Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STAAR SURGICAL CO | staa-8k_20210526.htm |

STAAR Surgical Company Investor presentation May 2021 Exhibit 99.1

Forward Looking Statements All statements that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections (including sales), plans, strategies, and objectives of management for 2021 or prospects for achieving such plans, expectations for sales, revenue, margin, expenses or earnings, the expected impact of the COVID-19 pandemic and related public health measures (including but not limited to its impact on sales, operations or clinical trials globally), product safety or effectiveness, the status of our pipeline of ICL products with regulators, including our EVO family of lenses in the U.S., and any statements of assumptions underlying any of the foregoing, including those relating to our product pipeline and market expansion activities. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to the COVID-19 pandemic and related public health measures, as well as the factors set forth in the Company’s Annual Report on Form 10-K for the year ended January 1, 2021 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this press release and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the impact of the COVID-19 pandemic on markets; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. The EVO version of our ICL lens is not yet approved for sale in the United States. 2

Investment Opportunity The Future of Refractive Surgery is Lens-Based... The Time for STAAR is Now 3

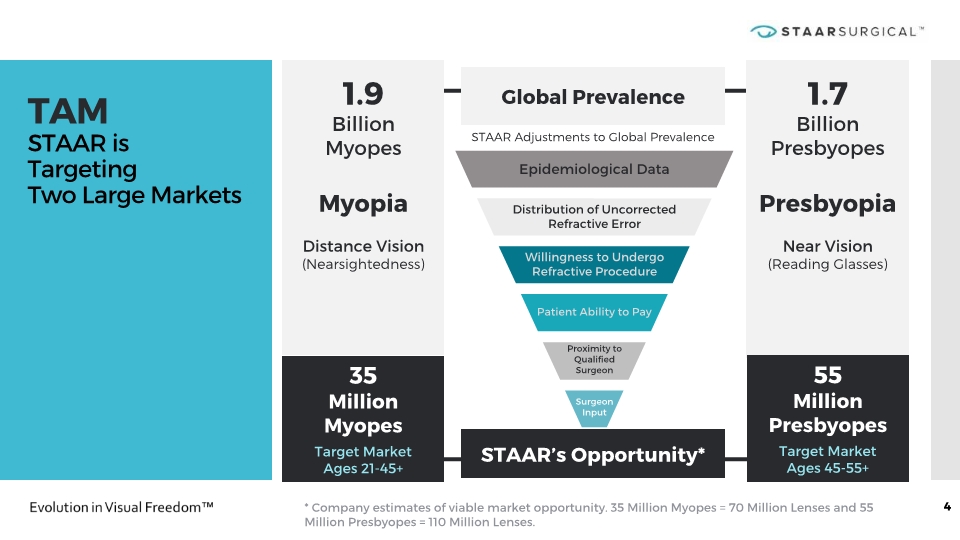

TAM STAAR is Targeting Two Large Markets 4 1.9 Billion Myopes Myopia Distance Vision (Nearsightedness) 1.7 Billion Presbyopes Presbyopia Near Vision (Reading Glasses) * Company estimates of viable market opportunity. 35 Million Myopes = 70 Million Lenses and 55 Million Presbyopes = 110 Million Lenses. Global Prevalence STAAR’s Opportunity* 35 Million Myopes Target Market Ages 21-45+ 55 Million Presbyopes Target Market Ages 45-55+ STAAR Adjustments to Global Prevalence

