Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 IDEAS INVESTOR CONFERENCE TRANSCRIPT - MEREDITH CORP | ideasinvestorconferencescr.htm |

| 8-K - FORM 8-K IDEAS INVESTOR CONFERENCE - MEREDITH CORP | mdp-20210616.htm |

Investor Update June 2021 Exhibit 99.2

2 Disclaimers CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This presentation contains certain forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting Meredith Corporation (“Meredith” or “the Company“) and its operations. Statements in this presentation that are forward-looking include, but are not limited to, statements related to the proposed merger (the “Merger”), the spin-off (the “Spin-off”) and Meredith’s future financial strength, including its leverage ratio, following the spin-off, and the timing of the transaction. Forward- looking statements can be identified by words such as may, should, expects, provides, anticipates, assumes, can, will, meets, could, likely, intends, might, predicts, seeks, would, believes, estimates, plans, continues, guidance or outlook, or variations of these words or similar expressions. Actual results may differ materially from those currently anticipated. Factors that could cause actual results to differ materially from those projected in the forward-looking statements include the following: market conditions; the impact of the COVID-19 pandemic; the parties’ ability to consummate the Merger and Spin-off; the conditions to the completion of the transactions, including the receipt of approval of Meredith’s shareholders; the regulatory approvals required for the Merger not being obtained on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transactions; potential inability to retain key employees; Meredith’s ability to operate the National Media Group successfully as a standalone business; the ability to obtain financing on the expected terms; changes in interest rates; the consequences of acquisitions and/or dispositions; and Meredith’s ability to comply with the terms of its debt financing; and market conditions. Additional information concerning these and other risk factors can be found in Meredith’s and Gray Television Inc.’s (“Gray” or “Parent”) filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Such risk factors may be amplified by the COVID-19 pandemic and its potential impact on the Company’s business and the global economy. Meredith, the new public company to be spun off and retains the Meredith Corporation name (“SpinCo”), and Gray assume no obligation to update or revise publicly the information in this communication, whether as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. RATIONALE FOR USE AND ACCESS TO NON-GAAP RESULTS Meredith uses and presents GAAP and non-GAAP results to evaluate and communicate its performance. Non-GAAP measures should not be construed as alternatives to GAAP measures. Adjusted EBITDA and net debt are common supplemental measure of performance used by investors and financial analysts. Adjusted EBITDA is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation, amortization, and special items. These special items have been removed as they have been deemed to be non-operational in nature. Net debt is defined as carrying value of total long-term debt less cash and cash equivalents. Net debt provides additional insight to the Company's financial position. Reconciliations of GAAP to non-GAAP measures are attached to this presentation and available at www.Meredith.com.

3 Disclaimers ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication is not a solicitation of a proxy from any shareholder of the Company. In connection with the Merger and Spin-Off, the Company intends to file relevant materials with the Securities and Exchange Commission (“SEC”), including a proxy statement. In addition, SpinCo intends to file a registration statement on Form 10 with respect to its common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SPINCO, PARENT, THE MERGER AND THE SPIN-OFF. The proxy statement and Form 10, and other relevant materials (when they become available), and any other documents filed by the Company, SpinCo and Parent with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. The documents filed by the Company may also be obtained for free from the Company’s Investor Relations web site (http://ir.meredith.com) or by directing a request to the Company’s Shareholder/Financial Analyst contact, Mike Lovell, Executive Director of Corporate Communications, at 515-284-3622. PARTICIPANTS IN THE SOLICITATION The Company and Parent and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the security holders of the Company in connection with the Merger and Spin-Off. Information about Parent’s directors and executive officers is available in Parent’s definitive proxy statement, dated March 25, 2021, for its 2021 annual meeting of shareholders. Information about the Company’s directors and executive officers is available in the Company’s definitive proxy statement, dated September 25, 2020, for its 2020 annual meeting of shareholders. Other information regarding the participants and description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and Form 10 registration statement regarding the Merger and Spin-Off that the Company and SpinCo will file with the SEC when it becomes available.

