Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Ventas, Inc. | tm2120804d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Ventas, Inc. | tm2120804d1_ex2-1.htm |

| 8-K - FORM 8-K - Ventas, Inc. | tm2120804d1_8k.htm |

Exhibit 99.2

Ventas’s Acquisition of New Senior Investment Group & Business Update June 28, 2021 Investor Presentation

2 Safe Harbor Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding New Senior and Ventas including, but not limited to, statements related to the proposed acquisition of New Senior and the anticipated timing, results and benefits thereof; statements regarding the expectations and beliefs of the board of d ire ctors of New Senior, New Senior management, the board of directors of Ventas or Ventas management and other statements that are not historical facts. You can generally identify forward - looking statements by the use of forward - looking terminology s uch as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “explore,” “evaluate,” “intend,” “may,” “might,” “ pla n,” “potential,” “predict,” “project,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon or compar abl e terminology. These forward - looking statements are based on New Senior’s and Ventas’s current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties, many of which are beyond New Senior’s or Ventas’s control. Actual results and the timing of events could differ materially from those anticipated in such forward - lookin g statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associate d w ith New Senior’s and Ventas’s ability to complete the proposed acquisition on the proposed terms or on the anticipated timeli ne, or at all, including: risks and uncertainties related to securing the necessary shareholder approval and satisfaction of othe r c losing conditions to consummate the proposed acquisition; the occurrence of any event, change or other circumstance that coul d give rise to the termination of the merger agreement relating to the proposed acquisition; risks related to diverting the att ent ion of New Senior and Ventas management from ongoing business operations; failure to realize the expected benefits of the proposed acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk of litigation in conn ect ion with the proposed acquisition, including resulting expense or delay; the risk that New Senior’s business will not be inte gra ted successfully or that such integration may be more difficult, time - consuming or costly than expected; the ability to obtain finan cing in connection with the proposed acquisition; risks related to future opportunities and plans for the combined company, including the uncertainty of financial performance and results of the combined company following completion of the proposed a cqu isition; the ability of the combined company to qualify and maintain its qualification as a real estate investment trust for U.S . federal income tax purposes and the potentially onerous consequences that any such failure to maintain such qualification wou ld have on the combined company’s business; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with property managers, tenants, employees or other third parties; effects relati ng to the announcement of the proposed acquisition or any further announcements or the consummation of the proposed acquisition on the market price of New Senior common stock or Ventas common stock; the possibility that, if Ventas does not a chi eve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors or at all, the market price of Ventas common stock could decline; regulatory initiatives and changes in tax laws; m ark et volatility and changes in economic conditions; and other risks and uncertainties affecting New Senior and Ventas, includin g those described from time to time under the caption “Risk Factors” and elsewhere in New Senior’s and Ventas’s U.S. Securities an d Exchange Commission (the “SEC”) filings and reports, including New Senior’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2020, Ventas’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2020 and future filings and reports by either company. In addition, the trajectory and future impact of the COVID - 19 pandemic remains highly uncertain and can change rapidly, and the extent of the pandemic’s continuing and ultimate impact on the combined company’s a bil ity to generate revenues from its operations and the operation of its facilities will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time. Moreover, other risks and uncertainties of which New S eni or or Ventas are not currently aware may also affect each company’s forward - looking statements and may cause actual results and the timing of events to differ materially from those anticipated. Readers of this communication are cautioned tha t f orward - looking statements are not guarantees of future performance. The forward - looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward - looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are subsequently made available by New Senior or Ventas on their respective websites or otherwise. Except as otherwise required by law, neither New Senior nor Venta s u ndertakes any obligation, and each expressly disclaims any obligation, to update or supplement any forward - looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that ex ist after the date as of which the forward - looking statements were made. Participants in the Solicitation New Senior, Ventas and their respective directors and certain of their executive officers and other employees may be deemed t o b e participants in the solicitation of proxies from New Senior’s stockholders in connection with the proposed acquisition. Information about New Senior’s directors and executive officers is set forth in New Senior’s Annual Report on Form 10 - K for the year ended December 31, 2020, which was filed with the SEC on February 25, 2021, and in its proxy statement on Schedule 14A for the 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 12, 2021 and subsequent statements of ben eficial ownership on file with the SEC. Information about Ventas’s directors and executive officers is set forth in Ventas’s Annual Report on Form 10 - K for the year ended December 31, 2020, which was filed with the SEC on February 23, 2021, and in its p roxy statement on Schedule 14A for the 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 13, 2021 and subsequent statements of beneficial ownership on file with the SEC. Additional information regarding the persons who ma y, under the rules of the SEC, be deemed participants in the solicitation of New Senior’s stockholders in connection with the proposed acquisition, including a description of their direct or indirect interests, by security holdings or otherwise, w ill be set forth in the registration statement on Form S - 4 and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Additional Information and Where to Find It In connection with the proposed acquisition, Ventas intends to file with the SEC a registration statement on Form S - 4 that will include a prospectus for the Ventas common stock that will be issued in the proposed acquisition and that will also constitut e a proxy statement for a special meeting of New Senior’s stockholders to approve the proposed acquisition. Each of New Senior an d V entas may also file other relevant documents with the SEC regarding the proposed acquisition. This communication is not a substitute for the registration statement, the proxy statement/prospectus or any other document that New Senior or Ventas m ay file with the SEC with respect to the proposed acquisition. The definitive proxy statement/prospectus (if and when available) will be mailed to New Senior’s stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, TH E P ROXY STATEMENT/PROSPECTUS, ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BE COM E AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT NEW SENIOR, VENTAS AND THE PROPOSED ACQUISITION. Investors and security holders will be able to obtain copies of these materials (if and when they are available), and other d ocu ments containing important information about New Senior, Ventas and the proposed acquisition, once such documents are filed with the SEC free of charge through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by New Senior will be made available free of charge on New Senior’s investor relations website at ir.newseniorinv.com. Copies of documents filed with the SEC by Ventas will be made available free of charge on Ventas’s investor relations website at ir.ventasreit.com. No Offer or Solicitation This presentation is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securit ies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec uri ties laws of any such jurisdiction. No offer of securities shall be made in the United States absent registration under the U .S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration r equ irements. Non - GAAP Financial Measures This presentation includes certain financial performance measures not defined by generally accepted accounting principles in the Unites States (“GAAP”). We believe such measures provide investors with additional information concerning our operating performance and a basis to compare our performance with the performance of other REITs. Our definitions and calculations of t hes e non - GAAP measures may not be the same as similar measures reported by other REITs. These non - GAAP financial measures should not be considered as alternatives to net income attributable to common stockholders (de termined in accordance with GAAP) as indicators of our financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of our liquidity, nor are these measures necessarily in dic ative of sufficient cash flow to fund all of our needs.

