Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MID PENN BANCORP INC | d199355d8k.htm |

| EX-99.1 - EX-99.1 - MID PENN BANCORP INC | d199355dex991.htm |

| EX-2.1 - EX-2.1 - MID PENN BANCORP INC | d199355dex21.htm |

June 30, 2021 Combination of Two Leading Franchises Creating a Premier Community Bank in Pennsylvania Exhibit 99.2

Disclaimer Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements that are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “project,” “plan,” “seek,” “target,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections and estimates and their underlying assumptions, statements regarding plans, objectives, expectations or consequences of various transactions and statements about the future performance, operations, products and services of Mid Penn Bancorp, Inc. (“Mid Penn”), Riverview Financial Corporation (“Riverview”) and our respective subsidiaries. These forward-looking statements are subject to various assumptions, risks, uncertainties and other factors. These risks are detailed in documents filed by Mid Penn and Riverview with the Securities and Exchange Commission (“SEC”), including Mid Penn’s and Riverview’s Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and other required filings. Because of the uncertainties, risks and the possibility of changes in these assumptions, actual results could differ materially from those expressed in any forward-looking statements. Investors are cautioned not to place undue reliance on these statements. Neither Mid Penn nor Riverview assume any duty or obligation to update any forward-looking statements made in this presentation. Additional Information and Where to Find it The proposed transaction will be submitted to the shareholders of Riverview and Mid Penn for their consideration and approval. In connection with the proposed transaction, Mid Penn will be filing with the SEC a registration statement on Form S-4 which will include a joint proxy statement/prospectus and other relevant documents to be distributed to the shareholders of Mid Penn and Riverview. Investors are urged to read the registration statement and the joint proxy statement/prospectus regarding the proposed transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Investors will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about Mid Penn and Riverview, free of charge from the SEC’s Internet Site (www.sec.gov), by contacting Mid Penn Bancorp, Inc. 349 Union Street, Millersburg, PA 17061, attention: Investor Relations (telephone (717) 692-7105); or Riverview Financial Corp., 3901 North Front Street, Harrisburg, PA 17110, attention: Investor Relations (telephone (717) 957-2196). INVESTORS SHOULD READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TRANSACTION. This presentation does not constitute an offer to sell or an offer to buy any securities or a solicitation of any vote for approval of the transaction. Solicitation Mid Penn, Riverview and their respective directors, executive officers, and certain other members of management and employees may be soliciting proxies from Mid Penn and Riverview shareholders in favor of the transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Mid Penn and Riverview shareholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find the information about Mid Penn’s and Riverview’s executive officers and directors in each company’s respective recent proxy statement filed with the SEC, which is available at the SEC’s Internet site (www.sec.gov). Free copies of these documents may be obtained as described above.

Transaction Rationale Compelling Combination Creates one of the largest community banks headquartered in Pennsylvania with pro forma assets of ~$4.8 billion and operations reaching many of the states’ most attractive markets Continues Mid Penn’s successful acquisition strategy – building market share, enhancing the core deposit profile and generating cost savings opportunities Expansion into attractive new markets, including the Lehigh Valley and State College region, while expanding our presence in the western part of Pennsylvania Low risk integration given high level of familiarity with the Riverview franchise Financially Attractive Accelerates our stated strategic goals of accelerating profitability, increasing operating leverage and shareholder liquidity Material earnings per share accretion of 25%+ per year Identified, achievable cost savings due to proximity of franchises Tangible book value dilution earned back in ~2.25 years Pro forma ROAA benefit of ~20 basis points resulting in a pro forma ROAA of ~1.00%+ Accelerates Shareholder Value Creation Provides increased scale, lending limits and competitive position throughout Pennsylvania markets of operation Enhanced core deposit profile provides funding for future loan growth and long-term franchise value Larger pro forma asset base and liquidity should drive multiple expansion Strong pro forma capital ratios allows combined company to continue to focus on organic growth as well as opportunistic M&A

Timing & Approvals MPB and RIVE shareholder approval Customary regulatory approvals Anticipated closing in Q4 2021 Transaction Summary Exchange Ratio & Consideration RIVE shareholders to receive 0.4833 shares of MPB common stock for each share outstanding 100% stock consideration Transaction Value Implied per share value of $13.281 Implied aggregate consideration of $124.7M Price to tangible book value of 128% Price to MRQ annualized2 earnings per share (excluding cost savings) of 10.2x Price to MRQ annualized2 earnings per share (including cost savings3) of 5.2x Core Deposit premium of 2.8% Pro Forma Ownership 72% MPB / 28% RIVE Board of Directors Representatives of RIVE to receive two holding company Board seats Per share value based on Mid Penn Bancorp closing price of $27.47 as of June 29, 2021 MRQ annualized EPS represents GAAP EPS for the period ending March 31, 2021 annualized Pre-tax cost savings equal to ~$14.5M

