Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Apartment Income REIT Corp. | airc-8k_20210607.htm |

NAREIT Presentation JUNE 2021 Apartment Income REIT Corp. (NYSE: AIRC) 82 112 120 23 57 70 193 198 200 224 219 227 The most efficient and most effective way to allocate capital to multi-family real estate. Ocean House on Prospect La Jolla, CA 53 Apartment Homes

AIR is an efficient way to invest in U.S. multi-family real estate Simple business model without complex investments or uncertain developments resulting in minimal execution risk High-quality and diversified portfolio of stabilized multi-family properties Best-in-class property operations Lowest controllable operating expense growth over the past one, five, and ten years Peer leading NOI margins for 15 consecutive quarters Coastal peer leading NOI growth during COVID pandemic Focus on customer selection and satisfaction leads to higher customer retention Low cost of leverage Strong and flexible balance sheet with lower leverage due to recent equity raise Growth opportunities through portfolio management and acquisition of under-managed communities Lowest G&A in sector as a percentage of GAV Higher FFO without development overhead or vacancy loss during lease-up Lower leverage and greater predictability of cash flows allow AIR to distribute a greater percentage of income, leading to an increased dividend payout ratio Refreshed tax basis reduces tax friction on transactions allowing for more efficient capital allocation Intentional focus on ESG; reporting in accordance with the Global Real Estate Sustainability Benchmark (GRESB) Leading corporate governance (only publicly traded Maryland apartment REIT to opt out of MUTA)

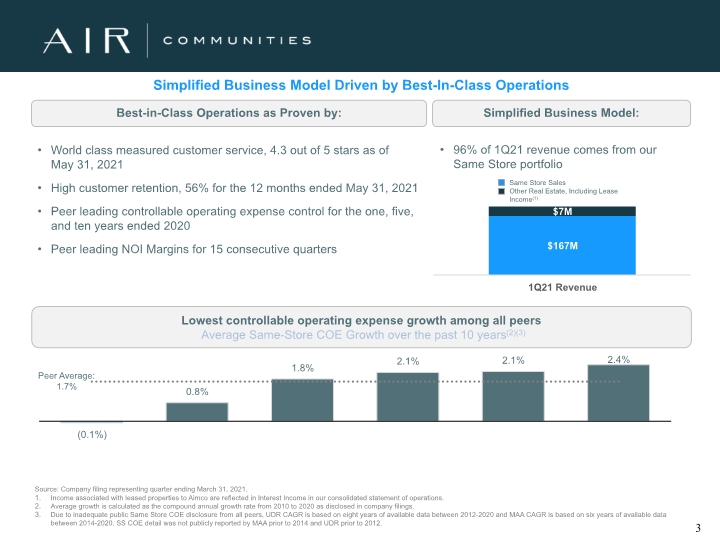

Best-in-Class Operations as Proven by: Simplified Business Model: Simplified Business Model Driven by Best-In-Class Operations Source: Company filing representing quarter ending March 31, 2021. Income associated with leased properties to Aimco are reflected in Interest Income in our consolidated statement of operations. Average growth is calculated as the compound annual growth rate from 2010 to 2020 as disclosed in company filings. Due to inadequate public Same Store COE disclosure from all peers, UDR CAGR is based on eight years of available data between 2012-2020 and MAA CAGR is based on six years of available data between 2014-2020. SS COE detail was not publicly reported by MAA prior to 2014 and UDR prior to 2012. World class measured customer service, 4.3 out of 5 stars as of May 31, 2021 High customer retention, 56% for the 12 months ended May 31, 2021 Peer leading controllable operating expense control for the one, five, and ten years ended 2020 Peer leading NOI Margins for 15 consecutive quarters 96% of 1Q21 revenue comes from our Same Store portfolio Lowest controllable operating expense growth among all peers Average Same-Store COE Growth over the past 10 years(2)(3)

