Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - First Foundation Inc. | ffwm-20210602xex99d1.htm |

| EX-2.1 - EX-2.1 - First Foundation Inc. | ffwm-20210602xex2d1.htm |

| 8-K - 8-K - First Foundation Inc. | ffwm-20210602x8k.htm |

Exhibit 99.2

| PRIVATE WEALTH MANAGEMENT ● PERSONAL BANKING ● BUSINESS BANKING June 3, 2021 Expanding into Southwest Florida with Acquisition of TGR Financial, Inc. |

| Copyright © 2021 First Foundation Inc. All Rights Reserved Safe Harbor Statement 1 Forward-Looking Statements This investor presentation includes forward-looking statements about First Foundation, Inc. (“FFWM”), TGR Financial, Inc. (“TGR”) and the combined company after the completion of the proposed merger that is intended to be covered by the “Safe-Harbor” provisions of the Private Securities Litigation Refor m Act of 1995, including forward- looking statements relating to FFWM’s current expectations regarding the proposed merger an d its business plans and expectations. These statements are necessarily subject to risk and uncertainty and actual results could differ materially from those anticipated due to various factors, including those set forth from time to time in the documents filed or furnished by FFWM with the Securities an d Exch an ge Commission (“SEC”). The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the possibility that the proposed merger does not cl ose when expected or at all because required regulatory, shareholder or other approvals, financial tests or other conditions to closing are not received or satisfied on a timely basis or at all; changes in FFWM’s or TG R’s stock price before closing, including as a result of its financial performance prior to cl osing or transaction-related uncertainty, or more generally due to broader stock market movements, and the performance offinancial companies and p eer group companies; the occurrence of any event, change or other circumstance that could give risk to the right of one or both of the parties to terminate the definitive agreement; the risk that the benefits from the proposed merger may not be fully realized or may take longer to realize than expected or be more costly to achieve, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which FFWM and TGR operate; the ability to promptly and effectively integrate the businesses of FFWM and TGR; reputational risks and the reaction of the companies’ customers, employees and counterparties to the proposed merger; diversion of management time on merger-related issues; lower than expected revenues, credit quality deterioration or a reduction in real es tate values or a reduction in net earnings; that the COVID-19 pandemic, including uncertainty and volatility in financial, commodities and other markets, and disruptions to bankingand other financial activity, could harm FFWM’s or TGR’s business, financial position and results of operations, an d could adversely affect the timing and anticipated benefits of the proposed merger; and other risks that are described in FFWM’s public filings with the SEC. You should not place undue reliance on forward-looking statements and FFWM and TGR undertake noobligation toupdate any such s tatements to reflect circums tances or events that occur after the date on which the forward-looking statement is made. Additional Information about the Merger and Where to Find it Investors and security holders are urged to carefully review FFWM’s public filings with the SEC, including but not limited toits Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, proxy state ments and CurrentReports on Form 8-K. The documents are filed with the SECand may be obtained free of charge atwww.sec.gov, at FFWM’s website at firstfoundation.com under the “Investor Relations” link, or writing First Foundation Inc. at 18101 Von Karman Ave., Suite 700, Irvine, CA 92612; Attention: Kevin Thompson. In connection with the proposed merger transacti on, FFWM will file with the SECa registration state ment on Form S-4 that will include a joint proxy statement of FFWM and TGR, and a prospectusof FFWM, which are referred to as the joint proxy statement/prospectus, as well as other relevant documents concerningthe proposed transaction. Before ma king any voting or investment decision, investors and security holders are urged to carefully read the entire registration statement and joint proxy statement/prospectus when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. A definitive joint proxy statement/prospectus will be sent to the shareholders of FFWM and TGR seeking required shareholder approvals. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus, and any other documents FFWM files with the SECfree of charge as described in the preceding paragraph. FFWM, TGR, their directors, executive offi cers and certain other persons may be deemed to be participants in the solicitati on of proxies from FFWM and TGR shareholders in favor of the approval of the transaction. Information about the directors and executive officers of FFWM and their ownership of FFWM common stock is set forth in the proxy statement for FFWM’s 2021 annual meeting of stockholders, as previously filed with the SEC. Additional information regarding the interests of those participants and other persons whomay be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when itbecomes available. |

