Attached files

| file | filename |

|---|---|

| EX-99.1 - OLD BAILEY CONSULTANCY LTD | ex99-1.htm |

| EX-23.1 - OLD BAILEY CONSULTANCY LTD | ex23-1.htm |

| EX-5.1 - OLD BAILEY CONSULTANCY LTD | ex5-1.htm |

| EX-3.2 - OLD BAILEY CONSULTANCY LTD | ex3-2.htm |

| EX-3.1 - OLD BAILEY CONSULTANCY LTD | ex3-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

OLD BAILEY CONSULTANCY LIMITED

(Exact name of registrant as specified in its charter)

Date: June 24, 2021

| Delaware | 8742 | 61-1979454 | ||

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer Identification No.) |

Room 2110, 21/F, One Pacific Centre,

Kwun Tong, Hong Kong

Issuer’s telephone number: (852) 6686 9909

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Room 2110, 21/F, One Pacific Centre,

Kwun Tong, Hong Kong

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (2) | ||||||||||||

| Common Stock, $0.0001 par value | 2,412,500 | $ | 0.80 | $ | 1,930,000.00 | $ | 210.56 | |||||||||

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

PRELIMINARY PROSPECTUS

OLD BAILEY CONSULTANCY LIMITED

2,412,500 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of Old Bailey Consultancy Limited Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares. As of the date of this registration statement it should be noted that our company is currently a shell company. We are not however, a blank check company.

In this public offering we, “Old Bailey Consultancy Limited” are offering 62,500 shares of our common stock and our selling shareholders are offering 2,350,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Mr. So Man Kit (“Mr. So”) who is deemed to be an underwriter of this offering. The selling shareholders are also deemed to be underwriters of this offering. There is uncertainty that we will be able to sell any of the 62,500 shares being offered herein by the Company. Mr. So will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.80 per share for the duration of the Offering. Additionally, all of the shares offered by the selling shareholders will be sold at a fixed price of $0.80 for the duration of the Offering. Assuming all of the 62,500 shares being offered by the Company are sold, the Company will receive $50,000 in net proceeds. Assuming 46,875 shares (75%) being offered by the Company are sold, the Company will receive $37,500 in net proceeds. Assuming 31,250 shares (50%) being offered by the Company are sold, the Company will receive $25,000 in net proceeds. Assuming 15,625 shares (25%) being offered by the Company are sold, the Company will receive $12,500 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our Company’s business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

None of the Company’s shareholders or management have plans to enter into any agreement resulting in a change of control of the Company, subsequent to this offering.

The Company’s selling shareholders listed on page 26 are deemed to be underwriters of this offering.

This offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

Currently, our Chief Executive Officer Mr. So Man Kit owns approximately 90.36% of the voting power of our outstanding capital stock. After the offering, assuming all of their personal shares that are being registered herein are sold, Mr. So will have the ability to control approximately 85.52% of the voting power of our outstanding capital stock.

The Company estimates the costs of this offering at $22,210.56. All expenses incurred in this offering are being paid for by the Company. There has been no public trading market for the common stock of Old Bailey Consultancy Limited.

Any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 6.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The date of this prospectus is June 24, 2021

| - 1 - |

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| - 2 - |

In this Prospectus, ‘‘Old Bailey Consultancy’’ the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Old Bailey Consultancy Limited, unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending December 31st. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 6, and the financial statements, before making an investment decision.

The Company

Old Bailey Consultancy Limited, a Delaware corporation (“the Company”) was originally incorporated under the laws of the State of Delaware on August 25, 2020.

We are a consultancy company in Hong Kong providing start-ups and small and medium enterprises (SMEs) with marketing advisory services.

The Company’s executive offices are located at Room 2110, 21/F, One Pacific Centre, Kwun Tong, Hong Kong. The Company’s office space is provided rent free by the Company’s Chief Executive Officer Mr. So Man Kit.

On August 25, 2020 Mr. So Man Kit was appointed Chief Executive Officer, Chief Financial Officer and Secretary of the Company.

