Attached files

| file | filename |

|---|---|

| 8-K - CHOICE ONE FORM 8-K - CHOICEONE FINANCIAL SERVICES INC | choice8k_052721.htm |

EXHIBIT 99.1

| |

This presentation contains forward - looking statements that are based on management’s beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy, and ChoiceOne . Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,” “may,” “could,” “look forward,” “continue”, “future”, and variations of such words and similar expressions are intended to identify such forward - looking statements . Examples of forward - looking statements also include, but are not limited to, statements related to risks and uncertainties related to, and the impact of, the global coronavirus (COVID - 19 ) pandemic on the businesses, financial condition and results of operations of ChoiceOne and its customers and statements regarding the outlook and expectations of ChoiceOne and its customers . The COVID - 19 pandemic is adversely affecting ChoiceOne and its customers, counterparties, employees, and third - party service providers . The ultimate extent of the impacts on ChoiceOne's business, financial position, results of operations, liquidity, and prospects is uncertain . All statements with references to future time periods are forward - looking . These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence . Therefore, actual results and outcomes may materially differ from what may be expressed, implied or forecasted in such forward - looking statements . Furthermore, ChoiceOne undertakes no obligation to update, amend, or clarify forward - looking statements, whether as a result of new information, future events, or otherwise . Additional risk factors include, but are not limited to, the risk factors described in Item 1 A in ChoiceOne’s Annual Report on Form 10 - K for the year ended December 31 , 2020 . forward - looking statements

| |

HISTORY • Grew organically and through acquisitions to a $2.1 billion bank holding company through March 31, 2021. • Merged with County Bank Corp ($673 million in assets) effective October 1, 2019. • Merged with Community Shores Bank Corporation ($245 million in assets) effective July 1, 2020. TODAY • ChoiceOne Financial Services is a $2.1 billion bank holding company headquartered in Sparta, Michigan. • Listed on NASDAQ® stock exchange in first quarter of 2020. • Lakestone Bank successfully merged with and into ChoiceOne Bank in the second quarter of 2020. • Community Shores Bank successfully merged with and into ChoiceOne Bank in the fourth quarter of 2020. • Maintain community feel of a small - town bank with technological capabilities of a larger bank.

| |

bank footprint ChoiceOne Bank Legacy Lakestone Offices Legacy Community Shores Offices Company Highlights 34 office locations including a Wealth Management office, Macomb loan office and Port Huron loan office, across West and Southeast Michigan. Merger in 2020 with Community Shores Bank Corporation ($245 million in assets). Merger in 2019 with County Bank Corp. ($673 million in assets).

| |

Our mission is to provide superior service, quality advice, and show utmost respect to everyone we meet. Our vision is to be the best bank in Michigan.

board of directors *Member, ChoiceOne Financial Services, Inc., Board of Directors G r eg L. A r mock James A. Bosse r d * Keith D . B r op h y * M ichael J . Bur k e , J r . * Ha r old J . Bur ns * Er ic E . Bur r ough * D a vid H. Bus h * Bru ce J . C ady * D a vid J . Chu r chill Cu r t E . C oul t er P a tr ick A. C r onin * Bru ce John Ess e x, J r . Jack G. Hendo n * P aul L. Johnso n * G r ego r y A. M c C onnell * B r adley F . M cGinnis Nels W . N yblad * R o xanne M. P age * Kelly J . P ot es * M ichelle M. W endling

