Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Elite Performance Holding Corp | exhibit322_ex32z2.htm |

| EX-32.1 - EXHIBIT 32.1 - Elite Performance Holding Corp | exhibit321_ex32z1.htm |

| EX-31.2 - EXHIBIT 31.2 - Elite Performance Holding Corp | exhibit312_ex31z2.htm |

| EX-31.1 - EXHIIBIT 31.1 - Elite Performance Holding Corp | exhibit311_ex31z1.htm |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

|

FORM 10-K |

|

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-55987

ELITE PERFORMANCE HOLDING CORP.

(Exact name of Registrant as specified in its charter)

Nevada | 20-1801530 |

(State of incorporation) | (IRS Employer Identification Number) |

|

|

3301 NE 1st Ave Suite M704 Miami, FL

| 33137

|

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (844) 426-2958

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

N/A |

| N/A |

| N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $0.0001 par value

Indicate by checkmark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ☐ No ☒

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ☐ No ☒

Indicate by checkmark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☒ Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Act). Yes ☐ No ☒

As of June 21, 2021, the registrant had 97,276,300 shares of common stock, par value $0.0001 per share, outstanding.

Documents Incorporated By Reference: None.

2

ELITE PERFORMANCE HOLDING CORP.

TABLE OF CONTENTS

ii

3

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties, and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The COVID-19 pandemic is adversely affecting us, our customers, counterparties, employees, and third-party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity and prospects are uncertain. Continued deterioration in general business and economic conditions, including further increases in unemployment rates, or turbulence in domestic or global markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, lead to a tightening of credit, and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect us in substantial and unpredictable ways. The forward-looking statements in this Report are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A - Risk Factors” below.

In this Report, unless otherwise indicated or the context otherwise requires, “Elite”, the “Company”, “we”, “us” or “our” refer to Elite Performance Holding Corp., a Nevada corporation, and its subsidiaries.

iii

4

PART I

Item 1. Business

Company Overview

Elite Performance Holding Corporation ("EPH") was formed on January 30, 2018 (inception) and is a holding company with anticipated holdings in companies centered on innovative and proprietary nutritional and dietary fitness enhancement products, that are in the sports performance, weight loss, nutritional, functional beverage and energy markets. The team is composed of highly experienced business, marketing and sales executives in the beverage and nutritional space, who are passionate about health and nutrition.

On February 2, 2018, the Company closed on a Stock Exchange Agreement (“SEA”) with Elite Beverage International Corp. (“Elite Beverage”). Pursuant to the SEA, we purchased all of Joey Firestone and Jon McKenzie’s 100,000,000 common shares and 10,000,000 preferred shares in Elite Beverage, which gave the Company ownership of all of its assets and liabilities in exchange for 50,000,000 common shares and 10,000,000 preferred shares of the Company. Following the SEA, Elite Beverage is a 100% wholly owned subsidiary of Elite Performance Holding Corp.

Elite Beverage was formed on November 29, 2017 (inception) and is currently producing a first of its kind functional sports beverage. BYLT® (Beyond Your Limit Training) sports drink is the first to combine the benefits of hydration, muscle repair, fat oxidation, and recovery all-in-one great tasting beverage. Whether you are looking to achieve optimal performance on the baseball field, basketball court, soccer field, in the gym or any competitive sport, BYLT® provides the competitive edge every athlete actively seeks. This unique product is designed with scientifically dosed key ingredients to bridge the gap between the current sports drinks filled with sugars that have serve no function, hydration beverages and dietary supplements, without the crash from sugars and jitters from caffeine which eventually leads to a decrease in performance for athletes. BYLT® is not only designed to enhance performance and support the intense physical demand of athletes but be safe and backed by science.

This acquisition was accounted for as an acquisition by entities under common control due to the fact that both Elite Performance Holding Corp. and Elite Beverage were commonly held by Joey Firestone and Jon McKenzie. The ownership structure of the Company did not change as a result nor did any of its officer’s change positions.

The mission of Elite Performance Holding Corp. is to aggressively seek and acquire companies with niche products that are first to market and can be exploited in the 35 billion dollar nutritional and sport beverage industries. The goal of EPH is to effectuate its unique business model through strategic branding and marketing, to aggressively scale companies to size, and operate them efficiently to maximize growth, revenue production and eventual net income. On February 2, 2018, a contribution and assignment agreement was executed by Joey Firestone and Jon McKenzie (collectively, the “Assignors”), and Elite Performance Holding Corp., a Nevada corporation (the “Assignee”). Whereas Firestone and McKenzie were the owners of 50,000,000 shares of common stock, $0.0001 par value, for a total of 100,000,000 shares of common stock (collectively, the “Shares”) of Elite Beverage International Corp., a Nevada corporation (the “Company”), which shares represented all authorized, issued and outstanding shares of the Company.

Our Products and Services

Elite Beverage offers a first to market functional beverage that redefines hydration and performance drinks using a patent pending amino/carbohydrate combination. The SmartCarb® technology blend provides a unique benefit of hydration, endurance and sustained energy without caffeine, the crash of sugars, and without artificial flavors or colors making it the ideal sports beverage for health-conscious consumers and serious athletes alike. BYLT® will introduce two flavors upon launch while planning to strategically introduce additional 6 flavors to support the launch after three to nine months of operation. These flavors will include Raspberry lemonade, Tropical Punch, Lemon Lime, Green Apple, Watermelon, Grape, Orange and Fruit Punch.

5

Competition and Market Overview

The functional beverage industry is extremely competitive and has low barriers to entry. We compete with other sports drinks. Several of which have greater experience, brand name recognition and financial resources than Elite Beverage International Inc.

Our management believes that the functional beverage industry competes in the global marketplace and therefore must be adaptable to remain competitive. Consumer spending for discretionary goods such as supplements and functional beverages are sensitive to changes in consumer confidence and ultimately consumer confidence is affected by general business considerations in the U.S. economy. Consumer discretionary spending generally declines during times of falling consumer confidence, which may affect the retail sale of our products. U.S. consumer confidence reflected these slowing conditions throughout the last few years.