3 Second Quarter 2021 Guidance & Business Update 1 2Q21 Guidance (per Share) as Provided May 7, 2021 1 Low High Net Income (Loss) Attributable to Common Stockholders $0.00 - $0.07 Nareit FFO 2 $0.67 - $0.70 Normalized FFO 2 $0.67 - $0.71 The trajectory and future impact of the COVID - 19 pandemic remain highly uncertain. The extent of the pandemic's continuing and ultimate effect on our operational and financial performance will depend on a variety of factors. Guidance As Provided on May 7, 2021 Updates As of June 28, 2021 SHOP Approximate Spot Occupancy Change Increase spot occupancy 150 to 250 bps from March 31, 2021 to June 30, 2021 Quarter - to - date through May 31, approximate spot occupancy increased ~140 bps Leads remain strong; June continues positive trends SHOP Operating Expenses (ex. HHS Grants) Stable at midpoint; customary operating expenses are expected to increase due to increased occupancy, activity levels in the communities and an additional day in the quarter, but COVID - 19 costs should decrease Accelerated reduction of COVID - 19 costs Other Business Segments Performing in line / stable Performing in line / stable Normalized FFO 2 At or above the high end of the range, driven by SHOP Updates on 2Q21 Guidance ▪ Leading Indicators including leads and move ins have trended favorably quarter - to - date ▪ Approximate spot occupancy quarter - to - date has grown nearly +140bps from March 31, 2021 to May 31, 2021 ▪ Net move - ins through June 19, 2021 are pacing ahead of the same month - to - date period in May 2021 ▪ SHOP operating expenses have also trended favorably with rapid declines in COVID - 19 costs versus 1Q21 SHOP Business Update 1. The Company’s guidance constitutes forward - looking statements within the meaning of the federal securities laws and is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. Actual result s m ay differ materially from the Company's expectations depending on factors discussed herein and in the Company’s filings with the Se curities and Exchange Commission; 2. This is a non - GAAP financial measure. Refer to the Non - GAAP Financial Measures Reconciliati on tables in our first quarter 2021 supplemental for additional information and a reconciliation to the most directly comparable GA AP measure. June 28, 2021 Update: Normalized FFO is trending at or above the high end of the range, driven by SHOP

