Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SoFi Technologies, Inc. | ipoe-super8xk.htm |

| EX-99.3 - EX-99.3 - SoFi Technologies, Inc. | exhibit993-super8xk.htm |

| EX-99.1 - EX-99.1 - SoFi Technologies, Inc. | exhibit991-super8xk.htm |

| EX-21.1 - EX-21.1 - SoFi Technologies, Inc. | exhibit211-super8xk.htm |

| EX-16.1 - EX-16.1 - SoFi Technologies, Inc. | exhibit161-super8xk.htm |

| EX-10.8 - EX-10.8 - SoFi Technologies, Inc. | exhibit108-super8xk.htm |

| EX-10.6 - EX-10.6 - SoFi Technologies, Inc. | exhibit106-super8xk.htm |

| EX-10.5 - EX-10.5 - SoFi Technologies, Inc. | exhibit105-super8xk.htm |

| EX-10.4 - EX-10.4 - SoFi Technologies, Inc. | exhibit104-super8xk.htm |

| EX-10.2 - EX-10.2 - SoFi Technologies, Inc. | exhibit102-super8xk.htm |

| EX-10.1 - EX-10.1 - SoFi Technologies, Inc. | exhibit101-super8xk.htm |

| EX-3.2 - EX-3.2 - SoFi Technologies, Inc. | exhibit32-super8xk.htm |

| EX-3.1 - EX-3.1 - SoFi Technologies, Inc. | exhibit31-super8xk.htm |

Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Unless the context otherwise requires, all references in this section to “we”, “us” or “our” refer to the combined business of Social Finance, Inc. and its consolidated subsidiaries (collectively, “SoFi”) prior to closing the business combination pursuant to the business combination agreement by and among SoFi, Social Capital Hedosophia Holdings Corp. V (“SCH”) and Plutus Merger Sub Inc. (the “Business Combination”), as further described in Note 2 to the accompanying unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K.

The following discussion and analysis provides information that management believes is relevant to an assessment and understanding of our consolidated results of operations and financial condition. You should read this discussion and analysis in conjunction with the accompanying unaudited condensed consolidated financial statements and notes thereto included elsewhere in this Current Report on Form 8-K and our unaudited pro forma financial information as of and for the three months ended March 31, 2021 included elsewhere in this Current Report on Form 8-K, of which this Management’s Discussion and Analysis of Financial Condition and Results of Operations forms a part. Certain amounts may not foot due to rounding. This discussion and analysis contains forward-looking statements and involves numerous risks and uncertainties, including, but not limited to, those described under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” included elsewhere in this Current Report on Form 8-K and in the final prospectus and definitive proxy statement, dated May 7, 2021 (the “Proxy Statement/Prospectus”) and filed with the Securities and Exchange Commission. We assume no obligation to update any of these forward-looking statements. Actual results may differ materially from those contained in any forward-looking statements.

Business Overview

We are a member-centric, one-stop shop for digital financial services that allows members to borrow, save, spend, invest and protect their money. Our mission is to help our members achieve financial independence in order to realize their ambitions. To us, financial independence does not mean being wealthy, but rather represents the ability of our members to have the financial means to achieve their personal objectives at each stage of life, such as owning a home, having a family, or having a career of their choice — more simply stated, to have enough money to do what they want. We were founded in 2011 and have developed a suite of financial products that offers the speed, selection, content, and convenience that only an integrated digital platform can provide. In order for us to achieve our mission, we have to help people get their money right, which means providing them with the ability to borrow better, save better, spend better, invest better and protect better. Everything we do today is geared toward helping our members “Get Your Money Right” and we strive to innovate and build ways for our members to achieve this goal.

Our three reportable segments and their respective products as of March 31, 2021 were as follows:

| Lending | Financial Services | Technology Platform | ||||||||||||

• Student Loans (in school and student loan refinancing) • Personal Loans • Home Loans | • SoFi Money • SoFi Invest (1) • SoFi Relay • SoFi Credit Card • SoFi At Work • SoFi Protect • Lantern Credit | • Technology Platform Services (Galileo) | ||||||||||||

__________________

(1)Our SoFi Invest service is comprised of three products: active investing accounts, robo-advisory accounts and cryptocurrency accounts.

