Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Homes 4 Rent | amh-20210607.htm |

American Homes 4 Rent June 2021 Investor Highlights

Forward-Looking Statements Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward- looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal,” “guidance,” “outlook” or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this presentation include, among others, our 2021 Guidance, our expectations with respect to the impacts of the COVID-19 pandemic, our belief that our acquisition and homebuilding programs will result in continued growth and the estimated timing and volume of our development deliveries. We have based these forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment philosophy and diversified acquisition strategy, our ability to expand our development program, our ability to grow our portfolio and to create a cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic, regulatory and real estate conditions that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation, June 7, 2021. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations, unless required by applicable law. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the adverse effect of the COVID-19 pandemic on us, our tenants, the economy and financial markets. The extent to which the COVID- 19 pandemic continues to impact us and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, including resurgences, new variants or strains, impact of government regulations, the speed and effectiveness of vaccine distribution, vaccine adoption rates and the direct and indirect economic effects of the pandemic and containment measures, among others. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, and in the Company’s subsequent filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP) because we believe they help investors understand our performance. Any non-GAAP financial measures presented are not, and should not be viewed as, substitutes for financial measures required by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies. Definitions of these non-GAAP financial measures and a reconciliation of these measures to GAAP is included in the Defined Terms and Non-GAAP Reconciliations section of this presentation, as well as the 1Q21 Supplemental Information Package available on our website at www.americanhomes4rent.com under “For Investors.” About American Homes 4 Rent American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high-quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, developing, renovating, leasing, and operating attractive, single-family homes as rental properties. As of March 31, 2021 we owned 53,984 single-family properties in selected submarkets in 22 states. 2 Legal Disclosures Contacts American Homes 4 Rent Investor Relations Phone: (855) 794-2447 / Email: investors@ah4r.com American Homes 4 Rent Media Relations Phone: (805) 413-5088 / Email: media@ah4r.com

3 Largest Builder of Single-Family Homes For Rent with more than 2,000 Deliveries Expected in 2021 11,000 Unit Land Pipeline to Fuel Further Acceleration Highest-Quality Product and Superior Investment Returns Three-Pronged External Growth Strategy Drives Consistent Growth in all Cycles 4,050 Total Inventory Additions Expected in 2021 AMH At A Glance 53,984 high-quality properties in 22 states with ~ 200,000 residents(1) Same-Home 1Q21 Average Occupied Days of 97.3% Best-in-Class Operating Platform with Proprietary Technology & Call Center Unhindered Operational Execution Through Pandemic 2021 Guidance of 9.5% Core FFO Growth at Midpoint Highest 2020 Core FFO Growth Among Residential REIT Peers Highly successful ~$690 million Equity Offering with 70% Issued on Forward Minimizing Dilution Net Debt and Preferred Shares to Adjusted EBITDAre of 6.0x(1) $16.1 Billion Total Market Capitalization(1) Industry Leading Operating Platform Peer-Leading Growth & Balance Sheet First-of-its-Kind Built- For-Rent Platform Note: Refer to Defined Terms and Non-GAAP Reconciliations, as well as the 1Q21 Supplemental Information Package, for defined metrics and reconciliations to GAAP. (1) As of March 31, 2021

4 AMH Recent Highlights & FY 2021 Guidance Record High Occupancy & Rental Rate Growth(1) • Leasing activity continues to accelerate into 2Q21 Strategic Priority: Grow, Grow, Grow • ~24% YoY increase in 2021 total expected AMH Development deliveries • Acquisition team identifying increased 2H21 traditional channel opportunities • Now expect $400 million to $600 million 2021 traditional channel acquisitions, a $200 million increase from prior midpoint expectations • 2021 capital deployment plan increased to $1.4B - $1.8B, including wholly-owned and gross joint venture investments Outsized Core FFO per share Growth • Achieved 1Q21 Core FFO / sh growth of 8.5% (without adjustment for COVID bad debt headwind) • Expect 2021 Core FFO / sh growth of 9.5% at guidance midpoint 2021 Guidance(2) Range Midpoint Core FFO per share and unit $1.24 - $1.30 $1.27 Core FFO per share and unit growth 6.9% - 12.1% 9.5% Same-Home Portfolio: Core revenues growth 3.75% - 4.75% 4.25% Core property operating expenses growth 4.00% - 5.50% 4.75% Core NOI growth 3.25% - 4.75% 4.00% Record-high leasing trends and robust momentum continuing in 2Q21 Note: Refer to Defined Terms and Non-GAAP Reconciliations, as well as the 1Q21 Supplemental Information Package, for defined metrics and reconciliations to GAAP. (1) Tabular data presented for the 2021 Same Home pool. (2) Refer to slide 27 for 2021 Outlook disclosure. May 2021 Common Equity Offering • Highly successful and oversubscribed common equity offering, raising ~$690 million gross proceeds • ~70% of transaction issued on forward sale agreement to minimize dilution during capital deployment • Strategically enables preferred share refinancing and incremental 2H21 acquisition opportunities, while maintaining best in class investment grade balance sheet 1Q21 QTD May-20 QTD May-21 YoY ∆ bps Avg. Occupied Days 97.3% 95.2% 97.8% + 260 New Lease Spreads 10.0% 4.0% 12.7% + 870 Renewal Spreads 5.1% 2.0% 5.3% + 330 Blended Spreads 6.9% 2.7% 7.6% + 490

