Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank First Corp | tm2119153d1_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION June 2021 TICKER: BFC (NASDAQ)

Safe Harbor Statement FORWARD LOOKING STATEMENTS This presentation may contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements reflect the Company’s current views with respect to, among other things, future events and its financial performance . These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward - looking nature . These forward - looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control . Accordingly, the Company cautions you that any such forward - looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict . Although the Company believes that the expectations reflected in these forward - looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward - looking statements . There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward - looking statements, including, but not limited to, the following : natural disasters and adverse weather, acts of terrorism, an outbreak of hostilities or other international or domestic calamities, and other matters beyond our control ; the geographic concentration of our markets in east - central Wisconsin ; our ability to prudently manage our growth and execute our strategy ; risks associated with our acquisition and de novo branching strategy ; changes in management personnel ; the amount of nonperforming and classified assets that we hold ; time and effort necessary to resolve nonperforming assets ; deterioration of our asset quality ; interest rate risk associated with our business ; business and economic conditions generally and in the financial services industry, nationally and within our primary markets ; the composition of our loan portfolio, including the identity of our borrowers and the concentration of loans in specialized industries ; changes in the value of collateral securing our loans ; our ability to maintain important deposit customer relationships and our reputation ; our ability to maintain effective internal control over financial reporting ; operational risks associated with our business ; increased competition in the financial services industry, particularly from regional and national institutions ; volatility and direction of market interest rates ; liquidity risks associated with our business ; systems failures or interruptions involving our information technology and telecommunications systems or third - party servicers ; interruptions or breaches in the Company’s information system security ; the results of regulatory examinations, investigations or reviews or the ability to obtain required regulatory approvals ; the failure of certain third party vendors to perform ; environmental liability associated with our lending activities ; the institution and outcome of litigation and other legal proceedings against us or to which we may become subject ; changes in the laws, rules, regulations, interpretations or policies relating to financial institution, accounting, tax, trade, monetary and fiscal matters ; and further government intervention in the U . S . financial system . The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included under “Cautionary Note Regarding Forward - Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10 - K filed with the SEC on March 26 , 2019 and any updates to those risk factors set forth in the Company’s subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K . If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate . Accordingly, you should not place undue reliance on any such forward - looking statements . Any forward - looking statement speaks only as of the date on which it is made, and the Company does not undertake any obligation to publicly update or review any forward - looking statement, whether as a result of new information, future developments or otherwise . New factors emerge from time to time, and it is not possible for the Company to predict which will arise . In addition, the Company cannot assess the impact of each factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements . All forward - looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement . This cautionary statement should also be considered in connection with any subsequent written or oral forward - looking statements that the Company or persons acting on the Company’s behalf may issue . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results .

BFC at - a - glance • Core franchise located in east - central Wisconsin - founded in 1894. • History of strong organic growth supplemented by the acquisition of Waupaca Bancorporation, Inc. (“Waupaca”) in 2017 ($420MM in assets), Partnership Community Bancshares, Inc. (“Partnership”) in 2019 ($308MM in assets) and Tomah Bancshares, Inc. (“Timberwood”) in May 2020 ($210MM in assets). • Efficient network of 21 branch offices located in the counties of Sheboygan (3), Manitowoc (6), Brown (2), Winnebago (1), Outagamie (2), Waupaca (3), Ozaukee (2), Monroe (1) and Jefferson (1). • Consolidated assets of $2.8 billion, loans of $2.2 billion and deposits of $2.4 billion. • Diverse loan portfolio with no identified concentrations and strong organic asset quality. • Low 0.38% cost of funds when including the impact of ~ 32% non - interest bearing deposits within the Bank’s deposit base • Investments in strategic fin - tech and insurance affiliates. • Talented and diverse senior management group. Our Promise: We are a relationship - based community bank focused on providing innovative products and services that are value - driven 2