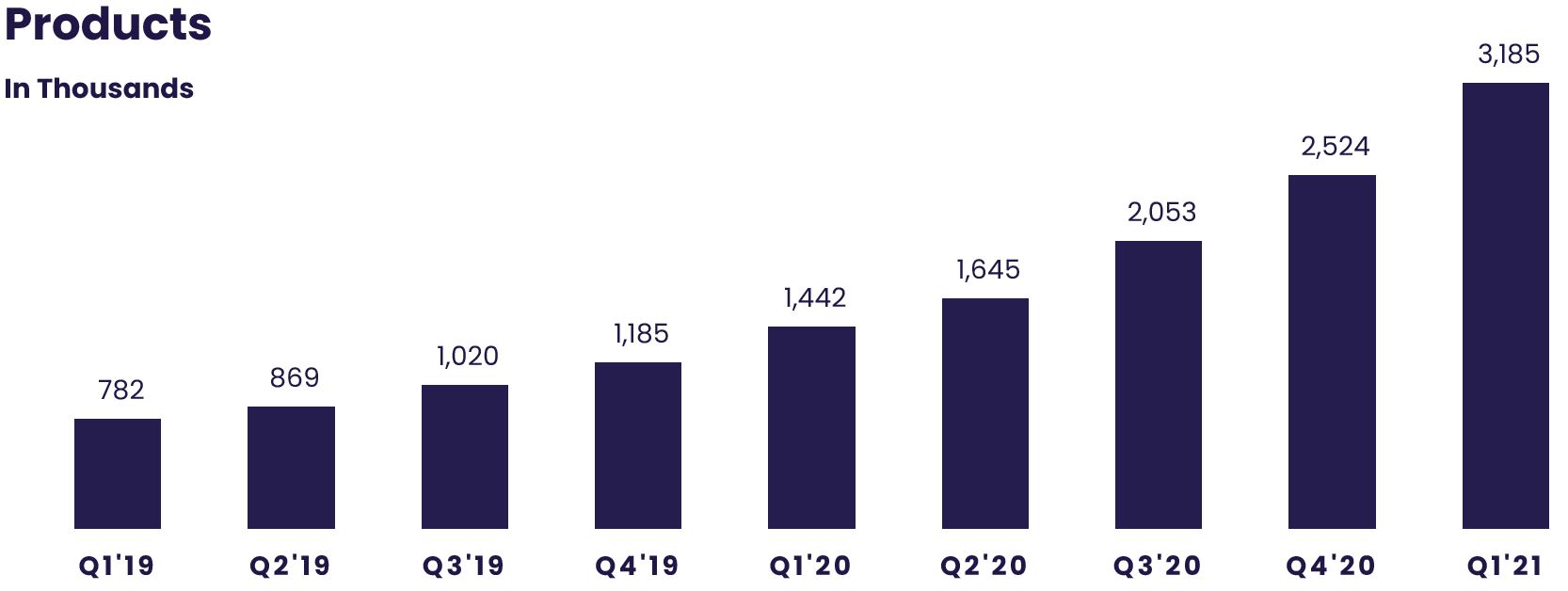

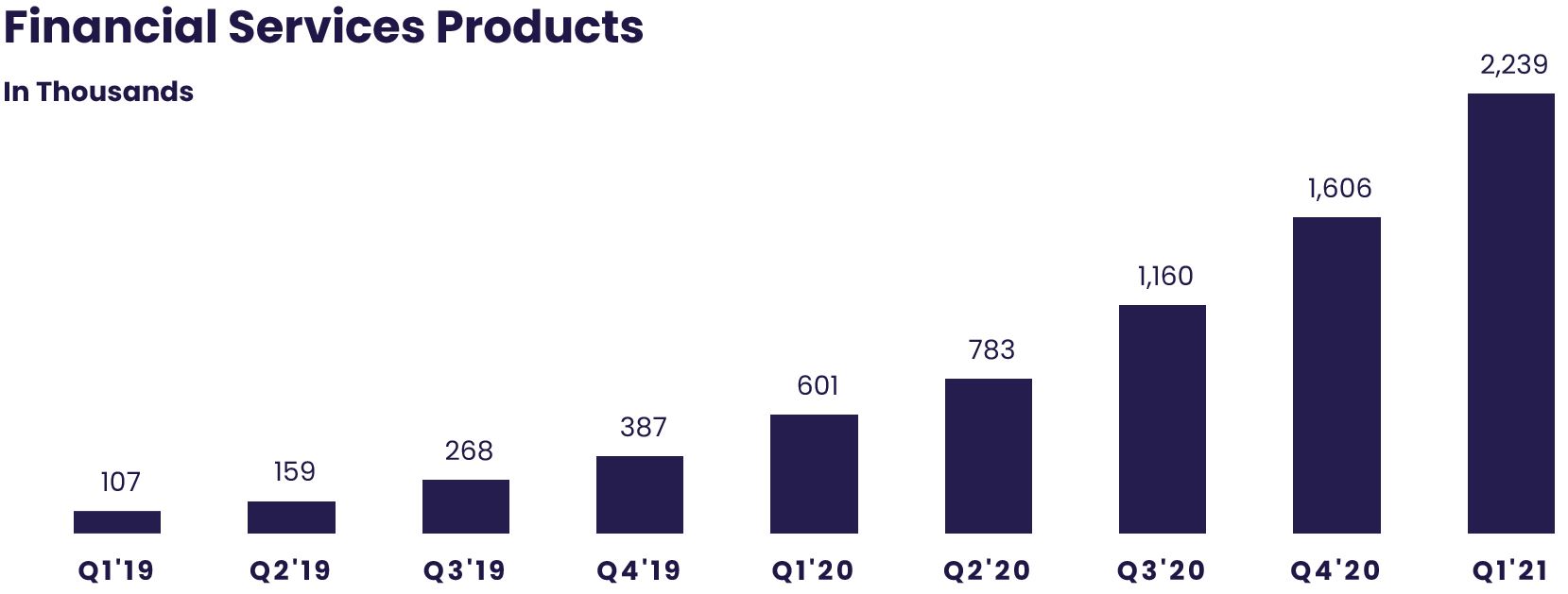

We refer to our customers as “members”. We define a member as someone who has a lending relationship with us through origination or servicing, opened a financial services account, linked an external account to our platform, or signed up for our credit score monitoring service. Once someone becomes a member, they are always considered a member unless they violate our terms of service given our members have continuous access to our CFPs, our career advice services, our member events, all of our content, educational material, news, tools and calculators at no cost to the member. Additionally, our mobile app and website have a member home feed that is personalized and delivers content to a member about what they must do that day in their financial life, what they should consider doing that day in their financial life, and what they can do that day in their financial life. Since our inception through March 31, 2021, we have served approximately 2.3 million members who have used approximately 3.2 million products on the SoFi platform and have experienced accelerating year-over-year member growth for the past seven consecutive quarters. We believe we are in the early stages of the digital transformation of financial services and,

as a result, have a substantial opportunity to continue to grow our member base and increase the number of products that our members use on the SoFi platform.

We offer our members a suite of financial products and services, enabling them to borrow, save, spend, invest and protect within one integrated platform. Our aim is to create a best-in-class, integrated financial services platform that will generate a virtuous cycle whereby positive member experiences will lead to more products adopted per member and enhanced profitability for each additional product by lowering overall member acquisition costs and increasing the lifetime value of our members. We refer to this virtuous cycle as our “Financial Services Productivity Loop.”

We believe that developing a relationship with our members and gaining their trust is central to our success as a financial services platform. Moreover, we believe that some of the current frictions faced by other financial institutions are caused by a disjointed and non-seamless product experience, a lack of digital acquisition, subpar mobile web products instead of digital native apps and incomplete product offerings to meet a customer’s holistic financial needs. Through our mobile technology and continuous effort to improve our financial services products, we are seeking to build a financial services platform that members can access for all of their financial services needs.

We believe we are in the early stages of realizing the benefits of the Financial Services Productivity Loop, as increasing numbers of our members are using multiple products on our platform. From the first quarter of 2020 through the first quarter of 2021, the number of our members who have used more than one of our product offerings grew 171% from approximately 216,000 to approximately 585,000.

In addition to benefiting our members, our products and capabilities are also designed to appeal to enterprises, such as financial services institutions that subscribe to our enterprise services called SoFi At Work, and have become interconnected with the SoFi platform. While these enterprises are not considered members, they are important contributors to the growth of the SoFi platform, and also have their own constituents who might benefit from our products in the future. Further, Galileo has over 69 million total accounts on its platform (excluding SoFi accounts). Galileo started contributing new accounts to the SoFi ecosystem during the second quarter of 2020.

While we primarily operate in the United States, in 2020, we expanded into Hong Kong with our acquisition of 8 Limited, an investment business. Additionally, with the acquisition of Galileo in May 2020, we gained clients in Mexico.

National Bank Charter. A key element of our long-term strategy is to secure a national bank charter, which we believe would enhance the profitability of our Lending segment and SoFi Money. While we currently rely on third-party bank holding companies to provide banking services to our members, securing a national bank charter would, among other things, allow us to provide members and prospective members broader and more competitive options across their financial services needs, including deposit accounts, and lower our cost to fund loans (by utilizing our SoFi Money members’ deposits to fund our loans), which would enable us to offer lower interest rates on loans to members as well as offer higher interest rates on SoFi Money accounts, all while continuing not to charge non-interest based fees.

2

In October 2020, we received preliminary, conditional approval from the OCC for our application for a national bank charter. Final OCC approval is subject to a number of preopening requirements. In March 2021, we entered into an agreement to acquire Golden Pacific Bancorp, Inc., a bank holding company (“Golden Pacific”), and its wholly-owned subsidiary, Golden Pacific Bank, National Association, a national bank (“Golden Pacific Bank”), for a total cash purchase price of $22.3 million. The acquisition is subject to regulatory approval, including approval from the OCC of a revised business plan for the acquiree national bank, and approval from the Federal Reserve to become a bank holding company and for a change of control, and other customary closing conditions. In March 2021, we submitted an application to the Federal Reserve to become a bank holding company. The application review process is ongoing.

In order to be compliant with all applicable regulations, to operate to the satisfaction of the banking regulators, and to successfully execute our business plan for the bank, SoFi has been building out the required infrastructure to run the bank and to operate as a bank holding company. This effort spans our people and organization, technology, marketing/product management, risk management, compliance, and control functions. We have invested and expect to continue to invest substantial time, money and human resources towards bank readiness, and towards the regulatory approval process. During the three months ended March 31, 2021, we incurred direct costs associated with securing a national bank charter of $5.5 million, which consisted primarily of professional fees and compensation and benefits costs. While largely dependent on the timing of the regulatory approvals, we estimate that we could incur additional costs of approximately $6 million to $10 million through the remainder of the regulatory approval process.

IPO Investment Center. Through our registered broker-dealer subsidiary, SoFi Securities LLC, we are licensed to underwrite securities offerings. In March 2021, we launched an IPO investment center that may allow members with a SoFi active Invest account that has at least $3,000 in total account value across SoFi Invest (inclusive of automated and active investing) to invest in initial public offerings before they trade on an exchange. As we receive mandates for any such initial public offerings, and as such offerings are registered with the SEC and then price and close, we serve as an underwriter or member of the selling group with respect to such offerings, which may include offerings involving SCH Sponsor V LLC or its affiliates. In the event the conditions above are satisfied, we expect to generate revenues in future periods for our IPO investment center activities in the form of underwriting fees.

Our Reportable Segments

We conduct our business through three reportable segments: Lending, Financial Services and Technology Platform. Below is a discussion of our segments and their corresponding products.

Lending Segment

Through our Lending segment, we offer student loans, personal loans, home loans and related services.

Student Loans. We primarily operate in the student loan refinance space, with a focus on super-prime graduate school loans. Subsequently, we expanded into “in-school” lending, which allows members to borrow funds while they attend school. We offer flexible loan sizes and repayment options, as well as competitive rates, on our student loan refinancing and in-school loan products.

Personal Loans. We primarily originate personal loans for debt consolidation purposes and home improvement projects. We offer fixed and variable rate loans with no origination fees and flexible repayment terms, such as unemployment protection. There are other personal loan purposes or channels that we have not aggressively pursued, which we believe could represent opportunities for us in the future.

Home Loans. We have historically offered agency and non-agency loans for members purchasing a home or refinancing an existing mortgage. On our home loan products, we offer competitive rates, flexible down-payment options for as little as 5% and educational tools and calculators.

