Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BED BATH & BEYOND INC | bbby-20210630.htm |

| EX-99.1 - EX-99.1 - BED BATH & BEYOND INC | exhibit991-pressreleaseq12.htm |

BED BATH & BEYOND 1 Mark Tritton, President & Chief Executive Officer Gustavo Arnal, Executive Vice President, Chief Financial Officer First Quarter Fiscal 2021 Earnings Presentation June 30, 2021

BED BATH & BEYOND 2 This presentation contains forward-looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 including, but not limited to, the Company’s progress and anticipated progress towards its long-term objectives, as well as more generally the status of its future liquidity and financial condition and its outlook for the Company’s fiscal 2021 second quarter and for its 2021 fiscal year. Many of these forward-looking statements can be identified by use of words such as may, will, expect, anticipate, approximate, estimate, assume, continue, model, project, plan, goal, preliminary, and similar words and phrases, although the absence of those words does not necessarily mean that statements are not forward-looking. The Company’s actual results and future financial condition may differ materially from those expressed in any such forward-looking statements as a result of many factors. Such factors include, without limitation: general economic conditions including the housing market, a challenging overall macroeconomic environment and related changes in the retailing environment; risks associated with the COVID-19 pandemic and the governmental responses to it, including its impacts across the Company’s businesses on demand and operations, as well as on the operations of the Company’s suppliers and other business partners, and the effectiveness of the Company’s actions taken in response to these risks; consumer preferences, spending habits and adoption of new technologies; demographics and other macroeconomic factors that may impact the level of spending for the types of merchandise sold by the Company; civil disturbances and terrorist acts; unusual weather patterns and natural disasters; competition from existing and potential competitors across all channels; pricing pressures; liquidity; the ability to achieve anticipated cost savings, and to not exceed anticipated costs, associated with organizational changes and investments, including the Company’s strategic restructuring program and store network optimization strategies; the ability to attract and retain qualified employees in all areas of the organization; the cost of labor, merchandise and other costs and expenses; potential supply chain disruption due to trade restrictions, and other factors such as natural disasters, pandemics, including the COVID-19 pandemic, political instability, labor disturbances, product recalls, financial or operational instability of suppliers or carriers, and other items; the ability to find suitable locations at acceptable occupancy costs and other terms to support the Company’s plans for new stores; the ability to establish and profitably maintain the appropriate mix of digital and physical presence in the markets it serves; the ability to assess and implement technologies in support of the Company’s development of its omnichannel capabilities; the ability to effectively and timely adjust the Company’s plans in the face of the rapidly changing retail and economic environment, including in response to the COVID-19 pandemic; uncertainty in financial markets; volatility in the price of the Company’s common stock and its effect, and the effect of other factors, including the COVID-19 pandemic, on the Company’s capital allocation strategy; risks associated with the ability to achieve a successful outcome for the Company’s business concepts and to otherwise achieve its business strategies; the impact of intangible asset and other impairments; disruptions to the Company’s information technology systems, including but not limited to security breaches of systems protecting consumer and employee information or other types of cybercrimes or cybersecurity attacks; reputational risk arising from challenges to the Company’s or a third party product or service supplier’s compliance with various laws, regulations or standards, including those related to labor, health, safety, privacy or the environment; reputational risk arising from third-party merchandise or service vendor performance in direct home delivery or assembly of product for customers; changes to statutory, regulatory and legal requirements, including without limitation proposed changes affecting international trade; changes to, or new, tax laws or interpretation of existing tax laws; new, or developments in existing, litigation, claims or assessments; changes to, or new, accounting standards; and foreign currency exchange rate fluctuations. Except as required by law, the Company does not undertake any obligation to update its forward-looking statements. Forward Looking Statements

BED BATH & BEYOND 3 Q1’21 Results Q2’21 & FY 2021 Outlook Transformation Progress Appendix Agenda