We believe that a stronger economy, more spending by young professionals with an overall trend toward health and fitness will lead to future growth. Therefore, we intend to make strong efforts to maintain our brand in the industry through our focus on the innovation and design of our products as well as being able to consolidate and increase cost efficiency when possible, through potential acquisitions.

Marketing and Distribution

It is our intention to position Elite Performance Holding Corp. as a holding company for the purpose of establishing the vertical integration of like companies in the health and fitness industry in order to develop multiple revenue streams while minimizing risks through diversification. Our branded product lines are currently functional beverages and will be the centerpiece of our branding efforts. This is in line with our strategy and belief that a brand name can create an association with innovation, design and quality which helps add value to the individual products as well as facilitate the introduction of new innovative products.

Sales and Marketing

With its all-encompassing benefits and better-for-you ingredients, BYLT® is positioned to succeed in a highly lucrative market due to being first to market, its superior product offering and an ideal market opportunity. The breakdown of favorable market trends that will help fuel the initial growth and long-term success of the Company include:

üHealthy living trends and lifestyles are continuing, creating a drive for better-for-you trends, active lifestyles, and a growing demand for industry products from everyday consumers.

üThere are currently no other RTD beverages that combine the benefits of BYLT® that athletes seek out. In order to achieve optimal nutrients, an athlete must take 3-4 supplements that are often packed with unhealthy additives such as sugars and caffeine.

üSports Drinks accounted for 70% of the entire Fortified/Functional beverage industry and is expected to continue its growth during the next five years to become a $9 Billion market by 2021.

üBYLT® is also positioned in the Nutrition and Performance Drink Industry which generated a total revenue of $14.2 billion. Mintel estimates sales of the category to continue to grow reaching $18.3 billion by 2021.

üAccording to Statista, 36% of individuals in the U.S. purchase a ready to drink sports drink 1 – 2 times a week, while 15% purchase one over 10 times a week.

üThere is high potential for customer loyalty in the industry and brands that deliver on their promised functional and health benefits usually keep loyal core consumers.

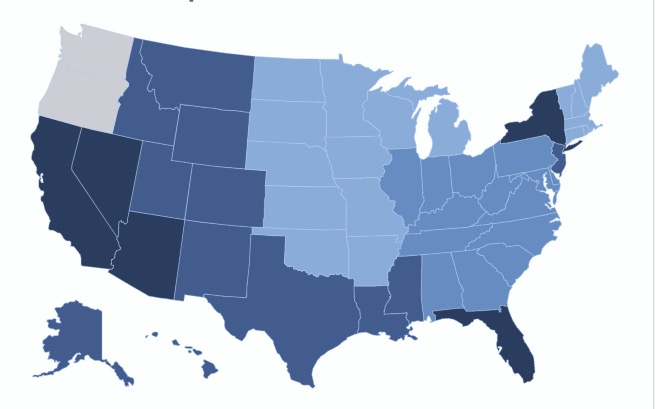

The Company has contracted GBS Growth Partners to strategically implement and execute its nationwide sales and distribution of our first to market sports drink. The key executives at GBS Growth Partners are comprised of former seasoned Coca-Cola, PepsiCo and Dr. Pepper executives that have over 120 years of combined experience in the beverage industry. Their previous clients include Coca-Cola, Bolthouse Farms, Cinnabon, Nestle Waters, Honest, Celsius, and others. The Company will launch its products in a series of region expansions, as shown in the figure below.

6

Figure 2: Map of BYLT Roll Out Strategy

As of December 31, 2019, accounts receivable, net amounted to only $0 and 0 customers represented 0% of this balance.

Sources and Availability of Raw Materials and Principal Suppliers

Most of the inventory and raw materials we purchase occurs through our manufacturers located in Dade City, FL. Our inventory supply is based on the sales and revenues of our products. Inventory supply is ultimately determined at the discretion of Mr. Firestone, and the Company’s COO, David Sandler based on his experience in the industry. Our inventories are commodities that can be incorporated into future products or can be sold on the open market. Additionally, we perform physical inventory inspections on a quarterly basis to assess upcoming styling needs and consider the current pricing in metals and stones needed for our products.

We acquire all packaging and other raw materials used for manufacturing our products on the open market. We are not constrained in our purchasing by any contracts with any suppliers and acquire raw material based upon, among other things, availability and price on the open wholesale market.

Intellectual Property

The Company presently has exclusive rights on a patent pending SmartCarb® technology (US Patent Application No. 16/785,498.) and entered into an Exclusivity Agreement between Elite Beverage International Corp. and Bruce Kneller on August 1st, 2020

Research and Development

There were $124.00 in expenses incurred for research and development in 2019.

Environmental Regulation and Compliance

The United States environmental laws do not materially impact our manufacturing as we are using state of the art facilities with equipment that complies with all relevant environmental laws. We adhere to the highest quality control standards to ensure the best possible product, meeting all of our specifications. We only use manufactures that belong to the following trade associations and organizations.

NSF – The Public Health and Safety Organization

NSF is an independent, accredited organization that tests, audits and certifies products and systems as well as provides education and risk management. We have recently received a passing grade in an NSF health food and safety audit.

cGMP – Current Good Manufacturing Practice

Good manufacturing practice guidelines provide guidance for manufacturing, testing and quality assurance in order to ensure that a dietary supplement is safe for human consumption. GMPs are enforced in the United States by the U.S. Food and Drug Administration (FDA.)

7

FDA Registered Food/Beverage Facility

The FDA is responsible for protecting and promoting public health through the regulation and supervision of food safety, tobacco products, dietary supplements, prescription and over-the-counter pharmaceutical drugs, cosmetics, and veterinary products.

Certifications

Our manufacture’s facility is certified to meet the standards by the following organizations enabling us to manufacture a variety of products including Organic and Kosher.

SQF Level III Certified

Newly acquired SQF certification, which ensures all safety and quality standards are met.

Certified HEPA Filtration

To qualify as HEPA by US government standards, an air filter must remove (from the air that passes through) 99.97% of particles that have a size of 0.3 µm or larger. All filling and blending rooms have HEPA filtration.

