Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GETTY REALTY CORP /MD/ | gty-8k_20210608.htm |

CORPORATE PROFILE JUNE 2021 CONVENIENCE AUTOMOTIVE RETAIL EXHIBIT 99.1

SAFE HARBOR STATEMENT Certain statements in this presentation constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are statements that relate to management’s expectations or beliefs, future plans and strategies, future financial performance and similar expressions concerning matters that are not historical facts. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential.” Such forward-looking statements reflect current views with respect to the matters referred to and are based on certain assumptions and involve known and unknown risks, uncertainties and other important factors, many of which are beyond the Company’s control, that could cause the actual results, performance, or achievements of the Company to differ materially from any future results, performance, or achievement implied by such forward-looking statements. While forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Unknown or unpredictable factors could have material adverse effects on our business, financial condition, liquidity, results of operations and prospects. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company does not undertake any obligation to release publicly any revisions to the forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. For a further discussion of factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and the Company’s other filings with the SEC, including, in particular, the section entitled “Risk Factors” contained therein. In light of these risks, uncertainties, assumptions and factors, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this presentation will, in fact, transpire. Moreover, because the Company operates in a very competitive and rapidly changing environment, new risks are likely to emerge from time to time. Given these risks and uncertainties, potential investors are cautioned not to place undue reliance on these forward-looking statements as a prediction of future results. Unless otherwise noted in this presentation, all reported financial data is presented as of the quarter ended March 31, 2021 and all portfolio data is as of May 31, 2021. This presentation presents certain non-GAAP financial measures, including the Company’s Funds From Operations (“FFO”) and Adjusted Funds From Operations (“AFFO”). Please refer to the Definitions and Reconciliations section of this presentation for additional information and complete reconciliations between each of these non-GAAP financial measures and the most directly comparable GAAP financial measure. The Company believes that FFO and AFFO are helpful to investors in measuring its performance because both FFO and AFFO exclude various items included in GAAP net earnings that do not relate to, or are not indicative of, the Company’s core operating performance. The Company pays particular attention to AFFO, a supplemental non-GAAP performance measure, as the Company believes it best represents its core operating performance and allows analysts and investors to better assess the Company’s core operating performance. Further, the Company believes that AFFO is useful in comparing the sustainability of the Company’s core operating performance with the sustainability of the core operating performance of other real estate companies. The information contained herein has been prepared from public and non-public sources believed to be reliable. However, the Company has not independently verified certain of the information contained herein and does not make any representation or warranty as to the accuracy or completeness of the information contained in this presentation.

Company

GETTY AT A GLANCE 1 Note: Enterprise Value based on market value of common equity as of June 7, 2021. Portfolio data as of May 31, 2021. $2.0 billion Enterprise Value 1,007 Properties 36 States+ DC BBB- Fitch Rated WE INVEST IN FREESTANDING, SINGLE TENANT PROPERTIES WHERE CONSUMERS SPEND MONEY IN THEIR CARS OR ON THEIR CARS Net Lease REIT specializing in Convenience and automotive retail real estate

2 Note: Portfolio Snapshot as of May 31, 2021, except Tenant Rent Coverage as of March 31, 2021. Financial Snapshot as of May 31, 2021, except Net Debt / EBITDA and Fixed Charge Coverage as of March 31, 2021 and Dividend Yield as of June 7, 2021. ABR = annual base rent. WALT = weighted average lease term. FINANCIAL SNAPSHOT INVESTMENT HIGHLIGHTS STABLE PORTFOLIO OF ESSENTIAL USE ASSETS WITH ATTRACTIVE GROWTH OPPORTUNITIES Durable Rental Income Essential, e-commerce and recession resistant, retail businesses Established national and regional tenants operating multi-store platforms Versatile Real Estate in Major Markets Freestanding properties on corner locations in high density metro areas Emphasis on accessibility, population trends and potential for alternate use Incremental Investment Opportunities Fragmented sectors and institutional capital flows driving transaction activity Sale leaseback and construction financing aligns with tenant “buy & build” strategies Well Positioned Balance Sheet Significant liquidity, moderate leverage, unencumbered assets Facilitates growth, mitigates risk and maximizes flexibility

