Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - LiveVox Holdings, Inc. | d126334dex993.htm |

| EX-99.1 - EX-99.1 - LiveVox Holdings, Inc. | d126334dex991.htm |

| 8-K - 8-K - LiveVox Holdings, Inc. | d126334d8k.htm |

May 2021 Business Update presentation Exhibit 99.2

Disclaimer This Management Presentation (this “Presentation”) has been prepared by LiveVox Holdings, Inc. and its affiliates (collectively, “LiveVox” or “Company”) and Crescent Acquisition Corp (“Crescent”) in connection with a proposed business combination involving Crescent and LiveVox as further described herein (the “Transaction”). This Presentation is for informational purposes only and does not constitute an offer or invitation for the sale or purchase of securities, assets or the business described herein or a commitment to Crescent or LiveVox with respect to any of the foregoing, and this Presentation shall not form the basis of any contract, nor is it a solicitation of any vote, consent, or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The terms "we", "us' and "our" in this Presentation refer to LiveVox or Crescent, depending on the context. This Presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These statements may be made directly in this Presentation. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions are intended to identify forward-looking statements. All forward-looking statements and projections set forth in this Presentation are based upon management estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Crescent or LiveVox, as the case may be, as of the date of this Presentation, and may include, without limitation, changes in general economic conditions, including as a result of COVID-19, all of which are accordingly subject to change. Any such estimates, assumptions, expectations, forecasts, views or opinions set forth in this Presentation constitute Crescent’s or LiveVox’s, as the case may be, judgments and should be regarded as indicative, preliminary and for illustrative purposes only. The forward-looking statements and projections contained in this Presentation are subject to a number of factors, risks and uncertainties, some of which are not currently known to Crescent or LiveVox, that may cause Crescent’s or LiveVox’s actual results, performance or financial condition to be materially different from the expectations of future results, performance of financial condition. Although such forward-looking statements and projections have been made in good faith and are based on assumptions that Crescent or LiveVox, as the case may be, believe to be reasonable, there is no assurance that the expected results will be achieved. Crescent’s and LiveVox’s actual results may differ materially from the results discussed in forward-looking statements. Additional information on factors that may cause actual results and Crescent’s performance to differ materially is included in Crescent’s reports filed with the Securities and Exchange Commission (“SEC”), including but not limited to Crescent’s definitive proxy statement on Schedule 14A relating to the Transaction (the “Proxy”) and Amendment No. 1 to Crescent's annual report on Form 10-K/A for the year ended December 31, 2020. Additional information on factors that may cause actual results and LiveVox’s performance to differ materially is included in the Proxy. Copies of Crescent’s filings with the SEC are available publicly on the SEC’s website at www.sec.gov or may be obtained by contacting Crescent. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. These forward-looking statements are made only as of the date hereof, and neither Crescent nor LiveVox undertake any obligations to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Certain metrics included in this Presentation are presented on a pro forma basis to include results of acquired businesses as if such acquisitions had been completed as of January 1 of the applicable year of the acquisition. In addition, this Presentation includes references to non-GAAP financial measures, including but not limited to Gross Margin and EBITDA, please see appendix for a reconciliation of non-GAAP financial measures. Such non-GAAP measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Neither Crescent nor LiveVox nor any of their respective directors, officers, employees, advisors, representatives or agents makes any representation or warranty of any kind, express or implied, as to the value that may be realized in connection with the Transaction, the legal, regulatory, tax, financial, accounting or other effects of a Transaction or the accuracy or completeness of the information contained in this Presentation, and none of them shall have any liability based on or arising from, in whole or in part, any information contained in, or omitted from, this Presentation or for any other written or oral communication transmitted to any person or entity in the course of its evaluation of the Transaction. Only those representations and warranties that are expressly made in a definitive written agreement with respect to the Transaction, if executed, and subject to the limitations and restrictions specified therein, shall have any legal effect. This Presentation contains information derived from third party sources, including research, surveys or studies conducted by third parties, information provided by customers and/or industry or general publications. While we believe that such third party information is reliable, we have not independently verified, and make no representation as to the accuracy of, such third party information. This Presentation contains financial forecasts. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. LTV is calculated as subscription gross margin divided by gross churn. CAC is calculated as trailing twelve months S&M expense divided by quarter 0 subscription revenue annualized less quarter 4 subscription revenue annualized. This Presentation contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Important Information about the Transaction and Where to Find It This Presentation may be deemed solicitation material in respect of the Transaction. The Transaction will be submitted to the stockholders of Crescent for their approval. In connection with such stockholder vote, Crescent has filed the Proxy with the SEC and is mailing the Proxy to its stockholders as of the established record date in connection with Crescent’s solicitation of proxies for the special meeting of the stockholders of Crescent to be held to approve the Transaction. This Presentation does not contain all the information that should be considered concerning the proposed Transaction and the other matters to be voted upon at the annual meeting and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. Crescent’s stockholders and other interested parties are urged to read the Proxy and any other relevant documents that are filed or furnished or will be filed or will be furnished with the SEC carefully and in their entirety in connection with Crescent’s solicitation of proxies for the annual meeting to be held to approve the Transaction and other related matters, as these materials will contain important information about LiveVox and Crescent and the proposed Transaction. Copies of the Proxy can be obtained, without charge, at the SEC’s website at http://ww.sec.gov, at Crescent’s website at http://www.crescentspac.com or by directing a request to Crescent Acquisition Corp, 11100 Santa Monica Blvd., Suite 2000, Los Angeles, CA 90025. Participants in the Solicitation Crescent and LiveVox, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies of Crescent’s stockholders in respect of the Transaction. Information about the directors and executive officers of Crescent and the directors and executive officers of LiveVox and more detailed information regarding the identity of all potential participants, and their direct and indirect interests, by security holdings or otherwise, is set forth in the Proxy. Additional information regarding the identity of all potential participants in the solicitation of proxies to Crescent stockholders in connection with the proposed Transaction and other matters to be voted upon at the special meeting, and their direct and indirect interests, by security holdings or otherwise, is included in the Proxy. Investors may obtain such information by reading the Proxy.