Government Regulation

Currently, we are subject to all of the government regulations that regulate businesses generally such as compliance with regulatory requirements of federal, state, and local agencies and authorities, including regulations concerning workplace safety, labor relations, and disadvantaged businesses. In addition, our operations are affected by federal and state laws relating to marketing practices in the functional beverage industry. We are subject to the jurisdiction of federal, various state and other taxing authorities. From time to time, these taxing authorities review or audit our business.

Where You Can Find More Information

Our website address is www.drinkbylt.com We do not intend for our website address to be an active link or to otherwise incorporate by reference the contents of the website into this Report. The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Risks Related to Our Business and Industry

WE HAVE HAD LIMITED OPERATIONS, HAVE INCURRED LOSSES SINCE INCEPTION, HAVE LIMITED CASH TO SUSTAIN OUR OPERATIONS, AND WE NEED ADDITIONAL CAPITAL TO EXECUTE OUR BUSINESS PLAN AND RECEIVED A GOING CONCERN OPINION IN PRIOR PERIODS.

The Company has suffered recurring losses. As of December 31, 2019, the Company had limited cash on hand and $518,967 in convertible debt and loans payable. At December 31, 2019, the Company also had a stockholders’ deficit of $928,567. These factors raise substantial doubt about the Company's ability to continue as a going concern. The recoverability of a major portion of the recorded asset amounts shown in the accompanying consolidated balance sheet is dependent upon continued operations of the Company, which in turn, is dependent upon the Company's ability to raise capital and/or generate positive cash flows from operations.

Management plans to achieve profitability by increasing its business through retail distribution and expanding its online ecommerce presence. There can be no assurance that the Company can raise the required capital to support operations or increase sales to achieve profitable operations. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

A DECLINE IN DISCRETIONARY CONSUMER SPENDING MAY ADVERSELY AFFECT OUR INDUSTRY, OUR OPERATIONS, AND ULTIMATELY OUR PROFITABILITY.

Consumer products, such as sports drinks, are discretionary purchases for consumers. Any reduction in consumer discretionary spending or disposable income may affect the sports beverage or functional beverage industry more significantly than other industries. Many economic factors outside of our control could affect consumer discretionary spending, including the financial markets, consumer credit availability, prevailing interest rates, energy costs, employment levels, salary levels, and tax rates. Any reduction in discretionary consumer spending could materially adversely affect our business and financial condition.

THERE IS A RISK ASSOCIATED WITH COVID-19

The Company’s operations were and may be continued to be affected by the recent and ongoing outbreak of the coronavirus disease (COVID-19) which in March 2020, was declared a pandemic by the World Health Organization. The ultimate disruption which may be caused by the outbreak is uncertain; however, it may result in a material adverse impact on the Company’s financial position, operations and cash flows. Possible areas that may be affected include, but are not limited to, disruption to the Company’s customers and revenue, labor workforce, unavailability of products and supplies used in operations, and the decline in value of assets held by the Company, including property and equipment.

8

OUR OPERATING RESULTS MAY BE ADVERSELY IMPACTED BY WORLDWIDE POLITICAL AND ECONOMIC UNCERTAINTIES AND SPECIFIC CONDITIONS IN THE MARKETS WE ADDRESS.

In the recent past, general worldwide economic conditions have experienced a downturn due to slower economic activity, concerns about inflation, increased energy costs, decreased consumer confidence, and reduced corporate profits and capital spending, and adverse business conditions. Any continuation or worsening of the current global economic and financial conditions could materially adversely affect (i) our ability to raise, or the cost of, needed capital, (ii) demand for our current and future products and (iii) our ability to commercialize products. We cannot predict the timing, strength, or duration of any economic slowdown or subsequent economic recovery, worldwide, or in the display industry.

THE LOSS OF THE SERVICES OF OUR KEY EMPLOYEES, PARTICULARLY THE SERVICES RENDERED BY OUR CHIEF EXECUTIVE OFFICER AND DIRECTOR, MR. JOEY FIRESTONE, COULD HARM OUR BUSINESS.

We believe our success will depend, to a significant extent, on the efforts and abilities of Joey Firestone, our Chief Executive Officer. If we lost Mr. Firestone, we would be forced to expend significant time and money in the pursuit of a replacement, which would result in both a delay in the implementation of our business plan and the diversion of limited working capital. We can give you no assurance that we could find a satisfactory replacement for Mr. Firestone at all, or on terms that are not unduly expensive or burdensome.

OUR FUTURE SUCCESS DEPENDS UPON, IN LARGE PART, OUR CONTINUING ABILITY TO ATTRACT AND RETAIN QUALIFIED PERSONNEL.

If we grow and implement our business plan, we will need to add managerial talent to support our business plan. There is no guarantee that we will be successful in adding such managerial talent. These professionals are regularly recruited by other companies and may choose to change companies. Given our relatively small size compared to some of our competitors, the performance of our business may be more adversely affected than our competitors would be if we lose well-performing employees and are unable to attract new ones.

BECAUSE WE INTEND TO GROW BY ACQUISITIONS AND SUCH ACTIVITY INVOLVES A NUMBER OF RISKS, OUR BUSINESS MAY SUFFER.

We may consider acquisitions of assets or other business. Any acquisition or opening of another retail store or other operations involves a number of risks that could fail to meet our expectations and adversely affect our profitability. For example:

·The acquired assets or business may not achieve expected results;

·We may incur substantial, unanticipated costs, delays or other operational or financial problems when integrating the acquired assets;

·We may not be able to retain key personnel of an acquired business;

·We may not be able to raise the required capital to expand;

·Our management’s attention may be diverted; or

·Our management may not be able to manage the acquired assets or combined entity effectively or to make acquisitions and grow our business internally at the same time.

If these problems arise, we may not realize the expected benefits of an acquisition.

BECAUSE WE DEPEND ON OUR ABILITY TO IDENTIFY AND RESPOND TO CONSUMER TRENDS, IF WE MISJUDGE THESE TRENDS, OUR ABILITY TO MAINTAIN AND GAIN MARKET SHARE WILL BE AFFECTED.