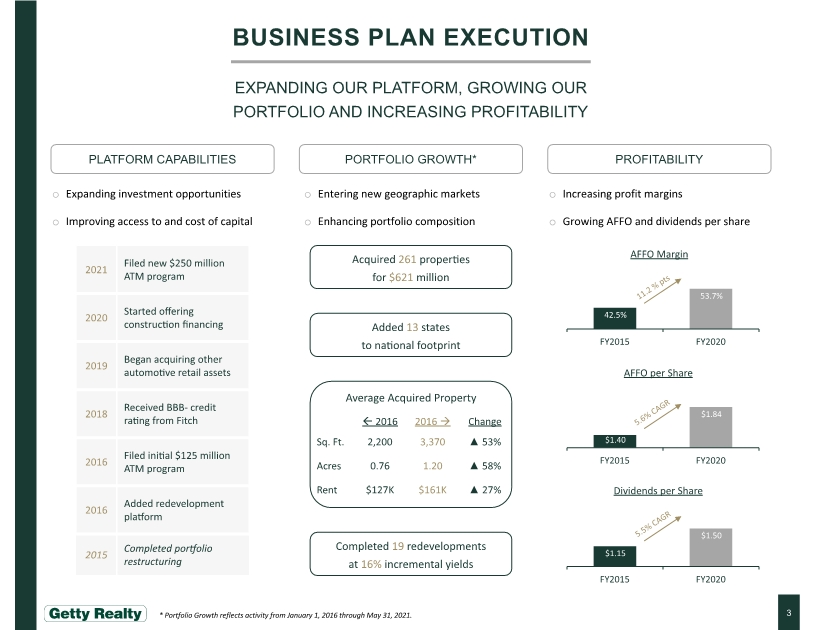

PLATFORM CAPABILITIES PROFITABILITY Expanding investment opportunities Improving access to and cost of capital Increasing profit margins Growing AFFO and dividends per share BUSINESS PLAN EXECUTION 3 Expanding OUR PLATFORM, Growing our Portfolio AND Increasing PROFITABILITY 5.5% CAGR 5.6% CAGR 11.2 % pts PORTFOLIO GROWTH* Entering new geographic markets Enhancing portfolio composition Acquired 261 properties for $621 million Added 13 states to national footprint Completed 19 redevelopments at 16% incremental yields * Portfolio Growth reflects activity from January 1, 2016 through May 31, 2021. Average Acquired Property

RECENT NEWS 4 STRONG YEAR TO DATE INVESTMENT ACTIVITY ACROSS MULTIPLE PROPERTY TYPES Note: Portfolio data as of May 31, 2021, except tenant rent coverage as of March 31, 2021. Balance Sheet data as of March 31, 2021. INVESTMENT ACTIVITY PORTFOLIO Invested $73 million across 59 properties year-to-date through June 1, 2021 Acquired 9 car washes for $32 million Acquired 46 oil change centers for $30 million Funded construction loans totaling $11 million for 4 new-to-industry convenience stores 99.5% occupied Full, normalized rent collections 2.7x tenant rent coverage BALANCE SHEET $332 million of liquidity (cash + Revolver capacity) 5.0x net debt / EBITDA EARNINGS Reported Q1 2021 AFFO of $20.9 million, up 8.6% vs. Q1 2020 Reported Q1 2021 AFFO per share of $0.47, up 2.2% vs. Q1 2020

PORTFOLIO

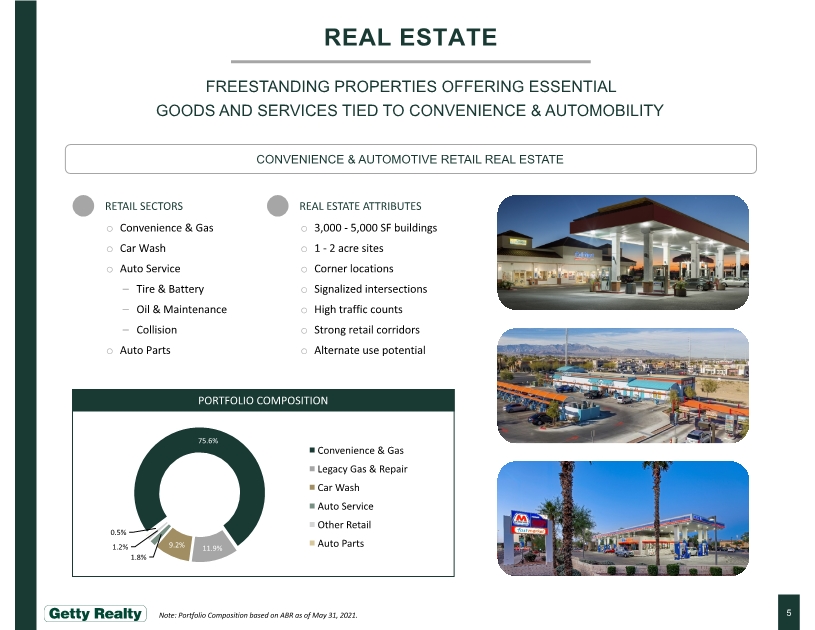

REAL ESTATE 5 FREESTANDING PROPERTIES OFFERING ESSENTIAL GOODS AND SERVICES TIED TO CONVENIENCE & AUTOMOBILITY CONVENIENCE & AUTOMOTIVE RETAIL REAL ESTATE RETAIL SECTORS Convenience & Gas Car Wash Auto Service Tire & Battery Oil & Maintenance Collision Auto Parts REAL ESTATE ATTRIBUTES 3,000 - 5,000 SF buildings 1 - 2 acre sites Corner locations Signalized intersections High traffic counts Strong retail corridors Alternate use potential PORTFOLIO COMPOSITION Note: Portfolio Composition based on ABR as of May 31, 2021.

