Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BANCFIRST CORP /OK/ | banf-8k_20210604.htm |

1 Exhibit 99.1

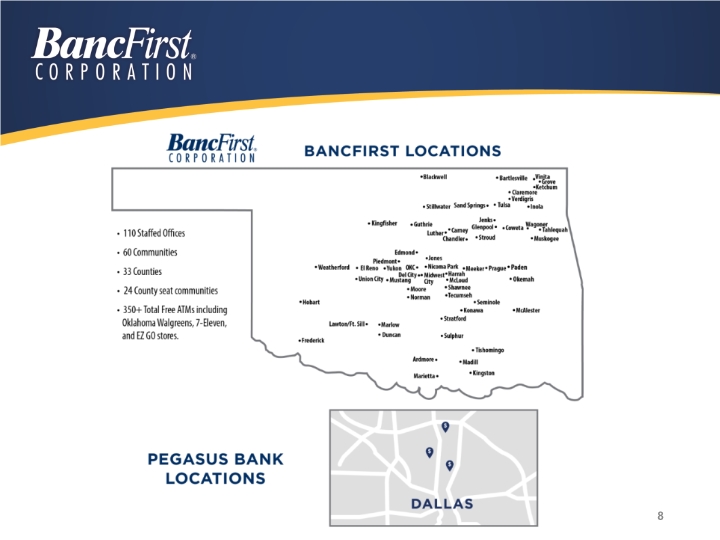

Relationship Banking 170,000 retail households and 40,000 commercial relationships More Oklahoma households bank with BancFirst than any other bank Overwhelmingly funded by core deposits 106 locations in 58 Oklahoma communities including the MSAs of Oklahoma City, Tulsa, Muskogee and Lawton Pegasus Bank adds three locations in Dallas Commercial Focus in MSAs Super Community Bank focused on providing a full range of banking services to small to medium sized businesses and their owners, managers and employees using a relationship banking approach Specialty Expertise SBA lending – largest producer in the state for over 25 consecutive years Cash Management – $2.2 billion in sweeps Trust assets over $7.3 billion Insurance Agency specializing in commercial lines – 3rd largest in Oklahoma BancFirst Corporation Profile 2

Conservative Credit Culture Aggressive loan review function; proactive portfolio management Historically low problem loan and charge off ratios Acquisition and Integration Strategy Communities with a diversified employment base and reasonable growth Disciplined analysis, pricing and structuring of each transaction Outstanding conversion and assimilation of acquired banks; over 50 transactions completed by management team High retention of acquired accounts 3 BancFirst Corporation Profile

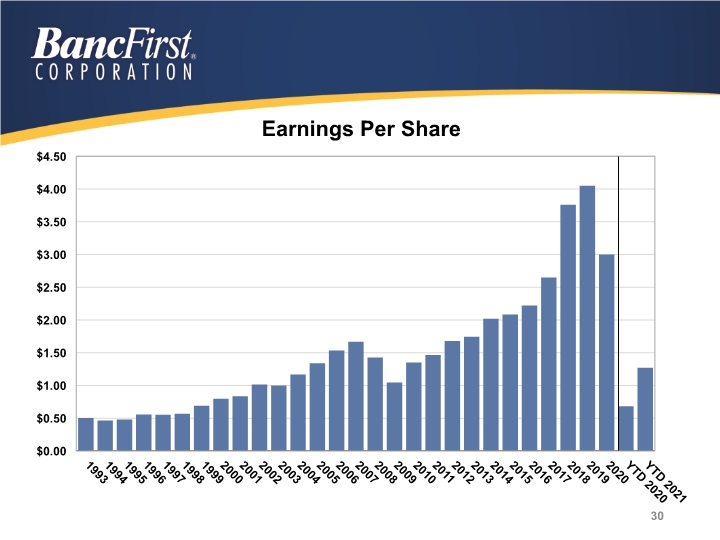

2020 Highlights Earnings of $99.6 million, $3.00 diluted earnings per share Acquisition of Citizens State Bank in Okemah added $26 million in loans and $42 million in deposits Nonperforming to total assets remained low Dividends have increased 28 consecutive years 4

On August 15, 2019 BancFirst Corporation acquired Dallas, TX based Pegasus Bank $624 million in assets, $373 million in loans, and $575 million in deposits Pegasus continues to operate as a separate Texas state charter under BANF with current Board and management. Transaction added the high growth MSA of Dallas, TX into BANF’s footprint which marks BANF’s first expansion outside of Oklahoma Superior growth with 5-year CAGR of 17.8% for loans and 15.7% for deposits Top-tier profitability with LTM ROAA of 1.16% and ROAE of 17.4% Three strategically situated branch locations in the Park Cities neighborhood of Dallas 5 Pegasus Bank Acquisition