Executive Summary (1) Usage multiplier defined as total revenue divided by contracted revenue. Adding High Quality, Independent Board Members: Leslie Campbell (Board member at Coupa and PetMed Express), Susan Morisato (Former President – Insurance Solutions, United Health Care) and Kathleen Pai (Chief People Officer, SolarWinds / N-Able) Added Dedicated IR Professional: Alexis Waadt joined in April from Qualcomm and brings 20+ years of experience Shareholder Vote Scheduled for June 16 Reiterating Guidance: Revenue on track for $129 million for 2021 Contracted Revenue is Accelerating: 25% contracted growth forecast for 2021, higher growth rate projected for contracted revenue in 2022 Usage Expected to Normalize as COVID Fades: End of direct-to-consumer stimulus and collections forbearances along with a general return to normal economic activity Potential for Usage-Driven Upside to 2022 Plan: 1.4x usage multiplier(1) assumed in revenue plan of $163 million (consistent with LTM COVID-Affected Period and less than 1.5x+ pre-COVID) Q1 Bookings Exceeded Plan: 119% Growth YoY and 107% of plan Strong Execution on Expanding Go To Market Capacity: Marketing lead generation, sales team hiring, and channel partnership development efforts all tracking on or ahead of plan Revenue on Plan: Q1 contracted revenue +23% YoY (102% of plan); usage rates remain below historical norms due to the pace of the COVID recovery Q1 Update Outlook Governance and Leadership

Q1 Update

Go To Market: Q1 ‘21 Bookings Ahead of Plan Broad-based outperformance of Q1 ’21 bookings plan positions LiveVox well to achieve its 2021 contracted revenue plan Key Enablers Of Momentum Strong YoY Growth Bookings Ahead of Plan 119% New Bookings Growth YoY 107% Bookings Attainment Relative To Plan Accelerating demand for non-voice and analytics products Continued optimization of product capabilities and packaging Substantial go to market investment Key Sales Metrics