On November 3, 2020, Old Bailey Consultancy Limited, a Delaware company (“OBC-Delaware”), acquired 100% of the equity interests of Old Bailey Consultancy Limited, a British Virgin Islands company (“OBC-BVI”), in consideration of $10,000 (U.S. Dollars). Our Chief Executive Officer, Mr. So Man Kit, was the beneficiary of the $10,000 (U.S. Dollars). Old Bailey Consultancy Limited, a Delaware company, now owns 100% of Old Bailey Consultancy Limited, a British Virgin Islands company.

On December 3, 2020, Old Bailey Consultancy Limited, a British Virgin Islands company (“OBC-BVI”), our wholly owned subsidiary, acquired 100% of the equity interests of Old Bailey Consultancy Limited, a Hong Kong company (“OBC-HK”), in consideration of $10,000 (Hong Kong Dollars). Our current Chief Executive Officer, Mr. So Man Kit, was the beneficiary of the $10,000 (Hong Kong Dollars).

| - 3 - |

The Offering

We have authorized capital stock consisting of 100,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”). We have 100,000,000 shares of Common Stock issued and outstanding. Through this offering we will register a total of 2,412,500 shares of common stock, in which 62,500 shares being offered herein by the Company and 2,350,000 shares being offered herein by our selling shareholders. Our selling shareholders may endeavor to sell all 2,350,000 shares of common stock after this registration becomes effective. The shares being offered herein by the Company and the selling stockholders are to be sold at a fixed price of $0.80 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

*We will notify investors by filing an information statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 62,500 shares of common stock, at a fixed price of $0.80 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason, terminate the offering. | |

| Securities being offered by the Selling Stockholders | 2,350,000 shares of common stock, at a fixed price of $0.80 offered by the selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. | |

| Offering price per share | All of the shares being registered herein will be sold at a fixed price per share of $0.80 for the duration of this Offering. | |

| Number of shares of common stock outstanding before the offering of common stock | 100,000,000 common shares are currently issued and outstanding. | |

| Number of shares of common stock outstanding after the offering of common stock | 16,662,500 common shares will be issued and outstanding following the offering. | |

| The

minimum number of shares to be sold in this offering |

None. | |

| Market for the common shares | There is no public market for the common shares. The price per share is $0.80. | |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | ||

| The offering price for the shares will remain at $0.80 per share for the duration of the offering. |

| - 4 - |

| Use of Proceeds | We intend to use the gross proceeds for, but not limited to, funding of day to day operations, ongoing reporting requirements, hiring staff, working space rent and marketing expenses. | |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 2,412,500 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. | |

| Terms of the Offering | Following effectiveness of this registration statement, Our Chief Executive Officer Mr. So Man Kit will sell the 62,500 shares of common stock being registered herein, on a BEST EFFORTS basis. Our selling shareholders will sell the 2,412,500 shares of common stock being registered herein, on a BEST EFFORTS basis. | |

| Registration Costs | We estimate our total offering registration costs to be approximately $22,210.56. | |

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

Currently, our Chief Executive Officer Mr. So Man Kit owns approximately 90.36% of the voting power of our outstanding capital stock. After the offering, assuming all of their personal shares that are being registered herein are sold, Mr. So will have the ability to control approximately 85.52% of the voting power of our outstanding capital stock.

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

| - 5 - |

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

Competition from both large, established industry participants and new market entrants may impair or limit our ability to attract potential attendees to our informative seminars.

Our competition in the industry of hosting seminars is highly competitive with numerous participants from new market entrants and established industry participants. Some established competitors have greater resources and better accessibility than us, therefore they are able to adapt more quickly to hosting seminars that are either more informative or pleasing to attend.

The accompanying financial statements have been prepared assuming the company will continue as a going concern.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of its assets and the liquidation of its liabilities in the normal course of business. This raises substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from this uncertainty.

Our current lineup of consultancy services is untested in our target demographic within Hong Kong and as such we cannot be certain that we will attract as many clients as we anticipate.