| Copyright © 2021 First Foundation Inc. All Rights Reserved Merger Rationale 2 Transaction Overview • First Foundation, Inc. will acquire TGR Financial, Inc. (“TGR”) and its subsidiary First Florida Integrity Bank, a community bank headquartered in Naples, Florida • TGR is the largest independent bank headquartered in Naples MSA • $2.3 billion in total assets and 7 branch locations in Naples MSA and Tampa MSA Complementary Banking Franchise • Increases FFWM diversification of geography, loan mix, funding base, and revenue • ~76% of loan portfolio in CRE and commercial business loans • Loan to deposit ratio of 60%, which provides attractive funding base to support FFWM’s loan pipeline • Maintains FFWM’s low credit risk model with TGR’s strong credit quality of 0.00% NPAs Market Expansion • Strategic expansion into Florida, which supports FFWM initiative to grow in attractive markets with positive demographic trends and business friendly environments • Florida ranks 3rd in total deposits raised from our nationwide digital bank channel behind California and New York and ranks one spot in front of Texas • Collier County, which includes Naples, ranks 2nd in Florida for Per Capita Income and ranks 22nd in the US (1) • Ability for FFWM to provide broader offering of products and services to TGR customers, including wealth management and trust services Attractive Financial Impact • Immediately accretive to EPS with 4.5% accretion in 2022 and 9.5% in 2023 with fully realized cost savings • Tangible book value earnback of 2.1 years Note(s): 1. Based on latest FRED annual data as of 2019 for Collier County. |