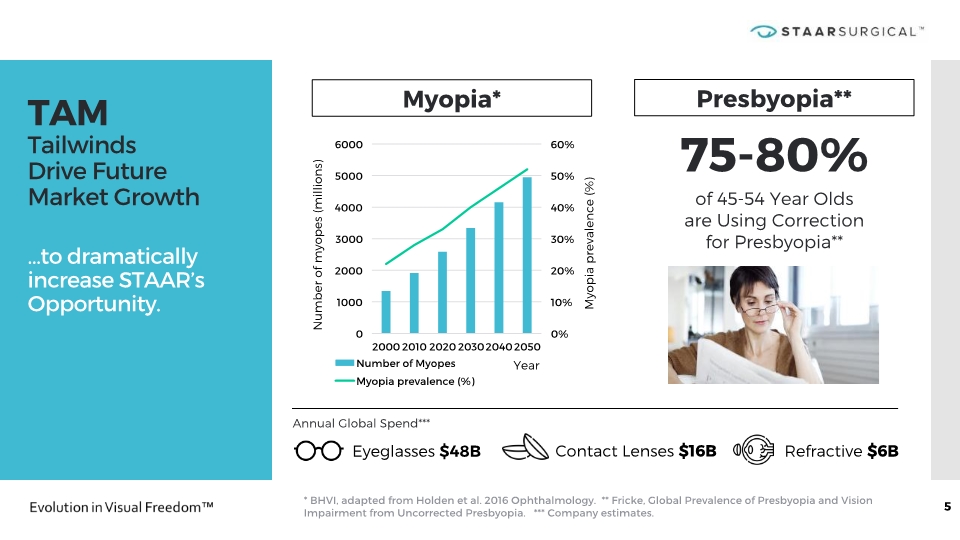

TAM Tailwinds Drive Future Market Growth …to dramatically increase STAAR’s Opportunity. * BHVI, adapted from Holden et al. 2016 Ophthalmology. ** Fricke, Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia. *** Company estimates. 5 Number of myopes (millions) Myopia* Myopia prevalence (%) Year 75-80% of 45-54 Year Olds are Using Correction for Presbyopia** Presbyopia** Eyeglasses $48B Contact Lenses $16B Refractive $6B Annual Global Spend***

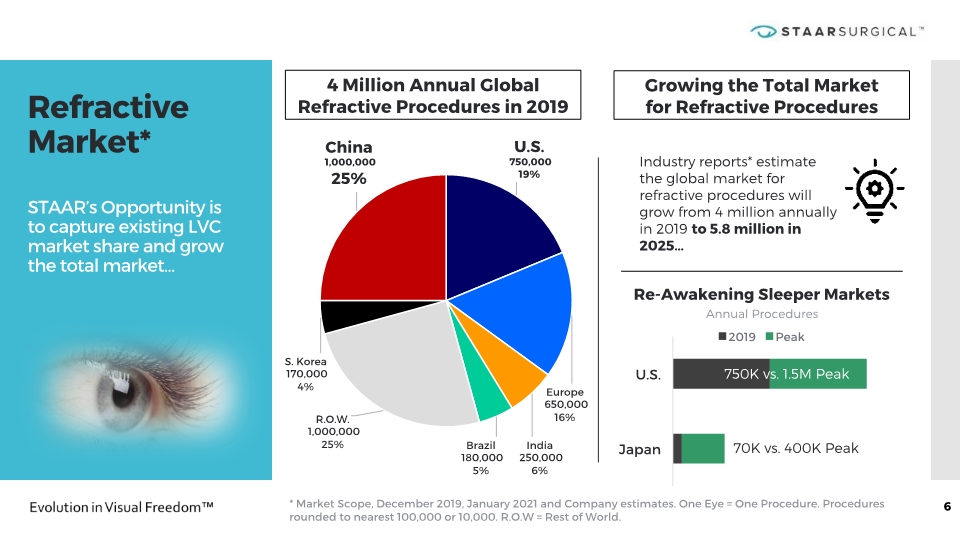

Refractive Market* STAAR’s Opportunity is to capture existing LVC market share and grow the total market… 6 * Market Scope, December 2019, January 2021 and Company estimates. One Eye = One Procedure. Procedures rounded to nearest 100,000 or 10,000. R.O.W = Rest of World. 4 Million Annual Global Refractive Procedures in 2019 Industry reports* estimate the global market for refractive procedures will grow from 4 million annually in 2019 to 5.8 million in 2025… Re-Awakening Sleeper Markets Annual Procedures 750K vs. 1.5M Peak 70K vs. 400K Peak Growing the Total Market for Refractive Procedures