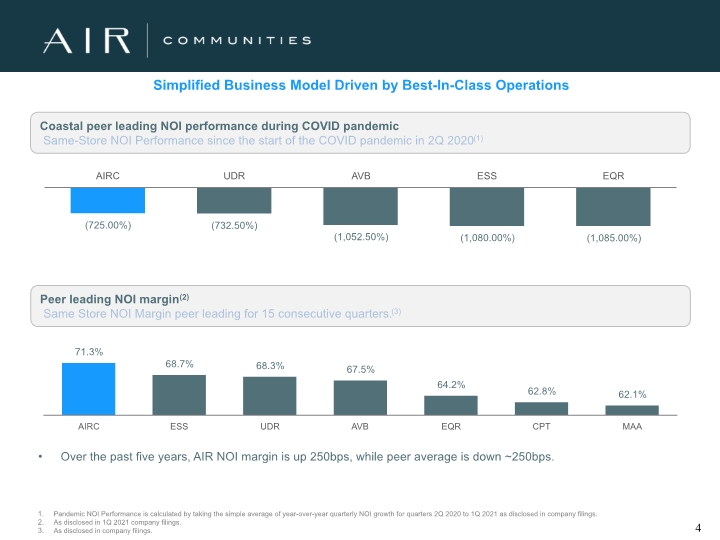

Over the past five years, AIR NOI margin is up 250bps, while peer average is down ~250bps. Simplified Business Model Driven by Best-In-Class Operations Pandemic NOI Performance is calculated by taking the simple average of year-over-year quarterly NOI growth for quarters 2Q 2020 to 1Q 2021 as disclosed in company filings. As disclosed in 1Q 2021 company filings. As disclosed in company filings. Peer leading NOI margin(2) Same Store NOI Margin peer leading for 15 consecutive quarters.(3) Coastal peer leading NOI performance during COVID pandemic Same-Store NOI Performance since the start of the COVID pandemic in 2Q 2020(1)

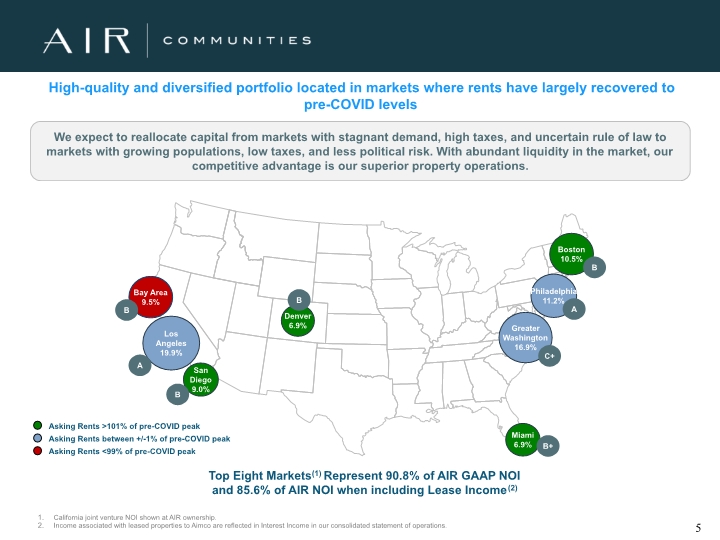

Top Eight Markets(1) Represent 90.8% of AIR GAAP NOI and 85.6% of AIR NOI when including Lease Income(2) California joint venture NOI shown at AIR ownership. Income associated with leased properties to Aimco are reflected in Interest Income in our consolidated statement of operations. High-quality and diversified portfolio located in markets where rents have largely recovered to pre-COVID levels We expect to reallocate capital from markets with stagnant demand, high taxes, and uncertain rule of law to markets with growing populations, low taxes, and less political risk. With abundant liquidity in the market, our competitive advantage is our superior property operations.