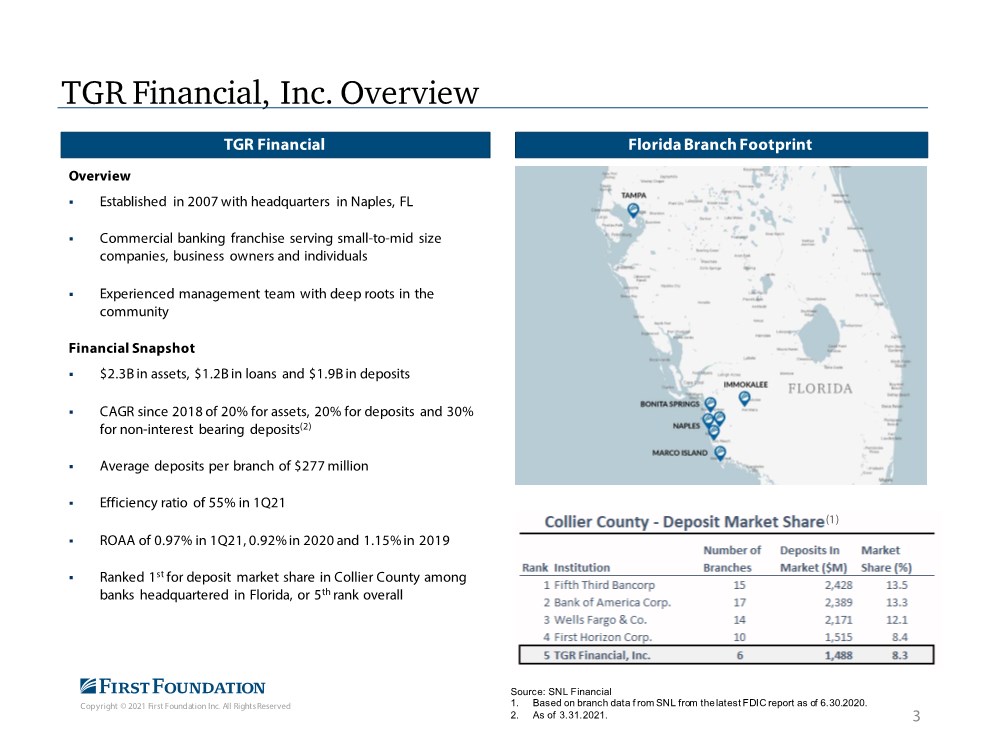

| Copyright © 2021 First Foundation Inc. All Rights Reserved TGR Financial, Inc. Overview TGR Financial Overview . Established in 2007 with headquarters in Naples, FL . Commercial banking franchise serving small-to-mid size companies, business owners and individuals . Experienced management team with deep roots in the community Financial Snapshot . $2.3B in assets, $1.2B in loans and $1.9B in deposits . CAGR since 2018 of 20% for assets, 20% for deposits and 30% for non-interest bearing deposits(2) . Average deposits per branch of $277 million . Efficiency ratio of 55% in 1Q21 . ROAA of 0.97% in 1Q21, 0.92% in 2020 and 1.15% in 2019 . Ranked 1st for deposit market share in Collier County among banks headquartered in Florida, or 5th rank overall 3 Florida Branch Footprint (1) Source: SNL Financial 1. Based on branch data f rom SNL from the latest FDIC report as of 6.30.2020. 2. As of 3.31.2021. |