4 Transaction Overview Positions Ventas to further capture powerful senior housing upside at market inflection point Transaction Overview All - stock acquisition by Ventas, Inc. (“Ventas”) of New Senior Investment Group Inc. (“New Senior”) New Senior shareholders to receive 0.1561 shares of newly issued Ventas stock per share of New Senior stock Transaction value of approximately $2.3 billion, including $1.5 billion of New Senior debt Valuation represents approximately $9.10 per New Senior share, a 31% premium based on New Senior’s 30 - day trading average, and a 10% premium on New Senior’s enterprise value, based on Ventas’s closing price on June 25, 2021 Valuation and Accretion Transaction valuation is expected to represent approximately a 6% capitalization rate on expected New Senior 2022 NOI and is expected to be approximately $0.09 to $0.11 accretive to Ventas’s normalized funds from operations per share on a full year basis The acquisition price implies a substantial 20% - 30% discount to estimated replacement cost on a per unit basis Ventas expects to assume certain existing New Senior mortgage debt and fund the repayment of any debt not assumed through other capital sources Superior Quality, High Performing Portfolio High quality independent living portfolio: 103 private pay senior living communities (102 IL; 1 CCRC) totaling 12,404 units ▪ Located in advantaged submarkets with compelling metrics: median home value >$300K, median income > $70K, proximity to premium retail locations, and favorable supply trends ▪ Strong historic performance with positive recent trends: “same - store” occupancy gains have accelerated in June and the 2Q21 “spot to spot” occupancy change is expected to be toward the high - end of the New Senior 2Q21 guidance range of +120bps to +150bps sequentially ▪ Revenue per occupied room of $2,740 and TTM NOI margin of 38% ▪ Well invested, purpose - built properties with attractive physical characteristics including large, well - designed floorplans and spacious units, appealing to the independent living demographic ▪ Principally operated by Holiday Retirement and Atria Senior Living, two longstanding Ventas operators ▪ Geographically diversified across 36 different states Timing & Approvals Expected to close in 2H 2021 Transaction is subject to customary closing conditions, including approval by the common shareholders of New Senior

5 “I am excited to include the New Senior assets in our portfolio. These independent living communities represent a strong fit with our existing portfolio, as we enhance our senior housing business to capture upside from the industry recovery. “New Senior’s independent living communities are located in advantaged markets, enjoy positive supply demand fundamentals, appeal to a large and growing middle market senior demographic, have demonstrated superior financial performance and are rapidly growing occupancy and leads.” J. Justin Hutchens, Ventas’s EVP, Senior Housing Furthering Ventas’s Ability to Drive Performance and Capitalize on Senior Housing Growth Ahead

6 Transaction Benefits and Strategic Rationale Enhances Ventas’s senior housing position at a cyclical inflection point in advance of the expected powerful senior housing industry recovery Adds a superior quality, high performing portfolio to Ventas that is well located in advantaged markets Expands Ventas’s exposure to independent living in the U.S., catering to a large and growing middle market Builds on existing relationships with leading operators; adds new operators Attractive valuation & financial returns 1 2 3 4 5

