Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Celanese Corp | tm2120738d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Celanese Corp | tm2120738d1_ex99-1.htm |

| 8-K - FORM 8-K - Celanese Corp | tm2120738d1_8k.htm |

Exhibit 99.2

Celanese to Acquire ExxonMobil’s Santoprene Œ TPV Elastomers Business Highly differentiated addition to Engineered Materials’ leading solution set June 2021

Forward - Looking Statements This presentation contains "forward - looking statements," which include information concerning the Company's plans, objectives, g oals, strategies, future revenues, synergies, performance, capital expenditures, financing needs and other information that is not historical information. All forward - looking statements are based upon current expectatio ns and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could ca use actual results to differ materially from the results expressed or implied in the forward - looking statements contained in this presentation. These risks and uncertainties include, among other things: the Company’s a bil ity to obtain regulatory approval for, and satisfy closing conditions to, the transactions described herein and the timing of closing thereof; our ability to realize the anticipated benefits of the transactions descr ibe d herein; the extent to which the COVID - 19 pandemic continues to adversely impact the economic environment, market demand and our operations, as well as the pace of any economic recovery; changes in general econ omi c, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, mobilit y, textiles, medical, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pul p and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintai n p lant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvemen ts to existing plants; the ability to identify desirable potential acquisition targets and to complete acquisition or investment transactions consistent with the Company's strategy; the ability to identify and execute o n o ther attractive investment opportunities towards which to deploy capital; increased price competition and the introduction of competing products by other companies; market acceptance of our products and technology; com pliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unre st, public health crises (including, but not limited to, the COVID - 19 pandemic); other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters or other crises including public health crises; the ability to obtain governmental approvals and to construct facilities on terms and schedul es acceptable to the Company; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; potential liability for reme dia l actions and increased costs under existing or future environmental, health and safety regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our abi lity to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; tax rates and changes thereto; and various other factors discussed from time to time in th e C ompany's filings with the Securities and Exchange Commission. Any forward - looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward - looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this document, together with the adjustments made to present the results on a comparable basis, have not been aud ited and are based on internal financial data furnished to management. Historical results should not be taken as an indication of the results of operations to be reported for any future period. Non - GAAP Financial Measures This presentation, and statements made in connection with this presentation, refer to non - GAAP financial measures. For more info rmation on the historical non - GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each historical non - GAAP financial measures used, including definitions and reconciliations of the differences between such non - GAAP financial measures and the comparable GAAP financial measures, please refer to the Non - US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Non - GAAP Financial Measures. We do not provide reconciliations for Adjusted EBIT, Adjusted EBITDA or adjusted earnings per share on a forward - looking basis ( including those contained in this document) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. Thi s is due to the inherent difficulty of forecasting the timing and amount of Certain Items, such as mark - to - market pension gains and losses, that have not yet occurred, are out of our control and/or cannot be reasonably predicte d. For the same reasons, we are unable to address the probable significance of the unavailable information. 2 Disclosures