Due to our limited knowledge of how receptive our target demographic will be to our consultancy services within the areas we are initially going to be targeting we cannot guarantee that we will have as many attendees sign up for our seminars as we anticipate. In the event that we do not have as many attendees as we anticipate then we may be our forced to scale back our operations considerably or cease operations altogether.

The company is subject to the risks inherent in the creation of a new business.

The Company is subject to substantially all the risks inherent in the creation of a new business. The implementation of our business strategy is still in the development stage. Our business and operations should be considered to be in the development stage and subject to all of the risks inherent in the establishment of an emerging business venture. Accordingly, our intended business and operations may not prove to be successful in the near future, if at all. Any future success that we might enjoy will depend upon many factors, several of which may be beyond our control, or which cannot be predicted at this time, and which could have a material adverse effect upon our financial condition, business prospects, and operations and the value of an investment in the Company.

We may be subject to Government laws and regulations particular to our operations with which we may be unable to comply.

We may not be able to comply with all current and future government regulations which are applicable to our business. Our business operations are subject to all government regulations normally incident to conducting business (e.g., occupational safety and health acts, workmen’s compensation statutes, unemployment insurance legislation, income tax, and social security laws and regulations, environmental laws and regulations, consumer safety laws and regulations, etc.) as well as to governmental laws and regulations applicable to small public companies and their capital formation efforts and further restrictions within the United States. Although we will make every effort to comply with applicable laws and regulations, we can provide no assurance of our ability to do so, nor can we predict the effect of those regulations on our proposed business activities. Our failure to comply with material regulatory requirements would likely have an adverse effect on our ability to conduct our business and could result in our cessation of active business operations.

| - 6 - |

Any failure to maintain adequate general liability, commercial and service liability insurance could subject us to significant losses of income.

We do not currently carry general liability, service liability and commercial insurance, and therefore, we have no protection against any general, commercial and/or service liability claims. Any general, commercial and/or service liability claims will have a material adverse effect on our financial condition. There can be no assurance that we will be able to obtain insurance on reasonable terms when we are able to afford it.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

Our revenue growth rate depends primarily on our ability to execute our business plan.

We may not be able to identify and maintain the necessary relationships within our industry. Our ability to execute our business plan also depends on other factors, including the ability to:

1. Offer consultancy services which are well received by our target demographic;

2. Hire and train qualified personnel;

3. Maintain marketing and development costs at affordable rates; and,

4. Maintain an affordable labor force.

A decline in general economic condition could lead to reduced consumer traffic and could negatively impact our business operation and financial condition, which could have a material adverse effect on our business, financial condition and results of operations.

Our operating and financial performance may be adversely affected by a variety of factors that influence the general economy. Consumer spending habits, including chiefly the demand for management consulting seminars, are affected by, among other things, prevailing economic conditions, levels of unemployment, salaries and wage rates, prevailing interest rates, income tax rates and policies, consumer confidence and consumer perception of economic conditions. In addition, consumer purchasing patterns may be influenced by consumers’ disposable income. In the event of an economic slowdown, consumer spending habits could be adversely affected and we could experience lower net sales than expected on a quarterly or annual basis which could have a material adverse effect on our business, financial condition and results of operations.

A failure to manage our growth effectively could harm our business and offering results.

Financial and management controls, and information systems may be inadequate to support our expansion. Managing our growth effectively will require us to continue to enhance these systems, procedures and controls, and to hire, train, and retain management and staff. We may not respond quickly enough to the changing demands that our expansion will impose on our management, employees and existing infrastructure. Our failure to manage our growth effectively could harm our business and operating results.

The company’s ability to expand its operations will depend upon the company’s ability to raise significant additional financing as well as to generate income.

