Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FOR 2021 ASM SLIDE DECK OF VIDLER WATER RESOURCES, INC. - VIDLER WATER RESOURCES, INC. | formx2021annualmeetingpres.htm |

1 VIDLER Water. Quality. Life. Vidler Water Resources, Inc. Annual Meeting of Shareholders June 10, 2021

2 VIDLER Water. Quality. Life. 2 FORWARD LOOKING STATEMENTS SAFE HARBOR This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and are made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements; these include, without limitation, any projections or guidance regarding earnings, earnings per share, revenues, cash flows, dividends, capital expenditures or other financial items; and any statements concerning plans, strategy and management objectives for future operations, as well as statements regarding future economic, industry, or company conditions or performance and any statements of belief and any statement of assumptions underlying any of the foregoing. Forward-looking statements often address current expected future business and financial performance, including the demand and pricing for Vidler Water Resources, Inc’s real estate and water assets, the completion of proposed monetization transactions, the return of capital to shareholders, and the reduction of costs. Forward-looking statements may contain words such as “expects,” “estimates,” “anticipates,” “intends,” “plans,” “projects,” “believes,” “seeks,” or “will.” All forward-looking statements included in this presentation are based on information available to Vidler Water Resources, Inc. as of the date hereof; Vidler Water Resources, Inc. specifically disclaims and assumes no obligation to update any forward-looking statements. Actual results could, and likely will, differ materially from those described in the forward-looking statements. Forward-looking statements involve risks and uncertainties, outside of our control, including, but not limited to, economic, competitive and governmental actions that may cause our business, industry, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in detail under the heading “Risk Factors” in Vidler Water Resources, Inc’s periodic reports filed with the U.S. Securities and Exchange Commission. This presentation should be reviewed in connection with, and is qualified by, Vidler Water Resources, Inc’s Annual Report on Form 10-K filed for the year ended December 31, 2020, and Vidler Water Resources, Inc’s quarterly report on Form 10-Q filed for the period ended March 31, 2021. A number of the slides in the presentation contain information from public sources that Vidler Water Resources, Inc. has not independently verified.

3 VIDLER Water. Quality. Life. 3 Our Mission We are governance – oriented and committed to advancing our shareholder and stakeholders’ interests: » Our corporate mission is to facilitate and support economic growth in water – scarce regions through the development of sustainable and reliable water supplies. » We have deep and decades – long relationships with government, developers, regulators and communities. For example, Vidler Water Company currently has partnerships with local governments and agencies such as Lincoln County and Lyon County, Nevada and the Truckee Meadows Water Authority to develop and manage new water resources. » Our Board of Directors has significant ownership interest and alignment with our shareholders. » Our Board possesses deep expertise in water engineering and development, finance, capital markets, environmental issues and regulations.

4 VIDLER Water. Quality. Life. 4 Our Business Plan » Monetize existing assets at maximum possible present value and return on invested capital » Return capital to our shareholders (we may occasionally use asset sale proceeds to enhance existing assets) » Reduce net costs where possible

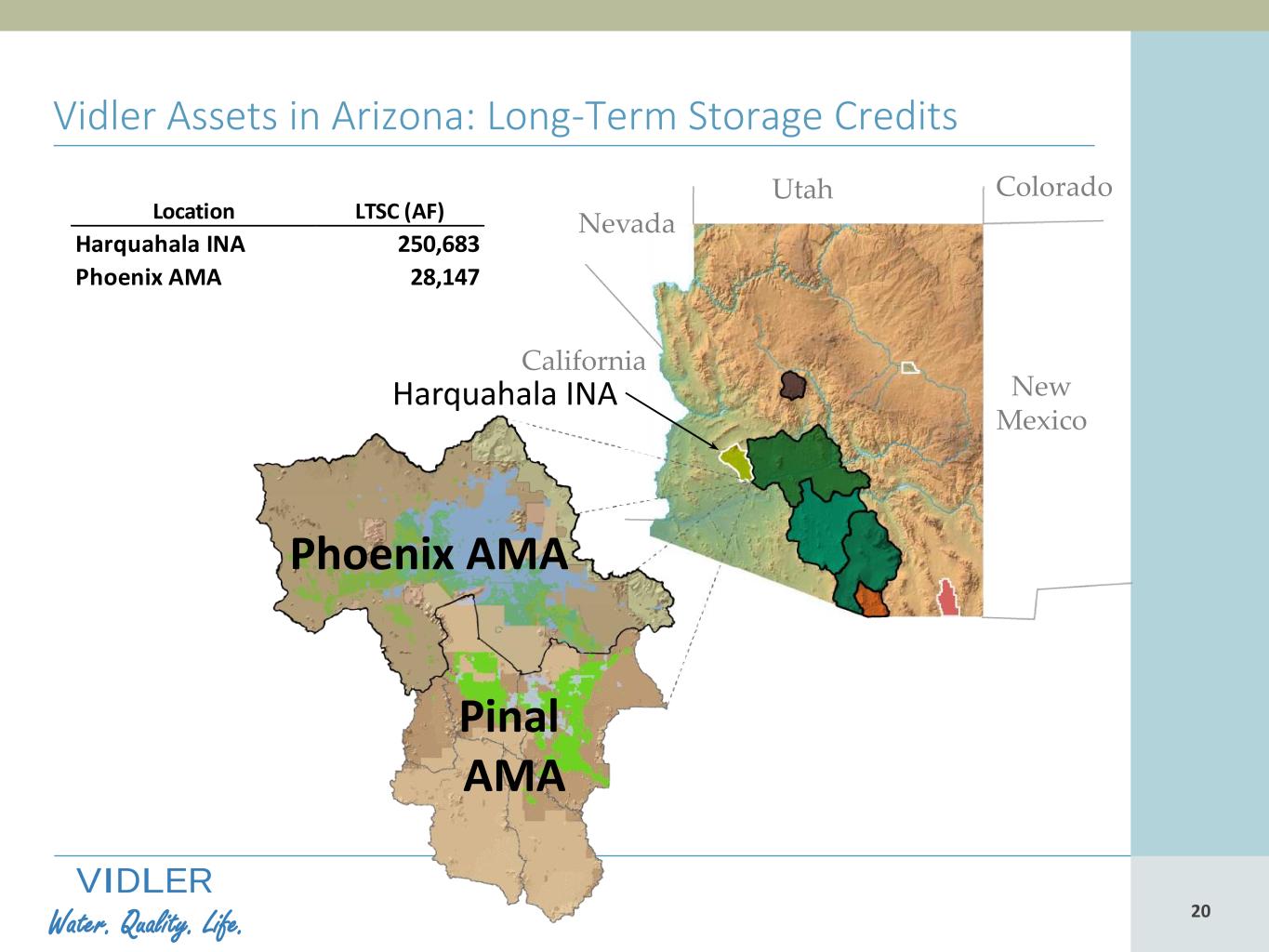

5 VIDLER Water. Quality. Life. 5 Our Major Assets: Summary -Arizona Arizona Long-Term Storage Credits (LTSCs) » Our Arizona LTSCs address water needs related to the Colorado River Lower Basin structural deficit, the drought contingency plan, the development of new communities, homebuilders, state agencies responsible for municipal water supplies, and other users. In addition, Phoenix and Pinal AMAs are experiencing water shortages - our LTSCs banked in Harquahala Valley can be used as a new water source to support existing users and for development. » Our current inventory totals 28,147 LTSCs banked in the Phoenix AMA and 250,683 LTSCs banked at our recharge site in Harquahala Valley, La Paz, County AZ. » We have 250 LTSCs banked in the Phoenix AMA under contract for $375/LTSC scheduled to close by June 30, 2021. » As of July 1, 2021, Vidler’s Phoenix AMA credits will be priced at $400.00 per credit; with similar pricing for our Harquahala Valley LTSCs.

6 VIDLER Water. Quality. Life. 6 Our Major Assets: Summary –Northern Nevada Northern Nevada Water Resources (North Valleys, Reno and Dayton Corridor areas) » Pent-up demand exists due to housing shortages and lack of available water in the North Valleys and Dayton corridor: Monetization and timing of water sales is highly dependent on new residential and commercial demand and issuance of building permits as Reno/Northern Nevada attracts new employers and employees in an increasingly diversified business environment – including from California’s “reverse Great Migration.” Our sustainable water resources in northern Nevada can support the increase in affordable homes and infrastructure necessary to support Reno’s growing population and workforce. » Our Fish Springs Ranch subsidiary owns 7,658.91 acre-feet (AF) municipal use water rights (with governmental permitting underway to move 3,000 AF of the remaining 5,000 AF) available for the North Valleys with pricing at $43,575 per AF for residential developments and $37,800 per AF for commercial and industrial development starting July 1, 2021. » We own or control the equivalent of 4,192 AF of municipal and industrial water rights in and around the Dayton corridor area; our current pricing is $27,000 per AF.

7 VIDLER Water. Quality. Life. 7 Our Major Assets: Summary – Southern Nevada Southern Nevada Water Resources (Tule Desert and the Lincoln County Land Act) » There is continued interest in our water rights located in Tule Desert from the Virgin Valley Water District (City of Mesquite) and from developers of the approximately 13,000 acres of the Lincoln County Recreation, Conservation and Development Act of 2004 (the “Land Act”). » In 2002, Lincoln County Water District and Vidler Water Company (Lincoln/Vidler) was awarded 2,100 AF to be developed from Tule Desert, which was sold to developers of the Land Act. » In 2010, through a settlement with the Nevada State Engineer, Lincoln/Vidler were awarded an immediate right to withdraw up to 2,900 AF for delivery to the Land Act, which when combined with the previously awarded 2,100 AF, allows for a total withdrawal of 5,000 AF from Tule Desert. » An additional 4,340 AF is subject to future staged pumping and development to assess the potential impacts from this additional withdrawal. » Lincoln/Vidler are working on a Plan of Development (POD) for the infrastructure, power, wells, pipeline, and storage tanks, needed to deliver this water to the Land Act.

8 VIDLER Water. Quality. Life. 8 Our Accomplishments in 2020 and 2021 Year-to- Date » Sold 76.86 AF of Fish Spring Ranch water credits for $3.07 million in 2020 ($36,000 per AF for Commercial and Industrial Uses, and $41,500 per AF for Residential Uses) and 37.21 AF of Fish Springs Ranch water credits for $1.5 million YTD 2021 at above unit prices. » Fish Springs Ranch Solar: Leased 727.80 acres of land to a major renewable energy company for $400 per acre with a 2.0% annual inflator, with 1,365.87 acres remaining under option. This is a 26 year lease with an option to renew for two additional 5-year options. » Sold 612.62 AF of water rights at Dodge Flat, NV for $4.1 million in 2020 and a further 296 AF in Q1 of 2021 for $2.074 million. » The entire Dodge Flat asset has now been sold (1,064 acres and 1,428 AF of water rights), at a combined gross margin of 89.4% on total revenue of $18.4 million » Generated Net Income before Tax of $668,000 in 2020 with no federal income taxes payable due to the utilization of our NOLs carried forward ($155.3 million federal NOLs at December 31, 2020). » Repurchased approximately 1.4 million shares on the open market for $12.5 million in 2020 and 2021 to date.

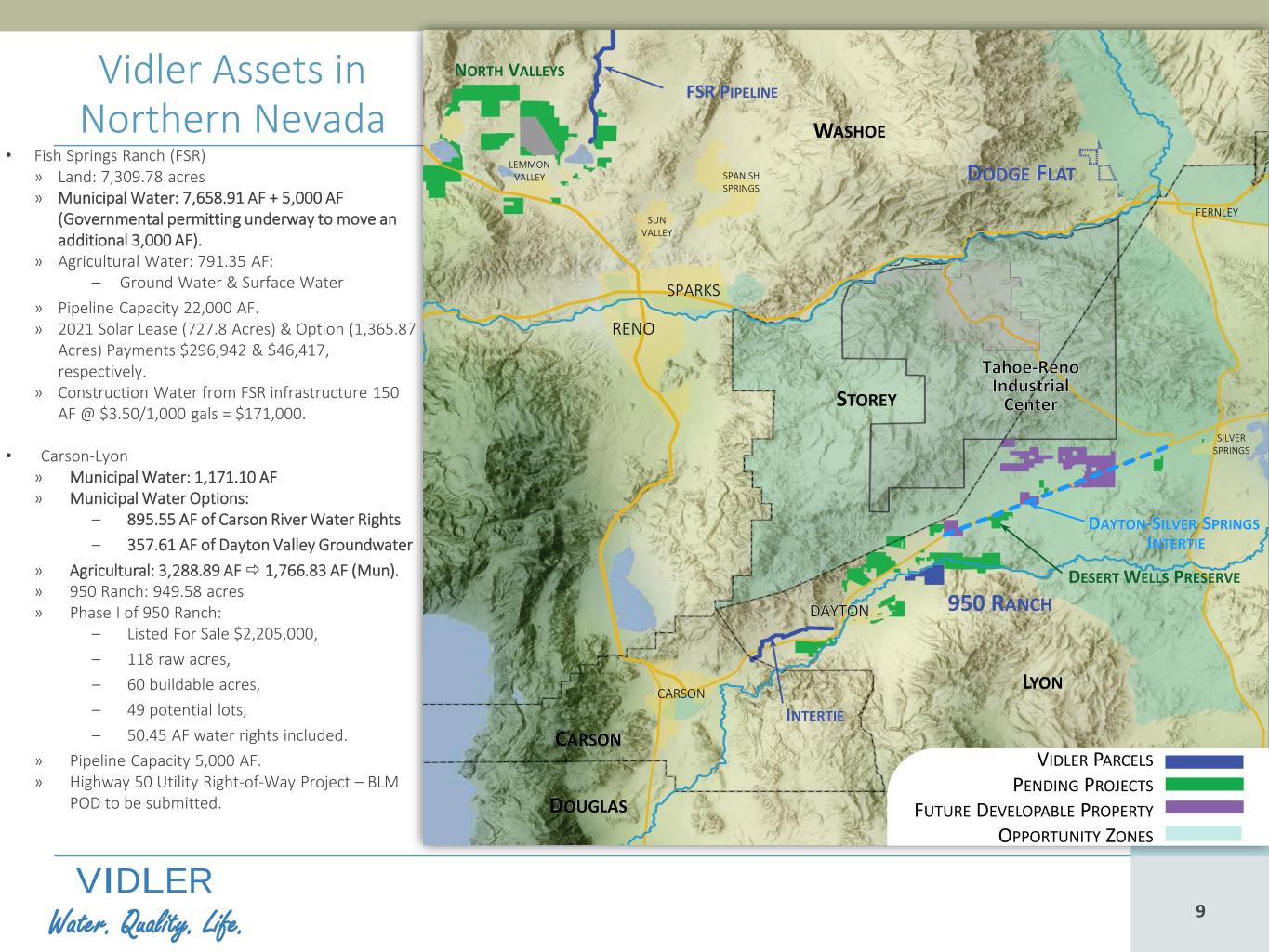

9 VIDLER Water. Quality. Life. 9 VIDLER PARCELS PENDING PROJECTS FUTURE DEVELOPABLE PROPERTY OPPORTUNITY ZONES WASHOE DESERT WELLS PRESERVE DODGE FLAT RENO SPARKS FERNLEY DAYTON CARSON 950 RANCH NORTH VALLEYS STOREY LYON DOUGLAS CARSON SPANISH SPRINGS SUN VALLEY SILVER SPRINGS LEMMON VALLEY FSR PIPELINE INTERTIE DAYTON-SILVER SPRINGS INTERTIE Vidler Assets in Northern Nevada • Fish Springs Ranch (FSR) » Land: 7,309.78 acres » Municipal Water: 7,658.91 AF + 5,000 AF (Governmental permitting underway to move an additional 3,000 AF). » Agricultural Water: 791.35 AF: – Ground Water & Surface Water » Pipeline Capacity 22,000 AF. » 2021 Solar Lease (727.8 Acres) & Option (1,365.87 Acres) Payments $296,942 & $46,417, respectively. » Construction Water from FSR infrastructure 150 AF @ $3.50/1,000 gals = $171,000. • Carson-Lyon » Municipal Water: 1,171.10 AF » Municipal Water Options: – 895.55 AF of Carson River Water Rights – 357.61 AF of Dayton Valley Groundwater » Agricultural: 3,288.89 AF 1,766.83 AF (Mun). » 950 Ranch: 949.58 acres » Phase I of 950 Ranch: – Listed For Sale $2,205,000, – 118 raw acres, – 60 buildable acres, – 49 potential lots, – 50.45 AF water rights included. » Pipeline Capacity 5,000 AF. » Highway 50 Utility Right-of-Way Project – BLM POD to be submitted.

