Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Ciner Resources LP | cinr-20210621.htm |

Ciner Resources LP Investor Presentation June 2021

2 Safe Harbor Statement This investor presentation contains forward-looking statements. Statements other than statements of historical facts included in this investor presentation that address activities, events or developments that Ciner Resources LP (the “Partnership”, “we”, “us”, “our” or “CINR”) expects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements include all statements that are not historical facts and in some cases may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “seek,” “anticipate,” “estimate,” “predict,” “forecast,” “project,” “potential,” “continue,” “may,” “will,” “could,” “should” or the negative of these terms or similar expressions. Such statements are based only on the Partnership’s current beliefs, expectations and assumptions regarding the future of the Partnership’s business, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Partnership’s control. The Partnership’s actual results and financial condition may differ materially from those implied or expressed by these forward-looking statements. Consequently, you are cautioned not to place undue reliance on any forward-looking statement because no forward-looking statement can be guaranteed. Factors that could cause the Partnership’s actual results to differ materially from the results contemplated by such forward-looking statements include: changes in general economic conditions, the Partnership’s ability to meet its expected quarterly distributions, changes in the Partnership’s relationships with its customers, including American Natural Soda Ash Corp. (“ANSAC”), the demand for soda ash and the opportunities for the Partnership to increase its volume sold, the development of glass and glass making product alternatives, changes in soda ash prices, operating hazards, unplanned maintenance outages at the Partnership’s production facility, construction costs or capital expenditures exceeding estimated or budgeted costs or expenditures, the effects of government regulation, tax position, and other risks incidental to the mining and processing of trona ore, and shipment of soda ash, the impact of a cybersecurity event, the impact of our agreement to exit ANSAC effective as of December 31, 2020, and our transition to the utilization of Ciner Group’s global distribution network for some of our export operations beginning on January 1, 2021, our ability to reinstate our distributions, and the impact of the ongoing COVID-19 pandemic, including the impact of government orders on our employees and operations, as well as the other factors discussed in the Partnership’s Annual Report on Form 10-K for the year ended December 31, 2020, and subsequent reports filed with the United States Securities and Exchange Commission. All forward-looking statements included in this investor presentation are expressly qualified in their entirety by such cautionary statements. Unless required by law, the Partnership undertakes no duty and does not intend to update the forward-looking statements made herein to reflect new information or events or circumstances occurring after this investor presentation. All forward-looking statements speak only as of the date made. This presentation includes certain market data that has been obtained through the Partnership’s own research, surveys or from studies conducted by third parties and industry or general publications. Industry or general publications and surveys or studies conducted by third parties generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While the Partnership believes that each of these surveys, studies and publications is reliable, the Partnership has not independently verified such data, and the Partnership makes no representation as to the accuracy of such information. Non-GAAP Financial Measures: This presentation includes non-GAAP financial measures such as Adjusted EBITDA (also referred to as “Adj. EBITDA”). Investors should recognize that this non-GAAP measure might not be comparable to similarly titled measures of other companies. This measure should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with GAAP. A reconciliation of this measure to our most directly comparable financial measures calculated and presented in accordance with GAAP is provided in the appendix to this presentation.

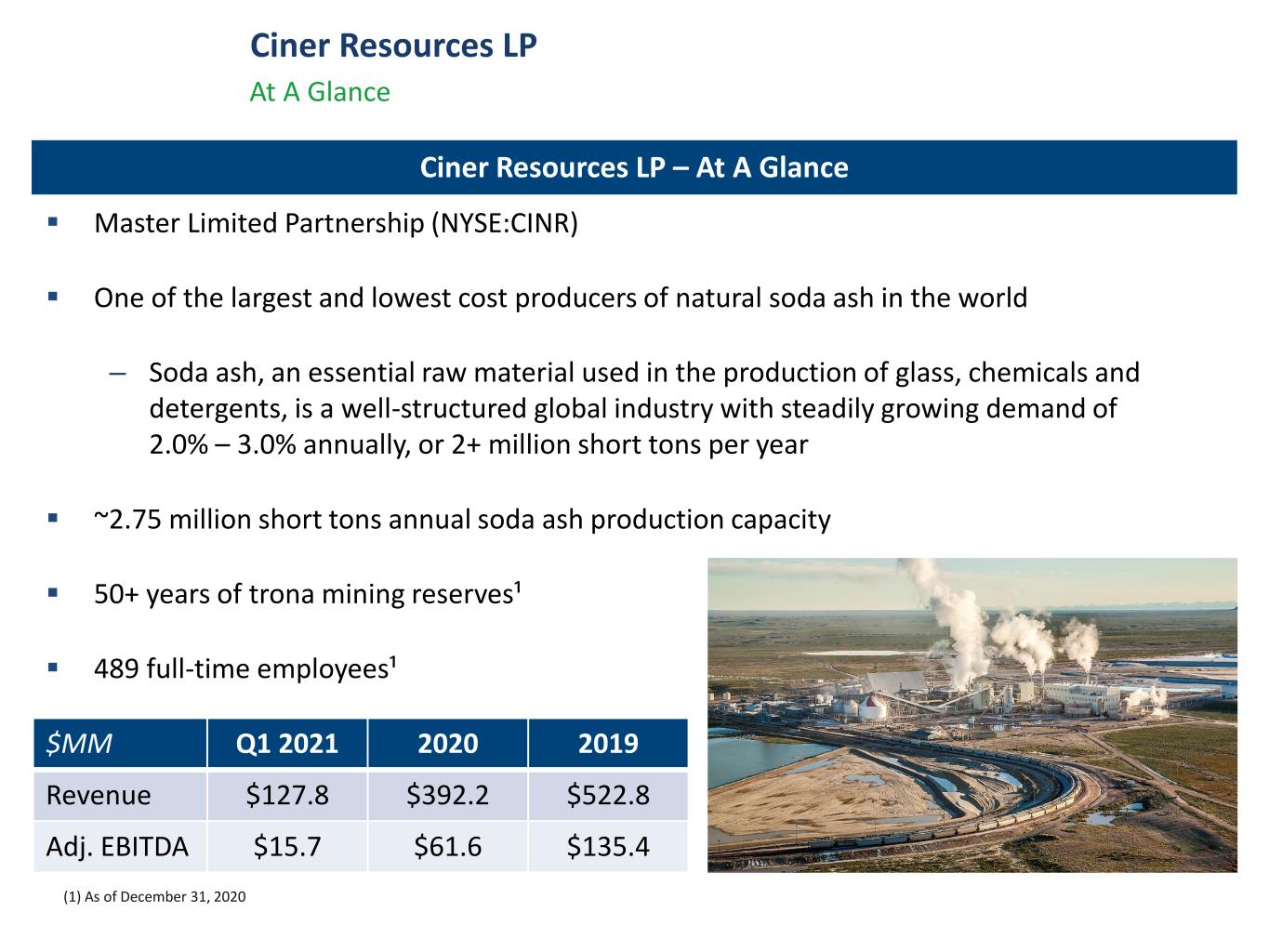

3 Ciner Resources LP At A Glance Ciner Resources LP – At A Glance $MM Q1 2021 2020 2019 Revenue $127.8 $392.2 $522.8 Adj. EBITDA $15.7 $61.6 $135.4 ▪ Master Limited Partnership (NYSE:CINR) ▪ One of the largest and lowest cost producers of natural soda ash in the world – Soda ash, an essential raw material used in the production of glass, chemicals and detergents, is a well-structured global industry with steadily growing demand of 2.0% – 3.0% annually, or 2+ million short tons per year ▪ ~2.75 million short tons annual soda ash production capacity ▪ 50+ years of trona mining reserves¹ ▪ 489 full-time employees¹ (1) As of December 31, 2020

4 Ciner Resources LP ▪ Naturally-occurring trona resource has substantially lower production cost than synthetic production ▪ ~90% of the world’s natural reserves are located in Green River, Wyoming ▪ Environmentally-friendly production process ▪ Low-input production process doesn’t require secondary chemicals Competitive Advantages Natural Soda Ash ▪ Operational advantages compared to other US trona-based producers ▪ High-return expansion opportunities ▪ Stable domestic customer relationships ▪ Experienced management and operational teams ▪ Marketing and logistics synergies with global parent company (WE Soda) Other Competitive Strengths