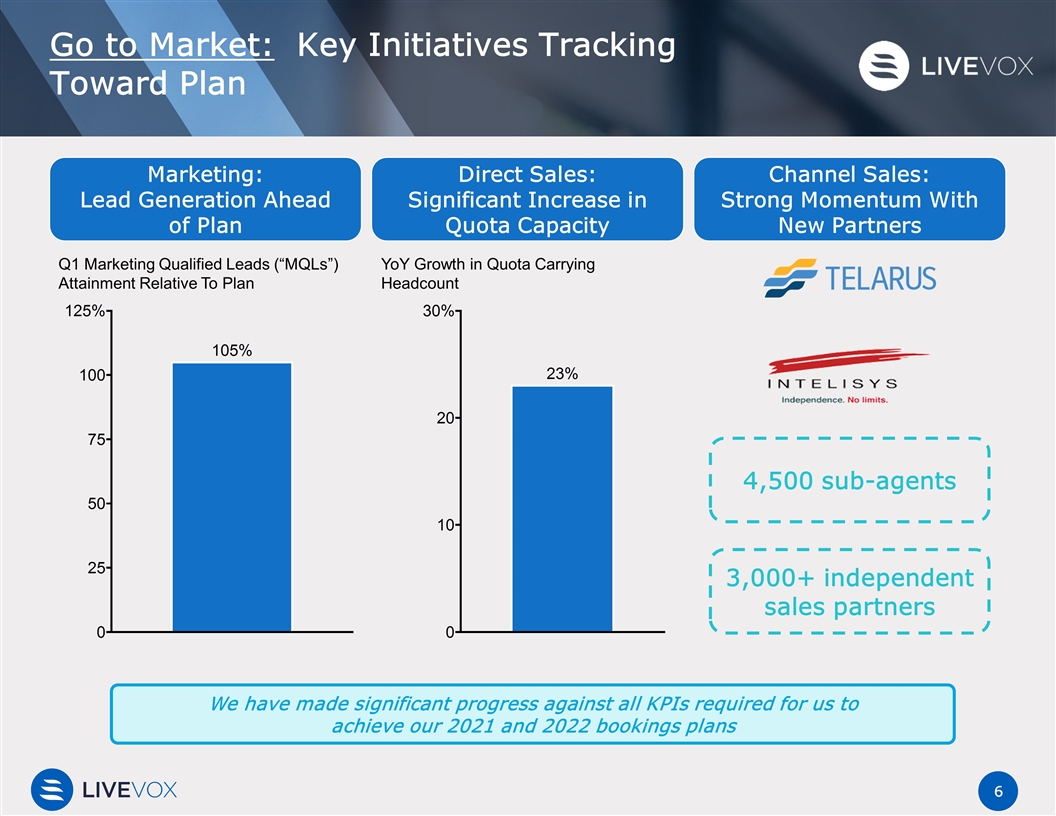

Go to Market: Key Initiatives Tracking Toward Plan 4,500 sub-agents 3,000+ independent sales partners We have made significant progress against all KPIs required for us to achieve our 2021 and 2022 bookings plans Channel Sales: Strong Momentum With New Partners Direct Sales: Significant Increase in Quota Capacity Marketing: Lead Generation Ahead of Plan YoY Growth in Quota Carrying Headcount Q1 Marketing Qualified Leads (“MQLs”) Attainment Relative To Plan

