Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pebblebrook Hotel Trust | peb-20210607.htm |

| EX-99.1 - EX-99.1 - Pebblebrook Hotel Trust | peb060721updateandsaleex991.htm |

Leisure Demand Strong, Business Travel Returning Operating Trends Improving Month (2021) RevPAR Var to ‘19 Total Revenue ($M) Hotel EBITDA ($M) Jan (80%) $19.4 ($11.1) Feb (74%) $26.0 ($5.8) Mar (68%) $38.1 $1.4 Apr (E) (67%) $43.1 $3.0 May (E) (61%)–(62%) $52–$53 $5–$6 Note: EBITDA refers to non-GAAP Hotel EBITDA; see appendix for reconciliations of non-GAAP financial measures to Hotel Net Income (Loss). (1) Includes all hotels owned by Pebblebrook as of June 7, 2021; $s and % amounts for April and May are estimates. (2) Debt balances shown in millions; current as of May 21, 2021. (3) Maturity date of January 2023 assumes Pebblebrook chooses to exercise its two six-month options to extend debt maturity of the credit facility. (4) The Convertible Notes have an initial conversion rate of 39.2549 per $1,000 principal amount of the Notes (equivalent to a conversion price of approximately $25.47 per common share of Pebblebrook and a conversion premium of approximately 35.0% based on the closing price of $18.87 per common share on December 10, 2020). ✓ Operating trends are improving each week ✓ Leisure demand continues to show robust growth; business travel is in the early stages of its recovery ✓ Expect to achieve positive Adjusted EBITDAre in Q2 2021 ✓ Net proceeds from recent property sales and preferred equity offering to be allocated for acquisitions ✓ Half of the portfolio has recently been or is currently being redeveloped and transformed to a higher quality ✓ These significant investments, most of which have already been made, are expected to drive a higher EBITDA growth rate as the pandemic ends and we enter a new business cycle over the next several years Returning to Profitability(1) Balance Sheet and Liquidity(2,3,4) ✓ Liquidity: $950M (as of May 31) ✓ No material debt maturities until Q4 2022 ✓ 100% of debt is unsecured ✓ Net Debt to Book Value: approx. 37%, or 23% if convertible bonds treated as equity ✓ Leisure demand continues to drive the industry’s recovery, but encouraging signs of increased weekday demand from the business transient segment have emerged ✓ Business group leads, Requests For Proposal (“RFPs”), and bookings for later this year have increased substantially in the last 60 days REITweek: Investor Conference Update June 8-10, 2021 11% 15% 21% 26% 30% 0% 10% 20% 30% 40% 50% 60% January February March April (E) May (E) Total Portfolio Occupancy: Weekday 17% 28% 36% 43% 52% 0% 10% 20% 30% 40% 50% 60% January February March April (E) May (E) Total Portfolio Occupancy: Weekend 13% 19% 25% 31% 0% 10% 20% 30% 40% 50% 60% January February March April (E) May (E) Total Portfolio Occupancy 37% ✓ Along with robust leisure travel, business travel is also contributing to positive EBITDA, and this trend is anticipated to accelerate as companies adopt less restrictive travel policies and return to the office 40% 35% 25% Recently Completed and Current Redevelopments and Transformations to Generate Outsized Returns Year # of Hotels Redeveloped, Transformed, or Renovated Total Amount Invested 2018-2019 14 $216M 2020 8 $104M 2021 4 $57M Total 26 $377M $4.8 $272.2 $747.6 $510.0 $2.4 $750.0 2021 2022 2023 2024 2025 2026 Convertible Notes Term Loans & Private Placement 1 Capital Re-Investments Historical Segmentation and Performance(1) ✓ Above totals do not include all currently contemplated and potential 2021/2022 investment projects that may begin later this year Current Portfolio 2019 Run Rate Statistics Total Revenues $1.4B Total Hotel EBITDA $463M Corporate Transient Leisure Transient Group March 2021 April 2021 (E) May 2021 (E) Occ ADR RevPAR Occ ADR RevPAR Occ ADR RevPAR Resort 57% $414 $236 64% $378 $244 64% $372 $240 Urban (open) 29% $161 $47 32% $177 $57 35% $197 $69 Total Portfolio 25% $245 $61 31% $239 $74 37% $242 $89 $s above in millions