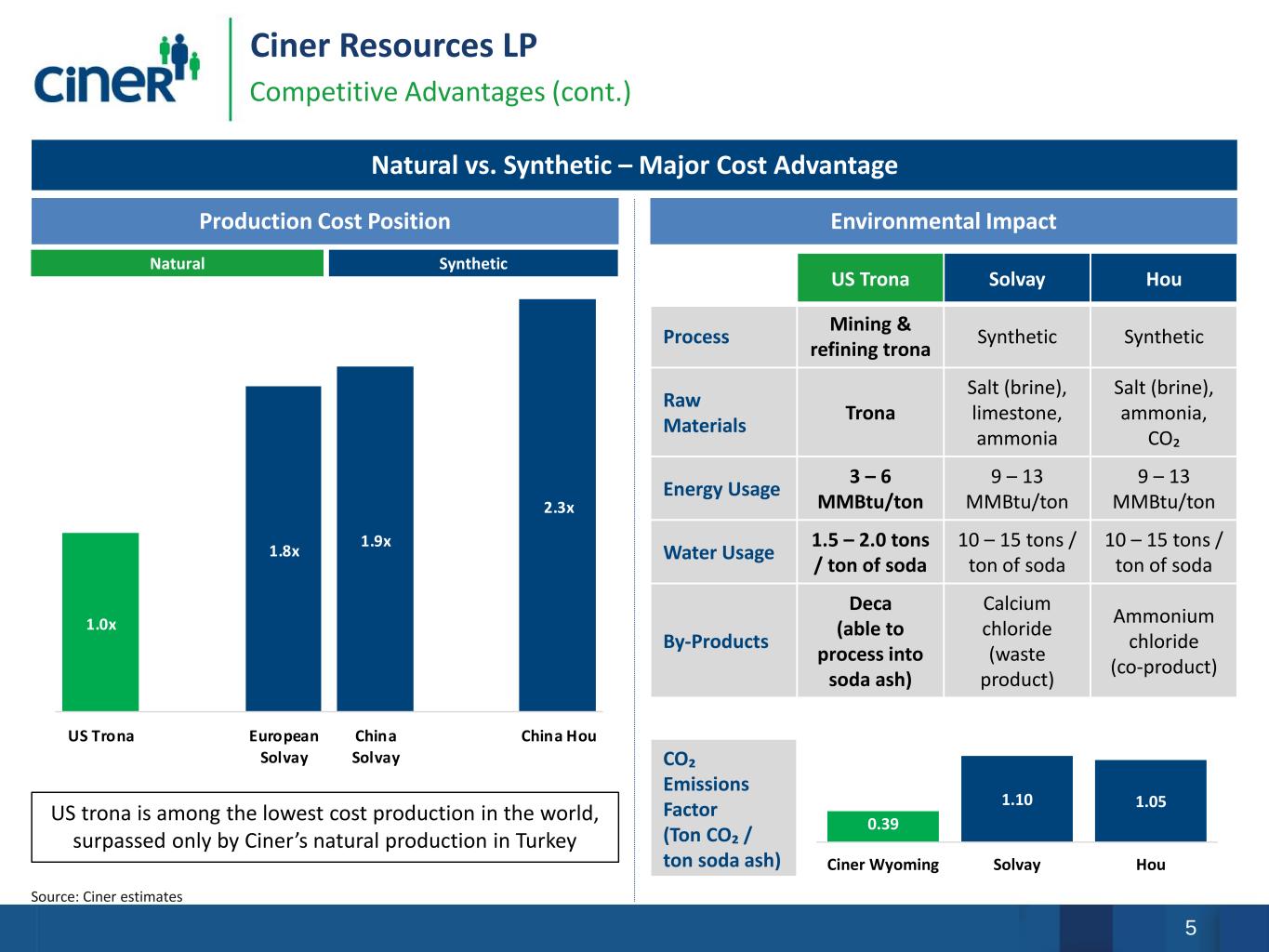

5 1.0x 1.8x 1.9x 2.3x US Trona European Solvay China Solvay China Hou Ciner Resources LP Competitive Advantages (cont.) Natural vs. Synthetic – Major Cost Advantage Production Cost Position Natural Synthetic Environmental Impact US Trona Solvay Hou Process Mining & refining trona Synthetic Synthetic Raw Materials Trona Salt (brine), limestone, ammonia Salt (brine), ammonia, CO₂ Energy Usage 3 – 6 MMBtu/ton 9 – 13 MMBtu/ton 9 – 13 MMBtu/ton Water Usage 1.5 – 2.0 tons / ton of soda 10 – 15 tons / ton of soda 10 – 15 tons / ton of soda By-Products Deca (able to process into soda ash) Calcium chloride (waste product) Ammonium chloride (co-product) 0.39 1.10 1.05 Ciner Wyoming Solvay Hou CO₂ Emissions Factor (Ton CO₂ / ton soda ash) Source: Ciner estimates US trona is among the lowest cost production in the world, surpassed only by Ciner’s natural production in Turkey

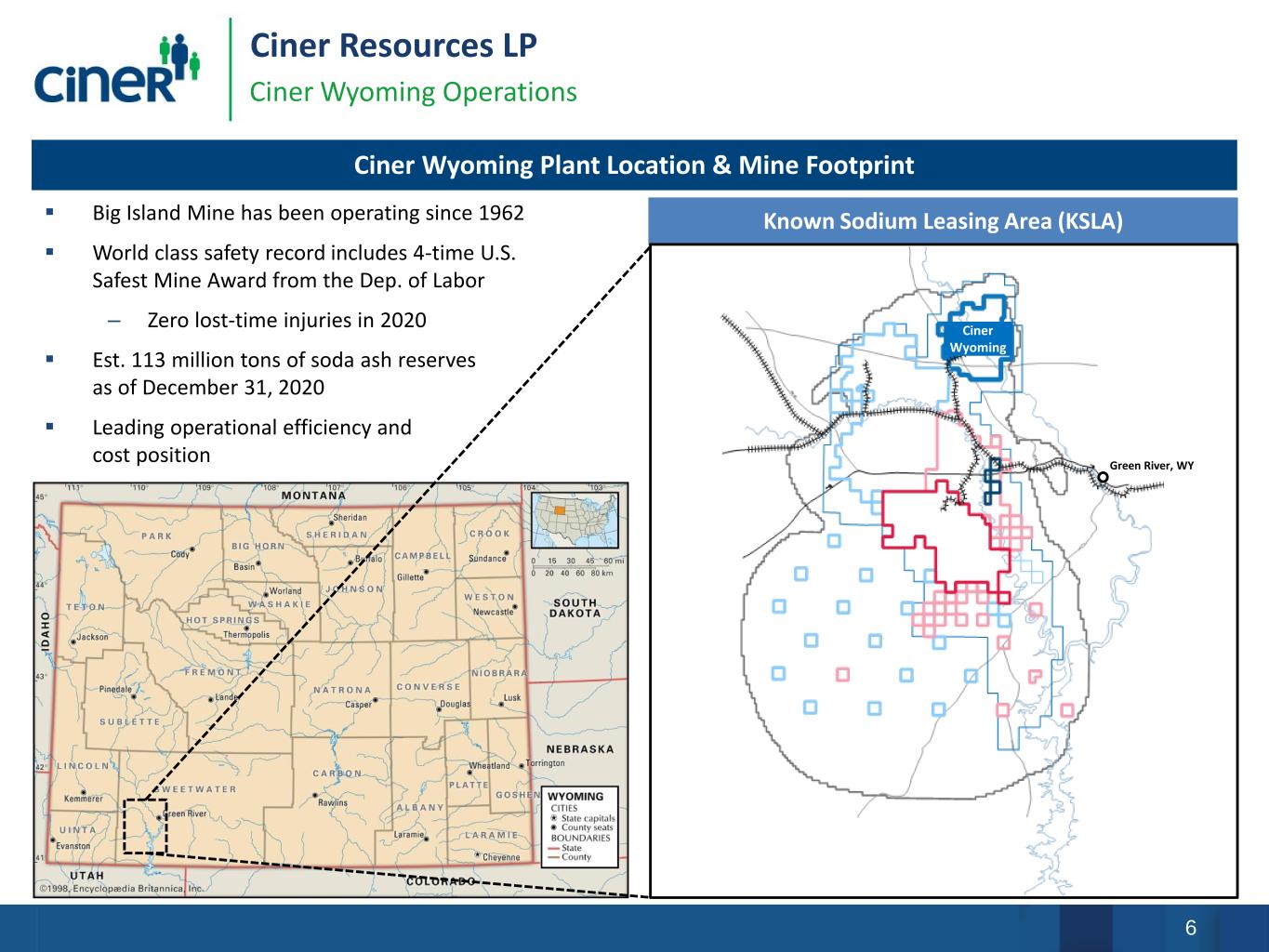

6 Ciner Resources LP Ciner Wyoming Operations Ciner Wyoming Plant Location & Mine Footprint Ciner Wyoming Known Sodium Leasing Area (KSLA) Green River, WY ▪ Big Island Mine has been operating since 1962 ▪ World class safety record includes 4-time U.S. Safest Mine Award from the Dep. of Labor – Zero lost-time injuries in 2020 ▪ Est. 113 million tons of soda ash reserves as of December 31, 2020 ▪ Leading operational efficiency and cost position

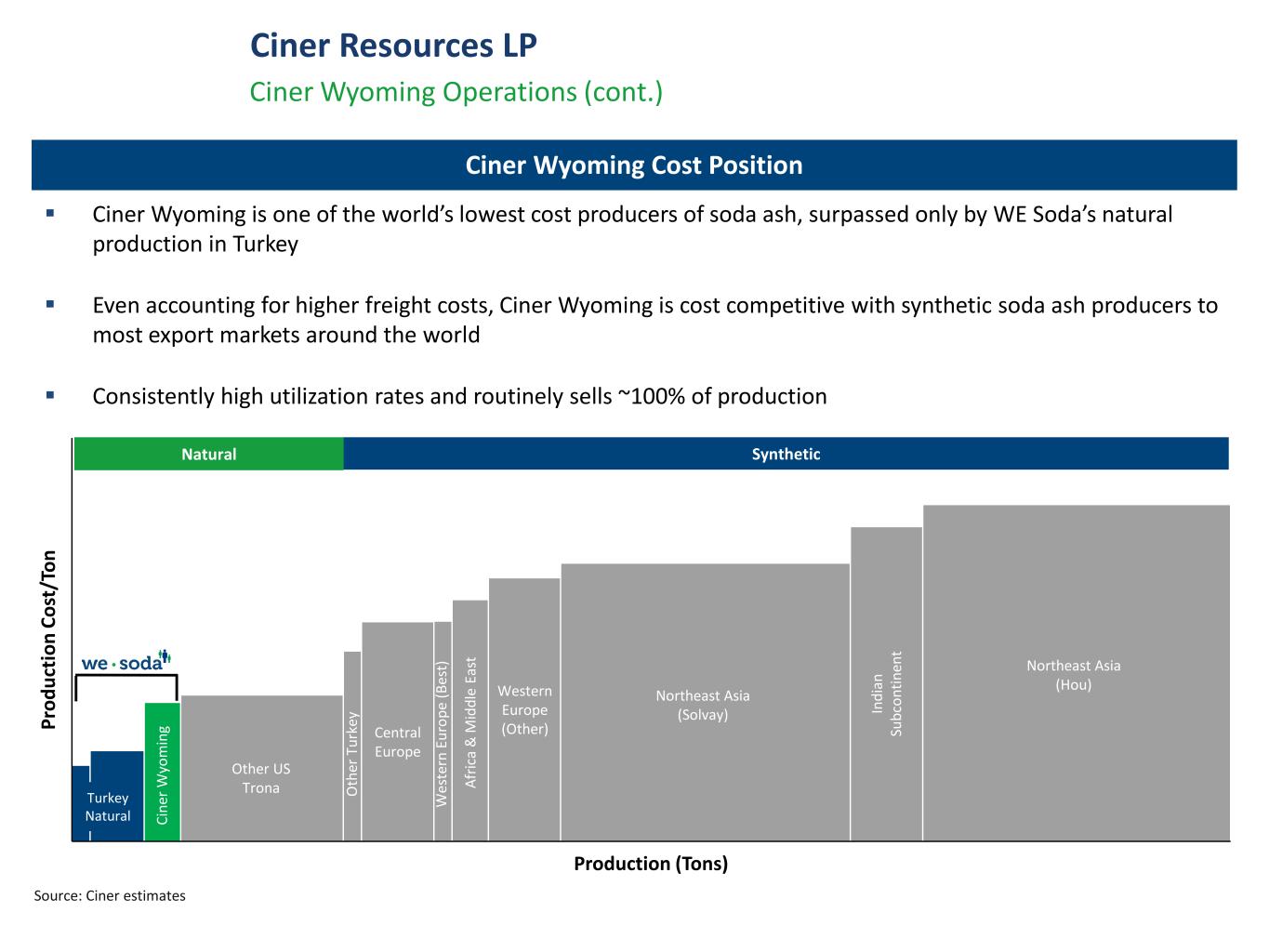

7 P ro d u ct io n C o st /T o n Production (Tons) Ciner Resources LP Ciner Wyoming Operations (cont.) Ciner Wyoming Cost Position ▪ Ciner Wyoming is one of the world’s lowest cost producers of soda ash, surpassed only by WE Soda’s natural production in Turkey ▪ Even accounting for higher freight costs, Ciner Wyoming is cost competitive with synthetic soda ash producers to most export markets around the world ▪ Consistently high utilization rates and routinely sells ~100% of production Turkey Natural Other US Trona C in e r W y o m in g Central Europe O th e r T u rk e y W e st e rn E u ro p e ( B e st ) A fr ic a & M id d le E a st Western Europe (Other) In d ia n S u b co n ti n e n t Northeast Asia (Hou) Northeast Asia (Solvay) Source: Ciner estimates Natural Synthetic

