 | ) | 48,050 | (3,250 | ) | |||||||||||

| Other Financial and Operating Data: |

||||||||||||||||||||

| Adjusted EBITDA(4) |

$ | 96,985 | $ | 131,999 | $ | 100,802 | $ | (8,198 | ) | $ | 75,711 | |||||||||

| Adjusted EBITDA margin(4) |

11 | % | 13 | % | 10 | % | (5 | %) | 23 | % | ||||||||||

| Comparable sales |

10 | % | 13 | % | (7 | %) | (38 | %) | 108 | % | ||||||||||

| Active customers (# in millions) |

3.0 | 3.4 | 3.2 | 3.2 | 3.4 | |||||||||||||||

| Store count (#) |

577 | 607 | 608 | 607 | 608 | |||||||||||||||

| As of | ||||||||||||

| February 1, 2020 |

January 30, 2021 |

May 1, 2021 |

||||||||||

| (dollars in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 28,804 | $ | 122,953 | $ | 190,782 | ||||||

| Total current assets |

164,013 | 242,143 | 319,974 | |||||||||

| Total current liabilities |

186,583 | 261,109 | 285,739 | |||||||||

| Total long-term debt |

240,393 | 193,406 | 190,530 | |||||||||

| Total liabilities and stockholder’s deficit |

635,988 | 648,209 | 711,117 | |||||||||

| (1) | The results of operations were impacted by share-based compensation expense related to revaluing our liability-classified incentive units. |