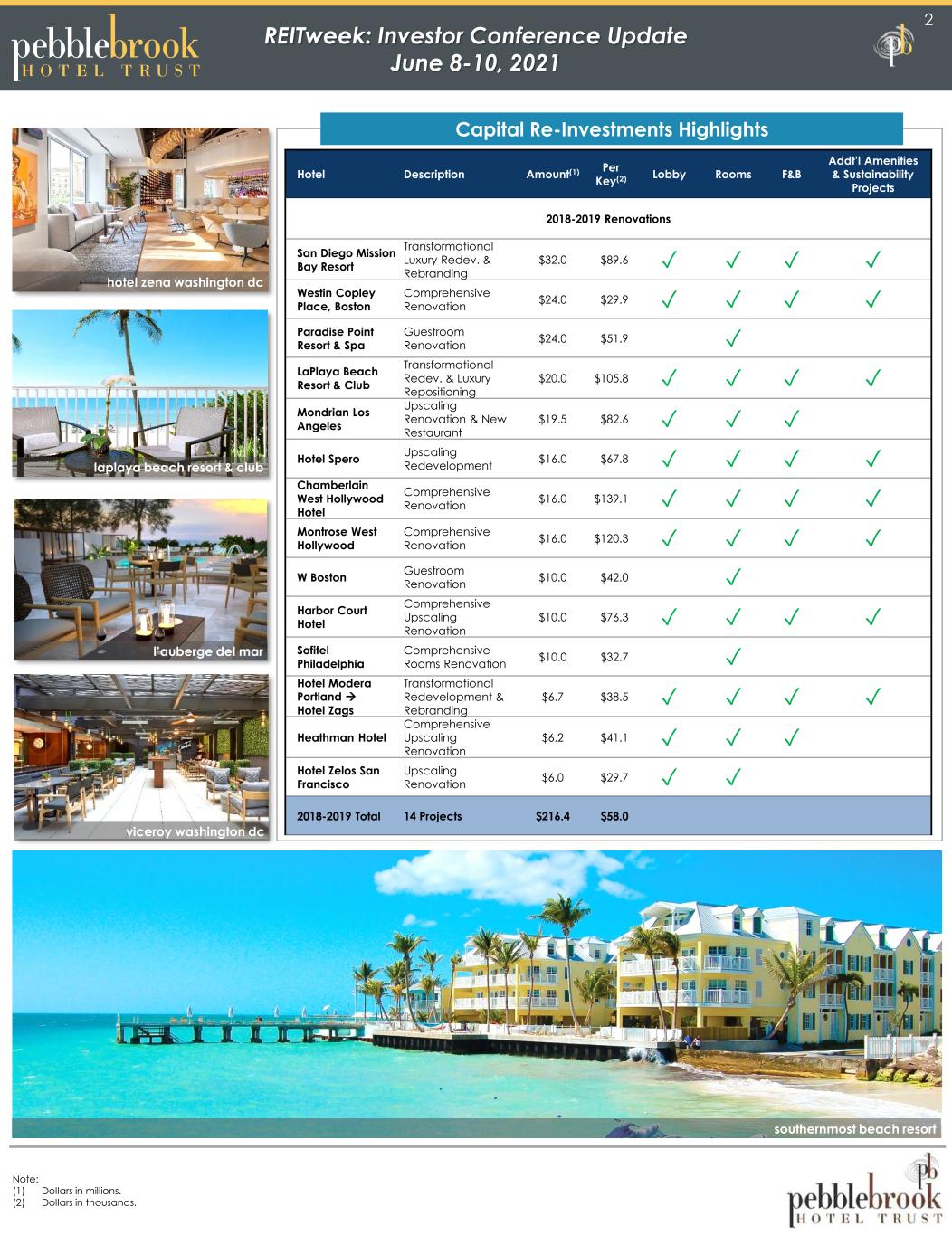

REITweek: Investor Conference Update June 8-10, 2021 hotel zena washington dc laplaya beach resort & club l’auberge del mar viceroy washington dc Hotel Description Amount(1) Per Key(2) Lobby Rooms F&B Addt’l Amenities & Sustainability Projects 2018-2019 Renovations San Diego Mission Bay Resort Transformational Luxury Redev. & Rebranding $32.0 $89.6 ✓ ✓ ✓ ✓ Westin Copley Place, Boston Comprehensive Renovation $24.0 $29.9 ✓ ✓ ✓ ✓ Paradise Point Resort & Spa Guestroom Renovation $24.0 $51.9 ✓ LaPlaya Beach Resort & Club Transformational Redev. & Luxury Repositioning $20.0 $105.8 ✓ ✓ ✓ ✓ Mondrian Los Angeles Upscaling Renovation & New Restaurant $19.5 $82.6 ✓ ✓ ✓ Hotel Spero Upscaling Redevelopment $16.0 $67.8 ✓ ✓ ✓ ✓ Chamberlain West Hollywood Hotel Comprehensive Renovation $16.0 $139.1 ✓ ✓ ✓ ✓ Montrose West Hollywood Comprehensive Renovation $16.0 $120.3 ✓ ✓ ✓ ✓ W Boston Guestroom Renovation $10.0 $42.0 ✓ Harbor Court Hotel Comprehensive Upscaling Renovation $10.0 $76.3 ✓ ✓ ✓ ✓ Sofitel Philadelphia Comprehensive Rooms Renovation $10.0 $32.7 ✓ Hotel Modera Portland → Hotel Zags Transformational Redevelopment & Rebranding $6.7 $38.5 ✓ ✓ ✓ ✓ Heathman Hotel Comprehensive Upscaling Renovation $6.2 $41.1 ✓ ✓ ✓ Hotel Zelos San Francisco Upscaling Renovation $6.0 $29.7 ✓ ✓ 2018-2019 Total 14 Projects $216.4 $58.0 Capital Re-Investments Highlights Note: (1) Dollars in millions. (2) Dollars in thousands. southernmost beach resort 2

