Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - 2U, Inc. | d189104dex991.htm |

| EX-10.1 - EX-10.1 - 2U, Inc. | d189104dex101.htm |

| EX-2.1 - EX-2.1 - 2U, Inc. | d189104dex21.htm |

| 8-K - 8-K - 2U, Inc. | d189104d8k.htm |

2U and edX: An Industry Redefining Combination June 29, 2021 Exhibit 99.2

Forward Looking Statements. This presentation contains forward-looking statements regarding 2U, Inc. (“2U”, the “company”, “our”), edX Inc., 2U’s acquisition of assets from edX Inc. (the “Acquisition”) and future business expectations, strategy and intentions all of which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained herein, including statements regarding future results of operations and financial position of 2U, including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. 2U has based these forward-looking statements largely on its estimates of its financial results and its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date hereof. The company undertakes no obligation to update these statements as a result of new information or future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from the results predicted, including, but not limited to: risks related to the Acquisition, including failure to obtain applicable regulatory and governmental approvals in a timely manner or at all, integration risks and failure to achieve the anticipated benefits of the Acquisition; trends in the higher education market and the market for online education, and expectations for growth in those markets; the acceptance, adoption and growth of online learning by colleges and universities, faculty, students, employers, accreditors and state and federal licensing bodies; the impact of competition on the company’s industry and innovations by competitors; the company’s ability to comply with evolving regulations and legal obligations related to data privacy, data protection and information security; the company’s expectations about the potential benefits of its cloud-based software-as-a-service technology and technology-enabled services to university clients and students; the company’s dependence on third parties to provide certain technological services or components used in its platform; the company’s expectations about the predictability, visibility and recurring nature of its business model; the company’s ability to meet the anticipated launch dates of its degree programs, short courses and boot camps; the company’s ability to acquire new university clients and expand its degree programs, short courses and boot camps with existing university clients; the company’s ability to successfully integrate the operations of its acquisitions, including edX and Trilogy, to achieve the expected benefits of its acquisitions and manage, expand and grow the combined company; the company’s ability to refinance its indebtedness on attractive terms, if at all, to better align with its focus on profitability; the company’s ability to service its substantial indebtedness and comply with the covenants and conversion obligations contained in the indenture governing its convertible senior notes and the credit agreement governing its revolving credit facility; the company’s ability to generate sufficient future operating cash flows from recent acquisitions to ensure related goodwill is not impaired; the company’s ability to execute its growth strategy in the international, undergraduate and non-degree alternative markets; the company’s ability to continue to recruit prospective students for its offerings; the company’s ability to maintain or increase student retention rates in its degree programs; the company’s ability to attract, hire and retain qualified employees; the company’s expectations about the scalability of its cloud-based platform; potential changes in regulations applicable to the company or its university clients; the company’s expectations regarding the amount of time its cash balances and other available financial resources will be sufficient to fund its operations; the impact and cost of stockholder activism; the impact of any natural disasters or public health emergencies, such as the coronavirus disease 2019 (“COVID-19”) pandemic; the company’s expectations regarding the effect of the capped call transactions and regarding actions of the option counterparties and/or their respective affiliates; and other factors beyond the company’s control. These and other potential risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed under the heading “Risk Factors” in 2U’s Annual Report on Form 10-K for the year ended December 31, 2020, and other SEC filings. Moreover, 2U operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for 2U management to predict all risks, nor can 2U assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements 2U may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially and adversely from those anticipated.

Key Takeaways 1. 2. 4. 3. 5. 2U acquiring assets including brand, website, and marketplace from edX —a nonprofit founded by Harvard and MIT—for $800 million Increases TAM through combined 50M+ global learner base, 1,200+ Enterprise clients, 230+ university and corporate partners, and comprehensive suite of 3,500+ offerings ranging from free-to-degree Combined entity will have massive global audience and strong consumer brand, top five education website with traffic of 120M+ Expected to improve ROIC through increased marketing efficiency Extends leadership position and supports increased access to high-quality digital education and sustainable value creation Expected to improve marketing cost efficiency by 10-15%