The beverage industry is subject to rapidly changing consumer trends and shifting consumer demands. Accordingly, our success may depend on the priority that our target customers place on fashion and our ability to anticipate, identify, and capitalize upon emerging consumer trends. If we misjudge consumer trends or are unable to adjust our products in a timely manner, our net sales may decline or fail to meet expectations and any excess inventory may be sold at lower prices.

OUR ABILITY TO MAINTAIN OR INCREASE OUR REVENUES COULD BE HARMED IF WE ARE UNABLE TO STRENGTHEN AND MAINTAIN OUR BRAND IMAGE.

We have limited revenues and have spent significant amounts of time and money in branding our beverage lines. We believe that primary factors in determining customer buying decisions, especially in the beverage industry, are determined by price, confidence in the merchandise and quality associated with a brand. The ability to differentiate products from competitors of the Company has been a factor in attracting consumers. However, if the Company’s ability to promote its brand fails to garner brand recognition, its ability to generate revenues may suffer. If the Company fails to differentiate its products, its ability to sell its products wholesale will be adversely affected. These factors could result in lower selling prices and sales volumes, which could adversely affect its financial condition and results of operations.

IF WE WERE TO EXPERIENCE SUBSTANTIAL DEFAULTS BY OUR CUSTOMERS ON ACCOUNTS RECEIVABLE, THIS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR LIQUIDITY AND RESULTS OF OPERATIONS.

If customers responsible for a large amount of accounts receivable were to become insolvent or otherwise unable to pay for our products, or to make payments in a timely manner, our liquidity and results of operations could be materially adversely affected. An economic or industry downturn could materially affect the ability to collect these accounts receivable, which could then result in longer payment cycles, increased collections costs and defaults in excess of management’s expectations. A significant deterioration in the ability to collect on accounts receivable could affect our cash flow and working capital position.

WE MAY NOT BE ABLE TO INCREASE SALES OR OTHERWISE SUCCESSFULLY OPERATE OUR BUSINESS, WHICH COULD HAVE A SIGNIFICANT NEGATIVE IMPACT ON OUR FINANCIAL CONDITION.

9

We believe that the key to our success will be to increase our revenues and available working capital. We may not have the resources required to promote our business and its potential benefits. If we are unable to gain market acceptance of our business, we will not be able to generate enough revenue to achieve and maintain profitability or to continue our operations.

We may not be able to increase our sales or effectively operate our business. To the extent we are unable to achieve sales growth, we may continue to incur losses. We may not be successful or make progress in the growth and operation of our business. Our current and future expense levels are based on operating plans and estimates of future sales and revenues and are subject to increase as strategies are implemented. Even if our sales grow, we may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall.

Further, if we substantially increase our operating expenses to increase sales and marketing, and such expenses are not subsequently followed by increased revenues, our operating performance and results would be adversely affected and, if sustained, could have a material adverse effect on our business. To the extent we implement cost reduction efforts to align our costs with revenue, our sales could be adversely affected.

WE MAY NEED ADDITIONAL FINANCING WHICH WE MAY NOT BE ABLE TO OBTAIN ON ACCEPTABLE TERMS. IF WE ARE UNABLE TO RAISE ADDITIONAL CAPITAL, AS NEEDED, THE FUTURE GROWTH OF OUR BUSINESS AND OPERATIONS COULD BE SEVERELY LIMITED.

A limiting factor on our growth is our limited capitalization, which could impact our ability to execute on our business plan. If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our Common Stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our business plan can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

WE MAY BE UNABLE TO MANAGE GROWTH, WHICH MAY IMPACT OUR POTENTIAL PROFITABILITY.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we will need to:

·Establish definitive business strategies, goals and objectives;

·Maintain a system of management controls; and

·Attract and retain qualified personnel, as well as, develop, train and manage management-level and other employees.

If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed, and our stock price may decline.

Risks Related to Our Common Stock

OUR COMMON STOCK IS NOT CURRENTLY QUOTED ON THE OTC MARKETS (PINK SHEETS), WHICH MAY MEANS THERE IS CURRENTLY NO STOCK PRICE QUOTE, NO TRADING IN OUR STOCK, AND NO LIQUIDITY.

We currently have no listing or trading symbol, and our common stock is not yet quoted on the Pink Sheets, an over-the-counter electronic quotation system maintained by the OTC Markets. We are seeking a market maker’s sponsorship in order to obtain a trading symbol, and then intend for our common stock to be quoted on the OTC Markets. However, even if we obtain a trading symbol, and our common stock becomes quoted on the OTC Markets, the future quotation of our shares on the Pink Sheets may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, and this illiquidity could depress the future trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

EVEN IF OUR COMMON STOCK BECOMES QUOTED ON THE OTC MARKETS, THERE IS LIMITED LIQUIDITY ON THE PINK SHEETS, WHICH ENHANCES THE VOLATILE NATURE OF OUR EQUITY.

If our common stock becomes quoted on the Pink Sheets, there will likely be few shares of our common stock initially traded, the volatility of our stock price may increase, and price movement may outpace the ability to deliver accurate quote information. Due to lower trading volumes in shares of a typical Pink Sheet’s common stock, there may be a lower likelihood that orders for shares of our common stock will be executed, and market prices may differ significantly from the price that was quoted at the time of entry of the order.

IF WE OBTAIN A TRADING SYMBOL, AND OUR COMMON STOCK IS QUOTED ON THE OTC MARKETS, OUR COMMON STOCK WILL BE CONSIDERED A “PENNY STOCK,” AND WILL BE SUBJECT TO ADDITIONAL SALE AND TRADING REGULATIONS THAT MAY MAKE IT MORE DIFFICULT TO SELL.

If we obtain a trading symbol and our common stock is quoted on the OTC Markets Pink Sheets, our common stock will be considered to be a “penny stock” since it will not qualify for one of the exemptions from the definition of “penny stock” under Section 3a of the Exchange Act. Our common stock is a “penny stock” because it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Stock Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

10

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor.