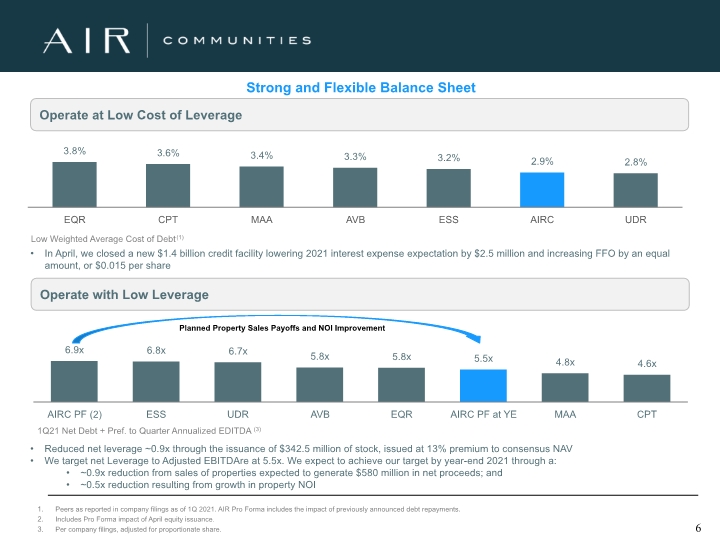

Peers as reported in company filings as of 1Q 2021. AIR Pro Forma includes the impact of previously announced debt repayments. Includes Pro Forma impact of April equity issuance. Per company filings, adjusted for proportionate share. Strong and Flexible Balance Sheet Planned Property Sales Payoffs and NOI Improvement Operate at Low Cost of Leverage Reduced net leverage ~0.9x through the issuance of $342.5 million of stock, issued at 13% premium to consensus NAV We target net Leverage to Adjusted EBITDAre at 5.5x. We expect to achieve our target by year-end 2021 through a: ~0.9x reduction from sales of properties expected to generate $580 million in net proceeds; and ~0.5x reduction resulting from growth in property NOI In April, we closed a new $1.4 billion credit facility lowering 2021 interest expense expectation by $2.5 million and increasing FFO by an equal amount, or $0.015 per share Operate with Low Leverage

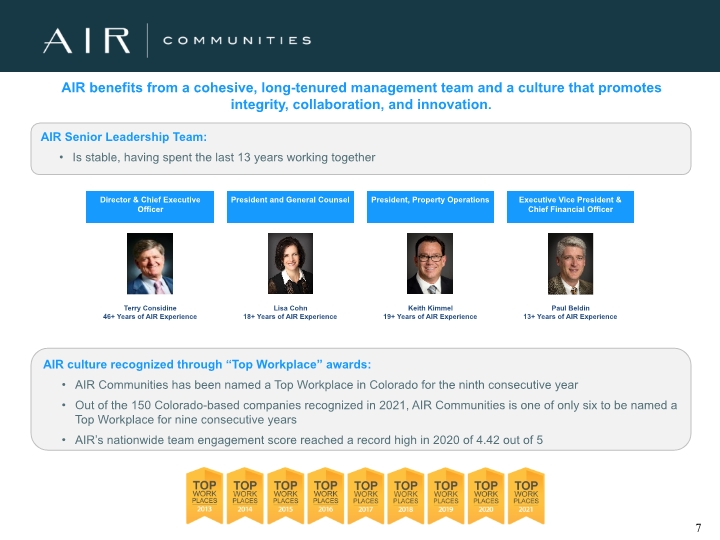

AIR benefits from a cohesive, long-tenured management team and a culture that promotes integrity, collaboration, and innovation. AIR Senior Leadership Team: Is stable, having spent the last 13 years working together AIR culture recognized through “Top Workplace” awards: AIR Communities has been named a Top Workplace in Colorado for the ninth consecutive year Out of the 150 Colorado-based companies recognized in 2021, AIR Communities is one of only six to be named a Top Workplace for nine consecutive years AIR’s nationwide team engagement score reached a record high in 2020 of 4.42 out of 5

Governance We are the only publicly traded Maryland apartment REIT to opt out of the MUTA provisions that permit a classified board. We are one of three to separate the role of Chairman and CEO. We have received a number of recognitions for our independent, diverse, and engaged board. We’ve elected four new directors in the past five years, and more are forthcoming this year. Our uncompromising Code of Business Conduct and Ethics defines how we treat our customers and teammates. Environmental We have made substantial investments to change our energy sources while installing energy efficient appliances, fixtures, and lighting. We have invested nearly $16.7 million in energy conservation over the past three years (2018-2020). We have installed smart home technology in substantially all properties to manage energy and water usage and provide early detection of any unusual usage and water leaks. We have appointed a Chief Corporate Responsibility Officer with a broad portfolio to advance and report all of AIR’s ESG activity. Social Our AIR Gives program provides each teammate 15 hours of paid time to volunteer in the service projects that mean the most to them. AIR has provided $1.3 million in scholarship funds to 630 children of teammates since 2006. Our team is our most valuable asset: We embrace and support teammates of different backgrounds and experiences as our culture is founded on dignity and respect. Intentional focus on ESG; reporting in accordance with Global Real Estate Sustainability Benchmark (GRESB).

AIR business has largely recovered from the COVID pandemic and the related government response. We view the recovery as occurring in five phases: 2) Recovery of Demand On the fourth quarter 2020 earnings call, we reported demand had returned to normal seasonal levels in January of 2021. 3) Recovery of Market Rents On the first quarter 2021 earnings call, we reported that average asking rents were now above pre-COVID peaks. We have increased effective asking rents by $175 in 2021 YTD, and by $25 in the month of May. 4) Recovery of Net Rental Income (“NRI”) NRI will recover as New and Renewal Leases are transacted in future months. 5) Recovery to Normalized Collections We expect bad debt expense to decline moving forward, but the timing and pace will depend on the still uncertain unwinding of the emergency ordinances that currently allow residents to live rent free, so that we are again able to collect rent or to re-rent these apartments. 1) Bottoming of Occupancy On the second quarter 2020 earnings call, we stated our expectation that occupancy would bottom in August. This occurred.