7 83.3% 81.1% 81.1% 80.3% 79.9% 79.3% 79.0% 78.7% 77.8% 76.8% 75.7% 75.5% 75.5% 76.0% 76.5% Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Enhances Ventas’s Senior Housing Position at a Cyclical Inflection Point in Advance of the Expected Powerful Senior Housing Industry Recovery 1Q21 Ventas (As Reported) 1 $1.7B Ann. Adj. NOI (at share) Month - End Senior Housing Occupancy Rate Across Select Peers 2 +100bps Early stage of expected powerful cyclical senior housing recovery (830)bps 1Q21 New Senior (As Reported) 1Q21 Pro Forma Ventas + New Senior 1 SHOP , 26% SH NNN , 18% Office , 32% HC NNN , 19% Loans , 4% SHOP , 95% SH NNN , 5% SHOP , 31% SH NNN , 17% Office , 30% HC NNN , 18% Loans , 4% $1.8B Ann. Adj. NOI (at share) 1. Reflects portfolio concentration based on Annualized Adjusted NOI, which represents an annualized result of a period’s Rep ort ed Segment NOI excluding (i) Reported Segment NOI not attributable to owned real estate or loan investments, (ii) Reported Se gme nt NOI related to the non - controlling interest of consolidated real estate entities and (iii) the annualizing impact of certain non - rec urring or out - of - period items, and including (x) the effects of transactions and events that were completed during the period, a s if the transaction or event had been consummated at the beginning of the relevant period, (y) the expected leased - up impact of recently completed deve lopments and (z) Ventas’s share of Annualized Adjusted NOI related to nonconsolidated real estate entities; 2 . Company filings, investor presentations, and press releases. Peer set includes Ventas Inc, Welltower, Brookdale Senior Living, National Health Investor s, and New Senior Investment Group Inc. 1 Impact of COVID - 19 pandemic

8 5M 7M 9M 11M 13M 15M 17M 19M 21M Compelling Supply and Demand Fundamentals in Senior Housing Aging Population Fuels Demand 1 Favorable Supply Trends 2 U.S. 80+ Population +7.5% growth +17.4% growth 5 - Years Post Financial Crisis 5 - Years Post COVID 1. Population estimates from the Organization for Economic Co - Operation and Development (OECD); 2. 1Q21 NIC Data for Top 99 (Primar y and Secondary) Markets and for the Senior Housing sector. ▪ C onstruction starts are at the lowest levels since 2011 and construction as a percent of inventory continues to decline below 2015 levels ▪ New development expected to remain muted because of low development yields driven by rising material costs and depressed industry occupancy ▪ Senior Housing Target 80+ population: o Growth post - COVID is expected to be over 2x rate witnessed during the recovery following the financial crisis o Expected to grow by 2+ million additional individuals through 2025 o Expected to increase from 13 million in 2020 to nearly 20 million by 2030 1 With resilient demand from a rapidly growing population of seniors, new construction at cyclical lows, and the trough of the COV ID - 19 pandemic behind us, senior housing is poised for exciting growth 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 1Q19 3Q19 1Q20 3Q20 1Q21 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Senior Housing New Starts (77%) from 4Q17 peak

9 Adds a Superior Quality Independent Living Portfolio Source: Based on New Senior’s June 2021 NAREIT Investor Presentation. 1. Percentages calculated based on 1Q21 NOI; 2. Excluding Watermark (a CCRC). IL Properties NNN Lease New Senior Portfolio Overview 103 Communities 12,400+ Units 2 CA , 12% NC , 12% FL , 10% PA , 4% OR , 9% Other , 53% 36 States 100% Private Pay 2 >80% Occupancy as of May 31, 2021 for 102 asset independent living portfolio 1Q21 NOI by State 1 1Q21 NOI by Operator As of July 1 $118M 1Q21 Annualized Cash NOI 81 Years Average Resident Age 58% 23% 12% 5% Watermark Other 1% Atria Hawthorn New Senior’s Geographically Diversified Portfolio Holiday

10 New Senior’s IL Portfolio Is Well Located in Advantaged Markets 1 2 Attractive Markets with Compelling Demographics 2 $303K Average Home Value $72K Average Household Income 3.8% Projected Total Population Growth 8.9% Projected Senior Population Growth Ideally Located within Markets: High Traffic & Proximity to Premium Retail Located in Submarkets with Limited Historical and New Construction Well Below National Averages 4 80% Near Premium Retail 3 High Visibility Locations 3 5.9% Last 2 Years – Deliveries % Inventory vs. 8.0% industry average 4.2% Next 2 Years – Deliveries % Inventory vs. 5.7% industry average 7.8% Next 4 Years – Deliveries % Inventory vs. 10.7% industry average 1. Summary statistics represent 102 Independent Living properties; 2. Demographic information per Claritas; 3. Premium retail pr oximity and visibility as measured by average traffic count per ArcGIS Living Atlas; 4. National Investment Center (NICMAP). 84% Submarket 1Q21 IL Occupancy 4