Steven M. DeVolder SVP, Chief Trust Officer Shelly M. Childers SVP, Chief Information Officer Peter Batistoni SVP, Sr. Lender - East MI Mortgage Sales Executive Michael J. Burke, Jr. President Bradley A. Henion SVP, Chief Lending Officer Lee A. Braford SVP, Chief Credit Officer Thomas L. Lampen SVP, Chief Financial Officer Adom J. Greenland SVP, Chief Operating Officer Kelly J. Potes CEO senior management Heather D. Brolick SVP, Human Resources

| |

• Online and mobile banking – apply for loans, open accounts, deposit checks • Open by appointment only for a time, have many people working from home, kept safety our number one priority Banking • 300+ Consumer Loans • 400+ Commercial Loans Deferred Payments as of June 30, 2020 • Less than 10 Commercial Loans • Less than 30 Consumer Loans Deferred Payments as of March 31, 2021 • $4,000,000 in 2020 • $250,000 in Q1 2021 Provision for loan losses covid - 19 response 9

| |

paycheck protection program Round 1 – Initiated April 2020 Total Loans $163 million (includes $37 million through acquisition) Total Fees $4.9 million Fees realized as of March 31, 2021 $4.4 million Round 2 – Initiated January 2021 Total Loans $77 million Total Fees $3.7 million Fees realized as of March 31, 2021 $208,000 10 Totals – Round 1 and 2 Total Loans $240 million Total Fees $8.6 million Fees realized as of March 31, 2021 $4.6 million

| |

loan information * Health Care and Social Assistance 11.2% Accommodations and Food Services loans 8.3% Construction loans 6.8% *Values represent a percentage of ChoiceOne Commercial Loans as of 3/31/2021.

| |

award - winning ACCOMPLISHMENT S 2019 Editor’s Choice Award for Community Commitment 2019 Best Small Business Solutions Nomination 2018 & 2019 Newsmaker Finalist of the Year 2019 Financial Literacy Award 2018 & 2019 True North Community Partner Award 2019 Silver Addy 2020 Five Star Bank 2018 National Top 20 Most Innovative Community Bank 2018 & 2019 Best of FinXTech Startup Innovation Finalist with Plinqit 2018 West Michigan Hispanic Chamber of Commerce Nominee 2018 BAI Global Innovation Awards Nominee

| |

| |

community support GIVING BACK We continued to support our communities b y don a ting OVER $331,000

| |

financial performance The following financial data include the impact of the merger with Community Shores Bank Corporation from the effective date of July 1, 2020 and the impact of the merger with County Bank Corp. From the effective date of October 1, 2019.

| |

$647,000 $671,000 $1,386,000 $1,919,000 $2,070,000 2017 FY 2018 FY 2019 FY 2020 FY 2021 Q1 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 total assets (in thousands)

$6,100 $6,200 $7,300 $7,200 $15,600 $1,700 $2,700 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 2016 2017 2018 2019 2020 *Tax - effected merger expenses refers to expenses related to the merger with County Bank Corp. effective on October 1, 2019, and the acquisition of Community Shores Bank Corporation effective on July 1, 2020. Adjusted amounts are not GAAP. Refer to Non - GAAP Reconciliation slide for further details . 5 years net income Net Income at year end (in thousands) Tax - effected Merger Expenses (in thousands)* $18,300 $8,900

| |

net income per quarter *Tax - effected merger expenses refers to the expenses related to the merger with County Bank Corp. effective on October 1, 2019, and the acquisition of Community Shores Bank Corporation effective on July 1, 2020. Adjusted amounts are not GAAP financial measures. Refer to Non - GAAP Reconciliation s lide for further details. $3,300 $4,400 $3,800 $4,100 $6,200 $300 $500 $1,400 $500 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 Q1 2020* Q2 2020* Q3 2020* Q4 2020* Q1 2021 Net Income (in thousands) Tax - effected Merger Expenses (in thousands)* $3,600 $4,900 $5,200 $4,600

| |

gross loans balance (in thousands) $399,000 $409,000 $802,000 $932,000 $898,000 $138,000 $137,000 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 2017 2018 2019* 2020* Q1 2021 Gross Loan Balance at year end and YTD 2021, excluding PPP Loans (in thousands) PPP Loans $1,070,000 $1,035,000

