Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Dorman Products, Inc. | dorm-ex991_25.htm |

| EX-2.1 - EX-2.1 - Dorman Products, Inc. | dorm-ex21_172.htm |

| 8-K - 8-K - Dorman Products, Inc. | dorm-8k_20210625.htm |

Dorman Products to Acquire Dayton Parts INVESTOR SUMMARY Exhibit 99.2

Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to net sales, diluted and adjusted diluted earnings per share, selling, general and administrative expenses, gross margins, adjusted gross margins, cash flow, indebtedness, liquidity, new product growth and the Company’s outlook. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should,” “will” and “likely” and similar expressions identify forward-looking statements. However, the absence of these words does not mean the statements are not forward-looking. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors (many of which are outside of our control) which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These risks, uncertainties and other factors include, but are not limited to: (i) the age, condition and number of vehicles that need servicing; (ii) competition in the automotive aftermarket industry; (iii) the loss or decrease in sales among one of our top customers; (iv) price competition; (v) limited customer shelf space; (vi) customer consolidation; (vii) widespread public health epidemics, including COVID-19; (viii) failure to maintain sufficient inventory or anticipate changes in customer demand; (ix) excess overstock inventory-related returns; (x) the inability to purchase raw materials, components and other items from our suppliers; (xi) the availability and cost of third-party transportation providers; (xii) reliance on new product development; (xiii) changes in, or restrictions on access to, automotive technology; (xiv) quality problems with our products; (xv) inability to protect our intellectual property; (xvi) claims of intellectual property infringement; (xvii) failure to maintain the value of our brands; (xviii) cyber-attacks; (xix) foreign currency fluctuations and dependence on foreign suppliers; (xx) exposure to risks related to accounts receivable; (xxi) changes in U.S. trade policy, including the imposition of tariffs; (xxii) the level of our indebtedness; (xxiii) risks related to accounts receivable sales agreements; (xxiv) the phaseout of LIBOR or the impact of the imposition of a new reference rate; (xxv) our executive chairman and his family owning a significant portion of the Company; (xxvi) unfavorable economic conditions; (xxvii) quarterly fluctuations and disruptions from events beyond our control; (xxviii) unfavorable results of legal proceedings; (xxix) volatility in the market price of our common stock and potential securities class action litigation; (xxx) losing the services of our executive officers or other highly qualified and experienced Contributors; (xxxi) the inability to identify suitable acquisition candidates, complete acquisitions or integrate acquisitions successfully; (xxxii) changes in tax laws; (xxxiii) global climate change and related regulations; (xxxiv) violations of anti-bribery laws; and (xxxv) import and export control and economic sanctions laws and regulations. These risks, uncertainties and other factors also include, but are not limited to: (i) the proposed transaction may not be completed, or completed within the expected timeframe; (ii) costs relating to the proposed transaction may be greater than expected; (iii) the possibility that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval in connection with the proposed transaction; (iv) anticipated tax benefits may not be achieved by the Company; (v) problems may arise in integrating the businesses of the two companies and the integration may not be successful; (vi) the combined companies may be unable to achieve any anticipated synergies or any benefits of the transaction may take longer to realize than expected; (vii) the businesses of one or both companies may suffer as a result of uncertainties surrounding the proposed transaction, including disruption of relationships with customers, employees, suppliers or dealers; (viii) the combined companies may not perform as expected following the closing; (ix) the failure to enter into a new $600 million revolving credit facility or to repay any borrowings thereunder; and (x) other risks beyond the control of either party. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. For additional information concerning factors that could cause actual results to differ materially from the information contained in this presentation, reference is made to the information in Part I, “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 26, 2020, and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 27, 2021. The Company is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this presentation, including but not limited to any situation where any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise.