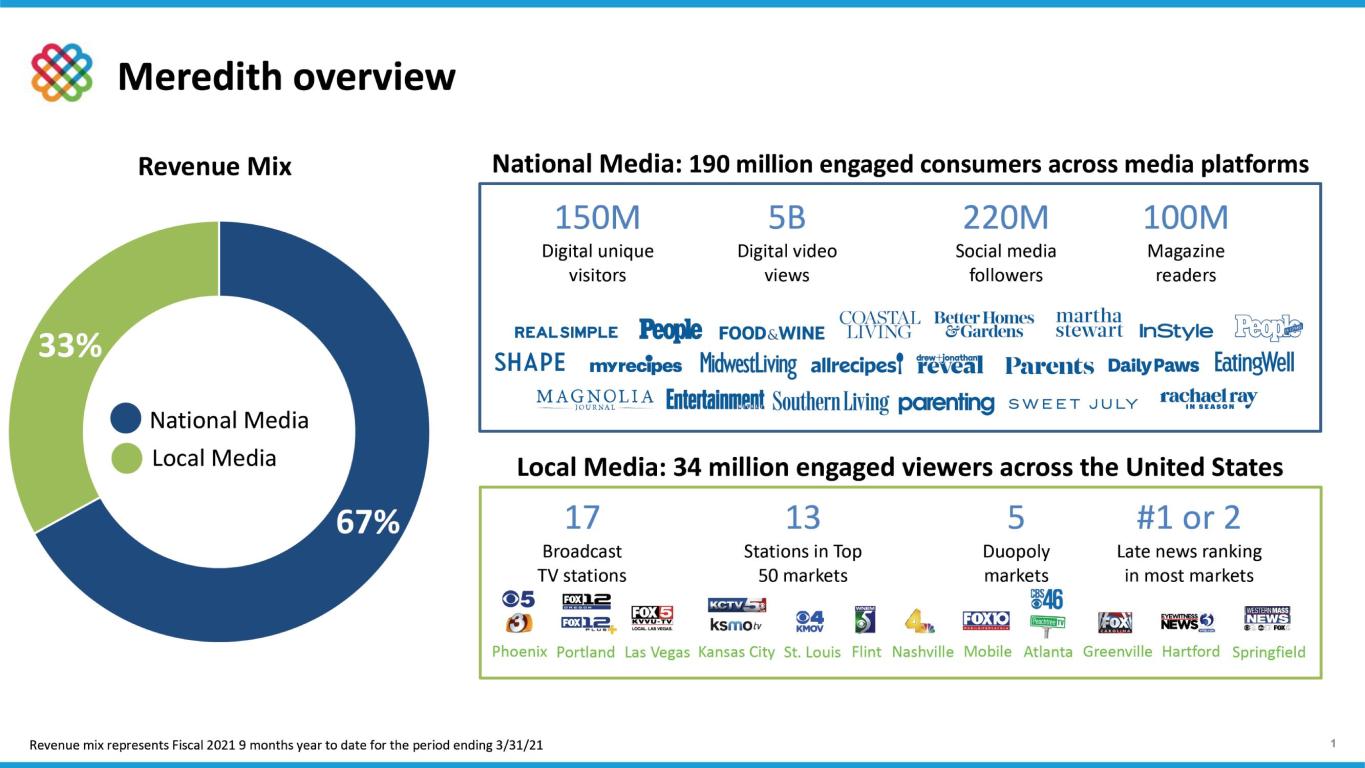

67% 33% Meredith overview National Media Local Media Revenue Mix Local Media: 34 million engaged viewers across the United States National Media: 190 million engaged consumers across media platforms 150M Digital unique visitors 100M Magazine readers 220M Social media followers 5B Digital video views 17 Broadcast TV stations 13 Stations in Top 50 markets 5 Duopoly markets #1 or 2 Late news ranking in most markets Phoenix Portland Las Vegas Kansas City St. Louis Flint Nashville Mobile Atlanta Greenville Hartford Springfield Revenue mix represents Fiscal 2021 9 months year to date for the period ending 3/31/21 4

What you’ll hear today 5 Post-transaction Meredith poised for growth and capital returns 1 2 3 4 5 Delivering results via audience scale, iconic brands and strong platforms Unlocking shareholder value through strategic Local Media Group sale Strategically evolving NMG to fast-growing digital ad & consumer revenues Optimizing legacy media businesses for profitability & cash flow

