Attached files

| file | filename |

|---|---|

| EX-23.1 - Glimpse Group, Inc. | ex23-1.htm |

| EX-5.1 - Glimpse Group, Inc. | ex5-1.htm |

| EX-3.2 - Glimpse Group, Inc. | ex3-2.htm |

As filed with the Securities and Exchange Commission on June 23, 2021

Registration No. 333-255049

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

The Glimpse Group, Inc.

(Exact Name of Registrant as specified in its charter)

| Nevada | 7371 | 81-2958271 | ||

| (State

or other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

15 West 38th St, 9th Fl

New York, NY 10018

917-292-2685

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lyron Bentovim

President & Chief Executive Officer

The Glimpse Group, Inc.

15 West 38th St, 9th Fl

New York, NY 10018

917-292-2685

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Darrin M. Ocasio, Esq. Jay Yamamoto, Esq. |

Andrew M. Tucker, Esq. Michael K. Bradshaw, Jr., Esq. | |

| Sichenzia Ross Ference LLP | Nelson Mullins Riley & Scarborough LLP | |

| 1185 Avenue of the Americas, 31st Fl | 101 Constitution Avenue, NW, Suite 900 | |

| New York, NY 10036 | Washington, D.C. 20001 | |

| Telephone: (212) 930-9700 | Telephone: (202) 689-2800 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [X] | Smaller Reporting Company [X] |

| Emerging Growth Company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered(1) | Proposed Maximum Aggregate Offering Price(2) | Amount

of Registration Fee | ||||||

| Common stock, $0.001 par value per share | $ | 14,087,500 | (3) | $ | 1,536.95 | |||

| Warrants to be issued to the representative of the underwriters(4) | — | — | ||||||

| Common stock underlying warrants to be issued to the representative of the underwriters(5) | $ | 704,375 | 76.85 | |||||

| Total | $ | 14,791,875 | $ | 1,613.80 | (6) | |||

| (1) | Pursuant to Rule 416 under the Securities Act, there are also being registered such indeterminate number of additional securities as may be issued to prevent dilution resulting from share splits, share dividends or similar transactions. | |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of any additional shares of common stock that the underwriters have the right to purchase to cover over-allotments. | |

| (3) | Includes 100,000 additional shares of common stock being sold to the underwriters by the selling stockholders. | |

| (4) | No registration fee required pursuant to Rule 457(g). | |

| (5) | We have agreed to issue to the representative of the underwriters warrants to purchase shares of common stock representing up to 5% of the common stock issued in the offering. The representative’s warrants are exercisable at a per share exercise price equal to 100% of the public offering price per share of the common stock offered hereby. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrants is $704,375 which is equal to 100% of $704,375 (5% of $14,087,500). | |

| (6) | $1,145.55 Previously Paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | June 23, 2021 |

1,750,000 Shares of Common Stock

The Glimpse Group, Inc.

This is the initial public offering of 1,750,000 shares of common stock of The Glimpse Group, Inc.

Prior to this offering, there was no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $6.00 and $8.00. We have applied to list our shares of common stock for trading on the Nasdaq Capital Market, subject to official notice of issuance, under the symbol “VRAR”. Completion of this offering is contingent on the approval of our listing application for trading on the Nasdaq Capital Market.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders | $ | $ |

| (1) | The underwriters will also be reimbursed for certain expenses incurred in the offering. “Underwriting (Conflicts of Interest)” contains additional information regarding underwriter compensation. |

We have granted to the underwriters an option to purchase up to 262,500 additional shares of common stock to cover overallotments, if any, exercisable at any time until 45 days after the date of this prospectus.

The selling stockholders identified in this prospectus are selling to the underwriters 100,000 shares of common stock at the initial public offering price less the underwriting discounts and commissions. We will not receive any of the proceeds from the sale of any shares of common stock by the selling stockholders upon any such exercise.

The underwriters expect to deliver the securities to purchasers in the offering on or about , 2021.

EF HUTTON

division of Benchmark Investments, LLC

The date of this prospectus is , 2021

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectuses or amendments thereto that we may provide to you in connection with this offering. Neither we, the selling stockholders nor any of the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or in any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we, the selling stockholders nor any of the underwriters can provide assurance as to the reliability of any other information that others may give to you. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of such free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates. Neither we, the selling stockholders nor any of the underwriters are making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted.

| ii |

GENERAL MATTERS

All references to Glimpse, the “company,” “we,” “us” and “our” are references to The Glimpse Group, Inc.

Unless otherwise indicated, all references to “dollars,” “US$,” or “$” in this prospectus are to United States dollars.

Unless otherwise indicated or the context otherwise requires, all information in this prospectus assumes no exercise of the over-allotment option.

Unless otherwise indicated, all references to “GAAP” in this prospectus are to United States generally accepted accounting principles.

Information contained on our websites, including www.theglimpsegroup.com, shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by prospective investors for the purposes of determining whether to purchase the units offered hereunder.

For investors outside the United States, neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourself about and to observe any restrictions relating to this offering and the distribution of this prospectus.

USE OF MARKET AND INDUSTRY DATA

This prospectus includes market and industry data that has been obtained from publicly available and non-commissioned third party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to those industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in those industries. Although our management believes such information to be reliable, neither we nor our management have independently verified any of the data from third party sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. In addition, the underwriters have not independently verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied upon by management. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report survey or article is not incorporated by reference in this prospectus. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.” Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus, any amendment or supplement to this prospectus and any related free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, not is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus or in any free writing prospectus is only accurate as of its date, regardless of its time of delivery or the time of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

TRADEMARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

| iii |

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under “Risk Factors” beginning on page 10 and our financial statements and notes thereto that appear elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

COMPANY OVERVIEW

We are a Virtual (“VR”) and Augmented (“AR”) Reality platform company, comprised of a diversified group of wholly-owned and operated VR and AR companies, providing enterprise-focused software, services and solutions. We believe that we offer significant exposure to the rapidly growing and potentially transformative VR and AR markets, while mitigating downside risk via our diversified model and ecosystem.

