Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Riot Blockchain, Inc. | ex99x3.htm |

| EX-99.1 - EXHIBIT 99.1 - Riot Blockchain, Inc. | ex99x1.htm |

| EX-10.1 - SHAREHOLDER AGREEMENT BY AND BETWEEN RIOT BLOCKCHAIN, INC. AND NORTHERN DATA AG - Riot Blockchain, Inc. | ex10x1.htm |

| 8-K - FORM 8-K - Riot Blockchain, Inc. | riot_8k-052621.htm |

EXHIBIT 99.2

Riot Blockchain, Inc. NASDAQ: RIOT / MAY 2021

The information provided in this presentation may include forward - looking statements within the meaning of the federal securities laws, including as to the effects of the acquisition by Riot Blockchain, Inc . (the “Company”) of Whinstone US, Inc . (“Whinstone”) and the future financial performance and operations of the Company and Whinstone . Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward - looking statements . Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope” and similar expressions are intended to identify forward - looking statements . Forward - looking statements are based upon current expectations of the Company and involve assumptions that may never materialize or may prove to be incorrect . Actual results and the timing of events could differ materially from those anticipated in such forward - looking statements as a result of various risks and uncertainties . These forward - looking statements may include, but are not limited to, statements about the benefits of the acquisition of Whinstone, including financial and operating results, and the Company’s plans, objectives, expectations and intentions . Among the risks and uncertainties that could cause actual results to differ from those expressed in forward - looking statements are : ( 1 ) the integration of the businesses of the Company and Whinstone may not be successful, or such integration may take longer or be more difficult, time - consuming or costly to accomplish than anticipated ; and ( 2 ) failure to otherwise realize anticipated efficiencies and strategic and financial benefits from the acquisition of Whinstone . Detailed information regarding other factors that may cause actual results to differ materially from those expressed or implied by statements in this presentation may be found in the Company's filings with the U . S . Securities and Exchange Commission (the “SEC”), including in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” of the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2020 , which was filed with the SEC on March 31 , 2021 and subsequently amended in a filing with the SEC on April 30 , 2021 , and the Company’s Quarterly Report on Form 10 - Q for the fiscal quarter ended March 31 , 2021 , which was filed with the SEC on May 17 , 2021 , and in the additional risk factors set forth in the Company’s Current Report on Form 8 - K filed with the SEC on May 26 , 2021 , copies of which may be obtained from the SEC's website at www . sec . gov . All forward - looking statements included in this presentation are made only as of the date of this presentation, and the Company does not undertake any obligation to publicly update or correct any forward - looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law . 2 FORWARD LOOKING STATEMENTS

3 Riot serves as a vehicle for investors seeking exposure to Bitcoin BITCOIN IS A RE - INVENTION OF GLOBAL FINANCE

"Do I think it's a durable mechanism that ... could take the place of gold to a large extent ?...I do, because it's so much more functional than passing a bar of gold around" "Fidelity has made a long - term commitment to the future of blockchain technology and to making digitally - native assets, such as Bitcoin , more accessible to investors " “I think that you can expect that we’ll have a billion people storing their value, in essence a savings account, on a mobile device within five years and they’re going to want to use something like Bitcoin ” "We believe that digital currencies have the potential to extend the value of digital payments to a greater number of people and places. As such, we want to help shape and support the role they play in the future of money" “We believe that Bitcoin has the potential to be a more ubiquitous currency in the future” 4 Source : Bloomberg, Forbes, CoinDesk, CNBC, Business Insider . INSTITUTIONAL BITCOIN ADOPTION IS HERE

5 (1) Coinmarketcap . com as of 5 / 25 / 21 . Dominant cryptocurrency with a US $ 735 billion global market capitalization (1) The strongest, most secure, and most decentralized network of all cryptocurrencies The data structure ( blockchain) serves as the public ledger of all transactions Decentralized - it is not controlled by any one person, entity , or governmen t (as compared to fiat currencies) S ound money , with a supply of only 21 million coins coded into its supply schedule WHAT IS BITCOIN ?