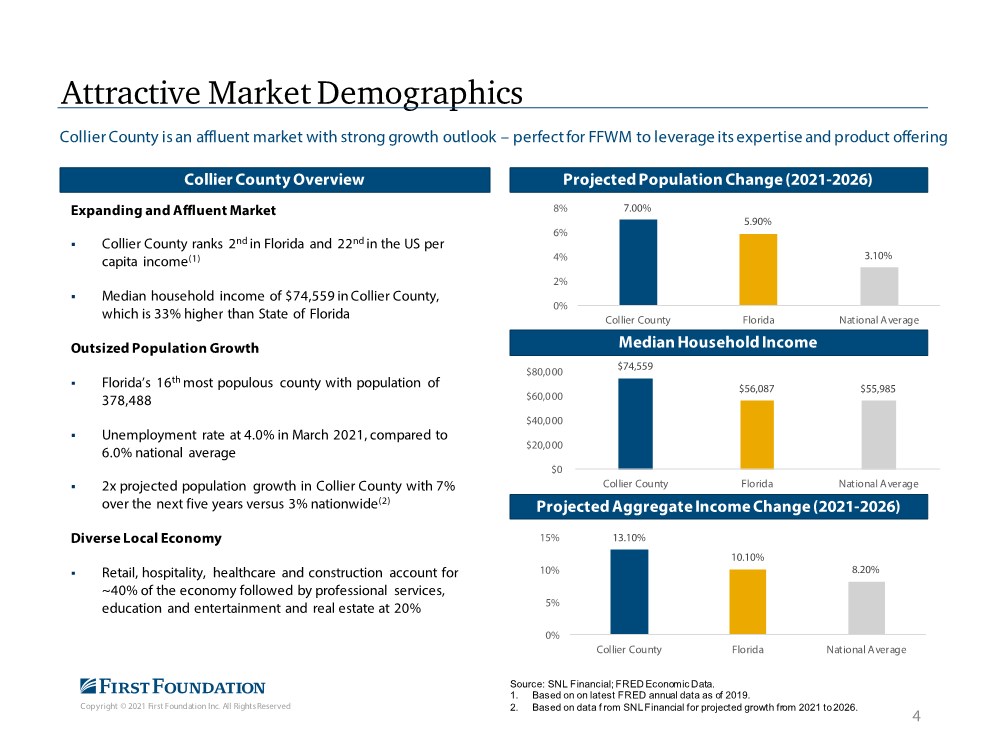

| Copyright © 2021 First Foundation Inc. All Rights Reserved Attractive Market Demographics 4 Collier County is an affluent market with strong growth outlook – perfect for FFWM to leverage its expertise and product offering Collier County Overview Projected Population Change (2021-2026) Expanding and Affluent Market . Collier County ranks 2nd in Florida and 22nd in the US per capita income(1) . Median household income of $74,559 in Collier County, which is 33% higher than State of Florida Outsized Population Growth . Florida’s 16th most populous county with population of 378,488 . Unemployment rate at 4.0% in March 2021, compared to 6.0% national average . 2x projected population growth in Collier County with 7% over the next five years versus 3% nationwide(2) Diverse Local Economy . Retail, hospitality, healthcare and construction account for ~40% of the economy followed by professional services, education and entertainment and real estate at 20% Projected Aggregate Income Change (2021-2026) Median Household Income Source: SNL Financial; FRED Economic Data. 1. Based on on latest FRED annual data as of 2019. 2. Based on data f rom SNL Financial for projected growth from 2021 to 2026. 7.00% 5.90% 3.10% 0% 2% 4% 6% 8% Collier County Florida Nat io nal A ver age $74,559 $56,087 $55,985 $0 $20,000 $40,000 $60,000 $80,000 Collier County Florida Nat io nal A ver age 13.10% 10.10% 8.20% 0% 5% 10% 15% Collier County Florida Nat io nal A ver age |

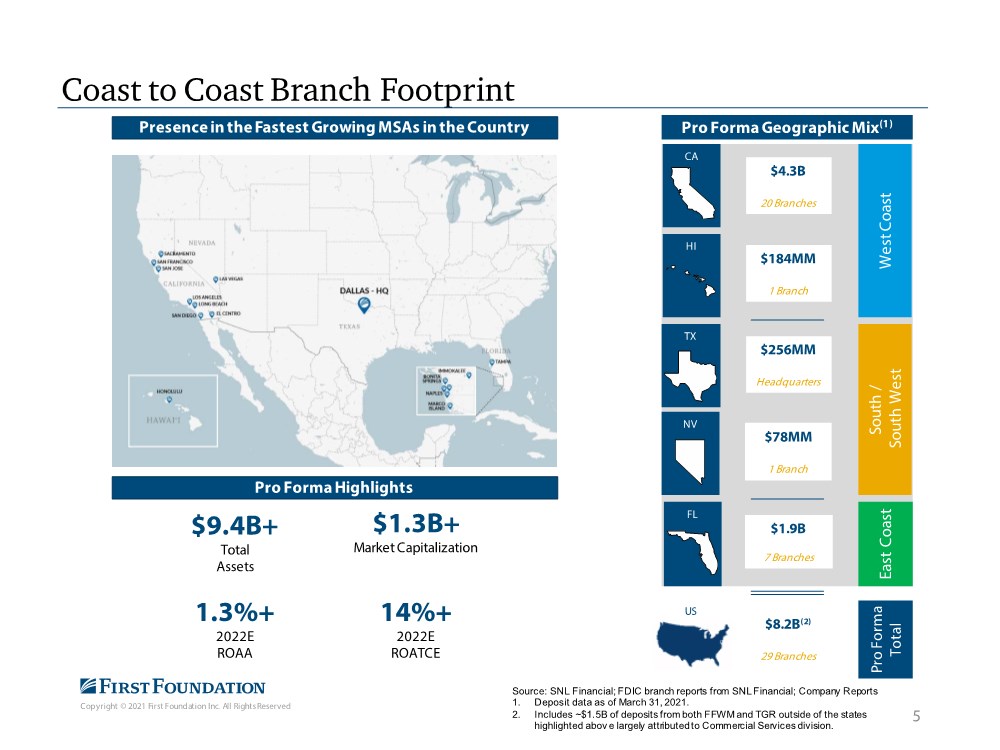

| Copyright © 2021 First Foundation Inc. All Rights Reserved Coast to Coast Branch Footprint 5 Source: SNL Financial; FDIC branch reports from SNL Financial; Company Reports 1. Deposit data as of March 31, 2021. 2. Includes ~$1.5B of deposits from both FFWM and TGR outside of the states highlighted abov e largely attributed to Commercial Services division. $9.4B+ Total Assets $1.3B+ Market Capitalization 1.3%+ 2022E ROAA 14%+ 2022E ROATCE Presence in the Fastest Growing MSAs in the Country Pro Forma Geographic Mix(1) Pro Forma Highlights FL NV TX HI CA West Coast South / South West East Coast $4.3B 20 Branches $184MM 1 Branch $256MM Headquarters $78MM 1 Branch $8.2B(2) 29 Branches $1.9B 7 Branches Pro Forma Total US |

