Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Seritage Growth Properties | brhc10025561_8k.htm |

Exhibit 99.1

N a r e i t R E I Tw o r l d 2 0 2 1 A n n u a l C o n f e r e n c eJ u n e 8 - 1 0 , 2 0 2

1

Seritage Growth Properties | Forward Looking Statements This document contains

forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions

concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking

statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking

statement. Factors that could cause or contribute to such differences include, but are not limited to: our historical exposure to Sears Holdings and the effects of its previously announced bankruptcy filing; the litigation filed against us

and other defendants in the Sears Holdings adversarial proceeding pending in bankruptcy court; competition in the real estate and retail industries; risks relating to our recapture and redevelopment activities; contingencies to the

commencement of rent under leases; the terms of our indebtedness; restrictions with which we are required to comply in order to maintain REIT status and other legal requirements to which we are subject; failure to achieve expected occupancy

and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on our ability to fund operations and ongoing development; our ability to access or obtain sufficient sources of financing to

fund our liquidity needs; our relatively limited history as an operating company; and the impact of the COVID-19 pandemic on the business of our tenants and our business, income, cash flow, results of operations, financial condition,

liquidity, prospects, ability to service our debt obligations and our ability to pay dividends and other distributions to our shareholders. For additional discussion of these and other applicable risks, assumptions and uncertainties, see the

“Risk Factors” and forward-looking statement disclosure contained in our filings with the Securities and Exchange Commission, including the risk factors relating to Sears Holdings. While we believe that our forecasts and assumptions are

reasonable, we caution that actual results may differ materially. We intend the forward-looking statements to speak only as of the time made and do not undertake to update or revise them as more information becomes available, except as

required by law. SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021

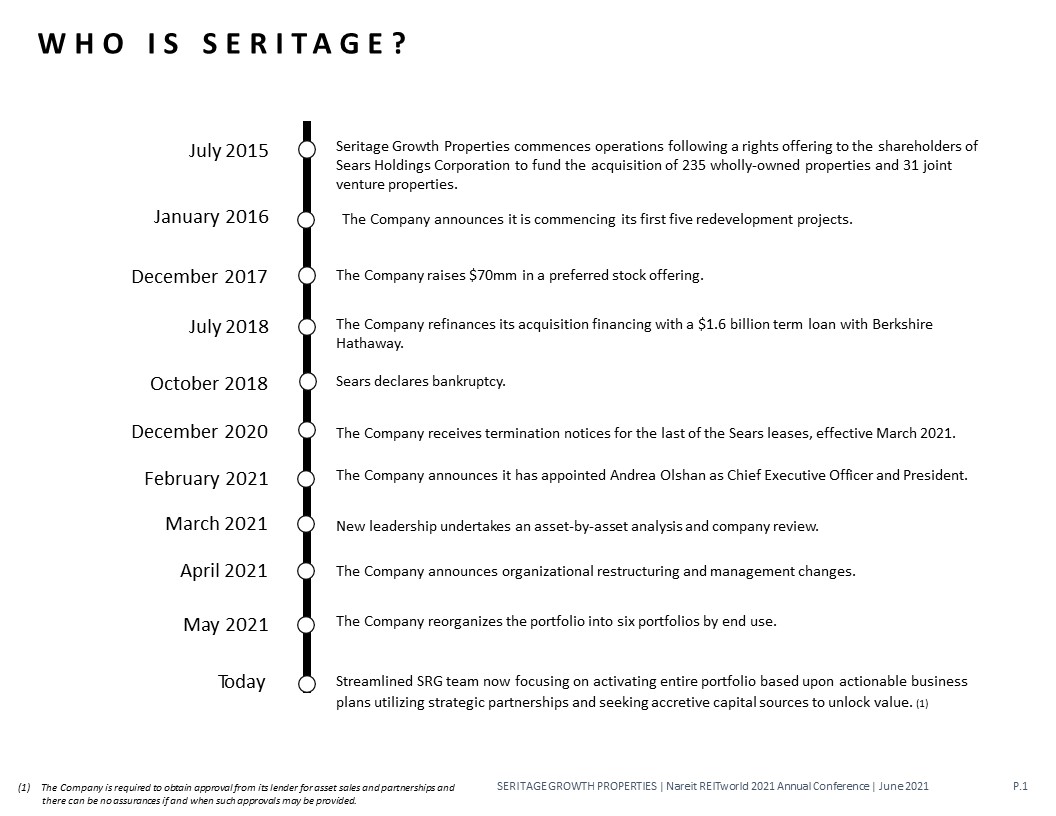

W H O I S S E R I T A G E ? SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual

Conference | June 2021

W H O I S S E R I T A G E ? SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual

Conference | June 2021 July 2015 Seritage Growth Properties commences operations following a rights offering to the shareholders of Sears Holdings Corporation to fund the acquisition of 235 wholly-owned properties and 31 joint venture

properties. December 2017 The Company raises $70mm in a preferred stock offering. July 2018 October 2018 The Company refinances its acquisition financing with a $1.6 billion term loan with Berkshire Hathaway. Sears declares

bankruptcy. March 2021 The Company announces it has appointed Andrea Olshan as Chief Executive Officer and President. February 2021 New leadership undertakes an asset-by-asset analysis and company review. April 2021 The Company

announces organizational restructuring and management changes. Today Streamlined SRG team now focusing on activating entire portfolio based upon actionable business plans utilizing strategic partnerships and seeking accretive capital

sources to unlock value. (1) The Company receives termination notices for the last of the Sears leases, effective March 2021. May 2021 The Company reorganizes the portfolio into six portfolios by end use. December 2020 (1) The Company is

required to obtain approval from its lender for asset sales and partnerships and there can be no assurances if and when such approvals may be provided. January 2016 The Company announces it is commencing its first five redevelopment

projects. P.1

2 5 . 9 4 1 2 , 3 0 0 m i l l i o n s q u a r e f e e t s t a t e s + P u

e r t o R i c o a c r e s o f l a n d W H O I S S E R I T A G E ? Seritage Growth Properties was formed to unlock the underlying value of a high-quality, national portfolio acquired from Sears Holdings Corporation in 2015. Our mission is

to maximize value for shareholders by repositioning the Company’s portfolio through leasing, redevelopment, formation of strategic partnerships and other bespoke solutions. SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference

| June 2021 Memphis, TN W e h a v e t h e l a n d a n d t h e v i s i o n t o c r e a t e s i g n i f i c a n t l o n g - t e r m v a l u e .Data as of March 31, 2021. P.2

