Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex10-1.htm |

| EX-4.2 - EXHIBIT 4.2 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex4-2.htm |

| EX-4.1 - EXHIBIT 4.1 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex4-1.htm |

| EX-2.1 - EXHIBIT 2.1 - 890 5th Avenue Partners, Inc. | tm2120621d1_ex2-1.htm |

| 8-K - FORM 8-K - 890 5th Avenue Partners, Inc. | tm2120621d1_8k.htm |

Exhibit 99.2

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed Investor Presentation June 2021

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed This presentation (together with oral statements made in connection herewith, the “ Presentation ” ) is for informational purposes only to assist interested parties in making their own evaluation of the proposed business combination (the “ Business Combination ” ) between 890 5th Avenue Partners, Inc. ( “ 890 ” ) and BuzzFeed, Inc. ( “ BuzzFeed ” or the “ Company ” ). By accepting this Presentation, you acknowledge and agree that all of the information contained in or disclosed with this Presentation (the “ Information ” ) is confidential, that you will not distribute, reproduce, disclose or use such information for any purpose other than for t he purpose of your firm’s participation in the potential financing, that you will not distribute, reproduce, disclosure or use such informa tio n in any way detrimental to BuzzFeed or 890, and that you will return, delete or destroy this Presentation upon request. You are also being advised that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is rea son ably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. The Information does not purport to be all - inclusive and none of the Company, 890, Cowen and Company, LLC., BofA Securities, Inc. or Craig - Hallum Capital Group LLC (the latter three, the “ Placement Agents ” ), nor any of their respective subsidiaries, stockholders, affiliates, representatives, control persons, partners, directors, offic ers , employees, advisers or agents, make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult with your own co unsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the Information or other inf orm ation provided by third parties, whether or not purported to be on behalf of the Company, to make any decision. To the fullest extent permitted by law, in no circumstances will the Company, 890, the Placement Agents, n or any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents be responsible or liable for a ny direct, indirect or consequential loss or loss of profit arising from the use of or reliance upon this Presentation, the Information, any omissions or any opinions communicated in relation thereto. In addition, this Present ati on does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of the Company, the potential financing or the Business Combination. The general explanation s i ncluded in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Use of Data Some of the Information relates to or is based on studies, publications, surveys and the Company’s and 890’s own internal est ima tes and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Fi nally, while the Company and 890 believe this internal research is reliable, such research has not been verified by any independent source and none of the Company, 890, the Placement Agents, nor any of their respecti ve subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents makes any representation or warranty with respect to the accurac y o f such information. Forward - Looking Statements Certain statements in this Presentation may be considered forward - looking statements. Forward - looking statements generally relat e to future events or 890’s or the Company’s future financial or operating performance. For example, statements concerning the following include forward - looking statements: the Company’s summary financial forecast; t he Company’s ability to achieve, and maintain, future profitability; the Company’s business plan and its ability to effectively manage its growth; continued market acceptance of, and traffic engagement with, the Company’s content; expectations, beliefs and objectives for future operations; the Company’s ability to further attract, retain, and increase its traffic; the Company’s ability to expand existing revenue stre ams , develop new revenue opportunities, and bring them to market in a timely manner; the Company’s expectations concerning relationships with strategic partners and other third parties; the Company’s ability to mai nta in, protect and enhance its intellectual property; future acquisitions or investments in complementary companies, content or technologies; the Company’s ability to attract and retain qualified employees; the procee ds of the Business Combination and the Company’s expected cash runway; and the potential effects of the Business Combination on the Company. In some cases, you can identify forward - looking statements by term inology such as “ believe, ” “ may, ” “ will, ” “ potentially, ” “ estimate, ” “ continue, ” “ anticipate, ” “ intend, ” “ could, ” “ would, ” “ project, ” “ target, ” “ plan, ” “ expect, ” or the negatives of these terms or variations of them or similar terminology. Such forward - looking statements are subject to ri sks, uncertainties, and other factors, some of which are unknown and unpredictable, which could cause actual results to differ mat eri ally from those expressed or implied by such forward - looking statements. These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by 890 and its management and t he Company and its management, as the case may be, are inherently uncertain. Notice to Recipient: Disclaimer 2

