Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Utz Brands, Inc. | utz-20210622.htm |

℠ Jefferies Consumer Conference Presentation June 22, 2021

℠ Disclaimer Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal” or other similar words, phrases or expressions. These forward-looking statements include the expected effects from the COVID-19 pandemic, future plans for the Company, the estimated or anticipated future results and benefits of the Company’s future plans and operations, future capital structure, future opportunities for the Company, and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Factors that may cause such differences include, but are not limited to: the risk that the recently completed business combination with Collier Creek Holdings and other acquisitions recently completed by the Company (collectively, the “Business Combinations”) disrupt plans and operations; the ability to recognize the anticipated benefits of such Business Combinations, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the outcome of any legal proceedings that may be instituted against the Company following the consummation of such Business Combinations; changes in applicable law or regulations; costs related to the Business Combinations; the inability of the Company to maintain the listing of the Company’s Class A Common Stock on the New York Stock Exchange; the inability of the Company to develop and maintain effective internal controls; the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in raw materials pricing, retail customer requirements and mix, sales velocities and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively; costs associated with building brand loyalty and interest in the Company’s products, which may be affected by the Company’s competitors’ actions that result in the Company’s products not suitably differentiated from the products of competitors; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business or competitive factors; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “Commission”) for the fiscal year ended January 3, 2021, as amended, and other reports filed by the Company with the Commission. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. Except as required by law, the Company undertakes no obligation to update such statements to reflect events or circumstances arising after such date and cautions investors not to place undue reliance on any such forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) including, but not limited to, Pro Forma Net Sales, Adjusted Gross Profit, Pro Forma Adjusted Gross Profit, Adjusted SG&A, EBITDA, Adjusted EBITDA, Further Adjusted EBITDA, Normalized Further Adjusted EBITDA, Adjusted Net Income and certain ratios and other metrics derived there from. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. 2

℠ Today’s Agenda Value Creation StrategyII Business Overview Recent PerformanceIII IV I 3

℠ Today’s Presenters ℠ Dylan Lissette Chief Executive Officer Cary Devore Chief Financial Officer CEO of Utz since 2012 Joined Utz in 1995; worked in a variety of capacities prior to becoming CEO EVP & CFO, joined Utz in 2016 Former Managing Director at Metropoulos & Co. 25 years in private equity, investment banking, and public accounting Ajay Kataria EVP, Finance & Accounting Joined Utz in 2017 20 years of CPG experience in senior finance roles including nine years at PepsiCo 4

I. Business Overview

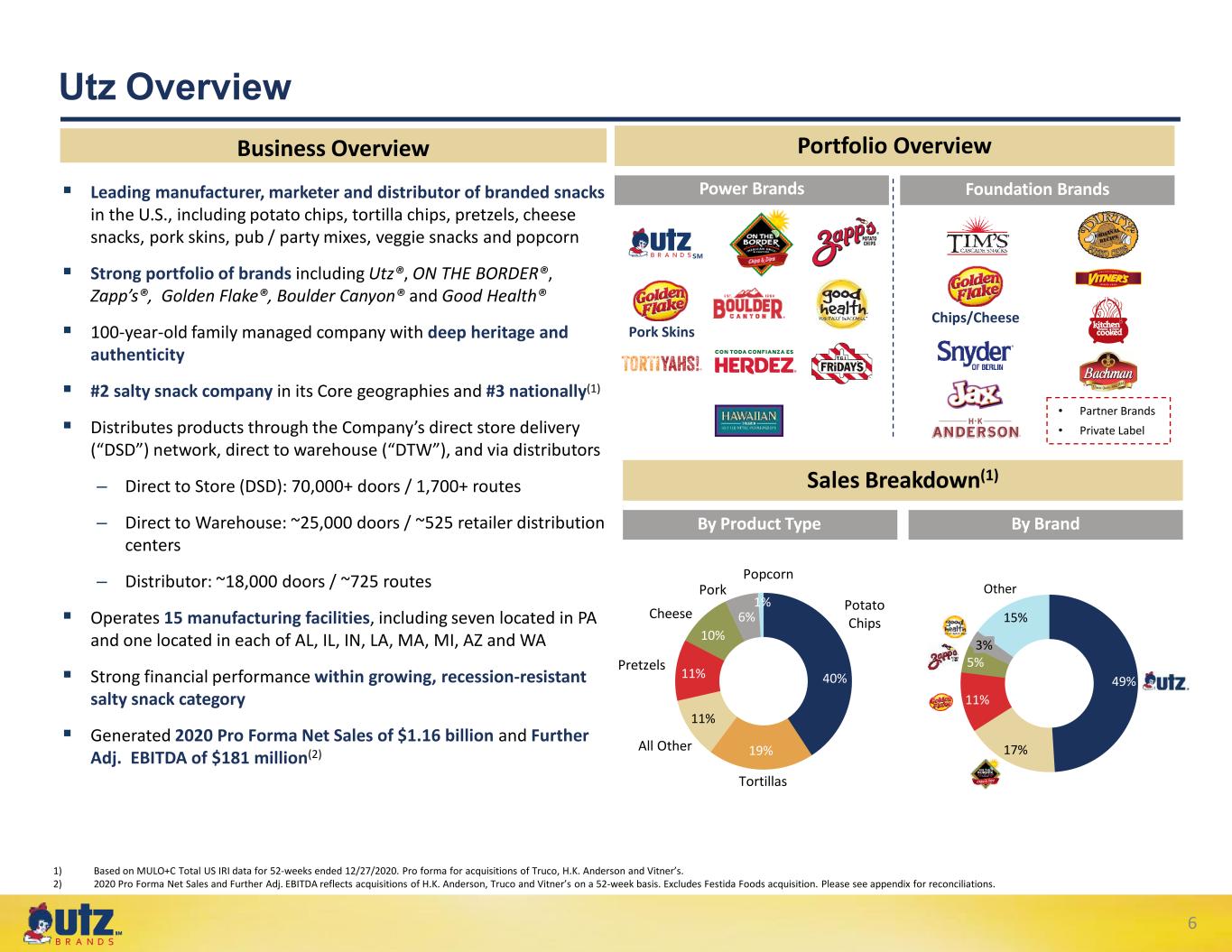

℠ 49% 17% 11% 5% 15% 3% Utz Overview 1) Based on MULO+C Total US IRI data for 52-weeks ended 12/27/2020. Pro forma for acquisitions of Truco, H.K. Anderson and Vitner’s. 2) 2020 Pro Forma Net Sales and Further Adj. EBITDA reflects acquisitions of H.K. Anderson, Truco and Vitner’s on a 52-week basis. Excludes Festida Foods acquisition. Please see appendix for reconciliations. Business Overview Leading manufacturer, marketer and distributor of branded snacks in the U.S., including potato chips, tortilla chips, pretzels, cheese snacks, pork skins, pub / party mixes, veggie snacks and popcorn Strong portfolio of brands including Utz®, ON THE BORDER®, Zapp’s®, Golden Flake®, Boulder Canyon® and Good Health® 100-year-old family managed company with deep heritage and authenticity #2 salty snack company in its Core geographies and #3 nationally(1) Distributes products through the Company’s direct store delivery (“DSD”) network, direct to warehouse (“DTW”), and via distributors – Direct to Store (DSD): 70,000+ doors / 1,700+ routes – Direct to Warehouse: ~25,000 doors / ~525 retailer distribution centers – Distributor: ~18,000 doors / ~725 routes Operates 15 manufacturing facilities, including seven located in PA and one located in each of AL, IL, IN, LA, MA, MI, AZ and WA Strong financial performance within growing, recession-resistant salty snack category Generated 2020 Pro Forma Net Sales of $1.16 billion and Further Adj. EBITDA of $181 million(2) Sales Breakdown(1) By Product Type By Brand Portfolio Overview Power Brands Foundation Brands Pork Skins Chips/Cheese • Partner Brands • Private Label Potato Chips Tortillas All Other Pretzels Cheese Pork Popcorn 40% 19% 11% 11% 10% 6% 1% Other ℠ 6

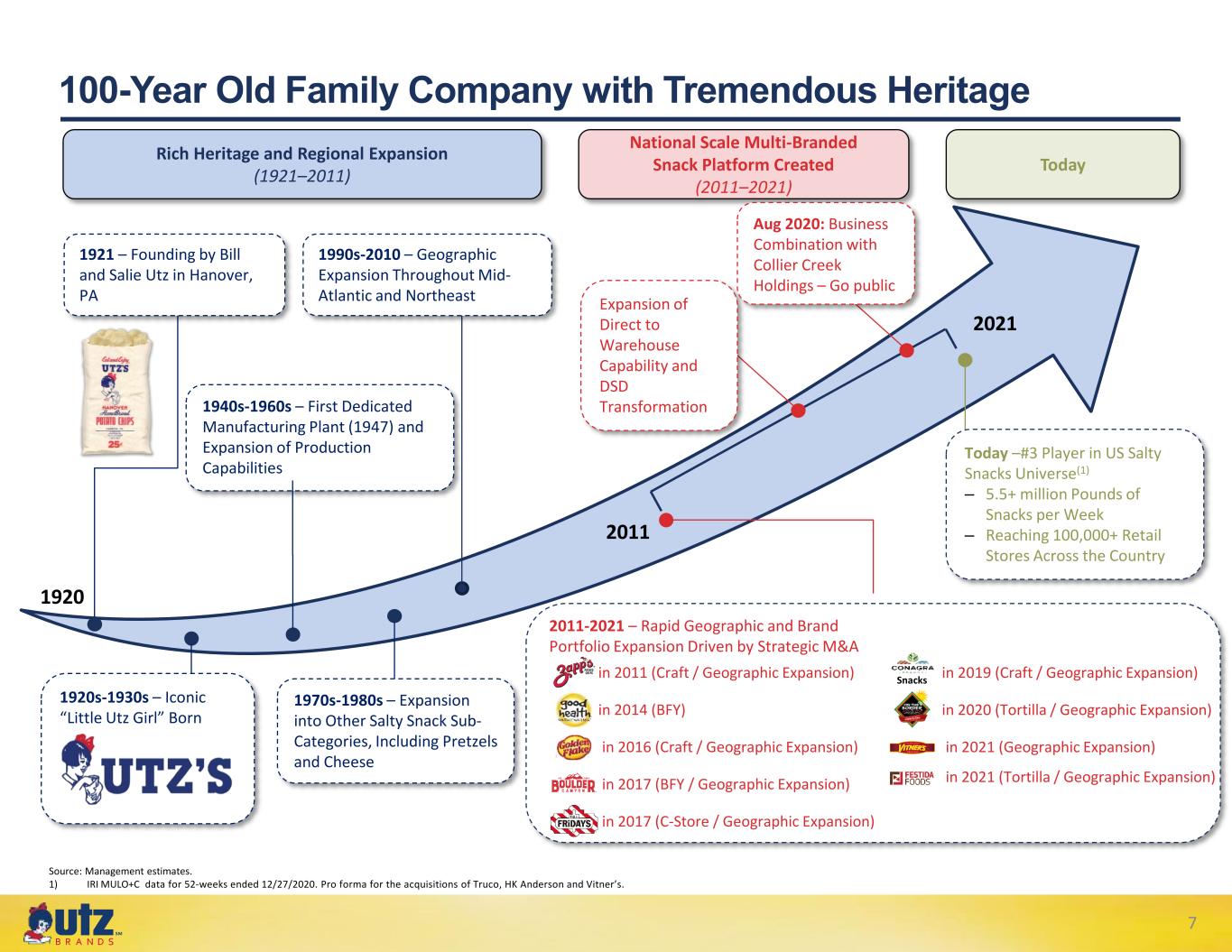

℠ 2011-2021 – Rapid Geographic and Brand Portfolio Expansion Driven by Strategic M&A 100-Year Old Family Company with Tremendous Heritage TodayRich Heritage and Regional Expansion (1921–2011) National Scale Multi-Branded Snack Platform Created (2011–2021) 1940s-1960s – First Dedicated Manufacturing Plant (1947) and Expansion of Production Capabilities 1970s-1980s – Expansion into Other Salty Snack Sub- Categories, Including Pretzels and Cheese 1920s-1930s – Iconic “Little Utz Girl” Born 1920 2021 1990s-2010 – Geographic Expansion Throughout Mid- Atlantic and Northeast Expansion of Direct to Warehouse Capability and DSD Transformation Source: Management estimates. 1) IRI MULO+C data for 52-weeks ended 12/27/2020. Pro forma for the acquisitions of Truco, HK Anderson and Vitner’s. Today –#3 Player in US Salty Snacks Universe(1) – 5.5+ million Pounds of Snacks per Week – Reaching 100,000+ Retail Stores Across the Country 1921 – Founding by Bill and Salie Utz in Hanover, PA Aug 2020: Business Combination with Collier Creek Holdings – Go public in 2011 (Craft / Geographic Expansion) in 2014 (BFY) Snacks in 2016 (Craft / Geographic Expansion) in 2017 (BFY / Geographic Expansion) in 2017 (C-Store / Geographic Expansion) in 2019 (Craft / Geographic Expansion) in 2020 (Tortilla / Geographic Expansion) in 2021 (Geographic Expansion) in 2021 (Tortilla / Geographic Expansion) 2011 7

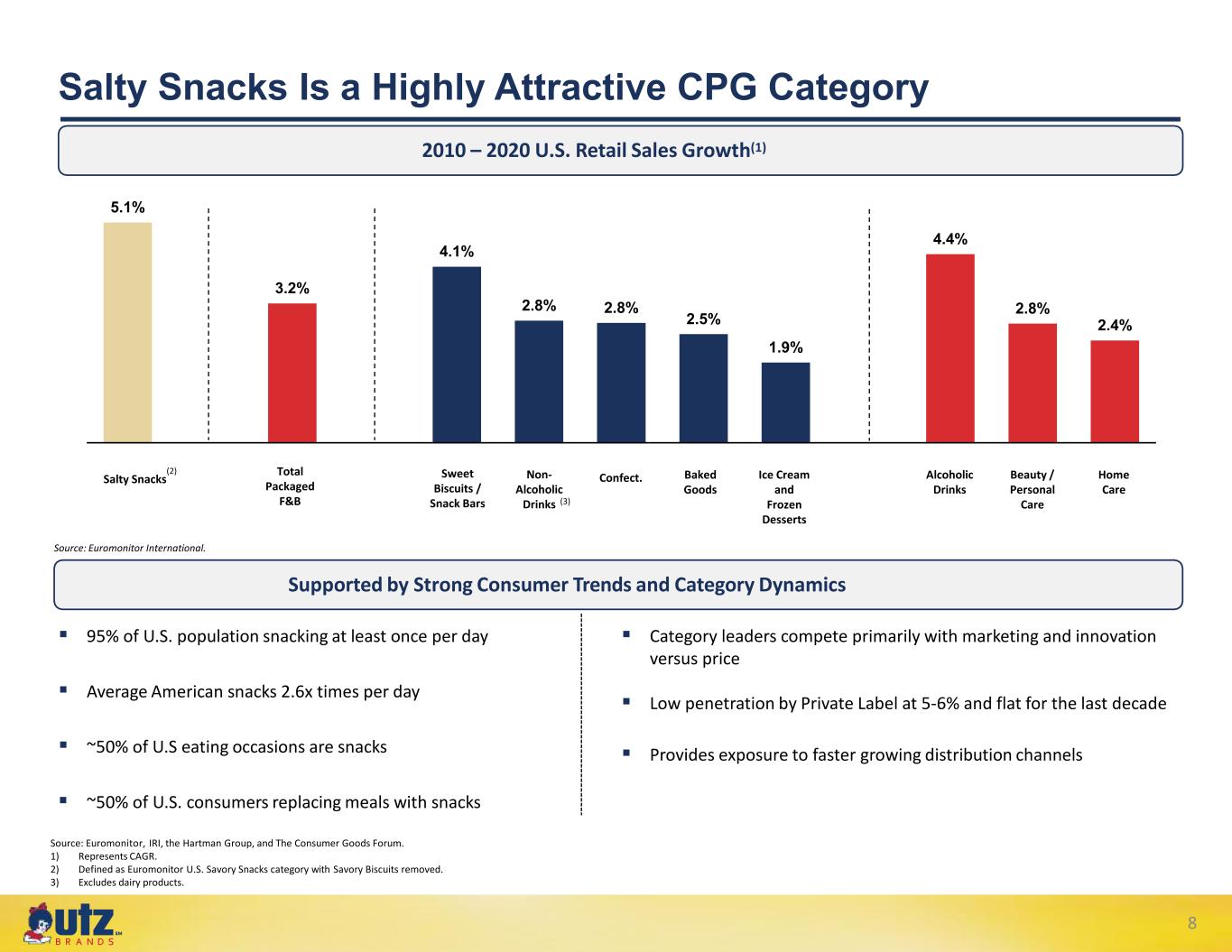

℠ Salty Snacks Is a Highly Attractive CPG Category Supported by Strong Consumer Trends and Category Dynamics Source: Euromonitor International. Category leaders compete primarily with marketing and innovation versus price Low penetration by Private Label at 5-6% and flat for the last decade Provides exposure to faster growing distribution channels 2010 – 2020 U.S. Retail Sales Growth(1) 95% of U.S. population snacking at least once per day Average American snacks 2.6x times per day ~50% of U.S eating occasions are snacks ~50% of U.S. consumers replacing meals with snacks 5.1% 3.2% 4.1% 2.8% 2.8% 2.5% 1.9% 4.4% 2.8% 2.4% (2) Salty Snacks Total Packaged F&B Sweet Biscuits / Snack Bars Non- Alcoholic Drinks Confect. Baked Goods Ice Cream and Frozen Desserts Alcoholic Drinks Beauty / Personal Care Home Care (3) Source: Euromonitor, IRI, the Hartman Group, and The Consumer Goods Forum. 1) Represents CAGR. 2) Defined as Euromonitor U.S. Savory Snacks category with Savory Biscuits removed. 3) Excludes dairy products. 8

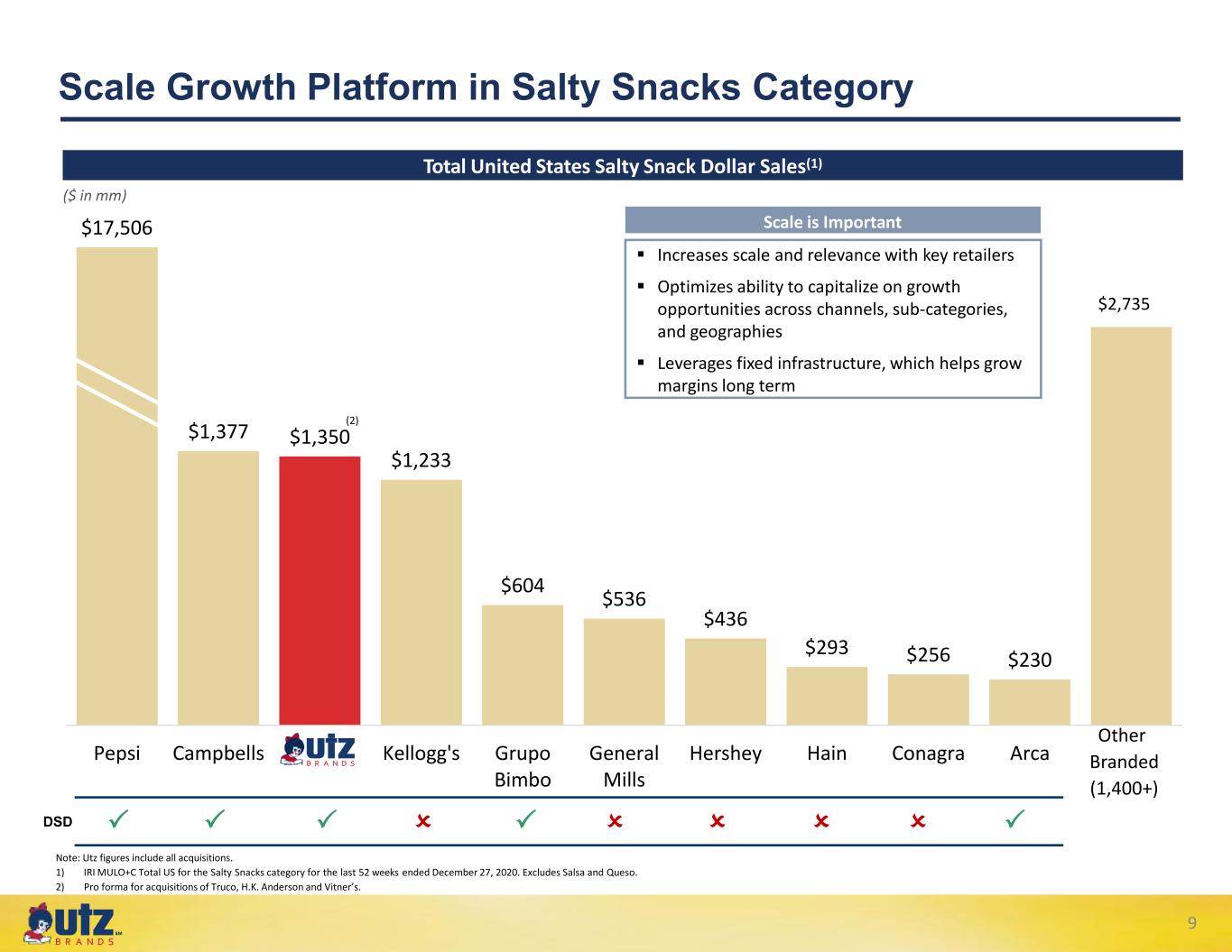

℠ Note: Utz figures include all acquisitions. 1) IRI MULO+C Total US for the Salty Snacks category for the last 52 weeks ended December 27, 2020. Excludes Salsa and Queso. 2) Pro forma for acquisitions of Truco, H.K. Anderson and Vitner’s. Total United States Salty Snack Dollar Sales(1) Scale is Important Increases scale and relevance with key retailers Optimizes ability to capitalize on growth opportunities across channels, sub-categories, and geographies Leverages fixed infrastructure, which helps grow margins long term Scale Growth Platform in Salty Snacks Category (2) ($ in mm) DSD Other Branded (1,400+) $17,506 $1,377 $1,350 $1,233 $604 $536 $436 $293 $256 $230 ~$2,000 Pepsi Campbells Utz Kellogg's Grupo Bimbo General Mills Hershey Hain Conagra Arca $2,735 9

