Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BRADY CORP ACQUIRES CODE CORP AND ANNOUNCES ACQUISITIONS WEBCAST - BRADY CORP | exhibit991pressrelease0617.htm |

| EX-2.1 - AGREEMENT FOR PURCHASE OF THE CODE CORPORATION - BRADY CORP | exhibit21agreementforpurch.htm |

| 8-K - 8-K - BRADY CORP | brc-20210615.htm |

June 18, 2021 Brady Corporation Q4 F’21 Acquisitions

2Forward-Looking Statements In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “continue” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: Brady’s ability to successfully integrate its recent acquisitions; adverse impacts of the novel coronavirus (“COVID-19”) pandemic or other pandemics; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; Brady’s ability to develop technologically advanced products that meet customer demands; raw material and other cost increases; difficulties in protecting our websites, networks, and systems against security breaches; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; risks associated with the loss of key employees; divestitures and contingent liabilities from divestitures; Brady’s ability to properly identify, integrate, and grow acquired companies; litigation, including product liability claims; foreign currency fluctuations; potential write-offs of Brady’s intangible assets; changes in tax legislation and tax rates; differing interests of voting and non-voting shareholders; numerous other matters of national, regional and global scale, including major public health issues and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2020 and subsequent Form 10-Q filings. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

3Introductory Comments In Q4 of F’21, we completed three acquisitions: • Magicard Limited - $59M purchase price. • Nordic ID - $13M purchase price. • Code Corp. - $173M purchase price. Strategic Rationale: • Technology-based acquisitions. • To move Brady into faster-growing end markets. Acquisition Funding: • Cash on hand and revolving line-of-credit borrowings. • Remain in a pro-forma net cash position after fully funding these acquisitions. Investments & Financial Strength Expected to Bode Well for the Future: • Each acquisition is ROI-positive on a stand-alone basis. • Acquisitions position Brady for a strong future with increased sales into end markets that we believe will have a faster organic sales growth rate.

