Attached files

| file | filename |

|---|---|

| 8-K - 8-K - N-able, Inc. | n-ableincx8xkannouncingeff.htm |

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. June 2021 Investor Presentation

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Disclaimers General This presentation and the accompanying oral presentation do not constitute an offer or invitation for the sale or purchase ofsecurities and has been prepared solely for informational purposes. The information contained in this presentation (the “Presentation”) has been prepared to assist financial analysts in making their own evaluation of N-able, Inc. in connection with publishing independent research reports and for no other purpose. This Presentation is subject to updating, completion, revision, verification and further amendment. None of N-able or its respective affil iates has authorized anyone to provide interested parties with additional or different information. The information contained herein does not purport to be all-inclusive or contain all of the information that may be required to make a full analysis of N-able. Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the federal securities law. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management and involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “aim,” “anticipate,” “believe,” “can,” “could,” “seek,” “should,” “feel,” “expect,” “will ,” “would,” “plan,” “project,” “intend,” “estimate,” “continue,” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may c ause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not l imited to, the following: (a) the risk that the spin-off may not be completed in a timely manner or at all; (b) our ability to defend against a nd mitigate cyberattacks, such as the cyberattack on SolarWinds Orion Software Platform and internal systems (the “Cyber Incident”), to our IT systems and those of our MSP partners and their SME customers; (c) potential tax l iabilities that may arise as a result of the spin-off; (d) our ability to operate as an independent publicly traded company, including compliance with applicable laws and regulations; (d) financial, legal, reputational and other risks to us related to the Cyber Incident, including risks that the incident may result in the loss, compromise or corruption of data, loss of business as a result of termination or non-renewal of agreements or reduced purchases or upgrades of our products, severe reputational damage adversely affecting customer, partner and vendor relationships and investor confidence, increased attrition of personnel and distraction of key and other personnel; (e) the possibility that the global COVID-19 pandemic and the Cyber Incident may adversely affect our business, results of operation s and financial condition; (f) any of the following factors either generally or as a result of the impacts of the global COVID-19 pandemic on the global economy or on our business operations and financial condition or on the business operations and financial conditions of our MSP partners and their SME customers: (1) reductions in information technology spending or delays in purchasing decisions by our MSP partners and their SME customers, (2) the inability to sell products to new MSP partners or to sell additional products or upgrades to our existing MSP partners, (3) any decline in our renewal or net revenue retention rates, (4) the inability to generate significant volumes of high quality sales leads from our digital marketing initiatives and convert such leads into new business at acceptable conversion rates, (5) the timing and adoption of new products, product upgrades or pricing model changes by us our competitors, (6) potential foreign exchange gains and losses related to expenses and sales denominated in currencies other than the functional currency of an associated entity, and (7) risks associated with our international operations; (g) the possibility that our operating income could fluctuate and may decline as percentage of revenue as we make further expenditures to support our business or expand our operations; (h) our inability to successfully identify, complete, and integrate acquisitions and manage our growth effectively; (i) our status as a controlled company; (j) Our status as an emerging growth company; and (k) such other risks and uncertainties described more fully in documents fi led with or furnished to the Securities and Exchange Commission by us or by SolarWinds Corporation, including the risk factors discussed in our registration statement on Form 10, as fi led with the Securities and Exchange Commission on April 6, 2021 and the SolarWinds Annual Report on Form 10-K for the period ended December 31, 2020 fi led on March 1, 2021. All information provided in this presentation is as of the date hereof and we undertake no duty to update this information except as required by law. 2

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Disclaimers continued Non-GAAP Financial Measures In addition to financial information prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets and determining compensation. The excluded items include the impact of purchase accounting, amortization of acquired intangible assets, stock-based compensation, acquisition and sponsor related costs, restructuring charges, unrealized foreign currency gains (losses) and certain debt-related costs. Please see the appendix at the end of this presentation for a description of these adjustments and a reconciliation of each non-GAAP financial measure to its nearest GAAP equivalent. The non-GAAP measures have limitations, and you should not consider them in isolation or as a substitute for our GAAP financial information. Presentation of Financials The spin-off of N-able by SolarWinds Corporation is anticipated to be completed towards the beginning of the third quarter of 2021. The Company’s financial statements for the periods prior to the spin-off are presented on a “carve-out” basis. The historical financial information in this presentation we have included does not reflect what our financial condition, results of operations or cash flows would have been had we been a stand-alone entity during the historical periods presented, or what our financial condition, results of operations or cash flows will be in the future as an independent entity. Accordingly, these historical results should not be relied upon as an indicator of our future performance. In addition, our financial projections do not include any costs or liabilities associated with the Cyber Incident. Confidentiality This presentation and the accompanying oral presentation are strictly confidential and is for you to familiarize yourself with the company. All confidential information is subject to the terms of the non-disclosure agreement entered into between the parties and we request that you keep such information we provide at this meeting confidential and that you do not disclose any of the information to any other parties without our prior express written permission. 3

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Spin-off transaction summary Overview • In August 2020, SolarWinds announced its board of directors authorized management to explore a potential spin-off of its MSP business into a newly created and separately traded public company (N-able) • N-able is a leading global provider of cloud-based software solutions for managed service providers (MSPs), enabling them to support digital transformation and growth within small and medium-sized enterprises (SMEs) Listing • NYSE: NABL Distribution • When-issued trading period: July 9 – July 19 • Record date: July 12 • Distribution date: July 19 • Regular way trading begins: July 20 Capital Structure • In connection with the spin-off, we expect to put a new credit facility in place, consisting of a $350M Term Loan B and a $60M Revolving Credit Facility • Pro forma for the transaction, N-able expects total gross and net leverage of ~2.9x and ~2.5x, respectively1 4 1 Based on FY 2020 Adjusted EBITDA of $121M

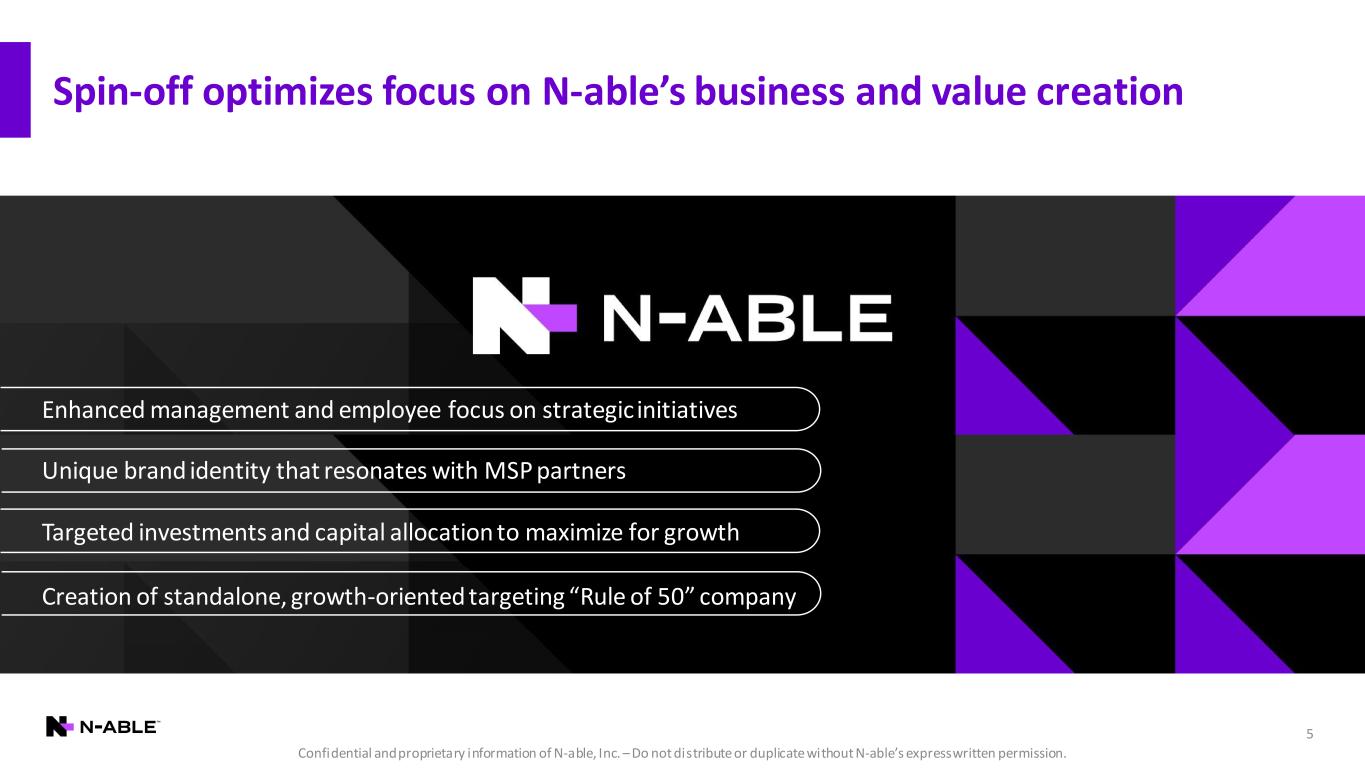

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Spin-off optimizes focus on N-able’s business and value creation 5 Enhanced management and employee focus on strategic initiatives Creation of standalone, growth-oriented targeting “Rule of 50” company Targeted investments and capital allocation to maximize for growth Unique brand identity that resonates with MSP partners

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Company Overview

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Empowering MSPs through purpose-built technology to enable and accelerate digital transformation for small to medium-sized enterprises 7

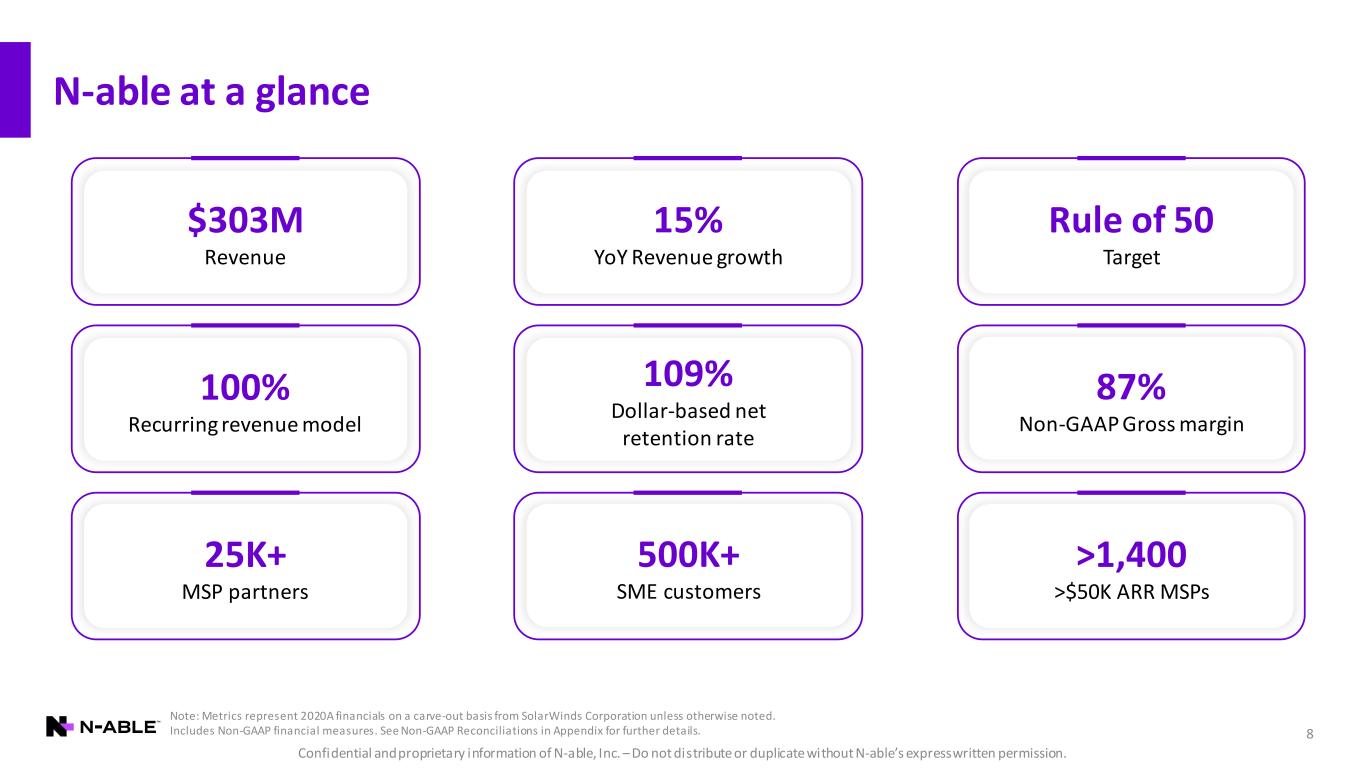

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. N-able at a glance Note: Metrics represent 2020A financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details. 8 25K+ MSP partners 109% Dollar-based net retention rate $303M Revenue 15% YoY Revenue growth Rule of 50 Target 100% Recurring revenue model >1,400 >$50K ARR MSPs 500K+ SME customers 87% Non-GAAP Gross margin

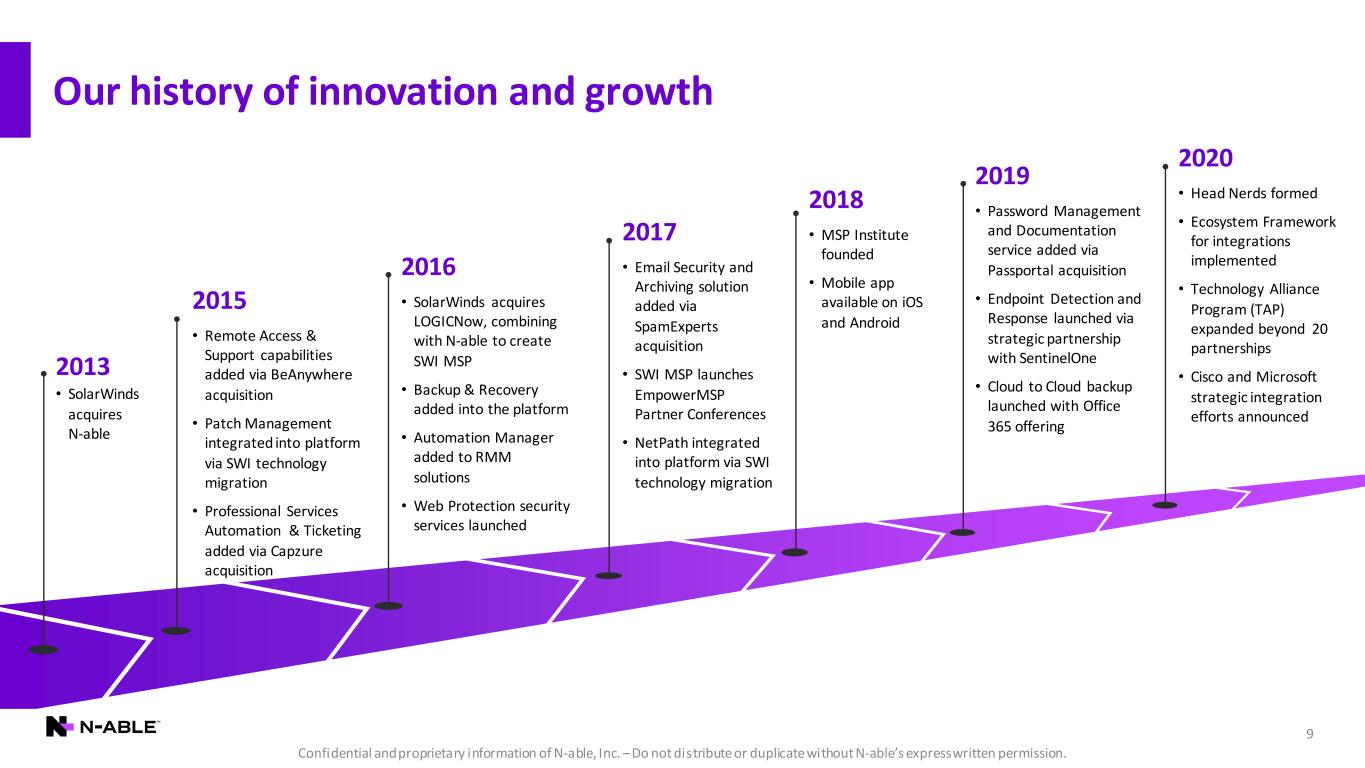

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Our history of innovation and growth 9 2013 • SolarWinds acquires N-able 2015 • Remote Access & Support capabilities added via BeAnywhere acquisition • Patch Management integrated into platform via SWI technology migration • Professional Services Automation & Ticketing added via Capzure acquisition 2016 • SolarWinds acquires LOGICNow, combining with N-able to create SWI MSP • Backup & Recovery added into the platform • Automation Manager added to RMM solutions • Web Protection security services launched 2017 • Email Security and Archiving solution added via SpamExperts acquisition • SWI MSP launches EmpowerMSP Partner Conferences • NetPath integrated into platform via SWI technology migration 2018 • MSP Institute founded • Mobile app available on iOS and Android 2019 • Password Management and Documentation service added via Passportal acquisition • Endpoint Detection and Response launched via strategic partnership with SentinelOne • Cloud to Cloud backup launched with Office 365 offering 2020 • Head Nerds formed • Ecosystem Framework for integrations implemented • Technology Alliance Program (TAP) expanded beyond 20 partnerships • Cisco and Microsoft strategic integration efforts announced

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. We believe COVID has validated our value to MSPs and SMEs 10 Mission critical value Transitory headwinds, long-term opportunity • Accelerated digital transformation by SMEs throughout the pandemic, with increased demand for secure, modern remote work environments • We believe MSPs became more important to SMEs during the pandemic, delivering critical services powered by our platform • We believe IT management and security of distributed workforces sustain long-term demand for our solutions in a post-COVID world • Q2’20 saw increased churn and downgrades from existing partners and slower pace of partner additions • Improvement over the remainder of 2020, including expansion within existing partners and growth in new additions

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Update on cyber incident 11 • On 12/14/20, SolarWinds announced that it had been the victim of a cyberattack on its Orion Software Platform and internal systems (the “Cyber Incident”) • Based on investigations to date: • Malicious code known as Sunburst was injected into builds of SolarWinds’ Orion Software Platform released between March and June 2020, which if present and activated, could potentially allow an attacker to compromise the server on which the Orion Software Platform was installed • SolarWinds has not identified Sunburst in any of its more than 70 non-Orion products and tools, including, as previously disclosed, any of our N-able solutions • The threat actor compromised credentials and conducted research and surveillance through persistent access to the SolarWinds software development environment and internal systems, including its Office 365 environment, for at least nine months prior to initiating a test run of its ability to inject code into builds of the Orion Software Platform in October 2019 • During this entire period, we were a part of the SolarWinds’ shared environment and the threat actor had persistent access to our systems and Office 365 environment • The threat actor created and moved files that we believe contained source code for our products and that may have contained data about our MSP partners and data relating to trial and product activation of our N-central On Demand solution • The threat actor accessed the email accounts of certain of our personnel, some of which contained information related to current or former employees and MSP partners • We believe the cyber incident has had an adverse impact on our reputation, new subscription sales and net retention rates, including in the first quarter of 2021, but we expect such impacts to diminish over time in the absence of new discoveries or events

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Summary of cyber indemnification 12 Under the separation agreement, SolarWinds will indemnify us for all liabilities based upon, arising out of, or relating to t he cyber incident, including for: • Actions brought by third parties within four years after the separation related to the cyber incident with respect to either our or SolarWinds’ products or services or any breach or exfiltration of information; • Actions brought by SolarWinds stockholders related to the cyber incident; • Any investigation that we conduct following our discovery within four years after the separation of a cyber event relating to , arising out of or resulting from the cyber incident; and • Actions brought by third parties with respect to statements in our public disclosure documents regarding the cyber incident t o the extent based on information provided to us by SolarWinds for use in such documents. In future periods, we may incur additional costs related to the cyber incident but do not have a reasonable estimate of poten tial costs and have not included amounts in our financial projections. Under the separation agreement, we will be responsible for: • Our costs related to compliance, mitigation, increased or changed IT, cybersecurity, research and development and additional personnel and related costs with respect to improving, enhancing or hardening the cyber security or defenses of our environment; • Other than to the extent otherwise covered by SolarWinds’ indemnity, our disclosure documents or any other public statements made by us or our directors or officers after the separation related to the cyber incident; and • Any consequential, special, or exemplary liabilities from any loss of customers, vendors, partners, employees or other commercial relationships or any increase in insurance premiums, whether or not relating to, arising out of resulting from the cyber inci dent. Note: The foregoing summary of the separation agreement to be entered into in connection with the spin-off is qualified in its entirety by reference to the full text of such agreement, a form of which is filed with N-able’s Form 10 registration statement, available on the SEC website at www.sec.gov under the name “N-able, Inc.”.

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 13 Digital transformation is a priority for SMEs 1 IDC FutureScape: Worldwide SMB 2019 Predictions of SMEs will have digital transformation as a key part of their IT strategies by end of 2023167% Cloud / Hybrid IT Security Distributed workforce Digital-first, Always-on

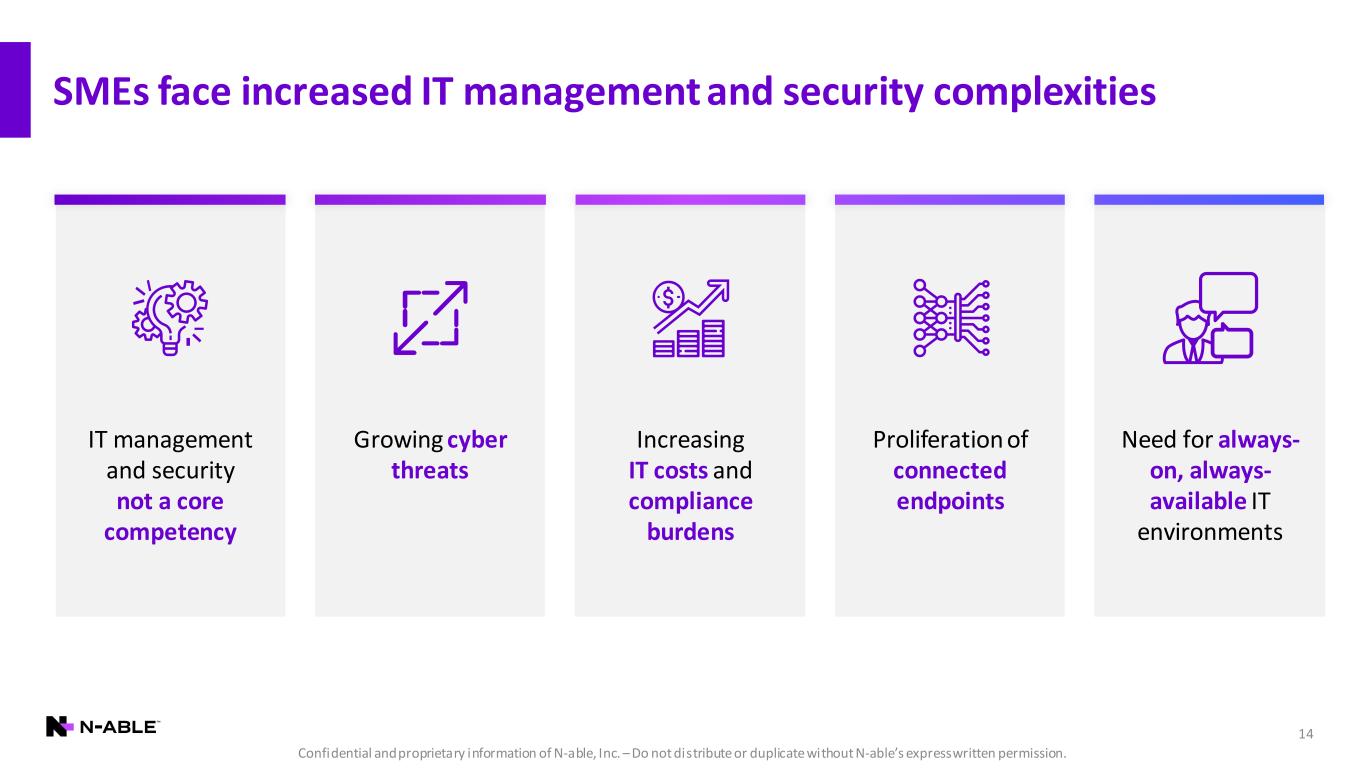

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 14 SMEs face increased IT management and security complexities IT management and security not a core competency Growing cyber threats Increasing IT costs and compliance burdens Proliferation of connected endpoints Need for always- on, always- available IT environments

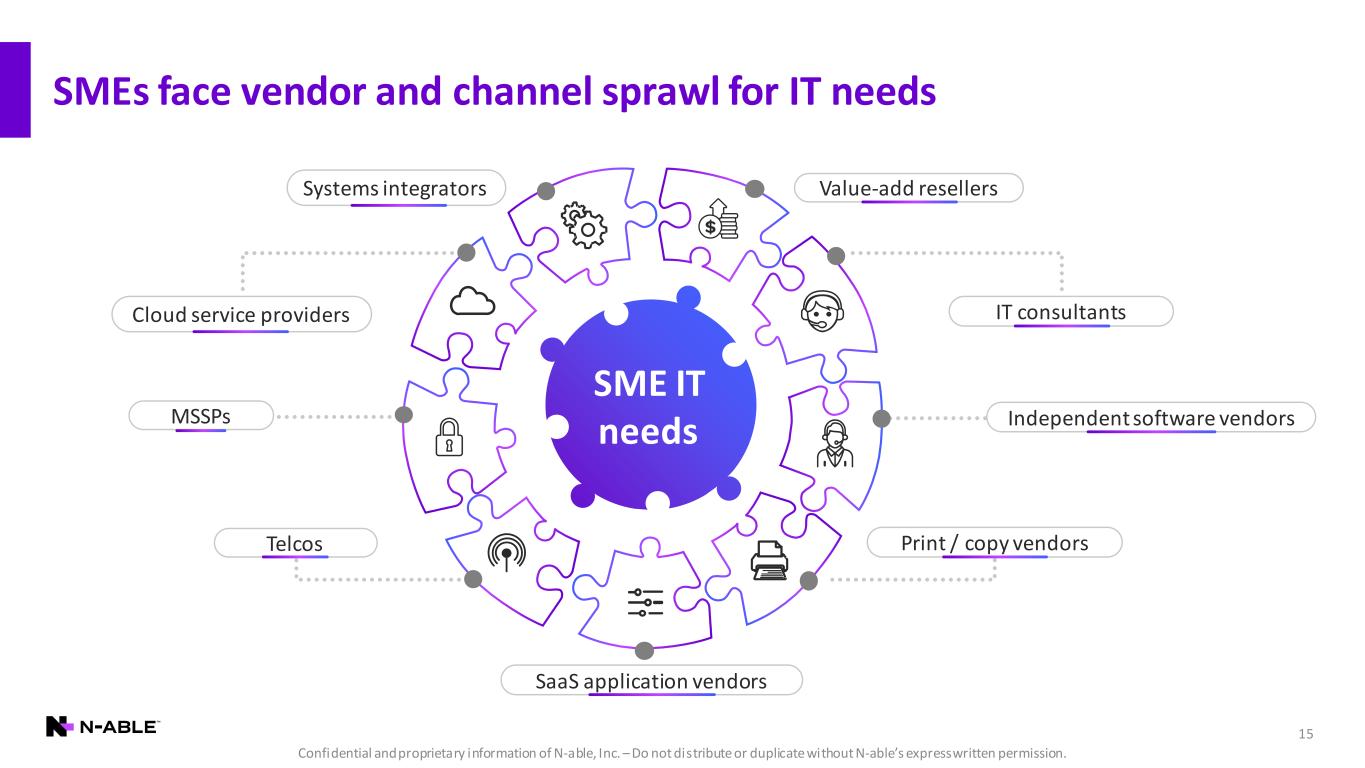

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. SMEs face vendor and channel sprawl for IT needs 15 SME IT needs Value-add resellersSystems integrators IT consultants Independent software vendors SaaS application vendors Print / copy vendors MSSPs Cloud service providers Telcos