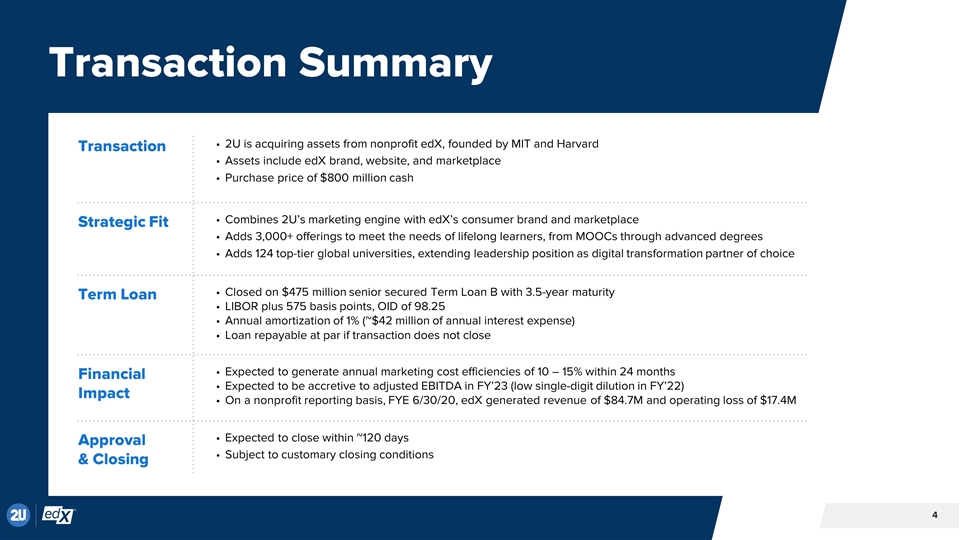

Transaction Summary Transaction 2U is acquiring assets from nonprofit edX, founded by MIT and Harvard Assets include edX brand, website, and marketplace Purchase price of $800 million cash Strategic Fit Combines 2U’s marketing engine with edX’s consumer brand and marketplace Adds 3,000+ offerings to meet the needs of lifelong learners, from MOOCs through advanced degrees Adds 124 top-tier global universities, extending leadership position as digital transformation partner of choice Term Loan Closed on $475 million senior secured Term Loan B with 3.5-year maturity LIBOR plus 575 basis points, OID of 98.25 Annual amortization of 1% (~$42 million of annual interest expense) Loan repayable at par if transaction does not close Financial Impact Expected to generate annual marketing cost efficiencies of 10 – 15% within 24 months Expected to be accretive to adjusted EBITDA in FY’23 (low single-digit dilution in FY’22) On a nonprofit reporting basis, FYE 6/30/20, edX generated revenue of $84.7M and operating loss of $17.4M Approval & Closing Expected to close within ~120 days Subject to customary closing conditions

Purpose-Aligned “As a global nonprofit, we’re relentlessly pursuing a world where every learner can access education to unlock their potential, without the barriers of cost or location.” “We believe that great nonprofit universities can redefine higher education to address society’s critical needs. Education must be must be high-quality, blended and connected, relevant, accessible and affordable, and sustainable.”

Meet Circuit. Founded by Harvard and MIT in May 2012 983rd ranked website in the world (Top 5 in education) 3,000 courses driving consumer marketplace flywheel Courses from 155 partners - 15 of top 20 universities in the world FOUNDED BY HARVARD AND MIT IN MAY 2012 A shared vision of universal access to the world’s best digital education 2U and edX have each built industry leading, mission-driven organizations by focusing on two shared beliefs. First, that great nonprofit universities are the most powerful engines of social and economic mobility. And second, that online learning has the potential to change lives and, in doing so, change the world. By bringing together edX and 2U’s deeply aligned values, strengths, and complementary offerings, we’ll be able to make our shared vision of universal access to high-quality education a reality.