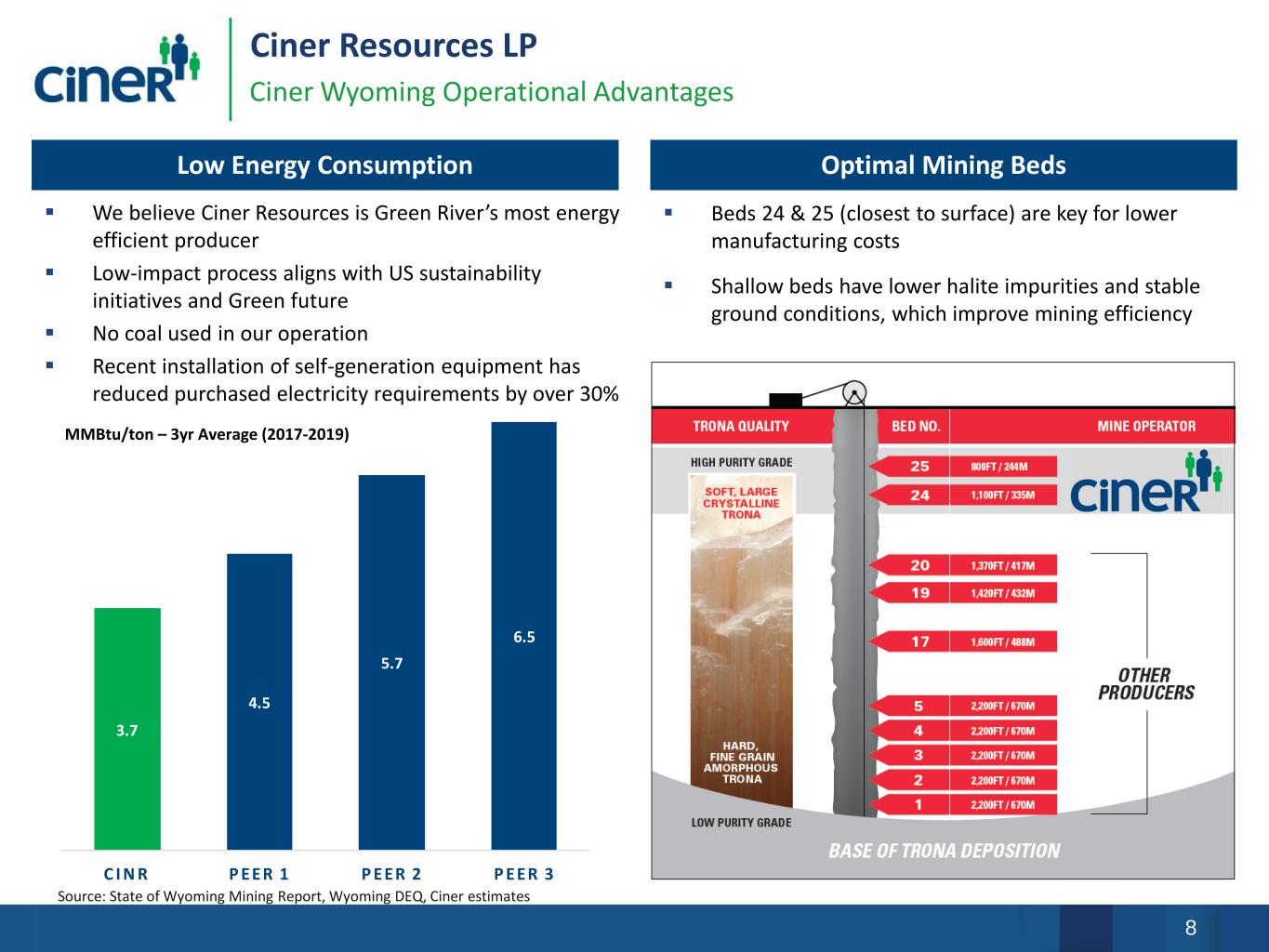

8 3.7 4.5 5.7 6.5 C I N R P EER 1 P EER 2 P EER 3 Ciner Resources LP ▪ We believe Ciner Resources is Green River’s most energy efficient producer ▪ Low-impact process aligns with US sustainability initiatives and Green future ▪ No coal used in our operation ▪ Recent installation of self-generation equipment has reduced purchased electricity requirements by over 30% Ciner Wyoming Operational Advantages Low Energy Consumption Optimal Mining Beds MMBtu/ton – 3yr Average (2017-2019) ▪ Beds 24 & 25 (closest to surface) are key for lower manufacturing costs ▪ Shallow beds have lower halite impurities and stable ground conditions, which improve mining efficiency Source: State of Wyoming Mining Report, Wyoming DEQ, Ciner estimates

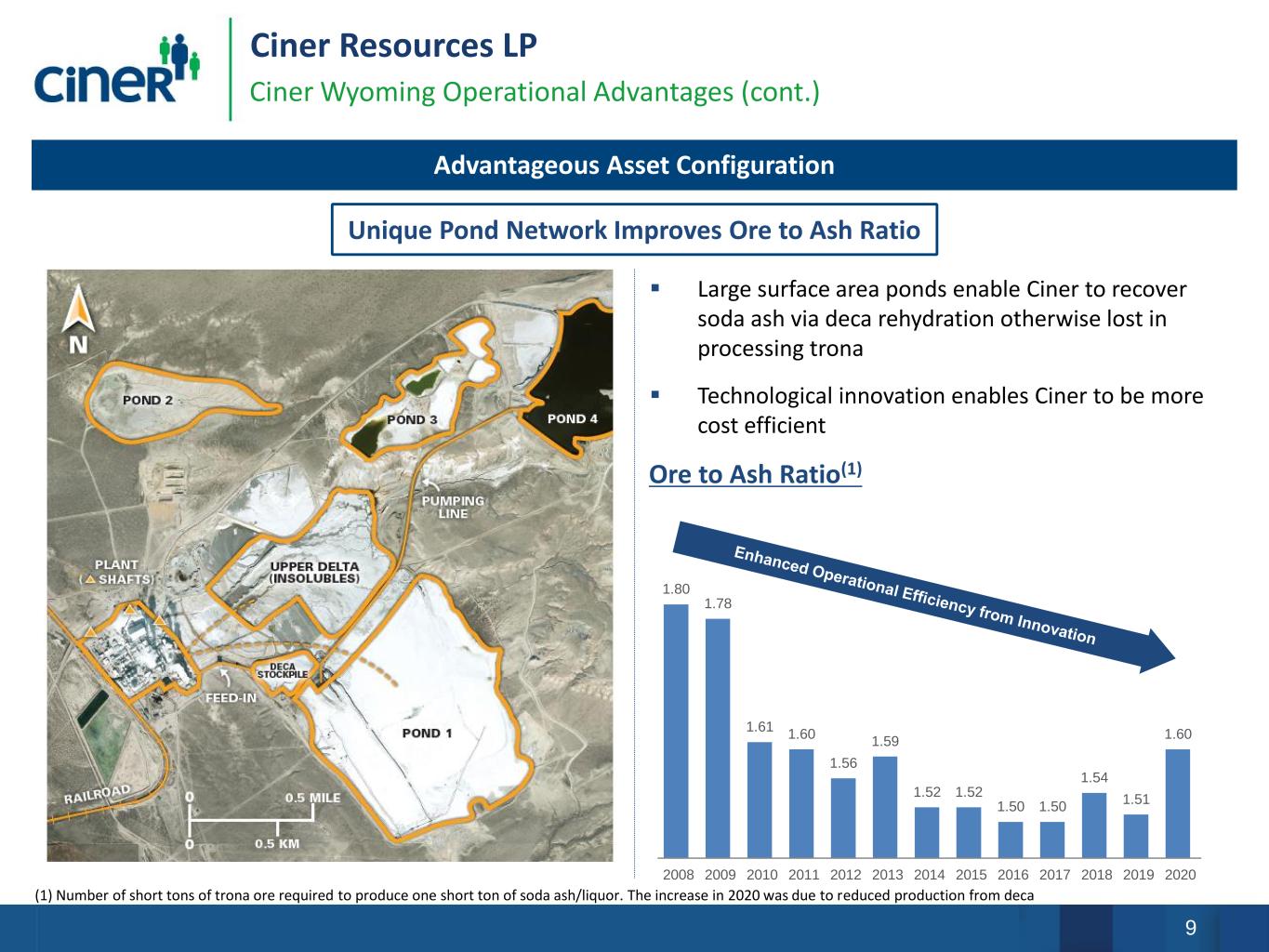

9 Ciner Resources LP Ciner Wyoming Operational Advantages (cont.) Unique Pond Network Improves Ore to Ash Ratio ▪ Large surface area ponds enable Ciner to recover soda ash via deca rehydration otherwise lost in processing trona ▪ Technological innovation enables Ciner to be more cost efficient Ore to Ash Ratio(1) 1.80 1.78 1.61 1.60 1.56 1.59 1.52 1.52 1.50 1.50 1.54 1.51 1.60 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (1) Number of short tons of trona ore required to produce one short ton of soda ash/liquor. The increase in 2020 was due to reduced production from deca Advantageous Asset Configuration