4BED BATH & BEYOND Q1’21 Results Q1’21 RESULTS

BED BATH & BEYOND 5 First Quarter Highlights 1Q’21 RESULTS Results within or above Company’s previously provided Q1’21 outlook Net Sales of $1.95 B Core Sales increased +73%, above guidance of +65-70% Comp Sales growth of +86% vs. Q1’20 and +3% versus Q1’19 Adjusted Gross Margin of 34.9%, above guidance of approx. 34% Adjusted EBITDA of $86 M, within guidance range of $80 M - $90 M Successfully launched Owned Brands: Nestwell, Haven and Simply Essential Next three Owned Brands slated for launch ahead of schedule 2 2 1

BED BATH & BEYOND 6 Net Sales $1.95 Billion [+49% vs. Q1’20] Adj. Gross Margin 34.9% [+820bps vs. Q1’20] [+40bps vs. Q1’19] Core Banner Growth +73% vs. Q1’20 Adj. EBITDA $86 Million Comp Sales +86% vs. Q1’20 [+3% vs. Q1’19] Adj. Diluted EPS $0.05 First Quarter Results – Sales & P&L 1Q’21 RESULTS 2 2 2 1 Note: The Company’s four Core banners include Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist.

BED BATH & BEYOND 7 1Q’21 RESULTS Total Net Sales to Comparable Sales – Q1’21 vs. Q1’20 • Total Net Sales growth of +49% includes: • planned reduction from non-core banner divestitures of -24% • Core banner net sales growth of +73% includes: • planned reduction from fleet optimization activity of -13% • Comparable sales growth of 86% 73% 86% 49% -24% -13% Total Net Sales Divestitures Core Banner Net Sales (excl. Divestitures) Fleet Optimization Comp Sales 1 Note: The Company’s four Core banners include Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist.

BED BATH & BEYOND 8 1Q’21 RESULTS Total Net Sales to Comparable Sales – Q1’21 vs. Q1’19 -18% -24% -6% -9% 3% • Total Net Sales of -24% includes: • planned reduction from non-core banner divestitures of -18% • Core banner net sales of -6% includes: • planned reduction from fleet optimization activity of 9% • Comparable sales growth of 3% (digital +84%; stores -20%) Total Net Sales Divestitures Core Banner Net Sales (excl. Divestitures) Fleet Optimization Comp Sales Note: The Company’s four Core banners include Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist.

BED BATH & BEYOND 9 Q1’20* 66% Q1'19 20% Q1'18 18% Increased Digital Penetration 1Q’21 RESULTS Key Drivers of Sales Growth Core Sales vs Q1’20 Comp Sales vs. Q1’19 Total Enterprise +73% +3% Bed Bath & Beyond Banner +96% +3% Top 5 Destination Categories at Bed Bath & Beyond Banner Core Sales vs Q1’20 Comp Sales vs. Q1’19 % of Net Sales in Q1’21 Bedding +128% +6% 18% Bath +147% -1% 10% Kitchen Food Prep +59% +15% 21% Indoor Décor +112% +1% 9% Home Organization +127% +5% 6% Destination Category +100% +7% 65% Other Categories +88% flat 35% Total Bed Bath & Beyond Banner +96% +3% 100% *Operated mainly as a digital business in Q1’20 due to store closures as a result of COVID-19 Q1'21 38%

BED BATH & BEYOND 10 Q1'21 Gross Margin Q1'20 Gross Margin Product Mix Cost Savings / Leverage Channel Mix / DTC Shipping Expense 34.9% 26.7% 290bps 240bps 290bps 1Q’21 RESULTS Note: numbers may not add due to rounding Gross Margin Bridge – Q1’20 to Q1’21 Q1’21 total enterprise gross margin expansion of +820 bps from product mix improvement due to Owned Brands penetration, cost savings/ leverage from higher sales and improved channel mix

BED BATH & BEYOND 11 Total Cash & Investments $1.2B Bonds $1.2B ABL $0.7B Strong Cash & Liquidity 1Q’21 RESULTS Total Liquidity of $1.9B Q4'20 Total Cash & Investments $1.4B Q1'21 Total Cash & Investments $1.2B Free Cash Flow -$0.1B Cash Flow used in Financing -$0.1B share repurchases $130M in Q1’21 No Net Debt 3 4

