Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - ATHENA GOLD CORP | athenagold_ex3202.htm |

| EX-32.1 - CERTIFICATION - ATHENA GOLD CORP | athenagold_ex3201.htm |

| EX-31.2 - CERTIFICATION - ATHENA GOLD CORP | athenagold_ex3102.htm |

| EX-31.1 - CERTIFICATION - ATHENA GOLD CORP | athenagold_ex3101.htm |

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K/A

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 000-51808

ATHENA GOLD CORPORATION (f/k/a ATHENA SILVER CORPORATION)

(Exact Name of Registrant as specified in its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

90-0775276 (IRS Employer Identification number) |

|

2010A Harbison Drive # 312, Vacaville, CA (Address of principal executive offices) |

95687 (Zip Code) |

Registrant's telephone number, including area code: (707) 291-6198

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $.0001 par value

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

Smaller Reporting Company ☒

Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,291,734 based upon the last sale price of $0.11 as reported on the OTC.QB effective June 30, 2020.

The number of shares outstanding of the registrant’s common stock, as of February 12, 2021 is 60,032,320.

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes:

None.

EXPLANATORY NOTE

Athena Gold Corporation (“we,” “our,” “us,” or “Athena”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend our Annual Report on Form 10-K for the year ended December 31, 2020 (our “Form 10-K”), originally filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2021, to correct the audit report date. No other changes.

| i |

Forward-looking Statements

In General

This Report contains statements that plan for or anticipate the future. In this Report, forward-looking statements are generally identified by the words "anticipate," "plan," "believe," "expect," "estimate," and the like.

The factors that could cause actual results to differ materially from those projected in the forward-looking statements include:

| · | the risk factors set forth below under “Risk Factors”; |

| · | our ability to raise additional financing necessary to conduct our business; |

| · | our future business plans and strategies; |

| · | changes that could result from future acquisition of new mining properties or businesses; |

| · | our ability to commercially develop our mining interests.; |

| · | risks and hazards inherent in the mining business, including environmental hazards, industrial accidents, weather or geologically related conditions; |

| · | uncertainties inherent in our exploratory and developmental activities, including risks relating to permitting and regulatory delays; |

| · | changes in the market prices of gold or silver; |

| · | uncertainties inherent in the estimation of gold or silver ore reserves; |

| · | effects of environmental and other governmental regulations; and |

| · | the worldwide economic downturn and difficult conditions in the global capital and credit markets. |

In addition to the foregoing, the ongoing COVID-19 pandemic poses significant risks and uncertainties in numerous areas, including the availability of labor and materials to explore our mineral interests, risks impacting the cost and availability of insurance and the markets for precious metals. We cannot predict with any certainty the nature and extent of the impact that the pandemic will have on our business plan and operations.

Readers are cautioned not to put undue reliance on forward-looking statements. We disclaim any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

In light of the significant uncertainties inherent in the forward-looking statements made in this Report, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans will be achieved.

| 1 |

PART I

ITEM 1 – DESCRIPTION OF BUSINESS.

Overview

We were incorporated on December 23, 2003, in Delaware and our principal business is the acquisition and exploration of mineral resources.

In January 2021, the company’s Board of Directors approved a name change from Athena Silver Corporation, to Athena Gold Corporation. Athena Gold Corporation (“we,” “our,” “us,” or “Athena”) is engaged in the acquisition and exploration of mineral resources. We began our mining operations in 2010.

We entered into a Mining Lease and Option Agreement which granted us mining rights to the Langtry silver prospect located in San Bernardino County California. Due to the depressed commodities prices over the ensuing decade, we were never able to engage in meaningful exploration efforts. On April 28, 2020, Athena Silver Corporation entered into Agreement to Terminate Lease with Option to Buy dated March 10, 2016 with Bruce and Elizabeth Strachan, Trustees of the Bruce and Elizabeth Strachan Revocable Living Trust dated July 25, 2007, including any and all amendments thereto dated April 28, 2020 with respect to the Langtry Mine in California. As a result of this termination agreement, all scheduled lease option payments due in 2020 and beyond were considered terminated and void upon signing of the Agreement.

In December 2009, we formed and organized a new wholly-owned subsidiary, Athena Minerals, Inc. (“Athena Minerals”) which owned and operated our mining interests and properties in California. On December 31, 2020 we sold the subsidiary to Tripower Resources Inc., a company controlled by Mr. John Gibbs, a related party, in a non-cash exchange to satisfy our more than $2.0 million debt to Mr. Gibbs which is discussed further below and in the Notes to the Consolidated Financial Statements included in this report.

Effective December 15, 2020, Athena entered into a definitive Property Option Agreement with Nubian Resources Ltd. (“Nubian”) (TSXV: NBR), pursuant to which Athena acquired a 10% interest in Nubian’s Excelsior Springs exploration project located in Esmeralda County, Nevada and has an option to acquire the remaining 90% held by Nubian.

The Option is exercisable in two tranches: the first tranche was exercised immediately pursuant to which the Company acquired a 10% interest in Excelsior Springs in consideration of issuing to Nubian an aggregate of 5,000,000 shares of Athena Gold Corporation common stock. On December 15, 2020 the company issued the 5,000,000 shares of its common stock valued at $0.03 per share totaling $150,000. The second tranche is exercisable on or before December 31, 2021 to purchase an additional 90% interest in Excelsior Springs in consideration of issuing to Nubian an additional 45 million shares of Athena common stock. Should both options be exercised, Nubian will hold 50 million shares of Athena common stock, which will be subject to a six-month lockup.

Athena’s agreement with Nubian includes 100% of the 140 unpatented claims at Excelsior Springs with two additional patented claims held under a lease option that are subject to a 2% net smelter returns royalty on gold production. Under the terms of the Option Agreement, Nubian will retain a 1% net smelter returns royalty (“NSR Royalty”) on the Excelsior Springs Project if Athena fully exercises the option. Athena will have the right to purchase 0.5% (being one half) of the NSR Royalty for CAD $500,000 and the remaining 0.5% of the NSR Royalty at fair market value.

Excelsior Springs is our flagship project and has recently completed a N.I. 43-101 Technical Report to support its planned listing on the Canadian Stock Exchange that details past work and drill programs and highlight future exploration plans to advance the Property.

We have not presently determined whether our mineral properties contain mineral reserves that are economically recoverable.

Our primary focus going forward will be to continue evaluating our properties, as well as possible acquisitions of additional mineral rights and exploration, all of which will require additional capital.

| 2 |

Conflicts of Interests

Magellan Gold Corporation (“Magellan”) is a publicly-held company under common control. Mr. Power is our President, CEO and a director and is a former officer and director of Magellan. John Gibbs is a significant shareholder of both Athena and Magellan.

Silver Saddle Resources, LLC (“Silver Saddle”) is a private company under common control. Mr. Power and Mr. Gibbs are significant investors and managing members of Silver Saddle.

Athena, Magellan and Silver Saddle are exploration stage companies, and each is involved in the business of acquisition and exploration of mineral resources.