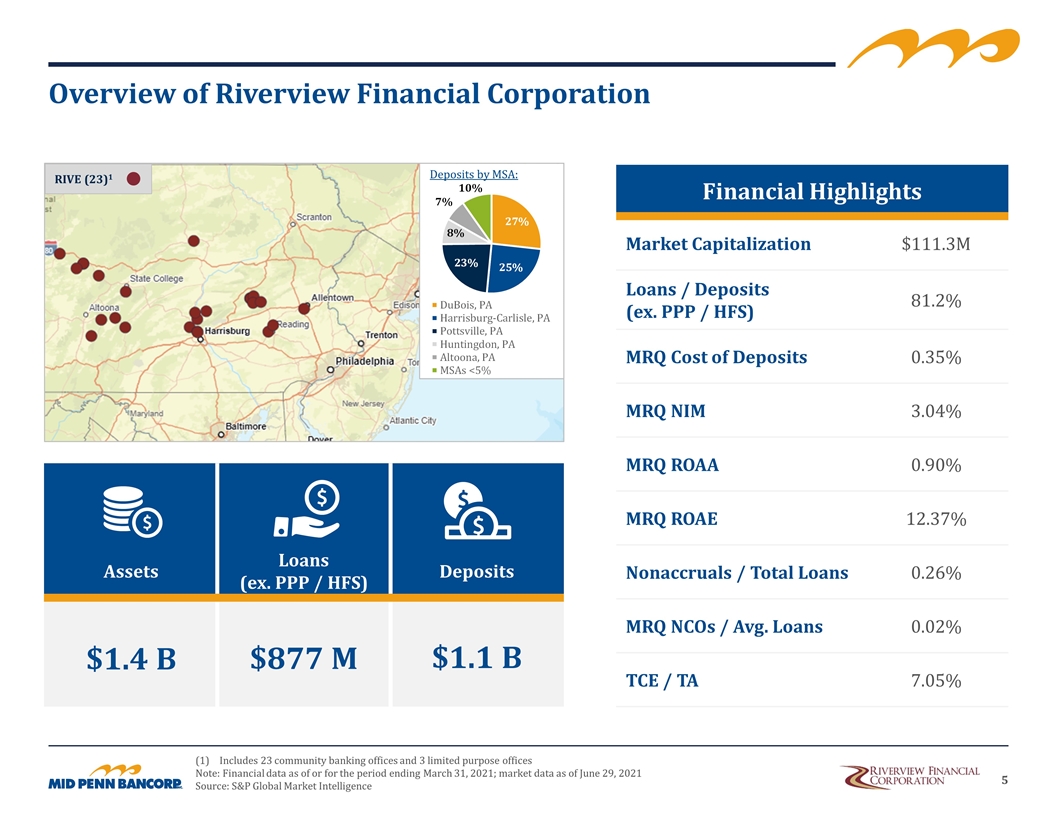

Overview of Riverview Financial Corporation Includes 23 community banking offices and 3 limited purpose offices Note: Financial data as of or for the period ending March 31, 2021; market data as of June 29, 2021 Source: S&P Global Market Intelligence Assets Loans (ex. PPP / HFS) $1.4 B $877 M $1.1 B Deposits Financial Highlights Market Capitalization $111.3M Loans / Deposits (ex. PPP / HFS) 81.2% MRQ Cost of Deposits 0.35% MRQ NIM 3.04% MRQ ROAA 0.90% MRQ ROAE 12.37% Nonaccruals / Total Loans 0.26% MRQ NCOs / Avg. Loans 0.02% TCE / TA 7.05% RIVE (23)1 Deposits by MSA:

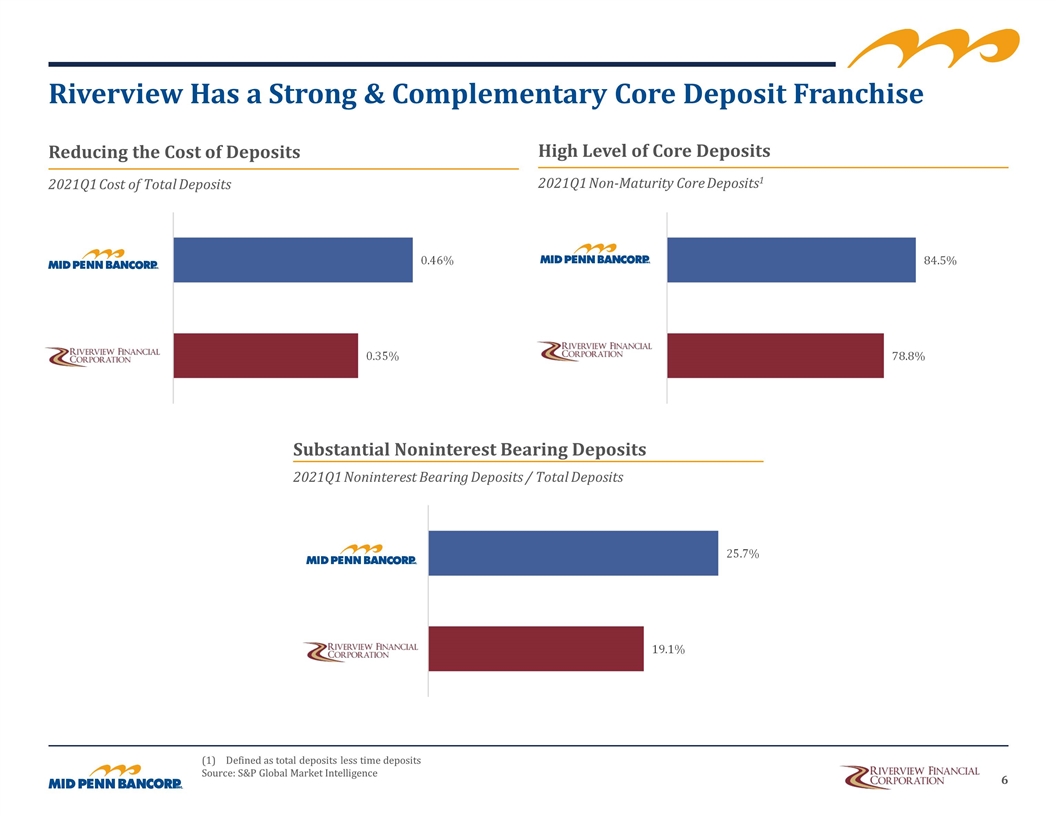

Riverview Has a Strong & Complementary Core Deposit Franchise Defined as total deposits less time deposits Source: S&P Global Market Intelligence Reducing the Cost of Deposits 2021Q1 Cost of Total Deposits Substantial Noninterest Bearing Deposits 2021Q1 Noninterest Bearing Deposits / Total Deposits High Level of Core Deposits 2021Q1 Non-Maturity Core Deposits1

