Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Elanco Animal Health Inc | tm2118507d3_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Elanco Animal Health Inc | tm2118507d3_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Elanco Animal Health Inc | tm2118507d3_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Elanco Animal Health Inc | tm2118507d3_ex2-1.htm |

Elanco Animal Health to Acquire June 16, 2021 Exhibit 99.2

Important Information 2 Important Information for Investors and Stockholders This presentation does not constitute a solicitation of any vote or approval in connection with the proposed acquisition of K ind red Biosciences, Inc. (“ KindredBio ”) by Elanco Animal Health Incorporated (“Elanco” and such proposed acquisition, the “Merger”). KindredBio intends to file with the SEC and mail to its stockholders a definitive proxy statement in connection with the proposed Merger. BEFORE MAKING ANY VOTING DECISION, KINDREDBIO’S STOCKHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRE TY THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED WITH THE SEC WHE N T HEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KINDREDBIO AND THE PROPOSED MERGER. The proposals for the Mer ger will be made solely through the proxy statement. Investors and stockholders may obtain copies of the proxy statement and other documents filed wi th the SEC by KindredBio (when they became available) free of charge from the SEC’s website at www.sec.gov or by accessing KindredBio’s website at www.kindredbio.com. In addition, a copy of the proxy statement (when it becomes available) may be obtained free of charge from Investor Relations at Kindred Biosciences, Inc., 1555 Bayshore Highway, Suite 200, Burlingame, C A 9 4010. Copies of the documents filed with the SEC by Elanco (when they become available) may be obtained free of charge from the SEC’s website at www.sec.gov or by accessing Elanco’s we bsi te at www.elanco.com. Participants in the Merger Solicitation Elanco, KindredBio , and certain of their directors, executive officers and employees may be considered participants in the solicitation of prox ies from KindredBio’s stockholders with respect to the proposed transactions. Information regarding the persons who may, under the SEC rules, be deemed participants in the soli cit ation of KindredBio’s stockholders in connection with the proposed Merger and a description of their direct and indirect interests therein, by security holdings or otherwise, will be set forth in the definitive proxy statement that KindredBio intends to file with the SEC when it becomes available. Information about Elanco’s directors and executive officers is set forth in Elanco’s def initive proxy statement for its 2021 Annual Meeting of Shareholders, which was filed with the SEC on March 25, 2021. Information about KindredBio’s directors and executive officers is set forth in KindredBio’s definitive proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 29, 2021. These documents may be obtained as indicated abo ve.