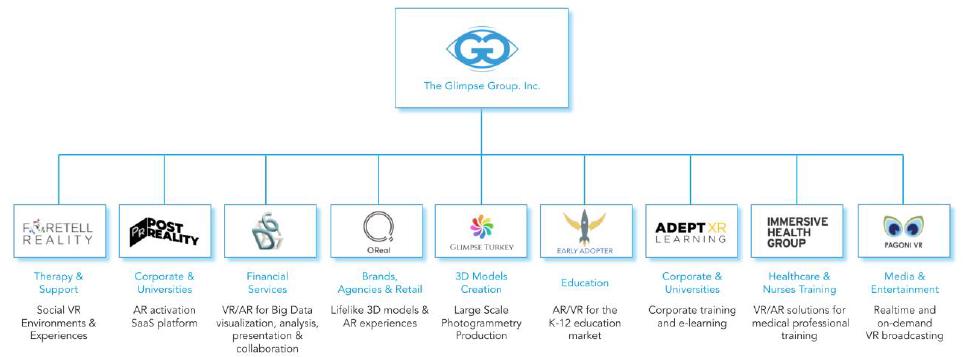

We were incorporated as The Glimpse Group, Inc. in the State of Nevada, on June 15, 2016 and are headquartered in New York, New York. We currently own and actively operate nine wholly-owned subsidiary companies (“Subsidiary Companies”, “Subsidiaries”) as represented in the below organizational charts:

| Name of Subsidiary | Date Acquired or Created | Ownership Percentage | Incorporation State | |||||

| Adept Reality, LLC (dba Adept Reality Learning) | 11/2016 | 100 | % | Nevada | ||||

| Kabaq 3D Technologies, LLC (dba QReal) | 11/2016 | 100 | % | Nevada | ||||

| KreatAR, LLC (dba PostReality) | 11/2016 | 100 | % | Nevada | ||||

| Foretell Studios, LLC (dba Foretell Reality) | 11/2016 | 100 | % | Nevada | ||||

| In-It, VR LLC (dba Mezmos, in-active) | 2/2017 | 100 | % | Nevada | ||||

| D6 VR, LLC | 6/2017 | 100 | % | Nevada | ||||

| Immersive Health Group, LLC | 10/2017 | 100 | % | Nevada | ||||

| Number 9, LLC (dba Pagoni VR) | 12/2017 | 100 | % | Nevada | ||||

| Early Adopter, LLC | 4/2018 | 100 | % | Nevada | ||||

| MotionZone, LLC (in-active) | 5/2018 | 100 | % | Nevada | ||||

| Glimpse Group Yazilim ve ARGE Ticaret Anonim Sirketi (Glimpse Turkey) | 3/2021 | 100 | % | Turkey | ||||

Our platform of VR/AR subsidiary companies, collaborative environment and diversified business model aims to simplify the challenges faced by entrepreneurs in the emerging VR/AR industry, potentially improving each subsidiary company’s ability to succeed, while simultaneously providing investors an opportunity to invest directly into the emerging VR/AR industry via a diversified infrastructure.

Leveraging our platform, we strive to cultivate and manage the business operations of our VR/AR subsidiary companies, with the goal of allowing each underlying company to better focus on mission-critical endeavors, collaborate with the other subsidiary companies, reduce time to market, optimize costs, improve product quality and leverage joint go-to-market strategies. Subject to operational, market and financial developments and conditions, we intend to carefully add to our current portfolio of subsidiary companies via a combination of organic expansion and/or outside acquisition.

The VR/AR industry is an early-stage technology industry with nascent markets. We believe that this industry has significant growth potential across verticals, may be transformative and that our diversified platform and ecosystem create important competitive advantages. Our subsidiary companies target a wide array of industry verticals, including but not limited to: Corporate Training, Education, Healthcare, Branding/Marketing/Advertising, Retail, Financial Services, Food & Hospitality, Media & Entertainment and Social VR group meetings. We do not currently target direct-to-consumer VR/AR software or services, only business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”), and we are hardware agnostic.

The Glimpse Platform

We develop, commercialize and market innovative and proprietary VR/AR software products, solutions and intellectual property (“IP”). Our platform is currently comprised of nine wholly-owned subsidiary companies, each targeting different industry segments in a non-competitive, collaborative manner. Our experienced management and dynamic VR/AR entrepreneurs have deep domain expertise, providing the foundation for value-add-collaborations throughout our ecosystem.

Each of our subsidiary companies share operational, financial and IP infrastructure, facilitating shorter time-to-market, higher quality products, reduced development costs, fewer redundancies, significant go-to-market synergies and, ultimately, a higher potential for success for each subsidiary company. We believe that our collaborative platform is unique and necessary, especially given the early nature of the VR/AR industry. By offering technologies and solutions in various industry segments, we aim to reduce dependency on any one single subsidiary company, technology or industry segment.

| 1 |

We believe that three core tenets enhance our probability of success: (1) our ecosystem of VR/AR companies, (2) diversification and (3) profitable growth.

| (1) | Our ecosystem of VR/AR software and service companies provides significant benefits to each subsidiary company and our group as a whole. We believe that the most notable benefits are: (a) economies of scale, cost efficiencies and reduced redundancies; (b) cross company collaboration, deep domain expertise, IP and knowledge transfer; (c) superior product offerings; (d) faster time to market; (e) enhanced business development and sales synergies; and (f) multiple monetization paths. In an emerging industry that is lacking in infrastructure, we believe that our ecosystem provides a distinct competitive advantage relative to a single, standalone company in the industry. | |

| (2) | By design, we incorporate multiple aspects of diversity to reduce the risks associated with an early stage industry, create multiple monetization venues and improve the probabilities of success. There is no single point of failure or dependency. This is created through: (a) ownership of numerous wholly-owned subsidiary companies operating in different industry segments; (b) targeting large industries with clear VR/AR use-cases; (c) developing and utilizing various technologies and IP; (d) expanding to different geographic technology centers in a hub model under our umbrella; and (e) across industries, having a wide array of customers and potential acquirers/investors. | |

| (3) | From our inception, we have prioritized achieving operational cash flow neutrality early in our life. This was an important factor that drove our strategy to: (a) focus on enterprise software and services, only onboarding companies that are generating revenues or clearly could in the short term; (b) target solutions that are based on use cases that have a clear return on investment (“ROI”) and can be effectively developed from existing technologies and hardware; and (c) centralize costs to reduce inefficiencies. By targeting cash flow neutrality, our goal is to minimize dilution and support greater independence from capital markets, thereby increasing resiliency and maximizing upside potential. |

As part of our platform, we provide a centralized corporate structure, which significantly reduces general and administrative costs (financial, operational, legal & IP), streamlines capital allocation and helps in coordinating business strategies. This allows our subsidiary company general managers to focus their time and effort almost exclusively on the core software, product and business development activities relating to their subsidiary.

