Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BUILD-A-BEAR WORKSHOP INC | a52433065ex99_1.htm |

| 8-K - BUILD-A-BEAR WORKSHOP, INC. 8-K - BUILD-A-BEAR WORKSHOP INC | a52433065.htm |

Exhibit 99.2

1 First Quarter Fiscal 2021 Update

Forward Looking and Cautionary Statements This presentation contains certain statements that are, or

may be considered to be, “forward-looking statements” for the purpose of federal securities laws, including, but not limited to, statements that reflect our current views with respect to future events and financial performance. We generally

identify these statements by words or phrases such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,” “potential” or “continue,” the negative or any derivative of these terms and

other comparable terminology. Forward-looking statements are based on current expectation and assumptions that are subject to risks and uncertainties which may cause results to differ materially from the forward-looking statements. We

undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise. Risks and uncertainties to which our forward-looking statements are subject include: (1)

macroeconomic and industry risks such as (a) the COVID-19 pandemic has had and is expected to continue to have an adverse effect on our business; (b) continued or further declines in consumer traffic at malls and tourist locations could

adversely affect our financial performance and profitability; (c) general global economic conditions could lead to disproportionately reduced discretionary consumer spending and demand for our products; (d) consumer interests change rapidly

and our success depends on the ongoing effectiveness of our marketing and online initiatives to build consumer affinity for our brand and drive consumer demand for key products and services; (e) our profitability could be adversely impacted

by fluctuations in petroleum products prices; and (f) our business may be adversely impacted by a variety of significant competitive threats; (2) operational risks such as: (a) we may be unable to generate demand for our interactive retail

experience and products, including timely responses to consumer preferences; (b) we are subject to risks associated with technology and digital operations;(c) we may be unable to renew, renegotiate our store leases or enter into new store

leases on favorable terms; (d) our company-owned distribution center and our third-party distribution center providers may experience disruptions or operate inefficiently; and (e) we may not be able to evolve our store locations to align with

market trends, successfully diversify our store models and formats, or otherwise effectively manage our overall portfolio of stores; (3) international risks such as: (a) we may not be able to operate our international corporately-managed

locations profitably; (b) we rely on a few global supply chain vendors to supply substantially all of our merchandise, and significant price increases or disruption in their ability to deliver merchandise could harm our ability to source

products and supply inventory to our stores; (c) our merchandise is manufactured by foreign manufacturers and the availability and costs of our products, as well as our product pricing, may be negatively affected by risks associated with

international manufacturing and trade and foreign currency fluctuations; and (d) we may be unable to effectively manage our international franchises, attract new franchisees or the laws relating to our international franchises change; (4)

Legal, technology and intellectual property risks such as: (a) we are subject to a number of risks related to disruptions, failures or security breaches of our information technology infrastructure; (b) we may fail to renew, register or

otherwise protect our trademarks or other intellectual property and may be sued by third parties for infringement or misappropriation of their proprietary rights; (c) we may suffer negative publicity or be sued if the manufacturers of our

merchandise or Build-A-Bear branded merchandise sold by our licensees ship products that do not meet current safety standards or production requirements or if such products are recalled or cause injuries; (d) we may suffer negative publicity

or be sued if the manufacturers of our merchandise violate labor laws or engage in practices that consumers believe are unethical; and (e) we may suffer negative publicity or a decrease in sales or profitability if the products from other

companies that we sell in our stores do not meet our quality standards or fail to achieve our sales expectations; (5) Risks related to owning our common stock such as: (a) fluctuations in our operating results could reduce cash flow or result

in restrictions under our credit agreement and we may be unable to repurchase shares; (b) fluctuations in our quarterly results of operations could cause the price of our common stock to substantially decline; (c) the market price of our

common stock is subject to volatility, which could in turn attract the interest of activist shareholders; and (d) provisions of our corporate governing documents and Delaware law may prevent or frustrate attempts to replace or remove

our management by our stockholders, even if such replacement or removal may be in our stockholders’ best interests; and (6) general risks such as: (a) we may not be able to operate successfully if we lose key personnel; and (b) we may be

unsuccessful in acquiring businesses or engaging in other strategic transactions, which may negatively affect our financial condition and profitability. For additional information concerning factors that could cause actual results to

materially differ from those projected herein, please refer to our most recent reports on Form 10-K, Form 10-Q and Form 8-K. 2