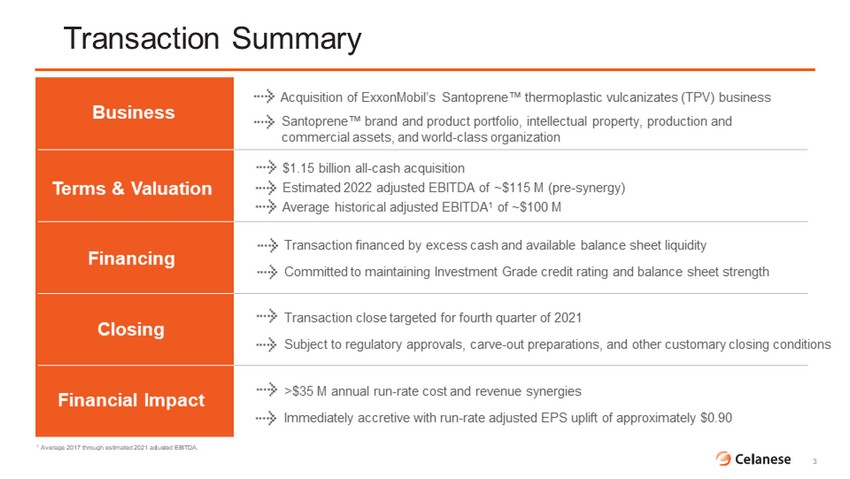

3 1 Average 2017 through estimated 2021 adjusted EBITDA. Transaction Summary Business Terms & Valuation Financing Closing Financial Impact Acquisition of ExxonMobil’s Santoprene Œ thermoplastic vulcanizates (TPV) business Average historical adjusted EBITDA 1 of ~$100 M Estimated 2022 adjusted EBITDA of ~$115 M (pre - synergy) $1.15 billion all - cash acquisition Transaction financed by excess cash and available balance sheet liquidity Committed to maintaining Investment Grade credit rating and balance sheet strength Transaction close targeted for fourth quarter of 2021 Subject to regulatory approvals, carve - out preparations, and other customary closing conditions >$35 M annual run - rate cost and revenue synergies Immediately accretive with run - rate adjusted EPS uplift of approximately $0.90 Santoprene Œ brand and product portfolio, intellectual property, production and commercial assets, and world - class organization

Acquisition of a global leader in TPV with an industry - renowned brand Highly differentiated product portfolio that will be enhanced by Engineered Materials’ (EM) customer engagement model Advantaged product, end - use, and regional positions to deliver future growth Strengthens Engineered Materials’ global leadership position in automotive Transaction Highlights Significant synergies and highly attractive financial metrics with run - rate adjusted EPS uplift of approximately $0.90 Exceeds disciplined Celanese M&A criteria shared at 2021 Investor Day 4 1 2 3 4 5 6

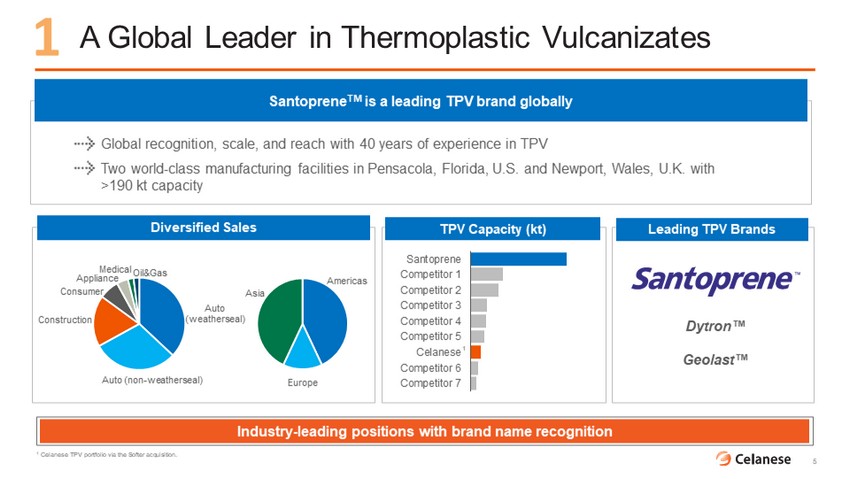

A Global Leader in Thermoplastic Vulcanizates 5 Diversified Sales Auto (weatherseal) Auto (non - weatherseal) Construction Consumer Appliance Medical Oil&Gas Americas Europe Asia Leading TPV Brands TPV Capacity (kt) Competitor 7 Competitor 6 Celanese Competitor 5 Competitor 4 Competitor 3 Competitor 2 Competitor 1 Santoprene Global recognition, scale, and reach with 40 years of experience in TPV Two world - class manufacturing facilities in Pensacola, Florida, U.S. and Newport, Wales, U.K. with >190 kt capacity Industry - leading positions with brand name recognition Santoprene TM is a leading TPV brand gl obally 1 1 1 Celanese TPV portfolio via the Softer acquisition. Dytron Œ Geolast Œ

