Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Ault Global Holdings, Inc. | ex99_1.htm |

| 8-K - Ault Global Holdings, Inc. | e692118k.htm |

Exhibit 99.2

June 10, 2021 Ault Global Holdings, Inc. LD Micro Main Event

Forward - Looking Statements S AFE H ARBOR 2 This presentation and other written or oral statements made from time to time by representatives of Ault Global Holdings, Inc. (sometimes referred to as “DPW”) contain “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Sec tion 21E of the Securities Exchange Act of 1934. Forward - looking statements reflect the current view about future events. Statements that are no t historical in nature, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “ projects,” “anticipates,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - l ooking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our business, business stra teg y, expansion, growth, products and services we may offer in the future and the timing of their development, sales and marketing strategy and capita l o utlook. Forward - looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict an d may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward - looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2020 (the “ 2020 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Commission’s website ( www.sec.gov ). Any forward - looking statements are qualified in their entirety by reference to the factors discussed in the 2020 Annual Report. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumptions prove incorrect, actual results may differ significantly from thos e a nticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include: a d ecline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; th e ability to protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other pro vid ers and products; risks in product development; inability to raise capital to fund continuing operations; changes in government regulation, the ability to complete customer transactions and capital raising transactions. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us t o p redict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results. All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are based entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing c ust omers about our products.

Overview of Company E XECUTIVE S UMMARY Raise capital to fund growth, increase lending activities and make potential acquisitions Shareholder value expected to increase through growth or strategic transactions Current focus on defense and aerospace, power solutions, lending Holding Company structure and focus Strategy • Key business units to operate with more autonomy • Provide the structure to raise, allocate, deploy and manage significant permanent capital • Raise capital to fund growth of subsidiaries • Provide the wherewithal to purchase companies we believe we can operate more effectively than incumbent management • Focus on opportunities with large addressable markets • Gresham Worldwide defense business led by CEO Jonathan Read and Chief Operating Officer Tim Long with announced new board of directors • Coolisys Technologies power solutions, EV charging, and power storage business led by CEO Amos Kohn • Ault Alliance Inc. lending, data center, media, and investments, led by CEO Darren Magot 3