Cautionary Statement Regarding Forward - Looking Statements 3 This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements included in this presentation that are not a description of historical facts are forward - looking statements. Words or phrases su ch as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” or similar expressions are intended to identify forward - look ing statements, and are based on our current beliefs and expectations. These forward - looking statements include, without limitation, statements regarding the proposed acquisition of KindredBio ; product launches and revenue from such products; independent company stand - up costs and timing; reduction of debt and leverage; our operations, performance and financial condition, and in p articular, statements relating to our business, growth strategies, distribution strategies, product development efforts and future expenses; benefits and synergies of the KindredBio acquisition and the expected timetable for completing the transaction; future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future. You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof. Forward - looki ng statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward - looking statements relate to the fu ture, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward - looking statements. Important facto rs that could cause actual results to differ materially from those in the forward - looking statements include uncertainties as to the timing of the pending acquisition of KindredBio ; the possibility that competing acquisition proposals will be made; the inability to complete the transaction due to the failure to obtain KindredBio’s stockholder adoption of the merger agreement or the failure to satisfy other conditions to completion of the merger, includin g required regulatory approvals; the failure of the transaction to close for any other reason; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, collaborators, customers, vendors and other business partners; the risk that stockholder litigation in connection wit h the transaction may result in significant costs of defense, indemnification and liability; diversion of management’s attention from ongoing business concerns and other risks and uncerta int ies that may affect future results of the combined company. Other important factors that could cause actual results to differ materially from those in the forward - looking statements includ e regional, national or global political, economic, business, competitive, market and regulatory conditions, including but not limited to the following: heightened competition, including fro m generics; the impact of disruptive innovations and advances in veterinary medical practices and animal health technologies; our ability to implement our business strategies or achieve targ ete d cost efficiencies and gross margin improvements; consolidation of our customers and distributors; the impact of the COVID - 19 pandemic on our operations, supply chain, customer demand and liquidity; unanticipated safety, quality or efficacy concerns and the impact of identified concerns associated with our products; the impact of weather conditions and the availab ili ty of natural resources; use of alternative distribution channels and the impact of increased or decreased sales to our channel distributors resulting in fluctuation in our revenues; manufact uri ng problems and capacity imbalances; challenges to our intellectual property rights or our alleged violation of rights of others; risks related to our presence in foreign markets; bre aches of our information technology systems; our ability to successfully integrate the businesses we acquire, including the animal health business of Bayer AG and KindredBio’s business; the effect of our substantial indebtedness on our business; the effect on our business resulting from our separation from Eli Lilly and Company; the uncertainties inherent in research relating to product sa fety and additional analyses of existing safety data; actions by regulatory bodies, including as a result of their interpretation of studies on product safety; unfavorable publicity resultin g f rom media reports on our products; and public acceptance of our products. For additional information about the factors that could cause actual results to differ from forward - looking statements , please see the section entitled “Risk Factors” in Elanco’s and KindredBio’s Annual Reports on Form 10 - K for the year ended December 31, 2020 and Quarterly Reports on Form 10 - Q for the quarter ended March 31, 2021. All forward - looking statements are qualified in their entirety by this cautionary statement and neither Elanco nor KindredBio undertake any obligation to revise or update this presentation to reflect events or circumstances after the date hereof, except as required by law.

4 Well - Positioned for the Next Era of Pet Health Growth Building a Global, Independent, Fit - for - Purpose Animal Health Leader

Accelerating Our Expansion in the Attractive Pet Health Market 5 Market Expansion in the fast - growing $1B+ dermatology market , increasing pet owner options beyond today’s current therapies Portfolio Significant accretive revenue growth opportunity through a differentiated, disruptive portfolio with KindredBio’s three potential blockbusters in dermatology , and shots on goal addressing other chronic unmet needs Customer Veterinarian Farmer Pet Owner Innovation Five additive development projects , complementing our existing pipeline, and increasing our biologics capability Leadership Bolstered omnichannel leadership by increasing our vet clinic presence in the leading therapeutic category , balancing our e - commerce and retail positions Value Creation Revenue: Adding $100M to our innovation expectation in 2025, with significant opportunity beyond the period, and potential to add a full percentage point of consistent top - line innovation growth to our long - term growth algorithm Margins: Accretive over time Leverage: Extension of <3x net leverage target by three months EPS: Slight dilution to non - GAAP EPS in 2021 and 2022

Amplified Innovation Expected Contribution to Revenue Growth 6 2021 2022 2023 2024 2025 $80 - $100 Pet Health Farm Animal $600 - $700 with KindredBio as outlined at Dec 2020 Investor Day Enriched probability of success in dermatology Peak Sales of Current KindredBio Pipeline Expected Well Beyond 2025 Additional shots on goal to address other unmet needs, including parvovirus $500 - $600 Expected Development Pipeline Contribution to Revenue $ Millions

Enhancing Our Long - Term Growth Algorithm (1) Non - GAAP financial measure 7 Growth Profitability Targets Expected Results Today ~3% - 4% a verage a nnual r evenue g rowth 60% adj. g ross m argin (1) by 2023 and 31% adj. EBITDA margin (1) by 2024 Net l everage <3x by the end of 2023 Potential to add a full percentage point of consistent top - line innovation growth over time (starting in 2024) No change to targets Greater margin accretion enabled over time Extends deleverage timeline by one quarter Slightly dilutive to non - GAAP EPS in 2021 and 2022