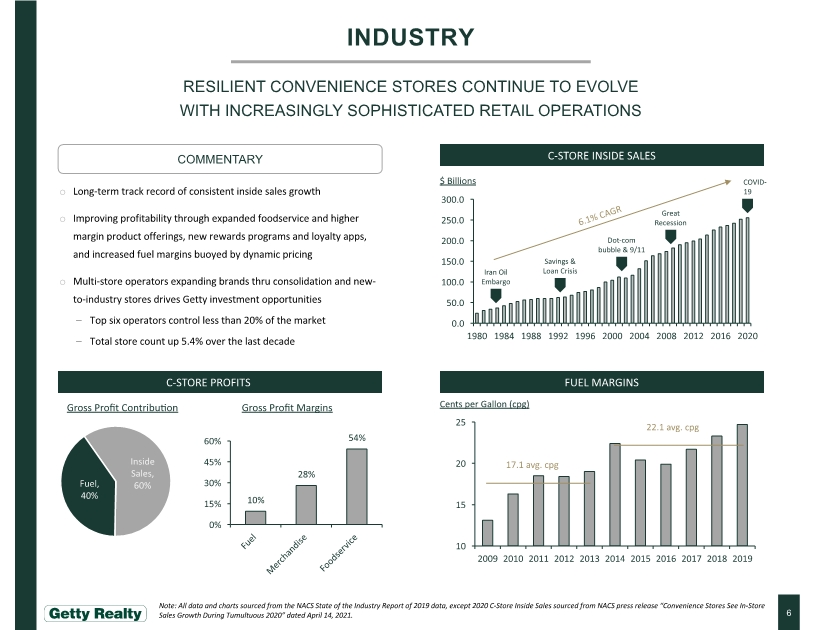

INDUSTRY 6 RESILIENT CONVENIENCE STORES CONTINUE TO EVOLVE WITH INCREASINGLY SOPHISTICATED RETAIL OPERATIONS Note: All data and charts sourced from the NACS State of the Industry Report of 2019 data, except 2020 C-Store Inside Sales sourced from NACS press release “Convenience Stores See In-Store Sales Growth During Tumultuous 2020” dated April 14, 2021. COMMENTARY Long-term track record of consistent inside sales growth Improving profitability through expanded foodservice and higher margin product offerings, new rewards programs and loyalty apps, and increased fuel margins buoyed by dynamic pricing Multi-store operators expanding brands thru consolidation and new-to-industry stores drives Getty investment opportunities Top six operators control less than 20% of the market Total store count up 5.4% over the last decade C-STORE INSIDE SALES C-STORE PROFITS FUEL MARGINS Gross Profit Contribution Gross Profit Margins Cents per Gallon (cpg) 17.1 avg. cpg 22.1 avg. cpg