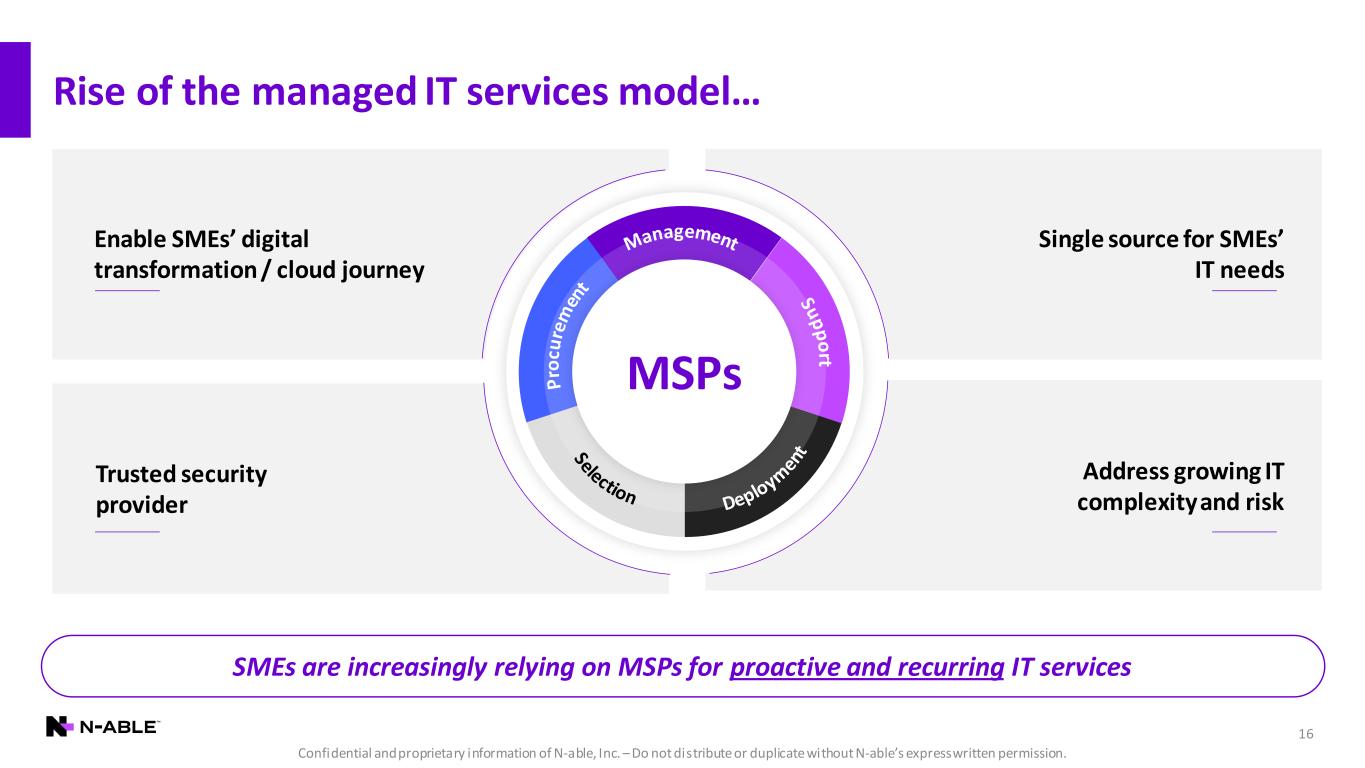

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSPs SMEs are increasingly relying on MSPs for proactive and recurring IT services 16 Rise of the managed IT services model… Enable SMEs’ digital transformation / cloud journey Trusted security provider Single source for SMEs’ IT needs Address growing IT complexity and risk

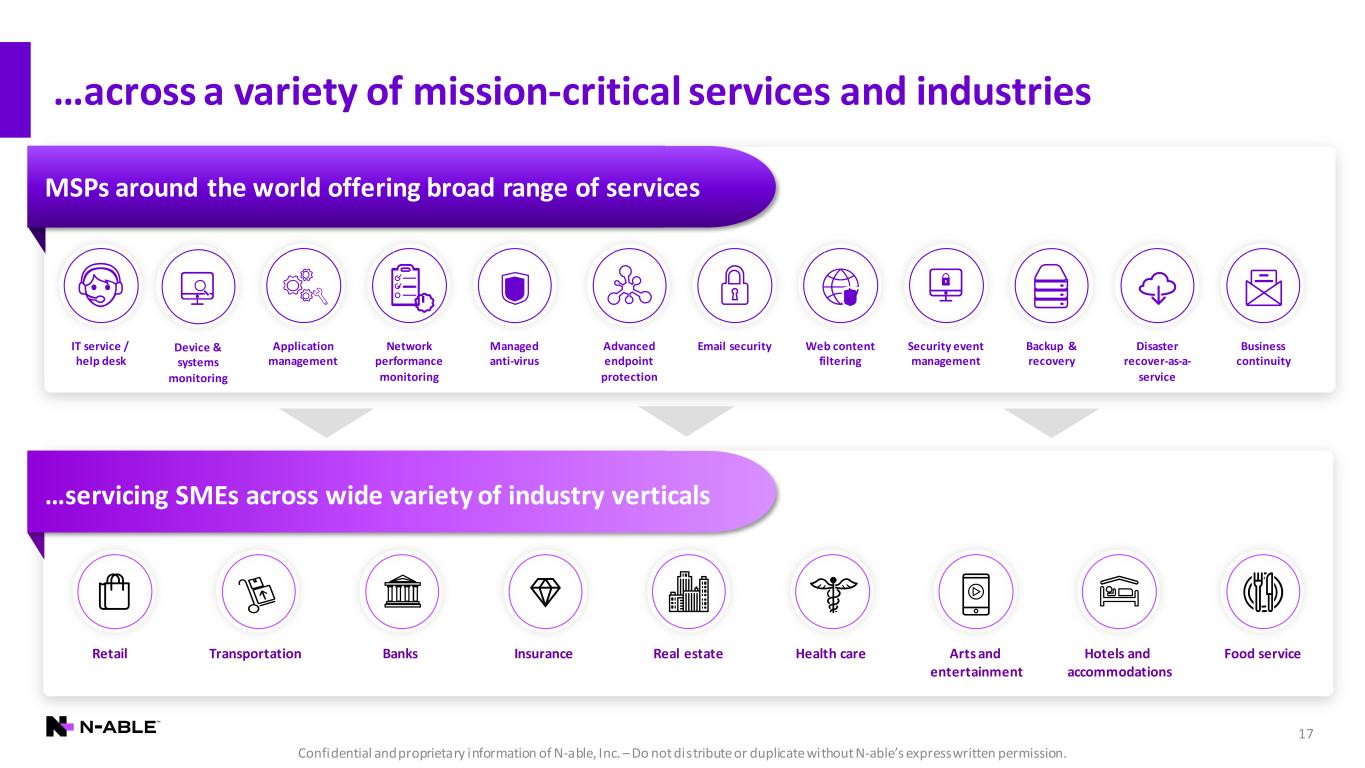

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 17 …across a variety of mission-critical services and industries MSPs around the world offering broad range of services IT service / help desk Application management …servicing SMEs across wide variety of industry verticals Network performance monitoring Managed anti-virus Advanced endpoint protection Web content filtering Backup & recovery Business continuity Retail Transportation Banks Insurance Real estate Health care Arts and entertainment Hotels and accommodations Food service Email security Security event management Disaster recover-as-a- service Device & systems monitoring !

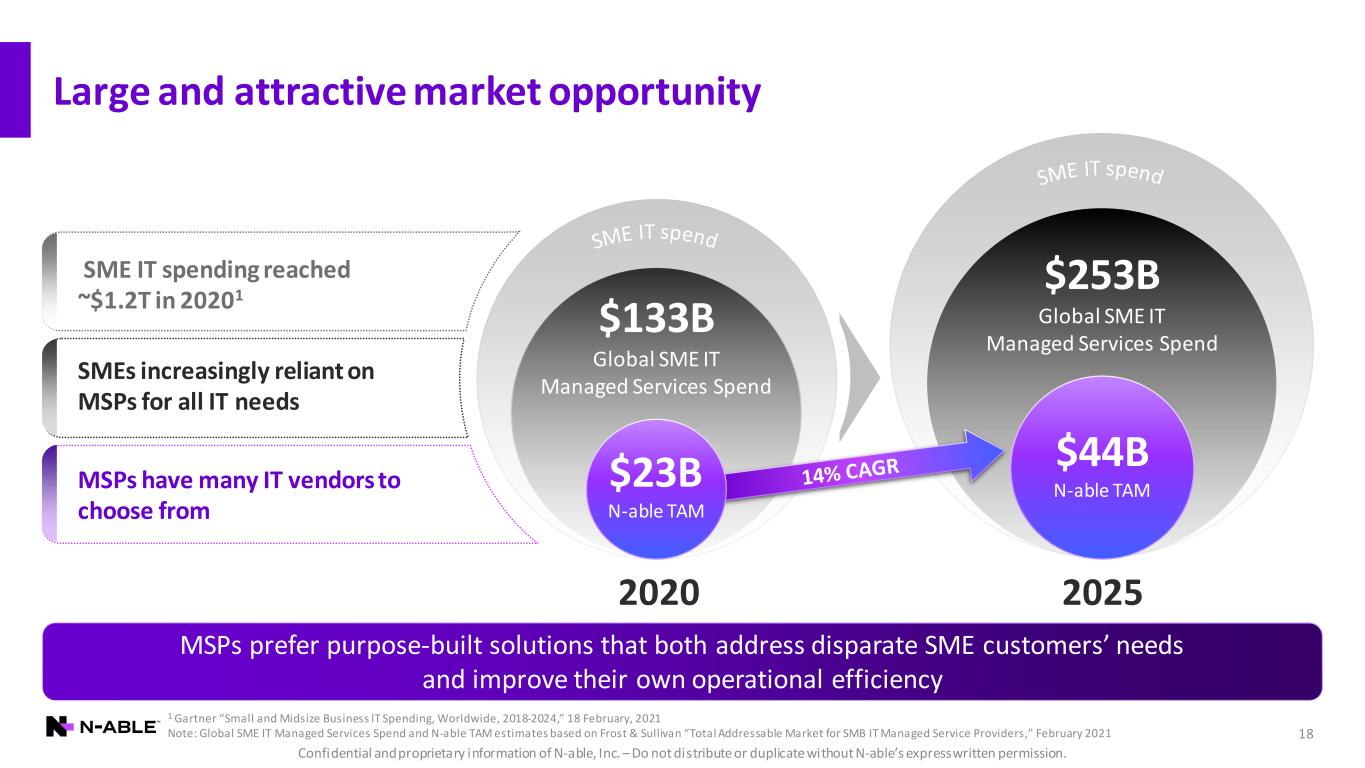

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 1 Gartner “Small and Midsize Business IT Spending, Worldwide, 2018-2024,” 18 February, 2021 Note: Global SME IT Managed Services Spend and N-able TAM estimates based on Frost & Sullivan “Total Addressable Market for SMB IT Managed Service Providers,” February 2021 18 Large and attractive market opportunity 20252020 MSPs prefer purpose-built solutions that both address disparate SME customers’ needs and improve their own operational efficiency $253B Global SME IT Managed Services Spend $133B Global SME IT Managed Services Spend $44B N-able TAM$23B N-able TAM SME IT spending reached ~$1.2T in 20201 SMEs increasingly reliant on MSPs for all IT needs MSPs have many IT vendors to choose from

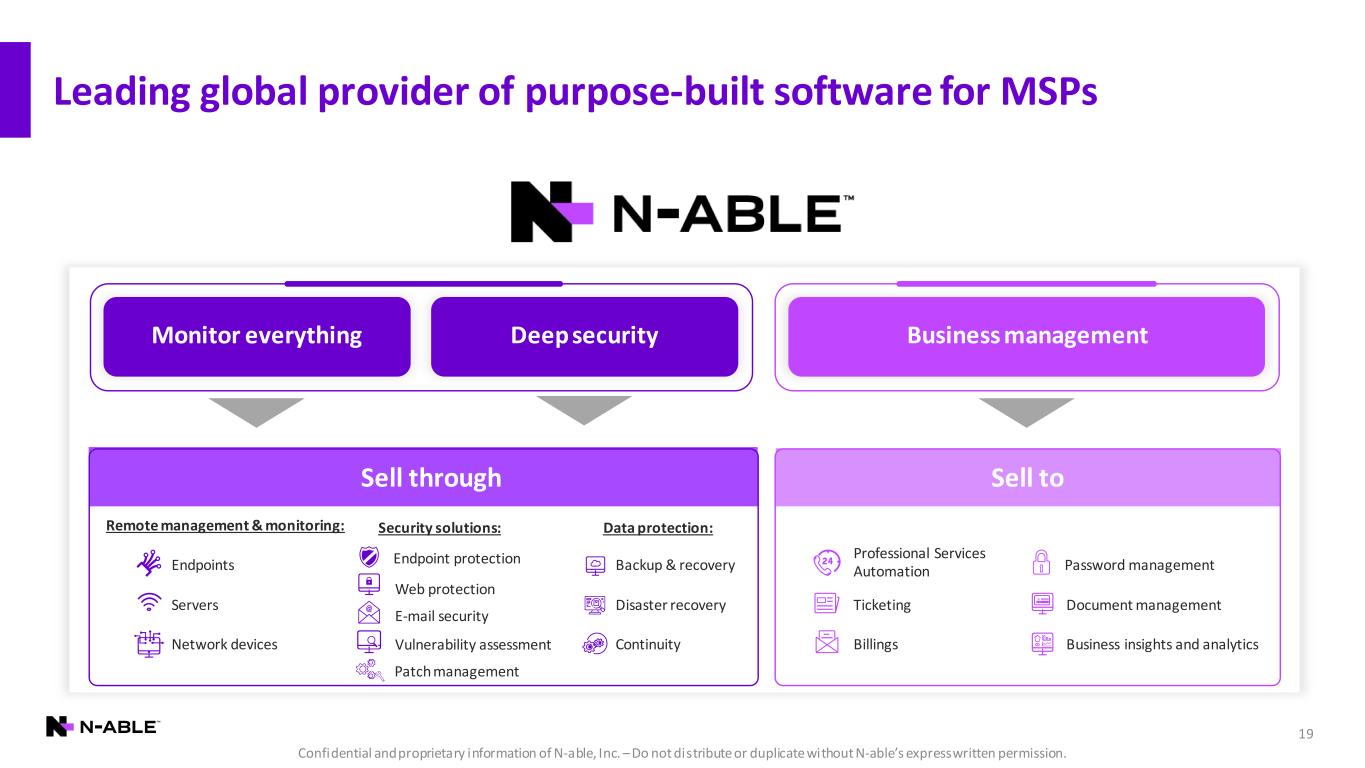

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Leading global provider of purpose-built software for MSPs 19 Business management Sell through Sell to Data protection: Backup & recovery Disaster recovery Continuity Remote management & monitoring: Endpoints Servers Network devices Professional Services Automation Ticketing Billings Security solutions: Endpoint protection Web protection E-mail security Vulnerability assessment Password management Document management Business insights and analytics Monitor everything Deep security Patch management

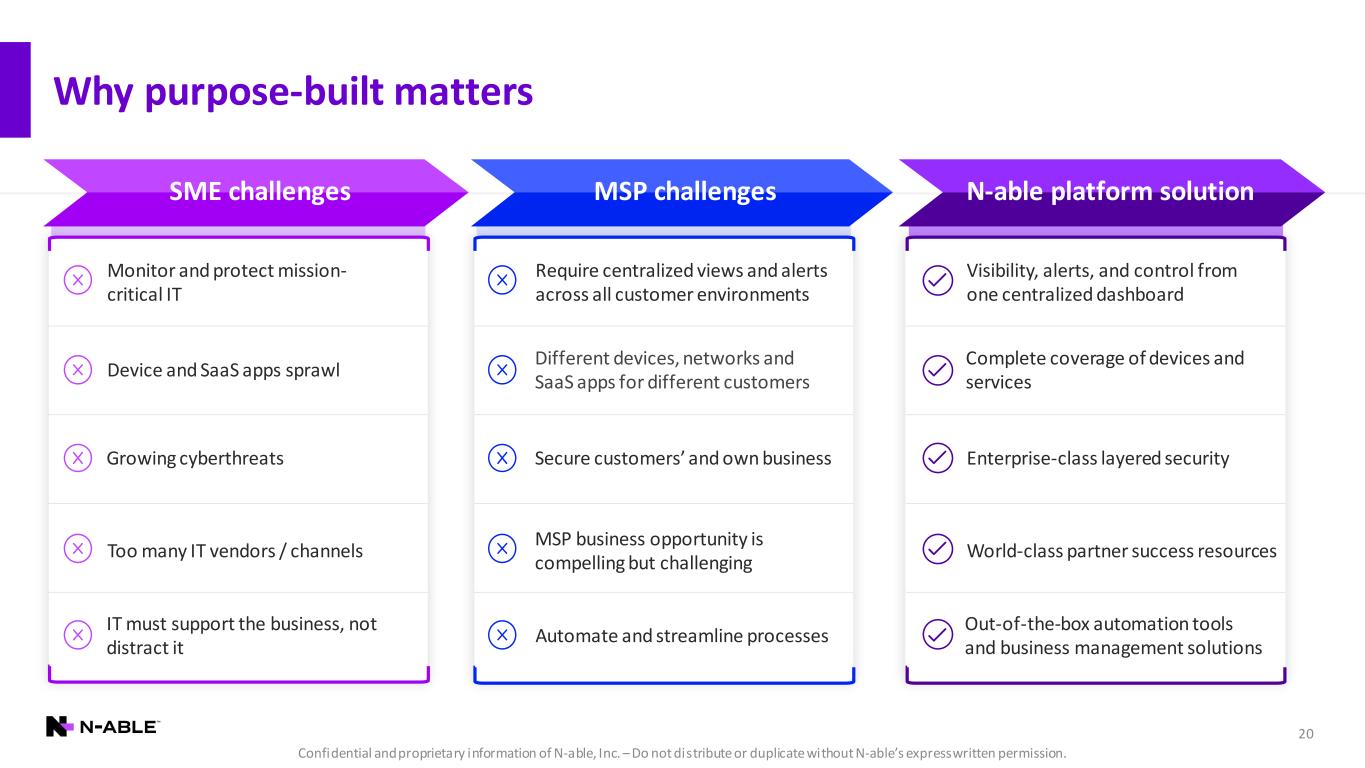

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 20 Why purpose-built matters Visibility, alerts, and control from one centralized dashboard Require centralized views and alerts across all customer environments Enterprise-class layered securitySecure customers’ and own business World-class partner success resources MSP business opportunity is compelling but challenging Different devices, networks and SaaS apps for different customers Automate and streamline processes Complete coverage of devices and services Out-of-the-box automation tools and business management solutions Device and SaaS apps sprawl Monitor and protect mission- critical IT Growing cyberthreats IT must support the business, not distract it Too many IT vendors / channels SME challenges MSP challenges N-able platform solution

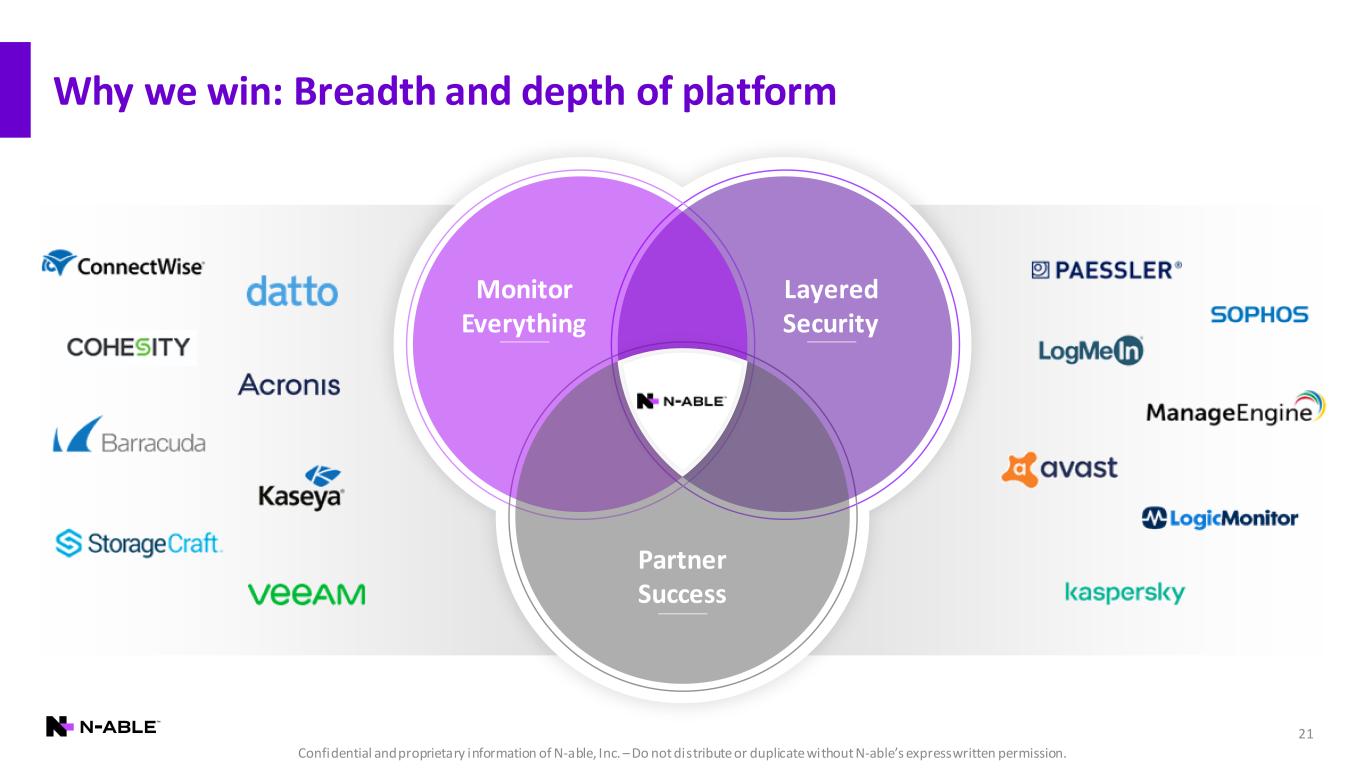

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 21 Why we win: Breadth and depth of platform Monitor Everything Layered Security Partner Success

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Experienced management team with culture of innovation 22Note: Reflects post-separation expected corporate titles. Mike Cullen Group Vice President, Partner Success Mav Turner Group Vice President, Product Management Jeff Nulsen Senior Vice President, Chief Marketing Officer Sara Foley Vice President, Product Management Joel Kemmerer Group Vice President, Chief Information Officer Kevin Bury Senior Vice President, Chief Customer Officer Tim O’Brien Executive Vice President, Chief Financial Officer Mike Adler Executive Vice President, Chief Technology Officer Frank Colletti Executive Vice President, Worldwide Sales Peter Anastos Executive Vice President, General Counsel John Pagliuca President, Chief Executive Officer Kathleen Pai Executive Vice President, Chief People Officer

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Platform & Technology Overview

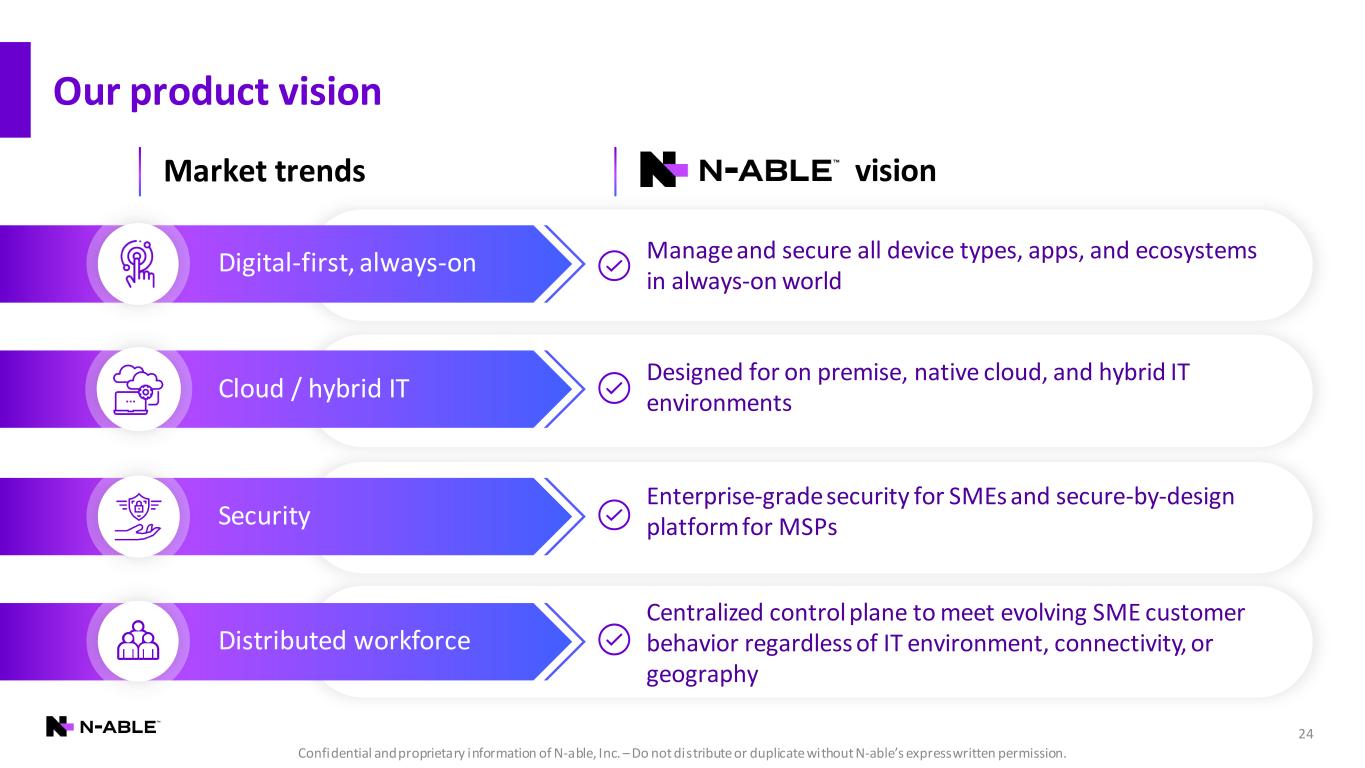

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Our product vision 24 Market trends Digital-first, always-on Cloud / hybrid IT Security Distributed workforce Manage and secure all device types, apps, and ecosystems in always-on world Designed for on premise, native cloud, and hybrid IT environments Enterprise-grade security for SMEs and secure-by-design platform for MSPs Centralized control plane to meet evolving SME customer behavior regardless of IT environment, connectivity, or geography vision