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed Forward - Looking Statements (Cont’d) New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Fact ors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions and other risks, uncertaint ies and factors set forth in the section entitled “ Risk Factors ” and “ Cautionary Note Regarding Forward - Looking Statements ” in 890’s final prospectus relating to its initial public offering, dated January 11, 2021, and other filings with the Securit ie s and Exchange Commission (the “ SEC ” ) as well as factors associated with companies that are engaged in the Company’s businesses, including anticipated trends, growth rates, and chall eng es in those businesses and in the markets in which they operate; macroeconomic conditions related to the global COVID - 19 pandemic; changes in the business and competitive environment in which the Company ope rates, the impact of national and local economic and other conditions and developments in technology, each of which could influence the levels (rate and volume) of the Company’s subscriptions and adv ert ising, the growth of its businesses and the implementation of its strategic initiatives; government regulation, including revised foreign content and ownership regulations; poor quality broadband infrastructure in cer tain markets; technological developments; demand for products and services; the failure to realize the anticipated benefits of the Business Combination; the ability of the issuer that results from the Business Com bin ation to issue equity or equity - linked securities or obtain debt financing in connection with the Business Combination or in the future. Nothing in this Presentation should be regarded as a representation by any person tha t the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither the Company nor 890 undertakes any dut y to update these forward - looking statements. Use of Projections This Presentation contains projected financial information with respect to BuzzFeed. Such projected financial information con sti tutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. See “ Forward - Looking Statements ” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a repres ent ation by any person that the results reflected in such forecasts will be achieved. Neither the Company’s nor 890’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the pr ojections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Pre sen tation. In preparing and making certain forward - looking statements contained in this presentation, BuzzFeed and 890 made a number of economic, market and operational assumptions. The Company cautions that its a ssu mptions may not materialize and that current economic conditions render such assumptions, although believed reasonable at the time they were made, subject to greater uncertainty. Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgate d under the Securities Act of 1933, as amended (the “ Securities Act ” ). Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, the registration statemen t t o be filed by BuzzFeed and 890 with the SEC. No Offer or Solicitation This Presentation shall not constitute a “ solicitation ” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offe rin g of securities (the “ Securities ” ) will not be registered under the Securities Act, and will be offered as a private placement to a limited number of “ accredited investors ” as defined in Rule 501(a) (1), (2), (3), (5) or (7) under the Securities Act and “ Institutional Accounts ” as defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirem ent s of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may al so be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of tim e. Neither the Company nor 890 is not making an offer of the Securities in any state where the offer is not permitted. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DET ERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Trademarks and Trade Names BuzzFeed owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operatio n o f its businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, s erv ice marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademark s, service marks and trade names referred to in this Presentation may appear with the ® , TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the full est extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Notice to Recipient: Disclaimer (Cont’d) 3

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Table of Contents Introduction 5 About BuzzFeed 9 Foundations for Growth 17 Financial Highlights 27 Transaction Overview 31 Appendix 36

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL Introduction 5

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Transaction Overview • BuzzFeed Inc., ( “ BuzzFeed ” ) and 890 5th Avenue Partners, Inc. ( “ 890 5th Avenue ” ) have executed a non - binding term sheet setting forth the potential terms of a business combination • Definitive documentation is expected to be signed in June 2021 • It is anticipated that the post - closing company will retain the BuzzFeed name and be listed on the NASDAQ • BuzzFeed plans to use $200 million from the transaction proceeds and $100 million in pro forma equity to fund their acquisition of Complex Networks, which is contingent upon the closing of the business combination. This acquisition provides an opportunity to accelerate growth and monetization of Complex’s attractive brands and IP, leveraging BuzzFeed’s ability to scale and reach massive audiences • Transaction implies a fully diluted pro forma enterprise value of $1.5 billion, representing 2.3x based on 2022E Revenue of $654 million and 13.0x based on 2022E Adj. EBITDA of $117 million − Implied acquisition multiples for Complex of 2.1x based on 2022E Revenue of $146 million and 19.0x based on 2022E Adj. EBITDA of $16 million • Existing BuzzFeed shareholders are expected to receive 72.5% of the pro forma equity (1) • The transaction will be funded by a combination of ~$288 million cash held in a trust account and proceeds from the $150 million Convertible Note offering (3) • Transaction is expected to result in up to ~$438 million of total cash proceeds to fund the acquisition of Complex and provide working capital to the combined company Transaction Overview and Structure Valuation Capital Structure (2) 6 Combination with and (1) Assumes no redemptions by 890 5 th Avenue existing shareholders (2) Based on $288 million cash in trust, $154 million in cash, $5 million of which represents the breakup fee held in escrow pend ing the closing of the Complex acquisition, and $35 million in debt, $15.5 million of which represents outstanding Letters of Credit issued by Capital One, N.A., all of the foregoing fr om Buzzfeed’s balance sheet as of May 31, 2021, $150 million Convertible Note less $35 million of transaction expenses (3) 5 - Year Unsecured $150 million Convertible Note bearing a coupon rate of 7.00% and a conversion price of $12.50.