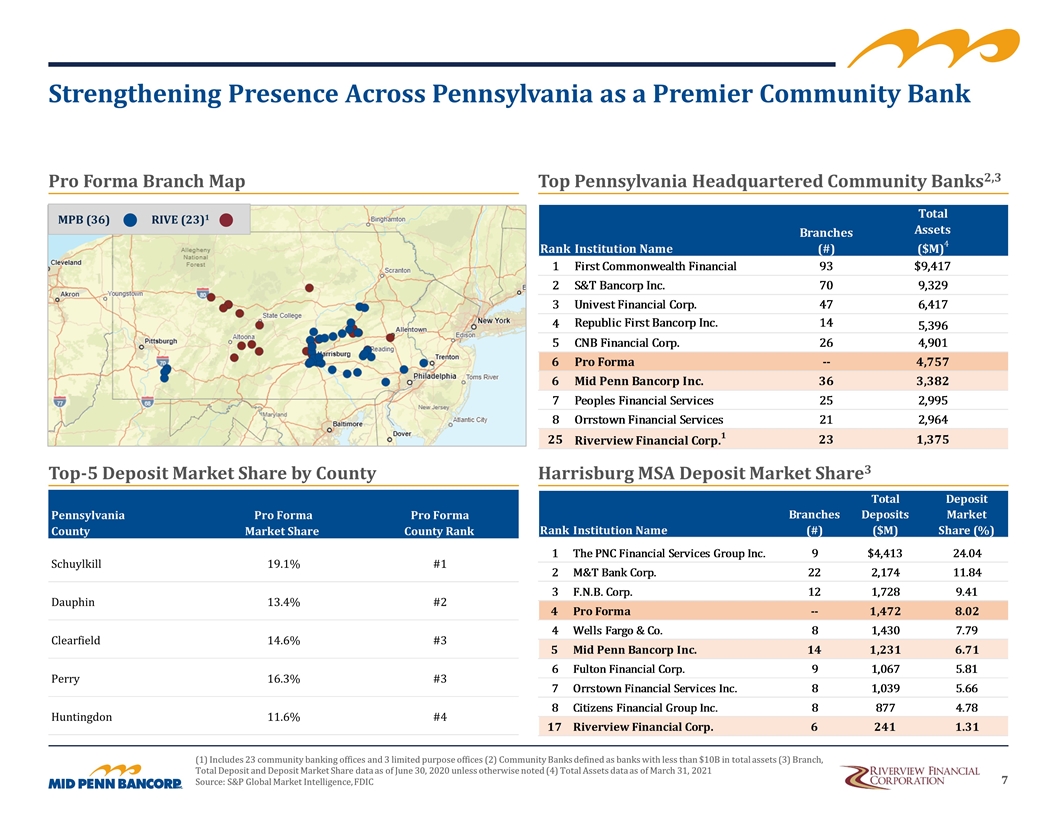

Strengthening Presence Across Pennsylvania as a Premier Community Bank Top Pennsylvania Headquartered Community Banks2,3 Pro Forma Branch Map Harrisburg MSA Deposit Market Share3 Top-5 Deposit Market Share by County (1) Includes 23 community banking offices and 3 limited purpose offices (2) Community Banks defined as banks with less than $10B in total assets (3) Branch, Total Deposit and Deposit Market Share data as of June 30, 2020 unless otherwise noted (4) Total Assets data as of March 31, 2021 Source: S&P Global Market Intelligence, FDIC MPB (36) RIVE (23)1 Pennsylvania County Pro Forma Market Share Pro Forma County Rank Schuylkill 19.1% #1 Dauphin 13.4% #2 Clearfield 14.6% #3 Perry 16.3% #3 Huntingdon 11.6% #4