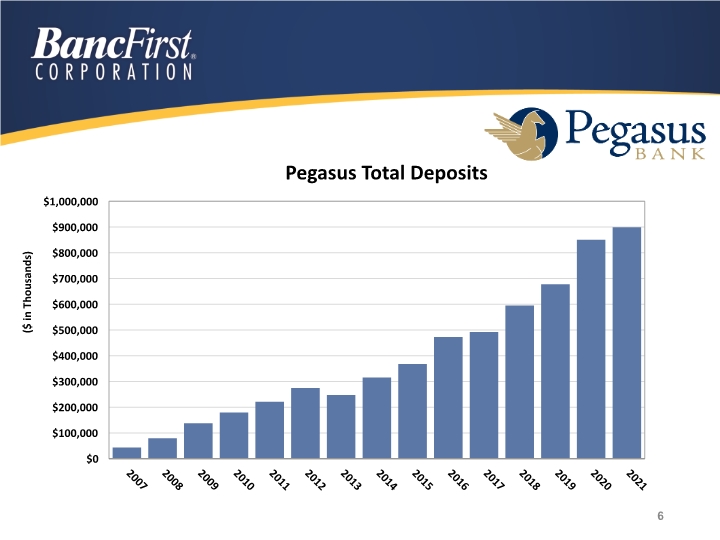

6 ($ in Thousands)

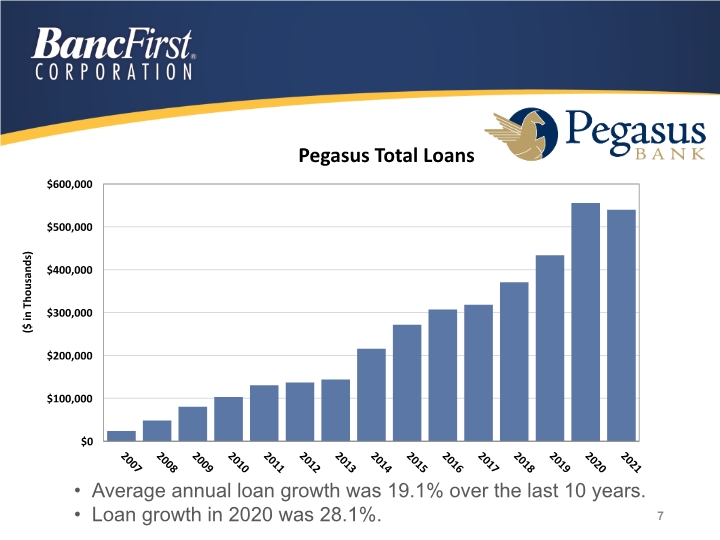

Average annual loan growth was 19.1% over the last 10 years. Loan growth in 2020 was 28.1%. 7 ($ in Thousands)

8

Primary Risk Factors Changes to the Oklahoma economy Oil prices Commercial real estate Threats to noninterest income Interchange revenue – payment system changes; consumer regulation Overdraft fees – consumer regulation $10 billion threshold Industry move toward paying interest on business checking accounts 9

COVID-19 Impact Began identification of loan customers impacted by COVID-19 that resulted in a modification of loan terms and coded these loans in accordance with interagency guidelines. As of 03/31/21, 286 loans totaling $88 million were coded accordingly. As of 03/31/21, BancFirst held $714 million in loans through the Paycheck Protection Program. Implemented an enhanced paid leave program for all employees, added incentive pay for all hourly employees in retail locations, and initiated a childcare stipend for hourly employees at work with school age children at home. Although strictly limiting lobby traffic and precisely following CDC guidance, we have kept all banking facilities open as we continue to fulfill the duty of being designated as a critical infrastructure by the Department of Homeland Security. 10

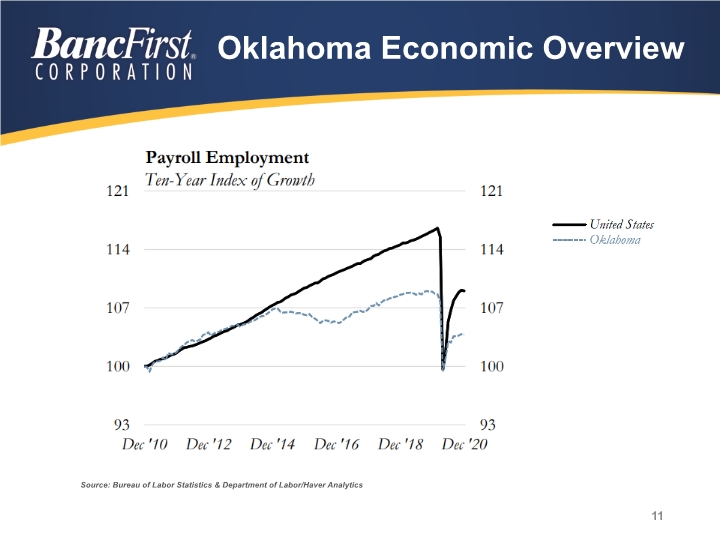

Oklahoma Economic Overview Source: Bureau of Labor Statistics & Department of Labor/Haver Analytics 11

