Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - TEMPUR SEALY INTERNATIONAL, INC. | a5272021tpxpressreleasemar.htm |

| EX-99.1 - EX-99.1 - TEMPUR SEALY INTERNATIONAL, INC. | a5272021tpxpressreleasedre.htm |

| EX-10.2 - EX-10.2 - TEMPUR SEALY INTERNATIONAL, INC. | a5262021ex102amendment4.htm |

| EX-10.1 - EX-10.1 - TEMPUR SEALY INTERNATIONAL, INC. | a5262021ex101sharepurchase.htm |

| 8-K/A - FORM 8-K/A MAY 27, 2021 - TEMPUR SEALY INTERNATIONAL, INC. | tpx-20210526.htm |

© 2021 Tempur Sealy International, Inc.1 Tempur Sealy International, Inc. (NYSE: TPX) Pictured above: Tempur-Pedic flagship store, 58th and Third Avenue, Manhattan, NY

© 2021 Tempur Sealy International, Inc.2 WHO WE ARE As a global leader in the design, manufacture and distribution of bedding products, we know how crucial a good night of sleep is to overall health and wellness. Utilizing over a century of knowledge and industry-leading innovation, we deliver award-winning products that provide breakthrough sleep solutions to consumers in over 100 countries. Our highly recognized brands include Tempur-Pedic®, Sealy® featuring Posturepedic® Technology, and Stearns & Foster® and our non-branded offerings include value-focused private label and OEM products. Our distinct brands allow for complementary merchandising strategies and are sold through third-party retailers, our Company-owned stores and e- commerce channels. Purpose: To Improve the Sleep of More People, Every Night, All Around the World More information about Tempur Sealy’s Corporate Social Values available at www.investor.tempursealy.com