The existence of common ownership and common management could result in significantly different operating results or financial position from those that could have resulted had Athena, Magellan and Silver Saddle been autonomous. In addition, the common ownership could result in significant conflicts of interest both in terms of the allocation of working capital as well as under the doctrine of corporate opportunity, inasmuch as all three entities are engaged in mineral exploration in the United States. Messrs. Power and Gibbs have not adopted any policy or guidelines to mitigate the potential adverse effects of their conflicting interests between and among, Athena, Magellan and Silver Saddle.

Investors in Athena should be cognizant that the interests of Athena may, in the future, be in conflict with the other activities of Athena’s control persons.

SUMMARY PROVISIONS OF THE NUBIAN AGREEMENT

Effective December 15, 2020, Athena entered into a definitive Property Option Agreement with Nubian Resources Ltd. (“Nubian”) (TSXV: NBR), pursuant to which Athena acquired a 10% interest in Nubian’s Excelsior Springs exploration project located in Esmeralda County, Nevada and has an option to acquire the remaining 90% held by Nubian.

The Option is exercisable in two tranches: the first tranche was exercised immediately pursuant to which the Company acquired a 10% interest in Excelsior Springs in consideration of issuing to Nubian an aggregate of 5,000,000 shares of Athena Gold Corporation common stock. On December 15, 2020 the company issued the 5,000,000 shares of its common stock valued at $0.03 per share totaling $150,000. The second tranche is exercisable on or before December 31, 2021 to purchase an additional 90% interest in Excelsior Springs in consideration of issuing to Nubian an additional 45 million shares of Athena common stock. Should both options be exercised, Nubian will hold 50 million shares of Athena common stock, which will be subject to a six-month lockup.

Athena’s agreement with Nubian includes 100% of the 140 unpatented claims at Excelsior Springs with two additional patented claims held under a lease option that are subject to a 2% net smelter returns royalty on gold production. Under the terms of the Option Agreement, Nubian will retain a 1% net smelter returns royalty (“NSR Royalty”) on the Excelsior Springs Project if Athena fully exercises the option. Athena will have the right to purchase 0.5% (being one half) of the NSR Royalty for CAD $500,000 and the remaining 0.5% of the NSR Royalty at fair market value.

EXCELSIOR SPRINGS PROJECT

Excelsior Springs is Athena Gold’s flagship property, and Athena holds the right to acquire 100% of the large claim block which is located in the southern portion of the Walker Lane.

The Excelsior Springs project has been explored by a number of companies over the past 30 years during which it is believed that at least 84 RC drill holes totaling x feet have been drilled. The target is a large tonnage, moderate grade gold deposit amenable to open pit mining.

| 3 |

Location and Access:

The Excelsior Springs Property is located in the southeast part of unsurveyed Township 5 south, Range 39 and 40 east, MDBM, Esmeralda County, Nevada, approximately 45 miles southwest of Goldfield, Nevada. The Property is accessed by traveling 14.5 miles (23.2 km) south of Goldfield on US highway 95 and then turning west onto Nevada State Route 266 at Lida Junction and proceeding west for approximately 28.7 miles (45.9 km). Just past mile marker 12, a county-maintained gravel road turns north and leads five miles (8 km) to the Property. There is a locked gate at the southern edge of the patented claims. The Property lies on the moderately hilly south flank of the Palmetto Mountains at an elevation of 6,000 to 8,000 feet (1,829 – 2,439 m) with moderate to heavy juniper/pinion pine cover.

The Excelsior Springs Property comprises 140 unpatented mining claims and two patented mining claims. All of the claims are held by Nubian Resources USA (“Nubian”) and located on Federal Government land administered by the Department of Interior's Bureau of Land Management ("BLM"). The two patented claims are leased to Nubian by the owner, Christian Bramwell, of Pahrump, Nevada. The patented claims, the Prout and Fortunatus (MS 4106), were located in 1873 and 1892, respectively, and were patented in 1912. The patented claims have both surface and mineral rights. Ownership of the unpatented claims gives the right to explore for and develop mineral resources but no surface rights.

The Property consists of 42 "EX" and 88 "ES" contiguous, unpatented lode mining claims covering approximately 2,884 acres (1,167 hct) and two patented claims covering 40 acres (16.1 hct). A separate block of ten "ES" claims covering 202 acres (84 hct) is located approximately one mile (1.6 km) northwest of the main block of claims.

Legal Ownership

Nubian leased the two patented claims comprising part of the Excelsior Springs Property until 2022 under the following terms: Nubian must make pre-production royalty payments to the owner of $15,000 per year during exploration and $20,000 per year once commercial production begins. All payments are credited against a 2% Net Smelter Return Royalty on production. After 2022, Nubian must purchase the two patented claims for $300,000 or renegotiate the terms of the lease.

In December 2020, Athena entered into a definitive agreement with Nubian (the "Option Agreement"), pursuant to which Nubian has granted Athena the option to acquire a 100% interest in the Excelsior Springs Property (the "Option").

The Option is exercisable in two stages. In December 2020, Athena acquired an initial 10% interest in the Excelsior Springs Property (the "First Option"), by making a $10,000 cash payment; and issuing 5,000,000 shares of Athena common stock to Nubian in accordance with the Option Agreement. To acquire the remaining 90% interest in the Excelsior Springs Property (the "Second Option"), Athena is required to, prior to December 31, 2021: (i) issue an additional 45,000,000 shares of Athena common stock to Nubian; (ii) obtain an initial listing of its common shares on a recognized Canadian stock exchange; and (iii) settle all outstanding debt prior to obtaining the exchange listing, with the exception of debt incurred in connection with the listing. If Athena fails to exercise the Second Option prior to December 31, 2021, the initial 10% interest earned by Athena pursuant to the First Option will revert to Nubian, and Athena will hold no interest in the Property.

Nubian, through their wholly owned U.S. subsidiary Nubian Resources USA Inc., will retain a 1% Net Smelter Returns Royalty (the "NSR Royalty") on the Property upon the exercise of the Second Option by Athena. One-half (0.5%) of the NSR Royalty may be purchased by Athena for CAD $500,000 payable to Nubian. An additional one-half (0.5%) of the NSR Royalty may be purchased by Athena at fair market value.

| 4 |

History:

The Buster Mine claim block was discovered in 1872 and has been through several periods of small-scale mining and exploration efforts. During the late 1800s and perhaps the early 1900s there was unconfirmed production from the Buster Mine of an estimated 18,000 tons at 1.2 oz Au/ton (37.3 g/T). Little else is known about work on the mine until Fernan Lemieux re-timbered the Buster shaft in 1964 at a reported cost of $50,000 (Grant, 1986). A visual inspection of the shaft indicated the ladders were still in good condition. Since 1964, the Property has been explored by a number of companies as described below:

| · | 1960s & 1970s – Efforts to re-timber the shafts and attempts at small scale mining | |

| · | 1986 – Great Pacific Resources (11 RC holes) | |

| · | 1988 – Lucky Hardrock JV (12 RC holes) | |

| · | 2005-2007 – Walker Lane Gold (22 RC holes) | |

| · | 2008 – Evolving Gold (8 RC holes) | |

| · | 2011-2014 – Global Geoscience and partner Osisko Mining (31 RC holes & Geophysics) |

Geology and Mineralization:

The project comprises 140 unpatented and two patented lode claims covering 2,884 acres (1,167 hct). The project has had some historic, high-grade gold production from silicified zones on the patented claims. These zones are contained in several, large, intensely altered, E-W-trending shear zones in Paleozoic siltstones and limestones. These shear zones host structurally and lithologically controlled gold mineralization within a 3 X 1 km area of intense clay alteration. The shear zones have been collectively named the Excelsior Springs Shear Zone, ESSZ, and form the core of the exploration targets on the property.