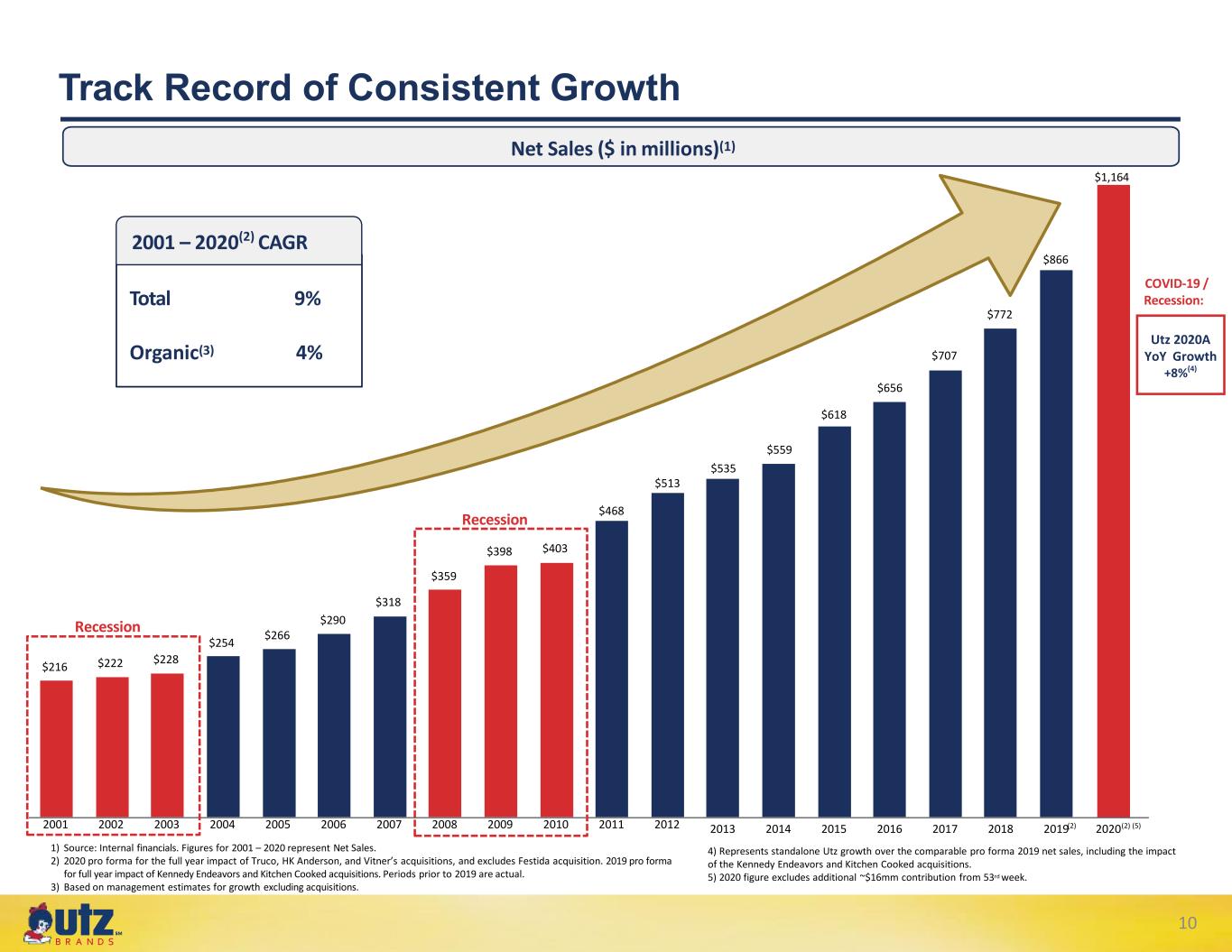

℠ $216 $222 $228 $254 $266 $290 $359 $318 $398 $403 $707 $772 Track Record of Consistent Growth 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 1) Source: Internal financials. Figures for 2001 – 2020 represent Net Sales. 2) 2020 pro forma for the full year impact of Truco, HK Anderson, and Vitner’s acquisitions, and excludes Festida acquisition. 2019 pro forma for full year impact of Kennedy Endeavors and Kitchen Cooked acquisitions. Periods prior to 2019 are actual. 3) Based on management estimates for growth excluding acquisitions. Net Sales ($ in millions)(1) Recession $656 Recession 2001 – 2020(2) CAGR Total 9% Organic(3) 4% 4) Represents standalone Utz growth over the comparable pro forma 2019 net sales, including the impact of the Kennedy Endeavors and Kitchen Cooked acquisitions. 5) 2020 figure excludes additional ~$16mm contribution from 53rd week. COVID-19 / Recession: Utz 2020A YoY Growth +8%(4) $866 2013 2014 2015 2016 2017 2018 2019 2020 $1,164 (2) (5)(2) $618 $559 $535 $513 $468 10

℠ Strong Brand Portfolio with Focus on Power Brands PorkSkins Foundation Brands (13% of Retail Sales)(1) Iconic Heritage Power Brands (87% of Retail Sales)(1) Craft Better For You Regional Licensed Other • Partner Brands • Private Label 1) Source: IRI MULO + C Total US for 52-weeks ended December 27, 2020. Chips/Cheese 11

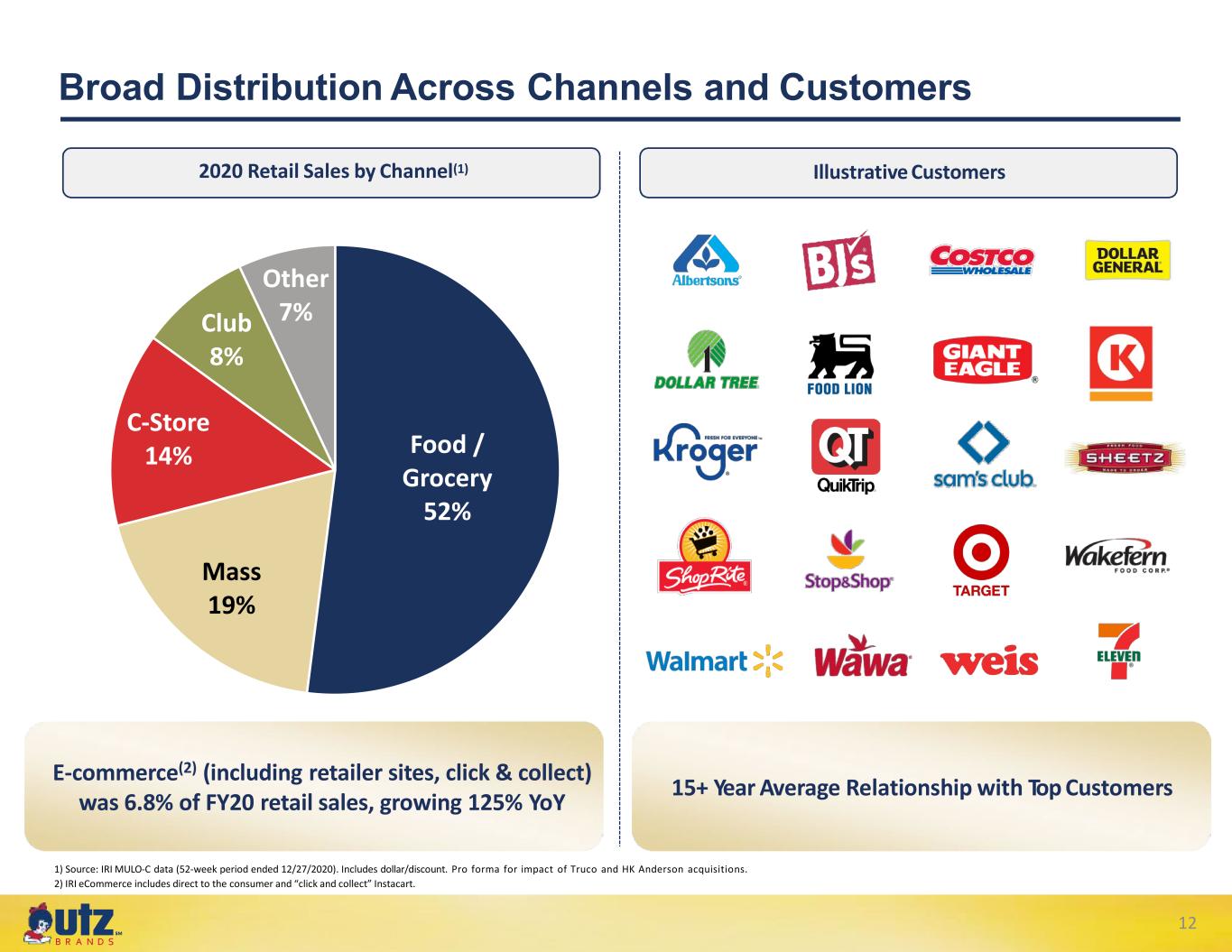

℠ Broad Distribution Across Channels and Customers 15+ Year Average Relationship with Top Customers 2020 Retail Sales by Channel(1) Illustrative Customers 1) Source: IRI MULO-C data (52-week period ended 12/27/2020). Includes dollar/discount. Pro forma for impact of Truco and HK Anderson acquisitions. 2) IRI eCommerce includes direct to the consumer and “click and collect” Instacart. Food / Grocery 52% Mass 19% C-Store 14% Club 8% Other 7% E-commerce(2) (including retailer sites, click & collect) was 6.8% of FY20 retail sales, growing 125% YoY 12

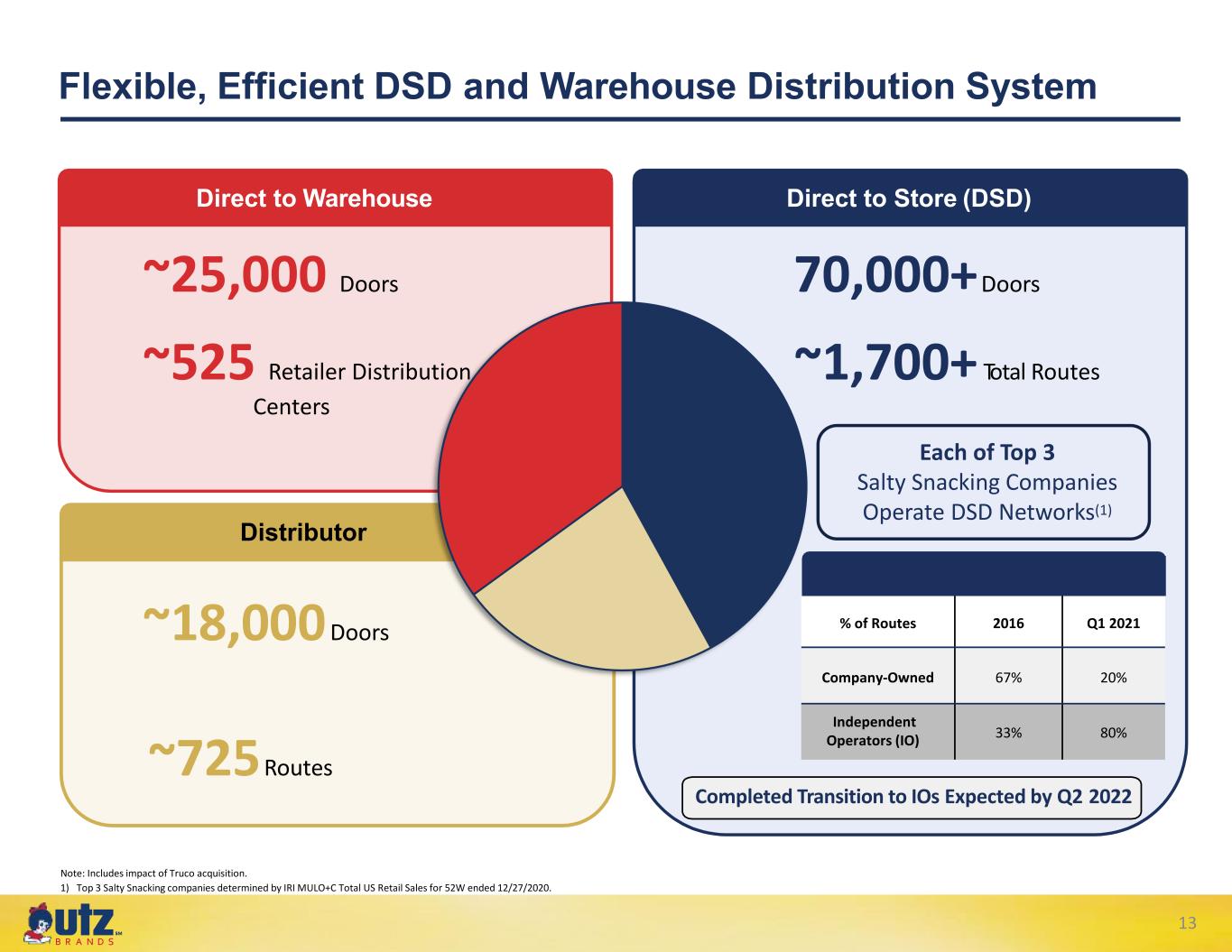

℠ Distributor Flexible, Efficient DSD and Warehouse Distribution System Direct to Warehouse Direct to Store (DSD) ~18,000Doors ~725Routes 70,000+Doors ~1,700+ Total Routes Each of Top 3 Salty Snacking Companies Operate DSD Networks(1) Note: Includes impact of Truco acquisition. 1) Top 3 Salty Snacking companies determined by IRI MULO+C Total US Retail Sales for 52W ended 12/27/2020. Utz Transition to IOs % of Routes 2016 Q1 2021 Company-Owned 67% 20% Independent Operators (IO) 33% 80% ~25,000 Doors ~525 Retailer Distribution Centers Completed Transition to IOs Expected by Q2 2022 13

℠ National Manufacturing Footprint with Broad Capabilities 400+ Million Lbs. Annual Capacity(1) Low 70s% Capacity Utilization(1) Strong Quality and Safety Record Opportunities to Optimize Footprint 15 Manufacturing Facilities Packaging MultipacksBarrelsBags TraysSeasonals Olive OilAvocado Oil Gluten-Free Organic Ingredients Continuous Chips Kettle Chips Extruded Popped Baked Processes Sheeted Veggie Pork (4) 1) Based on management estimates of available capacity in 2020 over a seven-day work schedule, excluding weekly clean-up time. Excludes Festida acquisition. Festida Acquisition Largest Manufacturer of ON THE BORDER® Tortilla Chips Located in Grand Rapids, MI Provides Increased Access to Midwest Festida Facility (Acquisition closed on June 7, 2021) 14

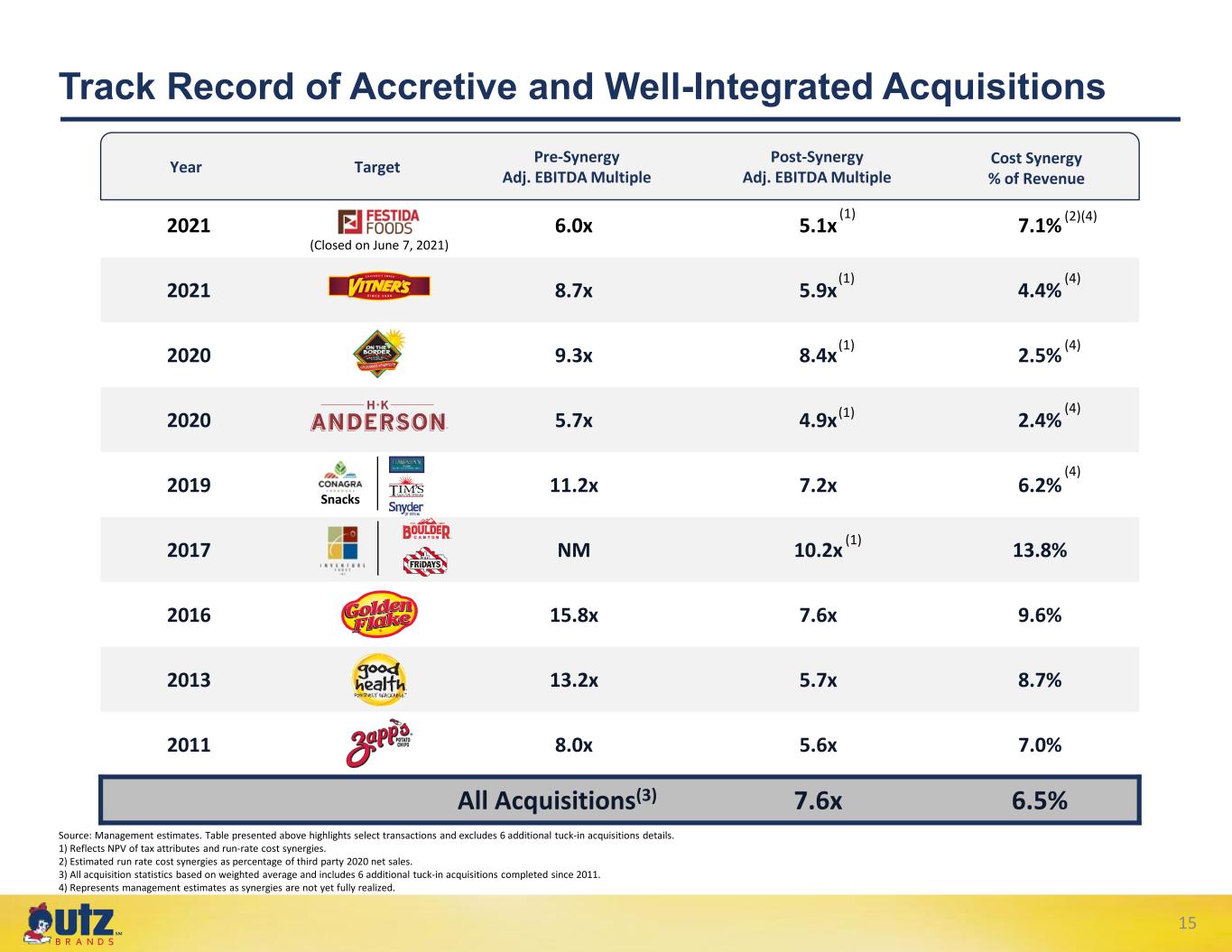

℠ 2021 6.0x 5.1x 7.1% 2021 8.7x 5.9x 4.4% 2020 9.3x 8.4x 2.5% 2020 5.7x 4.9x 2.4% 2019 11.2x 7.2x 6.2% 2017 NM 10.2x 13.8% 2016 15.8x 7.6x 9.6% 2013 13.2x 5.7x 8.7% 2011 8.0x 5.6x 7.0% All Acquisitions(3) 7.6x 6.5% Track Record of Accretive and Well-Integrated Acquisitions Year Pre-Synergy Adj. EBITDA Multiple Cost Synergy % of Revenue Snacks Target Post-Synergy Adj. EBITDA Multiple Source: Management estimates. Table presented above highlights select transactions and excludes 6 additional tuck-in acquisitions details. 1) Reflects NPV of tax attributes and run-rate cost synergies. 2) Estimated run rate cost synergies as percentage of third party 2020 net sales. 3) All acquisition statistics based on weighted average and includes 6 additional tuck-in acquisitions completed since 2011. 4) Represents management estimates as synergies are not yet fully realized. (1) (1) (1) (1) (2)(4) (4) (4) (4) (Closed on June 7, 2021) (1) (4) 15

