Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SINCLAIR BROADCAST GROUP INC | sbgi-20210621.htm |

| EX-99.2 - EX-99.2 - SINCLAIR BROADCAST GROUP INC | ex992-illustrativesuperi.htm |

| EX-99.1 - EX-99.1 - SINCLAIR BROADCAST GROUP INC | ex991-lenderandnoteholde.htm |

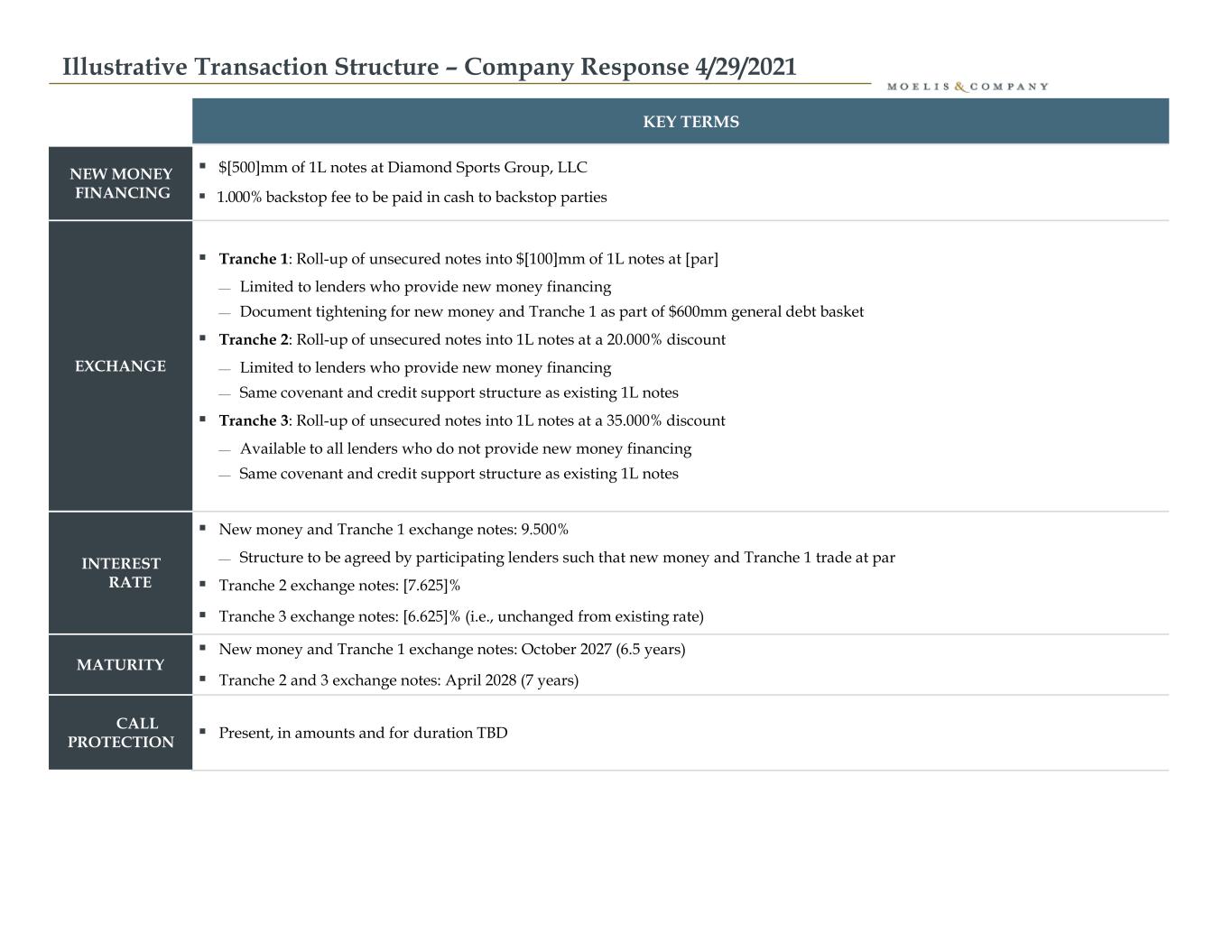

Illustrative Transaction Structure – Company Response 4/29/2021 KEY TERMS NEW MONEY FINANCING ▪ $[500]mm of 1L notes at Diamond Sports Group, LLC ▪ 1.000% backstop fee to be paid in cash to backstop parties EXCHANGE ▪ Tranche 1: Roll-up of unsecured notes into $[100]mm of 1L notes at [par] ⎯ Limited to lenders who provide new money financing ⎯ Document tightening for new money and Tranche 1 as part of $600mm general debt basket ▪ Tranche 2: Roll-up of unsecured notes into 1L notes at a 20.000% discount ⎯ Limited to lenders who provide new money financing ⎯ Same covenant and credit support structure as existing 1L notes ▪ Tranche 3: Roll-up of unsecured notes into 1L notes at a 35.000% discount ⎯ Available to all lenders who do not provide new money financing ⎯ Same covenant and credit support structure as existing 1L notes INTEREST RATE ▪ New money and Tranche 1 exchange notes: 9.500% ⎯ Structure to be agreed by participating lenders such that new money and Tranche 1 trade at par ▪ Tranche 2 exchange notes: [7.625]% ▪ Tranche 3 exchange notes: [6.625]% (i.e., unchanged from existing rate) MATURITY ▪ New money and Tranche 1 exchange notes: October 2027 (6.5 years) ▪ Tranche 2 and 3 exchange notes: April 2028 (7 years) CALL PROTECTION ▪ Present, in amounts and for duration TBD