PROMISE, CULTURE, VISION OUR PROMISE : We are a relationship - based community bank focused on providing innovative products and services that are value driven . OUR CULTURE : Bank First’s culture celebrates diversity, creativity, and responsiveness, with the highest ethical standards . Employees are encouraged to develop their careers . They are empowered with the tools to be successful and are held accountable for the results they deliver . We maintain a strong credit culture as a foundation of sound asset quality . We embrace innovation and provide the solutions our customers need and expect . OUR VISION : Bank First will remain an independent community bank . We will sustain our independence by remaining the top - performing provider of financial services in Wisconsin . Bank First will create value for the communities and customers we serve, resulting in exceptional return for our shareholders . We will grow relationship deposits and lend those funds to invest in and support the communities we serve, yielding superior growth in earnings per share .

FINANCIAL UPDATE Balanced Loan Growth, Organic and Through Acquisitions (dollars in millions) PORTFOLIO LOANS $0 $500 $1,000 $1,500 $2,000 $2,500 Organic Loans Acquired Loans SECONDARY MARKET LOANS $0 $150 $300 $450 $600 $750 Organic Loans Acquired Loans

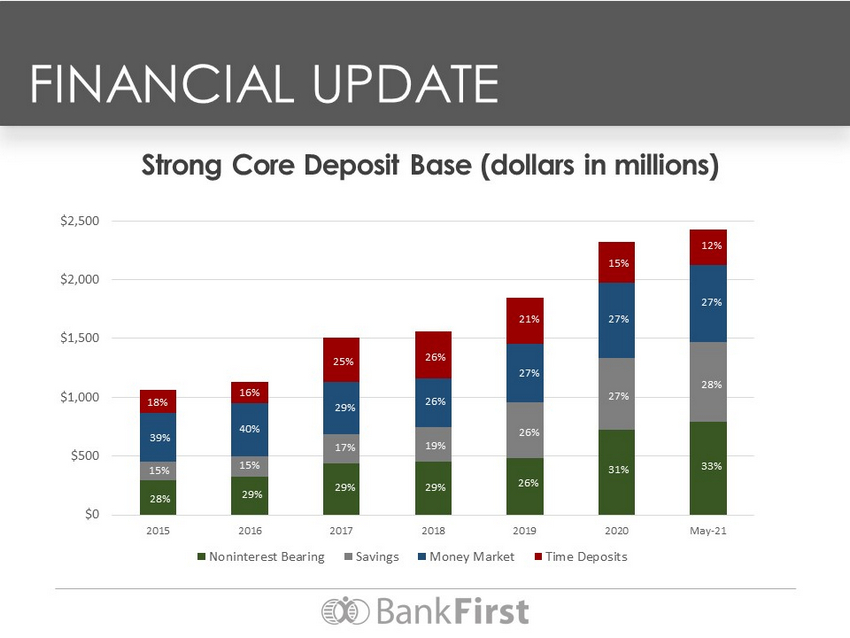

FINANCIAL UPDATE Strong Core Deposit Base (dollars in millions) $0 $500 $1,000 $1,500 $2,000 $2,500 2015 2016 2017 2018 2019 2020 May-21 Noninterest Bearing Savings Money Market Time Deposits 18% 29% 26% 27% 27% 27% 33% 16% 25% 26% 21% 15% 12% 39% 15% 28% 40% 15% 29% 17% 29% 19% 29% 26% 26% 27% 31% 28%

FINANCIAL U PDATE Dividends Per Share $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 2015 2016 2017 2018 2019 2020 2021* * Annualized based on the first two quarters of 2021 ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 2015 2016 2017 2018 2019 2020 Impact of Paycheck Protection Program Impact of Acquisition Costs Impact of Purchase Accounting Core EPS Earnings Per Share (EPS)

FINANCIAL UPDATE History of Strong Asset Quality CLASSIFIED ASSETS TO RISK BASED CAPITAL 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Organic Assets Acquired Assets NONPERFORMING LOANS TO TOTAL LOANS 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% Organic Loans Acquired Loans