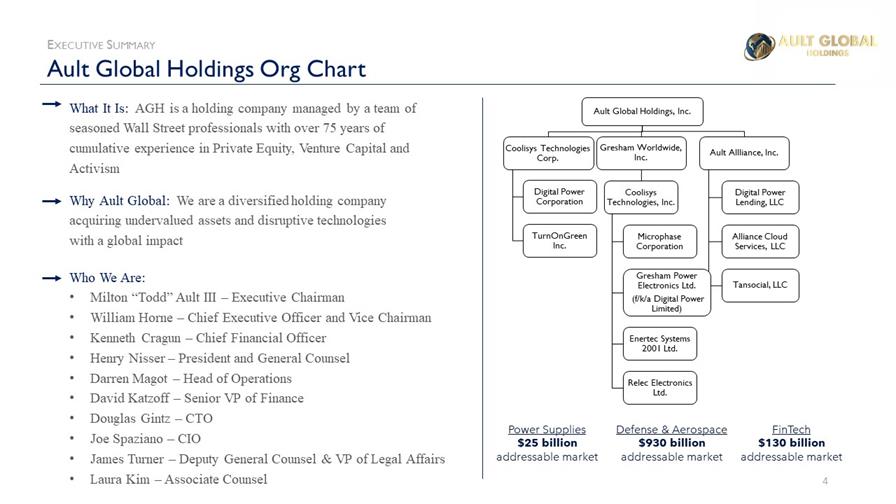

Ault Global Holdings Org Chart E XECUTIVE S UMMARY Who We Are: • Milton “Todd” Ault III – Executive Chairman • William Horne – Chief Executive Officer and Vice Chairman • Kenneth Cragun – Chief Financial Officer • Henry Nisser – President and General Counsel • Darren Magot – Head of Operations • David Katzoff – Senior VP of Finance • Douglas Gintz – CTO • Joe Spaziano – CIO • James Turner – Deputy General Counsel & VP of Legal Affairs • Laura Kim – Associate Counsel What It Is: AGH is a holding company managed by a team of seasoned Wall Street professionals with over 75 years of cumulative experience in Private Equity, Venture Capital and Activism Why Ault Global: We are a diversified holding company acquiring undervalued assets and disruptive technologies with a global impact 4 Defense & Aerospace $930 billion addressable market Power Supplies $25 billion addressable market FinTech $130 billion addressable market Ault Global Holdings, Inc. Coolisys Technologies Corp. Digital Power Corporation TurnOnGreen Inc. Gresham Worldwide, Inc. Coolisys Technologies, Inc. Microphase Corporation Gresham Power Electronics Ltd. (f/k/a Digital Power Limited) Enertec Systems 2001 Ltd. Relec Electronics Ltd. Ault Allliance , Inc. Digital Power Lending, LLC Alliance Cloud Services, LLC Tansocial, LLC

An Overview of DPW’s Current Holdings E XECUTIVE S UMMARY 5 Defense Category : High - reliability technology solutions for defense, medical, telecom Strategy : Raise c apital to execute on significant backlog. Possible acquisitions. Companies : Cloud Data Center Category : Licensed California Finance Lender Strategy : Raise additional capital t o fund lending activity and develop FinTech capabilities. Companies/Initiatives : Financial Services Category : Licensed California Finance Lender Strategy : Raise additional capital t o fund lending activity and develop FinTech capabilities. Begin loan brokering services under the lender license. Companies/Initiatives : Power Solutions Category : Power electronics products Strategy : Continue providing value - added solutions and expand sales and distribution capabilities. Grow new market for EV chargers. Companies/Brands :

Gresham Worldwide – Global Defense O PERATING C OMPANY 6 Phoenix, AZ Washington D.C. Shelton, CT Karmiel, Israel Salisbury, UK Headquartered in Phoenix, Arizona Global Footprint European defense, naval and power solutions through Gresham Power Electronics Limited, located in Salisbury, UK 1 2 3 5 4 Israel defense & aerospace combat solutions and medical technology through Enertec Systems 2001 Ltd., located in Karmiel, Israel North America defense & aerospace and telecommunication solutions through Microphase Corp., located in Shelton, CT European supplier of power conversion & display technology for industrial, rail transport & emerging electronic markets through Relec Electronics, Ltd, located in Wareham, UK 6 Wareham, UK 1 2 3 4 5 6 North America strategic development office

Overview of Gresham Worldwide Products & Customers O PERATING C OMPANY 7 • Provides high quality, ultra - reliable bespoke technology solutions for mission critical applications • Value - added services and “designed in” custom components/systems to deliver competitive advantage for providers of turnkey platforms and solutions • Narrows field of competition with elegant designs and high - quality products that limit exposure to commodity markets and support enhanced operating margins • Strong, long term relationships with “blue chip” customers in defense, aerospace and commercial sectors across the globe • Customers include Governments and top military contractors • Servicing global customers with global presence : Arizona, Washington D.C. , Connecticut, U.K. and Israel “Blue - Chip” Customers Mission Critical Applications High - quality Solutions Products and Solutions Customers and Relationships

Notable Global Customers O PERATING C OMPANY 8 Navy Hellenic Daewoo Shipyard

Coolisys Technologies – Power Solutions O PERATING C OMPANY 9 • Possesses over 50 years providing advanced - power solutions for demanding applications • Designs and manufactures innovative technologies and products to operate in the harshest environments, critical applications, and life - saving services • Provides comprehensive solutions for global defense and aerospace customers • Specializes in customized engineering solutions for medical , industrial and defense applications • Provides a wide range of Electrical Vehicle Service Equipment (EVSE) through subsidiary TurnOnGreen TM . • Provides comprehensive home energy storage solutions for power harvest Defense, Medical & Electric Vehicles Mission Critical Applications Innovative Technologies Core Competencies Markets

Turn O n Green TM EV Charger Product Line O PERATING C OMPANY 10 • Residential and commercial AC and DC smart charging stations • Level 2 chargers for home, work, and play • Level 3 DC fast chargers for a full charge in less than 30 minutes • Level 2 & 3 hybrid chargers built to fast charge all types of electrical vehicles • Charging management software • Member - facing mobile apps (IOS and Android) • Customized dashboards for charge point operators and fleet management • 24/7 customer service • Maintenance and warranty plans • Installation and repair Services AC & DC Smart Charging Stations Charging Management Software Support, Services & Installations For More Information, Please Visit www.turnongreen.com L EVEL 2 H OME C HARGER L EVEL 2 N ETWORKED C OMMERCIAL C HARGER L EVEL 3 DC F AST C HARGER