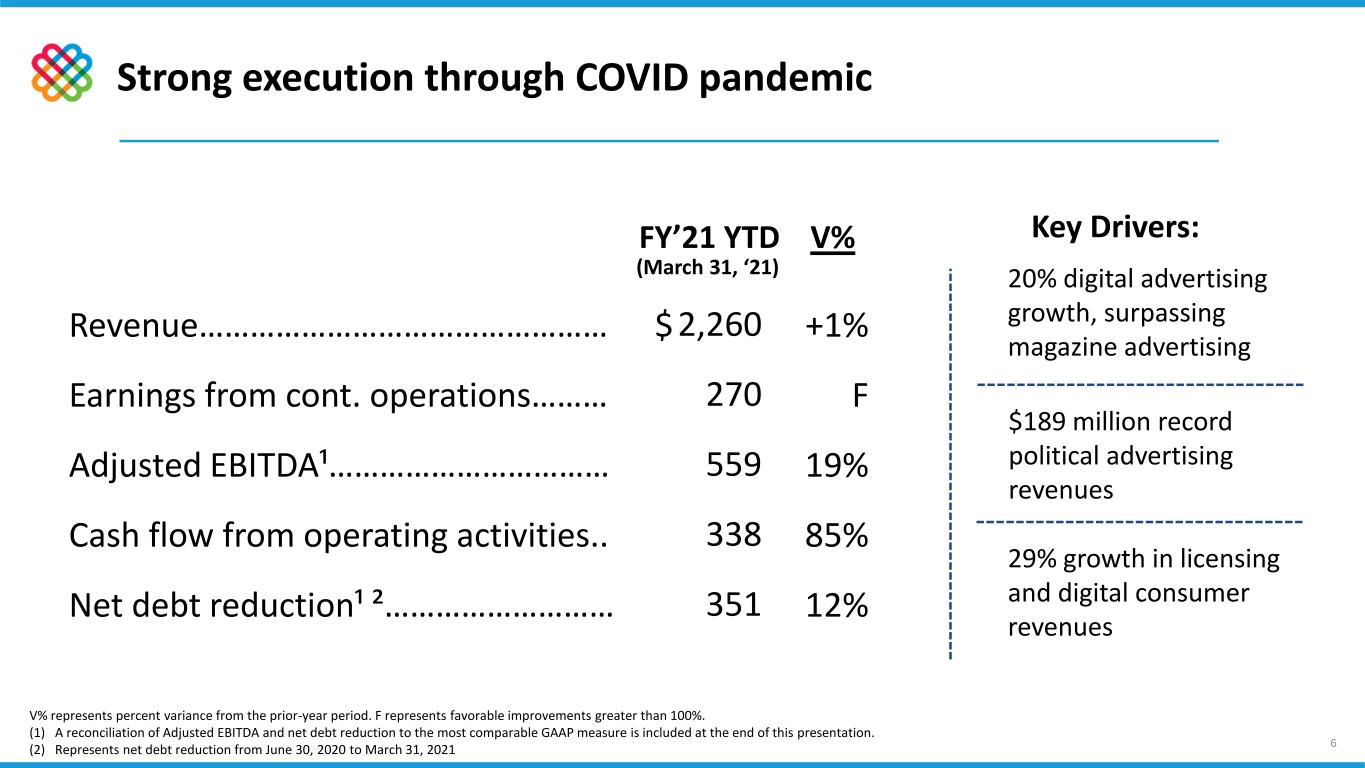

6 Strong execution through COVID pandemic 20% digital advertising growth, surpassing magazine advertising V% represents percent variance from the prior-year period. F represents favorable improvements greater than 100%. (1) A reconciliation of Adjusted EBITDA and net debt reduction to the most comparable GAAP measure is included at the end of this presentation. (2) Represents net debt reduction from June 30, 2020 to March 31, 2021 Key Drivers: 29% growth in licensing and digital consumer revenues $189 million record political advertising revenues Revenue………………………………………… Earnings from cont. operations……… Adjusted EBITDA¹…………………………… Cash flow from operating activities.. Net debt reduction¹ ²……………………… 2,260 270 559 338 351 $ +1% F 19% 85% 12% FY’21 YTD V% (March 31, ‘21)

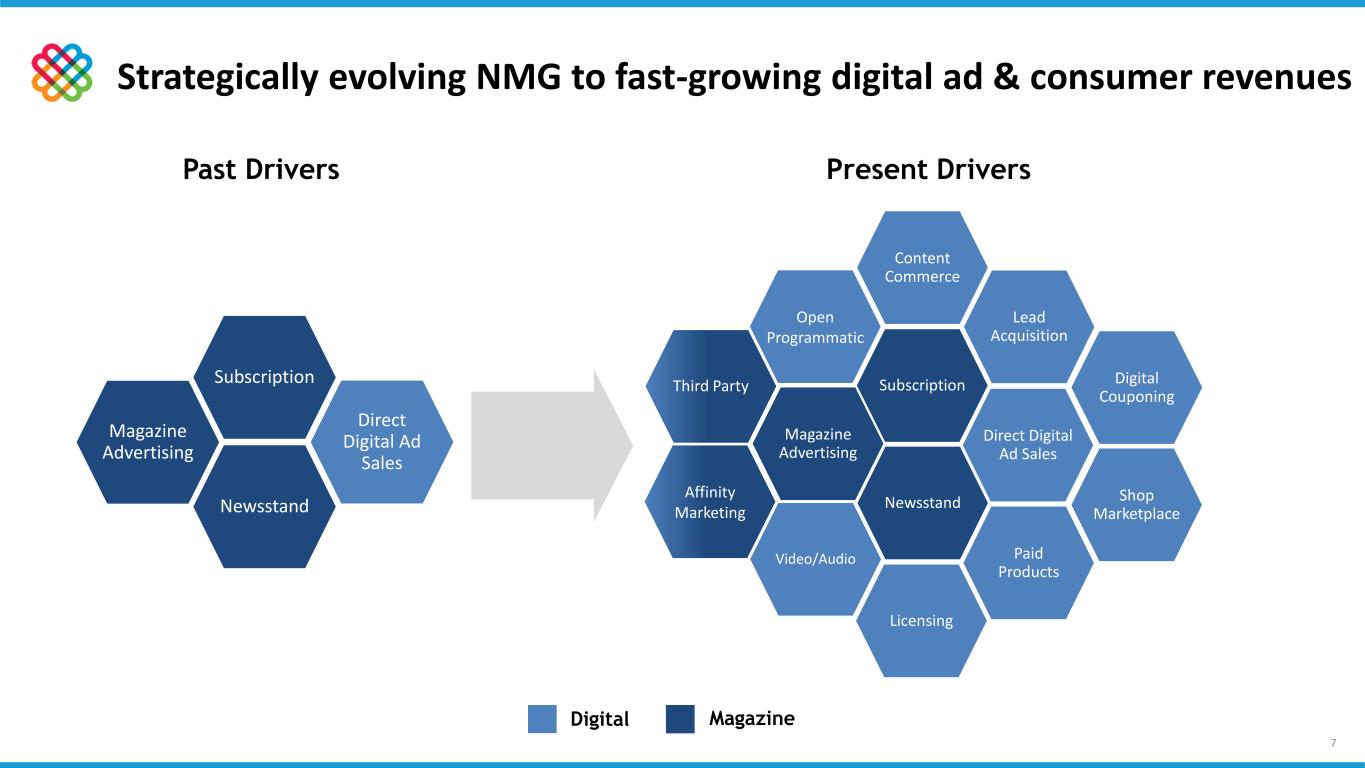

Strategically evolving NMG to fast-growing digital ad & consumer revenues Present Drivers Newsstand Subscription Direct Digital Ad Sales Affinity Marketing Video/Audio Newsstand Subscription Direct Digital Ad Sales Licensing Third Party Open Programmatic Content Commerce Digital Couponing Lead Acquisition Paid Products Shop Marketplace Past Drivers Magazine Advertising Magazine Advertising 7 Digital Magazine