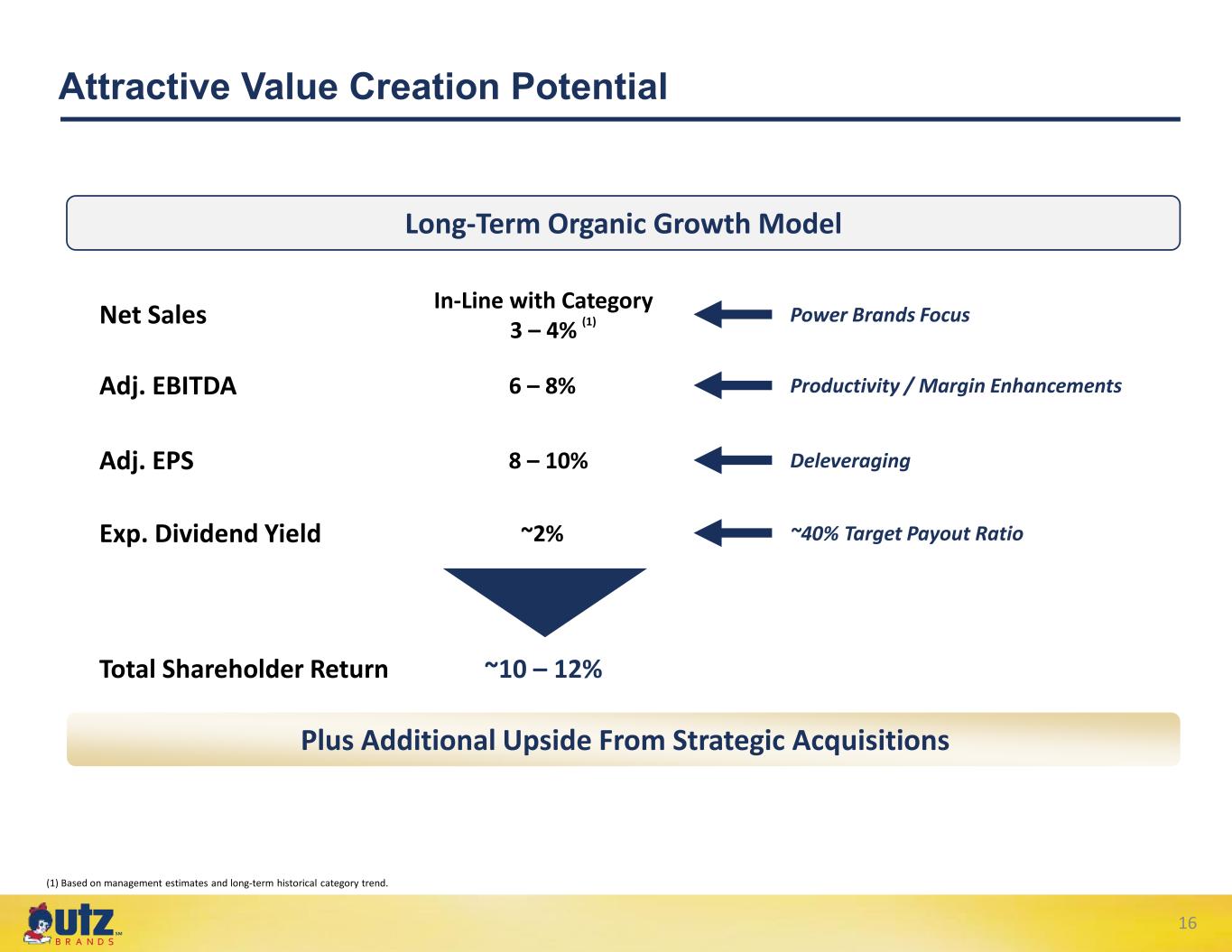

℠ Attractive Value Creation Potential Plus Additional Upside From Strategic Acquisitions Long-Term Organic Growth Model Adj. EBITDA 6 – 8% Productivity / Margin Enhancements Adj. EPS 8 – 10% Deleveraging ~10 – 12% (1) Based on management estimates and long-term historical category trend. Net Sales In-Line with Category 3 – 4% Power Brands Focus Exp. Dividend Yield ~2% ~40% Target Payout Ratio (1) Total Shareholder Return 16

II. Value Creation Strategy

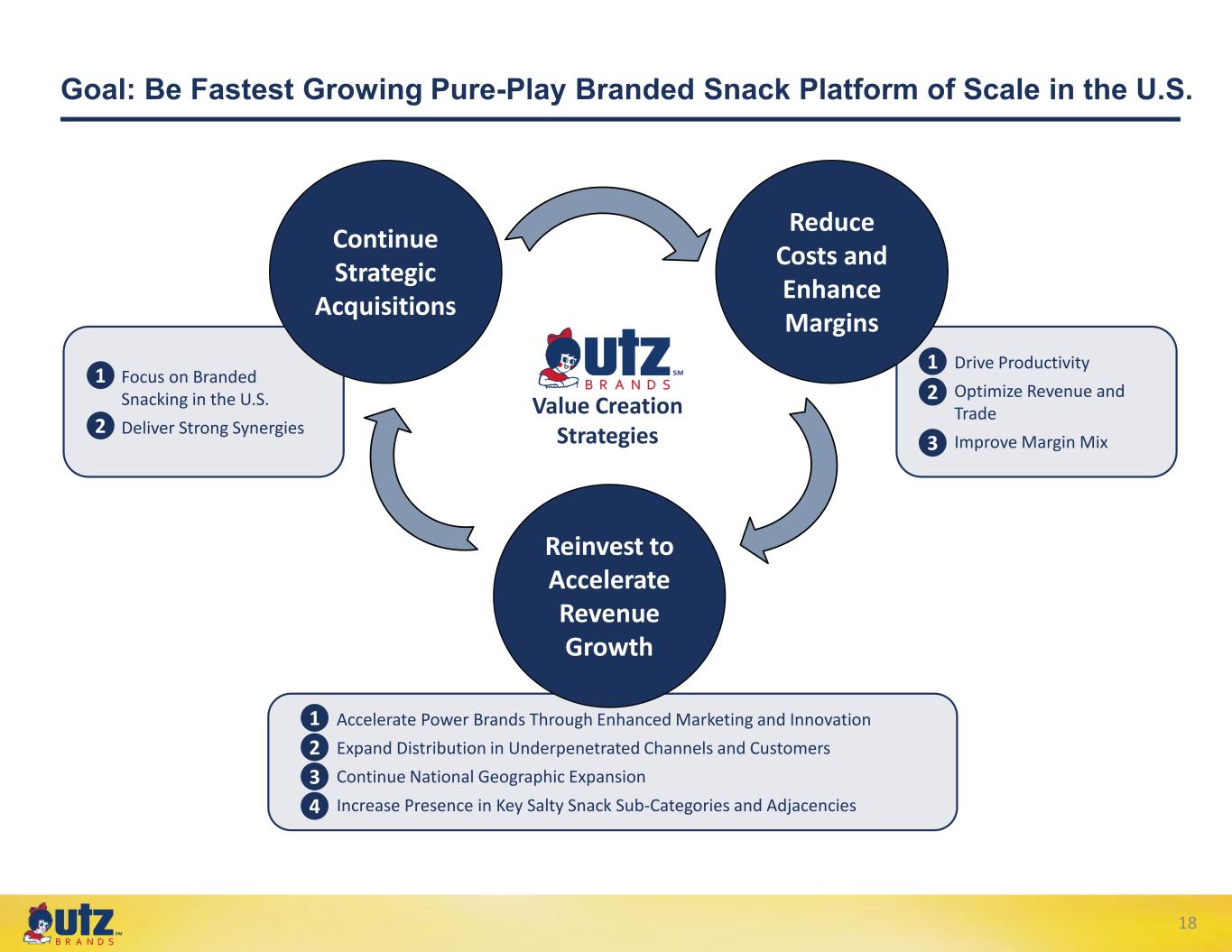

℠ Goal: Be Fastest Growing Pure-Play Branded Snack Platform of Scale in the U.S. 1. Drive Productivity 2. Optimize Revenue and Trade 3. Improve Margin Mix 1. Focus on Branded Snacking in the U.S. 2. Deliver Strong Synergies 1. Accelerate Power Brands Through Enhanced Marketing and Innovation 2. Expand Distribution in Underpenetrated Channels and Customers 3. Continue National Geographic Expansion 4. Increase Presence in Key Salty Snack Sub-Categories and Adjacencies Reinvest to Accelerate Revenue Growth Reduce Costs and Enhance Margins Continue Strategic Acquisitions Value Creation Strategies ℠ 18

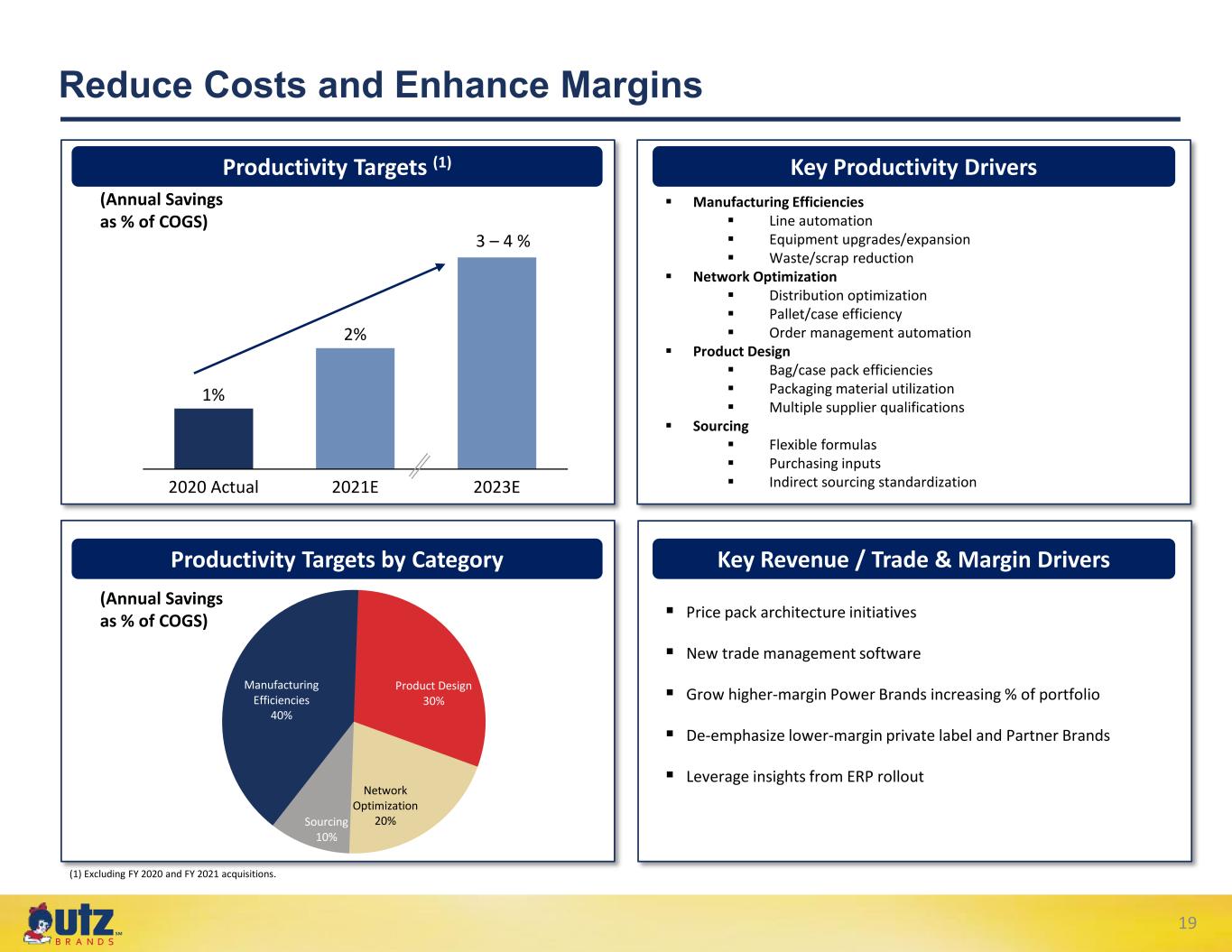

℠ Reduce Costs and Enhance Margins Manufacturing Efficiencies Line automation Equipment upgrades/expansion Waste/scrap reduction Network Optimization Distribution optimization Pallet/case efficiency Order management automation Product Design Bag/case pack efficiencies Packaging material utilization Multiple supplier qualifications Sourcing Flexible formulas Purchasing inputs Indirect sourcing standardization2020 Actual 2023E2021E 1% 2% Productivity Targets (1) Productivity Targets by Category Key Productivity Drivers (1) Excluding FY 2020 and FY 2021 acquisitions. 3 – 4 % Manufacturing Efficiencies 40% Product Design 30% Network Optimization 20%Sourcing 10% Price pack architecture initiatives New trade management software Grow higher-margin Power Brands increasing % of portfolio De-emphasize lower-margin private label and Partner Brands Leverage insights from ERP rollout Key Revenue / Trade & Margin Drivers (Annual Savings as % of COGS) (Annual Savings as % of COGS) 19

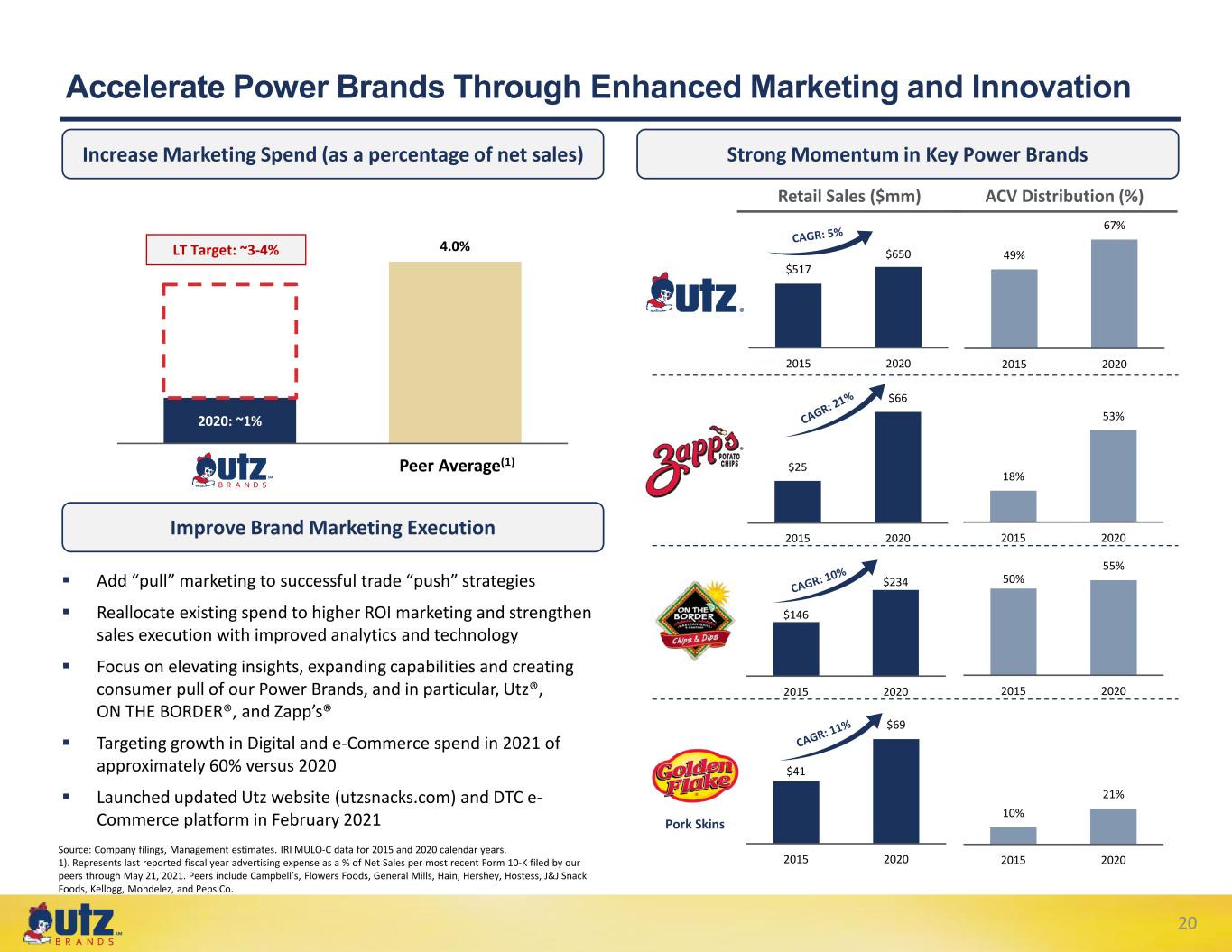

℠ 49% 67% 2015 2020 2020: ~1% 4.0% Utz Peer Average $517 $650 2015 2020 18% 53% 2015 2020 $25 $66 2015 2020 10% 21% 2015 2020 $41 $69 2015 2020 $146 $234 2015 2020 50% 55% 2015 2020 Accelerate Power Brands Through Enhanced Marketing and Innovation Source: Company filings, Management estimates. IRI MULO-C data for 2015 and 2020 calendar years. 1). Represents last reported fiscal year advertising expense as a % of Net Sales per most recent Form 10-K filed by our peers through May 21, 2021. Peers include Campbell’s, Flowers Foods, General Mills, Hain, Hershey, Hostess, J&J Snack Foods, Kellogg, Mondelez, and PepsiCo. Increase Marketing Spend (as a percentage of net sales) Strong Momentum in Key Power Brands Add “pull” marketing to successful trade “push” strategies Reallocate existing spend to higher ROI marketing and strengthen sales execution with improved analytics and technology Focus on elevating insights, expanding capabilities and creating consumer pull of our Power Brands, and in particular, Utz®, ON THE BORDER®, and Zapp’s® Targeting growth in Digital and e-Commerce spend in 2021 of approximately 60% versus 2020 Launched updated Utz website (utzsnacks.com) and DTC e- Commerce platform in February 2021 LT Target: ~3-4% Peer Average(1) Retail Sales ($mm) ACV Distribution (%) Pork Skins Improve Brand Marketing Execution ℠ 20

℠ Flavored Pretzels are 35% of Sub-Category and Growing over 30%, and Utz is Meaningfully Underweight in Flavored (<10% of our mix)(1) (1) Source: IRI, Total US MULO + C Authentic Mexican Style and Flavor Portfolio Expansion Strategic Variety Pack Partnerships 100 Year Celebration and Seasonal Offering Iconic Flavors Extended into New Textures Accelerate Power Brands Through Enhanced Marketing and Innovation 21

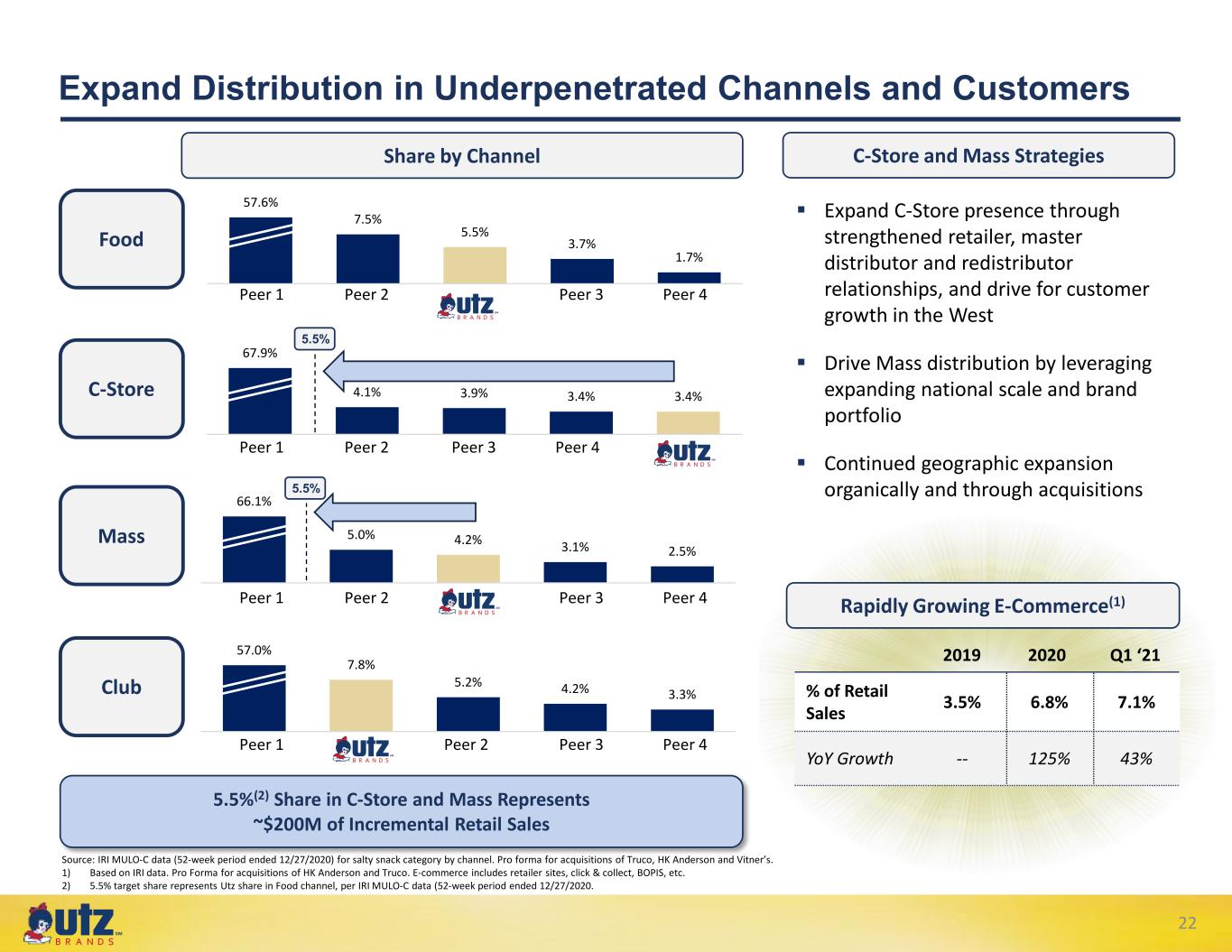

℠ 67.9% 4.1% 3.9% 3.4% 3.4% 66.1% 5.0% 4.2% 3.1% 2.5% 57.0% 7.8% 5.2% 4.2% 3.3% 57.6% 7.5% 5.5% 3.7% 1.7% Expand Distribution in Underpenetrated Channels and Customers Source: IRI MULO-C data (52-week period ended 12/27/2020) for salty snack category by channel. Pro forma for acquisitions of Truco, HK Anderson and Vitner’s. 1) Based on IRI data. Pro Forma for acquisitions of HK Anderson and Truco. E-commerce includes retailer sites, click & collect, BOPIS, etc. 2) 5.5% target share represents Utz share in Food channel, per IRI MULO-C data (52-week period ended 12/27/2020. 5.5%(2) Share in C-Store and Mass Represents ~$200M of Incremental Retail Sales C-Store and Mass Strategies Expand C-Store presence through strengthened retailer, master distributor and redistributor relationships, and drive for customer growth in the West Drive Mass distribution by leveraging expanding national scale and brand portfolio Continued geographic expansion organically and through acquisitions Share by Channel 5.5% 5.5% Food C-Store Mass Club Rapidly Growing E-Commerce(1) % of Retail Sales 3.5% 6.8% 7.1% YoY Growth -- 125% 43% ℠ ℠ ℠ ℠ 2019 Q1 ‘212020 Peer 1 Peer 2 Peer 3 Peer 4 Peer 1 Peer 2 Peer 3 Peer 4 Peer 1 Peer 2 Peer 3 Peer 4 Peer 1 Peer 2 Peer 3 Peer 4 22