Developing our business may require significant capital in the future. To meet our capital needs, we expect to rely on our cash flow from operations and, potentially, third-party financing. Third-party financing may not, however, be available on terms favorable to us, or at all. Our ability to obtain additional funding will be subject to various factors, including market conditions, our operating performance, lender sentiment and our ability to incur additional debt. These factors may make the timing, amount, terms and conditions of additional financings unattractive. Our inability to raise capital could impede our growth.

| - 7 - |

If we fail to maintain the value of our brand, our sales are likely to decline

Our success depends on the value created by Old Bailey Consultancy Limited Maintaining, promoting and positioning our brand will depend largely on the success of our marketing efforts and our ability to provide a consistent, high quality consultancy services that is well received by clients. Our brand could be adversely affected if we fail to achieve these objectives or if our public image or reputation were to be tarnished by negative publicity. Any of these events could result in a decrease in revenue and market share.

Strong competition in the seminar Industry could decrease our market share.

The industry of marketing consultancy services is highly competitive. We compete with various corporations and business entities with business plans comparable to our own. In addition, some of our competitors may have substantially greater name recognition and financial and other resources than we have, which may enable them to compete more effectively for the available market share. We also expect to face increased competition as a result of new entrants to our industry. There is the possibility may not be able to compete successfully against current or future competitors and may face competitive pressures that could adversely affect our business or results of operations.

Our success depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. If one or more of our senior executives or key employees are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace them easily or at all. In addition, competition for senior executives and key personnel in our industry is intense, and we may be unable to retain our senior executives and key personnel or attract and retain new senior executives and key personnel in the future, in which case our business may be severely disrupted.

The success of our business depends on our ability to maintain and enhance our reputation and brand.

We believe that our reputation in the industry in which we operate is of significant importance to the success of our business. A well-recognized brand name is critical to increasing our customer base and, in turn, increasing our revenue. To maintain and enhance our reputation and brand, we need to successfully manage many aspects of our business, such as cost-effective marketing campaigns to increase brand recognition and awareness in a highly competitive market. We will continue to conduct various marketing and brand promotion activities as we begin to offer our seminars. We cannot assure you, however, that these activities will be successful and achieve the brand promotion goals we expect. If we fail to maintain and enhance our reputation and brand, or if we incur excessive expenses in our efforts to do so, our business, financial conditions and results of operations could be adversely affected.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision. If we cannot provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly and result in a loss of some or all of your investment.

| - 8 - |

We expect our quarterly financial results to fluctuate.

We expect our net revenue and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

| ● | General Economic Conditions; |

| ● | Our ability to retain, grow our business and attract new clients; |

| ● | Administrative Costs; |

| ● | Advertising and other marketing costs; |

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our future success is dependent, in part, on the performance and continued service of Mr. So Man Kit, our Chief Executive Officer and President. Without his continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Mr. So Man Kit, our Chief Executive Officer and President. The loss of his services would delay our business operations substantially.

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company’s independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company’s internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

| - 9 - |

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

As we are a publicly reporting company, we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, which are necessary to remain as an SEC reporting Company, will be costly as an external third party consultant(s), attorney, or firm, may have to assist in some regard to following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we will eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that our officers and Director, have limited experience as an officer or Director of a reporting company, such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders.

Moreover, if we are not able to comply with the requirements or regulations as an SEC reporting company, in any regard, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Our Officers and Directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

Our Officers and Directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies and with serving as an Officer and or Director of a publicly-traded company. Such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our Officers’ and Director’s ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general.

The coronavirus (“COVID-19”) pandemic could adversely impact our operations, demand for our services and our operating results.

