Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNITED BANKSHARES INC/WV | d158023dex991.htm |

| EX-2.1 - EX-2.1 - UNITED BANKSHARES INC/WV | d158023dex21.htm |

| 8-K - 8-K - UNITED BANKSHARES INC/WV | d158023d8k.htm |

EXHIBIT 99.2

Merger Between

United Bankshares, Inc.

and Community Bankers Trust Corporation

Investor Presentation

June 3, 2021

United Bankshares, Inc. (UBSI) to Acquire Community Bankers Trust Corporation (ESXB) STRATEGIC ACQUISITION STRENGTHENS UNITED’S POSITION AS ONE OF THE LARGEST AND BEST PERFORMING REGIONAL BANKING COMPANIES IN THE MID-ATLANTIC AND SOUTHEAST June 3, 2021

Forward Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of a merger (the “Merger”) between Community Bankers Trust Corporation (“Community”) and United, including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that may be realized from the Merger; (ii) United’s and Community’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” “will,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of United and Community and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of United and Community. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of United and Community may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees, may be greater than expected; (4) the regulatory approvals required for the Merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the shareholders of Community may fail to approve the Merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which United and Community are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competitive pressures on product pricing and services; (10) success, impact, and timing of United’s business strategies, including market acceptance of any new products or services; (11) disruption from the Merger making it more difficult to maintain relationships with employees, customers or other parties with whom United and Community have business relationships; (12) diversion of management time on Merger-related issues; (13) risks relating to the potential dilutive effect of the shares of United common stock to be issued in the Merger; (14) the reaction to the proposed transaction from the companies’ customers, employees and counterparties; (15) the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement between United and Community; (16) the outcome of any legal proceedings that may be instituted against United or Community; (17) changes in general economic, political, or industry conditions; (18) uncertainty as to the extent of the duration, scope and impacts of the COVID-19 pandemic on United, Community and the Merger; (19) uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; (20) volatility and disruptions in global capital and credit markets; (21) reform of LIBOR; and (22) the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, those involving the OCC, Federal Reserve, FDIC, and CFPB. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Community’s and United’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission (“SEC”) and available on the SEC's Internet site (http://www.sec.gov). United and Community caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to United or Community or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. United and Community do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made. Additional Information About the Merger and Where to Find It This presentation shall not constitute an offer to sell, the solicitation of an offer to sell, or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Shareholders of United and Community and other investors are urged to read the proxy statement/prospectus that will be included in the registration statement on Form S-4 that United will file with the SEC in connection with the proposed Merger because it will contain important information about United, Community, the Merger, the persons soliciting proxies in the Merger and their interests in the Merger and related matters. Investors will be able to obtain all documents filed with the SEC by United free of charge at the SEC's Internet site (http://www.sec.gov). In addition, documents filed with the SEC by United will be available free of charge from the Corporate Secretary of United Bankshares, Inc., 514 Market Street, Parkersburg, West Virginia 26101, telephone (304) 424-8800 and any documents filed with the SEC by Community will be available free of charge from the Corporate Secretary of Community, 9954 Mayland Drive, Suite 2100, Richmond, Virginia 23233, telephone, (804) 934-9999. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing United’s website at www.ubsi-inc.com under the tab “Investor Relations” and then under the heading “SEC Filings” or by accessing Community’s website at www.cbtrustcorp.com under the tab “SEC Filings” and then under the heading “Documents”. You are urged to read the proxy statement/prospectus carefully, once it becomes available, before making a decision concerning the Merger. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Transactions United, Community and their respective directors, executive officers and certain other members of management and employees may be deemed “participants” in the solicitation of proxies from United’s and Community’s shareholders in favor of the Merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the United and Community shareholders in connection with the proposed Merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of United in its Annual Report on Form 10-K for the year ended December 31, 2020 and in its definitive proxy statement filed with the SEC on March 30, 2021. You can find information about Community’s executive officers and directors in its Annual Report on Form 10-K for the year ended December 31, 2020 and in its definitive proxy statement filed with the SEC on April 23, 2021. You can obtain free copies of these documents from United, or Community using the contact information above. IMPORTANT INFORMATION