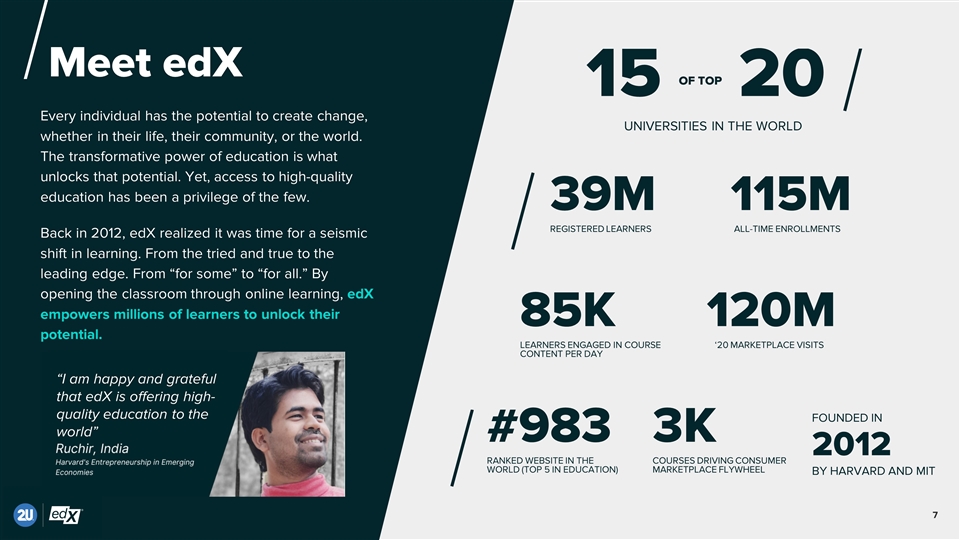

REGISTERED LEARNERS 39M ALL-TIME ENROLLMENTS 115M LEARNERS ENGAGED IN COURSE CONTENT PER DAY 85K ‘20 MARKETPLACE VISITS 120M RANKED WEBSITE IN THE WORLD (TOP 5 IN EDUCATION) #983 3K COURSES DRIVING CONSUMER MARKETPLACE FLYWHEEL 2012 BY HARVARD AND MIT 15 20 UNIVERSITIES IN THE WORLD OF TOP FOUNDED IN REGISTERED LEARNERS 35M ENROLLMENTS 110M LEARNERS ENGAGED IN COURSE CONTENT PER DAY 85K HOURS OF VIDEO CONSUMED 39M RANKED WEBSITE IN THE WORLD (TOP 5 IN EDUCATION) 983 RD 3K 15 COURSES DRIVING CONSUMER MARKETPLACE FLYWHEEL COURSES FROM 155 PARTNERS 20 UNIVERSITIES IN THE WORLD 2012 BY HARVARD AND MIT OF TOP FOUNDED IN Every individual has the potential to create change, whether in their life, their community, or the world. The transformative power of education is what unlocks that potential. Yet, access to high-quality education has been a privilege of the few. Back in 2012, edX realized it was time for a seismic shift in learning. From the tried and true to the leading edge. From “for some” to “for all.” By opening the classroom through online learning, edX empowers millions of learners to unlock their potential. Meet edX “I am happy and grateful that edX is offering high-quality education to the world”

A Compelling Combination LEARNERS 39M PARTNERS 165 OFFERINGS 3,000 CORPORATE CLIENTS 1,000 LEARNERS 15M PARTNERS 80 OFFERINGS 500 CORPORATE CLIENTS 200 LEARNERS 50M PARTNERS 230 OFFERINGS 3,500 CORPORATE CLIENTS 1,200 As of June 29, 2021 More than: More than: More than:

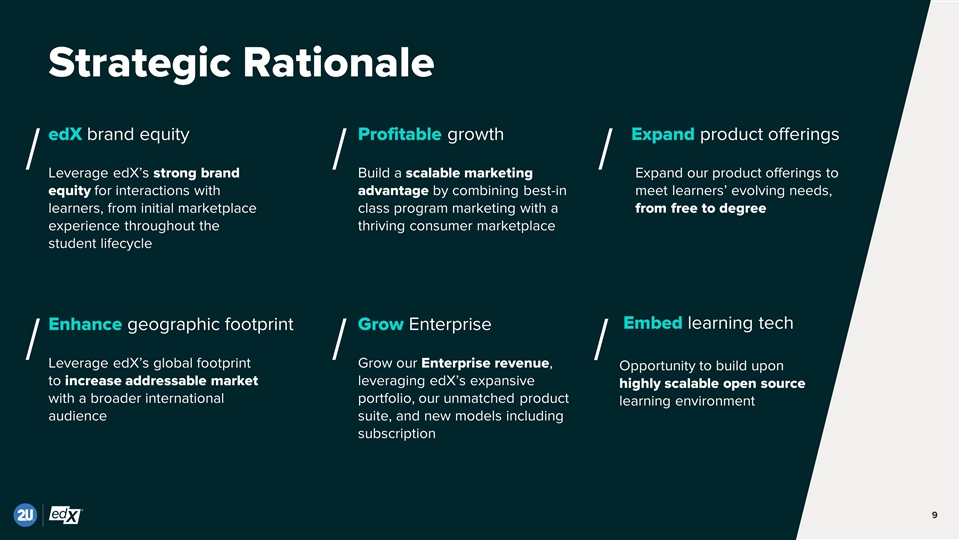

Promote access Profitable growth Build a scalable marketing advantage by combining best-in-class program marketing with a thriving consumer marketplace Strategic Rationale edX brand equity Leverage edX’s strong brand equity for interactions with learners, from initial marketplace experience throughout the student lifecycle Enhance geographic footprint Leverage edX’s global footprint to increase addressable market with a broader international audience Grow Enterprise Grow our Enterprise revenue, leveraging edX’s expansive portfolio, our unmatched product suite, and new models including subscription Expand product offerings Expand our product offerings to meet learners’ evolving needs, from free to degree Embed learning tech Opportunity to build upon highly scalable open source learning environment