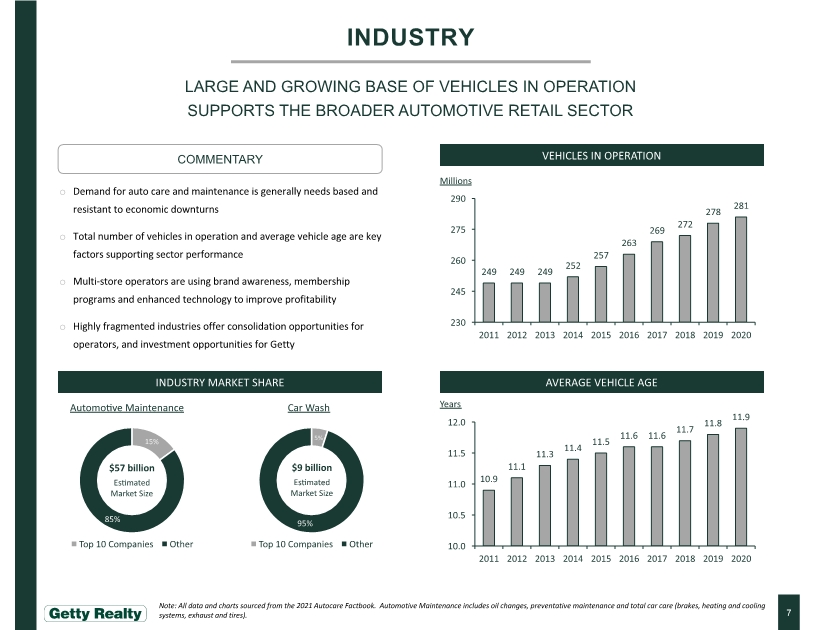

INDUSTRY 7 LARGE AND GROWING BASE OF VEHICLES IN OPERATION Supports THE BROADER AUTOMOTIVE RETAIL SECTOR Note: All data and charts sourced from the 2021 Autocare Factbook. Automotive Maintenance includes oil changes, preventative maintenance and total car care (brakes, heating and cooling systems, exhaust and tires). COMMENTARY Demand for auto care and maintenance is generally needs based and resistant to economic downturns Total number of vehicles in operation and average vehicle age are key factors supporting sector performance Multi-store operators are using brand awareness, membership programs and enhanced technology to improve profitability Highly fragmented industries offer consolidation opportunities for operators, and investment opportunities for Getty VEHICLES IN OPERATION AVERAGE VEHICLE AGE INDUSTRY MARKET SHARE $57 billion Estimated Market Size Automotive Maintenance Car Wash $9 billion Estimated Market Size

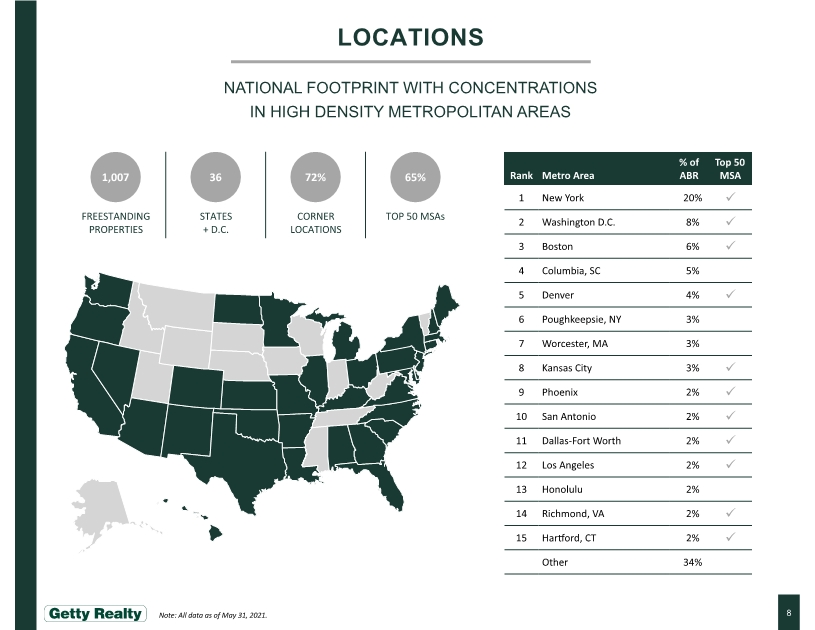

LOCATIONS 8 NATIONAL FOOTPRINT WITH CONCENTRATIONS IN HIGH DENSITY METROPOLITAN AREAS Note: All data as of May 31, 2021.

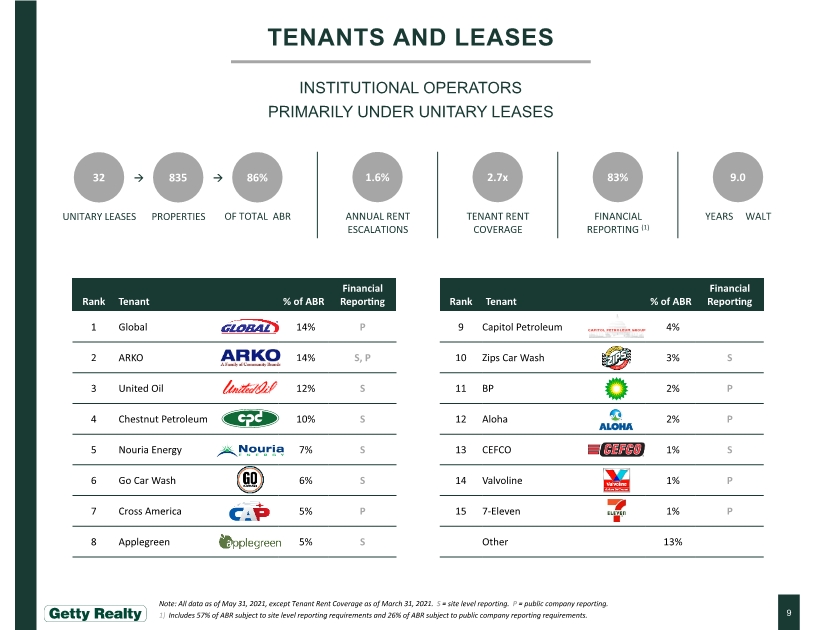

TENANTS AND LEASES 9 INSTITUTIONAL OPERATORS PRIMARILY UNDER UNITARY LEASES Note: All data as of May 31, 2021, except Tenant Rent Coverage as of March 31, 2021. S = site level reporting. P = public company reporting. 1) Includes 57% of ABR subject to site level reporting requirements and 26% of ABR subject to public company reporting requirements.