BBW 3 CCVVVV CCVVVV CCVVVV CCVVVV ACCELERATION OF DIGITAL TRANSFORMATION

Leverage expanded platform to effectively acquire new guests and increase lifetime value of existing consumer base POWERFUL and EVOLVED BRANDBuild-A-Bear has multi-generational consumer connections and monetizable brand equity almost 25

years in the making EXPERIENCED and DRIVEN TEAMFlexible, responsive and disciplined management team and organization STRONG MERCHANDISE PORTFOLIO INCLUDING LICENSED PROPERTIESOffer diverse products to broaden addressable market using

gift-giving, occasion-based options, increased personalization and best-in-class licenses PROVEN STRATEGY DELIVERING PROFITABLE GROWTHFocused on leveraging and monetizing brand equity to diversify revenue streams; Strong balance sheet

positions BBW to execute and expand growth plans

4 1997 2021 Build-A-Bear Workshop launches as the leading experiential retail-entertainment

concept, predominately located in malls where families with children primarily went for shopping and entertainment at the time. BBW: AN ICONIC BRAND EVOLVES…. Build-A-Bear is positioned to leverage its brand strength across all consumer

touch pointsdigital platforms retail…andentertainment & content offerings to reach a broader range of consumers in a variety of new ways. Build-A-Bear becomes a multi-generational brand that is recognized by and connected to consumers

globally.

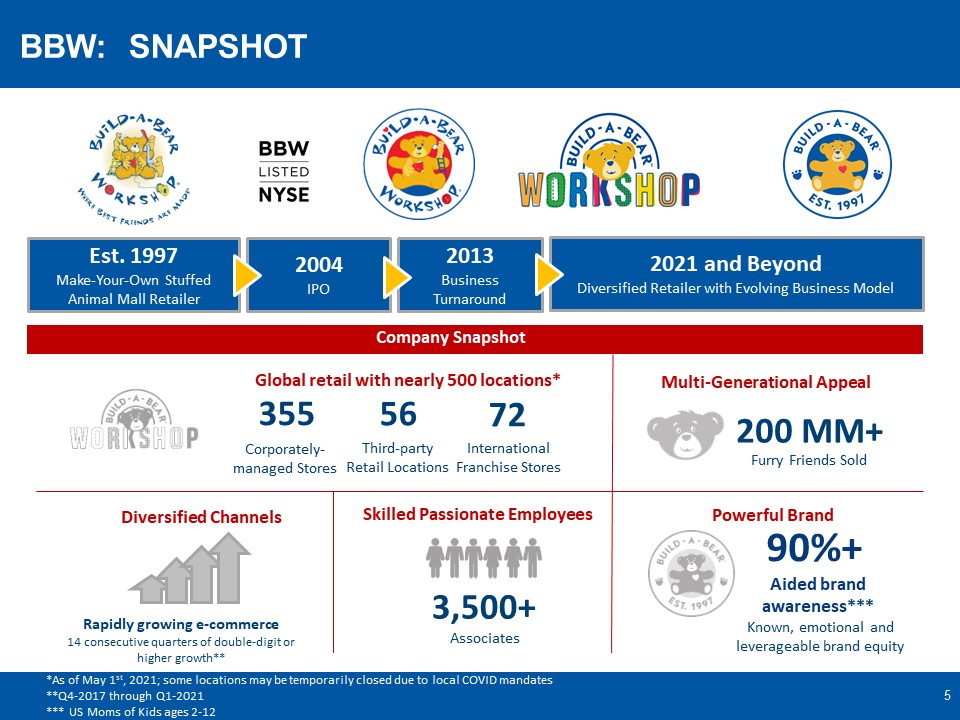

BBW: SNAPSHOT BBW 2019 5 Est. 1997Make-Your-Own Stuffed Animal Mall Retailer 2004IPO 2021 and