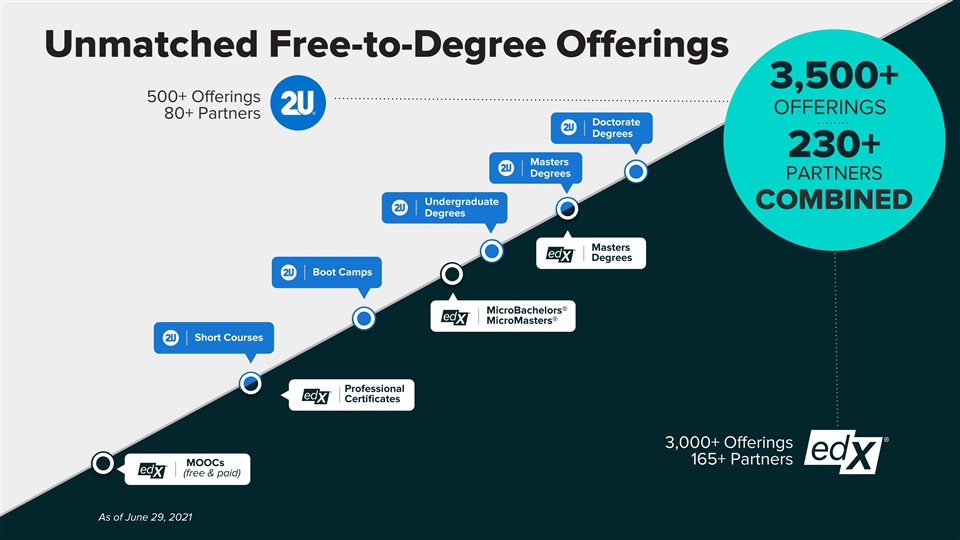

500+ Offerings 80+ Partners 3,000+ Offerings 165+ Partners Boot Camps MicroBachelors® MicroMasters® Masters Degrees Masters Degrees Short Courses MOOCs (free & paid) 230+ PARTNERS 3,500+ OFFERINGS COMBINED Undergraduate Degrees Doctorate Degrees Unmatched Free-to-Degree Offerings Professional Certificates As of June 29, 2021

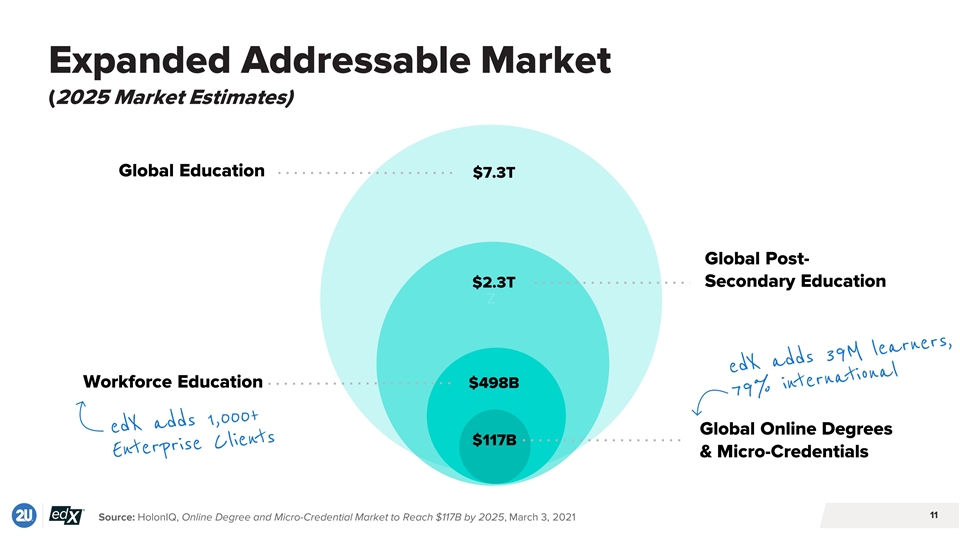

Expanded Addressable Market (2025 Market Estimates) Z $7.3T $2.3T $117B $498B $117B Global Education Workforce Education Global Post-Secondary Education Global Online Degrees & Micro-Credentials edX adds 1,000+ Enterprise Clients edX adds 39M learners, 79% international Source: HolonIQ, Online Degree and Micro-Credential Market to Reach $117B by 2025, March 3, 2021