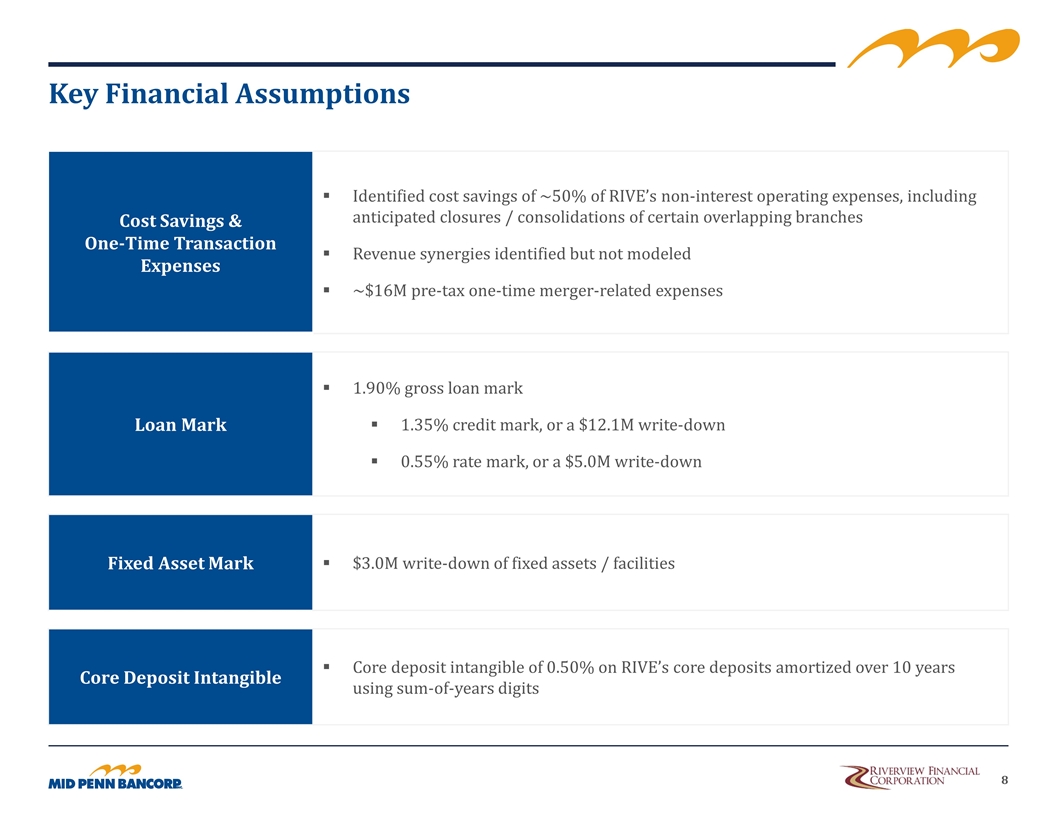

Key Financial Assumptions Cost Savings & One-Time Transaction Expenses Identified cost savings of ~50% of RIVE’s non-interest operating expenses, including anticipated closures / consolidations of certain overlapping branches Revenue synergies identified but not modeled ~$16M pre-tax one-time merger-related expenses Loan Mark 1.90% gross loan mark 1.35% credit mark, or a $12.1M write-down 0.55% rate mark, or a $5.0M write-down Fixed Asset Mark $3.0M write-down of fixed assets / facilities Core Deposit Intangible Core deposit intangible of 0.50% on RIVE’s core deposits amortized over 10 years using sum-of-years digits

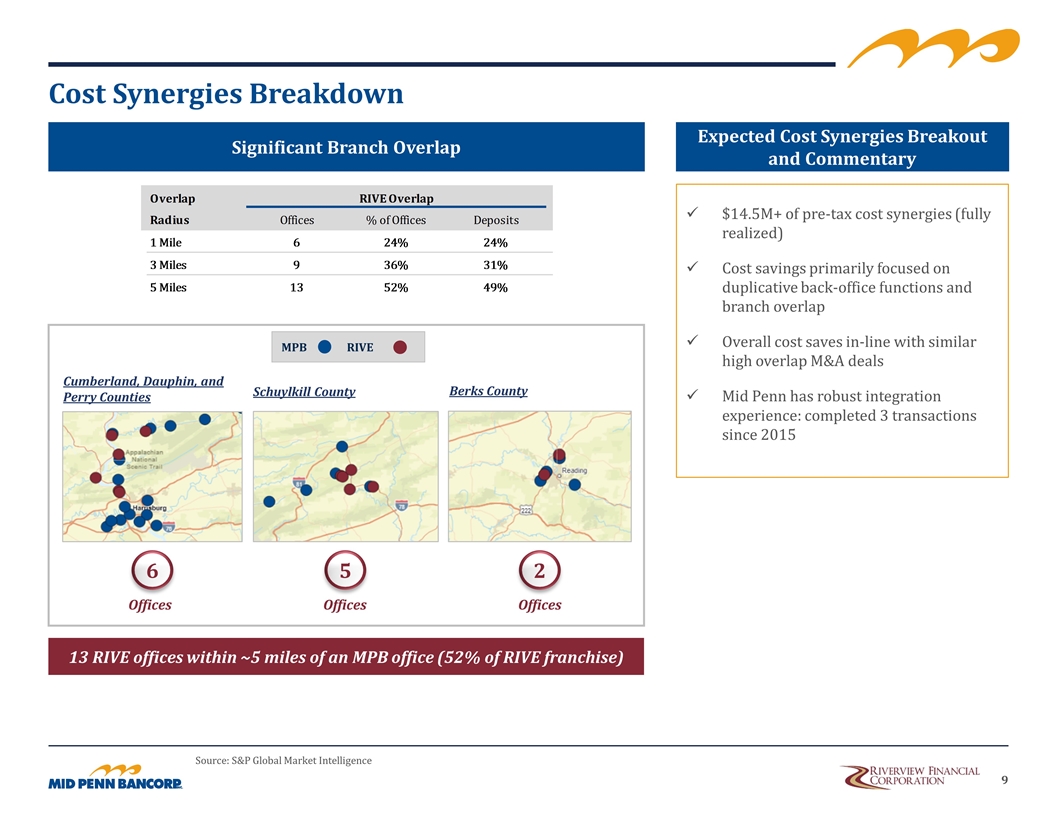

Cost Synergies Breakdown Source: S&P Global Market Intelligence Expected Cost Synergies Breakout and Commentary $14.5M+ of pre-tax cost synergies (fully realized) Cost savings primarily focused on duplicative back-office functions and branch overlap Overall cost saves in-line with similar high overlap M&A deals Mid Penn has robust integration experience: completed 3 transactions since 2015 Significant Branch Overlap Cumberland, Dauphin, and Perry Counties Schuylkill County Berks County 13 RIVE offices within ~5 miles of an MPB office (52% of RIVE franchise) MPB RIVE 2 5 6 Offices Offices Offices