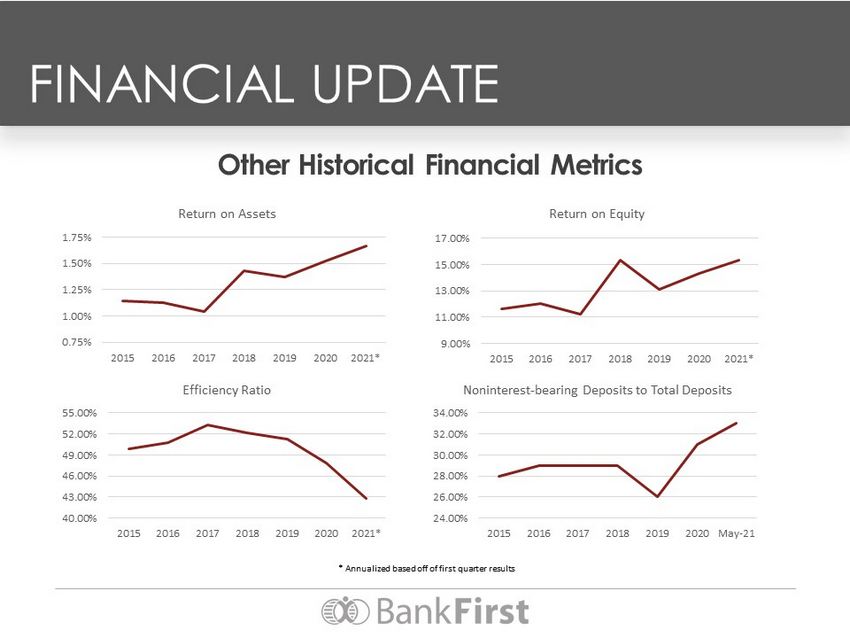

FINANCIAL UPDATE Other Historical Financial Metrics 0.75% 1.00% 1.25% 1.50% 1.75% 2015 2016 2017 2018 2019 2020 2021* Return on Assets * Annualized based off of first quarter results 9.00% 11.00% 13.00% 15.00% 17.00% 2015 2016 2017 2018 2019 2020 2021* Return on Equity 40.00% 43.00% 46.00% 49.00% 52.00% 55.00% 2015 2016 2017 2018 2019 2020 2021* Efficiency Ratio 24.00% 26.00% 28.00% 30.00% 32.00% 34.00% 2015 2016 2017 2018 2019 2020 May-21 Noninterest - bearing Deposits to Total Deposits

STOCK PERFORMANCE (Total Return) $0 $100 $200 $300 $400 $500 $600 Value of $100 invested on June 1, 2011 (10 year) BFC Russell 2000 S&P Regional Banking ETF $588.43 $276.33 $274.00

Acquisition of Waupaca Bancorporation, Inc. (October 2017) • Waupaca Bancorporation, Inc. was the holding company for First National Bank, headquartered in Waupaca, Wisconsin and founded in 1885. • Deal consideration was $78.1 million, consisting of cash of $53.4 million and 653,523 shares of BFC common stock valued at $24.7 million on the date of close (approximately 1.08x tangible book value). • Acquired assets totaled $418.2 million, acquired loans totaled $339.3 million and acquired deposits totaled $345.6 million. • Six of nine First National Bank branches were opened as Bank First branches on October 30, 2017. One has subsequently been sold, and another closed. Acquired Branches Legacy Branches • Tangible book value earn - back was slightly over three months • Acquired operations were immediately accretive to earnings per share • Goodwill totaled $7.0 million • BFC became the dominant bank in Waupaca County, with a 27.1% share of total deposits as of June 30, 2018 • Significant asset quality issues existed in the acquired loan portfolio, as noted on slide 7. • Acquired classified assets to risk - based capital was 30.5%, 22.5% and 21.3% as of December 31, 2017, December 31, 2018 and March 31, 2019, respectively