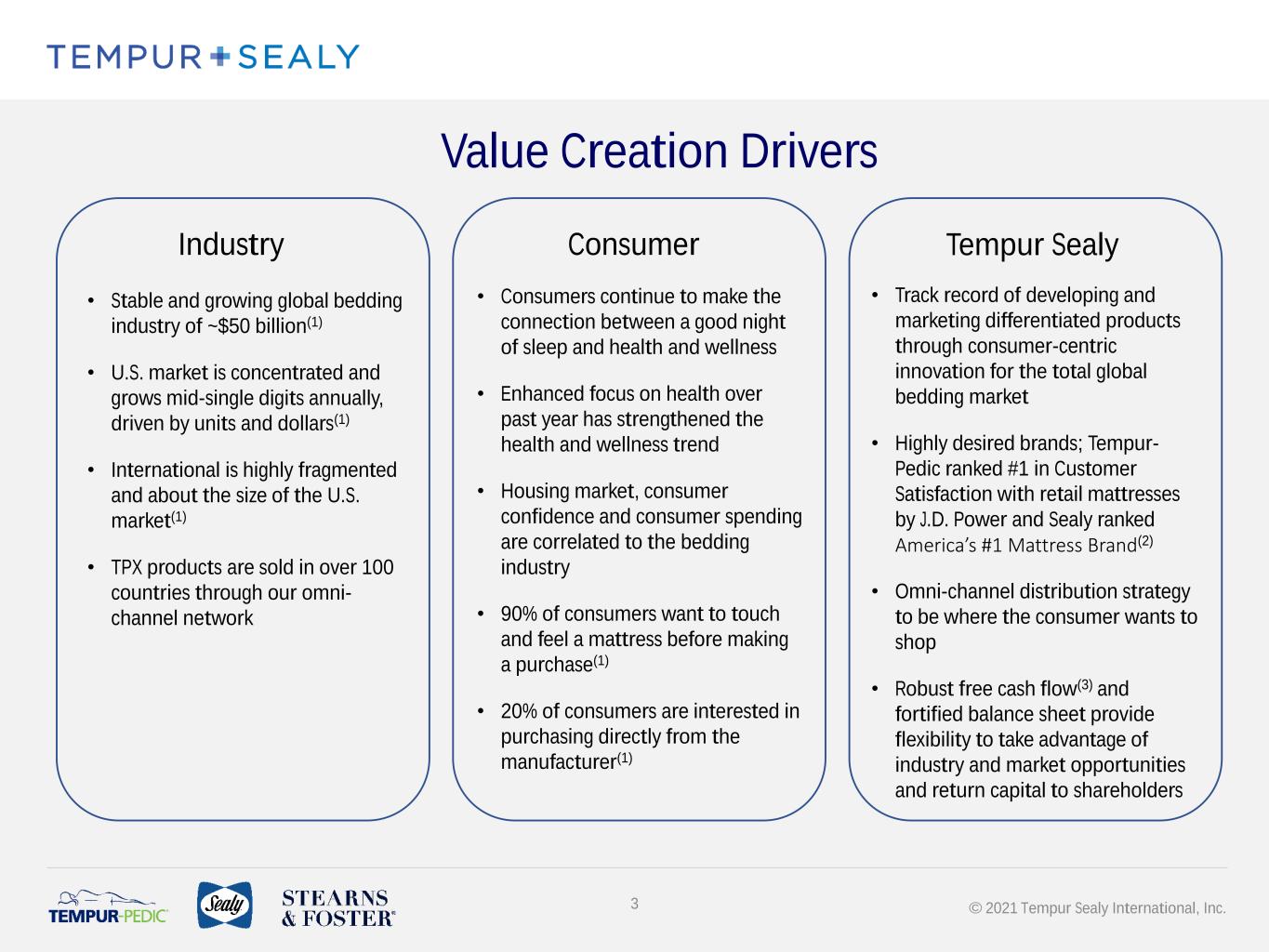

© 2021 Tempur Sealy International, Inc.3 Industry • Stable and growing global bedding industry of ~$50 billion(1) • U.S. market is concentrated and grows mid-single digits annually, driven by units and dollars(1) • International is highly fragmented and about the size of the U.S. market(1) • TPX products are sold in over 100 countries through our omni- channel network Consumer Tempur Sealy • Consumers continue to make the connection between a good night of sleep and health and wellness • Enhanced focus on health over past year has strengthened the health and wellness trend • Housing market, consumer confidence and consumer spending are correlated to the bedding industry • 90% of consumers want to touch and feel a mattress before making a purchase(1) • 20% of consumers are interested in purchasing directly from the manufacturer(1) • Track record of developing and marketing differentiated products through consumer-centric innovation for the total global bedding market • Highly desired brands; Tempur- Pedic ranked #1 in Customer Satisfaction with retail mattresses by J.D. Power and Sealy ranked America’s #1 Mattress Brand(2) • Omni-channel distribution strategy to be where the consumer wants to shop • Robust free cash flow(3) and fortified balance sheet provide flexibility to take advantage of industry and market opportunities and return capital to shareholders Value Creation Drivers

© 2021 Tempur Sealy International, Inc. o Established worldwide omni-channel presence o Iconic brand and product portfolio o World-class manufacturing capabilities o Industry-leading balance sheet and free cash flow(3) Our Position: 4 Three Months Ended March 31st 2021 2020 Reported % Change % Change Constant Currency(2) Net Sales $1,043.8 $822.4 26.9% 25.1% Net Income $130.5 $59.7 118.6% 113.9% Adjusted EBITDA (3) $230.3 $151.2 52.3% 49.7% EPS (3) $0.62 $0.28 121.4% 117.9% Adjusted EPS (3) $0.64 $0.34 88.2% 85.3% Annualized Dividend 28 cents 0 TTM Share Repurchase $445.6 $301.3 47.9% NORTH AMERICA Q1’21 INTERNATIONAL Q1’21 28% 72% 13% 87%

© 2021 Tempur Sealy International, Inc. o Targeting Q2’21 Sales Growth of approximately 60% compared to Q2’19 o Driven by growth in demand for Tempur-Pedic products in the U.S. o Consumer demand remains strong and broad-based o Further increases the Company’s backlog o Anticipates demand outlook is likely to result in some supply constraints and plant inefficiencies into the third quarter o Elected to delay a portion of the Sealy U.S. product launch to focus operations on producing current products o Acquisition of Dreams, Leading Bed Specialty Retailer in the United Kingdom(4) Current Update 5

© 2021 Tempur Sealy International, Inc. © 2021 Tempur Sealy International, Inc. 6 Worldwide Omni-Channel

© 2021 Tempur Sealy International, Inc. Powerful Omni-Distribution Platform Company Owned Stores Wholesale E-Commerce ➢ Third-party retailers are our largest distribution channel ➢ Significant OEM opportunity ➢ Significant worldwide sales growth ➢ Highly profitable and expanding rapidly ➢ Luxury Tempur-Pedic and multi-branded showroom experiences ➢ Operate 400+ stores worldwide with sales growth opportunity ➢ Highly profitable and expanding margins 7

