Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank First Corp | tm2119853d1_8k.htm |

Exhibit 99.1

House k eeping Items Open and close your control panel using the orange arrow . Audio Options : • Choose Computer audio to listen from your computer’s speakers • Choose Phone call and dial in using the phone number and pin provided in your registration confirmation email . Your Participation If you have a question or concern you would like addressed after today’s presentation, please reach out to our Investor Relations team at IR@BankFirstWI.bank or 920 - 652 - 3360.

ANNUAL SHAREHOLDER MEETING June 14, 2021

MICHAEL ANSAY Chairman of the Board

Board of Directors WELCOME

Senior Management WELCOME

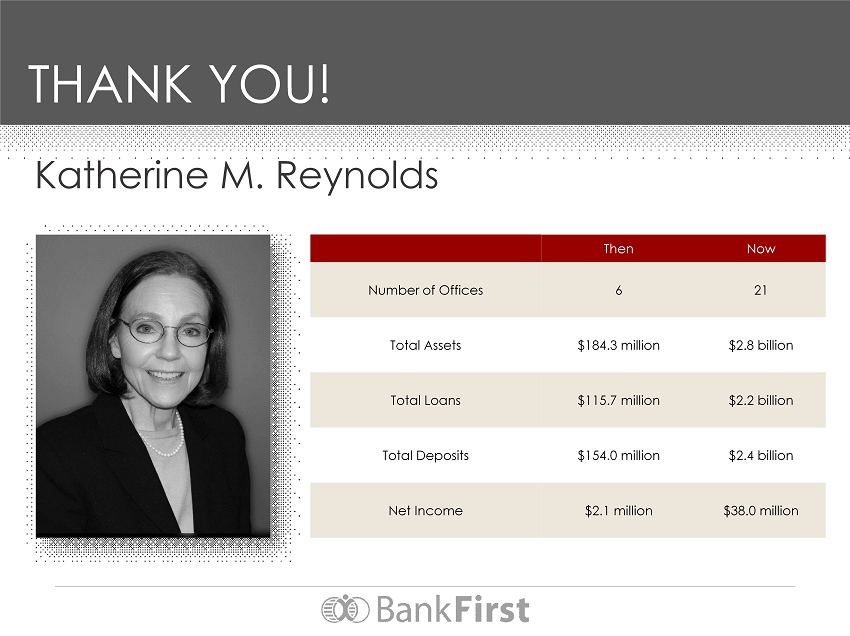

Katherine M. Reynolds THANK YOU! • Congratulations on your Board retirement! • Director since 1992 • Integral part of Bank First’s growth, helping the bank navigate through 7 acquisitions and 8 de novo branch openings during her tenure • Founding member and chair of the Governance & Nominating Committee • Was part of many key transitions: • Two legal name changes • Founding of UFS in 1993 • January 2009: CEO Thomas J. Bare to CEO Michael B. Molepske • SEC Registration in 2018

Katherine M. Reynolds THANK YOU! Then Now Number of Offices 6 21 Total Assets $184.3 million $2.8 billion Total Loans $115.7 million $2.2 billion Total Deposits $154.0 million $2.4 billion Net Income $2.1 million $38.0 million

Phillip R. Maples WELCOME • Welcome to the Board of Directors! • Partner at Michael Best & Friedrich, LLP in Manitowoc • Over 28 years of experience assisting individuals with estate, wealth, and business succession planning, and helping businesses with corporate and real estate matters.

• Determination of Quorum • Approval of Minutes • Business to be Conducted WELCOME

Election of Directors PROPOSAL 1 MARY - KAY H. BOURBULAS ROBERT D. GREGORSKI PHILLIP R. MAPLES PETER J. VAN SISTINE

Ratify the appointment of Dixon Hughes Goodman, LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2021 PROPOSAL 2

Forward Looking Statements: This presentation may contain certain “forward looking statements” that represent Bank First Corporation’s expectations or beliefs concerning future events. Such forward looking statements are about matters that are inherently subject to risks and uncertainties. Because of the risks and uncertainties inherent in forward looking statements, readers are cautioned not to place undue reliance on them, whether included in this presentation or made elsewhere from time to time by Bank First Corporation or on its behalf. Bank First Corporation disclaims any obligation to update such forward looking statements. In addition, statements regarding historical stock price performance are not indicative of or guarantees of future price performance. Forward looking statements