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Why 890 is Excited to Partner with BuzzFeed 890 5th Avenue’s investment thesis focuses on leveraging our collective operational expertise to add strategic value to a leading digital media company positioned to benefit from key secular trends x Leading, globally recognized “ Media 2.0 ” platform primed to benefit from digital tailwinds core to our thesis x Ideal platform to execute upon organic growth opportunities plus a roadmap for accretive strategic M&A x Partnering with a visionary management team that has operated at the forefront of innovation within digital media and content x Ability to add value from our operating expertise, strategic vision and growth mindset x Highly attractive financial profile and valuation 7

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Today’s Presenters Adam Rothstein Executive Chairman x Co - founder and General Partner at Disruptive Technology Partners x Independent Director of Roth CH Acquisition Companies I,II, and III (NASDAQ: ROCH, ROCC, ROCR) x Over 20 years of investment experience Jonah Peretti Co - Founder & Chief Executive Officer x Co - founder of The Huffington Post in 2005 x Pioneered viral project designs, shareable social advertising campaigns, news reporting, and content creation across industries 8 Michael Del Nin Chief Financial Officer & Chief Operating Officer x Served as Co - Chief Executive Officer of Central European Media Enterprises x Over two decades of media experience with strategy, M&A, business development and financial analysis roles BuzzFeed 890 5th Avenue Partners Felicia DellaFortuna Chief Financial Officer x Former Senior Director of Finance at Viant x Previously Director of Financial Planning & Analysis at XIX Entertainment x Previous experience in Transaction Advisory Services at Ernst & Young

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL About BuzzFeed 9

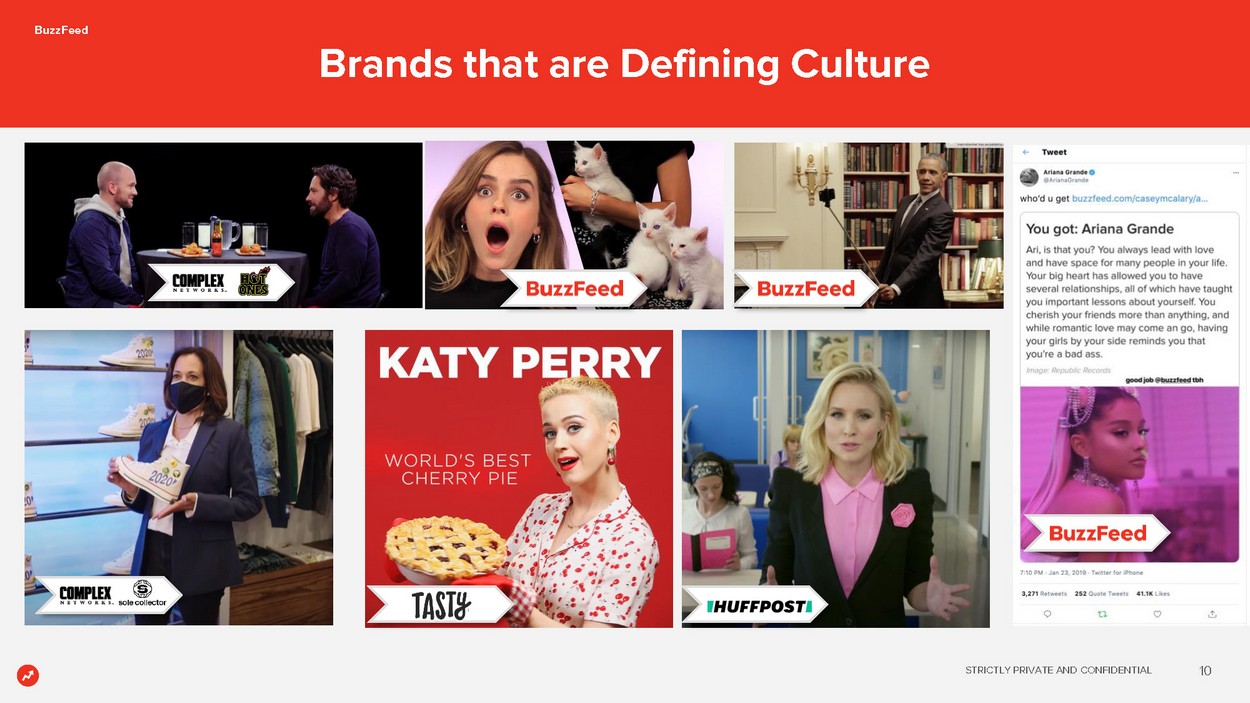

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Brands that are Defining Culture 10

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Leading Platform for Digital Content and Commerce Source: Management, company estimates. Financials are Pro Forma for Complex, excludes go90. (1) Comscore , October 2020 when compared to Core competitor set. Core competitor set includes Vox Media, Group Nine Media, Complex, POPSU GAR Media, Vice Media, REFINERY29.com. (2) Nielsen Digital Content Ratings, Monthly Data October 2020 (3) Q1 2020 BuzzFeed Brand Health Study (U.S. P13 - 54) In time spent in the U.S. among Gen Z and Millennials (1) #1 of Gen Z and Millennials (2) read BuzzFeed each month ~73% In Brand Awareness (3) for digital media #1 • Iconic brands with massive reach, engagement and distribution • Operating model for modern media built on technology and data enabling rapid scale and monetization with a deep understanding of virality and social • Reached an inflection point with a diversified revenue base and sustainable, profitable growth 11 • Rapidly scaling higher margin commerce revenue stream expected to be ~31% of total revenue by 2024E Foundational Concepts BuzzFeed at a Glance ~24% 2021E Revenue Growth ~25% 2022E Revenue Growth ~11% Adj. EBITDA Margin 2021E ~18% Adj. EBITDA Margin 2022E $521M 2021E Revenue $654M 2022E Revenue

