Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT-31.1 - Marvell Technology, Inc. | mrvl-512021exhibit311.htm |

| 10-Q - FORM 10-Q - Marvell Technology, Inc. | mrvl-20210501.htm |

| EX-32.2 - EXHIBIT-32.2 - Marvell Technology, Inc. | mrvl-512021exhibit322.htm |

| EX-32.1 - EXHIBIT-32.1 - Marvell Technology, Inc. | mrvl-512021exhibit321.htm |

| EX-31.2 - EXHIBIT-31.2 - Marvell Technology, Inc. | mrvl-512021exhibit312.htm |

| EX-10.20 - EXHIBIT-10.20 - Marvell Technology, Inc. | mrvl-512021exhibit1020.htm |

| EX-10.17 - EXHIBIT-10.17 - Marvell Technology, Inc. | mrvl-512021exhibit1017.htm |

Exhibit 10.18

April 20, 2021

Nariman Yousefi

[address removed]

Dear Nariman,

It is our pleasure to offer you the position of Executive Vice President, Automotive, Coherent DSP and Switching with Marvell Semiconductor, Inc. ("the Company"), a subsidiary of Marvell Technology, Inc. (“Marvell”), at a salary of $480,000.00 USD per year.

Your supervisor will be Matt Murphy. Your work location will be Irvine, California.

Cash Incentive Compensation

You will be eligible to participate in the Company’s executive Annual Incentive Program (AIP) with a target bonus of 90% of your current base salary. The amount of your actual AIP bonus payment will be determined by the Company at its sole discretion based on a number of factors including but not limited to company and individual performance. To ensure alignment between you and the other members of the Marvell executive team, you will be paid your Marvell FY2022 AIP bonus as if you had been an employee of Marvell for the entire year; and the amount of any prorated partial bonus for the current year paid to you, if any, for the period January 2021-April 2021 will be treated as a pre-payment and will be deducted from your final FY2022 AIP. You must be an active Company employee at the time of the bonus payout to be eligible for payment. It is clarified that the Company retains the right to modify, amend or terminate its plans and policies, including the AIP, from time to time, at its sole discretion. Any such modification or amendment will be communicated to you. It is also clarified that any payment of bonus or other compensation in one financial year, under any of the Company’s plans and/or policies does not create a right to claim such compensation or bonus from the Company in the future.

Equity Awards

You will be recommended to the Executive Compensation Committee (“ECC”) for the following grants:

•Time Based RSU Buy Award. A restricted stock unit award of common shares of Marvell equal to $900,000 (the “RSU”) divided by the Share Price, subject to applicable securities law restrictions. The RSU shall vest over three (3) years at the rate of 1/12 on the first quarterly anniversary of the vesting start date and 1/12th per quarter thereafter; provided that you continue to serve as an employee through each applicable vesting date.

•Performance Based RSU Award based on Total Shareholder Return. A performance-based restricted stock unit award of common shares of Marvell equal to $1,100,000 (the “TSR”) divided by the Share Price (as defined below); such amount being referred to as the target amount for this award. The TSR shall vest on the third anniversary of the date of grant, provided that you remain an employee through such vesting date. The number of shares that shall vest can range from zero to 200% of the above referenced target number based on achievement of performance objectives relating to the relative total shareholder return of Marvell 's stock as compared to the total shareholder return of other companies over the measurement period. The TSR shall be on the same terms, performance measures and payout curve as the TSR awards approved for the other executive officers in March 2021.

•Refresh Equity Grant. The Company generally conducts its annual employee compensation review in Q1 of its fiscal year, including equity grants. With respect to the review scheduled to be conducted in March 2022, you will receive an additional equity award. It is expected that those awards will be granted on and commence vesting on April 15, 2022 and it is also currently expected that such award will consist of a combination of (i) RSUs that will vest over a three (3) year period with 1/12th vesting per quarter over the succeeding three (3) years, provided that you continue to serve as an active employee through each applicable vesting date and (ii) performance based awards. The type and mix of awards will be identical to those awarded to other employees at the executive vice president level.

For the purposes of the equity awards described above, “Share Price” shall mean the closing price of Marvell common stock on the effective date the grant is approved by Marvell’s ECC (or a subcommittee thereof), subject to applicable securities law restrictions. This is expected to occur on May 15, 2021.