© 2021 Tempur Sealy International, Inc. TempurPedic.com Most profitable online bedding company in the world High growth and high margins Alternative Channels (Web-based Retailers) Dedicated sales team with focus on eMarketplace sales growth High growth and stable margins Traditional Retailers Online TPX proprietary RetailEdge training providing shopper-focused solutions High growth and stable margins Compressed Bedding Products TEMPUR-Cloud® COCOON by Sealy™ Sealy Posturepedic ® Foam DIRECT TO CONSUMER WHOLESALE OMNI- CHANNEL CHANNEL WHOLESALE 8 Traditional Bedding Products Tempur-Pedic® Stearns & Foster® Sealy® Success Online Through Our Wholesale and Direct Channels

© 2021 Tempur Sealy International, Inc.9 Wholesale • Strong worldwide distribution and broadly diversified • Over 5,400 retail partners around the world selling through over 25,000 doors and their e-commerce platforms • Global TPX sales force of over 500 people supporting our portfolio of brands Third-Party Retailers U.S. New OEM Opportunity • OEM is about 20% of the U.S. market and growing,(1) supported by recent U.S. anti-dumping actions • Leverages manufacturing expertise, diversifies consolidated sales stream and captures manufacturing profits from bedding brands beyond our own • Plan to invest an incremental $150 million by 2023 to increase U.S. pouring capacity for Tempur material, specialty and base foam by approximately 50% • ~$150 million of OEM sales in 2020; targeting the run rate to exceed $600 million of annual sales in 5 years(1)

© 2021 Tempur Sealy International, Inc. $- $20 $40 $60 $80 $100 $120 $140 $160 $180 Q1 2019 Q1 2020 Q1 2021 Global Direct Sales Intl NA Direct to Consumer • High growth and high margin sales from web, call center, and company-owned stores • Strong growth within the direct channel, growing 62% in the first quarter of 2021 Q1 global direct channel sales grew 117% over 2 years 10

© 2021 Tempur Sealy International, Inc. Sleep Outfitters® U.S. 11 Company-Owned Store Strategy TEMPUR® Europe Tempur-Pedic® U.S. SOVA® SwedenSealy Gallery Asia Tempur-Pedic® Mexico Operating over 400 retail stores globally

© 2021 Tempur Sealy International, Inc. International Markets 12 • Highly fragmented with broad geographic diversity across Europe and Asia • Developing new TEMPUR® line of mattresses to expand addressable market in 2022 • Tempur Sealy customizes go to market approach by country • Europe – success with high quality products, targeting share growth through distribution and innovation • Asia – share opportunity in emerging market, targeting aggressive share growth through distribution and innovation Global Bedding Market(1) International North America $50 Billion Retail Value Estimated Tempur Sealy Share* *Before acquisition of Dreams

© 2021 Tempur Sealy International, Inc. 13 Product Brands Mattresses / Pillows / Accessories Retailer Brands Online / Offline Manufacturing Branded / OEM Family of Brands and Capabilities (4)

© 2021 Tempur Sealy International, Inc. © 2021 Tempur Sealy International, Inc. 14 Dreams Acquisition(4)

© 2021 Tempur Sealy International, Inc.15 Leading Specialty Bed Retailer in the UK • Successful multi-channel sales strategy • Operates over 200 brick and mortar retail locations, an industry-leading online channel, as well as manufacturing and delivery assets More About Dreams • Markets served: United Kingdom • Addressable market: Complete bedroom • Product assortment: Mattresses, bed frames, divan bases and bedroom furniture • Operating footprint: retail locations, online channel, mattress production plant, logistics operations Dreams Sales Mix by Product Mattress 60% All Other 40% About Dreams

© 2021 Tempur Sealy International, Inc.16 Combines Tempur Sealy Global Leadership with UK’s Leading Specialist Bed Retailer • Diversifies global sales and creates leading position in the UK • Vertical integration expected to create meaningful synergies • Expands retail competency and online capabilities • Establishes wholly owned UK manufacturing and distribution assets • Complements existing Tempur UK operations and its recently formed Sealy UK joint venture operations Strategic Rationale "Dreams has created a strong retailer brand and business model, known for its outstanding products and customer service. We have worked with Dreams for many years and they are one of the most talented retailers we service.” –Scott Thompson, CEO

