Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AMEDISYS INC | d138311dex991.htm |

| 8-K - 8-K - AMEDISYS INC | d138311d8k.htm |

June 2021 Amedisys and Contessa Creating a Tech-Enabled Risk-Bearing Homecare Delivery Platform Exhibit 99.2

This presentation includes forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of words such as “believes,” “belief,” “expects,” “plans,” “anticipates,” “intends,” “projects,” “estimates,” “may,” “might,” “would,” “should” and similar expressions are intended to identify forward-looking statements. These forward-looking statements and all projections in this presentation are subject to risks and uncertainties and are based on the beliefs, estimates and assumptions of management and information currently available to management, which, though considered reasonable by the Company, are inherently subject to significant business, economic and competitive uncertainties beyond the Company’s control. There can be no assurance that the projected results can be realized, and actual results may differ materially from a conclusion, forecast or projection in the forward-looking information. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements and the projections are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business and clinical operations and control processes, and SEC filings. Forward-looking statements

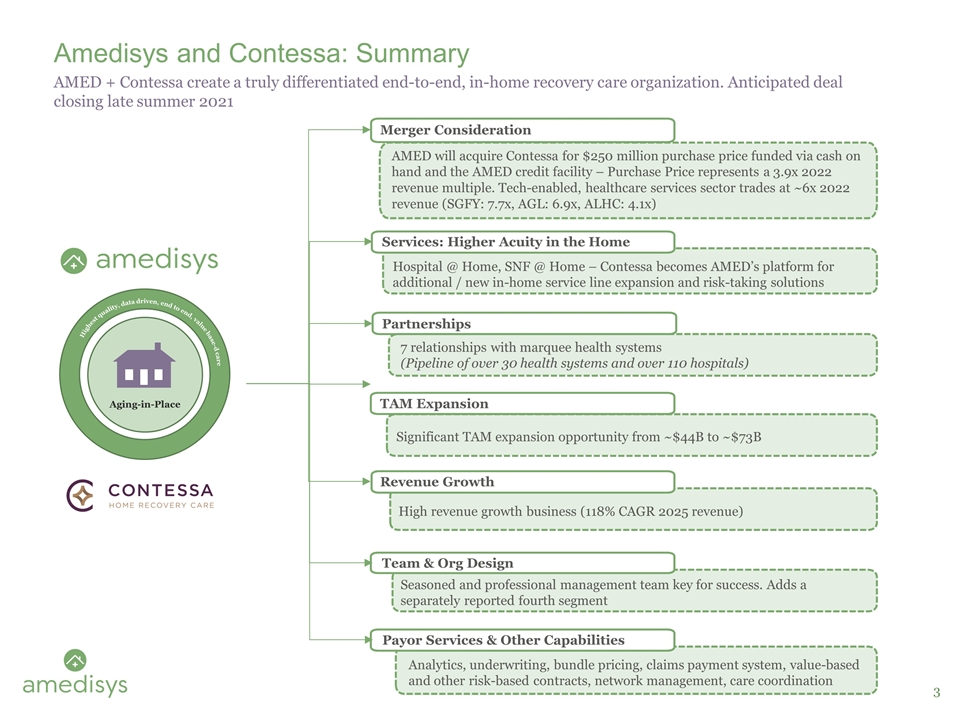

AMED + Contessa create a truly differentiated end-to-end, in-home recovery care organization. Anticipated deal closing late summer 2021 Aging-in-Place Highest quality, data driven, end to end, value base-d care Merger Consideration AMED will acquire Contessa for $250 million purchase price funded via cash on hand and the AMED credit facility – Purchase Price represents a 3.9x 2022 revenue multiple. Tech-enabled, healthcare services sector trades at ~6x 2022 revenue (SGFY: 7.7x, AGL: 6.9x, ALHC: 4.1x) Services: Higher Acuity in the Home Hospital @ Home, SNF @ Home – Contessa becomes AMED’s platform for additional / new in-home service line expansion and risk-taking solutions TAM Expansion Significant TAM expansion opportunity from ~$44B to ~$73B Revenue Growth High revenue growth business (118% CAGR 2025 revenue) Team & Org Design Seasoned and professional management team key for success. Adds a separately reported fourth segment Payor Services & Other Capabilities Analytics, underwriting, bundle pricing, claims payment system, value-based and other risk-based contracts, network management, care coordination Amedisys and Contessa: Summary Partnerships 7 relationships with marquee health systems (Pipeline of over 30 health systems and over 110 hospitals)