5 AMH Today The Market Opportunity Differentiated Growth Strategy: AMH Development Strong Governance Practices

6 AMH Strategic Priority: Grow, Grow, Grow AMH Development National Builder Program Traditional Channel Three-Pronged Growth Strategy Positions AMH for Opportunistic Capital Allocation and Consistent Growth Throughout a Cycle • Network of relationships with national home builders provides acquisition access to new construction homes, which is a growth supplement to our AMH Development program • Seasoned, in-market acquisition teams sharp-shoot existing inventory opportunities, adding additional market scale and density • Experienced AMH rehab personnel create additional value through initial renovation process (1) Includes inventory additions to our wholly owned and joint venture portfolios. 391 945 1,647 2,050 1,552 286 564 1,700 408 148 381 300 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2018 2019 2020 2021E Total Inventory Additions(1) AMH Development Traditional Acquisitions National Builder 2,351 1,379 2,592 4,050 • Early-mover advantage on built-for-rental strategy, which has potential to revolutionize the industry, made possible by the strength of our balance sheet • Barriers to entry as AMH is only rental-home builder with complementary and highly efficient property management platform • AMH Development is consistently delivering new home communities with more than 60 communities opened inception to date AMH Development: Superior Investment Return & Best Rental-Home Product

7 AMH Development - A Scalable and Differentiated Driver of Earnings Growth 0 19 391 945 1,647 2,050 3,000 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2016 2017 2018 2019 2020 2021 2023 G ui da nc e M id po in t 3Q16: The First Land Lots are Purchased and the Team Begins to Come Together 1Q16: A Pioneering In- House Built-to-Rent Development Program is Conceived +

8 AMH Core FFO Bridge $1.11 $1.16 $1.27 $0.07 $0.13 $0.01 $0.01 $0.01 $0.01 $1.00 $1.05 $1.10 $1.15 $1.20 $1.25 $1.30 $1.35 Three-Pronged External Investment Approach Gaining in Momentum, Driven by AMH Development Same-Home NOI Non Same-Home NOI Strong Execution and Robust Fundamentals Continue to Drive Strong Organic Growth

9 AMH vs. the Peer Set 2020 – YTD 2021 Total Shareholder Return(1) (1) Source: S&P Global Market Intelligence. Total Return % YTD through June 4, 2021, with the inclusion of distributions. (2) Source: Bureau of Labor Statistics, March 2021. (3) Source: JBREC April 2021 YoY population growth rate. YoY Population Growth Rates(3) Multi-family CoastalMulti-family National 48.4% 31.7% 27.3% 27.1% 10.9% 6.2% 6.1% 2.6% 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% AMH MAA CPT INVH UDR AVB ESS EQR March YoY Job Loss Statistics(2) 1.3% 1.3% 1.0% 0.8% 0.6% 0.0% 0.0% -0.1% AMH MAA INVH CPT UDR ESS EQR AVB -3.7% -4.1% -5.1% -5.9% -6.6% -7.3% -7.9% -7.9% MAA AMH CPT INVH UDR ESS AVB EQR

10 Investment Grade Balance Sheet to Drive Growth Capital Structure(1) Debt Maturity Schedule(1)(2)(3) Fixed Rate Debt 17.7% Preferred Shares 5.5% Common Shares & OP Units 76.3% Floating Rate Debt 0.5% Balance Sheet Philosophy Maintain flexible investment grade balance sheet with diverse access to capital Continue optimizing capital stack and utilize investment grade rating to reduce cost of capital Expand sources of available capital as the Company and the SFR sector evolves and matures Prudent retention of operating cash flow Credit Ratings & Ratios(1) Moody’s Investor Service S&P Global Ratings Baa3 / (Stable) BBB- / (Stable) Net Debt to Adjusted EBITDAre Net Debt and Preferred Shares to Adjusted EBITDAre Fixed Charge Coverage Unencumbered Core NOI Percentage 4.5 x 6.0 x 3.3 x 67.0% (1) As of March 31, 2021. (2) As of March 31, 2021, reflects maturity of entire principal balance at the fully extended maturity date inclusive of regular scheduled amortization. (3) The unsecured senior notes have maturity dates in 2028 and 2029, and the asset-backed securitizations maturing in 2045 on a fully extended basis have anticipated repayment dates in 2025. (4) Pro forma liquidity represents the sum of $75 million of unrestricted cash on balance sheet and $1,170 million of undrawn capacity under the revolving credit facility. The Revolving Credit Facility was amended on April 15, 2021, to expand the borrowing capacity to $1.25B and extend the maturity date to April 2026. $1,245 $16 $21 $21 $954 $10 $90 $10 $510 $410 $10 $870 $(150) $50 $250 $450 $650 $850 $1,050 $1,250 Principal Amortization Unsecured Senior Notes Revolving Credit Facility Liquidity - cash and cash equivalents Asset-backed Securitizations Liquidity - undrawn revolving credit facility Pro forma liquidity(4)