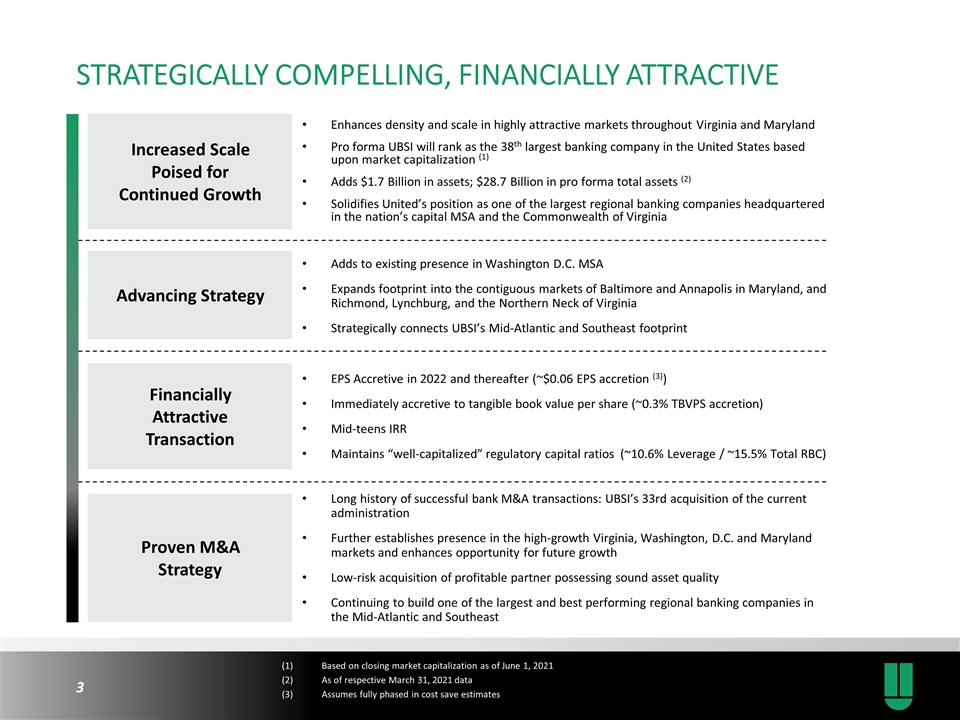

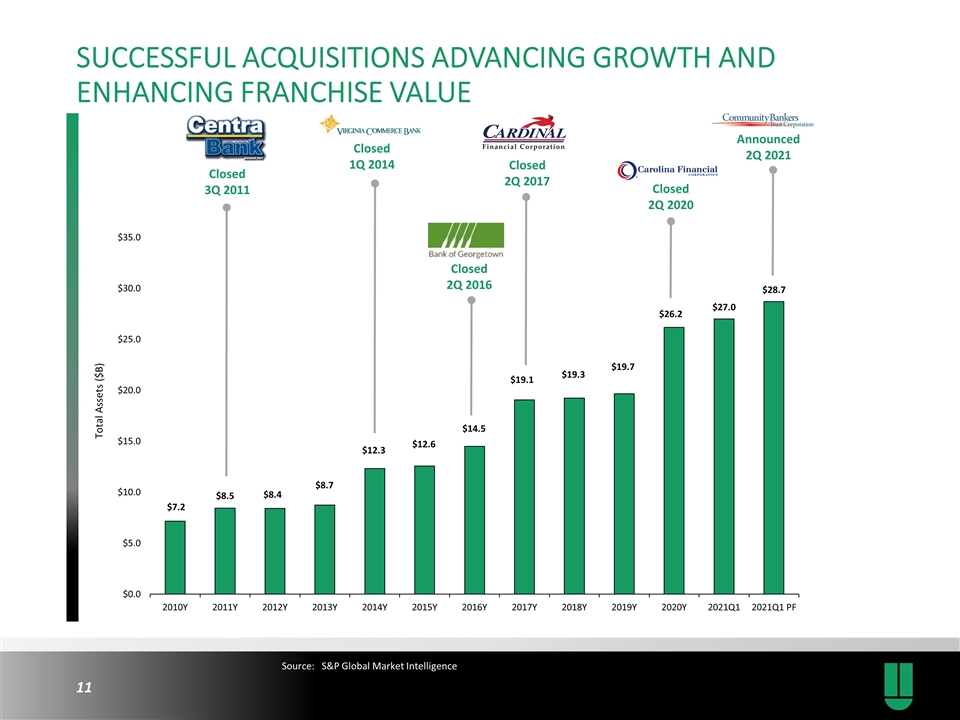

STRATEGICALLY COMPELLING, FINANCIALLY ATTRACTIVE Increased Scale Poised for Continued Growth Advancing Strategy Financially Attractive Transaction Proven M&A Strategy Based on closing market capitalization as of June 1, 2021 As of respective March 31, 2021 data Assumes fully phased in cost save estimates Enhances density and scale in highly attractive markets throughout Virginia and Maryland Pro forma UBSI will rank as the 38th largest banking company in the United States based upon market capitalization (1) Adds $1.7 Billion in assets; $28.7 Billion in pro forma total assets (2) Solidifies United’s position as one of the largest regional banking companies headquartered in the nation’s capital MSA and the Commonwealth of Virginia Adds to existing presence in Washington D.C. MSA Expands footprint into the contiguous markets of Baltimore and Annapolis in Maryland, and Richmond, Lynchburg, and the Northern Neck of Virginia Strategically connects UBSI’s Mid-Atlantic and Southeast footprint EPS Accretive in 2022 and thereafter (~$0.06 EPS accretion (3)) Immediately accretive to tangible book value per share (~0.3% TBVPS accretion) Mid-teens IRR Maintains “well-capitalized” regulatory capital ratios (~10.6% Leverage / ~15.5% Total RBC) Long history of successful bank M&A transactions: UBSI’s 33rd acquisition of the current administration Further establishes presence in the high-growth Virginia, Washington, D.C. and Maryland markets and enhances opportunity for future growth Low-risk acquisition of profitable partner possessing sound asset quality Continuing to build one of the largest and best performing regional banking companies in the Mid-Atlantic and Southeast