All of the foregoing equity awards are subject to applicable local laws and regulations and will be subject to your return to us of completed, signed award agreement (or acceptance of such award in accordance with the Company policies related to such awards) and the terms thereof.

Change-in-Control

You will be eligible to participate in the Marvell Change in Control and Severance Plan ("CIC Plan") at the “Tier 2” level, subject to the terms and conditions of the CIC Plan and in substantially the form of Tier 2 agreement attached hereto as Appendix A.

Inphi Equity Awards

You have been granted various equity awards by Inphi Corporation. Those awards continue to vest on their respective terms. The change in role and compensation under this agreement does not constitute an Involuntary Termination under your Inphi Change of Control Agreement.

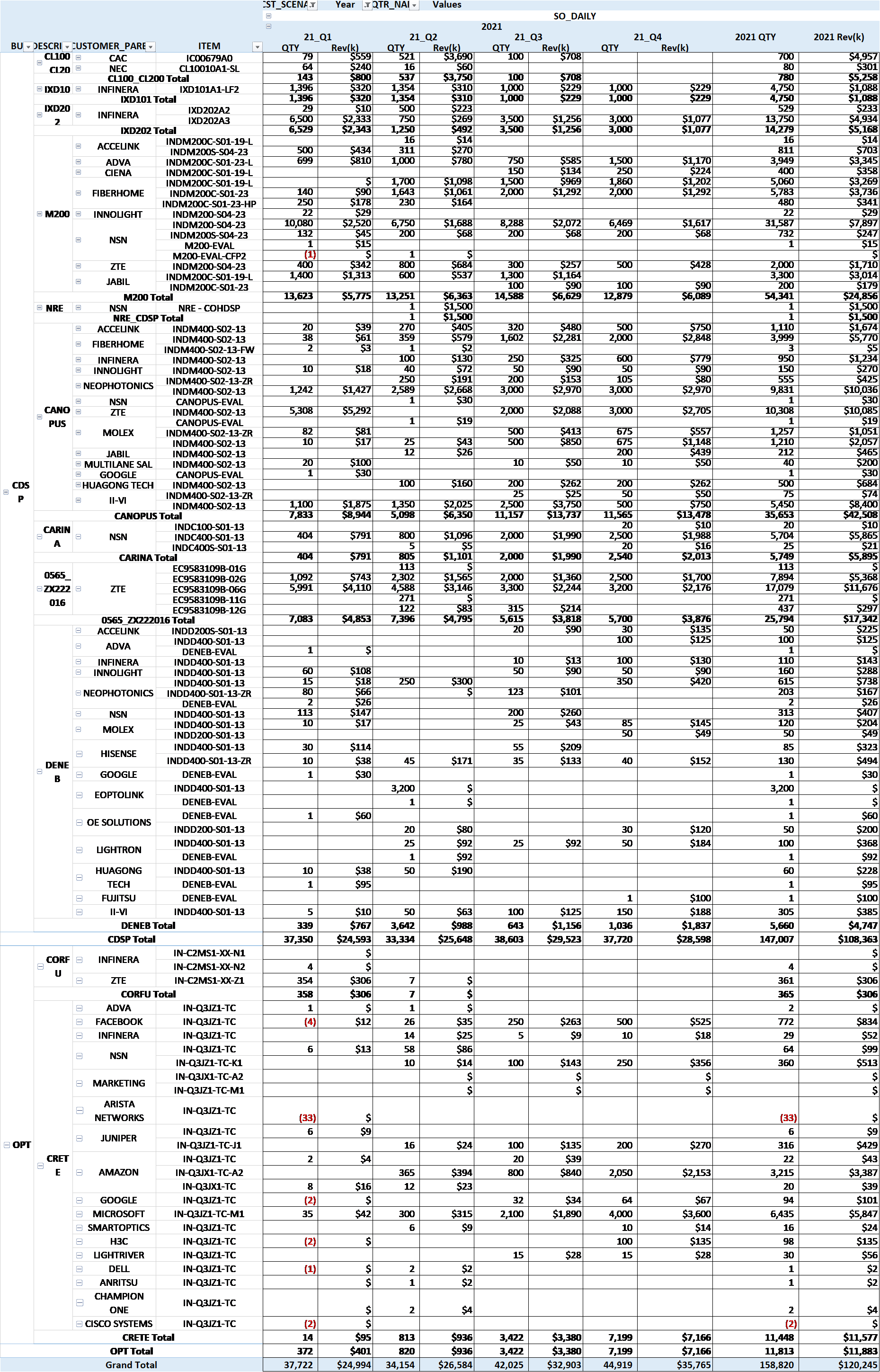

Your performance-based award granted April 24, 2019 for 24,110 target shares of Inphi Common Stock (the “PSU”) vests based on achievement of certain revenue targets (100% of target at $90M of applicable revenue and 150% of target at $120M of applicable revenue). A copy is attached as Appendix B. The provision of the PSU that states “Effect of Change of Control: If a Change of Control occurs prior to the end of the Performance Period, then the Performance Vesting Rate shall be deemed to be 100%” is, to the extent not previously modified by Inphi, hereby modified and shall be of no further force and effect. For purposes of determining the amount of revenue achievement under the PSU Coherent Digital Signal Processing revenue will be calculated in a manner consistent with how it was being calculated by Inphi immediately prior to the acquisition by Marvell (which is reflected on Appendix C). For the avoidance of doubt, it will include optical module revenue that has M200 or Canopus DSP incorporated, applicable NRE and the 016 ASIC.

Other Terms

In accordance with the Immigration Reform and Control Act of 1986, it will be necessary for you to submit documents to Human Resources evidencing both your employment authorization and identity within three (3) business days of your date of hire. Acceptable documents include, but are not limited to:

•A valid driver’s license and social security card, or

•A current passport

Please note your offer is contingent upon:

•Successful completion of a routine background investigation and reference checks;

•The Company’s receipt from you of a signed Employee Agreement, which contains the Company's Confidential Information and Invention Assignment Provisions, Code of Business Conduct and Ethics and Arbitration Agreement; and