Diversified Loan Portfolio History of successful lending to small business and agriculture. Strong commercial and industrial portfolio. Active residential real estate lending with sold (primarily service retained) and portfolio mortgages. Commercial Real Estate 45% Residential Real Estate 17% Commercial and Industrial 29% Agricultural 4% Consumer 3% Construction Real Estate 2% loans by category (as of March 31, 2021)

| |

gross deposits balance (in thousands) $388,000 $423,000 $867,000 $1,197,000 $1,324,000 $152,000 $154,000 $288,000 $478,000 $516,000 $- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 $2,000,000 2017 FY 2018 FY 2019 FY* 2020 FY* 2021 Q1 Interest Bearing Deposits Non - Interest Bearing Deposits $540,000 $577,000 $1,155,000 $1,675,000 $1,840,000

| |

deposits by category (as of March 31, 2021) Diverse Deposits Continued success in growing diversified deposits. Focus on locally sourced deposits. Expansion into growing markets elevates deposit growth. Significant non - maturity deposit base. Noninterest - bearing demand deposits 28% Interest - bearing demand deposits 28% Money market deposits 13% Savings deposits 21% Local CD s 10%

| |

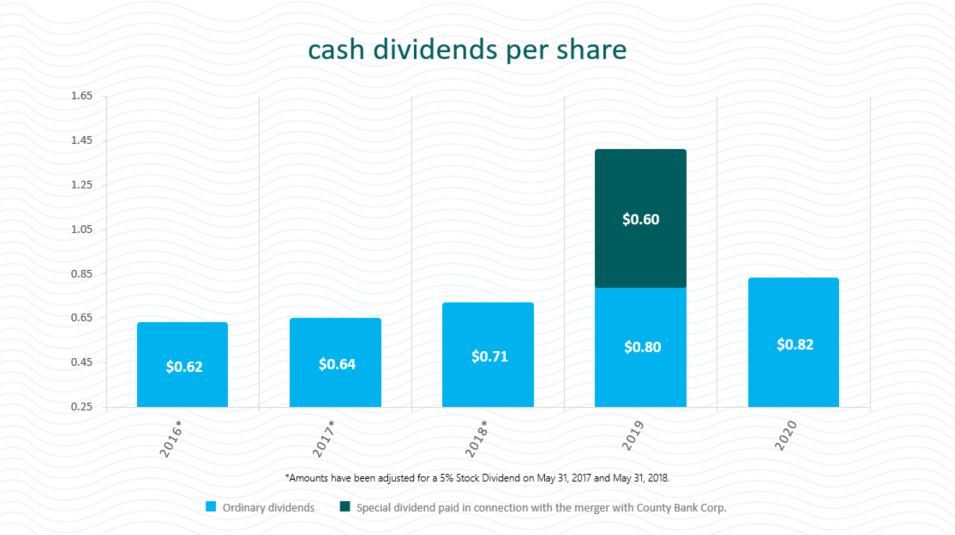

*Amounts have been adjusted for a 5% Stock Dividend on May 31, 2017 and May 31, 2018. $0.62 $0.64 $0.71 $0.80 $0.82 $0.60 0.25 0.45 0.65 0.85 1.05 1.25 1.45 1.65 cash dividends per share Ordinary dividends Special dividend p aid in connection with the merger with County Bank Corp.