11 AMH Today The Market Opportunity Differentiated Growth Strategy: AMH Development Strong Governance Practices

12 Multi-Year Demand Tailwind and Record-Low Supply Single-Family Propensity Increases with Parenthood / AgeMillennials Likely to Enter Prime Single-Family Living Years Existing Single-Family Home Inventory at Lows Mortgage Tax Savings No Longer There for Entry-Level Home Buyers Mortgage Interest and Property Taxes in Excess of Standard Tax Deduction(4) (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% 20 20 20 22 20 24 20 26 20 28 20 30 20 20 20 22 20 24 20 26 20 28 20 30 Projected Population Growth(1) Ages 34-50Ages 20-34 32% 53% 69% 74% 75% 76% 71% Under 25 25-34 35-44 45-54 55-64 65-74 75+ Share of Single-Family Housing by Age Cohort(2) (1) Sources: U.S. Census Bureau; AMH Research (2) Sources: U.S. Census Bureau; John Burns Real Estate Consulting, LLC (3) Sources: NAR; John Burns Real Estate Consulting, LLC (4) Source: Source: John Burns Real Estate Consulting, LLC (Data: 2020, updated quarterly) Pub: Mar-21. Assumes a married couple with a mortgage equal to 95% of median home price and a 1.5% property tax rate. 1.0 1.5 2.0 2.5 3.0 3.5 Ja n- 90 Se p- 91 M ay -9 3 Ja n- 95 Se p- 96 M ay -9 8 Ja n- 00 Se p- 01 M ay -0 3 Ja n- 05 Se p- 06 M ay -0 8 Ja n- 10 Se p- 11 M ay -1 3 Ja n- 15 Se p- 16 M ay -1 8 Ja n- 20 TTM Average National Existing Home Inventory (MM) Existing Home Inventory 47% Below Long-Term Average Levels as of Apr-2021

13 Ideal AMH Footprint: Migration Trends Existing Even Prior to Pandemic Sources: U.S. Census Bureau; AMH Research, John Burns Real Estate Consulting, LLC (Data: YoY Change from July 2018-July 2019) Pub: Oct-20. • Observable 2018 - 2019 trends of out-bound migration from coastal urban centers to higher quality of life markets • Trends continue into 2020 as the pandemic reinforced the advantages of suburban living such as extra living space, private yards, high quality schools and a sense of neighborhood community resulting in record breaking demand • AMH 1Q21 application data supports these trends with a 21% increase in applicants coming from states outside of AMH footprint over PY US Census Migration Data 2018 - 2019

14 AMH Today The Market Opportunity Differentiated Growth Strategy: AMH Development Strong Governance Practices

15 AMH Development – Revolutionizing the Industry Data driven insights from AMH’s years of experience formulate blueprint for the optimal rental home – made possible by AMH’s unique full lifecycle development capabilities and management platform. The AMH Developed Home Desirable • Existing AMH submarkets with proven strong demand • “Neighborhood feel” and / or community amenities designed to create emotional attachment • Designed for today’s home shopper: • Designer finishes & colors • Open floor plans • Pet friendly features Durable • Designed for durability and long- term efficient maintenance: • Hard surface flooring • Solid surface countertops • HVAC equipment & design • Cementitious siding • Durability proven appliances • LED lighting Efficient • Value engineering = superior quality at significant discount to market retail value: • Standardized floorplans based on resident feedback and construction efficiency • Square footage optimized to bed / bath count • Standardized finishes & SKUs for efficient construction & long-term maintenance Translates Into Premium Yield and Margin Enhancement

16 AMH Development in Highly Desirable Neighborhoods Within Current Footprint Bolstering Existing Markets • Continued investment into existing AMH markets • On-the-ground operating intelligence enables land acquisition “sharp shooting” • Active development teams in 16 markets provides geographic diversity Represents states in which we have active AMH Development markets

Building the Ideal Rental Home Open Concept • Designed to current lifestyle preferences First Floor Laundry • Facilitate easier washer/dryer move-in and move-out • Minimize potential washer leaks to first floor 2 or 3 Car Garage • Ample storage space to appeal to resident preferences and promote long term retention 1 2 3 1 2 3 First Floor Overview 17