10 VIDLER Water. Quality. Life. 10 Economic Development Authority of Western Nevada (EDAWN) National Recognition Slide: Source: Slide Presentation EDAWN’s State of the Economy in Northern Nevada Economic Update (February 2021)

11 VIDLER Water. Quality. Life. 11 North Valleys Estimated Total Water Usage from New Residential Projects Development Area Single Family Units Commercial / Industrial Acres Est. Demand or Remaining (AF) Sold (AF) Up to 6/4/2021 Stonegate 3,755 1245 Multi-Family, 51 Ac Commerc/Ind 1,793 Traincrest 2,900 0 700 White Lake Vistas 324 0 235 Silver Hills 1,872 0 715 Silver Star Ranch 1,600 0 449 Evans Ranch 5,679 62 1,832 Stead Airport 0 1,700 Prado Ranch North 490 0 112 NVIG 6 & 7 2522 0 792 NVIG 8 238 0 109 Arroyo Crossing 265 0 70 Echeverria Peavine 1,900 0 750 Military 8 60 15 North Valley Estates 252 0 0 64 Silver Dollar Estates 619 0 0 108.46 Lakes at Lemmon V. 72 Vista Enclave 75 0 17 28.19 Stonefield 12 Misc Commerical 38.86 Misc Residential 17.90 TOTAL 7,589 341.09

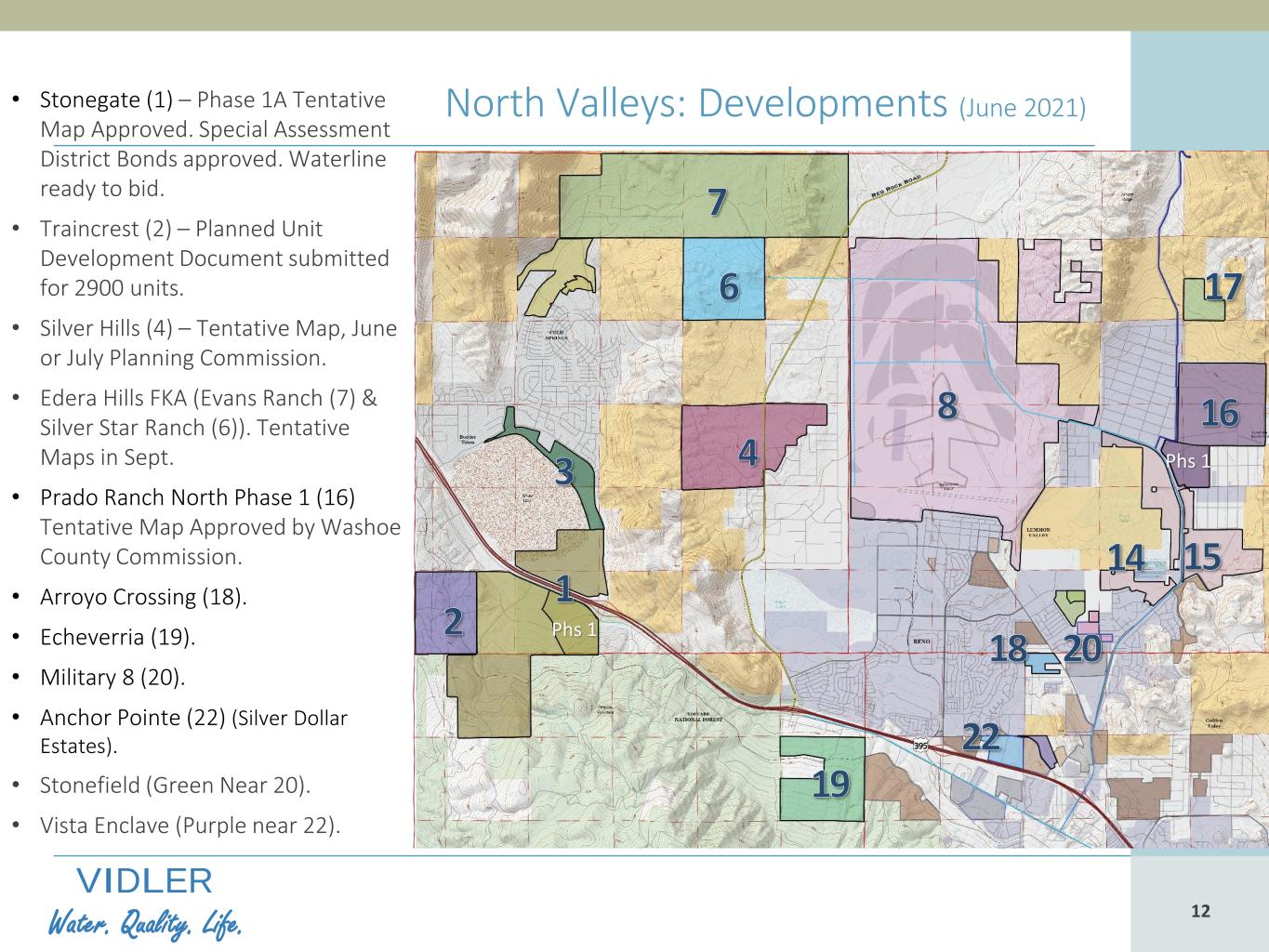

12 VIDLER Water. Quality. Life. 12 North Valleys: Developments (June 2021) Phs 1 Phs 1 • Stonegate (1) – Phase 1A Tentative Map Approved. Special Assessment District Bonds approved. Waterline ready to bid. • Traincrest (2) – Planned Unit Development Document submitted for 2900 units. • Silver Hills (4) – Tentative Map, June or July Planning Commission. • Edera Hills FKA (Evans Ranch (7) & Silver Star Ranch (6)). Tentative Maps in Sept. • Prado Ranch North Phase 1 (16) Tentative Map Approved by Washoe County Commission. • Arroyo Crossing (18). • Echeverria (19). • Military 8 (20). • Anchor Pointe (22) (Silver Dollar Estates). • Stonefield (Green Near 20). • Vista Enclave (Purple near 22).

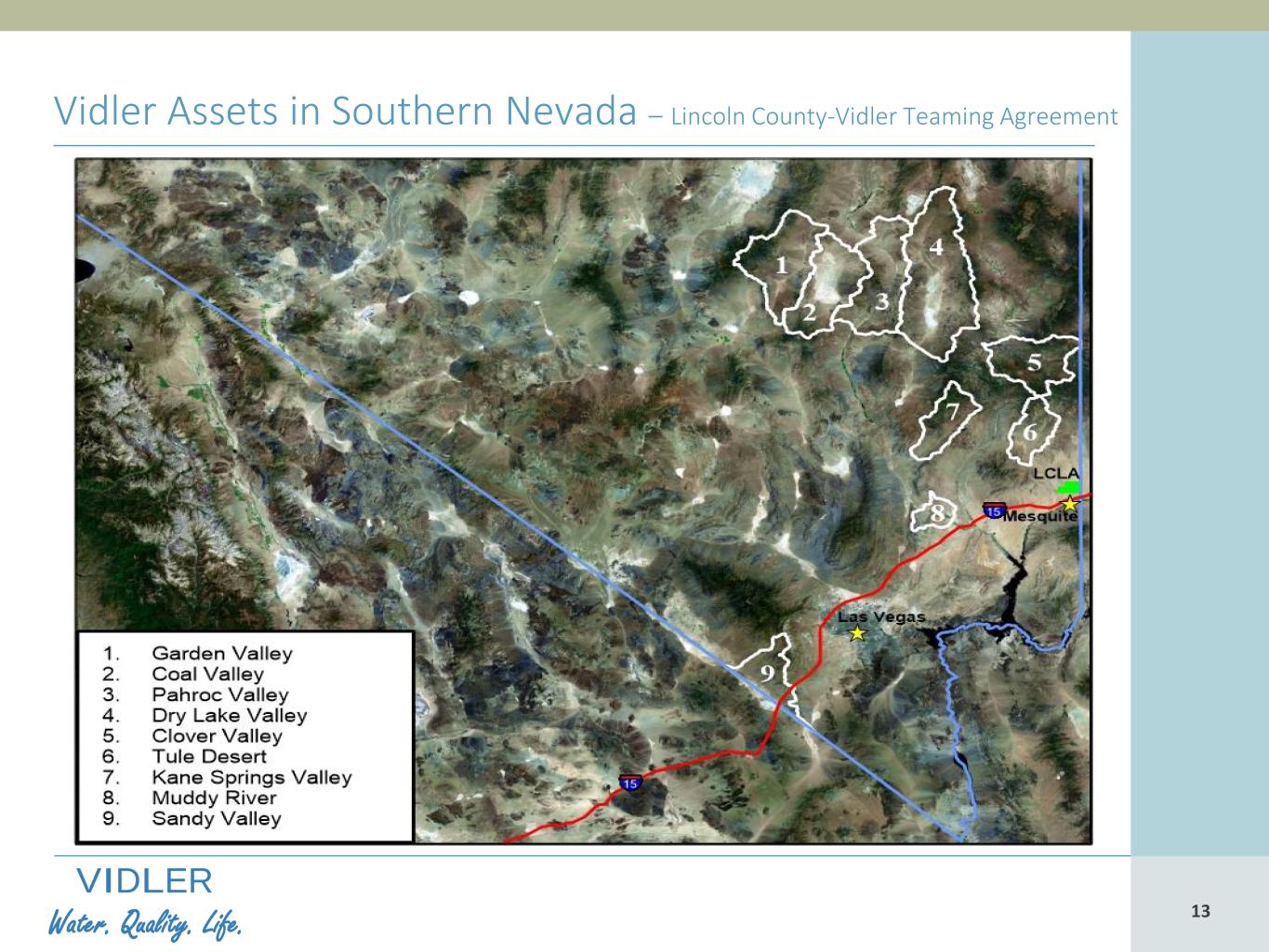

13 VIDLER Water. Quality. Life. 13 Vidler Assets in Southern Nevada – Lincoln County-Vidler Teaming Agreement 1 2 3 4 5 6 7 8

14 VIDLER Water. Quality. Life. 14 Tule Desert and Clover Valley – Lincoln County-Vidler Teaming Agreement • Tule Desert » 2,900 AF permitted water rights: – Additional water may be awarded after 8 years of pumping, up to 4,340 AF. » The proposed pipeline will deliver water from Tule Desert to the Lincoln County Land Act. » Additional work on the Plan of Development for the Tule Desert pipeline project includes: – Developing plan & profiles for the pipeline route. – Engaged Brown & Caldwell Engineering consultant to model the pipeline pressures. Currently in the process of finalizing draft report. – Continue working with the BLM to move the project forward. • Clover Valley » Applications filed. » Continued data collection including runoff, precipitation, soils temperature, and chloride data. C l o v e r V a l l e y Water Pipeline Utility Corridor Gas & Electricity L C L A