11 Well Invested, Purpose - built Properties with Attractive Physical Characteristics Pioneer Valley Lodge North Logan, UT Orchid Terrace St Louis, MO Manor at Oakridge Harrisburg, PA Large, well - designed floorplans appealing to the independent living demographic Well - invested, with ~$1,700 of CapEx per unit spent in 2019 (under New Senior ownership) 2 Spacious units, high ceilings and kitchenettes Assets were purpose - built by Holiday in a consistent format and design, typically ~120 units per building Attractive, well - lit common areas appeal to the active senior demographic: library, activity room, recreation areas and fitness rooms Appealing, multi - story exterior facades Because of good property condition and strong markets, Ventas has opportunity for redevelopment investment in select assets/ markets over time

12 84% 91% 88% 88% 89% 80% 79% 97% 98% 113% 106% 112% Excellent New Senior Historical Performance and Recent Trends 2 New Senior Leading Indicator Trends 1 Leads as a % of 2019 Move - ins as a % of 2019 1. Reflects data for the 2Q21 same - store portfolio, which excludes 21 properties transitioned to Atria on 4/1/21; 2. New Senior public materials; 3. National Investment Center (NICMAP). 73% 92% 97% 93% 96% 85% 76% 73% 81% 106% 109% 112% +36% since Dec20 +33% since Dec20 Resilient Margin Profile 2 39.7% 36.1% 1Q20 1Q21 Pre - pandemic margin typically 40%+ Occupancy Change New Senior portfolio has leading operating margins approximating 40% and benefitting from the independent living staffing model due to minimal need for care and a resident length of stay of approximately 3 years 87.1% 79.4% 1Q20 1Q21 (770) bps 87.4% 78.9% 1Q20 1Q21 (850) bps New Senior 2 NIC Industry Average 3 Accelerating June trends Accelerating June trends

13 Increased Exposure to Attractive U.S. Independent Living Market 3 1Q21 Ventas (As Reported) 1Q21 New Senior (As Reported) 1Q21 Pro Forma Ventas + New Senior IL , 48% AL , 40% MC , 13% IL , 100% IL , 58% AL , 32% MC , 10% 1. Reflects portfolio concentration based on units; 2. Revenue per occupied room per room as of 1Q21. ~50K SHOP Units ~12K SHOP Units ~62K SHOP Units Independent Living Unit Types Typical apartment amenities, including kitchenettes Meal Services ✓ Housekeeping ✓ Transportation ✓ Bathing & Grooming Can be contracted with a 3 rd party enabling longer length of stay Medication Management Nursing Care New Senior independent living portfolio is complementary to Ventas’s high end major market senior housing portfolio Independent Living Service Offering Structural Benefits of Independent Living 81 years average resident age Accessible price point at ~$2,700 RevPOR 2 ~40% pre - pandemic operating margins for New Senior portfolio Favorable historical and current construction exposure Attractive demographic and new supply trends ~3 year length of stay

14 Large and Growing Middle Market Independent Living Segment Large & Growing Middle Income Opportunity 1 Affordable Senior Housing Price Point 2 ▪ Middle income senior population is expected to grow by 82% to 14 million by 2029, at which time the segment will represent 43% of all seniors 1 • Middle income seniors expected to have annual financial resources of $41,000 ($52,000 including home equity) 1 ▪ New Senior’s independent living portfolio is well - positioned to serve middle income seniors • Affordability coverage for New Senior’s properties of 9.3x compared to 4.7x for U.S. senior housing average 2 • New Senior independent living average RevPOR of ~$2,700 1. NIC, “The Forgotten Middle”, published May 21, 2019; 2. Affordability coverage calculated as average household value relat ive to annual rent. New Senior household value of $300k and average revenue per occupied room per month (RevPOR) of approximately $2,700 as of 1Q21. All Senior Housing represents 140 NIC MSAs w ith household value of $235k and average annual rental rate of approximately $4,200 (rental rate per NIC). Household value information per Claritas. 8.1 8.9 7.9 14.4 4.0 10.3 20.0 33.6 2014 2029 Low Income Middle Income High Income 4.7x 9.3x All Senior Housing New Senior IL New Senior Target Market, 43% of Seniors New Senior portfolio expands the addressable market by appealing to the large and growing middle income senior population 3