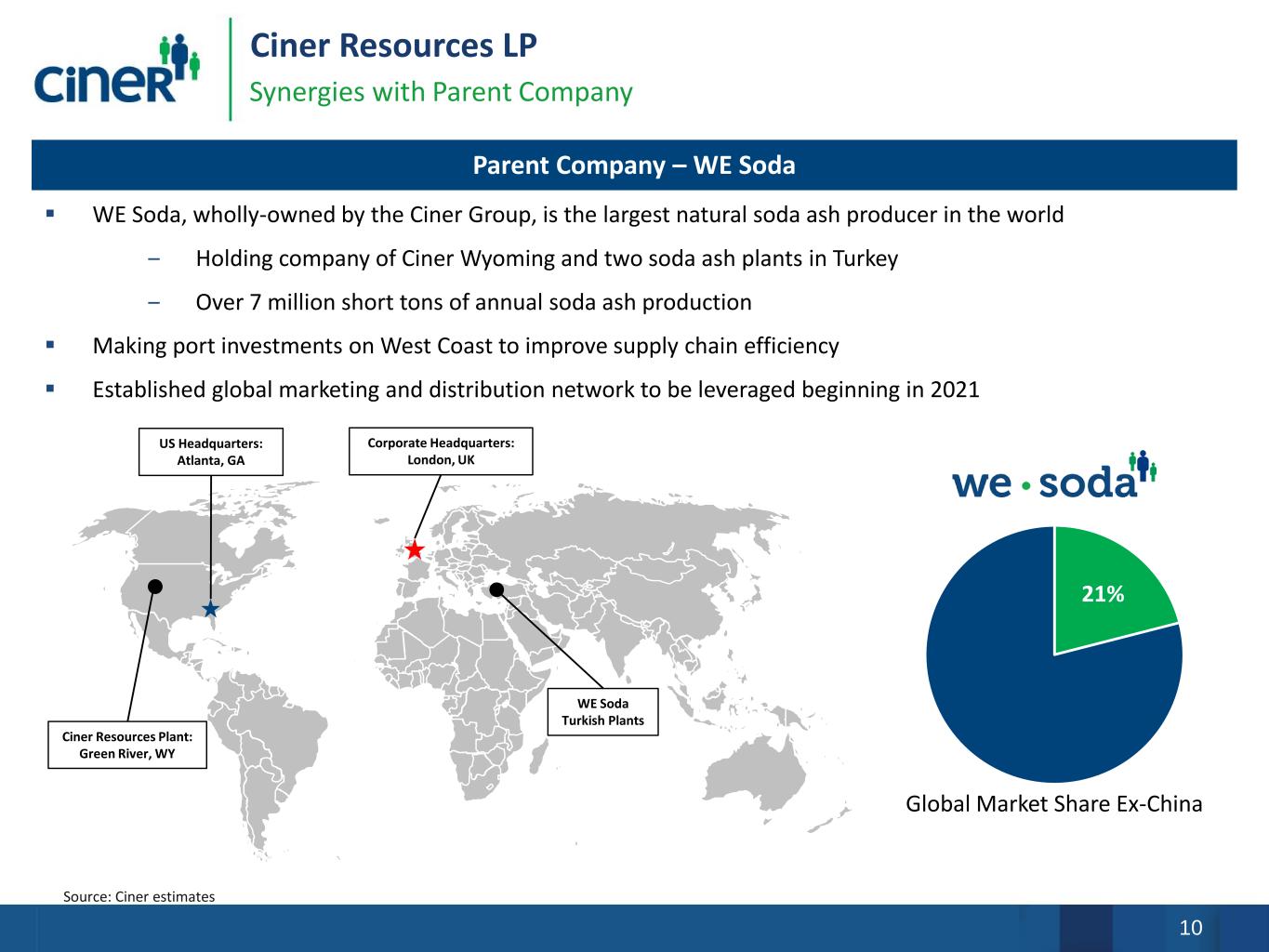

10 Ciner Resources LP Synergies with Parent Company Parent Company – WE Soda ▪ WE Soda, wholly-owned by the Ciner Group, is the largest natural soda ash producer in the world ‒ Holding company of Ciner Wyoming and two soda ash plants in Turkey ‒ Over 7 million short tons of annual soda ash production ▪ Making port investments on West Coast to improve supply chain efficiency ▪ Established global marketing and distribution network to be leveraged beginning in 2021 21% Global Market Share Ex-China Corporate Headquarters: London, UK US Headquarters: Atlanta, GA Ciner Resources Plant: Green River, WY WE Soda Turkish Plants Source: Ciner estimates

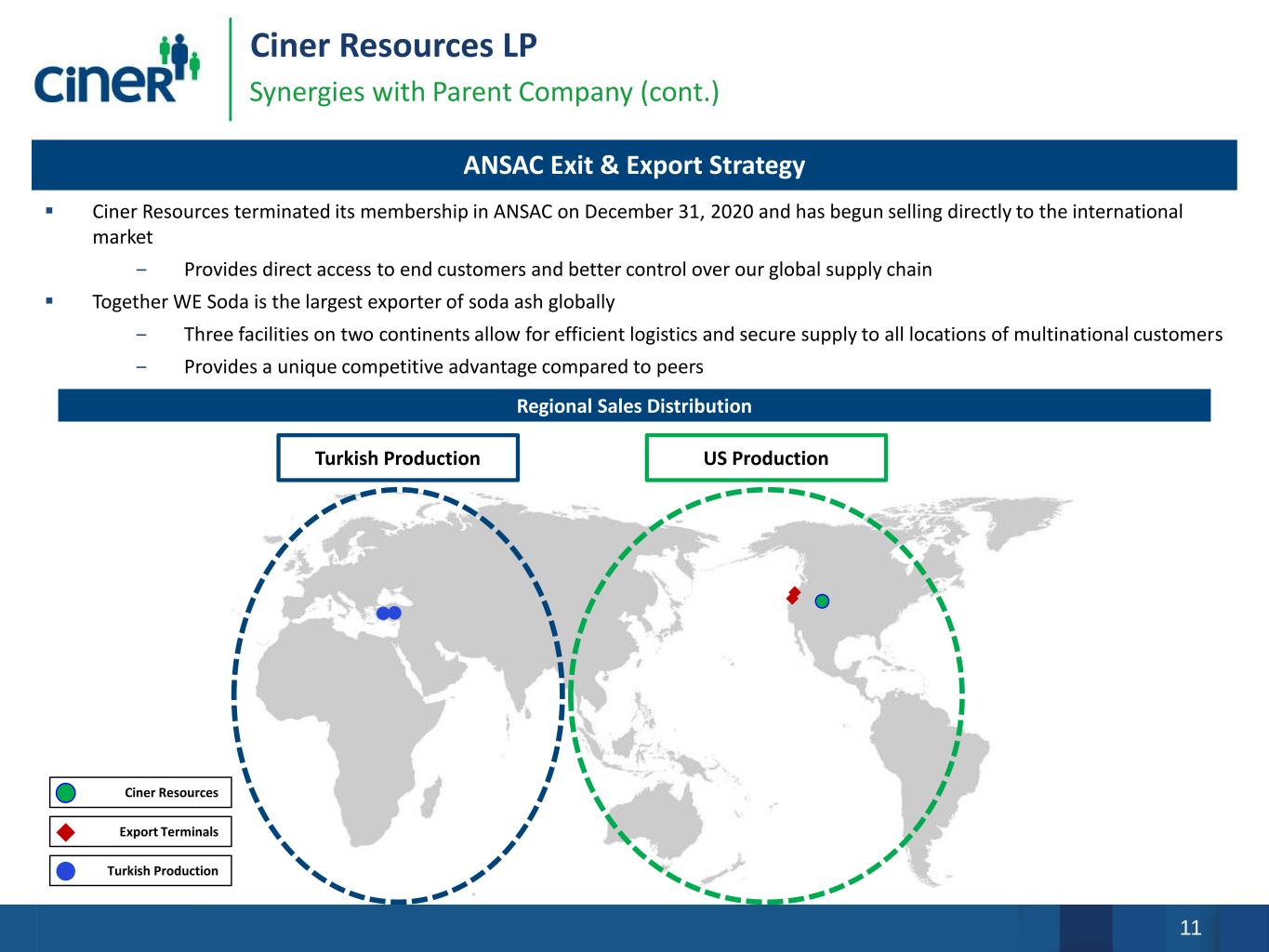

11 Ciner Resources LP Synergies with Parent Company (cont.) ANSAC Exit & Export Strategy ▪ Ciner Resources terminated its membership in ANSAC on December 31, 2020 and has begun selling directly to the international market ‒ Provides direct access to end customers and better control over our global supply chain ▪ Together WE Soda is the largest exporter of soda ash globally ‒ Three facilities on two continents allow for efficient logistics and secure supply to all locations of multinational customers ‒ Provides a unique competitive advantage compared to peers Turkish Production Export Terminals Ciner Resources Turkish Production US Production Regional Sales Distribution