KindredBio at a Glance 8 Company mission to bring to pets the same kinds of safe and effective medicines that humans enjoy Focused strategy to advance key molecule developments for established therapeutic targets through aggressive plans Exciting pipeline of high - value biologic candidates for dogs and cats in development Purpose - built biologics manufacturing operations in Burlingame, California and Elwood, Kansas Partnership - focused commercialization model, with companion animal commercial infrastructure rationalized in mid - 2020 Diverse team of 63 employees as of 12/31/2020 Elanco partnership announced in December 2020 with KIND - 030

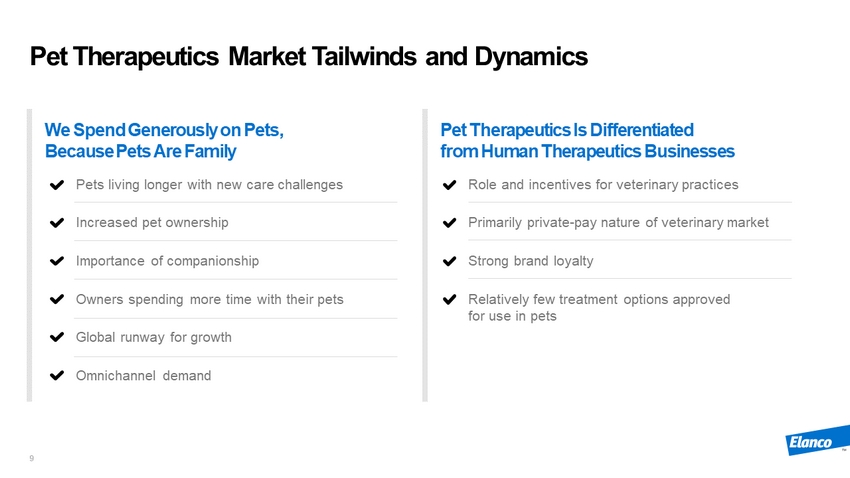

Pet Therapeutics Market Tailwinds and Dynamics 9 Pets living longer with new care challenges Increased pet ownership Importance of companionship Owners spending more time with their pets Global runway for growth Omnichannel demand Role and incentives for veterinary practices Primarily private - pay nature of veterinary market Strong brand loyalty Relatively few treatment options approved for use in pets We Spend Generously on Pets, Because Pets Are Family Pet Therapeutics Is Differentiated from Human Therapeutics Businesses

KindredBio Pipeline at a Glance Other product candidates in development (partial list) include KIND - bodies, VEGF antibody, and Checkpoint Inhibitors 10 Molecule Proposed Indication Preclinical Laboratory Pilot Studies Field Pilot Studies Pivotal Study Approval Partner Blockbuster Potential Canine Portfolio Tirnovetmab IL - 31 Antibody Atopic Dermatitis Long - Acting IL - 31 Antibody Atopic Dermatitis KIND - 032 IL - 4R Antibody Atopic Dermatitis KIND - 030 Parvovirus Anti - TNF Antibody Inflammatory Bowel Disease Other Animal Portfolio Mirataz Management of Weight Loss in Cats Zimeta Dipyrone Injection Control of Fever in Horses

Dermatology Is a Large and Growing Market 11 Canine atopic dermatitis (itching) is the leading reason owners take their dog to the veterinarian Atopic dermatitis is a large segment, with the leading two products selling approximately $1B annually We are pursuing a multi - pronged approach toward atopic dermatitis, with a portfolio of promising biologics and small molecules 70% of veterinarians, and a higher percentage of dermatologists, are expressing a need for alternatives to current therapies We expect the segment to continue to lead animal health industry growth #1 Reason for Vet Visits Current Products $1B+ Portfolio Approach Demand for Innovation Ample Runway for Growth Source: 2019 Canine Atopic Dermatitis Veterinarian Research, February 2019 (n=173 U.S. small animal veterinarians and dermato log y specialists). Data on file at Kindred Biosciences