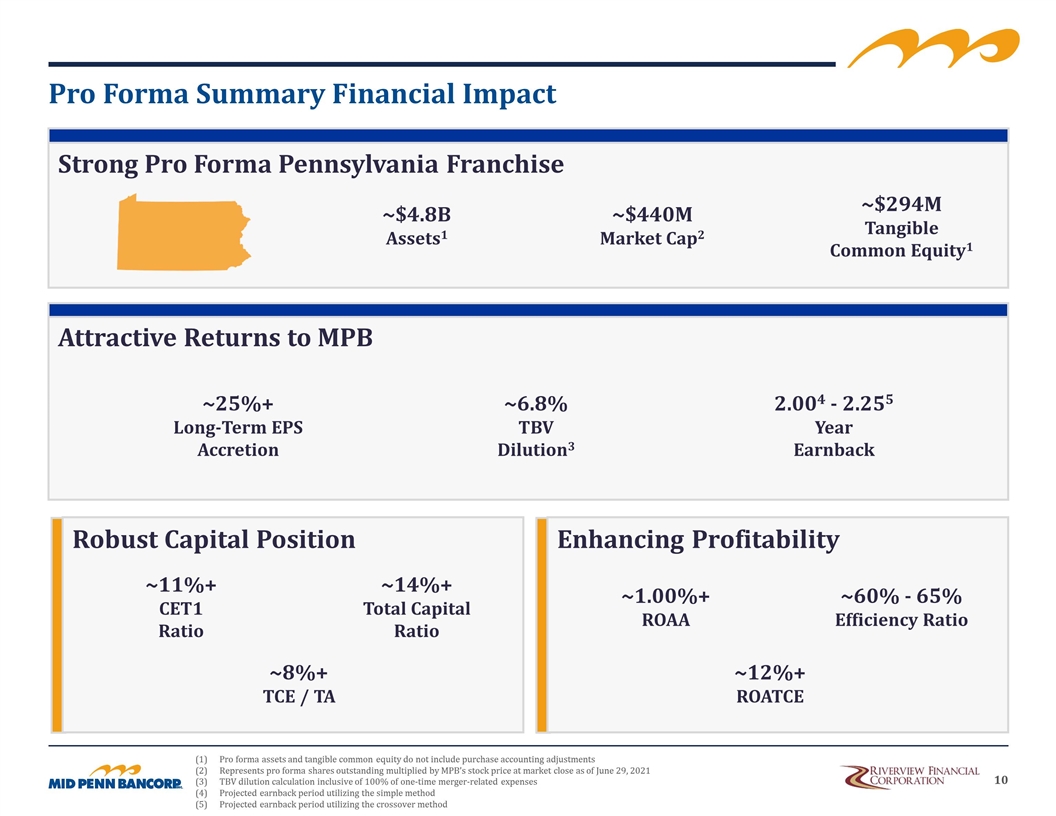

Pro Forma Summary Financial Impact Strong Pro Forma Pennsylvania Franchise ~$4.8B Assets1 ~$440M Market Cap2 Attractive Returns to MPB ~25%+ Long-Term EPS Accretion ~6.8% TBV Dilution3 2.004 - 2.255 Year Earnback Robust Capital Position ~11%+ CET1 Ratio ~14%+ Total Capital Ratio Enhancing Profitability ~1.00%+ ROAA ~60% - 65% Efficiency Ratio Pro forma assets and tangible common equity do not include purchase accounting adjustments Represents pro forma shares outstanding multiplied by MPB’s stock price at market close as of June 29, 2021 TBV dilution calculation inclusive of 100% of one-time merger-related expenses Projected earnback period utilizing the simple method Projected earnback period utilizing the crossover method ~8%+ TCE / TA ~12%+ ROATCE ~$294M Tangible Common Equity1