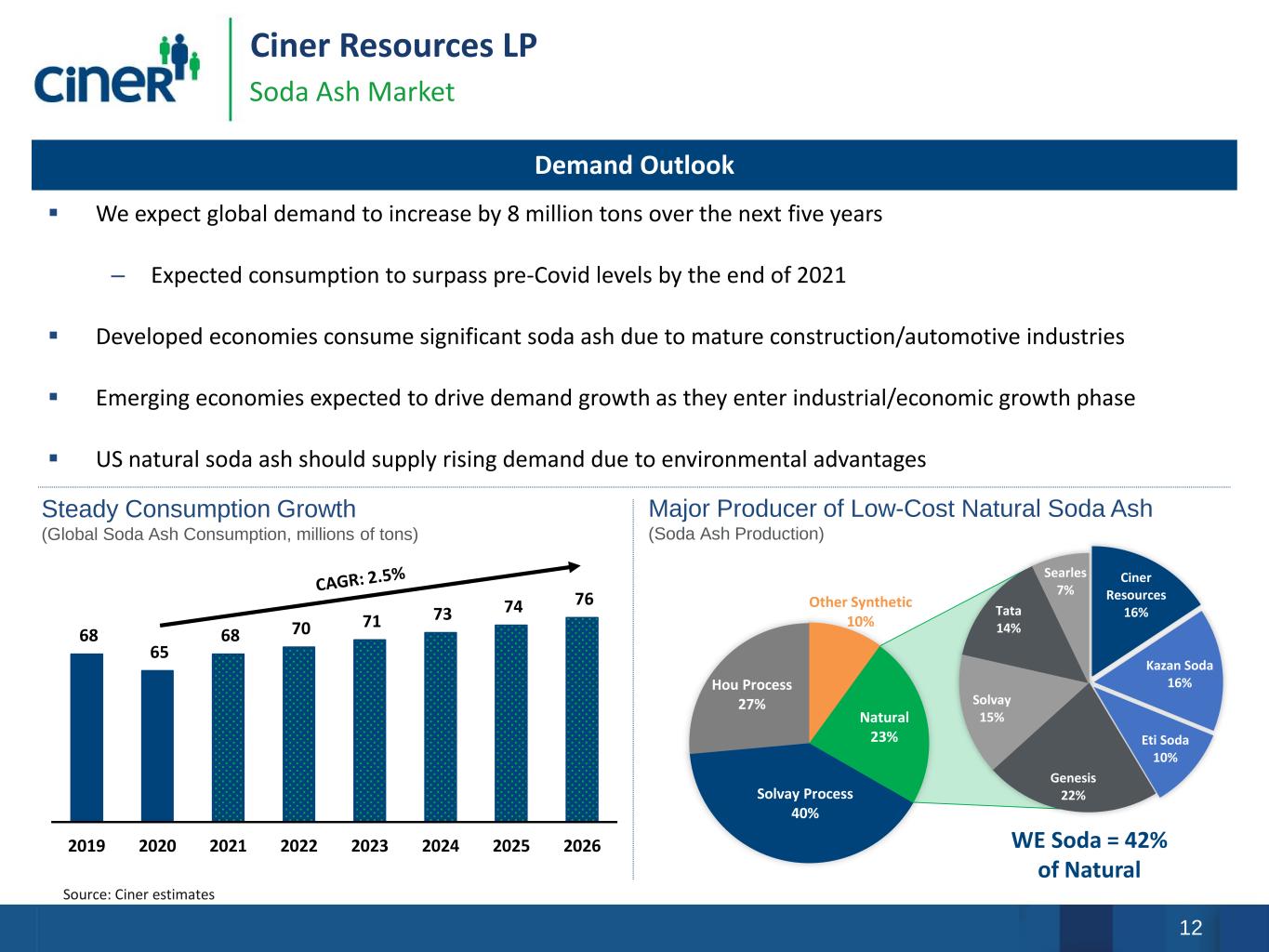

12 68 65 68 70 71 73 74 76 2019 2020 2021 2022 2023 2024 2025 2026 Ciner Resources LP Soda Ash Market Steady Consumption Growth (Global Soda Ash Consumption, millions of tons) Source: Ciner estimates Major Producer of Low-Cost Natural Soda Ash (Soda Ash Production) Other Synthetic 10% Natural 23% Solvay Process 40% Hou Process 27% WE Soda = 42% of Natural Ciner Resources 16% Kazan Soda 16% Eti Soda 10% Genesis 22% Solvay 15% Tata 14% Searles 7% ▪ We expect global demand to increase by 8 million tons over the next five years – Expected consumption to surpass pre-Covid levels by the end of 2021 ▪ Developed economies consume significant soda ash due to mature construction/automotive industries ▪ Emerging economies expected to drive demand growth as they enter industrial/economic growth phase ▪ US natural soda ash should supply rising demand due to environmental advantages Demand Outlook

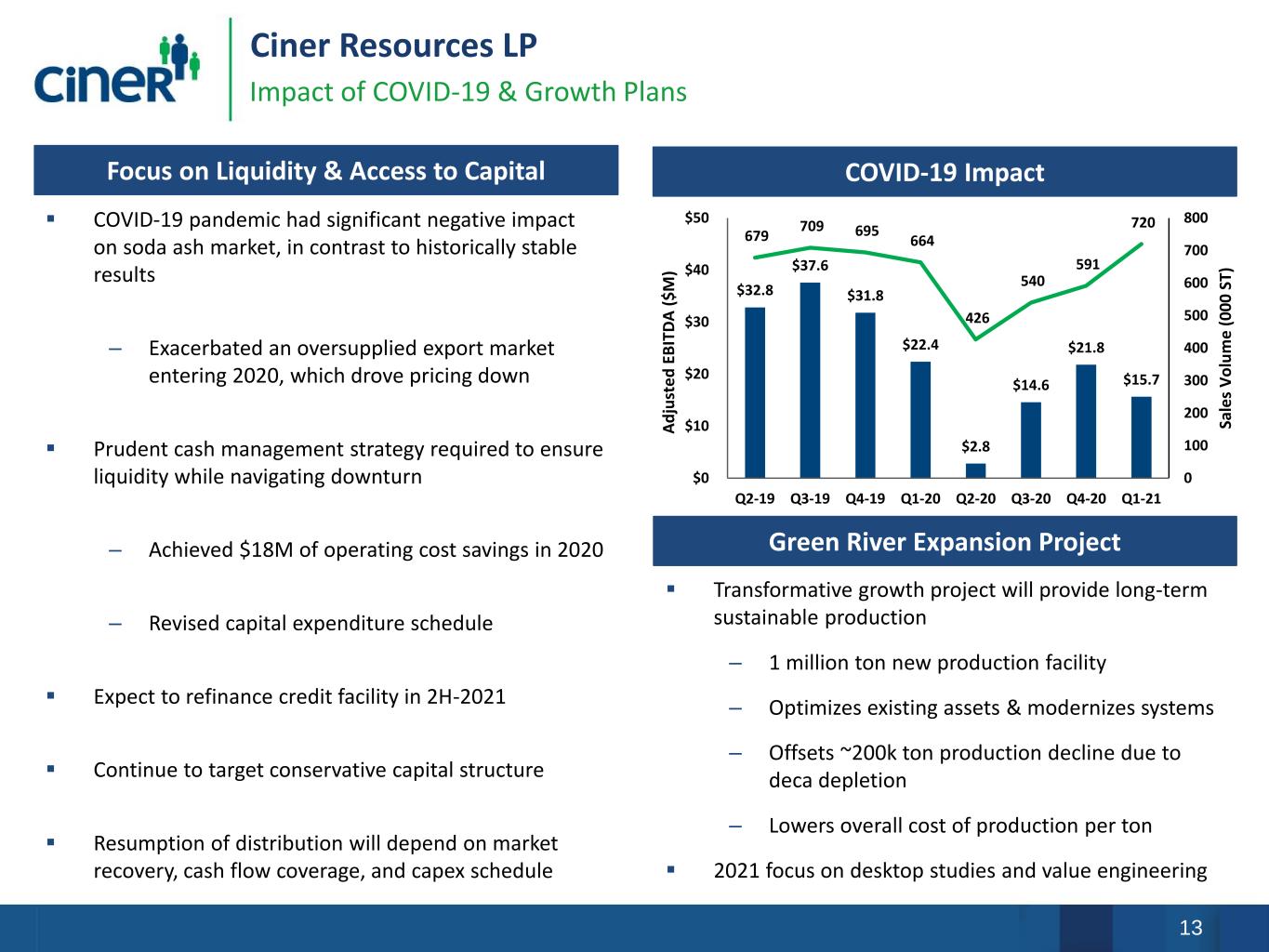

13 $32.8 $37.6 $31.8 $22.4 $2.8 $14.6 $21.8 $15.7 679 709 695 664 426 540 591 720 0 100 200 300 400 500 600 700 800 $0 $10 $20 $30 $40 $50 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 S a le s V o lu m e ( 0 0 0 S T ) A d ju st e d E B IT D A ( $ M ) Ciner Resources LP Impact of COVID-19 & Growth Plans ▪ COVID-19 pandemic had significant negative impact on soda ash market, in contrast to historically stable results – Exacerbated an oversupplied export market entering 2020, which drove pricing down ▪ Prudent cash management strategy required to ensure liquidity while navigating downturn – Achieved $18M of operating cost savings in 2020 – Revised capital expenditure schedule ▪ Expect to refinance credit facility in 2H-2021 ▪ Continue to target conservative capital structure ▪ Resumption of distribution will depend on market recovery, cash flow coverage, and capex schedule COVID-19 Impact Green River Expansion Project Focus on Liquidity & Access to Capital ▪ Transformative growth project will provide long-term sustainable production – 1 million ton new production facility – Optimizes existing assets & modernizes systems – Offsets ~200k ton production decline due to deca depletion – Lowers overall cost of production per ton ▪ 2021 focus on desktop studies and value engineering

14 Ciner Resources LP Investment Highlights ▪ Strong safety record and low environmental footprint ▪ Operational advantages, including strategic opportunities with WE Soda to leverage supply chain advantages ▪ Global marketing capability in coordination with WE Soda ▪ Balance sheet flexibility to support advantageous growth projects available for execution ▪ Longstanding customer base with low turnover ▪ Most efficient producer in Green River ▪ Low cost, environmentally friendly production process utilizing naturally occurring resource ▪ Significant mining reserve life ▪ Proven management and operational team Investment Highlights