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Expansion and Diversification of Business Model Note: Adj. EBITDA excludes stock - based compensation and other net income/expense. Revenue CAGR and Adj. EBITDA include Complex, excludes go90. (1) Deal signed in March 2021 and expected to close in connection with the proposed transaction. (2) Deal signed in November 2020 and closed in February 2021. 12 November 2006 Jonah Peretti launches BuzzFeed November 2014 Surpasses $100M in revenue November 2020 Acquires becomes a minority shareholder October 2018 Creates BuzzFeed Exchange, a unified programmatic offering March 2018 Tasty kitchenware line debuts at November 2016 Launches laying the groundwork for revenue diversification January 2012 Launches Lab Experimentation to Grow Audience Topline Growth Profitable Revenue Growth Revenue Model Diversification December 2018 >$100M in revenue from new revenue streams August 2017 Launches programmatic advertising August 2015 & November 2016 Invests $400M in BuzzFeed August 2018 Launches driving affiliate, programmatic and content licensing July 2020 Partnership w/ to produce feature films CAGR ~26% ‘ 20 - ’24 Revenue Margin ~25% ’24 Adj. EBITDA March 2021 Signs Definitive Agreement to acquire (1) June 2014 Releases as the first branded video content July 2015 Launches (2)

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Highly Attractive Acquisition of Complex # 1 reach amongst males ages 18 - 24 • Expands further into new audiences and verticals • Deepens engagement with existing demographic • Cements opportunity as defining youth media platform • Immediate synergies and monetization opportunities Source: Complex Management and publicly available information. (1) Complex materials and reports. (2) Represents 2020 monthly average, excluding views attributable to advertising consultin g s ervices. (3) Represents 2020 O&O original output and published content, both posts and videos. (4) Comscore , October 2020; total impressions represents 2020 O&O site and YouTube display and video impressions, includes both direct and indirect. (5) Refers to Black/African - American males age 18 - 34. Comscore , October 2020. Re sea r ch o ffering proprietary data Youth consultancy offering E co m m er c e destination Transaction Rationale Brands and IP (1) STRICTLY PRIVATE AND CONFIDENTIAL Key Statistics (1) Premiere f ood c ulture b rand #1 sneaker community #1 brand youth convention Leading m usic & artist discovery platform Other Key Initiatives 13 Synergistic Opportunities • Current pro forma financial model does not account for synergies • Immediate opportunities to promote brands and create cross - platform growth • Proven track record of creating second windowing opportunities for digital first IP Monthly Video Views (2) 150M Content Pieces ( 3 ) 170K Total Impressions ( 4 ) 3.2B Monthly Minutes ( 4 ) 322M Highly diverse reader demographic compared to total digital population ( 5 ) 2.5x

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Aligned with Massive Secular Trends Video & Social Video advertising contributes to traffic growth, increases average session time, attracts potential customers and increases sales 86% of users would like to see more video content from brands High Quality Content Big Tech platforms in need of trusted, brand - safe supply of digital content at scale Demand for voices that call for racial and social justice and more inclusive, transparent and just business practices eCommerce Shift to eCommerce accelerated by COVID - 19, expanding markets as the modern consumer discovers and buys new things Source: Company filings; S&P Global Market Intelligence Global Advertising Forecasts Jun 2020; eMarketer Oct 2020; Wyzowl Video Marketing Statistics 2020 report; Wall Street research. 14

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Benefitting from Underlying Digital Tailwinds Accelerating Shift to “ All Things Digital ” Massive acceleration in the shift to digital across content and commerce Evolving Privacy Landscape Privacy regulation increasingly stringent as consumers demand transparency and control of data Ad Spend Shifting from Mega Platforms Ad budgets diversifying with focus on authenticity and brand safety 15

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Reached inflection point with accelerating, sustainable and profitable growth Key Investment Highlights Demonstrated platform for both organic and acquisition - led growth Innovative management team that has been at the forefront of driving digital trends Leading “ Media 2.0 ” platform for the next generation of Internet Technology platform designed to rapidly scale and monetize digital content Globally recognized digital brands with massive, engaged audience 16