A key element of our underwriting process is the ability to facilitate risk-based interest rates that are appropriate for each loan. Using SoFi’s proprietary risk models, we project quarterly loan performance results, including expected losses and prepayments. The outcome of this process helps us determine a more data-driven, risk-based interest rate that we can offer our members.

SoFi has built a comprehensive underwriting process across each lending product that is focused on willingness to pay (credit), ability to pay (income verification), and capacity to pay (debt service in relation to other loans). Our student loan and

3

personal loan underwriting models consider credit reports, industry credit and bankruptcy prediction models, custom credit assessment models, and debt capacity analysis, as indicated by borrower free cash flow (defined as borrower monthly net income less revolving and installment payments less housing payments). Our minimum FICO requirements are 650 for student loan refinancing, 680 for in-school loans (primary or co-signer) and 680 for personal loans. Home loans originated by SoFi that are agency conforming loans are subject to Automated Underwriting System credit, debt service, and collateral eligibility established by Fannie Mae. Existing members generally experience a higher approval rate than new members, subject to the member being in good standing on their existing products. Home loans originated by SoFi that are non-agency are subject to SoFi Home Loans credit criteria, including minimum tri-bureau credit score, established credit history requirements, income verification, as well as maximum qualified mortgage limits on debt to income service and caps on LTV (loan to value) based on an accredited appraisal. We also leverage SoFi data to allow existing members to have a streamlined application process through automation.

Our lending business is primarily a gain-on-sale model, whereby we originate loans and recognize a gain from these loans when we sell them into either our whole loan or securitization channels. We sell our whole loans primarily to large financial institutions, such as bank holding companies, typically at a premium to par, and in excess of our costs to originate the loans. Our loan premiums fluctuate from time to time based on benchmark rates and credit spreads, and we are not guaranteed a gain on all or any of our loan sales. When securitizing loans, we first isolate the underlying loans in a trust and then sell the beneficial interests in the trust to a bankruptcy-remote entity. In securitization transactions that do not qualify for sale accounting, the related assets remain on our balance sheet and cash proceeds received are reported as liabilities, with related interest expense recognized over the life of the related borrowing. In securitization transactions that qualify for sale accounting, we typically have insignificant continuing involvement as an investor. In the case of both whole loan sales and securitizations, we also typically continue to retain servicing rights following transfer. We, therefore, view servicing as an integral component of the Lending segment.

Prior to selling our loans, we hold them on our balance sheet at fair value and rely upon warehouse financing arrangements. Net interest income, which we define as the difference between the earned interest income and interest expense to finance loans, is a key component of the profitability of our Lending segment.

With the exception of certain of our home loans, we retain servicing rights to our originated loans, and believe our servicing function is an important asset because of the connection to the member it affords us throughout the life of the loan. We directly service all of the personal loans that we originate. We act as master servicer for, and rely on sub-servicers to directly service, all of our student loans, credit cards and FNMA conforming home loans. We believe this ongoing relationship with our members enhances the effectiveness of our Financial Services Productivity Loop by increasing member touchpoints and driving the number of products per member.

Furthermore, our platform supports the full transaction lifecycle, including credit application, underwriting, approval, funding and servicing. Through data derived at loan origination and throughout the servicing process, SoFi has life of loan performance data on each loan in its ecosystem, which provides a meaningful data asset.

Financial Services Segment

Our Financial Services segment consists of cash management, investment and other related services.

SoFi Money

Through SoFi Money, a digital, mobile cash management experience for our members, we invest in member acquisition and marketing activities to attract new members, including by offering rewards to incentivize prospective members to house their cash management activities on the SoFi platform.

We generate interest income from deposits sitting in the various Member Banks, which is reduced by the interest fees paid to members. We also earn payment network fees on member expenditures via SoFi-branded debit cards issued by one of our member bank holding companies (each a “Member Bank”). Payment network fees are reduced by direct fees payable to card associations and the Member Bank.

The Bancorp Bank (“Bancorp”) is the issuer of all SoFi Money debit cards and sponsors access to debit networks for payment transactions, funding transactions and associated settlement of funds under a sponsorship agreement with SoFi Securities. Additionally, Bancorp provides sponsorship and support for ACH, check, and wire transactions along with associated funds settlement. The SoFi Money product also utilizes a sweep administrator, UMB Bank, National Association

4

(“UMB”), to sweep funds to and from the SoFi Money program banks, as necessary, under a program broker agreement between SoFi Securities and UMB and program account and program bank agreements with a variety of sweep program banks. The SoFi Securities agreement with Bancorp provides for receipt by Bancorp of program revenue and transaction fees, and is subject to a minimum monthly card activity fee. The agreement with Bancorp is terminable by SoFi Securities with 120 days prior notice. The program broker agreement between SoFi Securities and UMB provides for one-year terms that automatically renew and is terminable by either party with at least 90 days’ written notice prior to the end of the current term. The program account agreements and program bank agreements between SoFi Securities, UMB and the sweep banks provide for the rate of interest payable on the balances in a member’s SoFi Money account and include certain maximum transfer requirements on transfers. These arrangements are generally terminable upon termination of SoFi Securities’ sweep arrangement with UMB.

SoFi Invest

We also provide introductory brokerage services to our members, and have invested significantly in creating SoFi Invest, a streamlined mobile investing experience through which we offer multiple ways to invest and give members access to active investing, robo-advisory and cryptocurrency services. While we do not charge trading fees, other than for cryptocurrency trading, our platform benefits from increasing assets under management as we generate interest income on cash balances that we hold, and we also earn brokerage revenue through share lending and pay for order flow arrangements. We also believe there are opportunities to generate incremental future revenue through margin lending and options. Through our acquisition of 8 Limited in 2020, we expanded SoFi Invest into the Hong Kong market. With respect to our cryptocurrency trading activities, which we initiated in 2019, we do not hold or store members' cryptocurrencies, but instead rely on a third party custodian, and we hold an immaterial amount of cryptocurrencies in order to facilitate paying new cryptocurrency member bonuses when members initiate their first cryptocurrency trade. We do this for member convenience to facilitate a seamless payment of cryptocurrency. Historically, cryptocurrency buy and sell volume has had an immaterial impact on our results of operations.

Furthermore, our innovative “stock bits” feature allows members to purchase fractional shares in various companies. Through our “stock bits” offering, members with SoFi Invest active brokerage accounts may buy or sell fractional shares in a variety of equity securities. Members can place orders in dollars or shares. During the course of a trading day, all member orders are consolidated into a single order for each equity security, which may be a sell or buy order. These fractional orders are rounded up to the next whole share and executed as a market order prior to market close on a standard trading day. Following market close, we allocate the trades to each individual member. We maintain an insignificant stock inventory of between two and ten shares for each issuer for whose securities we provide fractional trading in order to facilitate “stock bits” trades. This stock inventory is recorded within other assets in our balance sheet and was not material as of any of the balance sheet dates presented in the accompanying unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K, nor were our revenues earned and expenses incurred associated with the “stock bits” feature material during any of the income statement periods presented.

Other

In August 2020, we began offering the SoFi Credit Card, which we expanded to a broader market in the fourth quarter of 2020. Additionally, we developed SoFi Relay within the SoFi mobile application, a personal finance management product which allows members to track all of their financial accounts in one place and utilize credit score monitoring services. Further, we leverage our technology and information infrastructure to offer services to other enterprises, such as loan referrals and SoFi At Work, which is a platform we offer to enterprises that are looking for a seamless way to provide financial benefits to their employees, such as student loan payments made on their employees’ behalf, for which we earn a fee. We have also developed a financial services marketplace platform branded Lantern Credit to help applicants that do not qualify for SoFi products with alternative products, as well as providing a product comparison experience.

We earn revenues in connection with our Financial Services segment through various partnerships and our SoFi Money and SoFi Invest products in the following ways:

•Referral fees: Through strategic partnerships, we earn a specified referral fee in connection with referral activity we facilitate through our platform, which is not directly tied to a particular Financial Services product. The referral fee is paid to us by third-party partners that offer services to end users who do not use one of our product offerings, but who were referred to the partners through our platform. As such, the third-party enterprise partners are our customers in these referral arrangements.

•Payment network fees: We earn payment network fees, which primarily constitute interchange fees, from our SoFi Money product. These fees are remitted by merchants and are calculated by multiplying a set fee percentage (as

5

stipulated by the debit card payment network) by the transaction volume processed through such network. We arrange for performance by a card association and the bank issuer to enable certain aspects of the SoFi branded transaction card process. We enter into contracts with both parties that establish the shared economics of SoFi Money branded transaction cards. Historically, these fees have not been a significant portion of total net revenue.