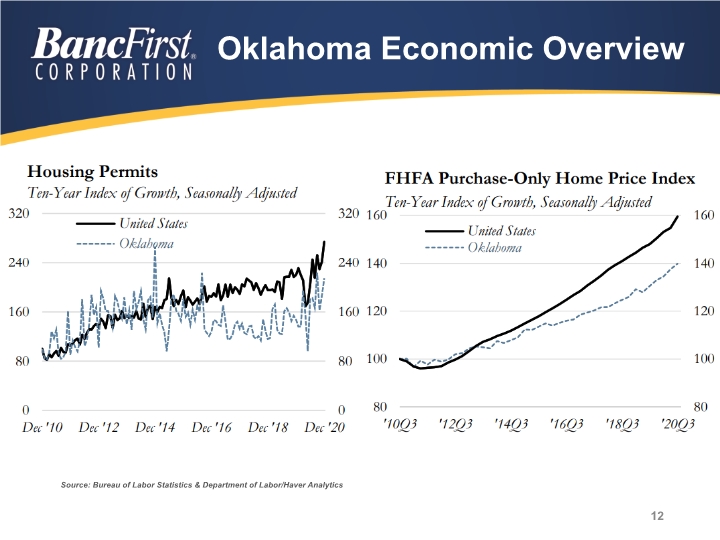

Oklahoma Economic Overview Source: Bureau of Labor Statistics & Department of Labor/Haver Analytics 12

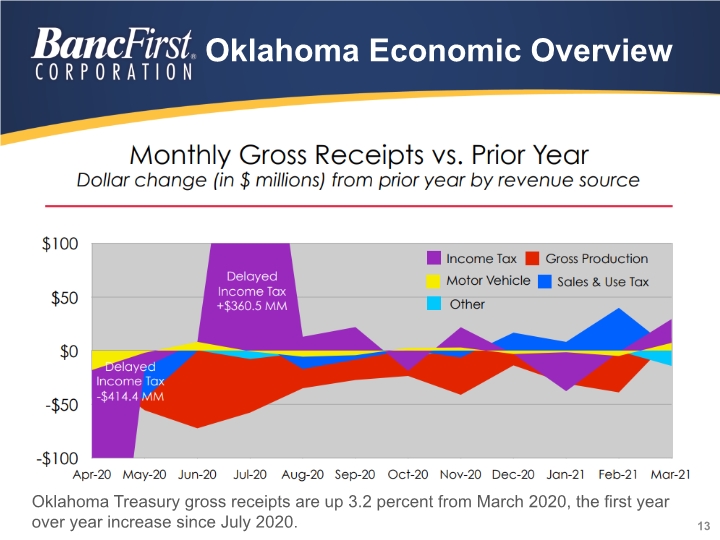

Oklahoma Economic Overview 13 Oklahoma Treasury gross receipts are up 3.2 percent from March 2020, the first year over year increase since July 2020.

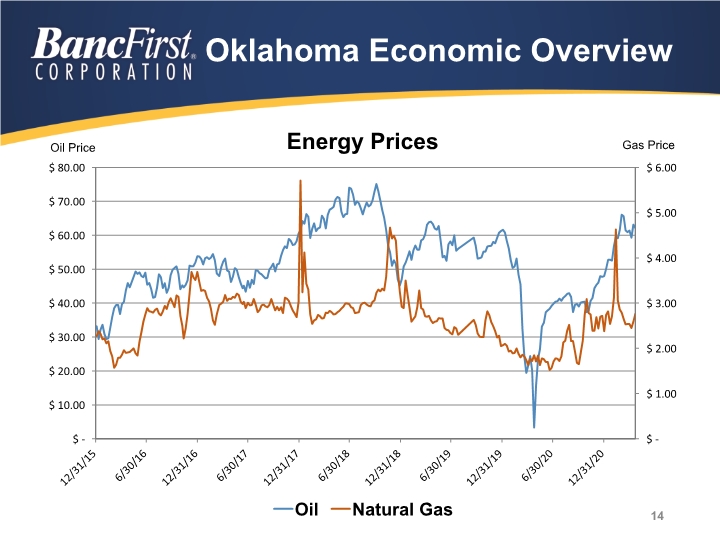

14 Oklahoma Economic Overview Gas Price

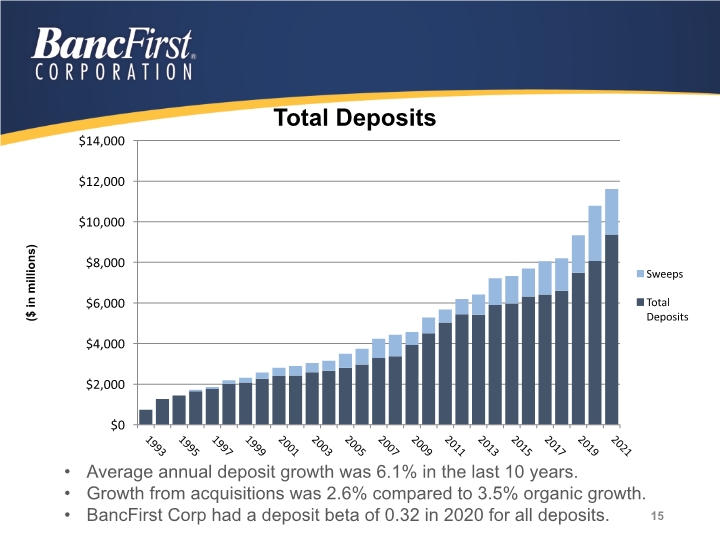

Total Deposits 15 Average annual deposit growth was 6.1% in the last 10 years. Growth from acquisitions was 2.6% compared to 3.5% organic growth. BancFirst Corp had a deposit beta of 0.32 in 2020 for all deposits. ($ in millions)