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL Foundations For Growth 17

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Portfolio of Premium and Emerging Digital Content Brands 18 Source: Comscore , Feb 2020, Comscore , Oct 2020, Nielsen Digital Content Ratings, Monthly Data, Oct 2020, Complex materials and reports, BuzzFeed internal survey con ducted via Qualtrics, Apr 2020, BuzzFeedNews.com, YouTube.com, Multi - Platform, Key Measures, Oct 2020, Tubular Intelligence, Oct 2020, Digital Media Brand Perceptions Study (Q3 2018), U.S. P13 - 54, ComscoreMedia Metrix, Key Measures, P13 - 24, Key Measures, A25 - 34. (1) BuzzFeed is acquiring Complex Networks as part of the proposed transacti on. Monthly Unique Visitors 32% Millennial and Gen Z Audience Composition A Leading News Brand for Young Readers A Leading Digital News Outlet 5 Minutes Spent by the Avg. Unique Visitor (2) News Food #1 Digital Publisher for Cultural Relevance A Leading Media Company for the Modern World YouTube Subscribers 20M+ 69M Monthly Likes, Comments and Shares 24M Pulitzer Prize Finalist 2x Monthly Unique Visitors (2) 11M Monthly Minutes (2) 51M A Leading Global Food Network 2.2B Monthly Views Across Platforms 1 in 3 Americans Have Seen Tasty on a Monthly Basis 8 in 10 Tasty Viewers Have Made a Recipe Entertainment / Culture #1 Reach Amongst Males Ages 18 - 24 A Leading Media Outlet for Young Readers Monthly Video Views 150M+ Original Content Pieces 170k+ (1) Emerging Brands (Travel) (Beauty) (Health) (Home) (Family)

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Creating content requires data, technology and scale All are key competitive moats and differentiators of BuzzFeed’s relationship with audiences Machine Learning Powers a Scaled Tech Stack Source: BuzzFeed Client Event Tracking Data, Dec 2020. 19 Headline Optimization Post - publication, BuzzFeed’s technology automatically finds the best headline from several options Proprietary Machine Learning Algorithms Generates both recommendations and automation of what and when to publish on social platforms Proprietary Quiz Maker Built into CMS 37M unique quiz takers Enables a dozen varieties of addictive quizzes, with new formats developed regularly Custom Tools for Content Creators Supports the efficient creation of the best content from what readers love and engage in, including flipped posts from comments and subbuzz remixer for market

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Growth Flywheel is Highly Scalable Across Platforms 1 3 4 2 20 Web Video Mobile Social Data - Driven Platform is Highly Repeatable Cross - Platform Distribution

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Massive, Deeply Engaged Audience in Key Demographics 21 Unique Visitors Time Spent (Minutes) Time Spent per Unique Visitor Unrivaled scale, reach and ability to successfully engage younger audiences with compelling content 31M 213M 6.9 Min. Source: ComscoreMedia Metrix, Multi - Platform, Key Measures, Oct 2020. Note: Core competitor set includes Vox Media, Group Nine Media, Complex, POPSUGAR Media Vice Media, REFINERY29.com. BuzzFeed Dig ital includes HuffPost and Complex. Group Nine includes POPSUGAR Media. Vice includes REFINERY29.com Vox Media includes New York Media/ Magazine.Total monthly site page views represent U.S. only. Time spent includes time spent across O&O properties and select video platforms. (1) Unique Visitors are unduplicated. 38M 806M 21.2 Min. Digital Digital Digital ( Gen Z + Millenials ) ( Gen Z + Millenials ) ( Gen Z + Millenials ) 20M 55M 2.8 Min. 19M 32M 2.6 Min. 12M (1)

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Enabled by unique approach to content Further monetization of high value audiences Inspiration driven Rapid growth with high margins High Growth Commerce Opportunity Note: Historical financials are based on unaudited statements. (1) Pro Forma for Complex. Excludes go90. 22 BuzzFeed’s Commerce revenue stream is enabled by a unique ability to deliver content to high value audiences This revenue stream drove ~$500M in attributable transactions in 2020, up 62% YoY Commerce Revenue Mix (1) 13% 87% 2020A $57M (1) 23% 77% 2022E $150M (1) 31% 69% 2024E $330M (1)

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL In five years, BuzzFeed has built Tasty into a scaled, cross - platform brand with multiple revenue streams Powering Organic Growth of Brands Source : Tubular Intelligence, Oct 2020, BuzzFeed Looker Data, NiemanLab, Jan 2017, Nielsen Digital Content Ratings, Monthly Data, Aug 2020. 23 Facebook Followers BuzzFeed Formats Applied to Cooking Applies popular BuzzFeed formats to cooking and discovers success Experimentation & Social Media Feedback / Data Loop UGC cooking videos going viral on Facebook; starts experimenting with original BuzzFeed food videos Audience Expansion Tasty Facebook channel surpasses 8M engagements (likes, comments, shares) the month after launch Iterations for Expansion & Development Applies learnings to launch international versions and develop new styles and formats Multiple Monetization Streams Popularity fuels product launches: Top Selling Cookbook, Tasty App and One Top cooking appliance Nov '15 Nov '20 ~15x 196M 13M