CAPABILITIES

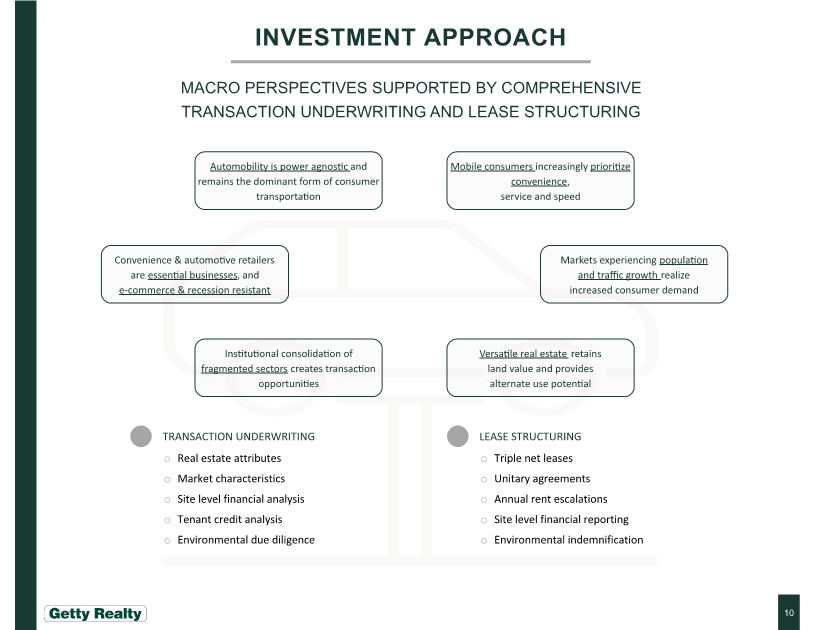

INVESTMENT APPROACH 10 MACRO PERSPECTIVES SUPPORTED BY comprehensive TRANSACTION UNDERWRITING AND LEASE STRUCTURING TRANSACTION UNDERWRITING Real estate attributes Market characteristics Site level financial analysis Tenant credit analysis Environmental due diligence LEASE STRUCTURING Triple net leases Unitary agreements Annual rent escalations Site level financial reporting Environmental indemnification Automobility is power agnostic and remains the dominant form of consumer transportation Institutional consolidation of fragmented sectors creates transaction opportunities Mobile consumers increasingly prioritize convenience, service and speed Versatile real estate retains land value and provides alternate use potential Markets experiencing population and traffic growth realize increased consumer demand Convenience & automotive retailers are essential businesses, and e-commerce & recession resistant

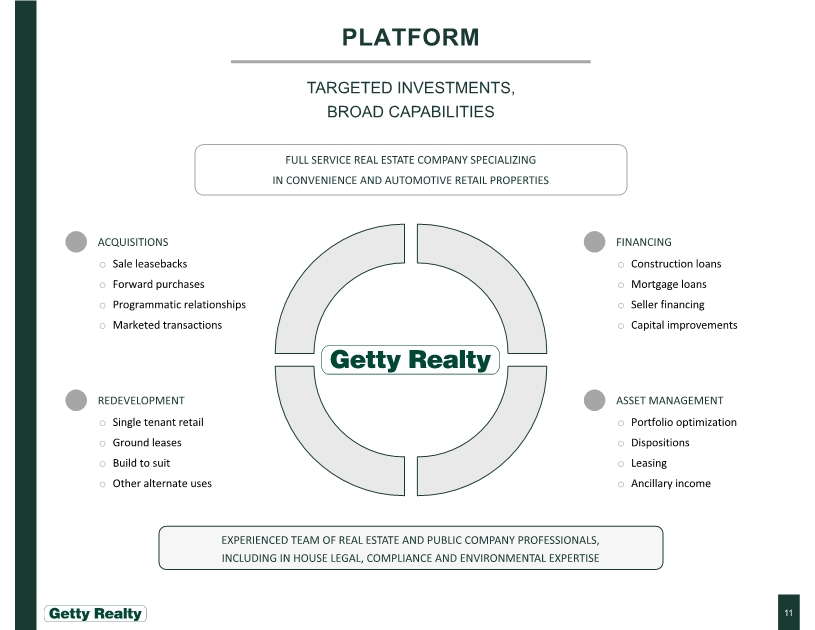

PLATFORM 11 TARGETED INVESTMENTS, BROAD CAPABILITIES ACQUISITIONS Sale leasebacks Forward purchases Programmatic relationships Marketed transactions FULL SERVICE REAL ESTATE COMPANY SPECIALIZING IN CONVENIENCE AND AUTOMOTIVE RETAIL PROPERTIES REDEVELOPMENT Single tenant retail Ground leases Build to suit Other alternate uses FINANCING Construction loans Mortgage loans Seller financing Capital improvements ASSET MANAGEMENT Portfolio optimization Dispositions Leasing Ancillary income EXPERIENCED TEAM OF REAL ESTATE AND PUBLIC COMPANY PROFESSIONALS, INCLUDING IN HOUSE LEGAL, COMPLIANCE AND ENVIRONMENTAL EXPERTISE