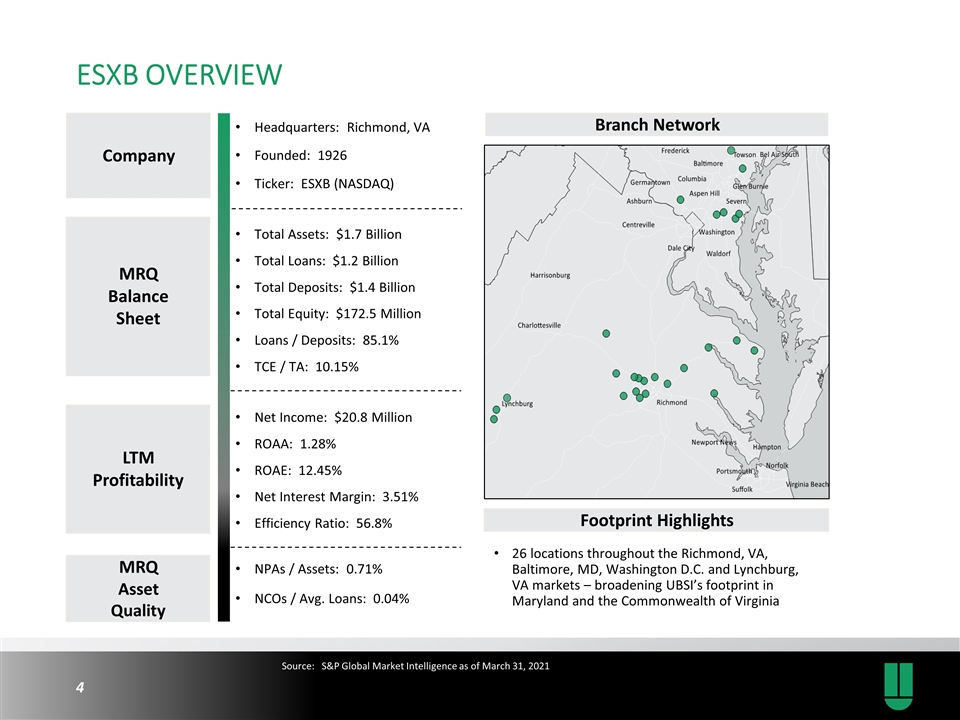

MRQ Asset Quality LTM Profitability MRQ Balance Sheet ESXB OVERVIEW Company 26 locations throughout the Richmond, VA, Baltimore, MD, Washington D.C. and Lynchburg, VA markets – broadening UBSI’s footprint in Maryland and the Commonwealth of Virginia Headquarters: Richmond, VA Founded: 1926 Ticker: ESXB (NASDAQ) Total Assets: $1.7 Billion Total Loans: $1.2 Billion Total Deposits: $1.4 Billion Total Equity: $172.5 Million Loans / Deposits: 85.1% TCE / TA: 10.15% Net Income: $20.8 Million ROAA: 1.28% ROAE: 12.45% Net Interest Margin: 3.51% Efficiency Ratio: 56.8% NPAs / Assets: 0.71% NCOs / Avg. Loans: 0.04% Branch Network Footprint Highlights Source:S&P Global Market Intelligence as of March 31, 2021

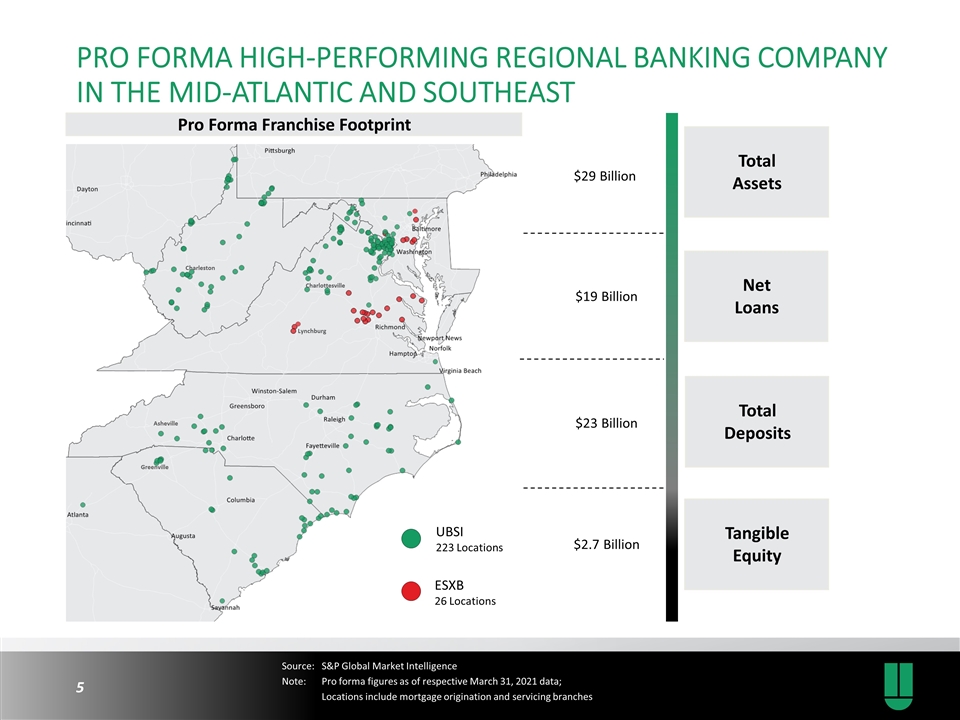

ESXB 26 Locations $29 Billion Tangible Equity Total Deposits Net Loans Total Assets Pro Forma Franchise Footprint Pro forma High-performing Regional banking company IN THE mid-atlantic and southeast $19 Billion $23 Billion $2.7 Billion UBSI 223 Locations Source:S&P Global Market Intelligence Note:Pro forma figures as of respective March 31, 2021 data; Locations include mortgage origination and servicing branches Charleston Greenville Asheville Lynchburg Charlottesville