The impact of the coronavirus (“COVID-19”) outbreak on the financial condition of the Company will depend on future developments, including the duration and spread of the outbreak and related advisories and restrictions and the impact of COVID-19 on the overall economy, all of which are highly uncertain and cannot be predicted. If the overall economy is impacted for an extended period, the Company’s future operating results may be materially adversely affected.

| - 10 - |

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTCQB. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 100,000,000 shares of common stock, of which 16,600,000 shares are issued and outstanding as of March 31, 2021. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

| - 11 - |

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a reporting company we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 is and will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $22,210.56 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

| - 12 - |

Risks Relating to this Offering

The trading in our shares will be regulated by the Securities and Exchange Commission Rule 15G-9 which established the definition of a “Penny Stock.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $4,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and must deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the OTCQB. The OTCQB is a regulated quotation service that display real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCQB is not an issuer listing service, market or exchange. Although the OTCQB does not have any listing requirements per se, to be eligible for quotation on the OTCQB, issuers must remain current in their filings with the SEC or applicable regulatory authority. If we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTCQB. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCQB that become delinquent in their required filings will be removed following a 30 to 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between the Company and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

We will incur ongoing costs and expenses for SEC reporting and compliance. Without revenue we may not be able to remain in compliance, making it difficult for investors to sell their shares, if at all.

The estimated cost of this registration statement is $18,142,61. After the effective date of this prospectus, we will be required to file annual, quarterly and current reports, or other information with the SEC as provided by the Securities Exchange Act. We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTCQB. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. The costs associated with being a publicly traded company in the next 12 months will be approximately $25,000. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all. Also, if we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTCQB.

| - 13 - |

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

The Company is electing to not opt out of JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Emerging Growth Company

The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

| ● | be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; | |

| ● | be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”; | |

| ● | be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; | |

| ● | be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended; | |

| ● | be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and, | |

| ● | be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

Our company will continue to be an emerging growth company until the earliest of:

| ● | the last day of the fiscal year during which we have annual total gross revenues of $1 billion or more; | |

| ● | the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act; | |

| ● | the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or | |

| ● | the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2). |

| - 14 - |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Results of operations from August 25, 2020 to December 31, 2020

Revenues

During the period from August 25, 2020 (Inception) until December 31, 2020, the Company generated revenues amounting to $5,000. The Company started to generate revenue in December 2020. The revenue represented income from marketing consultancy services. The revenue was attributed to an agreement with a third party client. The marketing consultancy services provided pursuant to the above agreement included pricing strategy, service and product development strategy, market positioning strategy, competitive analysis, social media and online presence, offline marketing events, online marketing funnel building, budgeting. As of December 31, 2020, we received full settlement from the client in cash as a result of this agreement.

Cost of Revenue

During the period from August 25, 2020 (Inception) until December 31, 2020, the cost incurred in providing service coordination was $2,500 and gross profit was generated in the amount of $2,500.

General and administrative expenses

During the period from August 25, 2020 (Inception) until December 31, 2020, we incurred general and administrative expenses in the amount of $21,231. These expenses represent incorporation fee, audit fee and bank charges incurred during the year.

Net loss

During the period from August 25, 2020 (Inception) until December 31, 2020, we incurred a net loss of $18,918.

Liquidity and Capital Resources

Our cash balance is $5,064 as of December 31, 2020. We estimate that our cash balance will be sufficient to continue operations through the next 12 months. We have been utilizing and intend to continue to utilize funds from our Officers and Directors, who have informally agreed to advance funds to allow us to pay for any Company responses. It is the Company’s intention to continue to fund our activities with monetary contributions from our Officers and Directors. We may also seek to fund operations going forward with future generated revenues.

Being an early stage company of which has generated minimal revenue, we have a very limited operating history. After a twelve-month period we may need additional financing but currently do not have any arrangements for such financing. We believe that our Officers and Directors will provide us enough funds to fund our business operations.

As of December 31, 2020 we have a net loss of $18,918. We believe that we will be able to generate revenue through the provision of marketing consultancy services. We will rely heavily on the business network acquired by our Chief Executive Officer Mr. So Man Kit in order to acquire future clients.

Cash Provided by Operating Activities

During the period from August 25, 2020 (Inception) until December 31, 2020, net cash inflow from operating activities was $2,269. The cash provided by operating activities was the result of the provision of marketing consultancy services provided by the Company.

Cash Provided By Financing Activities

During the period from August 25, 2020 (Inception) until December 31, 2020, net cash provided by financing activities was $1,295 and was primarily the result of the fund injection from a shareholder and bank overdraft.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

Results of operations for the three months ended March 31, 2021

Revenues

During the three months ended March 31, 2021, we did not generate any revenues.