•Completion of visa, license requirements, and government restricted party screening requirements, if applicable.

Your employment with the Company is at the mutual consent of you, the employee, and the Company, the employer. Your employment with the Company is at-will. Either you or the Company may terminate your employment at any time and for any or no reason. The at-will nature of your employment may only be changed by a written agreement signed by the CEO.

Marvell is an exciting company whose mission is to develop and deliver semiconductor solutions that process, move, store, and secure the world’s data faster and more reliably than anyone else. We look forward to your acceptance as we believe you will be an important addition to our team.

This letter (if accepted) and the Employee Agreement noted above constitute the entire agreement between you and the Company regarding the terms of your employment, and supersede any prior representations or agreements, whether written or oral, concerning the terms of your employment; except that your Inphi Change in Control Agreement and Employee Innovations and Proprietary Rights Assignment Agreement shall remain in full force and effect. This letter may not be modified or amended except by a signed written agreement.

To accept this offer, please sign this letter within one week of the offer date. Before submitting your response please print a copy of this letter for your records.

Sincerely,

Mitch Gaynor

Chief Administration and Legal Officer

Accepted By:

_____________________ Date signed: __________________

Nariman Yousefi

TIER 2

Appendix A

Marvell Technology Group Ltd. Change in Control Severance Plan

Participation Agreement

Participation Agreement

Marvell Technology Group Ltd. (the “Company”) is pleased to inform you, _______________________, that you have been selected to participate in the Company’s Change in Control Severance Plan (the “Plan”) as a Participant. A copy of the Plan was delivered to you with this Participation Agreement. Your participation in the Plan is subject to all of the terms and conditions of the Plan. The capitalized terms used but not defined herein will have the meanings ascribed to them in the Plan.

In order to actually become a participant in the Plan, you must complete and sign this Participation Agreement and return it to [NAME] no later than [DATE].

In the event of a Change in Control where the successor corporation does not assume your Equity Awards or substitute Equity Awards for substantially similar awards with the same or more favorable vesting schedule as your Equity Awards, then your Equity Awards will accelerate and vest in full in accordance with Section 3 of the Plan.