This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

OUR CURRENT CHIEF EXECUTIVE OFFICER AND DIRECTOR, MR. JOEY FIRESTONE HAS SUFFICIENT VOTING POWER TO CONTROL THE VOTE ON SUBSTANTIALLY ALL CORPORATE MATTERS.

Joey Firestone, our Chief Executive Officer and director has sufficient voting power through his ownership of 5,000,000 series A preferred with Super Voting Rights to control the vote on substantially all corporate matters. Accordingly, Mr. Firestone will be able to determine the composition of our board of directors, will retain the effective voting power to approve all matters requiring shareholder approval, will prevail in matters requiring shareholder approval, including, in particular the election and removal of directors, and will continue to have significant influence over our business. As a result of his ownership and position in the Company, Mr. Firestone is able to influence all matters requiring shareholder action, including significant corporate transactions.

EVEN IF WE OBTAIN A TRADING SYMBOL AND OUR COMMON STOCK IS QUOTED ON THE OTC MARKETS, TRADING OF OUR STOCK MAY BE RESTRICTED BY THE U.S. SECURITIES & EXCHANGE COMMISSION’S PENNY STOCK REGULATIONS, WHICH MAY LIMIT A STOCKHOLDER’S ABILITY TO BUY AND SELL OUR STOCK.

The U.S. Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the U.S. Securities and Exchange Commission, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules will discourage investor interest in and limit the marketability of our common stock.

WE CURRENTLY HAVE A LIMITED ACCOUNTING STAFF, AND IF WE FAIL TO DEVELOP OR MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROLS, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS TIMELY AND ACCURATELY OR PREVENT FRAUD, WHICH WOULD LIKELY HAVE A NEGATIVE IMPACT ON THE MARKET PRICE OF OUR COMMON UNITS.

We are subject to the public reporting requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Effective internal controls are necessary for us to provide reliable and timely financial reports, prevent fraud and to operate successfully as a publicly traded partnership.

We prepare our consolidated financial statements in accordance with accounting and principles generally accepted in the United States, but our internal accounting controls may not meet all standards applicable to companies with publicly traded securities. Our efforts to develop and maintain our internal controls may not be successful, and we may be unable to maintain effective controls over our financial processes and reporting in the future or to comply with our obligations under Section 404 of the Sarbanes-Oxley Act of 2002, which we refer to as Section 404. For example, Section 404 requires us, among other things, to annually review and report on, and our independent registered public accounting firm to attest to, the effectiveness of our internal controls over financial reporting. Based on management’s evaluation, as of December 31, 2019, our management concluded that we had several material weaknesses related to our internal controls over financial reporting (See Item 9A).

EVEN IF WE OBTAIN A TRADING SYMBOL AND OUR COMMON STOCK IS QUOTED ON THE OTC MARKETS, THE MARKET PRICE FOR OUR COMMON SHARES WILL BE PARTICULARLY VOLATILE GIVEN OUR STATUS AS A RELATIVELY UNKNOWN COMPANY WITH WHAT WILL BE A SMALL AND THINLY TRADED PUBLIC FLOAT, LIMITED OPERATING HISTORY AND LACK OF PROFITS WHICH COULD LEAD TO WIDE FLUCTUATIONS IN OUR SHARE PRICE. YOU MAY BE UNABLE TO SELL YOUR COMMON SHARES AT ALL, OR EVEN IF YOU CAN EVENTUALLY SELL YOUR SHARES, THERE

11

IS NO GUARANTEE THAT YOU CAN SELL SUCH SHARES AT OR ABOVE YOUR PURCHASE PRICE, WHICH MAY RESULT IN SUBSTANTIAL LOSSES TO YOU.

There is currently no market for our common shares, as we do not yet have a trading symbol, and our common stock is not quoted anywhere. Even if we obtain a trading symbol and our common stock is quoted on the OTC Markets Pink Sheets, the market for our common shares is expected to be characterized by significant price volatility when compared to the shares of larger, more established companies that trade on a national securities exchange and have large public floats, and we expect that our share price will continue to be more volatile than the shares of such larger, more established companies for the indefinite future. Even after our common stock is quoted, the expected volatility in our future share price is attributable to a number of factors. First, as noted above, our common shares will be, compared to the shares of such larger, more established companies, sporadically and thinly traded. As a consequence of this limited liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a larger, more established company that trades on a national securities exchange and has a large public float. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any predictions or projections as to when we will obtain a trading symbol, or when our stock will be quoted, or once quoted, what the prevailing market price for our common shares will be at any time, including as to whether our common shares will sustain their initial market prices, or as to what effect that the sale of shares or the availability of common shares for sale at any time will have on the future market price.

WE WILL INCUR INCREASED COSTS AS A RESULT OF BEING A PUBLIC COMPANY, WHICH COULD AFFECT OUR PROFITABILITY AND OPERATING RESULTS.

We voluntarily file annual, quarterly and current reports with the SEC. In addition, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the rules subsequently implemented by the SEC and the Public Company Accounting Oversight Board have imposed various requirements on public companies, including requiring changes in corporate governance practices. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities of ours more time-consuming and costly. We expect to spend between $25,000 and $50,000 in legal and accounting expenses annually to comply with our SEC reporting obligations and Sarbanes-Oxley. These costs could affect profitability and our results of operations.

WE HAVE NOT PAID DIVIDENDS IN THE PAST AND DO NOT EXPECT TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE. ANY RETURN ON INVESTMENT MAY BE LIMITED TO THE VALUE OF OUR COMMON STOCK, WHICH IS CURRENTLY ILLIQUID, AS OUR COMMON STOCK IS NOT QUOTED, AND THERE IS CURRENTLY NO MARKET FOR OUR COMMON STOCK.

No cash dividends have been paid on the Company’s common stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Company’s common stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

At the current time, the Company’s CEO, Joey Firestone, leases office space on a monthly bases for the operations, and tangible assets, other than inventory, consists of general office equipment and computers. Our expansion plans are in the preliminary stages with no formal negotiations being conducted. Most likely no expansions will take place until additional revenues can be achieved, or additional capital can be raised to help offset the costs associated with any expansion.

Item 3. Legal Proceedings.