BeyondDiversified Retailer with Evolving Business Model 2013Business Turnaround 355 Corporately-managed Stores 56 Third-party Retail Locations 72 International Franchise Stores 3,500+ Associates Rapidly growing

e-commerce14 consecutive quarters of double-digit or higher growth** 200 MM+ Furry Friends Sold Known, emotional and leverageable brand equity Global retail with nearly 500 locations* Multi-Generational Appeal Diversified

Channels Skilled Passionate Employees Powerful Brand 90%+ Aided brand awareness*** *As of May 1st, 2021; some locations may be temporarily closed due to local COVID mandates**Q4-2017 through Q1-2021*** US Moms of Kids ages

2-12 Company Snapshot

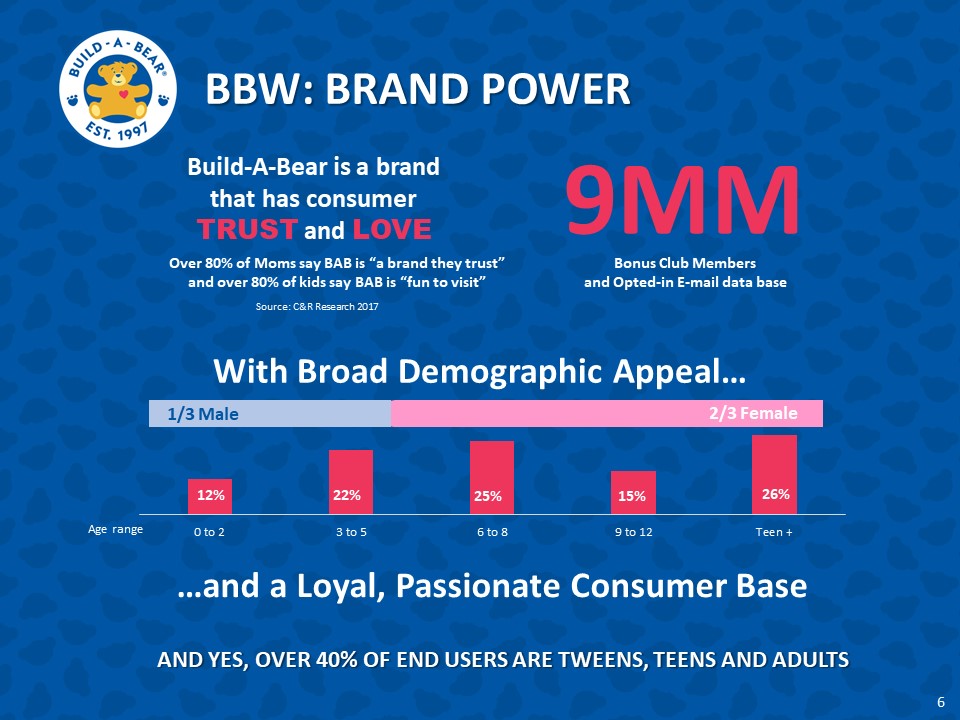

BBW: BRAND POWER 6 Build-A-Bear is a brand that has consumer TRUST and LOVE Over 80% of Moms say BAB

is “a brand they trust” and over 80% of kids say BAB is “fun to visit” 12% 22% 15% 25% 26% Age range 1/3 Male 2/3 Female With Broad Demographic Appeal… …and a Loyal, Passionate Consumer Base Source: C&R Research 2017 AND

YES, OVER 40% OF END USERS ARE TWEENS, TEENS AND ADULTS 9MM Bonus Club Members and Opted-in E-mail data base