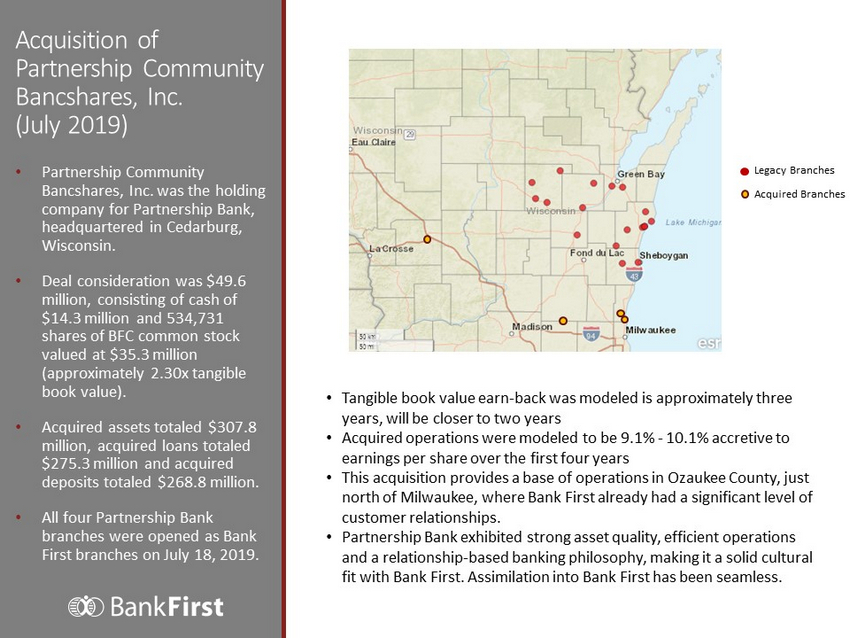

Acquisition of Partnership Community Bancshares, Inc. (July 2019) • Partnership Community Bancshares, Inc. was the holding company for Partnership Bank, headquartered in Cedarburg, Wisconsin. • Deal consideration was $49.6 million, consisting of cash of $14.3 million and 534,731 shares of BFC common stock valued at $35.3 million (approximately 2.30x tangible book value). • Acquired assets totaled $307.8 million, acquired loans totaled $275.3 million and acquired deposits totaled $268.8 million. • All four Partnership Bank branches were opened as Bank First branches on July 18, 2019. Acquired Branches Legacy Branches • Tangible book value earn - back was modeled is approximately three years, will be closer to two years • Acquired operations were modeled to be 9.1% - 10.1% accretive to earnings per share over the first four years • This acquisition provides a base of operations in Ozaukee County, just north of Milwaukee, where Bank First already had a significant level of customer relationships. • Partnership Bank exhibited strong asset quality, efficient operations and a relationship - based banking philosophy, making it a solid cultural fit with Bank First. Assimilation into Bank First has been seamless.

Acquisition of Tomah Bancshares, Inc. (May 2020) • Tomah Bancshares, Inc. was the holding company for Timberwood Bank, headquartered in Tomah, Wisconsin. • Deal consideration was $29.4 million, consisting of approximately 576,000 shares of BFC common stock (approximately 1.73x tangible book value). • Acquired assets totaled $210.4 million, acquired loans totaled $119.8 million and acquired deposits totaled $169.5 million. • During 2020, operations were consolidated with the Tomah branch acquired in the Partnership transaction. Acquired Branches Legacy Branches • Deal was modeled to be slightly accretive to capital. • Acquired operations were modeled to be 2.7% - 2.8% accretive to earnings per share over the first four years. • Cost savings were modeled at 50.0% due to the consolidation of operations within the market. • This acquisition gave Bank First scale on the western side of Wisconsin with which to explore further acquisitions there.