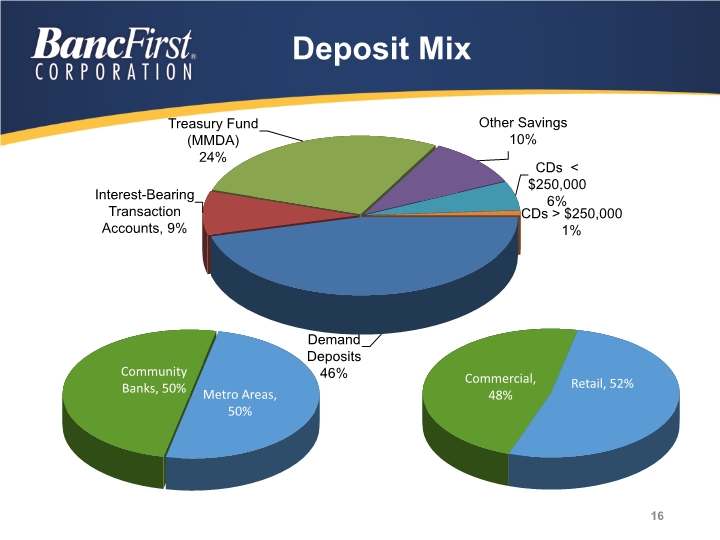

16 Deposit Mix

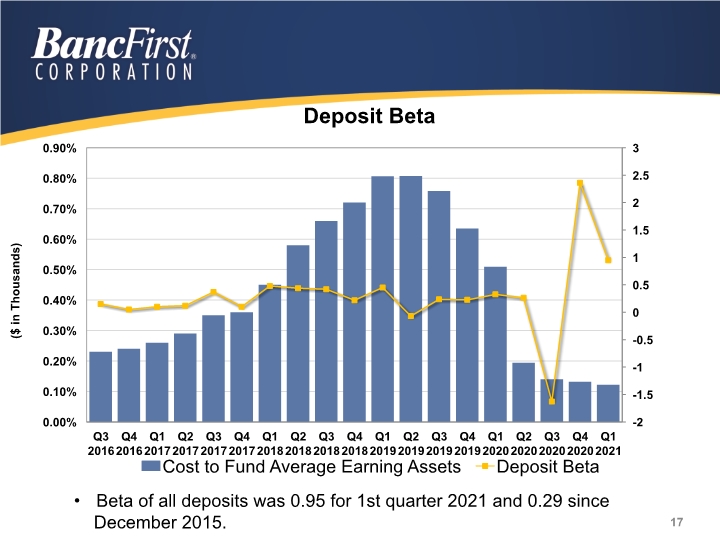

17 ($ in Thousands) Beta of all deposits was 0.95 for 1st quarter 2021 and 0.29 since December 2015.

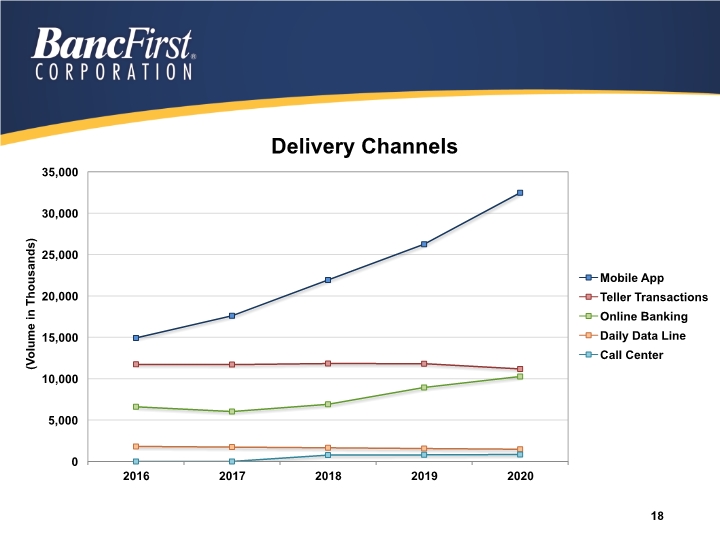

18 (Volume in Thousands)