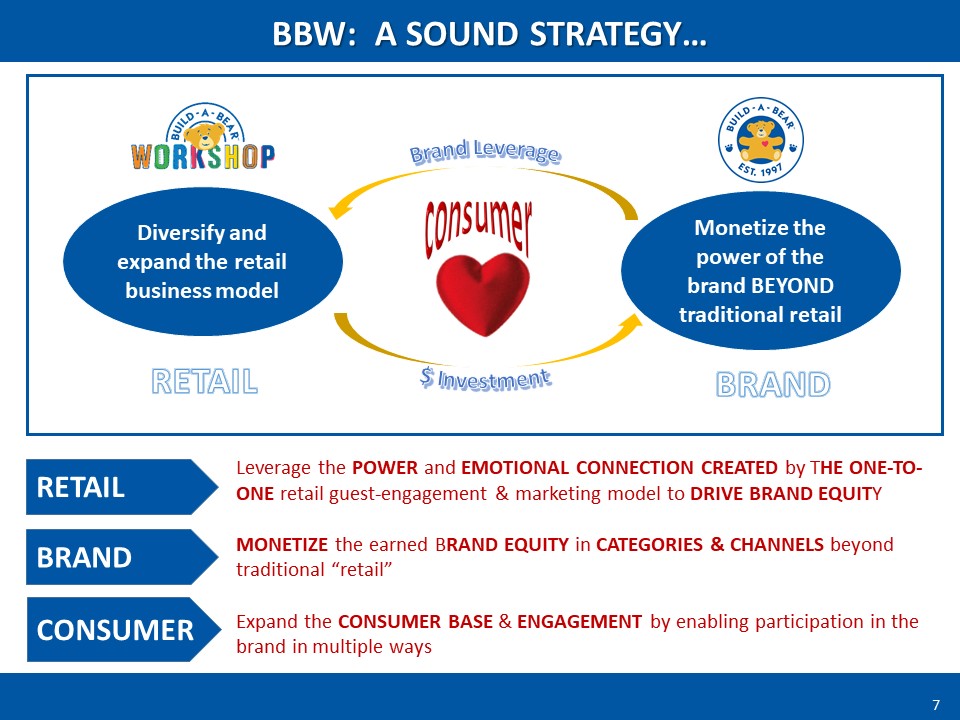

BRAND RETAIL 7 BBW: A SOUND STRATEGY… Leverage the POWER and EMOTIONAL CONNECTION CREATED by

THE ONE-TO-ONE retail guest-engagement & marketing model to DRIVE BRAND EQUITYMONETIZE the earned BRAND EQUITY in CATEGORIES & CHANNELS beyond traditional “retail”Expand the CONSUMER BASE & ENGAGEMENT by enabling participation in

the brand in multiple ways consumer Diversify and expand the retail business model Monetize the power of the brand BEYOND traditional retail Brand Leverage $ Investment BRAND RETAIL CONSUMER

8 2 1 3 CONTINUE TO ACCELERATE OUR KEY INITATIVES Further acceleration of digital

transformation Rapidly evolve omnichannel retail capabilities Leverage financial position to drive growth Expand digital capabilities and drive optimization across the entire organization to grow revenues and improve profitability

including content and entertainment initiatives. Extend ways to connect with and meet the changing needs of consumers across all retail channels while driving omnichannel engagement and expanded delivery options. Maintain the financial

discipline required to support our business while leveraging strong balance sheet to make select strategic investments designed for future growth.