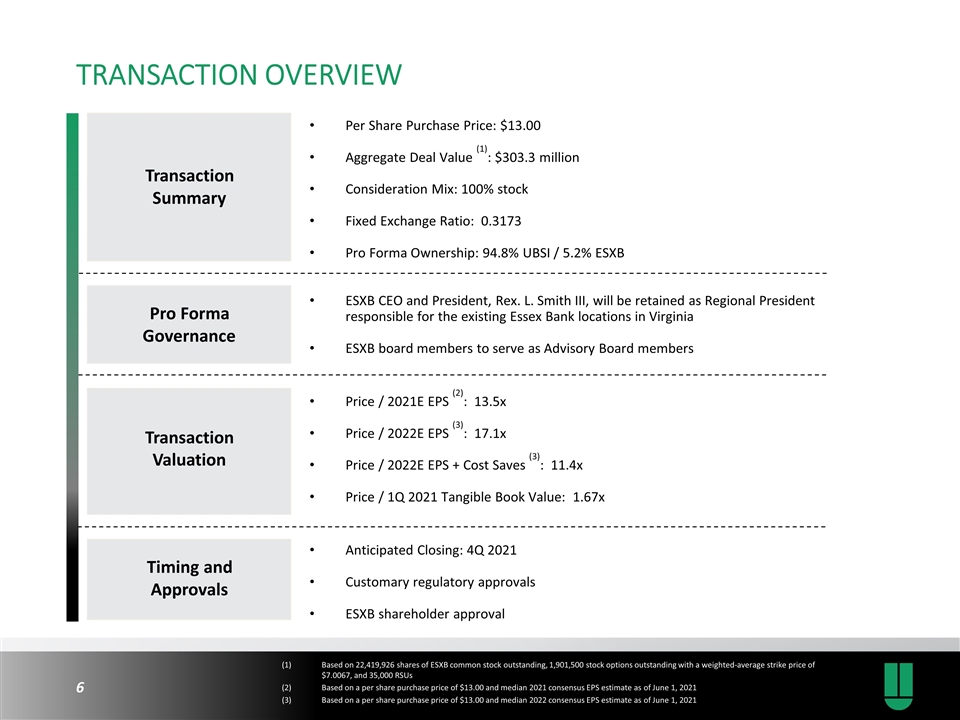

Transaction Valuation Pro Forma Governance Transaction Summary Per Share Purchase Price: $13.00 Aggregate Deal Value (1): $303.3 million Consideration Mix: 100% stock Fixed Exchange Ratio: 0.3173 Pro Forma Ownership: 94.8% UBSI / 5.2% ESXB ESXB CEO and President, Rex. L. Smith III, will be retained as Regional President responsible for the existing Essex Bank locations in Virginia ESXB board members to serve as Advisory Board members Price / 2021E EPS (2): 13.5x Price / 2022E EPS (3): 17.1x Price / 2022E EPS + Cost Saves (3): 11.4x Price / 1Q 2021 Tangible Book Value: 1.67x Anticipated Closing: 4Q 2021 Customary regulatory approvals ESXB shareholder approval TRANSACTION OVERVIEW Based on 22,419,926 shares of ESXB common stock outstanding, 1,901,500 stock options outstanding with a weighted-average strike price of $7.0067, and 35,000 RSUs Based on a per share purchase price of $13.00 and median 2021 consensus EPS estimate as of June 1, 2021 Based on a per share purchase price of $13.00 and median 2022 consensus EPS estimate as of June 1, 2021 Timing and Approvals

ESXB MARKET OVERVIEW Source:S&P Global Market Intelligence; FDIC as of June 30, 2020; US Census Bureau; Fortune 500; Forbes; USA Today; Richmond Chamber of Commerce; City of Lynchburg Richmond, VA Virginia’s capital with approximately 1.3 million residents in the metro area Headquarters of four Fortune 500 Companies Median household income of $73.3K – more than 8% higher than the national level Washington, D.C. Third highest 2020 median household income in the country by MSA; Top 5 of the 6 wealthiest counties in the country Global tech giants Amazon, Microsoft, Facebook, Yelp and Google have announced plans to expand existing presence for forthcoming hubs in the D.C. market 6th Largest MSA by population (6.3 million) Baltimore, MD Major employers include industry leaders T. Rowe Price and Under Armour Metro population of approximately 2.8 million Median household income of metro area nearly 30% above the national average Focus on Established, Growth-Driven Markets Lynchburg, VA Fifth most populous MSA in Virginia Home to five higher education institutions, including Liberty University United States $67,761