•Enterprise service fees: These fees are earned in connection with services we provide to enterprise partners to facilitate transactions for the benefit of their employees, such as 529 plan contributions or student loan payments through our At Work product, which represents our single performance obligation in the arrangements. Historically, these fees have been an immaterial component of our total net revenue.

•Brokerage fees: We earn brokerage fees from our share lending and pay for order flow arrangements related to our SoFi Invest product (for which Apex serves as principal), exchange conversion services and digital assets activity. In our share lending arrangements and pay for order flow arrangements with Apex, we do not oversee the execution of the transactions by our members, but benefit through a negotiated multi-year revenue sharing arrangement, since our members' brokerage activity drives the share lending and pay for order flow volume. Apex connects with market makers (order flow) and institutions (share lending) to facilitate the service and is responsible for execution. Apex carries inventory risk with the share lending program and ultimately is responsible for successful order routing to market makers that trigger the pay for order flow revenue. Apex sets the gross price and negotiates with market makers and institutions as part of our order flow and share lending arrangements. We have no discretion or visibility into this pricing and, instead, negotiate a net fee for our order flow and share lending arrangements, which is settled with Apex rather than with market makers or other institutions. In our digital assets arrangements, our fee is calculated as a negotiated percentage of the transaction volume. In our exchange conversion arrangements, we earn fees for exchanging one currency for another. Historically, these fees have not been a significant portion of our total net revenue. Our arrangements with Apex are governed by an agreement which contains certain minimum monthly requirements and which is terminable by either party upon notice. Although we no longer have an equity method investment in Apex as of the balance sheet date, Apex will continue to provide the services under this agreement.

•Net interest income: Our SoFi Invest and SoFi Money products also generate net interest income based on the cash balances held in these accounts. Historically, this income has not been a significant portion of our total net revenue.

Technology Platform Segment

Our Technology Platform segment consists of Galileo, and historically included our minority ownership of Apex, a technology-enabled provider of investment custody and clearing brokerage services, in which we invested in December 2018. During January 2021, the seller exercised its call rights on our Apex investment. Therefore, we did not recognize any Apex equity method investment income during the three months ended March 31, 2021, nor will we have such equity method investment income in future periods. Additionally, we measured the carrying value of the Apex equity method investment as of December 31, 2020 equal to the call payment that we received in January 2021. Although following the seller call we no longer have an equity method investment in Apex or recognize equity method investment income, Apex continues to provide investment custody and clearing services for SoFi Invest, including for our brokerage activities, under a multi-year revenue sharing arrangement.

In May 2020, we acquired Galileo, a provider of technology platform services to financial and non-financial institutions. Through Galileo, we provide services through a suite of program, event and authorization application programming interfaces for financial and non-financial institutions. Additionally, Galileo provides vertical integration benefits with SoFi Money. In addition to growth in its U.S. client base, Galileo is increasingly focused on international opportunities, including in Latin America and Asia.

We earn revenue on Galileo’s platform in the following two ways:

•Technology Platform Fees: The platform fees we earn are based on access to the platform and are specific to the type of transaction. For example, we offer “event pricing”, which includes a specific charge for an account setup, an active account on file, use of Program, Event and Authorization Application Programming Interfaces (“APIs”), card activation, authorizations and processing, and card loads. In addition, we offer “partner pricing”, which is the back-end support we provide to Galileo’s clients, such as live agent customer service, chargeback and fraud analysis and credit bureau reporting, all within one integrated solution for our clients.

6

•Program Management Fees: Also referred to as “card program fees”, these transaction fees are generated from the creation and management of card programs issued by banks and requested by enterprise partners. In these arrangements, Galileo performs card management services and the revenue stems from the payment network and card program fees generated by the card program. This revenue is reduced by association and bank issuer costs, and a revenue share passed along to the enterprise partner that markets the card program. We categorize this class of revenue as payment network fees.

Galileo typically enters into multi-year service contracts with its clients. The contracts provide for a variety of integrated platform services, which vary by client and are generally either non-cancellable or cancellable with a substantive payment. Pricing structures under these contracts are typically volume-based, or a combination of activity- and volume-based, and payment terms are predominantly monthly in arrears. Most of Galileo’s contracts contain minimum monthly payments with agreed upon monthly service levels and may contain penalties if service levels are not met.

COVID-19 Pandemic

Although the long-term effects of the novel coronavirus (“COVID-19”) pandemic globally and in the United States remain unknown, we are seeing signs of recovery from the impacts of the pandemic due to the increased availability of vaccinations and evolving government stimulus programs, particularly in the U.S., including businesses and schools reopening, improved employment metrics, and increased consumer spending and confidence levels. Through our business continuity program, which was expanded in response to the COVID-19 pandemic, we continue to monitor the recommendations and protocols published by the U.S. Centers for Disease Control and Prevention (“CDC”) and the World Health Organization, as well as state and local governments, and to communicate with employees on a regular basis to provide updated information and corporate policies for a safe return to the office. Notably, in May 2021, the CDC issued guidance advising that people fully vaccinated against COVID-19 do not need to wear masks or practice social distancing indoors or outdoors, except under certain circumstances. As the guidance issued by governments and regulators continues to evolve, we will likewise continue to assess the impacts on us and to adjust our business operations, policies and procedures as needed to best accommodate our ecosystem of members and prospective members, Member Banks and employees. See “— Key Factors Affecting Operating Results — Industry Trends and General Economic Conditions” for discussion of the impacts to our business of measures taken in response to the economic and financial effects of the COVID-19 pandemic.

Since the onset of the COVID-19 pandemic, we have continued to adapt our response and strategies to navigate uncertain economic, workplace and market conditions. We have taken a number of measures to proactively support our members, applicants for new loans, employees and investors.

Members: We have and will continue to approach hardship programs from a member-first perspective. In addition to our Unemployment Protection Plan, which remains available to all eligible members, we launched comprehensive forbearance programs that provided meaningful Federal Emergency Management Agency (“FEMA”) disaster hardship relief. Starting in March 2020, we made available a web-enabled self-service forbearance request process to enable members who faced unemployment, reduction in income or general economic uncertainty to defer their loan payment for an initial period with options to extend. For student loans and personal loans, when a forbearance request was accepted, interest on the loan continued to accrue and is amortized over the remaining life of the loan, and the maturity date of the loan is extended for the length of the deferment. Home loans are subject to FNMA servicing guidelines, which provide certain options to the borrower. For home loans, after the forbearance period has ended, members are required to repay the amount that was suspended, but are not required to repay the amount all at once, though they have that option. Other potential options allow members to make an additional payment each month for a period of time until the past due amounts are repaid, move the deferred amount to the end of the loan term, or set up a loan modification, if they are eligible. In all instances, interest continues to accrue during the forbearance period. In response to the hardship brought on by the COVID-19 pandemic, we also deferred certain collection recovery activities, while taking every opportunity to work with our members to find a path to repayment. We discontinued enrollment in our COVID-19 forbearance programs, which were designed to be temporary in nature, for personal loans and student loans on March 31, 2021 and April 30, 2021, respectively. Subject to eligibility, members may participate in other customary hardship programs.

7

The following table presents information about our loan products that were in active short-term hardship relief or payment deferral as of March 31, 2021 due to the COVID-19 pandemic or that were classified as performing (current or paid in full) as of March 31, 2021 after exiting payment deferral due to the COVID-19 pandemic:

| As of March 31, 2021 | Student Loans | Personal Loans | Home Loans | |||||||||||||||||

| Active short-term hardship relief or payment deferral due to COVID-19 pandemic | ||||||||||||||||||||

| Number of loans | 3,450 | 12 | 108 | |||||||||||||||||

| Aggregate balance ($ in millions) | $ | 249.4 | $ | 0.3 | $ | 31.0 | ||||||||||||||

| Classified as performing after exiting payment deferral due to COVID-19 pandemic | ||||||||||||||||||||

| Number of loans ever enrolled in COVID-19 forbearance program | 38,771 | 44,046 | 317 | |||||||||||||||||

| Number of loans enrolled classified as performing at measurement date | 33,436 | 37,692 | 212 | |||||||||||||||||

| Aggregate balance of loans ever enrolled in COVID-19 forbearance program ($ in billions) | $ | 2.90 | $ | 1.21 | $ | 0.07 | ||||||||||||||

| Aggregate balance of loans enrolled classified as performing at measurement date ($ in billions) | $ | 2.53 | $ | 1.02 | $ | 0.04 | ||||||||||||||

During the first quarter of 2021, we experienced lower enrollment rates into hardship programs across all loan products, indicating that our members are regaining financial confidence as we continue the economic recovery from the pandemic. Additionally, as indicated in the table above, those members who were distressed at the time of enrolling in a hardship program have demonstrated continued strong resiliency, with 86%, 86% and 67% of personal loan, student loan and home loan accounts, respectively, either current or paid-in-full as of March 31, 2021. Based on the combination of these factors, the number of loans in active short-term hardship relief or payment deferral due to the pandemic decreased by 38% as of March 31, 2021 compared to December 31, 2020.