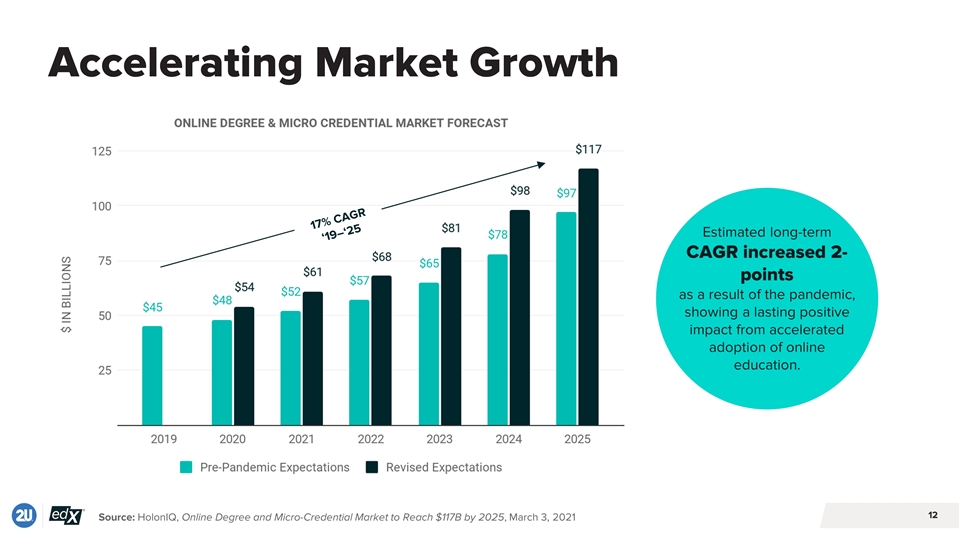

Accelerating Market Growth ESTIMATED LONG-TERM CAGR INCREASED 2-POINTS SINCE THE PANDEMIC, SHOWING A LASTING IMPACT FROM ACCELERATED ADOPTION OF ONLINE EDUCATION. Estimated long-term CAGR increased 2-points as a result of the pandemic, showing a lasting positive impact from accelerated adoption of online education. 17% CAGR $ BILLIONS 17% CAGR ‘19–‘25 Source: HolonIQ, Online Degree and Micro-Credential Market to Reach $117B by 2025, March 3, 2021

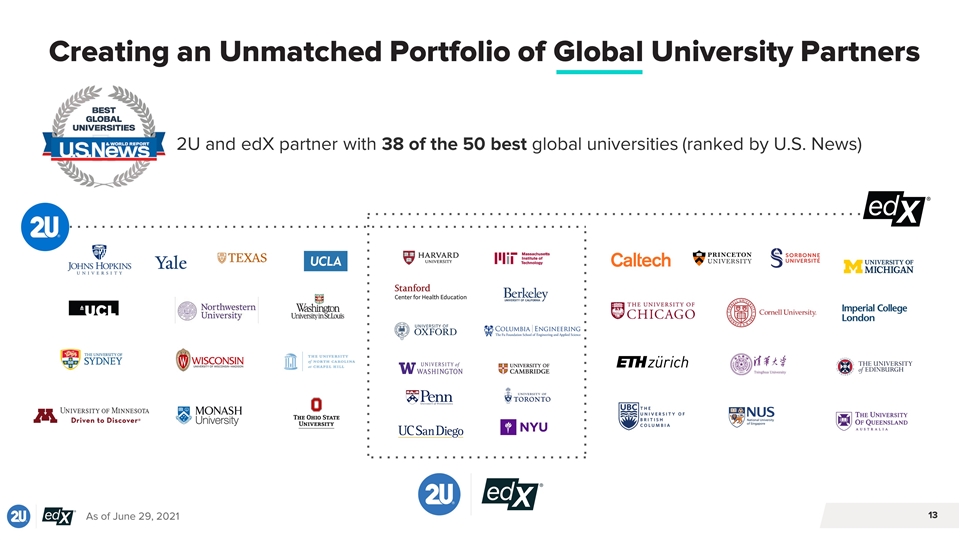

ESTIMATED LONG-TERM CAGR INCREASED 2-POINTS SINCE THE PANDEMIC, SHOWING A LASTING IMPACT FROM ACCELERATED ADOPTION OF ONLINE EDUCATION. Creating an Unmatched Portfolio of Global University Partners 2U and edX partner with 38 of the 50 best global universities (ranked by U.S. News) As of June 29, 2021