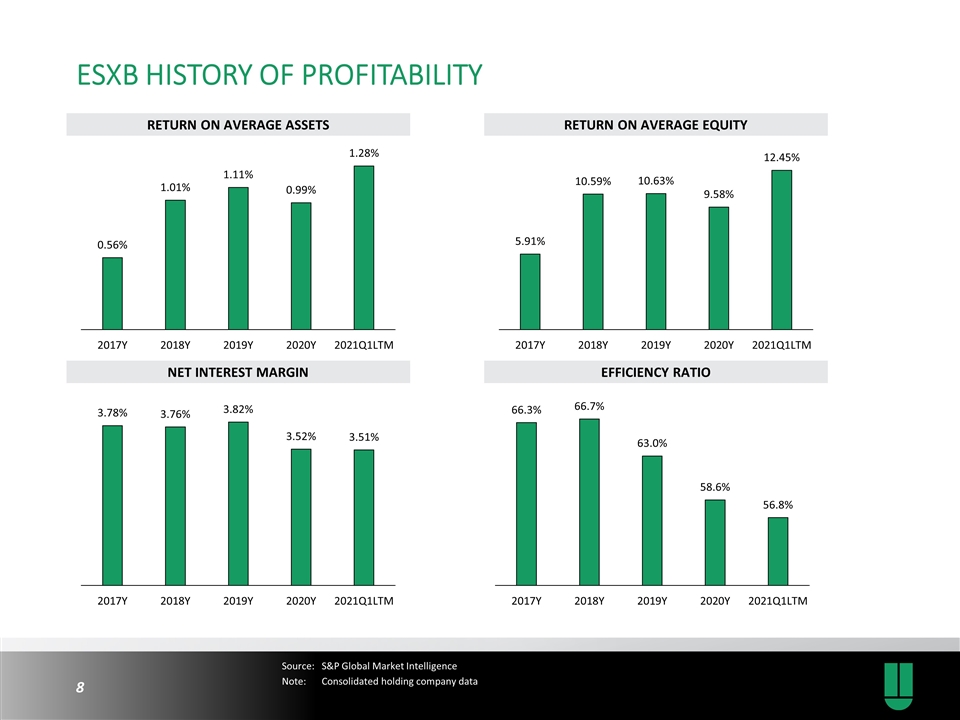

ESXB HISTORY OF PROFITABILITY Return on Average Assets Net Interest Margin Return on Average Equity Efficiency Ratio Source:S&P Global Market Intelligence Note:Consolidated holding company data

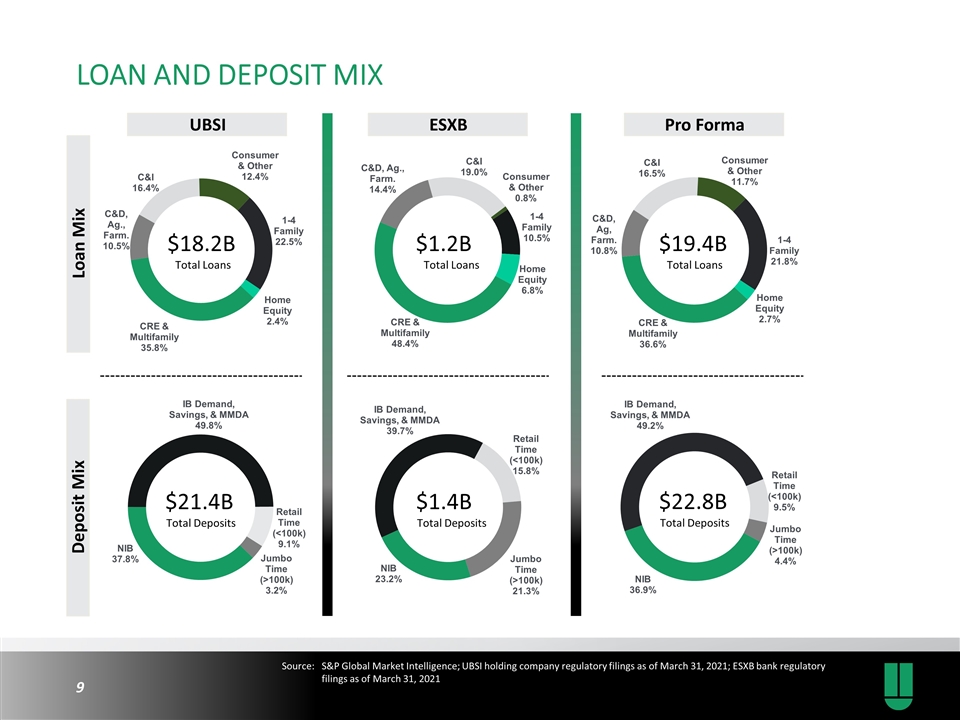

LOAN AND DEPOSIT MIX UBSI Loan Mix Deposit Mix ESXB Pro Forma $18.2B Total Loans $21.4B Total Deposits $1.2B Total Loans $1.4B Total Deposits $19.4B Total Loans $22.8B Total Deposits Source:S&P Global Market Intelligence; UBSI holding company regulatory filings as of March 31, 2021; ESXB bank regulatory filings as of March 31, 2021