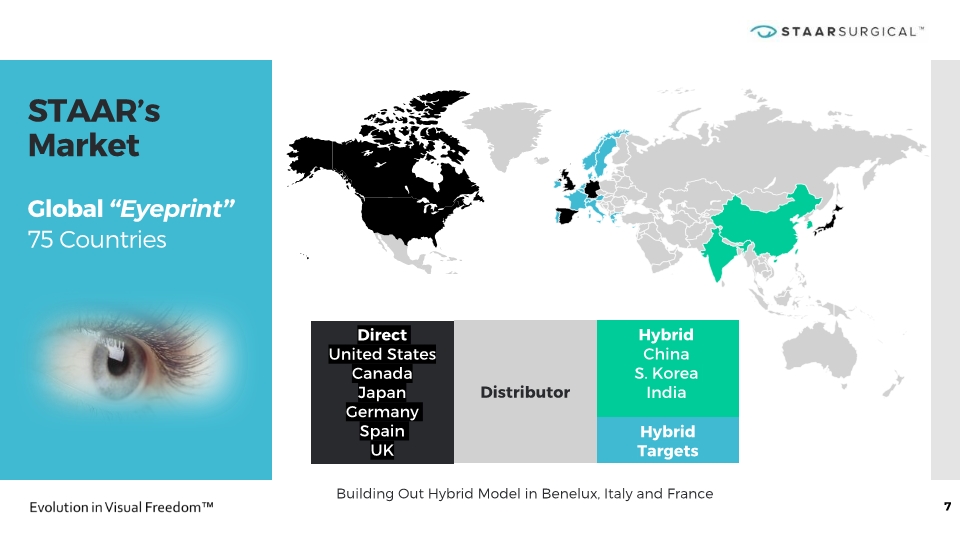

STAAR’s Market Global “Eyeprint” 75 Countries 7 Hybrid China S. Korea India Direct United States Canada Japan Germany Spain UK Distributor Hybrid Targets Building Out Hybrid Model in Benelux, Italy and France

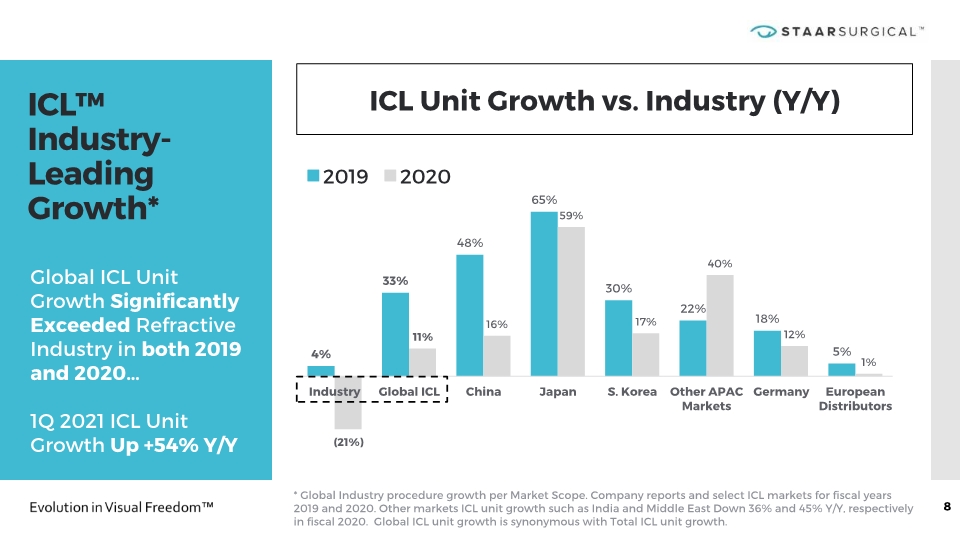

ICL™ Industry-Leading Growth* 8 ICL Unit Growth vs. Industry (Y/Y) Global ICL Unit Growth Significantly Exceeded Refractive Industry in both 2019 and 2020… 1Q 2021 ICL Unit Growth Up +54% Y/Y * Global Industry procedure growth per Market Scope. Company reports and select ICL markets for fiscal years 2019 and 2020. Other markets ICL unit growth such as India and Middle East Down 36% and 45% Y/Y, respectively in fiscal 2020. Global ICL unit growth is synonymous with Total ICL unit growth.