ACQUISITIONS 12 ACQUIRED 261 PROPERTIES FOR $621 MILLION SINCE January 2016… 1) Next rent escalation occurs in November 2022. 2) We expect to acquire these properties via a sale leaseback transaction at the end of the construction period. DATE: Q2 2021 Property Type: Auto Service – Oil & Maintenance Transaction Type: Acquired Leases # OF Properties: 46 Transaction Value: $30 million Geography: Michigan & Ohio Lease Term: 11.5 years Rent Escalations: 10% / 5 years (1)

DATE: Q4 2020 Property Type: Convenience & Gas Transaction Type: Sale Leaseback # OF Properties: 6 Transaction Value: $29 million Geography: Texas Lease Term: 15.0 years Rent Escalations: 10% / 5 years ACQUISITIONS 13 …ENHANCING TENANT, PROPERTY TYPE AND GEOGRAPHIC DIVERSIFICATION

RENT COMMENCEMENT: Q4 2020 Property Type: Auto Parts DEVELOPMENT Type: Ground Lease TOTAL INVESTMENT: $0.2 million INCREMENTAL yield: 47% Geography: Bloomfield, NJ RENT COMMENCEMENT: Q1 2020 Property Type: Other Retail DEVELOPMENT Type: Ground Lease TOTAL INVESTMENT: $1.6 million INCREMENTAL yield: 11% Geography: Bronx, NY REDEVELOPMENT 14 COMPLETED 19 PROJECTS TOTALING $14.4 million AT A 16% INCREMENTAL YIELD CURRENT PIPELINE INCLUDES 11 PROJECTS TOTALING ~$7.5 MILLION of NEW INVESTMENT WITH ESTIMATED COMPLETIONS SCHEDULED FOR 2021-2023

CORPORATE

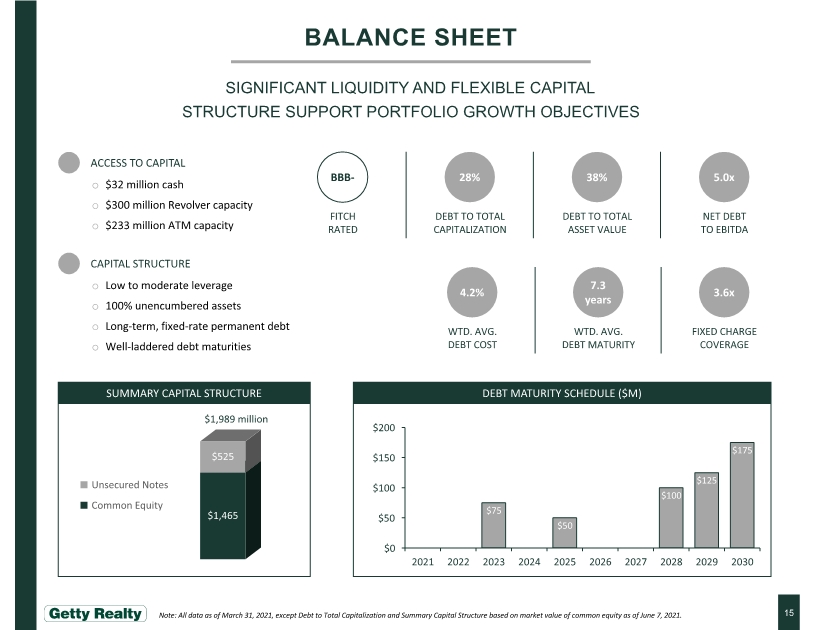

BALANCE SHEET 15 SIGNIFICANT LIQUIDITY AND FLEXIBLE CAPITAL STRUCTURE SUPPORT PORTFOLIO GROWTH Objectives Note: All data as of March 31, 2021, except Debt to Total Capitalization and Summary Capital Structure based on market value of common equity as of June 7, 2021. ACCESS TO CAPITAL $32 million cash $300 million Revolver capacity $233 million ATM capacity CAPITAL STRUCTURE Low to moderate leverage 100% unencumbered assets Long-term, fixed-rate permanent debt Well-laddered debt maturities DEBT MATURITY SCHEDULE ($M) SUMMARY CAPITAL STRUCTURE