Combined Dermatology Pipeline: Up to Four Launches by 2025 Ilunicitinib JAK Inhibitor Oral JAK inhibitor with similar profile to market incumbent Pivotal studies underway in the U.S. and EU Initial technical section submissions targeted for late 2022 KIND - 039 integrates novel half - life extension technology Pharmacokinetic study demonstrates up to 3x longer half - life vs. Tirnovetmab , which could translate to up to 3x longer interval between dosing Best - in - class potential with reduced dosing frequency and increased compliance Binds to the IL - 4 receptor on the surface of immune cells Prevents both IL - 4 and IL - 13 signaling pathways Positive results from pilot lab study with evidence of positive efficacy and dose response Pilot study to further assess dosing commenced in 3Q 2020. Preparations underway for a pivotal study Tirnovetmab IL - 31 Antibody Long - Acting IL - 31 Antibody KIND - 032 IL - 4R Antibody All Dermatology Shots on Goal Are Potential Blockbusters 12 1 4 3 2 Blocks IL - 31, a key mediator of itching Positive results in pilot effectiveness study Achieved rapid and dramatic reduction in pruritus (itch) and CADESI - 4 score versus placebo in pilot study Pivotal studies fully engaged

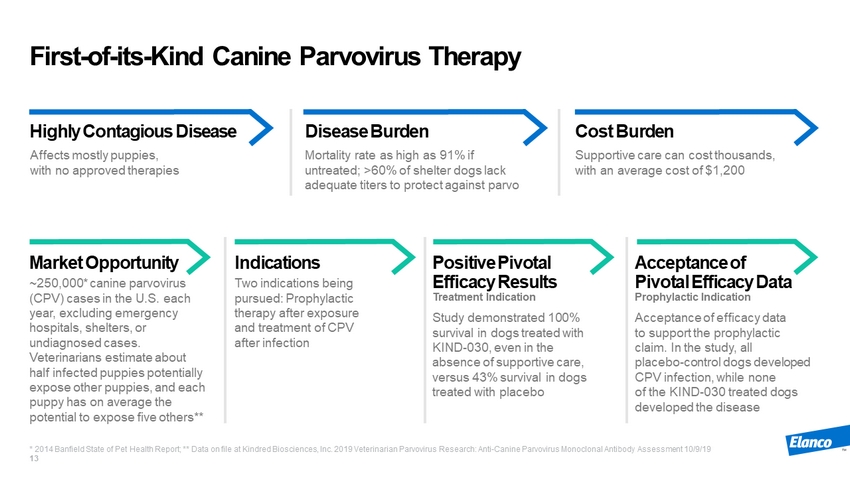

First - of - its - Kind Canine Parvovirus Therapy 13 Highly Contagious Disease Disease Burden Cost Burden Affects mostly puppies, with no approved therapies Mortality rate as high as 91% if untreated; >60% of shelter dogs lack adequate titers to protect against parvo Supportive care can cost thousands, with an average cost of $1,200 Market Opportunity Positive Pivotal Efficacy Results Treatment Indication Acceptance of Pivotal Efficacy Data Prophylactic Indication Indications ~250,000* canine parvovirus (CPV) cases in the U.S. each year, excluding emergency hospitals, shelters, or undiagnosed cases. Veterinarians estimate about half infected puppies potentially expose other puppies, and each puppy has on average the potential to expose five others** Study demonstrated 100% survival in dogs treated with KIND - 030, even in the absence of supportive care, versus 43% survival in dogs treated with placebo Acceptance of efficacy data to support the prophylactic claim. In the study, all placebo - control dogs developed CPV infection, while none of the KIND - 030 treated dogs developed the disease Two indications being pursued: Prophylactic therapy after exposure and treatment of CPV after infection * 2014 Banfield State of Pet Health Report; ** Data on file at Kindred Biosciences, Inc. 2019 Veterinarian Parvovirus Researc h: Anti - Canine Parvovirus Monoclonal Antibody Assessment 10/9/19

