Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED STATES STEEL CORP | tm2118228d1_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - UNITED STATES STEEL CORP | tm2118228d1_ex99-2.htm |

| EX-10.1 - EXHIBIT 10.1 - UNITED STATES STEEL CORP | tm2118228d1_ex10-1.htm |

Exhibit 99.1

| Transtar Divestiture Investor Presentation June 8, 2021 |

| 2 Forward-looking statements These slides are being provided to assist readers in understanding the sale of Transtar, LLC by United States Steel Corporation. This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Words such as, but not limited to, “will,” “believes,” “expects,” “anticipates,” “plans,” “could,” “may,” “should,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this current report include, among other things, statements about the potential benefits of the sale of Transtar, LLC (the “Transaction”); the Company’s plans, objectives, expectations and intentions; the financial condition, results of operations and business of the Company; and the anticipated timing of the closing of the Transaction. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions of the closing of the Transaction in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Transaction, including the possibility that the expected benefits and cost savings from the proposed Transaction or the capital and operational improvements will not be realized or will not be realized within the expected time period; disruption from the Transaction making it more difficult to maintain business and operational relationships; negative effects of the announcement or the consummation of the proposed Transaction on the market price of the Company’s common stock; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed Transaction; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; future business combinations or disposals; and competitive developments. All forward-looking statements rely on a number of assumptions, estimates and data concerning future results and events and are subject to a number of uncertainties and other factors that could cause actual results to differ materially from those reflected in such statements. Accordingly, the Company cautions that the forward-looking statements contained herein are qualified by these and other important factors and uncertainties that could cause results to differ materially from those reflected by such statements. For more information on additional potential risk factors, please review the Company’s filings with the SEC, including, but not limited to, the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. References to (i) "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context and (ii) “Big River Steel” refer to Big River Steel Holdings LLC and its direct and indirect subsidiaries unless otherwise indicated by the context. |

| 3 Continuation of portfolio optimization Transtar divestiture summary Delivering immediate, incremental value at an attractive transaction multiple Creating strategic partnership with an affiliate of Fortress Transportation and Infrastructure Investors LLC (“FTAI”) to support continued operations, including at Gary and Mon Valley Works Monetizing non-core assets to support transition to “Best for All” strategy ✓ ✓ ✓ |