Geology and Mineralization. The Property lies within the Walker Lane, a regional-scale zone of northwest-trending, strike-slip faulting. The Walker Lane hosts a significant number of precious metal deposits including the Comstock Lode at Virginia City, Borealis, Aurora, Mineral Ridge, Paradise Peak, Rawhide, Tonopah, Goldfield and the Bullfrog District. These deposits are Tertiary in age, and all have a very strong structural control for the mineralization. However, the author has not verified information with respect to the abovementioned deposits, and information in this Report with respect to these deposits is not necessarily indicative of the mineralization on the Excelsior Springs Property. The Excelsior Springs Property area contains a thick section of basal Precambrian-Cambrian sedimentary rocks that are complexly interlayered by thrust faults with the Ordovician Palmetto Formation. On the Property, there are a large number of prospect pits, small trenches and drill roads concentrated along the Excelsior Springs Property structural zone ("ESSZ"), a 1,000 foot-wide and 10,000 foot-long (304 m x 3,048 m), east-west-trending zone of shearing and alteration. Underground workings on the two patented claims have been the source of the Property's unverified, historic production, reported to be 19,200 oz Au (18,000 tons containing 1.2 oz Au/ton (37.3 g Au/T)). Assay results for the 84 RC holes that have been drilled on the Property show that 51 of the holes (61 %) contain a 20-foot interval averaging 0.25 g Au/T, typical cut-off grade for Nevada open-pit gold mines. Forty of the holes (48 %) contain a 20-foot interval averaging 0.5 g Au/T, and 24 of the holes (29 %) contain a 20-foot interval averaging 1.0 g Au/T.

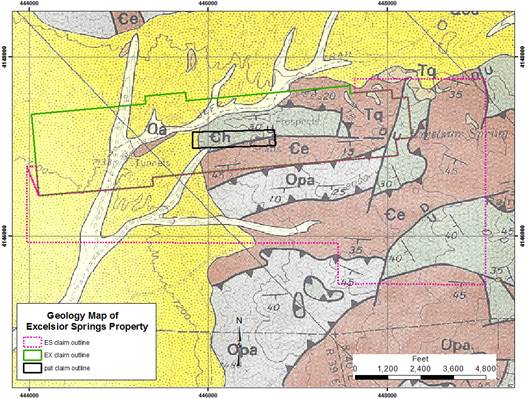

Property Geology. The Excelsior Springs Property area contains basal Precambrian-Cambrian sedimentary rocks complexly interlayered by thrust faults with the Ordovician Palmetto Formation, as seen in Figure 17 (McKee, 1985). Lithologic units shown on the map are listed below.

Qa - Alluvium, (Quaternary) - sand and gravel.

Tq - Quartz porphyry and alaskite dikes, (Miocene) - Light-colored, quartz-rich fine- grained intrusive rocks.

Opa - Palmetto Formation, (Ordovician) - Heterogeneous mixture of dark, thin-bedded chert, shale, limestone and quartzites, usually in thrust fault contact with older rocks.

| 5 |

Ce - Emigrant Formation, (Cambrian) - Gray- green limey siltstone with sandstone interbeds. Grades upward into platy, gray, aphanitic limestone with chert nodules, chert beds and intraformational limestone conglomerates.

Ch - Harkless Formation,(Cambrian) - Interbedded fine-grained sandstone, siliceous siltstone and thin limestone.

Miocene rhyolite and hornblende diorite dikes (Tq) occur throughout the Property and are particularly abundant in the area east of the Excelsior Springs Property. Most of the dikes are aligned parallel to the east-west to east-northeast trends of the mineralization in the ESSZ. The quartz-rich rhyolite dikes appear to be more closely associated with alteration and gold mineralization than do the hornblende diorite dikes.

| 6 |

The 3,500 foot-thick (1,067 m), Cambrian-age (Ch) Harkless Formation seems to be the predominant host for the alteration and mineralization and is divided into a lower, greenish-gray quartz-rich siltstone member and an upper olive-gray siltstone member. Limestone layers, up to 100 feet-thick (30 m), occur in the lower member. The Cambrian-age (Ce) Emigrant Formation overlying the Harkless consists of a lower, multi-colored limestone-siltstone member, a middle, greenish-gray shale member and an upper, gray, cherty limestone member. The Emigrant Formation is about 1,300 feet-thick (396 m).

Mineralized Zones. The east-west trending ESSZ shows strong hydrothermal alteration over an area 1,000-1,800 feet-wide (305 – 549 m) and 10,000 feet-long (3,050 m) and appears to extend under Quaternary gravels to the west of the Buster and pit areas. In addition to the area around the Buster shaft, there are many other scattered zones of anomalous gold and base metal mineralization within the ESSZ. There are large, well developed, east-west-trending drainages to the north and south of the ESSZ. These drainages also contain outcrops of strongly altered rocks that have not been closely examined. Mineralization on the claims is hosted mostly in the Harkless Formation and the Emigrant Formation. Mineralization occurs almost entirely in shear zones which are characterized by brecciation, silicification and local mylonitization. The ESSZ contains well developed fractures striking east-west and well mineralized sets of north-, northeast- and northwest-striking fractures. There are several gold-bearing quartz veins containing galena and tetrahedrite in the shear zones that represent a post-deformation period of mineralization. Most of the mineralized zones do not contain visible sulfides.

Gold mineralization is localized by the structures and occurs as veinlets and veins. Gold also appears to occur in a disseminated form in favorable stratigraphic units. Brecciated quartz veins are common in the mineralized zones but frequently exhibit no direct correlation with higher gold values. Quartz-copper veins and pods of white quartz are also brecciated and locally re-cemented with fine-grained crystalline to chalcedonic silica. A strong correlation between visible copper and/ or zinc oxides and carbonates and higher-grade gold values has been noted. Cadmium and antimony values are anomalous but somewhat randomly distributed, and arsenic is strongly correlated with gold values greater than 8 ppm.