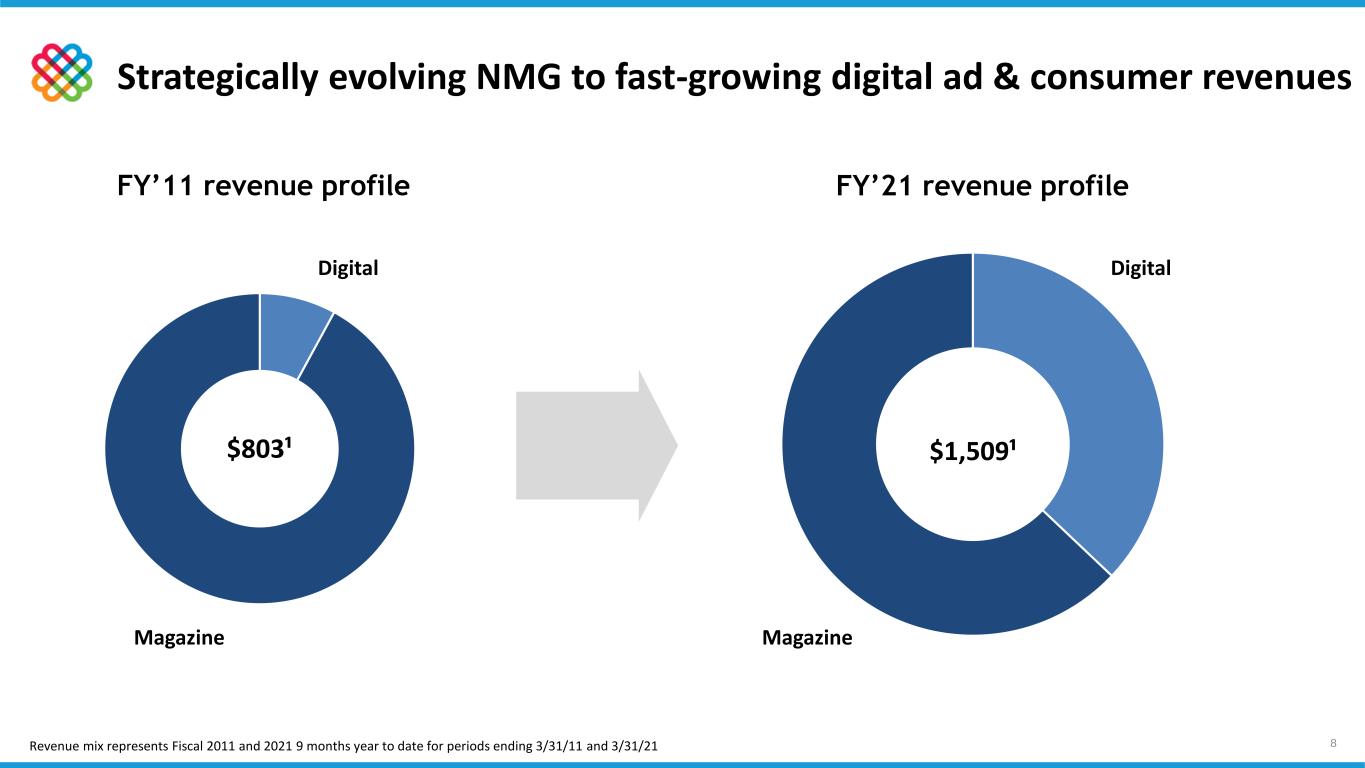

8 FY’11 revenue profile $803¹ Magazine Digital $1,509¹ FY’21 revenue profile Digital Magazine Strategically evolving NMG to fast-growing digital ad & consumer revenues Revenue mix represents Fiscal 2011 and 2021 9 months year to date for periods ending 3/31/11 and 3/31/21

Unlocking shareholder value through strategic transformation Meredith’s Board of Directors has approved a transaction to sell its Local Media Group to Gray Television for $2.825 billion and spin out National Media Group as a standalone company 9 Attractive point in cycle to monetize the Local Media Group Compelling value with a multiple of 10.4x(1) reflects highly competitive process and high-quality broadcast assets 1 Tax efficient transaction Allows full proceeds to extinguish existing Meredith Corporation debt and excess to be paid to Meredith shareholders 2 Significantly improves financial strength Stronger capital profile enables investments in digital growth and shareholder returns with an initial targeted leverage of approximately 2x 3 National Media Group becomes Meredith Fully establishes Meredith as a multi-platform, consumer-focused, lifestyle media company with sharper focus and enhanced capacity to invest 5 (1) Based on the average of LMG’s Fiscal 2020/2021 Adjusted EBITDA Efficiently unlocks shareholder value Existing shareholders to receive cash consideration plus one-for-one equity in Meredith 4