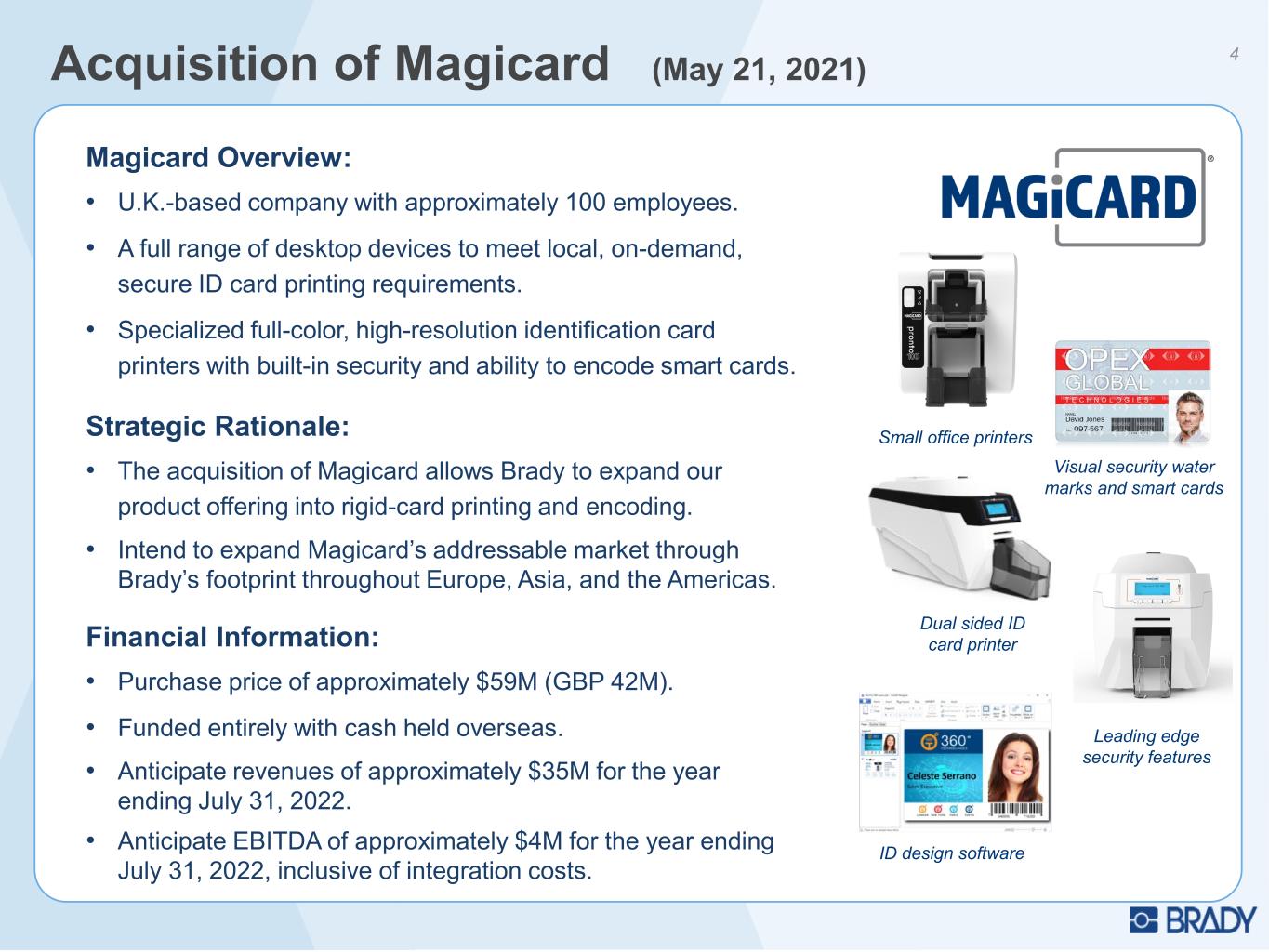

Magicard Overview: • U.K.-based company with approximately 100 employees. • A full range of desktop devices to meet local, on-demand, secure ID card printing requirements. • Specialized full-color, high-resolution identification card printers with built-in security and ability to encode smart cards. Strategic Rationale: • The acquisition of Magicard allows Brady to expand our product offering into rigid-card printing and encoding. • Intend to expand Magicard’s addressable market through Brady’s footprint throughout Europe, Asia, and the Americas. Financial Information: • Purchase price of approximately $59M (GBP 42M). • Funded entirely with cash held overseas. • Anticipate revenues of approximately $35M for the year ending July 31, 2022. • Anticipate EBITDA of approximately $4M for the year ending July 31, 2022, inclusive of integration costs. 4Acquisition of Magicard (May 21, 2021) Small office printers Visual security water marks and smart cards Dual sided ID card printer Leading edge security features ID design software