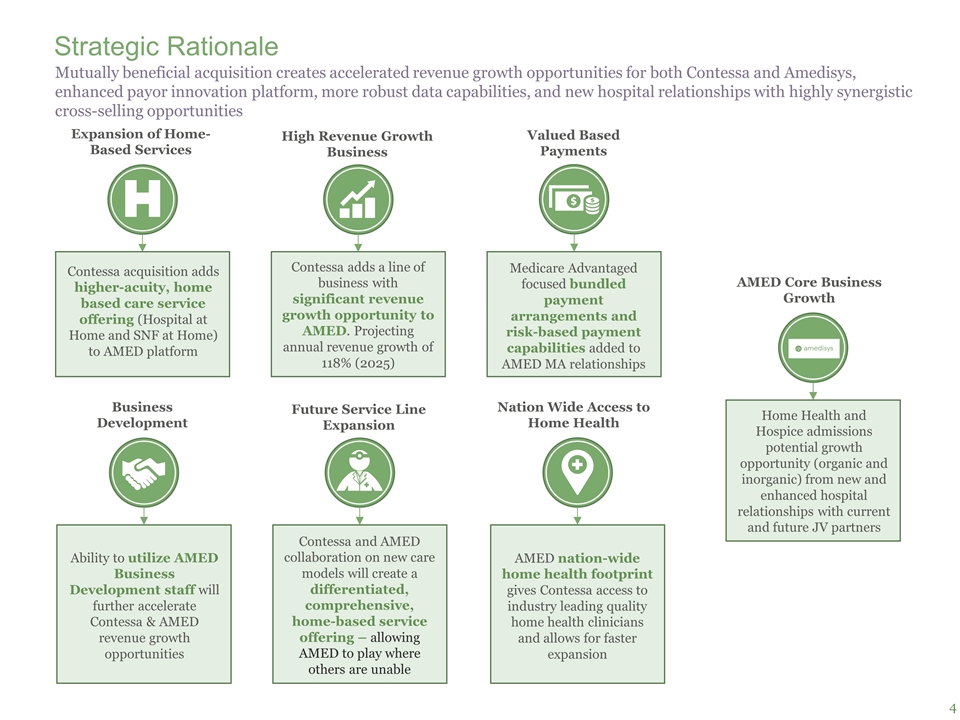

Strategic Rationale Mutually beneficial acquisition creates accelerated revenue growth opportunities for both Contessa and Amedisys, enhanced payor innovation platform, more robust data capabilities, and new hospital relationships with highly synergistic cross-selling opportunities Expansion of Home-Based Services High Revenue Growth Business Valued Based Payments Nation Wide Access to Home Health Contessa acquisition adds higher-acuity, home based care service offering (Hospital at Home and SNF at Home) to AMED platform Contessa adds a line of business with significant revenue growth opportunity to AMED. Projecting annual revenue growth of 118% (2025) Medicare Advantaged focused bundled payment arrangements and risk-based payment capabilities added to AMED MA relationships AMED nation-wide home health footprint gives Contessa access to industry leading quality home health clinicians and allows for faster expansion Business Development Future Service Line Expansion Ability to utilize AMED Business Development staff will further accelerate Contessa & AMED revenue growth opportunities Contessa and AMED collaboration on new care models will create a differentiated, comprehensive, home-based service offering – allowing AMED to play where others are unable AMED Core Business Growth Home Health and Hospice admissions potential growth opportunity (organic and inorganic) from new and enhanced hospital relationships with current and future JV partners