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

12

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

a) Market Information

The Company’s common stock currently has no trading symbol, and our common stock is not quoted on the OTC Markets Pink Sheets or anywhere else.

b) Holders

As of December 31, 2019, the Company had approximately 48 shareholders of record of its issued and outstanding common stock, and all of our common stock is currently restricted, whether held in certificate form or in book entry.

c) Dividends

We have not declared or paid any dividends on our common stock and intend to retain any future earnings to fund development and growth of our business. Therefore, we do not anticipate paying dividends on our common stock for the foreseeable future. There are no restrictions on our present ability to pay dividends to stockholders of our common stock, other than those prescribed by law.

d) Securities Authorized for Issuance under Equity Compensation Plans

None. We have not yet entered into Equity Compensation Plans for our officers, directors or employees.

Recent Sales of Unregistered Securities

During the period from January 30, 2018 (Inception) through December 31, 2019, we have issued the following securities which were not registered under the Securities Act and not previously disclosed in the Company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Unless otherwise indicated, all of the share issuances described below were made in reliance on the exemption from registration provided by Section 4(2) of the Securities Act for transactions not involving a public offering:

Restricted Shares issued and to be issued

On November 9, 2018 we issued 40,000 shares of common stock at $.05 per share which were subscribed for on October 9, 2018 for $2,000. These shares are restricted, and subject to SEC Rule 144.

On December 13, 2018 we issued 400,000 shares of restricted common stock for financing fees. These shares are restricted, and subject to SEC Rule 144. We valued the shares at $.05 (price of the shares issued in the Company’s Registered Offering) due to the lack of market activity and related price.

On December 18, 2018 we issued 250,000 shares of restricted common stock per an agreement with Carter, Terry & Associates. These shares are restricted, and subject to SEC Rule 144. We valued the shares at $.05 (price of the shares issued in the Company’s Registered Offering) due to the lack of market activity and related price.

On January 17, 2019 issued 400,000 shares of common stock in consideration for the execution of a convertible note. These shares are restricted and subject to SEC Rule 144. We valued the shares at $.05 (price of the shares issued in the Company’s Registered Offering) due to the lack of market activity and related price.

On October 9, 2018 we received $2,000 for a subscription for 40,000 shares of common stock. As of December 31, 2019, these shares are unissued but were issued in 2020 and are now reflected in the Company’s current outstanding shares.

On October 22, 2018 we received $2,000 for a subscription for 40,000 shares of common stock. These shares were issued in 2019 and are reflected in the Company’s current shares outstanding.

In 2019 we issued 2,090,000 common subscription shares to accredited investors for cash in the amount of $104,500.

In 2019 we issued 3,660,000 common shares for services valued at $183,001.

As of December 31, 2019, we had 16,994,000 shares to be issued in the amount of $849,700 from stock subscriptions to accredited individuals. These shares were issued in 2020 and are now reflected in the Company’s current outstanding shares.

In 2019 we issued 900,000 of common shares for financing fees in the amount of $45,000

On June 26, 2019, First Fire elected to convert the remaining balance of $124,715 of the note dated December 10, 2018 for restricted shares at .05 cents a share thereby retiring the original note in full, and 2,494,300 shares were issued on July 3, 2019. No gain or loss was recorded on the conversion as the transaction was performed within the terms of the convertible note.

13

As of December 31, 2019, we had consulting agreements that had shares to be issued, for a total of 60,440 shares. The vesting expense for these shares was $3,022 for the nine months ended December 31, 2019. These shares were issued in 2020 and are reflected in the Company’s current outstanding shares.

Common Stock Warrants

None.

Preferred Stock

The Company has authorized a total of 35,000,000 Shares of Preferred Stock, $.0001 par value, which may be issued from time to time and bearing such rights, privileges and preferences as shall be designated by the Board of Directors. As of December 31, 2017, Elite Beverage had issued 10,000,000 Shares of Preferred Stock, designated as series A “Cumulative Preference ‘A’, for $1,000.

10,000,000 Series A preferred which carries super voting rights. Each preferred share carries 20 votes.

On February 2, 2018 Elite Performance Holding Corp., owned and controlled by Firestone and McKenzie, acquired Elite Beverage through a 1:1 preferred share exchange as follows. 10,000,000 Series A preferred shares of Elite Performance Holding Corp. in exchange for 10,000,000 Series A preferred shares of Elite Beverage International Inc.

During the year ended December 31, 2019, there were no repurchases of the Company’s common stock by the Company.

Item 6. Selected Financial Data.

The Company is a smaller reporting company as defined in Item 10 (f) of Regulation S-K and therefore is not required to provide the information under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward Looking Statements

This report and other reports filed by the Company from time to time with the SEC (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof.

When used in the filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to us or our management identify forward-looking statements. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including those set forth in the Risk Factors on page 8. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except, as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing elsewhere in this report.

General

Management’s discussion and analysis of results of operations and financial condition is intended to assist the reader in the understanding and assessment of significant changes and trends related to the results of operations and financial position of the Company together with its subsidiary. This discussion and analysis should be read in conjunction with the consolidated financial statements and accompanying financial notes, and with the Critical Accounting Policies noted below.

Plan of Operation

The Company plans to offer a first to market functional beverage that redefines hydration and performance drinks using a patent pending amino/carbohydrate combination. The SmartCarb® technology blend provides a unique benefit of hydration, endurance and sustained energy without caffeine, the crash of sugars, and without artificial flavors or colors making it the ideal sports beverage for health-conscious

14

consumers and serious athletes alike. BYLT® will introduce two flavors upon launch while planning to strategically introduce additional 6 flavors to support the launch after three to nine months of operation. These flavors will include Blue Raspberry, Tropical Punch, Lemon Lime, Watermelon, Grape, Orange and Fruit Punch.

The Company has instituted various cost saving measures to conserve cash and has worked with its creditors in an attempt to negotiate various debt terms. The Company has been also investigating various strategies to increase sales and expand its business. The Company is in negotiations with some potential partners, but, at this time, there is nothing concrete, but the Company remains positive about its prospects. However, there is no assurance that the Company will be successful in its endeavors or that it will be able to increase its business.

