Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K CURRENT REPORT - Value Exchange International, Inc. | f8k061721_8k.htm |

Questions and Answers

Income Statement

1.Could you share why there is A/R growth with a decline in Sales?

Reply: The decrease in Revenue was primarily attributable to the decrease in our revenue from systems development and integration with revenue decreasing from $6,210,065 for the three months ended March 31, 2020 to $34,077 for the three months ended March 31, 2021.

The Accounts receivable increased to $1,285,191 as of March 31, 2021 from $599,436 as of December 31, 2020, mainly due to the some Revenue systems maintenance yet to be settled by customers, which the sales occurred in first Quarter, 2021.

2.In the 4q20 filing, the company stated there was no more amortization to deduct in future quarters. However in the 1q21 filing, there was a usd90k amortization expense. With this in mind, I didn’t see an acquisition in the 1q21 filing, so am curious if this is a mistake in either the 4q20 or 1q21 filings. Could you assist to clarify?

Reply: That is the amortization of operating lease of Right-of-use assets regarding office lease under the new accounting of rule under ASC842 (and similar to IFRS 16).

Balance sheet

1.Could you share what is included in deferred income? There was a sizable jump from usd254k in 4q20 to usd815k in 1q21 and I’m trying to understand why.

Reply: Deferred income increased mainly attributed to a sales advance received and performed in first quarter 2021, but the client yet to provide us Purchase Order to issue relevant Sales Invoice due to the customer internal personnel change, which approximately to US$ 576,000.

Company Overview / Summary

1.Were there any covid related subsidies received by the company in Hong Kong, China, Malaysia or Philippines? I didn’t see any line items in the financials, but would think the company would have been eligible for assistance.

Reply: That part included in the other income, which is under the name “VAT refund”. If there are any subsidy further, we will rename it as government subsidy if the amount is substantial.

To summary, we got HK$ 422,340 subsidies from Hong Kong operation.

2.Could you share who owns the 49% interest in Vei Hunan & Shanghai Zhaonan Hengan Information Technology? Is the fellow owner a related party?

Reply:

长沙心而惟信息科技有限公司 owns 49% of Value Exchange Int’l (Hunan) Limited.

上海南岸药妆科技发展有限公司 own 49% of Shanghai Zhaonan Hengan Information Technology Co., Limited.

These companies are the third-party cooperation partners of VEII.

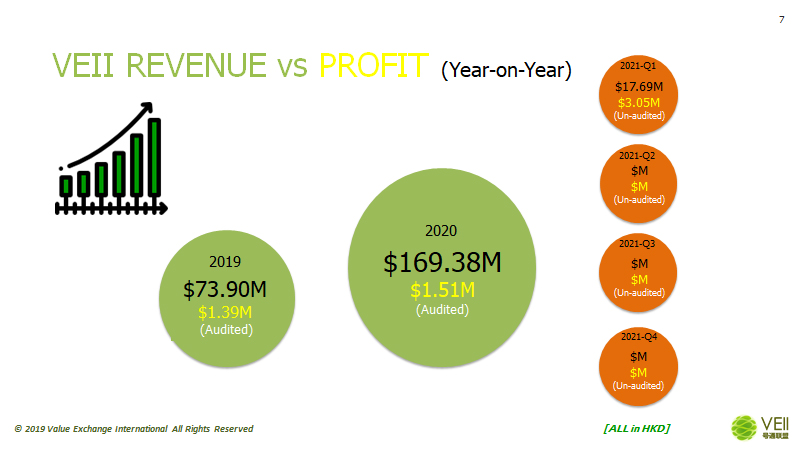

3.It looks like the revenue run rate in 1q21 has returned to levels seen in 2019. With that in mind, was the 2020 revenue an anomaly for the company?

Reply: The revenue from systems development and integration with revenue decreasing from $6,210,065 for the three months ended March 31, 2020, which is a one-off sales.