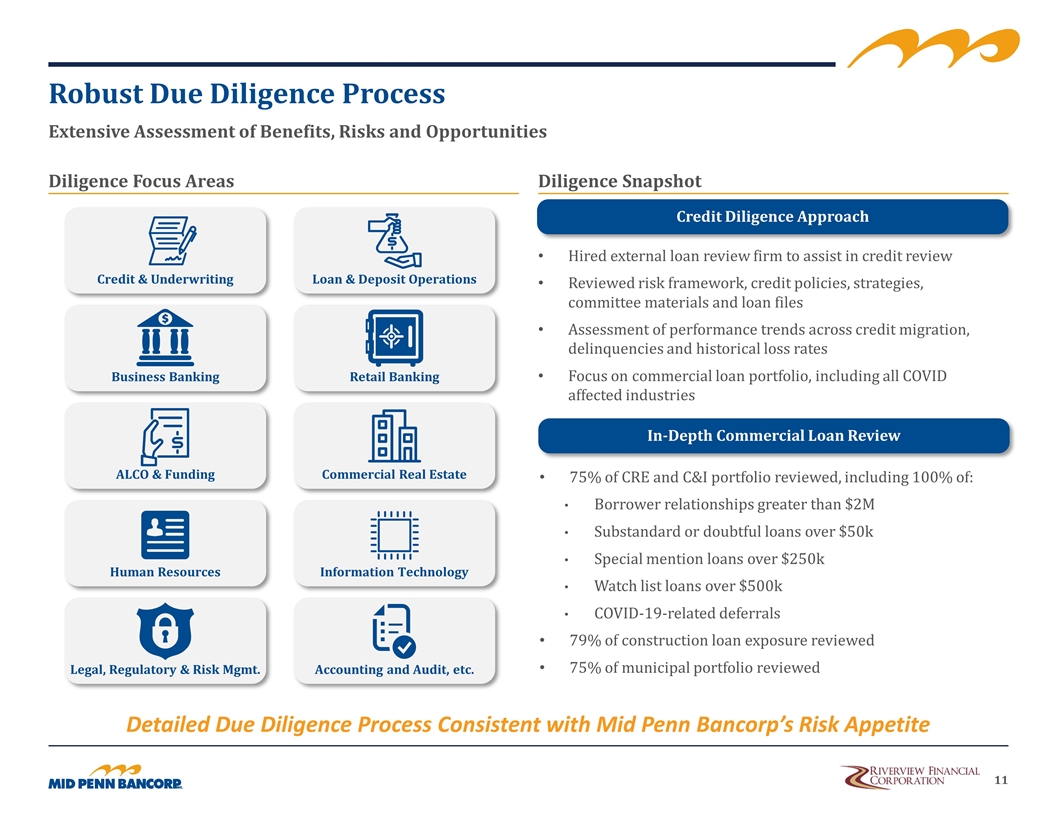

Robust Due Diligence Process Extensive Assessment of Benefits, Risks and Opportunities Diligence Snapshot Diligence Focus Areas Credit Diligence Approach In-Depth Commercial Loan Review Detailed Due Diligence Process Consistent with Mid Penn Bancorp’s Risk Appetite Credit & Underwriting Loan & Deposit Operations Business Banking Retail Banking Commercial Real Estate ALCO & Funding Human Resources Information Technology Legal, Regulatory & Risk Mgmt. Accounting and Audit, etc. Hired external loan review firm to assist in credit review Reviewed risk framework, credit policies, strategies, committee materials and loan files Assessment of performance trends across credit migration, delinquencies and historical loss rates Focus on commercial loan portfolio, including all COVID affected industries 75% of CRE and C&I portfolio reviewed, including 100% of: Borrower relationships greater than $2M Substandard or doubtful loans over $50k Special mention loans over $250k Watch list loans over $500k COVID-19-related deferrals 79% of construction loan exposure reviewed 75% of municipal portfolio reviewed

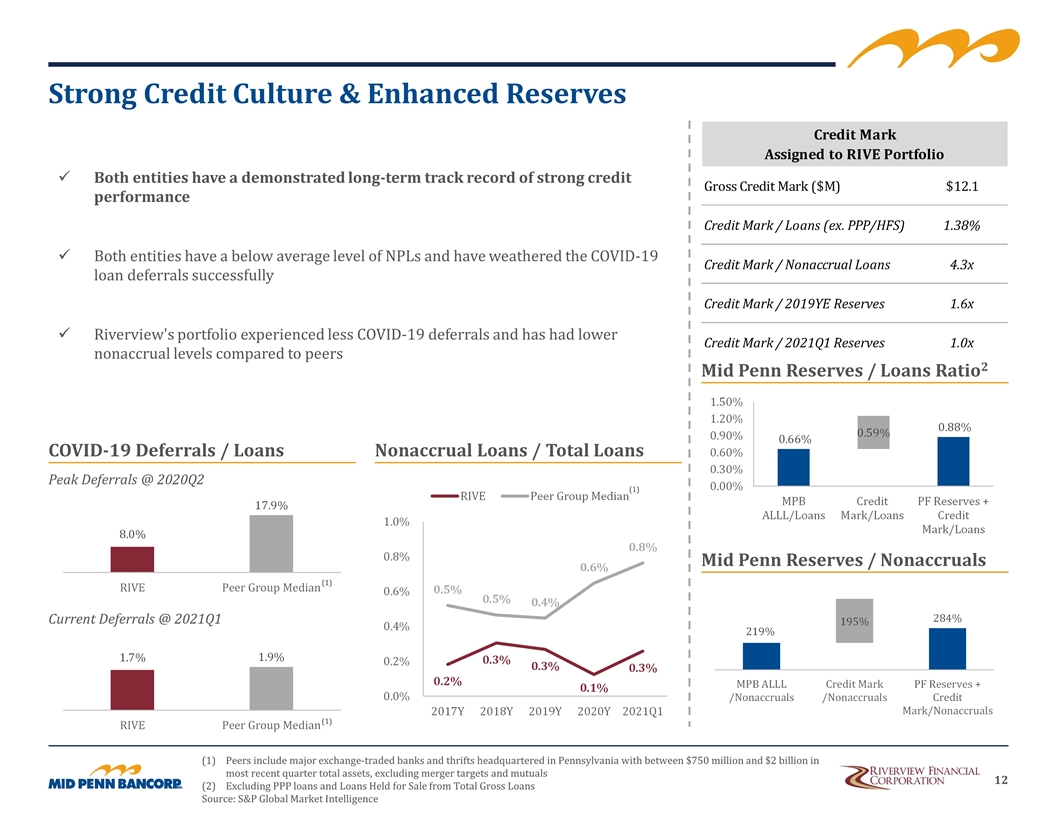

Strong Credit Culture & Enhanced Reserves COVID-19 Deferrals / Loans Nonaccrual Loans / Total Loans Mid Penn Reserves / Loans Ratio2 (1) (1) Peers include major exchange-traded banks and thrifts headquartered in Pennsylvania with between $750 million and $2 billion in most recent quarter total assets, excluding merger targets and mutuals Excluding PPP loans and Loans Held for Sale from Total Gross Loans Source: S&P Global Market Intelligence Both entities have a demonstrated long-term track record of strong credit performance Both entities have a below average level of NPLs and have weathered the COVID-19 loan deferrals successfully Riverview's portfolio experienced less COVID-19 deferrals and has had lower nonaccrual levels compared to peers Peak Deferrals @ 2020Q2 Current Deferrals @ 2021Q1 (1) Mid Penn Reserves / Nonaccruals