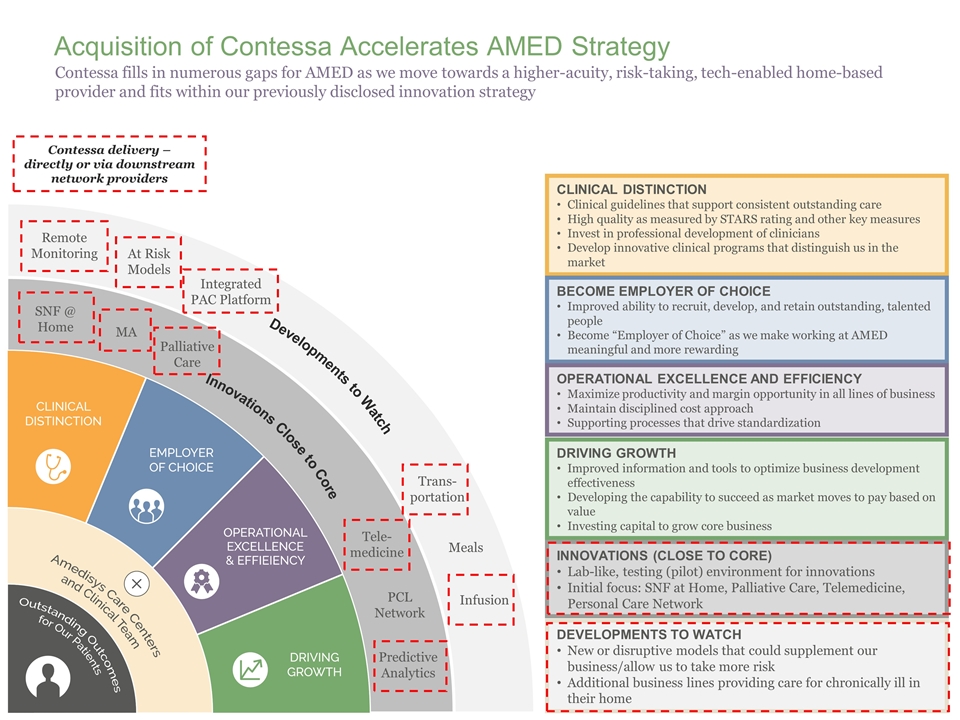

Contessa fills in numerous gaps for AMED as we move towards a higher-acuity, risk-taking, tech-enabled home-based provider and fits within our previously disclosed innovation strategy Clinical Distinction Clinical guidelines that support consistent outstanding care High quality as measured by STARS rating and other key measures Invest in professional development of clinicians Develop innovative clinical programs that distinguish us in the market Become Employer of Choice Improved ability to recruit, develop, and retain outstanding, talented people Become “Employer of Choice” as we make working at AMED meaningful and more rewarding Operational Excellence and Efficiency Maximize productivity and margin opportunity in all lines of business Maintain disciplined cost approach Supporting processes that drive standardization Driving Growth Improved information and tools to optimize business development effectiveness Developing the capability to succeed as market moves to pay based on value Investing capital to grow core business Acquisition of Contessa Accelerates AMED Strategy SNF @ Home Innovations Close to Core Developments to Watch MA Palliative Care Tele-medicine PCL Network Predictive Analytics Remote Monitoring At Risk Models Trans-portation Meals Infusion Innovations (Close to core) Lab-like, testing (pilot) environment for innovations Initial focus: SNF at Home, Palliative Care, Telemedicine, Personal Care Network Developments to watch New or disruptive models that could supplement our business/allow us to take more risk Additional business lines providing care for chronically ill in their home Integrated PAC Platform Contessa delivery – directly or via downstream network providers