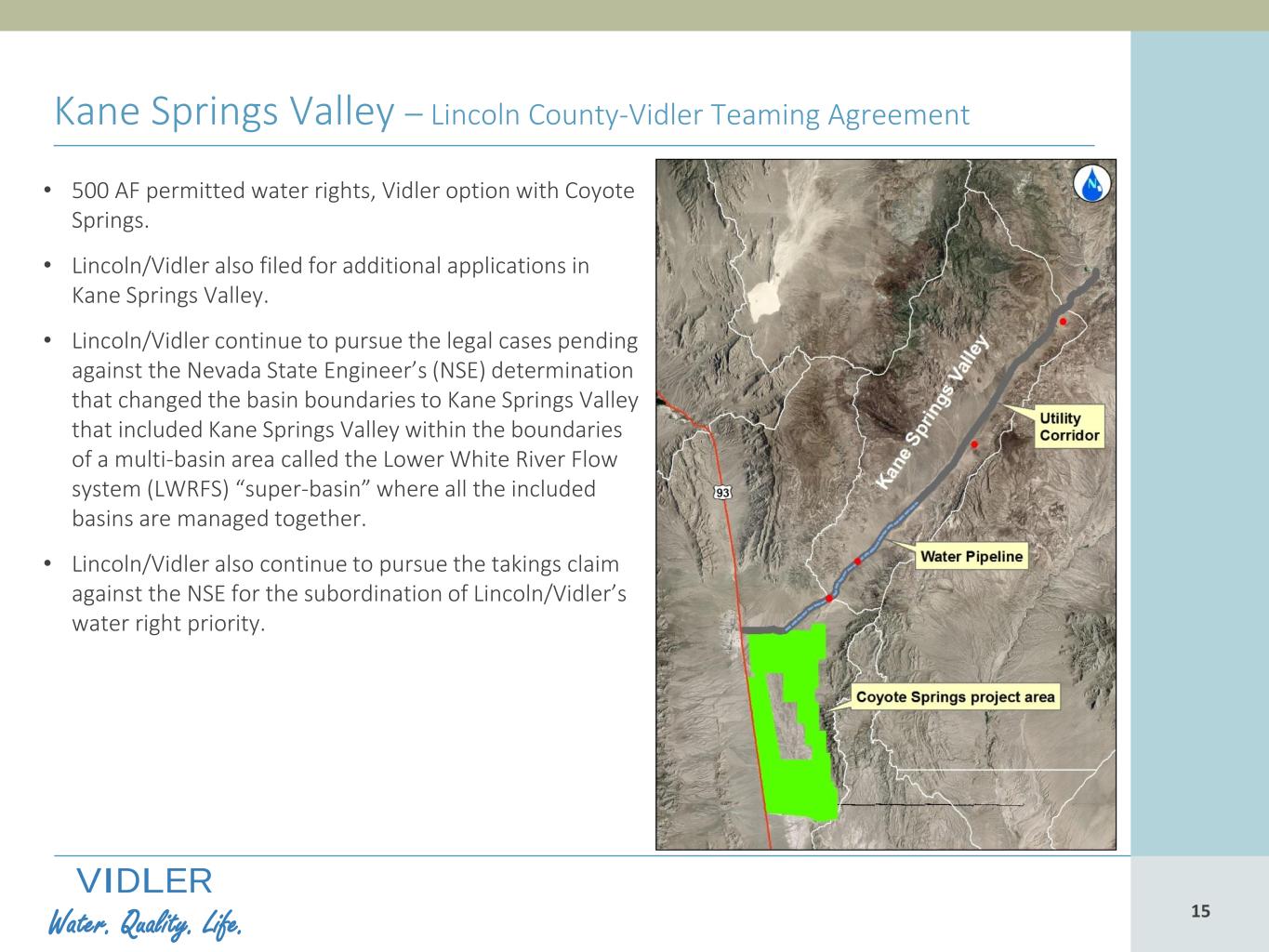

15 VIDLER Water. Quality. Life. 15 Kane Springs Valley – Lincoln County-Vidler Teaming Agreement • 500 AF permitted water rights, Vidler option with Coyote Springs. • Lincoln/Vidler also filed for additional applications in Kane Springs Valley. • Lincoln/Vidler continue to pursue the legal cases pending against the Nevada State Engineer’s (NSE) determination that changed the basin boundaries to Kane Springs Valley that included Kane Springs Valley within the boundaries of a multi-basin area called the Lower White River Flow system (LWRFS) “super-basin” where all the included basins are managed together. • Lincoln/Vidler also continue to pursue the takings claim against the NSE for the subordination of Lincoln/Vidler’s water right priority.

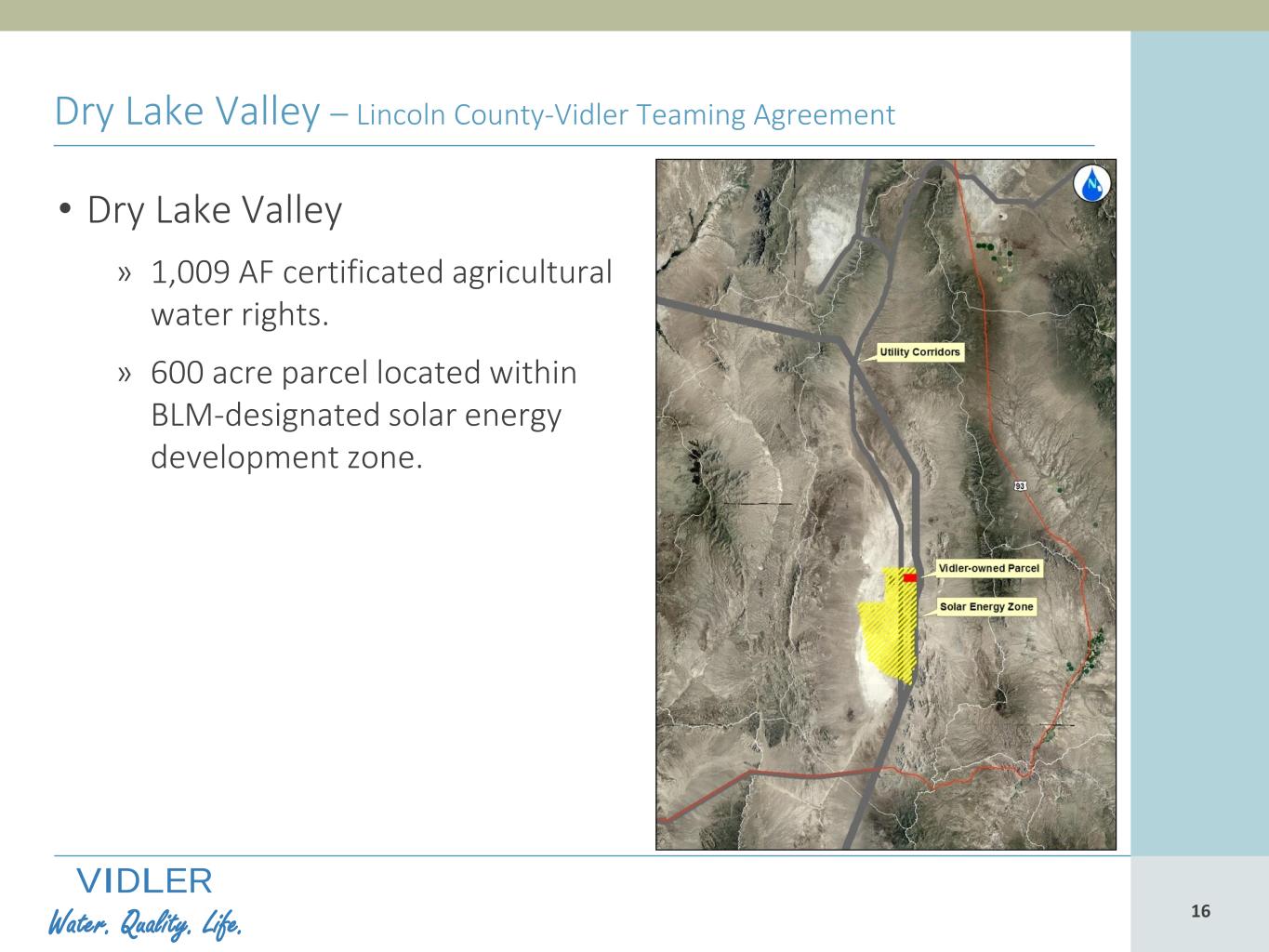

16 VIDLER Water. Quality. Life. 16 Dry Lake Valley – Lincoln County-Vidler Teaming Agreement • Dry Lake Valley » 1,009 AF certificated agricultural water rights. » 600 acre parcel located within BLM-designated solar energy development zone.

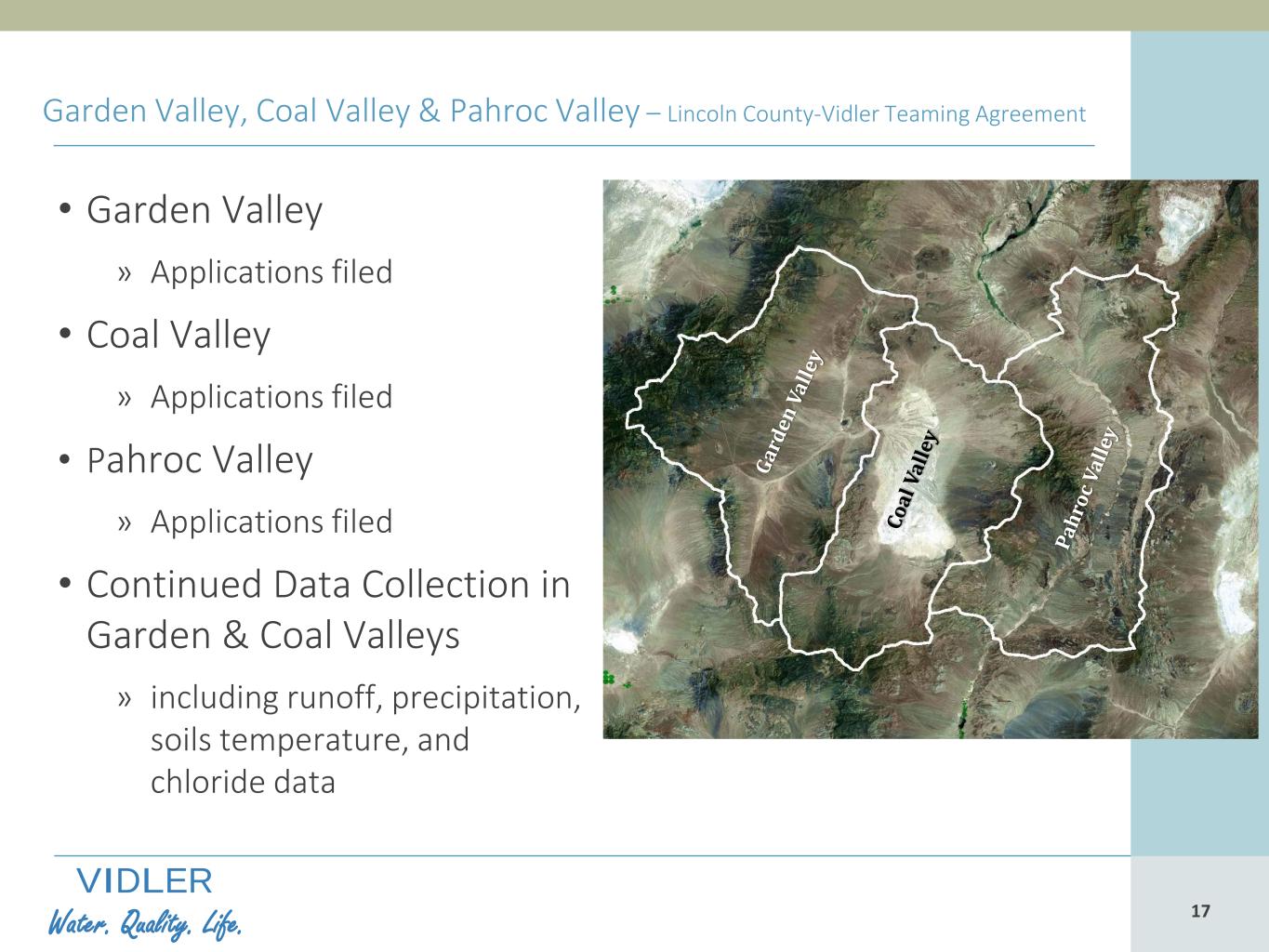

17 VIDLER Water. Quality. Life. 17 Garden Valley, Coal Valley & Pahroc Valley – Lincoln County-Vidler Teaming Agreement • Garden Valley » Applications filed • Coal Valley » Applications filed • Pahroc Valley » Applications filed • Continued Data Collection in Garden & Coal Valleys » including runoff, precipitation, soils temperature, and chloride data

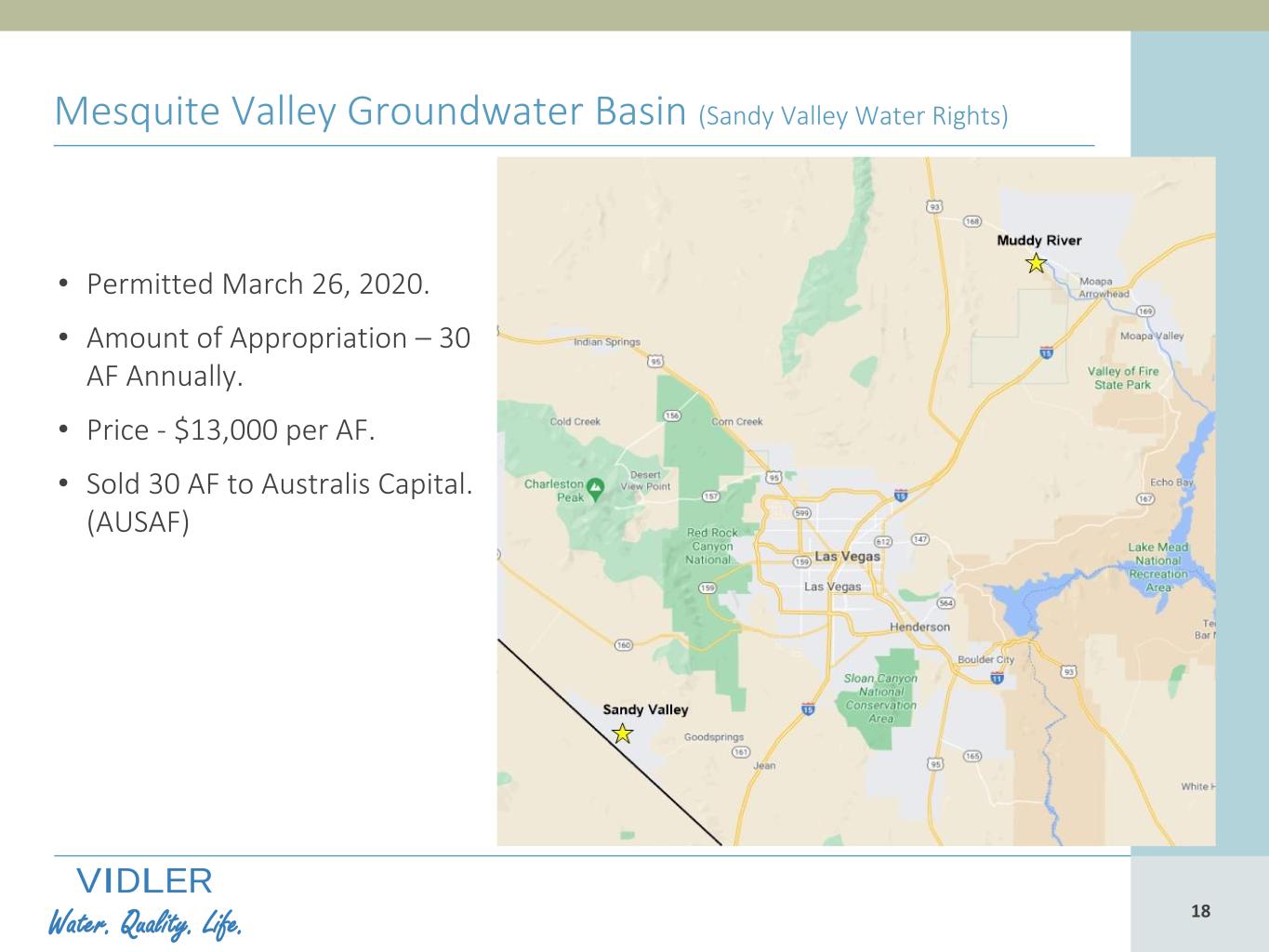

18 VIDLER Water. Quality. Life. 18 Mesquite Valley Groundwater Basin (Sandy Valley Water Rights) • Permitted March 26, 2020. • Amount of Appropriation – 30 AF Annually. • Price - $13,000 per AF. • Sold 30 AF to Australis Capital. (AUSAF)

19 VIDLER Water. Quality. Life. 19 Current Arizona Water Issues • The Lower Basin states continue to face a severe drought that will cause a Tier I shortage which means a reduction in mainly agricultural water to Arizona by a total of 592,000 AF. This determination will be made by the US Bureau of Reclamation in August 2021. This should drive the need for existing water supplies such as our LTSCs in the Phoenix AMA and our banked water in Harquahala Valley. • Increased water demand fueled by growth, especially within the Phoenix and Pinal Active Management Areas (AMA). • The Pinal AMA is a largely agricultural area located between the Phoenix and Tucson metropolitan areas. • The Pinal AMA is facing intense water shortages due to the increased growth from new residential, commercial, and industrial users, with: “…insufficient groundwater in the Pinal AMA to support all existing users and issued assured water supply determinations.” (Arizona Department of Water Resources). • Needs for existing and increasing housing supply and infrastructure cannot be met unless new water sources can be found to sustain this new development. • Our banked water in Harquahala Valley can be used as a new water supply to satisfy a portion of this need.