Applicants: In response to deteriorating economic conditions and market uncertainty amid the pandemic, in 2020 we proactively executed our recession readiness credit risk strategies. This included introducing elevated credit eligibility requirements for personal loans, thorough validation of income and income continuity, and limiting loan amounts. We expected originations incorporating credit risk strategy changes, when stressed using external loss forecasting models with stressed econometric scenarios, to perform similarly to previous vintages. Our student loan refinance business is substantially comprised of applicants refinancing federal loans and/or existing private student loans. We developed objective content and calculators to educate applicants about the Federal relief available to them through the CARES Act and subsequent extensions, which enabled them to maximize their savings. Throughout the first quarter of 2021, we eased our elevated credit eligibility requirements for personal loans through phases of reopening.

Employees: In order to safeguard the health and safety of our team members and their families, we virtualized our entire organization beginning in March 2020, enabling all of our team members to work virtually. We have taken a proactive approach to enable ongoing communication and engagement. In February 2021, we announced that our employees may work with their managers to determine the best place for them to work from, including continuing to work virtually. Additionally, based on feedback we received from an employee engagement survey, we intend to move forward with a pilot reopening of our U.S. offices in the summer of 2021 on a voluntary basis. We will continue to align our protocols with evolving CDC, state and local guidelines to continue to safeguard the health and safety of our team members and their families. We are proud to offer these flexible work arrangements to our employees.

Investors: Durability of, and confidence in, the performance of our originated asset classes has never been more important. Despite uncertain market and economic conditions, our serviced assets continue to perform at historic low delinquency and loss metrics for our Company, even when adjusted for forbearance. The majority of our members have validated their income resiliency and have returned to making full or partial payments on their loan or have paid in full. We have identified members who have sustained hardships and we have worked constructively with the investor community to establish expanded loss mitigation tools to maximize recovery while providing empathy for distressed members. Our team has worked to provide greater transparency to our investor community through access to our Capital Markets and Risk Management team and by providing internal and external analytical and stress testing forecasts, which provide a range of economic scenarios that could manifest in performance of their owned assets. Investors continue to not only have demand for our assets, but have grown their demand for our assets in light of their demonstrated performance.

8

Delinquencies: Members enrolled in forbearance or hardship relief programs do not appear in delinquency metrics and are not subject to collection activity. Despite this, during any re-enrollment, SoFi works with members to determine when a short-term hardship becomes long-term, which requires differing solutions to ensure a member has the best chance for repayment success. At the onset of the COVID-19 pandemic, we provided online self-service opportunities to members to request initial relief and subsequently extend that short-term forbearance relief as needed (subject to approval). COVID-19 hardship relief was available to members that were current or delinquent at the time of request, although the majority of student loan and personal loan initial enrollments were members that were “current” at the time of enrollment. As indicated in the table above, the majority of members that entered COVID-19 hardship programs have exited such programs.

Liquidity: We took action to prepare for potential liquidity needs resulting from the COVID-19 pandemic by securing additional committed warehouse capacity in May 2020. We were able to manage these needs along with other liquidity needs of our business by relying on our strong liquidity position going into the crisis, having a deep and diversified portfolio of warehouse lenders, being proactive and forward looking as it related to anticipated liquidity risks and needs, and managing decisions conservatively with regard to loan origination growth and loan sales.

The COVID-19 pandemic had a significant impact on consumer spending and money management behavior that has, in turn, impacted our business. See “— Key Factors Affecting Operating Results — Industry Trends and General Economic Conditions” for more information.

We remain committed to serving our members, applicants and investors, while caring for the safety of our employees and their families. See “Risk Factors — COVID-19 Pandemic Risks” included elsewhere in this Current Report on Form 8-K for additional discussion of the risks and uncertainties associated with the repercussions of the COVID-19 pandemic.

9

Executive Overview

The following tables display key financial measures for our three reportable segments and our consolidated company that are used, along with our key business metrics, by management to evaluate our business, measure our performance, identify trends and make strategic decisions. Contribution profit (loss) is the primary measure of segment-level profit and loss reviewed by management and is defined as total net revenue for each reportable segment less expenses directly attributable to the corresponding reportable segment and, in the case of our Lending segment, less fair value adjustments attributable to assumption changes associated with our servicing rights and residual interests classified as debt. See “— Results of Operations”, “— Summary Results by Segment” and “— Non-GAAP Financial Measures” herein for discussion and analysis of these key financial measures.

| Three Months Ended March 31, | ||||||||||||||

($ in thousands) | 2021 | 2020 | ||||||||||||

Lending | ||||||||||||||

| Total interest income | $ | 81,547 | $ | 93,177 | ||||||||||

| Total interest expense | (29,770) | (47,516) | ||||||||||||

| Total noninterest income | 96,200 | 28,217 | ||||||||||||

| Total net revenue | 147,977 | 73,878 | ||||||||||||

Adjusted net revenue(1)(2) | 168,037 | 81,755 | ||||||||||||

Contribution profit(1) | 87,686 | 4,095 | ||||||||||||

Financial Services | ||||||||||||||

| Total interest income | 540 | 1,737 | ||||||||||||

| Total interest expense | (311) | (1,522) | ||||||||||||

| Total noninterest income | 6,234 | 1,939 | ||||||||||||

Total net revenue(1) | 6,463 | 2,154 | ||||||||||||

| Contribution loss | (35,519) | (26,983) | ||||||||||||

Technology Platform(3) | ||||||||||||||

| Total interest expense | (36) | — | ||||||||||||

| Total noninterest income | 46,101 | 997 | ||||||||||||

Total net revenue(1) | 46,065 | 997 | ||||||||||||

Contribution profit | 15,685 | 997 | ||||||||||||

Other(4) | ||||||||||||||

| Total interest income | 441 | 2,368 | ||||||||||||

| Total interest expense | (5,131) | (1,095) | ||||||||||||

| Total noninterest income | 169 | — | ||||||||||||

| Total net revenue (loss) | (4,521) | 1,273 | ||||||||||||

Consolidated | ||||||||||||||

| Total interest income | $ | 82,528 | $ | 97,282 | ||||||||||

| Total interest expense | (35,248) | (50,133) | ||||||||||||

| Total noninterest income | 148,704 | 31,153 | ||||||||||||

| Total net revenue | 195,984 | 78,302 | ||||||||||||

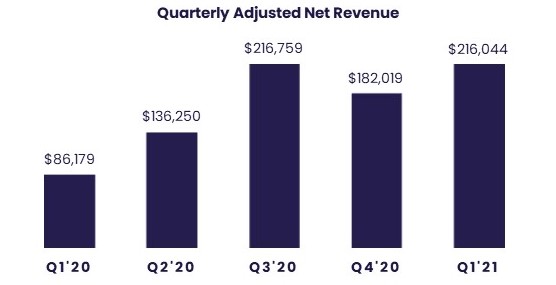

Adjusted net revenue(1)(2) | 216,044 | 86,179 | ||||||||||||

| Net loss | (177,564) | (106,367) | ||||||||||||

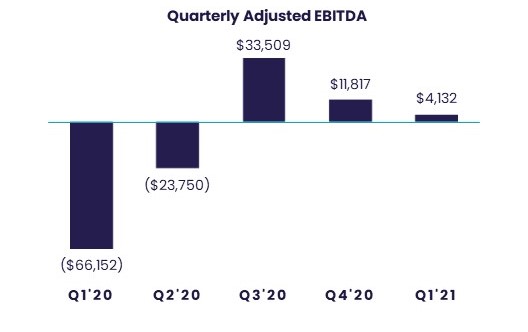

Adjusted EBITDA(2) | 4,132 | (66,152) | ||||||||||||

___________________

(1)Adjusted net revenue within our Lending segment is used by management to evaluate our Lending segment and our consolidated results. For the Lending segment, total net revenue is adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumption changes (including conditional prepayment and default and discount rates). We use this adjusted measure in our determination of contribution profit (loss) in the Lending segment, as well as to evaluate our consolidated results, as it removes non-cash charges that are not realized during the period and, therefore, do not impact the cash available to fund our operations, and our overall liquidity position. For our Financial Services and Technology Platform segments, there are no adjustments from total net revenue to arrive at the consolidated adjusted net revenue shown in this table.