Additionally, aligned economic incentives encourage cross-Company collaboration. All of our employees own equity in our Company. The leadership team of each subsidiary company, in addition to their equity ownership in our Company, also have an economic interest in their particular subsidiary company. This economic interest is negotiated with lead management of a subsidiary company upon their joining of our Company, and typically ranges between 5-10% of the total net sale proceeds of the subsidiary and includes a three-year vesting schedule. Thus, there is benefit to them not only when their subsidiary company succeeds but also when any of the other subsidiaries succeeds, and when our Company as a whole succeeds. We believe that this ownership mechanism is a strong driver of cross-pollination of ideas and fosters collaboration. While each subsidiary company owns its own IP, our parent company currently owns 100% of each subsidiary company. In addition, there will be perpetual licensing agreements between our subsidiary companies, so that if a subsidiary company is divested, then the remaining subsidiaries, if utilizing the IP of a divested subsidiary company, will continue to retain usage rights post-divestiture.

Our ecosystem currently consists of the following nine active subsidiary companies:

| 1. | Kabaq 3D Technologies, LLC (dba QReal): Creation of lifelike photorealistic 3D interactive digital models and experiences in AR |

| 2. | Adept Reality, LLC (dba Adept XR Learning): VR/AR solutions for higher education learning and corporate training |

| 3. | KreatAR, LLC (dba PostReality): AR presentation tools for design, creation and collaboration |

| 2 |

| 4. | D6 VR, LLC: VR/AR data visualization and data-analysis tools and collaboration for Financial Services and other data intensive industries |

| 5. | Immersive Health Group, LLC (IHG): VR/AR platform for evidence-based and outcome driven healthcare solutions |

| 6. | Foretell Studios, LLC (dba Foretell Reality): Customizable social VR platform for behavioral health, collaboration and soft skills training |

| 7. | Number 9, LLC (dba Pagoni VR): VR broadcasting solutions and environments for events, education, media & entertainment |

| 8. | Early Adopter, LLC (EA): AR/VR solutions for K-12 education |

| 9. | Glimpse Group Yazilim ve ARGE Ticaret Anonim Sirketi (Glimpse Turkey): a development center in Turkey, primarily developing and creating 3D models for QReal |

The VR and AR (XR) Markets

Virtual Reality (VR) fully immerses the user in a digital environment via a head mounted display (“HMD”), where the user is blocked out of their immediate physical environment. Augmented Reality (AR) is a less immersive experience, where the user views their immediate physical environment with digital images overlaid, via a phone, tablet or a dedicated HMD such as smart glasses. While distinct, VR and AR are related, utilize some similar underlying technologies and are expected to become increasingly interconnected - combined they are often referred to as Immersive Technology (XR).

VR and AR are emerging technologies, and the markets for them are still nascent. We believe that XR technologies and solutions have the potential to fundamentally transform how people and businesses interact, further enabling remote work, education and commerce. XR is also expected to increasingly interconnect with other emerging technologies such as artificial intelligence, computer vision, big data and crypto currencies. Additionally, HMD and telecommunication (5G) advancements have been driving vast improvements in capabilities and ease of use, while significantly reducing headset cost. As a result, market adoption has accelerated and is expected to continue. Leading technology companies such as Facebook, Apple, Microsoft, Google, Samsung, Sony and HP have been at the forefront of VR/AR hardware development and software infrastructure, while also increasing integration of their products with AR and VR capabilities.

Since Facebook released its first VR headset as a consumer product in 2016 (after its $2B+ acquisition of Oculus), successive iterations of it, as well as others, have become significantly lighter, more comfortable, lower priced, with higher resolution and increasingly wireless/mobile. With a standalone mobile headset, users no longer need an expensive gaming computer to power the headset and they also do not have a wire tethered to that computer restricting movement. These have facilitated easier corporate procurement and integration. The anticipated rollout of 5G should enable further improvement in user experience since with 5G, remote processing and heavier, real time applications become possible without noticeable visual lag, allowing for lighter, smaller, more comfortable HMDs with longer battery life.

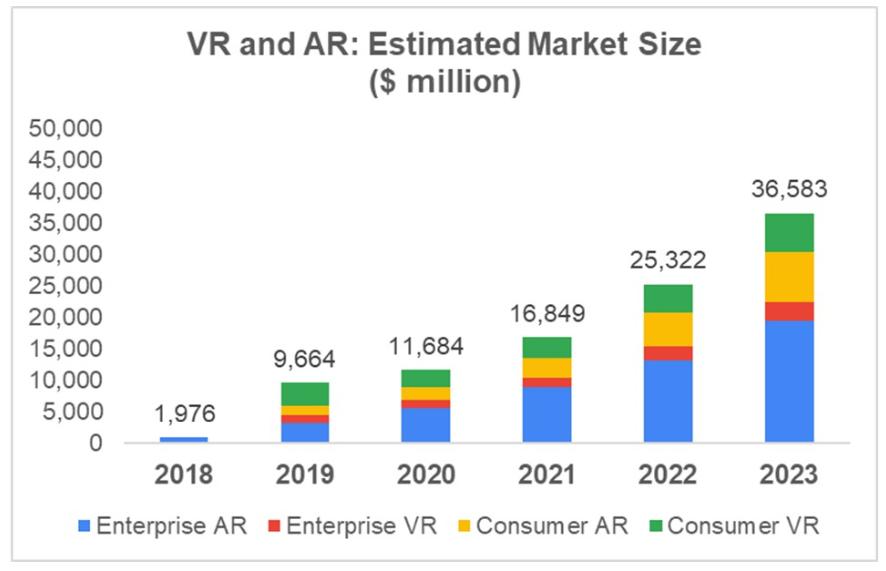

Based on Artillery Intelligence’s market forecasts, the VR and AR markets are forecasted to grow 31% in 2021 to over $9 billion, expanding at a 39% Compound Annual Growth Rate (CAGR) over the next three years, exceeding $35 billion by 2023. In particular, VR and AR enterprise software – the segment we are focused on – is projected to grow 59% in 2021 and expand at a 55% CAGR to more than $10 billion in 2023.

| 3 |

Business Development and Sales

We utilize a hybrid approach to the sales and distribution of our software products and services.