15 $17K ~120 45% IL / 55% AL $21K ~80 10% IL / 90% AL $11K ~270 90% IL / 10% AL $11K ~117 100% IL Atria Senior Living Sunrise Senior Living Le Groupe Maurice New Senior + Existing Ventas 26 Holiday Retirement Communities Transaction expands high quality SHOP portfolio Ékla Quebec City, Quebec Sunrise of Cuyahoga Falls Akron, OH Atria of Roslyn Harbor New York, NY Business Model NOI / Unit 1 Units / Building Acuity Mix x x x x Social assisted living model through multi - brand strategy Representative Community Full service, high acuity offering provides margin benefit from higher - rate residents High - quality independent living model benefits from lower expense margins and substantially higher building capacity vs. broader SHOP Assisted living light model benefits from moderate resident acuity, favorable expense margins and large building capacity High - margin middle - market independent living business largely protected from new competition Personalized full - service assisted living & memory care Active adult, high amenity independent living Mid - tier independent living Valencia Commons Rancho Cucamonga, CA Complementary Fit with High Quality Ventas Senior Housing Portfolio 3 4 1. NOI per unit reflects Ventas’s annualized 4Q 2019 Cash NOI per available unit included in the owned portfolio for the same pe riod for the relevant operator.

16 Builds on Existing Relationships with Leading Operators; Adds New Operators 4 1Q21 Ventas (As Reported) 1 1Q21 New Senior, Operators as of July 1, 2021 2 1. Reflects portfolio concentration based on Annualized Adjusted NOI, which represents an annualized result of a period’s Rep ort ed Segment NOI excluding (i) Reported Segment NOI not attributable to owned real estate or loan investments, (ii) Reported Se gme nt NOI related to the non - controlling interest of consolidated real estate entities and (iii) the annualizing impact of certain non - rec urring or out - of - period items, and including (x) the effects of transactions and events that were completed during the period, a s if the transaction or event had been consummated at the beginning of the relevant period, (y) the expected leased - up impact of recently completed deve lopments and (z) Ventas’s share of Annualized Adjusted NOI related to nonconsolidated real estate entities; 2. Reflects portf oli o composition based on 1Q21 annualized cash NOI. ▪ New Senior has, pro forma for 12 IL community operating transitions scheduled for July 1, 2021: o 65 IL communities under terminable management contracts with longstanding Ventas manager Holiday Retirement o 21 IL communities under long term management contracts with longstanding Ventas leading operator Atria Senior Living o 16 IL communities under management contracts with other senior housing managers including Grace Management, Merrill Gardens Senior Living, Hawthorn Senior Living and Watermark Retirement Communities ▪ Ventas holds a 34% ownership stake in Atria, and Atria and Holiday recently agreed to combine as one entity; this transaction will enable Ventas to benefit from the scale, technology, team and operating capabilities of both companies 13% 13% 9% 8% 8% 8% 39% Atria Lillibridge Brookdale Wexford Kindred Other Ardent Holiday 2% 58% 23% 12% 5% Watermark Other 1% Atria Hawthorn Holiday

17 Operator Total Properties New Senior Properties New Senior NOI 2 Ventas Properties 240 65 58% 26 • Largest pure - play IL operator in the United States • Focus on affordable, middle - market segment • Terminable management agreement 206 21 23% 170 • 21 Holiday properties transitioned on April 1 • Long term management agreement • Announced Holiday ManCo acquisition on June 21 73 10 12% No • 10 Holiday properties to be transitioned on July 1 • Well - regarded IL operator with presence in 20 states • Long term management agreement 57 1 5% No • Only NNN asset and non - IL property (rental CCRC) in portfolio • Leased through 2030 57 3 1% No • 2 Holiday properties to be transitioned on July 1 • Predominantly IL operator • Long term management agreement 70 3 0% No • Well - known operator and developer • Long term management agreement Total -- 103 100% -- Builds on Existing Relationships with Leading Operators; Adds New Operators 1 4 1. As adjusted for scheduled transitions scheduled to occur for New Senior’s IL communities; 2. Percent of 1Q21 cash NOI Current Ventas Operators