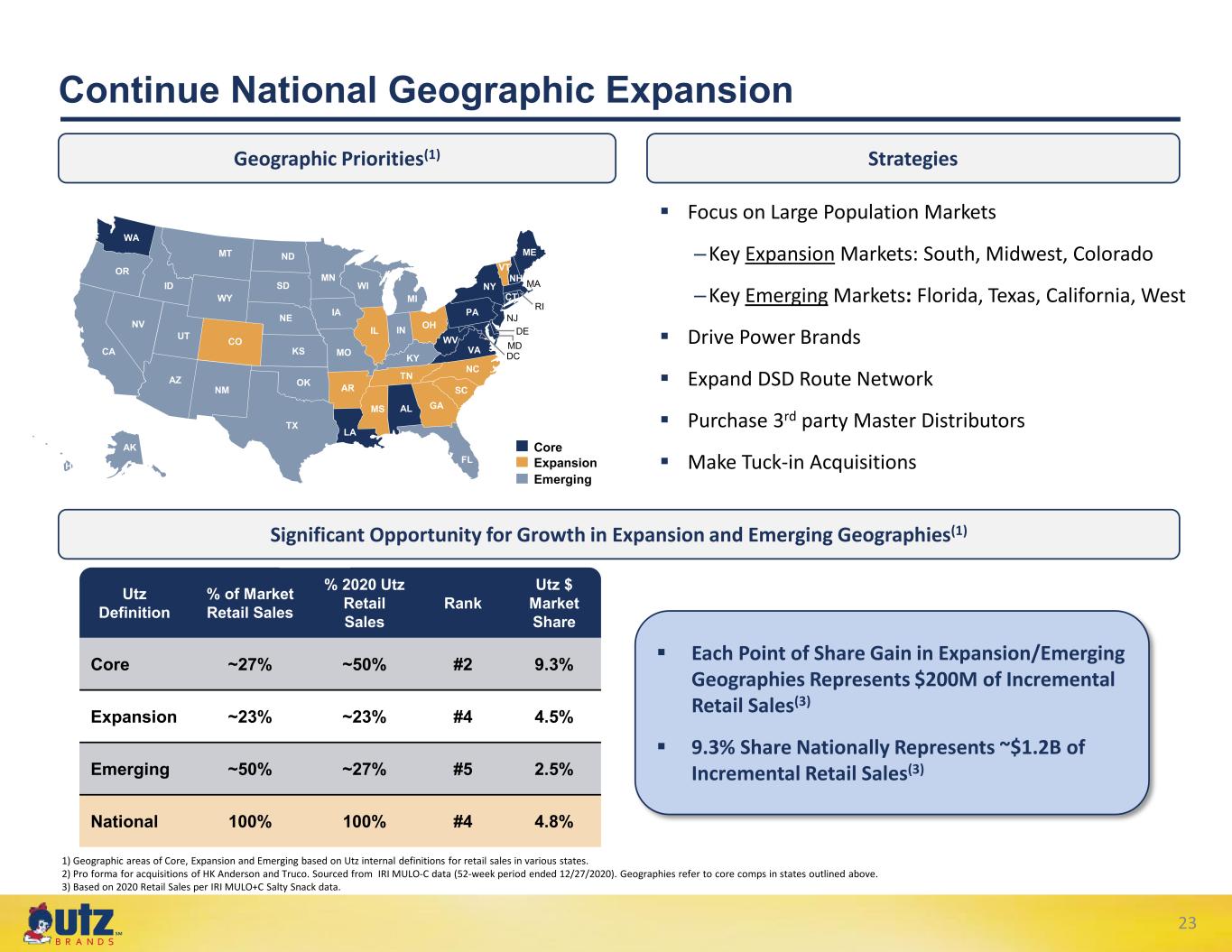

℠ Focus on Large Population Markets –Key Expansion Markets: South, Midwest, Colorado –Key Emerging Markets: Florida, Texas, California, West Drive Power Brands Expand DSD Route Network Purchase 3rd party Master Distributors Make Tuck-in Acquisitions Continue National Geographic Expansion Geographic Priorities(1) Strategies Significant Opportunity for Growth in Expansion and Emerging Geographies(1) Each Point of Share Gain in Expansion/Emerging Geographies Represents $200M of Incremental Retail Sales(3) 9.3% Share Nationally Represents ~$1.2B of Incremental Retail Sales(3) Utz Definition % of Market Retail Sales % 2020 Utz Retail Sales Rank Utz $ Market Share Core ~27% ~50% #2 9.3% Expansion ~23% ~23% #4 4.5% Emerging ~50% ~27% #5 2.5% National 100% 100% #4 4.8% 1) Geographic areas of Core, Expansion and Emerging based on Utz internal definitions for retail sales in various states. 2) Pro forma for acquisitions of HK Anderson and Truco. Sourced from IRI MULO-C data (52-week period ended 12/27/2020). Geographies refer to core comps in states outlined above. 3) Based on 2020 Retail Sales per IRI MULO+C Salty Snack data. Core Expansion Emerging FL NM DE MD TX OK KS NE SD NDMT WY COUT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DCVA OH MI HI AK 23

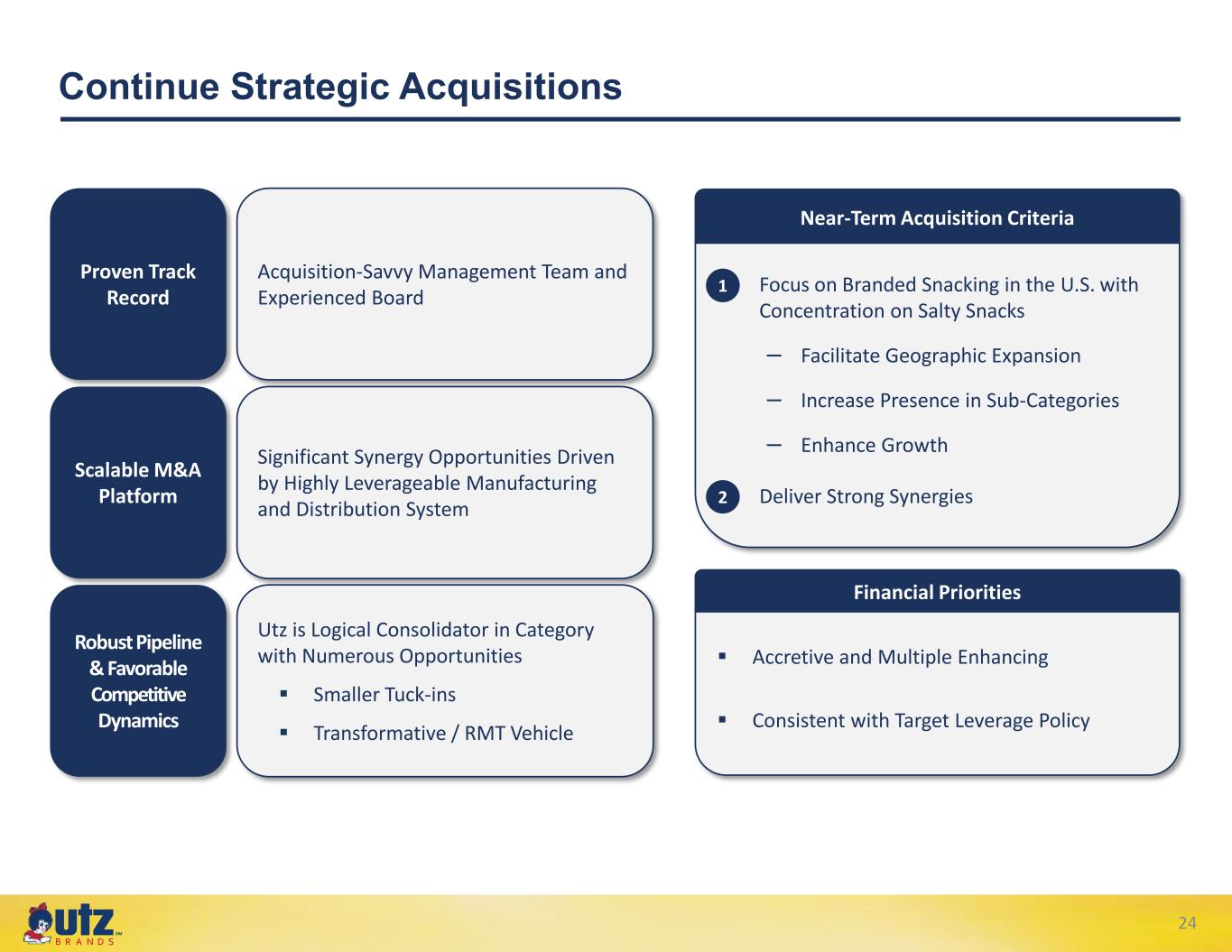

℠ Continue Strategic Acquisitions Scalable M&A Platform Significant Synergy Opportunities Driven by Highly Leverageable Manufacturing and Distribution System Robust Pipeline & Favorable Competitive Dynamics Utz is Logical Consolidator in Category with Numerous Opportunities Smaller Tuck-ins Transformative / RMT Vehicle Proven Track Record Acquisition-Savvy Management Team and Experienced Board Near-Term Acquisition Criteria 1. Focus on Branded Snacking in the U.S. with Concentration on Salty Snacks – Facilitate Geographic Expansion – Increase Presence in Sub-Categories – Enhance Growth 2. Deliver Strong Synergies Financial Priorities Accretive and Multiple Enhancing Consistent with Target Leverage Policy 24

III. Recent Performance

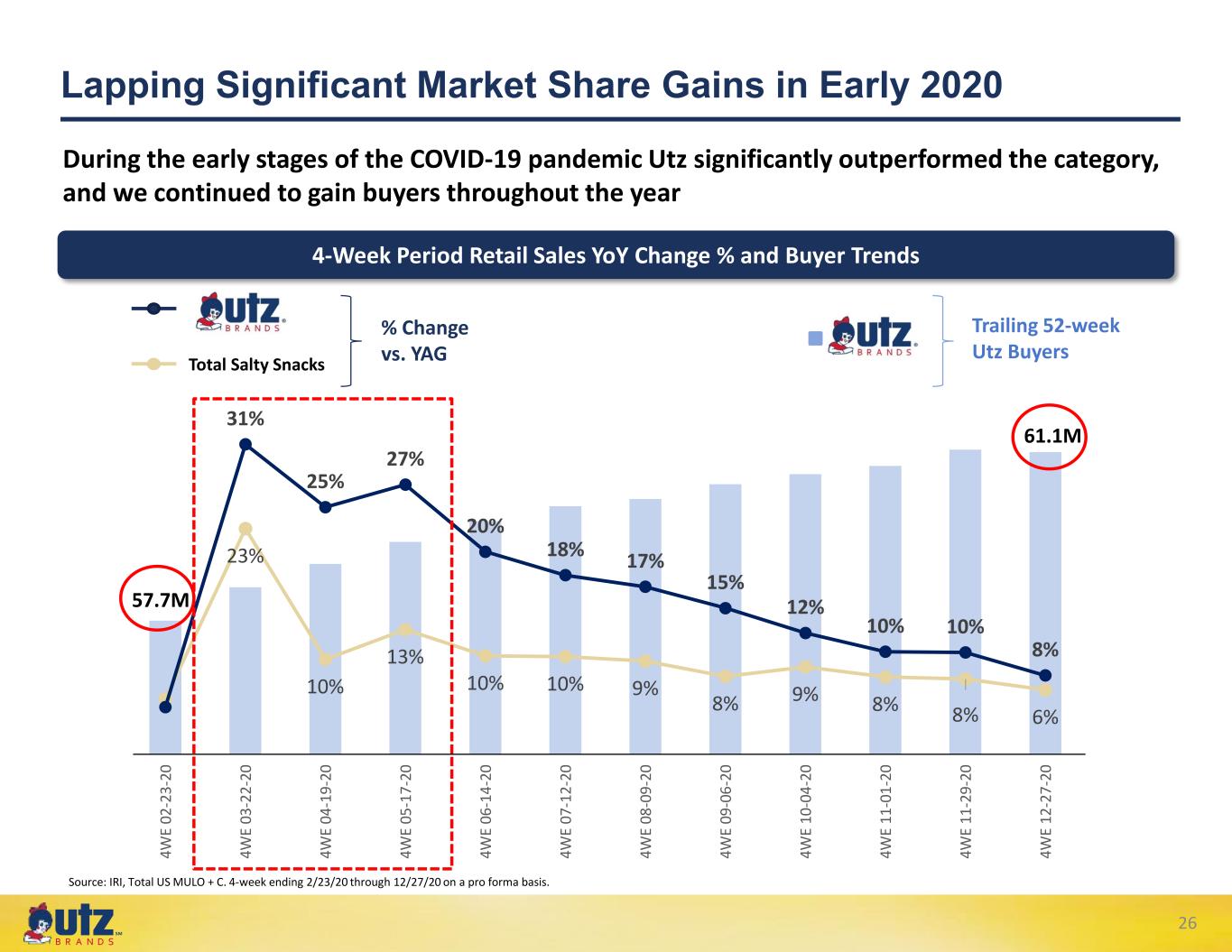

℠ Lapping Significant Market Share Gains in Early 2020 26 23% 10% 13% 10% 10% 9% 8% 9% 8% 8% 6% 31% 25% 27% 20% 18% 17% 15% 12% 10% 10% 8% 55,000,000 56,000,000 57,000,000 58,000,000 59,000,000 60,000,000 61,000,000 62,000,000 0% 5% 10% 15% 20% 25% 30% 35% 4W E 02 -2 3- 20 4W E 03 -2 2- 20 4W E 04 -1 9- 20 4W E 05 -1 7- 20 4W E 06 -1 4- 20 4W E 07 -1 2- 20 4W E 08 -0 9- 20 4W E 09 -0 6- 20 4W E 10 -0 4- 20 4W E 11 -0 1- 20 4W E 11 -2 9- 20 4W E 12 -2 7- 20 Total Salty Snacks Source: IRI, Total US MULO + C. 4-week ending 2/23/20 through 12/27/20 on a pro forma basis. 4-Week Period Retail Sales YoY Change % and Buyer Trends Trailing 52-week Utz Buyers % Change vs. YAG 61.1M 57.7M During the early stages of the COVID-19 pandemic Utz significantly outperformed the category, and we continued to gain buyers throughout the year

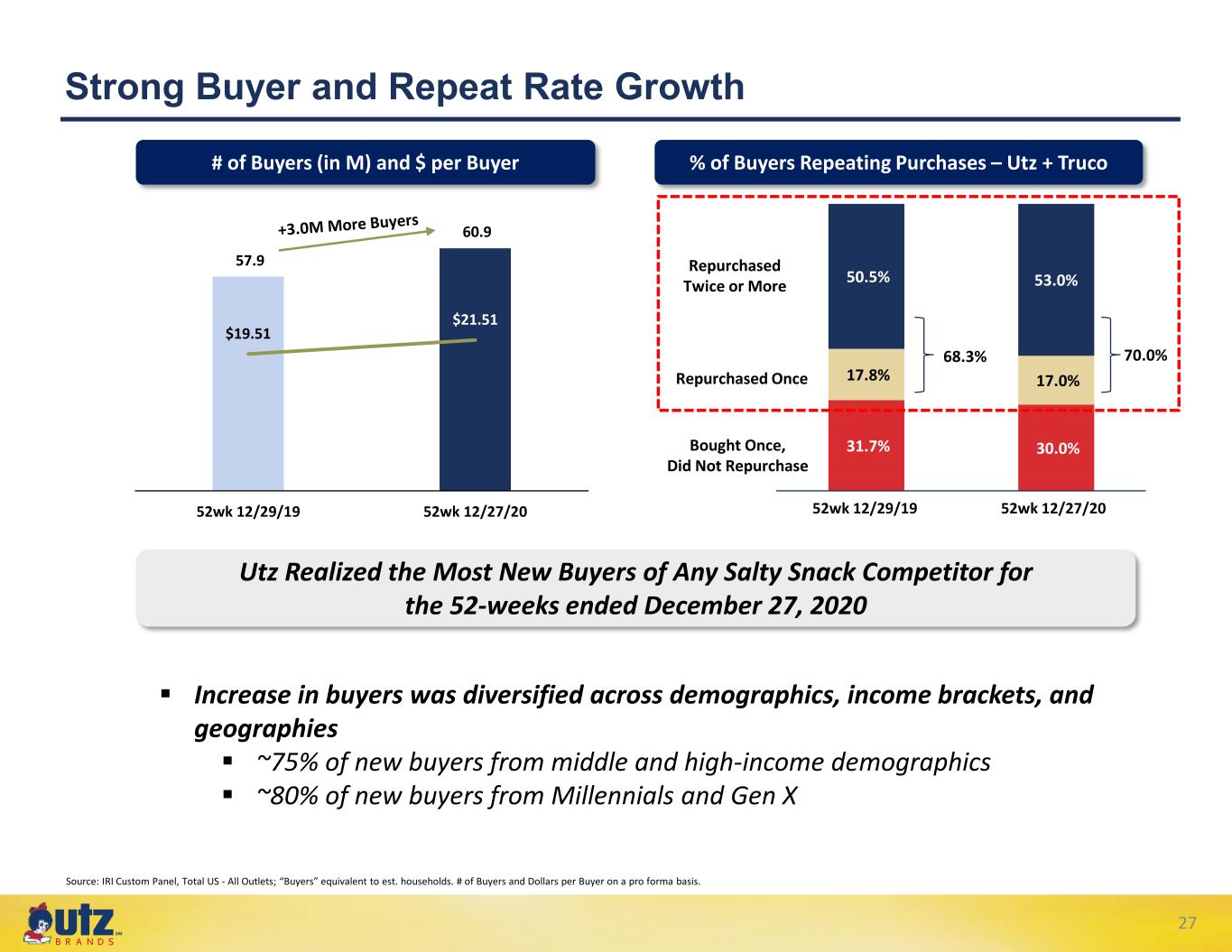

℠ 50.5% 53.0% 17.8% 17.0% 31.7% 30.0% 57.9 60.9 $19.51 $21.51 52wk 12/29/19 52wk 12/27/20 Source: IRI Custom Panel, Total US - All Outlets; “Buyers” equivalent to est. households. # of Buyers and Dollars per Buyer on a pro forma basis. 52wk 12/29/19 52wk 12/27/20 Repurchased Twice or More Repurchased Once Bought Once, Did Not Repurchase # of Buyers (in M) and $ per Buyer % of Buyers Repeating Purchases – Utz + Truco Increase in buyers was diversified across demographics, income brackets, and geographies ~75% of new buyers from middle and high-income demographics ~80% of new buyers from Millennials and Gen X Utz Realized the Most New Buyers of Any Salty Snack Competitor for the 52-weeks ended December 27, 2020 Strong Buyer and Repeat Rate Growth 68.3% 70.0% 27