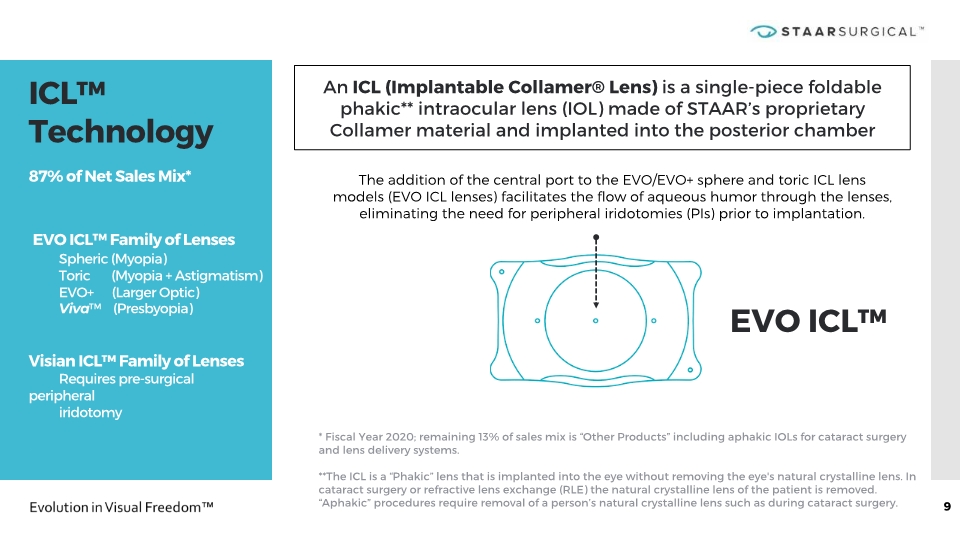

ICL™ Technology x 87% of Net Sales Mix* EVO ICL™ Family of Lenses Spheric (Myopia) Toric (Myopia + Astigmatism) EVO+ (Larger Optic) Viva™ (Presbyopia) Visian ICL™ Family of Lenses Requires pre-surgical peripheral iridotomy x 9 The addition of the central port to the EVO/EVO+ sphere and toric ICL lens models (EVO ICL lenses) facilitates the flow of aqueous humor through the lenses, eliminating the need for peripheral iridotomies (PIs) prior to implantation. EVO ICL™ * Fiscal Year 2020; remaining 13% of sales mix is “Other Products” including aphakic IOLs for cataract surgery and lens delivery systems. **The ICL is a “Phakic” lens that is implanted into the eye without removing the eye's natural crystalline lens. In cataract surgery or refractive lens exchange (RLE) the natural crystalline lens of the patient is removed. “Aphakic” procedures require removal of a person’s natural crystalline lens such as during cataract surgery. An ICL (Implantable Collamer® Lens) is a single-piece foldable phakic** intraocular lens (IOL) made of STAAR’s proprietary Collamer material and implanted into the posterior chamber

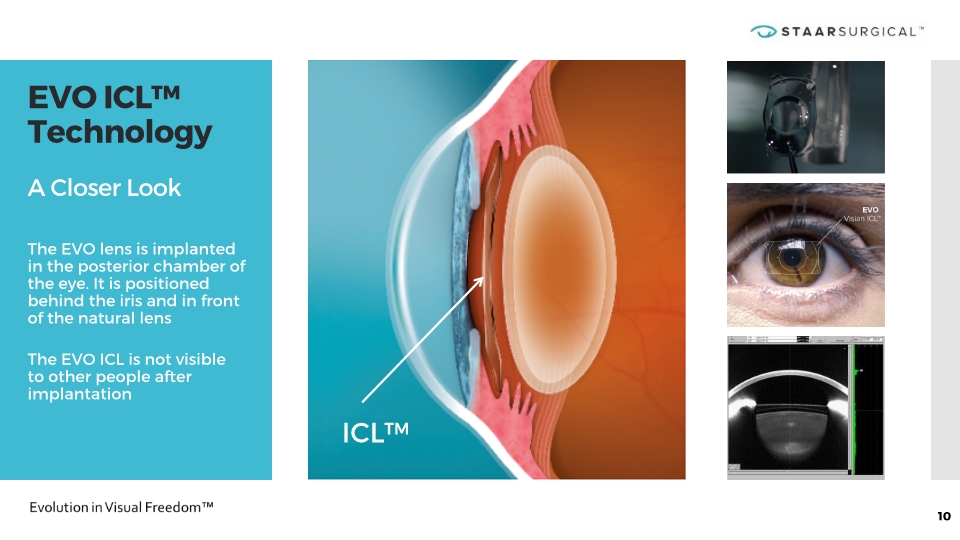

EVO ICL™ Technology A Closer Look The EVO lens is implanted in the posterior chamber of the eye. It is positioned behind the iris and in front of the natural lens The EVO ICL is not visible to other people after implantation 10 ICL™