Cost of Revenue

During the three months ended March 31, 2021, we did not incur any cost of revenue.

General and administrative expenses

During the three months ended March 31, 2021, we incurred general and administrative expenses in the amount of $2,530. These expenses represent bank charges and accounting review fee incurred during the period.

Net loss

During the three months ended March 31, 2021, we incurred a net loss of $2,530.

| -15- |

Liquidity and Capital Resources

Our cash balance is $12,976 as of March 31, 2021. We estimate that our cash balance will be sufficient to continue operations through the next 12 months. We have been utilizing and intend to continue to utilize funds from our Officers and Directors, who have informally agreed to advance funds to allow us to pay for any Company responses. It is the Company’s intention to continue to fund our activities with monetary contributions from our Officers and Directors. We may also seek to fund operations going forward with future generated revenues.

Being an early stage company of which has generated minimal revenue, we have a very limited operating history. After a twelve-month period we may need additional financing but currently do not have any arrangements for such financing. We believe that our Officers and Directors will provide us enough funds to fund our business operations.

As of March 31, 2021, we have a net loss of $2,530. We believe that we will be able to generate revenue through the provision of marketing consultancy services. We will rely heavily on the business network acquired by our Chief Executive Officer Mr. So Man Kit in order to acquire future clients.

Cash Used in Operating Activities

During the three months ended March 31, 2021, net cash outflow from operating activities was $30. The cash used in operating activities was mainly from the bank interest expenses and bank charges incurred during the period.

Cash Provided By Financing Activities

During the three months ended March 31, 2021, net cash provided by financing activities was $7,942 and was primarily the result of share issuances and changes in bank overdraft.

For the three months ended March 31, 2021, we have issued an aggregate of 1,600,000 shares of our common stock to 5 investors, in consideration of a total of $8,000. Shares of common stock were sold to these investors in 320,000 shares each at a price per share of $0.005.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

This Prospectus includes market and industry data that we have developed from publicly available information, various industry publications as well as other published industry sources and our internal data and estimates. Although we believe the publications and reports are reliable, we have not independently verified the data. Our internal data, estimates and forecasts are based upon information obtained from trade and business organizations and other contacts in the market in which we operate and our management’s understanding of industry conditions.

As of the date of the preparation of this Prospectus, these and other independent government and trade publications cited herein are publicly available on the Internet without charge. Upon request, the Company will also provide copies of such sources cited herein.

Our Industry

Our company falls into a number of industries due to the unique and varied nature of the material we plan to discuss at our future seminars. While we believe that our primary industry to be the business and management consultancy industry, we also fall into industries which include, but are not strictly limited to, business services, corporate development, etc. Management consultancy is the practice of helping organizations/businesses to improve their performance, operating primarily through the analysis of existing organizational problems and the development of plans for improvement. These are all topics we intend to cover in our informative seminars. Organizations may draw upon the services of management consultants for a number of reasons, including gaining external (and presumably objective) advice and access to the consultants’ specialized expertise. The keynote speakers and other staff at our seminars will not only offer informative information as previously denoted but will reach out to attendees on a more personal level to discover ways in which they could improve upon their own businesses and the challenges they face daily in running such businesses.

The global consulting industry revenues (including HR, IT, strategy, technical, operations, management and business advisory services) will be about $506 billion in 2019, according to Plunkett Research estimates. This represents reasonable growth from $491 billion during the previous year. In the U.S., consulting of all types, including management, scientific and technical, generated $274.1 billion during 2018, up from $261.0 billion the previous year. Accounting and related services (such as tax return preparation) generated an additional $179.4 billion in 2018, up from about $175.4 billion during 2017, according to the U.S. Bureau of the Census. The data from this paragraph can be found at: https://www.plunkettresearch.com/industries/consulting-market-research/#:~:text=Consulting%20OVERVIEW,according%20to%20Plunkett%20Research%20estimates.

| - 16 - |

This prospectus contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this prospectus.