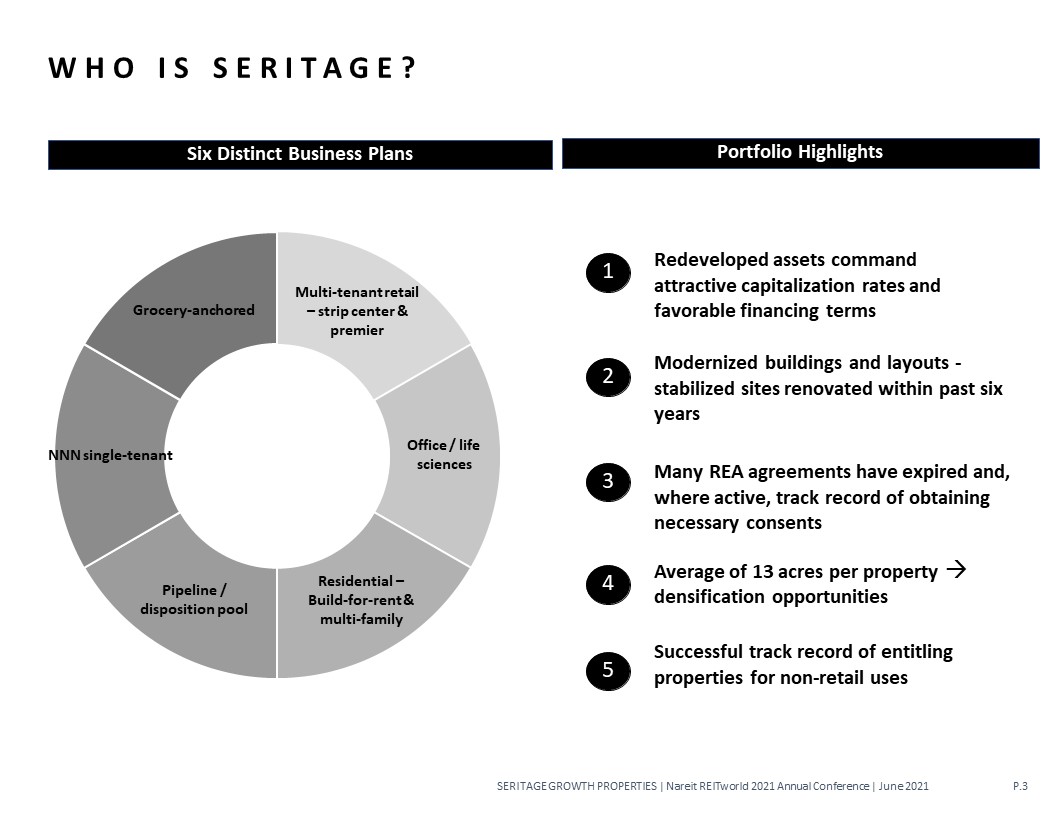

W H O I S S E R I T A G E ? Multi-tenant retail– strip center &

premier Office / life sciences Residential – Build-for-rent & multi-family Pipeline / disposition pool NNN single-tenant Grocery-anchored Six Distinct Business Plans Portfolio Highlights Redeveloped assets command attractive

capitalization rates and favorable financing terms Modernized buildings and layouts - stabilized sites renovated within past six years Many REA agreements have expired and, where active, track record of obtaining necessary consents Average

of 13 acres per property densification opportunities Successful track record of entitling properties for non-retail uses SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June

2021 1 2 3 4 5 P.3

T H E P O R T F O L I O SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual

Conference | June 2021 Anchorage, AK Victor, NY

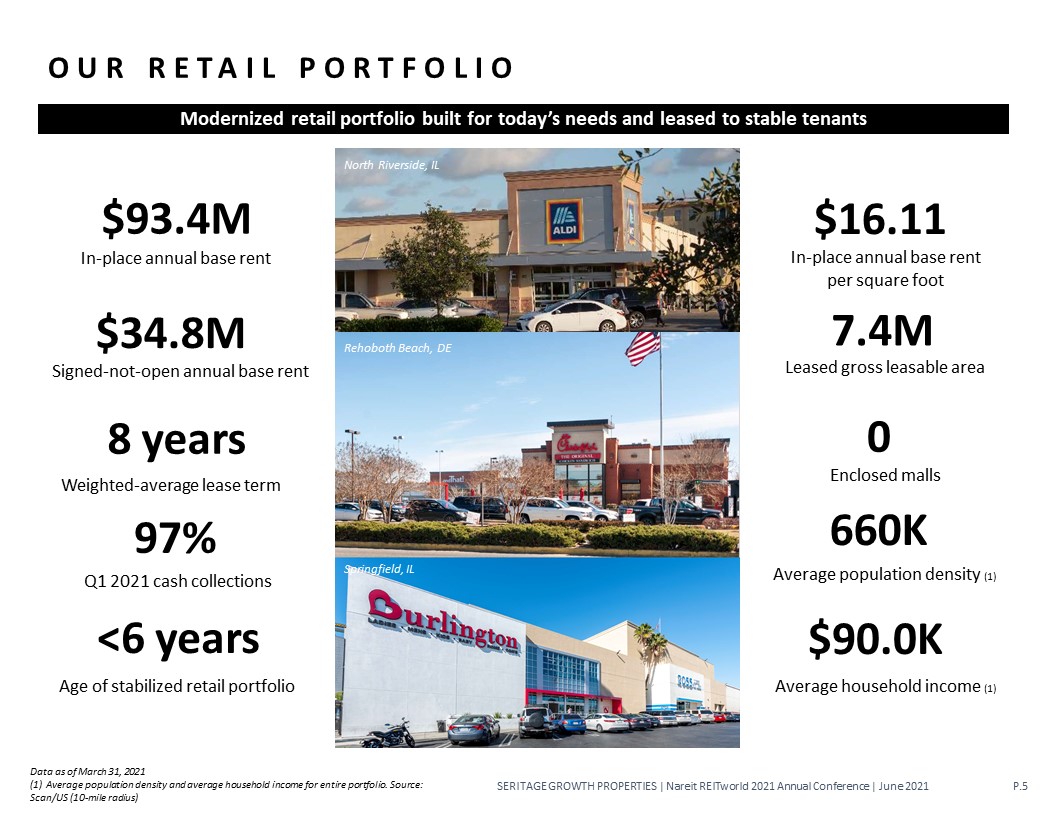

$93.4MIn-place annual base rent $34.8MSigned-not-open annual base rent 8

yearsWeighted-average lease term 97%Q1 2021 cash collections O U R R E T A I L P O R T F O L I O SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 North Riverside, IL Rehoboth Beach, DE Modernized retail

portfolio built for today’s needs and leased to stable tenants <6 yearsAge of stabilized retail portfolio $16.11In-place annual base rentper square foot 7.4MLeased gross leasable area 0Enclosed malls 660KAverage population density

(1) $90.0KAverage household income (1) Data as of March 31, 2021(1) Average population density and average household income for entire portfolio. Source: Scan/US (10-mile radius) P.5 Springfield, IL

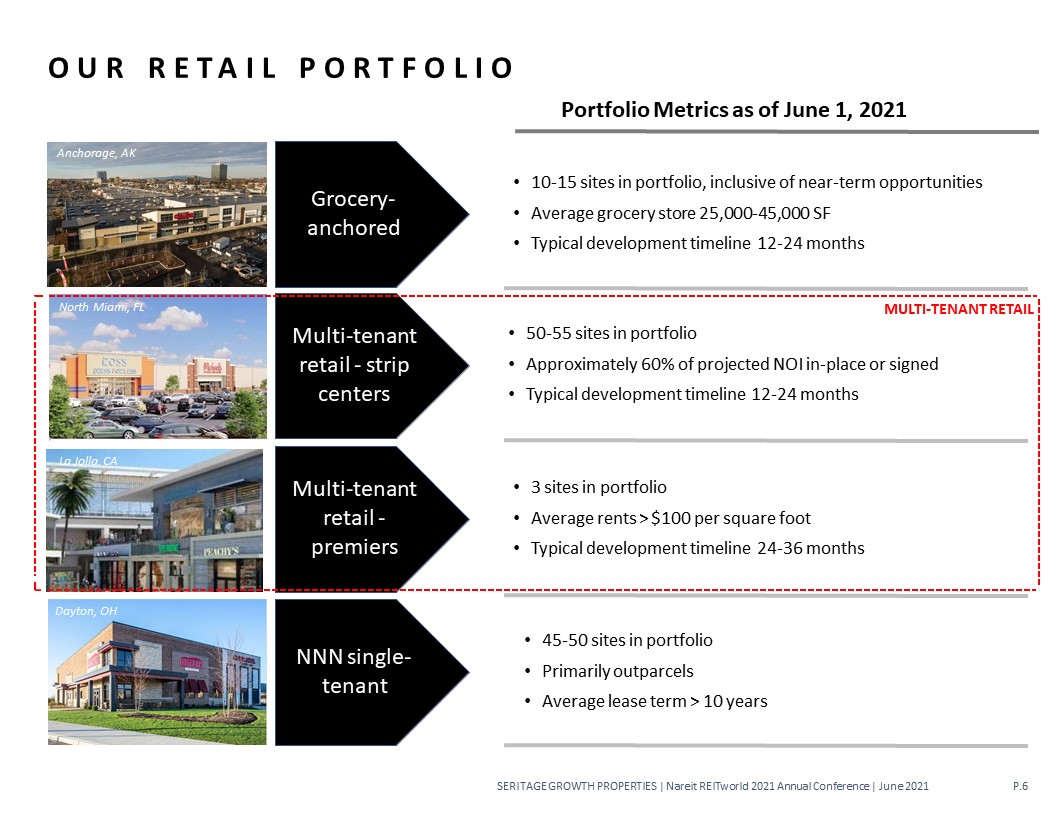

O U R R E T A I L P O R T F O L I O SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021

Annual Conference | June 2021 Grocery- anchored Multi-tenant retail - strip centers Multi-tenant retail - premiers NNN single- tenant Anchorage, AK North Miami, FL La Jolla, CA Portfolio Metrics as of June 1,