REITweek: Investor Conference Update June 8-10, 2021 Hotel Description Amount(1) Per Key(2) Lobby Rooms F&B Addt’l Amenities & Sustainability Projects 2020 Renovations Donovan Hotel → Hotel Zena Washington DC Transformational Redevelopment & Rebranding $25.0 $130.9 ✓ ✓ ✓ ✓ Embassy Suites San Diego Bay – Downtown Comprehensive Guestroom Renovation $18.0 $52.8 ✓ Westin San Diego Gaslamp Quarter Guestroom & Public Area Renovation $16.0 $35.6 ✓ ✓ ✓ Le Parc Suite Hotel Transformational Upscaling Redevelopment $12.5 $81.2 ✓ ✓ ✓ ✓ Viceroy Santa Monica Hotel Comprehensive Public Area Redevelopment $10.5 $62.1 ✓ ✓ ✓ Chaminade Resort & Spa Transformational Redev. & Luxury Repositioning $9.0 $57.7 ✓ ✓ ✓ Mason & Rook Hotel → Viceroy Washington DC Transformational Redevelopment & Rebranding $8.0 $44.9 ✓ ✓ ✓ ✓ The Marker Key West Harbor Resort Upscaling Renovation & Repositioning $5.0 $52.1 ✓ ✓ ✓ ✓ 2020 Total 8 Projects $104.0 $59.9 2021 Renovations L'Auberge Del Mar Transformational Luxury Redevelopment $11.9 $98.3 ✓ ✓ ✓ Hotel Vitale → 1 Hotel San Francisco(3) Transformational Luxury Redev. & Rebranding(3) $25.0 $125.0 ✓ ✓ ✓ ✓ Southernmost Beach Resort(3) Comprehensive Guestroom Renovation(3) $15.0 $57.3 ✓ ✓ Grafton on Sunset → Z Collection Hotel(3) Transformational Redev. & Rebranding(3) $5.0 $46.3 ✓ ✓ ✓ ✓ 2021 Total 4 Projects $56.9 $82.3 2018-2021 Total 26 Projects $377.3 $61.3 2018-2021 Total Excl’d Upcoming Projects 23 Projects $332.3 $59.5 chaminade resort & spa le parc suite hotel san diego mission bay resort viceroy santa monica hotel Note: (1) Dollars in millions. (2) Dollars in thousands. (3) Upcoming projects which have not yet commenced. 3 the marker key west harbor resort Capital Re-Investments Highlights, Continued

Appendix 4 For the twelve months ending December, For the month of January, For the month of February, For the month of March, For the month of April, For the month of May 2021 (E), 2019 2021 2021 2021 2021 (E) Low High Hotel net income $255.7 ($29.4) ($23.9) ($16.8) ($15.2) ($13.2) ($12.2) Adjustment: Depreciation and amortization 207.0 18.3 18.1 18.2 18.2 18.2 18.2 Hotel EBITDA $462.7 ($11.1) ($5.8) $1.4 $3.0 $5.0 $6.0 Adjustment: Capital reserve (57.2) (0.7) (1.1) (1.5) (1.7) (2.1) (2.1) Hotel Net Operating Income $405.5 ($11.8) ($6.9) ($0.1) $1.3 $2.9 $3.9 This presentation includes certain non-GAAP financial measures as defined under Securities and Exchange Commission (SEC) rules. These measures are not in accordance with, or an alternative to, measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the hotels' results of operations determined in accordance with GAAP. The Company has presented hotel EBITDA and hotel net operating income after capital reserves for the periods above because it believes these measures provide investors and analysts with an understanding of the hotel-level operating performance. These non-GAAP measures do not represent amounts availab le for management’s discretionary use, because of needed capital replacement or expansion, debt service obligations or other commitments and uncertainties, nor are they indicative of funds availab le to fund the Company’s cash needs, including its ab ility to make distributions. The Company’s presentation of the hotels' EBITDA and net operating income after capital reserves for the periods above should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of the hotels' financial performance. The tab le above is a reconciliation of the hotels' EBITDA and net operating income after capital reserves calculations to net income in accordance with GAAP for the periods above. Any differences are a result of rounding. This investor conference update contains certain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Reform Act of 1995. Forward-looking statements are generally identifiab le by use of forward-looking terminology such as “will,” “to be,” “anticipated,” “until,” “may,” “estimate,” “expect,” “approximately,” “continue,” “assume” or other similar words or expressions. These forward-looking statements relate to Adjusted EBITDre, allocation of offering proceeds, demand recovery, expected liquidity and financial measures and operating statistics for April and May of 2021. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the COVID-19 pandemic, the state of the U.S. economy and the supply of hotel properties, and other factors as are described in greater detail in the Company’s filings with the U.S. Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. All information in this investor conference update is as of June 7, 2021. The Company undertakes no duty to update the statements in this investor conference update to conform the statements to actual results or changes in the Company’s expectations. Pebblebrook Hotel Trust Total Property Portfolio Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net Operating Income Full Year 2019, January, February, March, April (estimate) and May (estimate) 2021 (Unaudited, in millions)