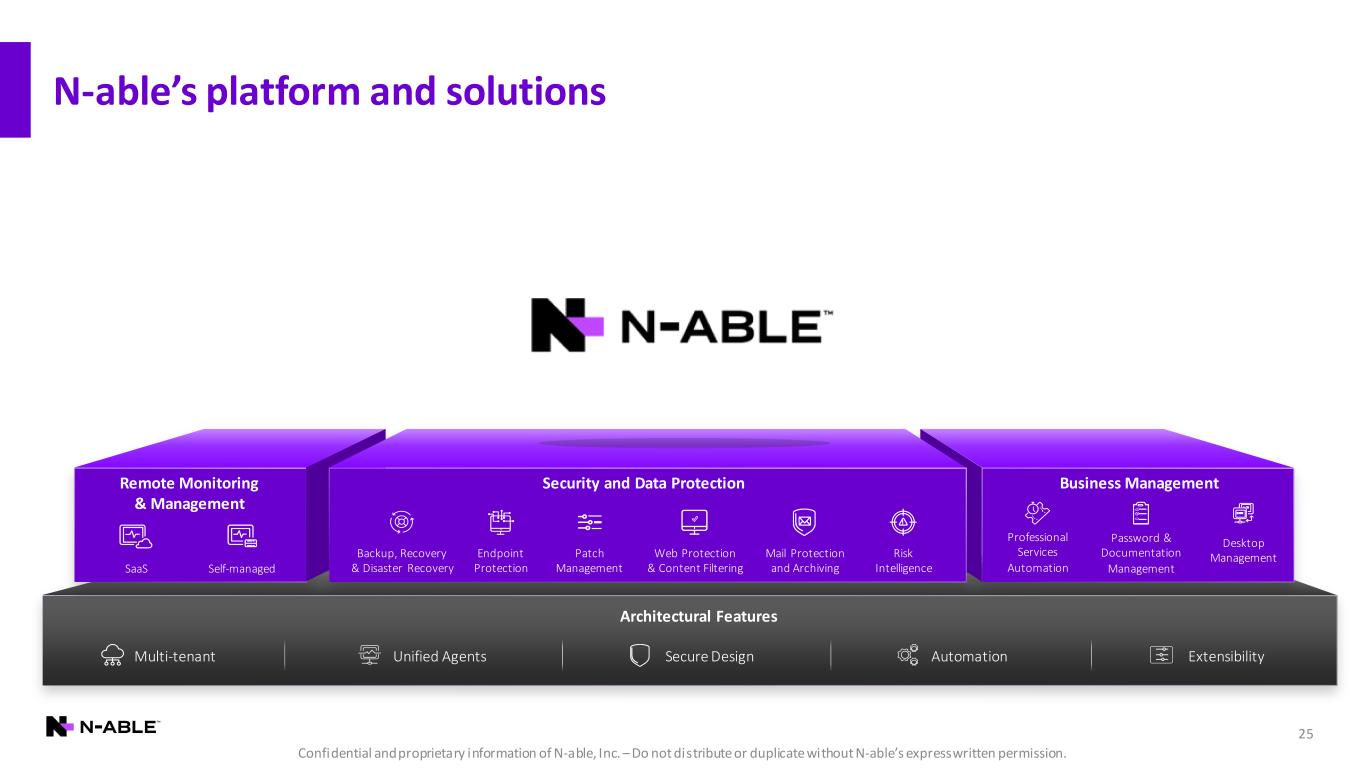

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 25 N-able’s platform and solutions Architectural Features SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Professional Services Automation Password & Documentation Management Desktop Management Business Management Unified Agents ExtensibilityMulti-tenant Secure Design Automation

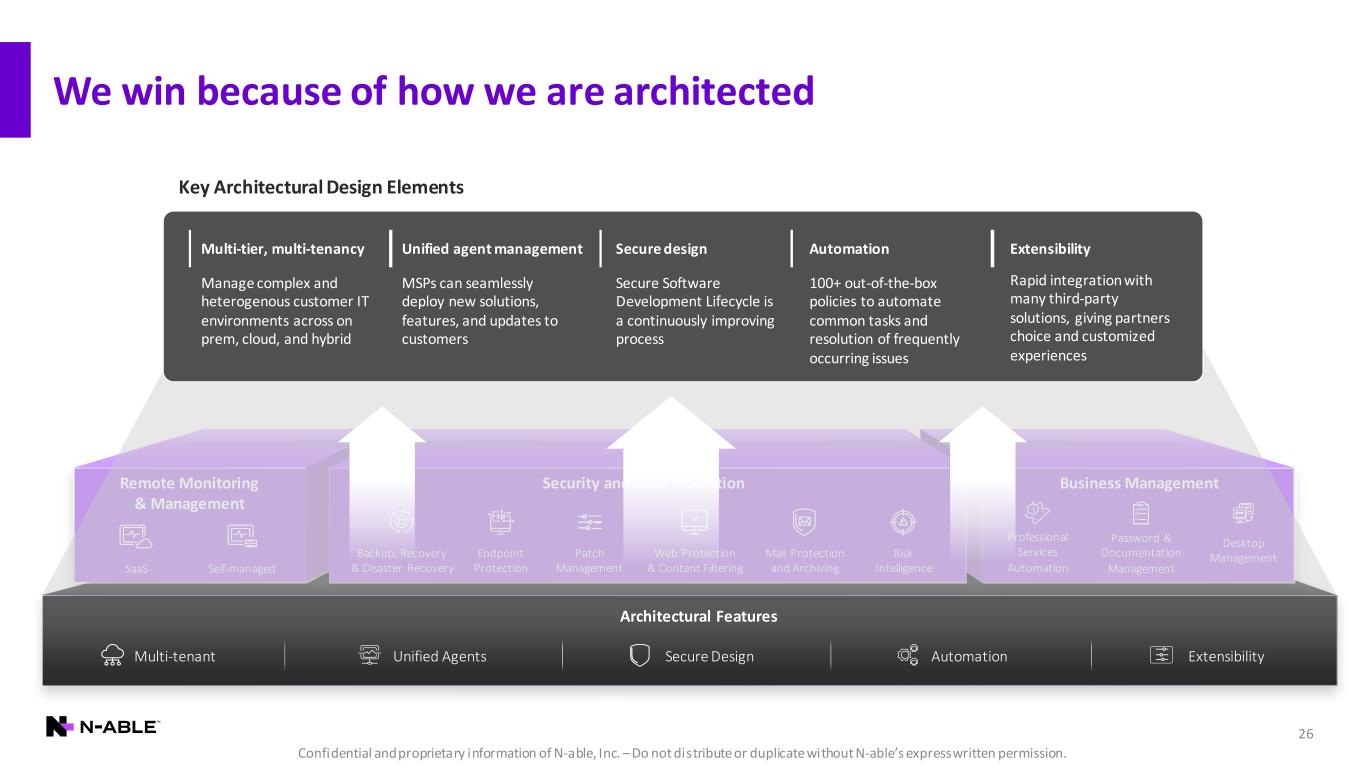

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 26 We win because of how we are architected Architectural Features Unified Agents ExtensibilityMulti-tenant Secure Design Automation SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Password & Documentation Management Desktop Management Business Management Professional Services Automation Key Architectural Design Elements Multi-tier, multi-tenancy Unified agent management ExtensibilitySecure design Automation Manage complex and heterogenous customer IT environments across on prem, cloud, and hybrid MSPs can seamlessly deploy new solutions, features, and updates to customers Rapid integration with many third-party solutions, giving partners choice and customized experiences Secure Software Development Lifecycle is a continuously improving process 100+ out-of-the-box policies to automate common tasks and resolution of frequently occurring issues

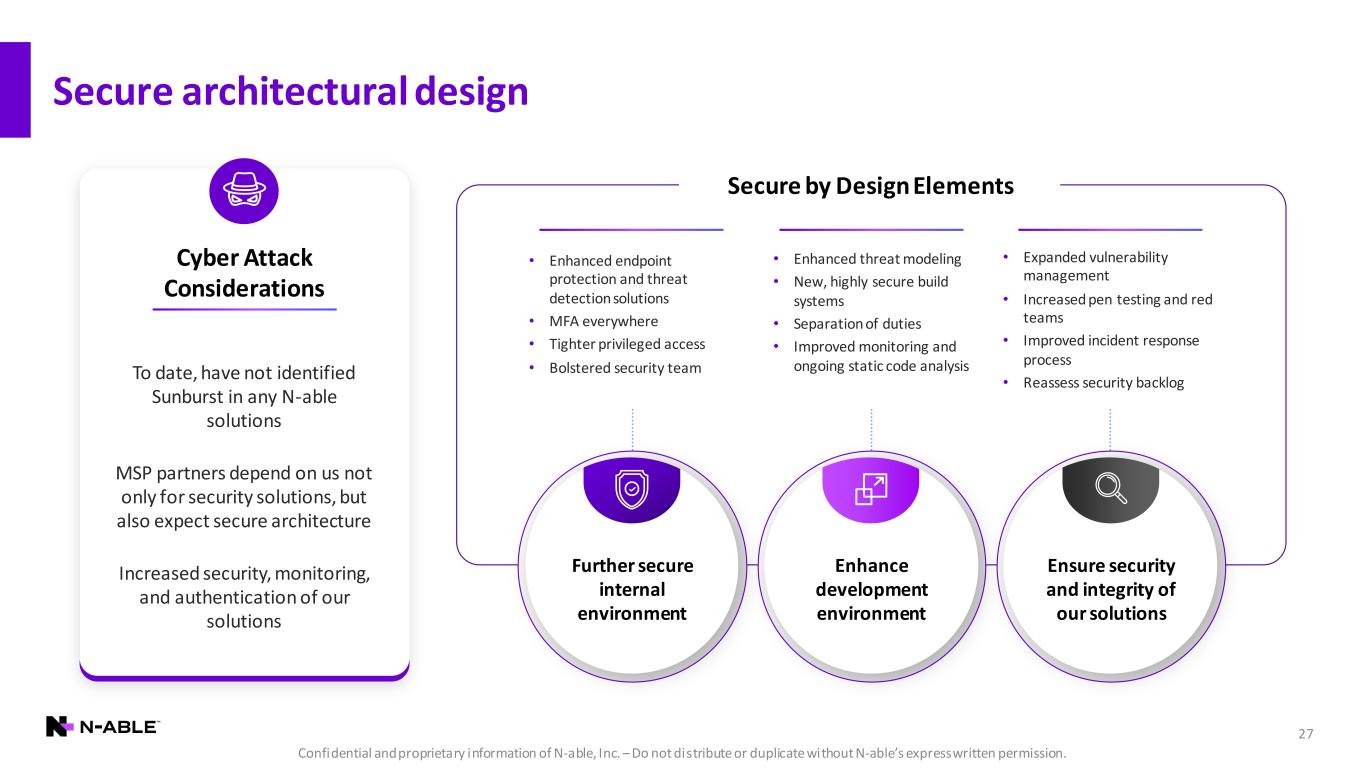

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 27 • Enhanced endpoint protection and threat detection solutions • MFA everywhere • Tighter privileged access • Bolstered security team • Enhanced threat modeling • New, highly secure build systems • Separation of duties • Improved monitoring and ongoing static code analysis • Expanded vulnerability management • Increased pen testing and red teams • Improved incident response process • Reassess security backlog Further secure internal environment Enhance development environment Ensure security and integrity of our solutions Secure by Design Elements To date, have not identified Sunburst in any N-able solutions MSP partners depend on us not only for security solutions, but also expect secure architecture Increased security, monitoring, and authentication of our solutions Cyber Attack Considerations Secure architectural design

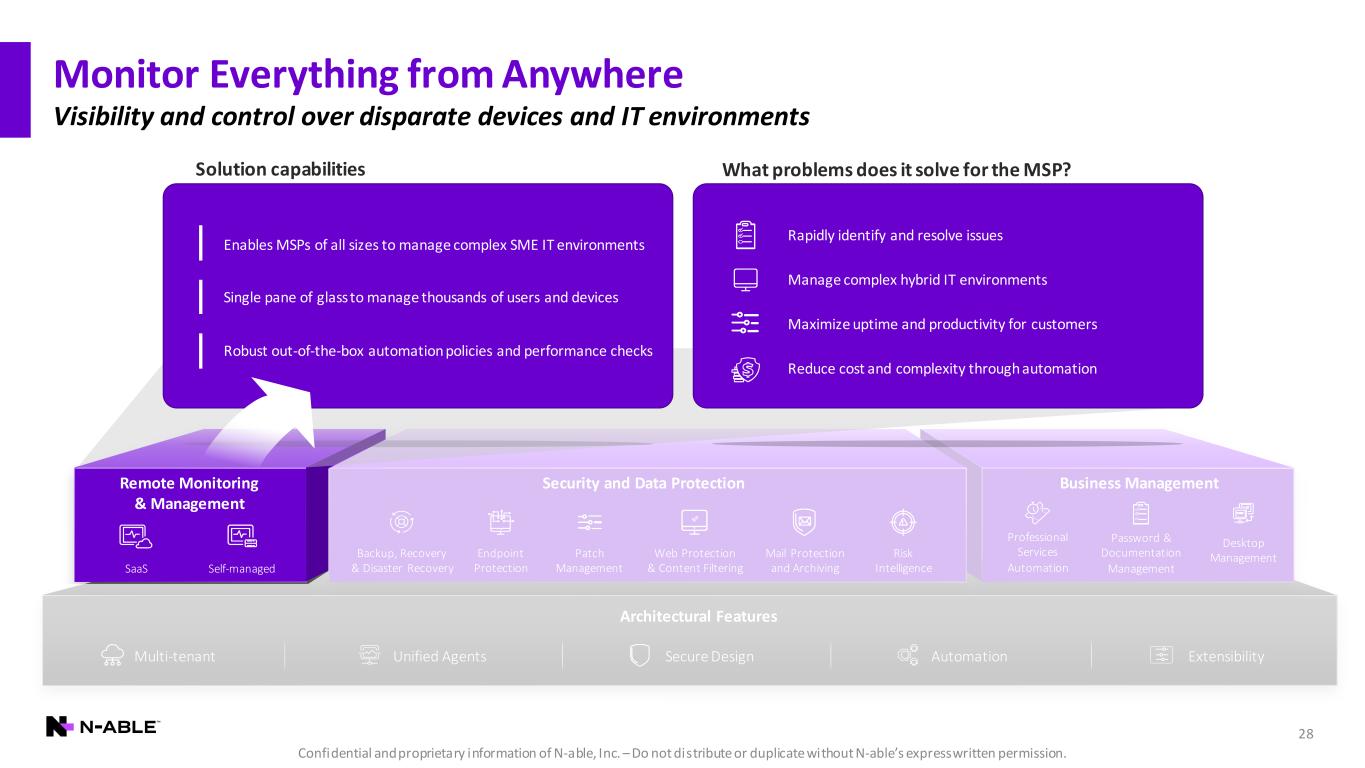

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 28 Monitor Everything from Anywhere Visibility and control over disparate devices and IT environments Solution capabilities What problems does it solve for the MSP? Architectural Features SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Password & Documentation Management Desktop Management Business Management Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Enables MSPs of all sizes to manage complex SME IT environments Single pane of glass to manage thousands of users and devices Robust out-of-the-box automation policies and performance checks Rapidly identify and resolve issues Manage complex hybrid IT environments Maximize uptime and productivity for customers Reduce cost and complexity through automation

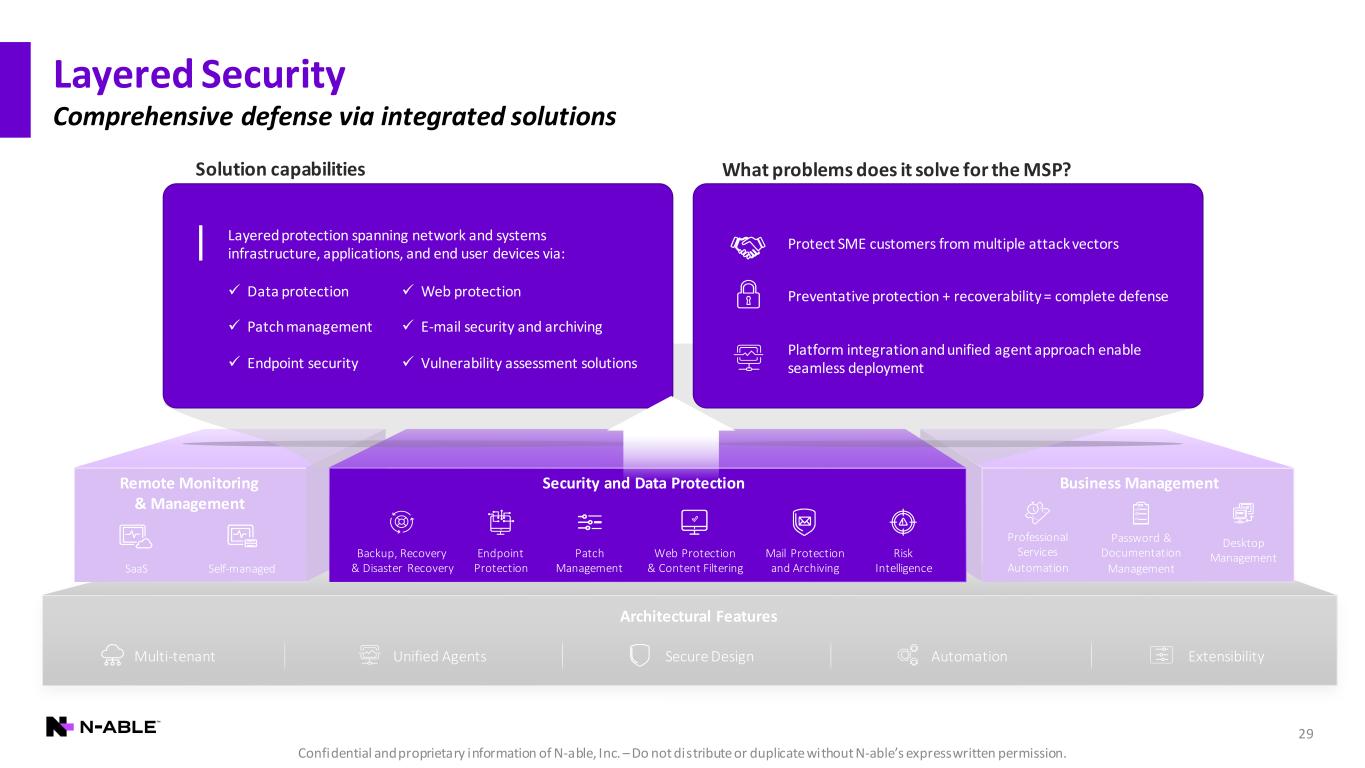

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 29 Layered Security Comprehensive defense via integrated solutions Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Layered protection spanning network and systems infrastructure, applications, and end user devices via: Protect SME customers from multiple attack vectors Preventative protection + recoverability = complete defense Platform integration and unified agent approach enable seamless deployment ✓ Data protection ✓ Patch management ✓ Endpoint security ✓ Web protection ✓ E-mail security and archiving ✓ Vulnerability assessment solutions

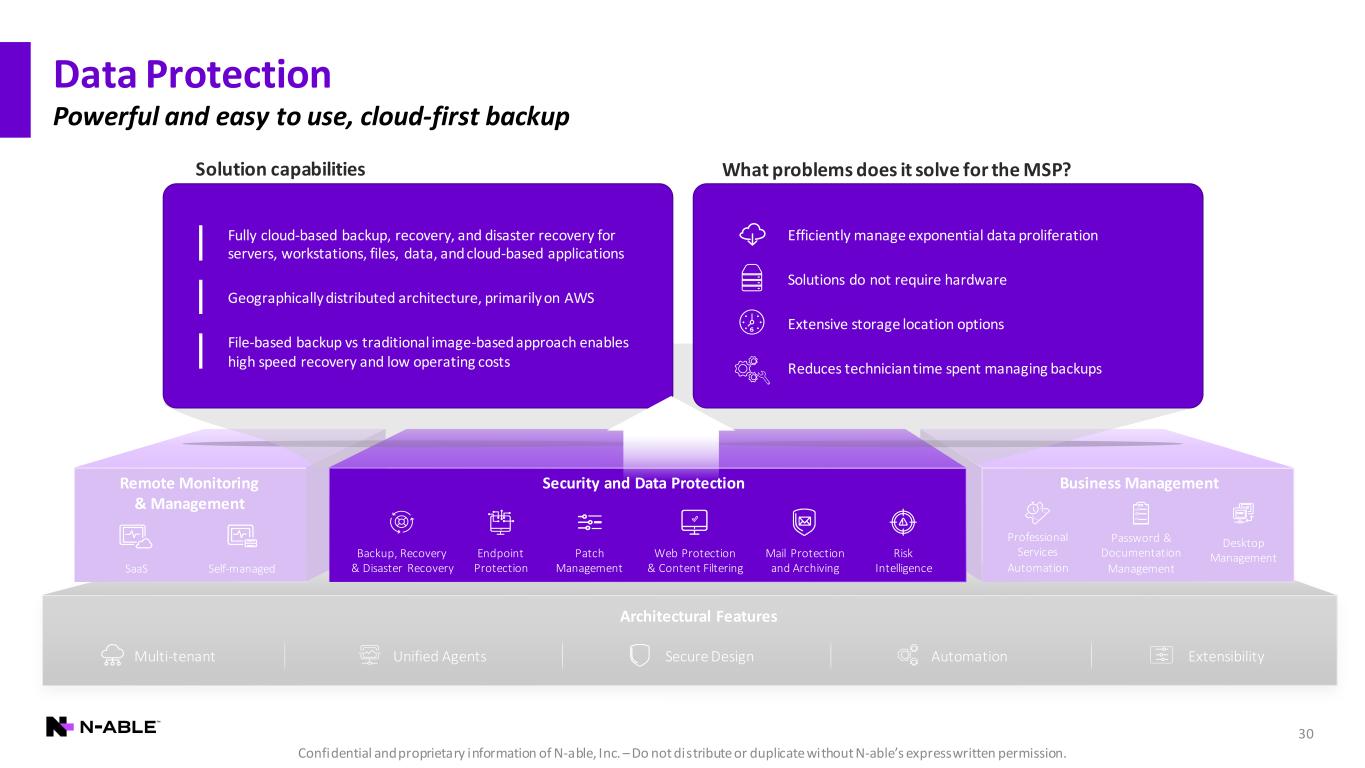

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 30 Data Protection Powerful and easy to use, cloud-first backup Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Fully cloud-based backup, recovery, and disaster recovery for servers, workstations, files, data, and cloud-based applications Geographically distributed architecture, primarily on AWS File-based backup vs traditional image-based approach enables high speed recovery and low operating costs Efficiently manage exponential data proliferation Solutions do not require hardware Extensive storage location options Reduces technician time spent managing backups

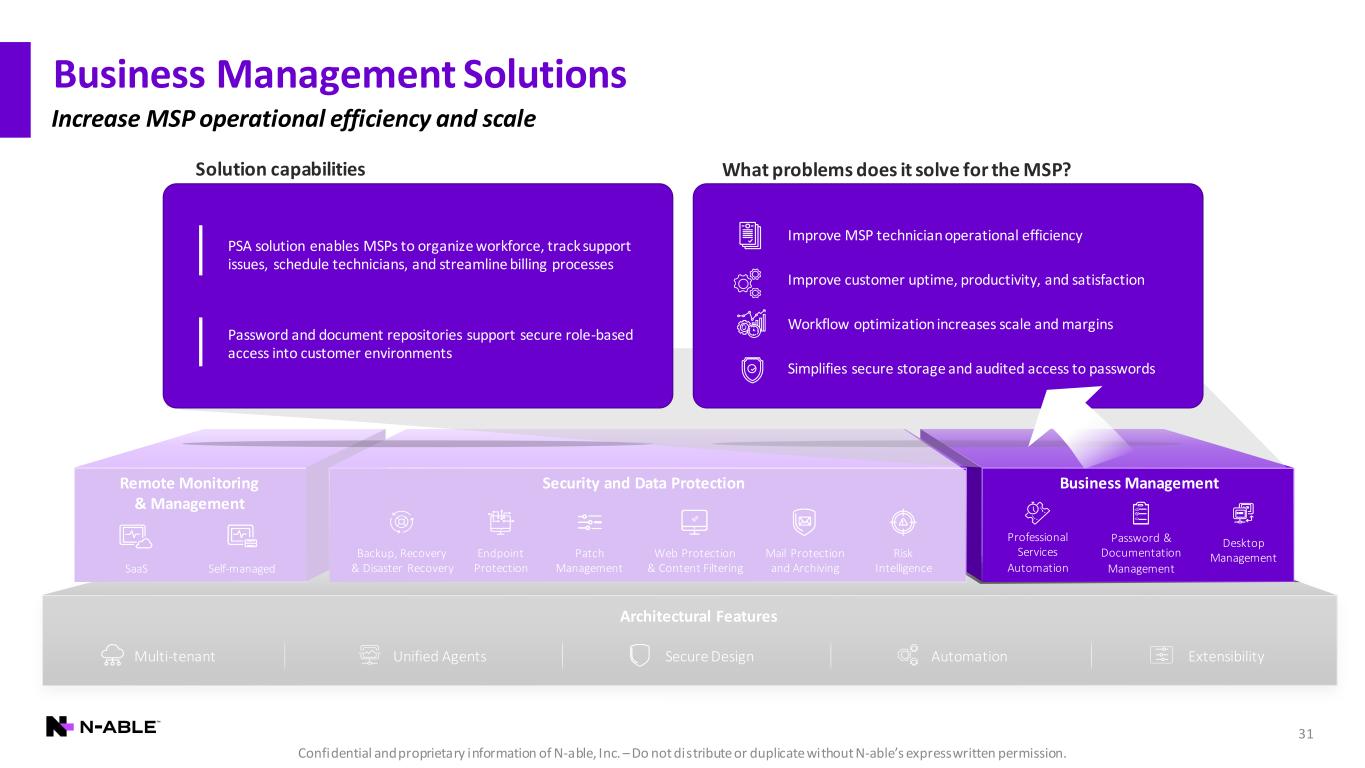

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 31 Business Management Solutions Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Increase MSP operational efficiency and scale Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Improve MSP technician operational efficiency Improve customer uptime, productivity, and satisfaction Workflow optimization increases scale and margins Simplifies secure storage and audited access to passwords PSA solution enables MSPs to organize workforce, track support issues, schedule technicians, and streamline billing processes Password and document repositories support secure role-based access into customer environments