2021 10-15 sites in portfolio, inclusive of near-term opportunitiesAverage grocery store 25,000-45,000 SFTypical development timeline 12-24 months 50-55 sites in portfolioApproximately 60% of projected NOI in-place or

signedTypical development timeline 12-24 months 3 sites in portfolioAverage rents > $100 per square footTypical development timeline 24-36 months 45-50 sites in portfolioPrimarily outparcelsAverage lease term > 10

years MULTI-TENANT RETAIL P.6 Dayton, OH

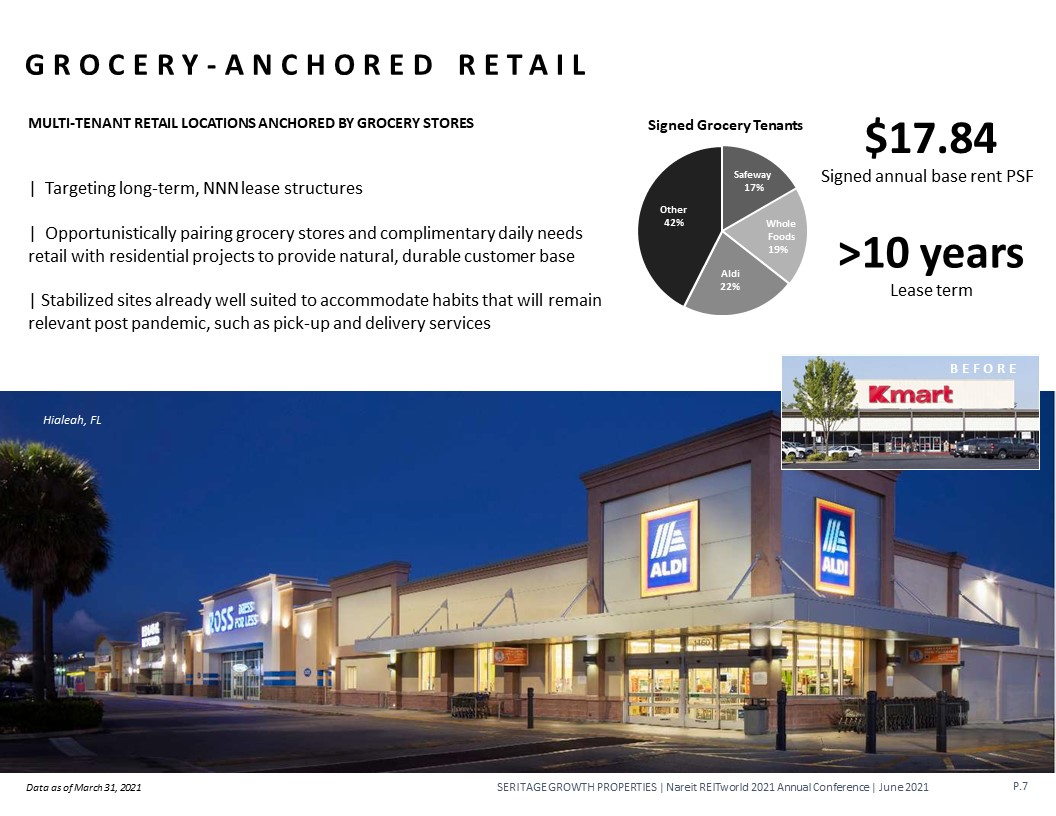

G R O C E R Y - A N C H O R E D R E T A I L MULTI-TENANT RETAIL LOCATIONS ANCHORED BY

GROCERY STORES | Targeting long-term, NNN lease structures | Opportunistically pairing grocery stores and complimentary daily needs retail with residential projects to provide natural, durable customer base | Stabilized sites already well

suited to accommodate habits that will remain relevant post pandemic, such as pick-up and delivery services SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 Hialeah, FL B E F O R E Safeway

17% Whole Foods 19% Aldi 22% Other 42% Signed Grocery Tenants $17.84Signed annual base rent PSF >10 yearsLease term P.7 Data as of March 31, 2021

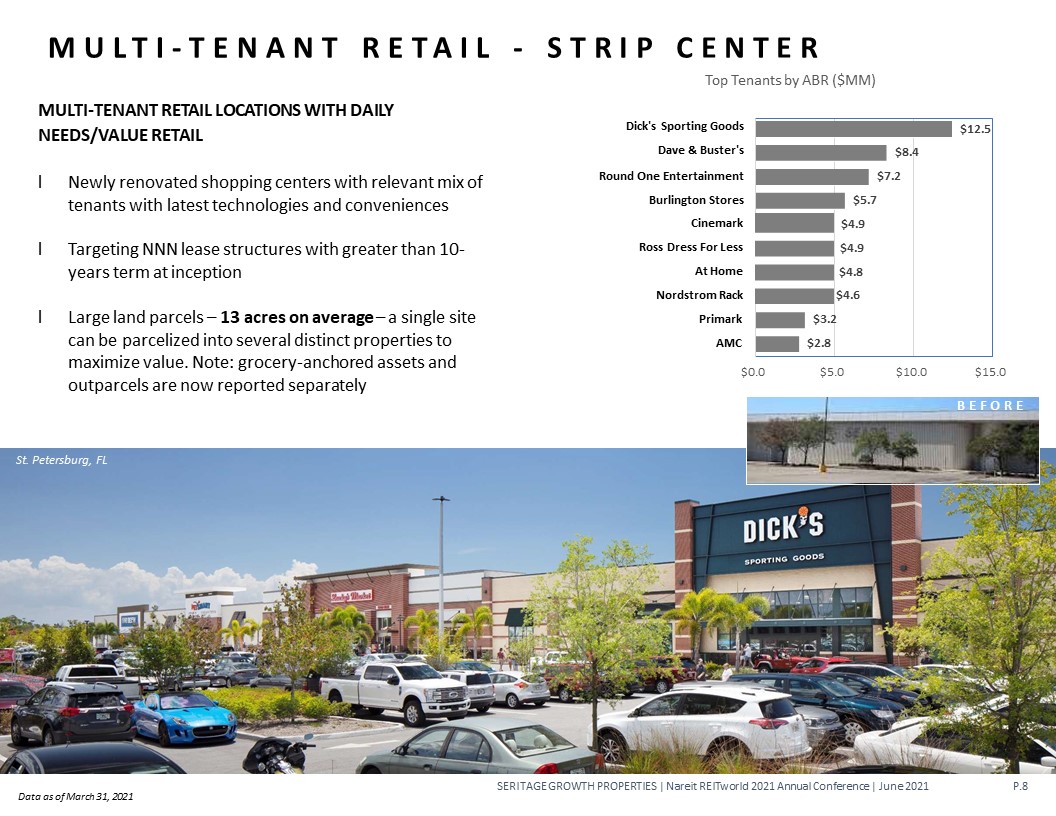

MULTI-TENANT RETAIL LOCATIONS WITH DAILY NEEDS/VALUE RETAIL l Newly renovated shopping