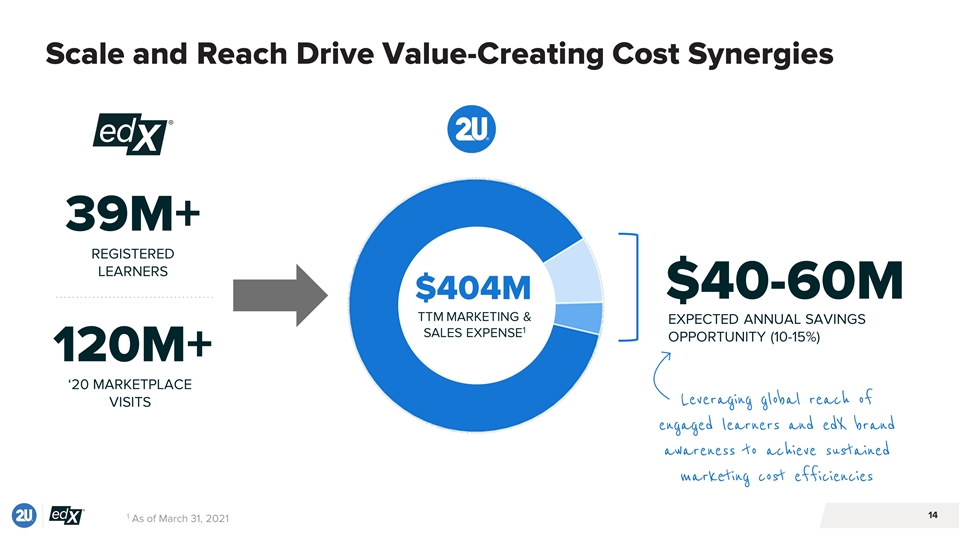

Scale and Reach Drive Value-Creating Cost Synergies REGISTERED LEARNERS 39M+ ‘20 MARKETPLACE VISITS 120M+ 1 As of March 31, 2021 EXPECTED ANNUAL SAVINGS OPPORTUNITY (10-15%) $40-60M TTM MARKETING & SALES EXPENSE1 $404M Leveraging global reach of engaged learners and edX brand awareness to achieve sustained marketing cost efficiencies

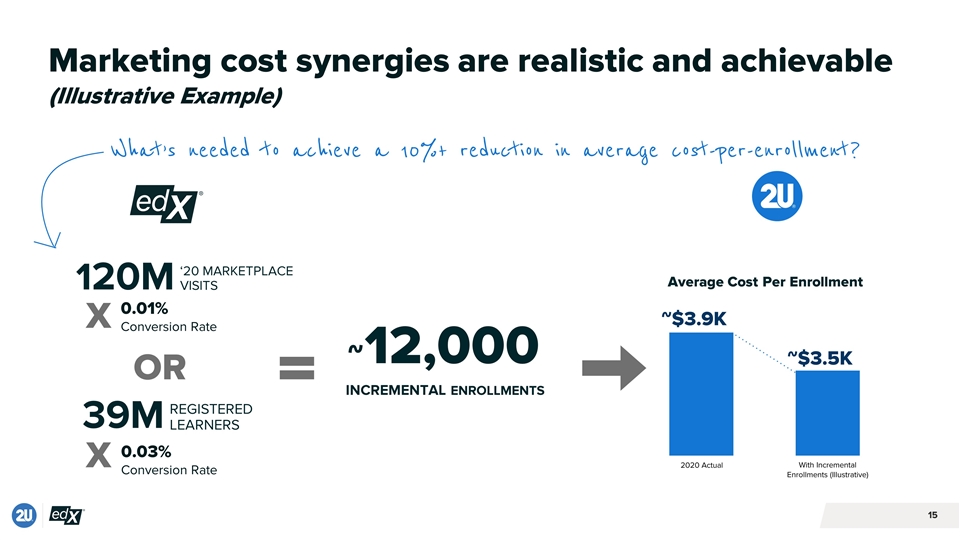

0.01% Conversion Rate 0.03% Conversion Rate With Incremental Enrollments (Illustrative) Average Cost Per Enrollment Marketing cost synergies are realistic and achievable (Illustrative Example) 120 Million Website Visitors 38 Million Registered Learners .01% Incremental Conversion Rate .03% Incremental Conversion Rate ~12,000 Incremental Enrollments 2020 Actual ~$3,900 ~$3,500 With Incremental Enrollments (Illustrative) Average Enrollment Cost 2020 Actual ‘20 MARKETPLACE VISITS 120M ~$3.9K ~$3.5K REGISTERED LEARNERS 39M 12,000 INCREMENTAL ENROLLMENTS ~ What’s needed to achieve a 10%+ reduction in average cost-per-enrollment? OR X X