CORPORATE RESPONSIBILITY 16 COMMITTED TO GOOD CORPORATE CITIZENSHIP AND BUSINESS PRACTICES THAT SERVE ALL OF OUR STAKEHOLDERS ENVIRONMENTAL PRACTICES CORPORATE GOVERNANCE We place a high priority on the protection of our assets and the environment Our team includes environmental experts who conduct extensive due diligence and monitor on-going compliance Our tenants are responsible for the environmental impact of their operations, and are required to maintain insurance and comply with applicable regulations We maintain an actively-managed program to oversee legacy environmental remediation for which we are responsible We emphasize sustainability efforts at our corporate headquarters We support and encourage our tenants’ sustainability initiatives SOCIAL RESPONSIBILITY Please visit CORPORATE RESPONSIBILITY AT www.gettyrealty.coM for additional information We believe that our people are the foundation of our success We aim to foster a diverse and inclusive work environment We are proud that women currently comprise 48% of our full-time team Our employee benefits include robust healthcare, commuter, profit sharing and wellness programs We promote and fund professional development opportunities Our Business Conduct Guidelines and Employee Handbook govern our professional conduct and ethics Our headquarters adheres to health and safety best practices We are dedicated to maintaining high standards for corporate governance predicated on integrity and transparency Our Board is comprised of 83% independent directors, including an independent Chairman We are committed to broadening the diversity composition of our Board We hold annual elections for all directors Our Board maintains a significant equity investment in our Company Our Board has delegated oversight of our ESG efforts to our Nominating & Corporate Governance Committee, and oversight of enterprise risk management to our Audit Committee

17 SUMMARY WE INVEST IN FREESTANDING, SINGLE TENANT PROPERTIES WHERE CONSUMERS SPEND MONEY IN THEIR CARS OR ON THEIR CARS STABLE PORTFOLIO OF ESSENTIAL USE ASSETS WITH ATTRACTIVE GROWTH OPPORTUNITIES

DEFINITIONS AND RECONCILIATIONS CONVENIENCE AUTOMOTIVE RETAIL

Non-GAAP Financial Measures 21 Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO). In addition to measurements defined by accounting principles generally accepted in the United States of America (“GAAP”), the Company also focuses on Funds From Operations (“FFO”) and Adjusted Funds From Operations (“AFFO”) to measure its performance. FFO and AFFO are generally considered by analysts and investors to be appropriate supplemental non-GAAP measures of the performance of REITs. FFO and AFFO are not in accordance with, or a substitute for, measures prepared in accordance with GAAP. In addition, FFO and AFFO are not based on any comprehensive set of accounting rules or principles. Neither FFO nor AFFO represent cash generated from operating activities calculated in accordance with GAAP and therefore these measures should not be considered an alternative for GAAP net earnings or as a measure of liquidity. These measures should only be used to evaluate the Company’s performance in conjunction with corresponding GAAP measures. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as GAAP net earnings before depreciation and amortization of real estate assets, gains or losses on dispositions of real estate, impairment charges and the cumulative effect of accounting changes. The Company’s definition of AFFO is defined as FFO less (i) certain revenue recognition adjustments (defined below), (ii) non-cash changes in environmental estimates, (iii) non-cash environmental accretion expense, (iv) environmental litigation accruals, (v) insurance reimbursements, (vi) legal settlements and judgments, (vii) acquisition costs expensed and (viii) other unusual items that are not reflective of the Company’s core operating performance. Other REITs may use definitions of FFO and/or AFFO that are different than the Company’s and, accordingly, may not be comparable. The Company believes that FFO and AFFO are helpful to analysts and investors in measuring the Company’s performance because both FFO and AFFO exclude various items included in GAAP net earnings that do not relate to, or are not indicative of, the Company’s core operating performance. Specifically, FFO excludes various items such as depreciation and amortization of real estate assets, gains or losses on dispositions of real estate and impairment charges. However, GAAP net earnings and FFO typically include certain other items that the Company excludes from AFFO, including the impact of revenue recognition adjustments comprised of deferred rental revenue (straight-line rental revenue), the net amortization of above-market and below-market leases, adjustments recorded for the recognition of rental income from direct financing leases and the amortization of deferred lease incentives (collectively, “Revenue Recognition Adjustments”) that do not impact the Company’s recurring cash flow and which are not indicative of its core operating performance. Deferred rental revenue results primarily from fixed rental increases scheduled under certain leases with the Company’s tenants. In accordance with GAAP, the aggregate minimum rent due over the current term of these leases is recognized on a straight-line basis rather than when payment is contractually due. The present value of the difference between the fair market rent and the contractual rent for in-place leases at the time properties are acquired is amortized into revenue from rental properties over the remaining lives of the in-place leases. Income from direct financing leases is recognized over the lease terms using the effective interest method, which produces a constant periodic rate of return on the net investments in the leased properties. The amortization of deferred lease incentives represents the Company’s funding commitment in certain leases, which deferred expense is recognized on a straight-line basis as a reduction of rental revenue. GAAP net earnings and FFO also include non-cash and/or unusual items such as changes in environmental estimates, environmental accretion expense, non-cash allowance for credit losses on notes and mortgages receivable and direct financing leases, environmental litigation accruals, insurance reimbursements, legal settlements and judgments, property acquisition costs expensed and loss on extinguishment of debt that do not impact the Company’s recurring cash flow and which are not indicative of the Company’s core operating performance. The Company pays particular attention to AFFO which the Company believes provides a more accurate depiction of the Company’s core operating performance than either GAAP earnings or FFO. By providing AFFO, the Company believes that it is presenting useful information that assists analysts and investors to better assess its core operating performance. Further, the Company believes that AFFO is useful in comparing the sustainability of its core operating performance with the sustainability of the core operating performance of other real estate companies. For a tabular reconciliation of FFO and AFFO to GAAP net earnings, see the table captioned “Reconciliation of Net Earnings to FFO and AFFO” included herein.