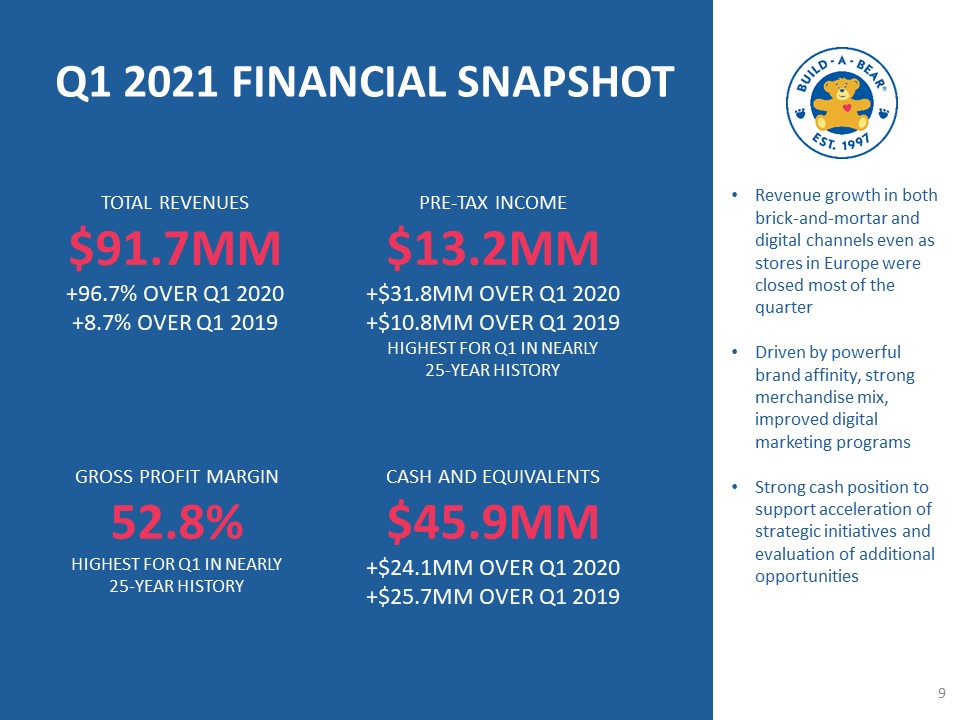

9 Q1 2021 FINANCIAL SNAPSHOT TOTAL REVENUES$91.7MM+96.7% OVER Q1 2020+8.7% OVER Q1 2019 PRE-TAX

INCOME$13.2MM+$31.8MM OVER Q1 2020+$10.8MM OVER Q1 2019HIGHEST FOR Q1 IN NEARLY 25-YEAR HISTORY CASH AND EQUIVALENTS$45.9MM+$24.1MM OVER Q1 2020+$25.7MM OVER Q1 2019 GROSS PROFIT MARGIN52.8%HIGHEST FOR Q1 IN NEARLY 25-YEAR HISTORY Revenue

growth in both brick-and-mortar and digital channels even as stores in Europe were closed most of the quarterDriven by powerful brand affinity, strong merchandise mix, improved digital marketing programsStrong cash position to support