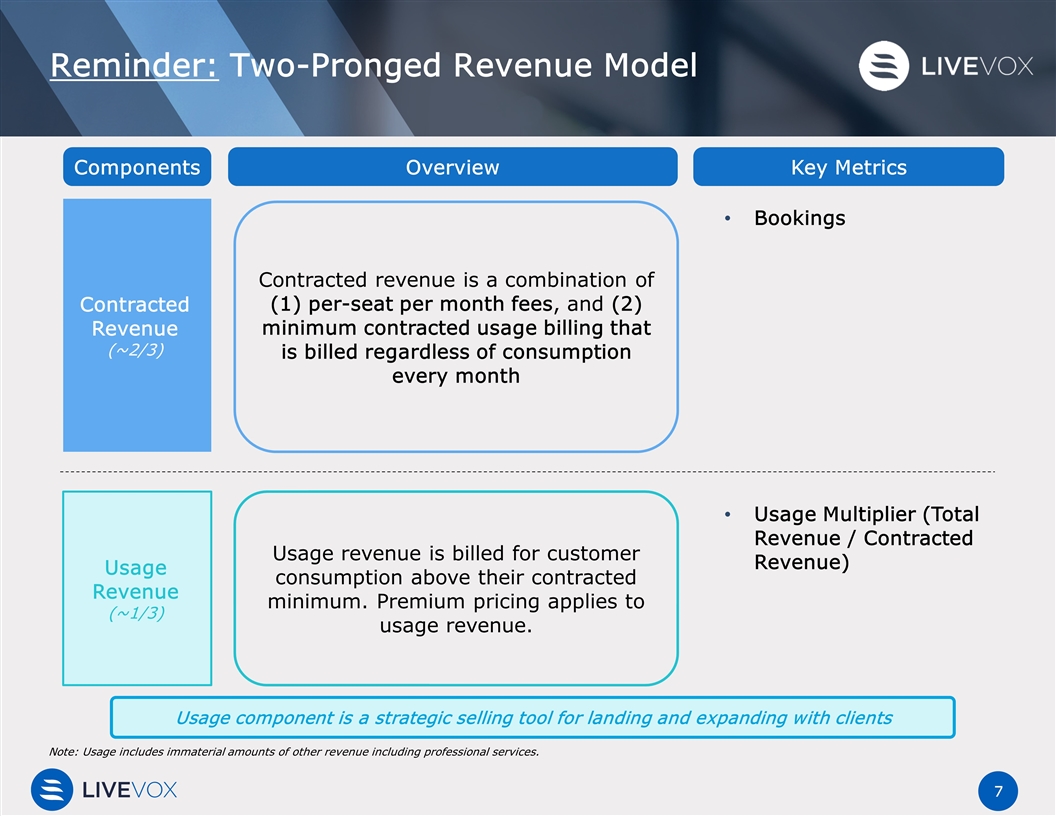

Overview Reminder: Two-Pronged Revenue Model Contracted Revenue (~2/3) Contracted revenue is a combination of (1) per-seat per month fees, and (2) minimum contracted usage billing that is billed regardless of consumption every month Usage revenue is billed for customer consumption above their contracted minimum. Premium pricing applies to usage revenue. Usage Revenue (~1/3) Key Metrics Components Bookings Usage Multiplier (Total Revenue / Contracted Revenue) Usage component is a strategic selling tool for landing and expanding with clients Note: Usage includes immaterial amounts of other revenue including professional services.