EXPLORATION ACTIVITIES:

Summary

Athena has begun an initial work program for the Excelsior Springs Property comprising the following:

| · | Data compilation and review; |

| · | Geologic mapping and sampling of selected areas of the project; |

| · | Acquisition and evaluation of hyperspectral satellite imagery for alteration studies; |

| · | Refining the project's structural model for mineralization; |

| · | Developing a 3-D, computer generated model of the Buster area mineralization; |

| · | Creating a new set of 1:1200 scale cross sections to include all drill holes. |

(a) Data Compilation. There is a large amount of historic data generated by previous exploration programs on the Property. Much of the earlier data is incomplete and weakly documented but still useful. A new compilation of all the drilling results including collar location, hole azimuth, dip, total depth and gold values has been completed and used to construct the three-dimensional model and new cross sections.

(b) Geologic Mapping and Sampling. Approximately 20 man-days have been spent mapping in selected areas of the project. Mapping was done on detailed color photos at a scale of 1:2,400 with a particular focus on alteration zones and structural features. This new work is being integrated into the existing geologic map and will be fully digital. The new geologic map has not been completed, but it will serve as a base layer for showing alteration, mineralization, structures, geophysical data and drill hole projections. In conjunction with the mapping of selected areas, the Company has collected and processed 100 surface rock chip samples. Custody of these samples was maintained by the geologists and then delivered to American Assay Labs in Sparks, Nevada. All samples were fire assayed for gold, and an ICP process was used for other elements. The assay process is described in Section 11.1 of this Report and duplicate, standard and blank samples were used.

(c) Hyperspectral Data. SpecTir Imagery of Reno, Nevada provided a suite of hyperspectral images covering the area around the project. The study shows the alteration mineralogy image generated by the SpecTIR data. The Buster zone clearly shows strong kaolinite and sodium-rich illite (paragonite) alteration. The strong clay alteration zone continues eastward to the Ridge zone (447300 E) and further east into the Excelsior Springs Property area (448000 E). Further east and west from the Buster zone the clay mineralogy becomes potassium-rich phengite along with muscovite.

| 7 |

(d) Refining the Structural Model. Ore deposits found within the Walker Lane and particularly mineralized zones in the ESSZ are both structurally and lithologically controlled.

(e) Three-Dimensional Model. Geo Vector Consultants in Ottawa, Canada has utilized the updated drill hole data base for the Property and has generated the 3-D model for the mineralized zones. There are multiple intercepts of potentially well mineralized material in many of the holes, but further infill drilling is needed to better confirm continuity of the zones between the holes.

(f) Cross Sections. Mine Development Associates ("MDA"), a division of RESPEC Inc., consultants in Reno, is generating a complete set of 1:600 scale cross sections along with a topographic map showing all of the drill holes and mineralized intervals.

EXPLORATION PLANS

A three-phase exploration program is recommended for the Property. Phase One will comprise the following items:

| 1. | Conducting a new gradient array IP survey that will provide data to a depth of approximately 900 feet (274 m) and better define the southwestern chargeability zone. |

| 2. | Analyzing of all surface mapping, assay and geophysical data to determine if moving to the Phase Two drilling program is warranted. |

Subject to obtaining the necessary permits in a timely manner, the Phase One should be completed in several months. A detailed budget proposal for the Phase One program totals $122,235.

If Phase One results demonstrate there are valid, untested drill targets, then the Phase Two core and RC drilling program should be initiated. A detailed budget for Phase Two, consisting of the 2,000 feet (610 m) of oriented core drilling and the 10,000 feet (3,048 m) of RC drilling will cost an estimated $866,870. Phase One and Two total $1,088,015, including a 10% contingency.

If Phase Two is successful, Phase Three is intended to precisely define depth, width, length, tonnage and value per ton of any deposit that has been identified and would involve:

| · | drilling to develop the mining site; | |

| · | conducting metallurgical testing; and | |

| · | obtaining other pertinent technical information required to define an ore reserve and complete a feasibility study. |

Depending upon the nature of the particular deposit, the third phase on any one property could take one to five years or more and cost well in excess of $1 million.

No Proven or Probable Mineral Reserves/Exploration Stage Company

We are considered an exploration stage company under SEC criteria since we have not demonstrated the existence of proven or probable mineral reserves at any of our properties. In Industry Guide 7, the SEC defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Proven or probable mineral reserves are those reserves for which (a) quantity is computed and (b) the sites for inspection, sampling, and measurement are spaced so closely that the geologic character is defined and size, shape and depth of mineral content can be established (proven) or the sites are farther apart or are otherwise less adequately spaced but high enough to assume continuity between observation points (probable). Mineral Reserves cannot be considered proven or probable unless and until they are supported by a feasibility study, indicating that the mineral reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable.

We anticipate further updating our mining properties disclosure in accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosures for Mining Registrants, which became effective February 25, 2019, and which rescinds SEC Industry Guide 7 following a two-year transition period, which means that we will be required to comply with the new rule no later than our fiscal year beginning January 1, 2021.

| 8 |

MARKETING

All of our mining operations, if successful, will produce gold in doré form or a concentrate that contains gold.

We plan to market our refined metal and doré to credit worthy bullion trading houses, market makers and members of the London Bullion Market Association, industrial companies and sound financial institutions. The refined metals will be sold to end users for use in electronic circuitry, jewelry, silverware, and the pharmaceutical and technology industries. Generally, the loss of a single bullion trading counterparty would not adversely affect us due to the liquidity of the markets and the availability of alternative trading counterparties.

We plan to refine and market its precious metals doré and concentrates using a geographically diverse group of third party smelters and refiners. The loss of any one smelting and refining client may have a material adverse effect if alternate smelters and refiners are not available. We believe there is sufficient global capacity available to address the loss of any one smelter.

GOVERNMENT REGULATION

General

Our activities are and will be subject to extensive federal, state and local laws governing the protection of the environment, prospecting, mine development, production, taxes, labor standards, occupational health, mine safety, toxic substances and other matters. The costs associated with compliance with such regulatory requirements are substantial and possible future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development and continued operation of our properties, the extent of which cannot be predicted. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards and regulations which may entail significant costs and delays. Although we are committed to environmental responsibility and believe we are in substantial compliance with applicable laws and regulations, amendments to current laws and regulations, more stringent implementation of these laws and regulations through judicial review or administrative action or the adoption of new laws could have a materially adverse effect upon our results of operations.