| |

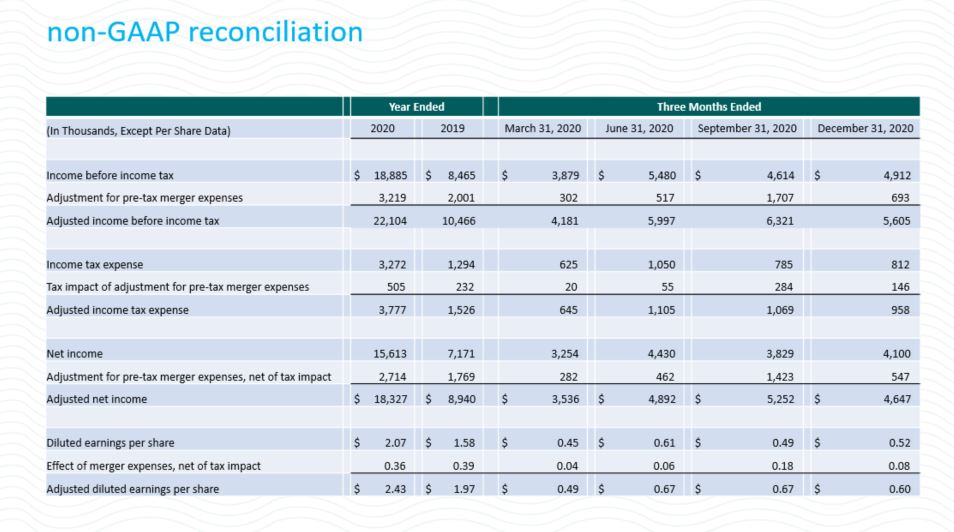

non - GAAP reconciliation Year Ended Three Months Ended (In Thousands, Except Per Share Data) 2020 2019 March 31, 2020 June 31, 2020 September 31, 2020 December 31, 2020 Income before income tax $ 18,885 $ 8,465 $ 3,879 $ 5,480 $ 4,614 $ 4,912 Adjustment for pre - tax merger expenses 3,219 2,001 302 517 1,707 693 Adjusted income before income tax 22,104 10,466 4,181 5,997 6,321 5,605 Income tax expense 3,272 1,294 625 1,050 785 812 Tax impact of adjustment for pre - tax merger expenses 505 232 20 55 284 146 Adjusted income tax expense 3,777 1,526 645 1,105 1,069 958 Net income 15,613 7,171 3,254 4,430 3,829 4,100 Adjustment for pre - tax merger expenses, net of tax impact 2,714 1,769 282 462 1,423 547 Adjusted net income $ 18,327 $ 8,940 $ 3,536 $ 4,892 $ 5,252 $ 4,647 Diluted earnings per share $ 2.07 $ 1.58 $ 0.45 $ 0.61 $ 0.49 $ 0.52 Effect of merger expenses, net of tax impact 0.36 0.39 0.04 0.06 0.18 0.08 Adjusted diluted earnings per share $ 2.43 $ 1.97 $ 0.49 $ 0.67 $ 0.67 $ 0.60

| |

25 allowance and credit mark (as of march 31, 2021) Allowance Balance $7,740,000 0.73% of Gross Loans Remaining Credit Mark $8,005,000 Total Funds Available to Cover Future Losses $15,745,000 1.48% of Gross Loans

| |

C OF S NO W T R ADES ON TH E NAS D A Q ® Market Makers in ChoiceOne Financial Services, Inc. Stock D.A. Davidson & Co. 3773 Attucks Drive Powell, Ohio 43065 800.394.9230 Boenning & Scattergood, Inc. 200 Barr Harbor Drive, Suite 300 West Conshohocken, PA 19428 - 2979 800.883.1212 Raymond James & Associates 2060 East Paris Avenue SE Suite 250 Grand Rapids, MI 49546 616.974.3380 Stifel, Nicolaus & Company, Inc. 5181 Cascade Road SE Grand Rapids, MI 49546 616.224.1553 Stock Registrar & Transfer Agent Continental Stock Transfer & Trust Company 1 State Street Plaza, 30th Floor New York, NY 10004 - 1561 212.509.4000 T he si z e of our C ompa n y di c t a t ed a mor e r e c o g ni z ed platform for our stock. In February of 2020, ChoiceOne began t r ading on the NASDAQ S t ock E x change under its current symbol, “COFS.” Listing on the Nasdaq is a natural p r o g r ession as w e look t o build inc r eased liquidi t y and long - t er m v alue f or our sha r eholder s .

| |

questions?

| |

thank you.