20 VIDLER Water. Quality. Life. 20 Phoenix AMA Harquahala INA Vidler Assets in Arizona: Long-Term Storage Credits Location LTSC (AF) Harquahala INA 250,683 Phoenix AMA 28,147 California Nevada Utah New Mexico Colorado Pinal AMA

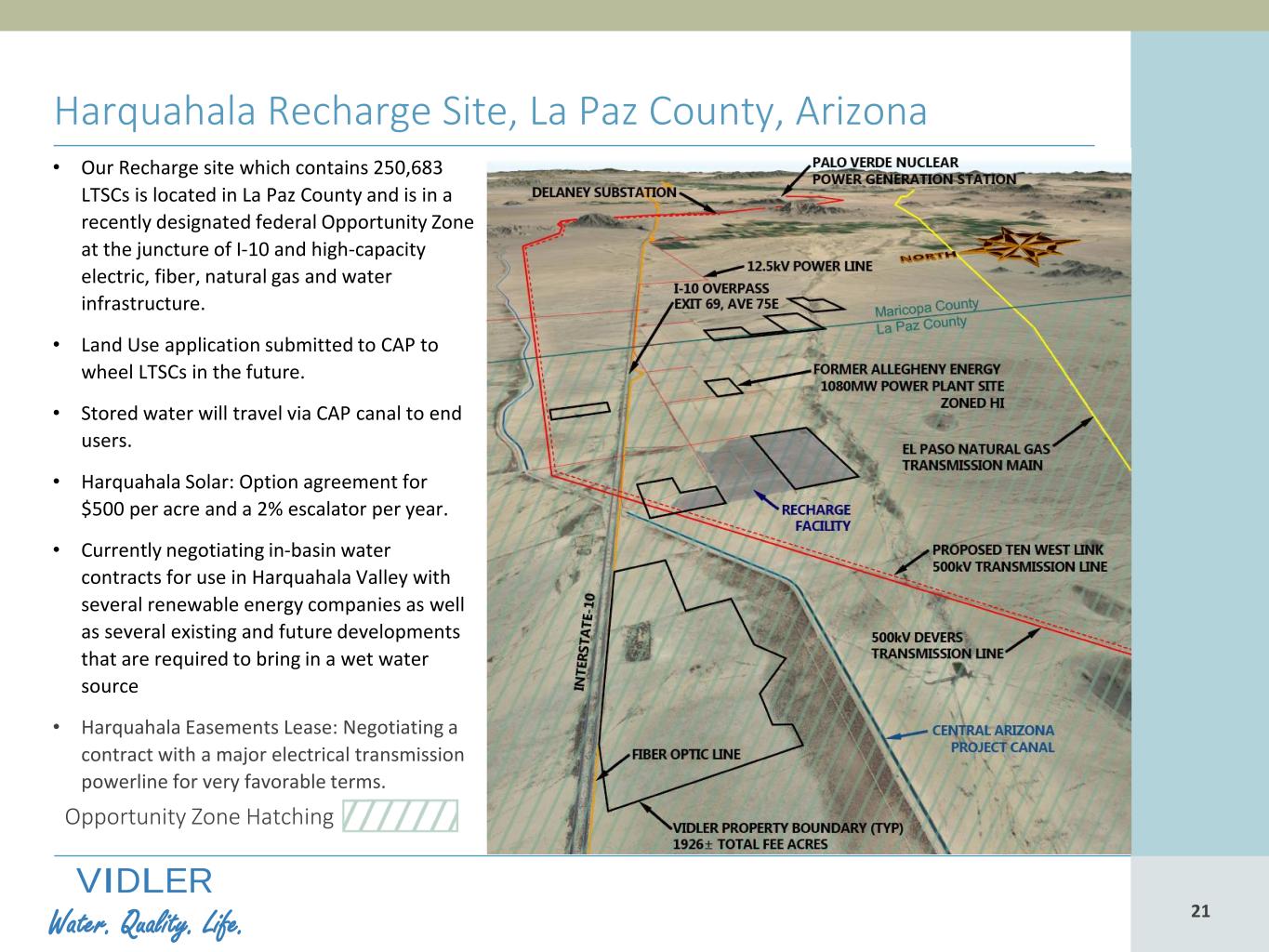

21 VIDLER Water. Quality. Life. 21 Harquahala Recharge Site, La Paz County, Arizona Opportunity Zone Hatching • Our Recharge site which contains 250,683 LTSCs is located in La Paz County and is in a recently designated federal Opportunity Zone at the juncture of I-10 and high-capacity electric, fiber, natural gas and water infrastructure. • Land Use application submitted to CAP to wheel LTSCs in the future. • Stored water will travel via CAP canal to end users. • Harquahala Solar: Option agreement for $500 per acre and a 2% escalator per year. • Currently negotiating in-basin water contracts for use in Harquahala Valley with several renewable energy companies as well as several existing and future developments that are required to bring in a wet water source • Harquahala Easements Lease: Negotiating a contract with a major electrical transmission powerline for very favorable terms.

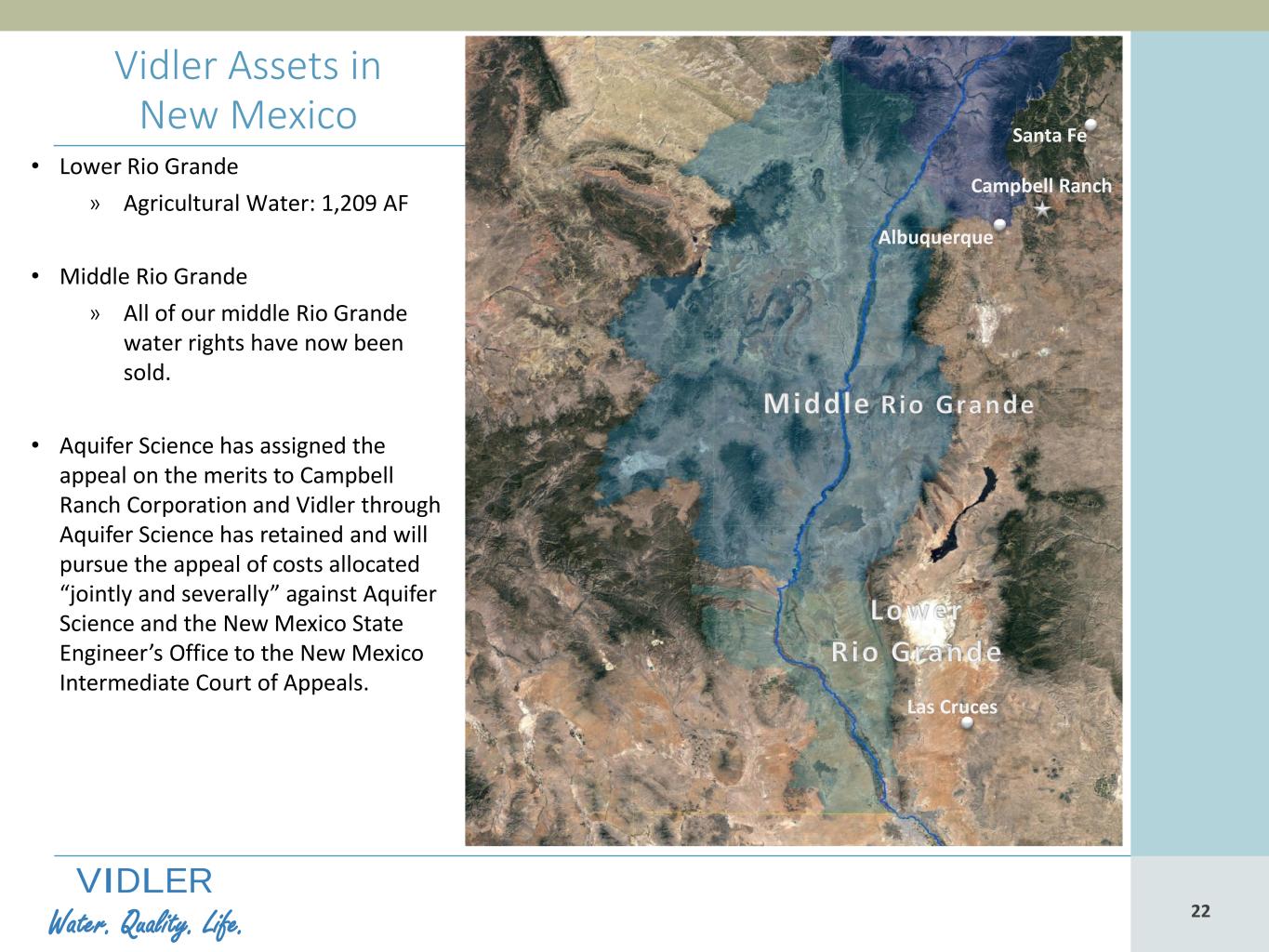

22 VIDLER Water. Quality. Life. 22 Vidler Assets in New Mexico • Lower Rio Grande » Agricultural Water: 1,209 AF • Middle Rio Grande » All of our middle Rio Grande water rights have now been sold. • Aquifer Science has assigned the appeal on the merits to Campbell Ranch Corporation and Vidler through Aquifer Science has retained and will pursue the appeal of costs allocated “jointly and severally” against Aquifer Science and the New Mexico State Engineer’s Office to the New Mexico Intermediate Court of Appeals. Albuquerque Santa Fe Las Cruces Campbell Ranch

23 VIDLER Water. Quality. Life. 23 Summit County - Colorado • Summit County Augmentation Plan » 93.373 AF of water for sale » 30.86 AF currently leased Denver

24 VIDLER Water. Quality. Life. 24 Return on Invested Capital • Our focus as we execute our business plan is to maximize our return on invested capital. • Our overall return on invested capital is dependent on the margin and turnover of asset monetizations, control over our net annual cash expenditures and our leverage. • We are currently unleveraged: Customers know we are a strong and reliable counterparty and that our water assets are "free and clear" for sale.

25 VIDLER Water. Quality. Life. 25 Incentives to Maximize Return on Invested Capital • We are incentivized and aligned with our shareholders to maximize asset gross margins, asset turnover, reduce net costs and allocate capital to highest return generating alternative: » Board and management equity ownership is over 11%. » Management equity grants comprises 50% of any annual bonus earned; management took equity grants for 100% of 2020 bonus earned. » Adjustment factor reduces management bonus in year in which capital not allocated in a form of a return of asset sale proceeds to shareholders. » Management bonus calculation includes a cumulative annual time value of money charge on invested capital. » Management bonus calculation includes all annual costs charged against margin generated on invested capital.

26 VIDLER Water. Quality. Life. 26 Return of Capital to Shareholders to Date • Special Dividend (tax-free return of capital) of $5 per share in 2017 (approximately $115.9 million). • Open market repurchases of stock: Inception of repurchase program to date approximately 4.9 million shares repurchased through May 31, 2021 for total cost of $50.9 million. • Any significant additional monetization proceeds may be returned to shareholders through open market repurchases, and/or special dividends, or other means, depending on facts and circumstances existing at the time of monetization.

27 VIDLER Water. Quality. Life. 27 Annual Net Cash Expenditures • Our current estimate of annual net cash expenditures (net annual cash flows from operating income less all operating costs – before (i) any asset monetizations and associated costs, and (ii) capital allocation) - is approximately $5.2 million. • Our gross operating costs consist of three elements: » costs directly related to a specific asset or project (22% of total); » overhead costs (62% of total); and » public company costs (16% of total). • We aim to reduce our annual net cash expenditures further by increasing annual recurring cash inflows from sources including, but not limited to, potential solar lease revenue from our Arizona real estate assets and continuous review of our operating cost base.

28 VIDLER Water. Quality. Life. 28 Current Liquidity • Our current cash on hand is approximately $7.7 million with minimal liabilities and no federal taxes payable on taxable income generated in 2019 and 2020 due to our federal NOLs carried forward. • Deferred certain payments for acquisition of Carson Lyon, NV water rights until 2022. • Evaluating / deferring project costs where possible. • Continual monitoring of share repurchase program and cash flow outlook: Balancing working capital needs with current favorable conditions to repurchase shares on the open market. • Our portfolio consists of a wide range of water resource assets; to date we have completed frequent monetizations to a varied pool of buyers and users.