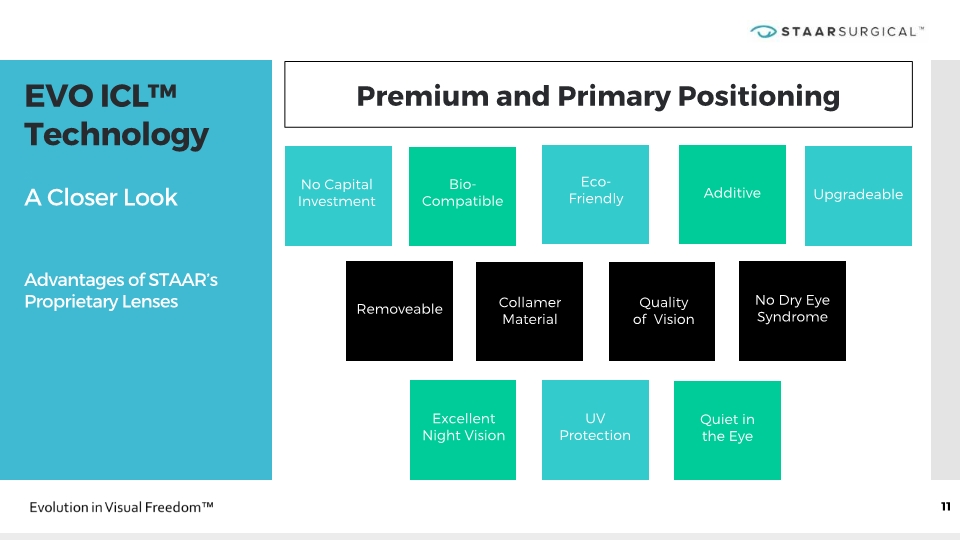

Premium and Primary Positioning EVO ICL™ Technology x x A Closer Look Advantages of STAAR’s Proprietary Lenses 11

99.4% of Patients 12 Would Elect STAAR’s EVO Implantable Collamer® Lens Again* Over 1 Million ICLs Implanted Globally * EVO ICL Patient Registry data on file.

What’s Going On in Active Markets Globally…

China What’s Going On… 14 Continuing Momentum and Market Share Gains in #1 Market Globally Myopia widespread among Chinese population, and particularly teenagers* First large market to adopt a model of strategic cooperation in 2016 “Primary”, “Premium” and “High Definition” messages used to position and promote EVO ICL family of lenses by STAAR and our surgeon partners “Hybrid” business model, which has 50+ STAAR employees on the ground in country working in concert with importer, hospitals and clinic customers Patient roadshows, in-person and virtually on social media such as WeChat, integral to demand cycle Tens of Thousands of EVO ICL procedures June, July, August in China Peak Season Greater EVO ICL awareness further fuels market momentum EVO ICL share of the refractive market has grown from approximately 2% of procedures in 2015 to more than 20% market share in 2020 * A Research Report on the Vision Health of Chinese People, China Health Development Research Center, Peking University, June 12, 2015.

United States What’s Going On… Increased surgeon engagement with Inaugural Surgeons Council Meeting August 2019 and Refractive Restart, Refractive Rethink and Refractive Relook programs began in 2020 to support surgeon partners, practices and patients Signed dozens of Strategic Agreements with potential future EVO luminary sites Introducing high quality and effective Consumer Marketing to raise ICL awareness GTM Strategy which includes bolstering sales infrastructure in key U.S. markets STRATEGIC IMPERATIVE Approval & Commercialization of EVO ICL™ in the U.S. (Expected 2H21) Commenced clinical trial in January 2020 with first of 333 participants implanted Submitted to FDA for marketing approval in late April 2021 EVO in U.S. will remove surgeon barrier to ICL utilization, e.g., less complexity (no preoperative peripheral iridotomies), fewer patient visits, greater surgeon efficiency EVO will more fully open the #2 market in the world, where the Company currently has approximately 1% market share with an earlier lens technology, to STAAR’s ‘game-changing’ EVO family of lenses 15 Laying Groundwork for STAAR’s Success in #2 Market Globally Consumer Marketing: St. Louis Billboard