centers with relevant mix of tenants with latest technologies and conveniences l Targeting NNN lease structures with greater than 10- years term at inception l Large land parcels – 13 acres on average – a single site can be parcelized into

several distinct properties to maximize value. Note: grocery-anchored assets and outparcels are now reported separately M U L T I - T E N A N T R E T A I L - S T R I P C E N T E RTop Tenants by ABR ($MM) St. Petersburg, FL SERITAGE GROWTH

PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 B E F O R E $2.8 $3.2 $5.7 $7.2 $8.4 $12.5 $0.0 $5.0 $10.0 $15.0 PrimarkAMC Cinemark $4.9 Ross Dress For Less $4.9 At

Home $4.8 Nordstrom Rack $4.6 Dick's Sporting Goods Dave & Buster'sRound One EntertainmentBurlington Stores P.8 Data as of March 31, 2021

M U L T I - T E N A N T R E T A I L - P R E M I E R LARGE-SCALE RETAIL, DINING AND

EXPERIENTIAL LOCATIONSl Unique, one-of-a-kind destinations at our properties in Boca Raton, FL, Aventura, FL and La Jolla, CA located in proven, national markets.l Base rents for signed leases at Boca Raton, FL, Aventura, FL and La Jolla, CA

are: SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 Aventura, FL 24MAnnual visitors inSouth Florida $8.4BTotal Miamiinternational overnight spending $17.9BTotal Miami visitorexpenditures 53%Of visitor

spending is on shopping, meals & entertainment $1,002Average expenditure per overnight visitor per trip 32%Households with income $100K+ Source: Greater Miami Convention & Visitors Bureau, 2019 Visitor Industry Overview Aventura,

FL Low Median High N/A$ 100.00 Boca Raton, FL Aventura, FL La Jolla, CA N/A$ 55.90$ 50.00 $ 78.51 N/A$ 125.00$ 119.68 P.9

N N N S I N G L E - T E N A N T OUTPARCELS PRIMARILY LOCATED ADJACENT TO OTHER USES SUCH

AS MULTI- TENANT OR RESIDENTIALl Opportunities to create outparcels on periphery of large land parcels l Primarily NNN retail with attractive cap rates and established brands l Low development risk – landlord work is typically limited to

preparation of pad with substantially all building construction work performed by tenant l Targeting NNN leases with greater than 10-years term at inception SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June

2021 Dayton, OH Orlando, FL 100-150Additional pad opportunities within the portfolio 6.5%-7.5%Average capitalization rates (1) P.10 (1) Average capitalization rates based upon comparable market data.

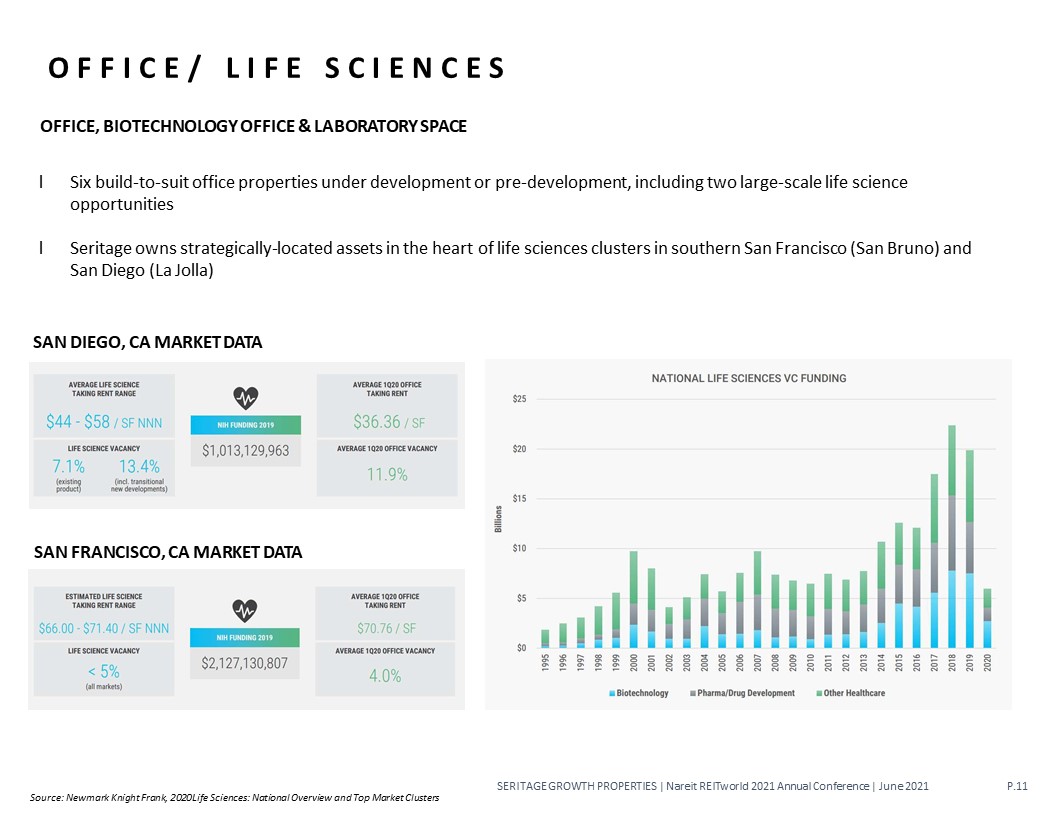

O F F I C E / L I F E S C I E N C E S OFFICE, BIOTECHNOLOGY OFFICE & LABORATORY SPACEl

Six build-to-suit office properties under development or pre-development, including two large-scale life science opportunitiesl Seritage owns strategically-located assets in the heart of life sciences clusters in southern San Francisco (San