Federal Environmental Laws

Certain mining wastes from extraction and beneficiation of ores are currently exempt from the extensive set of Environmental Protection Agency (“EPA”) regulations governing hazardous waste, although such wastes may be subject to regulation under state law as a solid or hazardous waste. The EPA has worked on a program to regulate these mining wastes pursuant to its solid waste management authority under the Resource Conservation and Recovery Act (“RCRA”). Certain ore processing and other wastes are currently regulated as hazardous wastes by the EPA under RCRA. If our future mine wastes, if any, were treated as hazardous waste or such wastes resulted in operations being designated as a “Superfund” site under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or “Superfund”) for cleanup, material expenditures would be required for the construction of additional waste disposal facilities or for other remediation expenditures. Under CERCLA, any present owner or operator of a Superfund site or an owner or operator at the time of its contamination generally may be held liable and may be forced to undertake remedial cleanup action or to pay for the government’s cleanup efforts. Such owner or operator may also be liable to governmental entities for the cost of damages to natural resources, which may be substantial. Additional regulations or requirements may also be imposed upon our future tailings and waste disposal, if any, in Nevada under the Federal Clean Water Act (“CWA”) and state law counterparts. We have reviewed and considered current federal legislation relating to climate change and we do not believe it to have a material effect on our operations. Additional regulation or requirements under any of these laws and regulations could have a materially adverse effect upon our results of operations.

| 9 |

EXCELSIOR SPRINGS PROJECT CLAIMS

The following map shows the location of the patented and unpatented mining claims that comprise the Excelsior Springs project:

| Excelsior Springs Project - List of ES Claims | |||||

| Claim Name | NMC # | Claimant | Valid Until | ||

| 1 | ES 1 | 1045871 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 2 | ES 3 | 1045873 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 3 | ES 5 | 1045875 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 4 | ES 7 | 1045877 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 5 | ES 9 | 1045879 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 6 | ES 11 | 1045881 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 7 | ES 13 | 1045883 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 8 | ES 15 | 1045885 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 9 | ES 17 | 1045887 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 10 | ES 19 | 1045889 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 11 | ES 21 | 1045891 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 12 | ES 23 | 1045893 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 13 | ES 25 | 1045895 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 14 | ES 27 | 1045897 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 15 | ES 29 | 1045899 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 16 | ES 31 | 1045901 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 17 | ES 33 | 1045903 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 18 | ES 35 | 1045905 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 10 |

| 19 | ES 37 | 1045907 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 20 | ES 39 | 1045909 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 21 | ES 40 | 1045910 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 22 | ES 41 | 1045911 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 23 | ES 42 | 1045912 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 24 | ES 43 | 1045913 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 25 | ES 44 | 1045914 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 26 | ES 45 | 1045915 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 27 | ES 46 | 1045916 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 28 | ES 47 | 1045917 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 29 | ES 48 | 1045918 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 30 | ES 49 | 1045919 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 31 | ES 50 | 1045920 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 32 | ES 51 | 1045921 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 33 | ES 52 | 1045922 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 34 | ES 53 | 1045923 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 35 | ES 54 | 1045924 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 36 | ES 55 | 1045925 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 37 | ES 56 | 1045926 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 38 | ES 57 | 1045927 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 39 | ES 58 | 1045928 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 40 | ES 59 | 1045929 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 41 | ES 60 | 1045930 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 42 | ES 61 | 1045931 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 43 | ES 62 | 1045932 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 44 | ES 63 | 1045933 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 45 | ES 64 | 1045934 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 46 | ES 65 | 1045935 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 47 | ES 66 | 1045936 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 48 | ES 67 | 1045937 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 49 | ES 68 | 1045938 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 50 | ES 69 | 1045939 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 51 | ES 70 | 1045940 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 52 | ES 71 | 1045941 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 53 | ES 72 | 1045942 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 54 | ES 73 | 1045943 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 55 | ES 74 | 1045944 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 56 | ES 75 | 1045945 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 57 | ES 76 | 1045946 | Nubian Resources USA Ltd. | 9/1/2021 |

| 11 |

| 58 | ES 77 | 1045947 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 59 | ES 78 | 1045948 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 60 | ES 79 | 1045949 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 61 | ES 80 | 1045950 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 62 | ES 81 | 1045951 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 63 | ES 82 | 1045952 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 64 | ES 83 | 1045953 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 65 | ES 84 | 1045954 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 66 | ES 85 | 1045955 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 67 | ES 86 | 1045956 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 68 | ES 87 | 1045957 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 69 | ES 88 | 1045958 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 70 | ES 89 | 1045959 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 71 | ES 90 | 1045960 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 72 | ES 91 | 1045961 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 73 | ES 92 | 1045962 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 74 | ES 93 | 1045963 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 75 | ES 94 | 1045964 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 76 | ES 95 | 1045965 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 77 | ES 96 | 1045966 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 78 | ES 97 | 1045967 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 79 | ES 98 | 1045968 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 80 | ES 99 | 1045969 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 81 | ES 100 | 1045970 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 82 | ES103 | 1057362 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 83 | ES105 | 1057364 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 84 | ES107 | 1057366 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 85 | ES109 | 1057368 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 86 | ES176 | 1057394 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 87 | ES179 | 1057395 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 88 | ES180 | 1057396 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 89 | ES245 | 1057460 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 90 | ES246 | 1057461 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 91 | ES247 | 1057462 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 92 | ES248 | 1057463 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 93 | ES249 | 1057464 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 94 | ES250 | 1057465 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 95 | ES251 | 1057466 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 96 | ES252 | 1057467 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 97 | ES253 | 1057468 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 98 | ES254 | 1057469 | Nubian Resources USA Ltd. | 9/1/2021 |

| 12 |

| Excelsior Springs Project - List of EX Claims | |||||

| Claim Name | NMC # | Claimant | Valid Until | ||

| 1 | EX 1 | 887756 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 2 | EX 2 | 887757 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 3 | EX 3 | 887758 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 4 | EX 4 | 887759 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 5 | EX 5 | 887760 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 6 | EX 6 | 887761 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 7 | EX 7 | 887762 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 8 | EX 8 | 887763 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 9 | EX 9 | 887764 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 10 | EX 10 | 887765 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 11 | EX 11 | 887766 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 12 | EX 12 | 887767 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 13 | EX 13 | 887768 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 14 | EX 14 | 887769 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 15 | EX 20 | 897986 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 16 | EX 21 | 897987 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 17 | EX 22 | 897988 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 18 | EX 23 | 897989 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 19 | EX 24 | 897990 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 20 | EX 25 | 897991 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 21 | EX 26 | 897992 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 22 | EX 27 | 897993 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 23 | EX 28 | 897994 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 24 | EX 29 | 897995 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 25 | EX 30 | 897996 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 26 | EX 31 | 897997 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 27 | EX 32 | 897998 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 28 | EX 33 | 897999 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 29 | EX 34 | 898000 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 30 | EX 35 | 898001 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 31 | EX 36 | 898002 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 32 | EX 37 | 898003 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 33 | EX 38 | 898004 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 34 | EX 39 | 898005 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 35 | EX 40 | 898006 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 36 | EX 41 | 898007 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 37 | EX 42 | 898008 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 38 | EX 43 | 898009 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 39 | EX 44 | 898010 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 40 | EX 45 | 898011 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 41 | EX 46 | 898012 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 42 | EX 47 | 898013 | Nubian Resources USA Ltd. | 9/1/2021 | |

| 13 |

Unpatented Mining Claims: The Mining Law of 1872

Except for the Langtry Property, our mineral rights consist of leases covering "unpatented" mining claims created and maintained in accordance with the U.S. General Mining Law of 1872, or the “General Mining Law.” Unpatented mining claims are unique U.S. property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. The validity of an unpatented mining claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law that supplement the General Mining Law. Also, unpatented mining claims and related rights, including rights to use the surface, are subject to possible challenges by third parties or contests by the federal government. In addition, there are few public records that definitively control the issues of validity and ownership of unpatented mining claims. We have not filed a patent application for any of our unpatented mining claims that are located on federal public lands in the United States and, under possible future legislation to change the General Mining Law, patents may be difficult to obtain.