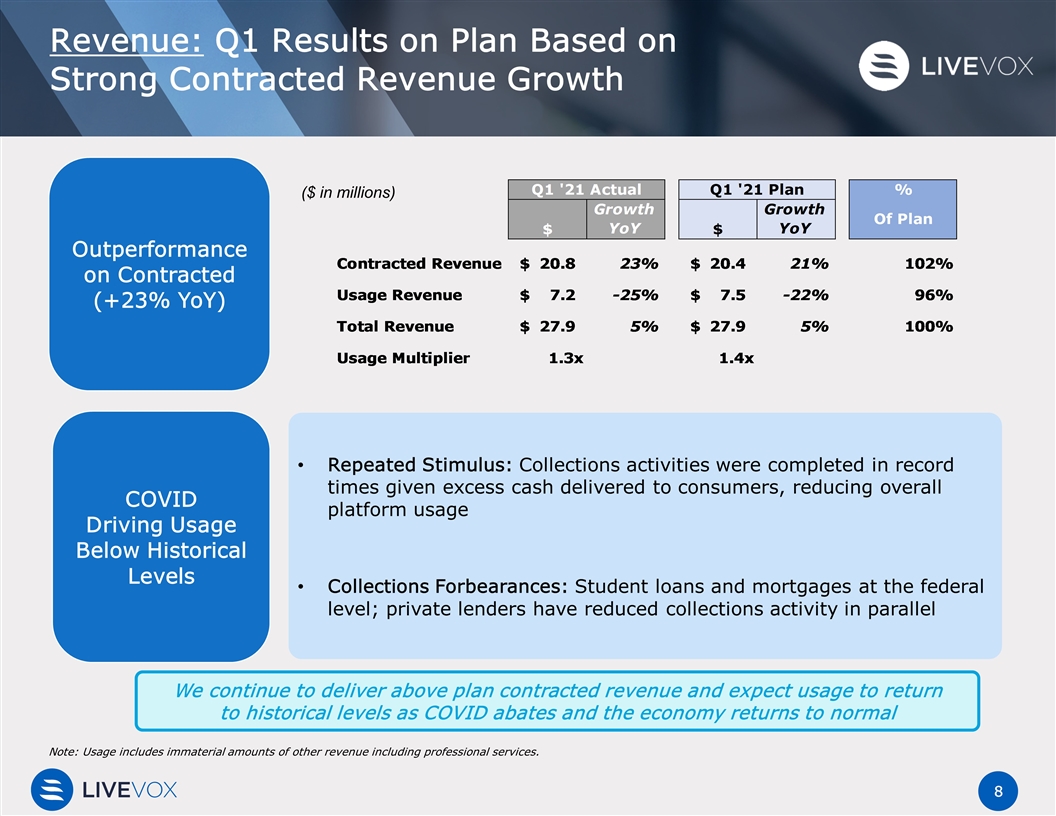

Revenue: Q1 Results on Plan Based on Strong Contracted Revenue Growth We continue to deliver above plan contracted revenue and expect usage to return to historical levels as COVID abates and the economy returns to normal Outperformance on Contracted (+23% YoY) COVID Driving Usage Below Historical Levels Repeated Stimulus: Collections activities were completed in record times given excess cash delivered to consumers, reducing overall platform usage Collections Forbearances: Student loans and mortgages at the federal level; private lenders have reduced collections activity in parallel ($ in millions) Note: Usage includes immaterial amounts of other revenue including professional services.