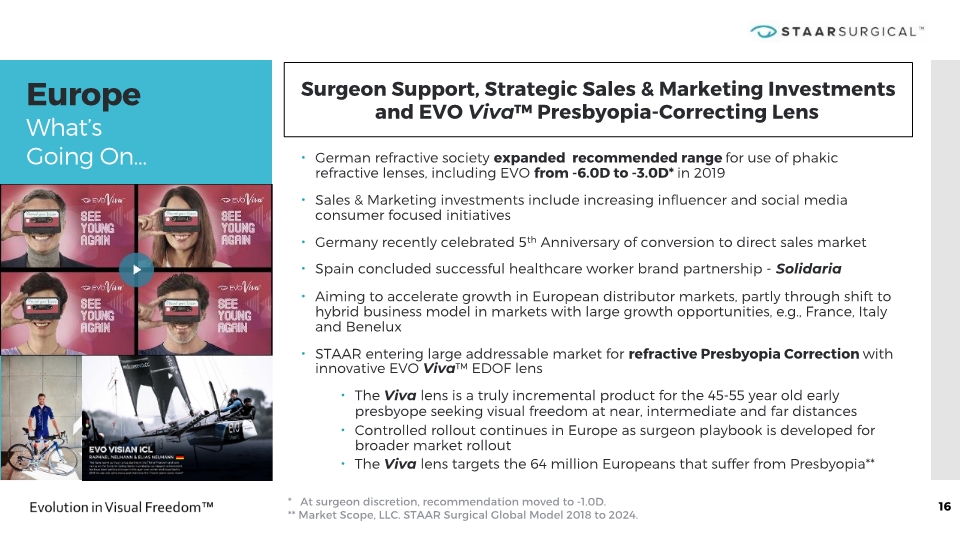

German refractive society expanded recommended range for use of phakic refractive lenses, including EVO from -6.0D to -3.0D* in 2019 Sales & Marketing investments include increasing influencer and social media consumer focused initiatives Germany recently celebrated 5th Anniversary of conversion to direct sales market Spain concluded successful healthcare worker brand partnership - Solidaria Aiming to accelerate growth in European distributor markets, partly through shift to hybrid business model in markets with large growth opportunities, e.g., France, Italy and Benelux STAAR entering large addressable market for refractive Presbyopia Correction with innovative EVO Viva™ EDOF lens The Viva lens is a truly incremental product for the 45-55 year old early presbyope seeking visual freedom at near, intermediate and far distances Controlled rollout continues in Europe as surgeon playbook is developed for broader market rollout The Viva lens targets the 64 million Europeans that suffer from Presbyopia** 16 Europe What’s Going On… Surgeon Support, Strategic Sales & Marketing Investments and EVO Viva™ Presbyopia-Correcting Lens * At surgeon discretion, recommendation moved to -1.0D. ** Market Scope, LLC. STAAR Surgical Global Model 2018 to 2024.

Impactful Consumer Marketing is Driving Increasing ICL Awareness, Doctor Finder Visits and Patients to Surgeons 17 Global Consumer Marketing What’s Going On… +98% Y/Y Increase in FY 2020 Doc Finder Visits

STAAR’s Proven Track Record of Operating and Financial Execution…

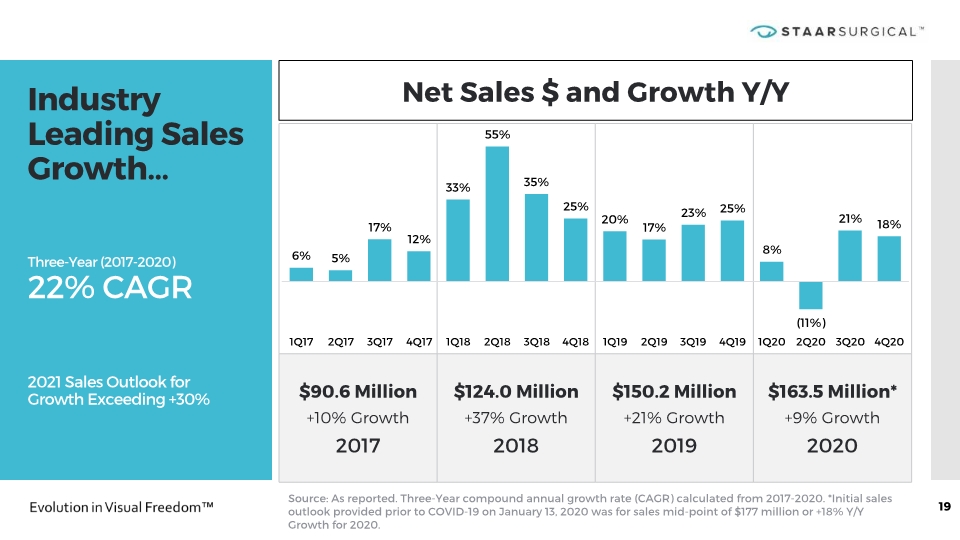

Industry Leading Sales Growth… Three-Year (2017-2020) 22% CAGR 2021 Sales Outlook for Growth Exceeding +30% 19 Net Sales $ and Growth Y/Y Source: As reported. Three-Year compound annual growth rate (CAGR) calculated from 2017-2020. *Initial sales outlook provided prior to COVID-19 on January 13, 2020 was for sales mid-point of $177 million or +18% Y/Y Growth for 2020.