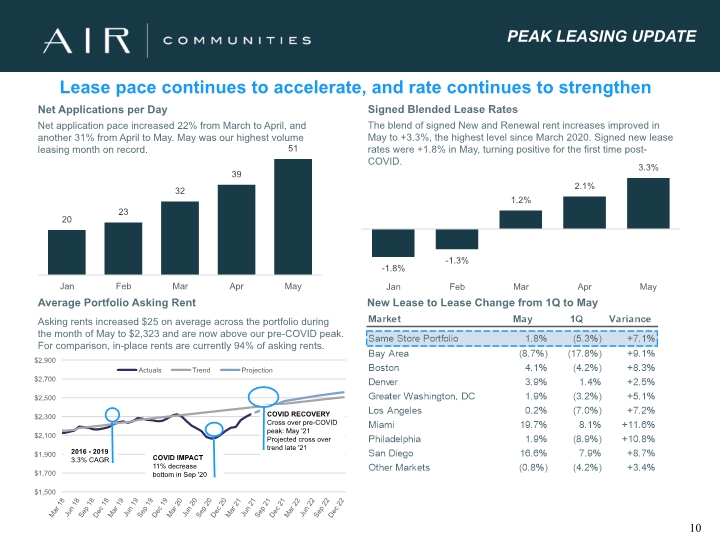

Peak leasing UPDATE Lease pace continues to accelerate, and rate continues to strengthen Net application pace increased 22% from March to April, and another 31% from April to May. May was our highest volume leasing month on record. The blend of signed New and Renewal rent increases improved in May to +3.3%, the highest level since March 2020. Signed new lease rates were +1.8% in May, turning positive for the first time post-COVID. Asking rents increased $25 on average across the portfolio during the month of May to $2,323 and are now above our pre-COVID peak. For comparison, in-place rents are currently 94% of asking rents. Net Applications per Day Average Portfolio Asking Rent New Lease to Lease Change from 1Q to May Signed Blended Lease Rates

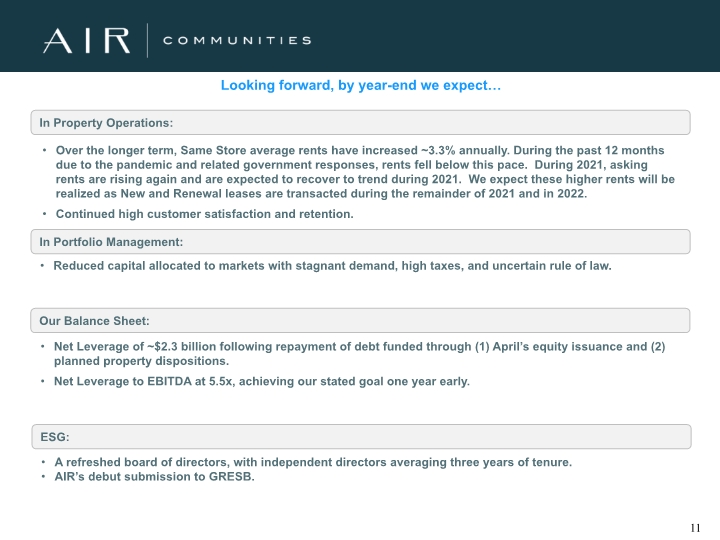

Looking forward, by year-end we expect…

Forward-looking Statements/ Non GAAP Measures This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically forecasts of 2021 results, including but not limited to: Pro forma FFO and selected components thereof; expectations regarding sales of AIR apartment communities and the use of proceeds thereof; and AIR liquidity and leverage metrics. We caution investors not to place undue reliance on any such forward-looking statements. These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to, those described from time to time in filings by AIR with the Securities and Exchange Commission (“SEC”), including in the section entitled “Risk Factors” in Item 1A of AIR’s Annual Report on Form 10-K for the year ended December 31, 2020, and the “Risk Factors” section of the registration statements that have been filed with the Securities and Exchange Commission. Readers should carefully review AIRs financial statements and the notes thereto, as well as the documents AIR files from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These forward-looking statements reflect management’s judgment as of this date, and AIR assumes no obligation to revise or update them to reflect future events or circumstances.