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Proven Consolidation Platform Source: Comscore , Feb 2020, Comscore , Oct. 2020, Complex materials and reports. Monthly Unique Visitors, Monthly Minutes and Minutes Spent by Average Unique Visi tor represent Gen Z + Millennials only. 24 • Universally known brand with cross - platform appeal • Extends leadership position and enhances scale • Expanding reach into attractive demographic • Near term opportunities to lift monetization • Clear opportunity to drive profitability Key Stats HuffPost Acquisition Rationale 11M Monthly Unique Visitors 51M Monthly Minutes 5 Minutes Spent by Avg. Unique Visitor • Expands further into new audiences and verticals • Deepens engagement with existing demographic • Creates defining youth media platform • Immediate synergies and monetization Key Stats Complex Acquisition Rationale 14M Monthly Unique Visitors 137M Monthly Minutes #1 Reach Among Males Ages 18 - 24 Massive scale and distribution Robust engagement and monetization Technology and data - driven approach Diversified revenue base & efficient model

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Consolidation Strategy Driving Accretive Results Target Criteria Engaging Content Creation Additive Audience Dynamics Influential, Iconic Brands &UHDWHGE\-XDQ3DEOR%UDYR IURPWKH1RXQ3URMHFW Monetization Opportunities Value Creation 25 Cross - Platform Integration Sustainable Revenue Growth Price Discipline Creating path to profitability

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Our Scaled Model has Powered Network Effects Creating Competitive Barriers and Driving Growth Leading Audience and Brands Data - Driven Tech Platform Scaled Cross - Platform Distribution Diversified Revenue Model (4) Growth & Profitability 3 out of 4 U.S. Millennials & almost half of U.S. Gen Z read BuzzFeed each month 4.0B Average minutes watched monthly in 2020 Owned & Operated Social Media Platforms 26 $654M ‘ 22E Revenue $117M ‘ 22E Adj. EBITDA 25% ’20A - ’22E Revenue CAGR 18% ‘ 22E Adj. EBITDA Margin Advertising Content Commerce (3) (1) Nielsen Digital Content Ratings, Monthly Data, Oct 2020. (2) APIs and Tubular Intelligence, Oct 2020. (3) Deal signed in March 2021 and expected to close in connection with the proposed transaction. (4) See slides 28 and 29, which show the actual revenue mix for 2019 and 2020 as well as the forecasted revenue mix for 2021 - 2024. (2) (1)

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL Financial Highlights 27

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Key Financial Themes 28 Note: Dollars in millions. Unless noted, figures are Pro Forma for Complex. (1) Not Pro Forma for Complex. (2) Top 5 Clients (of 2020, with comparison to 2019 spend) include a Leading Insurer, two Leading Retailers, a Leading CPG Conglo mer ate, and a Leading Grocer. Excludes revenue earned from platforms (i.e., affiliate commissions from Amazon, programmatic pre - roll and display). (3) Excludes D&A, SBC, Tax and other one - time non - recurring expenses. 2019A 2024E Key Customer Retention (1)(2) Annual Spend for Top 5 Clients Diversified Revenue Revenue Mix Advertising Commerce Content $27M $39M 2019A 2020A 42% YoY% 48% 41% 11% 25% 44% 31% 52% 50% 51% 48% 47% 47% 51% 46% 38% 34% 30% 29% COGS as a % of Revenue OpEx (3) as % of Revenue Delivering Profitability at Scale COGS and Operating Leverage as a % of Revenue

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL $176 $198 $261 $316 $387 $463 $202 $166 $165 $187 $221 $270 $47 $57 $95 $150 $225 $330 $425 $421 $521 $654 $833 $1,063 2019A 2020A 2021E 2022E 2023E 2024E Note: FY2021E and beyond includes HuffPost. Pro Forma includes Complex, excludes go90. (1) Please refer to Adj. EBITDA reconciliation on p.38. Accelerating Growth Profile with Continued Diversification 29 ($ in millions) Advertising Commerce Content 26% CAGR Adj. EBITDA Adj. EBITDA Margin ($14) $17 $57 $117 $187 $263 (3%) 4% 11% 18% 22% 25% 2019A 2020A 2021E 2022E 2023E 2024E Pro Forma Adj. EBITDA (1) Pro Forma Revenue Projections ($ in millions)

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Combined Company Financial Summary Revenue ($) Revenue Growth (%) Complex Pro Forma BuzzFeed Adj. EBITDA (1) ($) Adj. EBITDA Margin (1) (%) Note: BuzzFeed FY2021E and beyond includes HuffPost. Complex numbers excludes go90. (1) Please refer to Adj. EBITDA reconciliation on p.38. 30 $100 $119 $146 $321 $402 $508 $421 $521 $654 2020A 2021E 2022E (7%) 19% 22% 1% 25% 26% (1%) 24% 25% 2020A 2021E 2022E ($14) $2 $16 $31 $55 $102 $17 $57 $117 2020A 2021E 2022E (14%) 2% 11% 10% 14% 20% 4% 11% 18% 2020A 2021E 2022E

