Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF SALBERG & COMPANY, P.A. - Recruiter.com Group, Inc. | rcrt_ex231.htm |

| S-1MEF - S-1MEF - Recruiter.com Group, Inc. | rcrt_s1mef.htm |

Exhibit 5.1

|

|

|

June

29, 2021

Recruiter.com

Group, Inc.

100

Waugh Dr. Suite 300

Houston,

Texas 77007

RE: Form S-1 Registration Statement File No. 333- 249208 and

Registration Statement filed pursuant to Rule 462(b) under the

Securities Act of 1933, as amended

Gentlemen:

We have

acted as counsel to you, Recruiter.com Group, Inc., a Nevada

corporation (the “Company”), in connection with the

Registration Statement on Form S-1 (the “462(b) Registration

Statement”), filed on June 29, 2021 with the Securities and

Exchange Commission (the “Commission”) pursuant to the

Securities Act of 1933, as amended (the “Act”), which

incorporates by reference the Company’s Registration

Statement on Form S-1, as amended (File No. 333-249208) (the

“Registration Statement”) declared effective by the

Commission on June 29, 2021.

The

462(b) Registration Statement relates to the public offering and

sale of the following additional securities of the Company (the

“Additional Securities”):

1. Up

to an additional $2,300,000 worth of Units, including Units to be

issued pursuant to over allotments, if

any, to be offered and sold by the Company, each Unit to

consist of:

a. one

(1) share common stock, par value $0.0001 per share (all shares of

common stock of the Company contained within the Units shall be

referred to as the “Shares”); and

b. one

(1) warrant to purchase one (1) share of common stock of the

Company (all warrants contained within the Units shall be referred

to as the “Warrants”) at an exercise price equal to

110% of the public offering price per Unit;

2. The

shares of common stock of the Company, par value $0.0001 per share,

issuable upon exercise of the Warrants (the “Warrant

Shares”);

1

3.

Warrants to purchase a number of shares of common stock of the

Company equal to 10% of the number of Units sold, at an exercise

price equal to 125% of the public offering price of the Units, to

be issued to the Underwriters in the offering (the

“Underwriter Warrants”); and

4. The

shares of common stock of the Company, par value $0.0001 per share,

issuable upon exercise of the Underwriter Warrants (the

“Underwriter Warrant Shares”)

In

connection with this opinion, we have examined the originals or

copies certified or otherwise identified to our satisfaction of the

following: (a) Articles of Incorporation of the Company, as amended

to date, (b) Bylaws of the Company, as amended to date, and (c) the

462(b) Registration Statement and the Registration Statement and

all exhibits thereto. In addition to the foregoing, we also have

relied as to matters of fact upon the representations made by the

Company and its representatives and we have assumed the genuineness

of all signatures, the authenticity of all documents submitted to

us as originals, and the conformity to original documents of all

documents submitted to us certified or photostatic

copies.

Based

upon the foregoing and in reliance thereon, and subject to the

qualifications, limitations, exceptions and assumptions set forth

herein, we are of the opinion that: (i) the shares of Common Stock

included in the Additional Securities, when issued against payment

therefor as set forth in the 462(b) Registration Statement and the

Registration Statement, will be validly issued, fully paid and

non-assessable; (ii) the Warrants included in the Additional

Securities, when issued as set forth in the 462(b) Registration

Statement and the Registration Statement, will be legal, valid and

binding obligations of the Company, enforceable against the Company

in accordance with their terms; (iii) the Warrant Shares included

in the Additional Securities, when issued upon exercise of the

Warrants against payment therefor as set forth in the 462(b)

Registration Statement and the Registration Statement, will be

validly issued, fully paid and non-assessable; (iv) the Units

included in the Additional Securities, when issued against payment

thereof as set forth in the 462(b) Registration Statement and the

Registration Statement, will be validly issued, fully paid and

non-assessable, and will be legal, valid and binding obligations of

the Company, enforceable against the Company in accordance with

their terms; (v) the Underwriter Warrants included in the

Additional Securities, when issued as set forth in the 462(b)

Registration Statement and the Registration Statement, will be

legal, valid and binding obligations of the Company, enforceable

against the Company in accordance with their terms; and (vi) the

Underwriter Warrant Shares included in the Additional Securities,

when issued upon exercise of the Underwriter Warrants against

payment therefor as set forth in the 462(b) Registration Statement

and the Registration Statement, will be validly issued, fully paid

and non-assessable.

Our

opinion is limited to the federal laws of the United States and

Chapter 78 of the Nevada Revised Statutes. We express no opinion as

to the effect of the law of any other jurisdiction. Our opinion is

rendered as of the date hereof, and we assume no obligation to

advise you of changes in law or fact (or the effect thereof on the

opinions expressed herein) that hereafter may come to our

attention. This opinion letter is limited to the laws in effect as

of the date the 462(b) Registration Statement and the Registration

Statement are declared effective by the Commission and is provided

exclusively in connection with the public offering contemplated by

the 462(b) Registration Statement and the Registration

Statement.

This

opinion letter speaks only as of the date hereof and we assume no

obligation to update or supplement this opinion letter if any

applicable laws change after the date of this opinion letter or if

we become aware after the date of this opinion letter of any facts,

whether existing before or arising after the date hereof, that

might change the opinions expressed above.

This

opinion letter is furnished in connection with the filing of the

462(b) Registration Statement and may not be relied upon for any

other purpose without our prior writ ten consent in each instance.

Further, no portion of this letter may be quoted, circulated or

referred to in any other document for any other purpose without our

prior written consent.

2

We

hereby consent to the filing of this opinion with the Commission as

an exhibit to the 462(b) Registration Statement and to the use of

our name as it appears in the Prospectus included in the

Registration Statement. In giving such consent, we do not thereby

admit that we come within the category of persons whose consent is

required under Section 7 of the Act or the rules and regulations of

the Commission promulgated thereunder. This opinion is expressed as

of the date hereof unless otherwise expressly stated, and we

disclaim any undertaking to advise you of any subsequent changes in

the facts stated or assumed herein or of any subsequent changes in

applicable laws.

|

|

Very

Truly Yours,

|

|

|

|

|

|

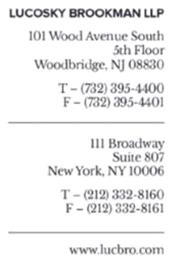

/s/ Lucosky Brookman LLP

|

|

|

Lucosky

Brookman LLP

|

3