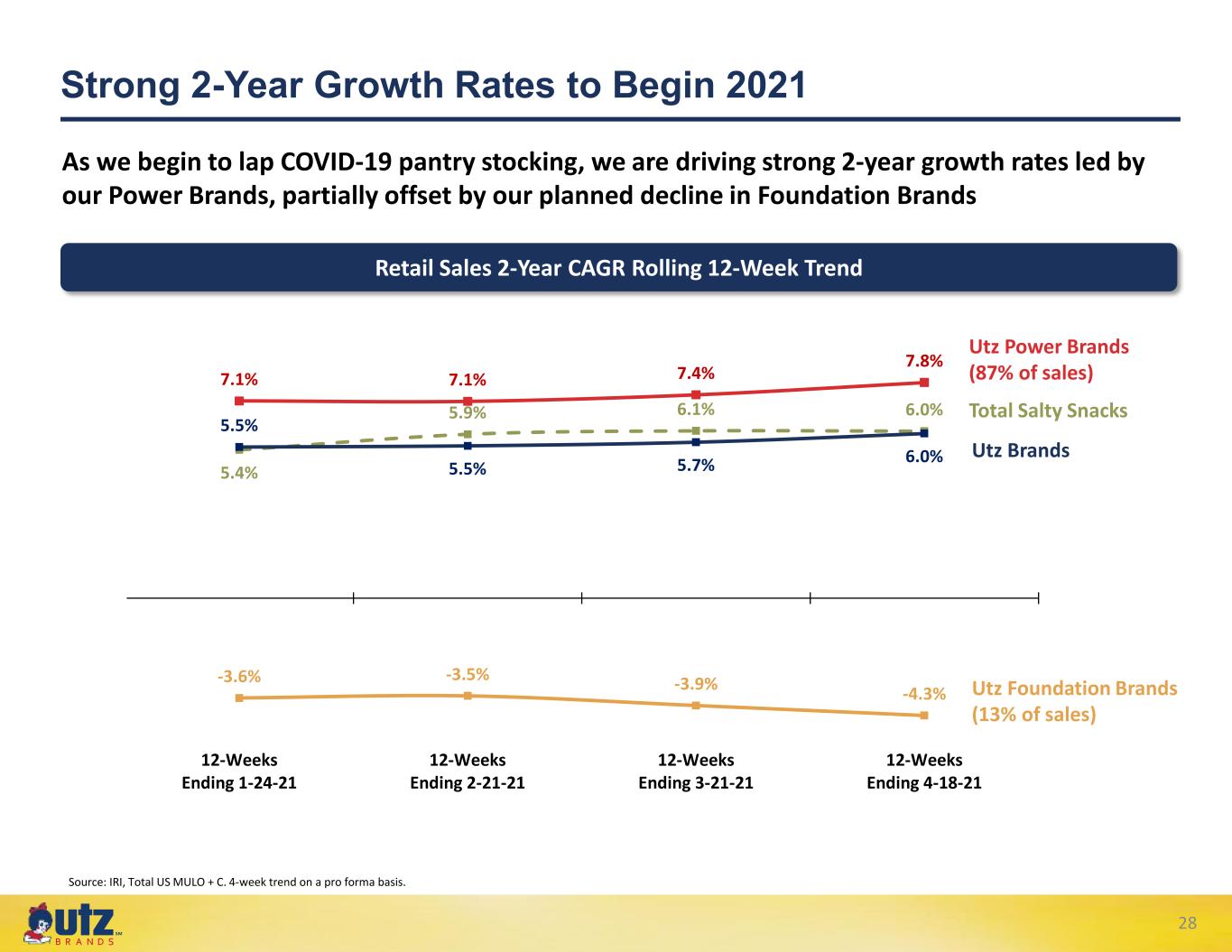

℠ Strong 2-Year Growth Rates to Begin 2021 Retail Sales 2-Year CAGR Rolling 12-Week Trend Source: IRI, Total US MULO + C. 4-week trend on a pro forma basis. As we begin to lap COVID-19 pantry stocking, we are driving strong 2-year growth rates led by our Power Brands, partially offset by our planned decline in Foundation Brands 5.4% 5.9% 6.1% 6.0% 5.5% 5.5% 5.7% 6.0% 7.1% 7.1% 7.4% 7.8% -3.6% -3.5% -3.9% -4.3% -5% 0% 5% 10% 12-Weeks Ending 1-24-21 12-Weeks Ending 2-21-21 12-Weeks Ending 3-21-21 12-Weeks Ending 4-18-21 Utz Foundation Brands (13% of sales) Utz Power Brands (87% of sales) Total Salty Snacks Utz Brands 28

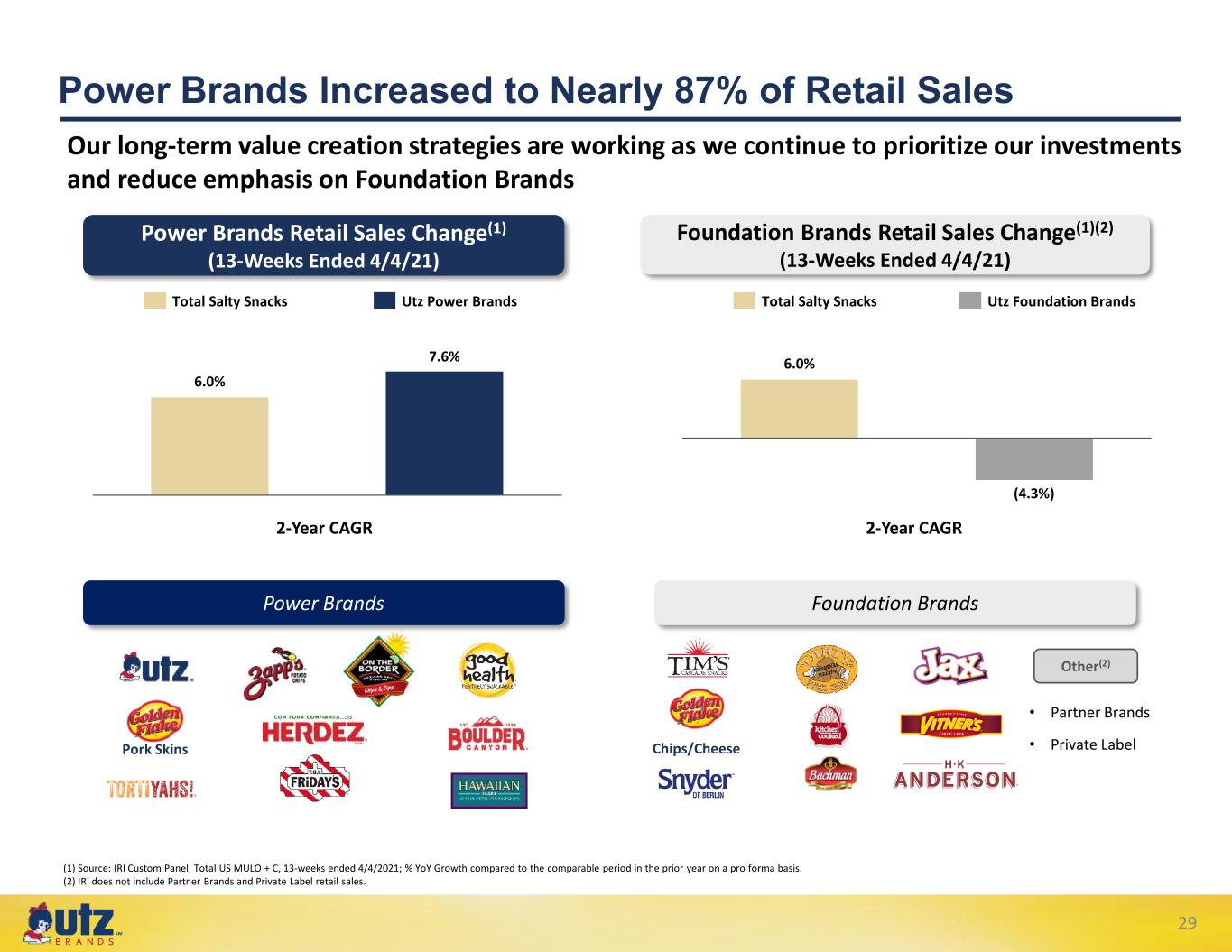

℠ (1) Source: IRI Custom Panel, Total US MULO + C, 13-weeks ended 4/4/2021; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. (2) IRI does not include Partner Brands and Private Label retail sales. Pork Skins Chips/Cheese Other(2) • Partner Brands • Private Label Power Brands Increased to Nearly 87% of Retail Sales Power Brands Retail Sales Change(1) (13-Weeks Ended 4/4/21) Foundation Brands Retail Sales Change(1)(2) (13-Weeks Ended 4/4/21) Power Brands Foundation Brands 2-Year CAGR Total Salty Snacks Utz Power Brands 2-Year CAGR Total Salty Snacks Utz Foundation Brands Our long-term value creation strategies are working as we continue to prioritize our investments and reduce emphasis on Foundation Brands 6.0% 7.6% 6.0% (4.3%) 29

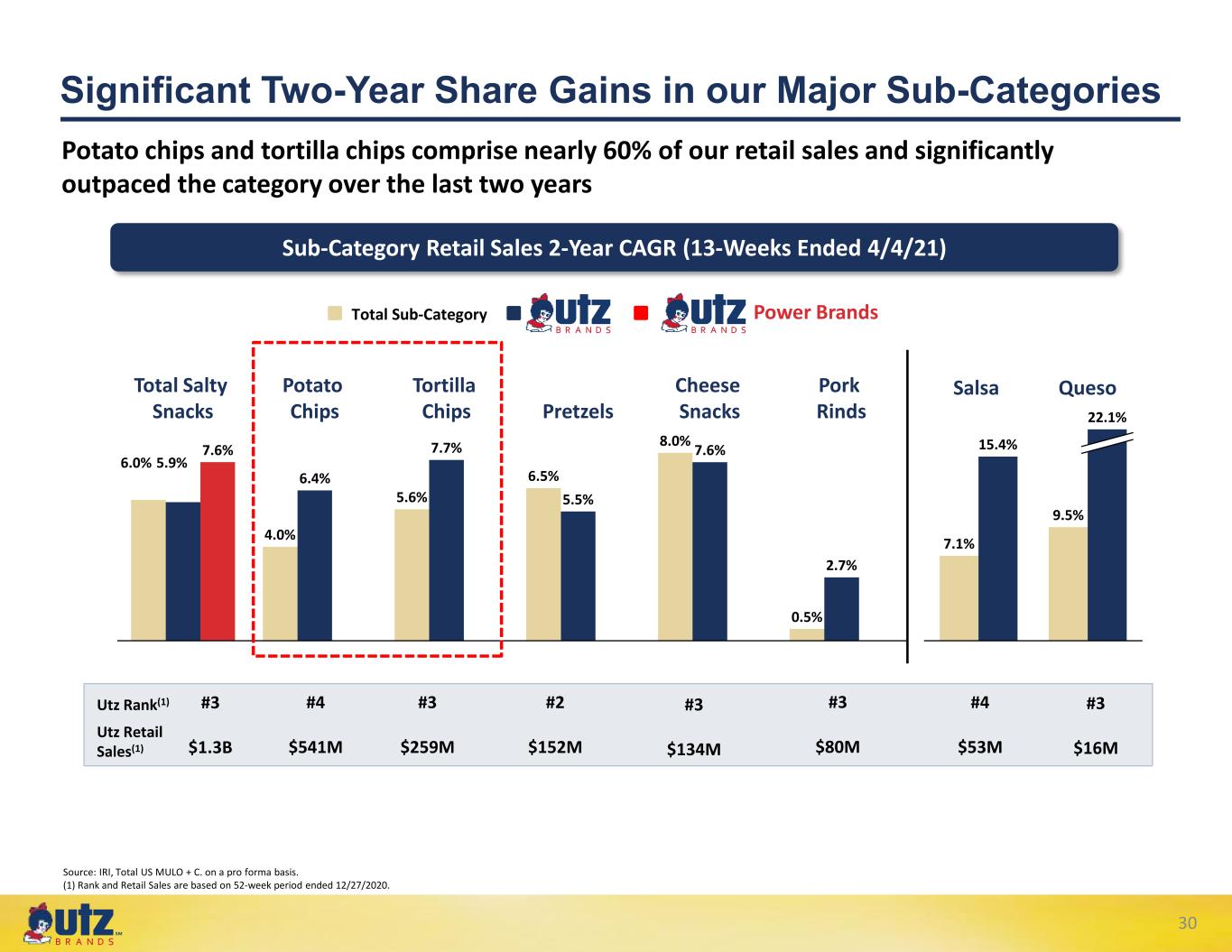

℠ 30 Significant Two-Year Share Gains in our Major Sub-Categories Sub-Category Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) Tortilla Chips Total Salty Snacks 7.6% Pork Rinds Cheese Snacks Potato Chips 2.7% Pretzels 0.5% 4.0% 6.4% 5.6% 7.7% 6.5% 5.5% 8.0% 7.6% Salsa 15.4% Queso 9.5% 7.1% 22.1% Total Sub-Category Power Brands Potato chips and tortilla chips comprise nearly 60% of our retail sales and significantly outpaced the category over the last two years 5.9%6.0% Utz Rank(1) Utz Retail Sales(1) #3 $1.3B #4 $541M #3 $259M #2 $152M #3 $134M #3 $80M #4 $53M #3 $16M Source: IRI, Total US MULO + C. on a pro forma basis. (1) Rank and Retail Sales are based on 52-week period ended 12/27/2020.

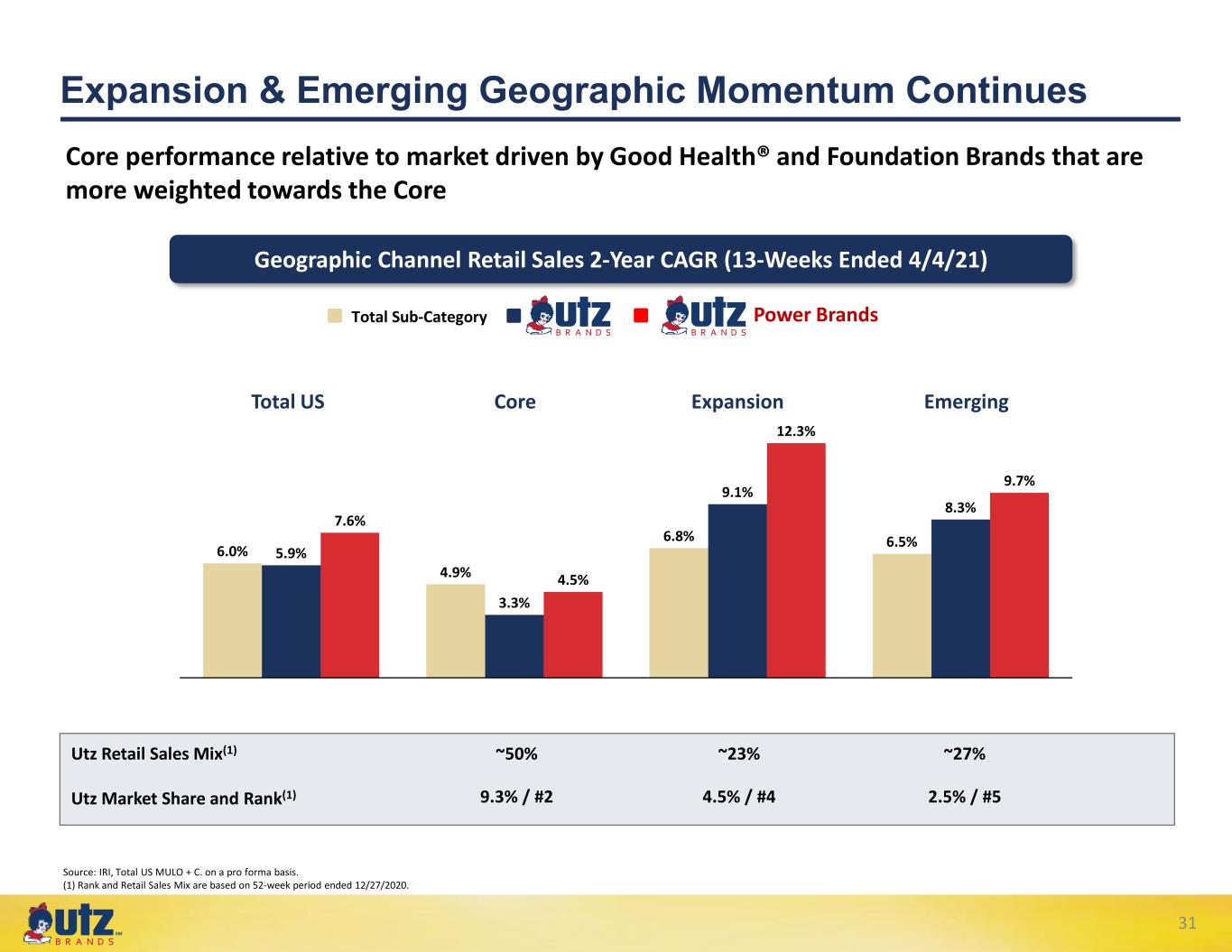

℠ Expansion & Emerging Geographic Momentum Continues Geographic Channel Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) ExpansionTotal US Core Emerging 6.0% 5.9% 9.7% 4.9% 7.6% 3.3% 12.3% 4.5% 6.8% 9.1% 6.5% 8.3% Core performance relative to market driven by Good Health® and Foundation Brands that are more weighted towards the Core Total Sub-Category Power Brands Utz Retail Sales Mix(1) Utz Market Share and Rank(1) ~50% ~23% ~27% Source: IRI, Total US MULO + C. on a pro forma basis. (1) Rank and Retail Sales Mix are based on 52-week period ended 12/27/2020. 9.3% / #2 4.5% / #4 2.5% / #5 31

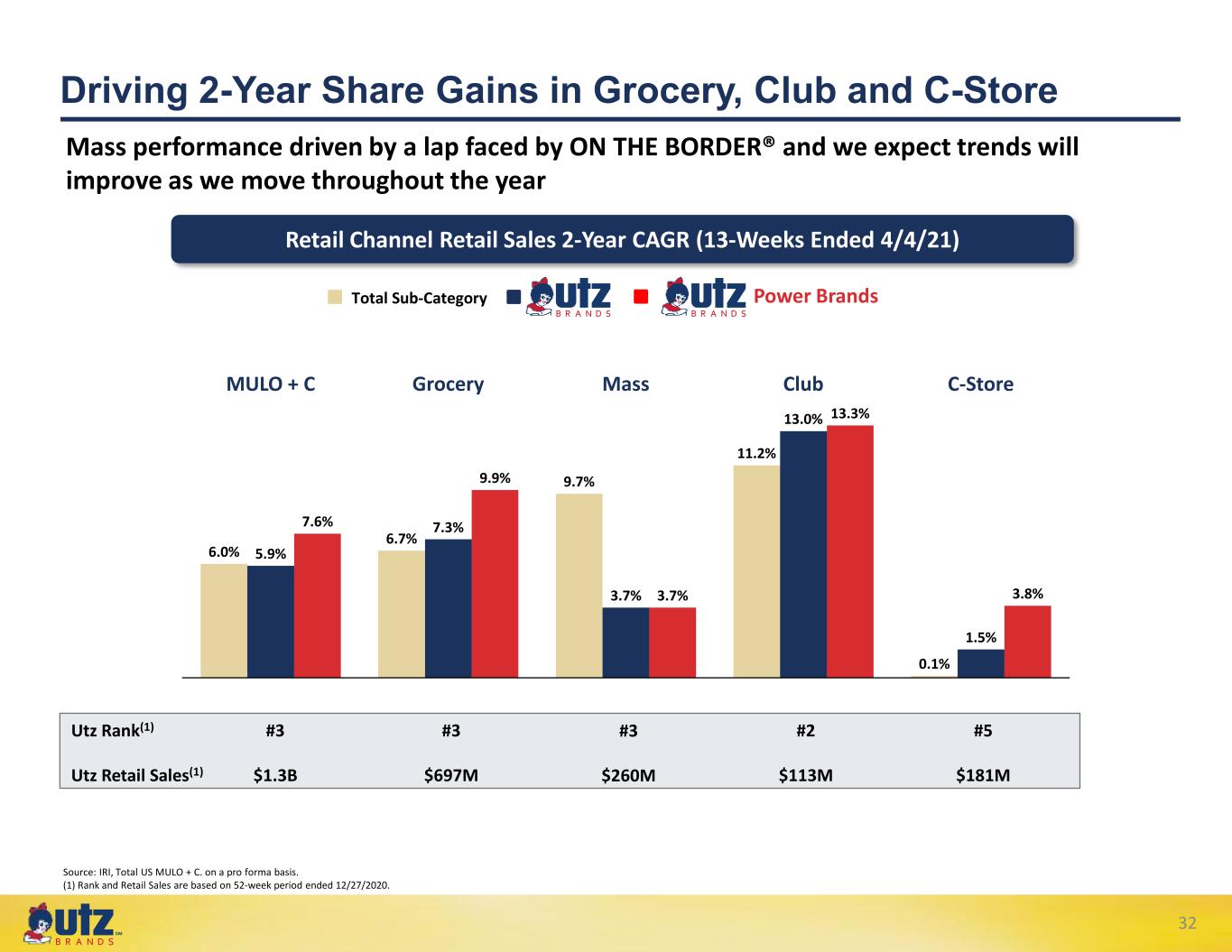

℠ Driving 2-Year Share Gains in Grocery, Club and C-Store Retail Channel Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) C-Store 11.2% MULO + C MassGrocery 3.8% 6.0% Club 5.9% 7.6% 6.7% 7.3% 9.9% 9.7% 13.3% 3.7% 3.7% 13.0% 0.1% 1.5% Total Sub-Category Power Brands Mass performance driven by a lap faced by ON THE BORDER® and we expect trends will improve as we move throughout the year Utz Rank(1) Utz Retail Sales(1) #3 $1.3B #3 $697M #3 $260M #2 $113M #5 $181M Source: IRI, Total US MULO + C. on a pro forma basis. (1) Rank and Retail Sales are based on 52-week period ended 12/27/2020. 32