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL Transaction Overview 31

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Sources & Uses / Pro Forma Valuation $ and share data (except share price) in millions 32 Estimated Sources & Uses Illustrative Pro Forma Valuation Illustrative Pro Forma Ownership SPAC Sponsor Shares SPAC Public Shareholders Existing BuzzFeed Shareholders Equity Rollover Complex Shareholders Note: Amounts presented on this slide assume no redemptions from the trust account. Amounts also exclude ( i ) outstanding unvested equity awards rolling over in the Transaction, (ii) the impact of any equity awards issued at or after the closing of the Transaction, (iii) the dilutive impact of 9.842M SPAC warrants with a st rike price of $11.50 per share, and (iv) potential future conversion of the $150M of Convertible Notes. Values subject to rounding. (1) $154 million cash balance as of May 31, 2021, $5 million of which represents the breakup fee held in escrow pending the closi ng of the Complex acquisition. (2) Debt balance consists of $35.1 million of debt from the Company balance sheet as of May 31, 2021, including $15.5 million in out standing Letters of Credit issued by Capital One, N.A. and $19.6 million of revolving credit loans drawn down from White Oak along with the 5 - Year Unsecured $150 million Convertible Note bearin g a coupon rate of 7.00% and a conversion price of $12.50 4.7% 16.9% 72.5% 5.9% Illustrative Share Price $10.00 Pro forma shares outstanding 170.165 Equity Value $1,702 Plus: Debt (2) $185 Less: Cash $356 Enterprise Value $1,530 Sources Existing BuzzFeed Shareholders Equity Rollover $1,335 SPAC Cash in Trust $288 Cash from Target Balance Sheet (1) $154 Convertible Note $150 Total Sources $1,926 Uses Existing BuzzFeed Shareholders Equity Rollover $1,235 Common Stock Issued to Complex $100 Cash Payment to Complex $200 Cash to Balance Sheet $356 Payment of Transaction Expenses $35 Total Uses $1,926

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL 24.6% 26.3% 25.9% 16.7% 13.0% 10.5% 51.8% 42.8% 26.5% 26.1% 0 ZNGA ETSY IACA IAC NYT SNAP PINS FB TWTR 18.0% 29.2% 27.7% 25.2% 17.0% 7.2% 52.6% 29.9% 28.7% 20.4% 2022E Pro Forma Adj. EBITDA Margin (%) 2020A – 2022E Pro Forma Revenue CAGR (%) Comparable Company Benchmarking Analysis Digital Media, Content & Commerce Social Platforms Source: Capital IQ as of June 18, 2021. Note: BuzzFeed metrics per management estimates and pro forma for Complex acquisition . Taboola Sales and Adj. EBITDA per management estimates. Social Platforms 33 Median: 16.7% Median: 34.6% Digital Media, Content & Commerce Mean: 18.5% Median: 25.2% Mean: 21.3% Mean: 36.8% Median: 29.3% Mean: 32.9%