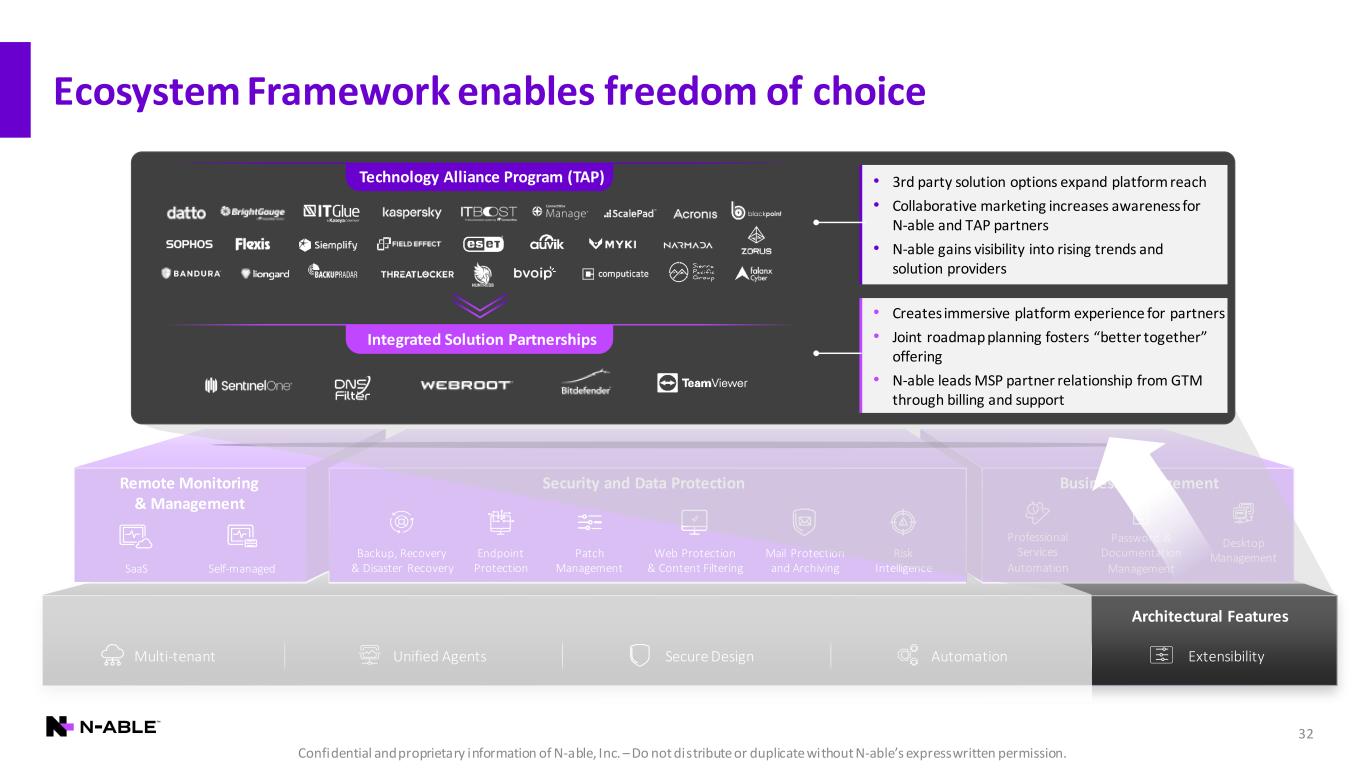

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Architectural Features 32 Ecosystem Framework enables freedom of choice SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Technology Alliance Program (TAP) Integrated Solution Partnerships • 3rd party solution options expand platform reach • Collaborative marketing increases awareness for N-able and TAP partners • N-able gains visibility into rising trends and solution providers • Creates immersive platform experience for partners • Joint roadmap planning fosters “better together” offering • N-able leads MSP partner relationship from GTM through billing and support

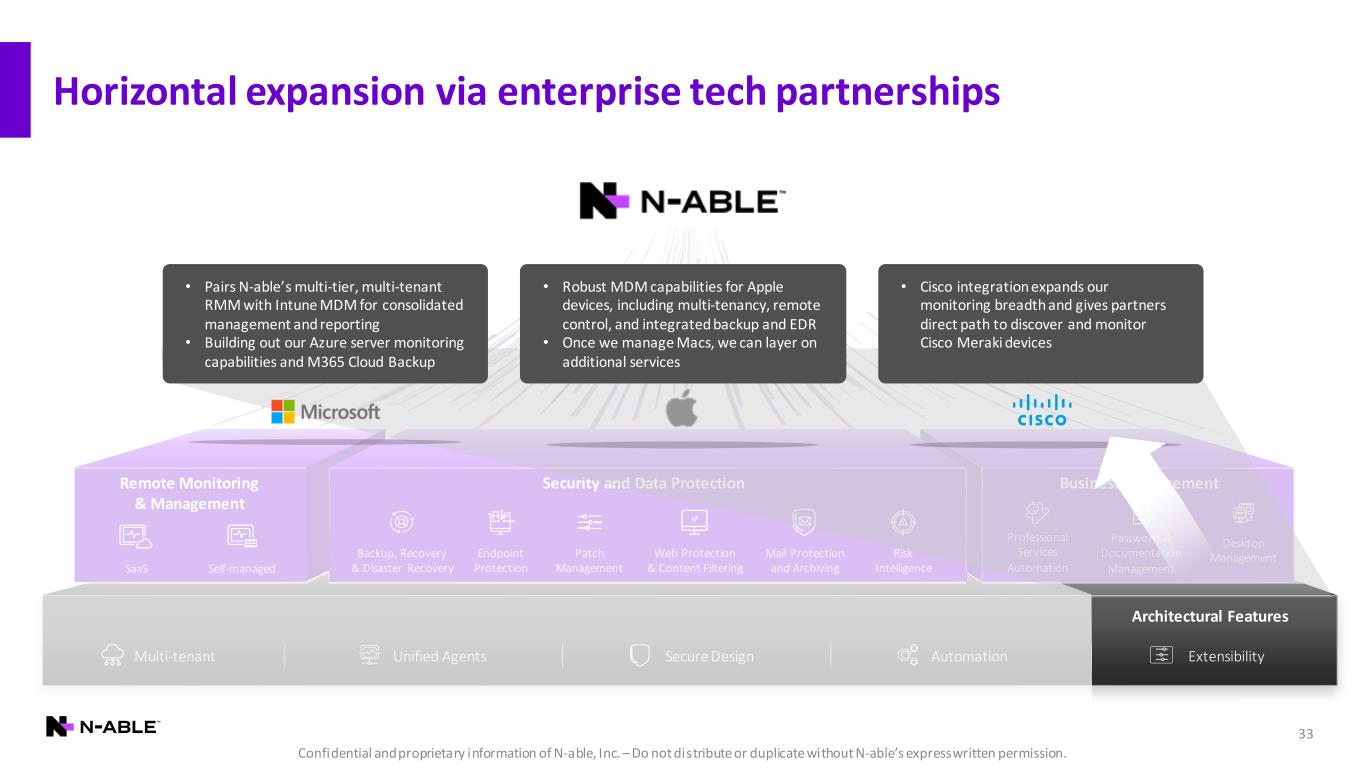

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Architectural Features 33 Horizontal expansion via enterprise tech partnerships SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation • Pairs N-able’s multi-tier, multi-tenant RMM with Intune MDM for consolidated management and reporting • Building out our Azure server monitoring capabilities and M365 Cloud Backup • Robust MDM capabilities for Apple devices, including multi-tenancy, remote control, and integrated backup and EDR • Once we manage Macs, we can layer on additional services • Cisco integration expands our monitoring breadth and gives partners direct path to discover and monitor Cisco Meraki devices

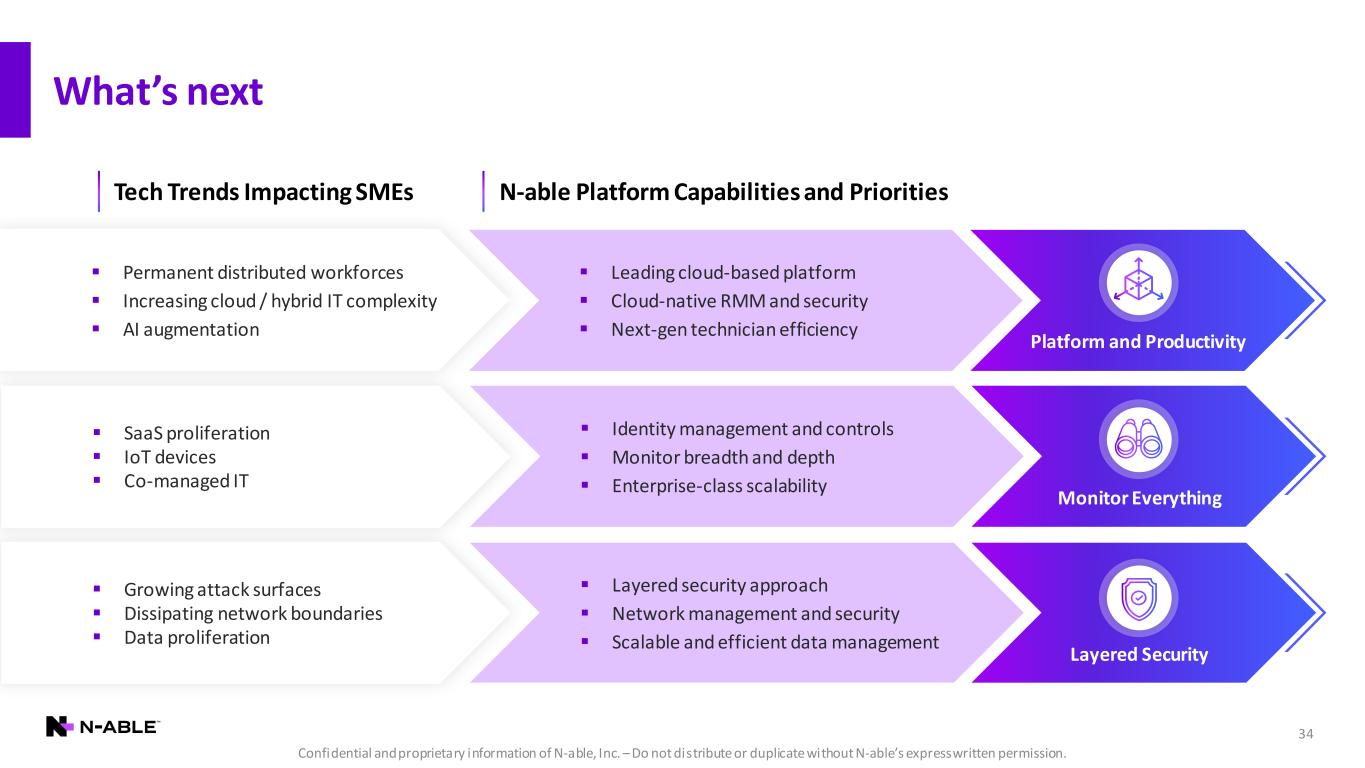

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. What’s next 34 Tech Trends Impacting SMEs N-able Platform Capabilities and Priorities ▪ Growing attack surfaces ▪ Dissipating network boundaries ▪ Data proliferation Layered Security ▪ Layered security approach ▪ Network management and security ▪ Scalable and efficient data management ▪ Permanent distributed workforces ▪ Increasing cloud / hybrid IT complexity ▪ AI augmentation Platform and Productivity ▪ Leading cloud-based platform ▪ Cloud-native RMM and security ▪ Next-gen technician efficiency ▪ SaaS proliferation ▪ IoT devices ▪ Co-managed IT Monitor Everything ▪ Identity management and controls ▪ Monitor breadth and depth ▪ Enterprise-class scalability

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Go-to-Market & Partner Success

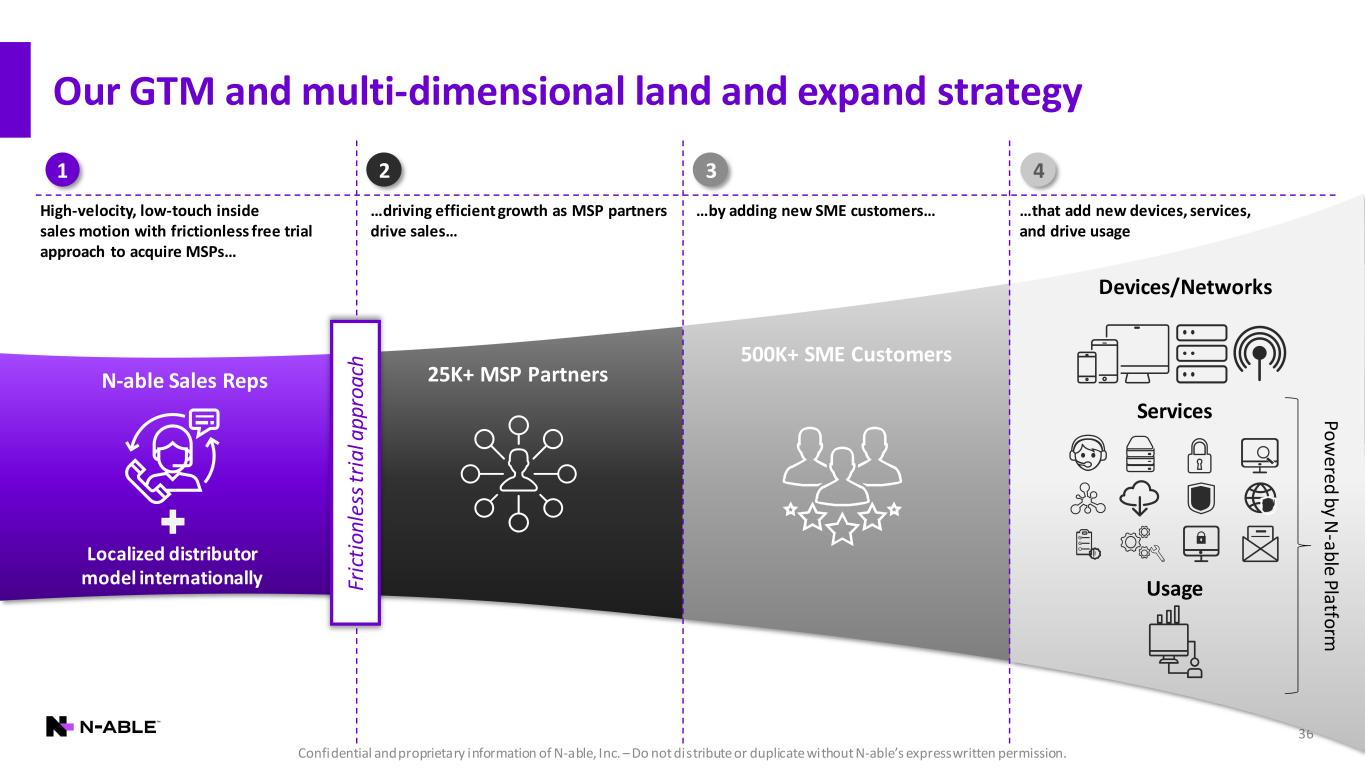

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 36 Our GTM and multi-dimensional land and expand strategy High-velocity, low-touch inside sales motion with frictionless free trial approach to acquire MSPs… …driving efficient growth as MSP partners drive sales… …by adding new SME customers… …that add new devices, services, and drive usage N-able Sales Reps Localized distributor model internationally 25K+ MSP Partners 500K+ SME Customers Devices/Networks Services UsageFr ic ti on le ss tr ia l a pp ro ac h 1 2 3 4 ! Po w ered by N -able Platform

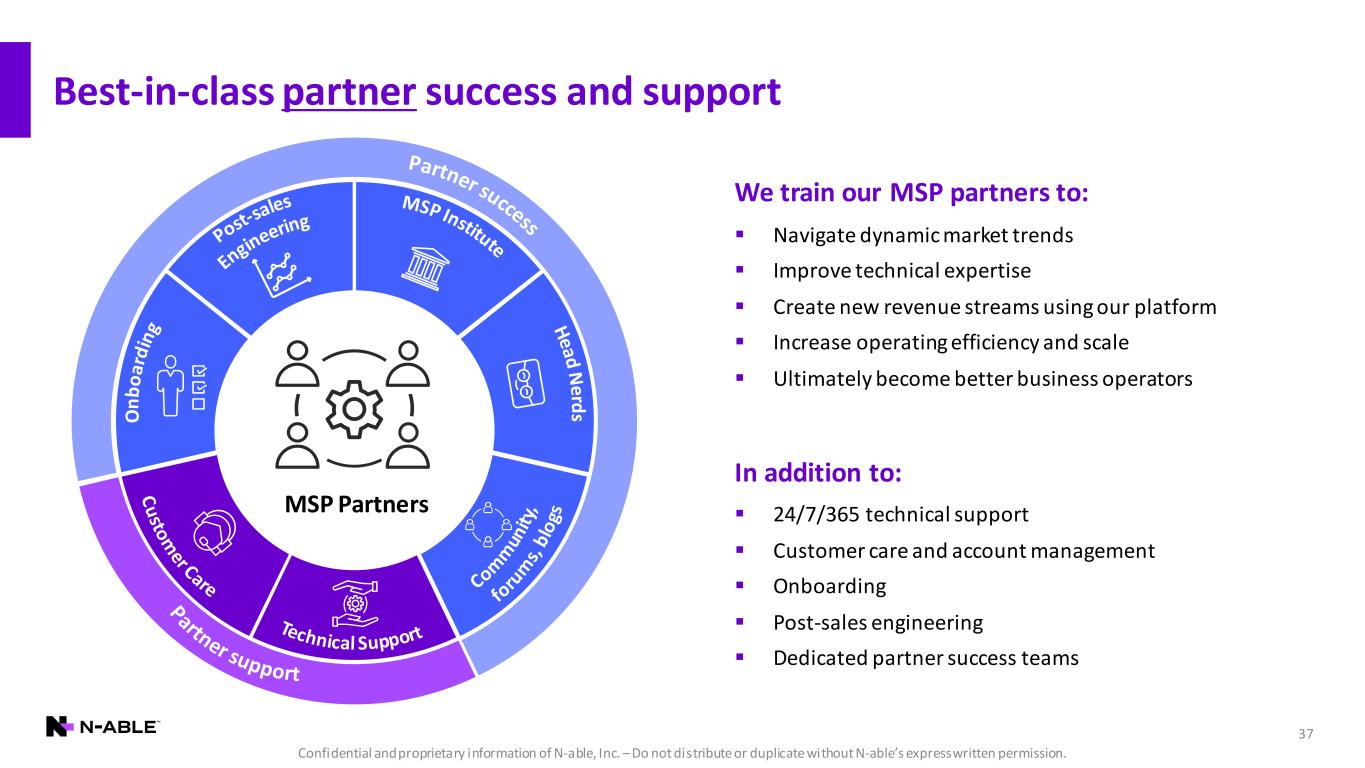

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 37 Best-in-class partner success and support MSP Partners We train our MSP partners to: ▪ Navigate dynamic market trends ▪ Improve technical expertise ▪ Create new revenue streams using our platform ▪ Increase operating efficiency and scale ▪ Ultimately become better business operators In addition to: ▪ 24/7/365 technical support ▪ Customer care and account management ▪ Onboarding ▪ Post-sales engineering ▪ Dedicated partner success teams

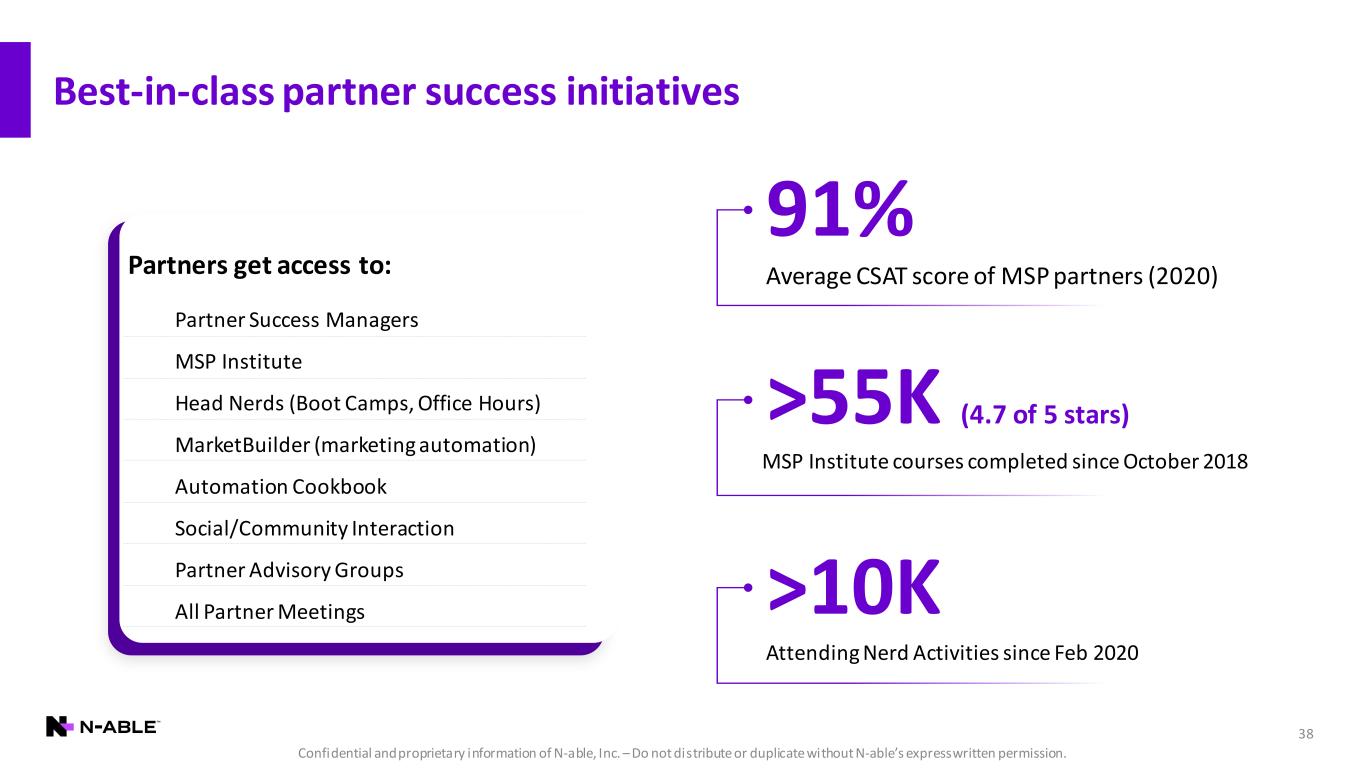

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Best-in-class partner success initiatives 38 Partner Success Managers MSP Institute Head Nerds (Boot Camps, Office Hours) All Partner Meetings MarketBuilder (marketing automation) Partner Advisory Groups Zero to Many (OnDemand) One to Many (Boot Camps & Office Hours) 91% Average CSAT score of MSP partners (2020) >55K (4.7 of 5 stars) MSP Institute courses completed since October 2018 >10K Attending Nerd Activities since Feb 2020 Automation Cookbook Social/Community Interaction Partners get access to:

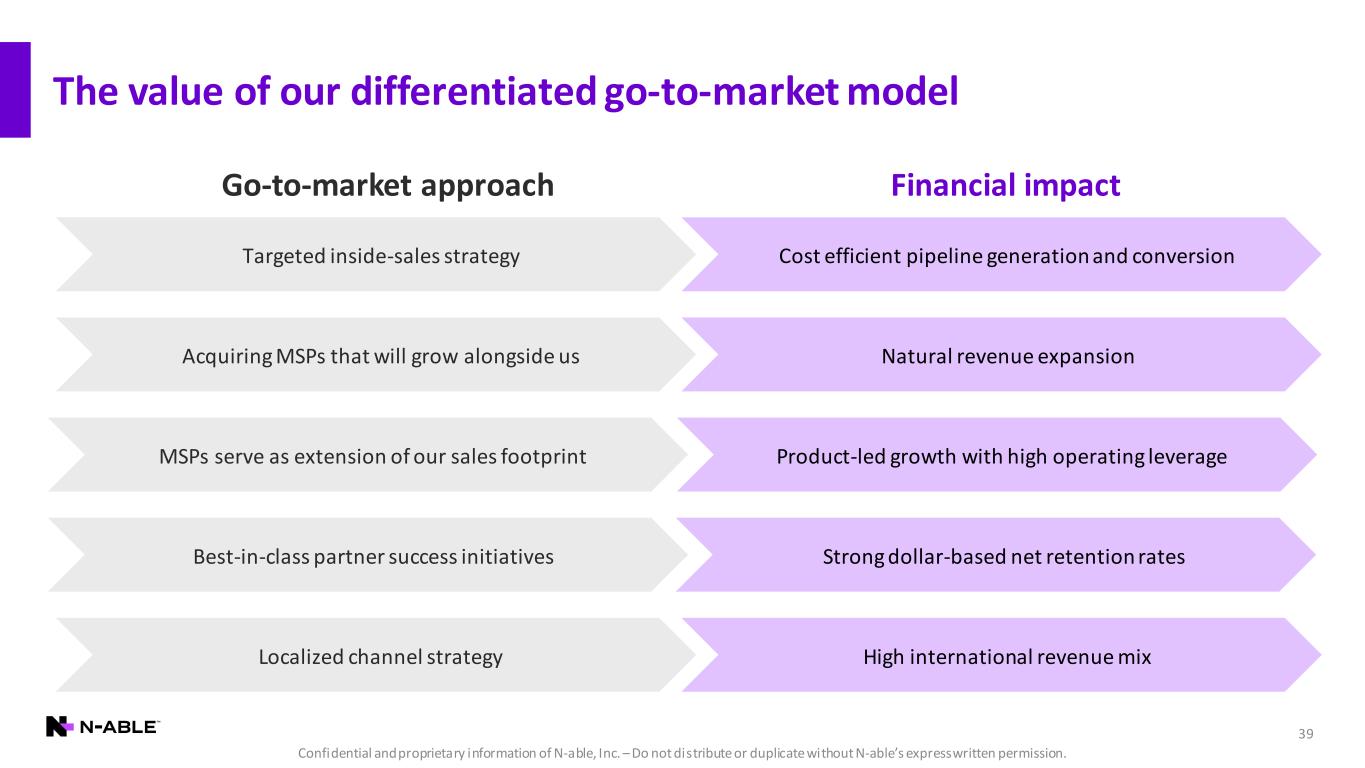

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 39 The value of our differentiated go-to-market model Financial impactGo-to-market approach Targeted inside-sales strategy Cost efficient pipeline generation and conversion Localized channel strategy High international revenue mix Acquiring MSPs that will grow alongside us Natural revenue expansion MSPs serve as extension of our sales footprint Product-led growth with high operating leverage Best-in-class partner success initiatives Strong dollar-based net retention rates

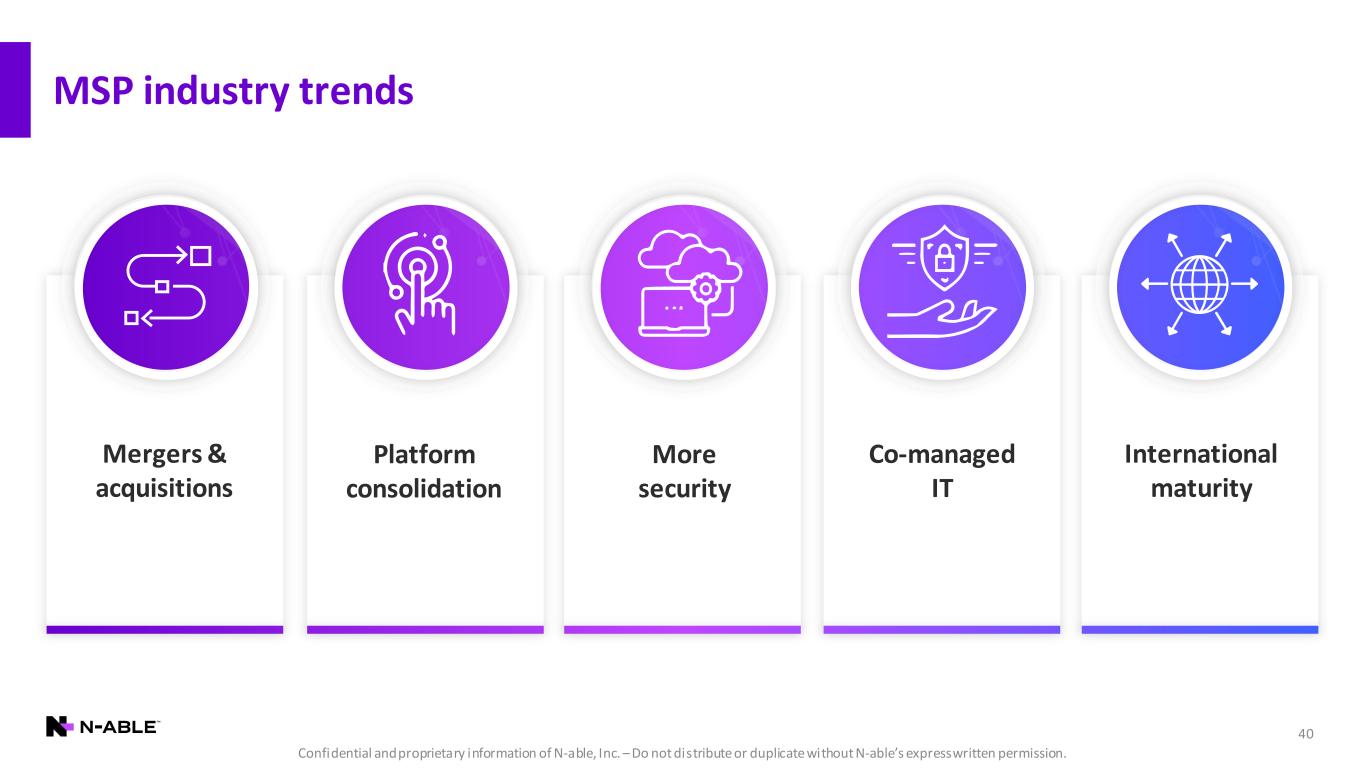

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSP industry trends 40 More security Co-managed IT Platform consolidation International maturity Mergers & acquisitions

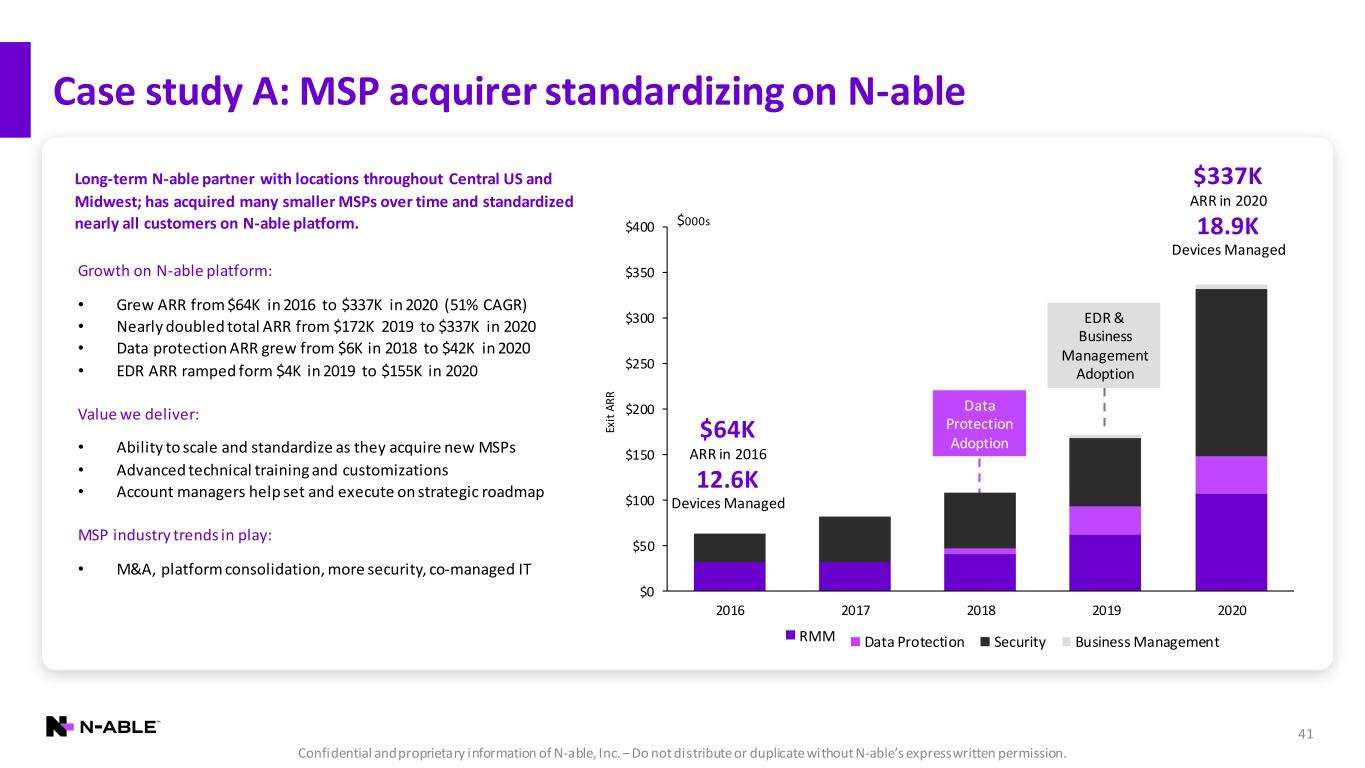

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 41 Case study A: MSP acquirer standardizing on N-able Ex it A R R $0 $50 $100 $150 $200 $250 $300 $350 $400 2016 2017 2018 2019 2020 Data Protection Security Business Management $337K ARR in 2020 18.9K Devices Managed Long-term N-able partner with locations throughout Central US and Midwest; has acquired many smaller MSPs over time and standardized nearly all customers on N-able platform. $64K ARR in 2016 12.6K Devices Managed RMM $000s Growth on N-able platform: • Grew ARR from $64K in 2016 to $337K in 2020 (51% CAGR) • Nearly doubled total ARR from $172K 2019 to $337K in 2020 • Data protection ARR grew from $6K in 2018 to $42K in 2020 • EDR ARR ramped form $4K in 2019 to $155K in 2020 Value we deliver: • Ability to scale and standardize as they acquire new MSPs • Advanced technical training and customizations • Account managers help set and execute on strategic roadmap MSP industry trends in play: • M&A, platform consolidation, more security, co-managed IT EDR & Business Management Adoption Data Protection Adoption

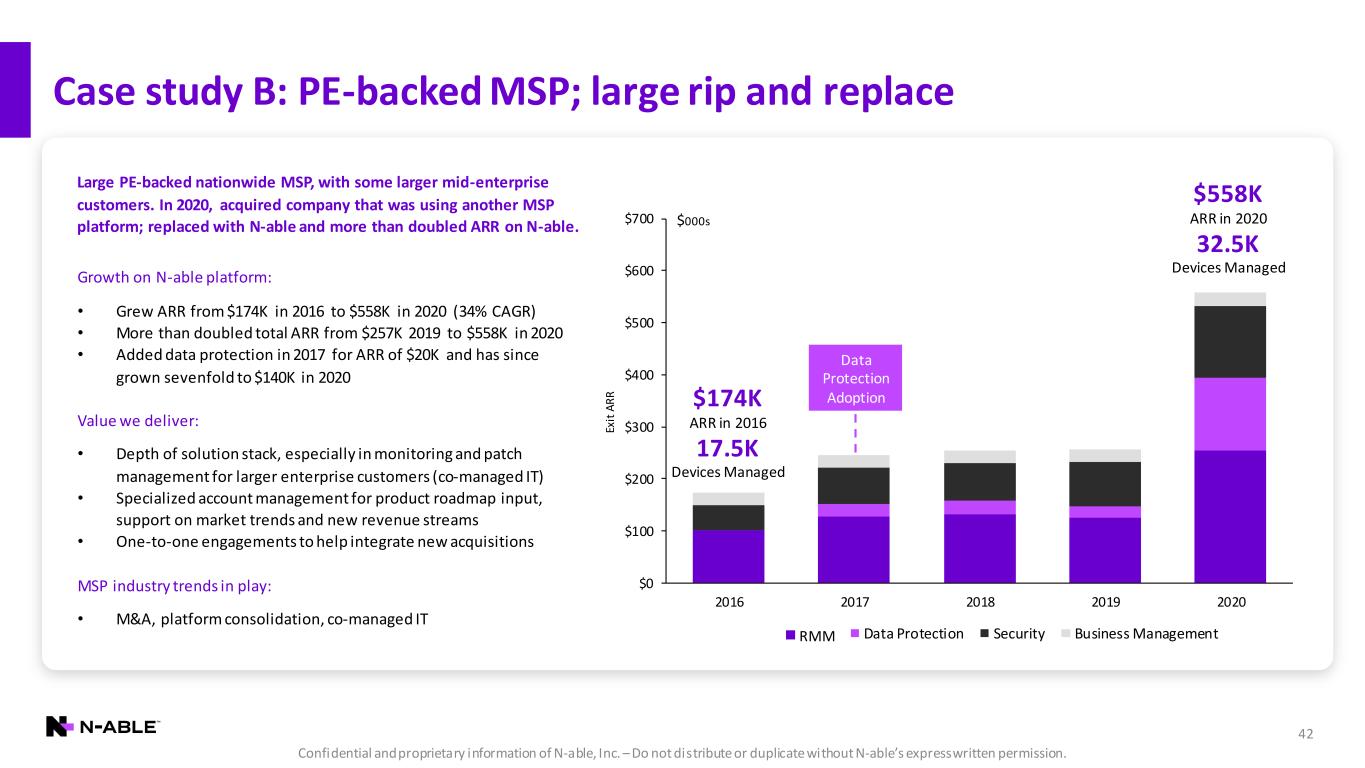

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 42 Case study B: PE-backed MSP; large rip and replace Ex it A R R $0 $100 $200 $300 $400 $500 $600 $700 2016 2017 2018 2019 2020 Data Protection Security Business Management $558K ARR in 2020 32.5K Devices Managed Large PE-backed nationwide MSP, with some larger mid-enterprise customers. In 2020, acquired company that was using another MSP platform; replaced with N-able and more than doubled ARR on N-able. $174K ARR in 2016 17.5K Devices Managed RMM $000s Growth on N-able platform: • Grew ARR from $174K in 2016 to $558K in 2020 (34% CAGR) • More than doubled total ARR from $257K 2019 to $558K in 2020 • Added data protection in 2017 for ARR of $20K and has since grown sevenfold to $140K in 2020 Value we deliver: • Depth of solution stack, especially in monitoring and patch management for larger enterprise customers (co-managed IT) • Specialized account management for product roadmap input, support on market trends and new revenue streams • One-to-one engagements to help integrate new acquisitions MSP industry trends in play: • M&A, platform consolidation, co-managed IT Data Protection Adoption

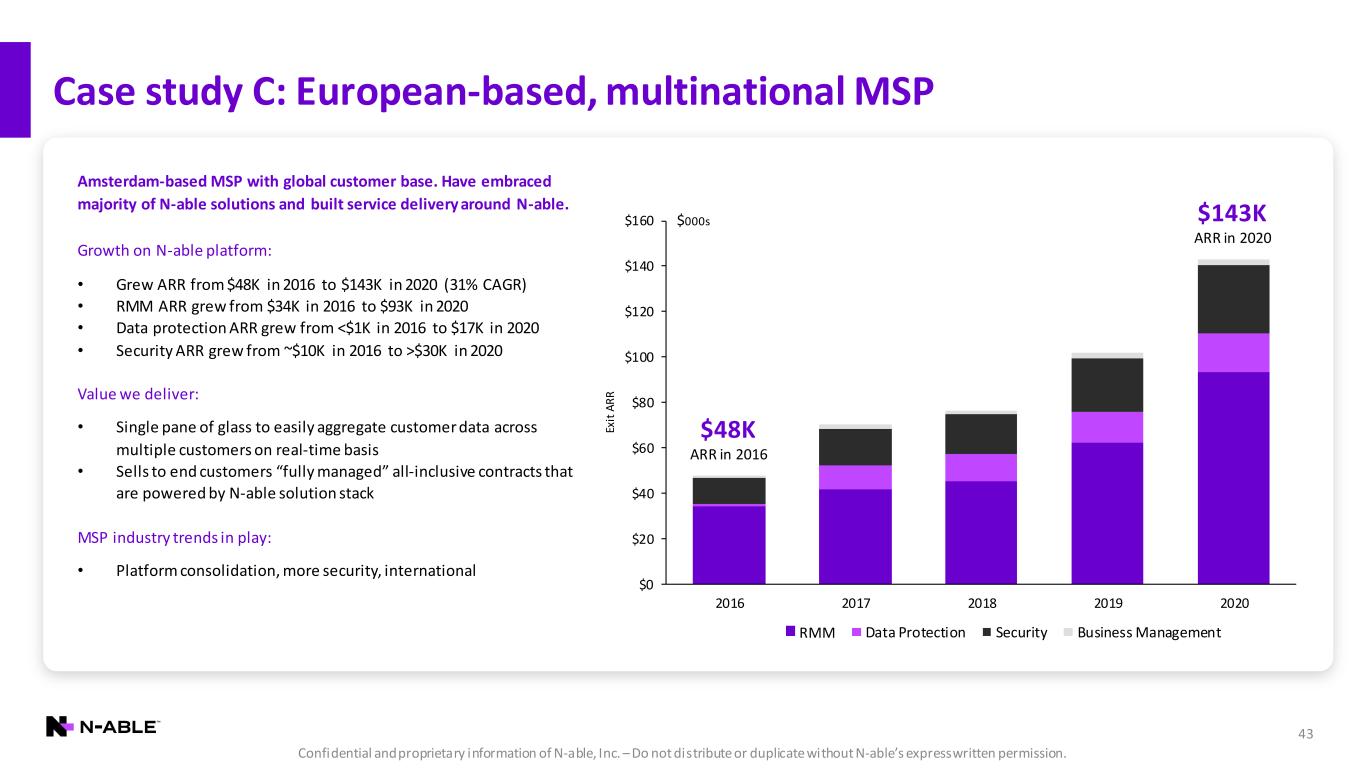

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 43 Case study C: European-based, multinational MSP $48K ARR in 2016 $0 $20 $40 $60 $80 $100 $120 $140 $160 2016 2017 2018 2019 2020 Data Protection Security Business ManagementRMM $143K ARR in 2020 Ex it A R R $000s Amsterdam-based MSP with global customer base. Have embraced majority of N-able solutions and built service delivery around N-able. Growth on N-able platform: • Grew ARR from $48K in 2016 to $143K in 2020 (31% CAGR) • RMM ARR grew from $34K in 2016 to $93K in 2020 • Data protection ARR grew from <$1K in 2016 to $17K in 2020 • Security ARR grew from ~$10K in 2016 to >$30K in 2020 Value we deliver: • Single pane of glass to easily aggregate customer data across multiple customers on real-time basis • Sells to end customers “fully managed” all-inclusive contracts that are powered by N-able solution stack MSP industry trends in play: • Platform consolidation, more security, international

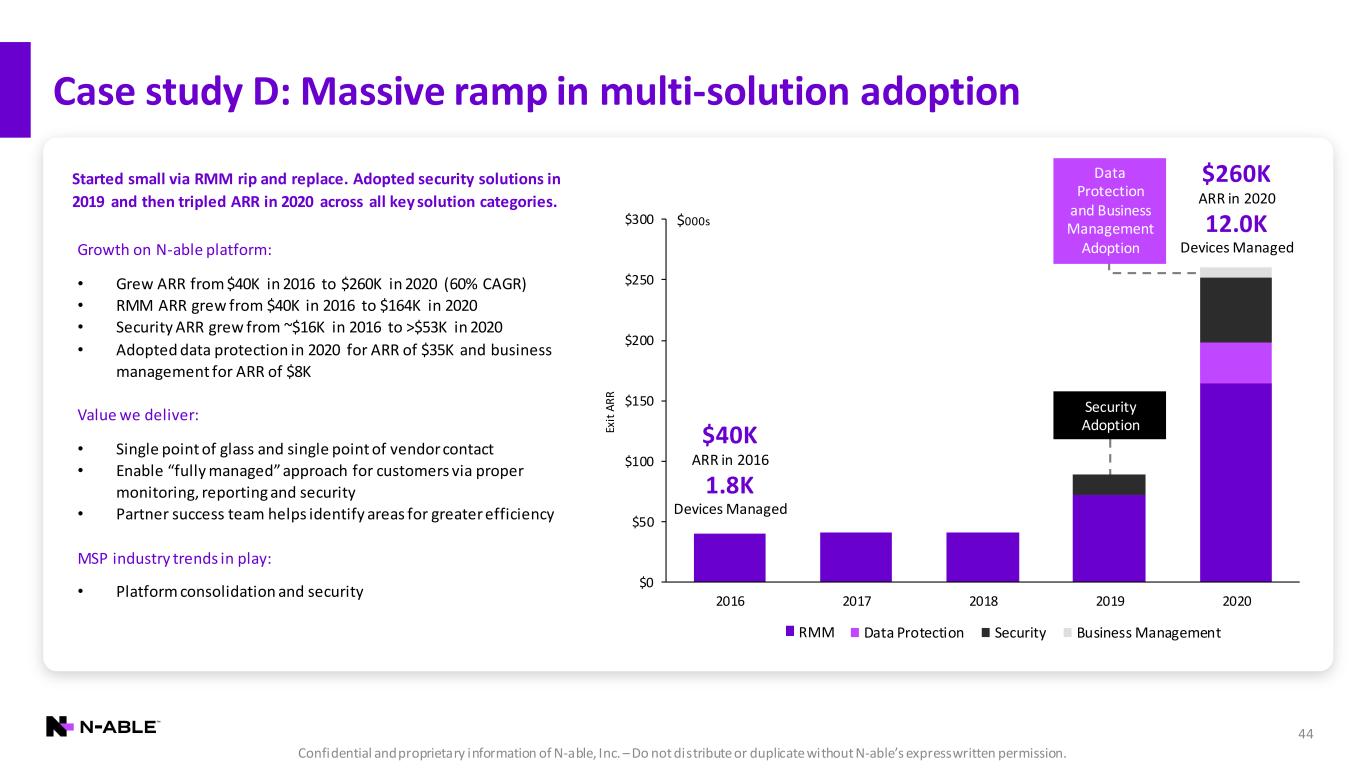

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 44 Case study D: Massive ramp in multi-solution adoption RMM $0 $50 $100 $150 $200 $250 $300 2016 2017 2018 2019 2020 Data Protection Security Business Management Security Adoption $40K ARR in 2016 1.8K Devices Managed $260K ARR in 2020 12.0K Devices Managed Data Protection and Business Management Adoption Ex it A R R $000s Started small via RMM rip and replace. Adopted security solutions in 2019 and then tripled ARR in 2020 across all key solution categories. Growth on N-able platform: • Grew ARR from $40K in 2016 to $260K in 2020 (60% CAGR) • RMM ARR grew from $40K in 2016 to $164K in 2020 • Security ARR grew from ~$16K in 2016 to >$53K in 2020 • Adopted data protection in 2020 for ARR of $35K and business management for ARR of $8K Value we deliver: • Single point of glass and single point of vendor contact • Enable “fully managed” approach for customers via proper monitoring, reporting and security • Partner success team helps identify areas for greater efficiency MSP industry trends in play: • Platform consolidation and security

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Financial Overview

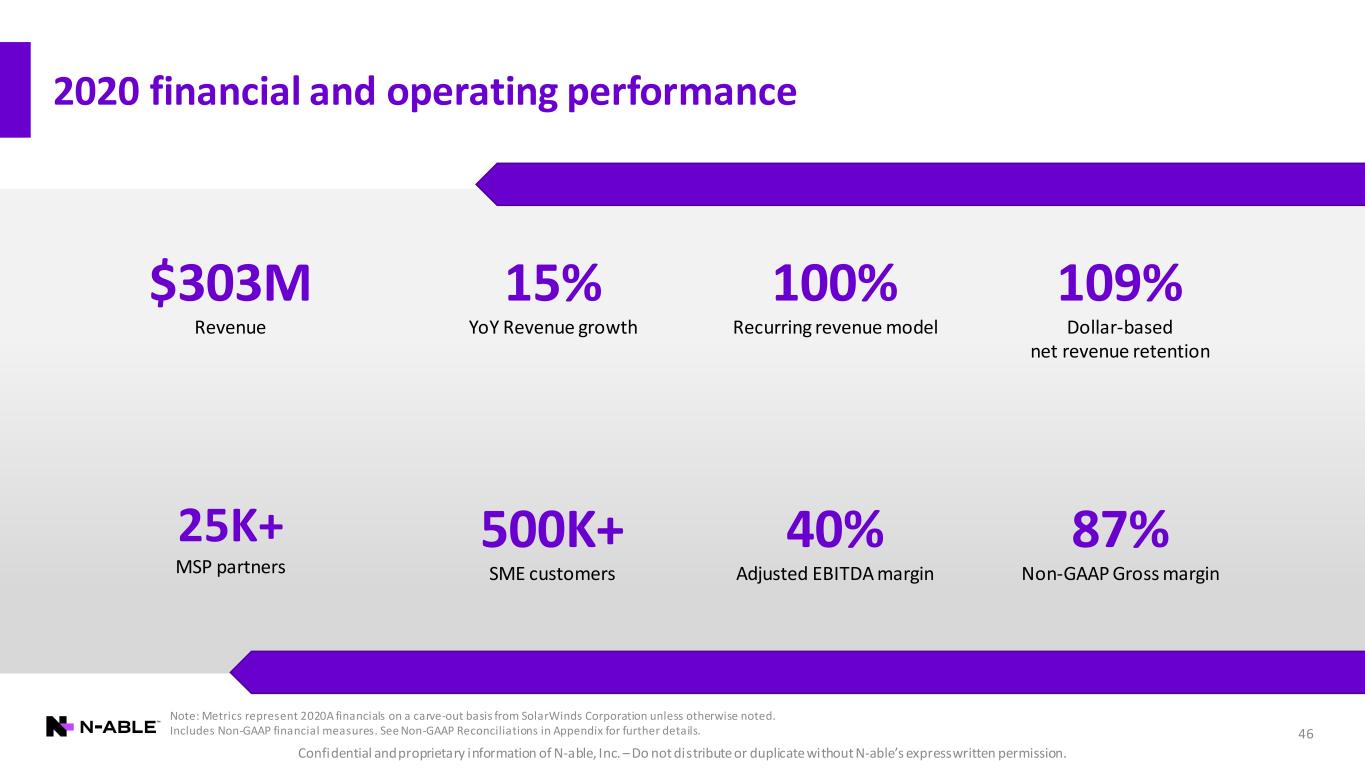

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 46 2020 financial and operating performance 25K+ MSP partners $303M Revenue 109% Dollar-based net revenue retention 500K+ SME customers 40% Adjusted EBITDA margin 15% YoY Revenue growth 100% Recurring revenue model 87% Non-GAAP Gross margin Note: Metrics represent 2020A financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details.