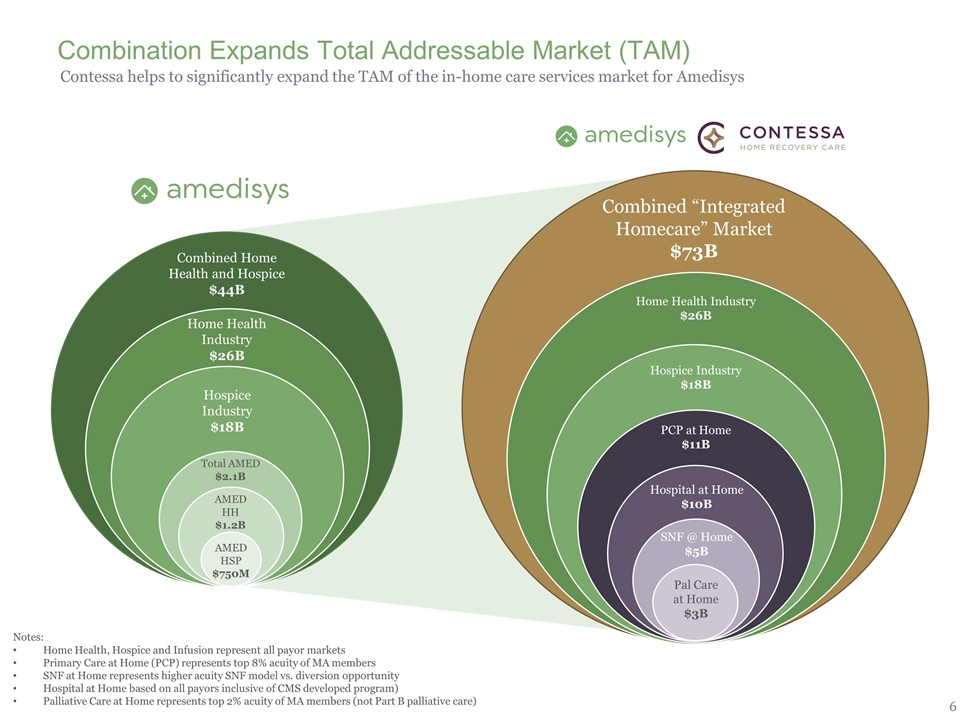

Combination Expands Total Addressable Market (TAM) Contessa helps to significantly expand the TAM of the in-home care services market for Amedisys Notes: Home Health, Hospice and Infusion represent all payor markets Primary Care at Home (PCP) represents top 8% acuity of MA members SNF at Home represents higher acuity SNF model vs. diversion opportunity Hospital at Home based on all payors inclusive of CMS developed program) Palliative Care at Home represents top 2% acuity of MA members (not Part B palliative care) Hospice Industry $18B Home Health Industry $26B Combined Home Health and Hospice $44B AMED HSP $750M AMED HH $1.2B Total AMED $2.1B Hospice Industry $18B Home Health Industry $26B Combined “Integrated Homecare” Market $73B PCP at Home $11B Hospital at Home $10B SNF @ Home $5B Pal Care at Home $3B

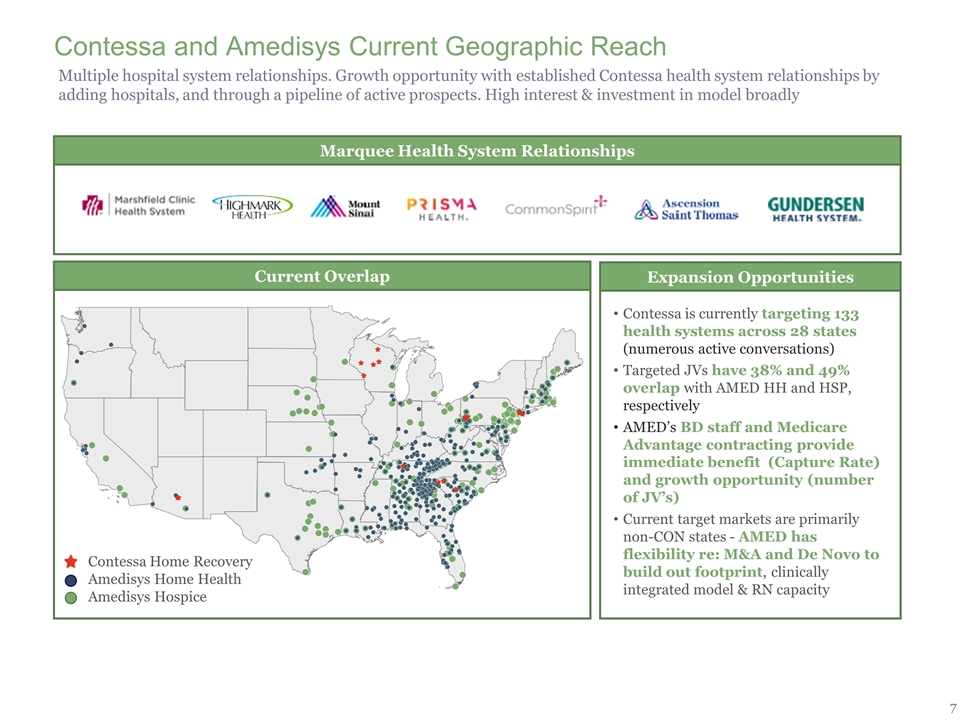

Contessa Home Recovery Amedisys Home Health Amedisys Hospice Contessa and Amedisys Current Geographic Reach Multiple hospital system relationships. Growth opportunity with established Contessa health system relationships by adding hospitals, and through a pipeline of active prospects. High interest & investment in model broadly Contessa is currently targeting 133 health systems across 28 states (numerous active conversations) Targeted JVs have 38% and 49% overlap with AMED HH and HSP, respectively AMED’s BD staff and Medicare Advantage contracting provide immediate benefit (Capture Rate) and growth opportunity (number of JV’s) Current target markets are primarily non-CON states - AMED has flexibility re: M&A and De Novo to build out footprint, clinically integrated model & RN capacity Marquee Health System Relationships Current Overlap Expansion Opportunities