10

(2)Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For information regarding our uses and definitions of these measures and for reconciliations to the most directly comparable GAAP measures, net loss and total net revenue, respectively, see “— Non-GAAP Financial Measures”.

(3)There was no interest income recorded within our Technology Platform segment for any of the periods presented.

(4)“Other” includes total net revenue associated with corporate functions that are not directly related to a reportable segment. For further discussion, see Note 16 included in the accompanying unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K.

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

($ in thousands) | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | December 31, 2019 | September 30, 2019 | June 30, 2019 | ||||||||||||||||||||||||||||||||||||||||||

Lending | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 81,547 | $ | 90,753 | $ | 86,468 | $ | 83,985 | $ | 93,177 | $ | 125,041 | $ | 161,926 | $ | 153,956 | ||||||||||||||||||||||||||||||||||

| Total interest expense | (29,770) | (33,626) | (34,246) | (39,650) | (47,516) | (57,497) | (67,989) | (68,609) | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 96,200 | 91,865 | 109,890 | 51,549 | 28,217 | (6,655) | 33,133 | 71,294 | ||||||||||||||||||||||||||||||||||||||||||

| Total net revenue | 147,977 | 148,992 | 162,112 | 95,884 | 73,878 | 60,889 | 127,070 | 156,641 | ||||||||||||||||||||||||||||||||||||||||||

Adjusted net revenue(1)(3) | 168,037 | 159,520 | 178,084 | 117,182 | 81,755 | 58,602 | 135,402 | 154,971 | ||||||||||||||||||||||||||||||||||||||||||

Contribution profit (loss)(1) | 87,686 | 85,204 | 103,011 | 49,419 | 4,095 | (33,362) | 35,674 | 67,283 | ||||||||||||||||||||||||||||||||||||||||||

Financial Services | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 540 | 378 | 365 | 316 | 1,737 | 1,924 | 2,071 | 1,406 | ||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | (311) | (290) | (267) | (233) | (1,522) | (1,798) | (1,798) | (1,242) | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 6,234 | 3,963 | 3,139 | 2,345 | 1,939 | 1,524 | 760 | 609 | ||||||||||||||||||||||||||||||||||||||||||

Total net revenue(1) | 6,463 | 4,051 | 3,237 | 2,428 | 2,154 | 1,650 | 1,033 | 773 | ||||||||||||||||||||||||||||||||||||||||||

Contribution loss | (35,519) | (36,067) | (37,467) | (30,893) | (26,983) | (34,517) | (33,533) | (27,855) | ||||||||||||||||||||||||||||||||||||||||||

Technology Platform(6) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | (36) | (42) | (47) | (18) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 46,101 | 36,838 | 38,865 | 19,037 | 997 | 325 | 206 | 149 | ||||||||||||||||||||||||||||||||||||||||||

Total net revenue(1) | 46,065 | 36,796 | 38,818 | 19,019 | 997 | 325 | 206 | 149 | ||||||||||||||||||||||||||||||||||||||||||

Contribution profit | 15,685 | 16,120 | 23,986 | 12,100 | 997 | 325 | 206 | 149 | ||||||||||||||||||||||||||||||||||||||||||

Other(2) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 441 | 942 | 1,284 | 1,764 | 2,368 | 2,533 | 2,434 | 2,316 | ||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | (5,131) | (19,292) | (4,345) | (3,417) | (1,095) | (1,155) | (1,351) | (1,355) | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 169 | 2 | (319) | (726) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Total net revenue (loss)(5) | (4,521) | (18,348) | (3,380) | (2,379) | 1,273 | 1,378 | 1,083 | 961 | ||||||||||||||||||||||||||||||||||||||||||

Consolidated | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 82,528 | $ | 92,073 | $ | 88,117 | $ | 86,065 | $ | 97,282 | $ | 129,498 | $ | 166,431 | $ | 157,678 | ||||||||||||||||||||||||||||||||||

| Total interest expense | (35,248) | (53,250) | (38,905) | (43,318) | (50,133) | (60,450) | (71,138) | (71,206) | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 148,704 | 132,668 | 151,575 | 72,205 | 31,153 | (4,806) | 34,099 | 72,052 | ||||||||||||||||||||||||||||||||||||||||||

Total net revenue(4) | 195,984 | 171,491 | 200,787 | 114,952 | 78,302 | 64,242 | 129,392 | 158,524 | ||||||||||||||||||||||||||||||||||||||||||

Adjusted net revenue(1)(3) | 216,044 | 182,019 | 216,759 | 136,250 | 86,179 | 61,955 | 137,724 | 156,854 | ||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | (177,564) | (82,616) | (42,878) | 7,808 | (106,367) | (122,541) | (57,559) | (10,218) | ||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA(3) | 4,132 | 11,817 | 33,509 | (23,750) | (66,152) | (101,004) | (27,656) | 6,611 | ||||||||||||||||||||||||||||||||||||||||||

___________________

(1)Adjusted net revenue within our Lending segment is used by management to evaluate our Lending segment and our consolidated results. For the Lending segment, total net revenue is adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumption changes (including conditional prepayment and default and discount rates). We use this adjusted measure in our determination of contribution profit (loss) in the Lending segment, as well as to evaluate our consolidated results, as it removes non-cash charges that are not realized during the period and, therefore, do not impact the cash available to fund our operations, and our overall liquidity position. For the Financial Services and Technology Platform segments, there are no adjustments from total net revenue.

(2)“Other” includes total net revenue associated with corporate functions that are not directly related to a reportable segment. For further discussion, see Note 16 in the accompanying unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K.

(3)Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For information regarding our uses and definitions of these measures and for reconciliations to the most directly comparable GAAP measures, net income (loss) and total net revenue, respectively, see “— Non-GAAP Financial Measures”.

(4)The significant trends in consolidated total net revenue throughout the periods presented were attributable to the following:

•The $29.1 million decrease from the second quarter to the third quarter of 2019 was primarily attributable to an unfavorable change in securitization loans of $49.9 million resulting primarily from an increase in yields based on expected declines in personal loan securitization credit performance. In addition, securitization loan charge-offs increased by $5.0 million period over period. This negative trend was partially offset by a $31.2 million positive variance associated with our loan origination and sale activities, net of hedges, which reflected improved sales execution to whole loan buyers period over period and was a significant factor in our quarterly whole loan valuations.

•The $65.2 million decrease from the third quarter to the fourth quarter of 2019 was primarily attributable to a $38.7 million loss related to the deconsolidation of three personal loan securitizations. In addition, net interest income decreased $26.2 million period over period, which was primarily attributable to a decline in the average total loans held on our balance sheet.

11

•The $14.1 million increase from the fourth quarter of 2019 to the first quarter of 2020 was primarily attributable to a $33.7 million lower loss related to the deconsolidations of two personal loan securitizations during the first quarter of 2020 as compared to the aforementioned three deconsolidations in the fourth quarter of 2019. The positive trend was partially offset by a decrease in net interest income of $21.9 million, which was primarily attributable to a decline in the average total loans held on our balance sheet.

•The $36.7 million increase from the first quarter to the second quarter of 2020 was primarily attributable to increases in securitization loan fair values of $71.7 million related to credit loss performance expectations improving, when we determined that delinquencies were better than expected during the period. This increase was offset by a decline of $38.1 million in loan origination and sales activities, net of hedges, a significant portion of which was related to a $22.5 million gain on credit default swaps in the first quarter of 2020 (which position we then closed during the same quarter), and because credit spreads widened significantly during the escalation of the COVID-19 pandemic, positively impacting our derivatives position.