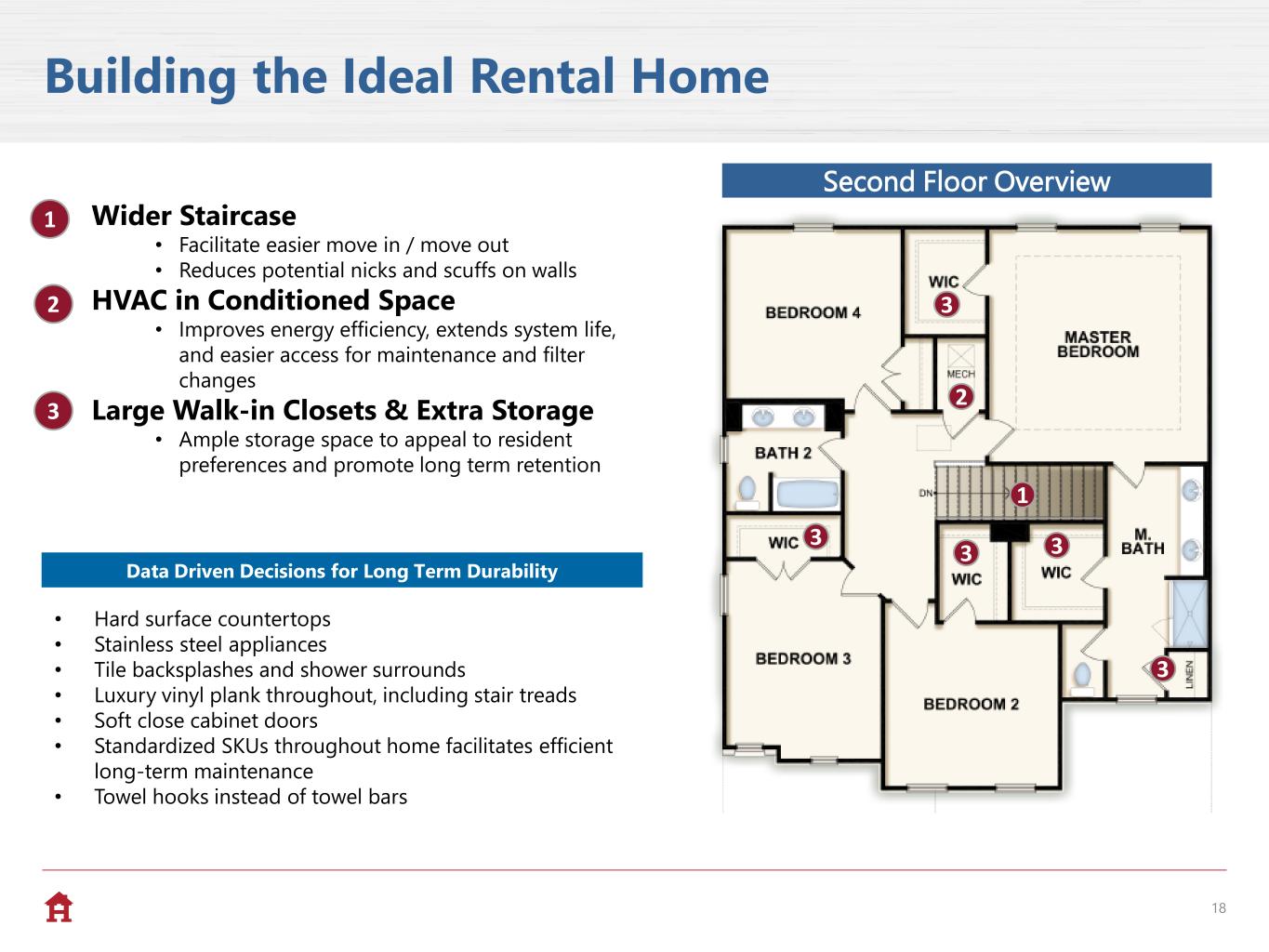

Building the Ideal Rental Home Wider Staircase • Facilitate easier move in / move out • Reduces potential nicks and scuffs on walls HVAC in Conditioned Space • Improves energy efficiency, extends system life, and easier access for maintenance and filter changes Large Walk-in Closets & Extra Storage • Ample storage space to appeal to resident preferences and promote long term retention 1 2 3 3 3 3 3 1 2 3 • Hard surface countertops • Stainless steel appliances • Tile backsplashes and shower surrounds • Luxury vinyl plank throughout, including stair treads • Soft close cabinet doors • Standardized SKUs throughout home facilitates efficient long-term maintenance • Towel hooks instead of towel bars Data Driven Decisions for Long Term Durability Second Floor Overview 18

Exterior Home Features TAMPA CHARLESTON JACKSONVILLE ORLANDO Standardized Floor Plans – Multiple Exteriors Provide construction efficiency across the portfolio 19