MIKE MOLEPSKE CEO & President

• Asset Growth • Stock Performance Graph • Awards • Financial Report • COVID - 19 • Mortgage Volume • Customer Experience Initiative • Facilities • Dividend Reinvestment Plan WELCOME

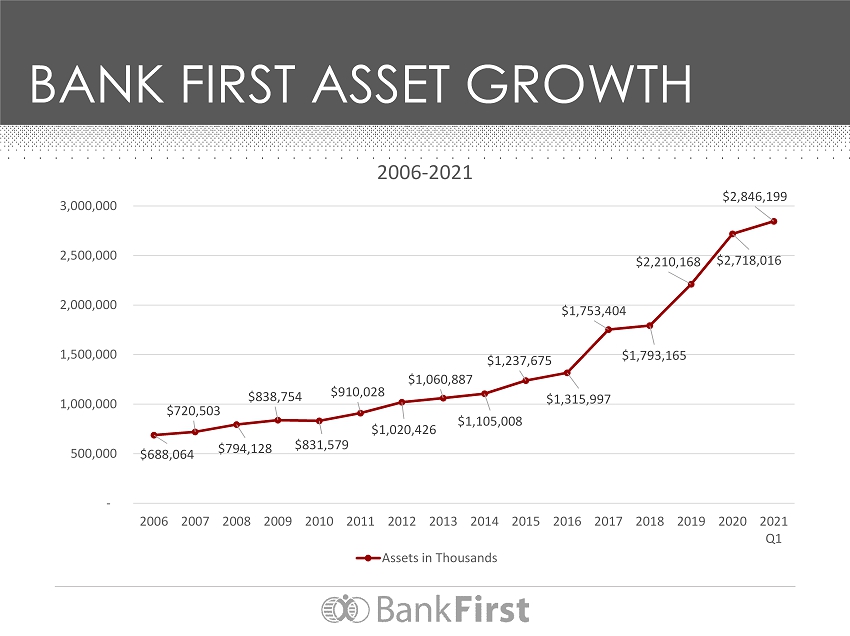

$688,064 $720,503 $794,128 $838,754 $831,579 $910,028 $1,020,426 $1,060,887 $1,105,008 $1,237,675 $1,315,997 $1,753,404 $1,793,165 $2,210,168 $2,718,016 $2,846,199 - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 2006 - 2021 Assets in Thousands BANK FIRST ASSET GROWTH

STOCK PERFORMANCE (Total Return) $0 $100 $200 $300 $400 $500 $600 Value of $100 invested on June 1, 2011 (10 year) BFC Russell 2000 S&P Regional Banking ETF $588.43 $276.33 $274.00

BANK FIRST AWARDS Bank First was one of 16 banking institutions across the United States to be recognized with this honor . The Honor Roll recognizes banks that consistently deliver exceptional growth. This is the third year in a row Bank First has been named to the honor roll. KBW Honor Roll Raymond James Community Bankers Cup Bank First was one of 25 banks awarded the 2020 Community Bankers Cup. This award recognizes the top 10% of community banks in the nation based on profitability, operational efficiency, and balance sheet metrics. This is the second year in a row Bank First has been recognized. Hovde High Performers Class of 2021 Bank First was one of 30 institutions included in the class. The Hovde High Performers Class, by the Hovde Group, recognizes financial institutions with a market capitalization below $1.0 billion at the end of 2020 and who achieve high - performing results.

FINANCIAL REPORT

FINANCIAL REPORT Balanced Loan Growth, Organic and Through Acquisitions (dollars in millions) PORTFOLIO LOANS $0 $500 $1,000 $1,500 $2,000 $2,500 Organic Loans Acquired Loans SECONDARY MARKET LOANS $0 $150 $300 $450 $600 $750 Organic Loans Acquired Loans

FINANCIAL REPORT Strong Core Deposit Base (dollars in millions) $0 $500 $1,000 $1,500 $2,000 $2,500 2015 2016 2017 2018 2019 2020 May-21 Noninterest Bearing Savings Money Market Time Deposits 18% 29% 26% 27% 27% 27% 33% 16% 25% 26% 21% 15% 12% 39% 15% 28% 40% 15% 29% 17% 29% 19% 29% 26% 26% 27% 31% 28%

FINANCIAL REPORT Dividends Per Share $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 2015 2016 2017 2018 2019 2020 2021* * Annualized based on the first two quarters of 2021 ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 2015 2016 2017 2018 2019 2020 Impact of Paycheck Protection Program Impact of Acquisition Costs Impact of Purchase Accounting Core EPS Earnings Per Share (EPS)