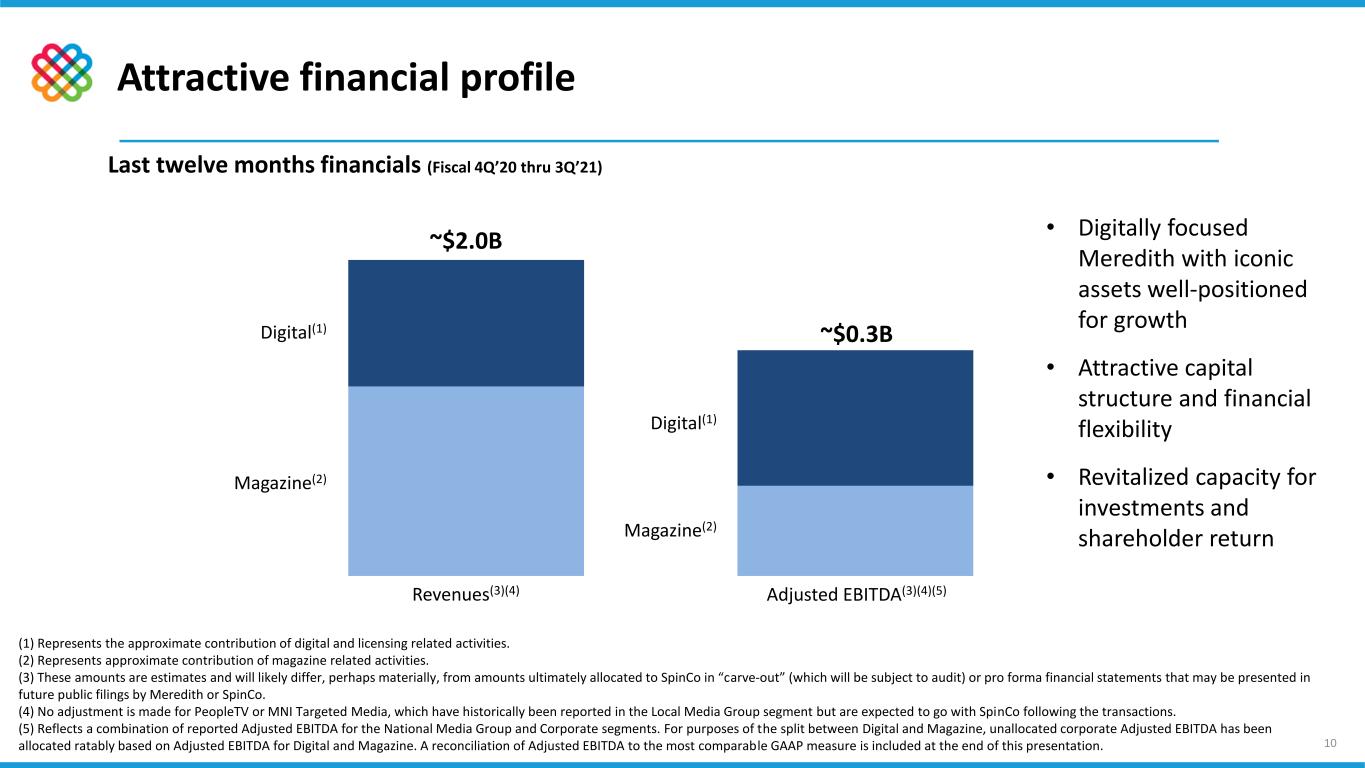

~$0.3B ~$2.0B Revenues(3)(4) Adjusted EBITDA(3)(4)(5) Digital(1) Magazine(2) (1) Represents the approximate contribution of digital and licensing related activities. (2) Represents approximate contribution of magazine related activities. (3) These amounts are estimates and will likely differ, perhaps materially, from amounts ultimately allocated to SpinCo in “carve-out” (which will be subject to audit) or pro forma financial statements that may be presented in future public filings by Meredith or SpinCo. (4) No adjustment is made for PeopleTV or MNI Targeted Media, which have historically been reported in the Local Media Group segment but are expected to go with SpinCo following the transactions. (5) Reflects a combination of reported Adjusted EBITDA for the National Media Group and Corporate segments. For purposes of the split between Digital and Magazine, unallocated corporate Adjusted EBITDA has been allocated ratably based on Adjusted EBITDA for Digital and Magazine. A reconciliation of Adjusted EBITDA to the most comparable GAAP measure is included at the end of this presentation. Last twelve months financials (Fiscal 4Q’20 thru 3Q’21) 10 Attractive financial profile • Digitally focused Meredith with iconic assets well-positioned for growth • Attractive capital structure and financial flexibility • Revitalized capacity for investments and shareholder return Digital(1) Magazine(2)