12BED BATH & BEYOND FINANCIAL OUTLOOK

BED BATH & BEYOND 13 Note: Adj. gross margin, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation. Key Considerations: July and August are important sales periods (i.e. Independence Day and Back-to-College) Depreciation & Amortization: $63 M - $65 M Interest Expense: approx. $16 M Tax Rate: 26% - 28% (excluding discrete items) Weighted Average Share Count: approx. 105 M P&L Q2’21 Sales $2.04 B - $2.08 B Comp Sales +low single-digits Adjusted Gross Margin 35.0% - 36.0% Adjusted EBITDA $150 M - $160 M Adjusted EPS Range $0.48 - $0.55 FINANCIAL OUTLOOK Second Quarter Fiscal 2021 Outlook

BED BATH & BEYOND 14 P&L FULL YEAR FISCAL 2021 CURRENT PRIOR CHANGE Sales $8.2 B - $8.4 B $8.0B - $8.2B Increased Comp Sales (Q2’21 – Q4’21) +low single-digit growth flat Increased Adjusted Gross Margin (as a percentage of sales) Approx. 35% Approx. 35% Reaffirmed Adjusted SG&A (as a percentage of sales) Approx. 31% Approx. 31% Reaffirmed Adjusted EBITDA $520 M - $540 M $500M - $525M Increased Adjusted EPS Range $1.40 - $1.55 NM Initial Raising Full Year Fiscal 2021 Outlook FINANCIAL OUTLOOK Note: Adj. gross margin, adj. SG&A, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation. Key Considerations: Depreciation & Amortization: approx. $250 M [updated] Interest Expense: approx. $63 M - $65 M Tax Rate: 26% - 28% (excluding discrete items) Weighted Average Share Count: approx. 105 M

BED BATH & BEYOND 15 CAPITAL ALLOCATION FULL YEAR FISCAL 2021 CURRENT PRIOR CHANGE CAPEX Approx. $400 M Approx. $400 M Reaffirmed Gross Debt-to-EBITDA Ratio Faster Improvement to <3.0x Faster Improvement to <3.0x Reaffirmed Share Repurchase $325 M $325 M Reaffirmed Weighted Average Share Count Approx. 105 M Approx. 105 M Reaffirmed Full Year Fiscal 2021 Outlook – Capital Allocation FINANCIAL OUTLOOK 6