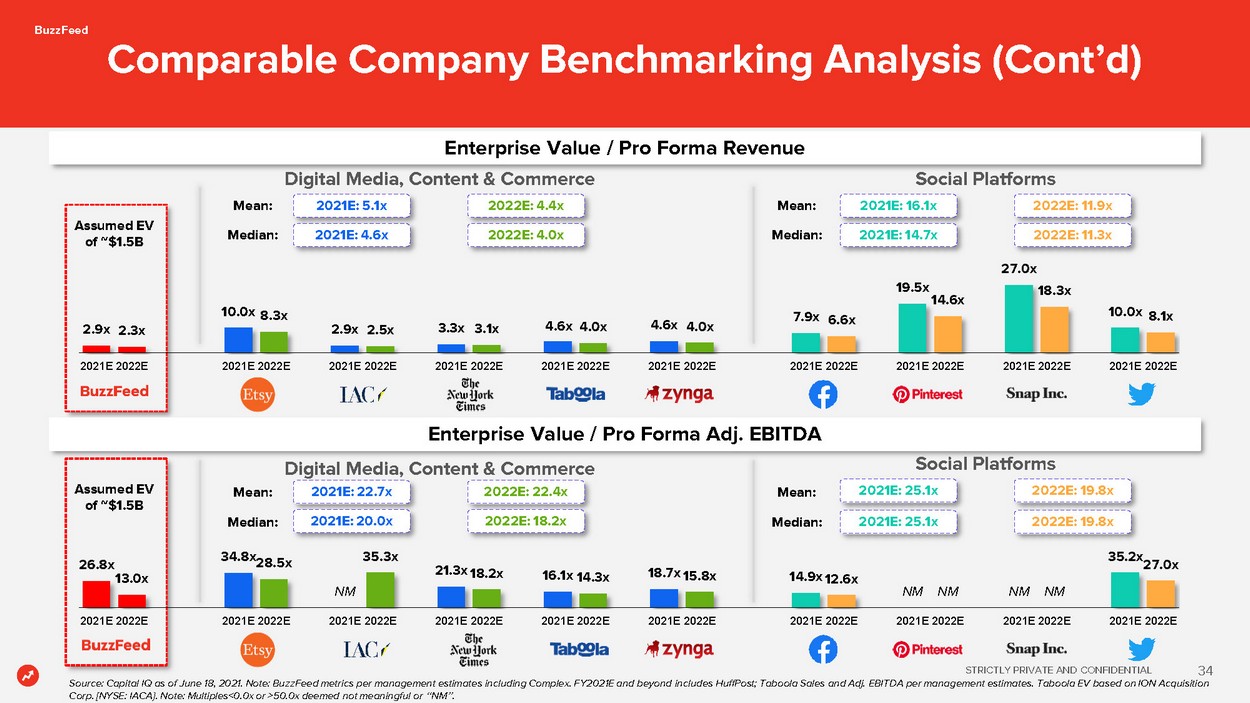

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Enterprise Value / Pro Forma Revenue Assumed EV of ~$1.5B Comparable Company Benchmarking Analysis (Cont’d) Digital Media, Content & Commerce Social Platforms Source: Capital IQ as of June 18, 2021. Note: BuzzFeed metrics per management estimates including Complex. FY2021E and beyond in cludes HuffPost; Taboola Sales and Adj. EBITDA per management estimates. Taboola EV based on ION Acquisition Corp. [NYSE: IACA}. Note: Multiples<0.0x or >50.0x deemed not meaningful or “ NM ” . Digital Media, Content & Commerce Assumed EV of ~$1.5B 34 Enterprise Value / Pro Forma Adj. EBITDA 2021E: 4.6x 2022E: 4.0x 2021E: 16.1x 2022E: 11.9x 2.9x 2.3x 10.0x 8.3x 2.9x 2.5x 3.3x 3.1x 4.6x 4.0x 4.6x 4.0x 7.9x 6.6x 19.5x 14.6x 27.0x 18.3x 10.0x 8.1x 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 26.8x 13.0x 34.8x 28.5x NM 35.3x 21.3x 18.2x 16.1x 14.3x 18.7x 15.8x 14.9x 12.6x NM NM NM NM 35.2x 27.0x 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E 2022E 2021E: 5.1x 2022E: 4.4x 2021E: 14.7x 2022E: 11.3x Social Platforms 2021E: 25.1x 2022E: 19.8x 2021E: 22.7x 2022E: 22.4x 2021E: 20.0x 2022E: 18.2x Mean: Median: Mean: Median: Mean: Median: Mean: Median: 2021E: 25.1x 2022E: 19.8x

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL Historical BuzzFeed Management Projections '20A - '24E 2019A 2020A 2021E 2022E 2023E 2024E CAGR Revenue Advertising $176 $198 $261 $316 $387 $463 24% % Growth 13% 13% 32% 21% 22% 20% Content 202 166 165 187 221 270 13% % Growth (8%) (18%) (1%) 13% 18% 22% Commerce 47 57 95 150 225 330 55% % Growth 48% 20% 67% 59% 50% 47% Total Revenue $425 $421 $521 $654 $833 $1,063 26% % Growth 4% (1%) 24% 25% 28% 28% Adj. EBITDA (1) ($14) $17 $57 $117 $187 $263 100% % Growth NM NM 246% 106% 59% 41% % Margin (3%) 4% 11% 18% 22% 25% Summary Financials Note: 2019A and 2020A excludes HuffPost revenue and Adj. EBITDA. Pro Forma includes Complex, excludes go90. Values subject to ro unding. (1) Please refer to Adj. EBITDA reconciliation on p.38. 35

STRICTLY PRIVATE AND CONFIDENTIAL

STRICTLY PRIVATE AND CONFIDENTIAL STRICTLY PRIVATE AND CONFIDENTIAL Appendix 37

STRICTLY PRIVATE AND CONFIDENTIAL BuzzFeed STRICTLY PRIVATE AND CONFIDENTIAL GAAP / Non - GAAP Reconciliation (Adj. EBITDA) 38 ($ in millions) 2019A 2020A Net Income (1) ($29) $4 go90 profit (29) (14) Income tax provision (benefit) 3 (2) Interest expense 0 1 Interest income (2) (0) Depreciation and amortization 31 27 Other income, net (2) (2) Loss on disposition of subsidiary - 1 Stock - based compensation 3 1 Restructuring 10 - Loss on disposal of assets 1 - Adj. EBITDA ($14) $17 Note: Values subject to rounding. (1) Excludes minority interest adjustment relating to noncontrolling interest in BuzzFeed Japan.