COVID - 19

COVID - 19 Paycheck Protection Program • At a time when many of the big banks and non - SBA community banks and credit unions choose not to participate in the program, Bank First took an “all hands on deck” approach to serve our customers as well as other businesses in our community that were not getting the support they need . • We did not prioritize customers based on dollar size or whether they were existing borrowers, unlike many of our big bank counterparts . Fees Expected to be Collected $ 14.7 MM TOTAL PPP FUNDED $ 376.2 MM NUMBER OF PPP LOANS 2,985 175 NEW DEPOSITORY RELATIONSHIPS AS A RESULT OF ASSISTING BUSINESSES IN THE PAYCHECK PROTECTION PROGRAM. *Numbers as of 6/10/2021

COVID - 19 Impac t on Financial Performance Consolidated YTD Net Income as of December 31 • Bank First’s ability to aggressively manage its cost of funds throughout the downturn in the overall interest rate environment has allowed it to experience only 0 . 02 % deterioration in NIM year - over - year . • Bank First’s low reliance on time deposits compared to peers allowed for this swift response without the need to wait for the maturity of significant levels of high - rate time deposits entered into in prior periods .

COVID - 19 Bank First’s Keys to Success • Value Driven : Employees working on the Paycheck Protection Program and retail loans have worked many nights, weekends, and holidays to process applications . • Nimble : Due to our size, we are able to act quickly in response to change . We redeployed over 70 employees from the front line and other departments to assist with the SBA Paycheck Protection Program . • Diverse : By leveraging the diverse backgrounds and experiences of our team, we were able to develop comprehensive reopening and ongoing procedures that ensure the safety and well - being of all employees, customers, and visitors . • Communication : We maintained regular contact with employees and customers to share updates and provide important information . Employees were updated via email and bank - wide video conferences . Customers were updated via email, phone, and personal contact with their relationship manager .

MORTGAGE VOLUME

MORTGAGE VOLUME Secondary Market Loan Originations Year - Over - Year Comparison $85,861,094 $54,196,707 $39,916,670 $113,677,351 $307,328,174 $0 $50,000,000 $100,000,000 $150,000,000 $200,000,000 $250,000,000 $300,000,000 $350,000,000 2016 2017 2018 2019 2020 538 329 221 597 1,621

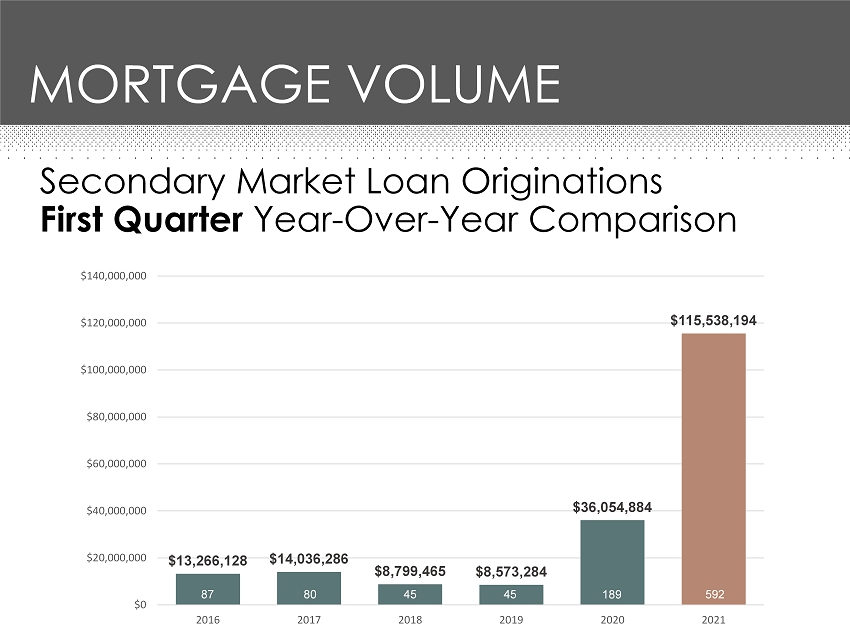

MORTGAGE VOLUME Secondary Market Loan Originations First Quarter Year - Over - Year Comparison $13,266,128 $14,036,286 $8,799,465 $8,573,284 $36,054,884 $115,538,194 $0 $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 $120,000,000 $140,000,000 2016 2017 2018 2019 2020 2021 87 80 45 45 189 592

CUSTOMER EXPERIENCE

CUSTOMER EXPERIENCE Our Mission: To deliver a world - class, consistent customer experience in our offices and all customer touch points as we grow. Where do we start? Establish a diverse team of employees from throughout our geographic footprint including our frontline, operations and trainers to gather the best ideas. This team of employees created our Customer Experience Guide to train all of our employees on the importance of our customer experience.