Ault Alliance Inc. – Lending & Media I NVESTMENTS 11 • On November 30, 2016, we formed Digital Power Lending, a wholly - owned subsidiary. • DP Lending provides commercial loans to companies throughout the United States to provide them with operating capital to finance the growth of their businesses . • California Finance Lending License #60DBO - 77905. • Support messaging for portfolio companies • Capital raising activities • eCommerce initiatives • Digital training products Provide Loans and Broker Loans Opportunity to incubate partner companies Licensed Finance Lender Lending Alliance Cloud Services Media

Ault Alliance Inc. Overview of Strategic Investments I NVESTMENTS 12 Biotech Category : Developing two treatments for Alzheimer’s Background : Alzheimer’s Disease is the 6 th leading cause of the death in the U. S. Alzamend Neuro is dedicated to researching, developing and commercializing treatment for Alzheimer’s and bringing two patented therapeutics into the clinical and commercialization stages. Company : Healthcare Category : Medical products for bodily fluid analysis Background : I nnovative technology and healthcare tools bringing the point of care closer to the patient related to bodily fluid analyses including blood analysis and male fertility testing. Company : Real Estate Category : Luxury Hotel development in NYC Background : Development of a 5 - Star ultra luxury hotel operated by a group who are very well - known and successful in the real estate and hospitality business. Located in the in the charming and highly sought - after, landmarked Northern TriBeCa district. Company : 456 L UX H OTEL Category : Revolutionary technology for Textiles Background : Advanced textile processing using Multiplexed Laser Surface Enhancement. Treats textiles in a cost effective and environmentally sustainable manner. Impact: 99% less energy consumed, 95% reduced chemical usage and 75% less water consumption. Company : Advanced

Q1 2021 Highlights F INANCIAL R ESULTS 13 □ Revenue of $13.2 million, an increase of 136% from $5.6 million in the prior first fiscal quarter □ Revenue from lending and trading activities of $5.2 million due to the allocation of capital to the Company’s wholly - owned subsidiary, Digital Power Lending, LLC □ Revenue from cryptocurrency mining of $130,000 as the Company resumed cryptocurrency mining operations with approximately 1,000 miners during March 2021 □ Net income of $2.0 million for the quarter, which represents the first quarterly profit under current management □ Cash of $107.8 million and marketable securities of $18.2 million and other investments of $36.5 million as of March 31, 2021

Revenues F INANCIAL R ESULTS 14 Our revenues increase by $ 7 , 639 , 195 ( 136 % ) to $ 13 , 244 , 629 for the first three months ended March 31 , 2021 from $ 5 , 605 , 434 for the first three months ended March 31 , 2020 . Gresham Worldwide Gresham Worldwide, Inc.’s revenues increased by $2.0 million, or 45%, to $6.4 million for the three months ended March 31, 20 21, from $4.4 million for the three months ended March 31, 2020. The increase in revenue from our Gresham Worldwide segment for customized solutions for th e m ilitary markets reflects the benefit of capital that was allocated to our defense business based on the overall improved capital structure of the Comp any . Gresham Worldwide’s revenue in 2021 includes $1.8 million from Relec Electronics Ltd., which was acquired on November 30, 2020. Revenue from Enertec Systems 2001 Ltd., which largely consists of revenue recognized over time, for the three months ended March 31, 2021 increased $133,000 or 5.8% from t he prior - year period. Coolisys Coolisys Technologies Corp.’s revenues increased by $201,000, or 16%, to $1.4 million for the three months ended March 31, 2021, from $1 .2 million for three months ended March 31, 2020. Ault Alliance Revenues from our cryptocurrency mining operations revenues increased by $130,000, or 100% from the three months ended March 31, 2020, as we resumed our cryptocurrency mining operations during the first quarter of 2021, due to improved business conditions. Our decision to r esu me cryptocurrency mining operations in 2021 was based on several factors, which had positively affected the number of active miners we operated, inclu din g the market prices of digital currencies, and favorable power costs available at our Michigan data center. Revenues from our lending and trading activities increased to $5.2 million, for the three months ended March 31, 2021, from $ 36, 000 for the three months ended March 31, 2020 which is attributable to a significant allocation of capital from our recent equity financing transactio ns to our loan and investment portfolio. Under its business model, Digital Power Lending generates revenue through origination fees charged to borrowers an d i nterest generated from each loan. Digital Power Lending may also generate income from appreciation of investments in marketable securities as well as any sh ares of common stock underlying convertible notes or warrants issued to Digital Power Lending in any particular financing.