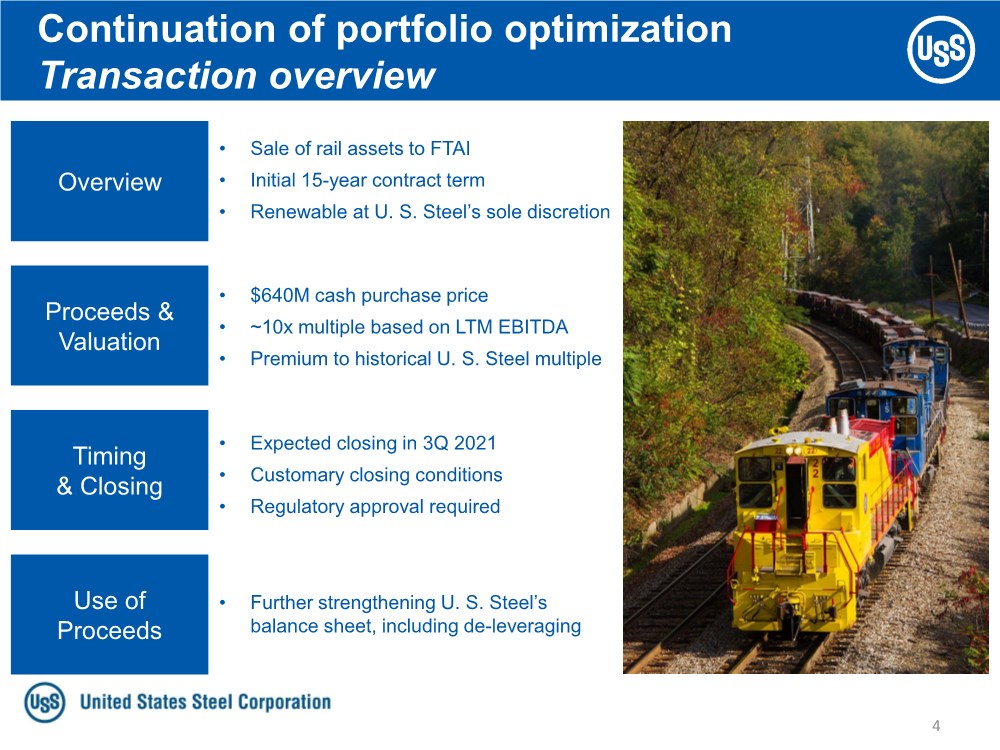

| 4 Continuation of portfolio optimization Transaction overview Overview Proceeds & Valuation Timing & Closing Use of Proceeds • Sale of rail assets to FTAI • Initial 15-year contract term • Renewable at U. S. Steel’s sole discretion • $640M cash purchase price • ~10x multiple based on LTM EBITDA • Premium to historical U. S. Steel multiple • Expected closing in 3Q 2021 • Customary closing conditions • Regulatory approval required • Further strengthening U. S. Steel’s balance sheet, including de-leveraging |

| 5 Continuation of portfolio optimization Uninterrupted service to U. S. Steel operations Enhancing focus on core competencies while partnering with FTAI to retain best-in-class rail services Services provided by Transtar: Hot metal transport / coil and slab movements ✓ In-plant switching of raw materials ✓ Interchanging inbound and outbound railcars ✓ Same high-quality service to continue with no impact to operations nor customers Gary and Mon Valley Works remain core operations in our footprint |