Currently, the reward is 6.25 BTC per block solved, totaling approximately 900 BTC per day network - wide repeatedly guessing inputs into an algorithm until the desired output is observed 6 the process of mining a Bitcoin : Bitcoin transactions are pooled together in a “block” Once a block is formed, miners compete to solve it, which is difficult to do but simple to verify After it is solved , the transactions are “verified” by the network The new block of verified transactions is attached to a chain of prior blocks (“blockchain”) For solving the puzzle, miners are rewarded with Bitcoin , which occurs every 10 minutes, on average

76% of Bitcoin miners utilize renewable energy as a part of their energy mix, with renewable energy accounting for ~40% of overall energy mix (1) Bitcoin miners are incentivized to minimize their power costs and seek out under - utilized renewables infrastructure 68.7% 31.3% Global Energy Production Energy Consumption Unused Energy 7 0.2% 99.8% Total Unused Energy Bitcoin Energy Consumption Remaining Unused Energy BITCOIN MINING AND ENERGY USE Source : https : //ourworldindata . org/energy - production - consumption (1) University of Cambridge Centre for Alternative Finance Bitcoin Electricity Consumption Index .

8 Riot’s mission is to become one of the most relevant and significant companies supporting the Bitcoin network and greater Bitcoin ecosystem (1) As of 5 / 25 / 21 ; ( 2 ) post - closing ; ( 3 ) 90 day average trading volume as of 5 / 25 / 21 ; ( 4 ) as of 3 / 31 / 21 ; ( 5 ) as of 3 / 31 / 21 ; ( 6 ) 4 / 12 / 21 press release ; ( 7 ) estimated by Q 4 2022 . Ticker Symbol NASDAQ RIOT Share Price $25.14 (1) Shares Issued & Outstanding 95.9 Million (2) Avg. Daily Trading Volume 26.4 Million (3) Net Cash $241 Million (4) BTC Held on Balance Sheet 1,569 BTC (5) Current Riot Hashing Capacity 1.6 EH/s (6) Future Riot Hashing Capacity 7.7 EH/s (7)

9 BITCOIN MINING MARGIN 67.5 % 1,56 9 BITCOIN HELD 5.46 AVERAGE BITCOIN MINED DAILY 491 TOTAL BITCOIN MINED $15,250 AVG . DIRECT COST PER BITCOIN MINED $ 241 MM CASH ON BALANCE SHEET NET INCOME $ 7.5 MM $ 10.3 MM ADJUSTED EBITDA $ 23.2 MM TOTAL REVENUE RIOT AT A GLANCE Q1 2021

10 PROFITABILITY DRIVERS IN BITCOIN MINING What R iot Does Not Control network hash rate price of BTC block rewards & # of blocks per year price of miners Riot’s hash rate cost of electricity corporate expenses What R iot Controls с ZŝŽƚ഻Ɛ ,ĂƐŚ ZĂƚĞ EĞƚǁŽƌŬ ,ĂƐŚ ZĂƚĞ п WƌŝĐĞ ŽĨ d п ϲ͘Ϯϱ ůŽĐŬ ZĞǁĂƌĚ н dƌĂŶƐĂĐƚŝŽŶ WƌĞŵŝƵŵ п ϱϮ͕ϱϲϬ ůŽĐŬƐ ƉĞƌ zĞĂƌ о WƌŝĐĞ ŽĨ DŝŶĞƌƐ н ŽƐƚ ŽĨ ůĞĐƚƌŝĐŝƚLJ н ZŝŽƚ ഻Ɛ ŽƌƉŽƌĂƚĞ džƉĞŶƐĞƐ Annual Mining Profitability

11 Riot began mining Bitcoin at 12 MW Oklahoma City facility , which it operated until mid - 2020 201 8 Riot moved its entire mining fleet to Coinmint’s Bitcoin mining hosting facility in Massena, NY, with over 51 MW currently live 2020 Acquired a 300 MW Bitcoin mining hosting facility in Rockdale, Texas 2021 RIOT HISTORY AND CURRENT OPERATIONS Moses Saunders Dam near Massena, NY Whinstone facility in Rockdale, TX