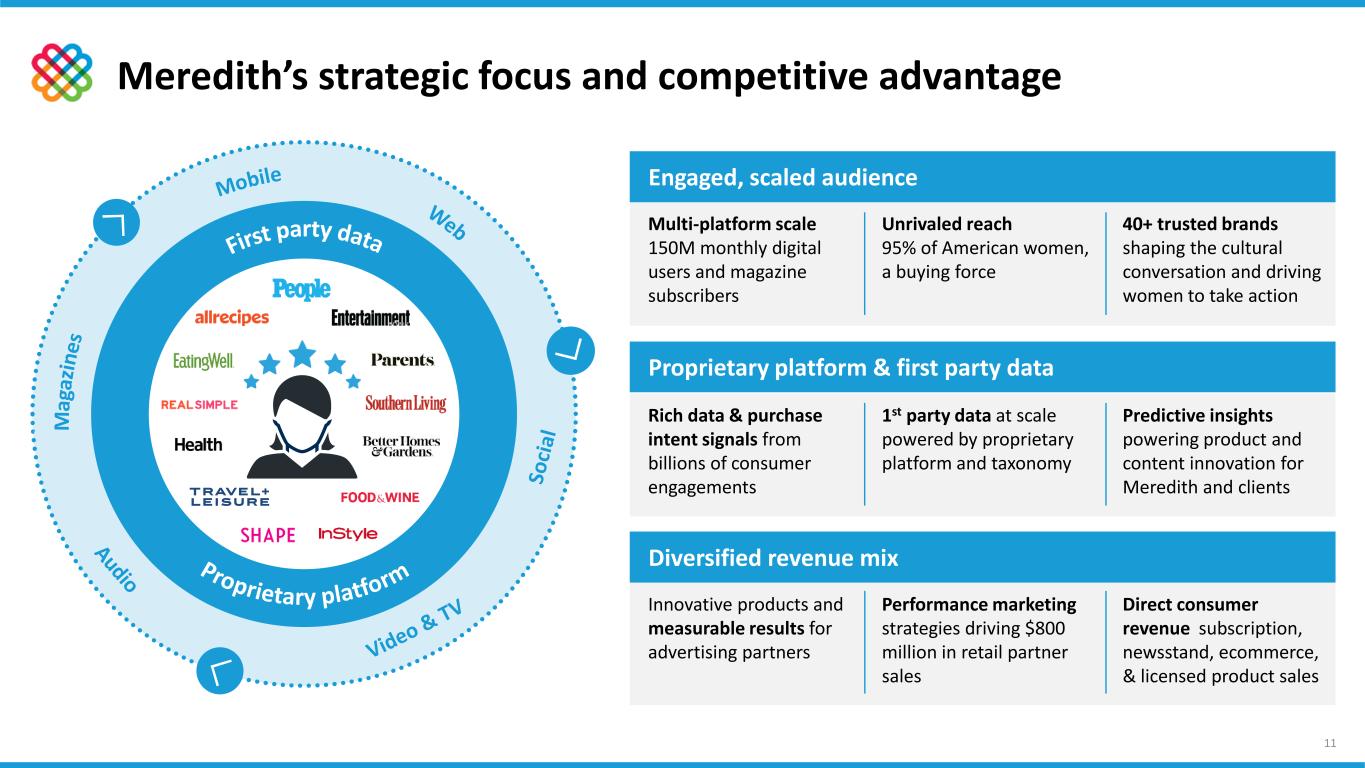

Meredith’s strategic focus and competitive advantage Engaged, scaled audience Multi-platform scale 150M monthly digital users and magazine subscribers Unrivaled reach 95% of American women, a buying force 40+ trusted brands shaping the cultural conversation and driving women to take action Proprietary platform & first party data Diversified revenue mix Innovative products and measurable results for advertising partners Rich data & purchase intent signals from billions of consumer engagements 1st party data at scale powered by proprietary platform and taxonomy Predictive insights powering product and content innovation for Meredith and clients Direct consumer revenue subscription, newsstand, ecommerce, & licensed product sales Performance marketing strategies driving $800 million in retail partner sales 11

Key takeaways 12 Post-transaction Meredith poised for growth and capital returns 1 2 3 4 5 Delivering results via audience scale, iconic brands and strong platforms Unlocking shareholder value through strategic Local Media Group sale Optimizing legacy media businesses for profitability & cash flow Strategically evolving NMG to fast-growing digital ad & consumer revenues