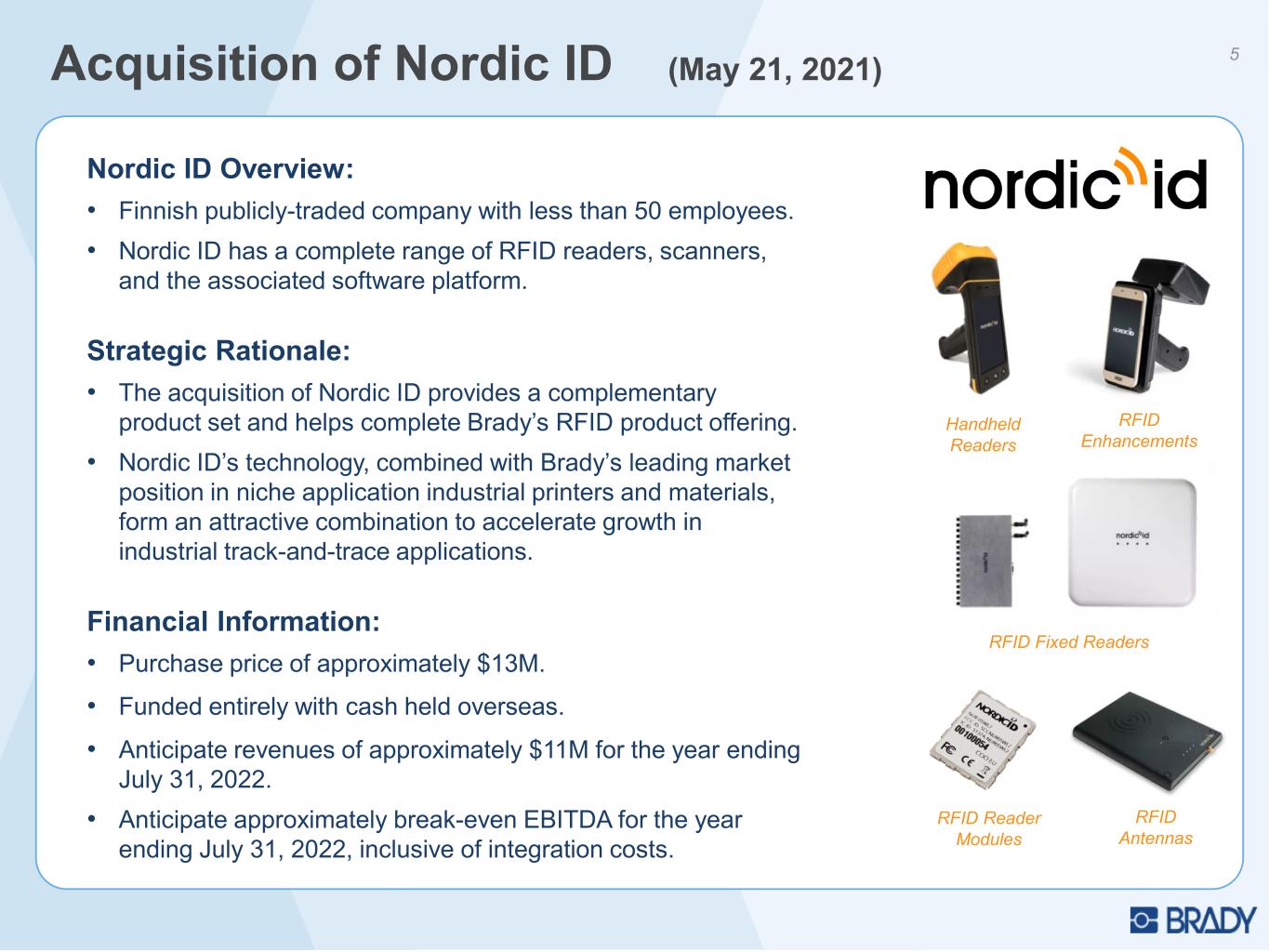

Nordic ID Overview: • Finnish publicly-traded company with less than 50 employees. • Nordic ID has a complete range of RFID readers, scanners, and the associated software platform. Strategic Rationale: • The acquisition of Nordic ID provides a complementary product set and helps complete Brady’s RFID product offering. • Nordic ID’s technology, combined with Brady’s leading market position in niche application industrial printers and materials, form an attractive combination to accelerate growth in industrial track-and-trace applications. Financial Information: • Purchase price of approximately $13M. • Funded entirely with cash held overseas. • Anticipate revenues of approximately $11M for the year ending July 31, 2022. • Anticipate approximately break-even EBITDA for the year ending July 31, 2022, inclusive of integration costs. 5Acquisition of Nordic ID (May 21, 2021) Handheld Readers RFID Fixed Readers RFID Enhancements RFID Antennas RFID Reader Modules

Code Corp. Overview: • U.S.-based company with approximately 100 employees. • Well-established brand for high-performance barcode scanners. • Strong image recognition software and a history of strong innovation with 100+ patents. • Strong presence in U.S. healthcare and expanding in industrial applications. Strategic Rationale: • Code combined with Nordic ID helps Brady become a complete solution provider in industrial track-and-trace. • Code’s technology, combined with Brady’s niche industrial printers and materials, form an attractive combination. Financial Information: • Purchase price of approximately $173M. • Funded through a combination of cash and short-term debt. • Anticipate revenues of approximately $50M for the year ending July 31, 2022. • Anticipate EBITDA of approximately $10M in for the year ending July 31, 2022, inclusive of integration costs. 6Acquisition of Code Corp Barcode technology scanning Handheld and hands-free barcode scanners

7Brady’s Track & Trace Solutions RFID Readers Barcode Readers Label ExpertiseAutomation Benchtop Mobile Historical Brady Portfolio Nordic ID & Code

8Financial Overview The combined financials of the acquisitions completed in Q4 F’21 are as follows: Overall: • All acquisitions are in the IDS segment. • Acquisitions funded with cash on hand as well as borrowings on our revolving line of credit (interest rate below 1%). Fiscal Year Ending July 31, 2022: • Anticipated annual revenues (summation of 3 acquisitions) = $96M. • Anticipated annual EBITDA, inclusive of integration-related costs = $14M (14.6% of sales). • Anticipated gross profit margins slightly above Brady’s historical gross profit margins. • Capital expenditure characteristics consistent with Brady’s. Q4 of F’21 (fiscal year ending July 31, 2021): • Anticipate Q4 F’21 revenues of approximately $11M. • Excluding the non-recurring purchase accounting-related charges, we expect the acquisitions to have a minimal impact on earnings in Q4 of F’21.

9Summary We are Shifting our Portfolio to Faster-Growing Applications & End Markets: • Magicard increases our presence in Access Control. • Code & Nordic ID fill gaps in our track-and-trace product offering. • Once integrated, we will increase our presence in faster-growing end markets. We are Investing in Future Growth: • Organically investing in innovation, sales-generating activities, and geographic expansion. • Investing in technology-based acquisitions. Investments & Financial Strength Expected to Bode Well for the Future: • Investments to drive organic sales growth, recent acquisitions and a strong balance sheet (net cash position) set the stage for strong future revenue and earnings growth.

10Investor Relations Brady Contact: Ann Thornton 414-438-6887 Ann_Thornton@Bradycorp.com See our website at www.bradycorp.com/investors