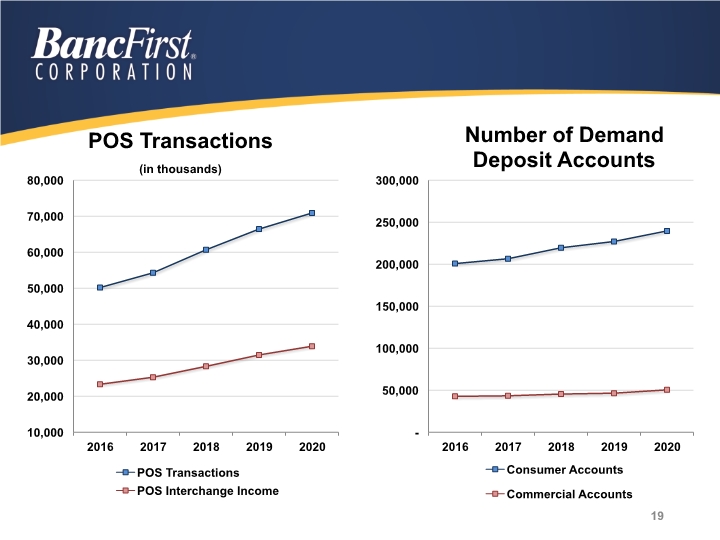

19

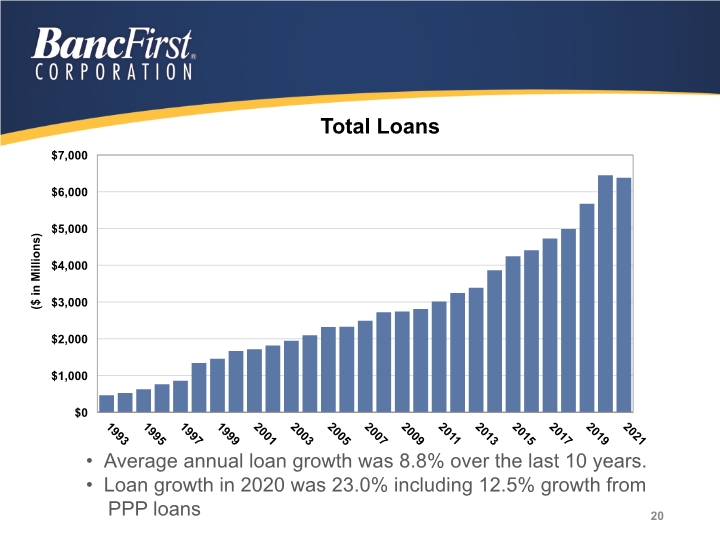

Average annual loan growth was 8.8% over the last 10 years. Loan growth in 2020 was 23.0% including 12.5% growth from PPP loans 20 ($ in Millions)