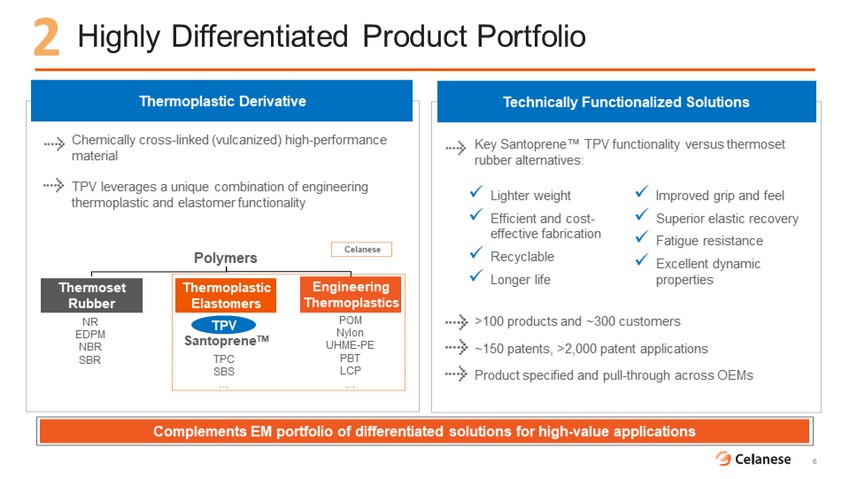

Key Santoprene Œ TPV functionality versus thermoset rubber alternatives: >100 products and ~300 customers ~150 patents, >2,000 patent applications Product specified and pull - through across OEMs Chemically cross - linked (vulcanized) high - performance material TPV leverages a unique combination of engineering thermoplastic and elastomer functionality 6 Thermoplastic Derivative Technically Functionalized Solutions Highly Differentiated Product Portfolio Polymers Engineering Thermoplastics Thermoset Rubber Thermoplastic Elastomers TPV Santoprene TM NR EDPM NBR SBR POM Nylon UHME - PE PBT LCP … x Lighter weight x Efficient and cost - effective fabrication x Recyclable x Longer life x Improved grip and feel x Superior elastic recovery x Fatigue resistance x Excellent dynamic properties 2 Complements EM portfolio of differentiated solutions for high - value applications TPC SBS … Celanese

7 2 Immediate contribution to EM project pipeline model with high - value solutions across similar applications Customer Solutions Tailored by Application Multi - party collaboration with Tiers and OEMs Customer Model Enhanced Breadth of Product Portfolio Tailored TPV Functionality x Design flexibility x Recycling opportunity x Temperature resistance x Anti - microbial x Processing ease x Flex fatigue x S ealing performance Customer Engagement Model Santoprene ΠAnti - vibration feet S hock absorber Grips & knobs Detergent compartment seal Front loader seal Inlet & outlet pipes Motor support gasket Hose connector Dedicated growth and innovation teams Case Study: Tailored Solutions in Consumer Appliances CE Engineered Materials Direct drive Transmission housing Drive hub Suspension damper Gear Pulley Shock absorber Pump cover Hinge cap Instrument panel Keypad Circuit case Detergent dispenser Door frame Soft touch door handle Filter seal Drum lifter