At our subsidiary company level, each company has its own business development and sales team, the size of which depends on its stage of development. Each subsidiary company’s general manager is responsible for business development, and as the subsidiary gains market traction, its business development and sales team are expanded as needed.

Our subsidiary companies’ business development and sales teams are enhanced by the shared resources and influence of our ecosystem. Our management takes an active role in the business development activities of each subsidiary company and in the overall development and integration of sale strategies, goals and budgets. As an integral part of the business development and sales processes, each subsidiary company’s general manager is very familiar with the product offerings of other subsidiary companies and leverages those into his or her own efforts when appropriate. This leads to substantial cross marketing collaboration.

We believe that a subsidiary company’s ability to demonstrate to potential customers scale as part of our ecosystem of companies, combined with our subsidiary’s ability to offer its products and solutions as well as those of our other subsidiary companies in an integrated manner, represents a key competitive advantage. We believe our customers often view us as a “one-stop-shop” for all their VR/AR needs and an expert in the emerging VR/AR space.

We and our subsidiary companies continue to develop a shared partner ecosystem to further scale business and expand our solutions into new and existing target markets.

Platform Expansion and Diversification Strategy

As described above in “The VR and AR (XR) Markets,” the VR/AR software and services industries are highly fragmented. There are numerous potential acquisition targets that, while having established a niche market position, product or technology, have limited resources and ability to pursue growth initiatives. We intend to leverage our position and relative scale in the industry in order to continue to add to our platform both earlier stage companies and technologies and, subject to the availability of capital and appropriate targets, more mature companies. Beyond the expected financial impact of each such potential addition, these could also enhance our ecosystem, technology, scale and competitive position. These potential acquisitions may be domestic or international. If there is sufficient scale in a certain geographic location (beyond our current NYC headquarters), then a new hub may be established in such location, with several subsidiary companies operating in that hub, under the overall Glimpse umbrella.

Employees

We currently have approximately 50 full time employees and consultants, primarily software developers, engineers and 3D artists.

Corporate Information

The Glimpse Group, Inc. was originally incorporated in the State of Nevada on June 15, 2016. Our principal business address is 15 West 38th St, 9th Fl, New York, NY 10018.

Information contained on our websites, including www.theglimpsegroup.com, shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by prospective investors for the purposes of determining whether to purchase the units offered hereunder.

| 4 |

| Common Stock offered by us | 1,650,000 shares of common stock (or 1,912,500 shares if the underwriters exercise their over-allotment option in full). | |

| Common Stock offered by the selling stockholders | 100,000 shares of common stock. | |

| Common Stock to be outstanding immediately after this offering | 9,551,902 shares (or 9,814,402 shares if the underwriters exercise their over-allotment option in full). | |

| Option to purchase additional shares: | We have granted the underwriters a 45-day option to purchase up to 262,500 additional shares of our common stock (equal to 15% of the number of shares of common stock sold in the offering), from us. | |

| Use of proceeds |

Based on an assumed initial public offering price of $7.00 per share (the midpoint of the price range set forth on the cover page of this prospectus), we expect to receive gross proceeds of $11.55 million, and net proceeds of $10.1 million after payment of commissions and expenses (or gross proceeds of $13.4 million and net proceeds of $11.8 million if the over-allotment option is exercised in full). We intend to use the net proceeds from this offering for general working capital purposes, including the growth and development of our existing subsidiaries and taking advantage of potential strategic opportunities through acquisition of other assets or subsidiaries, although no such acquisitions are currently identified.

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

The principal purposes of this offering are to increase our capitalization and financial flexibility, facilitate an orderly distribution of shares for the selling stockholders, create a public market for our common stock, and facilitate our future access to the capital markets. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. However, we currently intend to use the net proceeds we receive from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. We may use a portion of the net proceeds to acquire complementary businesses, products, services, or technologies. At this time, we do not have agreements or commitments to enter into any material acquisitions.

See “Use of Proceeds” on page 27 for a more complete description of the intended use of proceeds from this offering. | |

| Dividend Policy | Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors, or the Board, out of funds legally available. We have not paid any dividends since our inception, and, except for the future discretionary distributions described in the section entitled “Dividend Policy” of this prospectus, we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors. For further information see section entitled “Dividend Policy” of this prospectus. | |

| Voting Rights | Each share of common stock will entitle its holder to one vote on all matters to be voted on by stockholders. See “Description of Securities.” | |

| Risk Factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus before deciding whether or not to invest in our securities. |

| 5 |

| Conflicts of Interest | Affiliates of associated persons of EF Hutton, division of Benchmark Investments, LLC formerly known as Kingswood Capital Markets, division of Benchmark Investments, LLC (“EF Hutton”) will own in excess of 10% of our issued and outstanding common stock. Because EF Hutton is an underwriter in this offering, it is deemed to have a “conflict of interest” under Rule 5121 (“Rule 5121”) of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Due to certain of these conflicts of interest, Rule 5121 requires, among other things, that a “qualified independent underwriter” participate in the preparation of, and exercise the usual standards of “due diligence” with respect to, the registration statement and this prospectus. R.F. Lafferty & Co., Inc. has agreed to act as a qualified independent underwriter for this offering. R.F. Lafferty & Co., Inc. will not receive any additional fees for serving as a qualified independent underwriter in connection with this offering. We have agreed to indemnify R.F. Lafferty & Co., Inc. against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. | |

Proposed Nasdaq Ticker Symbol |

We have applied to list our common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “VRAR”. There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market. |

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| ● | gives effect to the consummation of this offering; | |

| ● | assumes the shares of common stock are offered at $7.00 per share (the midpoint of the price range listed on the cover page of this prospectus); | |

| ● | Excludes 4,749,699 shares issuable upon exercise of outstanding options; | |

| ● | excludes 5,250,301 shares reserved for issuance under The Glimpse Group Inc. 2016 Incentive Plan, as amended; and | |

| ● | assumes no exercise by the underwriters of their overallotment option. |

Selected Risks Associated With Our Business

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| ● | We are an early stage technology company; | |

| ● | Health epidemics have had, and could in the future have, an adverse impact on our business, operations, and the markets and communities in which we, our partners and customers operate; | |

| ● | We have incurred significant net losses since inception and anticipate that we will continue to incur net losses for the foreseeable future and may never achieve or maintain profitability; | |

| ● | We may not be successful in raising additional capital necessary to meet expected increases in working capital needs and we may not be able to continue our business operations; | |

| ● | Our market is competitive and dynamic and new competing products and services could be introduced at any time that could result in reduced profit margins and loss of market share; | |