Other Metrics and Definitions 22 Annual Base Rent (ABR). Contractually specified annual base rent in effect for all leases that have commenced as of the date noted, including those accounted for as direct financing leases. Annual Rent Escalations. Weighted average contractual rent increases per year under the terms of in-place leases, weighted by ABR. Automobility. Automobiles as the major means of transportation. Credit Agreements. Refers to (i) the amended and restated credit agreement governing the Company’s Revolver and (ii) the amended and restated note purchase and guarantee agreements governing the Company’s senior unsecured notes. Debt to Total Asset Value. The ratio of (a) Consolidated Total Indebtedness to (b) Total Asset Value, each as defined in the Credit Agreements. Debt to Total Capitalization. The ratio of (a) Consolidated Total Indebtedness, as defined in the Credit Agreements, to (b) Total Capitalization, which is defined as Consolidated Total Indebtedness plus the market value of the Company’s common stock as of the date noted. Fixed Charge Coverage. The ratio of (a) EBITDAR to (b) fixed charges, as defined and described, respectively, in the Credit Agreements. Incremental Yield. For redevelopment projects, the amount of incremental rent generated by the redeveloped property divided by the capital investment required to complete the project. Net Debt to EBITDA. The ratio of (a) Consolidated Total Indebtedness, as defined in the Credit Agreements, less cash and equivalents, to (b) EBITDA, as defined in the Credit Agreements. MSAs. Core Based Statistical Areas as defined by United States Office of Management and Budget. The Company uses MSAs to define the geographic markets in which it operates. Revolver. The Company’s $300 million unsecured revolving credit facility. Tenant Rent Coverage. Site-level rent coverage calculated one quarter in arrears based on trailing twelve month financial information provided by tenants. The Company does not independently verify financial information provided by tenants. Weighted Average Lease Term (WALT). The remaining lease term of all in-place leases as of the date noted, weighted by ABR.

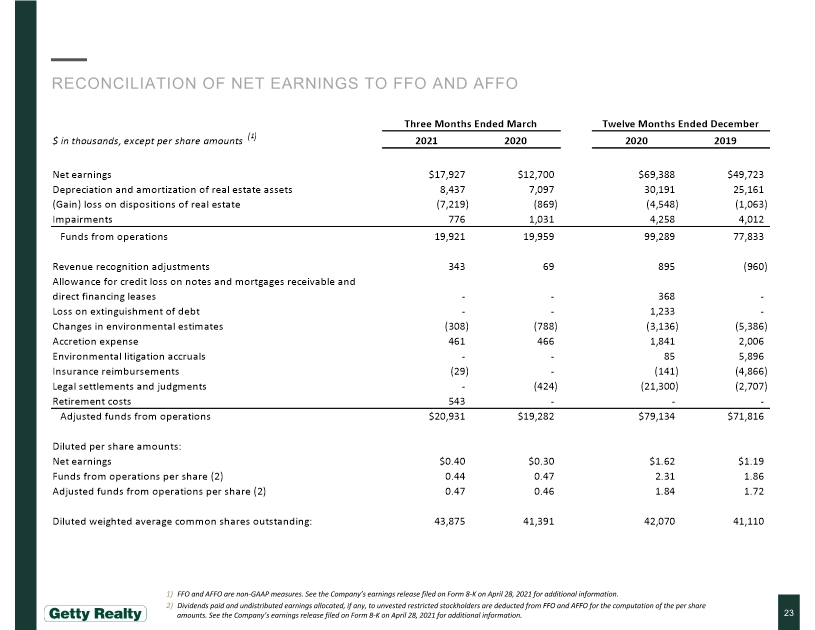

Reconciliation of Net Earnings to FFO and AFFO 23 FFO and AFFO are non-GAAP measures. See the Company’s earnings release filed on Form 8-K on April 28, 2021 for additional information. Dividends paid and undistributed earnings allocated, if any, to unvested restricted stockholders are deducted from FFO and AFFO for the computation of the per share amounts. See the Company’s earnings release filed on Form 8-K on April 28, 2021 for additional information.