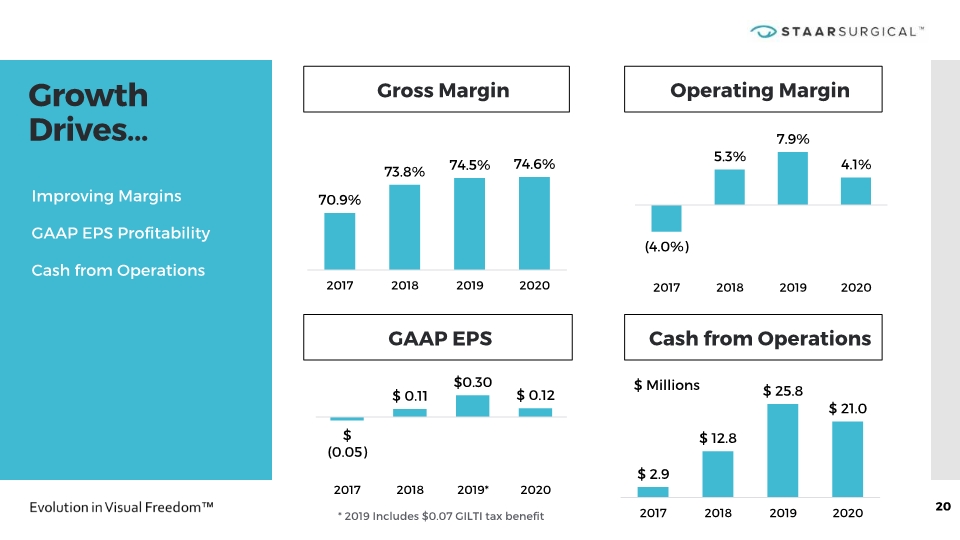

Growth Drives… 20 Gross Margin GAAP EPS * 2019 Includes $0.07 GILTI tax benefit Improving Margins GAAP EPS Profitability Cash from Operations Operating Margin Cash from Operations

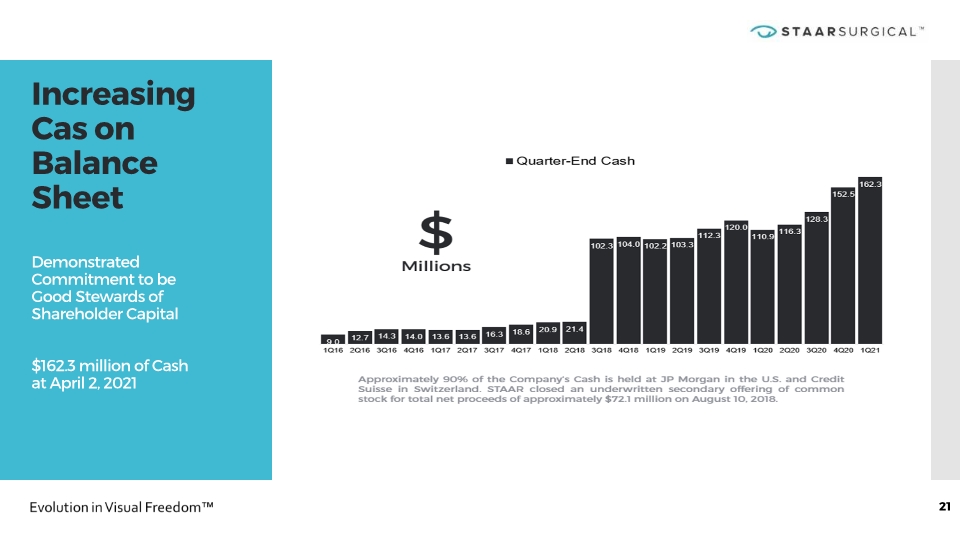

21 Increasing Cas on Balance Sheet Demonstrated Commitment to be Good Stewards of Shareholder Capital $162.3 million of Cash at April 2, 2021 21 Increasing Cash on Balance Sheet Demonstrated Commitment to be Good Stewards of Shareholder Capital $162.3 million of Cash at April 2, 2021 Approximately 90% of the Company’s Cash is held at JP Morgan in the U.S. and Credit Suisse in Switzerland. STAAR closed an underwritten secondary offering of common stock for total net proceeds of approximately $72.1 million on August 10, 2018. $ Millions Quarter-End Cash Graph