Appendix

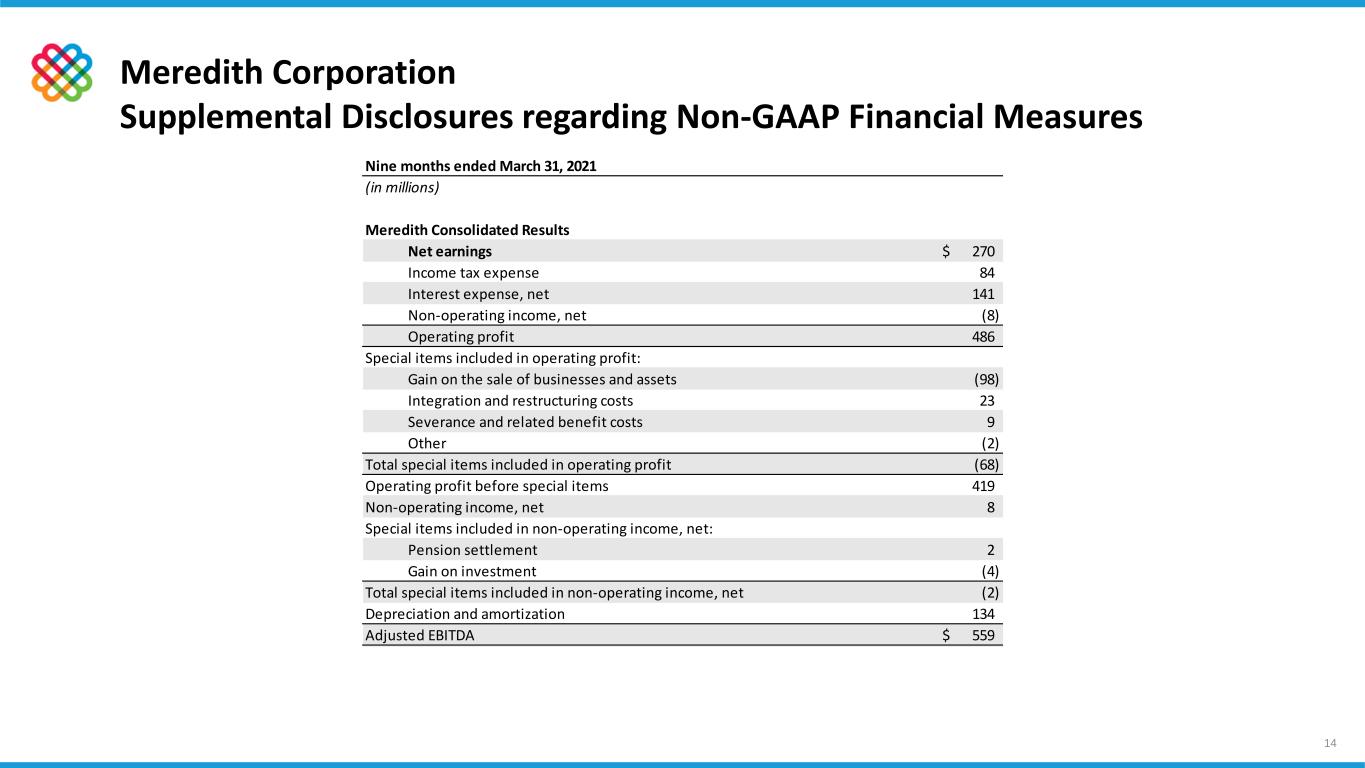

Meredith Corporation Supplemental Disclosures regarding Non-GAAP Financial Measures 14 Nine months ended March 31, 2021 (in millions) Meredith Consolidated Results Net earnings 270$ Income tax expense 84 Interest expense, net 141 Non-operating income, net (8) Operating profit 486 Special items included in operating profit: Gain on the sale of businesses and assets (98) Integration and restructuring costs 23 Severance and related benefit costs 9 Other (2) Total special items included in operating profit (68) Operating profit before special items 419 Non-operating income, net 8 Special items included in non-operating income, net: Pension settlement 2 Gain on investment (4) Total special items included in non-operating income, net (2) Depreciation and amortization 134 Adjusted EBITDA 559$