Corporate History

Old Bailey Consultancy Limited, a Delaware corporation (“the Company”) was incorporated under the laws of the State of Delaware on August 25, 2020.

On August 25, 2020, Mr. So Man Kit was appointed as Chief Executive Officer, Chief Financial Officer and Secretary. Additionally, on August 25, 2020, the Company issued 150,000 shares of restricted common stock, each with a par value of $0.01 per share, to Mr. So Man Kit for incorporation of the Company.

On November 3, 2020, the Company acquired 100% of the equity interests of Old Bailey Consultancy Limited, a company incorporated in the British Virgin Islands.

On November 18, 2020, a special meeting of Board of Director was held to amend the Certificate of Incorporation (the “Special Meeting”) and the amendment has been filed to the state of Delaware on the same date. Pursuant to the Special Meeting, the total amount of common stock the Company is authorized to issue would be increased to 100,000,000 shares and the par value would be changed to $0.0001 per share.

On December 3, 2020, the Company through its subsidiary in the British Virgin Islands, Old Bailey Consultancy Limited, acquired 100% of the equity interests of Old Bailey Consultancy Limited, a company incorporated in Hong Kong.

In regards to all of the above transactions we claim an exemption from registration afforded by Section 4a(2) and/or Regulation S of the Securities Act of 1933, as amended (“Regulation S”) for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

Our Business

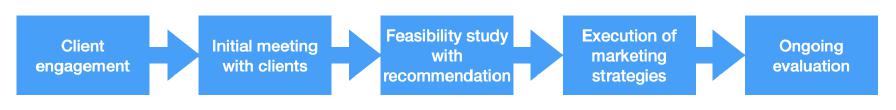

We are a consultancy company in Hong Kong providing local start-ups and small and medium enterprises (SMEs) with marketing advisory services (the “Marketing Advisory”). The Marketing Advisory is a standard marketing advisory services which aims to assist them in adapting to different market trends across the globe, including but not limited to the online marketing practices and the general marketing practices in Hong Kong. The Marketing Advisory is divided into five stages: (i) client engagement; (ii) initial meeting with clients; (iii) feasibility study with recommendations; (iv) execution of marketing strategies; and (v) ongoing evaluation.

| - 17 - |

| (i) | Client engagement |

We source clients through business networks of our management and various commerce chambers in Hong Kong. Upon acceptance by the client, a standard engagement letter will be signed by clients and us. The engagement letter contains scoop of our services, terms and conditions of the Marketing Advisory. Upon engagement, clients are required to settle the fee in full before the commencement of the Marketing Advisory.

| (ii) | Initial meeting with clients |

Upon commencement of the Marketing Advisory, we arrange an initial meeting with clients (the “Initial Meeting”) in order to obtain basic understanding of the clients’ business, including but not limited to:-

| - | nature of business; |

| - | products and/or services offered; |

| - | targeted customers; |

| - | targeted geographic locations; |

| - | budget for sales and marketing for the next three years; |

| - | business expansion plan for the next three years; and |

| - | clients’ specific preference for marketing plan |

The information obtained in the Initial Meeting would help us assess their current marketing positions and further support our recommendations to develop further marketing plan to be included in the feasibility study in stage (iii).

The Initial Meeting can be held in the client office or, depending on the clients’ preference, through online meeting, that is, by using online conferencing apps such as Zoom, Microsoft etc.

The Initial Meeting takes about two to three hours. Depending the complexity of clients’ business and situation, additional meetings will be held if necessary.

| (iii) | Feasibility study and recommendations for marketing strategies |

For each client, we conduct a report of feasibility study according to the clients’ current business operation and marketing strategies (the “Feasibility Study”). The Feasibility Study is a report includes findings on current client’s marketing position and recommendations on future marketing plan.

| - 18 - |

As for the findings on current client’s marketing position, we identify the market lead within the markets of the client. Then, we advise on mapping all the entities’ market activities and client flows by tracking all these activities. This allows our clients to have a clearer picture on formulating the suitable marketing plan. We also assess the level of market knowledge of our clients to make sure the clients keep up with all the market trends of where the clients are located.