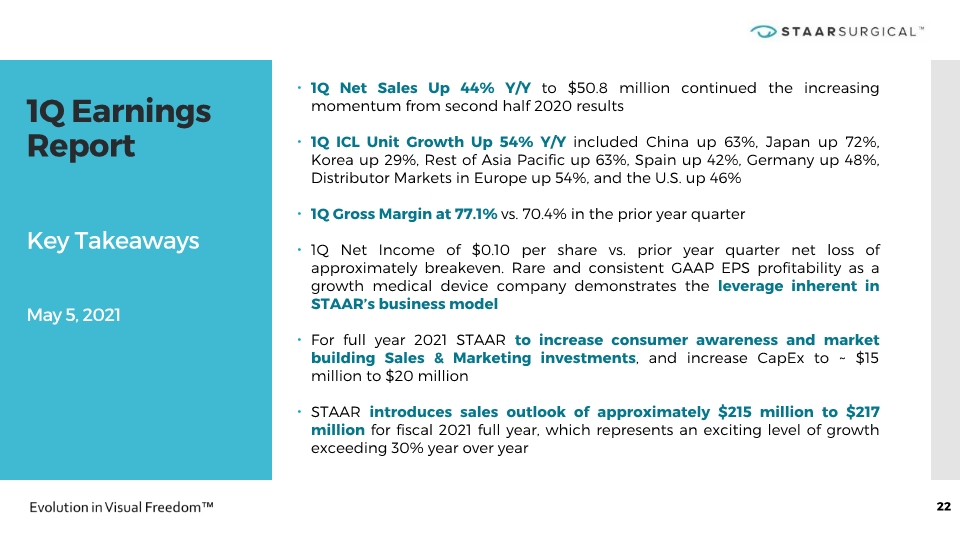

1Q Earnings Report Key Takeaways May 5, 2021 1Q Net Sales Up 44% Y/Y to $50.8 million continued the increasing momentum from second half 2020 results 1Q ICL Unit Growth Up 54% Y/Y included China up 63%, Japan up 72%, Korea up 29%, Rest of Asia Pacific up 63%, Spain up 42%, Germany up 48%, Distributor Markets in Europe up 54%, and the U.S. up 46% 1Q Gross Margin at 77.1% vs. 70.4% in the prior year quarter 1Q Net Income of $0.10 per share vs. prior year quarter net loss of approximately breakeven. Rare and consistent GAAP EPS profitability as a growth medical device company demonstrates the leverage inherent in STAAR’s business model For full year 2021 STAAR to increase consumer awareness and market building Sales & Marketing investments, and increase CapEx to ~ $15 million to $20 million STAAR introduces sales outlook of approximately $215 million to $217 million for fiscal 2021 full year, which represents an exciting level of growth exceeding 30% year over year 22

STAAR’s Vision 2020-2022 Strategic Imperatives Position EVO Implantable Lenses as a Special and Transformational Pathway to Visual Freedom… Promote Exceptional Desirability to Win Consumer Choice and Social Media Enthusiasm Support the Transformation of the Refractive Surgery Paradigm through Clinical Validation and Medical Affairs Excellence thereby Achieving Surgeon Commitment Innovate and Develop a Pipeline of Next Generation Premium Collamer-Based Intraocular Lenses… Monofocal, Presbyopic and Accommodating Deliver Foundations 2022: Assure World Class Supply Integrity and Delivery Performance while Driving Gross Margin Above 80% Continue our Focus on and Commitment to STAAR’s Culture of Quality Delight Shareholders! 23 We have a Passionate Commitment to Deliver Visual Freedom to Patients for an Active and Fulfilling Life Independent of Contact Lenses and Glasses…

The Future of Refractive Surgery is Lens-Based. The Time for STAAR is Now! We invite you to visit STAAR’s investor website for clinical papers, examples of global consumer marketing and much more at investors.staar.com www.staar.com www.discoverevo.com