Our future operations are contingent upon increasing revenues and raising capital for on-going operations and expansion of our product lines. Because we have a limited operating history, you may have difficulty evaluating our business and future prospects.

The Company’s operations continue to be affected by the recent and ongoing outbreak of the coronavirus disease (COVID-19) which in March 2020, was declared a pandemic by the World Health Organization. The ultimate disruption which may be caused by the outbreak is uncertain; however, it may result in a material adverse impact on the Company’s financial position, operations and cash flows. Possible areas that may be affected include, but are not limited to, disruption to the Company’s customers and revenue, labor workforce, unavailability of products and supplies used in operations, and the decline in value of assets held by the Company, including property and equipment.

Results of Operations - For the Year Ended December 31, 2019 Compared the period beginning January 30, 2018 (Inception) to the Year Ended December 31, 2018

Sales

Net sales for year ended December 31, 2019 were $35,820 compared to $9,900 for the period January 30, 2018 (Inception) through December 31, 2018. This increase is mostly attributed to the increased marketing and advertising.

Gross Profit

Gross profit for the year ended December 31, 2019 was $(150,688) compared to $(34) for the period January 30, 2018 (Inception) through December 31, 2018 This decrease in gross profit is primarily due to more marketing and advertising expenses.

Selling, General and Administrative Expenses

Total selling, general and administrative expenses were $1,418,901 for the year ended December 31, 2019 as compared to $692,348 for the period January 30, 2018 (Inception) through December 31, 2018. This increase is attributed to increase in consulting fees and marketing to grow the brand.

Loss from Operations

As a result of the above, the Company had a loss from operations in the amount of $1,569,589 for the year ended December 31, 2019 as compared to $692,382 for the period January 30, 2018 (Inception) through December 31, 2018.

Other Expense

For the year ended December 31, 2019, the Company had other expense of $144,520 as compared to other expense of $27,607 for the period January 30, 2018 (Inception) through December 31, 2018. This increase was attributable to the increase in debt discount amortization, Financing fees and interest expenses arising from the increases in the convertible debt.

Net Loss

As a result of the above, the Company had a net loss of $1,714,109 for the year ended December 31, 2019 as compared to $719,989 for the period January 30, 2018 (Inception) through December 31, 2018.

Liquidity and Capital Resources

The following table summarizes total current assets, liabilities and working capital at December 31, 2019, compared to December 31, 2018.

| December 31, 2019 |

| December 31, 2018 |

| ||

Current Assets | $171,852 |

|

| $149,054 |

|

|

|

|

|

|

|

|

|

Current Liabilities | $1,100,419 |

|

| $673,450 |

|

|

|

|

|

|

|

|

|

Working Capital | $(928,567) |

|

| $(524,396) |

|

|

Our working capital deficit was $(928,567) at December 31, 2019 as compared to a working capital deficit of ($524,396) at December 31, 2018. This decrease is primarily attributed to higher accounts payable and accrued liabilities, convertible debt and advances from related parties.

During the year ended December 31, 2019, the Company had a net increase in cash of $16,758. The Company’s principal sources and uses of funds were as follows:

15

Cash used in operating activities. For the year ended December 31, 2019, the Company used $(1,194,067) in cash from operating activities as compared to $(504,458) in cash for the period January 30, 2018 (Inception) through December 31, 2018. This decrease was mainly attributed to increase in the net loss

Cash used in investing activities. For the year ended December 31, 2019, the Company used $-0- in investing activities as compared to cash from investing activities of $14,447 for the period January 30, 2018 (Inception) through December 31, 2018 as result of the effect of acquisition in 2018.

Cash provided financing activities. For the year ended December 31, 2019 the Company provided $1,210,825 in financing activities as compared to $490,137 in cash for financing activities for the period January 30, 2018 (Inception) through December 31, 2018. This increase is primarily the result of an increase in proceeds from convertible debt, loans payable partially and proceeds from the sale of stock offset by higher payments of loans payable.

Our indebtedness is comprised of various convertible debt and advances from a stockholder/officer intended to provide capital for the ongoing manufacturing of our beverage line, in advance of receipt of the payment from our retail distributors.

Convertible Debt

The Company enters into certain financing agreements for convertible debt. For the most part, the Company settles these obligations with the Company’s common stock. As of December 31, 2019, the Company had outstanding convertible debt in the amount of $309,030. See note – 9 in the notes to the financial statements for the terms and conversion features.

Loans Payable

The Company has loans payable related party of $209,937 and related accrued interest of $22,947, at December 31, 2019.

Satisfaction of Our Cash Obligations for the Next 12 Months

A critical component of our operating plan impacting our continued existence is to increase sales and efficiently manage the production of our beverage lines and successfully develop new lines through our Company or through possible acquisitions and/or mergers. Our ability to obtain capital through additional equity and/or debt financing, and joint venture partnerships will also be important to our expansion plans. In the event we experience any significant problems assimilating acquired assets into our operations or cannot obtain the necessary capital to pursue our strategic plan, we may have to reduce the growth of our operations. This may materially impact our ability to increase revenue and continue our growth.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates continuation of the Company as a going concern.

The Company has suffered recurring losses, and at December 31, 2019, the Company had a stockholders’ deficit of $928,567. As of December 31, 2019, the Company had only $16,884 cash on hand and $518,967 in convertible debt and loans payable on December 31, 2019. These factors raise substantial doubt about the Company's ability to continue as a going concern. The recoverability of a major portion of the recorded asset amounts shown in the accompanying consolidated balance sheet is dependent upon continued operations of the Company, which in turn, is dependent upon the Company's ability to raise capital and/or generate positive cash flows from operations.

Research and Development

Research and development costs are expensed as incurred. Research and development expenses primarily consist of salaries and benefits for research and development employees, stock-based compensation, consulting fees, lab supplies, and regulatory compliance costs. For the Year ended December 31, 2019 and the period January 30, 2018 (Inception) through December 31, 2018 we had $124 and $77,608 respectively in R&D expense.