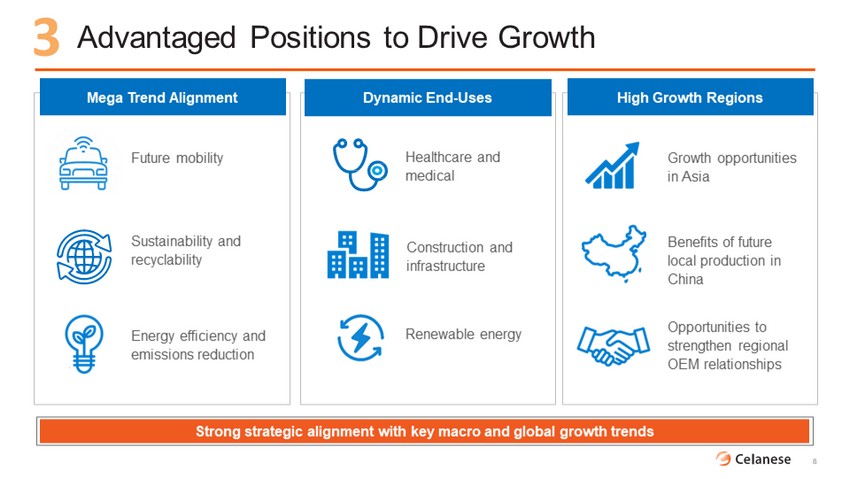

Advantaged Positions to Drive Growth Future mobility Sustainability and recyclability Energy efficiency and emissions reduction 8 Growth opportunities in Asia High Growth Regions 3 Strong strategic alignment with key macro and global growth trends Mega Trend Alignment Dynamic End - Uses Healthcare and medical Construction and infrastructure Renewable energy Benefits of future local production in China Opportunities to strengthen regional OEM relationships

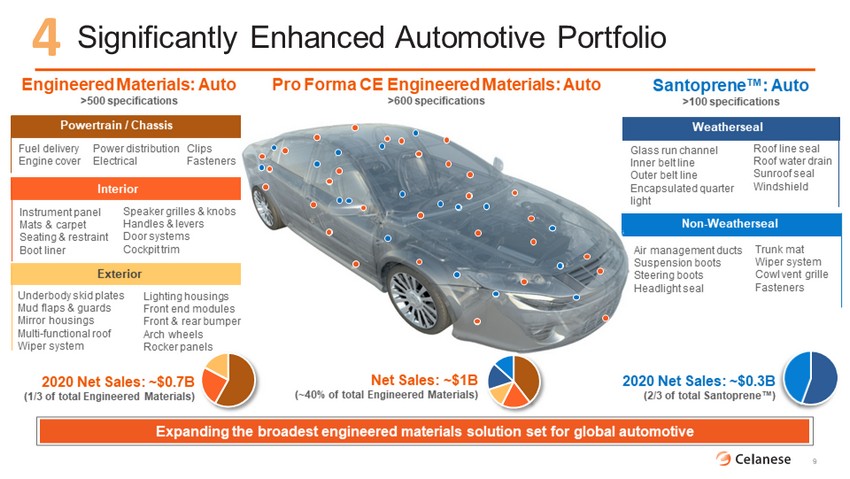

Significantly Enhanced Automotive Portfolio 9 4 Expanding the broadest engineered materials solution set for global automotive Engineered Materials: Auto >500 specifications Interior Exterior Fuel delivery Engine cover Powertrain / Chassis Instrument panel Mats & carpet Seating & restraint Boot liner Underbody skid plates Mud flaps & guards Mirror housings Multi - functional roof Wiper system Interior Lighting housings Front end modules Front & rear bumper Arch wheels Rocker panels Power distribution Electrical Speaker grilles & knobs Handles & levers Door systems Cockpit trim Clips F asteners Santoprene Π: Auto >100 specifications Weatherseal Non - Weatherseal Air management ducts Suspension boots Steering boots Headlight seal Glass run channel Inner belt line Outer belt line Encapsulated quarter light Roof line seal Roof water drain Sunroof seal Windshield Trunk mat Wiper system Cowl vent grille Fasteners 2020 Net Sales: ~$0.7B (1/3 of total Engineered Materials) 2020 Net Sales: ~$0.3B (2/3 of total Santoprene Π) Pro Forma CE Engineered Materials: Auto >600 specifications Net Sales: ~$1B (~40% of total Engineered Materials)