Appendix

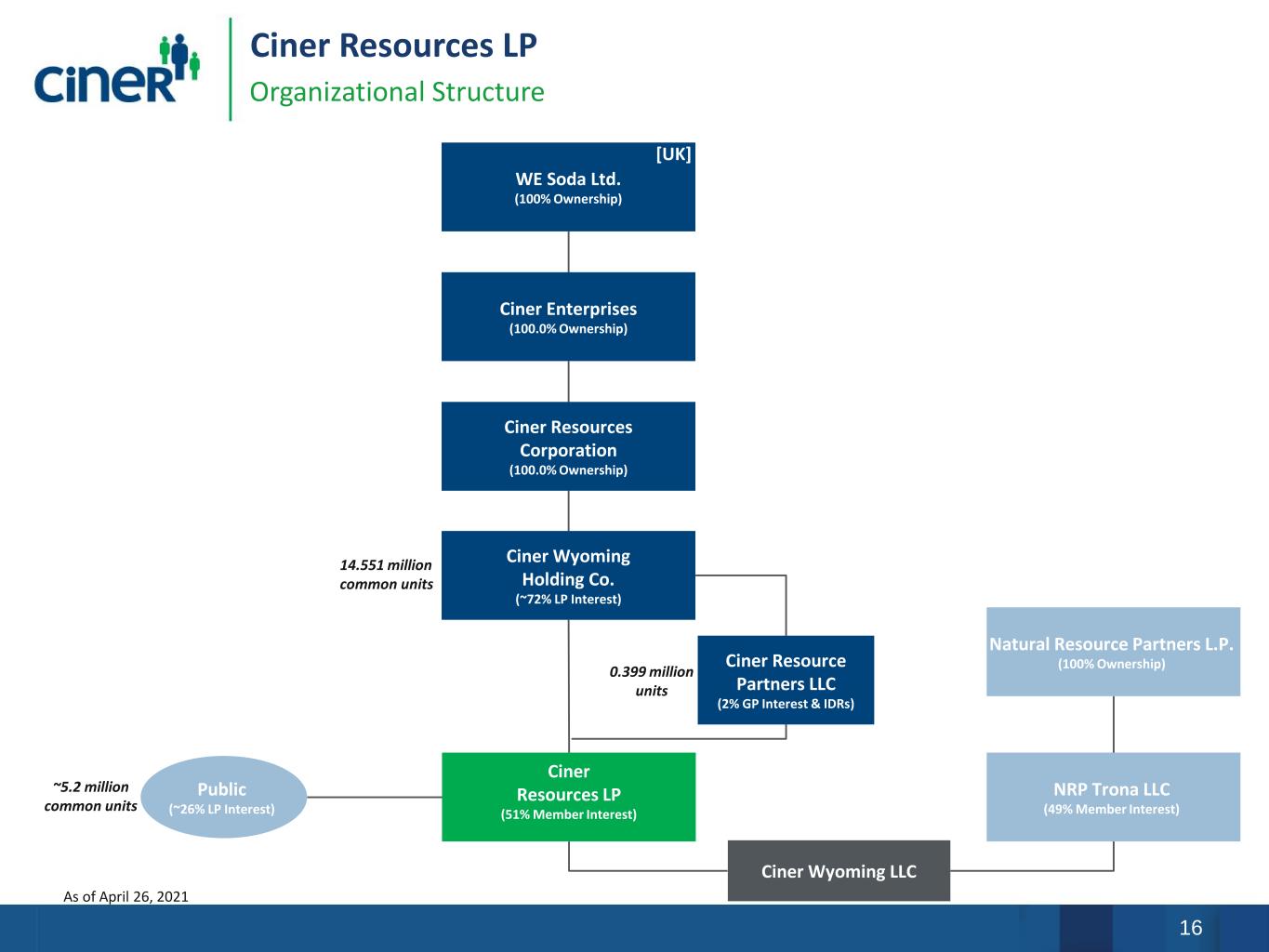

16 Ciner Resources LP Organizational Structure Ciner Resource Partners LLC (2% GP Interest & IDRs) Public (~26% LP Interest) Ciner Resources Corporation (100.0% Ownership) Ciner Wyoming Holding Co. (~72% LP Interest) Ciner Wyoming LLC Natural Resource Partners L.P. (100% Ownership) 0.399 million units ~5.2 million common units 14.551 million common units Ciner Resources LP (51% Member Interest) NRP Trona LLC (49% Member Interest) Ciner Enterprises (100.0% Ownership) WE Soda Ltd. (100% Ownership) [UK] As of April 26, 2021

17 104.4 120.5 133.9 116.5 120.1 136.5 135.4 61.6 2013 2014 2015 2016 2017 2018 2019 2020 2.50 2.55 2.66 2.74 2.71 2.61 2.76 2.22 2013 2014 2015 2016 2017 2018 2019 2020 Ciner Resources LP Stable Operating and Financial Results Soda Ash Volume Sold (millions of ST) Ciner Resources Adjusted EBITDA ($ in millions)

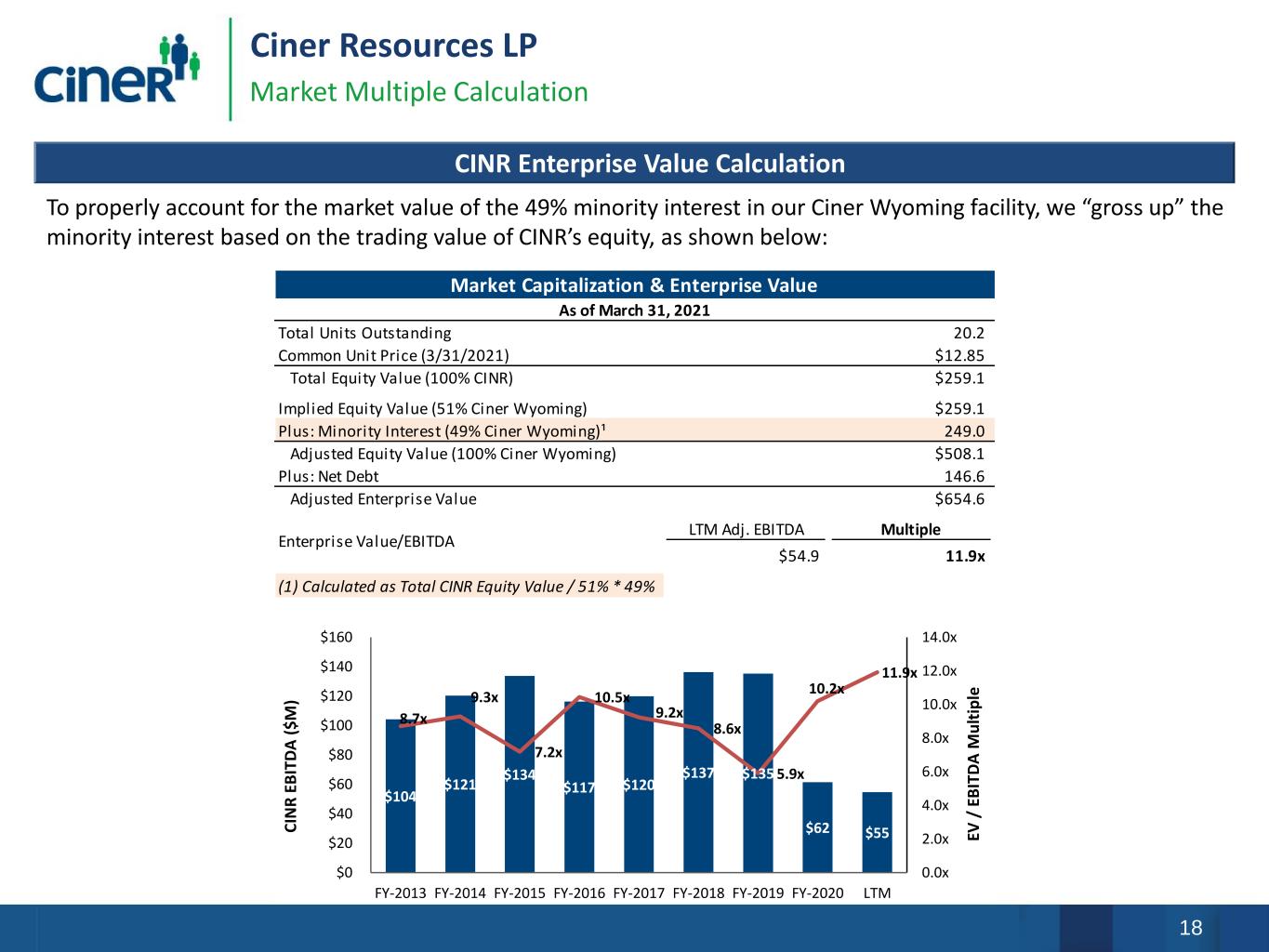

18 Ciner Resources LP Market Multiple Calculation To properly account for the market value of the 49% minority interest in our Ciner Wyoming facility, we “gross up” the minority interest based on the trading value of CINR’s equity, as shown below: CINR Enterprise Value Calculation $104 $121 $134 $117 $120 $137 $135 $62 $55 8.7x 9.3x 7.2x 10.5x 9.2x 8.6x 5.9x 10.2x 11.9x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x $0 $20 $40 $60 $80 $100 $120 $140 $160 FY-2013 FY-2014 FY-2015 FY-2016 FY-2017 FY-2018 FY-2019 FY-2020 LTM E V / E B IT D A M u lt ip le C IN R E B IT D A ( $ M ) Market Capitalization & Enterprise Value As of March 31, 2021 Total Units Outstanding 20.2 Common Unit Price (3/31/2021) $12.85 Total Equity Value (100% CINR) $259.1 Implied Equity Value (51% Ciner Wyoming) $259.1 Plus: Minority Interest (49% Ciner Wyoming)¹ 249.0 Adjusted Equity Value (100% Ciner Wyoming) $508.1 Plus: Net Debt 146.6 Adjusted Enterprise Value $654.6 LTM Adj. EBITDA Multiple $54.9 11.9x (1) Calculated as Total CINR Equity Value / 51% * 49% Enterprise Value/EBITDA