Bruno) and San Diego (La Jolla)SAN DIEGO, CA MARKET DATA Source: Newmark Knight Frank, 2020 Life Sciences: National Overview and Top Market Clusters SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 SAN

FRANCISCO, CA MARKET DATA P.11

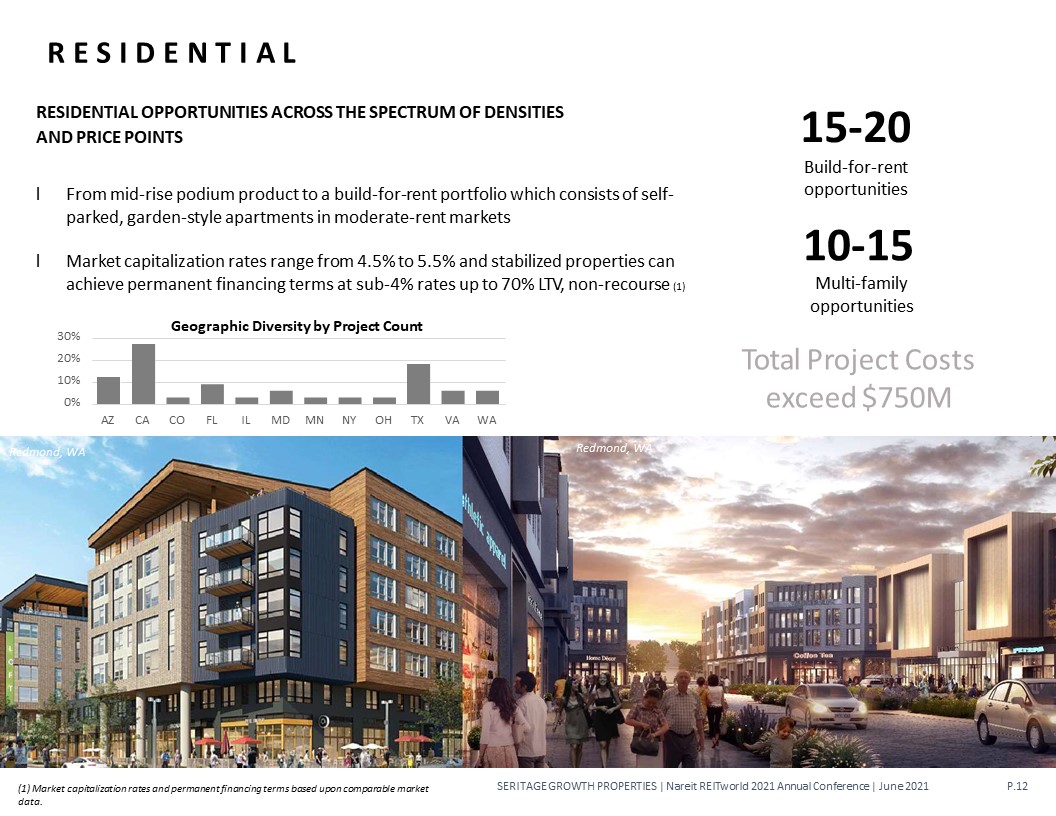

R E S I D E N T I A L RESIDENTIAL OPPORTUNITIES ACROSS THE SPECTRUM OF DENSITIES AND PRICE

POINTS l From mid-rise podium product to a build-for-rent portfolio which consists of self- parked, garden-style apartments in moderate-rent markets l Market capitalization rates range from 4.5% to 5.5% and stabilized properties can achieve

permanent financing terms at sub-4% rates up to 70% LTV, non-recourse (1) Redmond, WA Redmond, WA SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 15-20Build-for-rent opportunities 10-15Multi-family

opportunities Total Project Costs exceed $750M 30%20%10%0% AZ CA CO FL IL MD MN NY OH TX VA WA Geographic Diversity by Project Count P.12 (1) Market capitalization rates and permanent financing terms based upon

comparable market data.