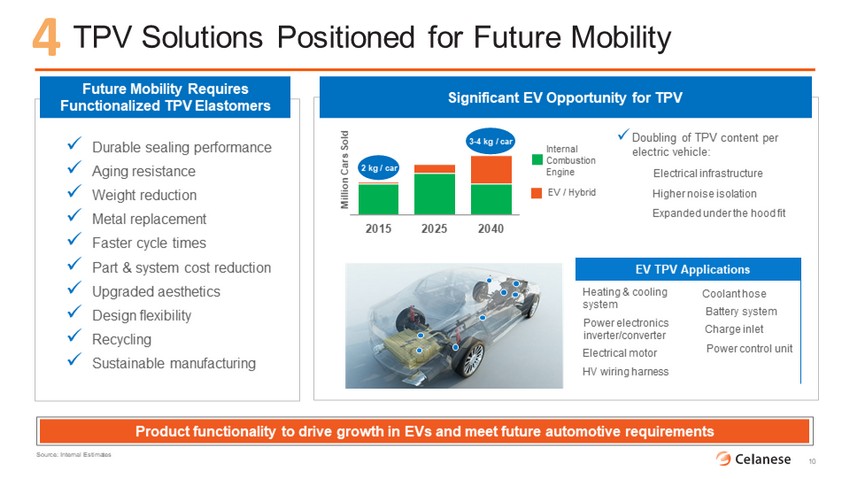

10 Product functionality to drive growth in EVs and meet future automotive requirements TPV Solutions Positioned for Future Mobility 2015 2025 2040 Million Cars Sold 2 kg / car 3 - 4 kg / car Future Mobility Requires Functionalized TPV Elastomers x Durable sealing performance x Aging resistance x Weight reduction x Metal replacement x Faster cycle times x Part & system cost reduction x Upgraded aesthetics x Design flexibility x Recycling x Sustainable manufacturing Significant EV Opportunity for TPV x Doubling of TPV content per electric vehicle: Electrical infrastructure Higher noise isolation Expanded under the hood fit 4 Internal Combustion Engine EV / Hybrid Power electronics inverter/converter Electrical motor Battery system HV wiring harness Charge inlet Heating & cooling system Coolant hose Power control unit Product functionality to drive growth in EVs and meet future automotive requirements Source: Internal Estimates EV TPV Applications

Santoprene Œ Exceeds Disciplined M&A Criteria 11 5 Santoprene Œ acquisition exceeds Celanese’s disciplined M&A criteria shared at 2021 Investor Day

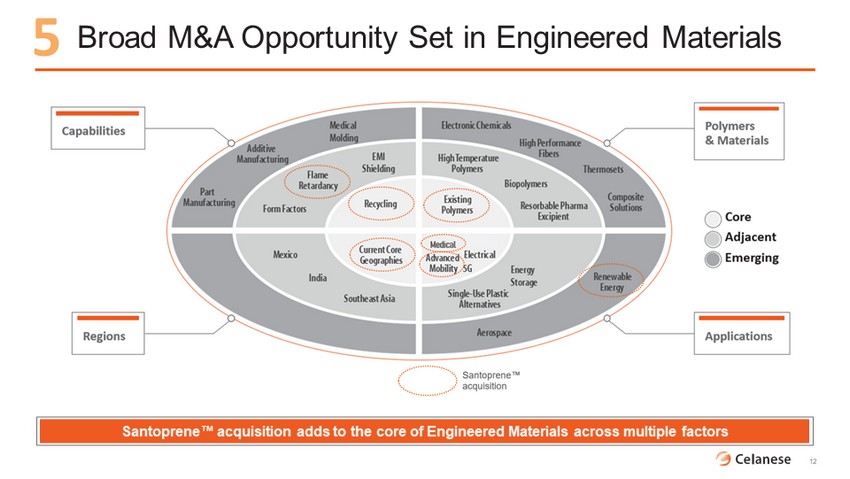

Broad M&A Opportunity Set in Engineered Materials 12 5 Santoprene Πacquisition adds to the core of Engineered Materials across multiple factors Santoprene Πacquisition Medical