acceleration of strategic initiatives and evaluation of additional opportunities

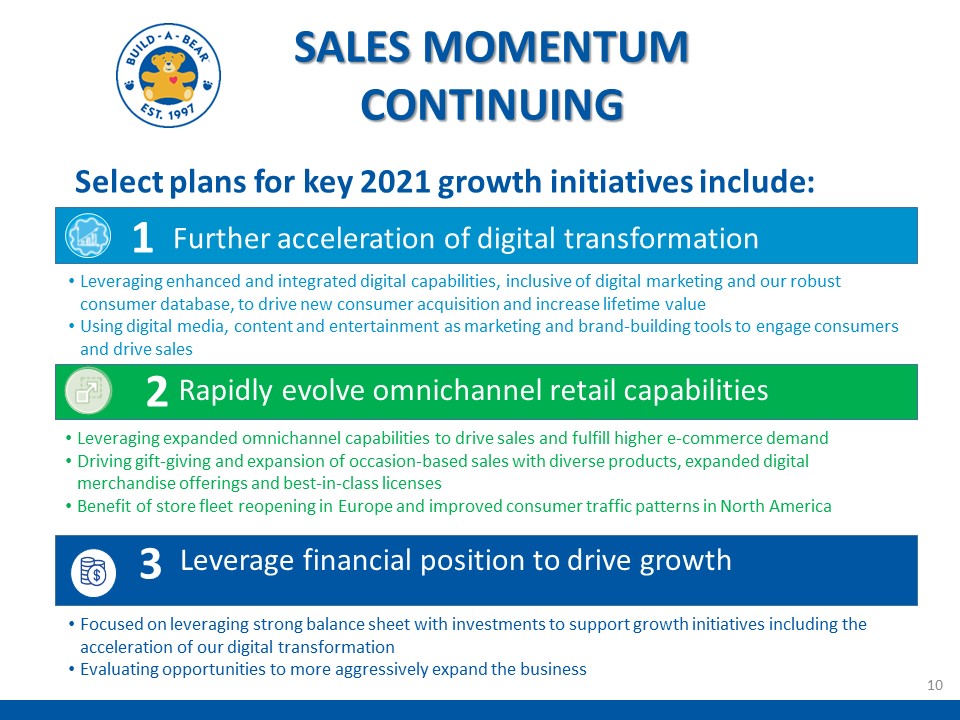

10 2 1 3 Further acceleration of digital transformation Rapidly evolve omnichannel retail

capabilities Leverage financial position to drive growth Focused on leveraging strong balance sheet with investments to support growth initiatives including the acceleration of our digital transformationEvaluating opportunities to

more aggressively expand the business Leveraging expanded omnichannel capabilities to drive sales and fulfill higher e-commerce demandDriving gift-giving and expansion of occasion-based sales with diverse products, expanded digital

merchandise offerings and best-in-class licensesBenefit of store fleet reopening in Europe and improved consumer traffic patterns in North America Leveraging enhanced and integrated digital capabilities, inclusive of digital marketing and

our robust consumer database, to drive new consumer acquisition and increase lifetime value Using digital media, content and entertainment as marketing and brand-building tools to engage consumers and drive sales SALES MOMENTUM

CONTINUING Select plans for key 2021 growth initiatives include:

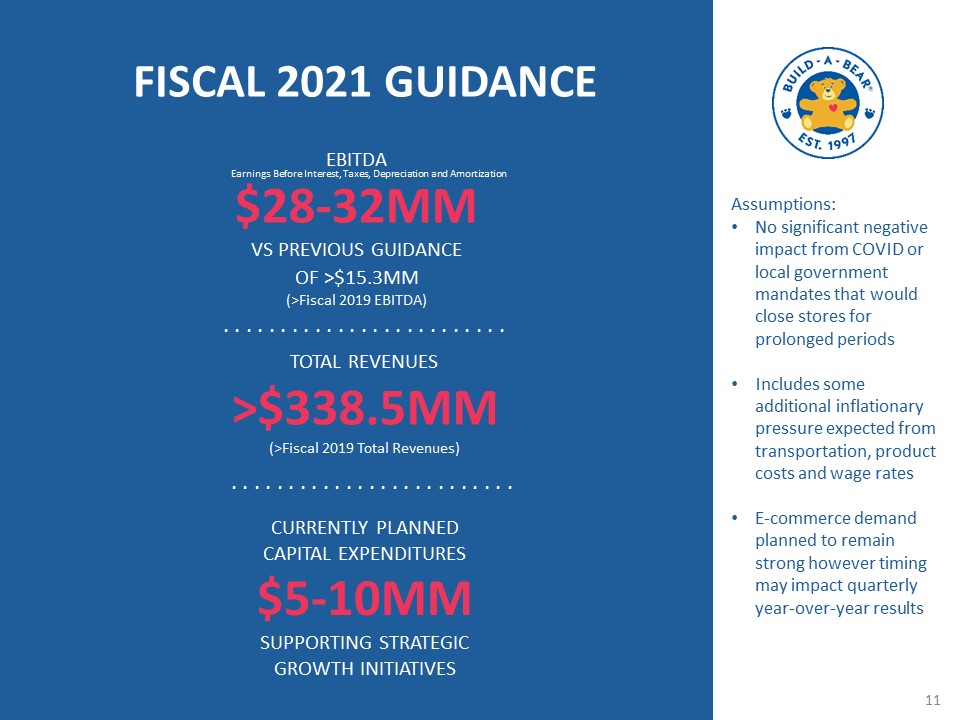

11 FISCAL 2021 GUIDANCE TOTAL REVENUES>$338.5MM(>Fiscal 2019 Total

Revenues) EBITDA$28-32MMVS PREVIOUS GUIDANCEOF >$15.3MM (>Fiscal 2019 EBITDA) CURRENTLY PLANNED CAPITAL EXPENDITURES$5-10MMSUPPORTING STRATEGIC GROWTH INITIATIVES Assumptions:No significant negative impact from COVID or local

government mandates that would close stores for prolonged periodsIncludes some additional inflationary pressure expected from transportation, product costs and wage ratesE-commerce demand planned to remain strong however timing may impact

quarterly year-over-year results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Earnings Before Interest, Taxes, Depreciation and Amortization