•The $85.8 million increase from the second quarter to the third quarter of 2020 was attributable to a $45.8 million increase in loan origination and sales activities, net of hedges, which was a function of us carrying a larger average loan balance on our balance sheet for all loan products and a meaningful increase in student loan fair values due to a decrease in expected prepayment speeds. This prepayment speed expectation also contributed to an improvement in servicing of $12.1 million period over period. The increased average loan balance also contributed to an increase in net interest income of $6.4 million. Moreover, the lower total net revenue in the second quarter was attributable to a loss on deconsolidation of securitizations of $8.6 million. Finally, securitization loan write-offs decreased $5.5 million, as we continued to see an improvement in credit performance from the early stages of the COVID-19 pandemic.

•The $29.3 million decrease from the third quarter to the fourth quarter of 2020 was primarily attributable to interest expense related to the Galileo seller note in our Technology Platform segment and a decrease in noninterest income in our Lending segment. On November 14, 2020, when the promotional period on the seller note lapsed and we did not pay off the note, we incurred incremental interest expense of $12.5 million. We incurred an additional $3.7 million of interest expense related to our outstanding seller note obligation during the fourth quarter of 2020. The primary driver of the decrease in noninterest income in our Lending segment was related to decreases of $12.6 million in the gains recognized related to securitization loan fair values as a result of securitization loan valuations remaining materially consistent from the third quarter to the fourth quarter of 2020 after two consecutive quarters of improvement related to credit loss expectations. Additionally, we recognized an impairment charge of $4.3 million during the fourth quarter to measure the carrying value of our Apex equity investment equal to the call payment that we received in January 2021 upon the seller exercising its call option on our equity interest in Apex.

•The $24.5 million increase from the fourth quarter of 2020 to the first quarter of 2021 was primarily attributable to $14.1 million lower corporate borrowing expense that was largely related to our seller note, as further discussed in footnote (5) below. Additionally, technology platform fees increased $7.1 million quarter over quarter, which was indicative of continued account growth and activity at Galileo. These increases were partially offset by a decrease in servicing income of $11.0 million, which was primarily due to the impact of prepayments on the fair value of our servicing rights. The remaining variance was primarily driven by our lending activities and was a function of our average loan balance, amounts pledged to our warehouse facilities and loan sale execution during the 2021 period.

(5)The significant trends in Other total net revenue (loss) during the periods presented were attributable to the following:

•Our cash balances, along with market interest rates, declined during the first three quarters of 2020, which resulted in declines in other total net revenue of: $0.2 million in the first quarter of 2020 compared to the fourth quarter of 2019; $0.4 million in the second quarter compared to the first quarter of 2020; and $0.4 million in the third quarter compared to the second quarter of 2020. From the third quarter of 2020 through the first quarter of 2021, interest income attributable to bank balances was lower each successive quarter due to declines in interest rates. Cash balances were higher in the fourth quarter of 2020 versus the third quarter of 2020, which offset some of the interest rate impact. Our cash balances were lower in the first quarter of 2021 versus the fourth quarter of 2020.

•Interest expense on our revolving credit facility increased by $0.7 million from the first quarter to the second quarter of 2020 due to an incremental $325.0 million borrowing and decreased by $0.5 million from the second quarter to the third quarter of 2020 due to decreases in one-month LIBOR.

•During the second quarter of 2020, we had a one-time investment impairment of $0.8 million.

•During the second quarter of 2020, we acquired Galileo and used a seller note to finance a portion of the purchase. We recorded seller note interest expense of $1.6 million, $3.0 million and $17.6 million during the second, third and fourth quarters of 2020, respectively, and $3.6 million during the first quarter of 2021. The fair value of the seller note was initially recorded below the stated face value, with the difference accreted into interest expense over time during 2020. Additionally, we incurred an incremental $12.5 million of interest during the fourth quarter of 2020 because we did not pay off the seller note before the promotional period ended. Finally, we paid off the seller note in February 2021 and, thus, did not incur a full quarter of seller note interest for the first quarter of 2021.

(6)There was no interest income recorded within our Technology Platform segment for any of the periods presented.

Key Recent Developments

We continue to execute on our growth and other strategic initiatives and in recent years, we have celebrated launches across our product suite and strategic partnerships, establishing ourselves as a platform that enables individuals to borrow, save, spend, invest, and protect their assets. Some of our key recent achievements are discussed below:

Acquisitions

During January 2021, Social Finance, Inc. entered into a business combination agreement (the “Agreement”) by and among SoFi, SCH, and Plutus Merger Sub Inc. (the “Business Combination”). The transactions contemplated by the terms of the Agreement were completed on May 28, 2021, upon which SoFi survived the merger and became a wholly owned subsidiary of SCH, which concurrently changed its name to “SoFi Technologies, Inc.” (“SoFi Technologies”). Shares of SoFi Technologies’ common stock and SoFi Technologies’ warrants began trading on the Nasdaq under the symbol “SOFI” and “SOFIW,” respectively, on June 1, 2021, in lieu of the ordinary shares, warrants and units of SCH. See Note 2 in the accompanying

12

unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K for additional information on the transaction.

As an alternative to establishing a de novo bank, for which we received preliminary conditional approval from the U.S. Office of the Comptroller of the Currency (“OCC”) in October 2020, we evaluated the acquisition of a national bank. In March 2021, we entered into an agreement to acquire Golden Pacific Bancorp, Inc., a bank holding company, and its wholly-owned subsidiary, Golden Pacific Bank, National Association, a national bank, for a total cash purchase price of $22.3 million. The acquisition is subject to regulatory approval, including approval from the OCC of a revised business plan for Golden Pacific Bank, and approval from the Federal Reserve to become a bank holding company and for a change of control, and other customary closing conditions, which we anticipate can be completed by the end of 2021. In March 2021, we submitted an application to the Federal Reserve to become a bank holding company. The application review process is ongoing.

In May 2020, we completed our acquisition of Galileo for a purchase price of $1.2 billion. Galileo provides technology platform services to financial and non-financial institutions. Our acquisition of Galileo represents a material addition to our Technology Platform segment, but was not a significant acquisition under Regulation S-X, Rule 3-05, Financial Statements of Businesses Acquired or to be Acquired.

In April 2020, we acquired 8 Limited, a Hong Kong based investment business, for a purchase price of $16.1 million. Our acquisition of 8 Limited marked our first expansion outside the United States and enables our non-U.S. members to experience many of the product features we have developed in the United States for SoFi Invest, including zero commission non-cryptocurrency trading.

In December 2018, we acquired a 16.7% interest in Apex for $100.0 million, which enabled us to earn income from Apex’s customers and provided partial integration of transaction clearing and asset custody functions integral to SoFi Invest. During January 2021, the seller exercised its call rights on our Apex equity investment. Therefore, we will no longer recognize Apex equity method investment income subsequent to the date the option was called. Additionally, we measured the carrying value of the Apex equity method investment as of December 31, 2020 equal to the call payment that we received in January 2021, which resulted in the recognition of an impairment charge of $4.3 million during the fourth quarter of 2020. Although following the seller call we no longer have an equity method investment in Apex or recognize equity method investment income, Apex continues to provide investment custody and clearing services for SoFi Invest, including for our brokerage activities, under a multi-year revenue sharing arrangement.

Product Development and Partnerships

Through our registered broker-dealer subsidiary, SoFi Securities LLC, we are licensed to underwrite securities offerings. In March 2021, we launched an IPO investment center that may allow members with a SoFi active Invest account that has at least $3,000 in total account value across SoFi Invest (inclusive of automated and active investing) to invest in initial public offerings before they trade on an exchange. See “—Business Overview” above for additional information.

In 2020, we celebrated the official opening of SoFi Stadium and the establishment of a 20-year partnership with LA Stadium and Entertainment District at Hollywood Park in Inglewood, California, a multi-purpose sports and entertainment district that serves as the stadium for the National Football League teams the Los Angeles Chargers and Los Angeles Rams. SoFi's 20-year partnership with the LA Stadium and Entertainment District at Hollywood Park, across the naming rights and sponsorship agreements, collectively requires SoFi to pay sponsorship fees quarterly in each contract year beginning in 2020 and ending in 2040 for an aggregate total of $625.0 million, which includes operating lease obligations, finance lease obligations and sponsorship and advertising opportunities at the stadium complex. See Note 14 for discussion of an associated contingent matter.

In the second half of 2020, we launched our SoFi Credit Card, which carries no annual membership fee and provides up to two percent unlimited cash back when the cash back rewards are applied to a SoFi Money or SoFi Invest account, or used to pay down SoFi student loans or personal loans, as well as a one-percent annual percentage rate reduction after 12 consecutive on-time credit card payments, with the reduced rate sustained with continued on-time payments.