12 + 300 MW 750 MW total developed capacity total power capacity 100 acres Rockdale, Texas $ 0.025 cost per kWh 190,000 ft 2 hosting space 60,000 ft 2 under construction TRANSACTION STRUCTURE ▪ $80 Million cash consideration ▪ 11.8 Million shares of RIOT common stock

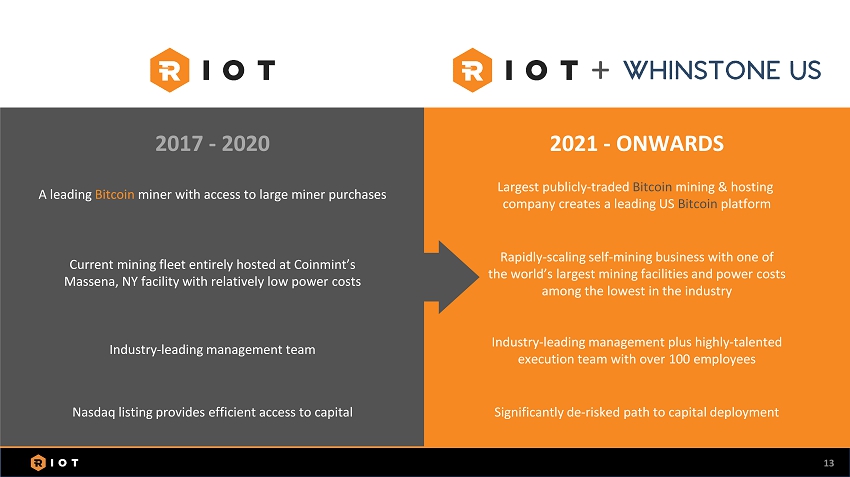

13 Nasdaq listing provides efficient access to capital Significantly de - risked path to capital deployment Industry - leading management team Industry - leading management plus highly - talented execution team with over 100 employees Current mining fleet entirely hosted at Coinmint’s Massena, NY facility with relatively low power costs Rapidly - scaling self - mining business with one of the world’s largest mining facilities and power costs among the lowest in the industry A leading Bitcoin miner with access to large miner purchases Largest publicly - traded Bitcoin mining & hosting company creates a leading US Bitcoin platform 2017 - 2020 2021 - ONWARDS +

14 ERCOT’S INCREASED RENEWABLE PENETRATION As one of the few deregulated energy markets, ERCOT’s market is driven by competition Source : ERCOT February 2021 Fact Sheet . ▪ Wind & solar generation has grown to 28.6% of total generating capacity ▪ 25,121 MW of installed wind capacity as of Jan uary 2021, the most of any state in the nation ▪ 3,854 MW of utility - scale installed solar capacity as of January 2021 The Electric Reliability Council of Texas (ERCOT) is a nonprofit organization that ensures reliable electric service for 90 percent of the state of Texas

15 0 225 450 675 900 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Riot Self-Mining Hosting Available Capacity Riot Miners at Coinmint (MW) Whinstone Total Capacity - 750 MW INDUSTRY - LEADING BITCOIN MINING CAPACITY Note: Forecast period estimates based on contracted capacity.

RIOT’S FORECASTED HASH RATE GROWTH SCHEDULE (EH/s) 16 Since 2019, multiple long - term purchase orders with Bitmain; monthly deliveries from purchase orders through Q4 2022 Riot’s aggregate Bitcoin mining hash rate capacity estimated to reach: 7.7 EH/s by Q4 2022 4.6 EH/s by Q4 2021 0 2 4 6 8 Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Miners at Coinmint Miners at Whinstone HASH RATE GROWTH

17 REVENUE ($MM) EARNINGS PER SHARE BITCOIN MINED HASH RATE (EH/s) $0 $10 $20 $30 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 ($0.35) ($0.20) ($0.05) $0.10 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 RIOT FINANCIAL HIGHLIGHTS 0 200 400 600 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 0.0 0.5 1.0 1.5 2.0 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1

18 Riot provides a best - of - class investment opportunity in the Bitcoin mining vertical Clear and significantly de - risked pathway for expansion Management team brings demonstrated track record of success INVESTMENT HIGHLIGHTS Serves as a vehicle for investors seeking exposure to Bitcoin A trailblazing US Bitcoin mining platform