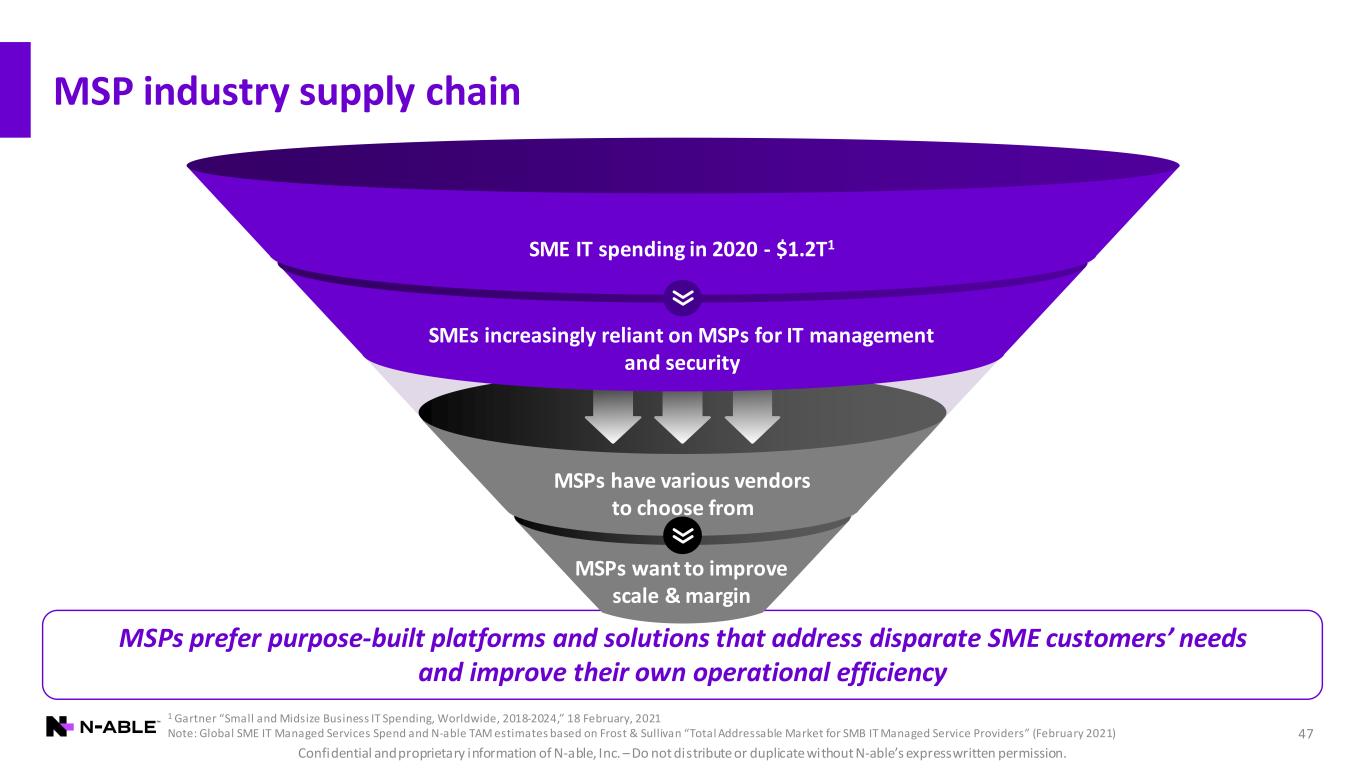

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSPs prefer purpose-built platforms and solutions that address disparate SME customers’ needs and improve their own operational efficiency MSP industry supply chain 47 SME IT spending in 2020 - $1.2T1 SMEs increasingly reliant on MSPs for IT management and security MSPs have various vendors to choose from MSPs want to improve scale & margin 1 Gartner “Small and Midsize Business IT Spending, Worldwide, 2018-2024,” 18 February, 2021 Note: Global SME IT Managed Services Spend and N-able TAM estimates based on Frost & Sullivan “Total Addressable Market for SMB IT Managed Service Providers” (February 2021)

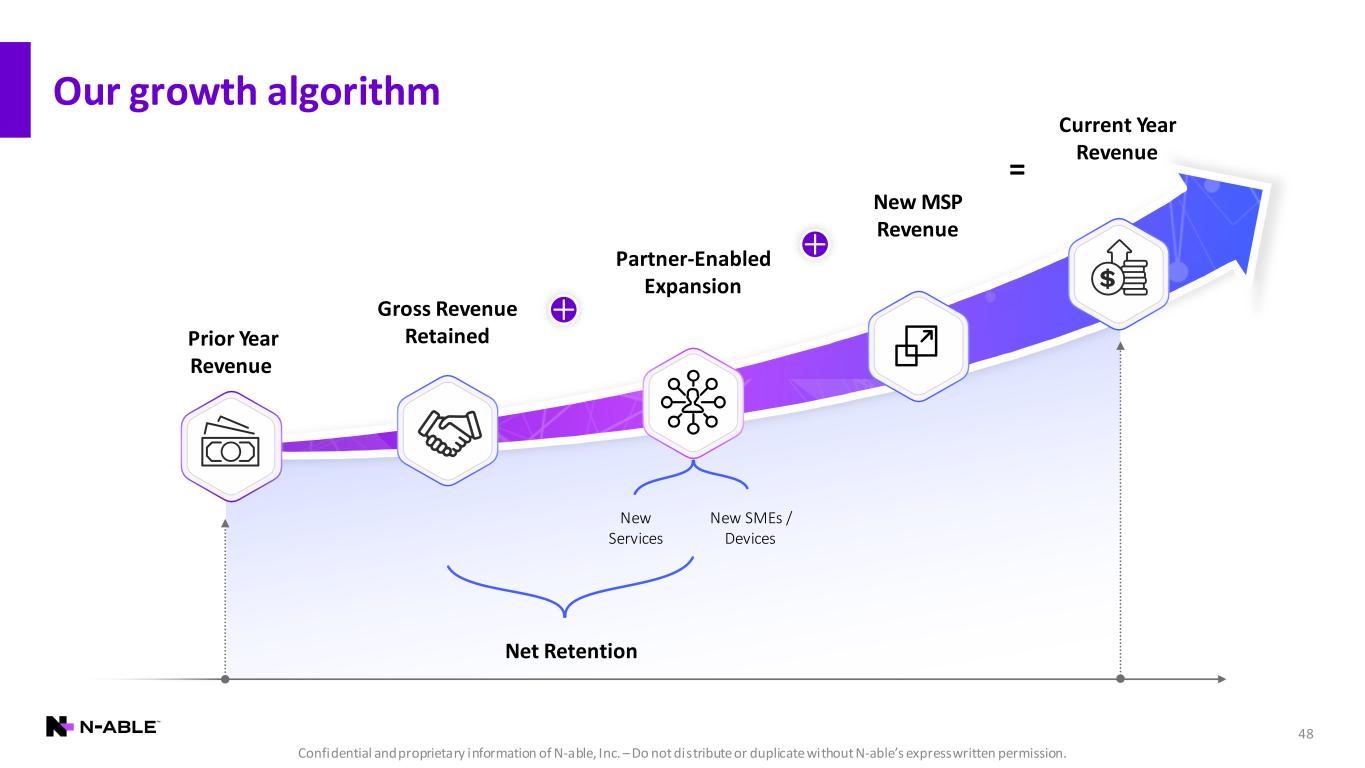

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 48 Our growth algorithm New MSP Revenue Current Year Revenue Gross Revenue Retained Net Retention Partner-Enabled Expansion = Prior Year Revenue New Services New SMEs / Devices

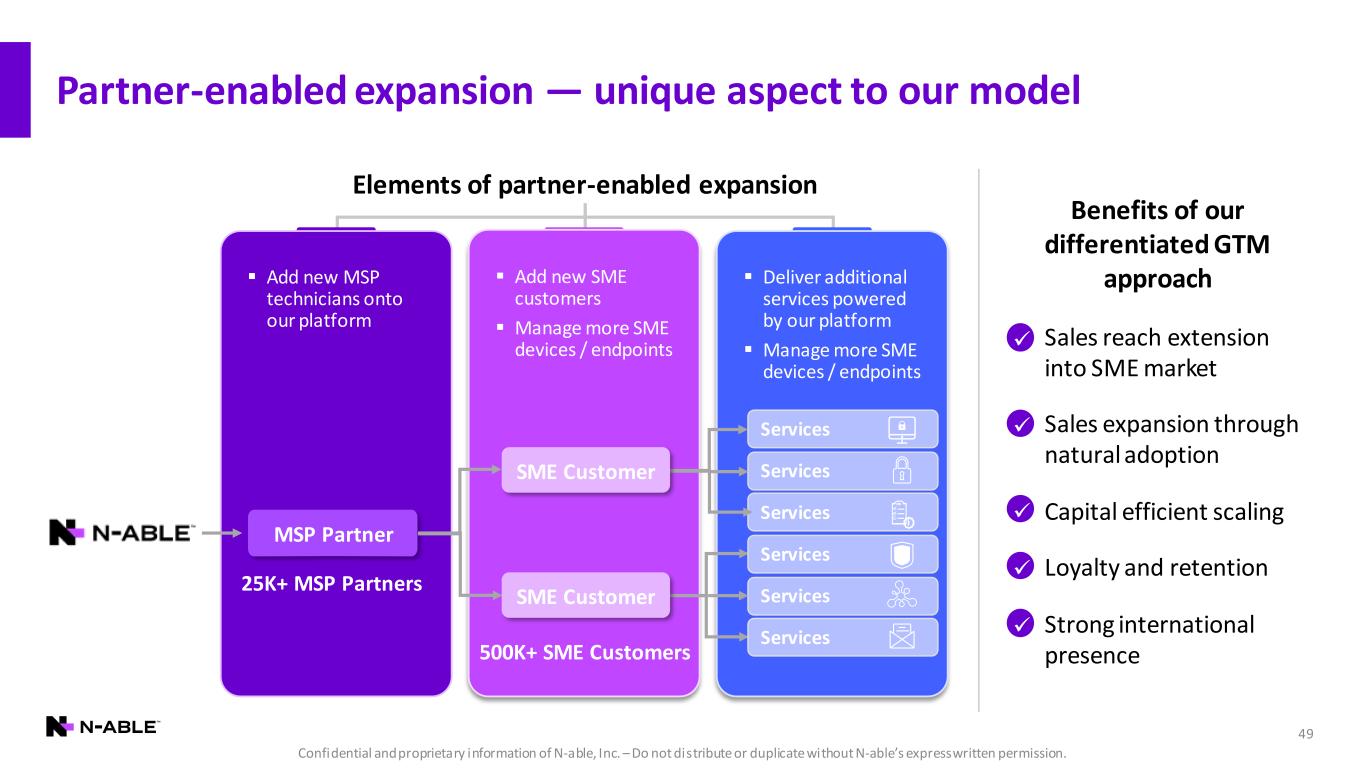

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. ▪ Add new MSP technicians onto our platform ▪ Add new SME customers ▪ Manage more SME devices / endpoints ▪ Deliver additional services powered by our platform ▪ Manage more SME devices / endpoints Partner-enabled expansion — unique aspect to our model 49 MSP Partner 25K+ MSP Partners 500K+ SME Customers Services Services Services Elements of partner-enabled expansion Services Services Services ! Benefits of our differentiated GTM approach ▪ Sales reach extension into SME market ▪ Sales expansion through natural adoption ▪ Capital efficient scaling ▪ Loyalty and retention ▪ Strong international presence ✓ ✓ ✓ ✓ ✓ SME Customer SME Customer

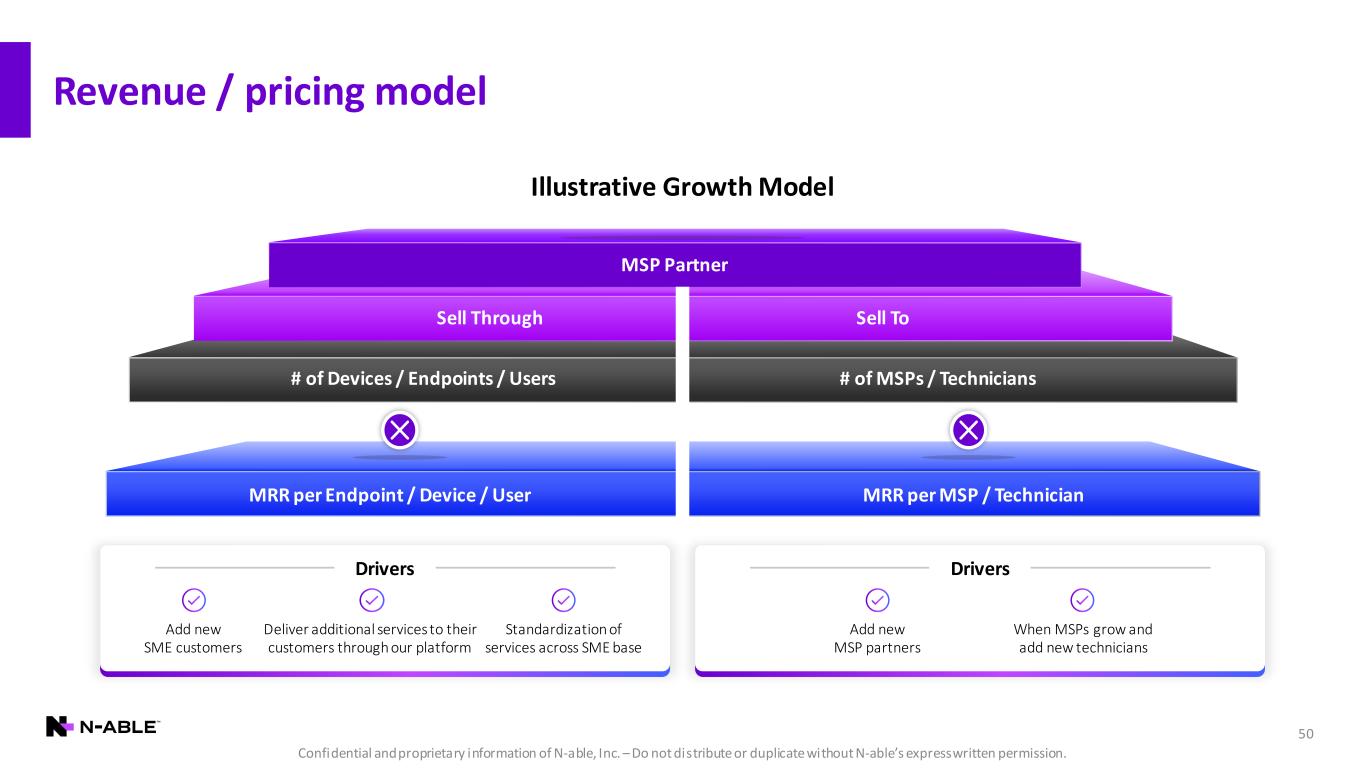

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. When MSPs grow and add new technicians Add new MSP partners Drivers Deliver additional services to their customers through our platform Add new SME customers Standardization of services across SME base Drivers Revenue / pricing model 50 MRR per Endpoint / Device / User MRR per MSP / Technician Illustrative Growth Model MSP Partner Sell Through Sell To # of Devices / Endpoints / Users # of MSPs / Technicians

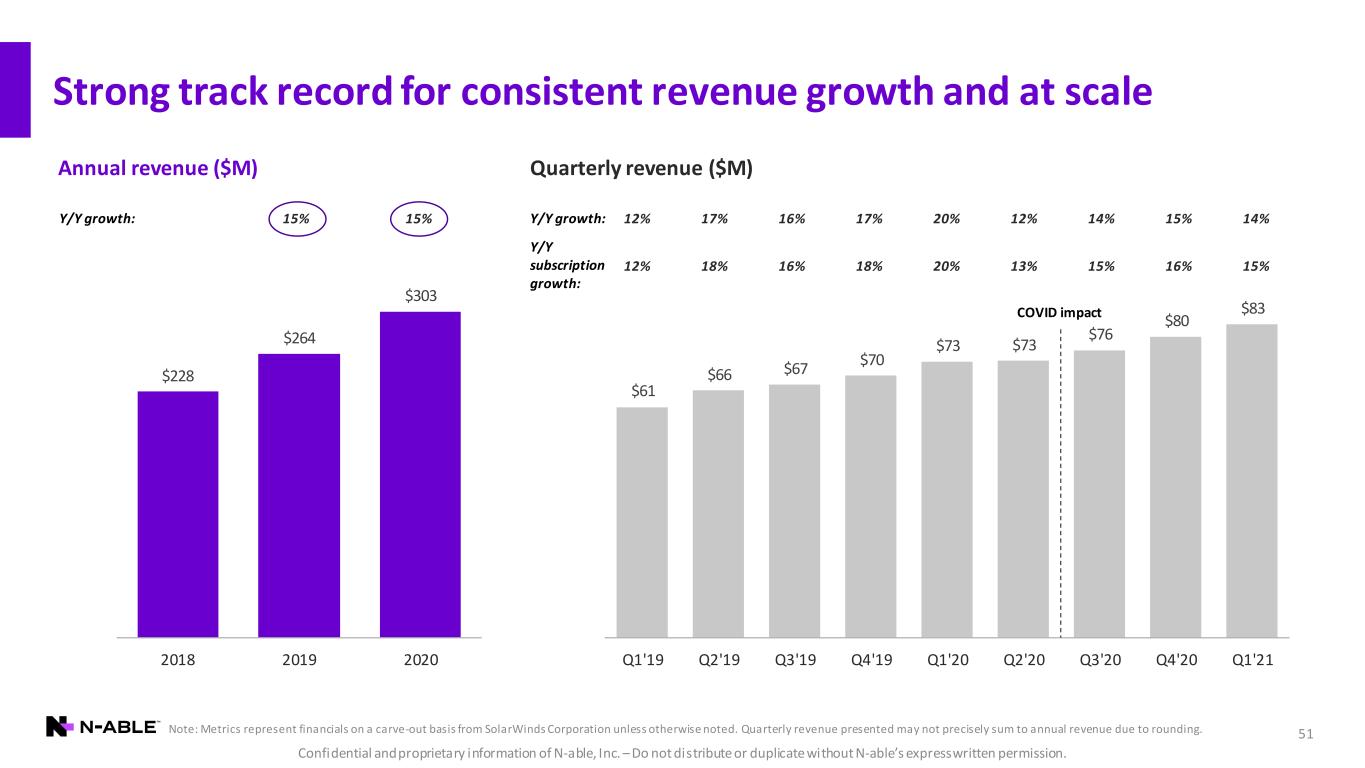

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Strong track record for consistent revenue growth and at scale Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Quarterly revenue presented may not precisely sum to annual revenue due to rounding. 51 Annual revenue ($M) $228 $264 $303 2018 2019 2020 15% 15%Y/Y growth: $61 $66 $67 $70 $73 $73 $76 $80 $83 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Quarterly revenue ($M) 12% 17% 16% 17% 20% 12% 14% 15% 14%Y/Y growth: 12% 18% 16% 18% 20% 13% 15% 16% 15% Y/Y subscription growth: COVID impact

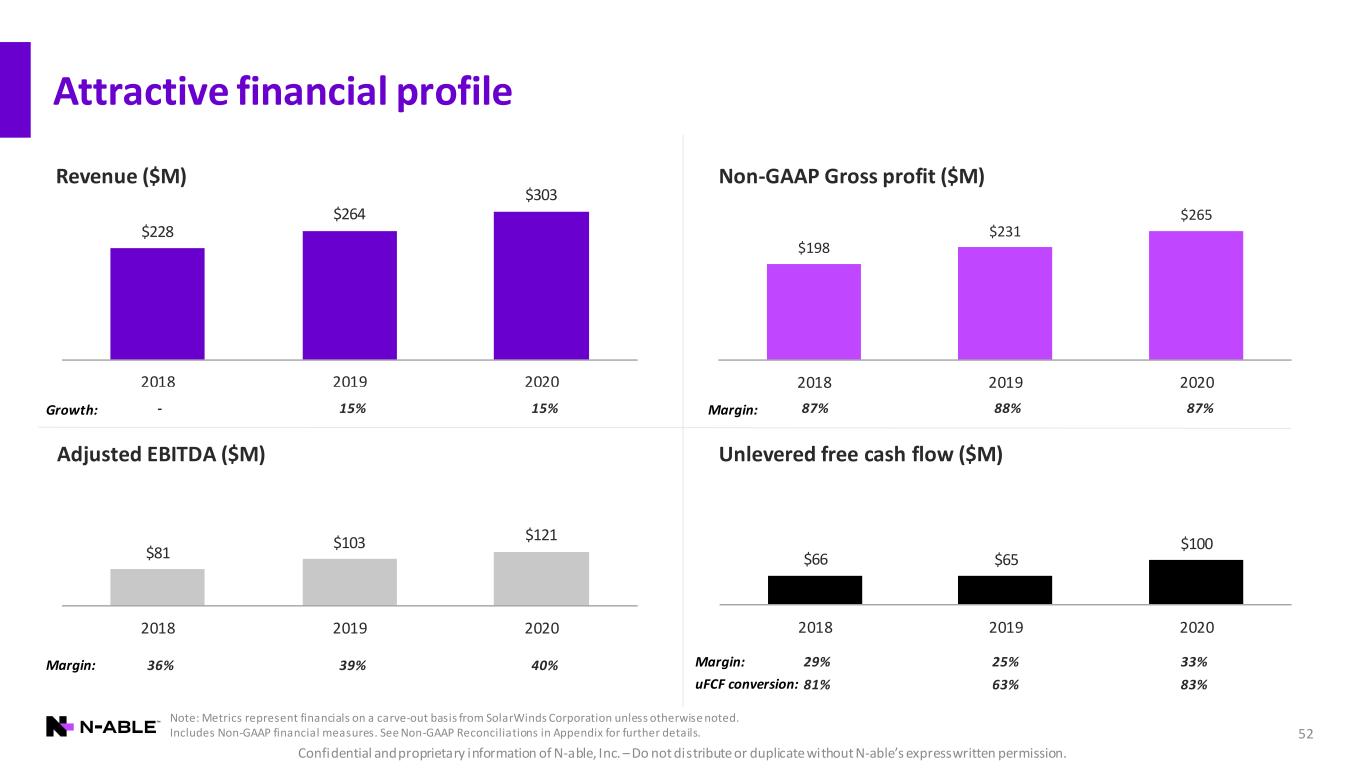

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. $228 $264 $303 2018 2019 2020 Attractive financial profile 52 $198 $231 $265 2018 2019 2020 $81 $103 $121 2018 2019 2020 $66 $65 $100 2018 2019 2020 - 15% 15%Growth: 87% 88% 87%Margin: 36% 39% 40%Margin: Adjusted EBITDA ($M) Unlevered free cash flow ($M) Revenue ($M) Non-GAAP Gross profit ($M) Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details. 29% 25% 33%Margin: 81% 63% 83%uFCF conversion:

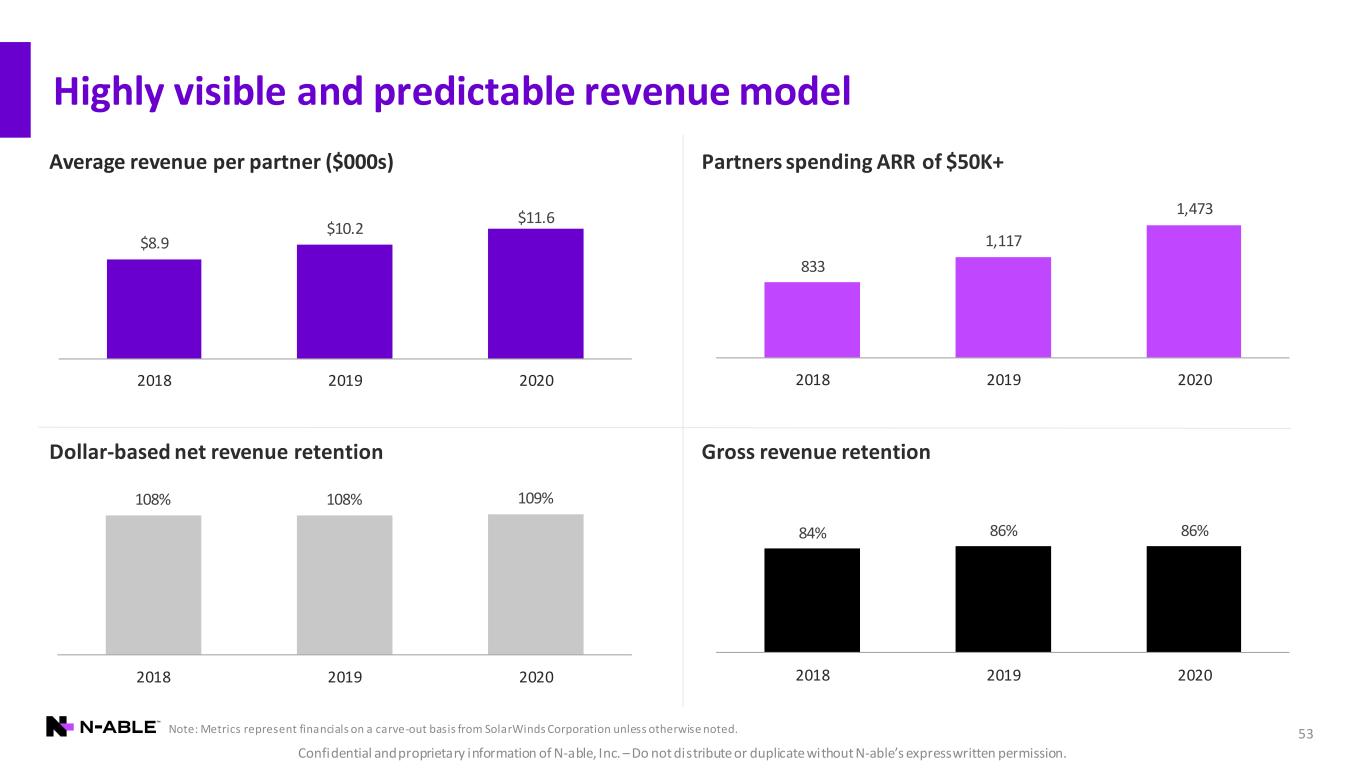

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 108% 108% 109% 2018 2019 2020 53 Highly visible and predictable revenue model 84% 86% 86% 2018 2019 2020 Average revenue per partner ($000s) Dollar-based net revenue retention Partners spending ARR of $50K+ Gross revenue retention $8.9 $10.2 $11.6 2018 2019 2020 833 1,117 1,473 2018 2019 2020 Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted.