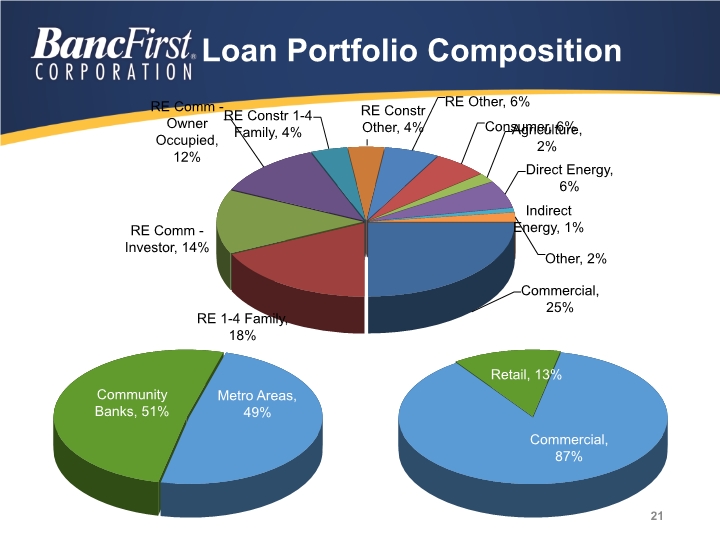

21 Loan Portfolio Composition

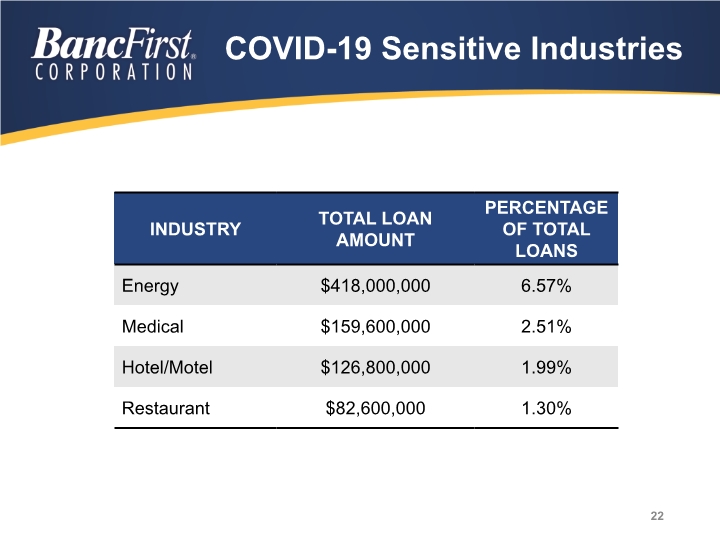

22 COVID-19 Sensitive Industries

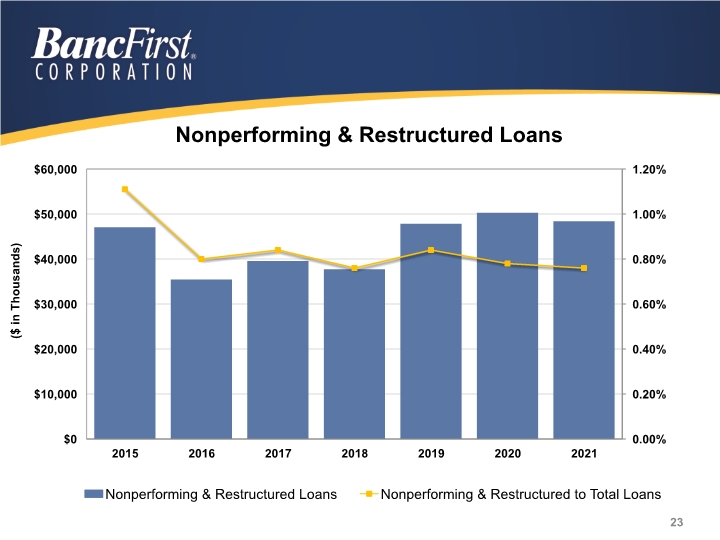

23 ($ in Thousands)