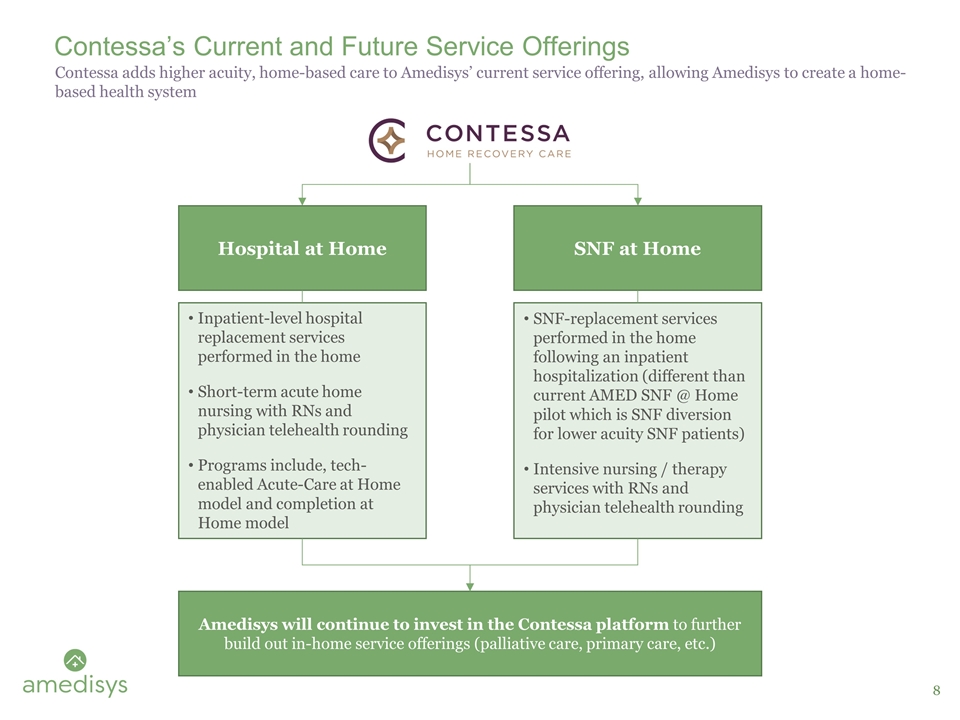

Contessa adds higher acuity, home-based care to Amedisys’ current service offering, allowing Amedisys to create a home-based health system Contessa’s Current and Future Service Offerings Hospital at Home SNF at Home Inpatient-level hospital replacement services performed in the home Short-term acute home nursing with RNs and physician telehealth rounding Programs include, tech-enabled Acute-Care at Home model and completion at Home model SNF-replacement services performed in the home following an inpatient hospitalization (different than current AMED SNF @ Home pilot which is SNF diversion for lower acuity SNF patients) Intensive nursing / therapy services with RNs and physician telehealth rounding Amedisys will continue to invest in the Contessa platform to further build out in-home service offerings (palliative care, primary care, etc.)