Canine Inflammatory Bowel Disease Therapy (Anti - TNF Antibody) 14 Disease Prevalence Disease Burden Cost Burden Recent Catalyst Majority of cases involve chronic states of diarrhea, vomiting, gastroenteritis, and other symptoms Diarrhea prevalence >5% Chronic condition, with diagnosis common in middle age Existing treatments can have significant drawbacks, leading to treatment lapses or poor quality of life High willingness to pay given impact on owner Positive results from pilot field effectiveness study. Complete remission* was achieved in 75% of the KIND - 509 anti - TNFα group compared to 17% in the placebo group. The treatment effect was early - onset and durable * Defined as ≥75% reduction in average post - dose Canine Inflammatory Bowel Disease Activity Index (CIBDAI) score from baseline

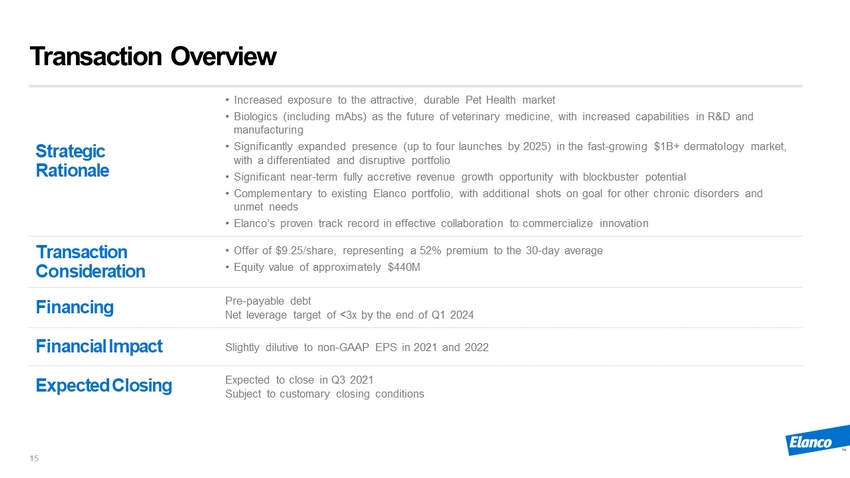

Transaction Overview 15 Strategic Rationale • Increased exposure to the attractive, durable Pet Health market • Biologics (including mAbs ) as the future of veterinary medicine, with increased capabilities in R&D and manufacturing • Significantly expanded presence (up to four launches by 2025) in the fast - growing $1B+ dermatology market, with a differentiated and disruptive portfolio • Significant near - term fully accretive revenue growth opportunity with blockbuster potential • Complementary to existing Elanco portfolio, with additional shots on goal for other chronic disorders and unmet needs • Elanco’s proven track record in effective collaboration to commercialize innovation Transaction Consideration • Offer of $9.25/share, representing a 52% premium to the 30 - day average • Equity value of approximately $440M Financing Pre - payable debt Net leverage target of <3x by the end of Q1 2024 Financial Impact Slightly dilutive to non - GAAP EPS in 2021 and 2022 Expected Closing Expected to close in Q3 2021 Subject to customary closing conditions

Building a Global, Independent, Fit - for - Purpose Animal Health Leader 16 Today’s Takeaways Positioning for the next era of pet health growth through KindredBio’s additive pipeline including three potential blockbusters and Elanco’s global commercial capabilities Significantly enhances Elanco offerings in the fast - growing dermatology market , with a differentiated and disruptive combined portfolio Complementary transaction to the existing Elanco portfolio, with additional shots on goal for other chronic disorders and unmet needs Advancing our IPP strategy and enhancing our long - term growth algorithm through margin - accretive innovation with a clear path to rapid deleverage