CUSTOMER EXPERIENCE • We chose G.U.E.S.T. as our foundation to teach our cu lture . • We share and celebrate customer letters and compliments to increase engagement, strengthen positive behaviors and share best practices. • We also ask our customers th rough customer satisfaction surveys for feedback. How are we doing? G reet your customer promptly . U se your customer’s name . E ye contact is important . S mile! T hank your customer and invite them back .

CUSTOMER EXPERIENCE • Since June of 2020, our marketing department launched weekly surveys to 5,457 people who opened a new checking account. We had 598 responses (11%). • Bank First Net Promoter Score of 82 • Our Opportunity: Grow our existing relationships, ask for referrals and learn from our customers. NET PROMOTER SCORE: 82 *Source: Satmetrix Net Promoter Network National banking industry average is 35*

FACILITIES

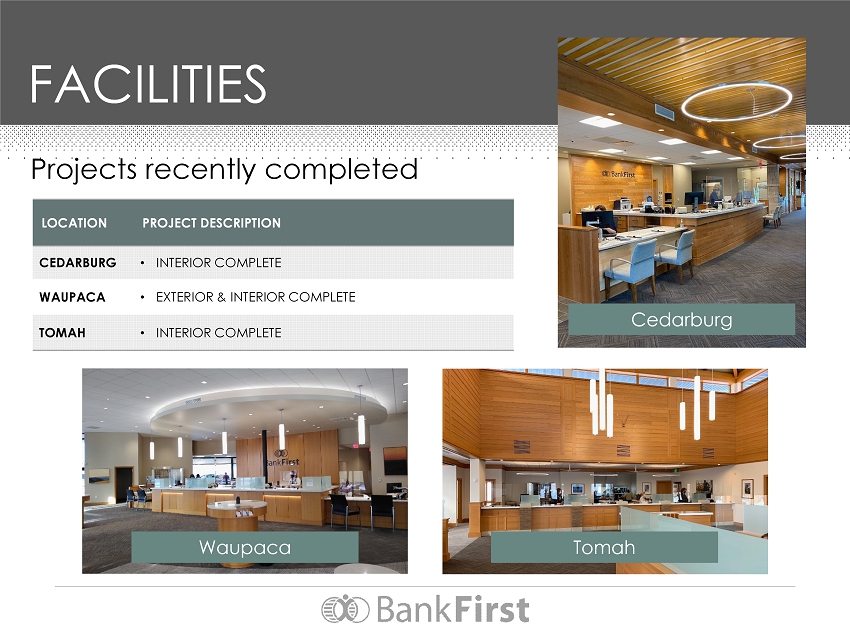

FACILITIES LOCATION PROJECT DESCRIPTION CEDARBURG • INTERIOR COMPLETE WAUPACA • EXTERIOR & INTERIOR COMPLETE TOMAH • INTERIOR COMPLETE Projects recently completed Cedarburg Tomah Waupaca

FACILITIES LOCATION PROJECT DESCRIPTION CLINTONVILLE • EXTERIOR & INTERIOR UPDATES SEYMOUR • INTERIOR UPDATES WATERTOWN • INTERIOR UPDATES OPERATIONS CENTER • SITE PURCHASED IN MANITOWOC, PROJECT OUT FOR BID GREEN BAY • OFFERS TO PURCHASE MADE ON TWO DIFFERENT PROPERTIES Current and upcoming projects Future Operations Center

DIVIDEND REINVESTMENT PLAN

DRIP Bank First has a Dividend Reinvestment Plan (DRIP). The Plan is designed to provide you with a convenient, cost - effective method to manage your investment in Bank First Corporation’s stock. If you are a registered shareholder, you can reinvest your cash dividends as well as purchase shares of Bank First Corporation stock directly through our transfer agent and Plan administrator, Computershare Trust Company. If you are a beneficial owner and hold your shares in “street name,” you can participate in the Plan through your broker . DRIP

COMMENTS and QUESTIONS