As for the recommendations on future marketing plan, it covers eight key areas of marketing, namely:-

| a. | Pricing Strategy | |

| b. | Service and Product Development Strategy | |

| c. | Market Positioning Strategy | |

| d. | Competitive Analysis | |

| e. | Social Media and Online Presence | |

| f. | Offline Marketing Events | |

| g. | Online Marketing Funnel Building | |

| h. | Budgeting |

The above marketing plan usually covers a period of three years. In view of the limitation in resources, there would be priorities on the implementation of the plans. As part of recommendation we advise our clients on the level of urgency of these analyses and provide support on their implementation.

Depending of the complexity of the client and the need of the client, the Feasibility Study takes about two to three weeks to complete. Once it is completed, we will arrange a meeting with client to explain the findings in the Feasibility Study and the recommendations of the future marketing plan. Clients will have an opportunity to comment on the recommendations given and raise questions. We may amend the recommendations according to the clients’ comments.

| (iv) | execution of marketing strategies |

Upon confirmation of the clients, we assist the client to execute the marketing plan based on our recommendations in the Feasibility Study. In the case that the clients face difficulties in executing our recommended marketing strategies, we may refer third-party expertise with relevant experience and qualifications to assist the clients in executing the marketing plan.

Ongoing monitoring and evaluation

We provide clients with one-year ongoing monitoring and evaluation. We arrange evaluation meetings with the clients once a month to evaluate the effectiveness of the marketing measures adopted and provide the latest news on the market trends. The ongoing evaluation allows the clients to adjust their marketing measures where necessary to respond to changing customers’ demand and preference. We will commence ongoing evaluation once the clients execute the marketing plan.

| - 19 - |

Future plan

Motivational and Productivity Speeches

We plan to provide a wide range of speeches which can be categorised as follows:

| 1. | Motivational Speeches | |

| 2. | Productivity Speeches |

Motivational Speeches

We will provide consultation, advisory and organization-wide speeches on motivation. We help clients choose the best way to keep their company momentum, manage their employees and create long term drive for the company. Our tools include but not limited to:

Seminars

● This will be in partnership with other management consulting companies to ensure everything will be backed with research and analysis

● Examples of topics we may advise our clients: employee drive and motivation, company values and practices. Entrepreneurial spirit, etc.

● In consultation with our company and in accordance with the client’s need, the speeches will be set up in a timely manner.

● We have a team dedicated to liaising with the clients to ensure that any follow-up action will be promptly dealt with, and the speeches are properly delivered.

Productivity Speeches

● We have staff specializing in productivity services.

● Clients will receive sufficient advice before drafting a concrete productivity plan. Advice includes but not limited to how to effectively use time; talent management, etc.

● In view of the fast-changing world, there will be more tools coming up to help manage the productivity. Our team will keep up with the trend and advise the clients on the options in different situations.

| - 20 - |

Topics included in our speeches

Scope of services is large and unlimited, but in short, the format of speeches can be summarised as follows:

| 1. | Offline organization wide motivational/productivity speech | |

| 2. | Offline individual motivational/productivity consultation | |

| 3. | Online organization wide motivational/productivity speech | |

| 4. | Online individual motivational/productivity consultation |

We aim to provide advice on matters including but not limited to:

| ● | Management psychology and employee motivation | |

| ● | Workplace communication and non-verbal communication | |

| ● | Healthy lifestyle for drive and motivation | |

| ● | Company value alignment | |

| ● | Employee relations and work life balance | |

| ● | Pressure relief | |

| ● | Time and project management | |

| ● | Usage of productivity tools within teams | |

| ● | Scheduling and effective meeting procedures | |

| ● | Effective communication | |

| ● | Any other topic to help clients achieve their business goals |

Corporate and Executive Training