Also, the Plan describes in detail certain circumstances under which you may become eligible for certain Severance Benefits under Section 5 of the Plan if, during the Change in Control Period, you incur an Involuntary Termination. If you become eligible for Severance Benefits as described in the Plan, then subject to the terms and conditions of the Plan, you will receive:

1.Cash Severance Benefits.

a.Base Salary. A lump-sum payment (less applicable withholding taxes) equal to 18 months of your annual base salary as in effect immediately prior to your Involuntary Termination (or if your Involuntary Termination is a termination for Good Reason due to a material reduction in your level of annual base salary, your annual base salary as in effect immediately prior to such reduction) or, if greater, at the level in effect immediately prior to the Change in Control.

b. Bonus. A lump-sum payment equal to 150% of your annual target bonus for the fiscal year in which your Involuntary Termination occurs or, if greater, your annual target bonus in effect immediately prior to the Change in Control.

c. Pro-Rata Bonus. A lump-sum payment equal to your annual target bonus for the fiscal year in which your Involuntary Termination occurs, pro-rated for the number of full months employed during the fiscal year.

2. Equity Award Vesting Acceleration. 100% of your then-outstanding and unvested Equity Awards will become vested in full. If, however, an outstanding Equity Award is to vest and/or the amount of the award to vest is to be determined based on the achievement of performance criteria, then the Equity Award will vest as to 100% of the amount of the Equity Award assuming the performance criteria had been achieved at target levels for the relevant performance period(s); provided however, that (A) if there is no “target” level, then the number that will vest shall be 100% of the maximum amount that could vest with respect to that relevant measurement period(s); and (B) if the performance period has been completed and the actual performance achieved is greater than the target level, then the number that will vest shall be 100% of the amount that would vest based on that actual performance achievement level with respect to that relevant measurement period; and (C) if the performance criteria is a Total Shareholder Return (“TSR”) or other measure based on the value of the Company’s stock, the amount that will vest will be calculated as if the measurement period ended on the date of the Change in Control (and including the final closing price of the Company’s stock on such date). Any Company stock options and stock appreciation rights shall thereafter remain exercisable following the Employee’s employment termination for the period prescribed in the respective option and stock appreciation right agreements.

3. Continued Medical Benefits. Your reimbursement of continued health coverage under COBRA or taxable monthly payment in lieu of reimbursement, as applicable, and as described in Section 5.3 of the Plan will be provided for a period of 18 months following your termination of employment. Notwithstanding the foregoing, if you are not employed in the United States, the benefit under this paragraph will be a regional equivalent to COBRA determined by the Administrator in its sole discretion.

In order to receive any Severance Benefits for which you otherwise become eligible under the Plan, you must sign and deliver to the Company the Release, which must have become effective and irrevocable within the requisite period.

By your signature below, you and the Company agree that your participation in the Plan is governed by this Participation Agreement and the provisions of the Plan. Your signature below confirms that: (1) you have received a copy of the Change in Control Severance Plan and Summary Plan Description; (2) you have carefully read this Participation Agreement and the Change in Control Severance Plan and Summary Plan Description; (3) decisions and determinations by the Administrator under the Plan will be final and binding on you and your successors; and (4) if you have previously entered into a Participation Agreement with the Company then you are agreeing that your prior Participation Agreement is terminated and superseded by this Participation Agreement.

MARVELL TECHNOLOGY GROUP LTD. | PARTICIPANT | |||||||

| Signature | Signature | |||||||

| Name | Date | |||||||

| Title | ||||||||

Appendix B

INPHI CORPORATION

2010 STOCK INCENTIVE PLAN

NOTICE OF STOCK UNIT AWARD - U.S. AND NON-U.S. EMPLOYEES AND CONSULTANTS

You have been granted the following stock units representing the common stock of INPHI CORPORATION (the “Company”) under the Company’s 2010 Stock Incentive Plan (the “Plan”). Capitalized terms that are used herein but not defined shall have the meanings set forth in the Plan.