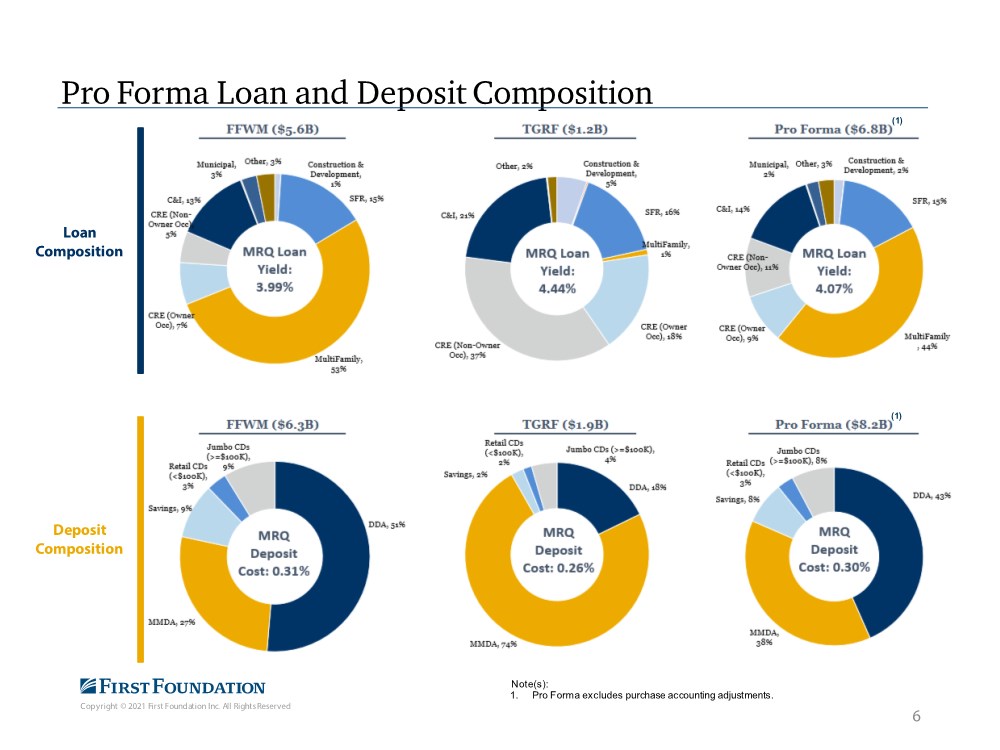

| Copyright © 2021 First Foundation Inc. All Rights Reserved Pro Forma Loan and Deposit Composition 6 Loan Composition Deposit Composition Note(s): 1. Pro Forma excludes purchase accounting adjustments. (1) (1) |