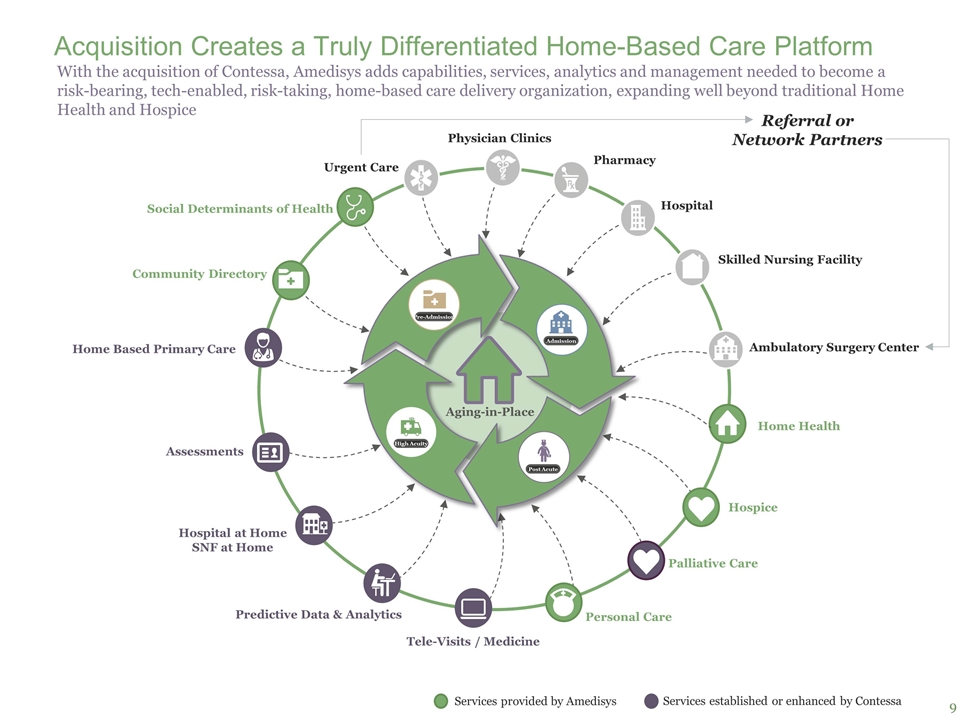

Pharmacy Ambulatory Surgery Center Urgent Care Assessments Physician Clinics Predictive Data & Analytics Hospital at Home SNF at Home Home Health Palliative Care Hospice Personal Care Hospital Skilled Nursing Facility Social Determinants of Health Home Based Primary Care Tele-Visits / Medicine Pre-Admission Admission Post Acute High Acuity Community Directory With the acquisition of Contessa, Amedisys adds capabilities, services, analytics and management needed to become a risk-bearing, tech-enabled, risk-taking, home-based care delivery organization, expanding well beyond traditional Home Health and Hospice Acquisition Creates a Truly Differentiated Home-Based Care Platform Aging-in-Place Services provided by Amedisys Referral or Network Partners Services established or enhanced by Contessa

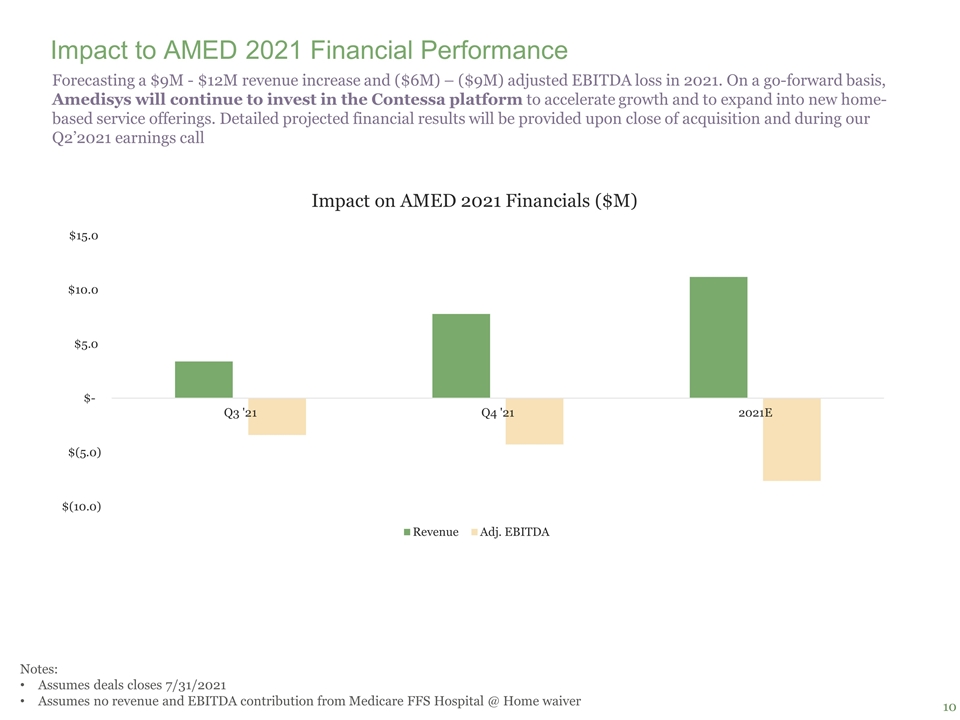

Forecasting a $9M - $12M revenue increase and ($6M) – ($9M) adjusted EBITDA loss in 2021. On a go-forward basis, Amedisys will continue to invest in the Contessa platform to accelerate growth and to expand into new home-based service offerings. Detailed projected financial results will be provided upon close of acquisition and during our Q2’2021 earnings call Impact to AMED 2021 Financial Performance Notes: Assumes deals closes 7/31/2021 Assumes no revenue and EBITDA contribution from Medicare FFS Hospital @ Home waiver