Explanatory Note on Non-GAAP Financial Measures: 12 Build-A-Bear Workshop (NYSE: BBW) reports it

financial results in accordance with generally accepted accounting principles (GAAP). We have supplemented the reporting of our financial information determined in accordance with GAAP with certain non-GAAP financial measures. These results

are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help identify underlying trends in the Company’s business and provide useful information to both management

and investors by excluding certain items that may not be indicative of the Company’s core operating results. These measures should not be considered a substitute for or superior to GAAP results. These non-GAAP financial measures are defined

and reconciled to the most comparable GAAP measure within this appendix.

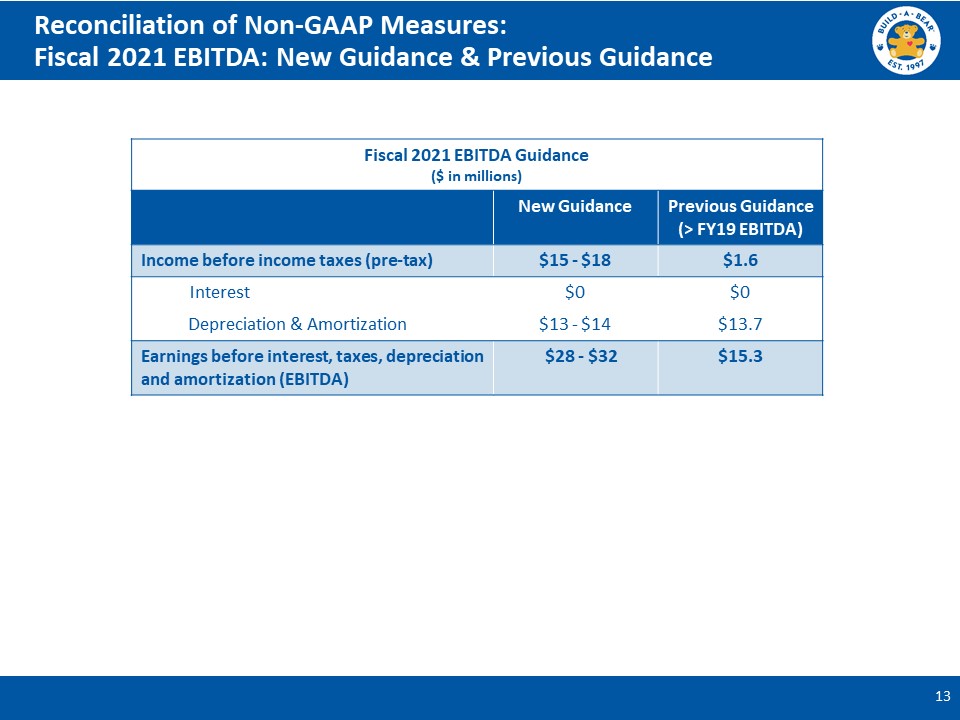

Reconciliation of Non-GAAP Measures:Fiscal 2021 EBITDA: New Guidance & Previous

Guidance 13 Fiscal 2021 EBITDA Guidance($ in millions) New Guidance Previous Guidance(> FY19 EBITDA) Income before income taxes (pre-tax) $15 - $18 $1.6 Interest $0 $0 Depreciation & Amortization $13 -

$14 $13.7 Earnings before interest, taxes, depreciation and amortization (EBITDA) $28 - $32 $15.3

Buildabear.com#celeBEARate