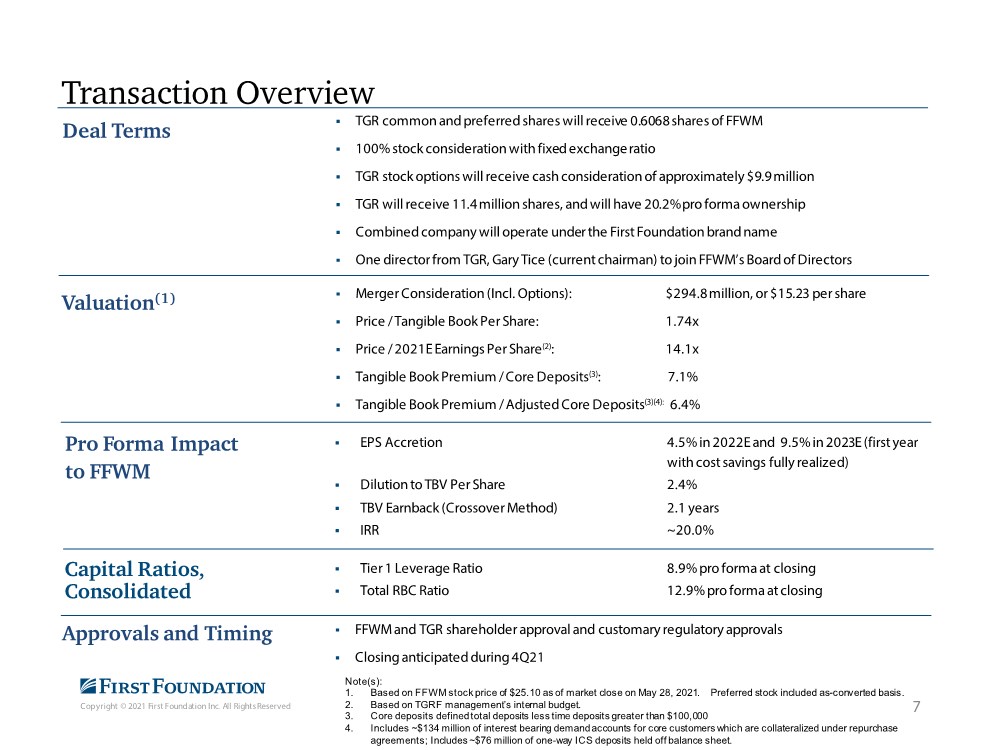

| Copyright © 2021 First Foundation Inc. All Rights Reserved Transaction Overview 7 . TGR common and preferred shares will receive 0.6068 shares of FFWM . 100% stock consideration with fixed exchange ratio . TGR stock options will receive cash consideration of approximately $9.9 million . TGR will receive 11.4 million shares, and will have 20.2% pro forma ownership . Combined company will operate under the First Foundation brand name . One director from TGR, Gary Tice (current chairman) to join FFWM’s Board of Directors Deal Terms Valuation(1) . Merger Consideration (Incl. Options): $294.8 million, or $15.23 per share . Price / Tangible Book Per Share: 1.74x . Price / 2021E Earnings Per Share(2): 14.1x . Tangible Book Premium / Core Deposits(3): 7.1% . Tangible Book Premium / Adjusted Core Deposits(3)(4): 6.4% Pro Forma Impact to FFWM . EPS Accretion 4.5% in 2022E and 9.5% in 2023E (first year with cost savings fully realized) . Dilution to TBV Per Share 2.4% . TBV Earnback (Crossover Method) 2.1 years . IRR ~20.0% Capital Ratios, Consolidated . Tier 1 Leverage Ratio 8.9% pro forma at closing . Total RBC Ratio 12.9% pro forma at closing Approvals and Timing . FFWM and TGR shareholder approval and customary regulatory approvals . Closing anticipated during 4Q21 Note(s): 1. Based on FFWM stock price of $25.10 as of market close on May 28, 2021. Preferred stock included as-converted basis. 2. Based on TGRF management’s internal budget. 3. Core deposits defined total deposits less time deposits greater than $100,000 4. Includes ~$134 million of interest bearing demand accounts for core customers which are collateralized under repurchase agreements; Includes ~$76 million of one-way ICS deposits held off balance sheet. |