| ● | Our plans for growth will place significant demands upon our resources and if we are unsuccessful in achieving our plan for growth, our business could be harmed; |

| 6 |

| ● | We have material customer concentration, with a limited number of customers accounting for a material portion of our 2020 and 2021 revenues; | |

| ● | We anticipate our products and technologies will require ongoing research and development and we may experience technical problems or delays and may not have the funds necessary to continue their development, which could lead our business to fail; | |

| ● | Our success depends on our ability to anticipate technological changes and develop new and enhanced products and services; | |

| ● | We place significant decision making powers with our subsidiaries’ management, which presents certain risks that may cause the operating results of individual subsidiaries to vary; | |

| ● | The failure to attract, hire, retain and motivate key personnel could have a significant adverse impact on our operations; | |

| ● | Our financial results may fluctuate substantially for many reasons, and past results should not be relied on as indications of future performance; | |

| ● | Our centralized management will have significant discretion over directing our resources and if management does not allocate resources effectively, our business, financial condition or result of operations could be harmed; | |

| ● | Competitive pricing pressure may reduce our gross profits and adversely affect our financial results; | |

| ● | Our future growth depends on our ability to attract, retain customers, and the loss of existing customers, or failure to attract new ones, could adversely impact our business and future prospects; | |

| ● | The continued operation of our business depends on the performance and reliability of the Internet, mobile networks, and other infrastructure that is not under our control; | |

| ● | If we do not make our platforms, including new versions or technology advancements, easier to use or properly train customers on how to use our platforms, our ability to broaden the appeal of our products and services and to increase our revenue could suffer; | |

| ● | Interruptions, performance problems or defects associated with our platforms may adversely affect our business, financial condition and results of operations; and | |

| ● | If we fail to timely release updates and new features to our platforms and adapt and respond effectively to rapidly changing technology, evolving industry standards, changing regulations, or changing customer needs, requirements or preferences, our platforms may become less competitive. |

Emerging Growth Company under the JOBS Act

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| ● | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | we are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting under the Sarbanes-Oxley Act; | |

| ● | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and | |

| ● | we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until June 30, 2026 (the last day of the fiscal year following the fifth anniversary of our initial public offering) if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act.

| 7 |

Pro Forma Security Ownership

The following table summarizes, on a pro forma basis as of March 31, 2021, the differences between affiliates, existing non-affiliate shareholders and the new investors with respect to the percentage ownership of our common stock after giving effect to this offering:

| Pre-Offering | Post-Offering | |||||||||||||||

| Number | Percent | Number | Percent | |||||||||||||

| Existing Affiliate Shareholders | 4,486,785 | 59.5 | % | 4,486,785 | 47.2 | % | ||||||||||

| Existing Non-Affiliate Shareholders | 3,052,459 | 40.5 | % | 3,276,609 | 34.4 | % | ||||||||||

| New investors | - | - | % | 1,750,000 | 18.4 | % | ||||||||||

| Total | 7,539,244 | 100 | % | 9,513,394 | 100 | % | ||||||||||

Selected Summary Financial Data

The following tables present our summary financial data and should be read together with our financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus. The summary financial data for the fiscal years ended June 30, 2020 and June 30, 2019 are derived from our audited annual consolidated financial statements, which are included elsewhere in this prospectus. The unaudited summary financial data for the nine months ended March 31, 2021 and 2020 have been derived from our unaudited interim consolidated financial statements, which are included elsewhere in this prospectus, and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our financial position and results of operations for these periods.

| Year Ended | Nine Months Ended | |||||||||||||||

| June 30, | March 31, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||

| Consolidated Statements of Operations Data | ||||||||||||||||

| Revenue | $ | 1,945 | $ | 983 | $ | 2,435 | $ | 1,404 | ||||||||

| Cost of revenue(1) | 1,137 | 425 | 1,278 | 883 | ||||||||||||

| Gross profit | 808 | 558 | 1,157 | 521 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Research and development(1) | 2,431 | 2,565 | 1,995 | 1,740 | ||||||||||||

| Sales and marketing(1) | 1,463 | 1,182 | 1,013 | 1,028 | ||||||||||||

| General and administrative(1) | 1,835 | 2,394 | 1,343 | 1,313 | ||||||||||||

| Total operating expenses | 5,729 | 6,141 | 4,351 | 4,081 | ||||||||||||

| Loss from operations | (4,921 | ) | (5,583 | ) | (3,194 | ) | (3,560 | ) | ||||||||

| Forgiveness of Paycheck Protection Program (PPP1) loan | - | - | 549 | - | ||||||||||||

| Other income (expense), net | - | - | 9 | - | ||||||||||||

| Interest income | 9 | 7 | 1 | 7 | ||||||||||||

| Interest expense | (81 | ) | - | (98 | ) | (30 | ) | |||||||||

| Loss on conversion of convertible notes | - | - | (515 | ) | - | |||||||||||

| Net loss | $ | (4,993 | ) | $ | (5,576 | ) | $ | (3,248 | ) | $ | (3,583 | ) | ||||

| Net loss per share, basic and diluted(2) | $ | (0.72 | ) | $ | (0.86 | ) | $ | (0.45 | ) | $ | (0.52 | ) | ||||

| Weighted-average shares used in computing net loss per share, basic and diluted(2) | 6,924 | 6,477 | 7,158 | 6,896 | ||||||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(2) | ||||||||||||||||

| Weighted-average shares used in computing pro forma net loss per share, basic and diluted (unaudited)(2) | ||||||||||||||||

| EBITDA | ||||||||||||||||

| Net loss | $ | (4,993 | ) | $ | (5,576 | ) | $ | (3,248 | ) | $ | (3,583 | ) | ||||

| Interest expense, net | 72 | (7 | ) | 97 | 23 | |||||||||||

| Depreciation and amortization | 20 | 22 | 18 | 16 | ||||||||||||

| EBITDA (loss) | (4,901 | ) | (5,561 | ) | (3,133 | ) | (3,544 | ) | ||||||||

| Impairment expense | 140 | - | - | - | ||||||||||||

| Forgiveness of PPP1 Loan and related | - | - | (559 | ) | - | |||||||||||

| Stock based compensation expenses | 2,652 | 3,163 | 2,336 | 1,929 | ||||||||||||