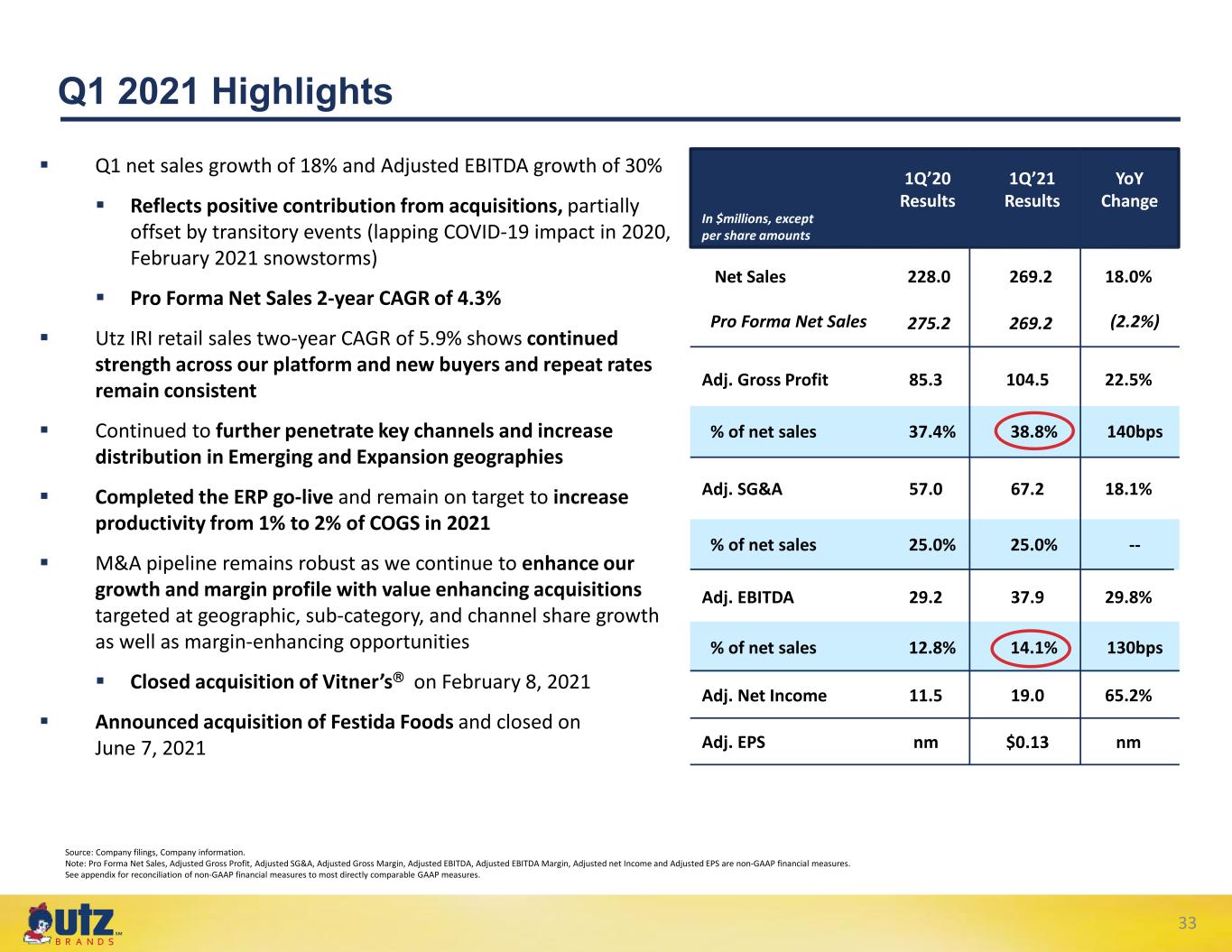

℠ Q1 2021 Highlights Source: Company filings, Company information. Note: Pro Forma Net Sales, Adjusted Gross Profit, Adjusted SG&A, Adjusted Gross Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted net Income and Adjusted EPS are non-GAAP financial measures. See appendix for reconciliation of non-GAAP financial measures to most directly comparable GAAP measures. 1Q’20 Results 1Q’21 Results In $millions, except per share amounts Net Sales Adj. SG&A % of net sales 228.0 57.0 25.0% Adj. Gross Profit % of net sales 85.3 37.4% YoY Change Adj. EBITDA % of net sales Adj. Net Income Pro Forma Net Sales 29.2 12.8% 11.5 269.2 67.2 25.0% 104.5 38.8% 37.9 14.1% 19.0 18.0% 18.1% -- 22.5% 140bps (2.2%) 29.8% 130bps 65.2% Adj. EPS nm $0.13 nm 275.2 269.2 Q1 net sales growth of 18% and Adjusted EBITDA growth of 30% Reflects positive contribution from acquisitions, partially offset by transitory events (lapping COVID-19 impact in 2020, February 2021 snowstorms) Pro Forma Net Sales 2-year CAGR of 4.3% Utz IRI retail sales two-year CAGR of 5.9% shows continued strength across our platform and new buyers and repeat rates remain consistent Continued to further penetrate key channels and increase distribution in Emerging and Expansion geographies Completed the ERP go-live and remain on target to increase productivity from 1% to 2% of COGS in 2021 M&A pipeline remains robust as we continue to enhance our growth and margin profile with value enhancing acquisitions targeted at geographic, sub-category, and channel share growth as well as margin-enhancing opportunities Closed acquisition of Vitner’s on February 8, 2021 Announced acquisition of Festida Foods and closed on June 7, 2021 33

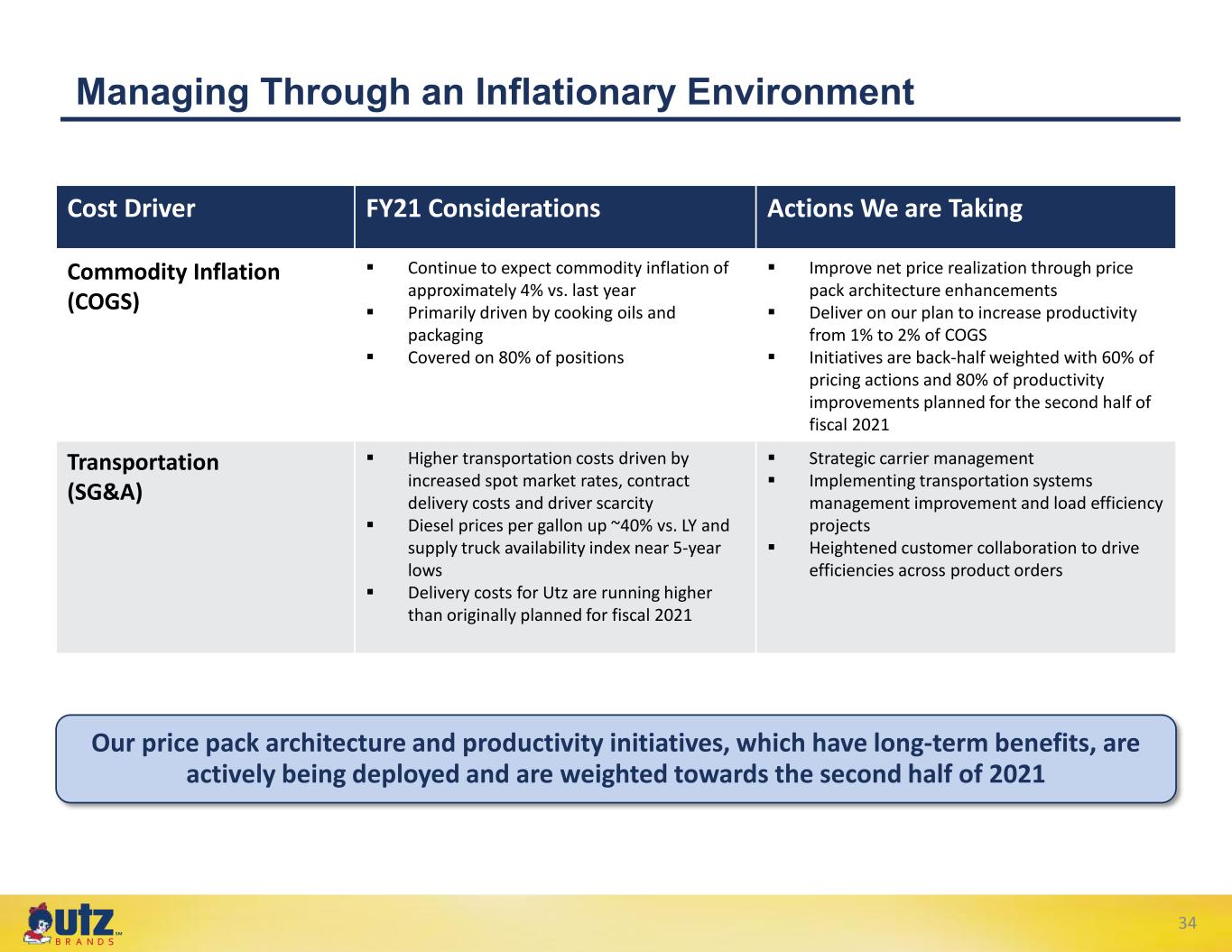

℠ Managing Through an Inflationary Environment Cost Driver FY21 Considerations Actions We are Taking Commodity Inflation (COGS) Continue to expect commodity inflation of approximately 4% vs. last year Primarily driven by cooking oils and packaging Covered on 80% of positions Improve net price realization through price pack architecture enhancements Deliver on our plan to increase productivity from 1% to 2% of COGS Initiatives are back-half weighted with 60% of pricing actions and 80% of productivity improvements planned for the second half of fiscal 2021 Transportation (SG&A) Higher transportation costs driven by increased spot market rates, contract delivery costs and driver scarcity Diesel prices per gallon up ~40% vs. LY and supply truck availability index near 5-year lows Delivery costs for Utz are running higher than originally planned for fiscal 2021 Strategic carrier management Implementing transportation systems management improvement and load efficiency projects Heightened customer collaboration to drive efficiencies across product orders Our price pack architecture and productivity initiatives, which have long-term benefits, are actively being deployed and are weighted towards the second half of 2021 34

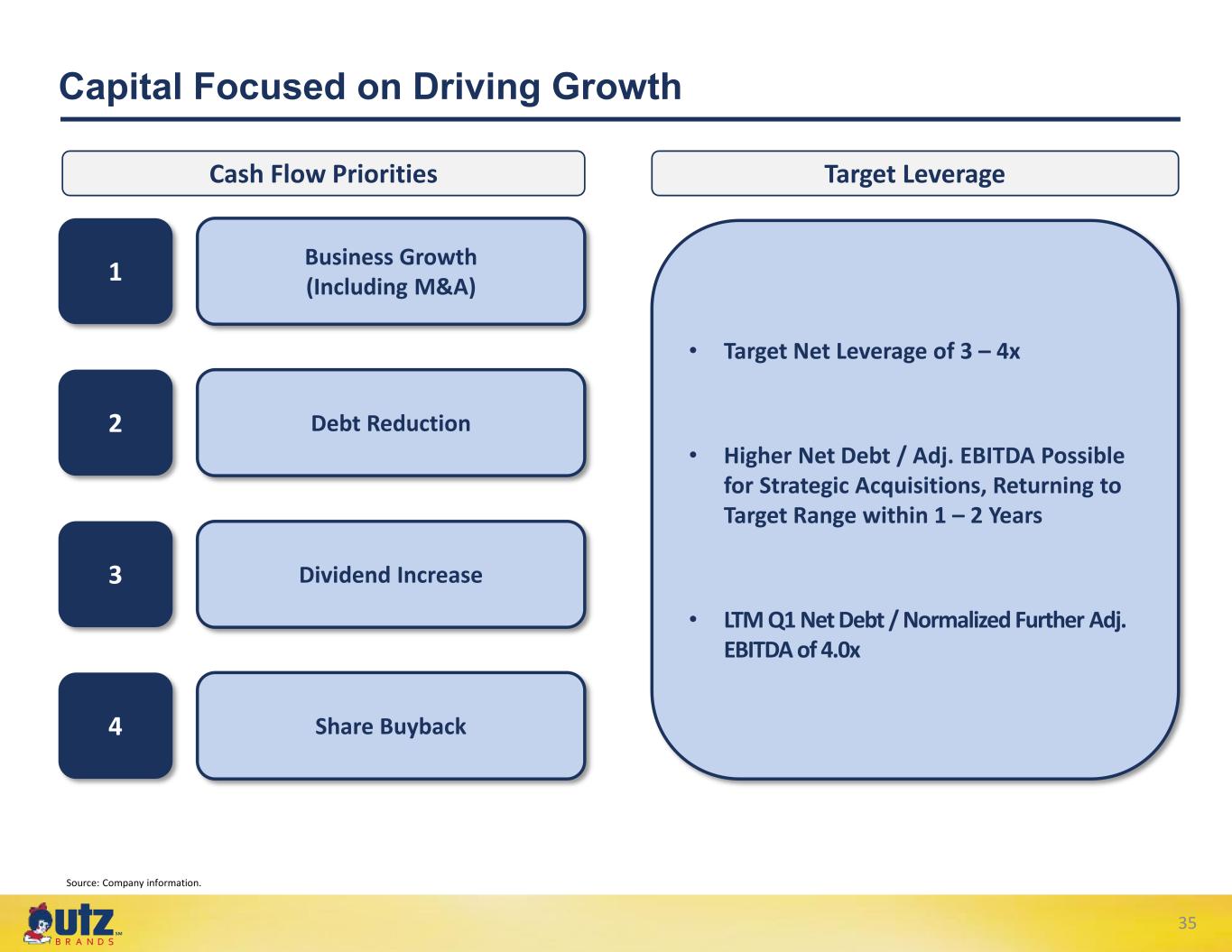

℠ Capital Focused on Driving Growth 1 Business Growth (Including M&A) 2 Debt Reduction 3 Dividend Increase 4 Share Buyback • Target Net Leverage of 3 – 4x • Higher Net Debt / Adj. EBITDA Possible for Strategic Acquisitions, Returning to Target Range within 1 – 2 Years • LTM Q1 Net Debt / Normalized Further Adj. EBITDA of 4.0x Cash Flow Priorities Target Leverage Source: Company information. 35

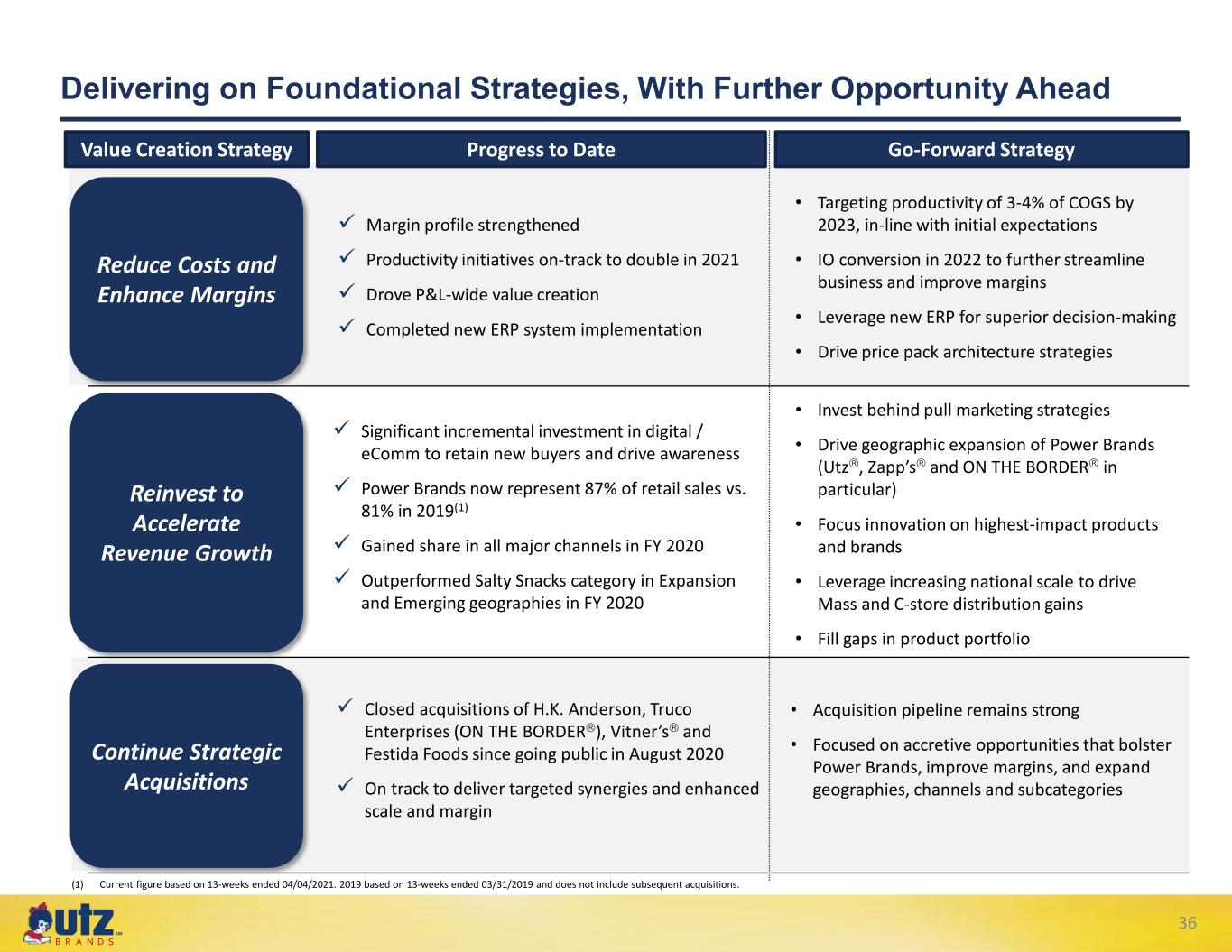

℠ Delivering on Foundational Strategies, With Further Opportunity Ahead Value Creation Strategy Reduce Costs and Enhance Margins (1) Current figure based on 13-weeks ended 04/04/2021. 2019 based on 13-weeks ended 03/31/2019 and does not include subsequent acquisitions. Margin profile strengthened Productivity initiatives on-track to double in 2021 Drove P&L-wide value creation Completed new ERP system implementation • Targeting productivity of 3-4% of COGS by 2023, in-line with initial expectations • IO conversion in 2022 to further streamline business and improve margins • Leverage new ERP for superior decision-making • Drive price pack architecture strategies Progress to Date Go-Forward Strategy Reinvest to Accelerate Revenue Growth Significant incremental investment in digital / eComm to retain new buyers and drive awareness Power Brands now represent 87% of retail sales vs. 81% in 2019(1) Gained share in all major channels in FY 2020 Outperformed Salty Snacks category in Expansion and Emerging geographies in FY 2020 • Invest behind pull marketing strategies • Drive geographic expansion of Power Brands (Utz, Zapp’s and ON THE BORDER in particular) • Focus innovation on highest-impact products and brands • Leverage increasing national scale to drive Mass and C-store distribution gains • Fill gaps in product portfolio Continue Strategic Acquisitions Closed acquisitions of H.K. Anderson, Truco Enterprises (ON THE BORDER), Vitner’s and Festida Foods since going public in August 2020 On track to deliver targeted synergies and enhanced scale and margin • Acquisition pipeline remains strong • Focused on accretive opportunities that bolster Power Brands, improve margins, and expand geographies, channels and subcategories 36