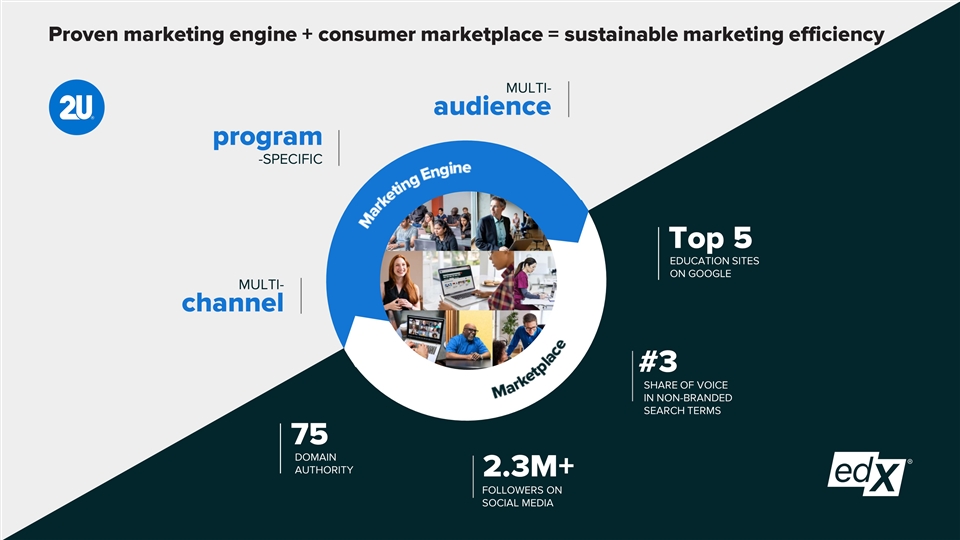

Proven marketing engine + consumer marketplace = sustainable marketing efficiency Top 5 EDUCATION SITES ON GOOGLE 75 DOMAIN AUTHORITY 2.3M+ FOLLOWERS ON SOCIAL MEDIA #3 SHARE OF VOICE IN NON-BRANDED SEARCH TERMS MULTI- channel program -SPECIFIC MULTI- audience

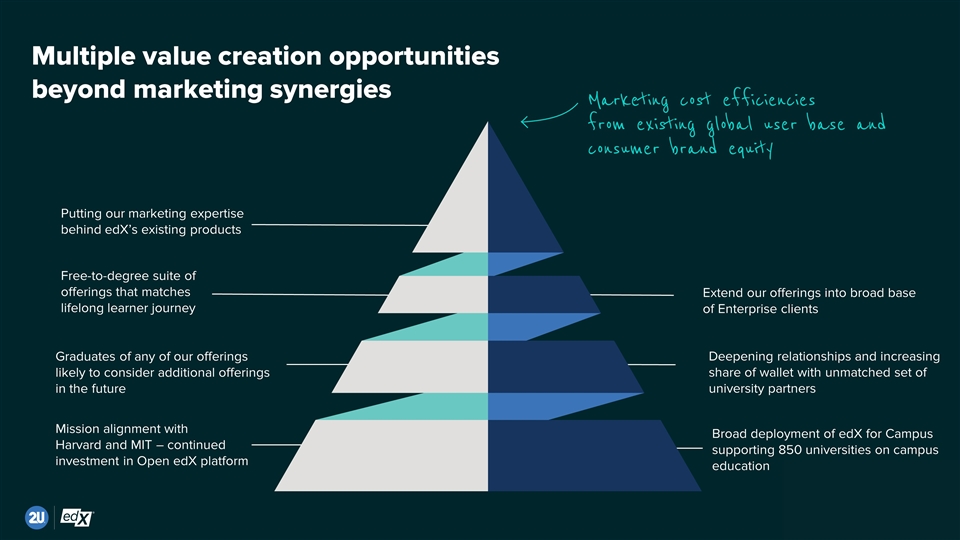

Multiple value creation opportunities beyond marketing synergies Mission alignment with Harvard and MIT – continued investment in Open edX platform Putting our marketing expertise behind edX’s existing products Free-to-degree suite of offerings that matches lifelong learner journey Extend our offerings into broad base of Enterprise clients Deepening relationships and increasing share of wallet with unmatched set of university partners Broad deployment of edX for Campus supporting 850 universities on campus education Graduates of any of our offerings likely to consider additional offerings in the future Marketing cost efficiencies from existing global user base and consumer brand equity