| Stock based acquisition related expenses | 131 | 231 | - | 84 | ||||||||||||

| Loss on conversion of convertible notes | - | - | 515 | - | ||||||||||||

| Adjusted EBITDA (loss) | $ | (1,978 | ) | $ | (2,167 | ) | $ | (841 | ) | $ | (1,531 | ) | ||||

| 8 |

(1) Amounts include stock option based compensation expense, for the years ended June 30, 2020 and 2019, and for the nine month periods ended March 31, 2021 and 2020, as follows:

| Year Ended | Nine Months Ended | |||||||||||||||

| June 30, | March 31, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Cost of revenue | $ | 237 | $ | 58 | $ | 497 | $ | 203 | ||||||||

| Research and development | 1,267 | 1,314 | 887 | 932 | ||||||||||||

| Sales and marketing | 293 | 182 | 311 | 170 | ||||||||||||

| General and administrative | 754 | 1,356 | 547 | 522 | ||||||||||||

| Total stock-based compensation expense | $ | 2,551 | $ | 2,910 | $ | 2,242 | $ | 1,827 | ||||||||

(2) See Note 3 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate our basic and diluted net loss per share and the weighted-average number of shares used in the computation of the per share amounts.

Non-GAAP financial measures should be viewed as supplemental to, and should not be considered as alternatives to net income, operating income, and cash flow from operating activities, liquidity or any other financial measures. They may not be indicative of the historical operating results of the Company nor are they intended to be predictive of potential future results. Our management uses and relies on EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. Investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP.

Elsewhere in this prospectus we have included a reconciliation of our non-GAAP financial measures to the most comparable financial measures calculated in accordance with GAAP. We believe that providing the non-GAAP financial measures, together with the reconciliation to GAAP, helps investors make comparisons between the Company and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measures and the corresponding GAAP measure provided by each company under applicable SEC rules.

| As of March 31, 2021 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma as Adjusted(2)(3) | ||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data | ||||||||||||

| Cash and cash equivalents | $ | 2,404 | $ | 2,404 | $ | 12,484 | ||||||

| Working capital(4) | 2,803 | 2,651 | 12,731 | |||||||||

| Total assets | 3,233 | 3,081 | 13,162 | |||||||||

| Deferred revenue | 205 | 205 | 205 | |||||||||

| Total debt, inclusive of convertible promissory notes (5) | 2,020 | 624 | 624 | |||||||||

| Accumulated deficit | (19,272 | ) | (19,628 | ) | (19,628 | ) | ||||||

| Total stockholders’ equity | 823 | 2,067 | 12,147 | |||||||||

(1) The pro forma column in the balance sheet data above reflects the conversion of an aggregate of $1.60 million of outstanding convertible promissory notes (net of remaining original issue discount), convertible into an aggregate of approximately 0.32 million shares of our common stock.

(2) The pro forma as adjusted column reflects the receipt of approximately $10.1 million in net proceeds from our sale of shares of common stock in this offering at an assumed initial public offering price of $7.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(3) Each $1.00 increase or decrease in the assumed initial public offering price of $7.00 per share, which is the midpoint of the assumed offering price range set forth on the cover of this prospectus, would increase or decrease, as applicable, the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $1.5 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions. We may also increase or decrease the number of shares we are offering. Similarly, each increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $6.4 million, assuming the assumed initial public offering price remains the same, and after deducting estimated underwriting discounts and commissions.

(4) Working capital is defined as current assets less current liabilities.

(5) See Note 9 to our consolidated financial statements included elsewhere in this prospectus.

| 9 |

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the market value of our securities could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

The Company is an early stage technology company

We were incorporated on June 15, 2016 and are an early stage technology development company, comprised of a wholly-owned group of early stage companies in the Virtual (“VR”) and Augmented Reality (“AR”) space. As such, we are subject to the risks associated with being an early stage company operating in an emerging industry, including, but not limited to, the risks set forth herein.

Health epidemics, including the current COVID-19 pandemic, have had, and could in the future have, an adverse impact on our business, operations, and the markets and communities in which we, our partners and customers operate. For example, sales cycles have generally lengthened and some customers have delayed purchase decisions.

Our business and operations could be adversely affected by health epidemics, including the current COVID-19 pandemic, impacting the markets and communities in which we, our partners and customers operate. The COVID-19 pandemic has caused and continues to cause significant business and financial markets disruption worldwide and there is significant uncertainty around the duration of this disruption on both a nationwide and global level, as well as the ongoing effects on our business.

The full extent to which the COVID-19 pandemic will directly or indirectly impact our business, results of operations and financial condition will depend on future developments that are highly uncertain and cannot be accurately predicted, and we may be unable to accurately forecast our revenue or financial results. Further, as many of our customers or partners experience downturns or uncertainty in their own business operations or revenue resulting from the spread of COVID-19, they may decrease or delay their spending, request pricing concessions or seek renegotiations of their contracts, any of which may result in decreased revenue for us. As a result of the COVID-19 pandemic, we have seen the length of our sale cycles generally increase and some of our customers have delayed purchase decisions. In addition, we may experience customer or strategic partner losses, including due to bankruptcy or our customers or strategic partners ceasing operations, which may result in an inability to collect receivables from these parties. A decline in revenue or the collectability of our receivables could harm our business.

In addition, in response to the spread of COVID-19, we are requiring or have required substantially all of our employees to work remotely to minimize the risk of the virus to our employees and the communities in which we operate, and we may take further actions as may be required by government authorities or that we determine are in the best interests of our employees, customers and business partners. There is no guarantee that we will be as effective while working remotely because our team is dispersed, employees may have less capacity to work due to increased personal obligations (such as childcare, eldercare, or caring for family members who become sick), may become sick themselves and be unable to work, or may be otherwise negatively affected, mentally or physically, by the COVID-19 pandemic and prolonged social distancing. Decreased effectiveness and availability of our team could adversely affect our results due to slow-downs in our sales cycles and recruiting efforts, delays in our entry into customer contracts, delays in addressing performance issues, delays in product development, delays and inefficiencies among various operational aspects of our business, including our financial organization, or other decreases in productivity that could seriously harm our business. Furthermore, we may decide to postpone or cancel planned investments in our business in response to changes in our business as a result of the spread of COVID-19, which may impact our ability to attract and retain customers and our rate of innovation, either of which could harm our business. In addition, our facilities needs could evolve based on continuing changes and impact on work environments as a result of the COVID-19 pandemic, and we may not be able to alter our contractual commitments to accommodate such changes, which could cause us to incur additional costs or otherwise harm our business. More generally, the COVID-19 outbreak has adversely affected economies and financial markets globally, which could decrease technology spending and adversely affect demand for our platforms and solutions.

| 10 |

The global impact of COVID-19 continues to rapidly evolve, and we will continue to monitor the situation and the effects on our business and operations closely. We do not yet know the full extent of potential impacts on our business, operations or the global economy as a whole, particularly if the COVID-19 pandemic and related public health measures continue and persist for an extended period of time. Given the uncertainty, we cannot reasonably estimate the impact on our future results of operations, cash flows or financial condition. While the spread of COVID-19 may eventually be contained or mitigated, there is no guarantee that a future outbreak of this or any other widespread epidemics will not occur, or that the global economy will recover, either of which could harm our business.