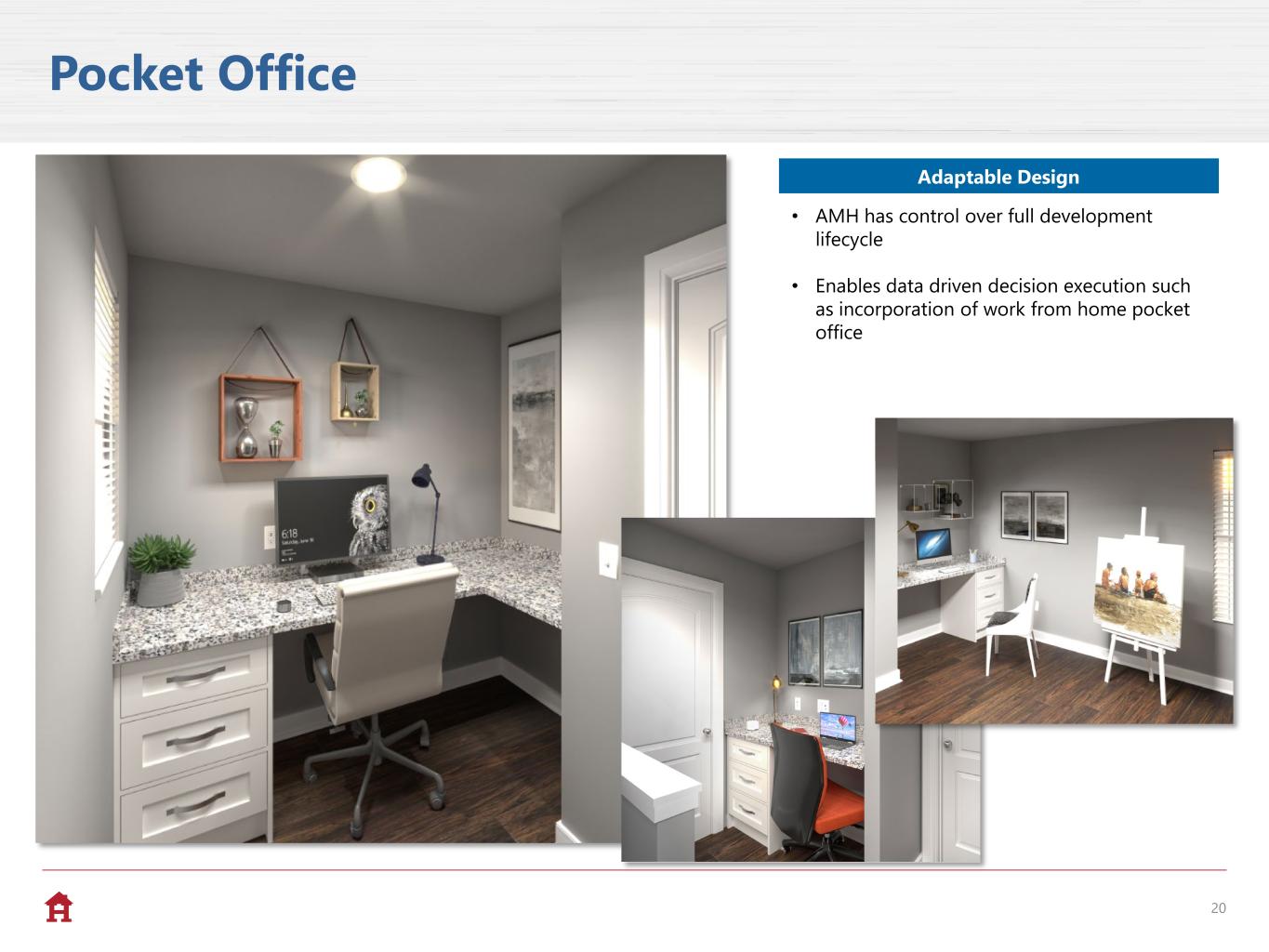

Pocket Office • AMH has control over full development lifecycle • Enables data driven decision execution such as incorporation of work from home pocket office Adaptable Design 20

21 AMH Development Communities • AMH leasing office • On-site and convenient access for better resident experience • Club room & casual kitchen • Facilitates social gatherings and neighborhood events • Conference rooms and co-working spaces • Allows for personal meetings • Provides alternative remote work environment • Fitness center & pool • Reduces resident need for gym membership • Large pool designed for relaxation and enjoyment • Lawn care • Priced into monthly rent driving additional revenues • AMH control over pristine curb appeal • Eases maintenance for residents • Fenced yards • Privacy and safety for pets and kids • Connected communities unlock future opportunities • Smart home and broadband ancillary revenue • Individually platted lots • Increases longer term exit optionality Amenity Centers Create a Community Feel Additional Benefits

22 AMH Development – Construction Sustainability Granite countertops, hard surface luxury vinyl plank (LVP) flooring and LED lighting are all designed to last for many years without repairs or replacement. We include tree planting plans as part of community design. AMH Develops Homes That Are Environmentally Friendly Development & Construction Sustainability Aim to minimize our carbon footprint in our development: • We conserve natural resources and reduce waste while focusing on building new single-family homes that are desirable to families To reduce our energy consumption: • We adhere to the most recent upgraded standards in energy efficiency and construction methodology • We select finishes that are both desirable and durable to reduce the waste generated by home turnover from one resident to another To help improve the community: • We build neighborhoods, not just homes, and we include green space or natural areas and tree planting plans as part of the design

23 AMH Today The Market Opportunity Differentiated Growth Strategy: AMH Development Strong Governance Practices

24 Corporate Governance Highlights Independent & Accountable Stewardship • AMH is governed by a 13-member board of trustees • Independent Chairman of the Board • Annual election of trustees • Majority voting standard (plurality carve-out voting standard only in contested elections) Continued Focus on Board Refreshment • Continual process to refresh and strengthen board composition • The average tenure of the Board is ~5 years • 6 new independent trustees added in the past 4 years • Michelle Kerrick joined the Board in September 2020, adding deep experience in corporate governance, financial and strategic planning, operational effectiveness and digital transformation • Lynn Swann joined the Board in August 2020, adding extensive public company board experience as well as considerable expertise in business, marketing and civic engagement • Matthew Zaist joined the Board in February 2020, adding homebuilding experience, a critical element given importance of the Company’s development program to drive value ESG Focus • Commitment to sound environmental, social responsibility and corporate governance practices is the foundation to help us provide a superior experience for our residents • These efforts can enhance shareholder value both by reducing our costs and by creating more desirable homes and communities that appeal to our current and future residents • When developing or renovating properties, we look for ways to reduce water and energy usage costs as well as using materials that are both durable and sustainable Performance-Based Compensation Practices • Cash and equity incentive compensation includes annual and multi-year performance periods tied to absolute and relative peer group metrics • Robust stock ownership requirements (6x for CEO, 5x for Trustees) • Align shareholders and management through standard vesting period

25 ESG Principles That Guide Us Sound environmental, social responsibility and corporate governance practices not only make good business sense, they uphold our obligation to employees, residents, communities and shareholders. Contribute to the well-being of the communities in which we operate through direct investments to rehabilitate, improve and develop our homes and residential communities. Educate our employees, residents and business partners regarding home energy conservation and environmental sustainability. Reduce our cost of operations by ongoing evaluation and improvement of our energy efficiency requirements and include energy- and water-saving technologies that lower operating costs and benefit the environment. Develop new homes and residential communities that meet the latest energy efficiency requirements and include energy- and water-saving technologies that lower operating costs and benefit the environment. Build and operate homes efficiently at scale that are both durable, and desirable to our residents, with a goal to limit future costs. Encourage our employees to participate in community service and philanthropic service to support local initiatives in our communities. Invest in our employees with health and wellness programs and diversity initiatives, and provide opportunities for education, advancement, training and competitive benefits. Continue to monitor and evaluate our corporate governance in light of prevailing practices. Report at least annually on our ESG practices and initiatives. Employees participate in local community volunteer events such as this program at Manna Food Bank. Yards feature efficient irrigation systems that are designed to use less water. Kitchens are designed with superior finishes and materials that are both durable and attractive.