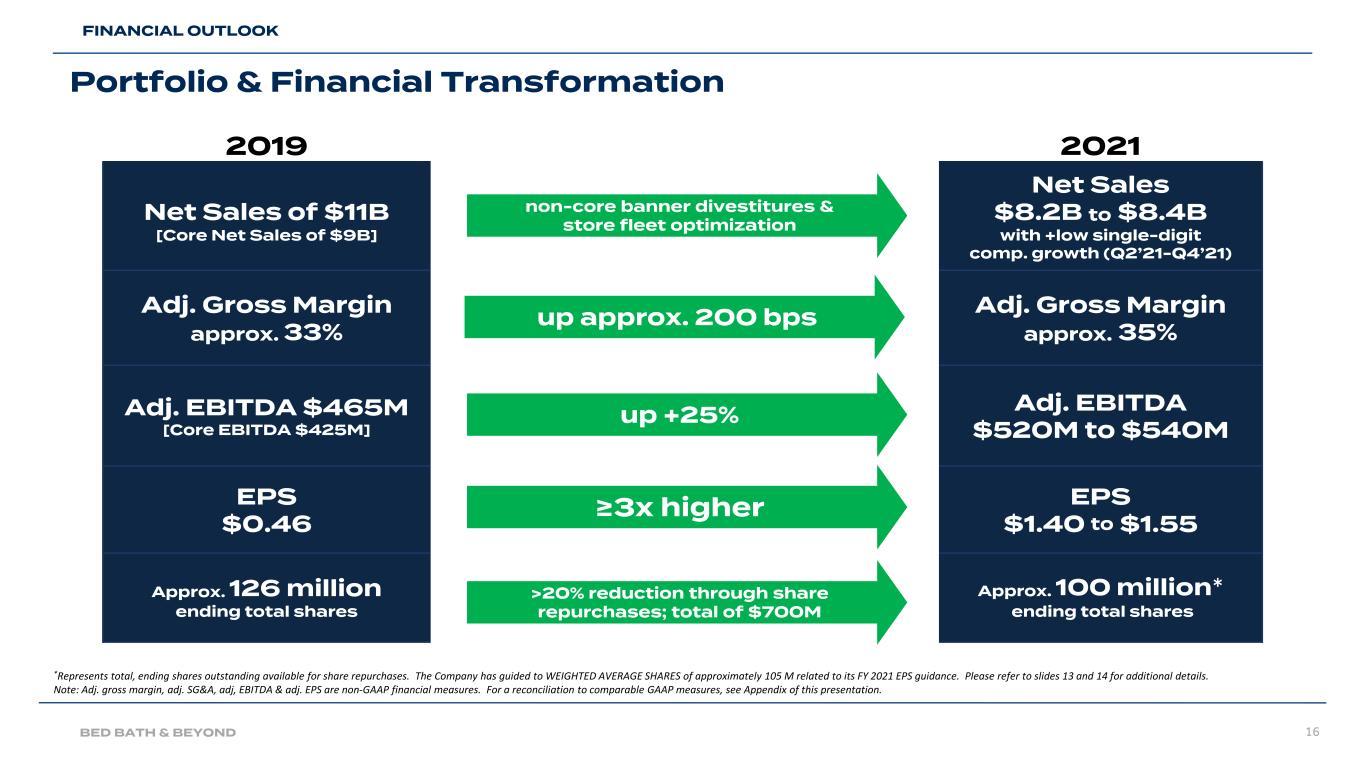

BED BATH & BEYOND 16 Portfolio & Financial Transformation FINANCIAL OUTLOOK 2019 2021 Net Sales of $11B Net Sales $8.2B to $8.4B [Core Net Sales of $9B] with +low single-digit comp. growth (Q2’21-Q4’21) Adj. Gross Margin approx. 33% Adj. Gross Margin approx. 35% Adj. EBITDA $465M [Core EBITDA $425M] Adj. EBITDA $520M to $540M EPS $0.46 EPS $1.40 to $1.55 Approx. 126 million Approx. 100 million* ending total shares ending total shares non-core banner divestitures & store fleet optimization up +25% ≥3x higher >20% reduction through share repurchases; total of $700M up approx. 200 bps *Represents total, ending shares outstanding available for share repurchases. The Company has guided to WEIGHTED AVERAGE SHARES of approximately 105 M related to its FY 2021 EPS guidance. Please refer to slides 13 and 14 for additional details. Note: Adj. gross margin, adj. SG&A, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

17BED BATH & BEYOND TRANSFORMATION UPDATE

BED BATH & BEYOND 18 Launched Significant TRANSFORMATION with pivot in 2020 TRANSFORMATION UPDATE

BED BATH & BEYOND 19 TRANSFORMATION UPDATE Key Strategic Initiatives 3-Year Strategic Plan Fiscal Year 2021 (Year 1) of Transformation Q1’21 Snapshot Digital-First, Omni-Always Stores as fulfillment hubs Omni-always platform Invest in key projects for enhanced capabilities Expanded same-day delivery services via DoorDash Mobile app enhancements Store Remodel & Fleet Optimization Remodel ~450 BBB stores Close ~ 200 BBB stores Approx. 130 to 150 remodels Approx. 200 BBB closures (cumulative) Initiated 26 BBB remodels Closed 16 BBB stores (160 cumulative) Inspirational merchandising assortment including Owned Brands Launch 10 BBB Owned Brands Owned Brand penetration of 30% Introduce 8 Owned Brands Launch 6 Owned Brands in 1H21 Owned brand penetration of 20% Launched 3 Owned Brands Penetration approx. 2x FY20 Accelerate growth of buybuy BABY & Harmon Banners Increase BABY sales to $1.5B+ Modernize destination categories & extend value prop Age up strategy Continued positive comp sales growth Digital penetration of 55% at BABY Modernize supply chain and technology Reduce store replenishment to 10 days (via RDCs) New tech roadmap (merch, ERP & supply chain) Plan and begin implementation of two RDCs in NE/West Initiate new Oracle ERP rollout On track for NE RDC Began IT testing and data migration c o m m e rc ia l o p e ra ti o n a l on-track on-track on-track on-track on-track on-track