F I N A N C I A L I N F O R M A T I O N SERITAGE GROWTH PROPERTIES | Nareit REITworld

2021 Annual Conference | June 2021 West Hartford, CT

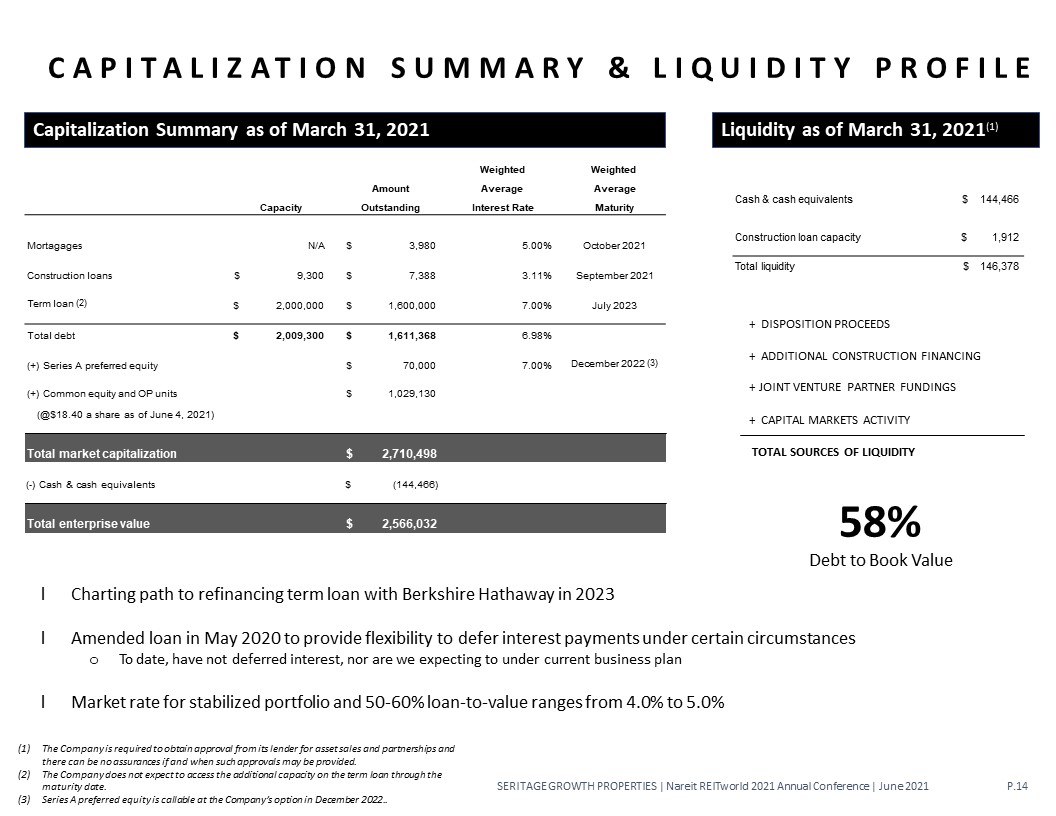

C A P I T A L I Z A T I O N S U M M A R Y & L I Q U I D I T Y P R O F I L E l Charting

path to refinancing term loan with Berkshire Hathaway in 2023l Amended loan in May 2020 to provide flexibility to defer interest payments under certain circumstanceso To date, have not deferred interest, nor are we expecting to under current

business planl Market rate for stabilized portfolio and 50-60% loan-to-value ranges from 4.0% to 5.0% SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021 Capitalization Summary as of March 31, 2021 Liquidity as

of March 31, 2021(1) Cash & cash equivalents $ 144,466 Construction loan capacity $ 1,912 Total liquidity $ 146,378 + DISPOSITION PROCEEDS+ ADDITIONAL CONSTRUCTION FINANCING+ JOINT VENTURE PARTNER FUNDINGS + CAPITAL MARKETS

ACTIVITY TOTAL SOURCES OF LIQUIDITY 58%Debt to Book Value The Company is required to obtain approval from its lender for asset sales and partnerships and there can be no assurances if and when such approvals may be provided.The Company

does not expect to access the additional capacity on the term loan through the maturity date.Series A preferred equity is callable at the Company’s option in December

2022.. P.14 Weighted Weighted Amount Average Average Capacity Outstanding Interest Rate Maturity Mortagages N/A $ 3,980 5.00% October 2021 Construction loans $ 9,300 $ 7,388 3.11% September 2021 Term loan (2) $

2,000,000 $ 1,600,000 7.00% July 2023 Total debt $ 2,009,300 $ 1,611,368 6.98% (+) Series A preferred equity $ 70,000 7.00% December 2022 (3) (+) Common equity and OP units $ 1,029,130 (@$18.40 a share as of June 4,

2021) Total market capitalization 2,710,498 $ (-) Cash & cash equivalents (144,466) $ Total enterprise value 2,566,032 $

L I Q U I D I T Y SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual Conference |