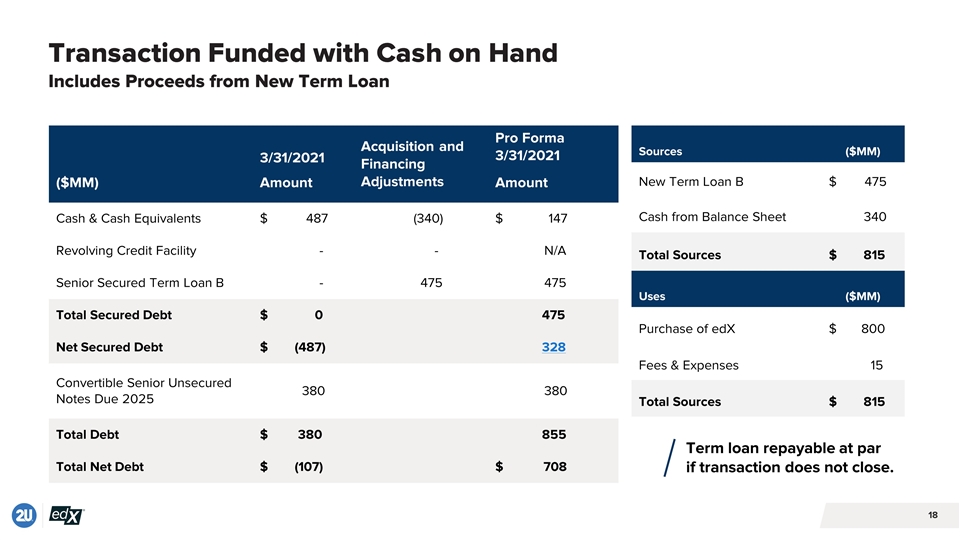

Uses ($MM) Purchase of edX $ 800 Fees & Expenses 15 Total Sources $ 815 Sources ($MM) New Term Loan B $ 475 Cash from Balance Sheet 340 Total Sources $ 815 3/31/2021 Acquisition and Financing Adjustments Pro Forma 3/31/2021 ($MM) Amount Amount Cash & Cash Equivalents $ 487 (340) $ 147 Revolving Credit Facility - - N/A Senior Secured Term Loan B - 475 475 Total Secured Debt $ 0 475 Net Secured Debt $ (487) 328 Convertible Senior Unsecured Notes Due 2025 380 380 Total Debt $ 380 855 Total Net Debt $ (107) $ 708 Term loan repayable without penalty if transaction does not close. Transaction Funded with Cash on Hand Includes Proceeds from New Term Loan Term loan repayable at par if transaction does not close.

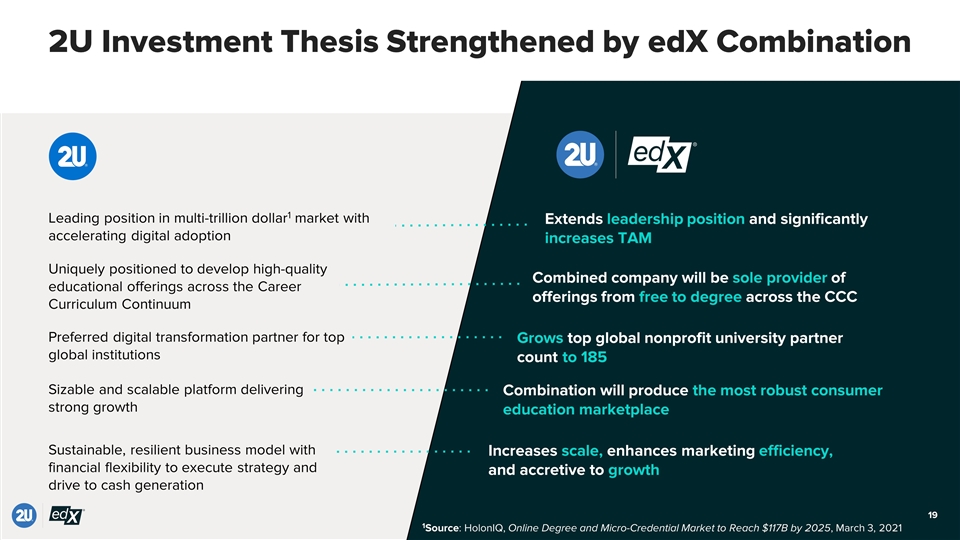

2U Investment Thesis Strengthened by edX Combination Leading position in multi-trillion dollar1 market with accelerating digital adoption Uniquely positioned to develop high-quality educational offerings across the Career Curriculum Continuum Preferred digital transformation partner for top global institutions Sizable and scalable platform delivering strong growth Sustainable, resilient business model with financial flexibility to execute strategy and drive to cash generation Extends leadership position and significantly increases TAM Combined company will be sole provider of offerings from free to degree across the CCC Grows top global nonprofit university partner count to 185 Combination will produce the most robust consumer education marketplace Increases scale, enhances marketing efficiency, and accretive to growth 1Source: HolonIQ, Online Degree and Micro-Credential Market to Reach $117B by 2025, March 3, 2021