© 2021 Tempur Sealy International, Inc.17 Consideration & Closing • The transaction price is approximately $475 million, less net debt and any working capital deficit • The transaction is expected to close in the third quarter of 2021, subject to receipt of regulatory approval from the UK Financial Conduct Authority Financial Profile Post-Acquisition(1) • Dreams expected to generate approximately $450 million annualized sales • Acquisition nearly doubles international sales compared to 2020 • Worldwide direct to consumer sales expected to reach over $1 billion • EPS accretion of approximately 20 cents in the first year before synergies Financing • The transaction will be financed through a combination of cash on hand and bank borrowings • The Company’s pro forma leverage is expected to be about 2 times adjusted EBITDA (1)(2) TPX Sales Geographic Mix Increased Sales Diversification HistoricWith Dreams North America ~86% North America ~80% Terms and Transaction Summary International 14% International +20%

© 2021 Tempur Sealy International, Inc. Thank you for your interest in Tempur Sealy International For more information please email: investor.relations@tempursealy.com 18

© 2021 Tempur Sealy International, Inc. Appendix © 2021 Tempur Sealy International, Inc. 19

© 2021 Tempur Sealy International, Inc. This investor presentation contains statements relating to the Company's quarterly cash dividend, the Company's share repurchase targets, the Company's expectations regarding net sales for 2021, adjusted EBITDA for 2021, and adjusted EPS for 2021 and subsequent periods and the Company's expectations for increasing sales growth, product launches, channel growth, acquisitions and commodities outlook and statements relating to the Company's acquisition of Dreams and the Company's expectations regarding future performance, EPS, cost synergies, integration with our business, personnel and the impact of the anticipated acquisition on the Company's brands, products, customer base, results of operations or financial position. Any forward-looking statements contained herein are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations, meet its guidance, or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company's control, could cause actual results to differ materially from any that may be expressed herein as forward-looking statements. These risk factors include risks associated with Dreams’ ongoing operations; the possibility that the acquisition will not occur; the possibility that the expected benefits of the acquisition are not realized when expected or at all; general economic, financial and industry conditions, particularly conditions relating to the financial performance and related credit issues present in the retail sector, as well as consumer confidence and the availability of consumer financing; the impact of the macroeconomic environment in both the U.S. and internationally on Dreams and the Company; uncertainties arising from national and global events; industry competition; the effects of consolidation of retailers on revenues and costs; and consumer acceptance and changes in demand for Dreams’ and the Company's products. Other potential risk factors include the risk factors discussed under the heading "Risk Factors" under ITEM 1A of Part 1 of the Company's Annual Report on Form 10-K for the year ended December 31, 2020. There may be other factors that may cause the Company's actual results to differ materially from the forward-looking statements. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Note Regarding Historical Financial Information: In this investor presentation we provide or refer to certain historical information for the Company. For a more detailed discussion of the Company’s financial performance, please refer to the Company’s SEC filings. Note Regarding Trademarks, Trade Names and Service Marks: TEMPUR®, Tempur-Pedic®, the TEMPUR-PEDIC & Reclining Figure Design®, TEMPUR-Adapt®, TEMPUR-ProAdapt®, TEMPUR-LuxeAdapt®, TEMPUR-PRObreeze™, TEMPUR-LUXEbreeze™, TEMPUR-Cloud®, TEMPUR- Contour™, TEMPUR-Rhapsody™, TEMPUR-Flex®, THE GRANDBED BY TEMPUR-PEDIC®, TEMPUR-Ergo®, TEMPUR-UP™, TEMPUR-Neck™, TEMPUR-Symphony™, TEMPUR-Comfort™, TEMPUR-Traditional™, TEMPUR- Home™, SEALY®, SEALY POSTUREPEDIC®, STEARNS & FOSTER®, COCOON by Sealy™, SealyChill™ and Clean Shop Promise™ are trademarks, trade names or service marks of Tempur Sealy International, Inc. and/or its subsidiaries. All other trademarks, trade names and service marks in this presentation are the property of the respective owners. Limitations on Guidance: The guidance included herein is from the Company’s press release and related earnings call on April 29, 2021. The Company is neither reconfirming this guidance as of the date of this investor presentation nor assuming any obligation to update or revise such guidance. See above. Forward-Looking Statements 20