We have incurred significant net losses since inception and anticipate that we will continue to incur net losses for the foreseeable future and may never achieve or maintain profitability.

Since inception, we have incurred significant net losses. As of June 30, 2020 and March 31, 2021, we had an accumulated deficit of approximately $16,000,000 and $19,300,000, respectively. The net loss for the fiscal year ended June 30, 2020 was approximately $5,000,000 and for the nine-month period ended March 31, 2021 was approximately $3,200,000. To date, we have devoted our efforts towards securing financing, building and evolving our technology platform and creating an infrastructure that allows for the growth of such technology platform. In the past, the combination of operating losses, cash expected to be used to continue operating activities and uncertain conditions relating to additional capital raises and continued revenue growth created an uncertainty about the Company’s ability to continue as a going concern. While doubt about the Company’s ability to continue as a going concern was alleviated on our financial statements for the year ended June 30, 2020, prior to that our June 30, 2019 audited financial statements had indicated doubt about our ability to continue as a going concern. We expect to continue to incur significant expenses and potential operating losses for the foreseeable future. We anticipate that our expenses will increase if, and as, we continue to:

| ● | hire and retain additional sales, accounting and finance, marketing and engineering personnel; | |

| ● | build out our product pipeline; | |

| ● | add operational, financial and management information systems and personnel; and | |

| ● | maintain, expand, protect and enforce our intellectual property portfolio. |

To become profitable, we must continue to grow our revenue base and control expenditures. This will require us to be successful in a range of challenging activities, and our expenses will increase as we continue to develop and bring our current products, as well as new ones, to market. We may never succeed in any or all of these activities and, even if we do, we may never generate revenue that is significant or sufficient to achieve profitability. If we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable or to sufficiently fund our operations through financing activity could potentially, again, create an uncertainty about the Company’s ability to continue as a going concern.

Based on our recent financing activity we believe that our existing cash and cash equivalents will enable us to fund our operating expenses and capital expenditure requirements for more than one year.

Based on our recent financing activity we believe that our existing cash and cash equivalents will enable us to fund our operating expenses and capital expenditure requirements for more than one year. Consequently, our financial statements have been prepared under the assumption that we will continue as a going concern. However, we have based this estimate on assumptions that may prove to be wrong, and we could exhaust our available capital resources sooner than we expect. In the future, if we are unable to obtain sufficient funding to support our operations, we could be forced to delay, reduce or eliminate some or all of our development and growth initiatives, and our financial condition and results of operations will be materially and adversely affected and we may be unable to continue as a going concern. In the future, reports from our independent registered public accounting firm may also contain statements expressing substantial doubt about our ability to continue as a going concern. If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms or at all.

We may not be successful in raising additional capital necessary to meet expected increases in working capital needs. If we need additional funding for operations and we are unable to raise it, we may not be able to continue our business operations.

We expect our working capital needs to increase in the future as we continue to expand and enhance our operations. Our ability to raise additional funds through equity or debt financings or other sources will depend on the financial success of our current business and successful implementation of our key strategic initiatives, financial, economic and market conditions and other factors, some of which are beyond our control. No assurance can be given that we will be successful in raising the required capital at reasonable cost and at the required times, or at all. Further equity financings may have a dilutive effect on shareholders and any debt financing, if available, may require restrictions to be placed on our future financing and operating activities. If we require additional capital and are unsuccessful in raising that capital, we may not be able to continue our business operations and advance our growth initiatives, which could adversely impact our business, financial condition and results of operations.

Our market is competitive and dynamic. New competing products and services could be introduced at any time that could result in reduced profit margins and loss of market share.

The AR and VR industries are very dynamic, with new technology and services being introduced by a range of players, from larger established companies to start-ups, on a frequent basis. Our competitors may announce new products, services, or enhancements that better meet the needs of end-users or changing industry standards. Further, new competitors or alliances among competitors could emerge. Increased competition may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, the worldwide AR and VR markets are increasingly competitive. A number of companies developing AR and VR products and services compete for a limited number of customers. Some of our competitors in this market have substantially greater financial and other resources, larger research and development staffs, and more experience and capabilities in developing, marketing and distributing products. Ongoing pricing pressure could result in significant price erosion, reduced profit margins and loss of market share, any of which could have a material adverse effect on our business, results of operations, financial position and liquidity.

| 11 |

Our plans for growth will place significant demands upon our resources. If we are unsuccessful in achieving our plan for growth, our business could be harmed.

We are actively marketing our products domestically and potentially internationally. The plan places significant demands upon managerial, financial, and human resources. Our ability to manage future growth will depend in large part upon several factors, including our ability to rapidly:

| ● | build or leverage, as applicable, a network of business partners to create an expanding presence in the evolving marketplace for our products and services; | |

| ● | build or leverage, as applicable, sales teams to keep end-users and business partners informed regarding the technical features, issues and key selling points of our products and services; | |

| ● | attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and provide services that respond to evolving customer needs; | |

| ● | develop support capacity for end-users as sales increase, so that we can provide post-sales support without diverting resources from product development efforts; and | |

| ● | expand our internal management and financial controls significantly, so that we can maintain control over our operations and provide support to other functional areas as the number of personnel and size increases. |

Our inability to achieve any of these objectives could harm our business, financial condition and results of operations.

We have material customer concentration, with a limited number of customers accounting for a material portion of our 2020 revenues.