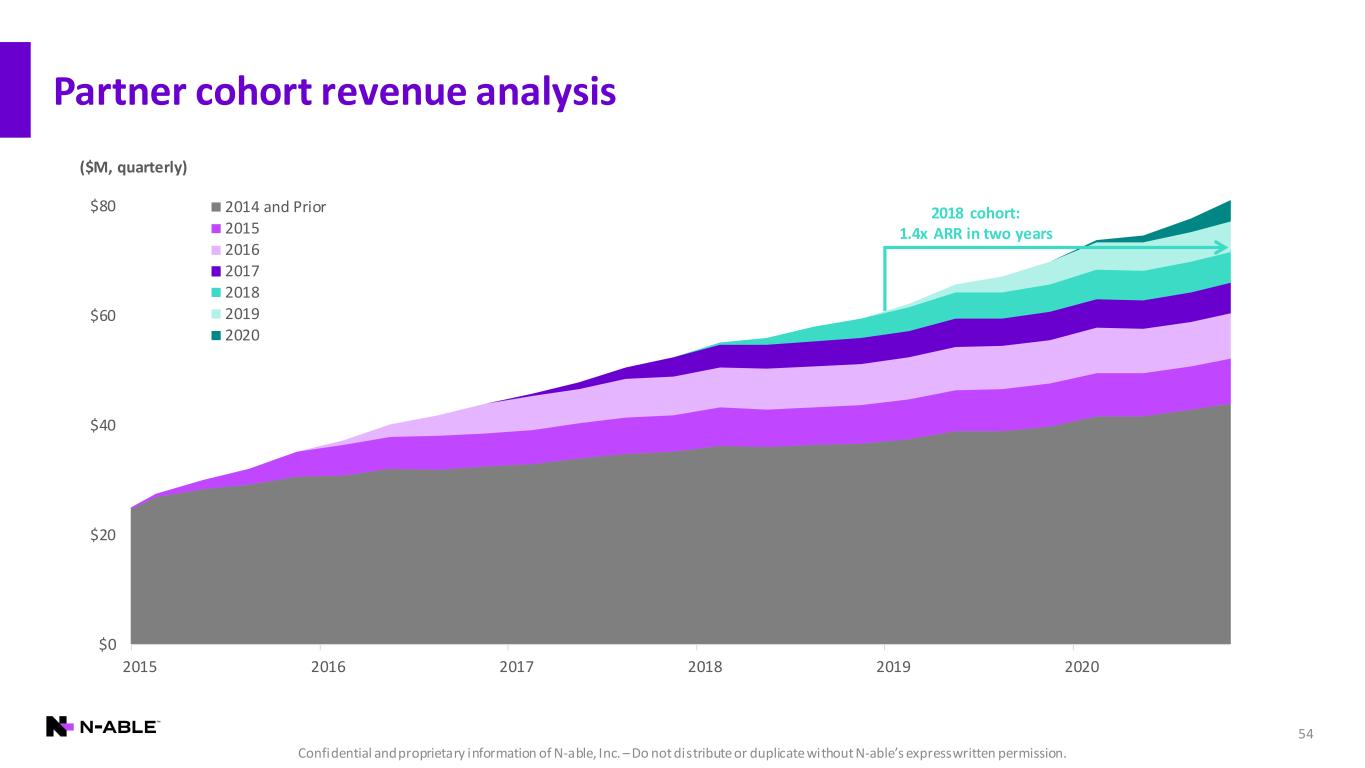

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Partner cohort revenue analysis 54 $0 $20 $40 $60 $80 2015 2016 2017 2018 2019 2020 2014 and Prior 2015 2016 2017 2018 2019 2020 ($M, quarterly) 2018 cohort: 1.4x ARR in two years

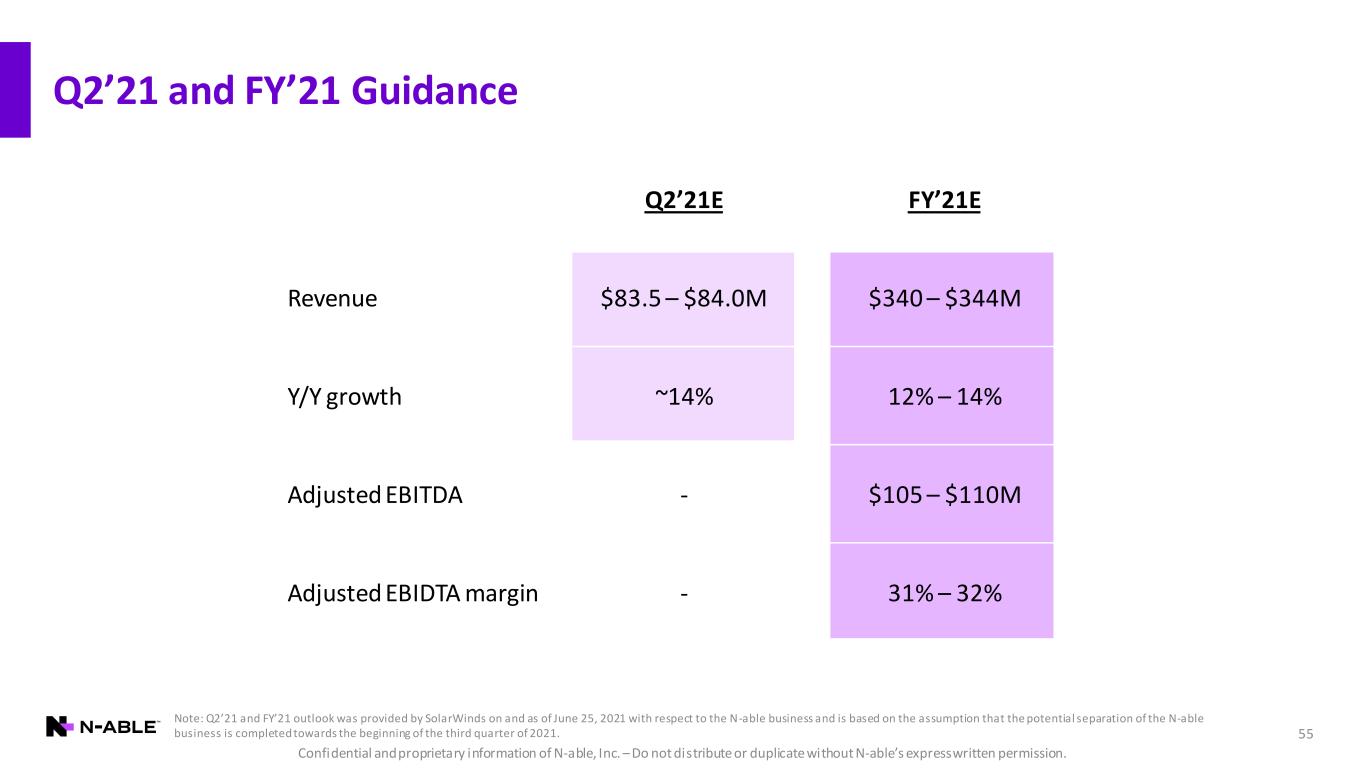

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Q2’21E FY’21E Revenue $83.5 – $84.0M $340 – $344M Y/Y growth ~14% 12% – 14% Adjusted EBITDA - $105 – $110M Adjusted EBIDTA margin - 31% – 32% Q2’21 and FY’21 Guidance 55 Note: Q2’21 and FY’21 outlook was provided by SolarWinds on and as of June 25, 2021 with respect to the N -able business and is based on the assumption that the potential separation of the N-able business is completed towards the beginning of the third quarter of 2021.

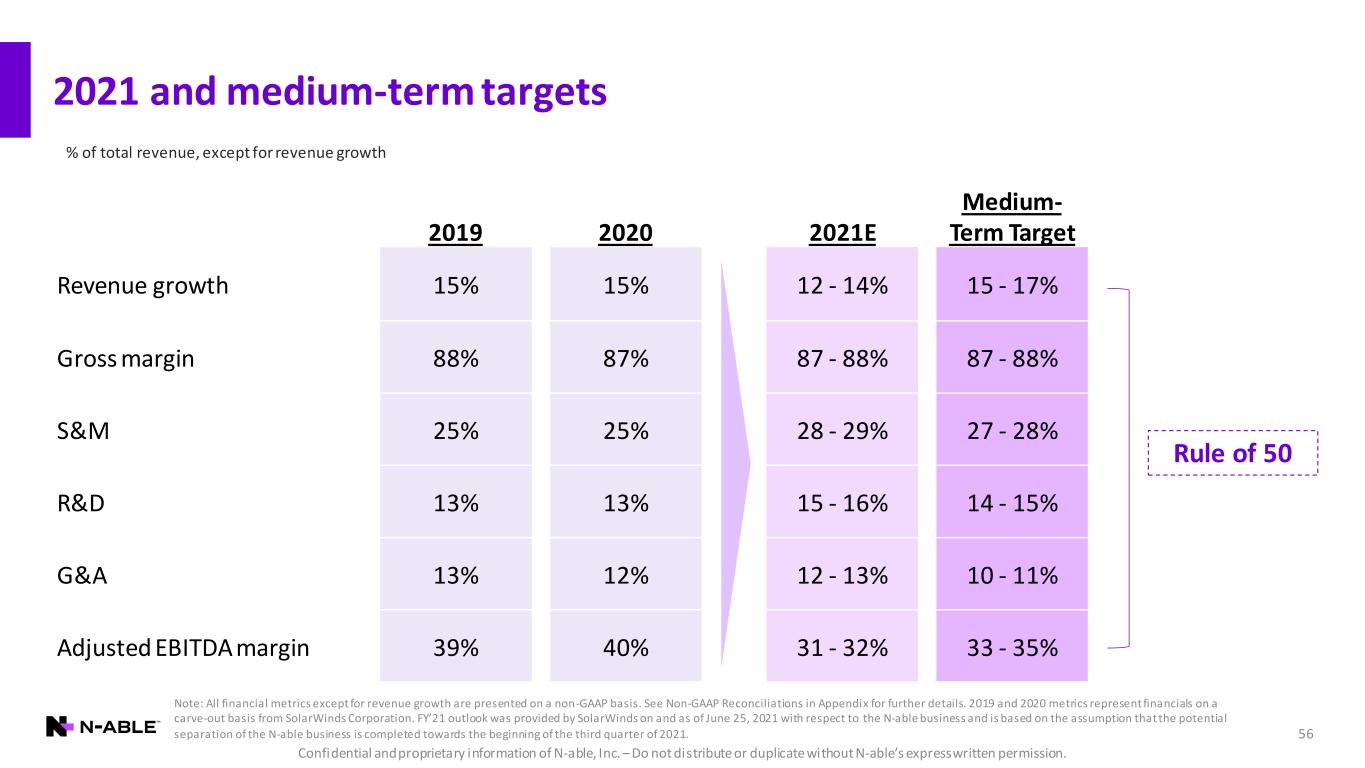

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 56 2021 and medium-term targets % of total revenue, except for revenue growth Rule of 50 2019 2020 2021E Medium- Term Target Revenue growth 15% 15% 12 - 14% 15 - 17% Gross margin 88% 87% 87 - 88% 87 - 88% S&M 25% 25% 28 - 29% 27 - 28% R&D 13% 13% 15 - 16% 14 - 15% G&A 13% 12% 12 - 13% 10 - 11% Adjusted EBITDA margin 39% 40% 31 - 32% 33 - 35% Note: All financial metrics except for revenue growth are presented on a non-GAAP basis. See Non-GAAP Reconciliations in Appendix for further details. 2019 and 2020 metrics represent financials on a carve-out basis from SolarWinds Corporation. FY’21 outlook was provided by SolarWinds on and as of June 25, 2021 with respect to the N-able business and is based on the assumption that the potential separation of the N-able business is completed towards the beginning of the third quarter of 2021.

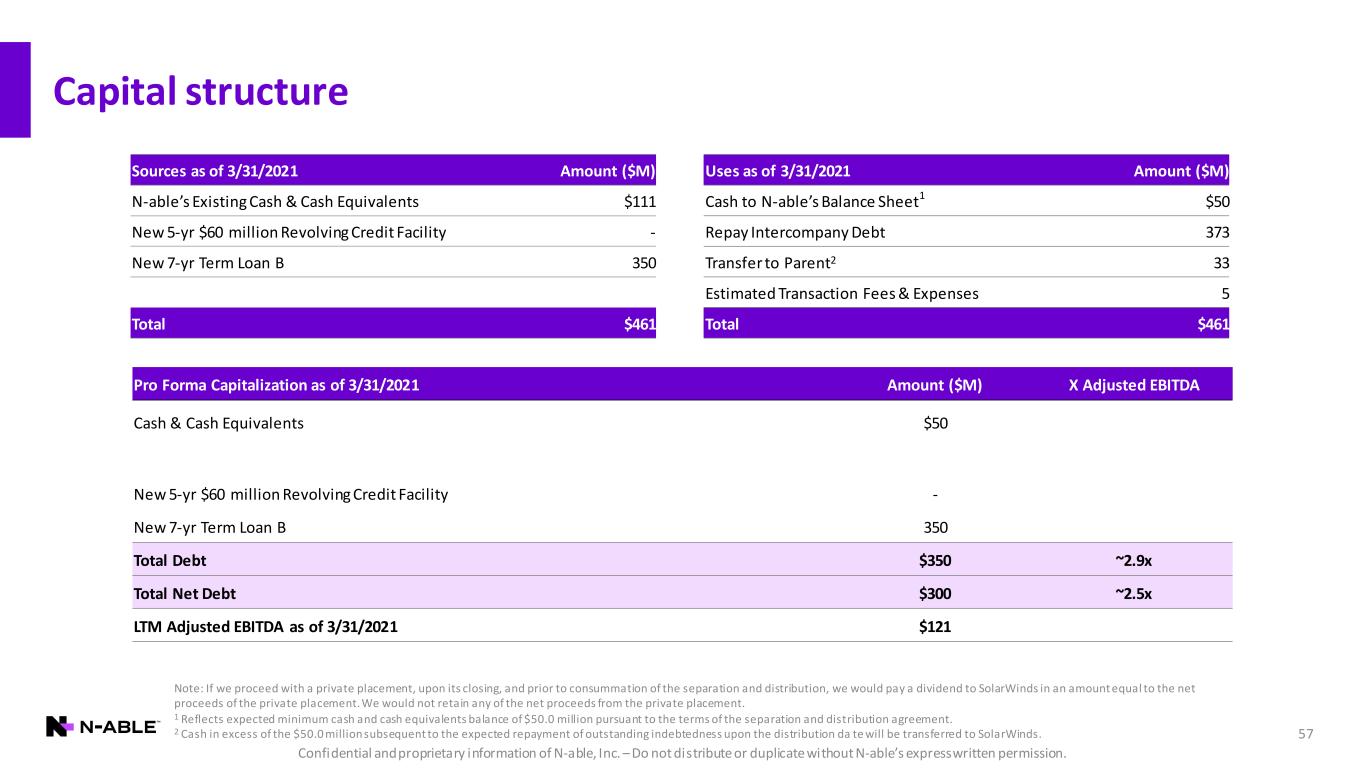

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Capital structure 57 Sources as of 3/31/2021 Amount ($M) N-able’s Existing Cash & Cash Equivalents $111 New 5-yr $60 million Revolving Credit Facility - New 7-yr Term Loan B 350 Total $461 Pro Forma Capitalization as of 3/31/2021 Amount ($M) X Adjusted EBITDA Cash & Cash Equivalents $50 New 5-yr $60 million Revolving Credit Facility - New 7-yr Term Loan B 350 Total Debt $350 ~2.9x Total Net Debt $300 ~2.5x LTM Adjusted EBITDA as of 3/31/2021 $121 Uses as of 3/31/2021 Amount ($M) Cash to N-able’s Balance Sheet1 $50 Repay Intercompany Debt 373 Transfer to Parent2 33 Estimated Transaction Fees & Expenses 5 Total $461 Note: If we proceed with a private placement, upon its closing, and prior to consummation of the separation and distribution, we would pay a dividend to SolarWinds in an amount equal to the net proceeds of the private placement. We would not retain any of the net proceeds from the private placement. 1 Reflects expected minimum cash and cash equivalents balance of $50.0 million pursuant to the terms of the separation and distribution agreement. 2 Cash in excess of the $50.0 million subsequent to the expected repayment of outstanding indebtedness upon the distribution da te will be transferred to SolarWinds.

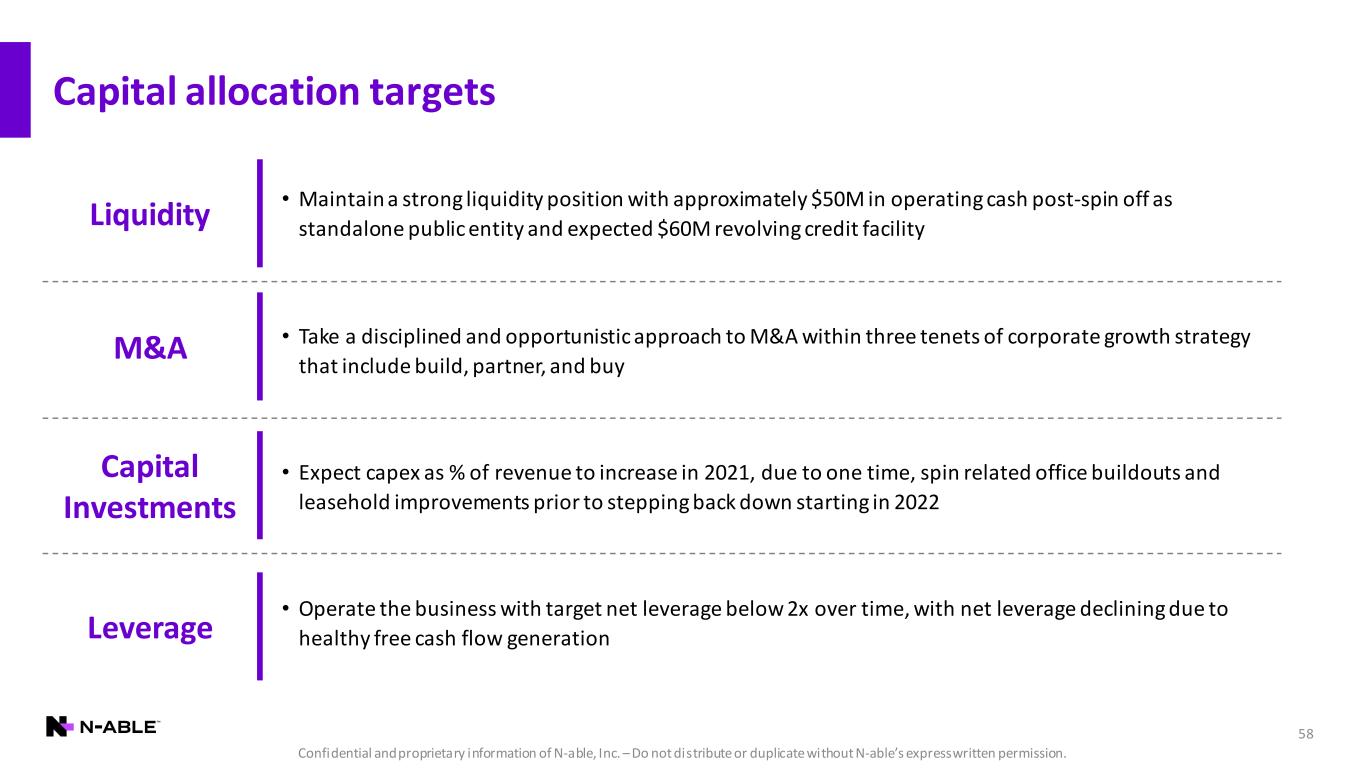

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 58 Capital allocation targets Liquidity • Maintain a strong liquidity position with approximately $50M in operating cash post-spin off as standalone public entity and expected $60M revolving credit facility Capital Investments • Expect capex as % of revenue to increase in 2021, due to one time, spin related office buildouts and leasehold improvements prior to stepping back down starting in 2022 M&A • Take a disciplined and opportunistic approach to M&A within three tenets of corporate growth strategy that include build, partner, and buy Leverage • Operate the business with target net leverage below 2x over time, with net leverage declining due to healthy free cash flow generation

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Investment Highlights

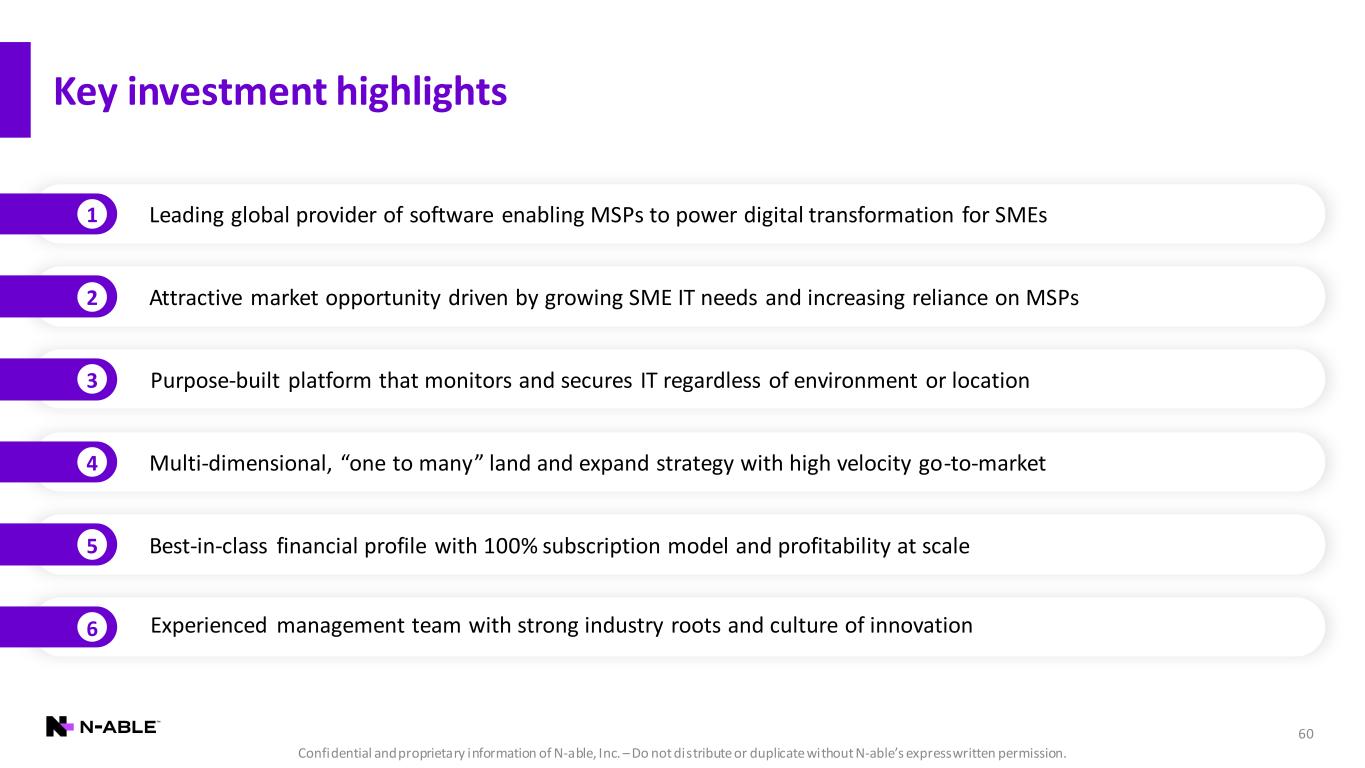

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 60 Key investment highlights Leading global provider of software enabling MSPs to power digital transformation for SMEs1 Attractive market opportunity driven by growing SME IT needs and increasing reliance on MSPs2 Multi-dimensional, “one to many” land and expand strategy with high velocity go-to-market4 Best-in-class financial profile with 100% subscription model and profitability at scale5 6 Experienced management team with strong industry roots and culture of innovation 3 Purpose-built platform that monitors and secures IT regardless of environment or location

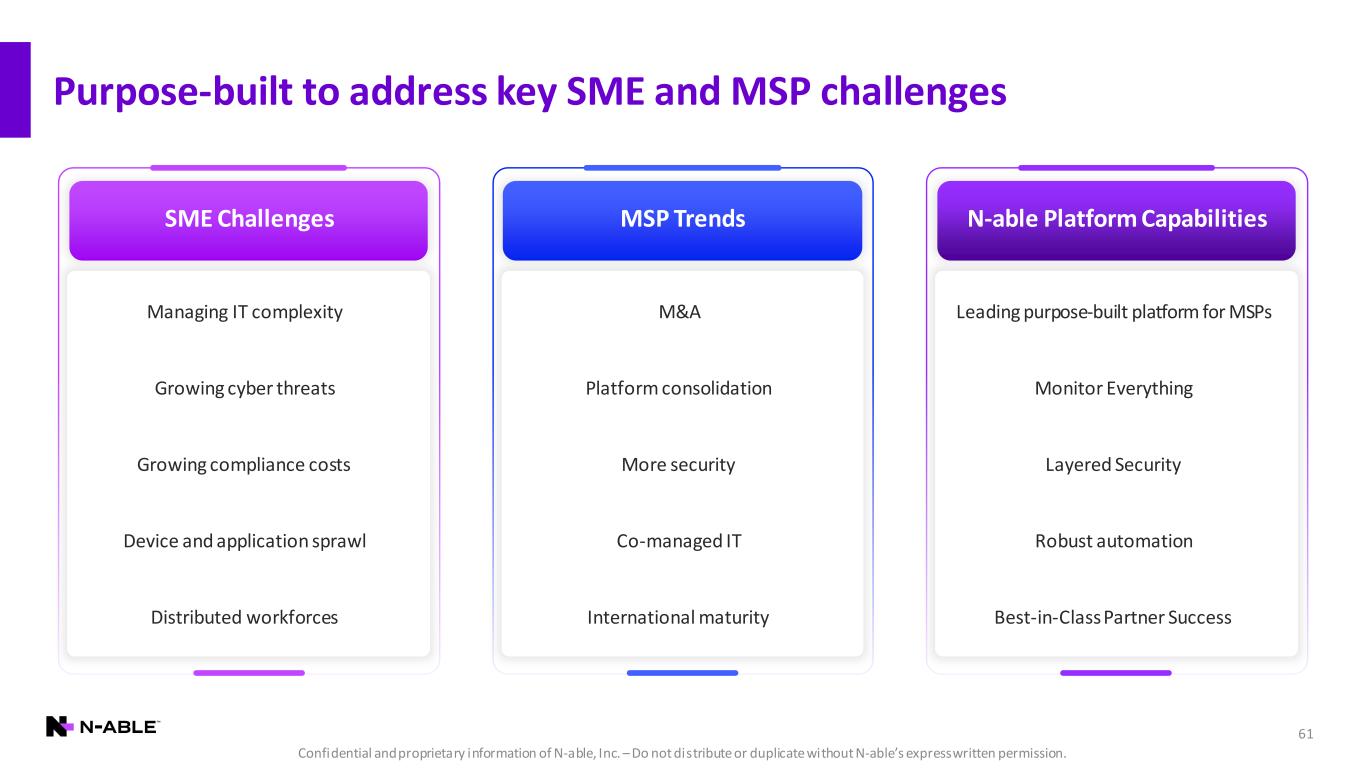

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Purpose-built to address key SME and MSP challenges 61 Growing cyber threats Managing IT complexity Growing compliance costs Distributed workforces Device and application sprawl SME Challenges Platform consolidation M&A More security International maturity Co-managed IT MSP Trends Monitor Everything Leading purpose-built platform for MSPs Layered Security Best-in-Class Partner Success Robust automation N-able Platform Capabilities