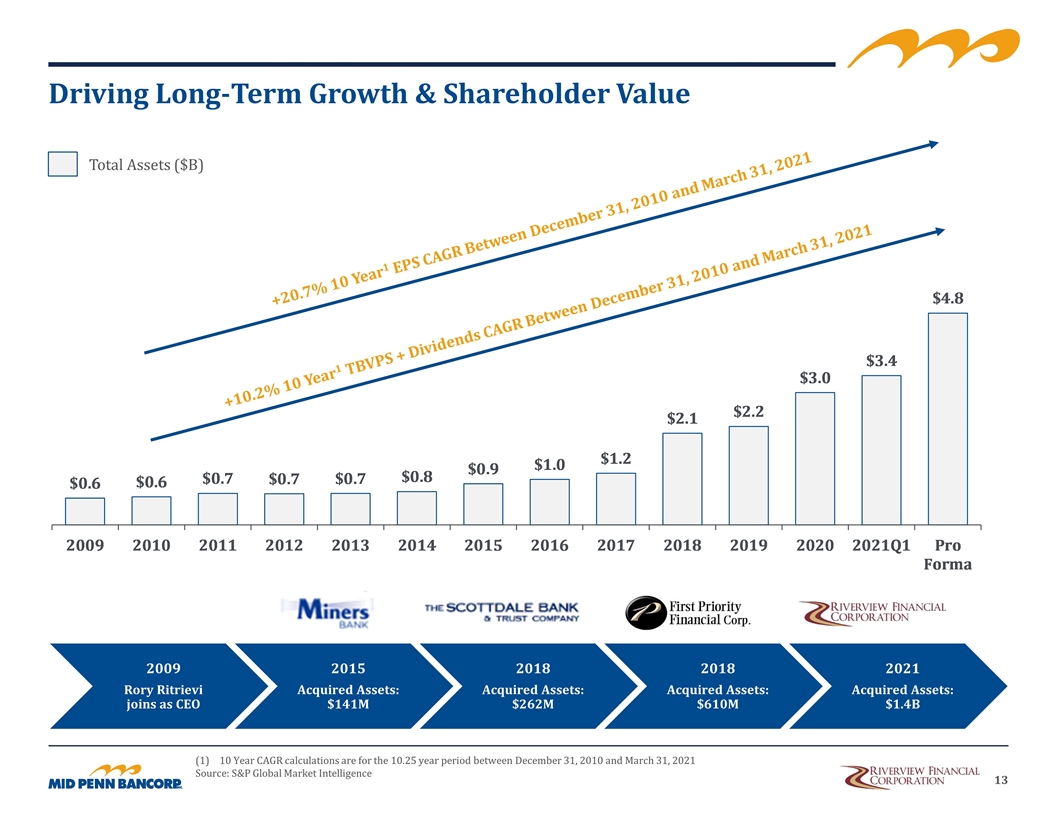

Driving Long-Term Growth & Shareholder Value 10 Year CAGR calculations are for the 10.25 year period between December 31, 2010 and March 31, 2021 Source: S&P Global Market Intelligence +20.7% 10 Year1 EPS CAGR Between December 31, 2010 and March 31, 2021 +10.2% 10 Year1 TBVPS + Dividends CAGR Between December 31, 2010 and March 31, 2021 2009 Rory Ritrievi joins as CEO 2015 Acquired Assets: $141M 2018 Acquired Assets: $262M 2018 Acquired Assets: $610M 2021 Acquired Assets: $1.4B Total Assets ($B)

Acquisition Helps Accomplish Our Strategic Goals Core Loan Production Additional high quality commercial lenders New group of “PPP” customers to convert into new commercial relationships Southeast PA Market Development Establishes our first location in the Lehigh Valley Enhances ability to increase loan origination volumes in greater Southeastern PA Fee Income Expansion Adds to our Wealth Management & Trust business Opportunistic M&A Transaction provides in-market expansion and an opportunity to create significant earnings accretion while adding talented new business development employees Expense Rationalization Opportunity to create significant operating leverage with over 50% of Riverview branches within 5 miles of a Mid Penn location Transaction will bring “core” efficiency ratio in line with goal of 60% to 65% Transaction Benefits Source: S&P Global Market Intelligence