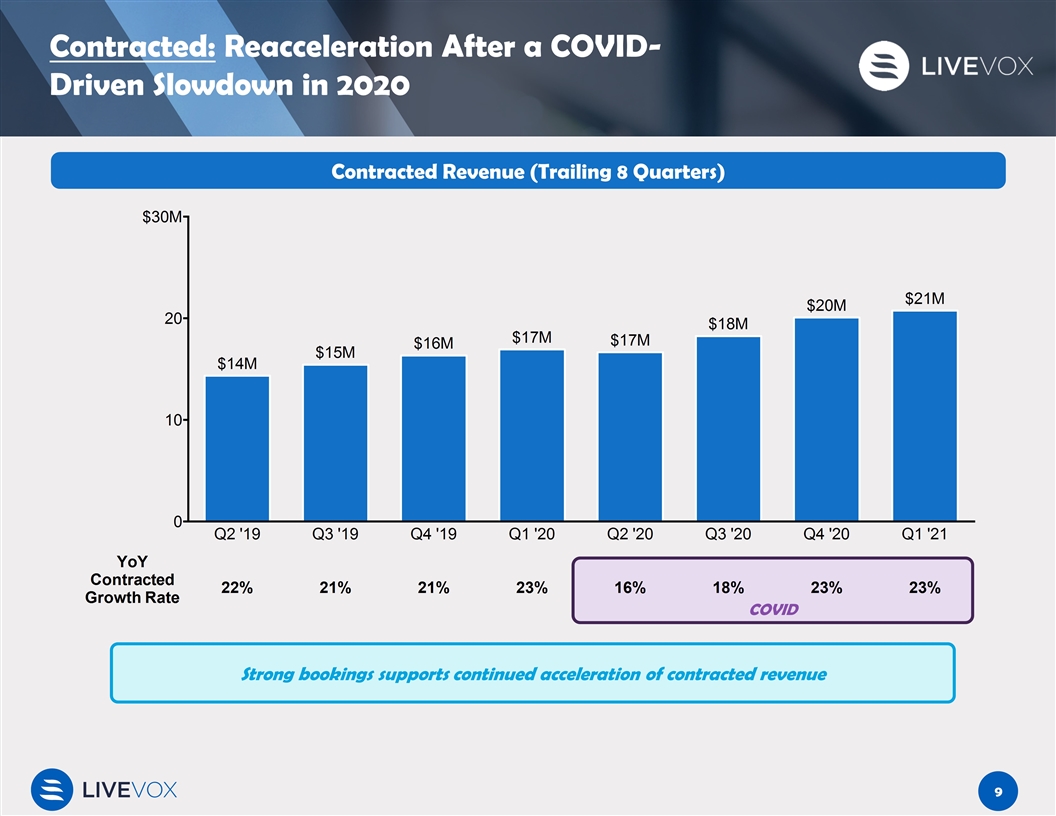

Contracted: Reacceleration After a COVID-Driven Slowdown in 2020 Strong bookings supports continued acceleration of contracted revenue COVID Contracted Revenue (Trailing 8 Quarters)