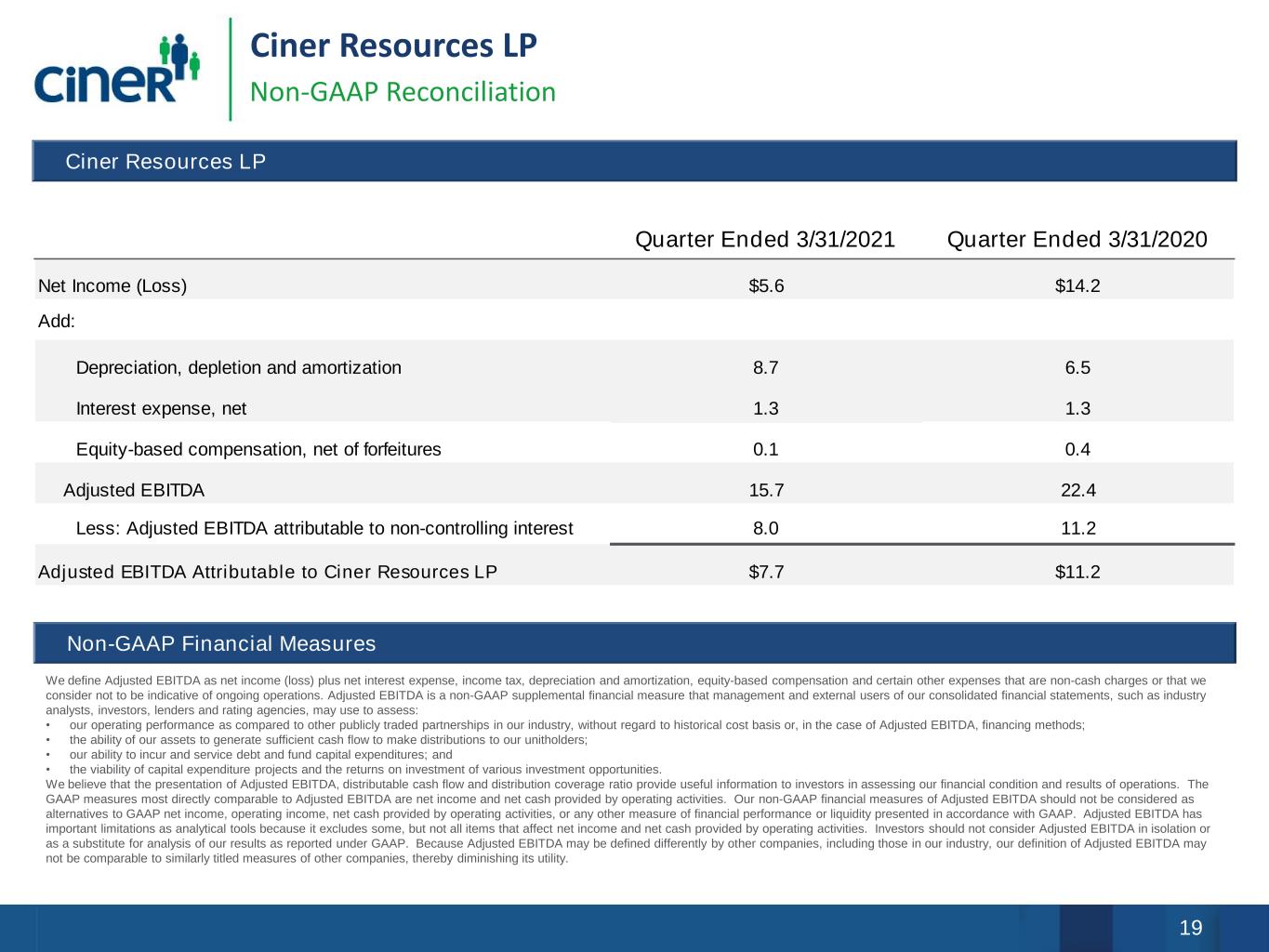

19 Ciner Resources LP Non-GAAP Reconciliation Ciner Resources LP We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax, depreciation and amortization, equity-based compensation and certain other expenses that are non-cash charges or that we consider not to be indicative of ongoing operations. Adjusted EBITDA is a non-GAAP supplemental financial measure that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess: • our operating performance as compared to other publicly traded partnerships in our industry, without regard to historical cost basis or, in the case of Adjusted EBITDA, financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; • our ability to incur and service debt and fund capital expenditures; and • the viability of capital expenditure projects and the returns on investment of various investment opportunities. We believe that the presentation of Adjusted EBITDA, distributable cash flow and distribution coverage ratio provide useful information to investors in assessing our financial condition and results of operations. The GAAP measures most directly comparable to Adjusted EBITDA are net income and net cash provided by operating activities. Our non-GAAP financial measures of Adjusted EBITDA should not be considered as alternatives to GAAP net income, operating income, net cash provided by operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDA has important limitations as analytical tools because it excludes some, but not all items that affect net income and net cash provided by operating activities. Investors should not consider Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies, including those in our industry, our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Non-GAAP Financial Measures Quarter Ended 3/31/2021 Quarter Ended 3/31/2020 Net Income (Loss) $5.6 $14.2 Add: Depreciation, depletion and amortization 8.7 6.5 Interest expense, net 1.3 1.3 Equity-based compensation, net of forfeitures 0.1 0.4 Adjusted EBITDA 15.7 22.4 Less: Adjusted EBITDA attributable to non-controlling interest 8.0 11.2 Adjusted EBITDA Attributable to Ciner Resources LP $7.7 $11.2

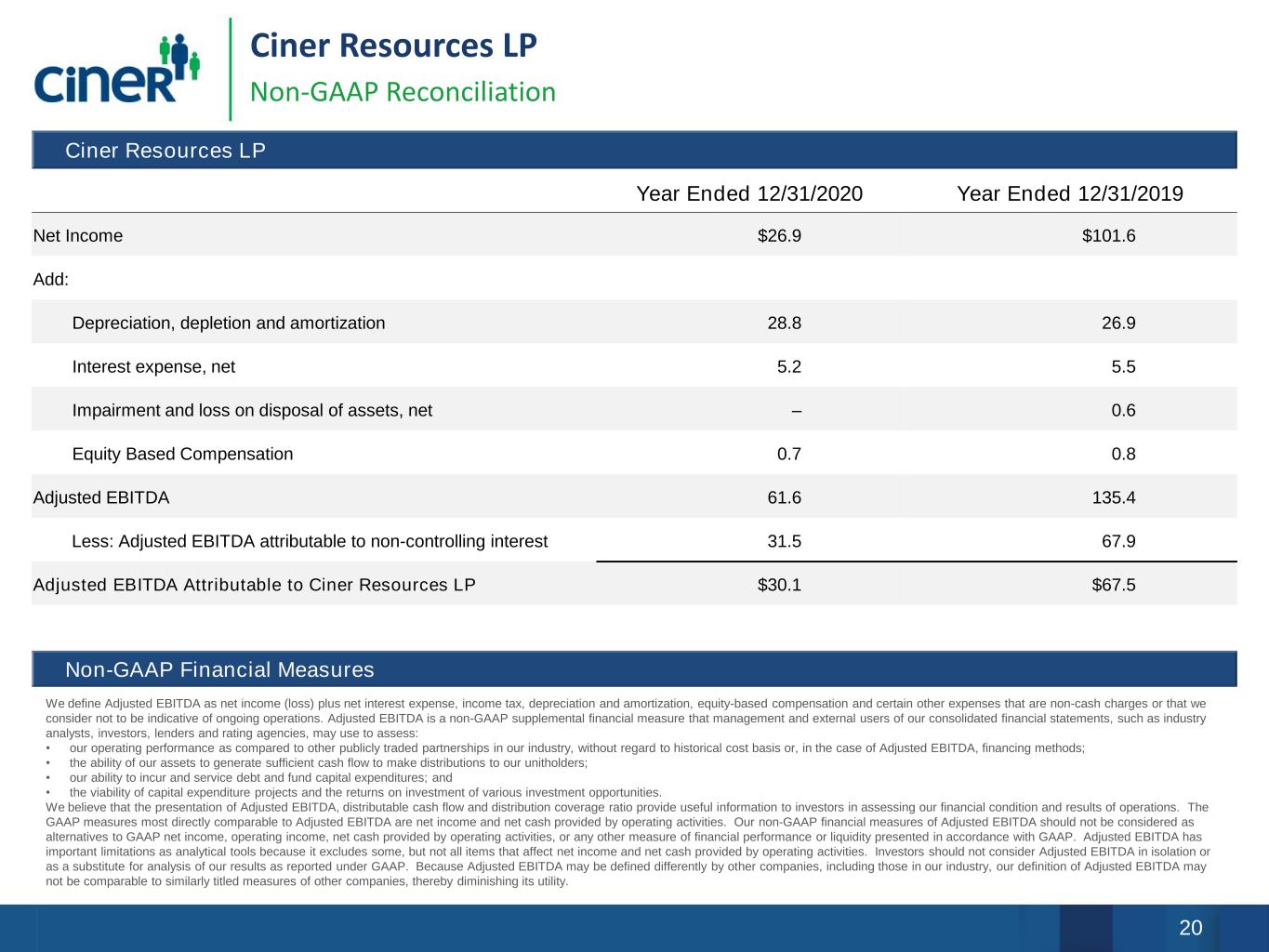

20 Ciner Resources LP Non-GAAP Reconciliation Ciner Resources LP Year Ended 12/31/2020 Year Ended 12/31/2019 Net Income $26.9 $101.6 Add: Depreciation, depletion and amortization 28.8 26.9 Interest expense, net 5.2 5.5 Impairment and loss on disposal of assets, net ‒ 0.6 Equity Based Compensation 0.7 0.8 Adjusted EBITDA 61.6 135.4 Less: Adjusted EBITDA attributable to non-controlling interest 31.5 67.9 Adjusted EBITDA Attributable to Ciner Resources LP $30.1 $67.5 Non-GAAP Financial Measures We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax, depreciation and amortization, equity-based compensation and certain other expenses that are non-cash charges or that we consider not to be indicative of ongoing operations. Adjusted EBITDA is a non-GAAP supplemental financial measure that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess: • our operating performance as compared to other publicly traded partnerships in our industry, without regard to historical cost basis or, in the case of Adjusted EBITDA, financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; • our ability to incur and service debt and fund capital expenditures; and • the viability of capital expenditure projects and the returns on investment of various investment opportunities. We believe that the presentation of Adjusted EBITDA, distributable cash flow and distribution coverage ratio provide useful information to investors in assessing our financial condition and results of operations. The GAAP measures most directly comparable to Adjusted EBITDA are net income and net cash provided by operating activities. Our non-GAAP financial measures of Adjusted EBITDA should not be considered as alternatives to GAAP net income, operating income, net cash provided by operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDA has important limitations as analytical tools because it excludes some, but not all items that affect net income and net cash provided by operating activities. Investors should not consider Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies, including those in our industry, our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