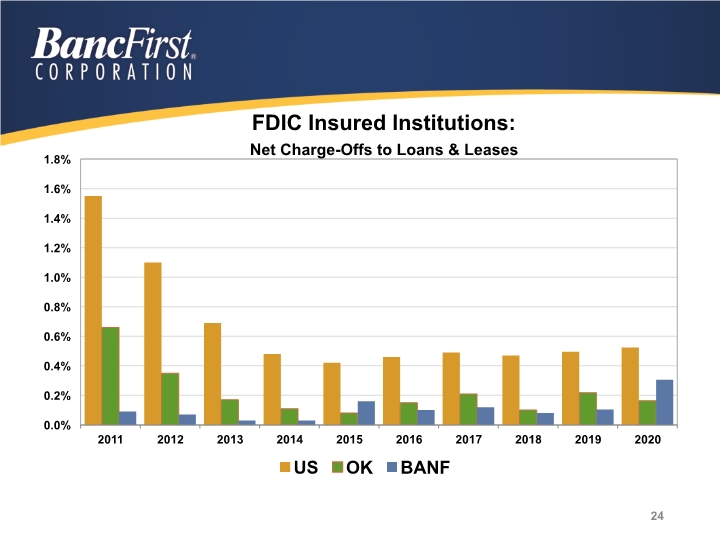

24

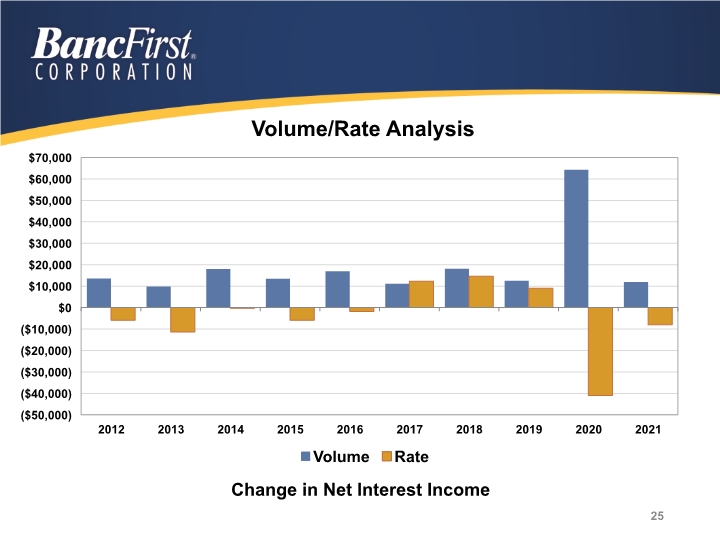

25 Change in Net Interest Income

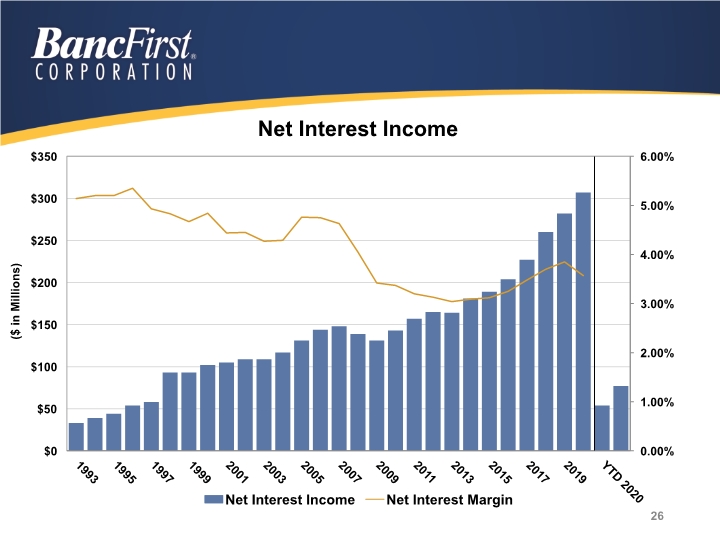

26

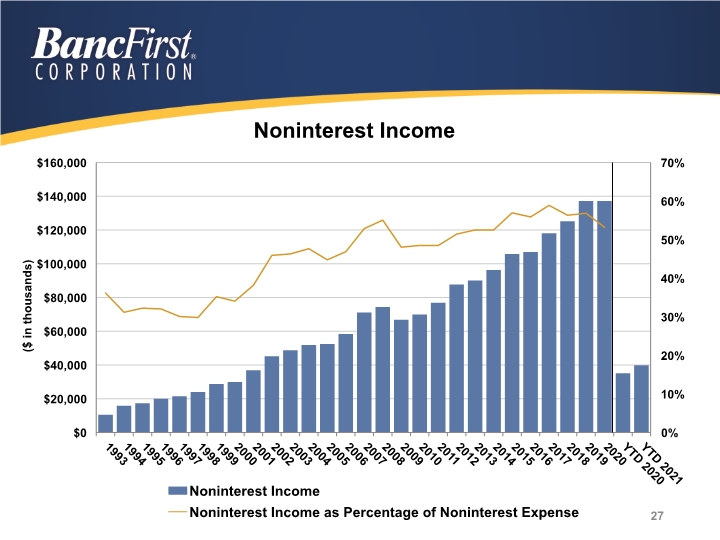

27 ($ in thousands) Noninterest Income

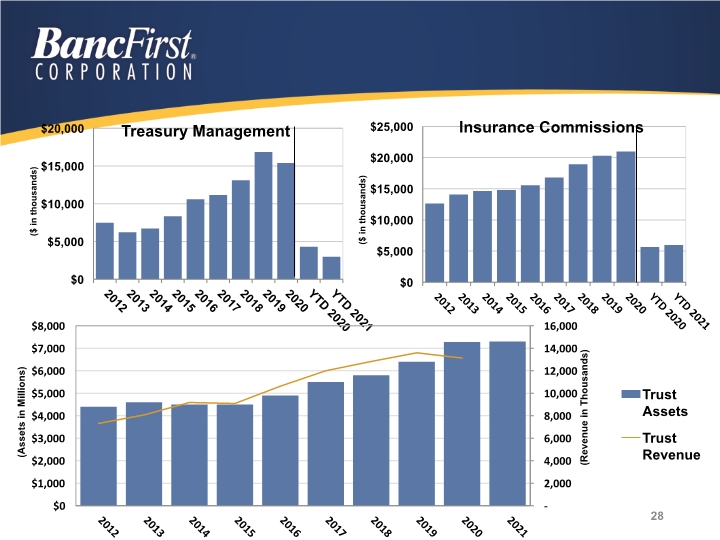

28 ($ in thousands)