29 VIDLER Water. Quality. Life. 29 Q. & A. Carson River

30 VIDLER Water. Quality. Life. 30 Data Appendix • Reno & Northern Nevada housing demand and population growth • Arizona water needs and population growth

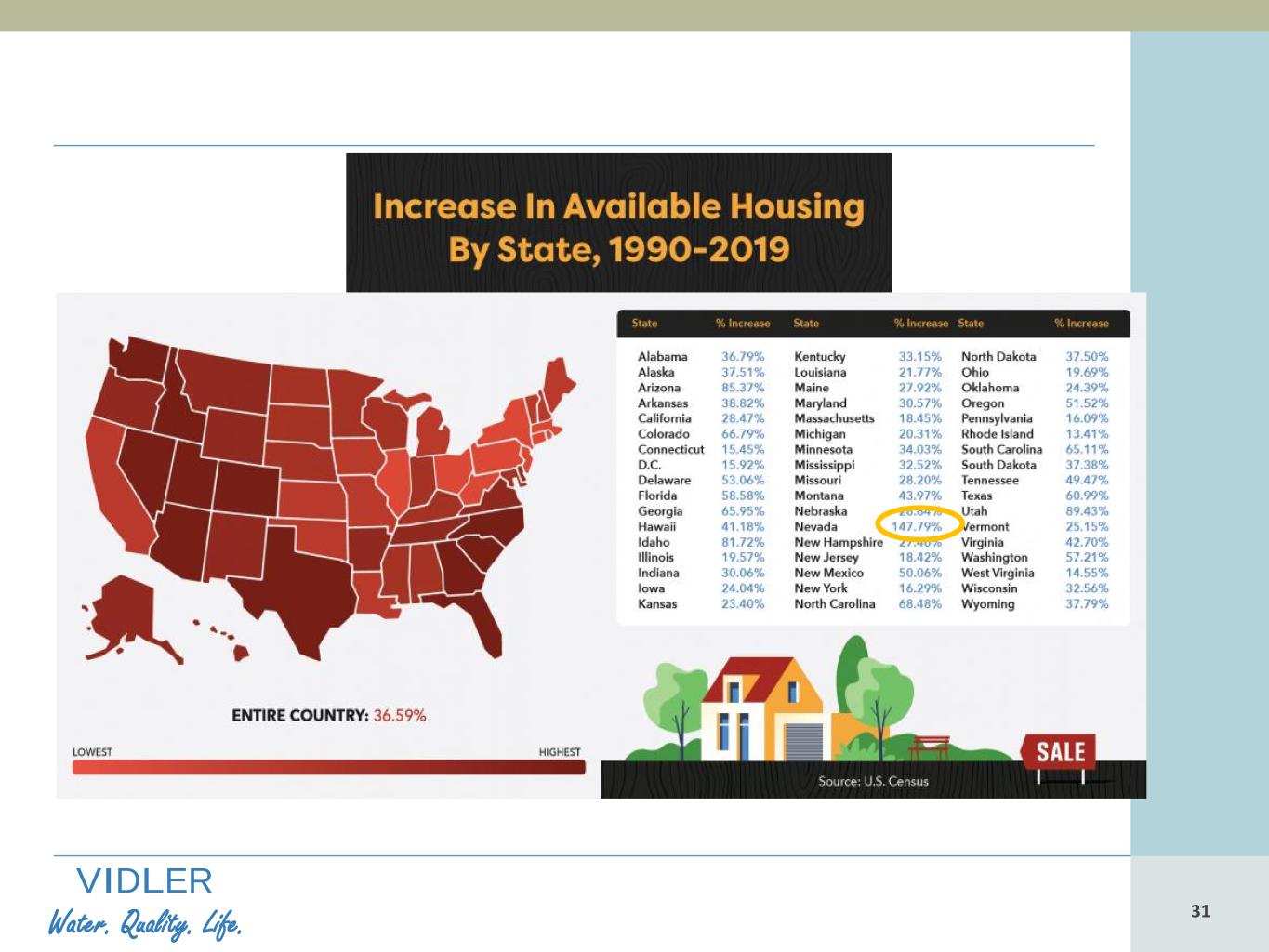

31 VIDLER Water. Quality. Life. 31

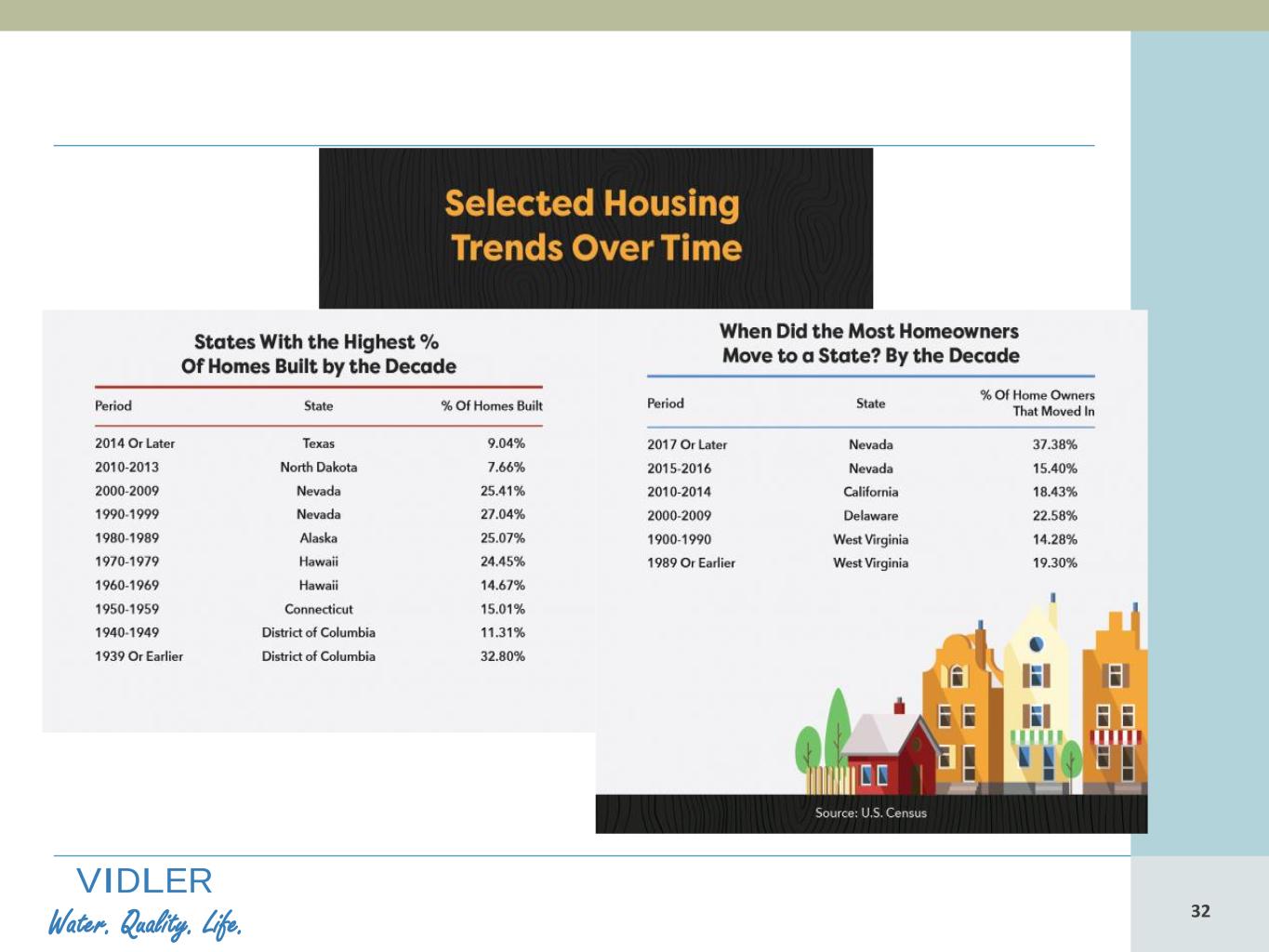

32 VIDLER Water. Quality. Life. 32

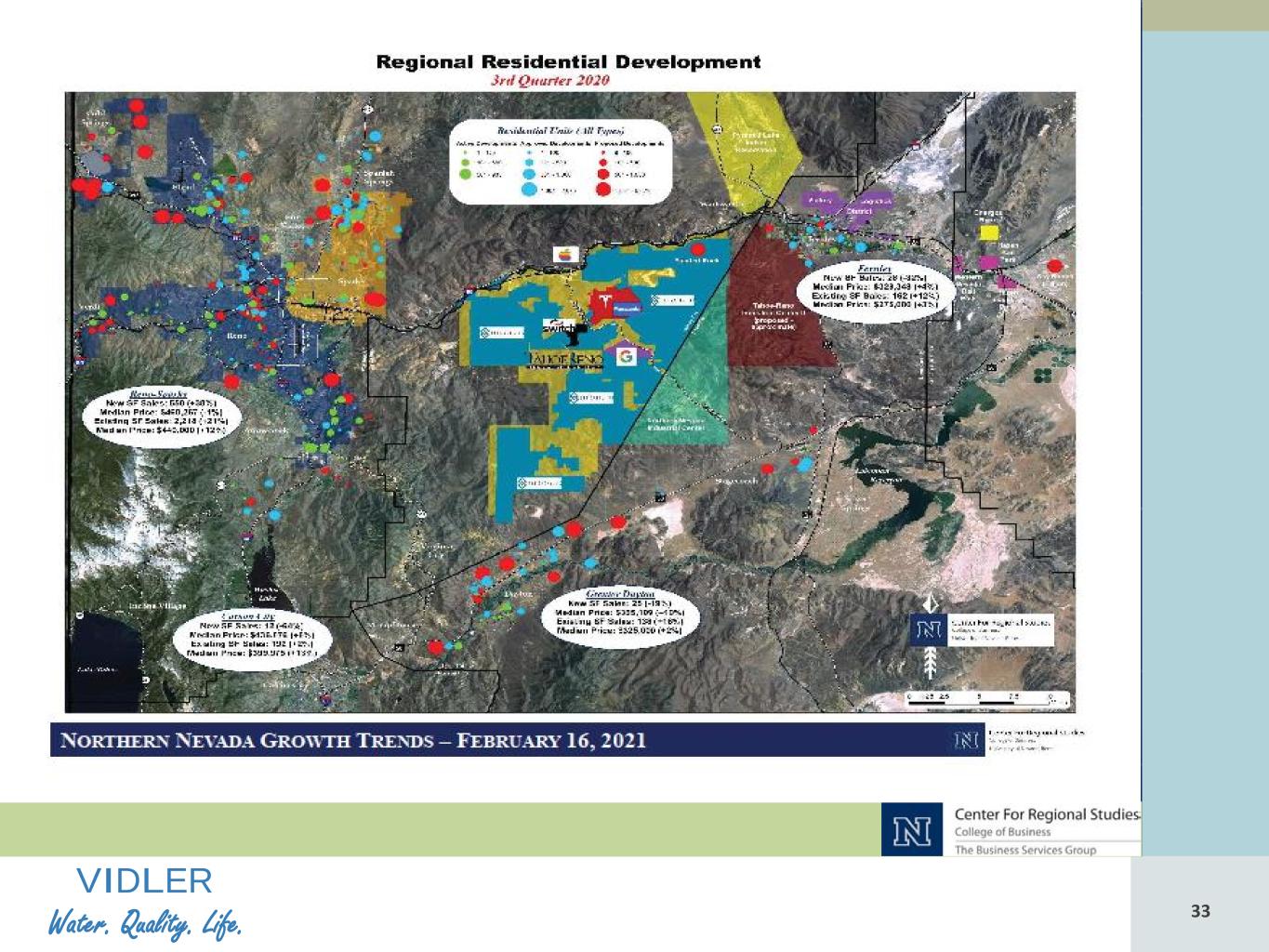

33 VIDLER Water. Quality. Life. 33

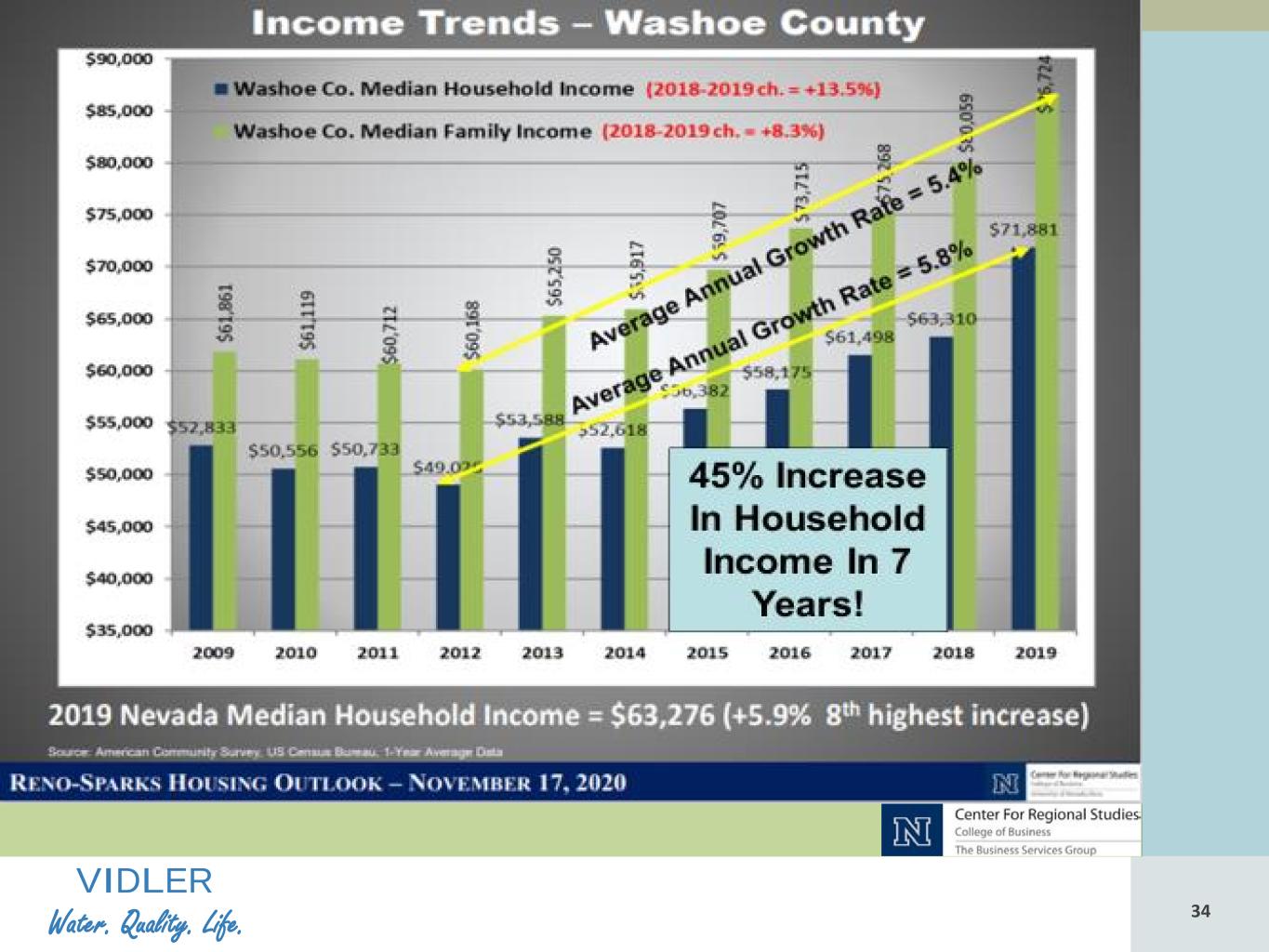

34 VIDLER Water. Quality. Life. 34

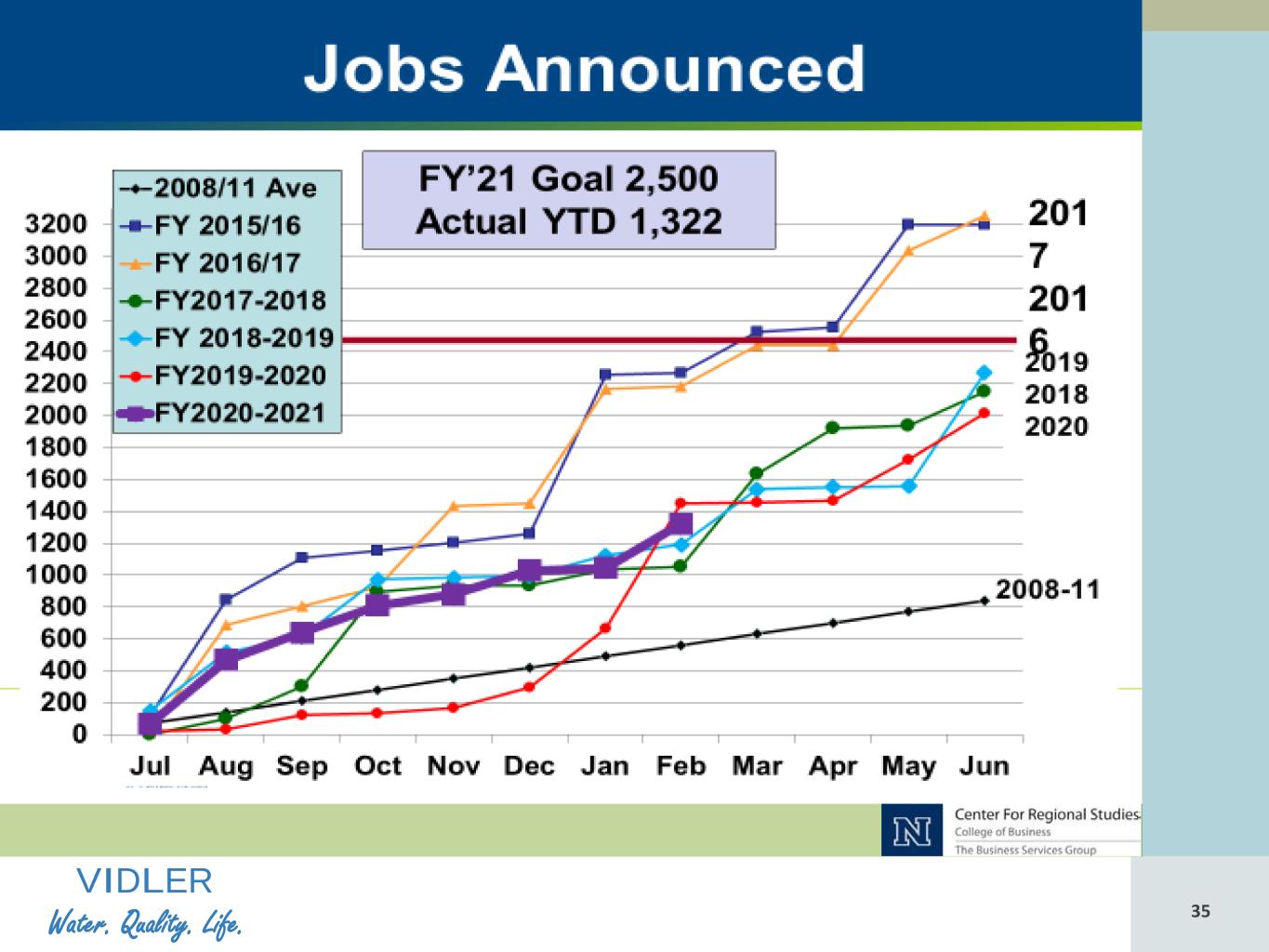

35 VIDLER Water. Quality. Life. 35

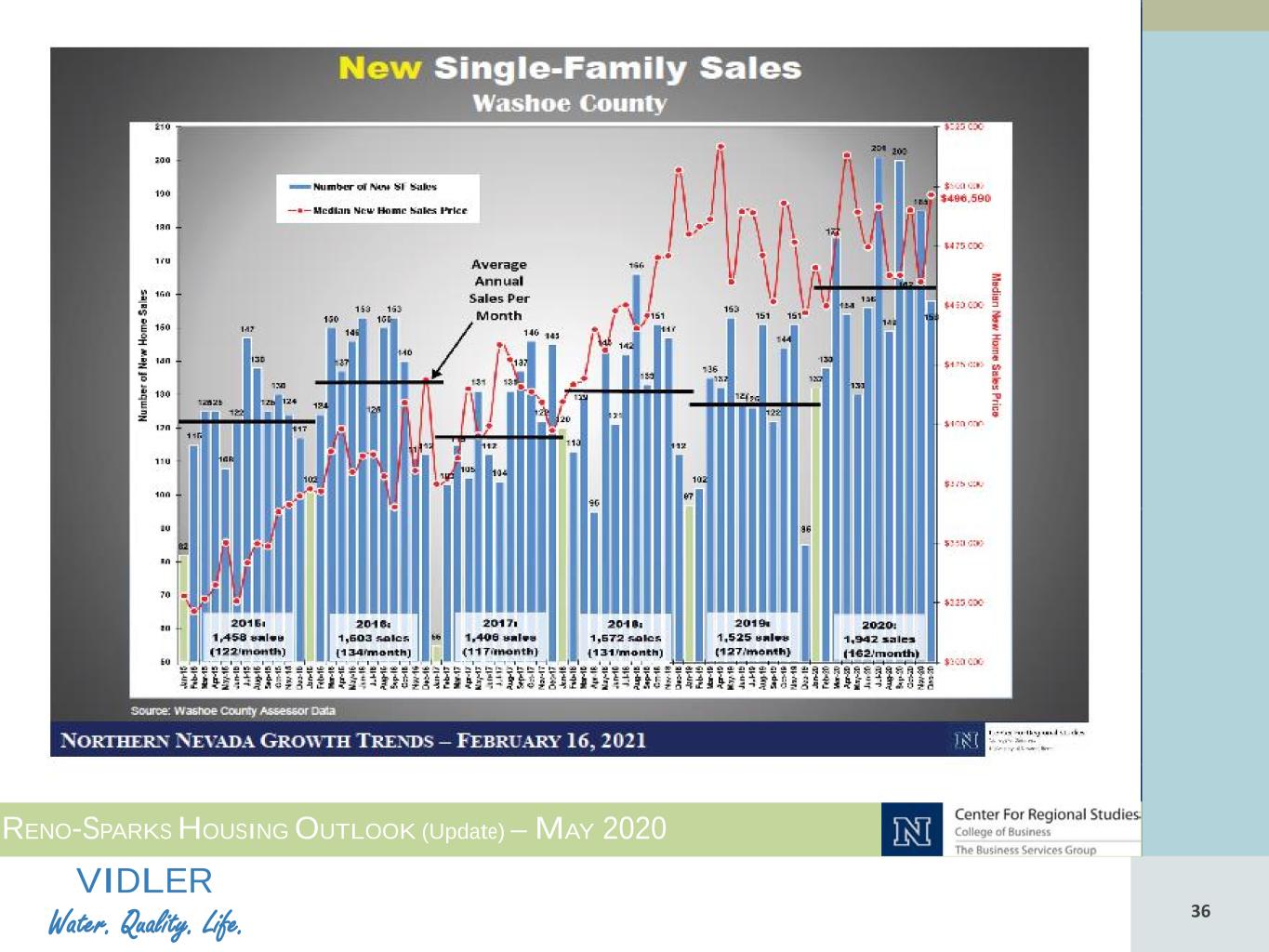