BED BATH & BEYOND TRANSFORMATION UPDATE Digital Transformation Three Pillars of Transformation ELEVATE EXPERIENCE: Overhauled websites with new look, reduced steps to checkout and AI-powered search UNLOCK OMNI-ALWAYS: launched BOPIS & curbside pickup services TRANSFORM TO DIGITAL FIRST: Upgraded tools and processes to improve speed to market Digital Sales penetration38% Visits to websites more than 200 million App launches approximately 16.4 million First-time app visitors approximately 500 thousand Omni + Digital shoppers50% of customers Note: App data (launches and first-time visitors) relates to Bed Bath & Beyond banner only

BED BATH & BEYOND 21 • Initiated 26 store remodels (after refreshing most stores LY) • Initial output of sales exceed estimates Q1’21 Progress • Expecting to remodel approx. 130 to 150 stores across US & CAN) FY 2021 TRANSFORMATION UPDATE Store Remodels AFTER BEFORE

BED BATH & BEYOND 22 TRANSFORMATION UPDATE Store Fleet Optimization • 16 store closures during the quarter • Total of 160 store closures through Q1’21 Q1’21 Progress • Expecting to close approx. 200 stores through FY21FY 2021 Continuing to position our network for the future: Disciplined management of inventory and receipts Partnership with recognized liquidation service Robust in-store and digital local marketing Data-driven tracking and monitoring

BED BATH & BEYOND 23 TRANSFORMATION UPDATE Escape the noise Launched March 2021 Assortment Progress: Launched 3 New Owned Brands in Q1’21 everyday comfort Launched April 2021 Launched May 2021 Home starts here

BED BATH & BEYOND 24 FY 2020 approx. 10% Q1’21 achieved high-teens percentage FY 2021 run rate of 20% FY 2023 GOAL OF 30% • Ahead of schedule to reach our Full Fiscal Year 2021 Owned Brands penetration goal Owned Brands Sales Penetration

BED BATH & BEYOND 25 TRANSFORMATION UPDATE Launching Next 3 New Owned Brands Ahead of Schedule Bring your story to life Launched June 2021 Start with food. End with love. Launched June 2021 Launching July 2021 Solutions for a well-kept home

BED BATH & BEYOND 26 Positive Net Sales growth vs. Q1’20 greater than 20% Digital penetration driven by BOPIS orders55% OPERATIONS UPDATE Continued Growth in buybuy Baby Banner #1 specialty baby retailer in markets with a presence #5 retailer in baby registry nationally

BED BATH & BEYOND 27 T E C H N O L O G Y FUTURE STATE S U P P L Y C H A IN Q1’21 PROGRESS OPERATIONS UPDATE Supply Chain and Technology Delivering Value Increased digital capabilities Flexibility, agility and scalability Speed to market More efficient technology operations Shift spend towards innovation Improved return on technology investment PRIOR STATE FUTURE STATE 35-day store replenishment Vendor direct network with consolidation hubs Inefficiencies driving high, uncompetitive costs Disparate legacy technology Legacy and siloed architecture and applications Reactive and manually intensive operating model Addressed first step of our store fulfillment strategy Selected NE DC location West DC plans underway RELEX system implementation underway Phase 1 of Oracle ERP design complete Phase 2 of Oracle ERP design underway 10-day store replenishment 4 regional DCs Increased standardization to lower total supply chain costs Cloud-based and scalable infrastructure New ERP Automated and agile operating model

BED BATH & BEYOND 28 Unlocking a Virtuous Cycle to Drive Sustainable Value Creation TRANSFORMATION UPDATE

BED BATH & BEYOND 29 -2% -2% -0.3% -1% -1% -1% -2% -1% -7% -8% -6% 3% vs. Q1’19 6% 2% 4% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 N/A* TRANSFORMATION UPDATE *Company did not disclose comp sales due to COVID-19 related temporary store closures Building a Positive Track Record of Performance – Comp Sales <20% Digital Penetration >35% Digital Penetration +80% Digital Growth 86% vs. Q1’20 -49% Net Sales