Location of mining claims under the General Mining Law, is a self-initiation system under which a person physically stakes an unpatented mining claim on public land that is open to location, posts a location notice and monuments the boundaries of the claim in compliance with federal laws and regulations and with state location laws, and files notice of that location in the county records and with the BLM. Mining claims can be located on land as to which the surface was patented into private ownership under the Stockraising Homestead Act of 1916, 43 U.S.C. §299, but the mining claimant cannot injure, damage or destroy the surface owner's permanent improvements and must pay for damage to crops caused by prospecting. Discovery of a valuable mineral deposit, as defined under federal law, is essential to the validity of an unpatented mining claim and is required on each mining claim individually. The location is made as a lode claim for mineral deposits found as veins or rock in place, or as a placer claim for other deposits. While the maximum size and shape of lode claims and placer claims are established by statute, there are no limits on the number of claims one person may locate or own. The General Mining Law also contains provision for acquiring five-acre claims of non-mineral land for millsite purposes. A mining operation typically is comprised of many mining claims.

The holder of a valid unpatented mining claim has possessory title to the land covered thereby, which gives the claimant exclusive possession of the surface for mining purposes and the right to mine and remove minerals from the claim. Legal title to land encompassed by an unpatented mining claim remains in the United States, and the government can contest the validity of a mining claim. The General Mining Law requires the performance of annual assessment work for each claim, and subsequent to enactment of the Federal Land Policy and Management Act of 1976, 43 U.S.C. §1201 et seq., mining claims are invalidated if evidence of assessment work is not timely filed with BLM. However, in 1993 Congress enacted a provision requiring payment of $140 per year claim maintenance fee in lieu of performing assessment work, subject to an exception for small miners having less than 10 claims. No royalty is paid to the United States with respect to minerals mined and sold from a mining claim.

The General Mining Law provides a procedure for a qualified claimant to obtain a mineral patent (i.e., fee simple title to the mining claim) under certain conditions. It has become much more difficult in recent years to obtain a patent. Beginning in 1994, Congress imposed a funding moratorium on the processing of mineral patent applications which had not reached a designated stage in the patent process at the time the moratorium went into effect. Additionally, Congress has considered several bills in recent years to repeal the General Mining Law or to amend it to provide for the payment of royalties to the United States and to eliminate or substantially limit the patent provisions of the law.

Mining claims are conveyed by deed, or leased by the claimant to the party seeking to develop the property. Such a deed or lease (or memorandum of it) needs to be recorded in the real property records of the county where the property is located, and evidence of such transfer needs to be filed with BLM. It is not unusual for the grantor or lessor to reserve a royalty, which as to precious metals often is expressed as a percentage of net smelter returns.

Patented Mining Claims

Patented mining claims, such as the two patented claims included in the Excelsior Springs project, are mining claims on federal lands that are held in fee simple by the owner. No maintenance fees or royalties are payable to the BLM; however, lease payments and royalties are payable under the operative leases.

| 14 |

DISCONTINUED MINERAL INTERESTS

LOCATION AND HISTORY OF THE LANGTRY PROJECT

[Athena terminated its interest in the Langtry Project in April 2020]

In 2010 we entered into a Mining Lease and Option Agreement which granted us mining rights to the Langtry silver prospect located in San Bernardino County California. Due to the depressed commodities prices over the ensuing decade, we were never able to engage in meaningful exploration efforts. On April 28, 2020, Athena Silver Corporation entered into Agreement to Terminate Lease with Option to Buy dated March 10, 2016 with Bruce and Elizabeth Strachan, Trustees of the Bruce and Elizabeth Strachan Revocable Living Trust dated July 25, 2007, including any and all amendments thereto. The Agreement to Terminate ended our interest in the Langtry prospect. As a result of this termination agreement, all scheduled lease option payments due in 2020 and beyond were considered terminated and void upon signing of the Agreement.

In December 2009, we formed and organized a new wholly-owned subsidiary, Athena Minerals, Inc. (“Athena Minerals”) which owned and operated our mining interests and properties in California, including the Langtry lease and option. After the Langtry lease and option had been terminated, Athena Mineral’s residual interests consisted of some assorted unproductive fee interests and unpatented mining claims which we considered to have questionable recoverable value. On December 31, 2020, after the Langtry lease and option had been terminated, we sold the subsidiary with its residual interests to Tripower Resources Inc., a company controlled by Mr. John Gibbs, a related party, in a non-cash exchange to satisfy our more than $2.0 million debt to Mr. Gibbs which is discussed further below and in the Notes to the Consolidated Financial Statements included in this report.

Langtry Project:

The Langtry Project covered approximately 1,200 acres and consisted of 20 patented and 2 unpatented lode mining claims held under the Strachan Lease and 36 unpatented lode mining claims with the BLM.

Location, Access and Composition

The Langtry Project is located in the central part of the Mojave Desert of Southern California. It is situated along the western flank of the Calico Mountains, about 10 miles northeast of Barstow in San Bernardino County. Access is good with paved county roads within a mile of the project. A rail shipping point is about five miles to the south.

The property can be accessed from Barstow by traveling north on I-15 to the Fort Irwin Road exit and traveling approximately 5.4 miles to a 4WD dirt road that leads to the claims.

The following map shows the location of the Langtry Project claims:

[Athena terminated its interest in the Langtry Project in April 2020]

| 15 |

GOLD PRICES

Our operating results are substantially dependent upon the world market prices of silver. We have no control over gold prices, which can fluctuate widely. The volatility of such prices is illustrated by the following table, which sets forth the high and low London Fix prices of silver (as reported by www.kitco.com) per ounce during the periods indicated:

| Year Ended December 31, | |||||||||||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||||||||||

| High | Low | High | Low | High | Low | ||||||||||||||||||||

| Gold | $ | 2,067.15 | $ | 1,474.25 | $ | 1,546.10 | $ | 1,269.50 | $ | 1,354.96 | $ | 1,178.40 | |||||||||||||

These historical prices are not indicative of future gold prices.

| 16 |

EMPLOYEES AND CONSULTANTS

We have only one part-time employee, Mr. Power, who devotes approximately 25% of his time and attention to our business. We have agreed to pay Mr. Power $2,500 per month for his services.

We rely heavily on the services of consulting engineers and geologists.

ITEM 1A – RISK FACTORS.

An investment in our securities is speculative and involves a high degree of risk. Please carefully consider the following risk factors, as well as the possibility of the loss of your entire investment, before deciding to invest in our securities.