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 62 Multiple levers to drive future growth Deliver globally Broaden co-managed IT footprint Add services Widen our surface area Partner-enabled expansion Expand MSP partner footprint

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Appendix

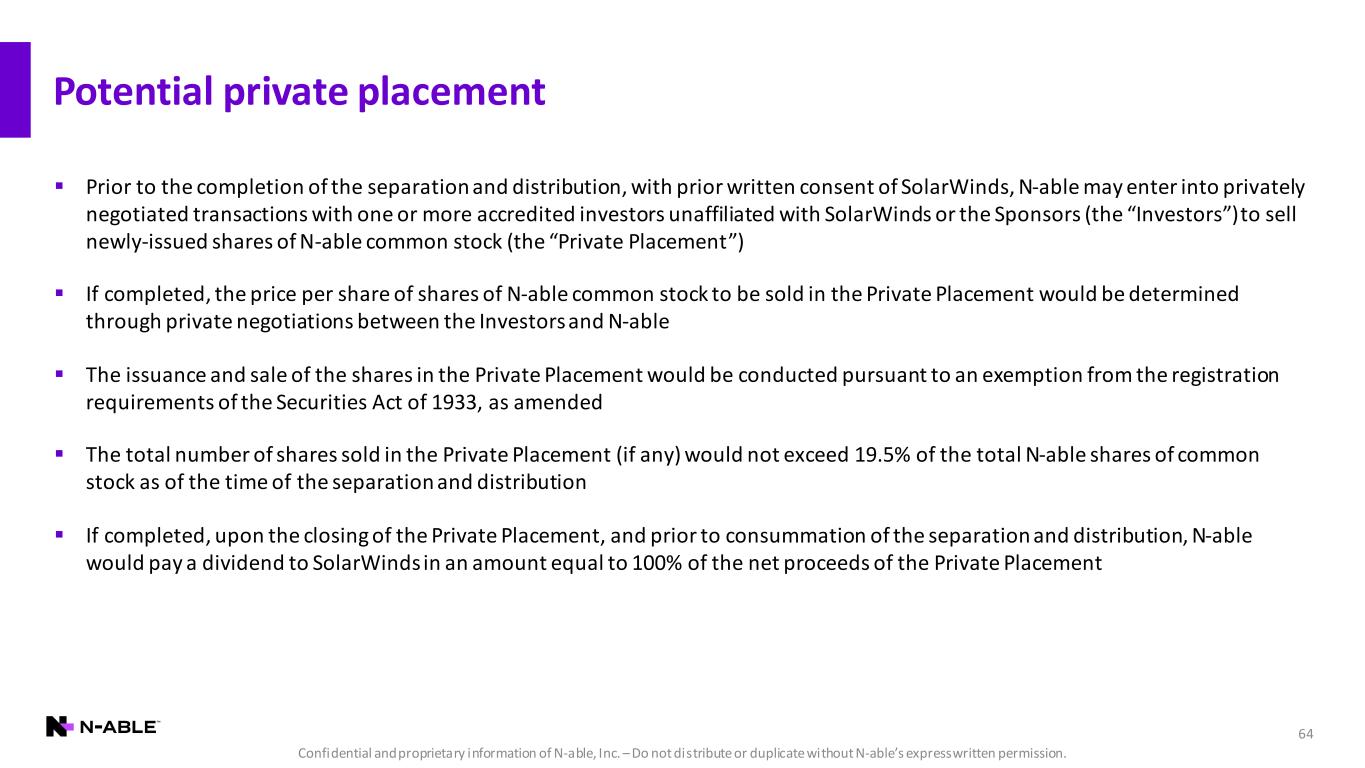

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Potential private placement 64 ▪ Prior to the completion of the separation and distribution, with prior written consent of SolarWinds, N-able may enter into privately negotiated transactions with one or more accredited investors unaffiliated with SolarWinds or the Sponsors (the “Investors”) to sell newly-issued shares of N-able common stock (the “Private Placement”) ▪ If completed, the price per share of shares of N-able common stock to be sold in the Private Placement would be determined through private negotiations between the Investors and N-able ▪ The issuance and sale of the shares in the Private Placement would be conducted pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended ▪ The total number of shares sold in the Private Placement (if any) would not exceed 19.5% of the total N-able shares of common stock as of the time of the separation and distribution ▪ If completed, upon the closing of the Private Placement, and prior to consummation of the separation and distribution, N-able would pay a dividend to SolarWinds in an amount equal to 100% of the net proceeds of the Private Placement

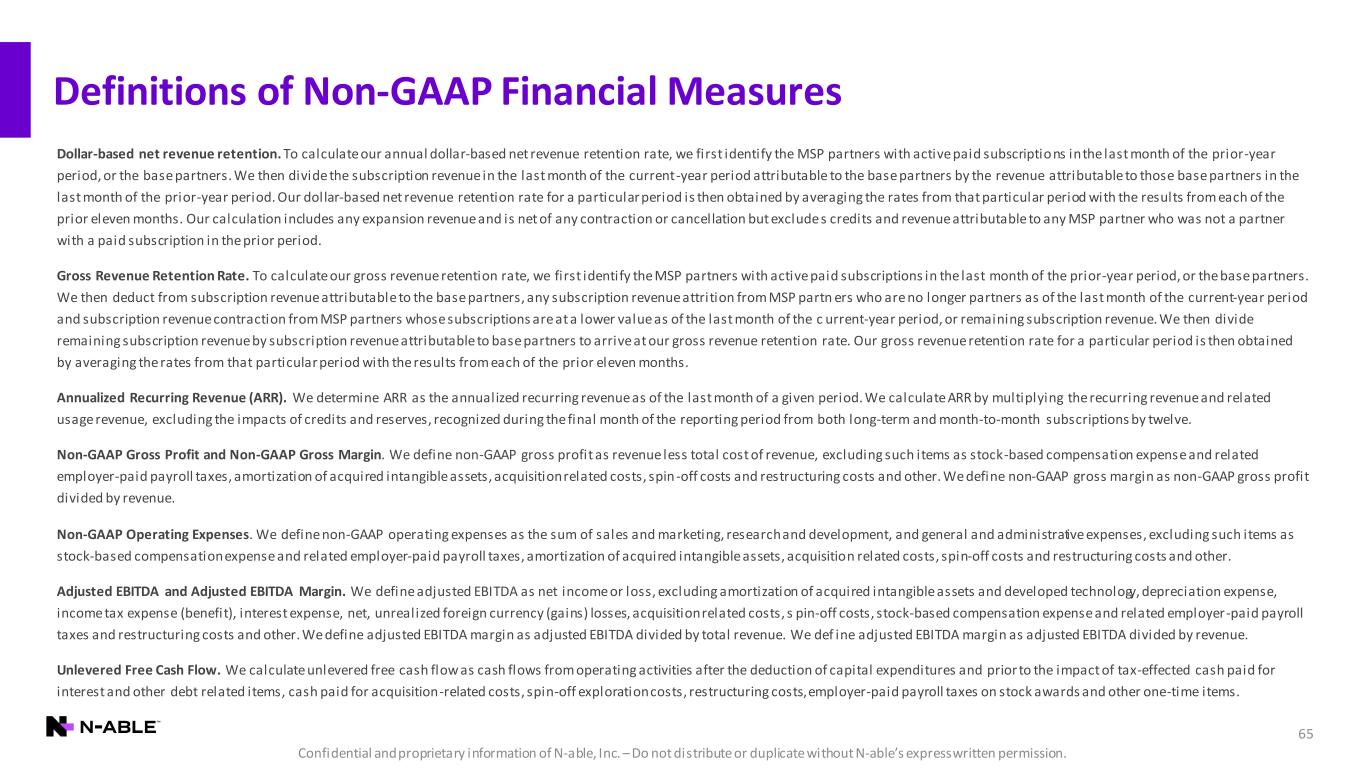

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Definitions of Non-GAAP Financial Measures 65 Dollar-based net revenue retention. To calculate our annual dollar-based net revenue retention rate, we first identify the MSP partners with active paid subscriptions in the last month of the prior-year period, or the base partners. We then divide the subscription revenue in the last month of the current-year period attributable to the base partners by the revenue attributable to those base partners in the last month of the prior-year period. Our dollar-based net revenue retention rate for a particular period is then obtained by averaging the rates from that particular period with the results from each of the prior eleven months. Our calculation includes any expansion revenue and is net of any contraction or cancellation but excludes credits and revenue attributable to any MSP partner who was not a partner with a paid subscription in the prior period. Gross Revenue Retention Rate. To calculate our gross revenue retention rate, we first identify the MSP partners with active paid subscriptions in the last month of the prior-year period, or the base partners. We then deduct from subscription revenue attributable to the base partners, any subscription revenue attrition from MSP partn ers who are no longer partners as of the last month of the current-year period and subscription revenue contraction from MSP partners whose subscriptions are at a lower value as of the last month of the c urrent-year period, or remaining subscription revenue. We then divide remaining subscription revenue by subscription revenue attributable to base partners to arrive at our gross revenue retention rate. Our gross revenue retention rate for a particular period is then obtained by averaging the rates from that particular period with the results from each of the prior eleven months. Annualized Recurring Revenue (ARR). We determine ARR as the annualized recurring revenue as of the last month of a given period. We calculate ARR by multiplying the recurring revenue and related usage revenue, excluding the impacts of credits and reserves, recognized during the final month of the reporting period from both long-term and month-to-month subscriptions by twelve. Non-GAAP Gross Profit and Non-GAAP Gross Margin. We define non-GAAP gross profit as revenue less total cost of revenue, excluding such items as stock-based compensation expense and related employer-paid payroll taxes, amortization of acquired intangible assets, acquisition related costs, spin-off costs and restructuring costs and other. We define non-GAAP gross margin as non-GAAP gross profit divided by revenue. Non-GAAP Operating Expenses. We define non-GAAP operating expenses as the sum of sales and marketing, research and development, and general and administrative expenses, excluding such items as stock-based compensation expense and related employer-paid payroll taxes, amortization of acquired intangible assets, acquisition related costs, spin-off costs and restructuring costs and other. Adjusted EBITDA and Adjusted EBITDA Margin. We define adjusted EBITDA as net income or loss, excluding amortization of acquired intangible assets and developed technology, depreciation expense, income tax expense (benefit), interest expense, net, unrealized foreign currency (gains) losses, acquisition related costs, s pin-off costs, stock-based compensation expense and related employer-paid payroll taxes and restructuring costs and other. We define adjusted EBITDA margin as adjusted EBITDA divided by total revenue. We def ine adjusted EBITDA margin as adjusted EBITDA divided by revenue. Unlevered Free Cash Flow. We calculate unlevered free cash flow as cash flows from operating activities after the deduction of capital expenditures and prior to the impact of tax-effected cash paid for interest and other debt related items, cash paid for acquisition-related costs, spin-off exploration costs, restructuring costs,employer-paid payroll taxes on stock awards and other one-time items.

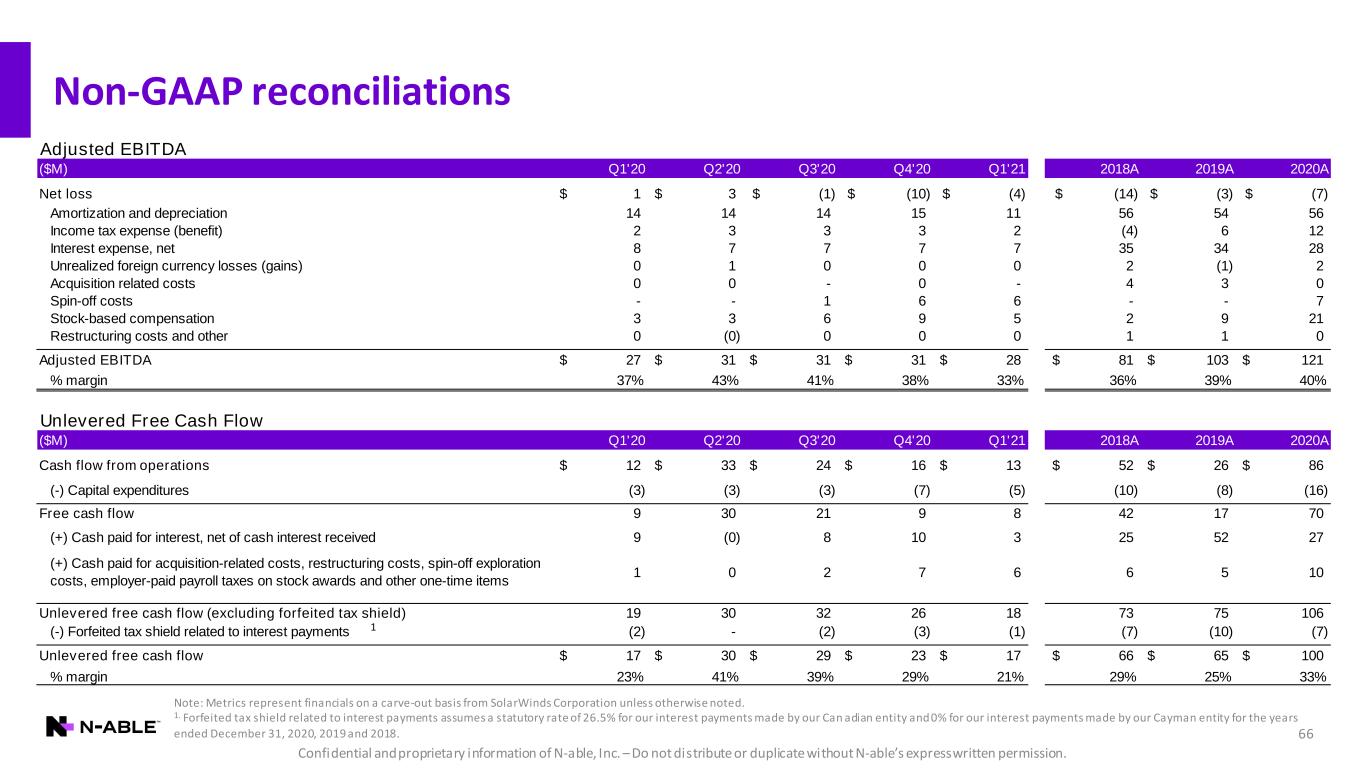

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 66 Non-GAAP reconciliations Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. 1. Forfeited tax shield related to interest payments assumes a statutory rate of 26.5% for our interest payments made by our Can adian entity and 0% for our interest payments made by our Cayman entity for the years ended December 31, 2020, 2019 and 2018. 1 Adjusted EBITDA ($M) Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A Net loss 1$ 3$ (1)$ (10)$ (4)$ (14)$ (3)$ (7)$ Amortization and depreciation 14 14 14 15 11 56 54 56 Income tax expense (benefit) 2 3 3 3 2 (4) 6 12 Interest expense, net 8 7 7 7 7 35 34 28 Unrealized foreign currency losses (gains) 0 1 0 0 0 2 (1) 2 Acquisition related costs 0 0 - 0 - 4 3 0 Spin-off costs - - 1 6 6 - - 7 Stock-based compensation 3 3 6 9 5 2 9 21 Restructuring costs and other 0 (0) 0 0 0 1 1 0 Adjusted EBITDA 27$ 31$ 31$ 31$ 28$ 81$ 103$ 121$ % margin 37% 43% 41% 38% 33% 36% 39% 40% Unlevered Free Cash Flow ($M) Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A Cash flow from operations 12$ 33$ 24$ 16$ 13$ 52$ 26$ 86$ (-) Capital expenditures (3) (3) (3) (7) (5) (10) (8) (16) Free cash flow 9 30 21 9 8 42 17 70 (+) Cash paid for interest, net of cash interest received 9 (0) 8 10 3 25 52 27 (+) Cash paid for acquisition-related costs, restructuring costs, spin-off exploration costs, employer-paid payroll taxes on stock awards and other one-time items 1 0 2 7 6 6 5 10 Unlevered free cash flow (excluding forfeited tax shield) 19 30 32 26 18 73 75 106 (-) Forfeited tax shield related to interest payments (2) - (2) (3) (1) (7) (10) (7) Unlevered free cash flow 17$ 30$ 29$ 23$ 17$ 66$ 65$ 100$ % margin 23% 41% 39% 29% 21% 29% 25% 33%

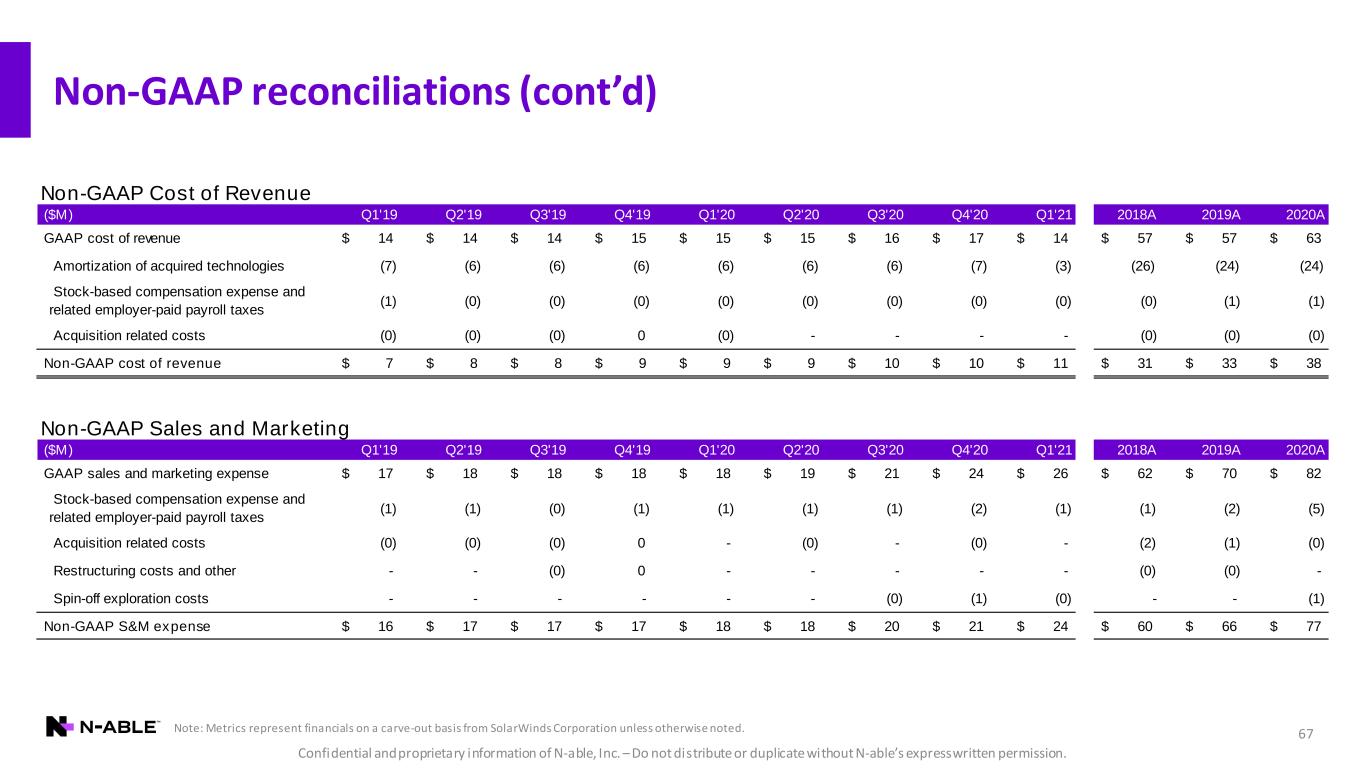

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 67 Non-GAAP reconciliations (cont’d) Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Non-GAAP Cost of Revenue ($M) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A GAAP cost of revenue 14$ 14$ 14$ 15$ 15$ 15$ 16$ 17$ 14$ 57$ 57$ 63$ Amortization of acquired technologies (7) (6) (6) (6) (6) (6) (6) (7) (3) (26) (24) (24) Stock-based compensation expense and related employer-paid payroll taxes (1) (0) (0) (0) (0) (0) (0) (0) (0) (0) (1) (1) Acquisition related costs (0) (0) (0) 0 (0) - - - - (0) (0) (0) Non-GAAP cost of revenue 7$ 8$ 8$ 9$ 9$ 9$ 10$ 10$ 11$ 31$ 33$ 38$ Non-GAAP Sales and Marketing ($M) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A GAAP sales and marketing expense 17$ 18$ 18$ 18$ 18$ 19$ 21$ 24$ 26$ 62$ 70$ 82$ Stock-based compensation expense and related employer-paid payroll taxes (1) (1) (0) (1) (1) (1) (1) (2) (1) (1) (2) (5) Acquisition related costs (0) (0) (0) 0 - (0) - (0) - (2) (1) (0) Restructuring costs and other - - (0) 0 - - - - - (0) (0) - Spin-off exploration costs - - - - - - (0) (1) (0) - - (1) Non-GAAP S&M expense 16$ 17$ 17$ 17$ 18$ 18$ 20$ 21$ 24$ 60$ 66$ 77$

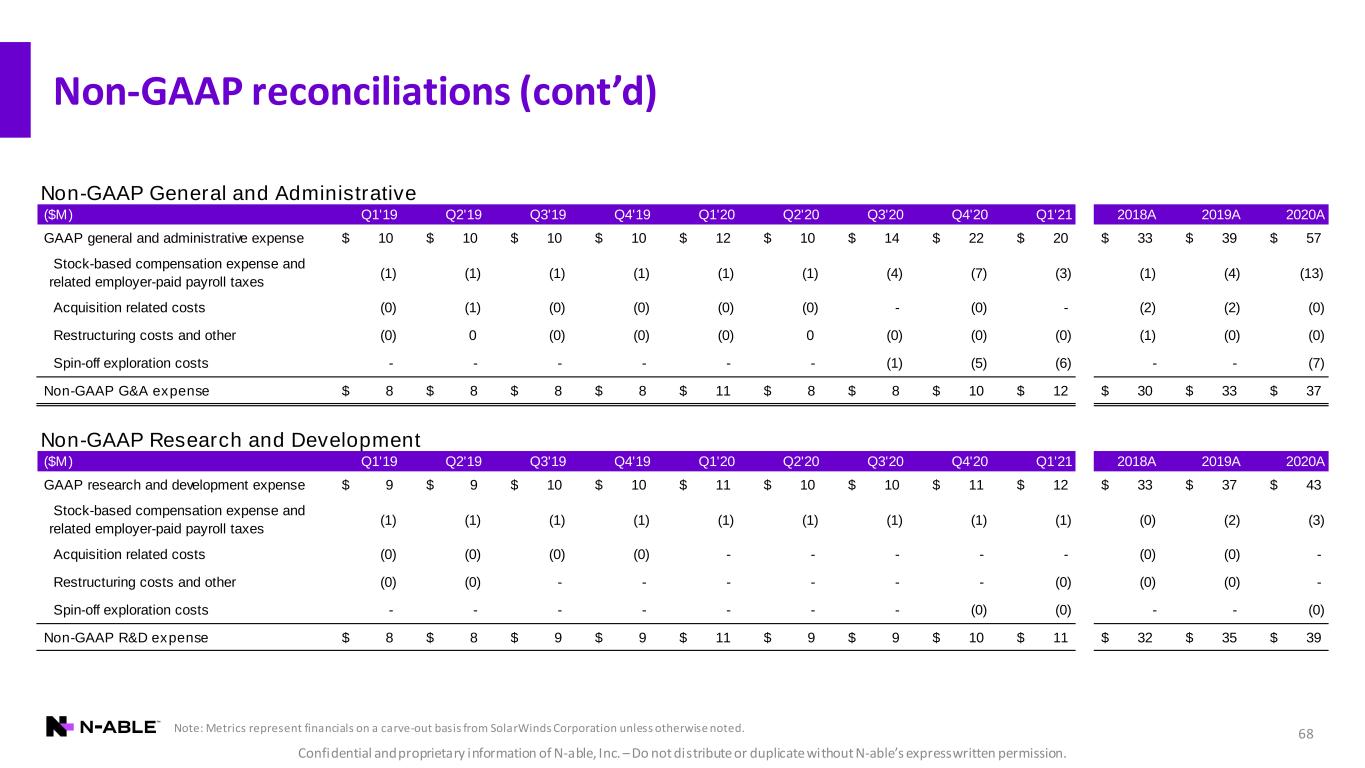

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 68 Non-GAAP reconciliations (cont’d) Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Non-GAAP General and Administrative ($M) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A GAAP general and administrative expense 10$ 10$ 10$ 10$ 12$ 10$ 14$ 22$ 20$ 33$ 39$ 57$ Stock-based compensation expense and related employer-paid payroll taxes (1) (1) (1) (1) (1) (1) (4) (7) (3) (1) (4) (13) Acquisition related costs (0) (1) (0) (0) (0) (0) - (0) - (2) (2) (0) Restructuring costs and other (0) 0 (0) (0) (0) 0 (0) (0) (0) (1) (0) (0) Spin-off exploration costs - - - - - - (1) (5) (6) - - (7) Non-GAAP G&A expense 8$ 8$ 8$ 8$ 11$ 8$ 8$ 10$ 12$ 30$ 33$ 37$ Non-GAAP Research and Development ($M) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 2018A 2019A 2020A GAAP research and development expense 9$ 9$ 10$ 10$ 11$ 10$ 10$ 11$ 12$ 33$ 37$ 43$ Stock-based compensation expense and related employer-paid payroll taxes (1) (1) (1) (1) (1) (1) (1) (1) (1) (0) (2) (3) Acquisition related costs (0) (0) (0) (0) - - - - - (0) (0) - Restructuring costs and other (0) (0) - - - - - - (0) (0) (0) - Spin-off exploration costs - - - - - - - (0) (0) - - (0) Non-GAAP R&D expense 8$ 8$ 9$ 9$ 11$ 9$ 9$ 10$ 11$ 32$ 35$ 39$