Operating Expenses F INANCIAL R ESULTS 15 Operating expenses increased to $6.9 million for the three months ended March 31, 2021, representing an increase of $2.2 mill ion compared to $4.7 million for the three months ended March 31, 2020. The increase in operating expenses from the three months ended March 31, 2020, was due to the following: • Engineering and product development expenses increased by $161,000 due to costs incurred at Coolisys related to the development of our electric vehicle charger products. • Selling and marketing expenses increased $903,000 as result of increases in personnel costs directly attributable to an incre ase in sales and marketing personnel and consultants primarily at Ault Alliance related to digital marketing, digital learning, and the lendin g a nd trading platform. • General and administrative expenses increased $2.2 million mainly due to higher consulting, audit, legal and insurance costs. In addition, general and administrative costs increased related to the Michigan Data Center, operated by Alliance Cloud Services. General and administrative expenses during the three months ended March 31, 2021 include $341,000 of costs from Relec , which was acquired on November 30, 2020. • The three months ended March 31, 2020 included a $1.0 million provision for credit losses. The Company’s Chief Financial Officer, Kenneth S. Cragun , said, “The financial results for the first quarter of 2021 demonstrate that we are achieving our objectives to grow revenue and improve operating results, with revenue growth of 136% over the prior first fisc al quarter and net income of $2.0 million. We saw tremendous growth from our lending and trading activities with the infusion of capital and con tin ued growth in our defense business. Our gross margins for the year ended December 31, 2020 improved considerably, up $6.4 million, or 364% fro m the prior first fiscal quarter. We significantly improved our balance sheet as well, ending fiscal year 2020 with positive working capi tal of $119.5 million, due to our ability to raise capital in the public market.”

Executive Chairman Commentary F INANCIAL R ESULTS 16 Ault Global’s Founder and Executive Chairman, Milton “Todd” Ault, III said, “Our positive financial results in the first quarter of 2021 result from years of strategic planning. During this time, we have strengthened our operating businesses, funded Digital Power Lending, our financial services subsidiary, and improved our balance sheet tremendously. We are pleased to report significant revenue growth and are optimistic of the long - term potential of Digital Power Lending. As I said in the previous quarter when commenting about our fiscal year ended December 31, 2020, with the strongest balance sheet in the Company’s history, a capable management team, and a talented group of CEOs at the subsidiary level, the future prospects look bright for the Company in the short and long term.” Mr. Ault added “I believe the current quarter results demonstrate that our holding company platform works as envisioned and provides the Company strength through the diversity of our holdings. Our recent capital raise of approximately $165 million has enabled us to fund our subsidiaries and eliminate our high cost debt. We see strength across all our subsidiaries and expect to allocate additional capital to our lending and investment platform in the second quarter. Simply stated, we are in the strongest position of our company’s 52 - year history. The preliminary first quarter results constitute a promising start to 2021. Considering our subsidiaries operating in the sectors of defense, electric vehicle chargers, power electronic businesses, data center, crypto mining, lending and investment platform the road ahead is bright.”

Key Corporate Initiatives & Business Updates C ORPORATE U PDATES 17 □ Exploring a potential IPO or other transaction to access capital markets for our Gresham Worldwide defense business □ Exploring a potential IPO for our power electronics and electric vehicle charger business □ Completing the initial 30,000 square foot buildout of our Michigan data center □ Ramping up cryptocurrency mining operations at our Michigan data center □ Ramping up fulfilment of the $50 million MTIX purchase order for MLSE plasma - laser systems □ Expanding our loan and investment portfolio at Digital Power Lending □ Considering further acquisitions

Thank You! Comments / Questions June 10, 2021