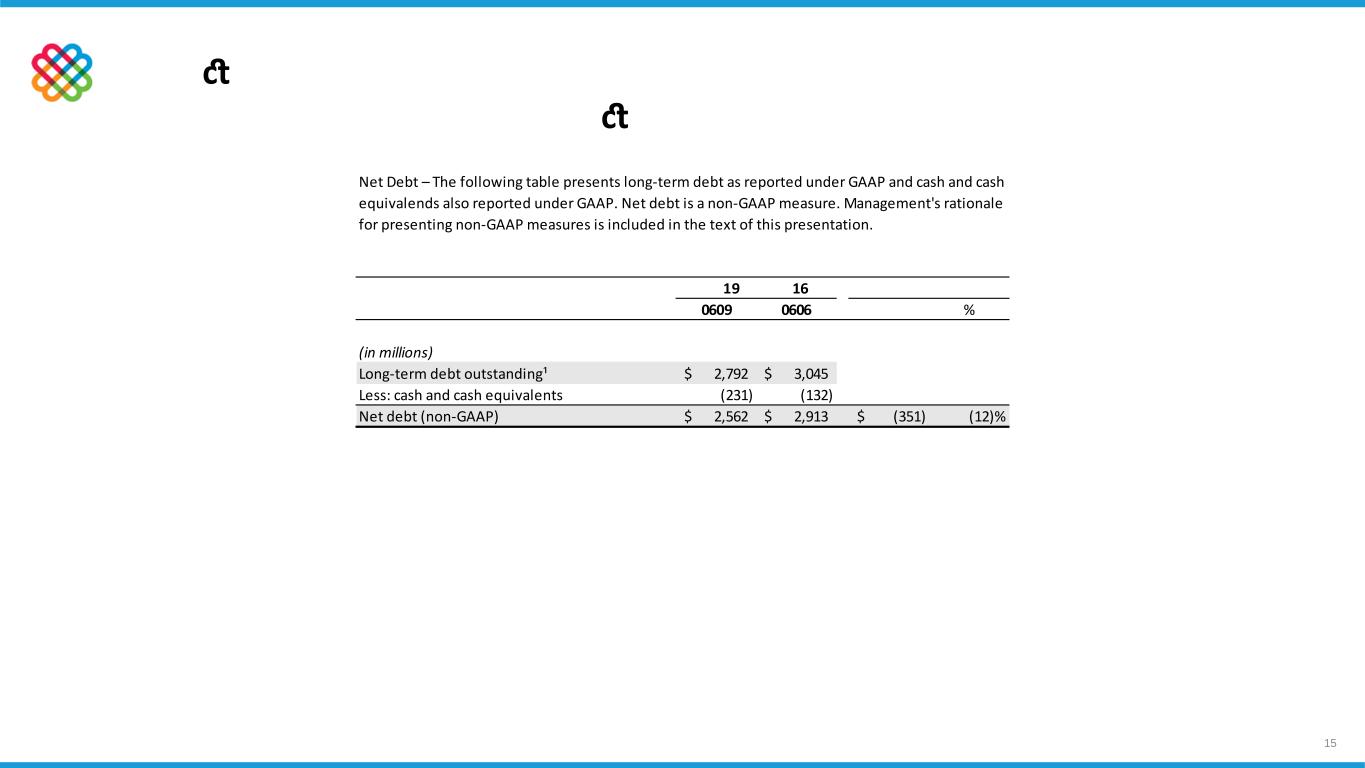

Meredith Corporation Supplemental Disclosures regarding Non-GAAP Financial Measures 15 March 31, June 30, 2021 2020 $ % (in millions) Long-term debt outstanding¹ 2,792$ 3,045$ Less: cash and cash equivalents (231) (132) Net debt (non-GAAP) 2,562$ 2,913$ (351)$ (12)% Change Net Debt – The following table presents long-term debt as reported under GAAP and cash and cash equivalends also reported under GAAP. Net debt is a non-GAAP measure. Management's rationale for presenting non-GAAP measures is included in the text of this presentation.

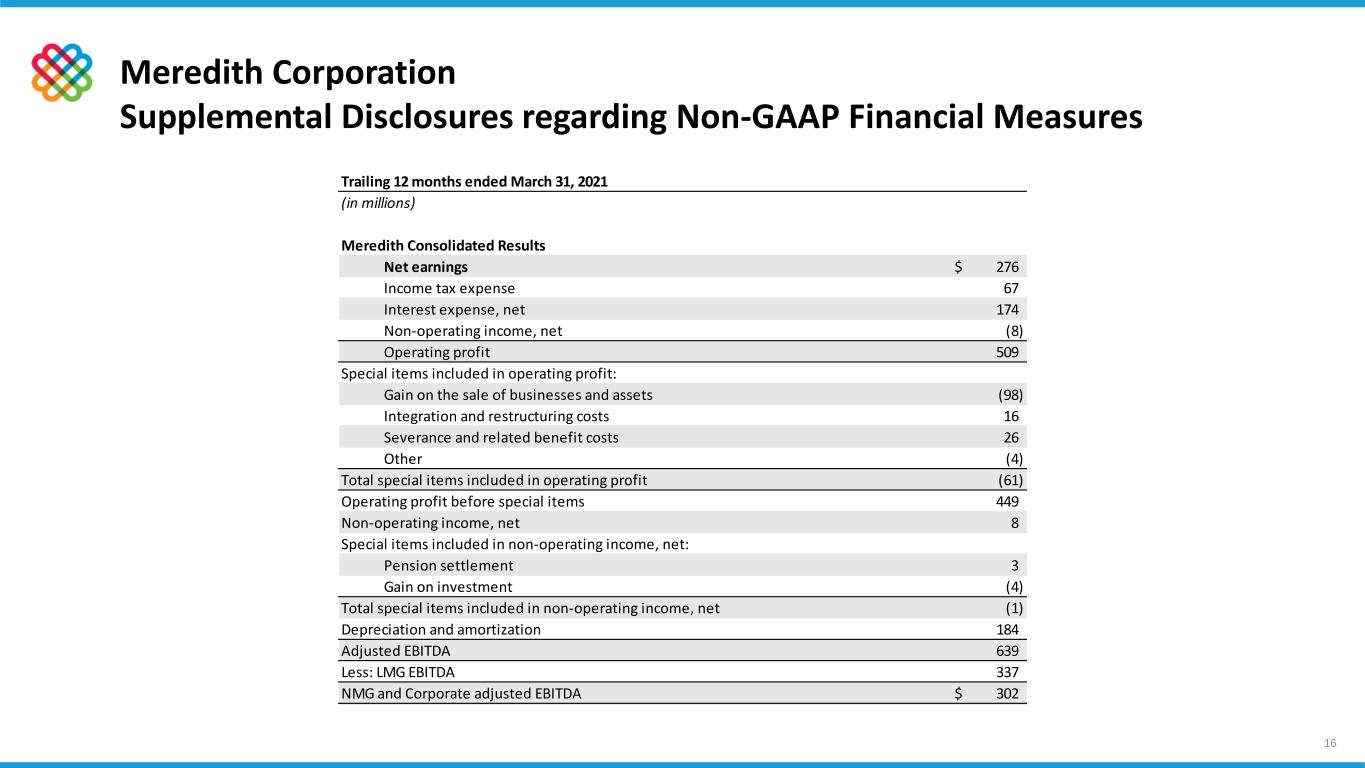

Meredith Corporation Supplemental Disclosures regarding Non-GAAP Financial Measures 16 Trailing 12 months ended March 31, 2021 (in millions) Meredith Consolidated Results Net earnings 276$ Income tax expense 67 Interest expense, net 174 Non-operating income, net (8) Operating profit 509 Special items included in operating profit: Gain on the sale of businesses and assets (98) Integration and restructuring costs 16 Severance and related benefit costs 26 Other (4) Total special items included in operating profit (61) Operating profit before special items 449 Non-operating income, net 8 Special items included in non-operating income, net: Pension settlement 3 Gain on investment (4) Total special items included in non-operating income, net (1) Depreciation and amortization 184 Adjusted EBITDA 639 Less: LMG EBITDA 337 NMG and Corporate adjusted EBITDA 302$

Investor Update June 2021