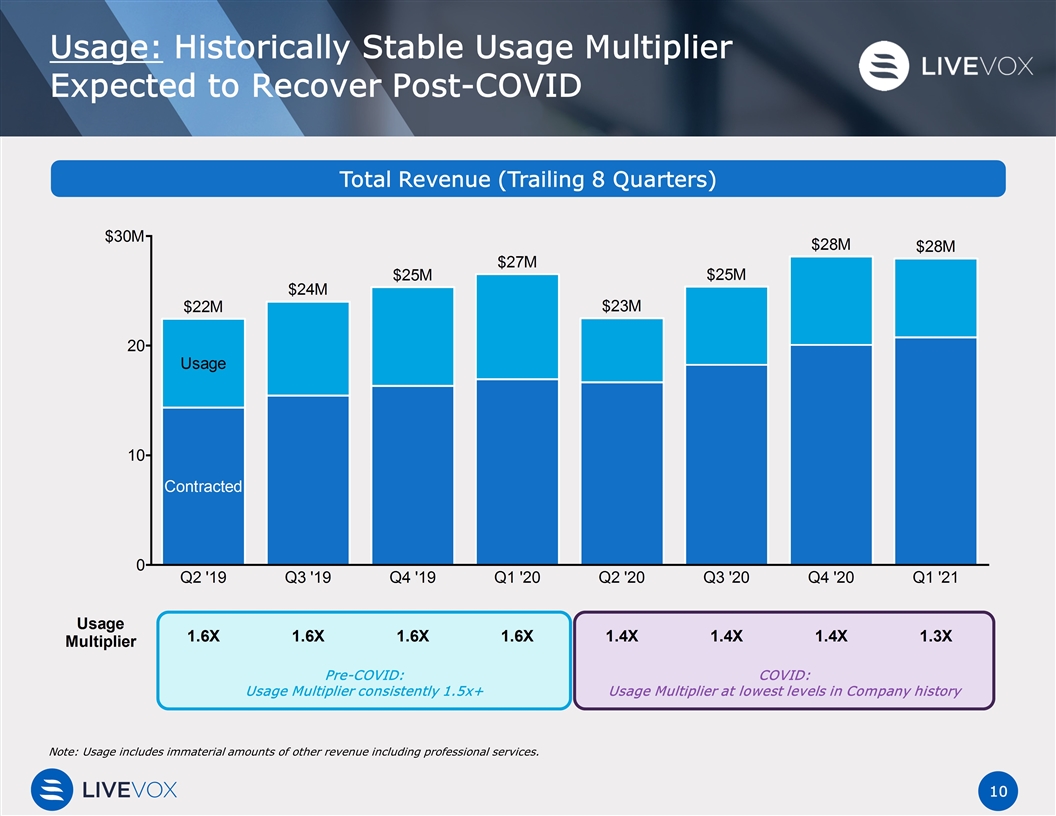

Note: Usage includes immaterial amounts of other revenue including professional services. Usage: Historically Stable Usage Multiplier Expected to Recover Post-COVID Pre-COVID: Usage Multiplier consistently 1.5x+ COVID: Usage Multiplier at lowest levels in Company history Total Revenue (Trailing 8 Quarters)

2021 and 2022 Outlook

Actual Forecast Contracted: Growth is Accelerating LiveVox is tracking on plan for 2021 and 2022 contracted revenue projections Annual Contracted Revenue