Non-GAAP Financial Measures

Our management and board of directors use adjusted net revenue and adjusted EBITDA, which are non-GAAP financial measures, to evaluate our operating performance, formulate business plans, help better assess our overall liquidity position, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly,

13

we believe that adjusted net revenue and adjusted EBITDA provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Adjusted Net Revenue

Adjusted net revenue is defined as total net revenue, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment. We adjust total net revenue to exclude these items, as they are non-cash charges that are not realized during the period, and therefore positive or negative changes do not impact the cash available to fund our operations. This measure helps provide our management with an understanding of the net revenue available to finance our operations and helps management better decide on the proper expenses to authorize for each of our operating segments, to ultimately help achieve target contribution profit margins, which are set by our CODM on an annual basis. Therefore, the measure of adjusted net revenue serves as both the starting point for how we think about the liquidity generated from our operations and also the starting point for our annual financial planning, the latter of which focuses on the cash we expect to generate from our operating segments to help fund the current year’s strategic objectives. Adjusted net revenue has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, the analysis of other GAAP financial measures, such as total net revenue. The primary limitation of adjusted net revenue is its lack of comparability to other companies that do not utilize this measure or that use a similar measure that is defined in a different manner. We reconcile adjusted net revenue to total net revenue, the most directly comparable GAAP measure, as presented for the periods indicated below:

| Three Months Ended March 31, | ||||||||||||||

($ in thousands) | 2021 | 2020 | ||||||||||||

Total net revenue | $ | 195,984 | $ | 78,302 | ||||||||||

Servicing rights – change in valuation inputs or assumptions(1) | 12,109 | (7,059) | ||||||||||||

Residual interests classified as debt – change in valuation inputs or assumptions(2) | 7,951 | 14,936 | ||||||||||||

Adjusted net revenue | $ | 216,044 | $ | 86,179 | ||||||||||

(1)Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment and default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. As such, these positive and negative changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance.

(2)Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment and default rates and discount rates. When third parties finance our consolidated securitization VIEs by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations.

14

| Quarter Ended | ||||||||||||||||||||||||||||||||

| ($ in thousands) | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||||

Total net revenue(1) | $ | 195,984 | $ | 171,491 | $ | 200,787 | $ | 114,952 | $ | 78,302 | ||||||||||||||||||||||

Servicing rights – change in valuation inputs or assumptions(2) | 12,109 | 1,127 | 4,671 | 18,720 | (7,059) | |||||||||||||||||||||||||||

Residual interests classified as debt – change in valuation inputs or assumptions(3) | 7,951 | 9,401 | 11,301 | 2,578 | 14,936 | |||||||||||||||||||||||||||

| Adjusted net revenue | $ | 216,044 | $ | 182,019 | $ | 216,759 | $ | 136,250 | $ | 86,179 | ||||||||||||||||||||||

___________________

(1)See “—Executive Summary” for a discussion of the significant trends in consolidated total net revenue.

(2)See footnote (1) to the table above.

(3)See footnote (2) to the table above.

The reconciling items to determine our non-GAAP measure of adjusted net revenue are applicable only to the Lending segment. The table below presents adjusted net revenue for the Lending segment for the periods indicated:

| Three Months Ended March 31, | ||||||||||||||

| ($ in thousands) | 2021 | 2020 | ||||||||||||

| Total net revenue – Lending | $ | 147,977 | $ | 73,878 | ||||||||||

Servicing rights – change in valuation inputs or assumptions(1) | 12,109 | (7,059) | ||||||||||||

Residual interests classified as debt – change in valuation inputs or assumptions(2) | 7,951 | 14,936 | ||||||||||||

| Adjusted net revenue – Lending | $ | 168,037 | $ | 81,755 | ||||||||||

(1)See footnote (1) to the table above.

(2)See footnote (2) to the table above.

Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss), adjusted to exclude: (i) corporate borrowing-based interest expense (our adjusted EBITDA measure is not adjusted for warehouse or securitization-based interest expense, nor deposit interest expense and finance lease liability interest expense, as discussed further below), (ii) income taxes, (iii) depreciation and amortization, (iv) stock-based expense (inclusive of equity-based payments to non-employees), (v) impairment expense (inclusive of goodwill impairment and of property, equipment and software abandonments), (vi) transaction-related expenses, (vii) warrant fair value adjustments, and (viii) fair value changes in servicing rights and residual interests classified as debt due to valuation assumptions. We believe adjusted EBITDA provides a useful measure for period-over-period comparisons of our business, as it removes the effect of certain non-cash items and certain charges that are not indicative of our core operating performance or results of operations. It is also a measure that management relies upon to evaluate cash flows generated from operations, and therefore the extent of additional capital, if any, required to invest in strategic initiatives. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, the analysis of other GAAP financial measures, such as net income (loss). Some of the limitations of adjusted EBITDA include that it does not reflect the impact of working capital requirements or capital expenditures and it is not a universally consistent calculation among companies in our industry, which limits its usefulness as a comparative measure.

15

We reconcile adjusted EBITDA to net loss, the most directly comparable GAAP measure, for the periods indicated below:

| Three Months Ended March 31, | ||||||||||||||

($ in thousands) | 2021 | 2020 | ||||||||||||

| Net loss | $ | (177,564) | $ | (106,367) | ||||||||||

Non-GAAP adjustments: | ||||||||||||||

Interest expense – corporate borrowings(1) | 5,008 | 1,088 | ||||||||||||

Income tax expense(2) | 1,099 | 57 | ||||||||||||

Depreciation and amortization(3) | 25,977 | 4,715 | ||||||||||||

Stock-based expense | 37,454 | 19,685 | ||||||||||||

Transaction-related expense(4) | 2,178 | 3,914 | ||||||||||||

Fair value changes in warrant liabilities(5) | 89,920 | 2,879 | ||||||||||||

Servicing rights – change in valuation inputs or assumptions(6) | 12,109 | (7,059) | ||||||||||||

Residual interests classified as debt – change in valuation inputs or assumptions(7) | 7,951 | 14,936 | ||||||||||||

| Total adjustments | 181,696 | 40,215 | ||||||||||||

| Adjusted EBITDA | $ | 4,132 | $ | (66,152) | ||||||||||

___________________

(1)Our adjusted EBITDA measure adjusts for corporate borrowing-based interest expense, which includes interest on our revolving credit facility and, for the three months ended March 31, 2021, the seller note issued in connection with our acquisition of Galileo and other financings assumed in the acquisition, as these expenses are a function of our capital structure. Our adjusted EBITDA measure does not adjust for interest expense on warehouse facilities and securitization debt, which are recorded within interest expense — securitizations and warehouses in the accompanying Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss, as these interest expenses are direct operating expenses driven by loan origination and sales activity. Additionally, our adjusted EBITDA measure does not adjust for interest expense on SoFi Money deposits or interest expense on our finance lease liability in connection with SoFi Stadium, which are recorded within interest expense — other, as these interest expenses are direct operating expenses driven by SoFi Money deposits and finance leases, respectively. As compared to the three months ended March 31, 2020, during the three months ended March 31, 2021, we had a higher average balance on our revolving credit facility as a result of the Galileo acquisition, as well as interest expense related to the Galileo seller note issued in May 2020, which we repaid in February 2021.

(2)The increase in income tax expense period over period was primarily a function of SoFi Lending Corp’s profitability in state jurisdictions where separate filing is required. See Note 12 in the accompanying unaudited condensed consolidated financial statements included elsewhere in this Current Report on Form 8-K for additional information.

(3)Depreciation and amortization expense for the three months ended March 31, 2021 increased compared to the same period in 2020 primarily due to: (i) amortization expense on intangible assets acquired during the second quarter of 2020 from Galileo and 8 Limited, (ii) acceleration of core banking infrastructure amortization, as Galileo’s infrastructure rendered the existing core banking infrastructure redundant, and (iii) amortization of purchased and internally-developed software.

(4)During the three months ended March 31, 2021, transaction-related expenses included financial advisory and professional services costs associated with our pending purchase of Golden Pacific Bancorp, Inc. During the three months ended March 31, 2020, transaction-related expenses included certain costs, such as financial advisory and professional services costs, associated with our acquisitions of Galileo and 8 Limited.

16