BED BATH & BEYOND 30 36.0% 34.1% 33.3% 33.6% 35.0% 38.0% FY 2017 FY 2018 FY 2019 FY 2020 FY 2021E FY 2022E FY 2023E Continued Gross Margin Expansion TRANSFORMATION UPDATE Building a Positive Track Record of Performance – Gross Margin

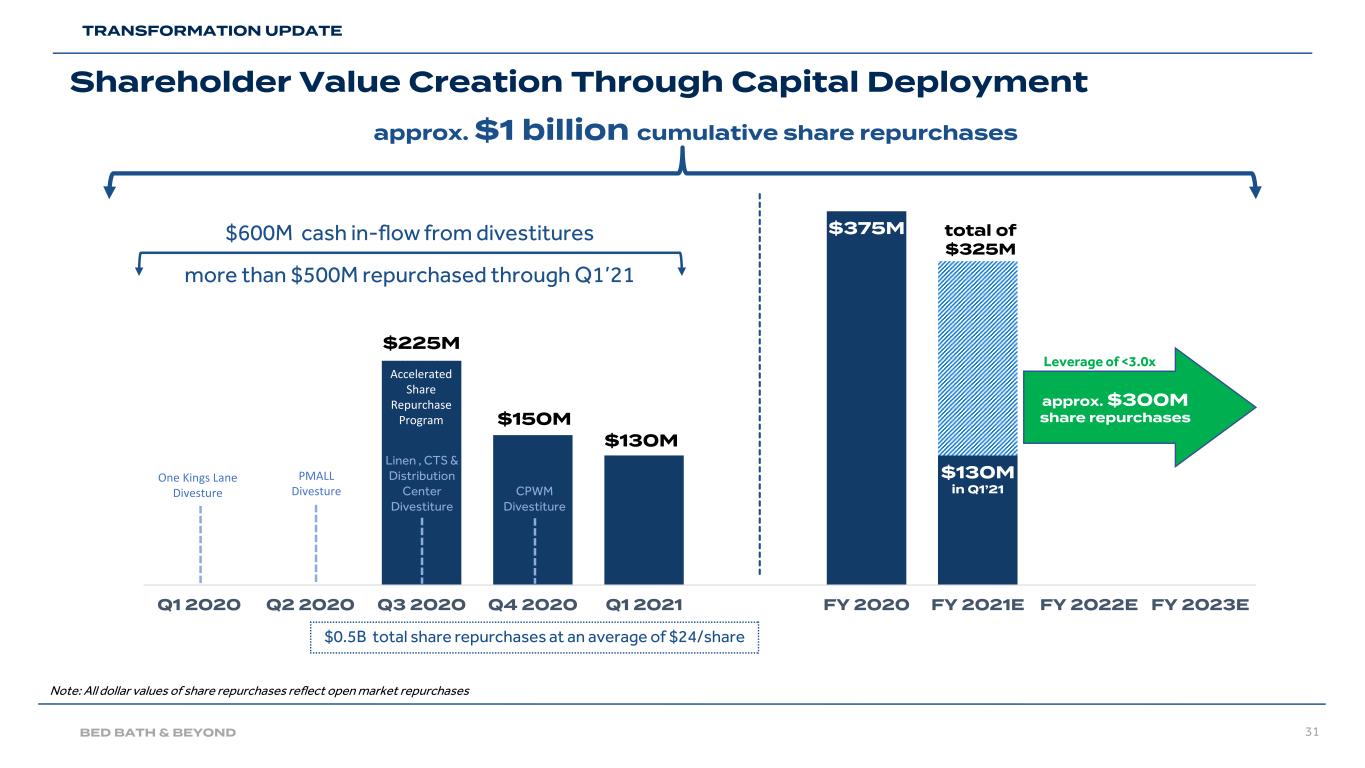

BED BATH & BEYOND 31 $225M $150M $130M $375M $130M in Q1’21 total of $325M $- $50 $100 $150 $200 $250 $300 $350 $400 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 FY 2020 FY 2021E FY 2022E FY 2023E Accelerated Share Repurchase Program Leverage of <3.0x PMALL Divesture One Kings Lane Divesture approx. $1 billion cumulative share repurchases TRANSFORMATION UPDATE Shareholder Value Creation Through Capital Deployment approx. $300M share repurchases Linen , CTS & Distribution Center Divestiture CPWM Divestiture $600M cash in-flow from divestitures Note: All dollar values of share repurchases reflect open market repurchases more than $500M repurchased through Q1’21 $0.5B total share repurchases at an average of $24/share