Risks Related to our Business

Due to our history of operating losses our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements have been prepared assuming that we will continue as a going concern. Due to our continuing operating losses and negative cash flows from our operations, the report of our auditors issued in connection with our financial statements for the years ended December 31, 2020 and 2019 contain explanatory paragraphs indicating that the foregoing matters raised substantial doubt about our ability to continue as a going concern. We cannot provide any assurance that we will be able to continue as a going concern.

Uncontrollable events like the COVID-19 pandemic may negatively impact our operations.

The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans and quarantine, and this may limit access to our facilities, customers, management, support staff and professional advisors. These factors, in turn, may not only impact our operations, financial condition and demand for our goods and services but our overall ability to react timely to mitigate the impact of this event. Also, it may hamper our efforts to comply with our filing obligations with the Securities and Exchange Commission.

We have no history of or experience in mineral production.

We have no history of or experience in producing gold or other metals. The development of our Excelsior Springs Project would require the construction and operation of mines, processing plants, and related infrastructure. As a result, we would be subject to all of the risks associated with establishing a new mining operation and business enterprise. We may never successfully establish mining operations, and any such operations may not achieve profitability.

Our principal shareholders and control persons are also principal shareholders and control persons of Athena and Silver Saddle, which could result in conflicts with the interests of minority stockholders.

Magellan Gold Corporation (“Magellan”) is a publicly-held company under common control. Mr. Power is our President, CEO and a director and is a former officer and director of Magellan. John Gibbs is a significant shareholder of both Athena and Magellan.

Messrs. Gibbs and Power are control persons and principal shareholders of Athena and Silver Saddle. Athena, Magellan and Silver Saddle are engaged in mineral exploration activities, although in different geographical regions. While the geographical focus of the companies is different, numerous conflicts could arise in the future. For example, Messrs. Gibbs and Power have provided the majority of working capital for all three companies to date, and in the likely event that these companies require additional capital in the future, their resources may be inadequate to finance the activities of all. In addition, if new prospects become available, a conflict may exist with respect to which company to offer those opportunities. Messrs. Gibbs and Power have not developed a conflict of interest policy to mitigate the potential adverse effects of these conflicts and as a result these conflicts represent a significant risk to the shareholders of the Company. Conflicts for access to limited resources and opportunities cannot be eliminated completely, and investors should be aware of their potential.

| 17 |

Our principal executive officer intends to devote only a limited amount of his time and attention to our business.

Mr. Power is the only executive officer of Athena. He anticipates that he will only devote approximately 25% of his time and attention to our business. This limited focus could result in significant delays in our exploration and development activities and ability to generate revenues and profits, if any, in the future.

We have no proven or probable reserves.

We are currently in the exploration stage and have no proven or probable reserves, as those terms are defined by the SEC, on any of our properties including the Excelsior Springs Project. The mineralized material identified to date in respect of the Excelsior Springs Project has not demonstrated economic viability and we cannot provide any assurance that mineral reserves with economic viability will be identified on that property.

In order to demonstrate the existence of proven or probable reserves under SEC guidelines, it would be necessary for us to advance the exploration of our Excelsior Springs Project by significant additional delineation drilling to demonstrate the existence of sufficient mineralized material with satisfactory continuity which would provide the basis for a feasibility study which would demonstrate with reasonable certainty that the mineralized material can be economically extracted and produced. We do not have sufficient data to support a feasibility study with regard to the Excelsior Springs Project, and in order to perform the drill work to support such feasibility study, we must obtain the necessary permits and funds to continue our exploration efforts. It is possible that, even after we have obtained sufficient geologic data to support a feasibility study on the Excelsior Springs Project, such study will conclude that none of the identified mineral deposits can be economically and legally extracted or produced. If we cannot adequately confirm or discover any mineral reserves of precious metals on the Excelsior Springs Property, we may not be able to generate any revenues. Even if we discover mineral reserves on the Excelsior Springs Property in the future that can be economically developed, the initial capital costs associated with development and production of any reserves found is such that we might not be profitable for a significant time after the initiation of any development or production. The commercial viability of a mineral deposit once discovered is dependent on a number of factors beyond our control, including particular attributes of the deposit such as size, grade and proximity to infrastructure, as well as metal prices. In addition, development of a project as significant as Excelsior Springs will likely require significant debt financing, the terms of which could contribute to a delay of profitability.

The exploration of mineral properties is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

| · | establish ore reserves through drilling and metallurgical and other testing techniques; |

| · | determine metal content and metallurgical recovery processes to extract metal from the ore; and, |

| · | design mining and processing facilities. |

If we discover ore at the Excelsior Springs Project, we expect that it would be several additional years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production could change. As a result of these uncertainties, there can be no assurance that our exploration programs will result in proven and probable reserves in sufficient quantities to justify commercial operations at the Excelsior Springs Project.

| 18 |

Even if our exploration efforts at Excelsior Springs are successful, we may not be able to raise the funds necessary to develop the Excelsior Springs Project.

If our exploration efforts at Excelsior Springs are successful, our current estimates indicate that we would be required to raise at least $50 million in external financing to develop and construct the Excelsior Springs Project. Sources of external financing could include bank borrowings and debt and equity offerings, but financing has become significantly more difficult to obtain in the current market environment. The failure to obtain financing would have a material adverse effect on our growth strategy and our results of operations and financial condition. There can be no assurance that we will commence production at Langtry or generate sufficient revenues to meet our obligations as they become due or obtain necessary financing on acceptable terms, if at all, and we may not be able to secure the financing necessary to begin or sustain production at the Excelsior Springs Project. In addition, should we incur significant losses in future periods, we may be unable to continue as a going concern, and we may not be able to realize our assets and settle our liabilities in the normal course of business at amounts reflected in our financial statements included or incorporated by reference in this Form 10-K.

We may not be able to obtain all of the permits required for development of the Excelsior Springs Project.

In the ordinary course of business, mining companies are required to seek governmental permits for expansion of existing operations or for the commencement of new operations. We will be required to obtain numerous permits for our Excelsior Springs Project. Obtaining the necessary governmental permits is a complex and time-consuming process involving numerous jurisdictions and often involving public hearings and costly undertakings. Our efforts to develop the Property may also be opposed by environmental groups. In addition, mining projects require the evaluation of environmental impacts for air, water, vegetation, wildlife, cultural, historical, geological, geotechnical, geochemical, soil and socioeconomic conditions. An Environmental Impact Statement would be required before we could commence mine development or mining activities. Baseline environmental conditions are the basis on which direct and indirect impacts of the Excelsior Springs Project are evaluated and based on which potential mitigation measures would be proposed. If the Excelsior Springs Project were found to significantly adversely impact the baseline conditions, we could incur significant additional costs to avoid or mitigate the adverse impact, and delays in the Excelsior Springs Project could result.

Permits would also be required for, among other things, storm-water discharge; air quality; wetland disturbance; dam safety (for water storage and/or tailing storage); septic and sewage; and water rights appropriation. In addition, compliance must be demonstrated with the Endangered Species Act and the National Historical Preservation Act.