19 APPENDIX

RIOT MANAGEMENT TEAM 20 Jason Les CEO & Board Member Jason became Riot’s CEO in February 2021 after serving as an independent board member since November 2017 Has been deeply involved with Bitcoin since 2013, with significant experience in cryptocurrency mining and as an engineer studying protocol development and contributing to open - source projects Founding partner of Binary Digital, a software - development company Former professional heads - up poker player Was selected as a human benchmark for testing the world’s best poker artificial intelligence in what was dubbed “Man vs Machine” at Carnegie Mellon University in 2015 and 2017 B.S. in Information & Computer Science from UC Irvine Jeff McGonegal CFO Megan Brooks COO Megan’s experience includes over 20 years in emerging industries in operations, finance, and risk management, with seven years of executive management Worked with international / domestic insurance domiciles, auditors, and regulatory bodies to design and implement guidelines / legislature for financial reporting, solvency, and asset portfolios Developed software applications focused on improving efficiency and accountability in captive insurance operations Received a global award for Power 50 "One to Watch List" and has written numerous technical pieces for global publications B.S. in Finance, along with a Masters Certificate of Accountancy from University of Houston, C.T. Bauer College of Business Certification in risk management and is a licensed Risk Manager Jeff is the longest - standing member of Riot’s executive team and resumed his duties as the Company’s permanent CFO in February 2021 Served as Riot’s CEO during 2019 and 2020 His career has spanned over 40 years in senior leadership roles working as an audit partner with a national accounting firm, in addition to roles as an executive within multiple public entities Started his public accounting career with BDO USA, LLP, most recently serving as Managing Partner of the BDO office in Denver, Colorado B.A. in Accounting from Florida State University and became a Certified Public Accountant in 1975, now retired

WHINSTONE FOUNDERS 21 Chad Harris CEO Lyle Theriot COO Ashton Harris C T O David Schatz VP Operations Chad Harris is the CEO of Whinstone and brings his vast entrepreneur and executive leadership skills to the Riot leadership team As a serial entrepreneur with a track record of building successful and profitable firms, Chad has used his marketing experiences in customer retention, acquisition, and negotiations to help businesses achieve successes Chad's ability to leverage his experience in construction, data analysis, and finance over the last 30 years provides him with a well - balanced approach to capture profitability from unrecognized sources Received the 2020 Community Economic Development Award and many other awards, including Holding a ranking in INC and being named one of the Top 100 Internet Retailer Lyle Theriot has served as the COO of Whinstone since 2018 and brings his vast knowledge of construction operations to the Riot leadership team For his efforts as COO of Whinstone, Lyle was awarded the 2020 Texas Economic Development Council - Community Economic Development Award for Secondary Benefit for the Whinstone Data Center Project Starting his career in construction management focusing on communication and team building, Lyle gained the needed skills to effectively solve complex construction problems and build with speed and efficiency Ashton Harris has been the CIO of Whinstone since its inception in 2018, and became the CTO in 2021 Ashton leverages his technical knowledge and his business acumen in creating an effective enterprise technology strategy Ashton's strategy focuses on providing scalable solutions for the facility’s technical design and software Ashton has been involved with Bitcoin since 2011 David Schatz is the Vice President of Operations at Whinstone In this capacity, he manages over 100 employees and has implemented safety programs, performance incentives, CPR training, and benefits for all Whinstone team members David’s leadership skills were shaped from his previous role at TriMet where, in a career spanning eight years, he mastered the art of leadership and mentoring staff David also has in - depth technical training from Mt. Hood Community College and Portland Community College, where he gained a tremendous mechanical foundation