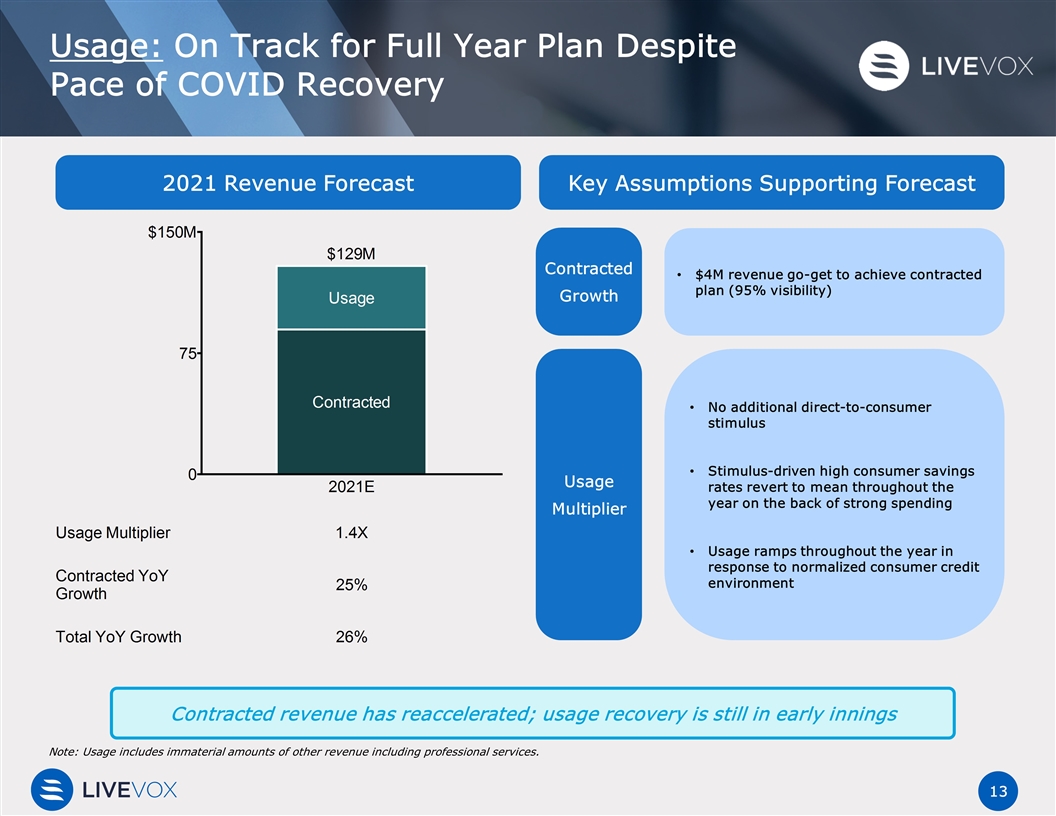

Usage: On Track for Full Year Plan Despite Pace of COVID Recovery 2021 Revenue Forecast No additional direct-to-consumer stimulus Stimulus-driven high consumer savings rates revert to mean throughout the year on the back of strong spending Usage ramps throughout the year in response to normalized consumer credit environment Key Assumptions Supporting Forecast Note: Usage includes immaterial amounts of other revenue including professional services. Usage Multiplier Contracted Growth $4M revenue go-get to achieve contracted plan (95% visibility) Contracted revenue has reaccelerated; usage recovery is still in early innings

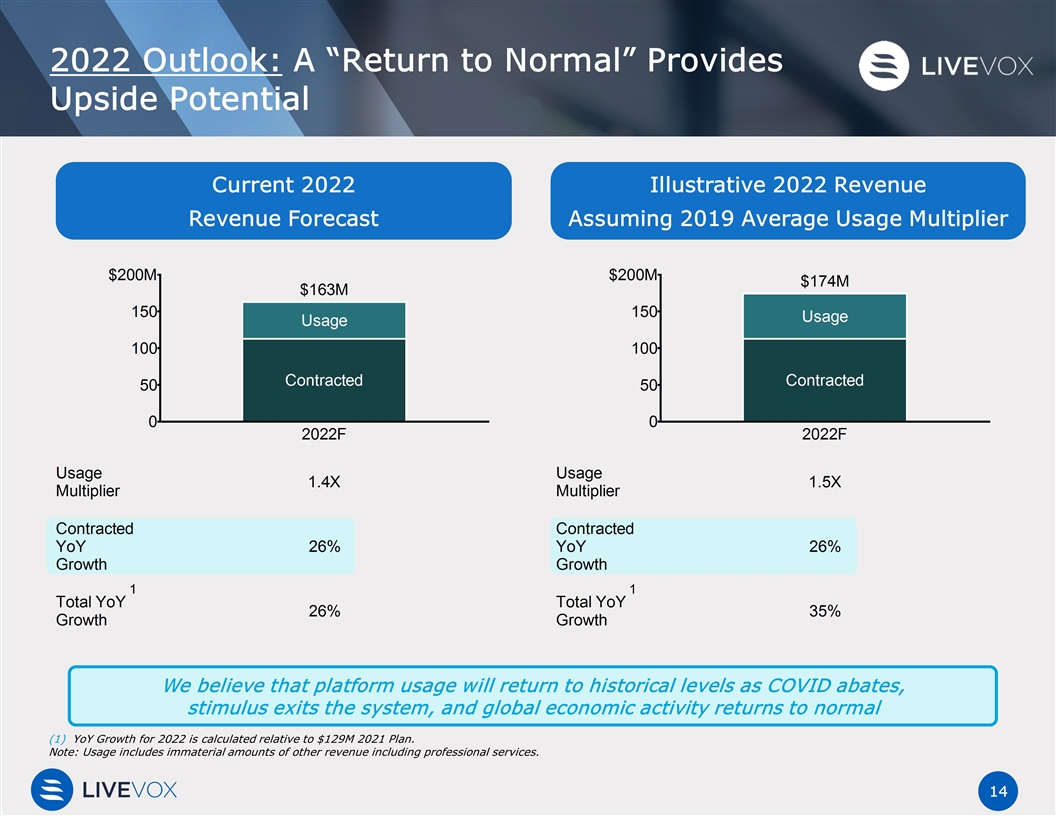

2022 Outlook: A “Return to Normal” Provides Upside Potential YoY Growth for 2022 is calculated relative to $129M 2021 Plan. Note: Usage includes immaterial amounts of other revenue including professional services. Current 2022 Revenue Forecast Illustrative 2022 Revenue Assuming 2019 Average Usage Multiplier We believe that platform usage will return to historical levels as COVID abates, stimulus exits the system, and global economic activity returns to normal 1 1