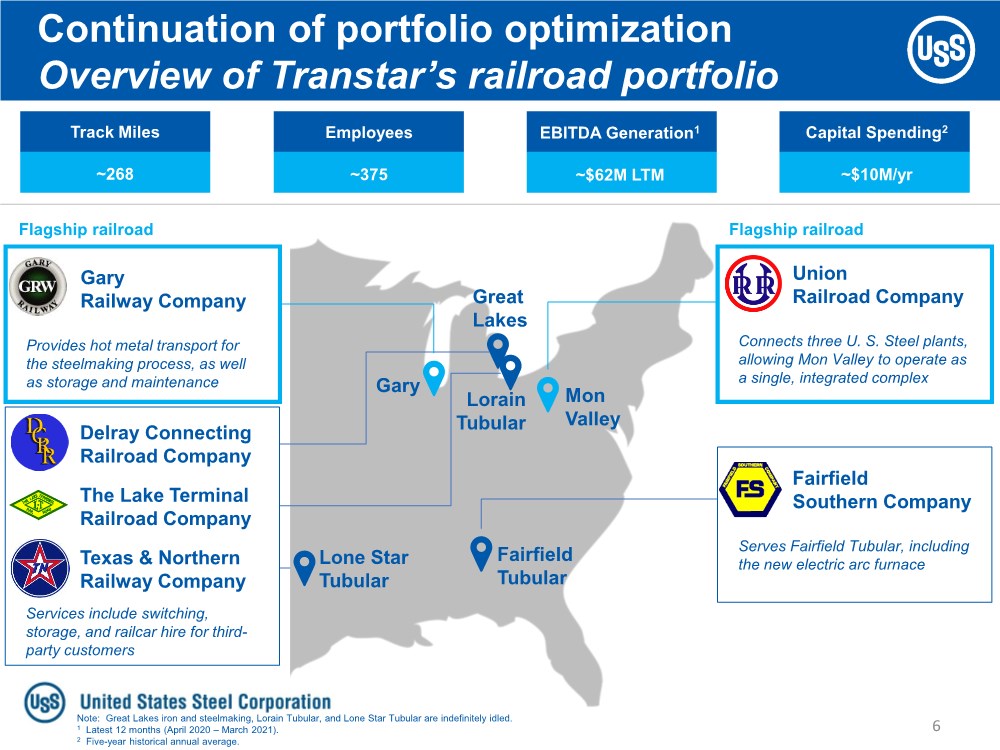

| 6 Continuation of portfolio optimization Overview of Transtar’s railroad portfolio Note: Great Lakes iron and steelmaking, Lorain Tubular, and Lone Star Tubular are indefinitely idled. 1 Latest 12 months (April 2020 – March 2021). 2 Five-year historical annual average. Great Lakes Mon Valley Gary Lone Star Tubular Lorain Tubular Fairfield Tubular Gary Railway Company Provides hot metal transport for the steelmaking process, as well as storage and maintenance Union Railroad Company Connects three U. S. Steel plants, allowing Mon Valley to operate as a single, integrated complex Fairfield Southern Company Serves Fairfield Tubular, including the new electric arc furnace Delray Connecting Railroad Company Services include switching, storage, and railcar hire for third- party customers The Lake Terminal Railroad Company Texas & Northern Railway Company Track Miles ~268 Employees ~375 EBITDA Generation1 ~$62M LTM Capital Spending2 ~$10M/yr Flagship railroad Flagship railroad |

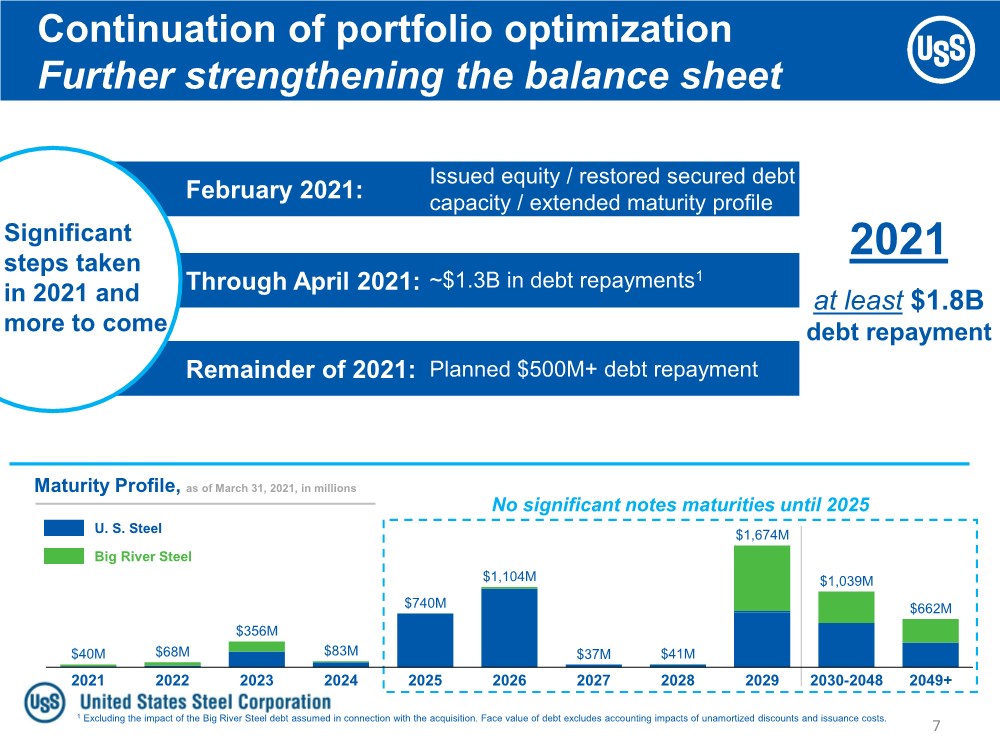

| 7 Continuation of portfolio optimization Further strengthening the balance sheet U. S. Steel Big River Steel Maturity Profile, as of March 31, 2021, in millions February 2021: Through April 2021: Remainder of 2021: Significant steps taken in 2021 and more to come at least $1.8B debt repayment 2021 Issued equity / restored secured debt capacity / extended maturity profile No significant notes maturities until 2025 ~$1.3B in debt repayments1 Planned $500M+ debt repayment 2024 $662M $83M $356M 2027 2028 2021 2026 2022 2023 2025 2030-2048 2029 2049+ $40M $68M $740M $1,104M $41M $37M $1,674M $1,039M 1 Excluding the impact of the Big River Steel debt assumed in connection with the acquisition. Face value of debt excludes accounting impacts of unamortized discounts and issuance costs. |

| INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 klewis@uss.com Eric Linn Director 412-433-2385 eplinn@uss.com www.ussteel.com |