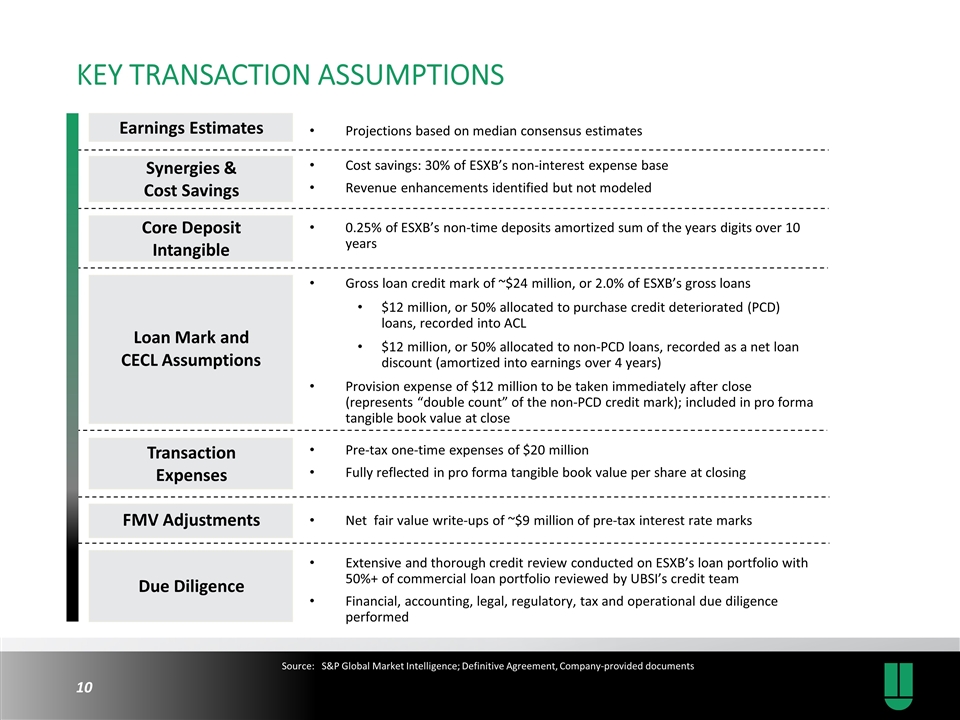

Core Deposit Intangible Synergies & Cost Savings Due Diligence Loan Mark and CECL Assumptions Earnings Estimates Projections based on median consensus estimates Cost savings: 30% of ESXB’s non-interest expense base Revenue enhancements identified but not modeled 0.25% of ESXB’s non-time deposits amortized sum of the years digits over 10 years Gross loan credit mark of ~$24 million, or 2.0% of ESXB’s gross loans $12 million, or 50% allocated to purchase credit deteriorated (PCD) loans, recorded into ACL $12 million, or 50% allocated to non-PCD loans, recorded as a net loan discount (amortized into earnings over 4 years) Provision expense of $12 million to be taken immediately after close (represents “double count” of the non-PCD credit mark); included in pro forma tangible book value at close Pre-tax one-time expenses of $20 million Fully reflected in pro forma tangible book value per share at closing Net fair value write-ups of ~$9 million of pre-tax interest rate marks Extensive and thorough credit review conducted on ESXB’s loan portfolio with 50%+ of commercial loan portfolio reviewed by UBSI’s credit team Financial, accounting, legal, regulatory, tax and operational due diligence performed KEY TRANSACTION ASSUMPTIONS Source:S&P Global Market Intelligence; Definitive Agreement, Company-provided documents FMV Adjustments Transaction Expenses

SUCCESSFUL ACQUISITIONS ADVANCING GROWTH AND ENHANCING FRANCHISE VALUE Source:S&P Global Market Intelligence Closed 3Q 2011 Closed 1Q 2014 Closed 2Q 2016 Closed 2Q 2017 Closed 2Q 2020 Announced 2Q 2021