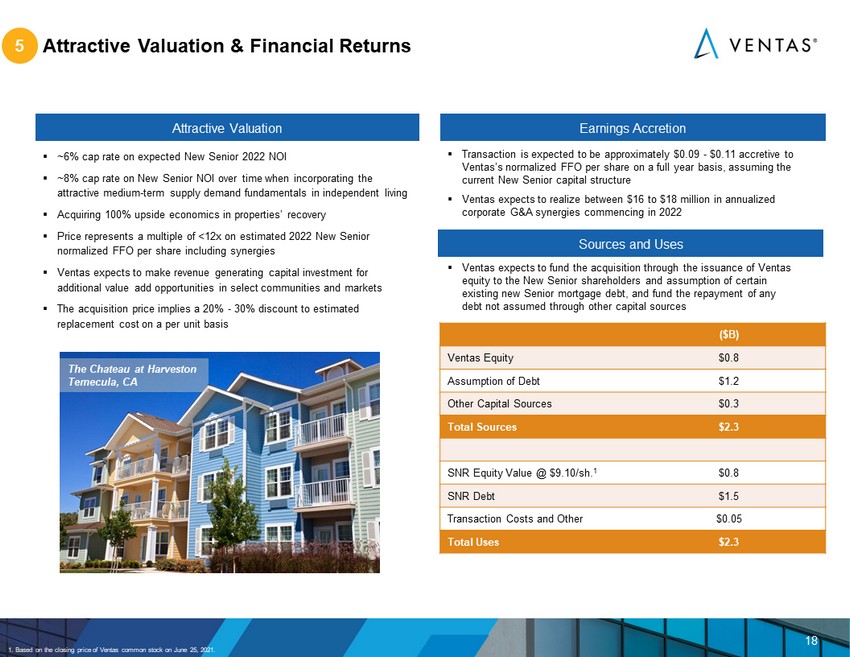

18 Attractive Valuation & Financial Returns Attractive Valuation Earnings Accretion ▪ ~6% cap rate on expected New Senior 2022 NOI ▪ ~8% cap rate on New Senior NOI over time when incorporating the attractive medium - term supply demand fundamentals in independent living ▪ Acquiring 100% upside economics in properties’ recovery ▪ Price represents a multiple of <12x on estimated 2022 New Senior normalized FFO per share including synergies ▪ Ventas expects to make revenue generating capital investment for additional value add opportunities in select communities and markets ▪ The acquisition price implies a 20% - 30% discount to estimated replacement cost on a per unit basis ▪ Transaction is expected to be approximately $0.09 - $0.11 accretive to Ventas’s normalized FFO per share on a full year basis, assuming the current New Senior capital structure ▪ Ventas expects to realize between $16 to $18 million in annualized corporate G&A synergies commencing in 2022 5 The Chateau at Harveston Temecula, CA ($B) Ventas Equity $0.8 Assumption of Debt $1.2 Other Capital Sources $0.3 Total Sources $2.3 SNR Equity Value @ $9.10/sh. 1 $0.8 SNR Debt $1.5 Transaction Costs and Other $0.05 Total Uses $2.3 Sources and Uses ▪ Ventas expects to fund the acquisition through the issuance of Ventas equity to the New Senior shareholders and assumption of certain existing new Senior mortgage debt, and fund the repayment of any debt not assumed through other capital sources 1. Based on the closing price of Ventas common stock on June 25, 2021.

19 Transaction Benefits and Strategic Rationale Enhances Ventas’s senior housing position at a cyclical inflection point in advance of the expected powerful senior housing industry recovery Adds a superior quality, high performing portfolio to Ventas that is well located in advantaged markets Expands Ventas’s exposure to independent living in the U.S., catering to a large and growing middle market Builds on existing relationships with leading operators; adds new operators Attractive valuation & financial returns 1 2 3 4 5