BED BATH & BEYOND 32 WHO WE ARE Our Commitments People: Become a Top 10 Retail Employer by 2030 by creating an equitable, inclusive work environment where all our people feel at home and can thrive Community: Donate $1 billion in products, 2 million volunteer hours by 2030 to help provide the safety and sense of home to our neighbors Planet: Lead by example to build a better home for the next generation by becoming Net Zero by 2040, and offering more access to sustainable products Investing in What We Believe In

BED BATH & BEYOND 33 WHO WE ARE Turnaround story with significant potential for sustainable financial results Sales acceleration through assortment curation, the addition of owned brands and a digital-first mindset Enhancing gross margin & EBITDA through product mix, pricing and operational efficiencies Strong balance sheet and consistent cash flow generation Capital allocation focused on shareholder return Investment Thesis

34BED BATH & BEYOND APPENDIX

BED BATH & BEYOND 35 APPENDIX Quarterly Summary of FY2019 & FY2020 Net Sales • The following table shows a quarterly summary of the Company’s fiscal 2019 and 2020 net sales on both a Reported GAAP basis and on a Core Go-Forward basis, which excludes sales from divested banners. • The Company is providing this additional transparency to help analysts and investors gain further perspective on the Company’s recent portfolio transformation and the quarterly comparisons of the Core Go-Forward banners, which include Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist. Note: numbers may not add due to rounding Net Sales ($ in millions) Q1’19 Q2’19 Q3’19 Q4’19 FY 2019 Q1’20 Q2’20 Q3’20 Q4’20 FY 2020 Reported $2,573 $2,719 $2,759 $3,107 $11,159 $1,307 $2,688 $2,618 $2,619 $9,233 Core $2,080 $2,263 $2,191 $2,471 $9,006 $1,128 $2,239 $2,186 $2,390 $7,943

BED BATH & BEYOND 36 1 The Company notes that first quarter growth rates in fiscal 2021 are not fully comparable due to last year’s extended store closures related to the COVID-19 pandemic. Therefore, Comparable Sales Growth for the three months ended May 29, 2021 has been calculated by adjusting Core Sales for the estimated negative impact on 2021 sales of the store closures in fiscal 2020 as part of the Company's fleet optimization program. The Company estimates that the stores closed in 2020 as part of this fleet optimization program would have contributed approximately 13% to Core Sales in the first quarter of fiscal 2021. The Company believes this calculation of comparable sales is a more meaningful reference for the current quarter. 2 Adjusted items refer to comparable sales as well as financial measures that are derived from measures calculated in accordance with GAAP, which have been adjusted to exclude certain items. Adjusted Gross Margin, Adjusted SG&A, Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Diluted EPS are non-GAAP financial measures. For more information about non-GAAP financial measures, see “Non-GAAP Information” below. 3 Free Cash Flow is defined as operating cash flow less capital expenditures. 4 Total Liquidity includes cash & investments and availability under the Company’s asset-based revolving credit facility. 5 Leverage ratio calculated using Moody's gross debt/EBITDA ratios. This presentation contains certain non-GAAP information, including adjusted earnings before interest, income taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA margin, adjusted gross margin, adjusted SG&A, adjusted net earnings per diluted share, and free cash flow. Non-GAAP information is intended to provide visibility into the Company’s core operations and excludes special items, including non-cash impairment charges related to certain store-level assets and tradenames, loss on sale of businesses, loss on the extinguishment of debt, charges recorded in connection with the restructuring and transformation initiatives, which includes accelerated markdowns and inventory reserves related to the planned assortment transition to Owned Brands and costs associated with store closures related to the Company's fleet optimization and the income tax impact of these items. The Company’s definition and calculation of non-GAAP measures may differ from that of other companies. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported GAAP financial results. For a reconciliation to the most directly comparable US GAAP measures and certain information relating to the Company’s use of Non-GAAP financial measures, see “Non- GAAP Financial Measures” below. Non-GAAP Information Footnotes