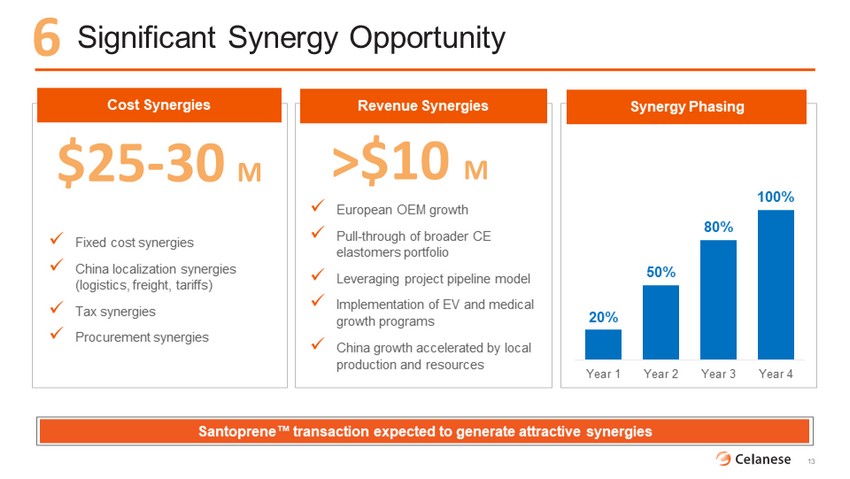

Cost Synergies Synergy Phasing Revenue Synergies x Fixed cost synergies x China localization synergies (logistics, freight, tariffs) x Tax synergies x Procurement synergies x European OEM growth x Pull - through of broader CE elastomers portfolio x Leveraging project pipeline model x Implementation of EV and medical growth programs x China growth accelerated by local production and resources 13 6 Significant Synergy Opportunity Santoprene Πtransaction expected to generate attractive synergies $25 - 30 M >$10 M 20% 50% 80% 100% Year 1 Year 2 Year 3 Year 4

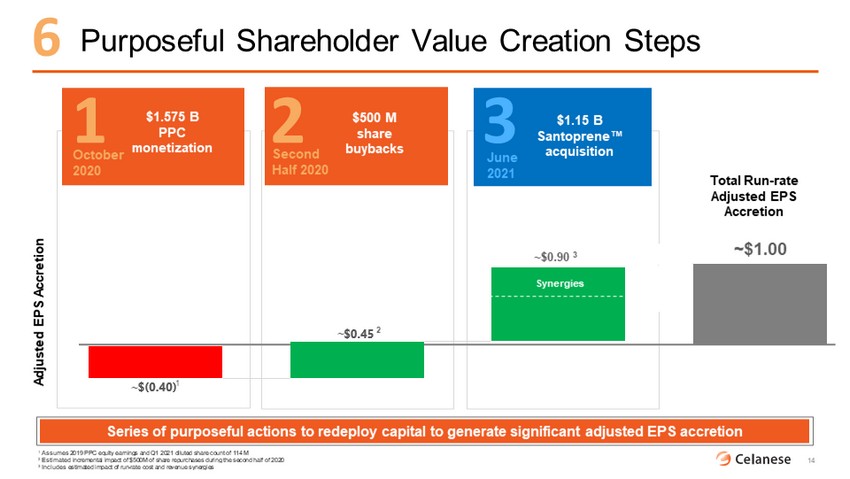

Purposeful Shareholder Value Creation Steps 14 1 Assumes 2019 PPC equity earnings and Q1 2021 diluted share count of 114 M 2 Estimated incremental impact of $500M of share repurchases during the second half of 2020 3 Includes estimated impact of run - rate cost and revenue synergies ~$0.90 3 1 2 ~$1.00 ~ ~ 6 $1.575 B PPC monetization 1 2 3 $500 M share buybacks $1.15 B Santoprene Πacquisition Adjusted EPS Accretion Total Run - rate Adjusted EPS Accretion Series of purposeful actions to redeploy capital to generate significant adjusted EPS accretion Synergies Second Half 2020 October 2020 June 2021