Transaction Summary OVERVIEW CAPITAL STRUCTURE VALUE CREATION TIMING Dorman Products to acquire Dayton Parts for total consideration of $338 million, subject to customary adjustments Dayton Parts offers a complete line of brake, spring, steering, suspension, driveline and hitch & coupling products for commercial vehicles in the USA and Canada, and is a leader in the undercarriage category Transaction expected to significantly accelerate Dorman’s efforts to drive our heavy-duty business growth strategy, and is consistent with Dorman’s acquisition strategy Dorman expects to enter into a new $600 million Revolving Credit Facility in connection with the transaction, which will replace its existing revolving credit facility Borrowings under the new facility that are used to complete the transaction are expected to result in less than 1.0X net leverage at closing Combined entities will generate significant free cash flow Sufficient liquidity post-closing to fund operations and pursue additional ongoing opportunistic acquisition strategy Dayton Parts generated $168 million in net sales for the twelve months ended December 2020 Transaction expected to enhance net sales growth, generate cost savings, and deliver strong margins We anticipate the transaction to be immediately accretive to adjusted diluted earnings per share, excluding one-time charges and acquisition-related intangible assets amortization Transaction is expected to close during the second half of 2021, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act

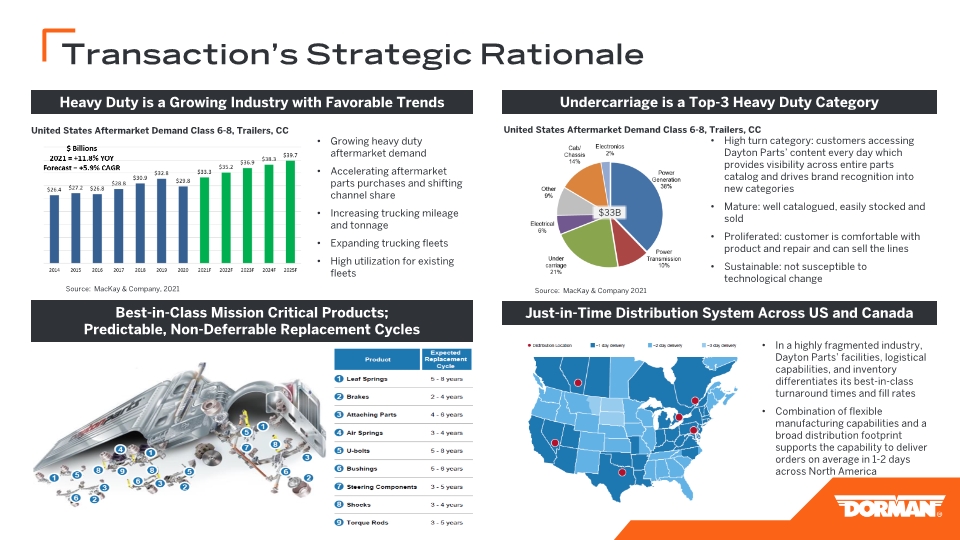

Just-in-Time Distribution System Across US and Canada In a highly fragmented industry, Dayton Parts’ facilities, logistical capabilities, and inventory differentiates its best-in-class turnaround times and fill rates Combination of flexible manufacturing capabilities and a broad distribution footprint supports the capability to deliver orders on average in 1-2 days across North America Best-in-Class Mission Critical Products; Predictable, Non-Deferrable Replacement Cycles Undercarriage is a Top-3 Heavy Duty Category Heavy Duty is a Growing Industry with Favorable Trends High turn category: customers accessing Dayton Parts’ content every day which provides visibility across entire parts catalog and drives brand recognition into new categories Mature: well catalogued, easily stocked and sold Proliferated: customer is comfortable with product and repair and can sell the lines Sustainable: not susceptible to technological change $33B United States Aftermarket Demand Class 6-8, Trailers, CC Growing heavy duty aftermarket demand Accelerating aftermarket parts purchases and shifting channel share Increasing trucking mileage and tonnage Expanding trucking fleets High utilization for existing fleets Transaction’s Strategic Rationale Source: MacKay & Company 2021 Source: MacKay & Company, 2021 United States Aftermarket Demand Class 6-8, Trailers, CC

Key Takeaways Transaction expected to accelerate heavy-duty growth through a beachhead full-line category, with high wear, high turn, and high touch components. Adds category-leading brands with 100-year legacy of aftermarket participation in a top-3 heavy-duty category. Capitalizes on Dayton’s North American distribution network driving industry-leading service speed in the heavy-duty space, with an average product delivery time of 1 to 2 days across the United States and Canada Leverages Dorman’s strengths in product innovation to accelerate Dayton’s new product growth Expected to drive accretive net sales and adjusted earnings per share with strong margins