The mining industry is intensely competitive.

The mining industry is intensely competitive. We may be at a competitive disadvantage because we must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than we do. Increased competition could adversely affect our ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future. We may also encounter increasing competition from other mining companies in our efforts to locate acquisition targets, hire experienced mining professionals and acquire exploration resources.

| 19 |

Our future success is subject to risks inherent in the mining industry.

Our future mining operations, if any, would be subject to all of the hazards and risks normally incident to developing and operating mining properties. These risks include:

| · | insufficient ore reserves; |

| · | fluctuations in metal prices and increase in production costs that may make mining of reserves uneconomic; |

| · | significant environmental and other regulatory restrictions; |

| · | labor disputes; geological problems; |

| · | failure of underground stopes and/or surface dams; |

| · | force majeure events; and |

| · | the risk of injury to persons, property or the environment. |

Our future profitability will be affected by changes in the prices of metals.

If we establish reserves, complete a favorable feasibility study for the Excelsior Springs Project, and complete development of a mine, our profitability and long-term viability will depend, in large part, on the market price of gold. The market prices for metals are volatile and are affected by numerous factors beyond our control, including:

| · | global or regional consumption patterns; |

| · | supply of, and demand for, silver and other metals; |

| · | speculative activities; |

| · | expectations for inflation; and |

| · | political and economic conditions. |

The aggregate effect of these factors on metals prices is impossible for us to predict. Decreases in metals prices could adversely affect our ability to finance the exploration and development of our properties, which would have a material adverse effect on our financial condition and results of operations and cash flows. There can be no assurance that metals prices will not decline.

| 20 |

The market price of gold is volatile. Low gold prices could result in decreased revenues, decreased net income or increased losses and decreased cash flows, and may negatively affect our business.

Gold is a commodity. Its price fluctuates, and is affected by many factors beyond our control, including interest rates, expectations regarding inflation, speculation, currency values, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors.

The price of gold may decline in the future. Factors that are generally understood to contribute to a decline in the price of gold include sales by private and government holders, and a general global economic slowdown. If the price of silver is depressed for a sustained period and our net losses continue, we may be forced to suspend operations until the prices increase, and to record asset impairment write-downs. Any continued or increased net losses or asset impairment write-downs would adversely affect our financial condition and results of operations.

We might be unable to raise additional financing necessary to complete capital needs, conduct our business and make payments when due.

We will need to raise additional funds in order to meet capital needs and implement our business plan. Any required additional financing might not be available on commercially reasonable terms, or at all. If we raise additional funds by issuing equity securities, holders of our common stock could experience significant dilution of their ownership interest, and these securities could have rights senior to those of the holders of our common stock.

Mineral exploration and development inherently involves significant and irreducible financial risks. We may suffer from the failure to find and develop profitable mines.

The exploration for and development of mineral deposits involves significant financial risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Unprofitable efforts may result from the failure to discover mineral deposits. Even if mineral deposits are found, such deposits may be insufficient in quantity and quality to return a profit from production, or it may take a number of years until production is possible, during which time the economic viability of the Project may change. Few properties which are explored are ultimately developed into producing mines. Mining companies rely on consultants and others for exploration, development, construction and operating expertise.

Substantial expenditures are required to establish ore reserves, extract metals from ores and, in the case of new properties, to construct mining and processing facilities. The economic feasibility of any development project is based upon, among other things, estimates of the size and grade of ore reserves, proximity to infrastructures and other resources (such as water and power), metallurgical recoveries, production rates and capital and operating costs of such development projects, and metals prices. Development projects are also subject to the completion of favorable feasibility studies, issuance and maintenance of necessary permits and receipt of adequate financing.

Once a mineral deposit is developed, whether it will be commercially viable depends on a number of factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; government regulations including taxes, royalties and land tenure; land use, importing and exporting of minerals and environmental protection; and mineral prices. Factors that affect adequacy of infrastructure include: reliability of roads, bridges, power sources and water supply; unusual or infrequent weather phenomena; sabotage; and government or other interference in the maintenance or provision of such infrastructure. All of these factors are highly cyclical. The exact effect of these factors cannot be accurately predicted, but the combination may result in not receiving an adequate return on invested capital.

| 21 |

Significant investment risks and operational costs are associated with our exploration, development and mining activities. These risks and costs may result in lower economic returns and may adversely affect our business.

Mineral exploration, particularly for gold, involves many risks and is frequently unproductive. If mineralization is discovered, it may take a number of years until production is possible, during which time the economic viability of the Project may change.

Development projects may have no operating history upon which to base estimates of future operating costs and capital requirements. Development project items such as estimates of reserves, metal recoveries and cash operating costs are to a large extent based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, and feasibility studies. Estimates of cash operating costs are then derived based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of metals from the ore, comparable facility and equipment costs, anticipated climate conditions and other factors. As a result, actual cash operating costs and economic returns of any and all development projects may materially differ from the costs and returns estimated, and accordingly, our financial condition and results of operations may be negatively affected.

The estimation of ore reserves is imprecise and depends upon subjective factors. Estimated ore reserves may not be realized in actual production. Our operating results may be negatively affected by inaccurate estimates.

If, in the future, we present estimates of ore reserve figures in our public filings, those figures may be estimated by our technical personnel. Reserve estimates are a function of geological and engineering analyses that require us to make assumptions about production costs and gold market prices. Reserve estimation is an imprecise and subjective process. The accuracy of such estimates is a function of the quality of available data and of engineering and geological interpretation, judgment and experience. Assumptions about gold market prices are subject to great uncertainty as those prices have fluctuated widely in the past. Declines in the market prices of gold may render future potential reserves containing relatively lower grades of ore uneconomic to exploit, and we may be required to reduce reserve estimates, discontinue development or mining at one or more of our properties, or write down assets as impaired. Should we encounter mineralization or geologic formations at any of our projects different from those we predicted, we may adjust our reserve estimates and alter our mining plans. Either of these alternatives may adversely affect our actual future production and operating results.

The estimation of the ultimate recovery of metals contained within a heap leach pad inventory is inherently inaccurate and subjective and requires the use of estimation techniques. Actual recoveries can be expected to vary from estimations.

We expect to use the heap leach process to extract gold from ore. The heap leach process is a process of extracting gold by placing ore on an impermeable pad and applying a diluted cyanide solution that dissolves a portion of the contained silver, which is then recovered in metallurgical processes.

We will use several integrated steps in the process of extracting gold to estimate the metal content of ore placed on the leach pads. Although we will refine our estimates as appropriate at each step in the process, the final amounts are not determined until a third-party smelter converts the doré and determines final ounces of gold available for sale. We will then review this end result and reconcile it to the estimates we developed and used throughout the production process. Based on this review, we may adjust our estimation procedures when appropriate. As a result, actual recoveries can vary from estimates, and the amount of the variation could be significant and could have a material adverse impact on our financial condition and results of operations.

| 22 |

Gold mining involves significant production and operational risks. We may suffer from the failure to efficiently operate our mining projects.