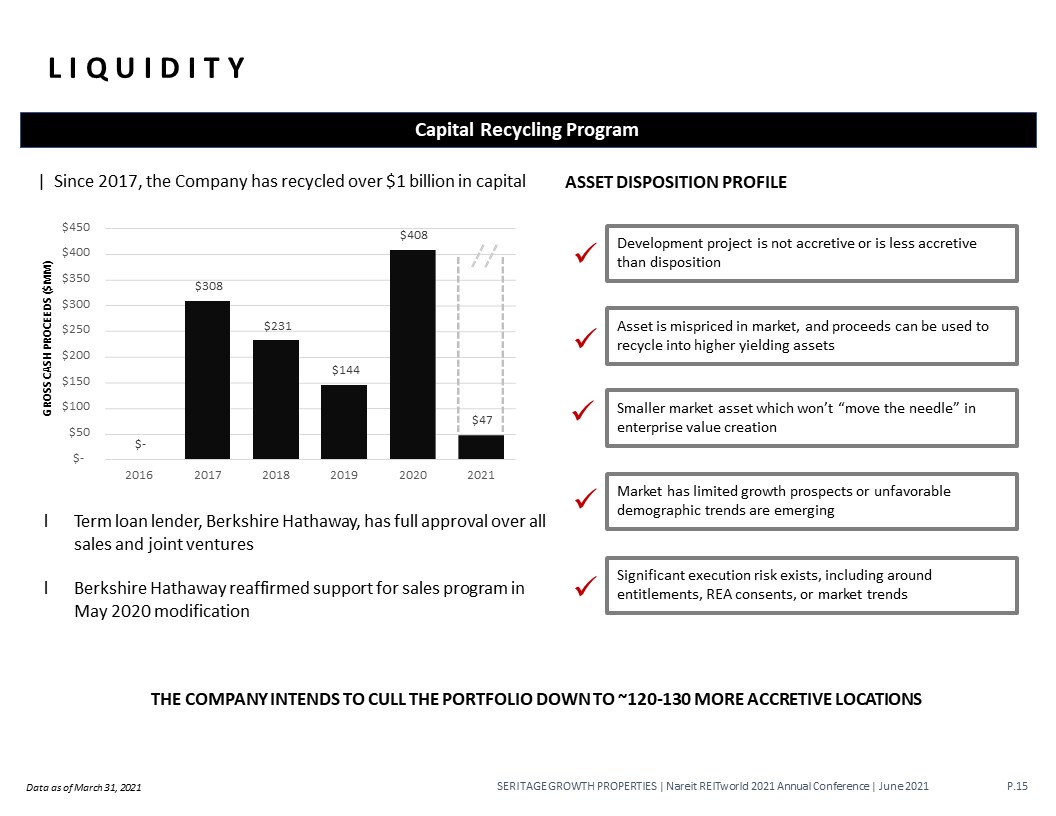

June 2021 THE COMPANY INTENDS TO CULL THE PORTFOLIO DOWN TO ~120-130 MORE ACCRETIVE LOCATIONS Capital Recycling Program | Since 2017, the Company has recycled over $1 billion in capital ASSET DISPOSITION

PROFILE $- $308 $231 $144 $408 $47 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 2016 2017 2018 2019 2020 2021 GROSS CASH PROCEEDS ($MM) Development project is not accretive or is less

accretive than disposition Asset is mispriced in market, and proceeds can be used to recycle into higher yielding assets Smaller market asset which won’t “move the needle” in enterprise value creation Market has limited growth prospects or

unfavorable demographic trends are emerging Significant execution risk exists, including around entitlements, REA consents, or market trends l Term loan lender, Berkshire Hathaway, has full approval over all sales and joint ventures l

Berkshire Hathaway reaffirmed support for sales program in May 2020 modification P.15 Data as of March 31, 2021

L I Q U I D I T Y C O N T I N U E D … SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021

Annual Conference | June 2021 1 Provides a meaningful source of capital for large-scale, multi-year projects Allows for partnership with strategic development partners, synergistic value creation and quicker execution

timelines Potentially generates increased returns on project through promotes and fees Illustrative Large-scale Development Joint Venture l Seritage believes strategic joint ventures are an important tool in our value creation story,

allowing us to leverage best in class execution expertise and historical levels of capital available for investment. Why do joint ventures make sense for Seritage? 2 3 Reduces Seritage cash equity requirements through imputed

pro-rata land value contributed to joint venture 4 P.16 Stabilized capitalization rates are illustrative and actual results may differ.Cash equity is computed as 50% of total costs less construction debt, minus 50% of the land

value. (dollar amounts in millions) Construction debt (60% of costs) $ 453.0 Cash equity funding required $ 302.0 50/50 Joint Venture SRG cost (land value + cash equity (2)) $ 238.5 Return on cost 11.5% Stabilized value (@

share) $ 500 Value creation $ 35 % increase in value over cost 14.7% Stabilized NOI $ 55.0 Land value $ 175.0 Development costs 755.0 Total costs $ 930.0 Return on cost 5.91% Stabilized capitalization rate

(1) 5.50% Stabilized value $ 1,000 Value creation $ 70 % increase in value over cost 7.5% Wholly-owned

L E A D E R S H I P & O R G A N I Z A T I O N A L San Diego, CA SERITAGE GROWTH

PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021

Andrea Olshan, Chief Executive Officer and President| Former CEO of Olshan Properties from

2012 to 2021, now Chair of Board of Directors| Former board member of Morgans Hotel Group| Extensive experience investing in, developing and managing retail, residential, office, hospitality and mixed-use properties AMANDA LOMBARD MATTHEW

FERNAND ANDREW GALVIN MARY ROTTLER Chief Financial Officer Chief Legal Officer Chief Investment Officer Chief Operating Officer | Promoted from CAO in 2020 | General Counsel of SRG since inception | Promoted from SVP

|Investments in 2019 Former EVP – Leasing since inception | Former CAO of Gramercy Property Trust | Former partner in Sidley Austin LLP’s real estate group | Held investment positions |at Centennial Real Estate, Rouse Properties &

GGP Former VP of Real Estate at Wal-Mart Stores, Inc. | Fully-integrated platform with leasing, development, construction, asset management, investments, accounting, operations and legal services staffed in house| Experienced team of 53

development, leasing, legal, finance and asset management professionals| Headquartered in New York City, with employees across the US M E E T T H E M A N A G E M E N T T E A M SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual

Conference | June 2021 P.18

E N V I O R N M E N T A L , S O C I A L , A N D G O V E R N A N C E ENVIRONMENTALOur

redevelopment projects are focused on reimaging aging and energy inefficient structures into modern, more energy efficient sites that take advantage of alternative energy sources, building management technology and remote

monitoring. SOCIALWe are focused on building projects that complement and are assets to the communities in which they are located. We also support minority owned businesses, and we provide competitive employee benefits. GOVERNANCEWe are

focused on maintaining high governance standards and increasing the diversity of our Board and leadership. We are committed to environmental, social responsibility and governance practices that we believe benefit our shareholders, our team

and our communities. Exploring alternative energy sources, includes usage of solar panels in 50 sites. Converted 10 sites to LED lighting. Utilizing LED lighting in future sites. Targeted utility usage reduction program. Implemented smart

technology to monitor for leaks. Adding electric vehicle charging stations at sites. Adding cardboard, plastic and metal recycling receptacles at sites. Vaccine and testing sites established in parking lots during pandemic. Minority-owned

business bid participation program.>60% of bids fit criteria. Corporate volunteer days with local and national charities Female-led company 50% of management team is diverse. SERITAGE GROWTH PROPERTIES | Nareit REITworld 2021 Annual

Conference | June 2021 P.19

500 Fifth Avenue | New York, NY 10110 212-355-7800 | www.seritage.com SERITAGE GROWTH

PROPERTIES | Nareit REITworld 2021 Annual Conference | June 2021