Appendix

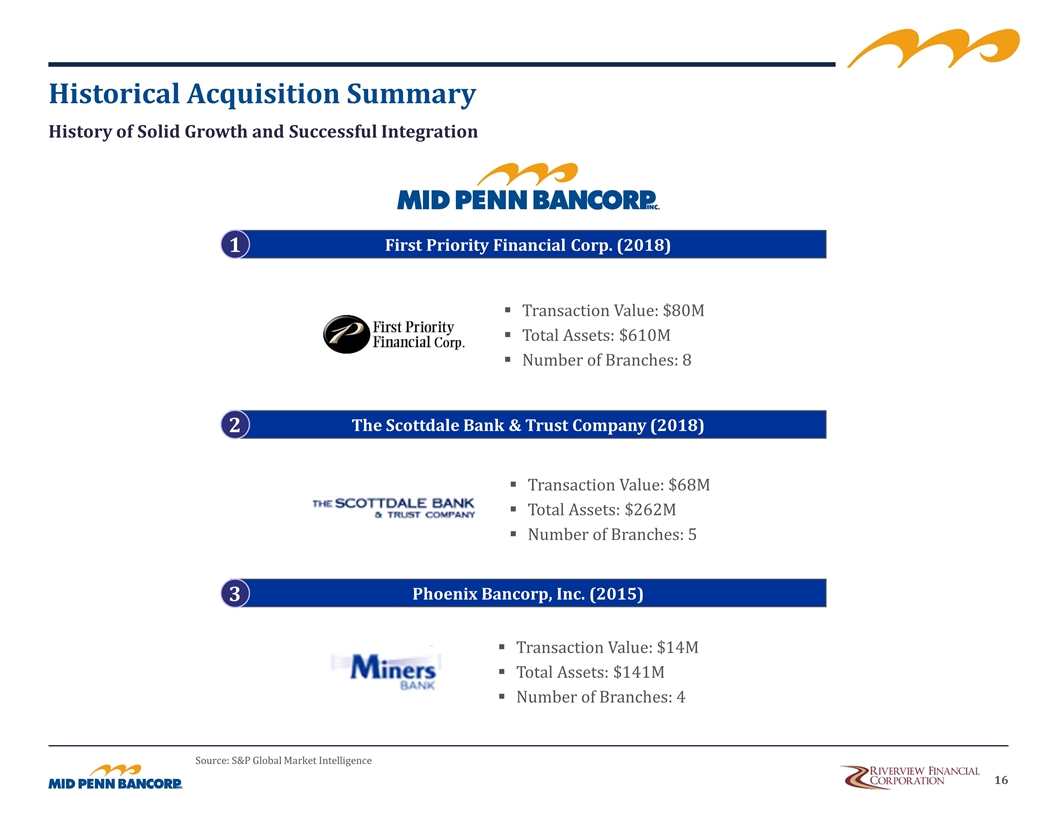

Historical Acquisition Summary History of Solid Growth and Successful Integration First Priority Financial Corp. (2018) 1 The Scottdale Bank & Trust Company (2018) 2 Phoenix Bancorp, Inc. (2015) 3 Transaction Value: $14M Total Assets: $141M Number of Branches: 4 Transaction Value: $68M Total Assets: $262M Number of Branches: 5 Transaction Value: $80M Total Assets: $610M Number of Branches: 8 Source: S&P Global Market Intelligence

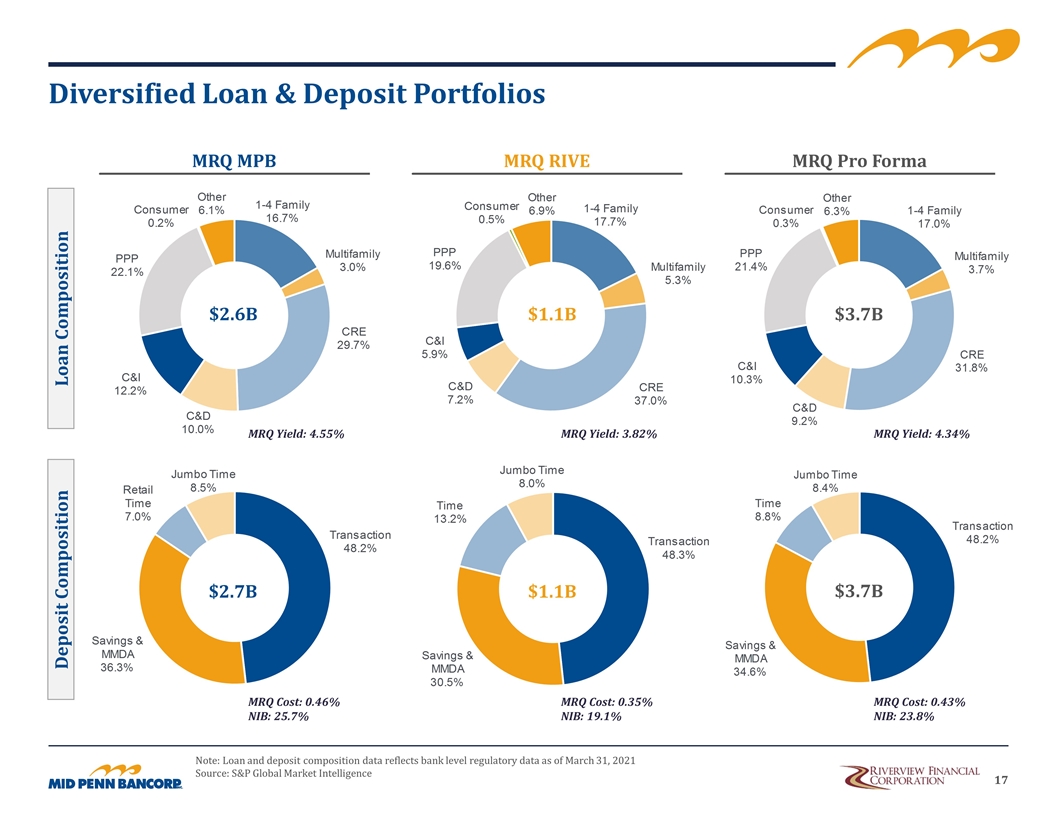

Diversified Loan & Deposit Portfolios $2.7B $1.1B $1.1B $2.6B $3.7B Loan Composition Deposit Composition MRQ RIVE MRQ MPB MRQ Pro Forma $3.7B MRQ Yield: 4.55% MRQ Yield: 3.82% MRQ Yield: 4.34% MRQ Cost: 0.46% NIB: 25.7% MRQ Cost: 0.35% NIB: 19.1% MRQ Cost: 0.43% NIB: 23.8% Note: Loan and deposit composition data reflects bank level regulatory data as of March 31, 2021 Source: S&P Global Market Intelligence