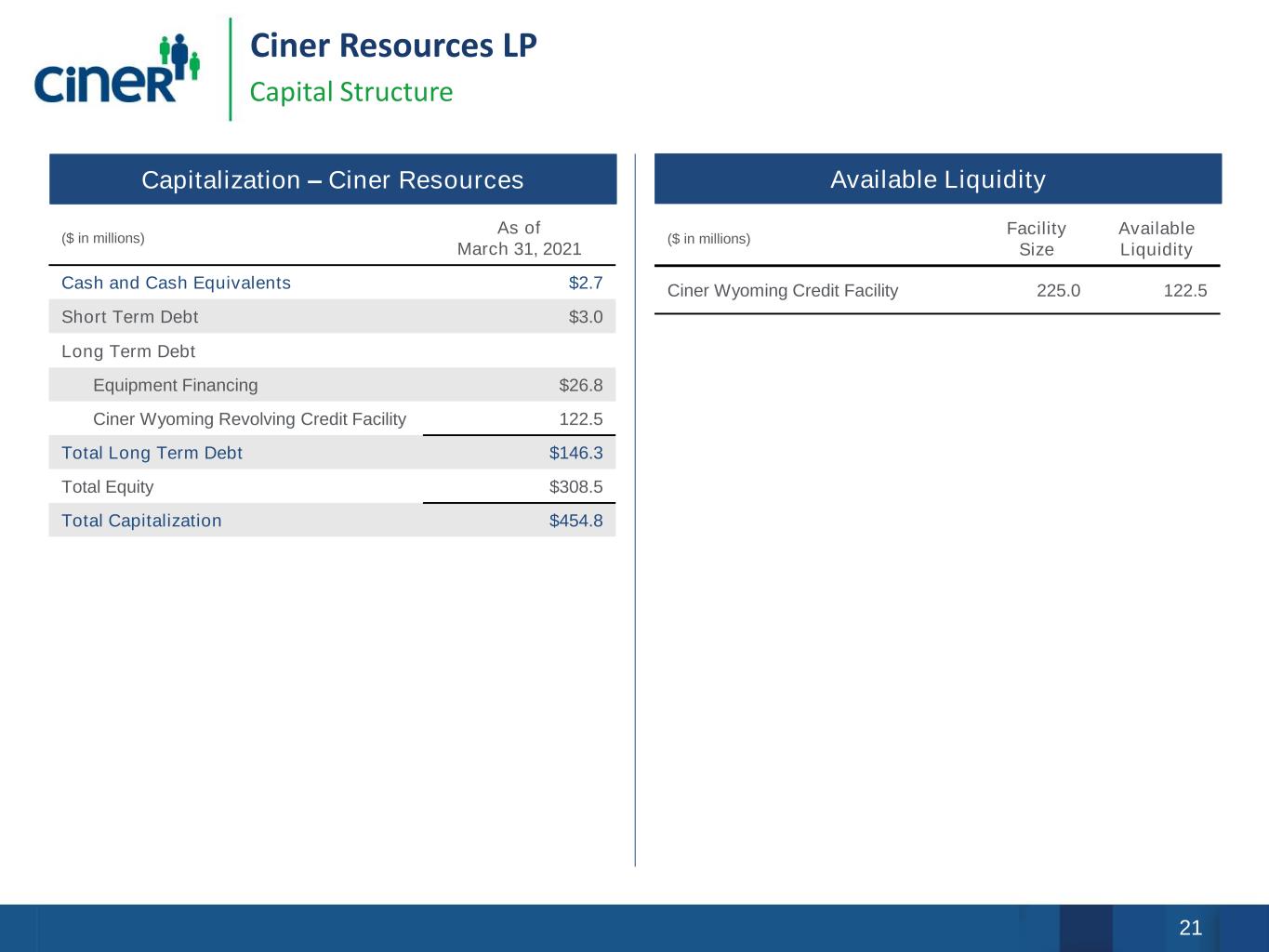

21 Ciner Resources LP Capital Structure ($ in millions) Facility Size Available Liquidity Ciner Wyoming Credit Facility 225.0 122.5 Available LiquidityCapitalization – Ciner Resources ($ in millions) As of March 31, 2021 Cash and Cash Equivalents $2.7 Short Term Debt $3.0 Long Term Debt Equipment Financing $26.8 Ciner Wyoming Revolving Credit Facility 122.5 Total Long Term Debt $146.3 Total Equity $308.5 Total Capitalization $454.8

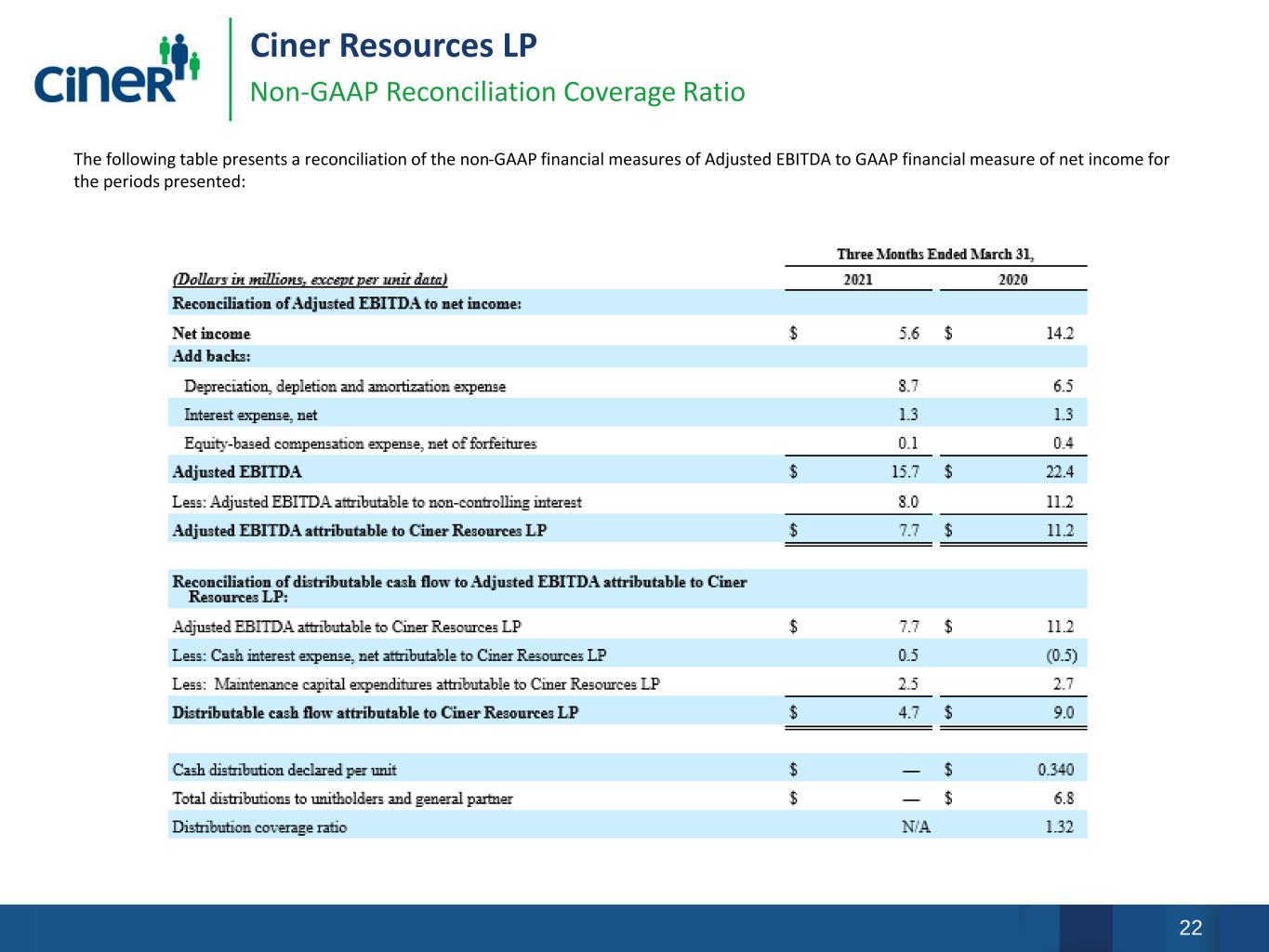

22 Ciner Resources LP Non-GAAP Reconciliation Coverage Ratio The following table presents a reconciliation of the non-GAAP financial measures of Adjusted EBITDA to GAAP financial measure of net income for the periods presented:

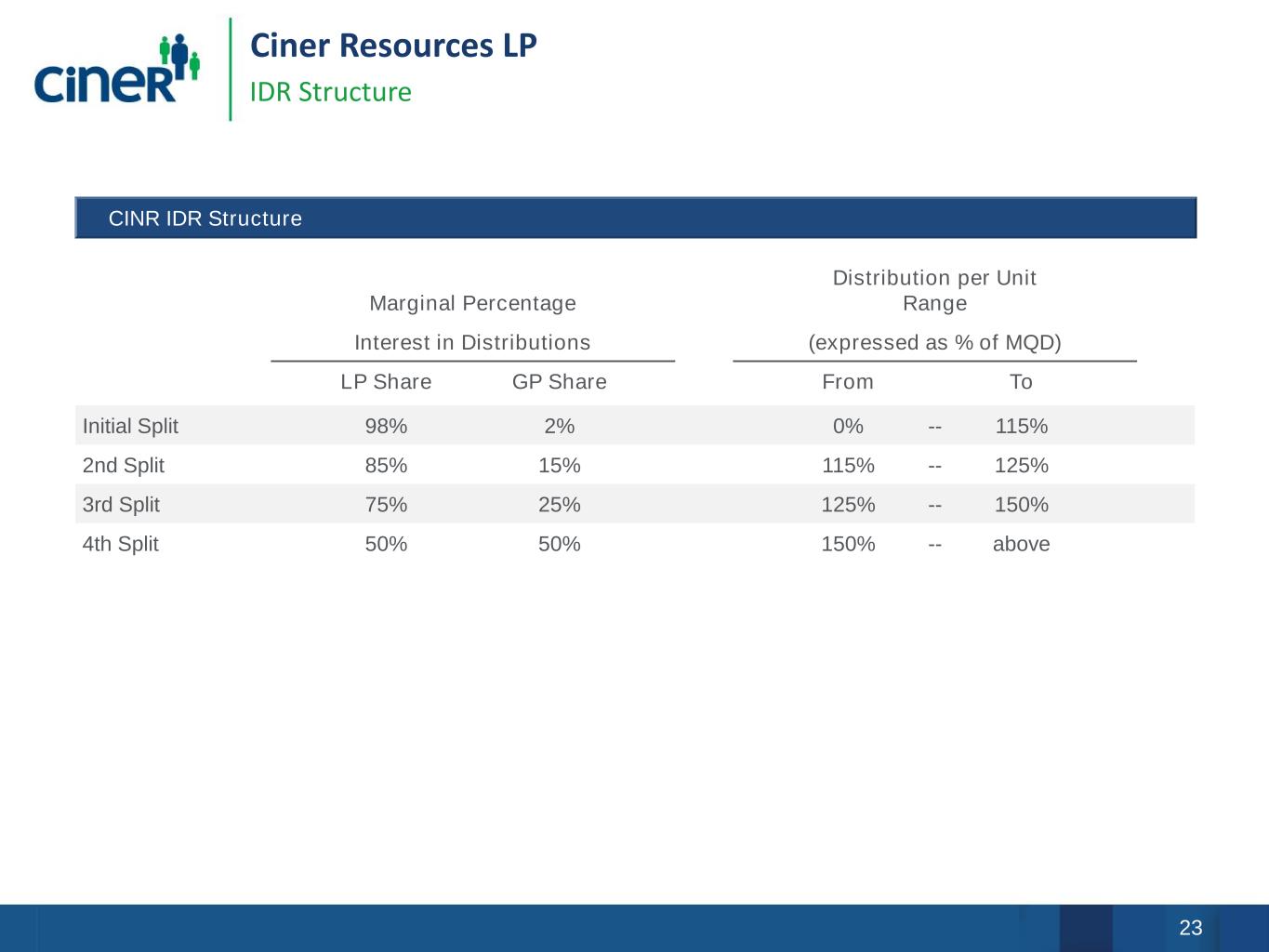

23 Ciner Resources LP IDR Structure Marginal Percentage Distribution per Unit Range Interest in Distributions (expressed as % of MQD) LP Share GP Share From To Initial Split 98% 2% 0% -- 115% 2nd Split 85% 15% 115% -- 125% 3rd Split 75% 25% 125% -- 150% 4th Split 50% 50% 150% -- above CINR IDR Structure