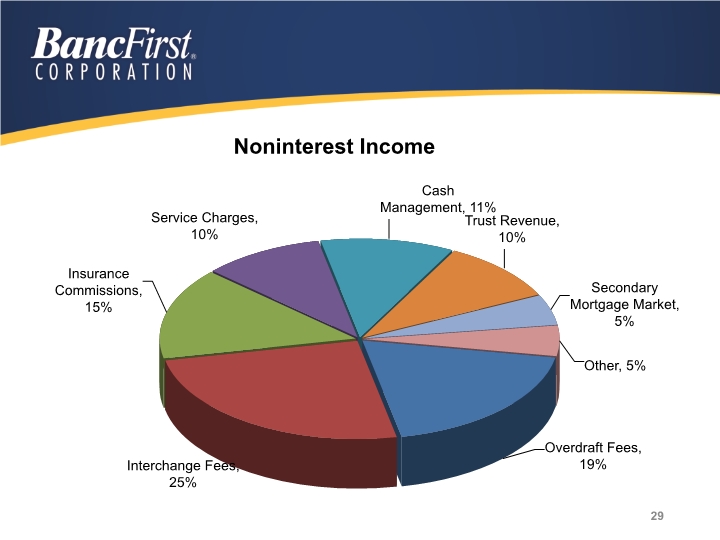

29

30

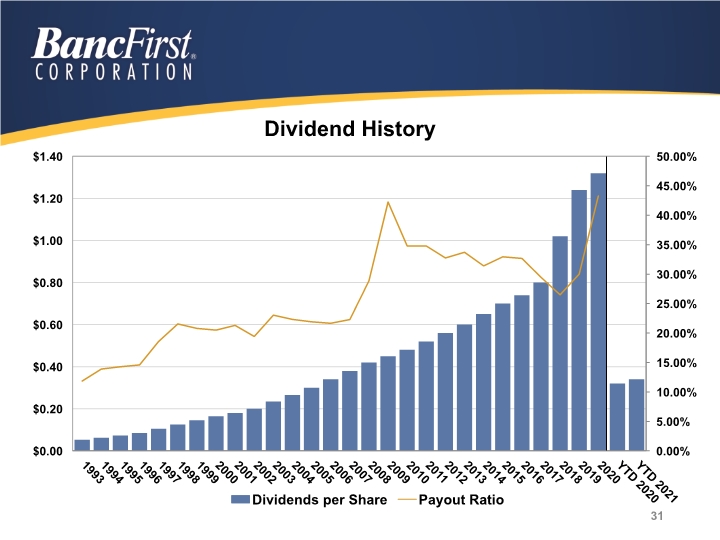

31

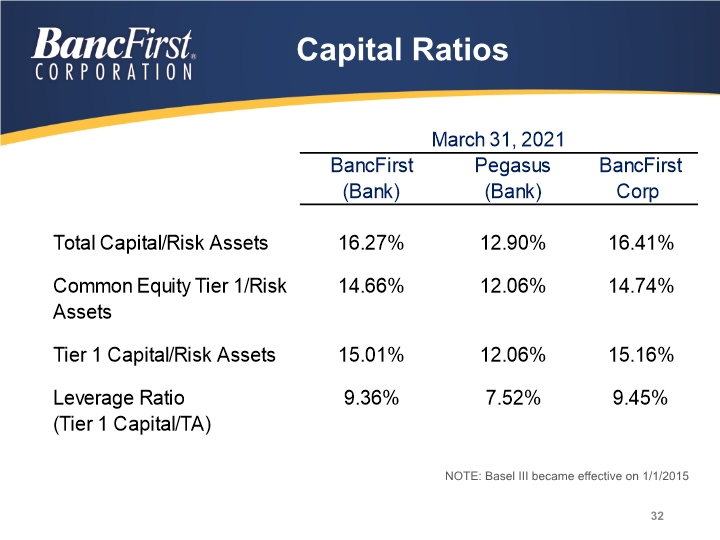

NOTE: Basel III became effective on 1/1/2015 32 Capital Ratios

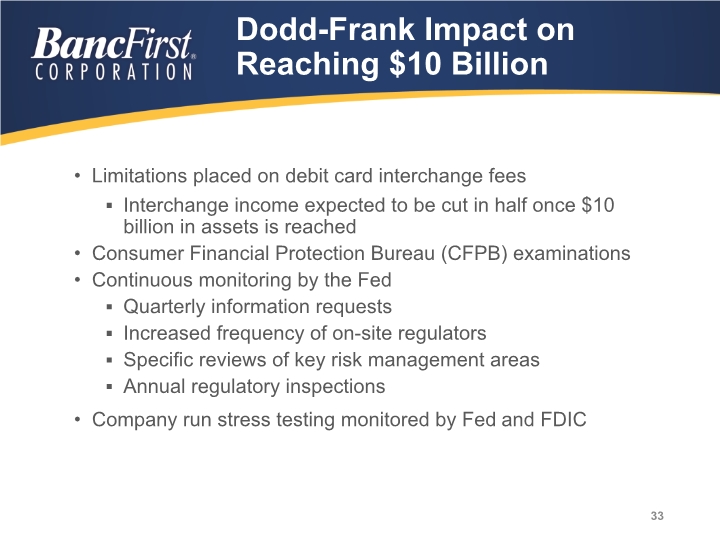

Dodd-Frank Impact on Reaching $10 Billion Limitations placed on debit card interchange fees Interchange income expected to be cut in half once $10 billion in assets is reached Consumer Financial Protection Bureau (CFPB) examinations Continuous monitoring by the Fed Quarterly information requests Increased frequency of on-site regulators Specific reviews of key risk management areas Annual regulatory inspections Company run stress testing monitored by Fed and FDIC 33

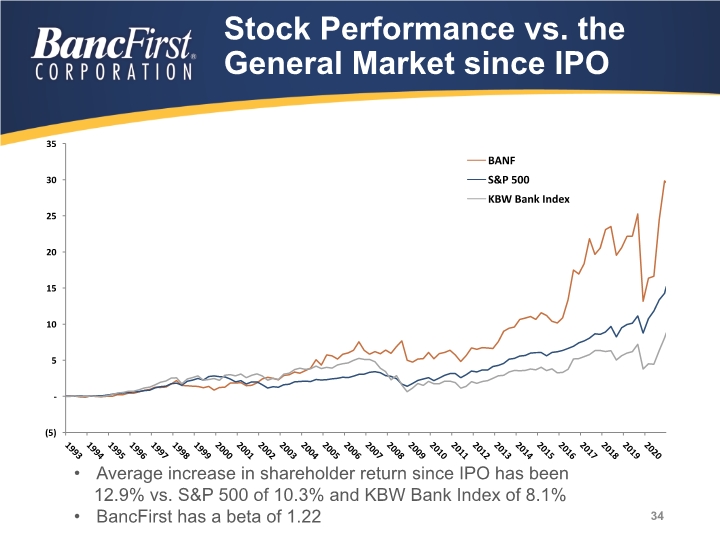

Stock Performance vs. the General Market since IPO 34 Average increase in shareholder return since IPO has been 12.9% vs. S&P 500 of 10.3% and KBW Bank Index of 8.1% BancFirst has a beta of 1.22

Summary Number and quality of both household and commercial core deposit relationships Sustained asset quality Strong capital Exceptional liquidity; high level of core deposit funding; modest rate risk Emphasis on non-interest income Invested management Acquisition/conversion expertise Strong currency 35

One of America’s Strongest Banks 36

37 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 with respect to earnings and other financial information, corporate objectives, and other business matters. Forward-looking statements include estimates and give our current expectations or forecasts of future events. These forward-looking statements are subject to numerous assumptions, risks and uncertainties. Actual results may differ materially. These risks and other factors are described more fully in the Company’s Annual Report on Form 10-K for 2020 and other filings with the Securities and Exchange Commission.