Expected Purchase or Sale of Plant and Significant Equipment

We do not anticipate the purchase or sale of any plant or significant equipment; as such items are not required by us at this time.

Critical Accounting Policies

These financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. As of December 31, 2019, the company had an accumulated deficit of ($2,459,098). The continuation of the Company as a going concern is dependent upon the continued financial support from its management, its ability to generate profits from the Company’ s future operations, identify future investment opportunities and obtain the necessary debt or equity financing. These factors raise doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Revenue Recognition

Effective January 1, 2018, the Company adopted ASC 606 — Revenue from Contracts with Customers. Under ASC 606, the Company recognizes revenue from the commercial sales of products, licensing agreements and contracts to perform pilot studies by applying the

16

following steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied. For the comparative periods, revenue has not been adjusted and continues to be reported under ASC 605 — Revenue Recognition. Under ASC 605, revenue is recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the performance of service has been rendered to a customer or delivery has occurred; (3) the amount of fee to be paid by a customer is fixed and determinable; and (4) the collectability of the fee is reasonably assured. The Company recognizes revenues and the related costs when persuasive evidence of an arrangement exists, delivery and acceptance has occurred, or service has been rendered, the price is fixed or determinable, and collection of the resulting receivable is reasonably assured. Amounts invoiced or collected in advance of product delivery or providing services are recorded as deferred revenue. The Company accrues for warranty costs, sales returns, bad debts, and other allowances based on its historical experience. For the year ended December 31, 2019 and the period January 30, 2018 (inception) through December 31, 2018 we had $35,820 and $9,900 respectively in revenue from the sale of our products.

Income Taxes

Federal Income taxes are not currently due since we have had losses since inception. On December 22, 2017 H.R. 1, originally known as the Tax Cuts and Jobs Act, (the “Tax Act”) was enacted. Among the significant changes to the U.S. Internal Revenue Code, the Tax Act lowers the U.S. federal corporate income tax rate (“Federal Tax Rate”) from 35% to 21% effective January 1, 2018. The Company will compute its income tax expense for the period January 30, 2018 (inception) through December 31, 2019 using a Federal Tax Rate of 21%.

Income taxes are provided based upon the liability method of accounting pursuant to ASC 740-10-25 Income Taxes – Recognition. Under this approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the “more likely than not” standard required by ASC 740-10-25-5.

Deferred income tax amounts reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax reporting purposes.

As of December 31, 2019, we had a net operating loss carry-forward of approximately $(2,434,098) and a deferred tax asset of $511,161 using the statutory rate of 21%. The deferred tax asset may be recognized in future periods, not to exceed 20 years. However, due to the uncertainty of future events we have booked valuation allowance of $(511,161). FASB ASC 740 prescribes recognition threshold and measurement attributes for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FASB ASC 740 also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. At December 31, 2019 the Company had not taken any tax positions that would require disclosure under FASB ASC 740.

Stock-Based Compensation

The Company records stock-based compensation using the fair value method. Equity instruments issued to employees and the cost of the services received as consideration are accounted for in accordance with ASC 718 “Stock Compensation” and are measured and recognized based on the fair value of the equity instruments issued. All transactions with non-employees in which goods or services are the consideration received for the issuance of equity instruments are accounted for in accordance with ASC 515 “Equity-Based Payments to Non-Employees”, based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

Long Lived Assets

Periodically the Company assesses potential impairment of its long-lived assets, which include property, equipment and acquired intangible assets, in accordance with the provisions of ASC Topic 360, “Property, Plant and Equipment.” The Company recognizes impairment losses on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying values. An impairment loss would be recognized in the amount by which the recorded value of the asset exceeds the fair value of the asset, measured by the quoted market price of an asset or an estimate based on the best information available in the circumstances. There were no such losses recognized during the Years ended December 31, 2019 and the period January 30, 2018 (Inception) through December 31, 2018.

Property, Equipment and Intangible Assets

Property and equipment are carried at cost, less accumulated depreciation. Additions are capitalized and maintenance and repairs are charged to expense as incurred. Intangible assets consist of acquired web site domains and web site content and are carried at cost, less accumulated amortization. Depreciation and amortization is provided principally on the straight-line basis method over the estimated useful lives of the assets.

Recently Issued Accounting Standards

The Company is reviewing the effects of following recent updates. The Company has no expectation that any of these items will have a material effect upon the financial statements.

FASB ASU 2016-02 “Leases (Topic 842)” – In February 2016, the FASB issued ASU 2016-02, which requires lessees to recognize almost all leases on their balance sheet as a right-of-use asset and a lease liability. For income statement purposes, the FASB retained a dual model, requiring leases to be classified as either operating or finance. Classification will be based on criteria that are largely similar to those applied in current lease accounting, but without explicit bright lines. Lessor accounting is similar to the current model but has been updated to align with certain changes to the lessee model and the new revenue recognition standard. This ASU is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. We have adopted the above ASU as of December 31, 2019.

17

Off Balance Sheet Arrangements

The Company is not party to any off-balance sheet arrangements that may affect its financial position or its results of operations.

No other recently issued accounting pronouncements had or are expected to have a material impact on the Company’s condensed consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We do not hold any derivative instruments and do not engage in any hedging activities.

18

Item 8. Financial Statements and Supplementary Data.

| Pages |

Financial Statements: |

|

|

|

Report of Independent Registered Public Accounting Firm | 23 |

|

|

Consolidated Balance Sheets - December 31, 2019 and 2018 | 24 |

|

|

Consolidated Statements of Operations for the Years Ended December 31, 2019 and for the period from January 30, 2018 (Inception) to December 31, 2018 | 25 |

|

|

Consolidated Statement of Changes in Stockholders' Equity (Deficit) from January 30, 2018 (Inception) to December 31, 2019 | 26 |

|

|

Consolidated Statements of Cash Flows - Years Ended December 31, 2019 and for the period from January 30, 2018 (Inception) to December 31, 2018 | 27 |

|

|

Notes to Consolidated Financial Statements | 28 |

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

Elite Performance Holding Corp.

Opinion on the Financial Statements