RIOT BOARD OF DIRECTORS 22 Benjamin Yi Executive Chairman Hubert Marleau Lead Independent Director Hannah Cho Independent Director Lance D’Ambrosio Independent Director Recruited to Riot in October 2018 to chair the audit committee and join a special committee of the Board Nominated Chairman in November 2020 and Executive Chairman in May 2021 Significant turn - around and governance experience with public companies Previously led the capital markets efforts at IOU Financial, a fintech portfolio company of Neuberger Berman Unique capital markets experience with particular expertise in specialty finance, energy, and special situations investing Master of Finance degree from University of Toronto and CFA charter holder Nominated to the Board in November 2020 Chief Economist at Palos Management, a boutique investment management firm headquartered in Montreal, Canada Previously served as a Governor of the Montreal and Vancouver stock exchanges, and as a Director of the Listing Committee for the Toronto Stock Exchange and Director of the Investment Dealers Association of Canada (now known as IIROC) Current or past board director of approximately 50 publicly - traded companies Honors Bachelor of Social Sciences in Economics from the University of Ottawa Award - winning marketing and communications executive with expertise in brand building and storytelling Currently VP of Marketing Communications at BMC Software, a portfolio company of KKR Formerly SVP, Technology Communications at Edelman in their San Mateo office Over 15 years of experience in enterprise technology brand marketing, product and corporate communications supporting hyper - growth companies and global, multinational organizations in business growth and expansion, rebranding efforts, M&A, IPO, and divestiture B.A. Honors in Criminology from Carleton University Successful entrepreneur, private investor, and corporate director Former recipient of the E&Y Entrepreneur of the Year award in the category of e - software and services Has founded and grown several companies spanning multiple industries Previously sold two businesses to Sprint and Comsat Int’l, a subsidiary of Lockheed Martin B.Sc. In Marketing and Management from the University of Utah

TEXAS PILOT PROJECT Riot continuously explores new mining technology to maintain a leading position within the mining industry In December 2020, Riot announced a pilot project utilizing up to 8 MW to assess the potential for higher productivity and lower cost mining opportunities Partnership with Lancium , LLC evaluating smart response software to reduce energy costs within ERCOT Partnership with Enigma Digital Assets AG (“Enigma”) evaluating next generation of immersion cooling technology First phase of project evaluates immersion cooling technology to cool the mining machines. Improved cooling helps extend machine life and opens the opportunity to increase mining hash rate Expect initial results of pilot project by year - end 2021 23 An Enigma container utilizing immersion cooling

24 Bitcoin ’s fixed supply schedule is driven by programmatic changes in the block reward; every 210,000 blocks (roughly every four years) the block reward is reduced by 50% (i.e., “halving”). Following each halving, Bitcoin miners receive half the Bitcoin block per block mined HISTORICAL BITCOIN PRICE AND “ HALVINGS ” 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 $1 $10 $100 $1,000 $10,000 $100,000 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 BTC Price (Logarithmic Scale) 2 nd Halving: Block Reward 25 to 12.5 3 rd Halving: Block Reward 12.5 to 6.25 1 st Halving: Block Reward 50 to 25 All else being equal, this results in a reduction of mining revenue. The halving mechanism results in an ever - decreasing issuanc e rate of Bitcoin as the supply asymptotically approaches its maximum supply of 21 million by July 2141. Following each historical halving, Bitcoin has experienced significant price appreciation in the ensuing 18 months BITCOIN “HALVING” OVERVIEW

Bitcoin (BTC) : a type of digital currency in which a record of transactions is maintained and new units of currency are generated by the computational solution of mathematical problems, and which operates independently of a central bank; a unit of Bitcoin Blockchain : a system in which a record of transactions made in Bitcoin or another cryptocurrency are maintained across several computers that are linked in a peer - to - peer network Block : a file that contains a “permanent” record of transactions Mining : the processing of transactions in the digital currency system, in which the records of current Bitcoin transactions, known as a blocks, are added to the record of past transactions, known as the blockchain Hash Rate : the measure of a miners performance; number of calculations a miner can perform in 1 second as it works to solve the block Block Reward : the amount of Bitcoin awarded for successfully mining / verifying a block 25 average # of Bitcoin mined each day = (Block Reward) x (6x / hour) x (24 hours / day) (6.25 BTC / Block) x (6x / hour) x (24 hours / day) = 900 Bitcoin per day on average GLOSSARY

contact: ir@riotblockchain.com 26