Questions

Appendix

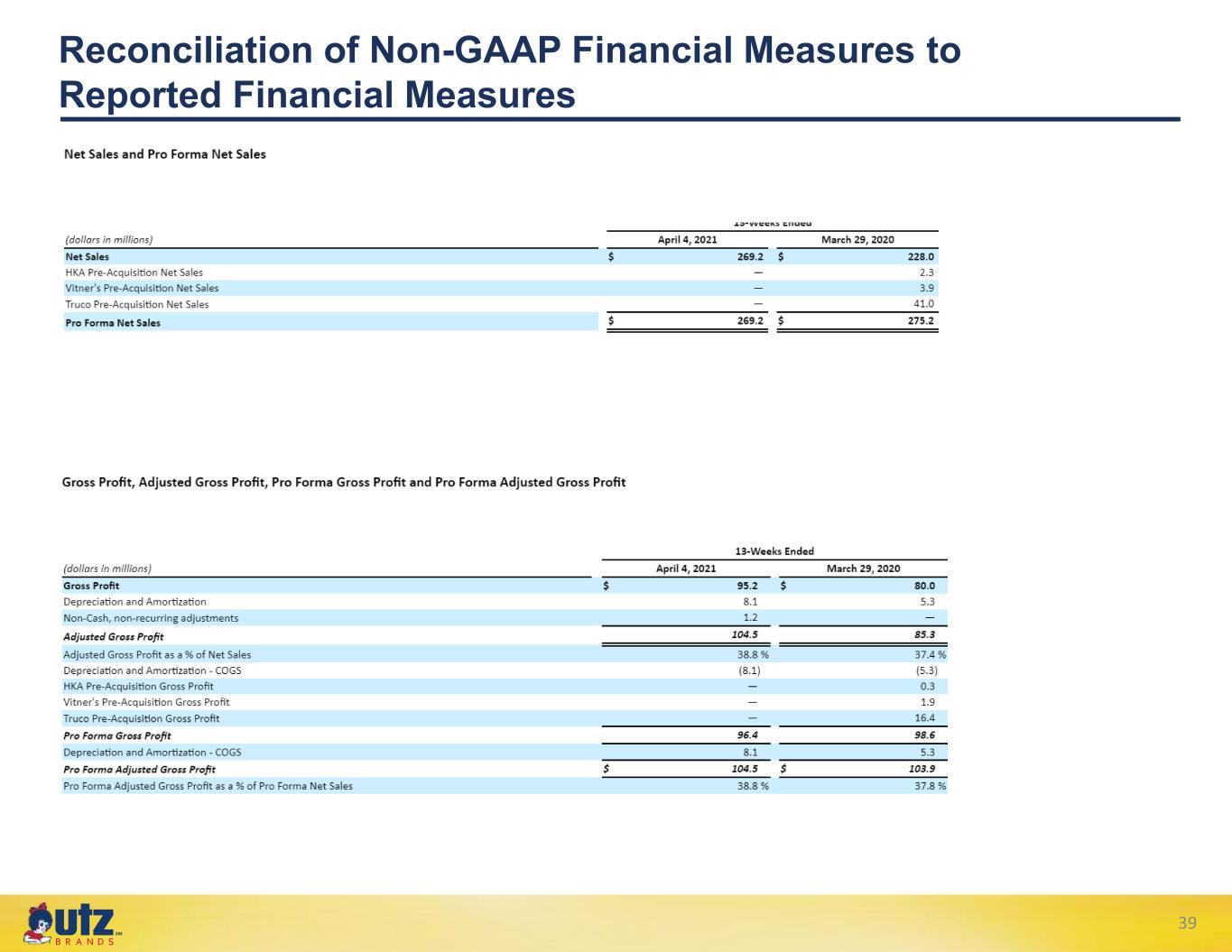

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 39

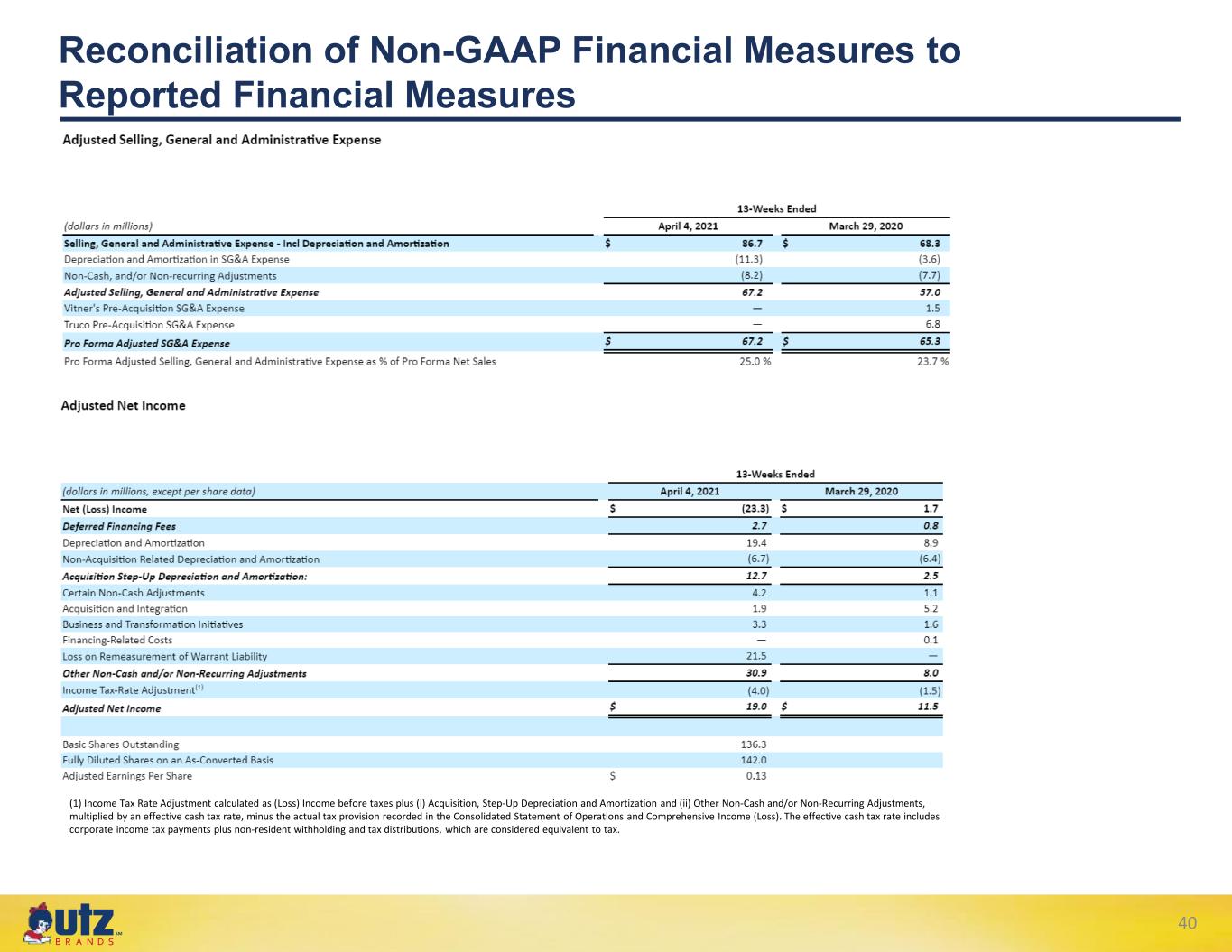

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (1) Income Tax Rate Adjustment calculated as (Loss) Income before taxes plus (i) Acquisition, Step-Up Depreciation and Amortization and (ii) Other Non-Cash and/or Non-Recurring Adjustments, multiplied by an effective cash tax rate, minus the actual tax provision recorded in the Consolidated Statement of Operations and Comprehensive Income (Loss). The effective cash tax rate includes corporate income tax payments plus non-resident withholding and tax distributions, which are considered equivalent to tax. 40

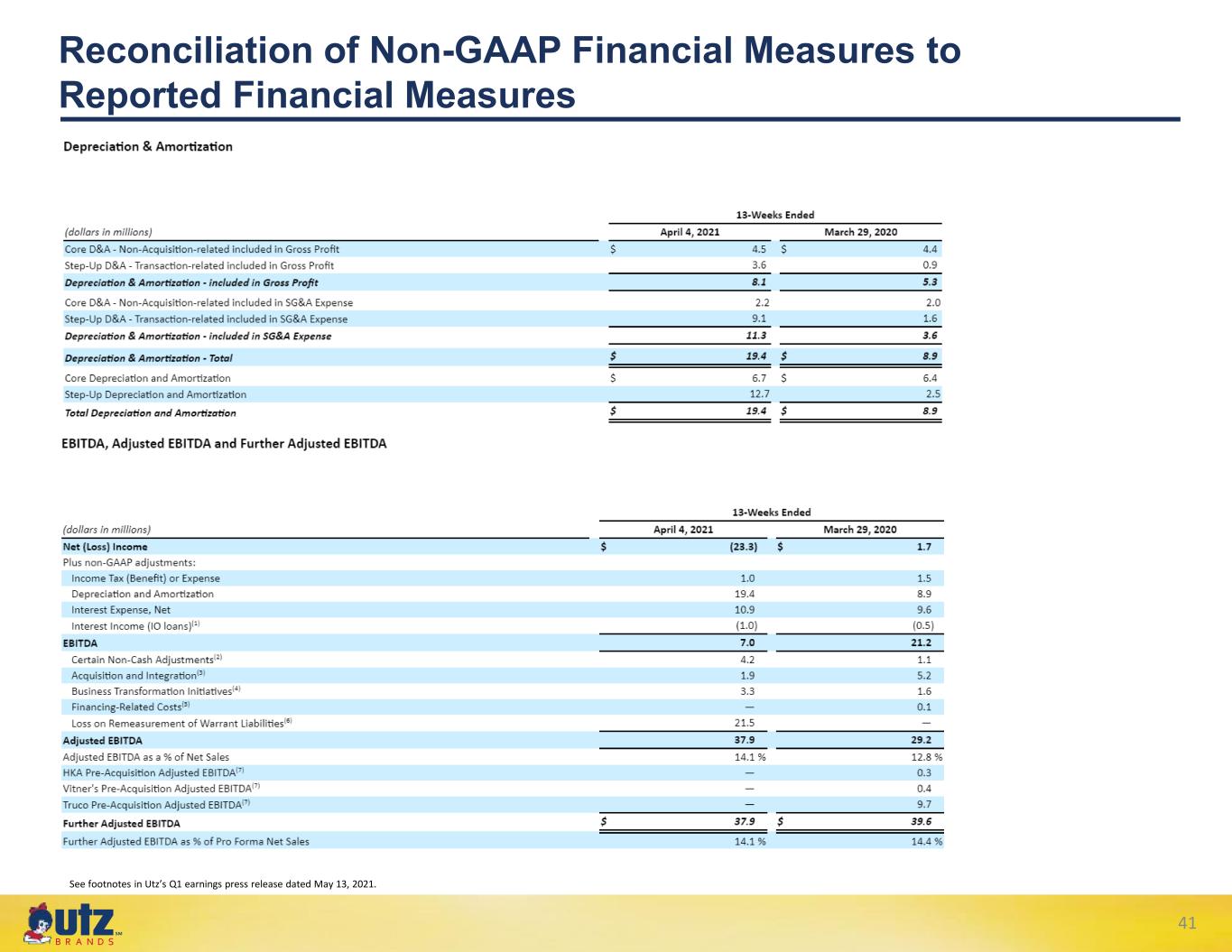

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures See footnotes in Utz’s Q1 earnings press release dated May 13, 2021. 41

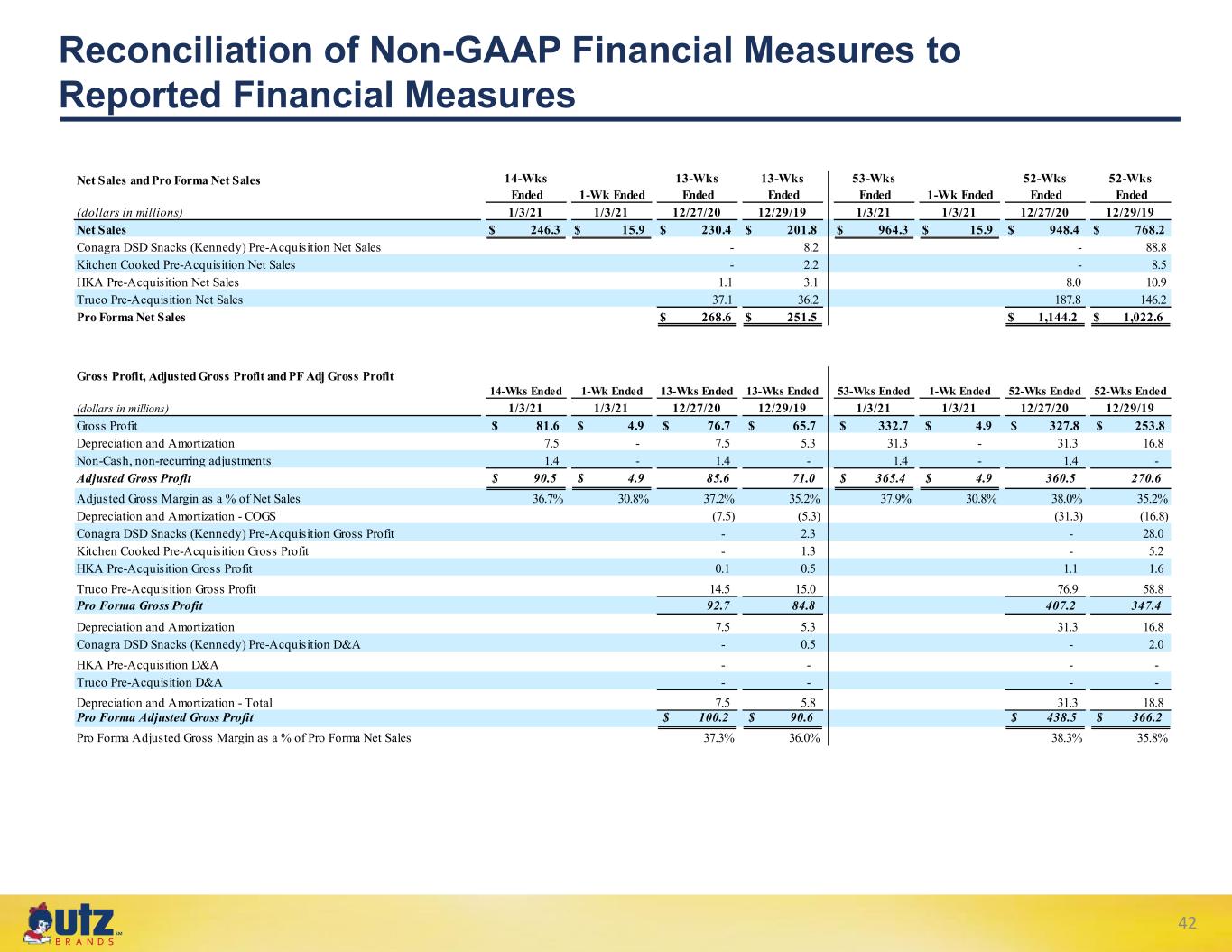

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Net Sales and Pro Forma Net Sales 14-Wks Ended 1-Wk Ended 13-Wks Ended 13-Wks Ended 53-Wks Ended 1-Wk Ended 52-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 1/3/21 12/27/20 12/29/19 1/3/21 1/3/21 12/27/20 12/29/19 Net Sales $ 246.3 $ 15.9 $ 230.4 $ 201.8 $ 964.3 $ 15.9 $ 948.4 $ 768.2 Conagra DSD Snacks (Kennedy) Pre-Acquisition Net Sales - 8.2 - 88.8 Kitchen Cooked Pre-Acquisition Net Sales - 2.2 - 8.5 HKA Pre-Acquisition Net Sales 1.1 3.1 8.0 10.9 Truco Pre-Acquisition Net Sales 37.1 36.2 187.8 146.2 Pro Forma Net Sales $ 268.6 $ 251.5 $ 1,144.2 $ 1,022.6 Gross Profit, Adjusted Gross Profit and PF Adj Gross Profit 14-Wks Ended 1-Wk Ended 13-Wks Ended 13-Wks Ended 53-Wks Ended 1-Wk Ended 52-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 1/3/21 12/27/20 12/29/19 1/3/21 1/3/21 12/27/20 12/29/19 Gross Profit $ 81.6 $ 4.9 $ 76.7 $ 65.7 $ 332.7 $ 4.9 $ 327.8 $ 253.8 Depreciation and Amortization 7.5 - 7.5 5.3 31.3 - 31.3 16.8 Non-Cash, non-recurring adjustments 1.4 - 1.4 - 1.4 - 1.4 - Adjusted Gross Profit $ 90.5 $ 4.9 85.6 71.0 $ 365.4 $ 4.9 360.5 270.6 Adjusted Gross Margin as a % of Net Sales 36.7% 30.8% 37.2% 35.2% 37.9% 30.8% 38.0% 35.2% Depreciation and Amortization - COGS (7.5) (5.3) (31.3) (16.8) Conagra DSD Snacks (Kennedy) Pre-Acquisition Gross Profit - 2.3 - 28.0 Kitchen Cooked Pre-Acquisition Gross Profit - 1.3 - 5.2 HKA Pre-Acquisition Gross Profit 0.1 0.5 1.1 1.6 Truco Pre-Acquisition Gross Profit 14.5 15.0 76.9 58.8 Pro Forma Gross Profit 92.7 84.8 407.2 347.4 Depreciation and Amortization 7.5 5.3 31.3 16.8 Conagra DSD Snacks (Kennedy) Pre-Acquisition D&A - 0.5 - 2.0 HKA Pre-Acquisition D&A - - - - Truco Pre-Acquisition D&A - - - - Depreciation and Amortization - Total 7.5 5.8 31.3 18.8 Pro Forma Adjusted Gross Profit $ 100.2 $ 90.6 $ 438.5 $ 366.2 Pro Forma Adjusted Gross Margin as a % of Pro Forma Net Sales 37.3% 36.0% 38.3% 35.8% 42