Appendix 26

27 Defined Terms and Non-GAAP Reconciliations 2021 Guidance The Company does not provide guidance for the most comparable GAAP financial measures of net income or loss, rents and other single-family property revenues and property operating expenses, or a reconciliation of the forward-looking non-GAAP financial measures to the comparable GAAP financial measures because we are unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company’s ongoing operations. Such items include, but are not limited to, net gain or loss on sales and impairment of single-family properties, casualty loss, Non-Same-Home revenues and Non-Same-Home property operating expenses. These items are uncertain, depend on various factors and could have a material impact on our GAAP results for the guidance period. Average Occupied Days Percentage The number of days a property is occupied in the period divided by the total number of days the property is owned during the same period after initially being placed in-service. This calculation excludes properties classified as held for sale. Core Net Operating Income ("Core NOI“) Core NOI, which we also present separately for our Same-Home, unencumbered and encumbered portfolios, is a supplemental non-GAAP financial measure that we define as core revenues, which is calculated as rents and other single-family property revenues, excluding expenses reimbursed by tenant charge-backs, less core property operating expenses, which is calculated as property operating and property management expenses, excluding noncash share-based compensation expense and expenses reimbursed by tenant charge-backs. Core NOI also excludes (1) gain or loss on early extinguishment of debt, (2) hurricane-related charges, net, which result in material charges to the impacted single-family properties, (3) gains and losses from sales or impairments of single-family properties and other, (4) depreciation and amortization, (5) acquisition and other transaction costs incurred with business combinations and the acquisition or disposition of properties as well as nonrecurring items unrelated to ongoing operations, (6) noncash share-based compensation expense, (7) interest expense, (8) general and administrative expense, and (9) other income and expense, net. We believe Core NOI provides useful information to investors about the operating performance of our single-family properties without the impact of certain operating expenses that are reimbursed through tenant charge-backs. Core NOI should be considered only as a supplement to net income or loss as a measure of our performance and should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Additionally, this metric should not be used as a substitute for net income or loss or net cash flows from operating activities (as computed in accordance with GAAP).

28 Defined Terms and Non-GAAP Reconciliations Core NOI For the Trailing Twelve Months Ended Mar 31, 2021 Net income 166,223$ Gain on sale and impairment of single-family properties and other, net (48,523) Depreciation and amortization 350,403 Acquisition and other transaction costs 11,997 Noncash share-based compensation - property management 2,305 Interest expense 115,328 General and administrative expense 52,456 Other income and expense, net (1,918) Core NOI 648,271$ The following is a reconciliation of Core NOI to its respective GAAP metric (amounts in thousands):