36 VIDLER Water. Quality. Life. 36 RENO-SPARKS HOUSING OUTLOOK (Update) – MAY 2020

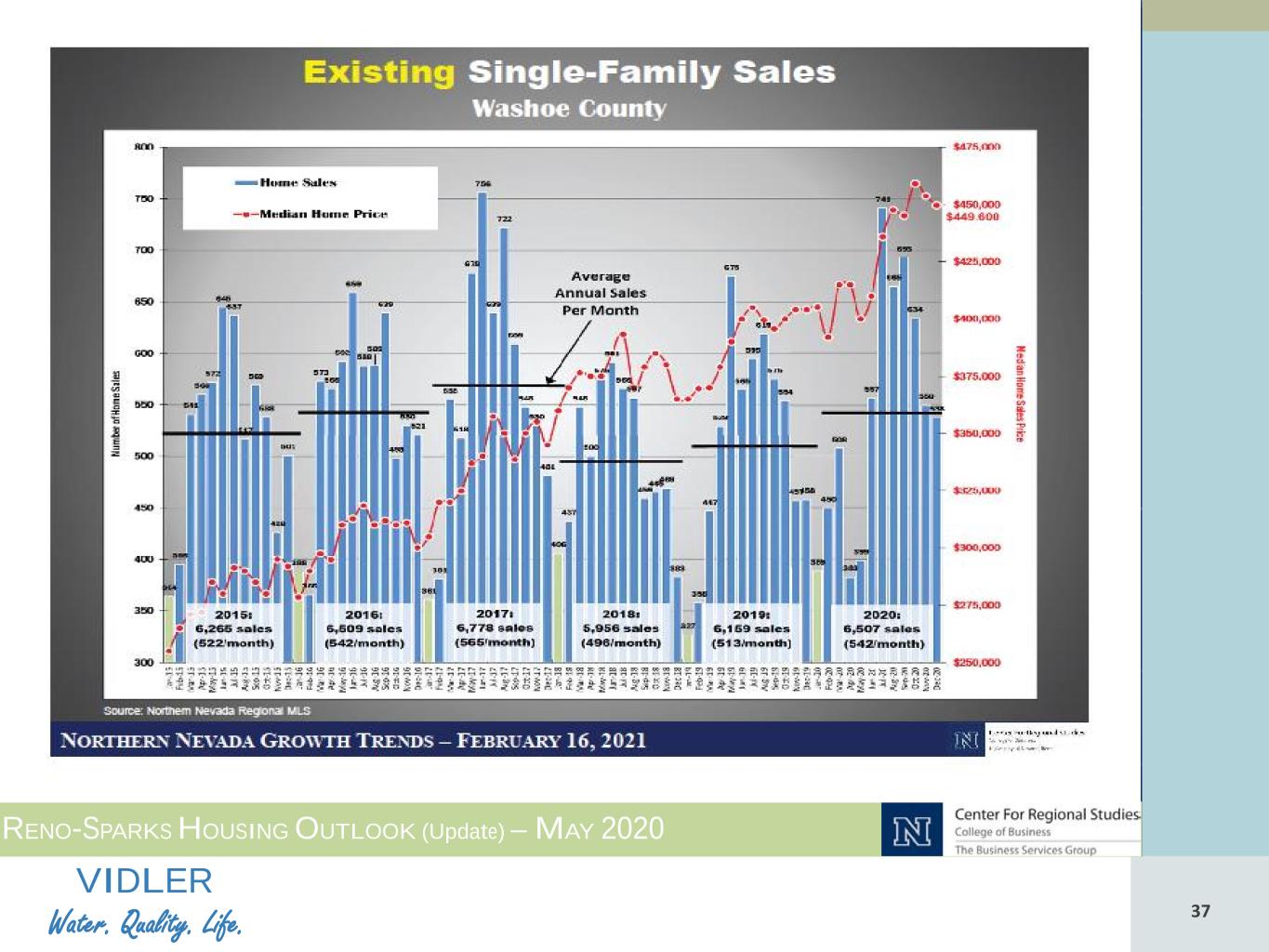

37 VIDLER Water. Quality. Life. 37 RENO-SPARKS HOUSING OUTLOOK (Update) – MAY 2020

38 VIDLER Water. Quality. Life. 38

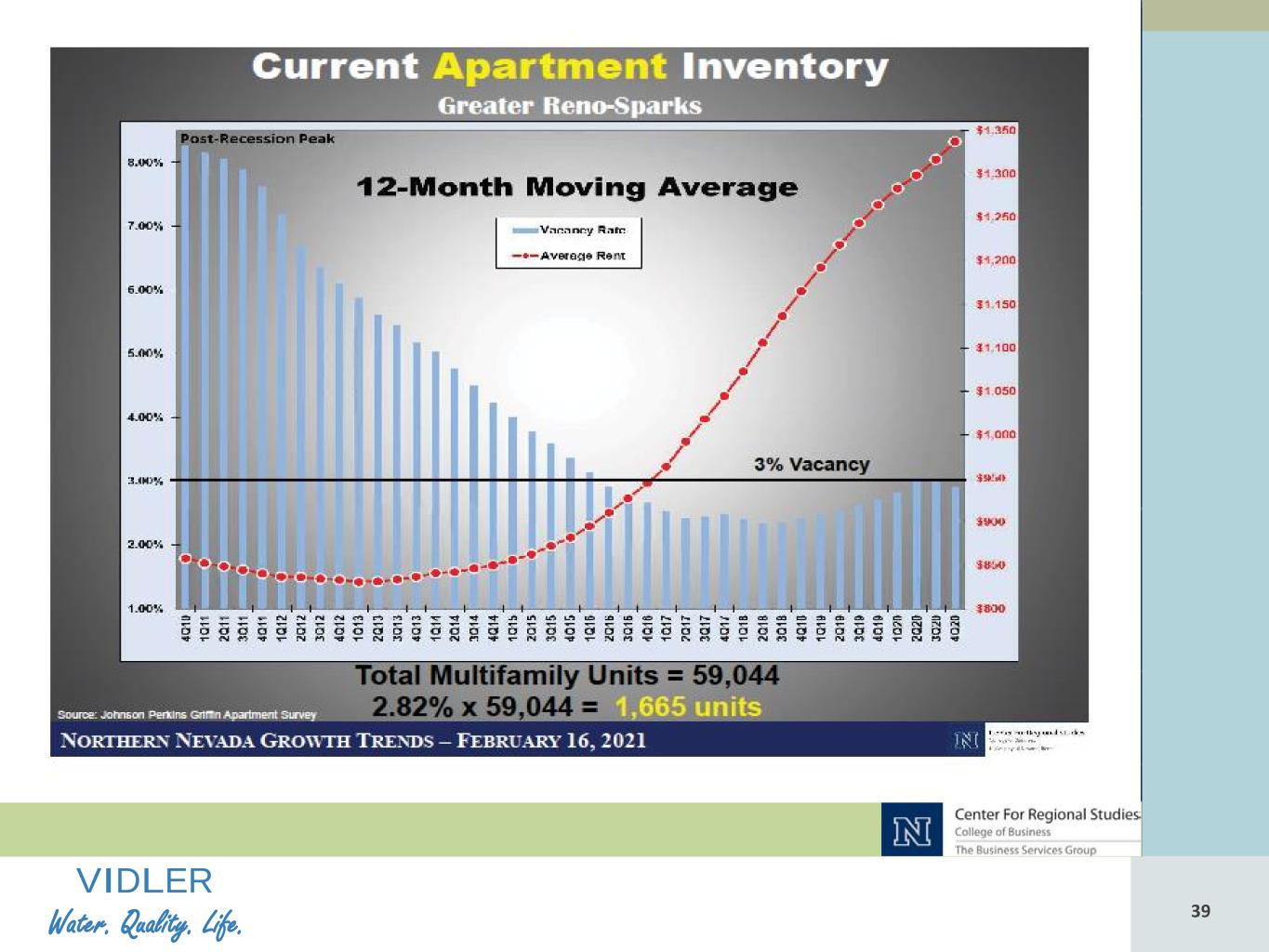

39 VIDLER Water. Quality. Life. 39

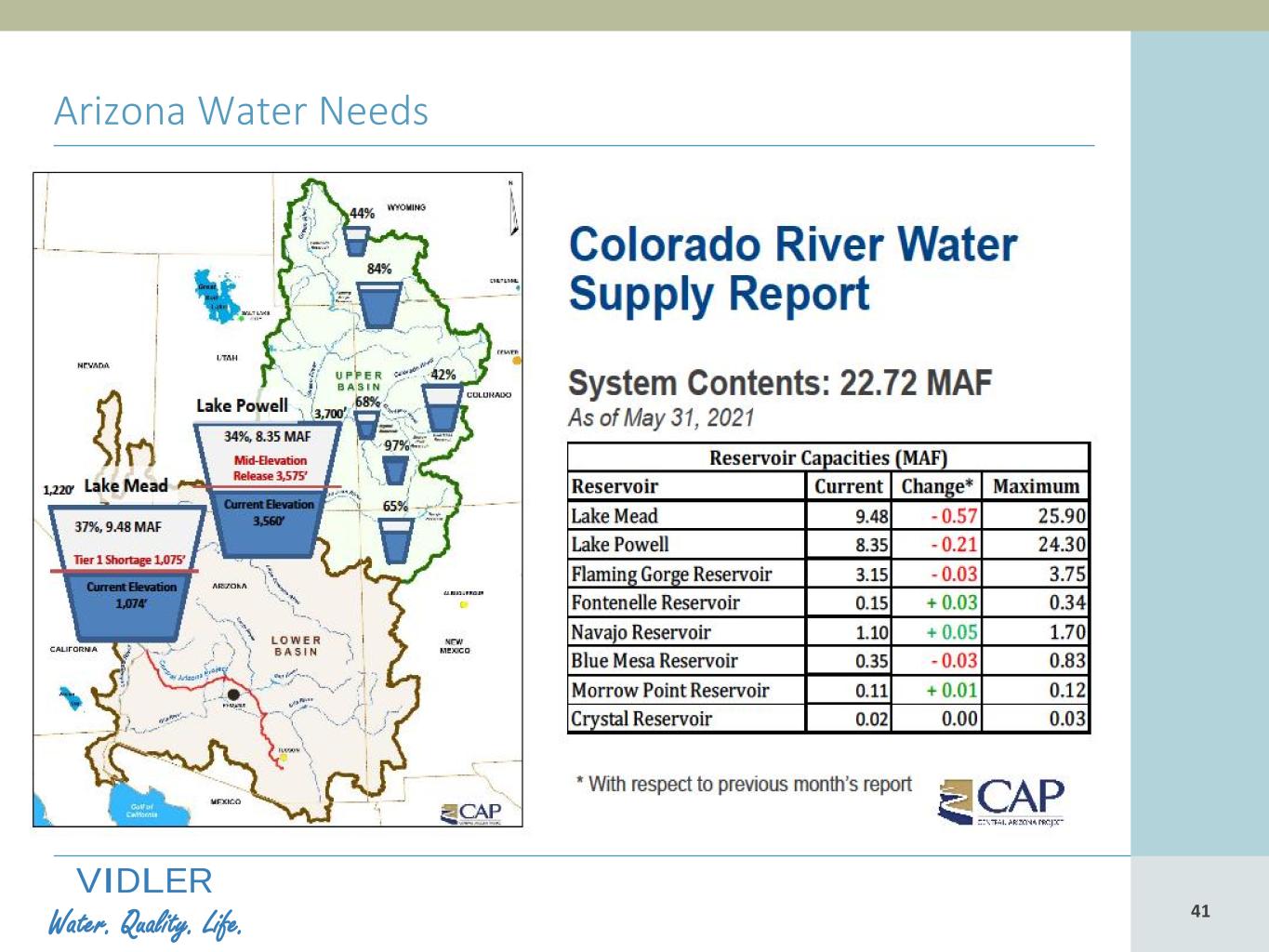

40 VIDLER Water. Quality. Life. 40 Recent Lake Mead Water Level Elevation Source: http://mead.uslakes.info/level.asp

41 VIDLER Water. Quality. Life. 41 Arizona Water Needs

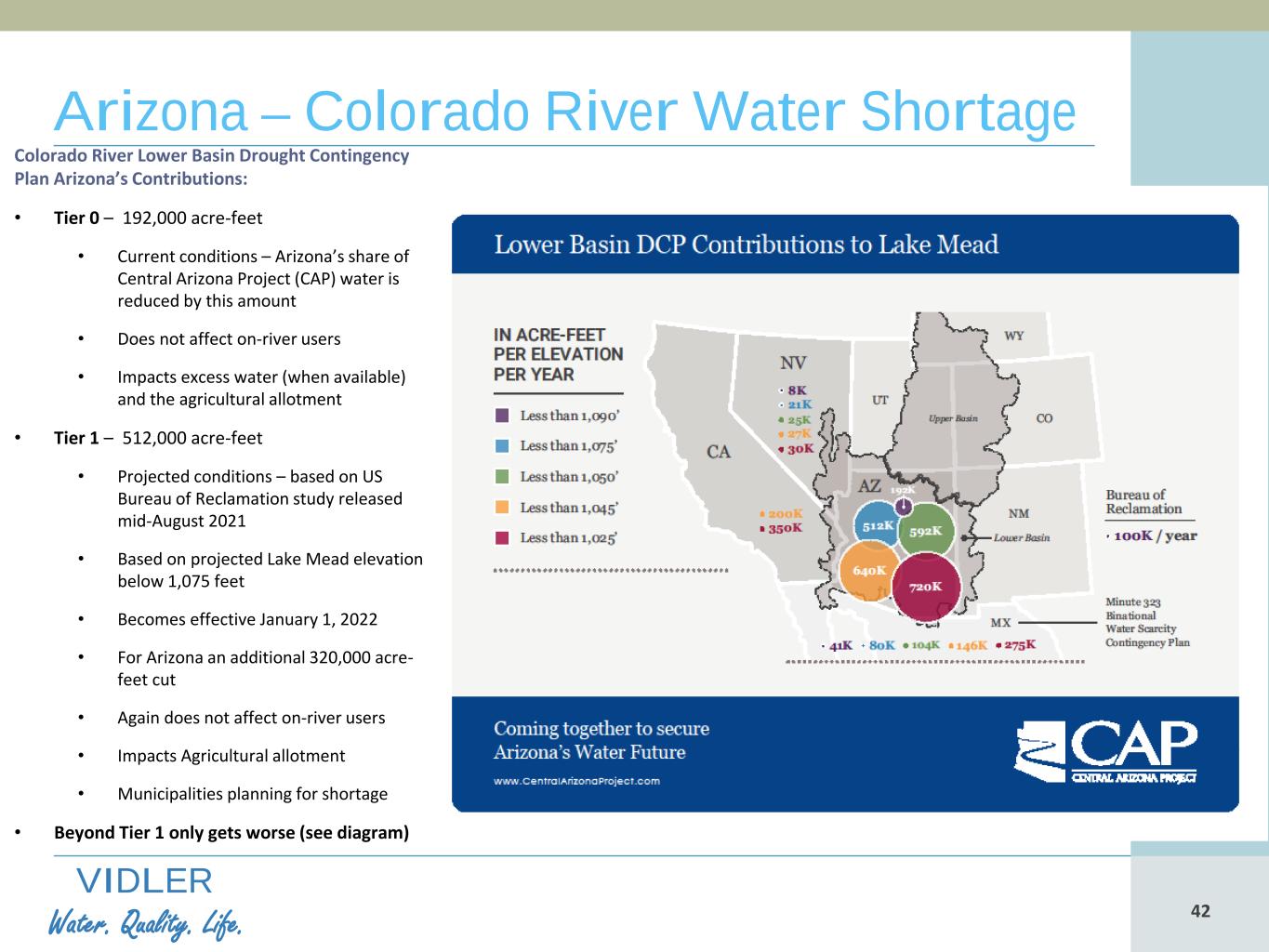

42 VIDLER Water. Quality. Life. 42 Arizona – Colorado River Water Shortage Colorado River Lower Basin Drought Contingency Plan Arizona’s Contributions: • Tier 0 – 192,000 acre-feet • Current conditions – Arizona’s share of Central Arizona Project (CAP) water is reduced by this amount • Does not affect on-river users • Impacts excess water (when available) and the agricultural allotment • Tier 1 – 512,000 acre-feet • Projected conditions – based on US Bureau of Reclamation study released mid-August 2021 • Based on projected Lake Mead elevation below 1,075 feet • Becomes effective January 1, 2022 • For Arizona an additional 320,000 acre- feet cut • Again does not affect on-river users • Impacts Agricultural allotment • Municipalities planning for shortage • Beyond Tier 1 only gets worse (see diagram)