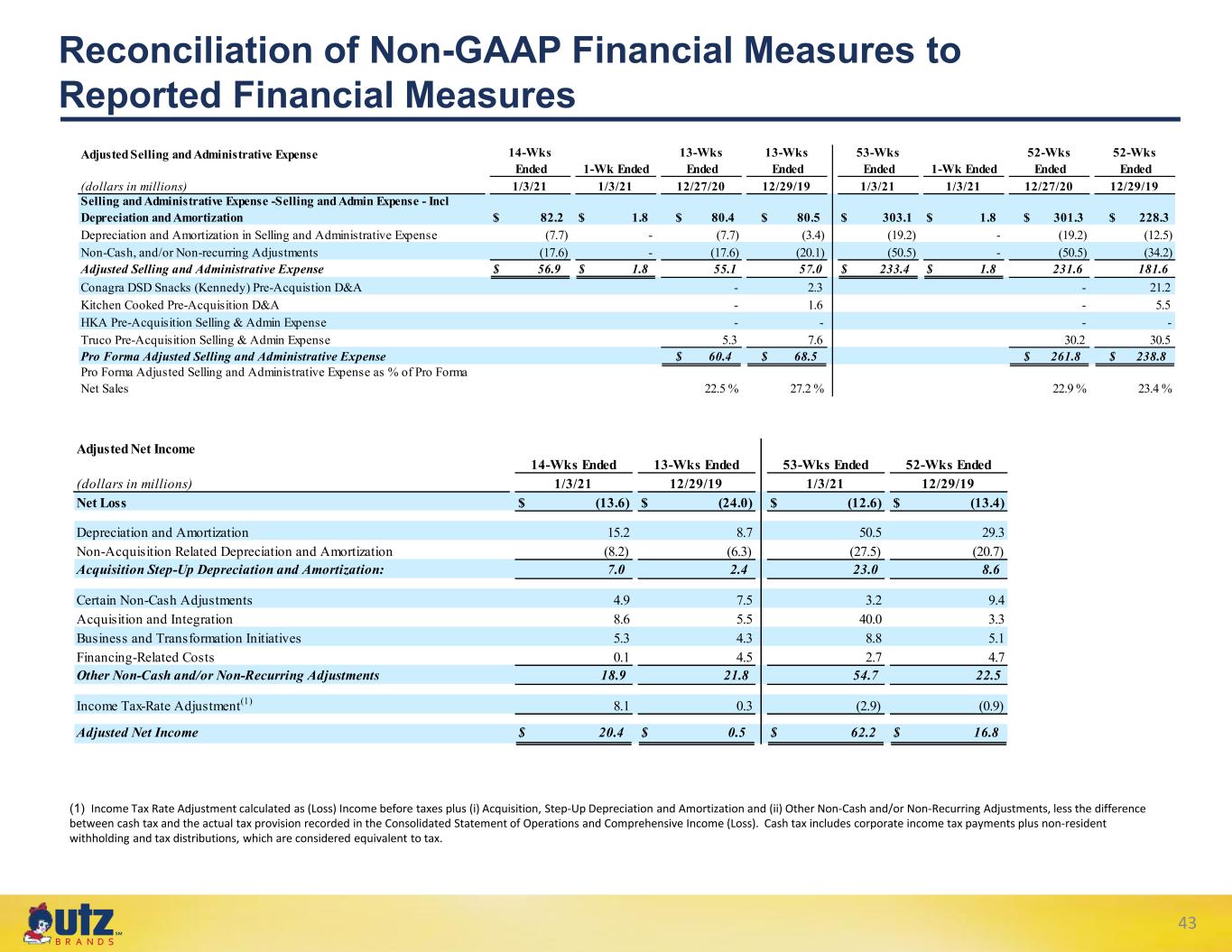

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (1) Income Tax Rate Adjustment calculated as (Loss) Income before taxes plus (i) Acquisition, Step-Up Depreciation and Amortization and (ii) Other Non-Cash and/or Non-Recurring Adjustments, less the difference between cash tax and the actual tax provision recorded in the Consolidated Statement of Operations and Comprehensive Income (Loss). Cash tax includes corporate income tax payments plus non-resident withholding and tax distributions, which are considered equivalent to tax. Adjusted Net Income 14-Wks Ended 13-Wks Ended 53-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 12/29/19 1/3/21 12/29/19 Net Loss $ (13.6) $ (24.0) $ (12.6) $ (13.4) Depreciation and Amortization 15.2 8.7 50.5 29.3 Non-Acquisition Related Depreciation and Amortization (8.2) (6.3) (27.5) (20.7) Acquisition Step-Up Depreciation and Amortization: 7.0 2.4 23.0 8.6 Certain Non-Cash Adjustments 4.9 7.5 3.2 9.4 Acquisition and Integration 8.6 5.5 40.0 3.3 Business and Transformation Initiatives 5.3 4.3 8.8 5.1 Financing-Related Costs 0.1 4.5 2.7 4.7 Other Non-Cash and/or Non-Recurring Adjustments 18.9 21.8 54.7 22.5 Income Tax-Rate Adjustment(1) 8.1 0.3 (2.9) (0.9) Adjusted Net Income $ 20.4 $ 0.5 $ 62.2 $ 16.8 Adjusted Selling and Administrative Expense 14-Wks Ended 1-Wk Ended 13-Wks Ended 13-Wks Ended 53-Wks Ended 1-Wk Ended 52-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 1/3/21 12/27/20 12/29/19 1/3/21 1/3/21 12/27/20 12/29/19 Selling and Administrative Expense -Selling and Admin Expense - Incl Depreciation and Amortization $ 82.2 $ 1.8 $ 80.4 $ 80.5 $ 303.1 $ 1.8 $ 301.3 $ 228.3 Depreciation and Amortization in Selling and Administrative Expense (7.7) - (7.7) (3.4) (19.2) - (19.2) (12.5) Non-Cash, and/or Non-recurring Adjustments (17.6) - (17.6) (20.1) (50.5) - (50.5) (34.2) Adjusted Selling and Administrative Expense $ 56.9 $ 1.8 55.1 57.0 $ 233.4 $ 1.8 231.6 181.6 Conagra DSD Snacks (Kennedy) Pre-Acquistion D&A - 2.3 - 21.2 Kitchen Cooked Pre-Acquisition D&A - 1.6 - 5.5 HKA Pre-Acquisition Selling & Admin Expense - - - - Truco Pre-Acquisition Selling & Admin Expense 5.3 7.6 30.2 30.5 Pro Forma Adjusted Selling and Administrative Expense $ 60.4 $ 68.5 $ 261.8 $ 238.8 Pro Forma Adjusted Selling and Administrative Expense as % of Pro Forma Net Sales 22.5 % 27.2 % 22.9 % 23.4 % 43

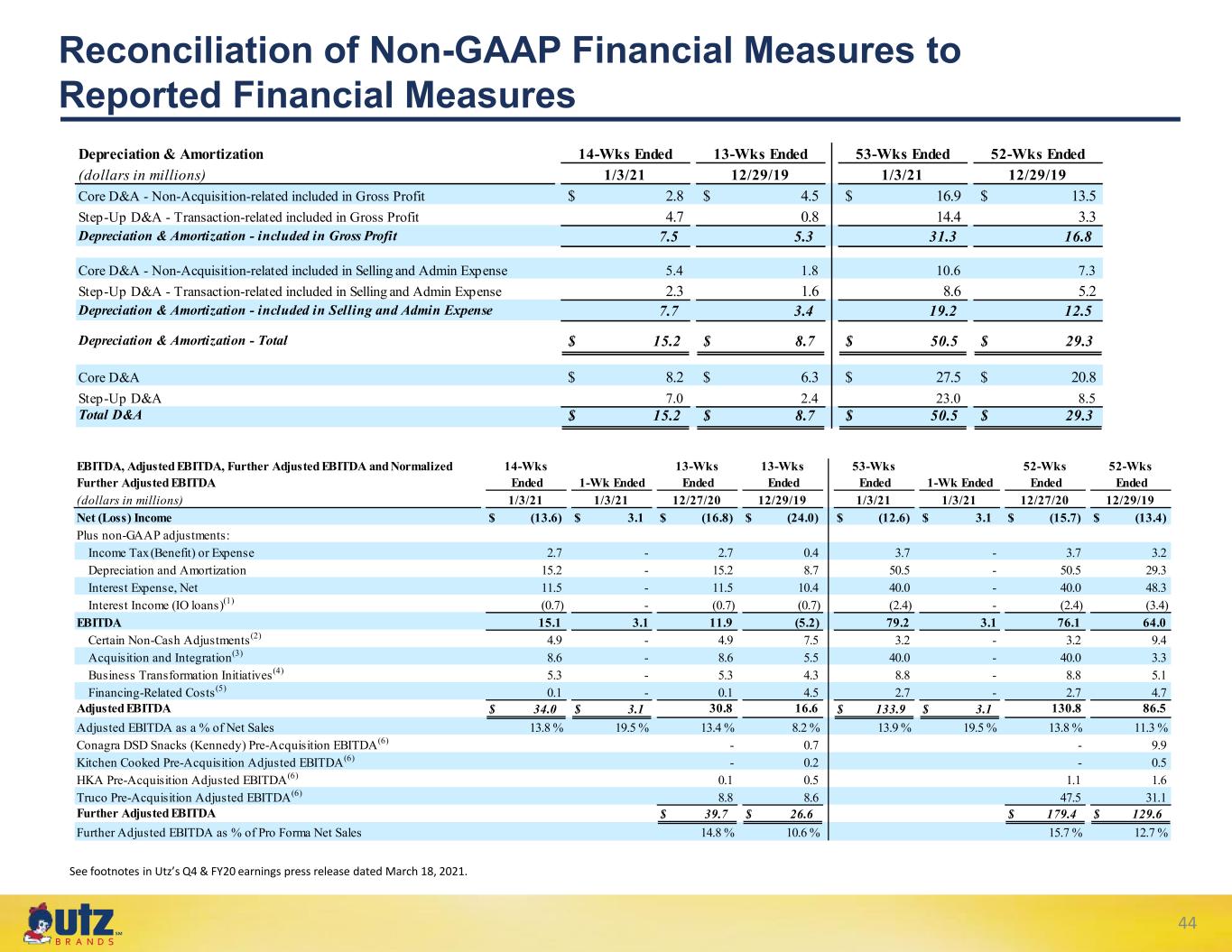

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Depreciation & Amortization 14-Wks Ended 13-Wks Ended 53-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 12/29/19 1/3/21 12/29/19 Core D&A - Non-Acquisition-related included in Gross Profit $ 2.8 $ 4.5 $ 16.9 $ 13.5 Step-Up D&A - Transaction-related included in Gross Profit 4.7 0.8 14.4 3.3 Depreciation & Amortization - included in Gross Profit 7.5 5.3 31.3 16.8 Core D&A - Non-Acquisition-related included in Selling and Admin Expense 5.4 1.8 10.6 7.3 Step-Up D&A - Transaction-related included in Selling and Admin Expense 2.3 1.6 8.6 5.2 Depreciation & Amortization - included in Selling and Admin Expense 7.7 3.4 19.2 12.5 Depreciation & Amortization - Total $ 15.2 $ 8.7 $ 50.5 $ 29.3 Core D&A $ 8.2 $ 6.3 $ 27.5 $ 20.8 Step-Up D&A 7.0 2.4 23.0 8.5 Total D&A $ 15.2 $ 8.7 $ 50.5 $ 29.3 EBITDA, Adjusted EBITDA, Further Adjusted EBITDA and Normalized Further Adjusted EBITDA 14-Wks Ended 1-Wk Ended 13-Wks Ended 13-Wks Ended 53-Wks Ended 1-Wk Ended 52-Wks Ended 52-Wks Ended (dollars in millions) 1/3/21 1/3/21 12/27/20 12/29/19 1/3/21 1/3/21 12/27/20 12/29/19 Net (Loss) Income $ (13.6) $ 3.1 $ (16.8) $ (24.0) $ (12.6) $ 3.1 $ (15.7) $ (13.4) Plus non-GAAP adjustments: Income Tax (Benefit) or Expense 2.7 - 2.7 0.4 3.7 - 3.7 3.2 Depreciation and Amortization 15.2 - 15.2 8.7 50.5 - 50.5 29.3 Interest Expense, Net 11.5 - 11.5 10.4 40.0 - 40.0 48.3 Interest Income (IO loans)(1) (0.7) - (0.7) (0.7) (2.4) - (2.4) (3.4) EBITDA 15.1 3.1 11.9 (5.2) 79.2 3.1 76.1 64.0 Certain Non-Cash Adjustments(2) 4.9 - 4.9 7.5 3.2 - 3.2 9.4 Acquisition and Integration(3) 8.6 - 8.6 5.5 40.0 - 40.0 3.3 Business Transformation Initiatives(4) 5.3 - 5.3 4.3 8.8 - 8.8 5.1 Financing-Related Costs(5) 0.1 - 0.1 4.5 2.7 - 2.7 4.7 Adjusted EBITDA $ 34.0 $ 3.1 30.8 16.6 $ 133.9 $ 3.1 130.8 86.5 Adjusted EBITDA as a % of Net Sales 13.8 % 19.5 % 13.4 % 8.2 % 13.9 % 19.5 % 13.8 % 11.3 % Conagra DSD Snacks (Kennedy) Pre-Acquisition EBITDA(6) - 0.7 - 9.9 Kitchen Cooked Pre-Acquisition Adjusted EBITDA(6) - 0.2 - 0.5 HKA Pre-Acquisition Adjusted EBITDA(6) 0.1 0.5 1.1 1.6 Truco Pre-Acquisition Adjusted EBITDA(6) 8.8 8.6 47.5 31.1 Further Adjusted EBITDA $ 39.7 $ 26.6 $ 179.4 $ 129.6 Further Adjusted EBITDA as % of Pro Forma Net Sales 14.8 % 10.6 % 15.7 % 12.7 % See footnotes in Utz’s Q4 & FY20 earnings press release dated March 18, 2021. 44

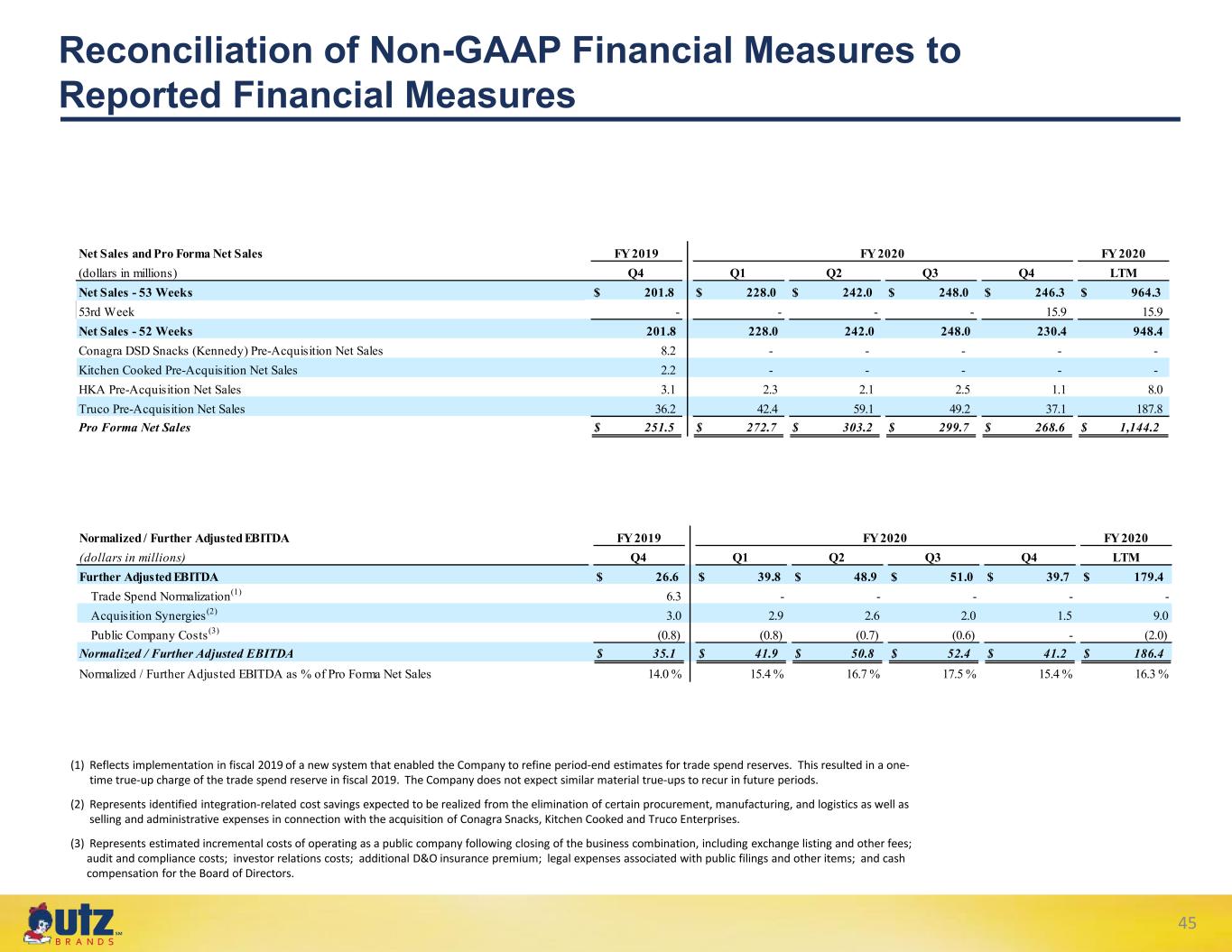

℠ (1) Reflects implementation in fiscal 2019 of a new system that enabled the Company to refine period-end estimates for trade spend reserves. This resulted in a one- time true-up charge of the trade spend reserve in fiscal 2019. The Company does not expect similar material true-ups to recur in future periods. (2) Represents identified integration-related cost savings expected to be realized from the elimination of certain procurement, manufacturing, and logistics as well as selling and administrative expenses in connection with the acquisition of Conagra Snacks, Kitchen Cooked and Truco Enterprises. (3) Represents estimated incremental costs of operating as a public company following closing of the business combination, including exchange listing and other fees; audit and compliance costs; investor relations costs; additional D&O insurance premium; legal expenses associated with public filings and other items; and cash compensation for the Board of Directors. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Normalized / Further Adjusted EBITDA FY 2019 FY 2020 (dollars in millions) Q4 Q1 Q2 Q3 Q4 LTM Further Adjusted EBITDA $ 26.6 $ 39.8 $ 48.9 $ 51.0 $ 39.7 $ 179.4 Trade Spend Normalization(1) 6.3 - - - - - Acquisition Synergies(2) 3.0 2.9 2.6 2.0 1.5 9.0 Public Company Costs(3) (0.8) (0.8) (0.7) (0.6) - (2.0) Normalized / Further Adjusted EBITDA $ 35.1 $ 41.9 $ 50.8 $ 52.4 $ 41.2 $ 186.4 Normalized / Further Adjusted EBITDA as % of Pro Forma Net Sales 14.0 % 15.4 % 16.7 % 17.5 % 15.4 % 16.3 % FY 2020 Net Sales and Pro Forma Net Sales FY 2019 FY 2020 (dollars in millions) Q4 Q1 Q2 Q3 Q4 LTM Net Sales - 53 Weeks $ 201.8 $ 228.0 $ 242.0 $ 248.0 $ 246.3 $ 964.3 53rd Week - - - - 15.9 15.9 Net Sales - 52 Weeks 201.8 228.0 242.0 248.0 230.4 948.4 Conagra DSD Snacks (Kennedy) Pre-Acquisition Net Sales 8.2 - - - - - Kitchen Cooked Pre-Acquisition Net Sales 2.2 - - - - - HKA Pre-Acquisition Net Sales 3.1 2.3 2.1 2.5 1.1 8.0 Truco Pre-Acquisition Net Sales 36.2 42.4 59.1 49.2 37.1 187.8 Pro Forma Net Sales $ 251.5 $ 272.7 $ 303.2 $ 299.7 $ 268.6 $ 1,144.2 FY 2020 45

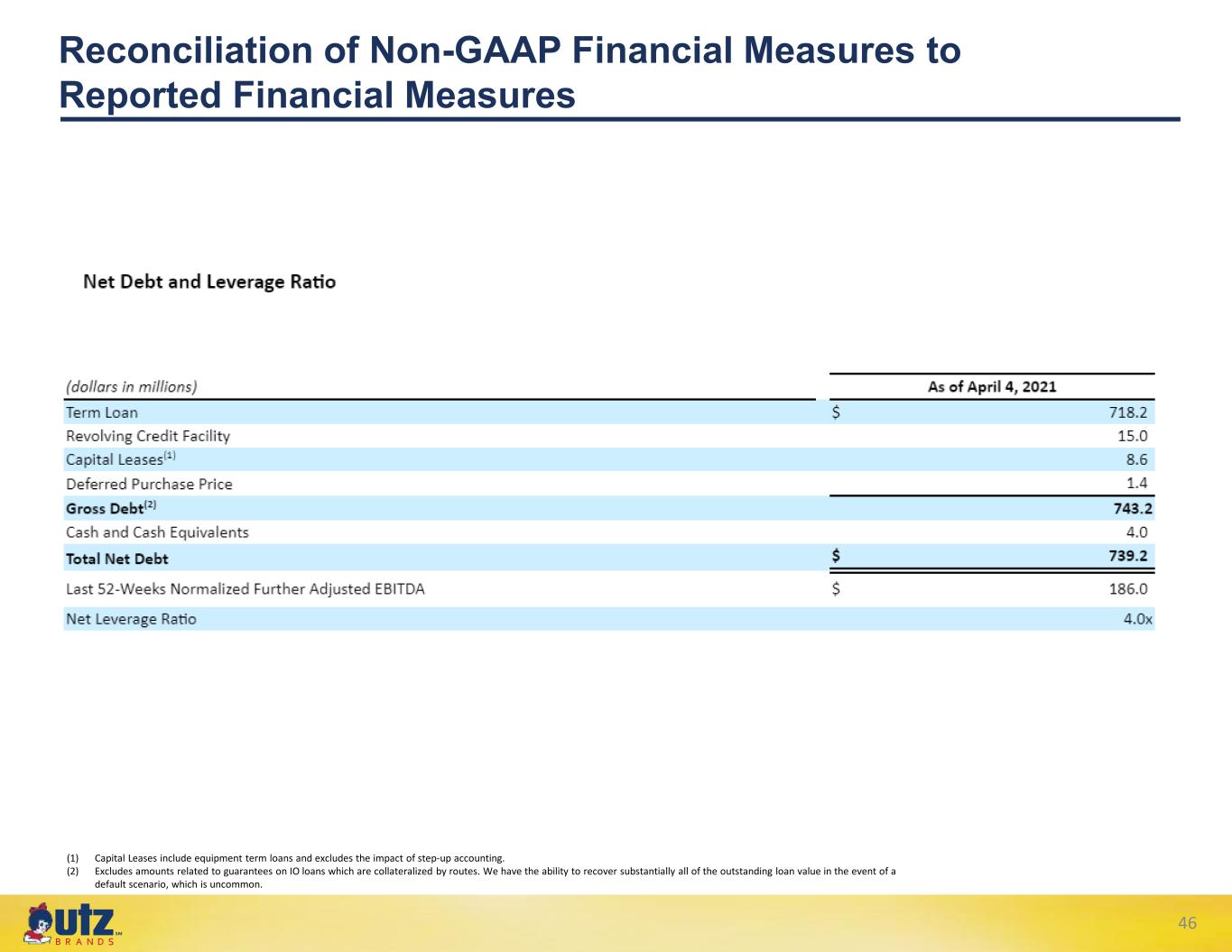

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (1) Capital Leases include equipment term loans and excludes the impact of step-up accounting. (2) Excludes amounts related to guarantees on IO loans which are collateralized by routes. We have the ability to recover substantially all of the outstanding loan value in the event of a default scenario, which is uncommon. 46