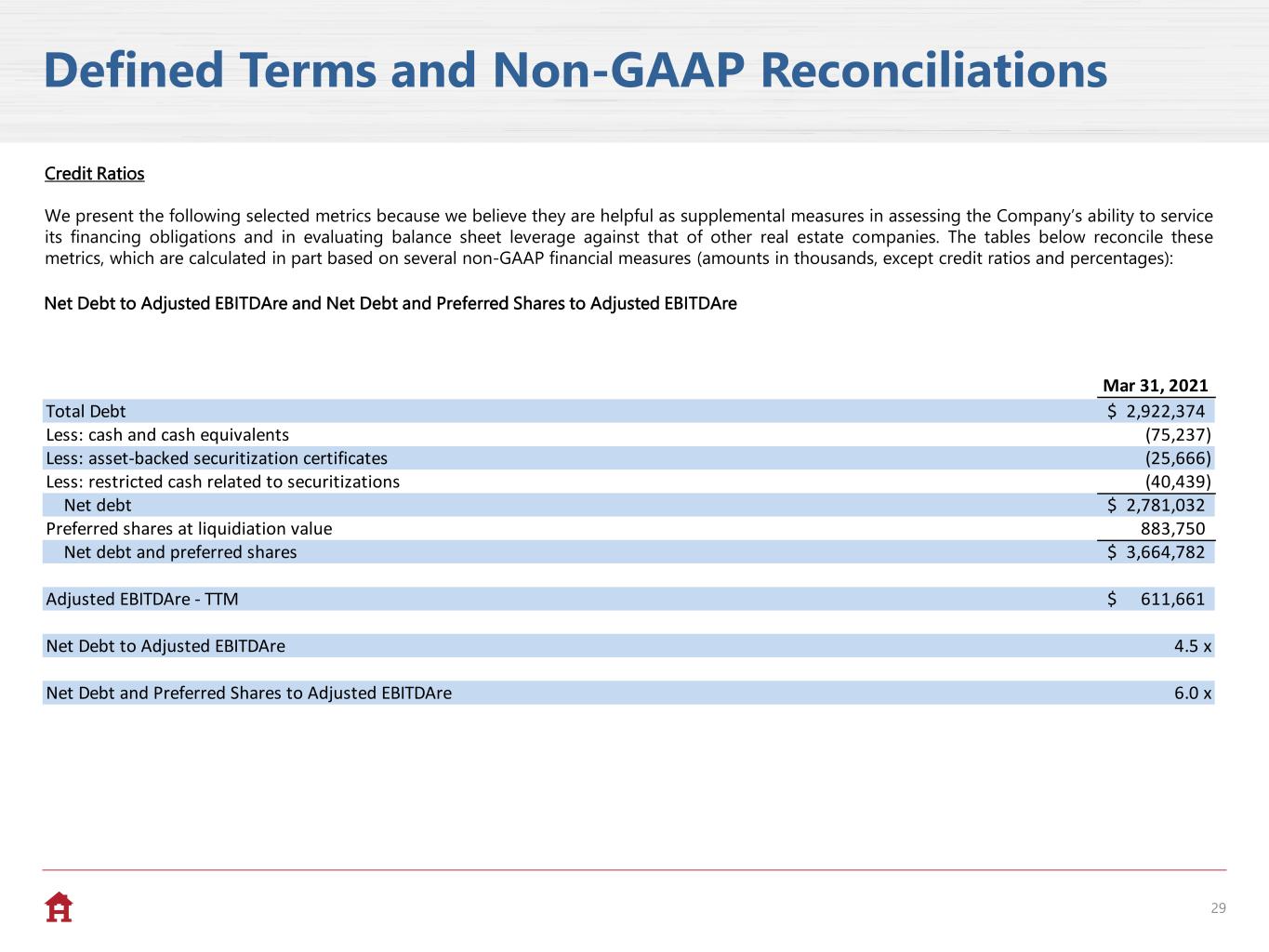

29 Defined Terms and Non-GAAP Reconciliations Credit Ratios We present the following selected metrics because we believe they are helpful as supplemental measures in assessing the Company’s ability to service its financing obligations and in evaluating balance sheet leverage against that of other real estate companies. The tables below reconcile these metrics, which are calculated in part based on several non-GAAP financial measures (amounts in thousands, except credit ratios and percentages): Net Debt to Adjusted EBITDAre and Net Debt and Preferred Shares to Adjusted EBITDAre Mar 31, 2021 Total Debt 2,922,374$ Less: cash and cash equivalents (75,237) Less: asset-backed securitization certificates (25,666) Less: restricted cash related to securitizations (40,439) Net debt 2,781,032$ Preferred shares at liquidiation value 883,750 Net debt and preferred shares 3,664,782$ Adjusted EBITDAre - TTM 611,661$ Net Debt to Adjusted EBITDAre 4.5 x Net Debt and Preferred Shares to Adjusted EBITDAre 6.0 x

30 Defined Terms and Non-GAAP Reconciliations Unencumbered Core NOI Percentage For the Trailing Twelve Months Ended Mar 31, 2021 Unencumbered Core NOI $ 434,419 Core NOI 648,271 Unencumbered Core NOI Percentage 67.0% Fixed Charge Coverage For the Trailing Twelve Months Ended Mar 31, 2021 Interest expense per income statement $ 115,328 Less: amortization of discounts, loan costs and cash flow hedge (7,411) Add: capitalized interest 21,225 Cash interest 129,142 Dividends on preferred shares 55,128 Fixed charges $ 184,270 Adjusted EBITDAre - TTM $ 611,661 Fixed Charge Coverage 3.3 x

31 Defined Terms and Non-GAAP Reconciliations EBITDA / EBITDAre / Adjusted EBITDAre EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and others as a supplemental measure of performance. EBITDAre is a supplemental non-GAAP financial measure, which we calculate in accordance with the definition approved by the National Association of Real Estate Investment Trusts (“NAREIT”) by adjusting EBITDA for gains and losses from sales or impairments of single-family properties and adjusting for unconsolidated partnerships and joint ventures on the same basis. Adjusted EBITDAre is a supplemental non-GAAP financial measure calculated by adjusting EBITDAre for (1) acquisition and other transaction costs incurred with business combinations and the acquisition or disposition of properties as well as nonrecurring items unrelated to ongoing operations, (2) noncash share-based compensation expense, (3) hurricane-related charges, net, which result in material charges to the impacted single-family properties, and (4) gain or loss on early extinguishment of debt. The following is a reconciliation of net income, as determined in accordance with GAAP, to EBITDA, EBITDAre and Adjusted EBITDAre (amounts in thousands): For the Trailing Twelve Months Ended Mar 31, 2021 Net income 166,223$ Interest expense 115,328 Depreciation and amortization 350,403 EBITDA 631,954$ Gain on sale and impairment of single-family properties and other, net (48,523) Adjustments for unconsolidated joint ventures 1,496 EBITDAre 584,927$ Noncash share-based compensation - general and administrative 9,546 Noncash share-based compensation - property management 2,305 Acquisition, other transaction costs and other (1) 14,883 Adjusted EBITDAre 611,661$ (1) Included in acquisition, other transaction costs and other is a net $2.9 million nonrecurring expense related to a legal matter involving a former employee during the quarter ended September 30, 2020.