BED BATH & BEYOND 37 APPENDIX Q1’21 Non-GAAP Reconciliation

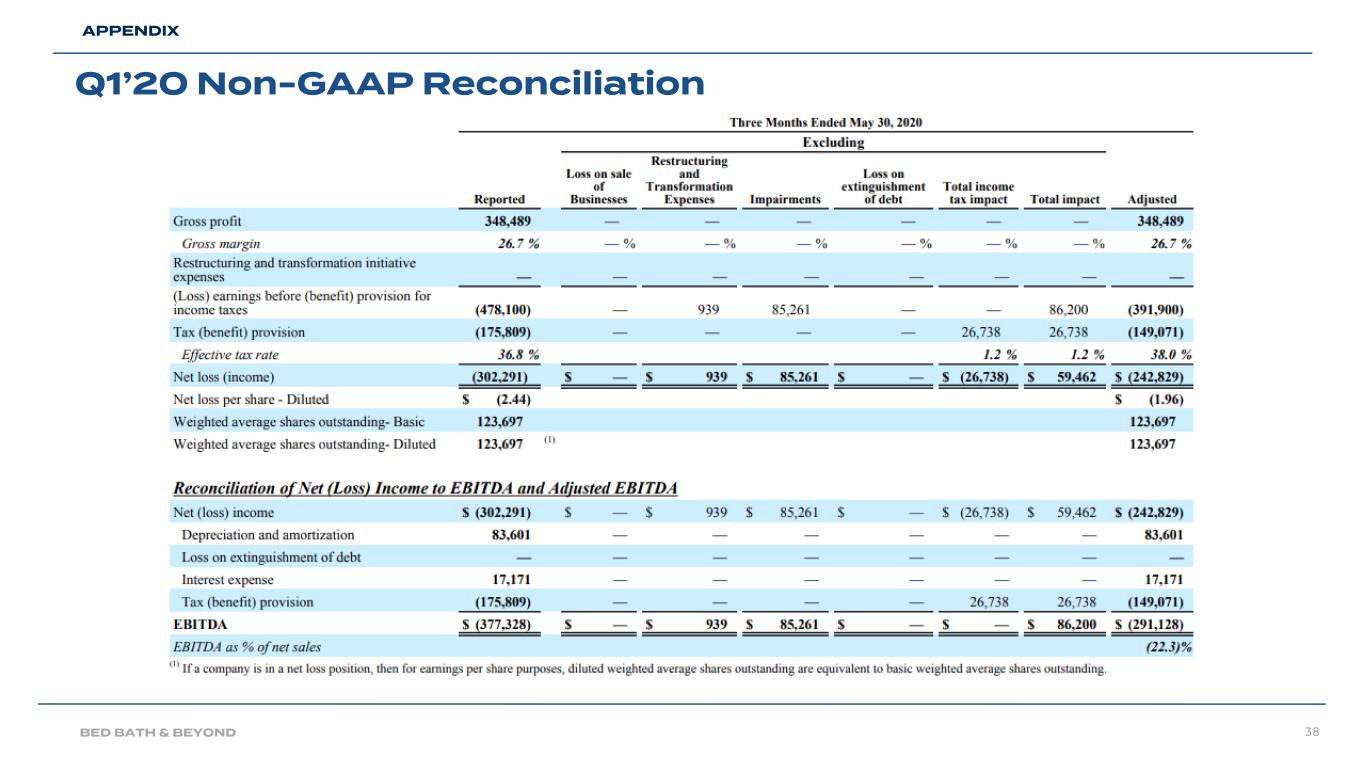

BED BATH & BEYOND 38 APPENDIX Q1’20 Non-GAAP Reconciliation

BED BATH & BEYOND 39 Mark Tritton, President & Chief Executive Officer Gustavo Arnal, Executive Vice President, Chief Financial Officer First Quarter Fiscal 2021 Earnings Presentation June 30, 2021