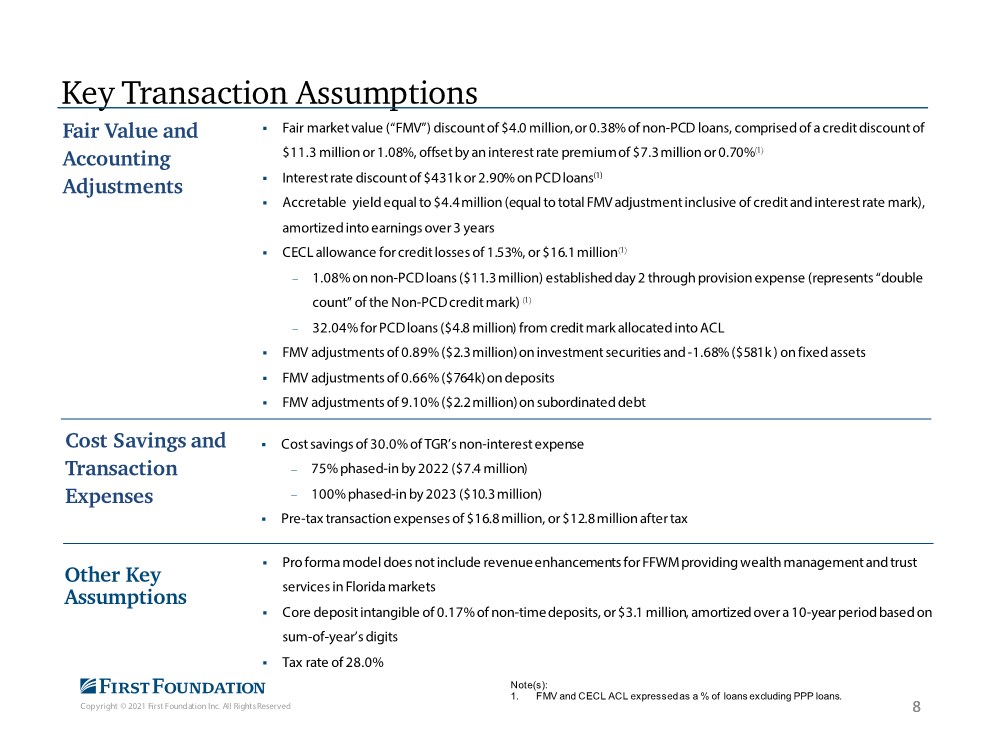

| Copyright © 2021 First Foundation Inc. All Rights Reserved Key Transaction Assumptions 8 8 Fair Value and Accounting Adjustments Cost Savings and Transaction Expenses Other Key Assumptions . Fair market value (“FMV”) discount of $4.0 million, or 0.38% of non-PCD loans, comprised of a credit discount of $11.3 million or 1.08%, offset by an interest rate premium of $7.3 million or 0.70%(1) . Interest rate discount of $431k or 2.90% on PCD loans(1) . Accretable yield equal to $4.4 million (equal to total FMV adjustment inclusive of credit and interest rate mark), amortized into earnings over 3 years . CECL allowance for credit losses of 1.53%, or $16.1 million(1) − 1.08% on non-PCD loans ($11.3 million) established day 2 through provision expense (represents “double count” of the Non-PCD credit mark) (1) − 32.04% for PCD loans ($4.8 million) from credit mark allocated into ACL . FMV adjustments of 0.89% ($2.3 million) on investment securities and -1.68% ($581k ) on fixed assets . FMV adjustments of 0.66% ($764k) on deposits . FMV adjustments of 9.10% ($2.2 million) on subordinated debt . Cost savings of 30.0% of TGR’s non-interest expense − 75% phased-in by 2022 ($7.4 million) − 100% phased-in by 2023 ($10.3 million) . Pre-tax transaction expenses of $16.8 million, or $12.8 million after tax . Pro forma model does not include revenue enhancements for FFWM providing wealth management and trust services in Florida markets . Core deposit intangible of 0.17% of non-time deposits, or $3.1 million, amortized over a 10-year period based on sum-of-year’s digits . Tax rate of 28.0% Note(s): 1. FMV and CECL ACL expressed as a % of loans excluding PPP loans. |

| Copyright © 2021 First Foundation Inc. All Rights Reserved Summary 9 . Pro forma FFWM total assets of ~$9.4 billion . Complementary combination which enhances operational scale . Florida expansion fits with strategy to identify opportunities for FFWM to leverage its expertise and product offering . Attractive core deposit funding base, which FFWM can utilize with its asset origination platform . Meaningfully accretive to EPS with a reasonable TBV earnback period |

| Copyright © 2021 First Foundation Inc. All Rights Reserved firstfoundationinc.com |