© 2021 Tempur Sealy International, Inc. Use of Non-GAAP Financial Measures and Constant Currency Information In this investor presentation and certain of its press releases and SEC filings, the Company provides information regarding adjusted net income, adjusted EPS, EBITDA, adjusted EBITDA per credit facility, free cash flow, consolidated indebtedness less netted cash, and leverage which are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”) and do not purport to be alternatives to net income and earnings per share as a measure of operating performance, an alternative to cash provided by operating activities as a measure of liquidity, or an alternative to total debt. The Company believes these non-GAAP measures provide investors with performance measures that better reflect the Company's underlying operations and trends, including trends in changes in margin and operating expenses, providing a perspective not immediately apparent from net income and operating income. The adjustments management makes to derive the non-GAAP measures include adjustments to exclude items that may cause short-term fluctuations in the nearest GAAP measure, but which management does not consider to be the fundamental attributes or primary drivers of the Company's business. The Company believes that exclusion of these items assists in providing a more complete understanding of the Company's underlying results from continuing operations and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company's business, to evaluate its consolidated and business segment performance compared to prior periods and the marketplace, to establish operational goals and management incentive goals, and to provide continuity to investors for comparability purposes. Limitations associated with the use of these non-GAAP measures include that these measures do not present all of the amounts associated with the Company’s results as determined in accordance with GAAP. These non-GAAP measures should be considered supplemental in nature and should not be construed as more significant than comparable measures defined by GAAP. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies. For more information regarding the use of these non-GAAP financial measures, please refer to the reconciliations on the following pages and the Company’s SEC filings. Constant Currency Information In this presentation the Company refers to, and in other communications with investors the Company may refer to, net sales or earnings or other historical financial information on a "constant currency basis," which is a non-GAAP financial measure. These references to constant currency basis do not include operational impacts that could result from fluctuations in foreign currency rates. To provide information on a constant currency basis, the applicable financial results are adjusted based on a simple mathematical model that translates current period results in local currency using the comparable prior corresponding period's currency conversion rate. This approach is used for countries where the functional currency is the local country currency. This information is provided so that certain financial results can be viewed without the impact of fluctuations in foreign currency rates, thereby facilitating period-to-period comparisons of business performance. EBITDA and Adjusted EBITDA per Credit Facility A reconciliation of the Company's GAAP net income to EBITDA and adjusted EBITDA as defined in the credit agreement (which we refer to in this investor presentation as adjusted EBITDA) is provided on the subsequent slides. Management believes that the use of EBITDA and adjusted EBITDA per credit facility provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period as well as the Company’s compliance with requirements under its credit agreement. Adjusted Net Income A reconciliation of the Company's GAAP net income to adjusted net income and a calculation of adjusted EPS are provided on subsequent slides. Management believes that the use of adjusted net income and adjusted EPS also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period. Leverage Consolidated indebtedness less netted cash to adjusted EBITDA per credit facility, which the Company may refer to as leverage, is provided on a subsequent slide and is calculated by dividing consolidated indebtedness less netted cash, as defined by the Company’s senior secured credit facility, by adjusted EBITDA per credit facility. The Company provides this as supplemental information to investors regarding the Company’s operating performance and comparisons from period to period, as well as general information about the Company's progress in reducing its leverage. Free Cash Flow The Company defines free cash flow as net cash provided by operating activities less purchases of property, plant and equipment. Management believes that free cash flow may be useful for investors in assessing the Company’s operating performance, ability to generate cash and ability to fund the Company’s capital expenditures and meet the Company’s debt service requirements. 21

© 2021 Tempur Sealy International, Inc. Adjusted EBITDA Reconciliation © 2021 Tempur Sealy International, Inc. 22

© 2021 Tempur Sealy International, Inc. Adjusted Net Income and Adjusted EPS 23

© 2021 Tempur Sealy International, Inc. Free Cash Flow and Free Cash Flow / Adjusted EBITDA Reconciliation 24 *For a reconciliation of adjusted EBITDA per credit facility to net income for reporting periods in the years 2016-2021, please refer to the Company’s SEC filings.

© 2021 Tempur Sealy International, Inc. Footnotes 1. Management estimates 2. Sealy was ranked number one on Furniture Today's list of the Top 20 U.S. Bedding Producers in June 2020. See Furniture Today's Top 20 U.S. Bedding Producers methodology that includes SEALY® and STEARNS & FOSTER® products in Sealy ranking. 3. Adjusted Net Income, EBITDA, adjusted EBITDA per credit facility, adjusted EPS, leverage, free cash flow and constant currency are non-GAAP financial measures. Please refer to the "Use of Non-GAAP Financial Measures and Constant Currency Information" on a previous slide for more information regarding the definitions of adjusted Net Income, EBITDA, adjusted EBITDA per credit facility, adjusted EPS, leverage, free cash flow and constant currency, including the adjustments (as applicable) from the corresponding GAAP information. Please refer to “Forward-Looking Statements” and “Limitations on Guidance” on a previous slide. 4. The transaction is expected to close in the third quarter of 2021, subject to receipt of regulatory approval from the UK Financial Conduct Authority. 25