For the years ended June 30, 2020 and 2019, our five largest customers, accounted for approximately 38% and 45% of our revenues, respectively. For the nine months ended March 31, 2021 and 2020, our five largest customers accounted for approximately 63% and 47% of our revenues, respectively. There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers or the future demand for the products and services of these customers in the end-user marketplace. In addition, revenues from these customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. Further, some of our contracts with these customers permit them to terminate our services at any time (subject to notice and certain other provisions). If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services or we could lose a major customer. Any such development could have an adverse effect on our margins and financial position, and would negatively affect our revenues and results of operations and/or trading price of our common stock.

We anticipate our products and technologies will require ongoing research and development (“R&D”) and we may experience technical problems or delays and may not have the funds necessary to continue their development, which could lead our business to fail.

Our R&D efforts are subject to the risks typically associated with the development of new products and technologies based on emerging and innovative technologies, including, for example, unexpected technical problems or the possible insufficiency of funds for completing development of these products or technologies. If we experience technical problems or delays, further improvements in our products or technologies and the introduction of future products or technologies could be delayed, and we could incur significant additional expenses and our business may fail.

| 12 |

We anticipate that we may require additional funds to increase or sustain our current levels of expenditure for the R&D of new products and technologies, and to obtain and maintain patents and other intellectual property rights in these technologies, the timing and amount of which are difficult to forecast. Any funds we need may not be available on commercially reasonable terms or at all. If we cannot obtain the necessary additional capital when needed, we might be forced to reduce our R&D efforts which would materially and adversely affect our business. If we attempt to raise capital in an offering of shares of our common stock, preferred stock, convertible securities or warrants, our then-existing stockholders’ interests will be diluted.

Our success depends on our ability to anticipate technological changes and develop new and enhanced products and services.

The markets for our and products and services are characterized by rapidly changing technology, evolving industry standards and increasingly sophisticated customer requirements. The introduction of products embodying new technology and the emergence of new industry standards can negatively impact the marketability of our existing products and can exert price pressures on existing products. It is critical to our success that we are able to anticipate and react quickly to changes in technology or in industry standards and to successfully develop, introduce, and achieve market acceptance of new, enhanced and competitive products and services on a timely basis and cost-effective basis. We invest substantial resources towards continued innovation; however, there can be no assurance that we will successfully develop new products and services or enhance and improve our existing products and services, that new products and services and enhanced and improved existing products and services will achieve market acceptance or that the introduction of new products and services or enhanced existing products and services by others will not negatively impact us. Our inability to develop products and services that are competitive in technology and price and that meet end-user needs could have a material adverse effect on our business, financial condition or results of operations.

Development schedules for technology products and services are inherently uncertain. We may not meet our products and/or services development schedules, and development costs could exceed budgeted amounts. Our business, results of operations, financial position and liquidity may be materially and adversely affected if the products or product enhancements that we develop are delayed or not delivered due to developmental problems, quality issues or component shortage problems, or if our products or product enhancements do not achieve market acceptance or are unreliable. We or our competitors will continue to introduce products embodying new technologies. In addition, new industry standards may emerge. Such events could render our existing products obsolete or not marketable, which would have a material adverse effect on our business, results of operations, financial position and liquidity.

We place significant decision making powers with our subsidiaries’ management, which presents certain risks that may cause the operating results of individual subsidiaries to vary.

We believe that our practice of placing significant decision making powers with each of our subsidiaries’ management is important to our successful growth and allows us to be responsive to opportunities and to our customers’ needs. However, this practice can make it difficult to coordinate procedures across our operations and presents certain risks, including the risk that we may be slower or less effective in our attempts to identify or react to problems affecting an important business issue, or that we would be slower to identify a misalignment between a subsidiary’s and our overall business strategy. Inconsistent implementation of corporate strategy and policies at the subsidiary level could materially and adversely affect our financial position, results of operations and cash flows and prospects.

The operating results of an individual subsidiary may differ from those of another subsidiary for a variety of reasons, including market size, customer base, competitive landscape, regulatory requirements and economic conditions affecting a particular industry vertical. As a result, certain of our subsidiaries may experience higher or lower levels of profitability and growth than other subsidiaries.

| 13 |

The failure to attract, hire, retain and motivate key personnel could have a significant adverse impact on our operations.

Our success depends on the retention and maintenance of key personnel, including members of senior management and our technical, sales and marketing teams. Achieving this objective may be difficult due to many factors, including competition for such highly skilled personnel; fluctuations in global economic and industry conditions; changes in our management or leadership; competitors’ hiring practices; and the effectiveness of our compensation programs. The loss of any of these key persons could have a material adverse effect on our business, financial condition or results of operations. Competition for qualified employees is particularly intense in the technology industry. Our failure to attract and to retain the necessary qualified personnel could seriously harm our operating results and financial condition. Competition for such personnel can be intense, and no assurance can be provided that we will be able to attract or retain highly qualified technical and managerial personnel in the future, which may have a material adverse effect on our future growth and profitability.

Our financial results may fluctuate substantially for many reasons, and past results should not be relied on as indications of future performance.

Our revenues and operating results may fluctuate from quarter to quarter and from year to year due to a combination of factors, including, but not limited to:

| ● | varying size, timing and contractual terms of orders for our products and services, which may delay the recognition of revenue; | |

| ● | competitive conditions in the industry, including strategic initiatives by us or our competitors, new products or services, product or service announcements and changes in pricing policy by us or our competitors; | |

| ● | market acceptance of our products and services; | |

| ● | our ability to maintain existing relationships and to create new relationships with customers and business partners; | |

| ● | the discretionary nature of purchase and budget cycles of our customers and end-users; | |

| ● | the length and variability of the sales cycles for our products; | |

| ● | general weakening of the economy resulting in a decrease in the overall demand for our products and services or otherwise affecting the capital investment levels of businesses with respect to our products or services; | |

| ● | timing of product development and new product initiatives; | |

| ● | changes in customer mix; | |

| ● | increases in the cost of, or limitations on, the availability of materials; | |

| ● | changes in product mix; and | |

| ● | increases in costs and expenses associated with the introduction of new products. |

Further, the markets that we serve are volatile and subject to market shifts that we may be unable to anticipate. A slowdown in the demand for AR or VR products and services can have a significant adverse effect on the demand for our products and services in any given period. Our customers may cancel or delay purchase orders for a variety of reasons, including, but not limited to, the rescheduling of new product introductions, changes in our customers’ inventory practices or forecasted demand, general economic conditions affecting our customers’ markets, changes in our pricing or the pricing of our competitors, new product announcements by us or others, quality or reliability problems related to our products, or selection of competitive products as alternate sources of supply.