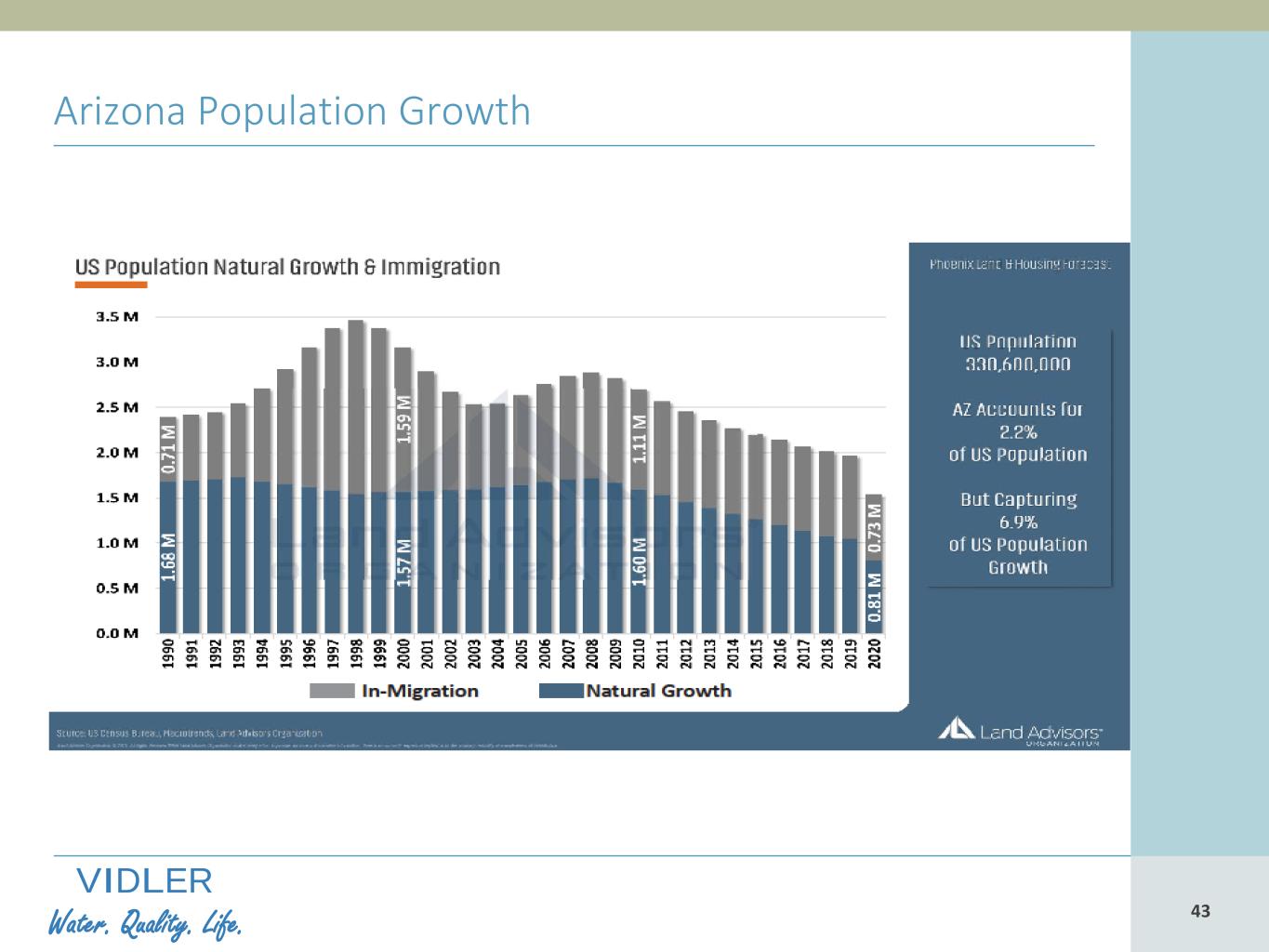

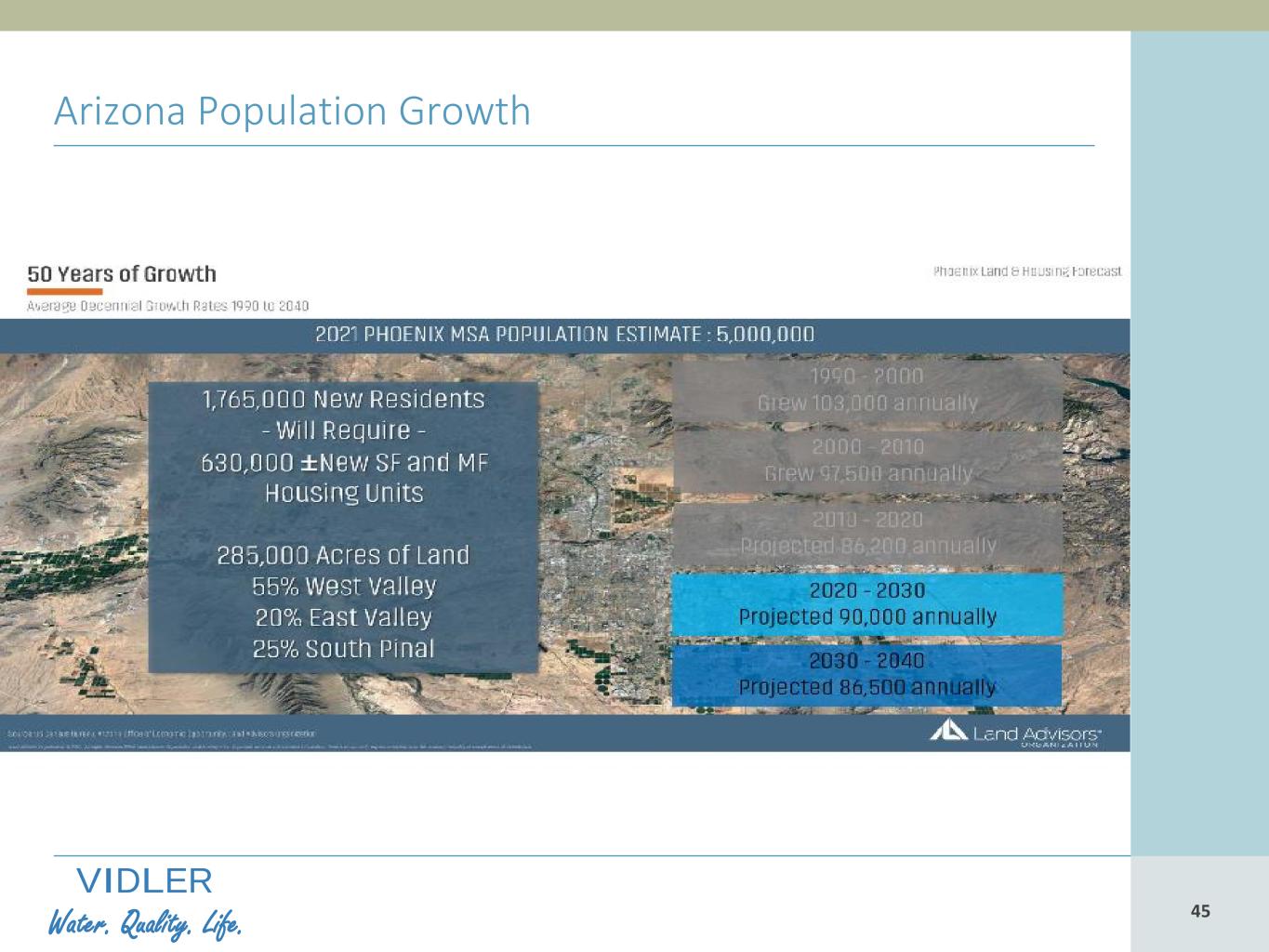

43 VIDLER Water. Quality. Life. 43 Arizona Population Growth

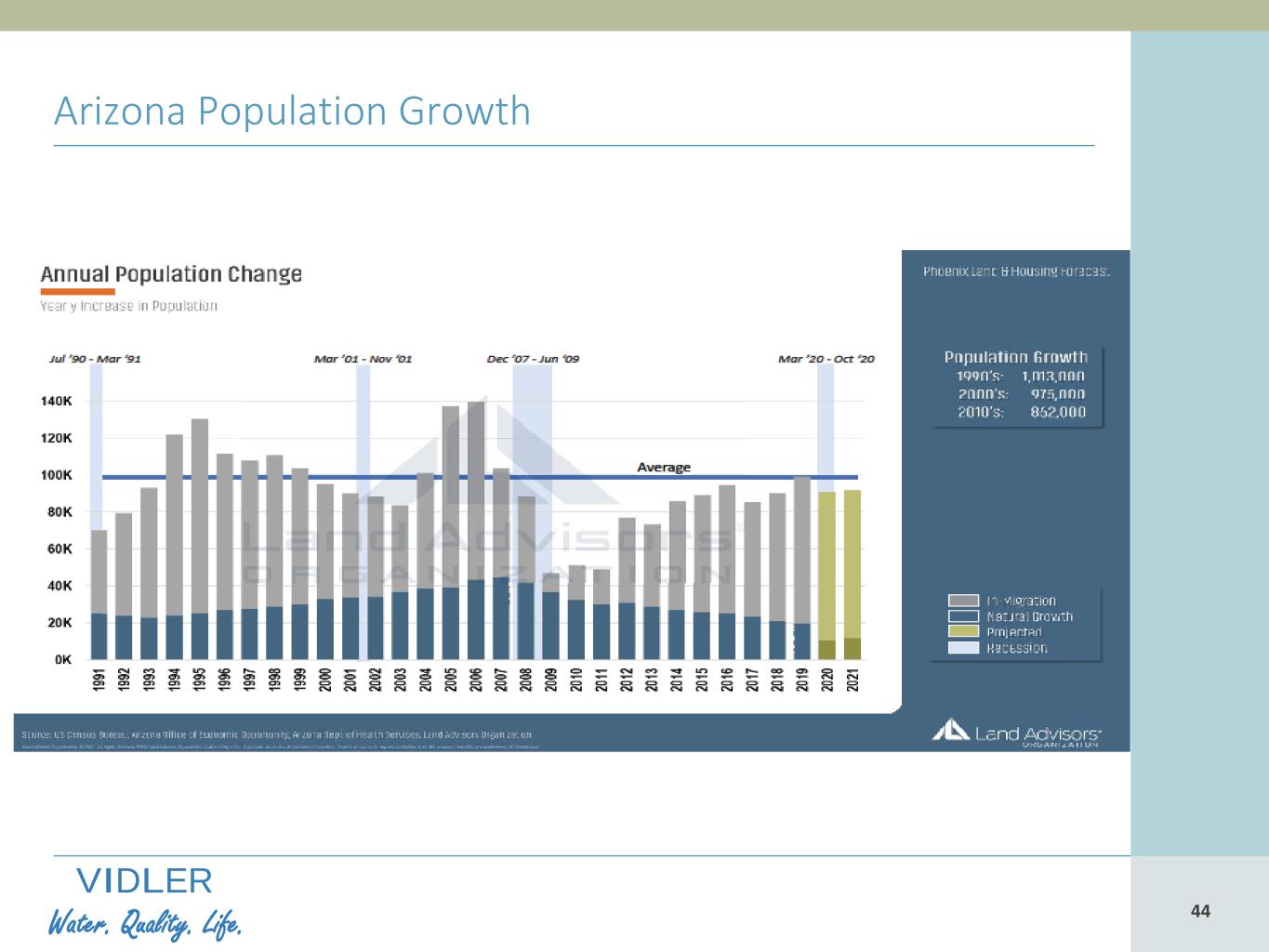

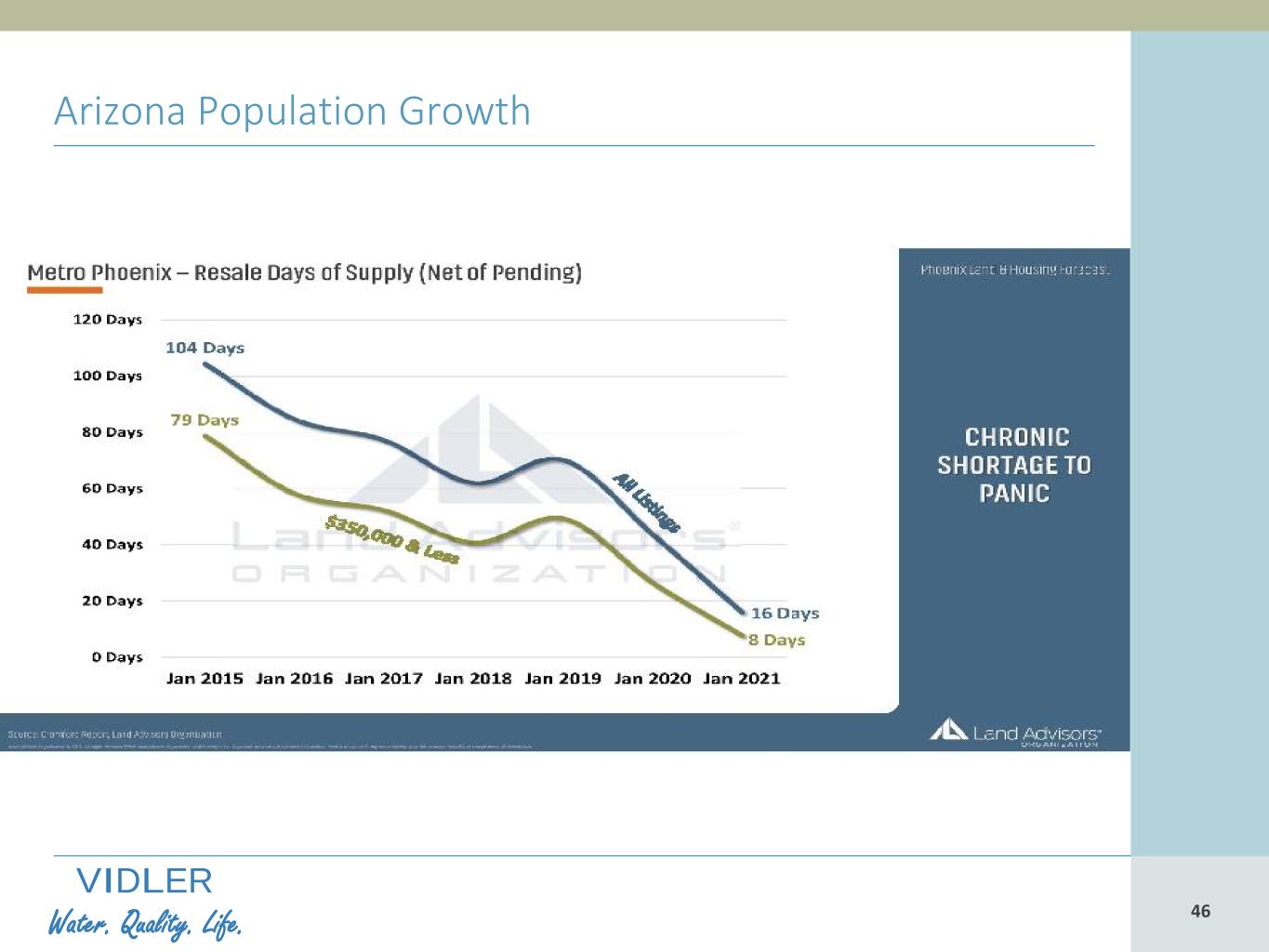

44 VIDLER Water. Quality. Life. 44 Arizona Population Growth

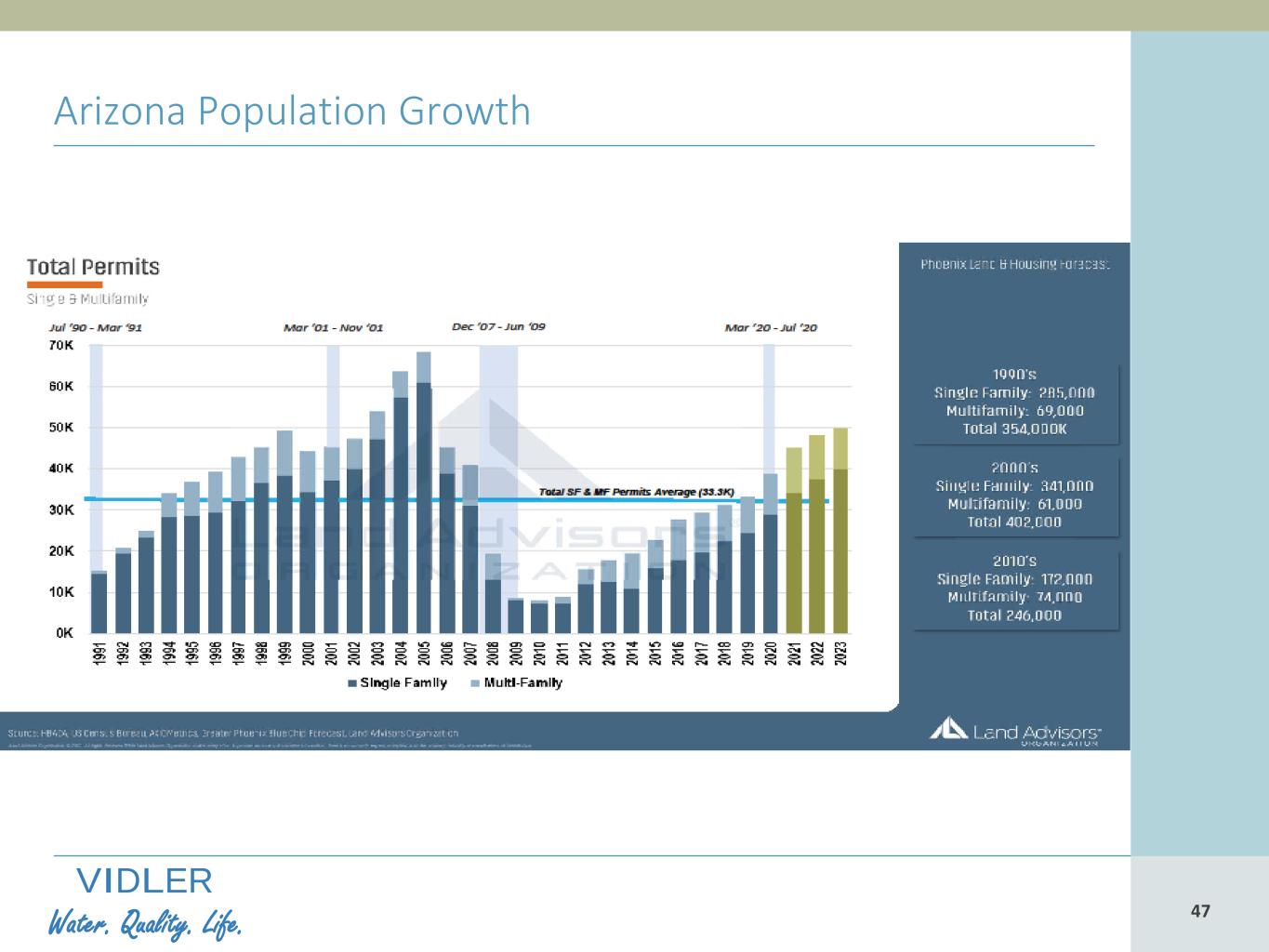

45 VIDLER Water. Quality. Life. 45 Arizona Population Growth

46 VIDLER Water. Quality. Life. 46 Arizona Population Growth

47 VIDLER Water. Quality. Life. 47 Arizona Population Growth