32 Defined Terms and Non-GAAP Reconciliations FFO / Core FFO / Adjusted FFO attributable to common share and unit holders FFO attributable to common share and unit holders is a non-GAAP financial measure that we calculate in accordance with the definition approved by NAREIT, which defines FFO as net income or loss calculated in accordance with GAAP, excluding gains and losses from sales or impairment of real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustments for unconsolidated partnerships and joint ventures to reflect FFO on the same basis. Core FFO attributable to common share and unit holders is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute this metric by adjusting FFO attributable to common share and unit holders for (1) acquisition and other transaction costs incurred with business combinations and the acquisition or disposition of properties as well as nonrecurring items unrelated to ongoing operations, (2) noncash share-based compensation expense, (3) hurricane-related charges, net, which result in material charges to the impacted single-family properties, and (4) gain or loss on early extinguishment of debt. Adjusted FFO attributable to common share and unit holders is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute this metric by adjusting Core FFO attributable to common share and unit holders for (1) Recurring Capital Expenditures that are necessary to help preserve the value and maintain functionality of our properties and (2) capitalized leasing costs incurred during the period. As a portion of our homes are recently developed, acquired and/or renovated, we estimate Recurring Capital Expenditures for our entire portfolio by multiplying (a) current period actual Recurring Capital Expenditures per Same-Home Property by (b) our total number of properties, excluding newly acquired non-stabilized properties and properties classified as held for sale. We present FFO attributable to common share and unit holders, as well as on a per FFO share and unit basis, because we consider this metric to be an important measure of the performance of real estate companies, as do many investors and analysts in evaluating the Company. We believe that FFO attributable to common share and unit holders provides useful information to investors because this metric excludes depreciation, which is included in computing net income and assumes the value of real estate diminishes predictably over time. We believe that real estate values fluctuate due to market conditions and in response to inflation. We also believe that Core FFO and Adjusted FFO attributable to common share and unit holders, as well as on a per FFO share and unit basis, provide useful information to investors because they allow investors to compare our operating performance to prior reporting periods without the effect of certain items that, by nature, are not comparable from period to period. FFO, Core FFO and Adjusted FFO attributable to common share and unit holders are not a substitute for net income or net cash provided by operating activities, each as determined in accordance with GAAP, as a measure of our operating performance, liquidity or ability to pay dividends. These metrics also are not necessarily indicative of cash available to fund future cash needs. Because other REITs may not compute these measures in the same manner, they may not be comparable among REITs.

33 Defined Terms and Non-GAAP Reconciliations The following is a reconciliation of net income attributable to common shareholders, as determined in accordance with GAAP, to Core FFO attributable to common share and unit holders (amounts in thousands, except share and per share data): (1) Included in acquisition, other transaction costs and other is a net $2.9 million nonrecurring expense related to a legal matter involving a former employee during the year ended December 31, 2020. (2) Reflects the effect of potentially dilutive securities issuable upon the assumed vesting/exercise of restricted stock units and stock options. Mar 31, 2020 Mar 31, 2021 Dec 31, 2019 Dec 31, 2020 Net income attributable to common shareholders 20,244$ 30,214$ 85,911$ 85,246$ Adjustments : Noncontrol l ing interests in the Operating Partnership 3,501 4,925 15,221 14,455 Ga in on sa le and impairment of s ingle-fami ly properties and other, net (6,319) (16,069) (40,210) (38,773) Adjustments for unconsol idated joint ventures 238 382 1,797 1,352 Depreciation and amortization 82,821 90,071 329,293 343,153 Less : depreciation and amortization of non-rea l es tate assets (2,064) (2,788) (7,933) (9,016) FFO attributable to common share and uni t holders 98,421$ 106,735$ 384,079$ 396,417$ Adjustments : Acquis i tion, other transaction costs and other (1) 2,852 4,846 3,224 12,889 Noncash share-based compensation - genera l and adminis trative 1,369 4,342 3,466 6,573 Noncash share-based compensation - property management 439 999 1,342 1,745 Loss on early extinguishment of debt - - 659 - Core FFO attributable to common share and uni t holders 103,081$ 116,922$ 392,770$ 417,624$ Core FFO attributable to common share and uni t holders per FFO share and uni t 0.29$ 0.32$ 1.11$ 1.16$ Weighted-average FFO shares and uni ts : Common shares outstanding 300,813,069 316,982,460 299,415,397 306,613,197 Share-based compensation plan (2) 720,386 756,539 686,050 724,523 Operating partnership uni ts 52,026,980 51,664,757 53,045,004 51,990,094 Tota l weighted-average FFO shares and uni ts 353,560,435 369,403,756 353,146,451 359,327,814 For the Three Months Ended For the Year Ended

34 Defined Terms and Non-GAAP Reconciliations Same-Home Property A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period presented under comparison. A property is removed from Same-Home if it has been classified as held for sale or has been taken out of service as a result of a casualty loss. Stabilized Property A property acquired individually (i.e., not through a bulk purchase) is classified as stabilized once it has been renovated by the Company or newly constructed and then initially leased or available for rent for a period greater than 90 days. Properties acquired through a bulk purchase are first considered non-stabilized, as an entire group, until (1) we have owned them for an adequate period of time to allow for complete on-boarding to our operating platform, and (2) a substantial portion of the properties have experienced tenant turnover at least once under our ownership, providing the opportunity for renovations and improvements to meet our property standards. After such time has passed, properties acquired through a bulk purchase are then evaluated on an individual property basis under our standard stabilization criteria. Total Debt Includes principal balances on asset-backed securitizations, unsecured senior notes and borrowings outstanding under our revolving credit facility as of period end, and excludes unamortized discounts and unamortized deferred financing costs. Total Market Capitalization Includes the market value of all outstanding common shares and operating partnership units (based on the NYSE AMH Class A common share closing price as of period end), the current liquidation value of preferred shares as of period end and Total Debt.