| Name of Participant: | Nariman Yousefi | ||||

| Target Number of Stock Units Granted: | 24,110 | ||||

| Date of Grant: | April 24, 2019 | ||||

| Performance Period: | January 1, 2019 through December 31, 2021 | ||||

| Vesting Schedule: | Subject to your continuous Service as an Employee (“Employment”) through the final day of the Performance Period (December 31, 2021), you will “cliff-vest” on that day in a percentage up to 150% (the “Performance Vesting Rate”) of the total Target Number of Stock Units subject to this Award based on performance relative to the established objectives as set forth below in the section of this Notice entitled “Performance Vesting Rate.” If the Performance Vesting Rate is less than 100%, a number of Stock Units will be automatically cancelled equal to the product of (i) the number of target Stock Units and (ii) the difference between 100% and the Performance Vesting Rate. Except as provided in the section of this Notice entitled “Coordination with Severance Agreement,” the Award is entirely forfeited upon a termination of Employment occurring prior to the end of the Performance Period. Continuous Employment will not be considered to have terminated in the event of an approved leave of absence during the Performance Period. However, to the extent vesting credit would not be provided for such leave under the general leave of absence policy under the Plan, the number of Stock Units that would otherwise vest will be prorated by that percentage of the relevant period during which you were not on leave of absence and the remaining portion of the Award relating to the leave of absence period will be forfeited. In addition, Employment is not continuous if you terminate employment notwithstanding that you may be subject to a period of notice or garden leave protection under employment laws in the jurisdiction in which you reside or under the terms of any employment agreement. | ||||

| Effect of Change of Control: | If a Change of Control occurs prior to the end of the Performance Period, then the Performance Vesting Rate shall be deemed to be 100%. | ||||

| Settlement: | The vested Stock Units will be settled as soon as practicable following the last day of the Performance Period and the determination by the Compensation Committee of the Board of Directors of the Company (the “Committee”) of the Performance Vesting Rate, but in no event later than 2-1/2 months following the last day of the calendar year in which the Stock Units vest. | ||||

| Coordination with Severance Agreement: | The Stock Units are subject to acceleration of vesting pursuant to the provisions of the Change of Control Severance Agreement between you and the Company dated February 24, 2016, as amended from time to time (“Change of Control Severance Agreement”); provided, however, that notwithstanding the provisions of any agreement dated on or prior to the Date of Grant, including but not limited to the Change of Control Severance Agreement, no accelerated vesting shall be received for any Stock Units in excess of the actual or deemed Performance Vesting Rate as determined pursuant to the terms hereof. | ||||

| Performance Vesting Rate: | The Performance Vesting Rate for the Stock Units subject to this Award shall be based on the percentage achievement of the established objectives set forth on the Performance Goals Addendum hereto, as recommended by the Chief Executive Officer of the Company and certified by the Committee. | ||||

By your signature and the signature of the Company’s representative below, you and the Company agree that these Stock Units are granted under and governed by the terms and conditions of the Plan and the Stock Unit Agreement - U.S. and Non-U.S. Employees and Consultants, including any applicable country-specific Appendix (together, the “Agreement”), all of which are attached to and made a part of this document.

By signing this document, you further agree that the Company may, in its sole discretion, deliver by e-mail all documents relating to current or future participation in the Plan or this Award (including without limitation, prospectuses required by the U.S. Securities and Exchange Commission) and all other documents that the Company is required to deliver to its security holders (including without limitation, annual reports and proxy statements). You also agree that the Company may deliver these documents by posting them on a website maintained by the Company or by a third party under contract with the Company. If the Company posts these documents on a website, it will notify you by e-mail.

PARTICIPANT | INPHI CORPORATION: | |||||||

| By: | ||||||||

| Its: | Chief Financial Officer | |||||||

| Print Name | ||||||||

INPHI CORPORATION

2010 STOCK INCENTIVE PLAN

NOTICE OF STOCK UNIT AWARD

PERFORMANCE GOALS ADDENDUM

The Performance Vesting Rate for the Stock Units subject to this Award for the entire three-year Performance Period shall be based on the percentage achievement of the Coherent Digital Signal Processing revenue objectives for the 2021 fiscal year as set forth below:

2021 Revenue:

| Performance | Payout | ||||

| <$80M | 0% vests | ||||

| $80M | 80% vests | ||||

| $90M | 100% vests | ||||

| >=$120M | 150% vests | ||||

Interpolated in between performance levels

Appendix C